Download Free Accounting Invoice Template for Simplified Billing

Managing payments and keeping track of transactions can be a complex task for businesses of any size. To ensure smooth financial operations, having a structured and easy-to-use document for requesting payments is essential. This document not only helps with organization but also establishes a professional approach to dealing with clients. Whether you are a freelancer, a small business owner, or a large enterprise, creating these records accurately is crucial for maintaining cash flow and avoiding confusion.

By utilizing a customizable and efficient form, you can easily capture essential details like services provided, amounts due, and payment terms. These forms allow for consistency in every transaction, reducing the chances of errors and misunderstandings. Moreover, having a clear layout ensures that clients have all the information they need to process payments promptly.

In this guide, we will explore how to create, customize, and implement a form that fits your business needs. From basic structures to more advanced features, you’ll discover how to streamline your invoicing process and save time, enabling you to focus on what matters most: growing your business.

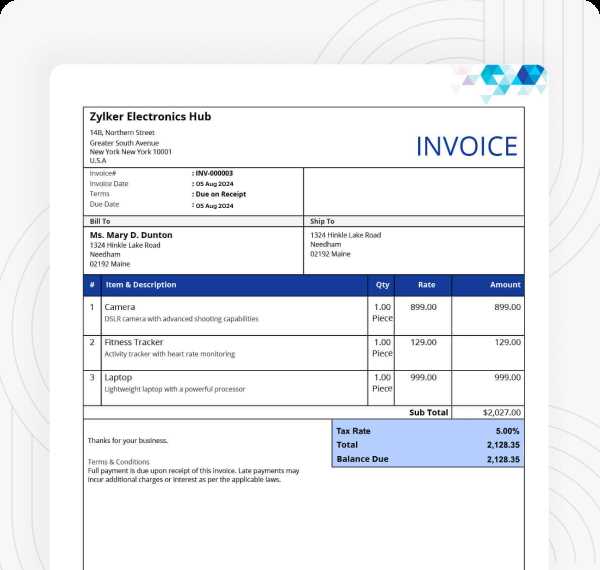

Accounting Invoice Template Overview

Effective financial documentation is crucial for every business. A well-structured document used for requesting payment from clients provides clarity, ensures transparency, and helps maintain smooth business operations. These documents act as formal records of the products or services rendered, outlining the payment terms and due dates. Having a clear and professional layout can improve client relationships and streamline the collection process.

Key Features of a Professional Document

At its core, a comprehensive payment request document includes several important elements: the business details, client information, a detailed description of services or goods provided, and the total amount due. These features ensure that the client has all the necessary information to process the payment correctly. Furthermore, a well-designed document includes fields for payment instructions and due dates, making it easier for both parties to understand their obligations.

Why Use Pre-Designed Forms

Pre-designed forms offer numerous advantages for businesses. They eliminate the need to create a new document from scratch each time, saving time and reducing the risk of missing key information. With customizable fields, businesses can easily tailor these documents to their specific needs, ensuring a professional appearance while also maintaining consistency in their financial dealings.

Why You Need an Invoice Template

Having a ready-made structure for requesting payments is essential for maintaining order and professionalism in any business transaction. Without a standardized form, managing client payments can become chaotic, leading to missed details, errors, and delayed payments. A pre-designed document helps ensure consistency, accuracy, and efficiency in your financial communication, making it easier to track sales and payments over time.

Benefits of Using a Standardized Form

- Time-saving: You don’t need to create a new document from scratch each time you need to request payment.

- Clarity: All important details, such as amounts, payment terms, and services provided, are clearly listed for both you and your client.

- Professionalism: A clean and consistent design shows clients that your business is organized and trustworthy.

- Accuracy: Using a set format reduces the chances of missing or entering incorrect information.

How It Improves Cash Flow Management

With a standardized form, your clients will know exactly how to pay and when the payment is due. This clarity not only speeds up the payment process but also helps avoid disputes over billing details. Additionally, these forms provide a useful record of your transactions, making it easier to track cash flow and manage finances more effectively.

Key Elements of an Accounting Invoice

When creating a formal document to request payment, it is important to include specific details that ensure clarity and transparency. A well-structured document not only outlines the financial aspects of the transaction but also serves as a record for both parties involved. These elements help establish a clear agreement, minimize errors, and make it easier to track payments over time.

Essential Information for Both Parties

The first section of any payment request document should include the contact details of both the business and the client. This ensures that both parties can easily communicate if any issues arise. Key details to include are:

- Business Name and Contact Information: Include your company name, address, phone number, and email.

- Client Details: Add the client’s name, address, and contact information to avoid confusion.

