How to Create and Customize Dynamics 365 Invoice Template

Creating professional and functional billing documents is essential for businesses looking to streamline their financial processes. Tailoring these documents allows companies to meet specific needs, reflect their branding, and improve communication with clients. With the right approach, businesses can enhance accuracy, reduce errors, and maintain consistency in all transactions.

By configuring the right settings and incorporating dynamic elements, it’s possible to generate documents that not only capture the necessary information but also improve the overall customer experience. This section will guide you through customizing your billing solutions to fit your exact requirements.

Understanding the fundamentals of customization ensures you are well-equipped to modify your business tools and make them work for you. Whether you’re automating processes or manually adjusting details, making these adjustments is a step toward greater efficiency and professionalism.

Comprehensive Guide to Billing Document Customization

Customizing billing documents is an essential part of any business operation. The ability to create personalized and efficient billing records allows businesses to ensure accuracy, meet client expectations, and maintain a professional image. By adjusting specific settings, organizations can improve document quality and simplify financial processes.

This guide will walk you through the necessary steps to fully customize your billing documents, from layout design to data integration. The process involves understanding both the technical aspects and the functional needs of your business. With the right configuration, you can create documents that reflect your brand while remaining flexible for different scenarios.

- Setting up document structure: Learn how to define the layout of your billing documents, including where to place key information such as client details, dates, and payment terms.

- Customizing fields and data: Discover how to add or modify fields to match your business requirements, ensuring that all necessary information is included in every document.

- Incorporating branding elements: Understand how to include logos, color schemes, and other branding materials to align your billing documents with your company’s identity.

- Automating document creation: Explore how to automate the generation of billing records, saving time and reducing human error by using pre-defined formats and rules.

- Handling multiple currencies and taxes: Learn how to configure templates to handle different currencies, tax rates, and complex pricing structures for international transactions.

- Exporting and sharing documents: Understand the various export options available for sharing your customized documents, ensuring compatibility with different systems and formats.

By following these steps, you can ensure that your billing documents are not only functional but also professional and tailored to your business needs. This customization approach will help enhance operational efficiency and improve client satisfaction.

Understanding the Basics of Billing Document Layouts

To efficiently manage business transactions, it is crucial to understand the core elements that make up a well-designed document for recording payments and services. A proper layout ensures that all necessary information is captured clearly and is easy to read for both the business and the client. Familiarity with the key components helps in designing an effective document structure that meets legal, organizational, and customer needs.

At the heart of creating these documents is the ability to control the content, design, and flow. Customizing these aspects enables businesses to ensure accuracy while reflecting their brand identity. The primary goal is to produce a document that is both functional and visually appealing.

- Key fields: These are the essential sections where information such as client details, products/services provided, and payment terms are included.

- Document structure: Understanding how to arrange various elements–such as headers, tables, and footer sections–helps ensure clarity and coherence.

- Design considerations: Customizing the visual layout with logos, fonts, and colors can enhance the professional appearance of your documents.

- Dynamic content: Using adaptable sections that automatically update based on transaction details ensures that each document is personalized for each client.

- Legal requirements: Knowing the mandatory fields and formatting needed for compliance is essential to avoid legal issues and errors.

With a solid understanding of these basics, creating documents that serve both functional and branding purposes becomes an easier, more structured process. These documents are a critical touchpoint between a business and its customers, and getting them right is essential for smooth financial operations.

Setting Up the System for Billing Documents

Before you can start generating billing records, it is important to configure the system to support all necessary processes. Setting up the right parameters ensures smooth document creation, proper data flow, and integration with other business functions. This step involves selecting the correct settings, defining key elements, and ensuring all required fields are included to meet organizational and legal standards.

Configuring System Parameters

The first step in setting up your system is defining the basic parameters. This includes adjusting preferences for currency, tax rates, and default payment terms, which will automatically be applied when generating new records. By establishing these settings, you save time on manual data entry and reduce the risk of errors.

| Parameter | Description | Recommended Setting |

|---|---|---|

| Currency | Select the default currency for all transactions | USD (or local currency) |

| Tax Rates | Set up default tax rules applicable to products and services | Standard VAT rate |

| Payment Terms | Specify the default terms for payments (e.g., net 30) | Net 30 |

Integrating Key Business Data

Next, you should integrate critical business information into the system. This includes linking customer profiles, products or services offered, and business contact information. The system will pull this data into each document, ensuring consistency and accuracy across all records.

