Free Graphic Designer Invoice Template PDF Download

For freelancers and small business owners, ensuring accurate and professional billing is essential. A well-structured document helps maintain a smooth workflow and builds trust with clients. Whether you’re offering creative services or technical expertise, having a reliable tool to manage payments can make a significant difference.

With the right format, you can easily outline services provided, rates, and terms, ensuring both parties are clear on expectations. Digital documents offer a flexible, easy-to-share solution, and can be tailored to reflect your personal brand. The convenience of customizing and sending these documents quickly is key to maintaining an efficient business operation.

Adopting a straightforward, editable structure allows you to focus on your craft rather than spending time on administrative tasks. Tools for creating these documents can save time and reduce errors, letting you concentrate on what matters most–delivering exceptional results to your clients.

Understanding Billing Documents for Creative Services

For professionals offering creative services, ensuring clear communication regarding compensation is essential for maintaining a smooth business relationship. A well-organized document outlining the details of work done, payment terms, and deadlines not only establishes trust but also ensures that all financial matters are handled efficiently. These documents serve as a formal request for payment, detailing what services were provided and the agreed-upon rates.

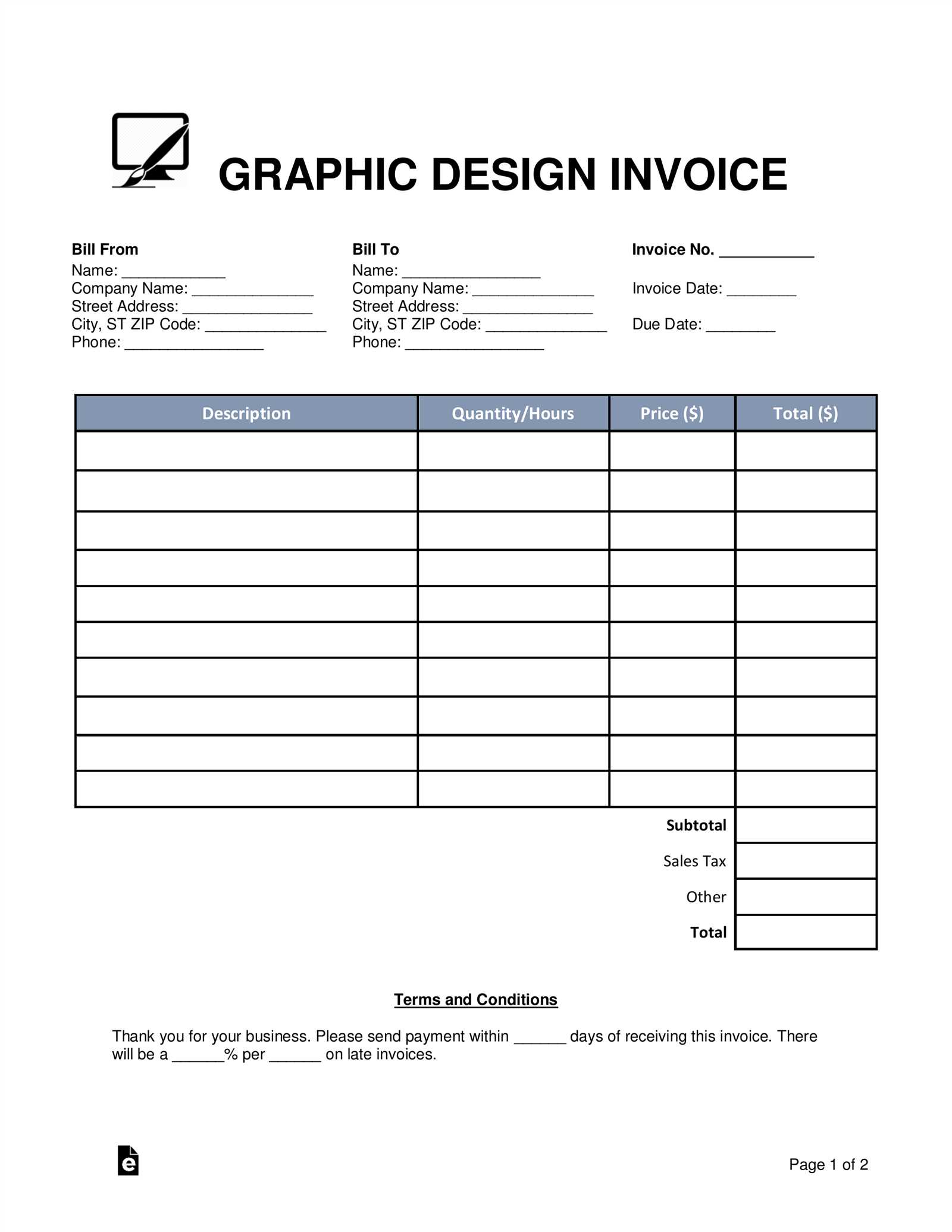

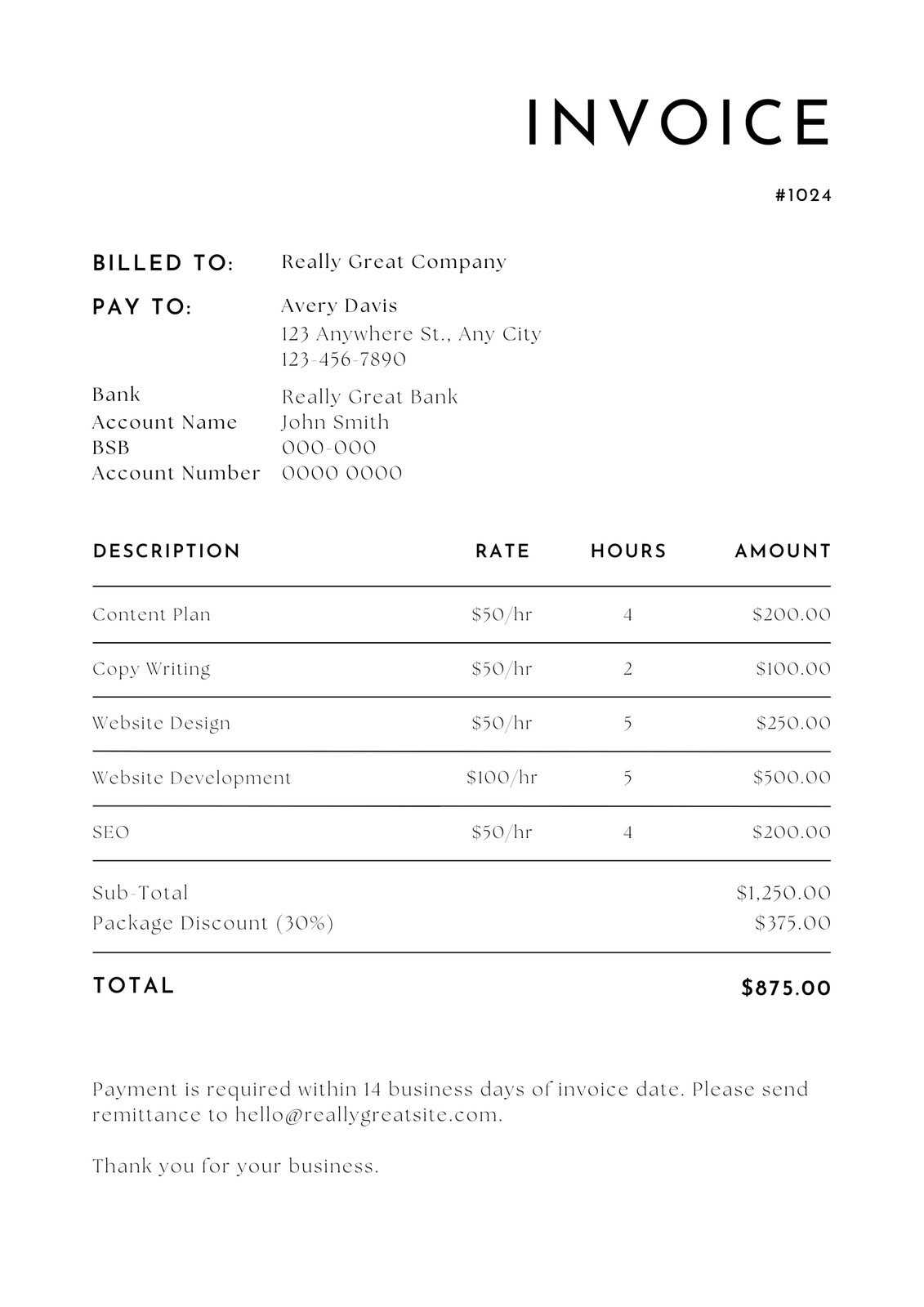