- Document Date: The date when the document is issued to keep track of when payment is due.

Transaction Details and Payment Terms

The second crucial part of the document involves detailing the services or products provided, the corresponding fees, and payment instructions. Clear and accurate descriptions help avoid misunderstandings and make the payment process smoother. Key points include:

- Description of Goods/Services: A breakdown of what was provided, including quantities, unit prices, and any discounts offered.

- Total Amount Due: The overall sum that the client needs to pay, including taxes and any additional fees.

- Payment Due Date: A specified deadline for payment helps establish expectations and prompt timely payments.

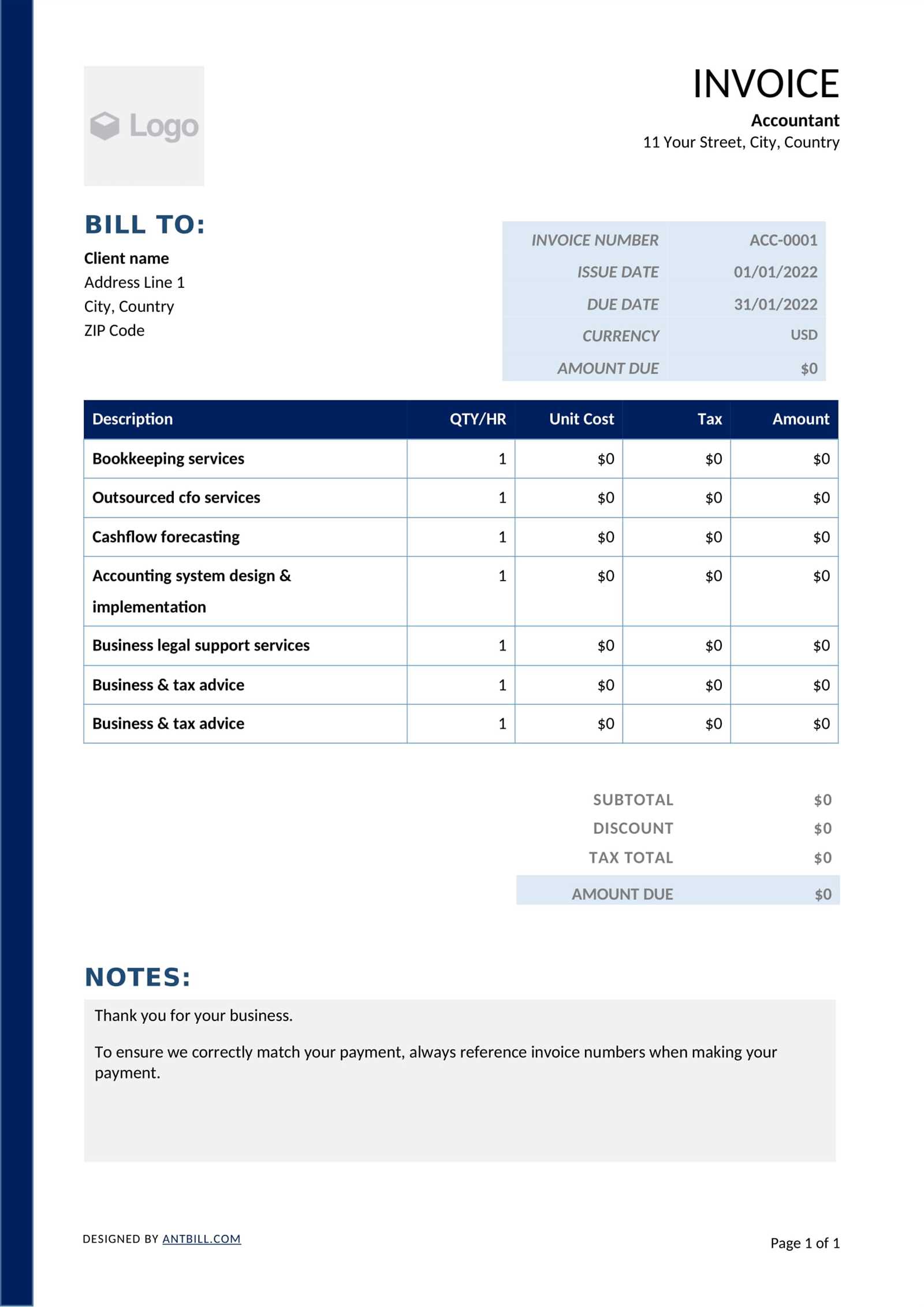

How to Customize Your Invoice Template

Customizing your payment request document allows you to tailor it to your specific business needs and brand identity. A personalized form not only enhances professionalism but also ensures that all relevant details are included. With the right adjustments, you can create a document that is both functional and aligned with your company’s style, making the process smoother for both you and your clients.