Once set up, you will be ready to generate customized documents that contain all necessary details, ensuring professional communication with clients while improving efficiency and accuracy in your operations.

How to Create Custom Billing Document Layouts

Designing personalized billing records involves more than just filling out predefined fields. It’s about creating a layout that effectively communicates key details in a way that reflects your brand and meets business needs. Customizing the layout allows you to highlight important information, organize content logically, and maintain a professional appearance throughout all documents.

The process of creating a custom layout begins with understanding which elements are essential for your business transactions and how they should be presented. Whether you’re focusing on the arrangement of customer data, product details, or payment terms, the goal is to create a document that is both visually appealing and functional.

To get started with layout customization, consider the following steps:

- Define the structure: Decide how you want to organize key sections such as the header, body, and footer. Typically, the header includes your company logo and contact details, while the body lists products or services, and the footer contains payment instructions and legal disclaimers.

- Customize fields: Identify which fields are essential for your records and adjust their placement. Common fields include customer name, address, item description, quantities, pricing, and totals.

- Enhance branding: Incorporate your company’s visual identity into the document by adding colors, logos, and fonts that match your branding guidelines.

- Use dynamic elements: Implement dynamic fields that auto-fill based on transaction data to ensure each document is personalized and up-to-date.

- Ensure clarity: Focus on legibility and simplicity. Use clear fonts, proper spacing, and logical flow to make the document easy to read and understand.

By following these steps, you can create layouts that not only look professional but also enhance the clarity and functionality of your business records. Customizing the structure to fit your specific needs will help streamline operations and improve the overall customer experience.

Customizing Billing Document Fields

Customizing the fields within your billing documents allows you to tailor the information displayed to suit your business needs. By adjusting these fields, you ensure that all essential details are captured accurately and presented in a clear and organized manner. This process enables businesses to adapt their documents to different industries, regulatory requirements, and client expectations.

The customization process involves selecting the appropriate fields, arranging them in a logical order, and deciding which details are necessary for each transaction. This helps streamline document creation and ensures consistency across all communications with clients.

- Identify Required Information: Determine which fields are essential for your business operations. Common fields include customer name, billing address, products or services provided, quantities, and payment terms.

- Adjust Field Layout: Customize the position of each field to ensure that the most critical information stands out. Consider using tables or grids for better organization of product details and pricing.

- Add Custom Fields: In some cases, you may need to include additional information not covered by standard fields. Custom fields can be added to capture specific data such as order numbers, project names, or internal references.

- Ensure Accuracy: Double-check the logic behind the fields. Make sure that dynamic fields pull in the correct information, such as automatically calculating totals, taxes, or discounts based on the entries provided.

- Include Legal and Regulatory Information: Depending on your location or industry, you may need to include specific legal disclaimers or tax identification numbers. Customizing your fields ensures that these details are automatically included when necessary.

Once customized, the fields will provide a streamlined, consistent way of generating billing documents that are tailored to both business and client requirements. This customization not only improves the efficiency of the process but also enhances the professionalism of your communications.

Integrating Payment Terms in Documents

Integrating clear and consistent payment terms into your documents ensures that clients understand when and how they are expected to make payments. By including these terms within your billing records, you set clear expectations and streamline the payment process. Customizing the payment terms allows businesses to align their financial policies with client needs and regional requirements.

The key to integrating payment terms effectively is to ensure that they are visible, easily understood, and appropriate for each transaction. Whether you offer immediate payment options or extended terms, having these details included automatically helps maintain consistency across all communications.

- Defining Payment Terms: Clearly specify whether the payment is due immediately, within a set number of days, or based on specific milestones. Common options include net 30, net 60, or cash on delivery.

- Adjusting for Discounts: If you offer early payment discounts or other incentives, make sure these are reflected within the payment terms. Include clear instructions on how discounts are applied if the payment is made early.

- Late Payment Fees: Include any penalties or interest rates for late payments. Clearly state how these will be calculated and when they will be applied to overdue accounts.

- Payment Methods: List the acceptable payment methods (e.g., bank transfer, credit card, or online payments) and ensure they are easily accessible for the customer.

