How to Use an Invoice Note Template for Streamlined Billing

In any business, clear and accurate financial communication is essential for maintaining strong relationships with clients and ensuring timely payments. Having a well-organized system for documenting transactions can save time, reduce errors, and improve the overall efficiency of your billing process. This is where customizable billing documents come into play, offering a streamlined way to track and communicate payment details.

Using a pre-designed structure for your financial statements not only saves time but also helps ensure that important information is consistently included. Whether you’re dealing with small service fees or larger transactions, a structured format can give your documents a polished, professional look. With the right tool, creating detailed billing records becomes an effortless task that you can easily adapt to suit your business’s needs.

Customizing these forms to reflect your brand, and adding specific payment terms, is an excellent way to maintain a professional image. In this guide, you’ll learn how to create the perfect document that fits your business and its requirements, while also ensuring you meet legal and financial standards.

What is an Invoice Note Template

When managing financial transactions with clients, having a clear and structured way to document payments is crucial. A well-designed document serves as a formal record of the terms of a transaction, providing both the sender and the recipient with a detailed summary of the agreement. This system helps ensure transparency, reduce confusion, and maintain a professional approach to billing.

Purpose of a Billing Document

Such documents are typically used to communicate essential details such as amounts owed, services provided, and payment deadlines. They can act as a reminder for clients, ensuring that all important information is clearly outlined. These documents are also useful for keeping accurate financial records, whether for tax purposes or general accounting.

Customization for Specific Needs

Customizing these forms allows businesses to tailor them to their specific needs. Adding company branding, payment terms, or even personalized messaging ensures that each document is aligned with your business identity. This makes the document not only functional but also an extension of your brand’s professionalism.

Benefits of Using an Invoice Note Template

Implementing a structured format for billing documents can provide a range of advantages that enhance both efficiency and professionalism. By using a pre-designed structure, businesses can streamline their financial processes, ensuring that every essential detail is included and clearly communicated. The use of such forms not only saves time but also helps maintain consistency across all transactions.

- Time Savings: Pre-designed forms reduce the amount of time spent creating each document from scratch. With a reusable structure, you can quickly fill in the necessary details and generate records efficiently.

- Consistency: A standard layout ensures that all billing documents are uniform, which enhances clarity and prevents any information from being overlooked.

- Professionalism: A polished, well-structured form helps create a strong, professional impression with clients. It reflects attention to detail and fosters trust.

- Accuracy: With predefined fields for important data, there’s less chance of omitting crucial information, reducing the likelihood of errors and misunderstandings.

- Customization: Many formats allow for personalization, so you can add company logos, payment terms, or specific client details to match your business needs.

- Legal Compliance: Structured formats often include the essential elements required for legal purposes, helping you stay compliant with financial regulations.

By adopting a standard approach to creating financial records, businesses can achieve a smoother workflow, better organization, and clearer communication with clients, ultimately leading to improved cash flow and stronger professional relationships.

