Real Estate Tax Invoice Template for Easy Property Tax Management

In the world of property management and ownership, maintaining clear and accurate financial records is crucial. Proper documentation not only ensures transparency but also helps in streamlining payment processes. One essential document in this regard is a formal receipt that outlines amounts due for property-related charges. These documents serve as a record of transactions and can be customized to meet specific needs.

Creating a professional and consistent form for these payments is key to avoiding errors and maintaining a smooth workflow. A well-structured document can make the payment process faster, more efficient, and legally sound. Whether you’re a property owner, landlord, or agent, having the right format for these records can save both time and effort.

In this guide, we explore how to construct a comprehensive payment record form that ensures accuracy and professionalism. By using the right tools, you can make this often-overlooked task a seamless part of your property management routine.

Understanding Property Payment Documents

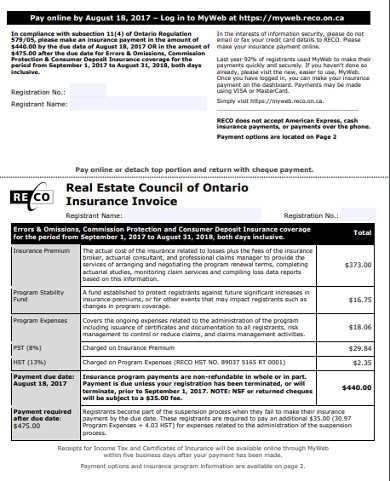

In the realm of property ownership and management, certain documents are essential for tracking payments owed for property-related expenses. These documents serve as formal records, providing both the payer and the payee with clear details about amounts due, deadlines, and relevant information. Properly formatted documents ensure both parties are aligned and that the financial transactions are legally sound.

The Purpose of Payment Records

At their core, these documents act as a receipt and a request for payment. They detail the specific charges related to the property, including any fees, dues, or costs associated with its upkeep or ownership. For landlords, agents, or property owners, creating a clear and precise record helps avoid confusion and disputes with tenants or other parties involved in the transaction.

Key Elements to Include in Property Payment Records

To create a document that is both comprehensive and useful, certain key elements must always be included. These typically include the recipient and payer’s information, a breakdown of the charges, payment terms, and due dates. Including clear instructions on how and when payments should be made ensures smooth communication between the involved parties.

Whether you are managing a single property or an entire portfolio, ensuring that these documents are correctly filled out and maintained will help establish trust and ensure timely payments. Having a solid understanding of how to structure these forms will streamline the process and keep everything in order.

What is a Property Payment Record

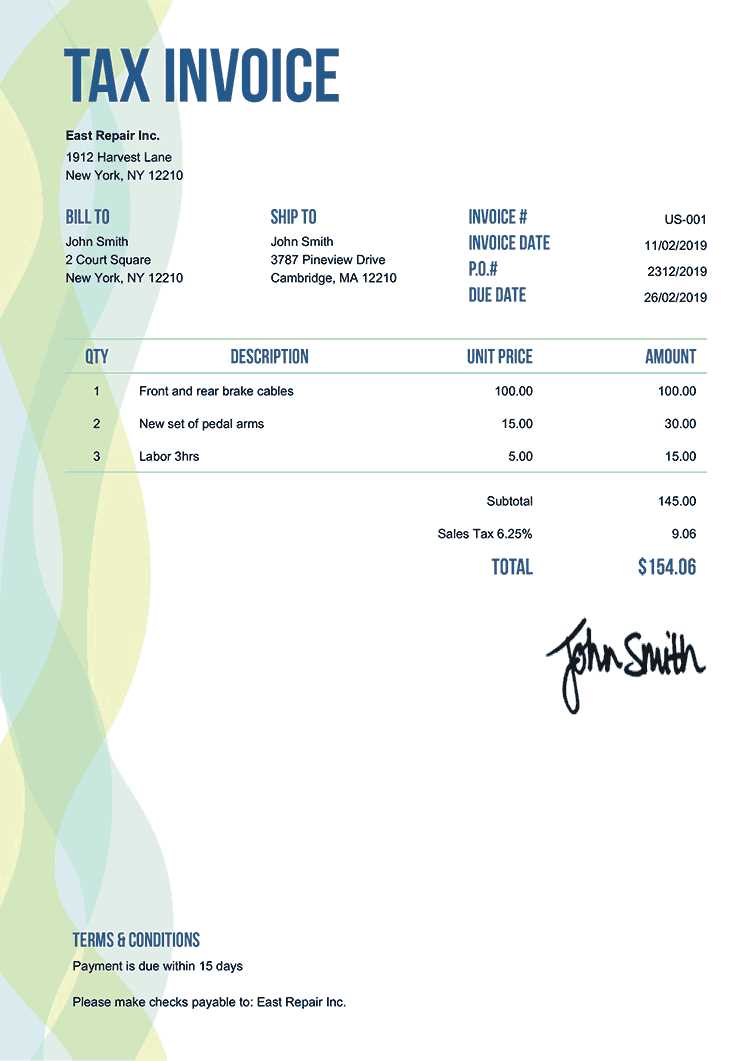

A property payment record is an official document used to outline amounts due for various property-related expenses. This form provides a detailed breakdown of charges that need to be settled by the payer. Such records are typically used in transactions involving land, rental properties, or other real estate dealings. These documents serve as both a request for payment and a formal acknowledgment of the owed amounts.

These records are designed to ensure transparency in property-related transactions, making it clear what fees or costs are being charged, when payment is due, and how much is expected. They are essential for both property owners and tenants or other parties involved in the transaction, as they provide the necessary details to avoid confusion and ensure proper financial management.