- Automatic Payment Reminders: Set up automatic reminders to notify clients of approaching or overdue payments, improving your collection process and reducing manual follow-ups.

By integrating these payment terms directly into your documents, you simplify the payment process, improve cash flow, and maintain professionalism in every transaction. Clear and consistent terms can help minimize misunderstandings and encourage timely payments, benefiting both your business and your clients.

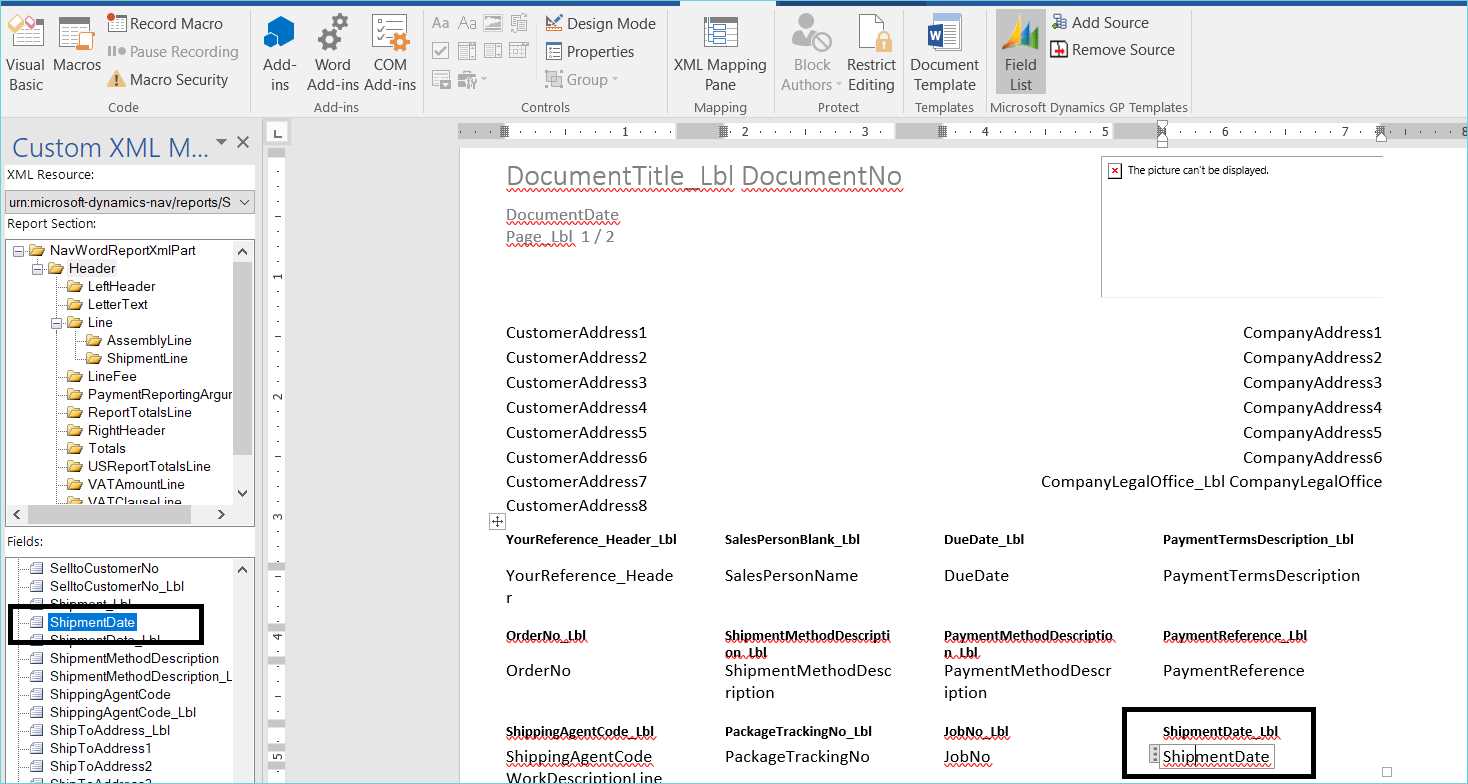

Working with Dynamic Data Fields in Billing Documents

Dynamic data fields allow businesses to automate and personalize their billing records, making each document unique to the specific transaction. By incorporating these fields, businesses can reduce the time spent manually entering information and ensure accuracy. Dynamic fields are automatically populated with relevant data, such as customer details, products or services, and amounts, based on the context of the transaction.