How to Create an Invoice Note

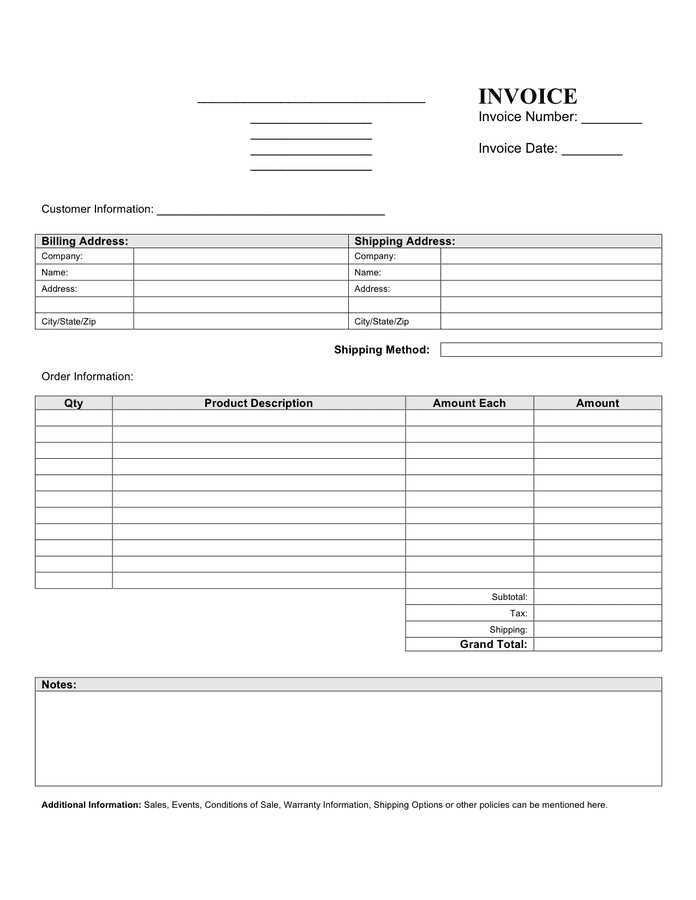

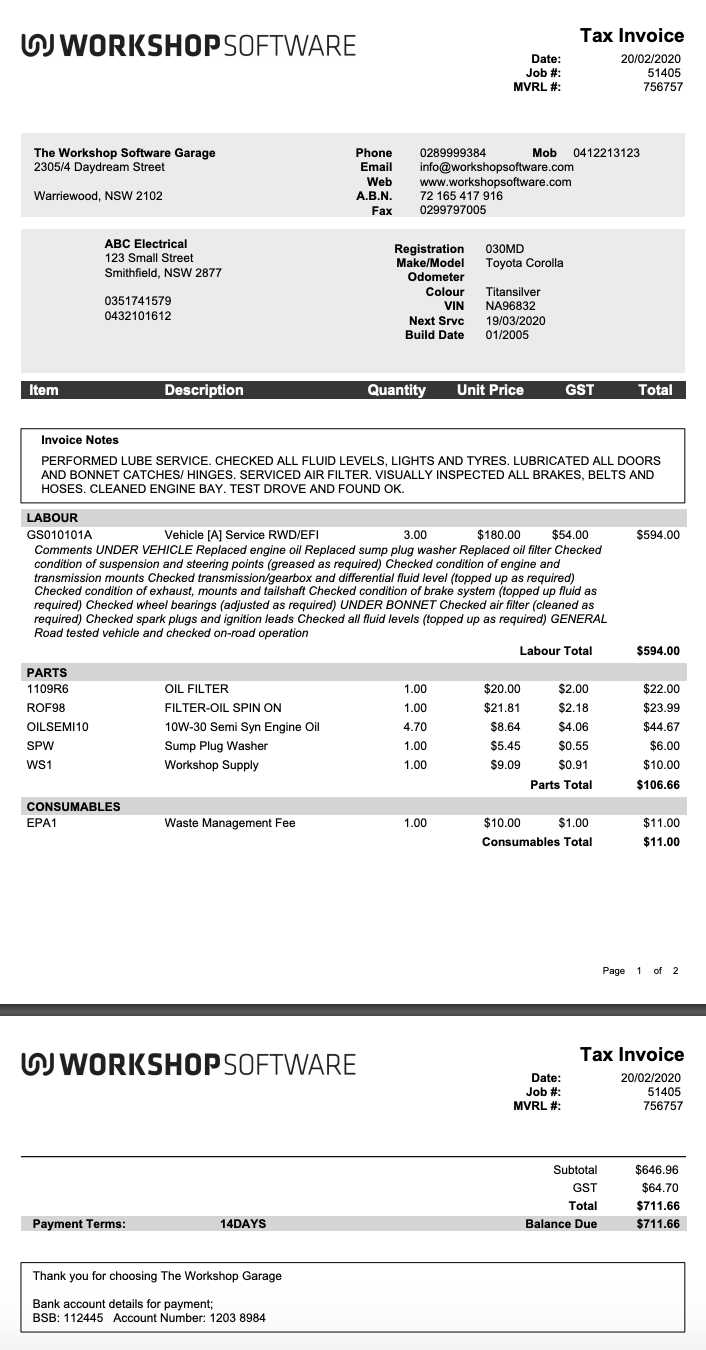

Creating a well-organized billing document requires a few essential steps to ensure all necessary information is clearly presented. Whether you’re dealing with a one-time transaction or regular payments, a structured approach helps ensure your records are professional and easy to understand. The process involves selecting the right format, entering key details, and customizing it to suit your business needs.

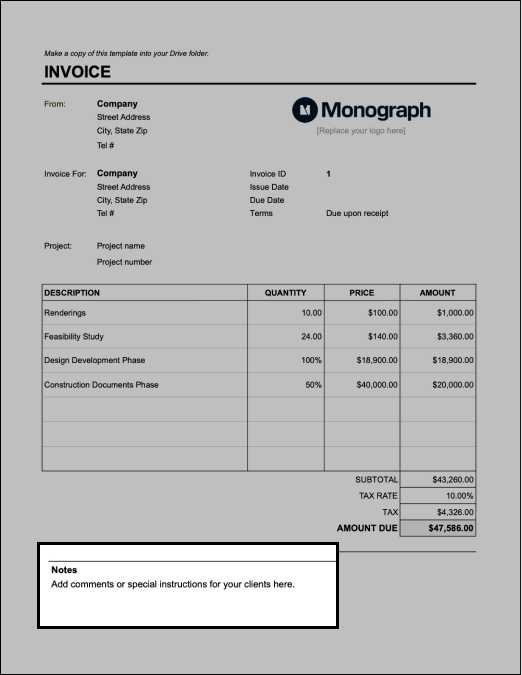

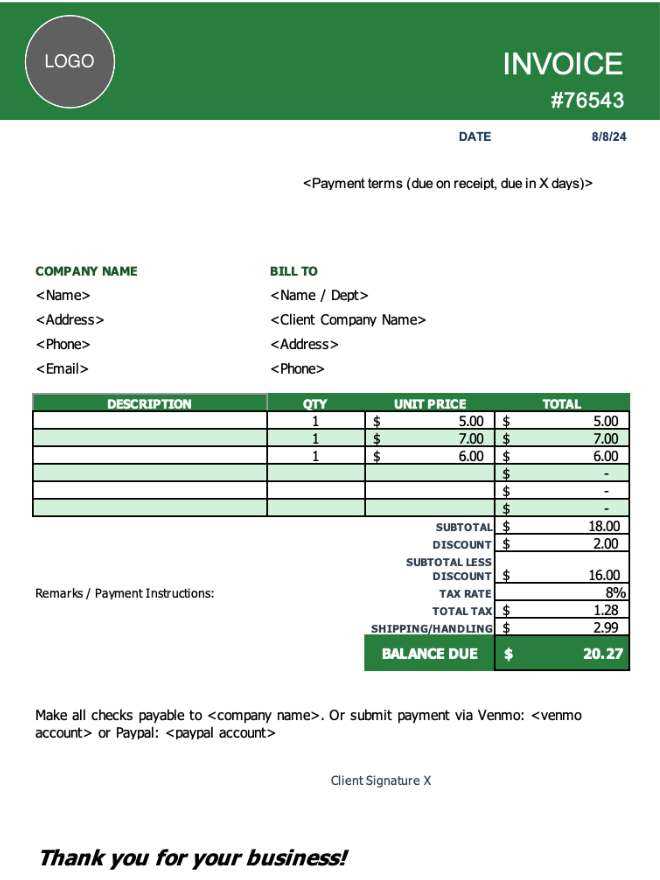

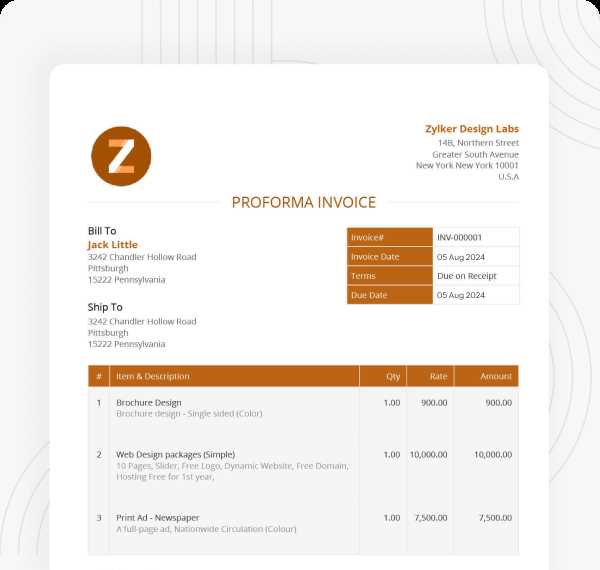

First, you’ll need to choose a structured format that suits your business. You can either design one from scratch or use a ready-made layout that you can modify. After selecting the right structure, it’s important to enter key information such as the client’s name, transaction details, services rendered, and total amount due. Each section should be clearly labeled to avoid confusion.

