Create Professional Invoices with the Best Online Invoice Template

Managing business transactions efficiently is crucial for any entrepreneur or freelancer. One of the key components of smooth operations is creating professional, error-free documents that clearly outline payments due. In today’s fast-paced world, automating and simplifying this process can save valuable time and reduce the risk of mistakes.

By using pre-designed forms that can be easily customized, businesses can generate professional documents within minutes. These tools allow for quick adjustments, such as adding company details, client information, and payment terms, ensuring each document aligns with your specific needs. Not only does this approach enhance productivity, but it also gives a polished look to every transaction.

Efficiency and accuracy are the main benefits of using such digital solutions, as they eliminate manual work and streamline the billing process. This allows companies to focus more on growth and less on administrative tasks.

What is an Online Invoice Template

In today’s business environment, creating and managing payment requests has become easier and more efficient with the help of digital tools. These tools allow businesses to quickly generate structured documents that serve as official records for transactions. They can be customized to suit specific business needs, offering both flexibility and professionalism in communication with clients and customers.

Purpose of These Documents

Such tools are designed to simplify the process of requesting payment for goods or services. They provide a standardized format that includes all the essential details for both the service provider and the client. With these solutions, businesses can easily produce clear, concise, and legally sound records without the need for manual drafting or printing.

Key Elements Included

- Business name and contact details

- Client information

- Description of services or goods provided

- Payment amount and terms

- Due date

- Unique identification number

These documents ensure that all necessary information is included for both parties, making the payment process more transparent and reducing the chances of confusion or disputes.

Why Use an Online Invoice Template

Efficiency and accuracy are essential when it comes to managing business transactions. Using digital tools to generate payment requests eliminates the time-consuming task of creating documents from scratch. These pre-designed forms simplify the process, ensuring consistency and reducing the likelihood of errors, which is crucial for maintaining a professional image and fostering trust with clients.

Time-Saving Benefits

- Quickly generate documents with pre-filled sections

- Automate calculations such as totals and taxes

- Save time by reusing the same layout for different clients

Enhanced Accuracy

- Built-in validation to avoid mistakes in payment details

- Ensure consistent formatting and structure every time

- Reduce human errors in manual data entry

By leveraging these tools, businesses can focus more on core activities while ensuring every transaction is documented professionally and accurately. These solutions are designed to streamline billing processes, improve cash flow, and maintain strong client relationships.

Key Features of a Good Invoice Template

A well-designed document for payment requests plays a crucial role in maintaining professionalism and clarity in business transactions. The key to an effective tool lies in its ability to convey all necessary information in a clear, concise, and organized manner. When choosing a solution for generating payment forms, it’s important to ensure it includes several essential features that help both the business and the client.

Essential Information and Structure

Clear organization is one of the most important features. A well-structured document ensures that all necessary details are included and easily identifiable. Key sections to consider are:

- Business details (name, address, and contact information)

- Client information (name, company, and contact details)

- Itemized list of goods or services provided, with descriptions and quantities

- Payment terms (due date, late fees, and payment methods)

- Unique reference number to help track payments easily

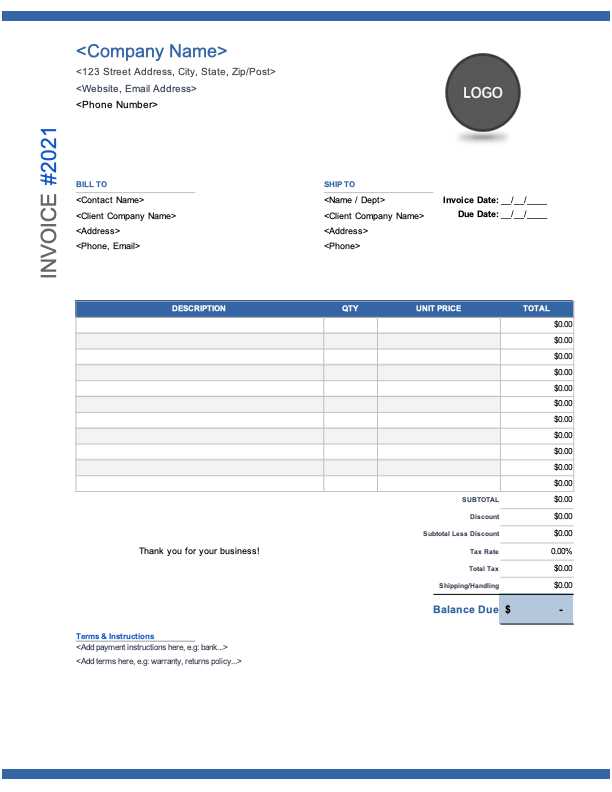

Customization and Flexibility

A good tool should also offer customization options to fit the specific needs of a business. This includes:

- Ability to add or remove sections based on business type

- Option to incorporate branding elements like logos or color schemes

- Space for personalized messages or payment instructions

Having these features ensures that the document can be adapted for any type of transaction, whether it’s a one-time project or ongoing service agreement. This flexibility is key to presenting a professional and cohesive brand image across all communications.

