New Invoice Email Template to Improve Your Billing Process

Effective communication with clients is crucial when managing financial transactions. Sending clear and professional messages can significantly enhance the relationship between businesses and their customers. A well-structured approach ensures that clients understand their obligations, leading to timely payments and fewer misunderstandings.

By crafting a polished message that includes all necessary details, businesses can convey professionalism and efficiency. This process goes beyond simply requesting payment; it fosters trust and helps maintain a positive business reputation. Adopting a consistent and clear method of communication is essential for any organization that deals with regular billing cycles.

In this guide, we will explore the key components that make a payment reminder message both effective and customer-friendly. From tone to content, every aspect plays a role in ensuring smooth and prompt transactions.

Fresh Billing Communication Strategy for Businesses

For businesses, effective communication regarding payments is essential to maintaining cash flow and professional relationships. A structured approach ensures that clients understand the details of their financial obligations clearly, reducing the risk of confusion or delayed payments. By establishing a consistent and polished method for sending payment requests, companies can streamline their operations and maintain a positive reputation.

A well-crafted payment request message is more than just a request for funds; it is an opportunity to reinforce your brand’s professionalism and reliability. The format, language, and overall tone of the message should reflect your business’s values while also making it easy for clients to understand and act on the information provided.

Incorporating specific components such as payment terms, due dates, and clear contact information can further enhance the clarity of your correspondence. A thoughtful structure can help prevent errors, reduce inquiries, and ultimately encourage faster responses from clients.

Why You Need a Payment Request Message Structure

Consistency in communication is crucial for any business when dealing with financial matters. A pre-defined format for sending payment reminders ensures that all necessary details are included, reducing the risk of misunderstandings or omissions. This structure helps businesses save time and present a professional image, all while maintaining clarity in their correspondence with clients.

By using a standardized approach, businesses can avoid errors that might arise from manually drafting each request. Whether it’s specifying the due date, payment method, or additional notes, a set structure ensures nothing is overlooked, which in turn enhances client trust and encourages timely payments.

| Benefit | Impact |

|---|---|

| Consistency | Reduces errors and improves clarity in communication |

| Time-saving | Speeds up the process of preparing and sending payment requests |

| Professionalism | Helps maintain a polished, reliable image with clients |

| Clarity | Ensures all necessary payment details are communicated effectively |

Having a clear and repeatable structure for financial communications is an investment in both efficiency and customer satisfaction. By eliminating guesswork and ensuring uniformity, businesses can foster stronger client relationships and reduce the likelihood of delayed or missed payments.

Key Elements of a Professional Payment Request Message

When requesting payment from clients, clarity and professionalism are paramount. The structure of your message plays a crucial role in ensuring that the recipient understands the details, urgency, and expectations without confusion. A well-crafted message will not only convey the necessary information but also reflect positively on your business, fostering trust and encouraging prompt action.

Several key elements should always be included to make sure your communication is both clear and effective. These components ensure that your clients can quickly find the information they need to process the payment and respond accordingly.

| Element | Description |

|---|---|

| Clear Subject Line | Ensure the recipient immediately knows the purpose of the message. |

| Professional Salutation | Start with a polite greeting, addressing the recipient by name if possible. |

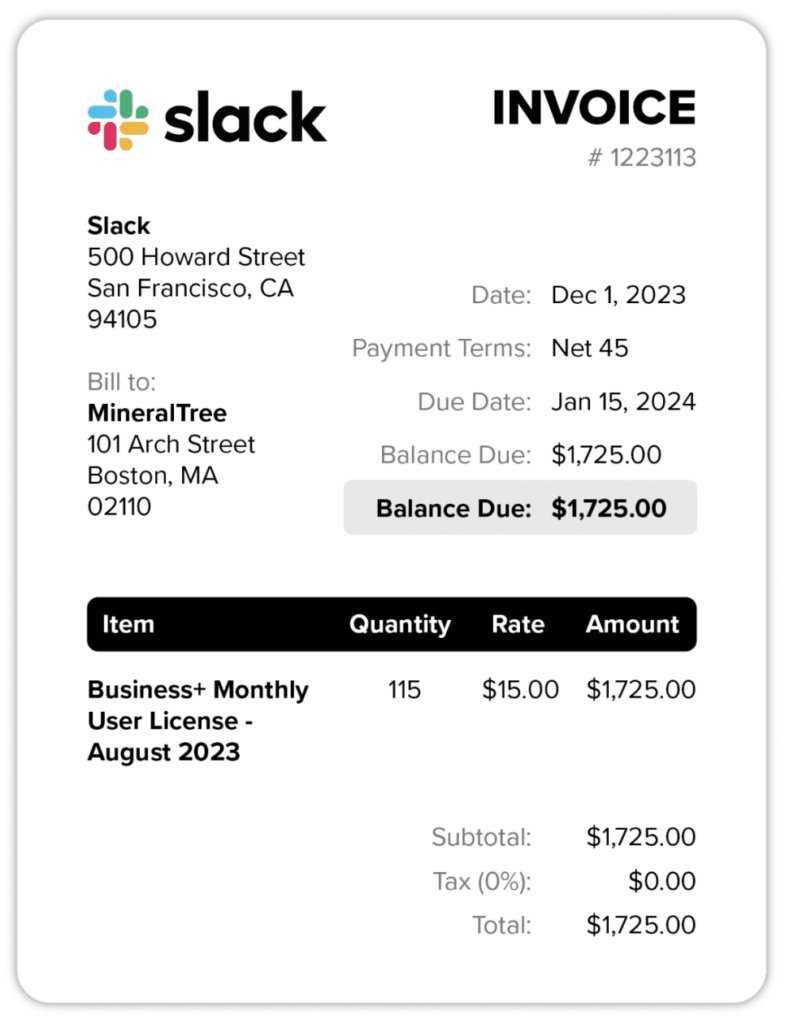

| Payment Details | Include the amount due, payment method, and due date clearly. |