Next, customize the document by adding your business logo, contact information, and any specific payment terms you want to highlight. Including these details will not only reinforce your brand identity but also help clients easily identify your business. Finally, review the document for accuracy before sending it to the client, ensuring all details are correct and clearly visible.

Key Components of an Invoice Note

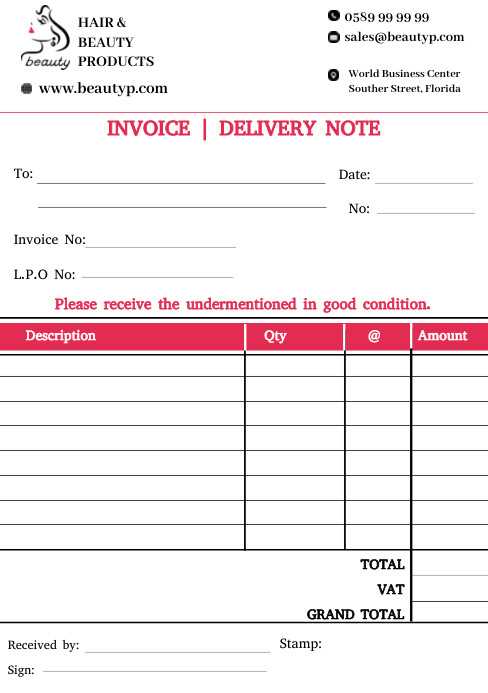

Every billing document should contain several key pieces of information to ensure that the transaction is fully documented and easily understood by both parties. These components serve as the foundation for creating accurate records and help prevent any confusion or disputes regarding payment. The following are the essential sections that should be included in any well-structured financial statement.

| Component | Description |

|---|---|

| Business Information | Includes your company’s name, address, phone number, and email. This helps clients easily identify the sender of the document. |

| Client Information | Details of the recipient such as name, address, and contact information. This ensures the document is properly addressed. |

| Transaction Date | The date when the service or product was provided. It establishes the timeline for payment. |

| Services or Products Provided | A clear description of the items or services that were delivered, including quantities and unit prices. |

| Total Amount Due | The total cost that the client needs to pay, including any taxes, discounts, or additional charges. |

| Payment Terms | Any specific payment instructions, such as due dates, accepted payment methods, and late fees if applicable. |

By including all of these elements in your document, you can ensure clarity and avoid misunderstandings when it comes to payment expectations. Having these key components readily available helps both businesses and clients stay on the same page throughout the transaction process.

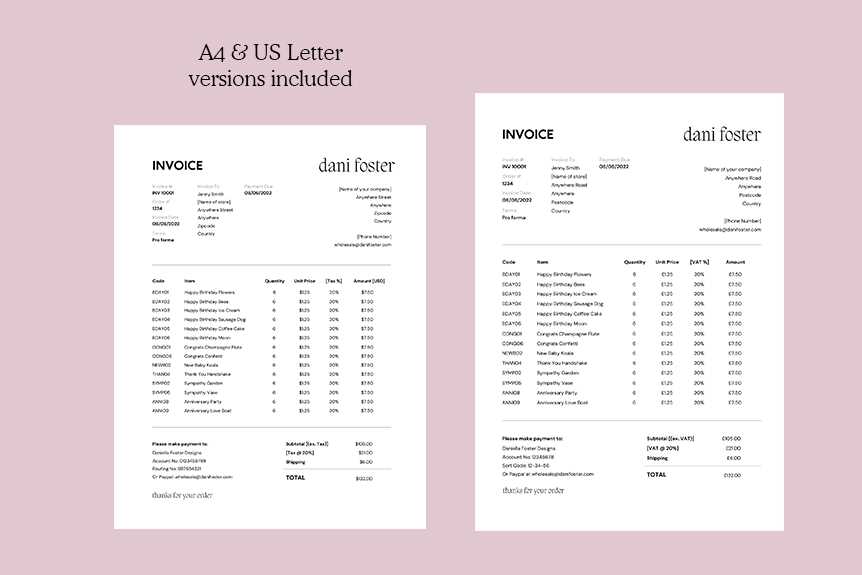

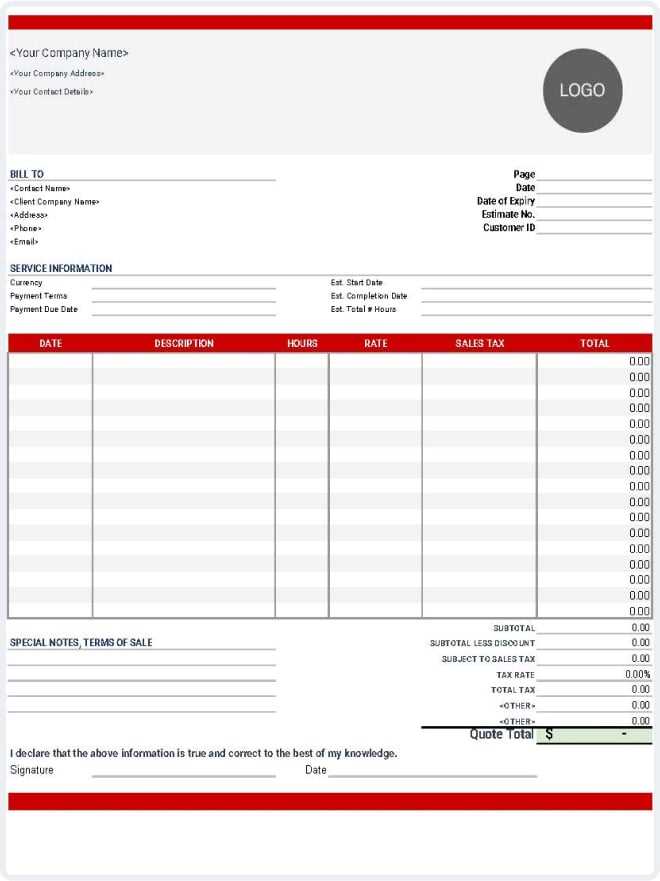

Choosing the Right Template for Your Business

Selecting the appropriate structure for your financial documents is essential for maintaining consistency and professionalism. The format you choose should reflect your business’s unique needs, ensuring it is both functional and easy to understand for your clients. With many options available, it’s important to consider various factors before making your decision.