How to Create an Invoice Online

Generating a professional payment request has never been easier. With the right digital tools, businesses can create customized documents quickly, saving time and ensuring accuracy. The process involves a few simple steps, which allow for easy personalization, efficient management, and quick delivery to clients. Here’s a step-by-step guide to creating a payment document using an online solution.

Step 1: Choose a Reliable Tool

First, select a trusted platform or software that provides customizable forms for payment documentation. Many platforms offer free and paid options, depending on your needs. Choose one that allows you to input your details and select pre-made designs that suit your business.

Step 2: Fill in Your Business Details

Start by entering your company’s information, such as its name, address, phone number, and email. This ensures that clients can easily reach you in case of questions or payment inquiries. You should also include a unique identification number for each document for easy tracking.

Step 3: Add Client Information

Enter the client’s details, such as their name, company, address, and contact information. This is essential for clarity and ensures that the document is correctly addressed to the right party.

Step 4: List the Products or Services

Provide a detailed description of the goods or services provided, including quantities and unit prices. Most tools will automatically calculate totals, taxes, and any discounts. Double-check all figures to ensure accuracy.

Step 5: Set Payment Terms

Clearly outline payment terms, including the amount due, due date, accepted payment methods, and any late fees if applicable. These details prevent confusion and set expectations for both parties.

Step 6: Review and Send

Once all information is entered, review the document for accuracy. Many tools allow you to save, print, or send the completed document directly to the client via email. After confirmation, you can easily track the payment status and follow up as needed.

Benefits of Digital Invoicing for Businesses

In today’s fast-paced business environment, managing payments through digital methods offers several advantages over traditional paper-based approaches. By adopting electronic solutions for creating and sending payment requests, companies can streamline their operations, reduce overhead costs, and improve efficiency. Below are some key benefits of using digital tools for business transactions.

| Benefit | Description |

|---|---|

| Time Efficiency | Automating payment requests allows businesses to create and send documents within minutes, reducing manual efforts and speeding up the entire process. |

| Cost Savings | By eliminating paper, printing, and postage costs, businesses can significantly reduce their operational expenses. |

| Improved Accuracy | Automated calculations minimize human errors in totals, taxes, and discounts, ensuring precise and accurate records every time. |

| Faster Payments | Digital documents can be sent instantly, which encourages quicker client responses and expedites payment processing. |

| Environmentally Friendly | Switching to digital transactions reduces paper waste and contributes to a more sustainable business model. |

| Easy Tracking and Management | Digital solutions make it easy to track the status of payments, manage overdue accounts, and maintain organized records for financial reporting. |

These benefits help businesses stay competitive, reduce administrative burdens, and focus more on growth rather than getting bogged down by manual paperwork.

Choosing the Right Invoice Template for Your Business

Selecting the right document for billing is an essential part of maintaining a professional image and ensuring smooth transactions with clients. The right design and structure not only help communicate your business effectively but also ensure that all necessary details are included. With various options available, it’s important to consider your business type, branding, and the specific needs of your clients when choosing the right solution.

Here are a few factors to consider when selecting the best option for your business:

- Business Type: Different industries may require specific layouts or information. For instance, a freelancer might need a simple format, while a service-based business may need additional sections like terms of service or payment schedules.

- Customization Options: Look for a format that allows you to easily add your logo, modify the color scheme, and tailor sections to your brand’s identity. Customization helps create a consistent and professional appearance across all client communications.

- Ease of Use: The document should be user-friendly and easy to update. Choose a solution that allows you to create and send payment requests without needing advanced technical skills.

- Compliance: Ensure the tool or solution complies with local tax laws and financial regulations. Including the correct fields for tax information and payment terms is crucial for legal purposes.

- Compatibility with Other Systems: If your business uses accounting or financial management software, choose a tool that integrates easily with these systems to save time and reduce the need for manual data entry.

By carefully considering these factors, you can choose a solution that not only suits your business needs but also helps maintain a professional image while ensuring efficient payment processing.

Customizing Your Invoice Template

Creating a professional and branded document for payment requests involves more than just filling out basic information. Customization allows you to tailor the document to reflect your business’s identity and ensures that the document meets both your and your clients’ specific needs. By adjusting various elements, you can create a more personalized and cohesive experience for your clients.