| Call to Action | Encourage the recipient to take immediate action, such as making a payment or contacting you with questions. |

| Contact Information | Provide a way for the client to reach you if they have any questions or concerns. |

| Polite Closing | End with a courteous thank you and express appreciation for their business. |

Incorporating these elements into your communication ensures that your requests are clear, professional, and more likely to result in timely payments. Every detail matters, and structuring your messages with care can make a significant difference in how clients perceive and respond to your financial correspondence.

How to Create a Clear Payment Request Message

For a payment request to be effective, clarity is essential. The recipient should instantly understand what is being asked, when it is due, and how they can fulfill the request. A disorganized or unclear message can lead to confusion and delays, ultimately affecting cash flow and client relationships. Crafting a concise and easy-to-understand message ensures that clients can quickly respond and make payments without unnecessary back-and-forth.

Steps to Ensure Clarity

Follow these simple steps to create a clear and effective payment reminder:

- Use a Direct and Informative Subject Line: Make sure the subject immediately conveys the purpose of the message, such as “Payment Due: [Amount] for [Service/Product].”

- Open with a Polite Greeting: Address the client by name, if possible, and start with a courteous tone.

- State the Amount Due: Clearly mention the amount the client owes. Avoid unnecessary jargon and keep it straightforward.

- Specify the Due Date: Be clear about when the payment should be made, so the recipient is not left guessing.

- Provide Payment Instructions: Outline the payment methods available and provide any necessary details, such as bank account numbers or links to payment portals.

- Include Contact Information: Make it easy for clients to reach out if they have questions or need assistance.

- Close Politely: Thank the recipient for their business and express your willingness to assist them with any concerns.

Additional Tips for Clarity

- Keep Language Simple: Avoid overly complex or technical terms that may confuse the reader.

- Highlight Important Information: Use bold text or bullet points to draw attention to key details like amounts, due dates, and payment methods.

- Be Concise: Keep your message short and to the point. Long, rambling emails can overwhelm the recipient.

By following these guidelines, you ensure that your message is clear, professional, and actionable. A well-organized communication not only increases the chances of a prompt response but also helps build trust and credibility with your clients.

Best Practices for Writing Payment Request Messages

Crafting effective payment request messages is an essential skill for businesses looking to maintain professional relationships and ensure timely payments. A well-written message is clear, courteous, and designed to make the process as easy as possible for your clients. By following certain best practices, you can increase the likelihood of receiving prompt payments while preserving your business’s reputation.

Key Practices to Follow

To create effective payment reminders, keep the following best practices in mind:

- Be Clear and Concise: Avoid unnecessary details or jargon. Keep the message straightforward, focusing on the essential information–amount due, payment method, and deadline.

- Use a Professional Tone: Always maintain a polite and respectful tone. Even if the payment is overdue, it’s important to stay diplomatic and professional.

- Personalize the Message: Address the recipient by name whenever possible. Personalization can help create a more positive connection and enhance the recipient’s response.

- Set Clear Expectations: Specify the due date for payment and any late fees that may apply if the payment is delayed. Make sure the client knows exactly when and how to pay.

- Offer Multiple Payment Options: Make it easy for clients to pay by offering different methods such as bank transfers, online payment portals, or credit card options.

Additional Tips for Effectiveness

- Include All Relevant Details: Provide a breakdown of the charges or services being paid for, if applicable. This adds transparency and helps prevent misunderstandings.

- Use Clear Subject Lines: Make sure the subject line is specific and immediately conveys the purpose of the message, such as “Payment Due for [Service/Product].”

- Follow Up Professionally: If payment is not received by the deadline, send a polite reminder. Keep it courteous and professional, reiterating the details and the due date.

- Proofread Before Sending: Always check for spelling and grammatical errors to ensure the message looks professional and is easy to understand.

By implementing these best practices, your payment requests will be clearer, more professional, and more likely to result in timely payments. Clear communication not only improves cash flow but also strengthens your relationship with clients, ensuring that both parties remain satisfied.