Here are a few steps to help you customize your form effectively:

Adjusting the Layout and Design

The design of your payment request document should reflect your brand’s aesthetics. You can modify the font, colors, and layout to make the document look more professional or aligned with your branding guidelines. Some key design elements to consider include:

- Company Logo: Add your business logo at the top for immediate brand recognition.

- Fonts and Colors: Use your brand’s colors and preferred fonts for consistency across all documents.

- Document Structure: Organize sections in a clear, easy-to-read format. Use tables and lines to separate different parts of the form.

Including Relevant Information

Once the basic layout is in place, ensure that all essential details are present. Customize sections to suit your business’s needs, whether it’s adding specific payment instructions or including your company’s tax ID. Here’s a simple table format to help structure key information:

| Description | Details |

|---|---|

| Company Name | Your Business Name |

| Client Name | Client’s Full Name |

| Service Provided | Details of the Service or Product |

| Total Amount Due | $Amount |

| Payment Due Date | MM/DD/YYYY |

By adjusting the layout, fonts, colors, and including all necessary fields, you can create a payment request document that is clear, professional, and customized to your specific business needs.

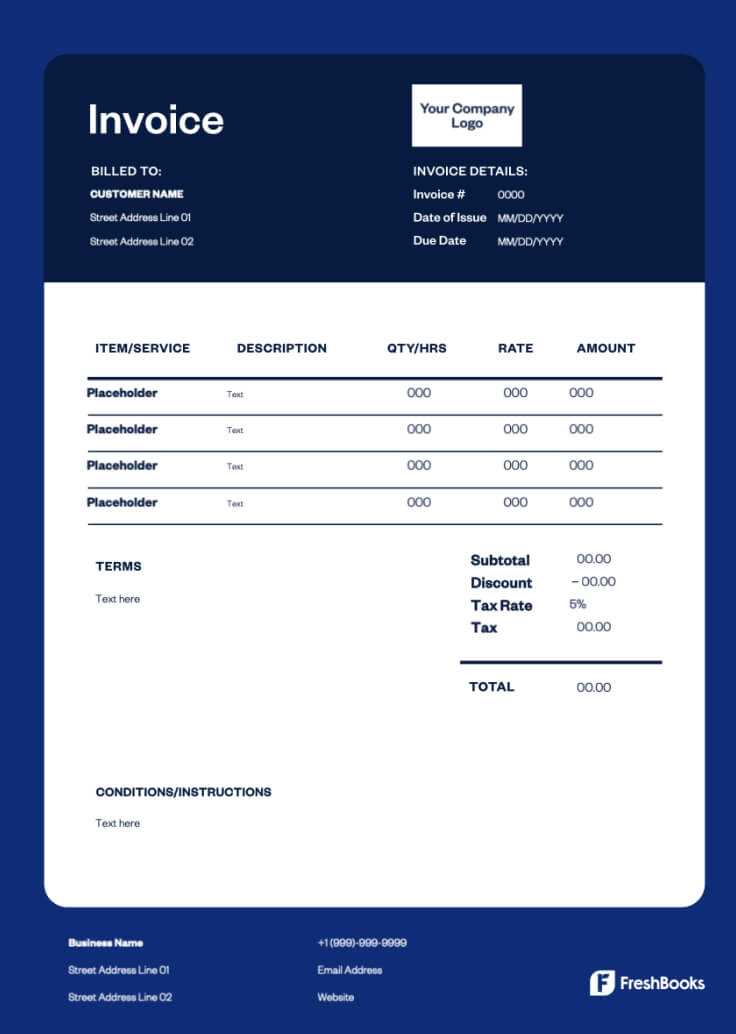

Free Invoice Templates for Small Businesses

For small business owners, having access to a pre-designed document to request payment can make a significant difference in streamlining operations. Instead of spending valuable time creating a new payment request from scratch, free customizable forms provide an efficient and professional solution. These ready-to-use documents allow small businesses to focus on their core operations while ensuring accurate billing and improved cash flow.

Free forms are especially beneficial for startups and small enterprises with limited resources. By using these tools, business owners can save both time and money, avoiding the need for costly accounting software or hiring additional staff. Many of these documents come with essential features such as clear fields for client details, payment terms, and itemized services or goods provided. With these forms, businesses can ensure consistent billing practices and minimize errors that could lead to payment delays.