Key Elements to Customize

When adapting your document, consider the following elements to align it with your branding and functional requirements:

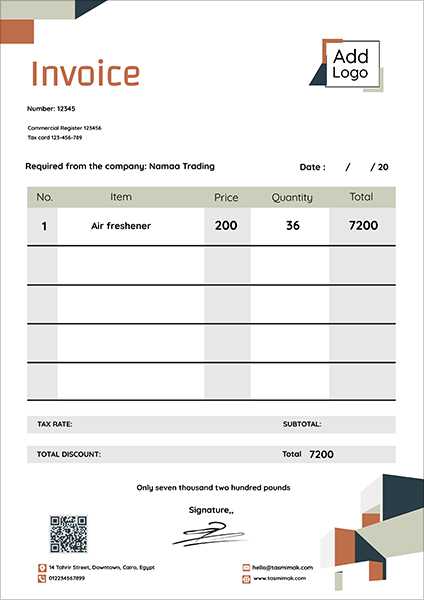

- Company Branding: Add your company logo, use your brand colors, and select a font that aligns with your business identity. A well-branded document reflects your professionalism and makes your communication stand out.

- Business Information: Include your complete business details such as address, phone number, email, and website. Customizing these sections ensures that clients can contact you easily and enhances your business credibility.

- Payment Terms: Adjust payment terms according to your agreement with the client. This can include payment methods, due dates, late fees, and any special terms that are specific to your business or the project.

- Layout and Design: Choose a layout that suits your business needs. Some businesses may require more space for detailed descriptions, while others may need a minimalist approach with only essential information.

Additional Customization Options

In addition to basic design features, consider these options to enhance functionality and professionalism:

- Personalized Messages: Add a note at the bottom or a thank you message to express appreciation for the client’s business. Personal touches help build stronger client relationships.

- Tax Information: Ensure that all necessary tax details are included, such as tax identification numbers or applicable tax rates, depending on your region.

- Unique Identifiers: Assign a unique reference number or order number to each document for easy tracking and organization. This makes it simple for both you and your clients to reference specific transactions.

By customizing the document to suit your business needs, you not only enhance the professionalism of your transactions but also improve the clarity and efficiency of the billing process.

Common Mistakes to Avoid in Invoices

When creating documents for payment requests, accuracy is critical. Even small errors can lead to misunderstandings, delayed payments, or a negative impression of your business. Being aware of common mistakes and taking the time to review your payment requests carefully can prevent issues and ensure that transactions go smoothly. Below are some common mistakes businesses make and how to avoid them.

| Error | How to Avoid It |

|---|---|

| Incorrect Client Information | Double-check the spelling of the client’s name, company details, and contact information before sending the document. Inaccuracies can cause confusion and delay payments. |

| Missing Payment Terms | Clearly state payment due dates, methods, and late fees. Leaving out these details can lead to misunderstandings about when and how to pay. |

| Failure to Itemize Products/Services | Provide detailed descriptions of the goods or services provided, including quantities, unit prices, and totals. This ensures clarity and prevents confusion about what is being billed. |

| Wrong Amounts or Calculations | Always verify totals, taxes, and discounts to ensure they are correct. Using automated calculations helps minimize errors in financial figures. |

| Unclear or Missing Due Date | Clearly indicate when the payment is due. An ambiguous or missing due date can cause delays in payment and affect cash flow. |

| Lack of a Unique Reference Number | Assign a unique identifier to each document for easy tracking and referencing. This is especially important when managing multiple transactions. |

By avoiding these common mistakes, you ensure that your payment requests are clear, professional, and accurate, leading to quicker payments and stronger client relationships.

How Online Templates Save Time and Money

Using pre-designed solutions for creating payment requests significantly reduces the time spent on administrative tasks. Instead of manually designing documents for every transaction, businesses can rely on ready-made formats that require only minimal adjustments. This streamlined process not only saves time but also helps lower operational costs, allowing companies to focus more on their core activities.

Here are some ways these tools help businesses save both time and money:

- Efficiency in Creation: Pre-made formats allow businesses to generate payment requests in minutes by simply filling in the necessary details. This eliminates the need to start from scratch every time.

- Reduced Risk of Errors: Automated calculations for totals, taxes, and discounts help reduce the risk of human errors, which could lead to costly corrections or delays in payment processing.

- Lower Operational Costs: By eliminating the need for physical printing, mailing, and manual data entry, businesses can significantly cut down on paper, postage, and administrative costs.

- Faster Turnaround: Sending digital documents instantly via email speeds up the entire process, allowing businesses to receive payments more quickly and improve cash flow.

- Scalability: As businesses grow, using a digital solution allows for easy scaling. Whether handling a few or hundreds of transactions, the process remains efficient without the need for additional resources.

By adopting these streamlined tools, businesses can operate more efficiently, reduce costs, and improve overall productivity, which ultimately contributes to greater profitability and smoother operations.

Types of Invoice Templates Available Online

There are various types of pre-designed formats available for businesses to use when creating payment requests. Each type is tailored to meet the needs of different industries and business structures, offering flexibility in presentation and functionality. By choosing the right style for your needs, you can ensure that your documents are professional, clear, and in line with your business’s operations.