Factors to Consider

When selecting a layout for your records, consider the nature of your business and the types of transactions you typically process. For instance, if you offer a variety of products or services, you may require a more detailed format that allows for itemized lists. Conversely, if your services are simple and straightforward, a minimalist structure may be more appropriate.

Customization and Flexibility

Another crucial aspect to keep in mind is customizability. A good structure should be adaptable, allowing you to add or remove fields as necessary. Whether it’s incorporating your company logo, adjusting payment terms, or adding special discounts, the ability to modify the document ensures that it aligns with your business’s identity and specific client needs.

By carefully selecting a well-suited format, you can create documents that streamline your workflow while enhancing your professional image. A consistent and tailored approach to billing records is a key factor in building strong client relationships and ensuring smooth business operations.

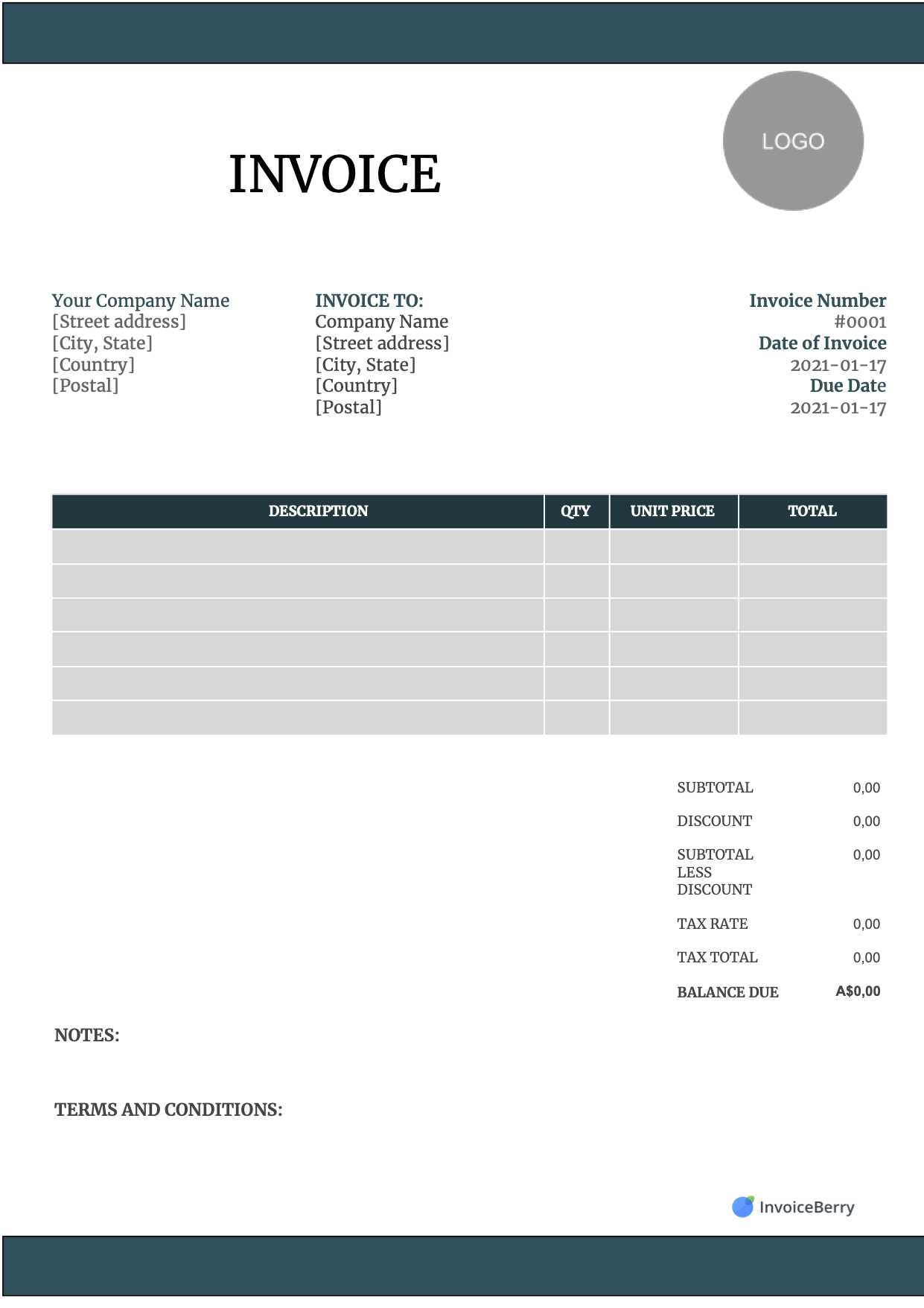

Customizing Your Invoice Note Template

Tailoring your billing document to fit the specific needs of your business and clients is an essential step in creating professional, efficient records. Customization allows you to add personal touches that reflect your brand, and to include all the necessary details that will make the document clearer and more useful for both you and your clients.