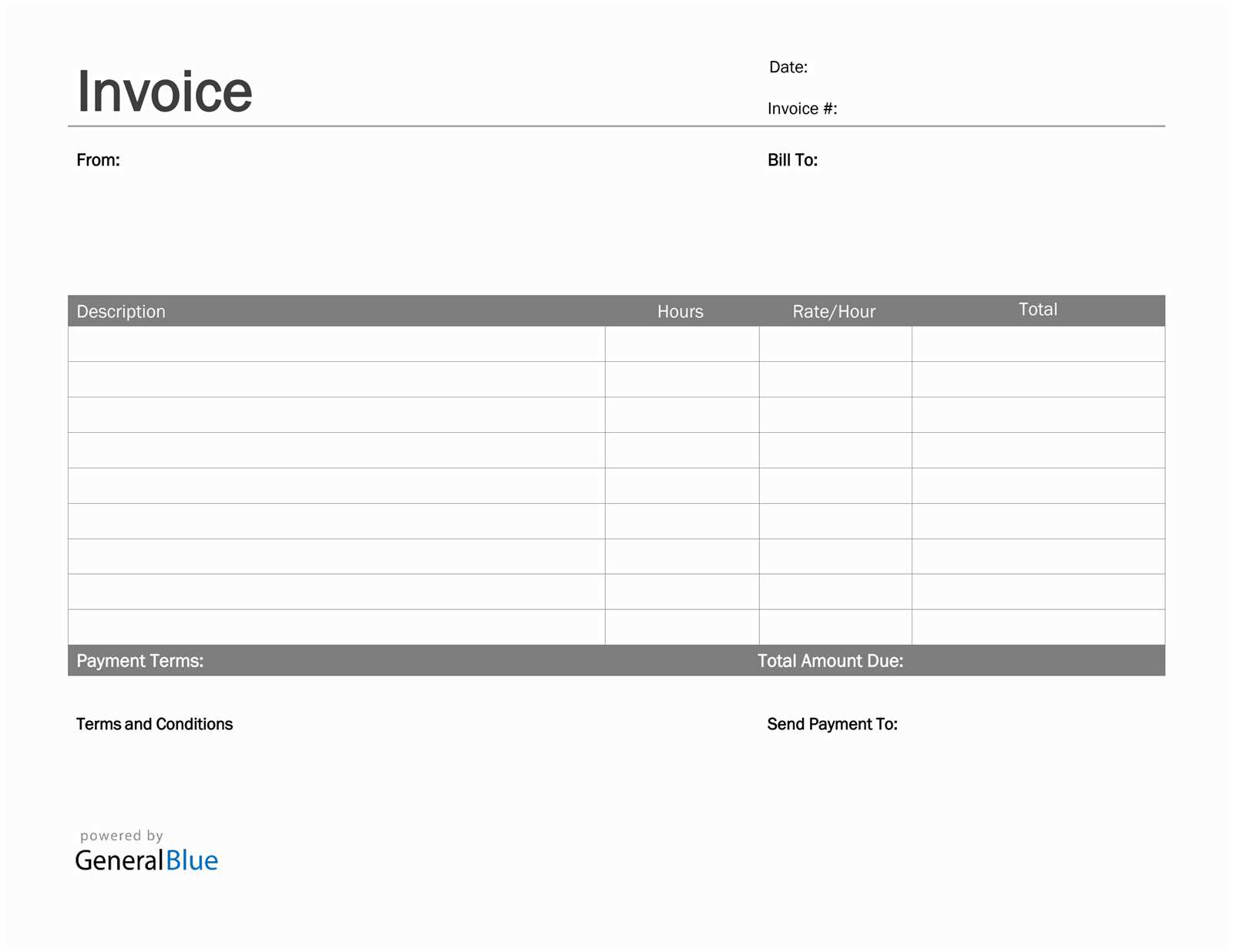

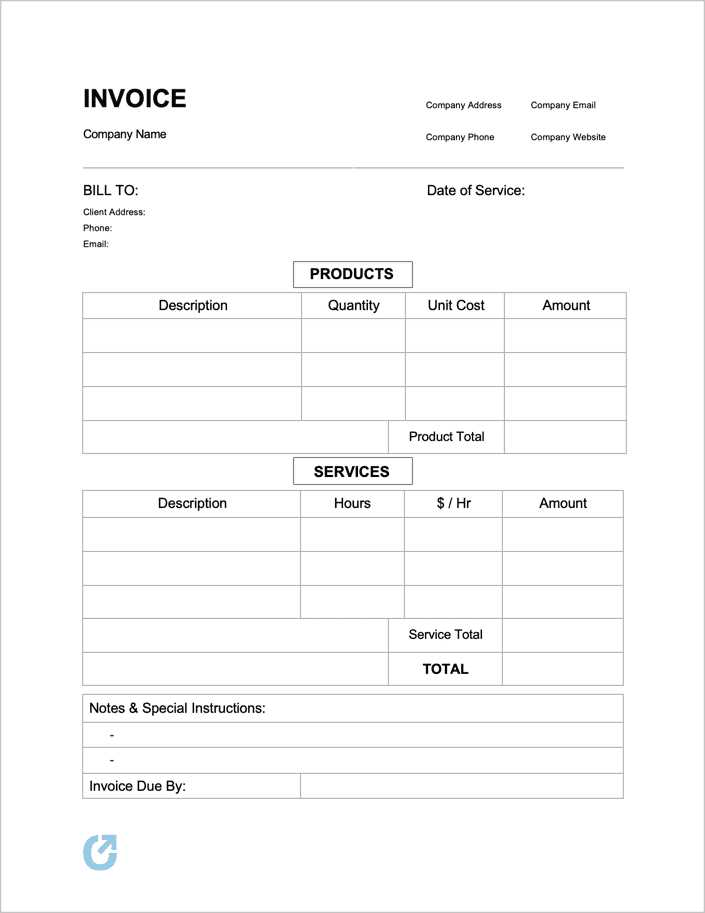

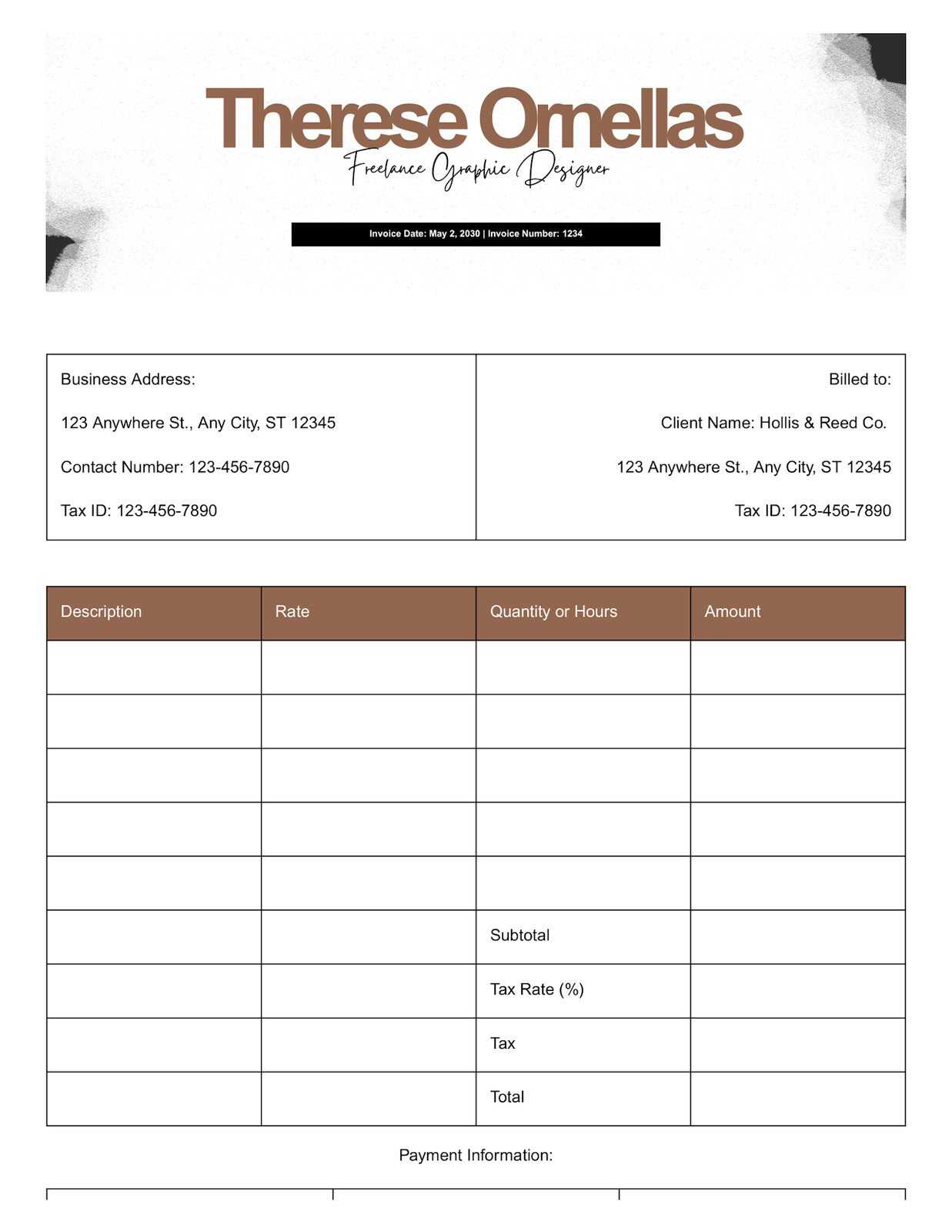

When crafting a billing document, it’s important to include all necessary information to avoid confusion. This typically includes contact details, a description of services, hourly rates or fixed prices, payment due dates, and any additional terms such as late fees or payment methods. Below is an example of the typical components that should be included in any billing document for creative work:

| Section | Details |

|---|---|

| Client Information | Includes name, address, and contact details of the client. |

| Service Description | Details of work completed, including project specifics and deliverables. |

| Rates and Pricing | Hourly rates or agreed-upon fixed costs for services rendered. |

| Payment Terms | Due date for payment, payment methods, and any late fees or penalties. |

| Additional Notes | Any special instructions or terms related to the project. |

Including all relevant information in a clear and organized manner not only helps avoid misunderstandings but also ensures that payment is processed smoothly. A professional billing document demonstrates your commitment to transparency and sets a positive tone for future collaborations.

Why Use an Invoice Template

Managing financial transactions can be time-consuming, especially for professionals handling multiple projects at once. Utilizing a standardized document for billing helps streamline the process, ensuring accuracy and consistency across all transactions. It provides a reliable framework for organizing the necessary details, reducing the chances of errors and simplifying the overall workflow.

Time Efficiency

One of the biggest advantages of using a pre-designed format is the time it saves. Instead of starting from scratch each time, a ready-made document allows you to quickly input the relevant information and generate a professional-looking request for payment. This efficiency is especially important when juggling multiple clients or projects.

Professional Appearance

Having a structured, polished document not only improves internal organization but also enhances your reputation with clients. It reflects professionalism and attention to detail, which are critical in maintaining positive working relationships. A consistent format reassures clients that their transactions are handled reliably, contributing to trust and confidence in your services.

Overall, using a standardized document for billing can significantly reduce administrative burden and help maintain a smooth, professional interaction with clients. It frees up time for more creative or business-focused tasks, while ensuring financial matters are clear and well-documented.

How to Create Professional Billing Documents

Creating a clear and professional payment request is an essential step for any service provider. A well-organized document not only ensures you receive timely payments but also reflects your attention to detail and professionalism. Crafting a structured document can be a straightforward process if you follow a few key guidelines.

Essential Elements to Include

Every payment request should contain specific information to ensure clarity and avoid confusion. These elements will provide the recipient with all necessary details for processing the payment:

- Client Information: Include the client’s name, address, and contact details.

- Your Information: Clearly list your name, business name (if applicable), and contact details.

- Unique Identifier: Assign an invoice number to keep track of transactions.

- Description of Services: Provide a clear breakdown of the work done or products delivered.

- Rates and Amount: Specify the agreed price for each service or item and the total amount due.

- Payment Terms: Define the payment due date and accepted methods of payment.

- Late Payment Policy: Include any penalties or fees for overdue payments, if applicable.

Formatting Tips for a Clean Look

A well-formatted document not only looks more professional but also makes it easier for clients to find the information they need. Consider these formatting tips:

- Use Clear Headings: Break down each section with bold, easy-to-read headings to make the document navigable.

- Keep It Simple: Avoid unnecessary graphics or complicated layouts that might distract from the key information.

- Maintain Consistent Fonts: Use a standard, readable font for the entire document.

- Use Tables for Clarity: When listing services or amounts, tables can help keep the information organized and clear.

By following these steps and ensuring that all the necessary information is included, you’ll be able to create a professional, well-organized document that makes the payment process easier for both you and your client.

Essential Elements of a Billing Document

When requesting payment for services rendered, it’s crucial to include certain key details in the document. These elements ensure that both you and your client have a clear understanding of the terms and expectations, which reduces the risk of confusion or delay. A well-structured document helps maintain transparency and professionalism in all financial transactions.

Key Information to Include

There are several essential pieces of information that should be present in every billing document to make sure it serves its purpose effectively:

- Contact Information: Both your details (name, business name, address, phone number, and email) and the client’s contact details should be clearly listed at the top of the document.

- Document Date: Always include the date the document is created. This helps establish a timeline for payment and serves as a record for both parties.

- Unique Identifier: Assign a unique reference number to the document for easy tracking and future reference.

- Description of Services: Provide a breakdown of the work completed, including dates and the nature of the services rendered. This ensures the client understands exactly what they are paying for.

- Amount Due: Clearly state the amount owed, including any applicable taxes or additional fees. Make sure it’s easy to identify and understand.

- Payment Terms: Include the payment due date, acceptable methods of payment, and any applicable late fees if the payment is not received on time.