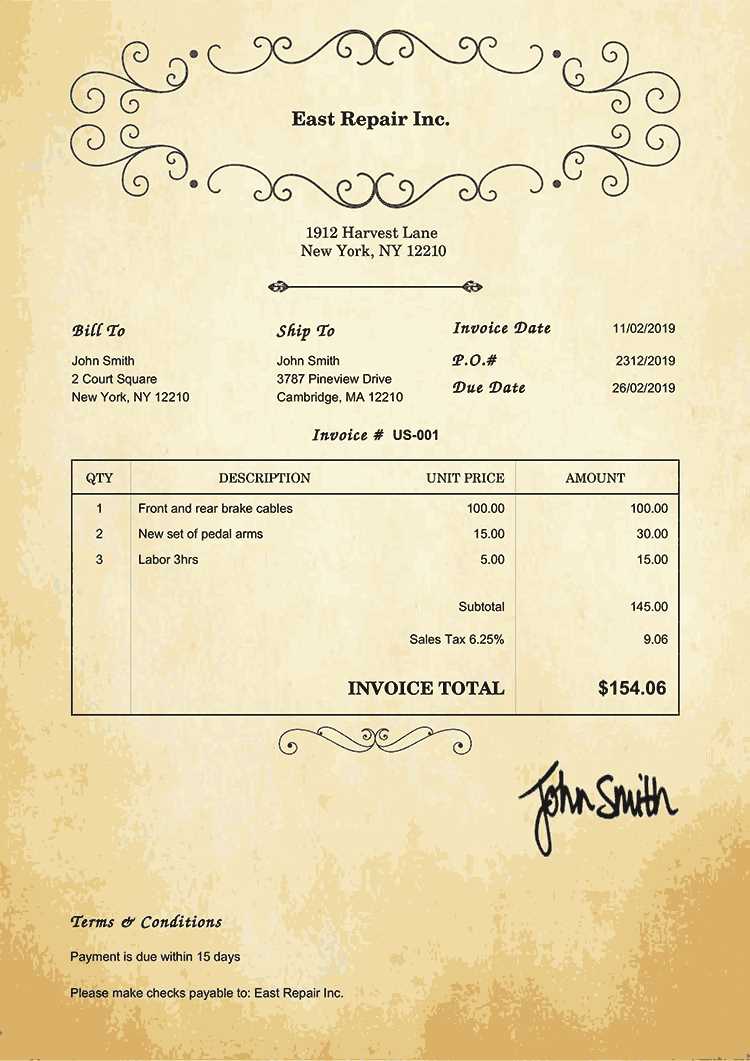

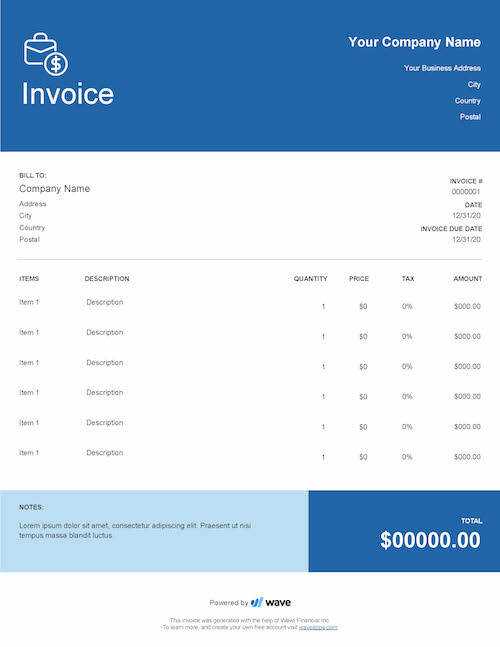

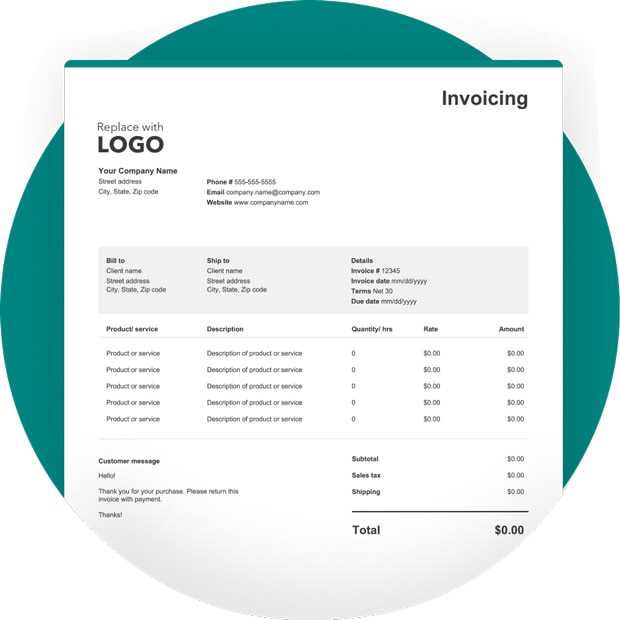

Basic Format

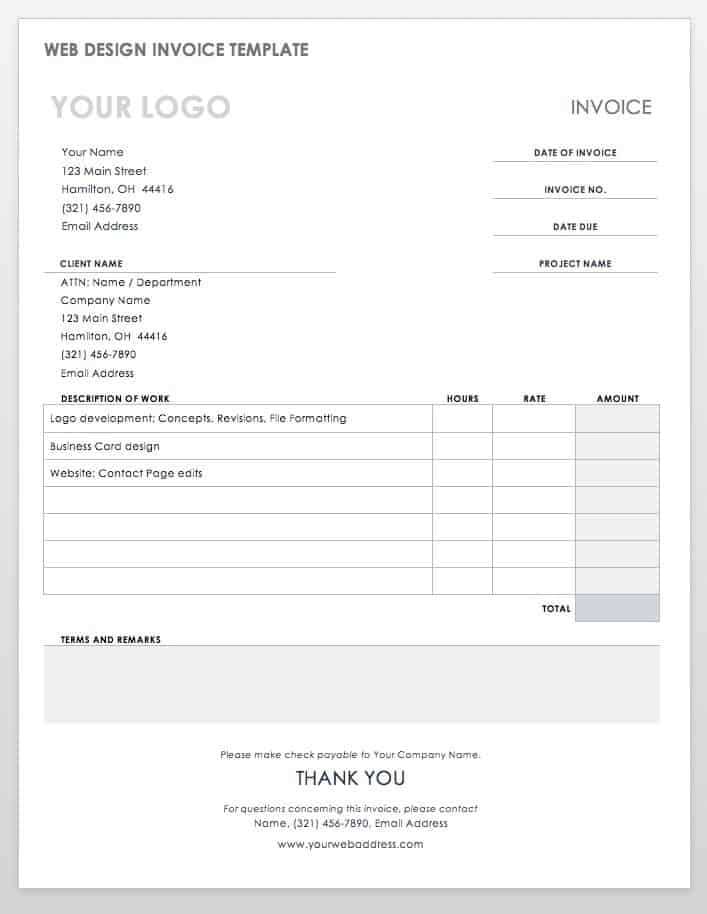

The simplest style is the basic, no-frills document. These formats typically include just the essential information such as the service/product description, amount due, and payment terms. This style is ideal for freelancers or small businesses that need a straightforward solution without the need for excessive customization. It’s quick to fill out and easy for clients to understand.