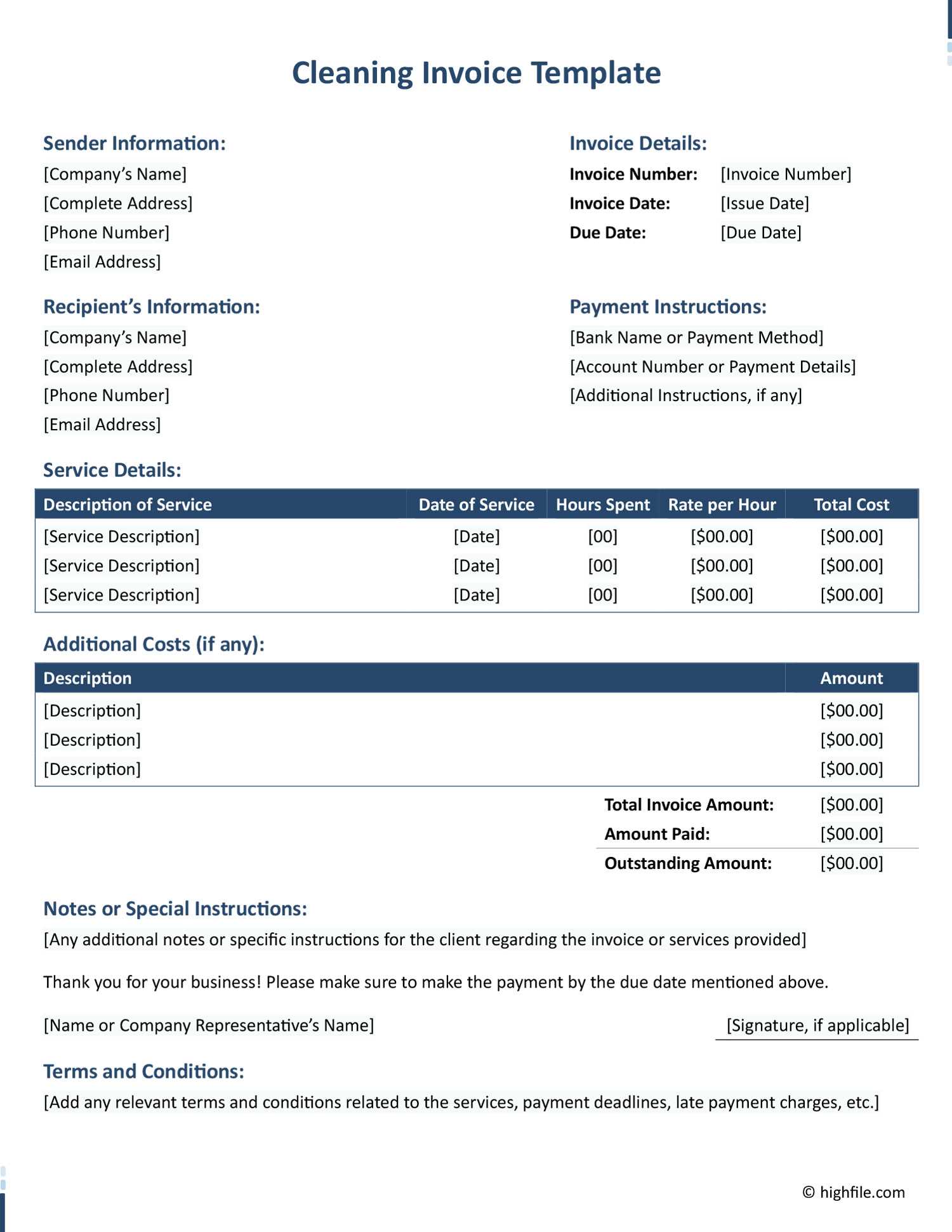

Personalizing the Layout

One of the first areas to customize is the overall design and layout of your form. This includes adjusting fonts, colors, and adding your company logo to ensure the document aligns with your brand identity. A clean, organized layout improves readability and makes a strong professional impression.

Essential Information to Include

Beyond design, it’s important to customize the content fields to match your specific business needs. Here are some key details you may want to adjust:

| Component | Customizable Options |

|---|---|

| Business Information | Include your company logo, name, address, contact details, and any other relevant identifiers. |

| Client Information | Modify the client section to capture their full name, address, and contact details accurately. |

| Services or Products | Adjust the descriptions of your offerings, including itemized lists or service categories relevant to your business. |

| Payment Terms | Customize payment instructions, including due dates, accepted payment methods, and late fees. |

By adjusting these elements, you can ensure that the document meets your business requirements and provides all the necessary information in a clear, concise manner.

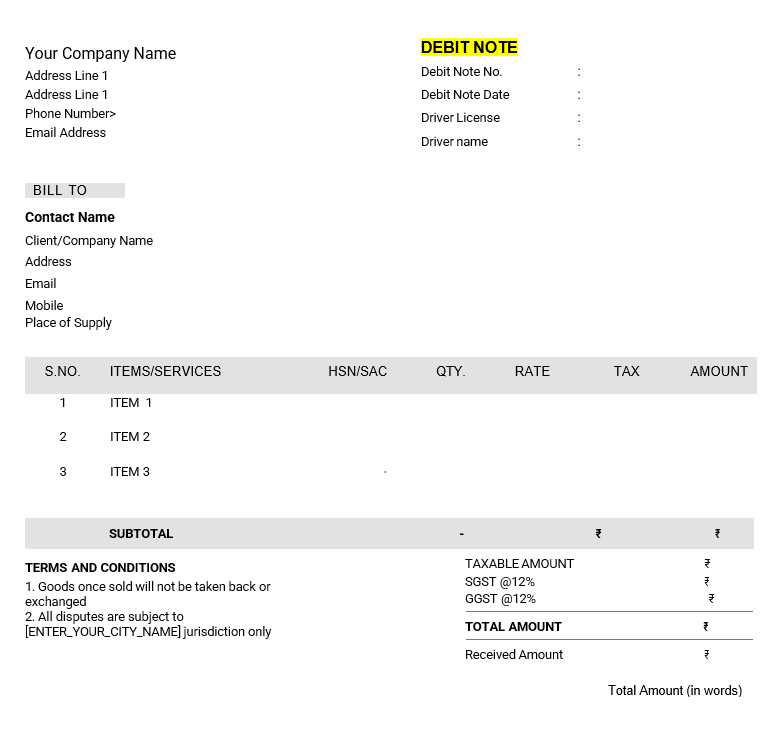

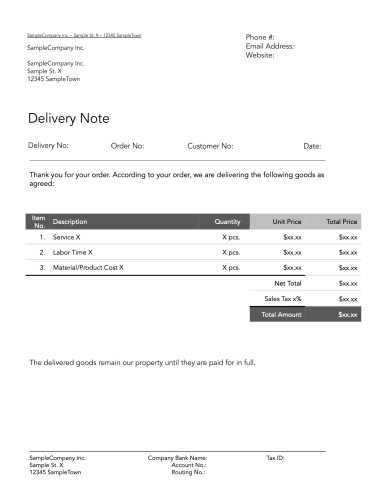

Invoice Notes vs Regular Invoices

Though both serve the purpose of documenting financial transactions, there are key differences between a standard billing document and a more specific supplementary record. While the former is generally used to outline the full details of a transaction, the latter often functions as a supporting statement, usually indicating adjustments, clarifications, or additional terms. Understanding these distinctions can help businesses decide which document is most appropriate depending on the context of the transaction.

A regular billing statement is typically issued when a product or service has been delivered, and it includes a comprehensive breakdown of charges, payment terms, and due dates. It serves as a formal request for payment, providing all relevant information for the client to settle the balance. On the other hand, a supplementary record is often used for situations like partial payments, corrections, or adding additional charges after the main transaction has been completed. It does not necessarily request immediate payment but instead clarifies or adjusts the original agreement.