Formatting for Clarity

Proper formatting ensures that the important details are easy to locate and understand. A clean layout will help both you and your client quickly reference key points, such as the payment amount and due date. Below are some tips to help improve document readability:

- Bold Headers: Use bold or larger font sizes for headings like “Description of Services,” “Amount Due,” and “Payment Terms” to make them stand out.

- Organize in Sections: Break the document into sections for easy navigation, using white space to separate each part.

- Tables for Financial Information: For clarity, list the services and their respective costs in a table format, making it easier for the client to see the breakdown.

By including these essential elements and formatting your document for clarity, you ensure that both parties have a clear and professional reference for financial transactions.

Choosing the Right Invoice Format

When preparing a payment request document, selecting the correct structure is crucial to ensure clarity and professionalism. The format you choose will directly impact how easily your clients can understand and process the information, leading to smoother transactions and timely payments. It’s important to consider the needs of both the business and the customer when deciding on the layout, style, and included details.

Factors to Consider

- Clarity and Simplicity: The layout should be clean and easy to read, avoiding unnecessary complexity. Key elements like payment terms, services provided, and amounts due should stand out.

- Customization: Tailor the format to reflect your brand, but make sure it still serves its primary function: delivering essential financial information in an accessible way.

- Compliance: Ensure that the format adheres to any legal requirements in your region, such as including tax details or specific business identifiers.

Popular Options

- Basic Layout: Ideal for small businesses or freelancers, this format includes only essential details, making it straightforward and efficient.

- Advanced Design: For those looking to make a lasting impression, a more elaborate format with custom branding and additional sections (such as terms of service or project descriptions) can be used.

Benefits of PDF Invoice Templates

Utilizing pre-formatted payment request documents in a fixed file format offers numerous advantages. These structured files ensure consistency, enhance professionalism, and simplify the billing process for both businesses and clients. By choosing this approach, you can streamline administrative tasks and improve the accuracy of your records.

Key Advantages

- Consistency: Pre-designed files help maintain uniformity in all your billing communications, ensuring that every document looks professional and adheres to your business standards.

- Portability: Files in a fixed format can be easily shared across various platforms and devices without losing quality or formatting. This makes it easy to send documents to clients, partners, or accounting teams.

- Security: The format ensures that the content remains unaltered once the file is created, protecting sensitive financial information from unauthorized changes.

- Ease of Use: With a pre-established format, the process of creating payment requests becomes faster and more efficient, saving you time and reducing the chance of errors.

- Professional Appearance: A well-structured, fixed-format file enhances the overall presentation of your documents, leaving a positive impression on clients and reinforcing your credibility.

Additional Considerations

- Customizability: While the structure remains fixed, many solutions allow for easy customization, enabling you to adapt the document to your specific needs.

- Archiving: This format ensures that your documents are compatible with long-term storage systems, making it easy to keep detailed records for future reference.

Customizing Your Invoice for Branding

Personalizing your payment request documents can significantly enhance your business’s image and make your communications stand out. By incorporating elements of your brand into the structure, you can create a cohesive experience for your clients, reinforcing your identity with every transaction. Customization not only makes your documents more professional but also helps create a memorable impression.

Key Elements to Include

- Logo: Your company logo is one of the most powerful branding tools. Placing it at the top of the document ensures instant recognition and reinforces your identity.

- Color Scheme: Use your brand colors throughout the layout to maintain consistency with other business materials. This can be applied to headings, borders, or background elements.

- Typography: Choose fonts that align with your brand’s style. Consistent typography adds to the professionalism and visual appeal of your documents.

- Contact Information: Including your business’s contact details in a prominent position ensures clients can easily reach you for any inquiries.

Design Layout Example

| Section | Branding Element |

|---|---|

| Header | Company logo and brand colors |

| Body | Typography matching your brand style |

| Footer | Contact information and social media links |

Free vs Paid Invoice Templates

When choosing a format for your payment request documents, you’ll find two main options: free versions and premium choices. Both have their advantages and drawbacks depending on your needs and budget. It’s important to weigh the benefits of each to determine which will provide the best value for your business, considering factors such as design flexibility, ease of use, and long-term efficiency.

Advantages of Free Options

- Cost-effective: Free options provide immediate access to basic layouts without any financial commitment, making them an ideal choice for small businesses or startups.

- Simplicity: Many free designs are straightforward and easy to use, which can save time when creating documents quickly.

- Accessibility: A wide range of free resources are available online, allowing you to find options that suit your specific needs with little effort.

Benefits of Paid Versions

- Customization: Premium designs often offer more flexibility, allowing you to tailor layouts to fit your brand identity or specific business needs.

- Advanced Features: Paid formats may come with extra functionalities such as automatic calculations, tax integration, or built-in tracking tools.