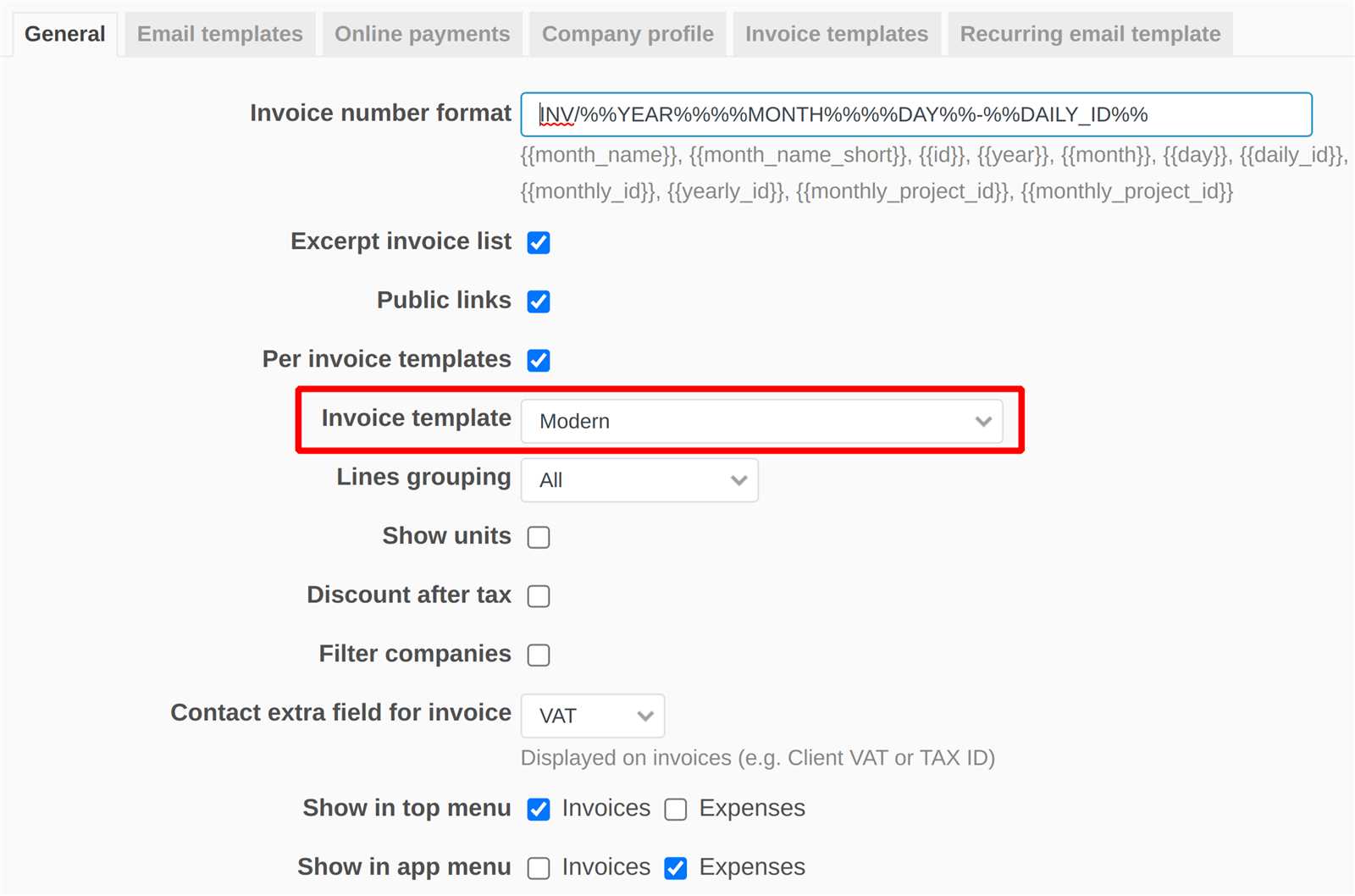

Customizing Your Payment Request Message Format

Personalizing your payment request format is a crucial step in creating a more engaging and professional experience for your clients. A tailored approach ensures that each communication reflects your brand’s voice and meets the specific needs of your business and customers. Customizing the structure not only adds a personal touch but also allows you to highlight important details in a way that aligns with your business goals.

To create a more personalized and effective communication, consider adjusting elements such as the tone, layout, and content. Tailoring these aspects can make the message more relevant to the recipient, increasing the likelihood of prompt action. Customization can also help reinforce your business’s identity, making it stand out and more memorable to clients.

Here are a few strategies to consider when tailoring your payment request format:

- Adjust the Tone to Fit Your Brand: Whether your business is formal or casual, match the tone of the message to your brand’s voice. A friendly tone might work for small businesses, while a more formal tone may be appropriate for corporate clients.

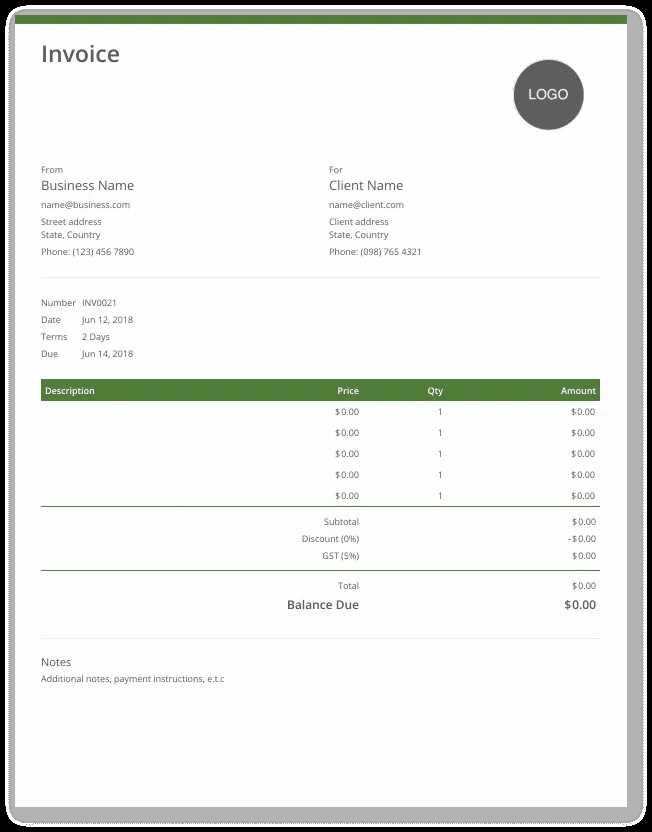

- Include Your Branding: Add your company logo, colors, and contact information to the message. This reinforces your brand identity and makes the communication look more professional.