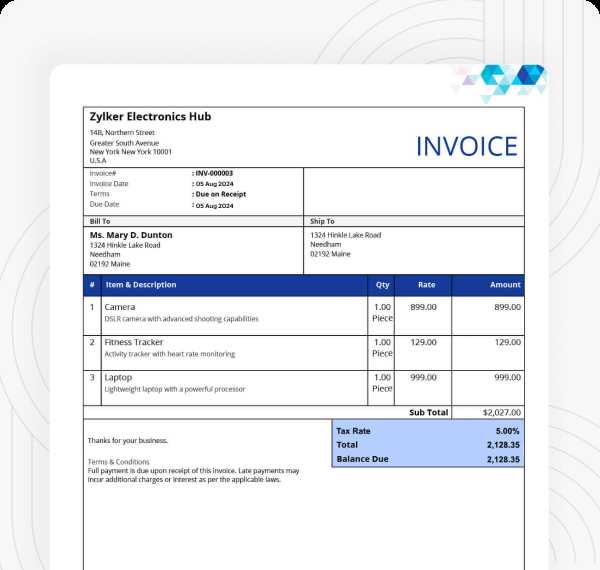

Itemized Format

For businesses that offer a range of products or services, an itemized format is often the best choice. This version breaks down each item or service, listing the quantity, unit price, and total cost for each. This level of detail not only ensures clarity but also helps clients understand the breakdown of charges, making it suitable for contractors, consultants, or service providers who offer multiple services or products in a single transaction.