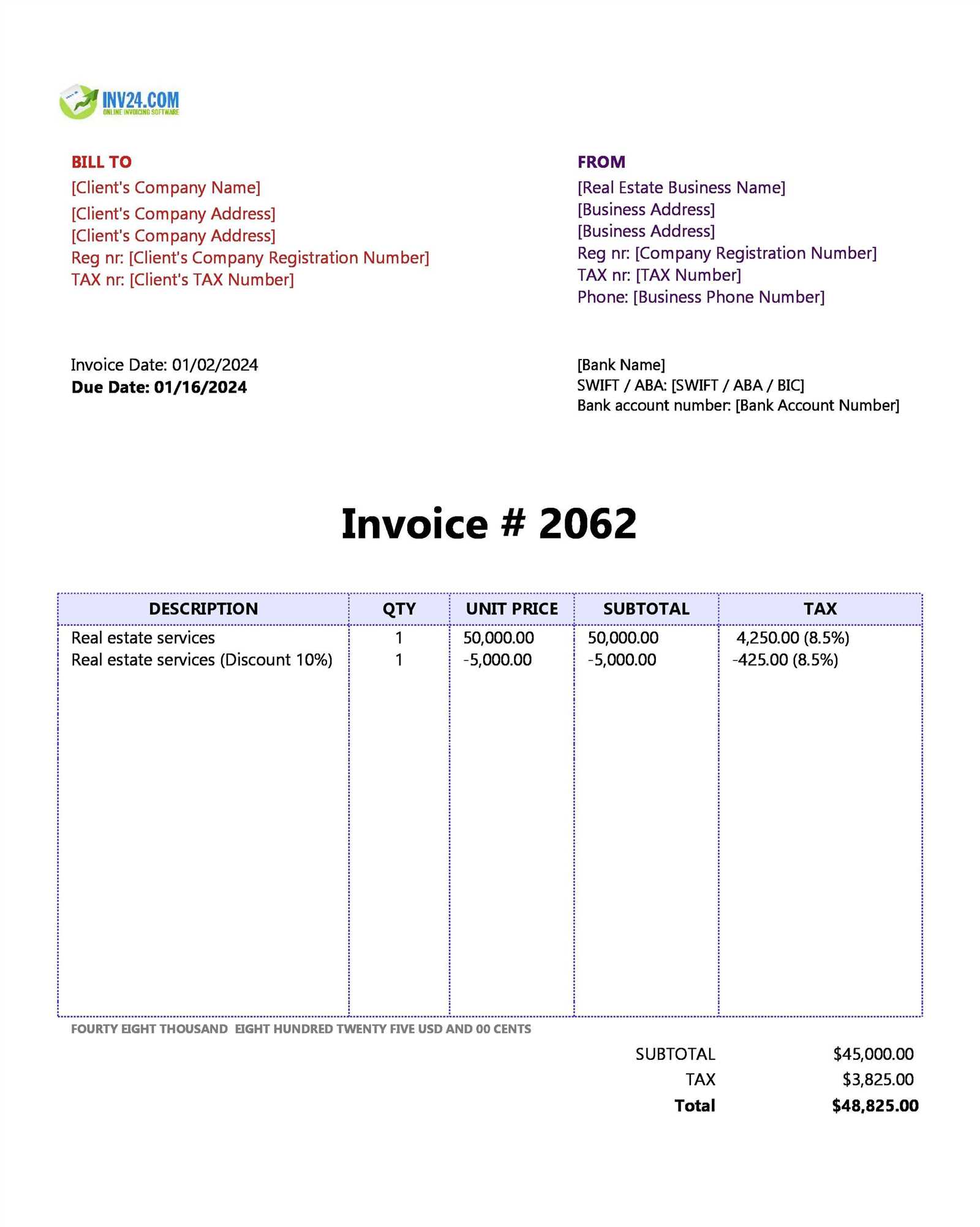

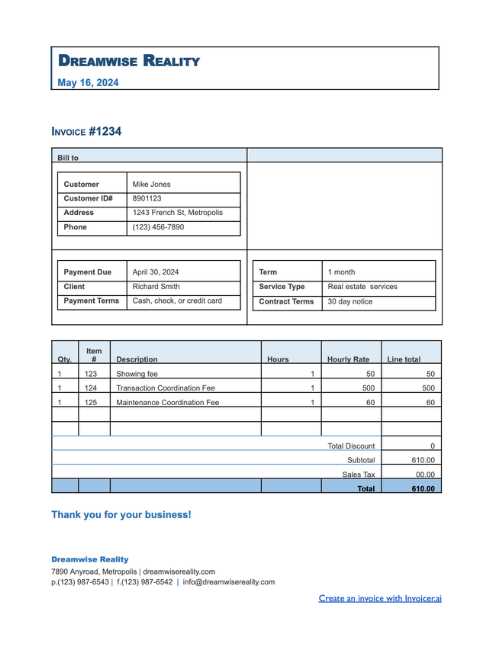

| Component | Description |

|---|---|

| Recipient Information | Name, address, and contact details of the payee |

| Payer Information | Name, address, and contact details of the payer |

| Charge Breakdown | Details of individual charges, such as fees, utilities, or service costs |

| Due Date | The deadline by which the payment must be made |

| Payment Instructions | Methods of payment, bank details, or payment links |

By including all relevant information, this type of document helps prevent disputes and ensures that both parties are clear on the financial obligations involved. Whether it’s for monthly payments, annual fees, or one-time charges, a well-organized property payment record is an essential tool for managing property finances effectively.

Why Use a Payment Record Format

Using a standardized document for property-related charges offers numerous advantages, particularly in terms of consistency and efficiency. When dealing with financial transactions, especially those that involve recurring payments, having a set format ensures that all necessary details are consistently included, reducing the chances of errors. A pre-designed form can also save time and effort, making the process of generating and managing payment records much easier for both property owners and tenants.