Understanding how to configure and work with these dynamic fields can significantly improve the efficiency of creating financial documents. Whether you’re dealing with regular customers or handling one-time transactions, dynamic fields can adjust to include the most relevant information for each case.

Benefits of Dynamic Fields

Dynamic fields offer several advantages when creating billing documents:

- Automation: Automatically pulling data from your system reduces the need for manual entry, saving time and minimizing errors.

- Personalization: These fields ensure that each document contains specific details, making it more relevant and professional for the recipient.

- Consistency: By using the same dynamic fields across all documents, you maintain uniformity in the structure and content of your records.

- Accuracy: Dynamic fields help ensure that the correct pricing, quantities, and client information are included, reducing the risk of discrepancies.

Configuring Dynamic Fields

To work with dynamic fields effectively, follow these steps to configure them within your system:

- Select the Appropriate Fields: Choose which fields should be dynamic based on the document type. This might include customer name, service description, quantities, or totals.

- Map Data Sources: Link the dynamic fields to the appropriate data sources in your system. Ensure that each field pulls from the correct database or record.

- Test and Verify: After configuring the fields, conduct tests to ensure that the correct data is populated and that no fields are missing or misrepresented.

- Maintain Flexibility: Dynamic fields should be adaptable to different business processes, so ensure they can be easily updated if your business requirements change.

By incorporating dynamic fields into your billing documents, you not only automate repetitive tasks but also enhance the professionalism and accuracy of your communications. These fields streamline your workflow, saving valuable time and improving customer satisfaction.

Adding Company Branding to Billing Documents

Incorporating company branding into your billing documents is essential for maintaining a consistent professional appearance across all client communications. Customizing these documents to reflect your brand helps establish trust and recognition, while also ensuring that your materials align with your overall business identity. From logos to color schemes, branding elements can be seamlessly integrated to create a polished and cohesive look.

Branding your documents is more than just adding a logo; it involves strategically placing elements that represent your company’s values and visual identity. This process allows clients to immediately recognize your business, even in the context of financial documentation.

- Logo Integration: Place your company logo prominently at the top of the document. This is often the first thing clients will see and it helps reinforce brand recognition.

- Color Scheme: Use your brand’s color palette throughout the document. Apply these colors to headings, borders, and background elements to create a cohesive and professional appearance.

- Typography: Choose fonts that reflect your brand’s style, whether modern, traditional, or casual. Make sure they are easy to read and complement the overall design.

- Contact Information: Include your company’s contact details in a consistent and visible location. This can be in the header or footer and should match the style used in other marketing materials.

- Tagline or Slogan: If your company has a tagline, consider incorporating it subtly in the document. This reinforces your message and strengthens your brand identity.

By adding these branding elements, you ensure that your billing documents not only fulfill their practical function but also reinforce your company’s image. A well-branded document is a reflection of your business’s professionalism and attention to detail, which can help foster stronger relationships with clients.

Utilizing Pre-built Billing Document Layouts

Using pre-designed layouts for your billing records can significantly streamline the process of creating professional and consistent documents. These ready-made designs come with standard fields and structure, allowing businesses to quickly generate documents without needing to start from scratch. Pre-built layouts help save time, maintain consistency, and ensure that all essential information is included in each record.

By leveraging these layouts, companies can avoid the hassle of manually designing each document. Instead, they can focus on inputting specific details, knowing that the layout is already optimized for clarity and professionalism. Additionally, many pre-built designs are customizable, allowing businesses to make minor adjustments to better suit their unique needs.

- Time-saving: Pre-built layouts provide a quick solution for generating consistent and accurate documents, freeing up valuable time for other business activities.

- Consistency: Using a standard layout ensures that all your records are uniform, which helps reinforce your brand’s image and maintain a professional appearance.

- Easy Customization: While the layout is pre-designed, you can still adjust the content to fit your specific business needs, adding details like your company logo, payment terms, or custom fields.

- Regulatory Compliance: Many pre-designed layouts are created with industry standards and legal requirements in mind, making it easier to ensure your documents meet necessary regulations.