Whether you’re a freelancer, a consultant, or a small shop owner, there are numerous free options available online. These customizable forms are easy to download and adapt to your specific needs, making them an excellent choice for businesses looking to maintain professionalism without extra costs.

Benefits of Using Free Forms:

- Cost-effective: No need to purchase expensive software or hire a designer.

- Time-saving: Pre-designed forms are ready to use, reducing preparation time.

- Customization: Tailor the document to reflect your brand’s style and requirements.

- Professionalism: Clean, organized documents that help build trust with clients.

Creating Professional Invoices with Ease

Crafting a well-organized and professional payment request doesn’t have to be complicated. With the right structure in place, you can easily generate a document that not only looks polished but also effectively communicates the details needed for your client to process payment promptly. A streamlined approach allows you to save time and minimize errors, all while maintaining a high standard of professionalism.

Steps for Creating a Clean and Clear Payment Request

Follow these simple steps to create a professional payment request document:

- Start with Clear Contact Information: Ensure both your business and the client’s contact details are clearly visible at the top of the document.

- Provide a Detailed Breakdown: Include a list of services or products provided, including quantities, unit prices, and any applicable discounts.

- Highlight Payment Terms: Clearly state the payment due date, method, and any late fees if applicable.

- Keep it Simple and Organized: Use sections, lines, or tables to keep the document easy to read and well-organized.

Tools to Simplify the Process

There are numerous tools available online that can help automate and simplify the process of creating professional payment requests. Many of these tools allow you to:

- Customize Layouts: Adjust the document’s structure to fit your branding needs.

- Generate Recurring Requests: Set up templates that can be reused for regular clients.

- Track Payments: Some tools automatically track payments and remind clients of overdue balances.

By using these tools, you can produce professional-looking documents quickly, helping you stay organized and maintain a good relationship with your clients.

Common Mistakes in Invoice Design

When creating a formal document for requesting payment, small errors in design can lead to confusion, delays, and even disputes with clients. The layout, structure, and clarity of the information are all crucial for ensuring smooth transactions. Avoiding common mistakes in the document’s design can help maintain professionalism and foster trust with clients. In this section, we will discuss the most frequent pitfalls and how to avoid them.

Frequent Design Mistakes

Here are some common mistakes to watch out for when creating your payment request document:

- Overcomplicated Layout: Too many colors, fonts, or cluttered sections can make the document hard to read. Keep the design clean and straightforward.

- Missing Essential Details: Failing to include critical information such as payment terms, due dates, or the breakdown of services can cause confusion and delay payments.

- Inconsistent Formatting: Using inconsistent fonts, font sizes, or alignment can create an unprofessional appearance and distract from the important details.

- Lack of Client Identification: Not clearly specifying the client’s name and contact details can lead to miscommunication, especially if multiple clients are involved.

How to Fix These Mistakes

By making a few simple adjustments, you can avoid these common errors and create a more effective document. Below is a table showing a simple structure to follow:

| Element | Best Practice |

|---|---|

| Design | Keep it simple, use clear fonts, and leave plenty of white space for readability. |

| Contact Information | Clearly display both your and the client’s contact details at the top of the document. |

| Service Breakdown | Provide a clear list of services or products, including quantities and prices. |

| Payment Terms | Always specify the payment due date, method, and any applicable late fees. |

By avoiding these mistakes and following best practices, you can ensure that your payment request documents are professional, clear, and effective, helping you get paid on time and with minimal hassle.