Efficiency and Time-Saving

One of the most significant benefits of using a structured document is the amount of time it saves. Rather than creating a new record from scratch for each transaction, you can use an established layout. This not only speeds up the process but also reduces the likelihood of forgetting key information. By automating the structure, you ensure that the document remains organized and complete every time.

Improved Accuracy and Compliance

Another important advantage is accuracy. A pre-designed form ensures that all relevant details–such as the amounts owed, payment deadlines, and recipient information–are included correctly. This is crucial for maintaining proper records, especially in legal and financial matters. Furthermore, using a consistent format can help ensure compliance with local regulations, as the necessary components will always be present.

| Benefit | Explanation |

|---|---|

| Time Efficiency | Faster preparation and fewer errors in documentation |

| Consistency | Ensures all required information is included in each document |

| Legal and Financial Accuracy | Reduces the risk of mistakes and ensures compliance |

In conclusion, using a structured form for property-related financial documents is an effective way to streamline the payment process, improve organization, and minimize potential errors. Whether you are managing multiple properties or handling a single transaction, having a reliable format in place can save you time and help maintain accurate records.

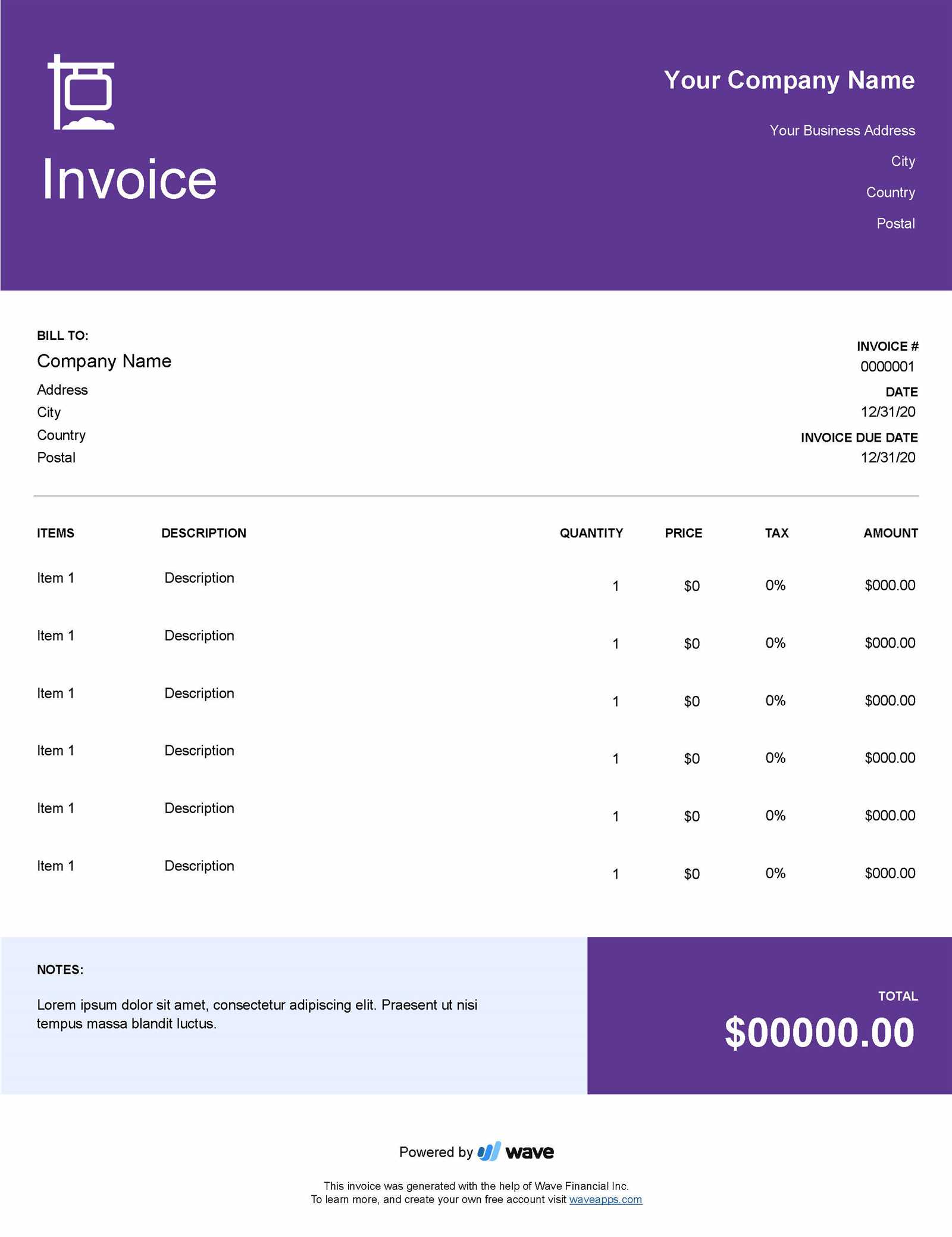

Benefits of Customizable Payment Record Formats

Using a customizable format for property-related financial documents offers several advantages, especially when flexibility is important. By tailoring the design and structure to meet specific needs, property managers and owners can ensure that each record is perfectly suited to their situation. Customization allows for the inclusion of unique details, ensuring the document reflects the nature of the transaction accurately and professionally.

Flexibility is one of the key benefits of having the ability to adjust the layout and content of the document. Whether it’s adding additional fees, altering the payment terms, or including specific property details, the option to modify the structure ensures that every record matches the requirements of the transaction. This adaptability is crucial for handling various property dealings, from simple rental agreements to more complex arrangements involving multiple fees or services.