In essence, while both documents deal with financial exchanges, their functions differ based on the stage and nature of the transaction. Regular billing records provide a detailed account of what is owed, while supporting statements serve to update or amend previous records as needed.

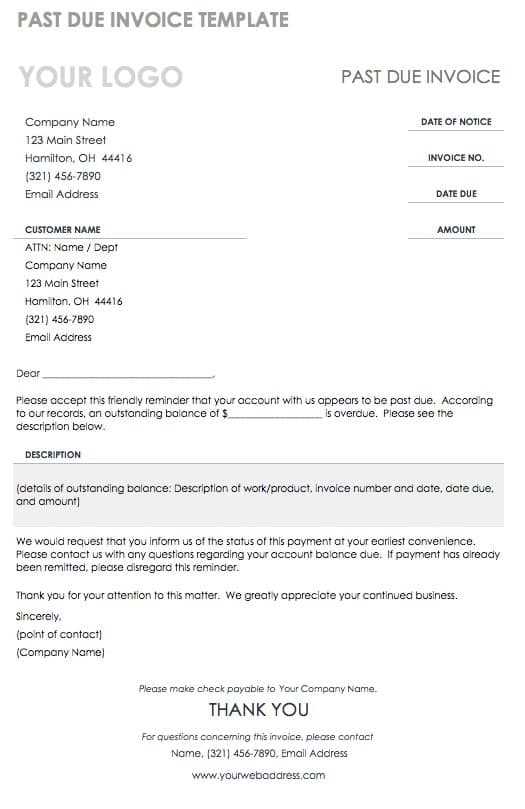

When to Use an Invoice Note

There are specific situations when a supplementary billing document is more appropriate than a standard statement. These documents are typically used when adjustments, clarifications, or updates need to be communicated after the original transaction has occurred. They provide a clear, formal way to update the client about changes, without requiring a full rewrite of the original record.

Common Scenarios for Using a Supplementary Billing Document

Such documents are often used in the following scenarios:

- Partial Payments: When a client makes only a partial payment, this document can be issued to reflect the remaining balance and provide updated payment terms.

- Additional Charges: If new charges are added after the original transaction, this document can detail those new fees and explain why they were incurred.

- Corrections or Adjustments: If there was an error in the original billing statement (such as a miscalculation or missing item), a supplementary document can be issued to correct the mistake and update the client.

Clarifying Changes without Reissuing Full Statements

These documents are useful because they allow businesses to make necessary changes without the need to reissue an entire new statement. This makes the process more efficient for both businesses and clients, ensuring that updates are clear and formalized in a professional manner.

Common Mistakes to Avoid in Invoice Notes

When creating financial documents to outline transactions, it’s important to avoid errors that could lead to confusion or misunderstandings. These documents are essential for clear communication with clients and for maintaining accurate records. Small mistakes can result in delays in payments, disputes, or even damage to your business’s reputation. Understanding the most common mistakes and how to avoid them will help ensure your records are both professional and efficient.

Key Errors to Watch Out For

Here are some of the most common mistakes businesses should be aware of:

- Missing or Incorrect Contact Information: Always double-check the details of both your business and your client. Missing or incorrect contact information can cause delays and prevent clients from reaching you when needed.

- Inaccurate Amounts: Ensure that all figures are correct and reflect the services or products provided. A miscalculation or omission can lead to payment discrepancies and create trust issues.

- Unclear Payment Terms: If the payment terms are not specified clearly, clients may be confused about the due date, accepted methods of payment, or any late fees. Always be explicit about your expectations to avoid confusion.

- Failure to Include Necessary Details: Each document should include all relevant transaction details, including item descriptions, dates, and totals. Missing key information may lead to questions or disputes that could have been avoided.

- Inconsistent Formatting: A professional layout is essential. Avoid inconsistent font sizes, spacing, or alignment that can make the document difficult to read or appear unprofessional.

Ensuring Accuracy and Professionalism

To avoid these pitfalls, take the time to review each document carefully before sending it out. A thorough check will help ensure that all necessary details are accurate, complete, and clearly presented, ultimately fostering smoother transactions and better client relationships.

How to Save Time with Invoice Templates

Efficient management of financial records is crucial for businesses of any size, and one of the best ways to streamline this process is by using pre-designed formats for your billing documents. Instead of creating each record from scratch, a reusable structure allows you to quickly enter the necessary information, saving you valuable time and reducing the risk of errors. This method ensures that every transaction is properly documented without requiring significant effort on your part.

Automating Repetitive Tasks

By using a structured format, many tasks that are typically time-consuming become automated. For example, once the basic structure is in place, you can easily copy and paste common information, such as client names, addresses, and payment terms. This eliminates the need to repeatedly input the same data, speeding up the entire process.

Reducing Errors and Revisions

Consistency is key when it comes to creating accurate records. Using the same format for every document helps ensure that all necessary fields are included, reducing the likelihood of omitting crucial details. This consistency not only saves time during document creation but also minimizes the need for revisions or corrections later on.

By implementing this approach, you can focus on other important aspects of your business, knowing that your financial documentation is being handled quickly and efficiently. Ultimately, using a structured approach to creating billing records helps improve overall productivity and organization.

Best Practices for Writing Invoice Notes

When creating billing documents, clarity, accuracy, and professionalism are key to ensuring that the transaction is understood and processed smoothly. Following best practices not only helps maintain good client relations but also prevents any misunderstandings or delays in payments. This section will highlight some effective strategies to improve the quality and effectiveness of your financial records.

Clear and Concise Information

Always ensure that the document contains all necessary details in a clear and concise manner. Avoid lengthy explanations and focus on presenting key information such as the total amount due, payment terms, and the description of services or products. Make sure the language is straightforward, and the document is easy to read.

Consistency and Professionalism

Maintain a consistent format throughout all your documents. Using the same structure for each transaction ensures that the client knows exactly where to look for specific information. Additionally, include your company’s branding, such as logos and contact details, to reinforce your business’s professional image. A polished, standardized look will help build trust and credibility.

By following these best practices, you can make sure that your financial documents are not only informative but also reflect your business’s commitment to quality and attention to detail. This approach helps prevent confusion, reduces errors, and encourages prompt payments from clients.

Ensuring Professionalism in Invoice Notes

Creating a professional billing document is essential for any business looking to establish trust and credibility with its clients. The way you present your financial records can have a significant impact on how your business is perceived. A well-structured, error-free document demonstrates attention to detail and conveys a sense of reliability. This section will explore key strategies for ensuring that your records maintain a professional standard.