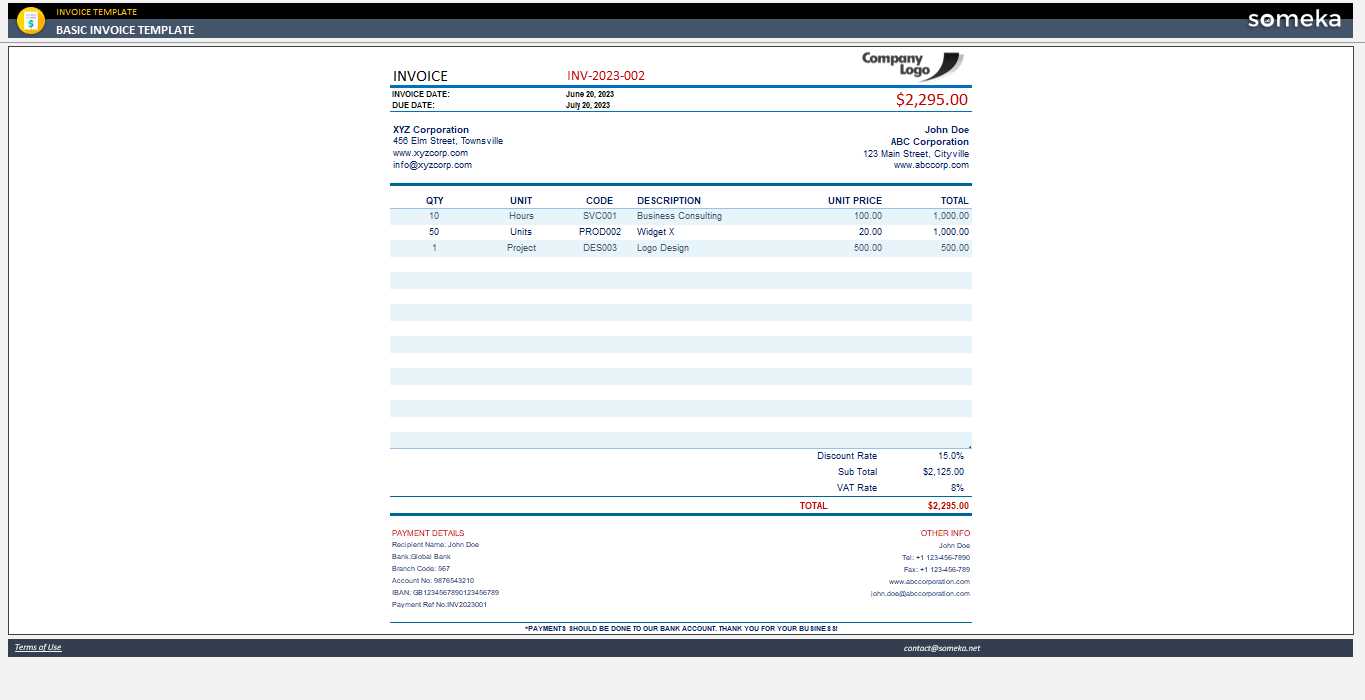

Best Formats for Accounting Invoices

Choosing the right format for your payment request document is essential for ensuring clarity and efficiency in your billing process. A well-organized structure can make it easier for both you and your clients to understand the details of the transaction, ultimately helping to expedite payments. Different formats cater to various business needs, depending on the type of services or products provided and the complexity of the transaction.

Traditional Paper vs. Digital Formats

When it comes to choosing a format, businesses generally have two main options: traditional paper documents or digital versions. Each has its own advantages, depending on your workflow and client preferences:

- Paper Documents: Useful for businesses that prefer physical copies for record-keeping or clients who request paper bills. Paper forms can be printed and mailed to clients, but they take longer to process and track.

- Digital Documents: The most efficient option for most modern businesses, as they can be created, sent, and tracked easily. Digital formats can be customized to include hyperlinks for online payment options and can be stored for long-term record-keeping without physical space requirements.

Popular Document Formats for Payment Requests

Here are a few of the most commonly used formats for creating payment requests:

- PDF Format: Widely used due to its universal compatibility and easy-to-read structure. PDFs are perfect for both digital and printed documents, ensuring that the layout remains consistent across different devices.

- Word Documents: Ideal for businesses that want a more flexible format. Word files can be easily edited, allowing you to customize the document before sending it to clients.

- Excel Spreadsheets: Best for businesses with multiple line items, as it allows easy calculations and the ability to create detailed tables. Excel files can also be used for tracking and managing multiple transactions at once.

Selecting the right format ultimately depends on your business needs and how your clients prefer to receive and process payment requests. By understanding the benefits of each format, you can choose the one that enhances your workflow and ensures timely payments.

Invoice Template for Freelancers and Contractors

Freelancers and independent contractors often juggle multiple clients and projects, making it essential to have a clear and professional way to request payment. A well-organized document not only helps streamline the billing process but also ensures that all necessary details are included, making it easier for clients to process payments without confusion. Having a pre-designed format for these requests can save time and reduce administrative burdens, allowing freelancers to focus on delivering high-quality work.

Essential Elements for Freelance Payment Requests

When creating a payment request document for freelance work, there are several key elements to include that ensure both clarity and professionalism:

- Freelancer Information: Clearly list your name or business name, contact details, and any relevant tax identification numbers.

- Client Information: Include the client’s name, address, and contact details to avoid confusion, especially when working with multiple clients.

- Detailed Breakdown of Services: Include a description of the services provided, hours worked, or deliverables, along with the agreed-upon rate.

- Total Amount Due: Make sure to clearly show the total amount the client owes, including any taxes or additional charges.

- Payment Terms: Specify the payment due date, accepted payment methods, and any penalties for late payments.