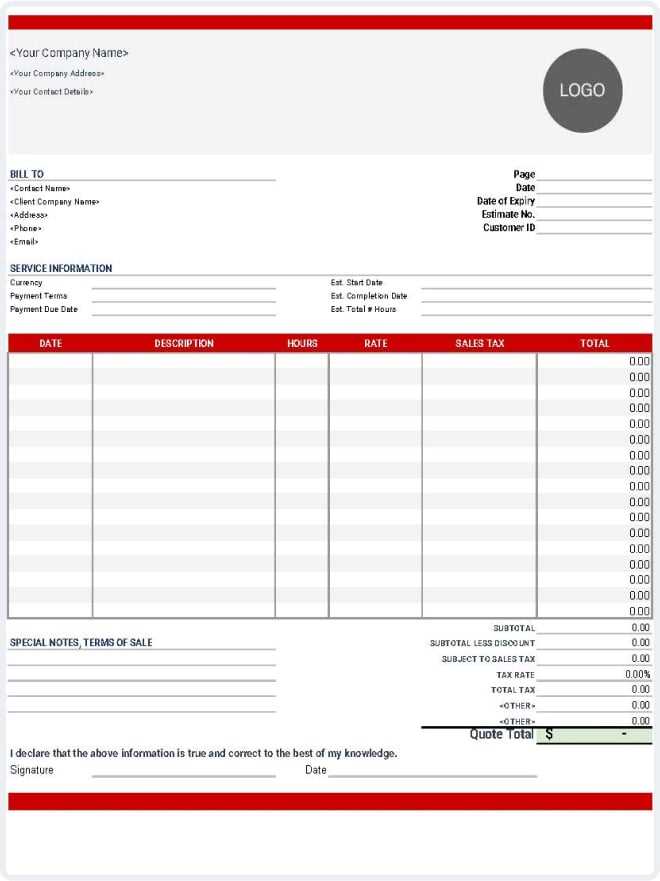

Detailed Format with Terms

For businesses that need to include specific terms and conditions (e.g., payment deadlines, penalties, or discounts), a more comprehensive format is appropriate. This style includes additional sections for payment terms, discount offers, and other contractual details that clarify expectations between both parties. It is commonly used by businesses involved in long-term projects or contractual agreements, such as construction, legal, or consulting firms.

Recurring Billing Format

Businesses that offer subscription-based services or recurring billing may benefit from a specialized format that automates periodic payments. These forms include fields for recurring dates, payment cycles, and subscription details, making it easy to manage and track ongoing transactions.

By understanding the different types of solutions available, businesses can select the one that best fits their operational needs and client requirements, ensuring smooth transactions and professional communication.

Best Free Invoice Templates to Use

For businesses looking to save on costs while still maintaining a professional appearance, free payment request formats are a great option. Many platforms offer high-quality, customizable designs that meet a variety of business needs without any financial commitment. Whether you’re a freelancer, small business owner, or large corporation, there are plenty of options available that can help streamline your billing process.

Here are some of the best free formats you can use for creating professional payment documents:

- Simple Billing Form: A minimalist design ideal for small businesses and freelancers who need to send straightforward payment requests. It includes basic sections such as client details, service descriptions, and payment terms, making it easy to complete and send.

- Itemized Billing Sheet: Perfect for businesses that provide multiple products or services, this design allows you to list each item along with quantity, unit price, and total cost. It’s especially useful for contractors, consultants, and retailers who need to break down the charges clearly.

- Recurring Payment Form: If your business offers subscription services or regular payments, this format can automate recurring billing cycles. It includes sections for payment frequency, subscription duration, and payment details, making it easy to manage ongoing transactions.

- Professional Service Billing Format: Designed for service-based businesses, this layout provides ample space to list services, add tax rates, and set payment deadlines. It’s great for consultants, designers, and other professionals who need to communicate complex pricing or project terms.

- Estimates and Quotes: While not strictly a payment request, this format allows you to send a detailed breakdown of potential charges before work begins. It’s helpful for businesses that provide quotes before finalizing contracts, such as construction or design services.

By using these free formats, businesses can maintain a professional image and save valuable time while keeping costs low. With customization options, it’s easy to tailor each design to fit your specific branding and business requirements.

How to Add Your Business Logo to an Invoice

Including your business logo on payment requests is a simple yet effective way to enhance your brand’s visibility and professionalism. It helps establish a strong identity and creates consistency across all your communications. Fortunately, adding your logo to a billing document is an easy process and can be done in just a few steps.

Steps to Add Your Logo

Follow these simple steps to include your business logo in a payment request:

- Step 1: Choose the Right Format – Select a format that allows easy insertion of images, such as a Word document, PDF editor, or a dedicated accounting tool. Many free tools offer built-in logo upload features.

- Step 2: Upload Your Logo – Locate the logo image file on your computer. Ideally, this file should be in a high-quality format (like PNG or JPG). Once found, upload it to the payment document using the upload feature provided in your chosen software.

- Step 3: Resize the Logo – Adjust the logo’s size to fit the top section of the document. Make sure it’s large enough to be clearly visible but not so large that it overshadows the other information on the document.

- Step 4: Position the Logo – Position the logo in a prominent place, typically the top left or top center of the page. Ensure it doesn’t interfere with other key information like the client’s details or the total amount due.

- Step 5: Save and Use – Once the logo is added, save the document. From there, you can send it to your clients digitally or print it as needed.

Best Practices for Logo Placement

- Keep it Professional: Make sure the logo is clear, crisp, and professional. Avoid overly complex designs that may distract from the document’s purpose.

- Consistency: Use the same logo across all your business communications to ensure a unified brand image.

- Color Matching: If possible, match the colors of your logo to the overall color scheme of the payment document to enhance brand cohesion.

