Effective Invoice Request Email Template for Clear Payment Communication

In business transactions, clear communication is key to ensuring timely payments and maintaining healthy client relationships. When the time comes to follow up on outstanding amounts, a well-crafted message can make all the difference. Crafting an effective payment reminder requires attention to tone, clarity, and professionalism, especially when the goal is to secure prompt payment without damaging the relationship.

Whether you’re a freelancer, a small business owner, or part of a larger organization, mastering the art of payment follow-ups can streamline your accounting process. A carefully composed message can help you maintain a professional image while ensuring you get compensated for your services. By understanding the essential components of a payment reminder, you can create messages that are polite, direct, and effective.

Understanding how to write a well-structured follow-up can improve your cash flow and reduce misunderstandings. This section provides practical guidance on creating communication that is clear, respectful, and persuasive, without being overly demanding.

Invoice Request Email Template Overview

When it comes to securing payments for services rendered, a clear and professional follow-up message is essential. This section covers the core components of a communication designed to remind clients of an outstanding balance. Such messages should balance courtesy with directness, ensuring that the client understands the urgency without feeling pressured.

Creating a well-structured payment reminder helps businesses maintain smooth operations and cash flow. A well-composed message includes several key elements to ensure clarity and professionalism. Below are the basic components that should be considered when drafting your communication:

Essential Components

- Subject Line: A concise, clear subject line ensures that the recipient knows the purpose of the message immediately.

- Greeting: A polite and friendly greeting sets the tone for the rest of the message.

- Details of the Amount Due: Clearly state the amount that is outstanding, including the due date if applicable.

- Payment Instructions: Provide clear instructions on how the client can make the payment, including any necessary payment details.

- Closing: A courteous closing reinforces professionalism and leaves the door open for further communication.

Best Practices for Creating an Effective Message

- Be Clear and Direct: Clearly state the purpose of the communication, the amount due, and any necessary deadlines.

- Keep a Polite Tone: Maintain a respectful tone throughout, even when you are asking for payment.

- Use Friendly Reminders: A gentle reminder is often more effective than a demanding message.

- Provide Payment Options: Offering multiple ways for the client to pay can help expedite the process.

By using these guidelines, you can craft a message that encourages prompt action while maintaining positive relationships with your clients.

Why Use an Invoice Request Email?

When managing finances, timely communication is essential for ensuring that clients fulfill their payment obligations. Sending a polite and professional reminder helps maintain positive relationships while also protecting your cash flow. Using a clear, well-structured message is an effective way to gently nudge clients towards settling outstanding balances without coming across as aggressive or confrontational.

Opting for this form of communication offers several advantages, from streamlining the payment process to reducing the likelihood of misunderstandings. Below are key reasons why it’s beneficial to use a structured reminder to request payment:

Maintain Professionalism and Clarity

Clear communication is essential in business. A well-written follow-up message ensures that your client understands their obligations and the urgency of the situation. It also projects professionalism, showing that you are organized and reliable in your business dealings.

Improve Cash Flow and Reduce Delays

Prompt reminders help speed up payments, ensuring that your business maintains a healthy cash flow. Clients are more likely to take action when they are gently reminded of pending payments. A clear message removes any ambiguity, reducing the chances of delays or forgotten invoices.

Overall, using a professional follow-up message to prompt payments can save time, minimize confusion, and contribute to smoother business operations.

Key Elements of an Invoice Request

To create an effective payment reminder, certain components must be present in the communication. A well-structured message not only conveys the necessary information clearly but also maintains a tone that encourages prompt payment while fostering positive relationships. Each part of the message plays a crucial role in ensuring that the recipient understands the request and takes appropriate action.

Here are the key elements to include in your follow-up message:

- Subject Line: The subject should be concise and to the point, clearly indicating the purpose of the message, such as “Outstanding Balance Reminder” or “Payment Due for [Service/Product].”

- Professional Greeting: Begin with a courteous and respectful salutation, addressing the recipient by name if possible. This sets a positive tone for the rest of the message.

- Clear Amount Due: Specify the exact amount owed and the due date if applicable. Being specific reduces any potential confusion about the balance that needs to be settled.

- Payment Instructions: Provide clear instructions on how the client can pay. This might include payment methods, account details, or links to an online payment portal.

- Friendly Reminder of Terms: It’s important to gently remind the client of any previously agreed-upon payment terms, such as late fees or discounts for early payment. This helps reinforce expectations.