One of the most important aspects of professionalism is clarity. Each document should be easy to read and navigate. Ensure that the information is organized logically, with clear headings, consistent formatting, and legible fonts. By presenting your information in a straightforward manner, you reduce the risk of confusion and help clients process the details more efficiently.

Another crucial factor is accuracy. A professional document must be error-free. Double-check all amounts, dates, client information, and descriptions before sending. Even small mistakes can lead to misunderstandings or damage your business’s reputation. Correct spelling, grammar, and punctuation also contribute to a polished, professional image.

Finally, consistency plays a vital role. Using the same format and layout across all your financial documents helps create a cohesive brand identity. This consistent approach not only makes your records easier to follow but also reinforces your professionalism and attention to detail.

Automating Invoice Note Creation

Automating the process of generating billing documents can significantly improve efficiency and accuracy within a business. Instead of manually filling out the same details for every transaction, automation tools allow you to create standardized records in a fraction of the time. By streamlining this process, businesses can reduce errors, save time, and focus on other important tasks.

Benefits of Automation

There are several advantages to automating the creation of financial documents, including:

- Time Efficiency: Automation eliminates the need to repeatedly enter the same information, allowing you to generate multiple documents quickly and easily.

- Reduced Errors: By using pre-set fields and formats, automation minimizes the risk of mistakes such as incorrect calculations or missing information.

- Consistency: Automated systems ensure that every document follows the same format and structure, creating a professional and cohesive appearance.

- Improved Tracking: Automation tools often include tracking features that help monitor payment statuses and keep your records up-to-date.

How to Automate Your Process

To implement automation effectively, you can use software tools that are specifically designed for this purpose. Many of these platforms allow you to:

- Create Custom Templates: Design pre-made layouts that can be reused for each new transaction.

- Integrate Client Data: Automatically import client information from your CRM or database, reducing the need for manual entry.

- Set Payment Reminders: Automatically send reminders to clients for upcoming or overdue payments.

- Generate and Send Documents: With a few clicks, you can create and send professional documents directly to your clients, saving time and improving client satisfaction.

By leveraging automation, businesses can not only streamline the billing process but also ensure greater accuracy, consistency, and efficiency in their operations.