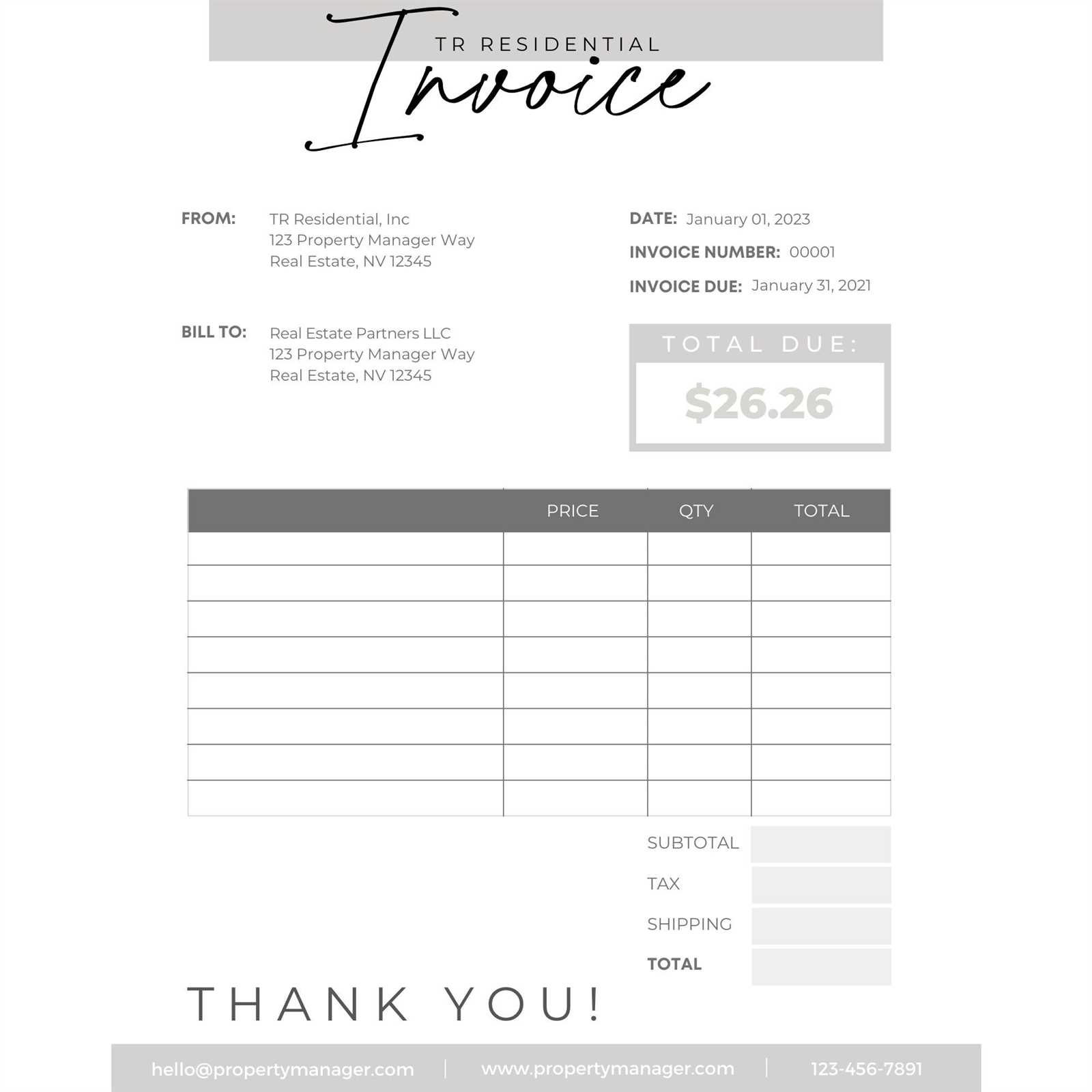

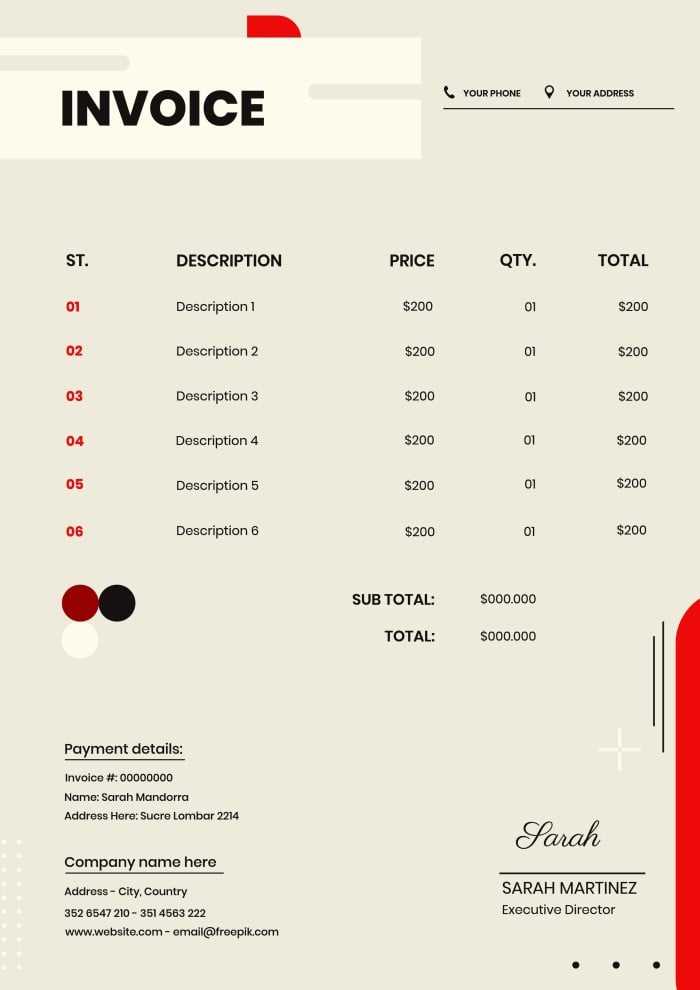

Another important advantage is the professionalism that a tailored document can bring. A customized payment record can be designed to match your company’s branding, ensuring that it reflects your business identity. This can include the use of logos, specific fonts, and tailored headers, making the document not only functional but also visually aligned with your brand’s image.