- Professional Appearance: Higher-quality designs typically have a more polished look, which can leave a stronger impression on clients and help you build credibility.

- Customer Support: Many premium options provide customer support, ensuring that you can resolve any issues quickly and maintain smooth business operations.

Common Mistakes to Avoid in Invoicing

While creating payment request documents may seem straightforward, there are several common pitfalls that can lead to confusion, delayed payments, or even strained client relationships. Avoiding these mistakes is essential for maintaining professionalism and ensuring smooth financial transactions. A small oversight can have a big impact on your business, so it’s important to pay attention to every detail.

1. Inaccurate Information

Always double-check the details before sending your document. Incorrect contact information, service descriptions, or amounts can cause unnecessary delays or confusion. Ensure that everything is accurate, including the client’s name, the services rendered, and any taxes applied.

2. Missing Payment Terms

Clearly state your payment terms, such as the due date and any late fees. Leaving this out can result in misunderstandings or delayed payments, as clients might not be aware of when to pay or the consequences of missing the deadline.

3. Lack of Clear Breakdown

Always include a detailed breakdown of services or products provided, along with the corresponding amounts. A vague description can lead to confusion and disputes, making it harder for clients to understand what they are paying for.

4. Not Following Up

Even with a well-prepared document, it’s important to follow up if payment hasn’t been received by the agreed date. Failing to do so could result in forgotten payments or a lack of urgency on the client’s part.

5. Overcomplicating the Design

While personalization is important, overly complicated layouts can make the document harder to read. Keep the design clean and professional, focusing on the essential information. Too much clutter can distract from the key details and reduce the clarity of your communication.

How to Send Invoices Efficiently

Sending payment request documents efficiently is key to maintaining a smooth workflow and ensuring timely payments. Streamlining the process can save time, reduce errors, and enhance your professionalism. With the right approach, you can automate parts of the process while maintaining control over the details.

Steps for Efficiently Sending Documents

- Use a Consistent Format: Stick to a clear and standardized layout for all your payment requests. This ensures your clients know exactly what to expect and can quickly locate key details.

- Automate Reminders: Set up automatic reminders to notify clients when a payment is due or overdue. This helps ensure you don’t forget to follow up and reduces the need for manual tracking.

- Choose the Right Delivery Method: Depending on your client’s preferences, you can use email, cloud-based services, or even physical mail. Digital delivery is often quicker, but ensure that your chosen method is secure and reliable.

- Track Sent Documents: Keep a record of all sent payment requests, including dates and delivery methods. This will help you stay organized and follow up more effectively if needed.

Tools to Streamline the Process

- Online Billing Platforms: Platforms such as QuickBooks or FreshBooks offer automated solutions for creating, sending, and tracking payment requests.

- Email Scheduling Tools: Tools like Boomerang or FollowUpThen allow you to schedule reminders or follow-up emails automatically.

- Cloud Storage: Using cloud storage services like Google Drive or Dropbox can make it easy to organize and share documents securely with clients.

Invoice Template for Different Clients

Adapting your billing documents to suit different client types is essential for maintaining professional relationships and meeting their specific needs. Whether you’re working with large corporations, small businesses, or individual clients, understanding how to tailor your format can enhance clarity and improve the payment process. By customizing the content and presentation, you can cater to various expectations and ensure timely payments.

| Client Type | Customization Suggestions |

|---|---|

| Large Corporations | Include detailed project breakdowns, payment terms, tax information, and any references to contracts or agreements. Ensure the layout is formal and professional. |

| Small Businesses | Provide clear, concise information with flexible payment terms. A clean, simple design works best, focusing on transparency without excessive detail. |

| Freelance Clients | Use a straightforward and easy-to-understand format, especially if the project scope is small. Personalized details like your branding can help foster a personal connection. |

| International Clients | Include multi-currency options, specify international payment methods, and clearly state applicable taxes or customs fees. Ensure all terms are easy to understand across language barriers. |

Legal Requirements for Graphic Designer Invoices

When preparing a payment request document, it is important to comply with the legal standards set by your local jurisdiction. These requirements ensure that your document is not only professional but also legally enforceable. Failing to include necessary elements could lead to delays in payment or even disputes. Understanding the key legal aspects can help protect both your business and your clients.

Essential Legal Elements

- Contact Information: Always include your full name or business name, address, and contact details. This provides clarity and establishes the identity of the person requesting payment.

- Unique Identification Number: In many regions, each document should have a unique reference number for tracking and record-keeping purposes.

- Detailed Description of Services: Clearly outline the services or products provided, including dates, quantities, and rates. This helps avoid misunderstandings and provides transparency.

- Payment Terms: State the payment deadline, accepted methods, and any late fees. This ensures that both parties are on the same page regarding when and how payment should be made.