- Personalize the Subject Line: Tailor the subject line to each specific client, including their name or a reference to the particular service or product they purchased.

- Highlight Key Information: Use bold text or bullet points to make critical details such as the payment amount, due date, and payment methods stand out, making the message easier to scan quickly.

- Incorporate Additional Notes: Include any relevant instructions or personal messages to the client, such as a thank you note or a reminder of a discount if paid early.

Customizing your payment communication format to match both your clients’ preferences and your business’s values ensures that your messages are more effective and engaging. By tailoring each aspect of the message, you not only increase the chance of timely payment but also enhance your client relationships over time.

How to Address Clients in Payment Request Messages

Addressing your clients appropriately in payment reminders is crucial for maintaining a professional and respectful relationship. The way you begin your message sets the tone for the rest of the communication and can influence how your client responds. By using the right level of formality and personalization, you can ensure your messages are both polite and effective.

Considerations When Addressing Clients

When addressing your clients, it’s important to strike a balance between professionalism and personalization. The appropriate salutation can depend on factors like your relationship with the client, the nature of your business, and the context of the payment request.

- Use the Client’s Name: Personalizing your message by using the recipient’s name creates a connection and makes the communication feel more direct. For example, “Dear [Client Name],” is a standard approach for most situations.

- Consider the Formality Level: Choose a greeting that reflects the tone of your business. For formal clients or corporate entities, “Dear [Client’s Full Name]” or “To Whom It May Concern” is more appropriate. For informal relationships, “Hello [Client’s First Name]” or even “Hi [Name]” can work well.

- Use Titles Where Relevant: If the client holds a specific title, such as “Dr.” or “Mr./Ms.,” it’s respectful to use it. This is especially important when addressing clients in a more professional or corporate setting.

- Avoid Overly Casual Greetings: While it’s important to be friendly, avoid overly casual language like “Hey” or “What’s up” unless you have a very informal relationship with the client.

Examples of Appropriate Salutations

Here are some examples to guide you in selecting the right salutation for different situations:

- Formal: “Dear Mr. Smith,” or “Dear Dr. Johnson,”

- Professional with a bit of warmth: “Hello Ms. Williams,” or “Hi John,”

- General/Formal: “To Whom It May Concern,”

- Informal (if appropriate): “Hi Sarah,” or “Hey Alex,”

By carefully selecting how you address your clients, you help ensure that your message conveys the right level of professionalism and respect, while also fostering a positive relationship for future communications.

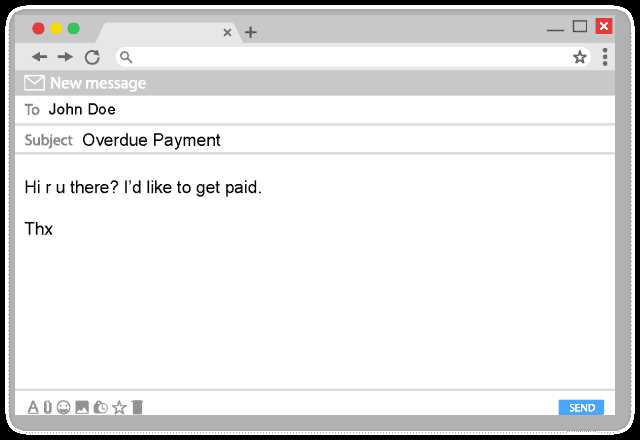

Choosing the Right Tone for Payment Request Messages

The tone of your payment request message plays a significant role in shaping the client’s response. A message that is too harsh or too casual can create misunderstandings or damage the relationship. Striking the right balance between professionalism and politeness is key to ensuring that your request is taken seriously without alienating the recipient. The tone should reflect the nature of your business, the relationship with the client, and the urgency of the payment.

Factors to Consider When Setting the Tone

To determine the most appropriate tone, consider the following factors:

- Relationship with the Client: If you have an established relationship with the client, you may use a more casual tone. However, if the client is new or the transaction is more formal, stick to a professional and respectful tone.

- Payment History: For clients who have always paid on time, a polite reminder with a friendly tone is appropriate. For overdue payments, a more urgent tone may be necessary, but still keep it polite.

- Nature of the Business: Some industries, such as law or finance, require a more formal tone, while others, like small creative businesses, may allow for a more relaxed approach.

- Urgency of Payment: If the payment is urgent or overdue, your tone should reflect the urgency without being overly demanding. A firm yet respectful tone will convey the need for prompt action.

Examples of Tone for Different Scenarios

Here are some examples of how to tailor your tone based on the situation:

- Friendly Reminder: “Hello [Client Name], we hope you’re doing well. This is a friendly reminder that payment for [service/product] is due soon. We appreciate your prompt attention to this matter.”

- Polite but Firm: “Dear [Client Name], we noticed that the payment for [service/product] was due on [date]. Please kindly settle the amount at your earliest convenience. If you have any questions, don’t hesitate to reach out.”