Lastly, customization ensures accuracy by allowing the inclusion of all relevant data specific to the transaction. By creating a format that works for your particular needs, there’s a lower chance of missing important details or including irrelevant information. This results in a more accurate and reliable document, which is essential for maintaining clear communication and preventing errors.

How to Create a Property Payment Record

Creating an accurate and effective payment record for property-related charges is a critical task for landlords, property managers, or agents. This document should clearly outline the amounts due, payment deadlines, and any other relevant details to ensure both parties are on the same page. The process can be straightforward if you follow a structured approach to gathering and organizing the necessary information.

Here are the basic steps to create a comprehensive property payment record:

- Gather Necessary Information

Before you begin, collect all the details that will be required for the document:

- Payer and recipient contact details (name, address, phone number, etc.)

- A detailed list of charges (rent, maintenance fees, utilities, etc.)

- Payment terms (due date, late fees, payment methods)

- Any other specific instructions related to the payment

- Choose the Right Format

Once you have all the information, choose a format that will suit your needs. Whether you’re using an automated system or creating the document manually, ensure that the format is simple and easy to understand for all parties involved.

- Fill in the Details

Using the collected information, fill in the relevant fields in the payment record. Ensure that all amounts are clearly stated, and that the recipient’s and payer’s details are correct.

- Review and Double-Check

Before finalizing the document, review all the information carefully. Verify that all amounts, dates, and other details are accurate. This step helps prevent mistakes that could lead to confusion or legal issues later on.

- Send the Document

Once the document is complete and reviewed, send it to the appropriate party. Be sure to provide clear instructions for making the payment and include any necessary contact details for follow-up.

By following these steps, you can create a reliable and professional document that ensures clarity and accuracy in all property-related financial transactions. Whether you’re managing a single property or handling multiple units, these records are essential for maintaining smooth operations.

Key Components of a Payment Record

A well-structured payment record for property-related charges is essential for ensuring transparency and accuracy in financial transactions. To create an effective document, it’s important to include several key elements that provide all the necessary information for both the payer and the recipient. These components help clarify the details of the transaction and ensure that no crucial information is overlooked.

Essential Information to Include

Every payment document should contain the following key details:

- Payer and Recipient Information: The full names, addresses, and contact details of both parties are crucial for identifying the individuals involved in the transaction.

- Charge Breakdown: A detailed list of the specific charges, including rent, maintenance fees, utilities, and any additional costs, should be outlined clearly.

- Payment Amount: The total amount due, including any applicable taxes or additional charges, must be clearly stated.

- Due Date: The date by which payment must be made should be prominently displayed to avoid any confusion.

- Payment Instructions: Clear instructions on how the payment should be made, including bank details or online payment links, are essential for smooth transactions.

Additional Elements for Clarity

To further enhance clarity and prevent misunderstandings, it may also be useful to include the following:

- Late Payment Penalties: If applicable, outline any penalties for late payment, including the percentage or fixed fee to be charged after the due date has passed.

- Transaction Reference Number: A unique identifier or reference number for each transaction can help both parties track the payment easily.

- Legal Disclaimers: Any relevant legal clauses or terms, such as property-specific regulations, should be included to ensure compliance.

By ensuring all these components are present, you can create a payment document that is not only legally sound but also clear and easy to understand for both parties involved. A well-organized record simplifies the payment process, reduces the risk of disputes, and ensures smooth financial operations.

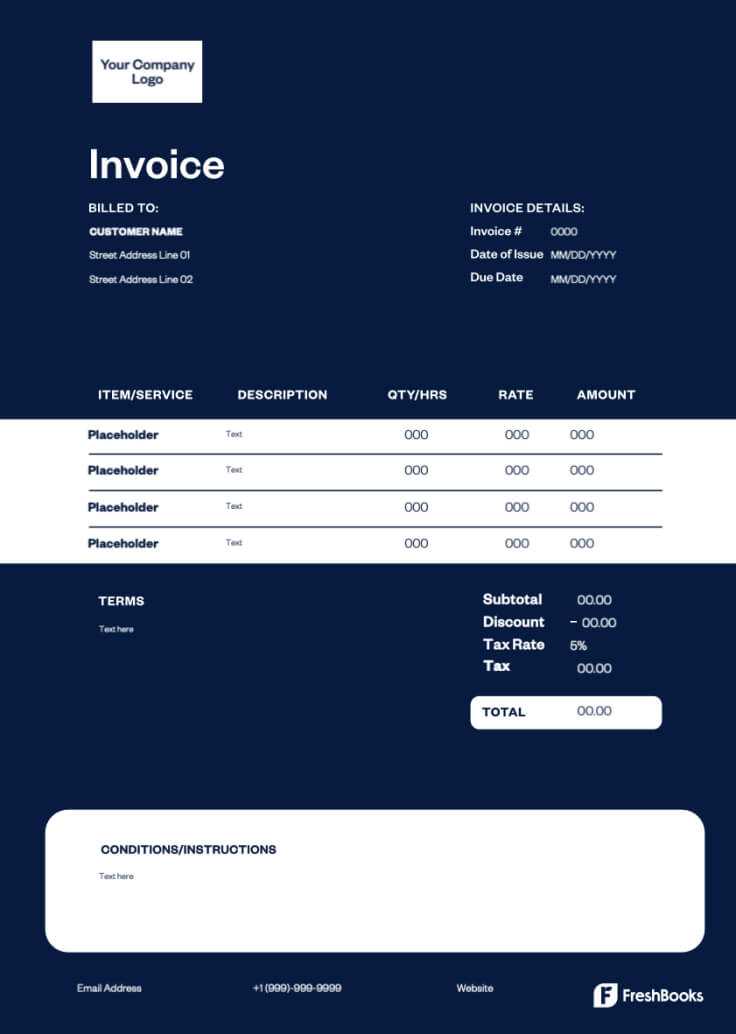

Property Payment Record Formats

When creating financial documents for property-related charges, the format plays a crucial role in ensuring that the information is clear, consistent, and easy to understand. Different formats serve different needs depending on the complexity of the transaction, the method of payment, and the involved parties. Choosing the right format is essential for streamlining the process and ensuring that all necessary details are included accurately.