How to Streamline the Billing Process

For freelancers and contractors, streamlining the billing process can significantly improve cash flow and reduce delays. By using a standard document for every client, you ensure that all necessary details are always included. Additionally, using a digital version of the document allows you to easily customize it for each client and keep track of outstanding payments. Tools like online invoicing platforms can further simplify the process by automatically generating the document, sending it to the client, and even tracking when the payment is made.

How to Track Payments with Templates

Tracking payments efficiently is crucial for maintaining healthy cash flow and managing finances. Using a standardized document for each transaction can simplify this process and help you stay organized. By incorporating tracking features into your payment request form, you can easily monitor whether clients have paid, when they made the payment, and if any outstanding amounts need to be followed up on.

Incorporating Payment Tracking into Your Documents

Many businesses use customizable documents that include sections specifically designed for payment tracking. Here are some ways to integrate this feature into your payment request forms:

- Payment Status: Add a “Payment Status” section where you can mark whether the payment is “Paid,” “Pending,” or “Overdue.” This gives you a quick overview of the status of each transaction.

- Payment Date: Include a field for the date when the payment is made. This helps you keep accurate records and ensures that you track the payment timeline.

- Payment Method: Clearly list the method of payment (e.g., bank transfer, credit card, PayPal), so you can easily identify how each payment was processed.

Tools to Enhance Payment Tracking

For businesses that deal with multiple clients, using digital documents or invoicing software can further simplify payment tracking. These tools often allow you to:

- Automatically Update Status: Once a payment is received, the document can automatically update to reflect the status as “Paid.”

- Send Payment Reminders: Set up automatic reminders for clients with overdue payments, helping reduce the chances of missed deadlines.

- Generate Reports: Many invoicing platforms can generate financial reports that summarize your incoming payments over a specific period, giving you a clear overview of your business’s cash flow.

By incorporating payment tracking into your payment request documents, you can save time, reduce errors, and ensure timely follow-ups for outstanding payments. Whether you’re using a simple form or a more sophisticated tool, the ability to track payments is essential for managing your business finances effectively.

Benefits of Using an Invoice Template

Using a pre-designed document to request payments can greatly simplify the billing process for businesses of any size. A standardized structure ensures that all necessary details are included, reducing errors and minimizing the time spent on administrative tasks. With a well-organized form, you can maintain consistency, professionalism, and accuracy in all your financial transactions.

Key Advantages of a Pre-Formatted Payment Request

Here are some of the most significant benefits of using a pre-designed document for payment requests:

- Time Efficiency: Instead of creating a new document for each transaction, you can use a ready-made structure and only need to fill in the relevant details, saving you valuable time.

- Consistency: Using the same format for every request helps maintain uniformity across your business communications, making your requests look more professional and organized.

- Reduced Errors: A structured format minimizes the chance of missing critical information such as due dates, payment terms, or item descriptions.

- Improved Cash Flow: By ensuring that your payment request documents are clear and complete, you can encourage timely payments from clients, improving your overall cash flow.

How a Standardized Document Enhances Professionalism

By using a consistent format, you present yourself as a professional business to your clients. This can help build trust and strengthen your brand. Additionally, a clear and organized document makes it easier for clients to process your request and reduces the likelihood of misunderstandings.

| Benefit | How It Helps Your Business |

|---|---|

| Time Efficiency | Saves time on document creation, allowing you to focus on core business tasks. |

| Consistency | Maintains a uniform appearance across all client communications, reinforcing professionalism. |

| Reduced Errors | Helps avoid mistakes like missing information or incorrect details, ensuring smoother transactions. |

| Improved Cash Flow | Encourages faster payments by providing clear and detailed payment instructions. |

By incorporating a standardized document into your business operations, you can streamline your billing process, enhance client relationships, and ensure more reliable cash flow.

Digital vs Paper Invoices for Accounting

When choosing between digital and paper payment request forms, businesses need to consider factors like cost, efficiency, and convenience. Both options have their advantages and drawbacks depending on the nature of the business, the volume of transactions, and client preferences. The decision to use one over the other can have a significant impact on how quickly payments are processed, how easy it is to track finances, and the overall administrative workload.

Advantages of Digital Payment Requests

Digital payment requests have become increasingly popular due to their convenience and speed. Below are some of the key benefits:

- Cost-Effective: Digital documents eliminate the need for paper, ink, and postage, reducing overall administrative costs.

- Faster Processing: Sending digital requests via email or through online platforms speeds up delivery and allows clients to make payments more quickly.

- Automation Features: Many online platforms offer automated reminders, payment tracking, and integration with accounting software, streamlining the entire billing process.