- Accessibility: Pre-built layouts are often compatible with various software platforms, making them easy to integrate into your existing workflow without extensive training or setup.

Pre-designed billing layouts are an effective tool for businesses looking to streamline their document creation process. They provide a reliable foundation for producing accurate, professional, and compliant records while saving time and reducing errors.

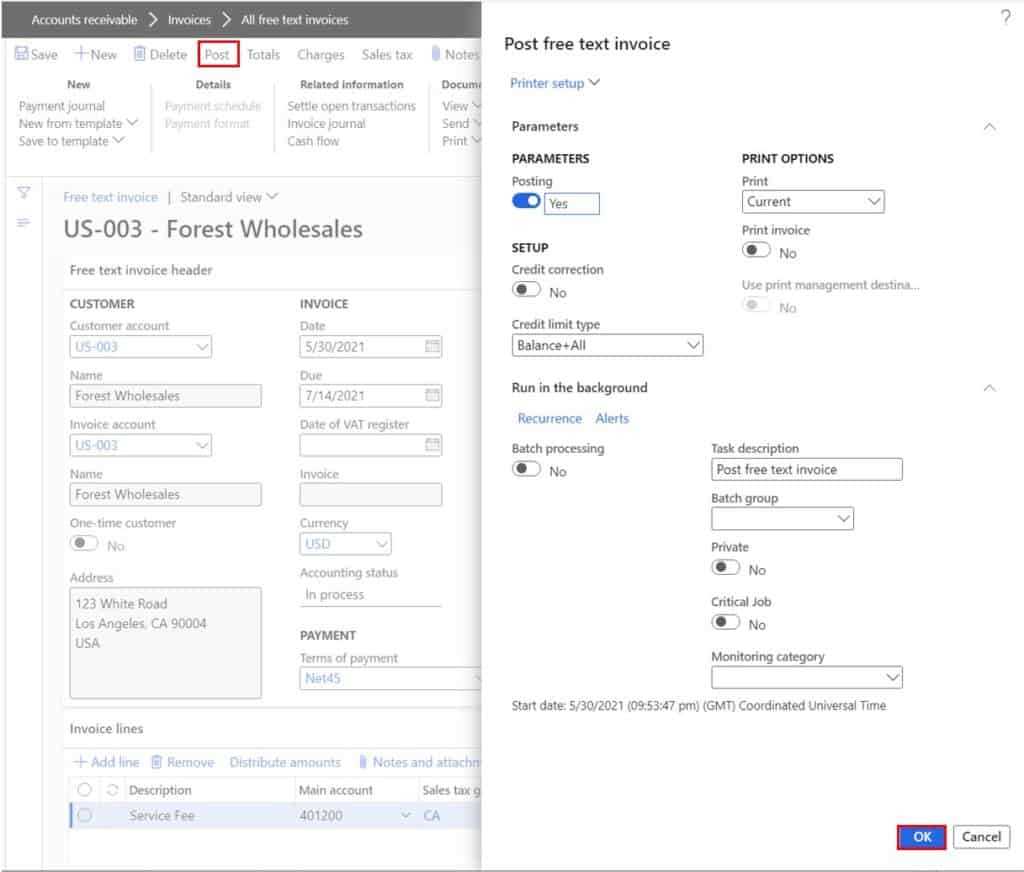

Automating Billing Document Creation

Automating the process of generating billing documents can greatly improve efficiency and accuracy within a business. By setting up automated workflows, businesses can ensure that every transaction is accompanied by the correct document without requiring manual intervention. Automation helps reduce the time spent on repetitive tasks, eliminates human error, and accelerates the entire process, allowing companies to focus on more strategic activities.

With automated billing document generation, all relevant information is pulled from your system, ensuring that each document is created with up-to-date details, including customer information, product descriptions, pricing, and terms. This system-driven process is not only faster but also ensures consistency across all your financial records.

Setting Up Automation

To automate the creation of your billing records, follow these steps:

- Define Triggers: Determine the events that will trigger the automatic creation of a document, such as a completed sale or a service rendered.

- Configure Data Sources: Link the automation process to your customer database and sales system, ensuring that all relevant details (e.g., customer names, amounts, dates) are populated correctly.