Common Document Formats

There are several common formats available for property payment records, each designed for different levels of complexity and specific requirements:

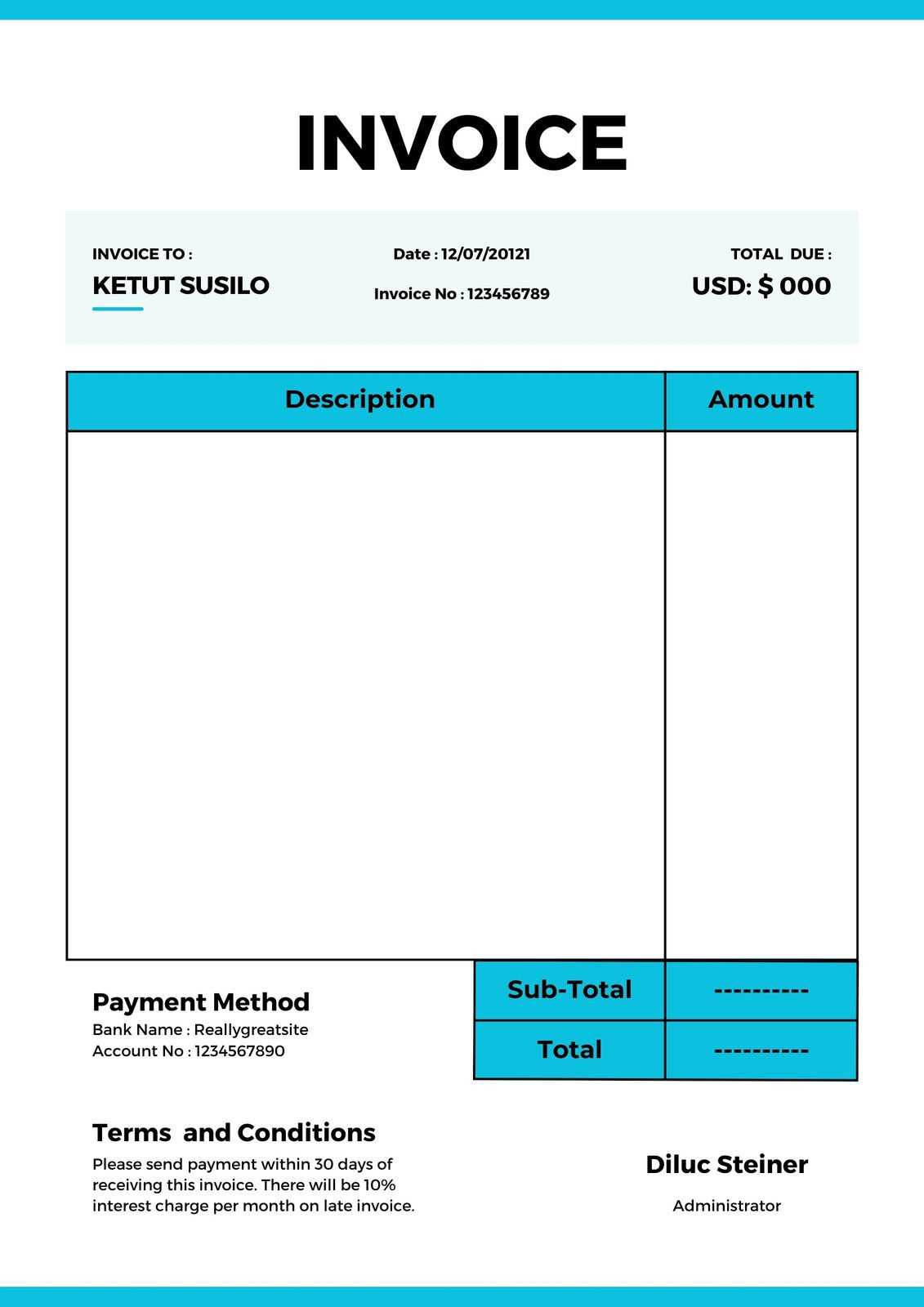

- Basic Format: This format is simple and straightforward, suitable for one-time or recurring payments with minimal detail. It includes essential elements such as payer and recipient information, the amount due, and payment instructions. It’s ideal for small-scale transactions.