- Urgent Request: “Dear [Client Name], we would like to remind you that the payment for [service/product] is now overdue. Please process the payment immediately to avoid any disruptions in service. We appreciate your prompt action on this matter.”

By choosing the right tone, you ensure that your payment requests are respectful and effective. A well-crafted tone can improve client relationships, prompt timely payments, and contribute to a more positive overall experience for both parties.

Common Mistakes in Payment Request Messages to Avoid

When drafting payment request messages, it’s easy to overlook certain details that can lead to confusion or delays. Making common mistakes can not only harm your professionalism but also impact the timeliness of payments. By being aware of these errors, you can craft clearer, more effective communications that promote timely responses and maintain positive relationships with your clients.

Common Errors in Payment Requests

Here are some frequent mistakes businesses make when composing payment requests, and how to avoid them:

| Mistake | Consequences | How to Avoid |

|---|---|---|

| Vague Subject Line | Recipients may ignore or overlook the message, not recognizing its importance. | Use a clear, direct subject like “Payment Due for [Service/Product Name].” |

| Missing Payment Details | Clients may be confused about the amount, due date, or payment method, causing delays. | Ensure all relevant details (amount, due date, payment options) are included in the message. |

| Unclear Language | Unnecessary jargon or complex wording may confuse the recipient. | Use simple, straightforward language that is easy to understand. |

| Lack of Personalization | The message may feel impersonal and less engaging, leading to a lower response rate. | Personalize the message with the recipient’s name and reference their specific service or product. |

| Failure to Follow Up | Clients may not take the payment request seriously if there’s no follow-up. | Set up reminders for overdue payments to encourage timely action. |

| Unprofessional Tone | Clients may feel alienated or disrespected, leading to poor relationships. | Keep the tone polite and professional, balancing firmness with courtesy. |

Additional Mistakes to Watch Out For

- Overcomplicating the Message: Don’t add too much information that might distract from the main point. Stick to the essentials to avoid overwhelming the reader.

- Forgetting to Include Contact Information: Always make sure clients have a way to reach you if they have questions or concerns.

- Neglecting Mobile Compatibility: Many clients may read messages on their phones, so ensure your message is well-formatted and easy to read on all devices.

By avoiding these common mistakes, you can increase

How to Improve Client Response Rates

Boosting client response rates is essential for ensuring timely payments and maintaining positive business relationships. To achieve this, your communication must be clear, engaging, and actionable. The goal is to make the process as easy as possible for your clients, while also encouraging prompt action. By refining the way you communicate and optimizing your approach, you can significantly increase the likelihood of a swift response.

Key Strategies to Enhance Client Engagement

Here are some effective strategies to improve response rates from clients:

- Personalize the Communication: A personalized message makes the recipient feel valued. Use their name and reference specific services or products they have purchased to create a more tailored experience.

- Be Clear and Direct: Clients are more likely to respond when the message is straightforward. Clearly state the purpose of the communication and what action you want the client to take, such as making a payment or reviewing an invoice.

- Provide Multiple Contact Methods: Offering several ways for clients to reach out if they have questions or concerns increases the chances of getting a response. Include email, phone numbers, or even links to live chat support.

- Set a Deadline: A sense of urgency can encourage clients to act quickly. Include a clear due date for any action required and emphasize the importance of meeting the deadline.

- Make It Easy to Respond: The fewer steps a client needs to take, the more likely they are to follow through. Simplify payment options and provide clear instructions on how to proceed with the next steps.

Additional Tips for Better Results

- Follow Up Politely: If a response hasn’t been received within a reasonable time, send a friendly reminder. Make sure the tone remains respectful and polite.

- Use a Professional but Friendly Tone: While your message should be clear and direct, it’s important to maintain a tone that is both professional and approachable. This can foster goodwill and encourage action.

- Track and Optimize: Monitor the response rates from different communication methods and experiment with different approaches to see what works best for your clients.

By applying these strategies, you can increase the effectiveness of your communications and improve client response rates. Timely and efficient responses are critical not only for cash flow but also for maintaining long-term positive relationships with your clients.

Adding Payment Terms in Your Communication Format

Clearly stating payment terms is a fundamental part of ensuring smooth financial transactions and managing expectations. Including detailed payment terms in your messages helps prevent confusion and establishes a professional tone. It also ensures that your clients understand when and how to settle their balances, reducing the likelihood of delays or disputes.

Why Payment Terms Matter

Payment terms outline the specific conditions under which a transaction is to be completed. By including them in your communication, you set clear guidelines for both parties and encourage timely payments. Here are some reasons why including payment terms is essential:

- Reduces Ambiguity: Clear terms help avoid misunderstandings about payment deadlines, methods, or late fees.

- Builds Professionalism: Stating terms upfront reinforces your credibility and business practices.

- Encourages Timely Payments: When clients know the due dates and penalties for late payments, they are more likely to pay on time.

Common Payment Terms to Include

There are several key details to include when specifying payment terms in your message. The more information you provide, the clearer the expectations will be:

| Term | Description |

|---|---|

| Due Date | The specific date by which payment is expected. For example, “Payment due within 30 days of receipt.” |

| Late Fees | If applicable, specify any late fees that will be charged if payment is not made on time. For example, “A 5% late fee will apply after the due date.” |

| Payment Methods | Outline the accepted methods of payment (e.g., bank transfer, credit card, PayPal). |

| Discounts for Early Payment | If offering a discount for early settlement, be sure to specify the percentage and timeframe. For example, “A 10% discount for payments made within 7 days.” |

| Partial Payments | If you allow partial payments, clarify the terms, such as “Installments of 50% due upon receipt and 50% due within 30 days.” |

Including these payment terms helps your clients know exactly what to expect, ensuring both clarity and fairness. It also reduces the likelihood of disputes and late payments, leading to more efficient business operations.