- Customize Document Layout: Choose the layout and format that suits your business needs, ensuring that all necessary fields are included in the automatically generated document.

- Test and Verify: Before going live, thoroughly test the automation system to ensure that all information is correctly inserted into the document and that the workflow functions as expected.

Benefits of Automation

By automating the creation of billing documents, businesses can enjoy several key benefits:

- Time Savings: Automation significantly reduces the time spent on manual entry and document creation, freeing up employees for more value-added tasks.

- Accuracy: Automatic data population reduces the risk of human errors, ensuring that all financial records are precise and reliable.

- Consistency: Automated processes ensure that all documents adhere to the same structure and format, providing a uniform experience for clients.

- Efficiency: With automated workflows, businesses can generate large volumes of documents quickly, improving overall operational efficiency.

Automating the creation of billing documents streamlines operations, enhances accuracy, and ensures that businesses can respond quickly to customer needs without sacrificing attention to detail.

Handling Multiple Currencies in Billing Documents

When operating internationally, it is essential to manage various currencies in your financial documents. Handling multiple currencies ensures that your clients from different regions receive accurate and relevant pricing information. With the right configuration, you can create billing records that automatically adjust to the correct currency based on the client’s location or preferences.

Properly managing multiple currencies in financial records involves not only converting amounts but also ensuring the correct exchange rate is applied, the appropriate currency symbols are displayed, and all calculations are accurate. This can be automated through integration with financial systems to ensure that clients receive the most up-to-date pricing and avoid discrepancies caused by manual conversions.

Steps to Handle Multiple Currencies

To effectively manage multiple currencies, follow these key steps:

- Enable Currency Fields: Ensure your financial system supports multiple currencies and enables fields that can display different currency symbols and exchange rates.

- Set Exchange Rates: Regularly update exchange rates to reflect market conditions. Some systems allow you to automatically pull live rates from financial sources.

- Client Currency Preferences: Store each client’s preferred currency in their profile, so the system can automatically apply the right currency when generating a document.

- Multi-Currency Formatting: Customize the format for each currency, ensuring that numbers, symbols, and decimals are correctly displayed for each region’s standards.

- Cross-Currency Calculations: Ensure that your system can handle calculations between different currencies and apply the proper exchange rate for each transaction.

Benefits of Managing Multiple Currencies

By handling multiple currencies efficiently, businesses can achieve several benefits:

- Global Reach: Serving international clients becomes smoother, as documents are automatically tailored to the client’s location or preferences.

- Improved Accuracy: Automating currency conversions and rate applications reduces the risk of human error and ensures consistency across all documents.

- Enhanced Client Experience: Clients will appreciate receiving documents in their local currency, which can help build trust and strengthen business relationships.

- Operational Efficiency: Managing multiple currencies through automated systems saves time and ensures that financial processes run smoothly, even across regions.

By implementing these strategies, businesses can seamlessly manage multiple currencies, making international transactions more efficient and transparent.

Creating Detailed Itemized Billing Statements

Providing a clear and comprehensive breakdown of charges is essential for maintaining transparency and trust with your clients. Detailed itemized billing statements allow customers to understand exactly what they are being charged for, how much each item or service costs, and any additional fees or discounts that may apply. By clearly outlining all costs, businesses can reduce disputes and enhance customer satisfaction.

To create an effective itemized billing statement, it is crucial to list each product, service, or charge separately, including relevant details such as quantities, unit prices, and total amounts. This level of detail ensures that the client fully understands the charges and can easily verify the accuracy of the statement.

Steps to Create Detailed Statements

Follow these steps to create a well-structured, itemized billing statement:

- List Each Item Separately: Ensure every product, service, or charge is displayed as a distinct line item, including clear descriptions and quantities.

- Provide Unit Prices: Include the cost per unit for each item, whether it is a product or service, to help clients understand how the total price is calculated.

- Include Taxes and Additional Fees: Clearly list any taxes, shipping fees, or other additional charges that apply to the overall total.

- Apply Discounts and Adjustments: If applicable, specify any discounts or price adjustments that have been applied to reduce the final amount due.

- Provide a Clear Total: Sum up all the charges, ensuring that the final amount reflects all items, taxes, fees, and discounts.