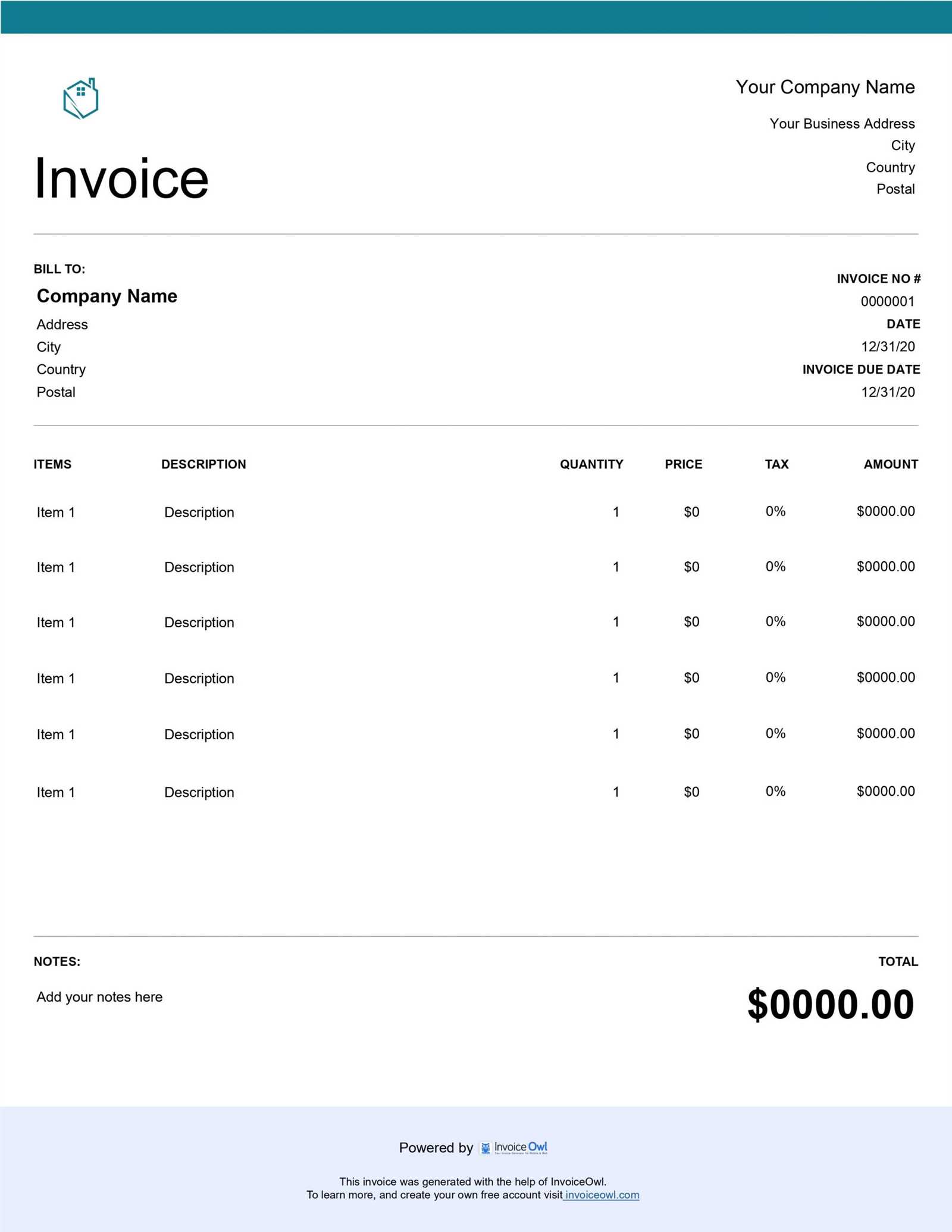

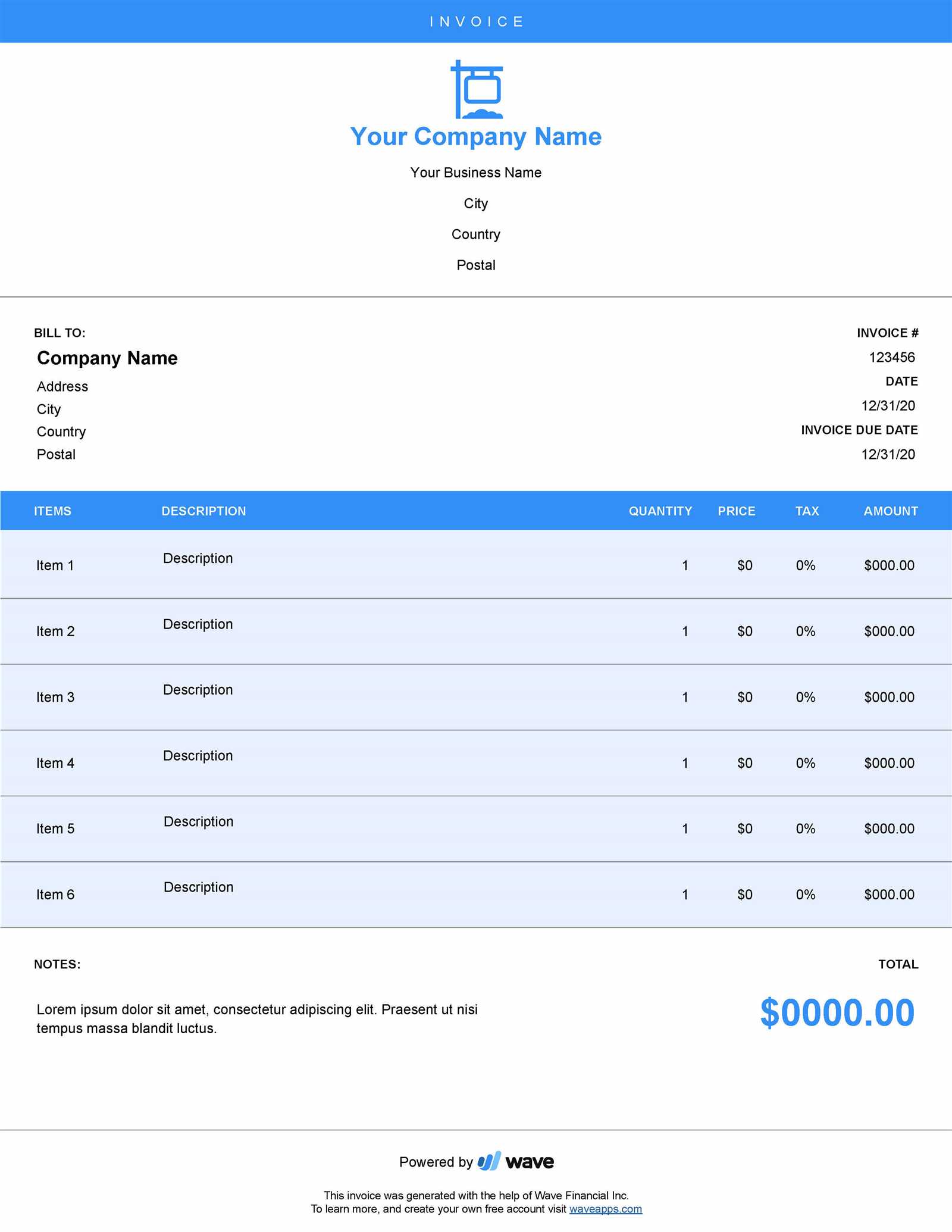

- Detailed Format: For more complex transactions, such as multiple charges, additional fees, or payments involving multiple parties, a more detailed format is needed. This includes itemized charges, payment breakdowns, and specific terms related to each charge. It is often used for rental agreements, service contracts, or property management companies.

- Automated Format: Many property owners and managers opt for digital solutions that generate payment records automatically. These formats are often integrated with accounting software and allow for easy customization, quick generation, and automatic inclusion of necessary details such as due dates and late fees.

Choosing the Right Format for Your Needs

Selecting the most suitable format depends on several factors, including the type of property, the nature of the payment, and the preferences of both the payer and recipient. A simple format may suffice for straightforward rental payments, while more detailed records may be necessary for properties with multiple tenants or additional services such as maintenance or utilities. Digital formats offer flexibility and efficiency, making them a popular choice for modern property management.

Ultimately, the goal is to ensure that the payment record is both comprehensive and easy to read. A well-chosen format can save time, reduce errors, and improve overall communication between all parties involved.

Common Mistakes When Filling Out Payment Records

Creating a clear and accurate payment record is crucial for maintaining smooth financial transactions in property management. However, many individuals and businesses make common mistakes when completing these documents, which can lead to confusion, disputes, or even legal issues. Understanding these frequent errors can help ensure that your documents are always precise and professional.

Frequent Errors to Avoid

Here are some of the most common mistakes made when preparing property-related financial records:

- Incorrect or Missing Contact Information: Failing to provide accurate payer and recipient details is a common oversight. Missing or incorrect names, addresses, or phone numbers can create confusion and complicate communication.

- Not Listing All Charges: Sometimes, additional fees such as maintenance, utilities, or late payment penalties are overlooked. It’s important to include a detailed breakdown of all applicable charges to avoid misunderstandings.

- Omitting Payment Terms: Clearly outlining payment deadlines, accepted payment methods, and any applicable late fees is essential. Without this information, it may be unclear when and how the payment should be made.

- Typographical Errors: Simple mistakes like misspelled names or incorrect numbers can undermine the professionalism of your document and lead to confusion about amounts owed or due dates.

- Using Inconsistent Formats: Using different styles, fonts, or layouts can make the document harder to read and cause important information to be overlooked. Consistency in formatting is key to maintaining clarity.

How to Avoid These Mistakes

To prevent errors when filling out property payment records, consider the following tips:

- Double-Check Information: Before finalizing the document, review all details carefully. Verify contact information, charges, dates, and amounts.