- Environmental Benefits: Reduces paper usage, contributing to a greener and more sustainable business operation.

- Easy Record Keeping: Digital files can be stored, organized, and searched efficiently, making it easier to track payments and reconcile accounts.

Benefits of Paper Payment Requests

While digital documents are becoming more common, paper payment requests may still be preferred by certain businesses or clients. Some of the benefits include:

- Personal Touch: For clients who prefer traditional communication methods, a physical document can feel more personal and professional.

- Less Dependence on Technology: For businesses in areas with limited internet access or clients who prefer paper, physical documents may be the preferred method.

- Guaranteed Delivery: While digital requests may end up in spam folders or get lost in email chains, paper documents are more likely to be received and noticed.

- No Need for Software: Paper requests do not require any special software or internet access to create, send, or receive, which may be ideal for businesses with limited technical resources.

Ultimately, the choice between digital and paper payment requests depends on the needs of your business and the preferences of your clients. Many businesses find that a combination of both methods works best, allowing flexibility and ensuring that all clients can receive payment requests in their preferred format.

Integrating Invoice Templates with Accounting Software

Integrating standardized payment request documents with accounting software can significantly streamline the financial management process. By automating the creation and tracking of these documents, businesses can reduce manual data entry, minimize errors, and ensure accurate record-keeping. This integration helps to bridge the gap between billing and financial management, making it easier to monitor payments, generate reports, and keep track of outstanding balances.

Benefits of Integration

Integrating payment request forms with accounting platforms offers several key advantages for businesses:

- Automated Data Entry: By linking documents to your accounting software, client and transaction information can be automatically populated into payment requests, reducing the time spent on manual input.

- Real-Time Updates: Once a payment is received, the system can update the status of the transaction in both the document and the accounting software, ensuring that all records are current.

- Consistency Across Documents: Integration ensures that all payment requests follow the same structure and contain the correct information, helping maintain uniformity and professionalism.

- Improved Accuracy: With automation, the risk of human error in calculations and data entry is reduced, leading to more accurate financial records.

- Efficient Reporting: Integration allows for seamless generation of financial reports, providing business owners with a clear overview of their cash flow, outstanding payments, and overall financial health.

How to Integrate Payment Request Forms with Software

Most modern accounting platforms offer built-in tools to link with payment request documents. Here’s how to integrate your forms effectively:

- Choose the Right Software: Select accounting software that supports integrations with document creation tools or customizable payment forms.

- Link Client Data: Ensure that your software is connected to your client database so that contact information, payment terms, and transaction details can be automatically included in each payment request.

- Customize the Layout: Customize the layout of the payment request document to match your business’s branding and requirements, while ensuring it aligns with the accounting software’s capabilities.

- Enable Payment Tracking: Set up your system to track when payments are made and update the payment status automatically in the software, reducing manual follow-ups and ensuring accurate records.

By integrating payment request forms with accounting software, businesses can improve efficiency, reduce administrative tasks, and maintain accurate, up-to-date financial records with minimal effort.

How to Automate Invoice Creation

Automating the process of creating payment request documents can save time, reduce human error, and ensure consistency across all client communications. With the right tools, businesses can streamline their billing process, allowing for quicker document generation, easier tracking, and more efficient financial management. Automation eliminates the need for repetitive manual entries, freeing up valuable time for other tasks while maintaining accuracy in every transaction.

Steps to Automate Payment Request Creation

Here are some steps to help you automate the creation of your payment request forms:

- Choose Automation Software: Select a software or platform that supports automation for payment request documents. Many tools offer integrations with accounting systems and can automatically generate documents based on data from your client database.

- Set Up Templates: Design standardized forms that can be automatically populated with client and transaction details. Customizable fields allow you to adjust the document format for specific client needs or different types of services.

- Link Client Information: Integrate your automation tool with your client management system to ensure that client names, addresses, payment terms, and rates are automatically inserted into each document.

- Automate Due Dates and Reminders: Many automation tools allow you to set specific due dates for payments and automatically send reminders to clients as the due date approaches, improving cash flow and reducing late payments.

- Enable Payment Tracking: Some systems allow you to track payments in real time. When a payment is made, the system can update the payment request status, marking it as “Paid” or “Overdue” automatically.

Benefits of Automating Payment Requests

Automating the creation of payment documents provides several advantages for businesses:

- Time Savings: With automated document generation, there’s no need to create each request manually, allowing for faster billing cycles.

- Consistency: Automation ensures that all payment request documents follow the same format, reducing mistakes and presenting a professional image to your clients.

- Accuracy: By automatically filling in the necessary details, the risk of errors in calculations, client information, or payment terms is minimized.