By adding your business logo to your payment requests, you help build a recognizable brand presence and reinforce your professionalism, ensuring that your clien

How to Include Taxes in Your Invoice

Including taxes in your payment requests is crucial for ensuring that you comply with local tax regulations and provide clarity to your clients. Accurate tax calculations prevent disputes and ensure that you collect the correct amount. Understanding how to properly calculate and display taxes on your billing document is an essential skill for any business owner.

Here’s how to correctly include taxes in your billing document:

Steps to Include Taxes

Follow these steps to ensure your tax calculations are accurate and clearly displayed on your payment requests:

- Step 1: Know the Tax Rate – Research the applicable tax rate for your region or industry. This may vary depending on the goods or services you provide, as well as the location of your business or your client.

- Step 2: Calculate the Tax – Multiply the total amount for the goods or services by the applicable tax rate. For example, if the total amount is $100 and the tax rate is 10%, the tax would be $10.

- Step 3: Add the Tax to the Total – After calculating the tax, add it to the subtotal of your billing document. The new total amount should reflect the price of the products/services plus the tax amount.

- Step 4: Display Tax Details – Clearly break down the tax on the document. Include a separate line item that specifies the tax amount and the tax rate applied. This transparency helps clients understand how the total was calculated.

Tax Breakdown Example

The table below shows an example of how to include taxes in a billing document:

| Description | Amount |

|---|---|

| Product/Service Total | $100.00 |

| Tax (10%) | $10.00 |

| Total Due | $110.00 |

By clearly listing the tax rate and amount, you ensure that your clients understand how the final total was calculated and avoid any potential confusion or disagreements about pricing.

Managing Payments with Invoice Templates

Efficient management of payments is essential for the smooth operation of any business. Using well-structured billing formats allows companies to track payments easily, ensure accurate records, and streamline the entire billing process. By leveraging standardized payment request formats, businesses can create clear, professional documents that help both clients and teams stay organized and on top of financial transactions.

Tracking Payments

One of the main advantages of using pre-designed billing formats is the ability to clearly track and manage outstanding payments. By including specific payment terms, due dates, and unique reference numbers, businesses can stay on top of what’s owed and by when. This system allows for easy follow-ups and ensures that no payments are overlooked.

- Reference Numbers: Each document can include a unique reference number for easy tracking and reconciliation.

- Due Dates: Including a clearly stated due date helps ensure that both parties are aware of the expected timeline for payment.

- Payment Methods: Clearly outlining acceptable payment methods in the document provides transparency and helps clients choose the most convenient option for them.

Streamlining Collections

Another benefit of using pre-designed billing formats is the simplification of collections. With a consistent and professional approach to documenting transactions, businesses can reduce misunderstandings and improve communication with clients. For example, including a section for late fees or discounts for early payment encourages timely transactions and further streamlines the collection process.

- Late Fees: Clearly state any late fees to encourage timely payments and avoid unnecessary delays.

- Discounts for Early Payment: Offering discounts for early payment can incentivize clients to pay sooner, improving cash flow.

- Payment Tracking: Using an organized system allows businesses to follow up easily and keep track of the status of each payment.

By using structured, consistent billing formats, businesses can ensure efficient payment management, reduce errors, and maintain strong cash flow while enhancing client relationships through clear communication.

Ensuring Accuracy in Your Online Invoices

Maintaining accuracy in billing documents is crucial for ensuring smooth transactions and fostering trust with clients. A small mistake in a payment request, such as incorrect calculations or missing details, can lead to confusion, delayed payments, and even damage to professional relationships. To avoid these issues, it’s important to have a reliable process for creating error-free documents.

Steps to Ensure Accuracy

Here are some key steps to help ensure that your billing documents are always accurate:

- Double-Check Details: Always verify client information, such as names, addresses, and contact details, to prevent errors that could delay payment processing.

- Verify Item Descriptions: Ensure that all products or services listed are described correctly and match what was actually delivered or agreed upon.

- Accurate Calculations: Use automated tools to calculate totals, taxes, and discounts. Manually checking the math can help catch any miscalculations that might occur.

- Clear Payment Terms: Specify payment terms clearly, including the due date, late fees (if any), and acceptable methods of payment to avoid confusion later.

- Check Tax Rates: Make sure the correct tax rate is applied based on the region or product/service type. Incorrect tax rates can result in legal and financial issues.

- Include All Required Information: Ensure all necessary fields are filled out, such as the unique reference number, date of issue, and your business’s contact details, to maintain professionalism and prevent delays in payment.

Using Automation to Reduce Errors

Automation tools and software can significantly reduce the risk of errors in your billing documents. Many platforms offer features that automatically calculate totals, apply taxes, and even generate unique reference numbers, helping streamline the process and minimize mistakes.

- Auto-Calculation Features: Use tools that automatically calculate the total amount, taxes, and discounts, saving you time and ensuring accuracy.