- Call to Action: End with a direct but polite request for payment. A simple “Please arrange payment by [date]” is effective.

- Polite Closing: Close with a friendly, respectful sign-off that invites further communication if necessary, such as “Feel free to reach out with any questions” or “Thank you for your prompt attention to this matter.”

By ensuring that these essential elements are present, you can craft a message that is not only effective but also professional and courteous, encouraging timely payment while maintaining strong business relationships.

How to Write a Clear Invoice Request

When you need to ask a client to settle an outstanding balance, clarity is essential. A well-written message ensures that there is no confusion about the amount owed, the due date, and how the payment should be made. To create a clear and effective reminder, it’s important to be concise, direct, and polite while providing all the necessary details for the recipient to take action.

Steps for Writing a Clear Payment Reminder

Follow these steps to ensure your message is straightforward and effective:

- State the Purpose Early: Begin your message by stating the reason for the communication. Let the recipient know immediately that the purpose is to remind them of an outstanding balance. This sets the tone and context right away.

- Be Specific About the Amount Due: Clearly indicate the total amount that needs to be paid. Mention the specific services or products the payment relates to, and include any relevant dates such as the original due date.

- Provide Clear Payment Instructions: Include precise information on how the payment should be made. This could be bank account details, a link to an online payment platform, or instructions for other methods of payment.

- Set a Deadline: Give the recipient a clear timeline for when the payment is expected. If a late fee or other consequence applies after a certain period, include that information in a tactful manner.

Maintaining a Professional and Polite Tone

Even though you are requesting payment, it’s important to keep your message professional and polite. A courteous tone fosters goodwill and makes it more likely that the recipient will act promptly. Avoid being overly demanding, and instead offer assistance or invite the recipient to contact you with any questions. A respectful approach can go a long way in maintaining a positive business relationship.

By following these simple guidelines, you can craft a clear and effective message that ensures payment while keeping your communication professional and friendly.

Polite Phrases for Payment Requests

When following up on overdue payments, it’s important to use language that is both firm and respectful. The way you phrase your request can significantly impact how the recipient responds. Polite and courteous language helps maintain a professional relationship while encouraging prompt action. Below are some effective and polite phrases that can be used to request payment in a professional manner.

1. Gentle Reminders

Instead of being demanding, gentle reminders create a sense of urgency without being confrontational. Here are a few examples:

- “We would appreciate it if you could settle the balance by [date].”

- “This is a friendly reminder that payment is due for the services provided.”

- “We kindly ask that you process the payment as soon as possible.”

2. Acknowledging the Client’s Situation

Sometimes, clients may have genuine reasons for delays. Acknowledging this while still requesting payment shows understanding and flexibility:

- “We understand that delays can happen, but we kindly request that the outstanding balance be cleared as soon as possible.”

- “If there’s any issue with the payment, please let us know, and we’ll be happy to assist.”

- “We appreciate your prompt attention to this matter, and if there are any concerns, please feel free to contact us.”

3. Offering Assistance

In some cases, offering assistance or clarification can help expedite the payment process:

- “If you need any further details to process the payment, please don’t hesitate to get in touch.”

- “Should you have any questions about the payment details, feel free to reach out at your convenience.”

- “If you would like to discuss payment options, we are more than happy to assist.”

By using these polite and considerate phrases, you can request payment in a way that is both effective and professional. The key is to balance firmness with respect, ensuring that the message is clear but also courteous and cooperative.

When to Send an Invoice Request Email

Timing is crucial when it comes to sending payment reminders. Sending the message too early can make it seem unnecessary, while sending it too late might result in delayed payments. Finding the right moment to send a follow-up can improve your chances of prompt payment and help maintain a positive relationship with your clients. Understanding when to send such messages is key to managing your business finances effectively.

Ideal Timing for Payment Reminders

Below are some recommended time frames for sending a reminder, depending on the situation:

- Immediately After the Due Date: If the payment deadline has passed, send a reminder the day after. This keeps the issue at the forefront of your client’s mind without causing unnecessary delay.

- One Week After the Due Date: If no payment has been made after the due date, send a polite reminder a week later. This can serve as a gentle nudge while giving your client some time to settle the amount.

- Two Weeks After the Due Date: After two weeks, if no communication has been made from the client, it’s time for a firmer but still polite reminder. At this stage, you can begin to mention potential late fees or other consequences for delayed payment.