Using a Call to Action in Payment Request Messages

Incorporating a clear call to action (CTA) in your communication is essential for encouraging clients to take the next steps in settling their balances. A well-placed CTA guides the recipient on what to do next, making the process of payment simple and straightforward. Without a strong CTA, clients may be unsure of how to proceed, which can delay payment or lead to missed opportunities for action.

The Importance of a Strong CTA

Including a clear call to action ensures that your client knows exactly what is expected of them. It provides direction and increases the likelihood of prompt responses. Here are a few reasons why having a CTA is vital:

- Encourages Immediate Action: A CTA directs the recipient to take the next step, whether it’s making a payment or contacting you with questions. It’s a simple way to prompt action.

- Improves Conversion Rates: Including a CTA increases the chances that the client will act on the message, which leads to faster payments and fewer delays.

- Clarifies Next Steps: A well-defined CTA removes any confusion, letting the client know exactly how to proceed–whether it’s clicking a payment link, sending a check, or contacting your office.

Effective Examples of CTAs

When crafting a CTA for payment requests, it’s important to keep it clear, actionable, and easy to follow. Here are some examples of effective calls to action:

- “Click here to pay now” – Providing a direct link to your payment portal makes it simple for clients to make payments immediately.

- “Please complete your payment by [Due Date]” – Including a deadline with the CTA encourages clients to act quickly to avoid penalties or late fees.

- “Contact us if you need assistance” – Offering help shows that you are available for any questions or concerns, which can build trust and facilitate the payment process.

- “Review and confirm your payment details” – If there’s any need for confirmation or clarification, a CTA like this makes it easy for the client to know what to do next.

By using a well-defined call to action, you ensure that your client is not left wondering what to do next. A clear CTA boosts engagement and significantly improves the chances of receiving timely payments.

Design Tips for an Effective Payment Request Message

The design of your payment request message plays a crucial role in ensuring clarity, professionalism, and ease of understanding. A well-organized and visually appealing message makes it easier for clients to quickly grasp the essential details, such as the amount due, payment methods, and deadlines. A clean layout can also improve the overall recipient experience and increase the likelihood of timely payments.

Key Design Principles to Follow

Here are some design tips to help you create effective, user-friendly payment requests:

- Keep It Simple: Avoid cluttering the message with unnecessary information. Focus on the essentials–amount due, payment method, and due date. A clean, straightforward design improves readability.

- Use Clear Headings and Subheadings: Break up the content with headings to make the message easy to scan. Use subheadings to guide the recipient to specific sections, such as payment instructions or contact details.

- Highlight Key Information: Make important details, like the amount due and due date, stand out by using bold text, larger fonts, or color to draw attention.

- Be Consistent: Use a consistent font style, size, and color scheme throughout your message. A uniform design ensures the message appears professional and cohesive.

- Mobile Optimization: Ensure that your message looks good on both desktop and mobile devices. Many clients may access the request on their phones, so make sure it’s easy to read and navigate.