- Pre-filled Information: Save client details and billing terms in your system so that they are automatically filled in for every new document, reducing the chance of human error.

- Templates with Built-In Checks: Choose a platform that offers pre-designed, error-checking templates, which can automatically flag missing or incorrect details before sending the document.

By taking these steps and leveraging the right tools, you can ensure that your payment requests are always accurate, which helps you maintain a professional image and improves the overall efficiency of your business operations.

Integrating Online Invoices with Accounting Software

Connecting your payment request process with accounting software can significantly streamline your business operations. By automating the transfer of financial data between your billing documents and your accounting system, you can save time, reduce errors, and ensure that your records are always up to date. This integration also simplifies financial reporting and tax filing, making it easier to track cash flow and meet compliance requirements.

Benefits of Integration

Here are some of the key advantages of integrating your billing documents with accounting software:

- Time Savings: By automating data entry, you eliminate the need to manually input payment details into your accounting software, speeding up your workflow.

- Reduced Errors: Automation minimizes the risk of human error, ensuring that the information in both your billing system and accounting software is accurate and consistent.

- Improved Cash Flow Management: Integration allows you to track payments in real time, ensuring you’re aware of outstanding balances and reducing the likelihood of missed payments.

- Seamless Financial Reporting: With integrated systems, generating financial reports is faster and more accurate, giving you a clear overview of your business’s financial health.

- Efficient Tax Management: Integration makes it easier to calculate and manage taxes by automatically tracking the necessary data for tax reporting purposes.

How to Integrate Your Billing System with Accounting Software

To integrate your payment request process with accounting software, follow these steps:

- Step 1: Choose Compatible Software – Make sure the billing system or platform you use is compatible with your accounting software. Many accounting tools, such as QuickBooks, Xero, or FreshBooks, offer integration features with popular billing platforms.

- Step 2: Set Up the Integration – Follow the instructions provided by both your billing system and accounting software to connect the two platforms. This typically involves linking the accounts and enabling data syncing between them.

- Step 3: Sync Client and Payment Data – Once the systems are connected, ensure that all client information and payment details are automatically transferred between both platforms. This includes amounts due, taxes, and payment history.

- Step 4: Review and Confirm – Before fully relying on the integration, review the data in both systems to ensure everything is syncing correctly and that no information is missing or duplicated.

- Step 5: Automate Data Entry – After confirming the setup, let the integration handle future data entry for you. Most systems will automatically update payment records and financial reports without any additional effort on your part.

By integrating your billing system with accounting software, you can create a seamless, efficient workflow that minimizes administrative tasks and enhances the accuracy of your financial management. This integration helps you focus more on growing your business rather than spending time on manual data entry and reconciliation.

How to Track Invoice Payments Online

Tracking payments for your billing documents efficiently is essential to ensure timely collections and accurate financial records. By leveraging digital tools and systems, businesses can easily monitor when payments are made, identify overdue balances, and automate reminders. A well-organized tracking process not only streamlines cash flow but also reduces the risk of overlooking unpaid accounts.

Methods for Tracking Payments

There are several ways to track payments digitally, helping you stay on top of your financial records and ensuring you never miss a payment.

- Automated Payment Reminders: Use billing systems that automatically send reminders to clients before the due date, as well as follow-up emails once the payment is overdue.

- Real-Time Payment Updates: Many digital billing platforms provide real-time updates when a payment is received. You can set up notifications to alert you whenever a payment is made.

- Payment Status Tracking: Within your system, set up columns or categories such as “Pending,” “Paid,” and “Overdue” to easily monitor the status of each transaction.

- Bank Integration: Some platforms integrate directly with your business bank account, allowing for automatic payment tracking and reconciliation without manual input.

- Client Payment Portals: Allow clients to pay directly through a portal and track their payments within the system, ensuring you have a record of every transaction made.

Steps to Track Payments Efficiently

Follow these simple steps to ensure smooth tracking of payments for your billing documents:

- Step 1: Set Up a Tracking System – Choose a platform that suits your business needs and provides the features you need for payment tracking, such as payment status updates and automated notifications.

- Step 2: Enter Payment Terms Clearly – Ensure your payment requests have clear due dates and payment instructions to avoid any confusion. This makes it easier to track payments once they’re due.

- Step 3: Monitor Payment Status – Regularly check your digital platform to monitor the status of payments. Keep an eye out for any overdue balances and take appropriate action if needed.

- Step 4: Reconcile Payments – Cross-check the payments recorded in your digital system with your actual bank account to ensure all incoming payments are accounted for correctly.

- Step 5: Send Reminders – For overdue payments, send polite reminders or follow-up notifications to encourage prompt payment. Automate these reminders if possible to save time.

By using these methods and tools, you can streamline the payment tracking process, improve your cash flow management, and avoid the headaches of manually tracking every transaction. Accurate payment tracking ensures your business remains financially healthy and organized, while reducing the chances of payment delays.