Advantages of Detailed Itemized Statements

There are several benefits to providing detailed itemized statements to clients:

- Increased Transparency: Clients appreciate the clarity of seeing exactly what they are being charged for, which helps build trust and reduce misunderstandings.

- Better Record Keeping: Itemized statements provide a detailed record for both clients and businesses, making it easier to track expenses and resolve disputes.

- Improved Customer Relationships: When clients feel confident in the accuracy and fairness of their billing statements, they are more likely to return for future business.

- Enhanced Professionalism: Offering itemized statements reflects professionalism and attention to detail, improving the overall reputation of the business.

By providing clear, itemized billing statements, businesses can enhance client satisfaction, improve communication, and ensure a smoother billing process.

How to Apply Tax Rules to Billing Documents

Correctly applying tax regulations to billing documents is a critical step in ensuring compliance with local and international laws. Tax rules can vary depending on the region, the type of goods or services provided, and the tax status of both the business and the customer. It is essential to automate and standardize tax calculations to ensure accuracy and avoid costly mistakes.

By setting up automated tax rules within your billing system, you can ensure that the appropriate tax rates are applied based on various factors such as the location of the transaction, the type of product or service, and any exemptions that might apply. Properly configured tax rules help streamline the billing process and reduce the administrative burden of manually calculating taxes.

Steps to App

Setting Up Invoice Numbering Systems

Establishing an efficient numbering system for billing documents is a crucial part of financial management. A clear and systematic approach to numbering ensures easy tracking, reference, and organization of transactions. Whether for internal record-keeping or compliance with regulatory standards, the numbering system must be both unique and sequential to avoid confusion and duplication.

The main goal of a structured numbering system is to provide clarity and order. This system should be adaptable to your business needs, whether you’re managing hundreds or thousands of transactions. A consistent approach helps with both daily operations and long-term financial reporting, making it easier to find, retrieve, and audit documents as necessary.

Steps to Set Up a Numbering System

To set up an effective numbering system for your billing documents, consider the following steps:

- Define Number Format: Determine the structure of the number. It might include elements like the year, month, department code, or transaction type. For example, a number like “INV-2023-0045” could indicate the invoice type, year, and a sequential number.

- Ensure Uniqueness: Every document should have a unique number. Implement systems that automatically increment numbers for each new entry, ensuring no duplicates.

- Set Starting Point: Choose a starting number that fits your system. It might start from 001 or another meaningful number that aligns with your business cycle.

- Automate Number Generation: Utilize software or systems that automatically generate numbers based on predefined rules. This reduces the risk of human error and ensures consistency.

- Consider Prefixes and Suffixes: Adding prefixes or suffixes to the number can help categorize documents by type or department, which can be useful for large organizations or businesses with multiple divisions.

Benefits of a Structured Numbering System

Implementing a consistent numbering system for billing documents provides several key advantages:

- Better Organization: A clear numbering system makes it easier to track and find documents, saving time in retrieval and reference.

- Improved Compliance: Many regulations require businesses to maintain a clear and consistent system of numbering for audit purposes, making your system crucial for legal compliance.

- Enhanced Transparency: Unique and sequential numbers prevent confusion and ensure transparency in your financial records, making it easy for customers and auditors to verify transactions.

- Efficient Reporting: A systematic numbering structure makes reporting more accurate and simplifies reconciliation processes when dealing with multiple documents or financial periods.

Setting up a well-organized and automated numbering system for your billing documents ensures that your business operates smoothly, maintains accurate record