Example of an Effective Design Layout

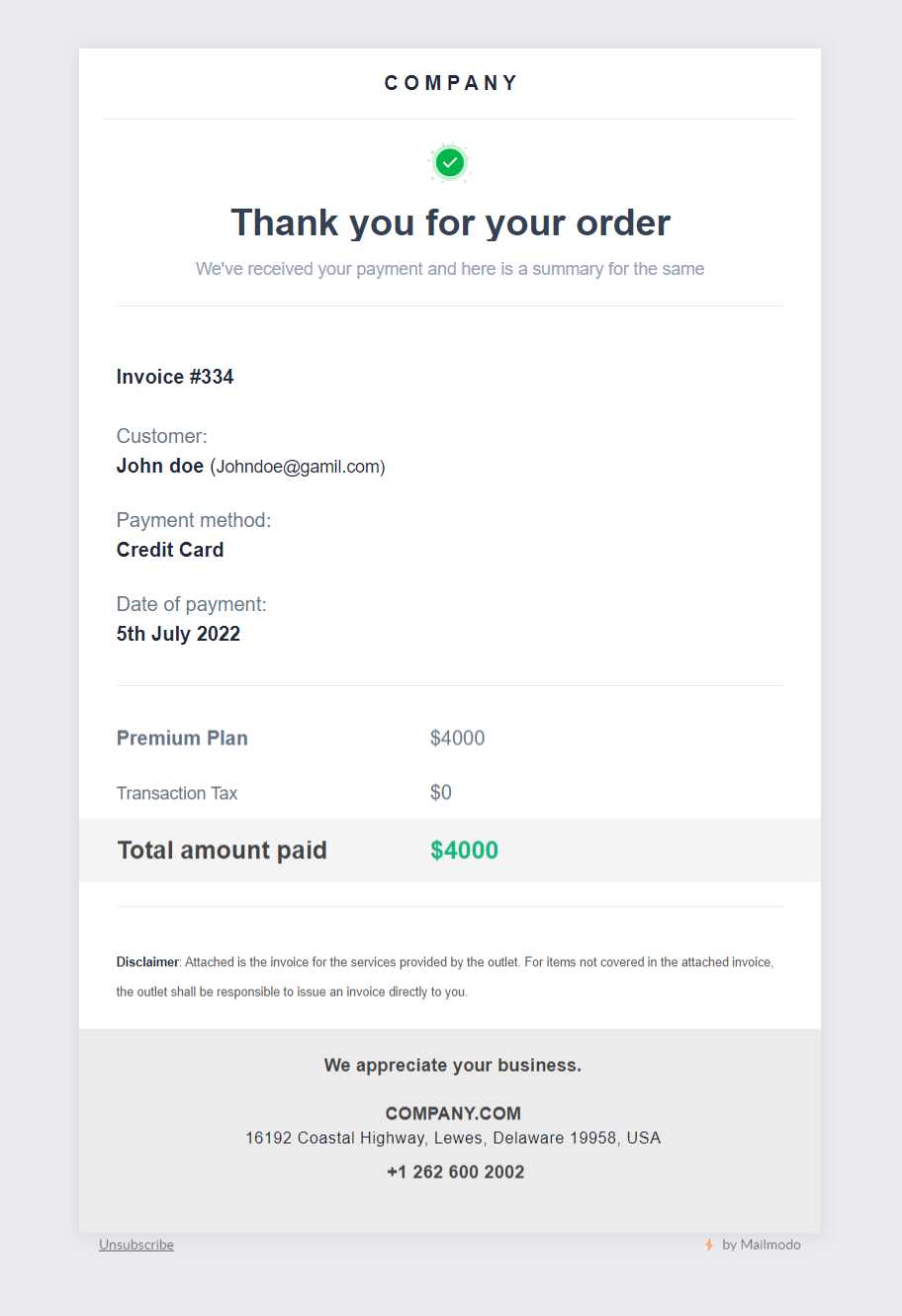

A well-structured design layout can make a significant difference in how your message is received. Below is an example of how to present your payment request effectively:

| Section | Purpose |

|---|---|

| Header | Clearly state the purpose of the message, such as “Payment Due for [Service/Product].” Use a professional yet friendly tone. |

| Payment Details | Present the amount due, payment methods, and due date in a clear and easy-to-read format. Consider using bullet points for clarity. |

| Call to Action | Provide a clear, easy-to-follow action for the client, such as “Click here to pay now” or “Please complete payment by [due date].” |

| Contact Information | Offer multiple ways for clients to reach you in case of questions or concerns. Include phone numbers, email addresses, and links to support resources. |

By applying these design principles, your payment requests will be more visually appealing, easy to navigate, and professional. A well-designed message increases the chances that your clients will promptly review and act on the

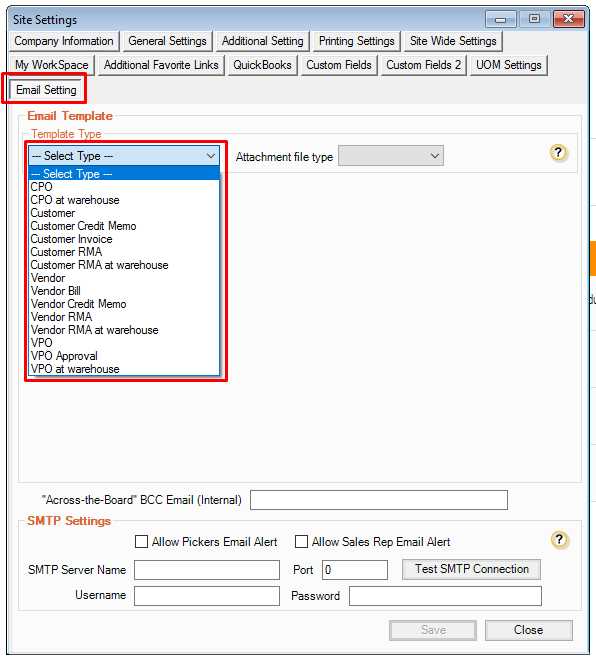

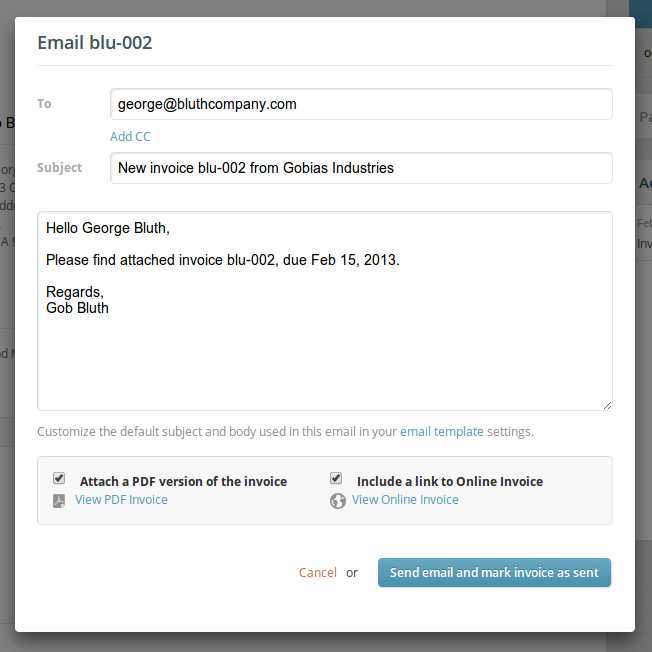

How to Automate Payment Request Sending

Automating the process of sending payment requests can save time and ensure that your clients receive timely notifications without manual effort. Automation helps streamline workflows, reduces the risk of human error, and ensures consistent follow-ups. By setting up automated systems, you can focus on other important tasks while ensuring that your clients are regularly reminded to settle their accounts.