- Improved Cash Flow: Automation can help ensure timely follow-ups, set reminders for overdue payments, and speed up the payment process.

- Reduced Administrative Work: By automating tasks such as document generation, reminders, and tracking, you can reduce the time spent on administrative tasks, allowing you to focus on other aspects of your business.

Automating your payment request process not only enhances operational efficiency but also helps maintain better financial oversight, ensuring that your billing system works seamlessly and improves the overall client experience.

Tips for Streamlining Your Billing Process

Streamlining your billing process is key to improving efficiency, reducing errors, and ensuring timely payments. A smooth and well-organized payment request system can save you time and effort, while also enhancing your client relationships. By adopting a few smart practices, you can simplify your billing cycle, eliminate unnecessary steps, and focus more on growing your business.

Steps to Simplify Your Billing System

Here are some actionable tips to help streamline your billing process:

- Use Standardized Forms: Create a uniform payment request form that you can reuse for all clients. This will save time and ensure consistency across all transactions.

- Automate Payment Reminders: Set up automatic reminders to notify clients of upcoming due dates or overdue payments. This helps reduce late payments and minimizes manual follow-ups.

- Leverage Digital Solutions: Move from paper-based requests to digital formats. Digital documents are easier to manage, send, and store, which reduces administrative overhead.

- Centralize Client Information: Store all client details, such as contact information and payment terms, in a centralized system. This ensures easy access to data when creating payment requests and reduces the chance of errors.

- Integrate with Payment Systems: Use software that integrates with online payment gateways. This makes it easy for clients to pay directly from the request, speeding up the transaction process.

- Track Payments in Real-Time: Use tools that automatically update the payment status once a transaction is completed. This helps you stay on top of payments without manual tracking.

Best Practices for Efficient Billing

In addition to the above steps, here are some best practices to consider when refining your billing process:

- Set Clear Payment Terms: Clearly define payment terms, including due dates, late fees, and acceptable payment methods. Transparency reduces confusion and ensures that clients know exactly what is expected.

- Offer Multiple Payment Options: Provide clients with various payment options such as credit cards, bank transfers, or online payment platforms. The easier it is for clients to pay, the faster you will receive payments.

- Maintain a Professional Appearance: Use a clean, easy-to-read layout for your payment requests. A professional-looking document reinforces your brand and ensures that all essential information is included.

- Consolidate Billing Periods: Instead of sending frequent requests, consider consolidating payments for multiple services or products into one request. This reduces administrative workload and makes it easier for clients to process payments.

- Review and Update Billing Processes Regularly: Periodically assess your billing process to identify areas for improvement. Streamlining and adjusting your methods can help you stay efficient as your business grows.

By imp

Maintaining Consistency in Invoicing Practices

Consistency in billing practices is essential for maintaining professionalism, ensuring accurate financial tracking, and building trust with clients. A uniform approach helps streamline the entire payment process, reduces confusion, and ensures that important details are never overlooked. By establishing clear guidelines and sticking to them, businesses can simplify their billing cycle and improve overall efficiency.

Why Consistency Matters

Consistency in billing has several key benefits for your business:

- Improved Accuracy: By following the same structure for each document, you minimize the chance of missing important details like payment terms, dates, and amounts.

- Professional Image: A consistent approach to billing gives clients the impression of a well-organized business, boosting your reputation.

- Faster Payment Processing: When clients are familiar with the format and details of your requests, they can process them more quickly, leading to faster payments.

- Easier Financial Management: Consistency makes it easier to track payments, reconcile accounts, and generate reports, improving your overall financial oversight.

How to Ensure Consistency

Here are some best practices to maintain consistency in your billing procedures:

- Standardize Document Layout: Use the same layout for every request to ensure clarity and uniformity. This includes consistent use of headings, font sizes, and logos.

- Set Clear Payment Terms: Always define payment terms, such as due dates, late fees, and accepted methods of payment, to avoid confusion with clients.

- Automate Recurrent Requests: For clients with regular billing schedules, automate the creation of recurring payment requests. This ensures all necessary information is included without the need for manual intervention.

- Maintain Accurate Client Records: Keep client contact information, billing addresses, and payment preferences up to date. This will ensure all details are correct every time you send a request.

- Review Billing Practices Regularly: Periodically evaluate your billing process to ensure that all practices align with your goals and client needs, and make adjustments as necessary.

By adhering to consistent practices, you ensure smoother operations, reduce errors, and create a more seamless experience for both your business and clients. Consistency is key in building trust and efficiency, both of which are vital to the long-term success of your business.