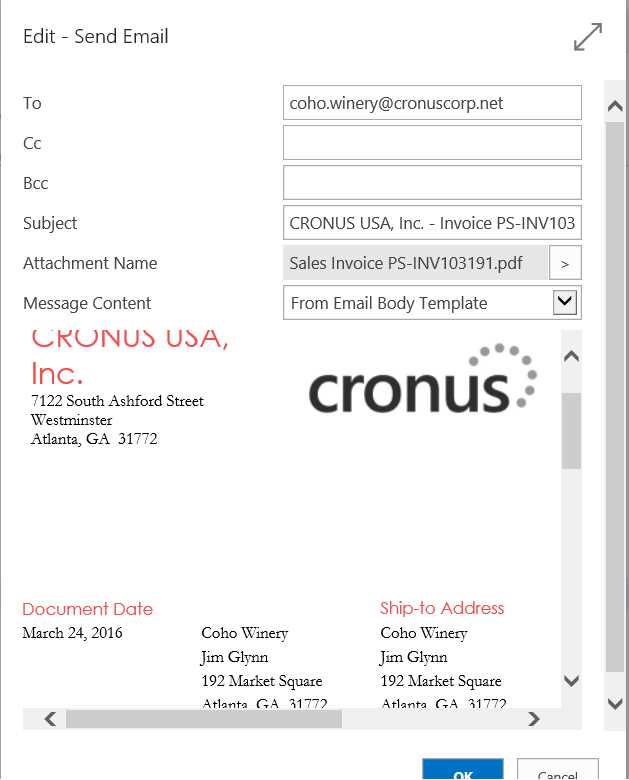

Exporting and Sharing Invoice Templates

Sharing and exporting billing document layouts is essential for collaboration and seamless workflow management. Whether you need to send an updated version to your team, share it with clients, or archive it for future reference, having the capability to export and distribute documents efficiently ensures smooth operations. The process allows you to provide stakeholders with consistent and up-to-date versions of your business documents.

There are various formats and methods available for exporting and sharing these documents, ensuring flexibility in how they are utilized or transmitted. Below are the common options for exporting and sharing billing layouts:

| Format | Description | Use Case |

|---|---|---|

| Portable Document Format is widely used for sharing and preserving the layout and design. | Ideal for sending via email or printing for official documentation. | |

| Excel | Spreadsheet format allows easy manipulation and customization of data. | Useful for editing calculations or bulk data adjustments before sharing with clients or teams. |

| Word | Document format for those needing a customizable layout with text fields. | Perfect for generating formal documents that can be further edited or personalized. |

| CSV | Comma-separated values for exporting data without formatting, often used for further processing. | Best for transferring large datasets or integrating with other software systems. |

In addition to exporting, sharing these documents internally or with clients can be done through various methods, depending on your business needs:

- Email: Attach the exported file directly to an email for easy sharing with clients, colleagues, or external partners.

- Cloud Storage: Upload the document to platforms like Google Drive or Dropbox for access from any device and by multiple users.

- Printing: If a physical copy is required, documents can be printed directly from the chosen export format.

- Software Integration: For businesses with automated workflows, exporting and sharing can be integrated into accounting or customer relationship management (CRM) systems.

By leveraging the correct export formats and distribution channels, you ensure that your business documents are accessible and usable by all necessary parties while maintaining consistency and accuracy.

Troubleshooting Common Invoice Template Issues

While using custom billing document formats, users often encounter various challenges that can affect the appearance or functionality of the final output. Understanding the common problems and knowing how to address them ensures smooth document generation and delivery. Whether it’s issues with formatting, missing data, or incorrect calculations, troubleshooting these problems can be done systematically to identify the root cause and resolve it efficiently.

Below are some of the most common issues users face when working with billing documents, along with steps to troubleshoot and resolve them:

- Misaligned Fields: If text or fields appear misaligned in the final document, it may be caused by incorrect layout settings or inconsistent use of margins and padding.

- Check that all fields are properly aligned and the spacing between them is uniform.

- Adjust the page layout settings or use grid lines to ensure correct positioning.

- Missing Data: Data fields may not display the expected information, or they may appear blank.

- Ensure that all relevant data is being pulled from the correct source.

- Check for any missing links or incorrect field mappings in the document setup.

- Verify that all required fields are populated in the system before generating the document.

- Incorrect Calculations: Sometimes the amounts or totals displayed in the document are incorrect.

- Review any formulas or calculations used in the document to ensure they are correct.

- Test individual data inputs to ensure that they are being processed accurately.

- Formatting Errors: Font sizes, colors, or other styling elements may not appear as expected.

- Double-check the formatting settings for text and numbers to ensure they are applied consistently across the document.

- Ensure that any custom styles are properly defined and supported by the document editor.

- Export Problems: The document might not export correctly to the chosen format.

- Check the compatibility of the export format with the document structure.

- Ensure that any necessary plugins or add-ons for exporting are properly installed and configured.

If these troubleshooting steps do not resolve the issue, consider reaching out to support services or consulting the documentation to find specific solutions for your system. Regularly updating software and reviewing system settings can also prevent many of these common issues from arising.