Benefits of Automating Payment Requests

Implementing automation in your payment communications provides several key advantages:

- Efficiency: Automating the process allows you to send multiple payment requests with minimal effort, improving overall workflow efficiency.

- Consistency: Automation ensures that all clients receive consistent communication, reducing the chance of missed or delayed messages.

- Time-Saving: With automated systems, you can eliminate the need for manually drafting and sending payment requests, saving valuable time.

- Improved Cash Flow: Regular and timely reminders can help speed up payments and keep your accounts up-to-date, improving your cash flow.

Steps to Set Up Automated Payment Requests

To set up an automated system for sending payment reminders, follow these steps:

- Choose an Automation Tool: Use accounting software or email marketing platforms that offer automation features. Some popular options include QuickBooks, Xero, and Mailchimp.

- Set Up Payment Triggers: Determine when payment reminders should be sent. This could be immediately after a transaction, on specific due dates, or at scheduled intervals leading up to the payment deadline.

- Create a Payment Reminder Message: Design a standard communication that will be sent automatically. Include essential details such as the amount due, payment methods, and the due date. Keep the tone professional yet polite.

- Personalize Communications: Ensure that your automation tool allows for personalization, such as adding the client’s name, the product or service purchased, and the specific payment due. Personalization helps maintain a human touch.

- Monitor and Adjust: Track the effectiveness of your automated messages. If payment responses are low, consider adjusting the frequency, tone, or content of the reminders to improve engagement.

By automating your payment reminders, you can ensure a seamless process for both you and your clients. This not only saves time but also helps in maintaining professional relationships and improving your financial processes.

Integrating Your Payment Request with Accounting Software

Integrating your payment request system with accounting software streamlines the entire invoicing process, helping you automate the creation, sending, and tracking of payments. This integration allows for real-time updates to your financial records, reducing manual data entry and ensuring that all transactions are accurately recorded. By connecting your payment request system with accounting software, you can enhance operational efficiency, maintain up-to-date records, and reduce the risk of errors.

Benefits of Integration

Here are several reasons why integrating your payment requests with accounting software can be a game-changer for your business:

- Automation: Once integrated, payment requests can be automatically generated and sent based on pre-set conditions, reducing the need for manual intervention.

- Real-Time Data Sync: All payments and adjustments are reflected immediately in your accounting records, ensuring your financial information is always up to date.

- Improved Accuracy: Integration eliminates the need for manual data entry, which can lead to errors or discrepancies. Financial data is synced directly between the two systems.

- Time Savings: Automating the invoicing and payment follow-up process saves you time that would otherwise be spent manually managing these tasks.

How to Integrate Your System

Integrating your payment request system with accounting software is a straightforward process when using the right tools. Here are the steps to follow:

| When to Send Payment Requests for Maximum Effect

Timing plays a crucial role in the effectiveness of your payment requests. Sending them at the right moment can increase the likelihood of receiving prompt payments while reducing follow-up efforts. By strategically determining when to send out these messages, you can improve cash flow, enhance client relationships, and avoid delays in payment processing. Best Times to Send Payment RequestsHere are key moments when sending payment reminders will have the greatest impact:

Factors to Consider When Timing Payment RequestsTo maximize the effectiveness of your payment reminders, consider these factors:

By carefully considering when to send your payment requests, you can increase response rates and ensure that your business receives timely payments, helping to maintain positive cash flow and strong client relationships. How to Handle Late Payments in MessagesDealing with overdue payments requires tact and professionalism. When clients miss payment deadlines, it’s important to address the situation with care to maintain a positive relationship while ensuring that your business gets paid. The key is to remain firm yet respectful, and to clearly communicate the expectations for payment moving forward. Steps for Handling Late PaymentsFollow these steps to address late payments effectively:

Example of a Late Payment ReminderHere’s an example of how to address late payments in a message:

By handling late payments in a clear, polite, and professional manner, you maintain positive client relationships while ensuring that your business’s cash flow remains healthy. Examples of Well-Written Payment Request Messages

A well-crafted payment request can make a significant difference in how clients respond to your communications. Clear, concise, and professional messages not only help prompt timely payments but also reinforce the positive image of your business. Below are examples of effective payment requests that maintain a balance of professionalism and clarity. Example 1: Simple and Direct Payment RequestThis type of message works best when the payment is due or slightly overdue. It is direct, polite, and to the point:

Example 2: Payment Reminder with Grace PeriodThis message works well when you are offering a short grace period for a delayed payment. It maintains professionalism while still encouraging prompt action:

Example 3: Firm Reminder with Late Fee Notice

This message is appropriate when the payment is significantly overdue, and you need to add a late fee or express the urgency of the situation:

Key Takeaways for Writing Effective Payment Request MessagesWhen crafting your own payment request messages, here are a few best practices to keep in mind:

These examples should provide a strong foundation for writing effective payment request messages that enhance client communication and improve payment collection rates. |

|---|