- Use a Structured Format: Stick to a consistent format that includes all necessary sections and is easy to follow. Automated tools or pre-designed layouts can help streamline this process.

- Include Clear Payment Instructions: Make sure payment terms are easy to understand. Include due dates, payment methods, and any applicable penalties for late payments.

- Proofread: Take the time to proofread the document to catch any spelling or numerical errors before sending it out.

| Mistake | Consequences | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Incorrect Contact Information | Delays in communication, missed payments | |||||||||||||||||||

| Omitting Charges | Unclear payment expectations, potential disputes | |||||||||||||||||||

| Missing Payment Terms | Confusion about

Best Practices for Payment Record Design

Designing an effective property payment document requires attention to both functionality and aesthetics. A well-organized and clearly designed record not only ensures that all necessary information is included, but also helps the payer and recipient quickly understand the details of the transaction. By following best practices in document design, you can create payment records that are professional, clear, and easy to read. Here are some key guidelines to consider when designing property payment records:

By following these best practices, you can create payment documents that are not only functional but also visually appealing and easy to understand. A well-designed record enhances communication, reduces errors, and reinforces your professionalism in property management. How to Automate Payment Record Generation

Automating the creation of property-related financial documents can greatly improve efficiency and accuracy. With the right tools and software, the process of generating payment records becomes faster, reducing the chances of errors while saving time. This section explores how automation can streamline the process, making it easier for property managers and business owners to manage multiple transactions without the hassle of manual document preparation. Steps to Automate Payment Record CreationTo successfully automate payment record generation, follow these basic steps:

Benefits of AutomationAutomation not only saves time but also offers several other benefits:

By automating the process of generating property payment documents, you can significantly enhance your workflow, minimize the chances of errors, and focus more on the core aspects of property management. Automation is a powerful Legal Considerations for Property Payment Records

When preparing property-related financial documents, it’s essential to understand the legal requirements that apply to these records. These documents serve as formal proof of a transaction, and failure to comply with the relevant legal standards can result in penalties or disputes. To ensure that your payment records are legally valid, it is important to consider various legal elements, such as the required information, compliance with local laws, and the proper handling of sensitive data. Below are the key legal considerations to keep in mind when creating property payment records: Key Legal Requirements

The following points highlight the primary legal aspects to consider when preparing these documents:

Potential Legal Pitfalls

In addition to understanding the legal requirements, it’s important to be aware of potential legal pitfalls that can arise when creating property payment records:

|