- Tax Information: If applicable, include any necessary tax details, such as VAT numbers or sales tax rates, as required by law in your country or region.

Additional Considerations

- Legal Jurisdiction: Make it clear where the contract is governed, especially if working with international clients. This can help resolve disputes more efficiently.

- Compliance with Local Laws: Ensure your document follows local tax laws, invoicing regulations, and business practices to remain compliant with national or international requirements.

Automating Invoice Creation Process

Automating the process of generating payment request documents can save valuable time, reduce errors, and ensure consistency in your billing system. By utilizing the right tools and technology, you can streamline the process, allowing for faster and more accurate document creation. Automation not only enhances efficiency but also helps maintain a smooth workflow, especially for businesses with frequent transactions.

| Automation Method | Benefits |

|---|---|

| Accounting Software | Automates the creation of payment requests with pre-filled client information, service descriptions, and payment terms. Many programs also allow for recurring billing. |

| Cloud-Based Platforms | These platforms enable easy access from anywhere and often integrate with other business tools, helping to synchronize client data and streamline document generation. |

| Custom Scripts | If you have specific needs, custom scripts or macros can be written to automatically generate documents based on your own criteria and data sources. |

| Online Payment Services | Some payment platforms allow you to generate payment request documents directly within their interface, automatically updating payment status and providing reminders. |

How to Track Payments on Invoices

Managing payment statuses for services rendered is a crucial aspect of maintaining smooth financial operations. Without an efficient system for monitoring, it becomes challenging to ensure timely receipts, avoid confusion, and maintain healthy cash flow. Tracking payments allows individuals and businesses to have a clear view of their outstanding balances and helps to organize follow-ups with clients who may have missed payments or are overdue.

Setting Clear Payment Terms

Establishing transparent payment terms at the outset can significantly simplify the tracking process. Clearly specifying due dates, acceptable payment methods, and late fees on agreements or service records is key. This clarity eliminates ambiguity and creates a solid foundation for both parties to reference when payments are processed.

Using Digital Tools to Monitor Payments

Leveraging software solutions or spreadsheets can streamline the monitoring of received and outstanding payments. By organizing transactions by date, amount, and client, you can quickly assess whether payments have been completed. Many tools also offer reminders for due dates, providing a proactive approach to ensure nothing slips through the cracks.

Regularly updating your records and cross-checking payment statuses with bank accounts or payment processors will ensure consistency and help avoid errors in tracking. Keeping this information organized also helps when reviewing past work or preparing for tax filings.

Best Practices for Invoice Organization

Efficient management of billing records is essential for smooth financial operations and avoiding confusion over payments. Properly organizing payment requests ensures that each transaction is tracked accurately, reducing the risk of errors and missed deadlines. A well-structured system for handling these documents not only improves workflow but also enhances professionalism when dealing with clients.

1. Use a Consistent Filing System

Establishing a systematic approach to organizing billing documents is the first step toward better management. Whether you prefer physical files or digital records, consistency is key. Here are some effective methods:

- Label files by client name or project title

- Sort documents by date or due date

- Create separate folders for paid and outstanding records

- Use subfolders to track specific phases of projects or services rendered

2. Implement a Digital Management Tool

Using digital tools can simplify the process of tracking and organizing payment records. Software programs and cloud-based platforms offer numerous benefits:

- Quick access to past transactions

- Automatic reminders for due payments

- Easy generation of reports on outstanding balances

- Ability to share records with clients securely

By implementing these practices, you ensure that your payment records are always accessible, up-to-date, and accurate, helping you maintain better control over your financial processes.

Where to Find Invoice Templates Online

Accessing ready-made documents for billing purposes has become increasingly simple, thanks to the numerous online resources available today. Whether you need a professional layout or a simple format, there are various platforms that offer customizable solutions. These resources help save time and effort, providing you with a polished and effective tool for managing payments.

Here are some of the best places to find free and paid options for creating billing documents:

| Platform | Features | Cost |

|---|---|---|

| Microsoft Office Templates | Variety of designs, customizable options, integrated with Office tools | Free with Office subscription |

| Canva | User-friendly interface, drag-and-drop editor, many modern designs | Free with limited features, paid subscription for premium templates |

| Template.net | Wide selection, downloadable in different formats, customizable layouts | Free options, subscription for full access |

| Zoho Invoice | Automated features, customizable templates, easy integration with accounting tools | Free with limited features, paid plan for full access |

These platforms cater to various needs, offering both simple and advanced layouts to suit your specific billing requirements. By exploring these options, you can find the perfect solution to streamline your payment processing and maintain a professional image with clients.