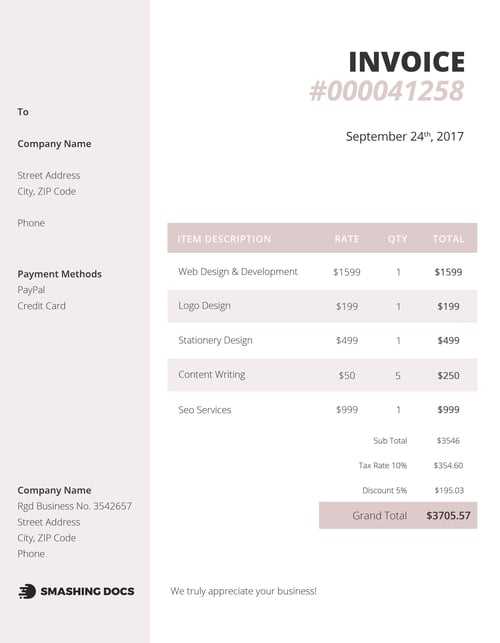

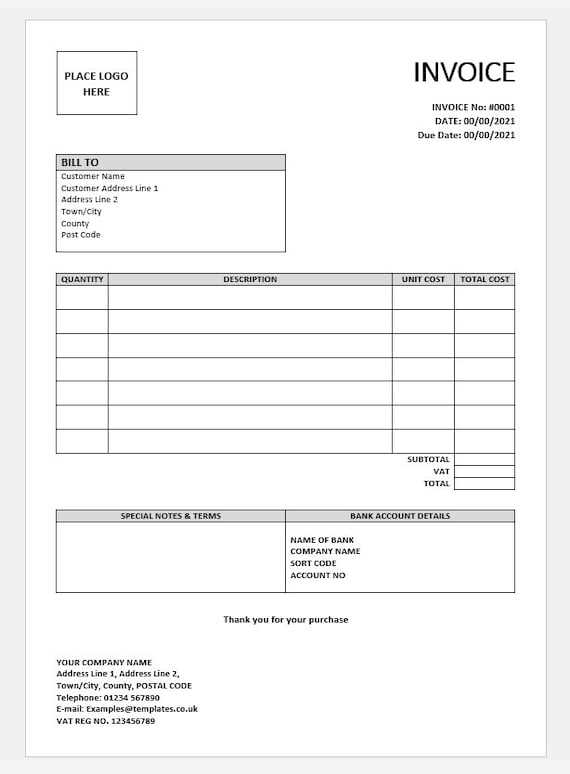

Where to Find Free Invoice Note Templates

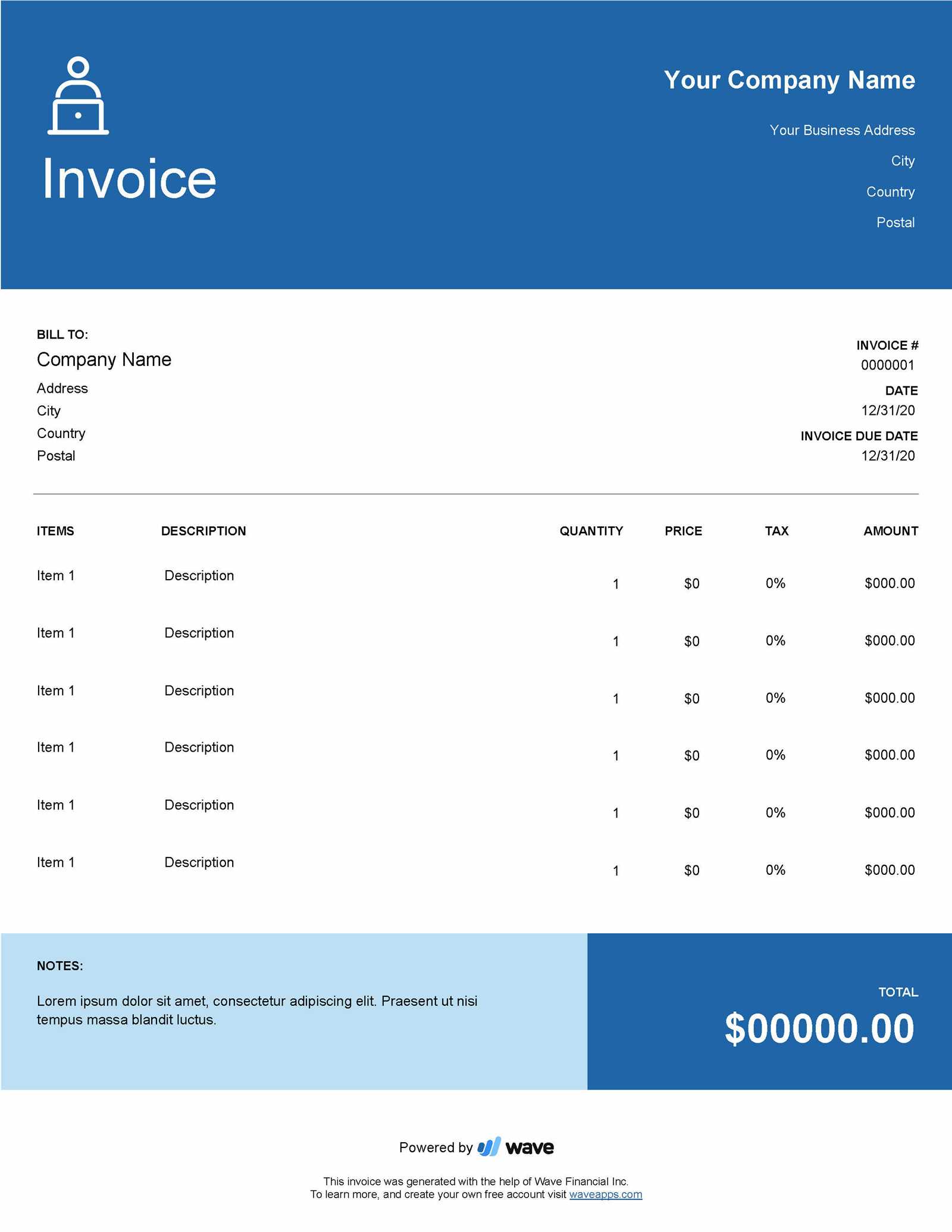

If you’re looking to save time and resources when creating your financial documents, there are many free options available online. Numerous websites and platforms offer ready-to-use designs that can be downloaded and customized for your business needs. These pre-made structures not only help you maintain professionalism but also ensure that your records are formatted correctly without needing to start from scratch.

Top Sources for Free Billing Document Layouts

Here are some reliable platforms where you can find no-cost options for your business:

- Google Docs: Offers a variety of simple, customizable layouts that can be easily modified for any transaction type.

- Microsoft Office Templates: A wide selection of free formats for download that are perfect for small and medium-sized businesses.

- Canva: Provides visually appealing designs, many of which are free, and offers an intuitive drag-and-drop editor to personalize them.

- Template.net: Features free and premium options, allowing you to find something that matches your business style and specific needs.

- Zoho Invoice: Includes free billing record designs that integrate with their accounting software, making the entire process seamless.

Customizing Free Layouts for Your Needs

Most free sources offer fully editable formats, allowing you to adjust the design, fields, and even incorporate your company logo. Be sure to personalize the template by adding specific terms, payment instructions, or other relevant details to make it fit your unique requirements.

By taking advantage of these free resources, you can create professional, functional billing documents in no time, while keeping your costs down and workflow efficient.

Legal Considerations for Invoice Notes

When preparing financial documents for transactions, it’s essential to ensure that they comply with applicable laws and regulations. These documents serve as legal records that may be used in case of disputes, audits, or legal proceedings. Understanding the legal requirements for creating and using such records is crucial for businesses to avoid legal issues and protect their interests.

Key Legal Elements to Include

There are several critical elements that should always be included in any billing document to ensure legal compliance:

- Clear Identification: Ensure that both your business and the client are clearly identified, including names, addresses, and contact information.

- Transaction Details: A detailed description of the goods or services provided, including dates, quantities, and pricing, should be included to avoid any confusion or ambiguity.

- Payment Terms: Specify payment deadlines, accepted methods, and any applicable penalties or late fees for overdue payments.

- Tax Information: Include any necessary tax identification numbers, VAT, or other applicable taxes, based on your local jurisdiction and business type.

Compliance with Local Laws

Different countries and regions have varying regulations regarding financial documentation. For example, some areas require that specific information, such as tax numbers or contract references, be included in every transaction record. It’s important to stay informed about the legal obligations in your area and industry, as non-compliance can lead to penalties or disputes.

In addition to the basic requirements, businesses must also consider data protection laws. Depending on your location, client information may need to be securely stored and transmitted. Always ensure that your financial documents comply with local privacy laws and regulations, such as GDPR in Europe or CCPA in California.

By understanding and adhering to these legal considerations, businesses can protect themselves from potential disputes and ensure that their financial transactions are properly documented and legally binding.

Tracking Payments with Invoice Notes

Tracking payments efficiently is vital for maintaining a healthy cash flow and ensuring that your business runs smoothly. By keeping accurate records of all transactions, you can easily monitor outstanding balances, identify overdue payments, and ensure timely follow-ups with clients. This section explores methods for effectively tracking payments through structured financial documents, ensuring that nothing falls through the cracks.

Organizing Payment Information

A well-organized document can help you keep track of the payments received and those still pending. Including clear, structured payment terms and status fields in your financial documents is key to monitoring payment progress. Here’s an example of how you can organize payment information:

| Client Name | Amount Due | Amount Paid | Payment Date | Outstanding Balance |

|---|---|---|---|---|

| Client A | $500.00 | $500.00 | 2024-10-01 | $0.00 |

| Client B | $750.00 | $500.00 | 2024-10-05 | $250.00 |

| Client C | $1,000.00 | $0.00 | 2024-10-10 | $1,000.00 |

This simple table allows you to track which clients have paid, which have outstanding balances, and how much is due. Regularly updating such records ensures you can easily spot overdue accounts and take appropriate action.

Using Payment Status Indicators

Adding a payment status indicator to your financial documents can further enhance tracking. For example, marking entries as “Paid,” “Partial Payment,” or “Outstanding” helps you immediately identify the status of each transaction without needing to read through all the details. By implementing such systems, you can streamline your follow-up process and avoid errors when communicating with clients about their payments.

Ultimately, consistent and organized payment tracking helps businesses stay on top of finances, minimize disputes, and ensure a steady flow of income.