Factors to Consider When Timing Your Message

- Client Relationship: Consider how well you know the client. Long-term or repeat clients may appreciate a gentler reminder, while newer clients may require a more formal approach.

- Payment Terms: Review the original agreement or payment terms. If you agreed upon a specific payment schedule, adhere to it when sending a reminder.

- Payment Method: If the payment method is complex or requires more processing time, be understanding of any delays but follow up after the expected time frame.

Sending reminders at the appropriate time ensures that clients know their obligations without feeling pressured. By keeping these timing guidelines in mind, you can strike the right balance between being firm and maintaining good customer relations.

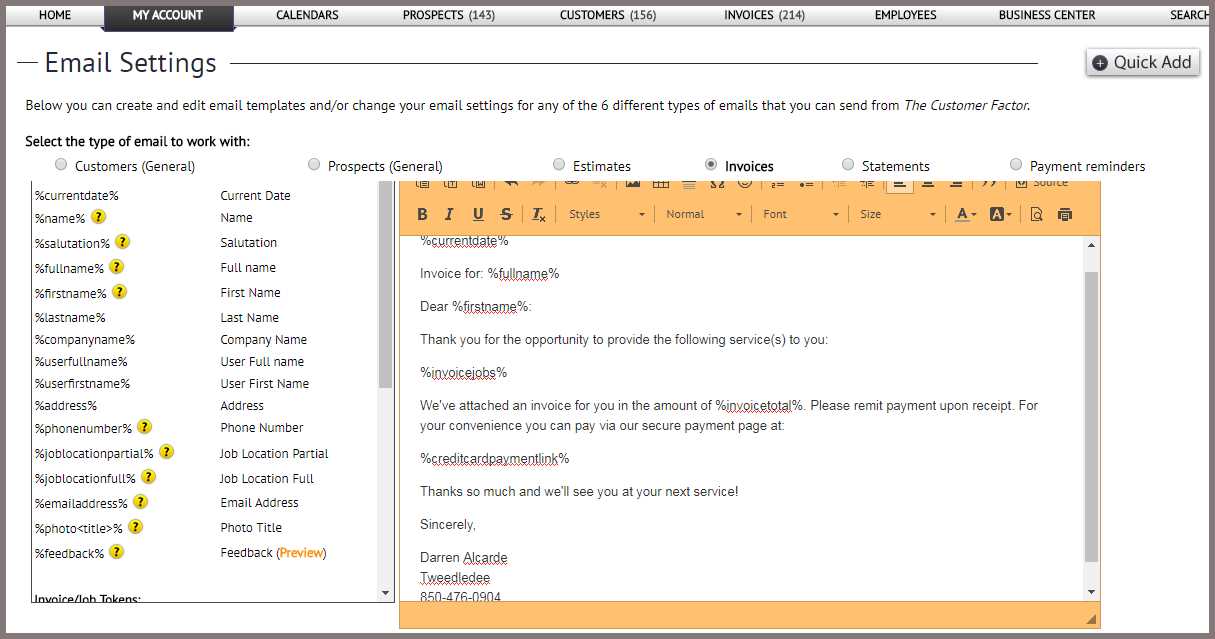

Customizing Your Invoice Request Template

Personalizing your payment follow-up communication is essential for ensuring it resonates with each client. A one-size-fits-all approach may not be as effective as a tailored message that reflects the specific details of the transaction and the relationship you have with the client. Customizing your message can make it feel more personal, which can improve the likelihood of a timely payment.

When adapting your message, there are several key areas you should focus on to ensure that the tone, content, and structure are appropriate for each situation:

Key Elements to Personalize

- Client Name: Always address the recipient by their name to create a personal connection. A simple “Dear [Client Name]” can make the communication feel more tailored and professional.

- Specific Details of the Transaction: Refer to the specific product or service provided. This not only clarifies the purpose of the follow-up but also reminds the client of the value they received.

- Due Date and Amount: Clearly state the amount owed and the original due date. If applicable, mention any previous communication related to the payment.

- Flexible Payment Options: If appropriate, offer flexible payment methods or terms, such as installment options or extensions, to make it easier for the client to fulfill their obligation.

- Payment Terms and Conditions: If you have specific terms (such as late fees or discounts), reference these in your communication to reinforce the expectations.

Adjusting Tone Based on Client Relationship

- Long-Term Clients: For repeat clients, you can afford to be more friendly and understanding. Emphasize your appreciation for their ongoing business and offer a reminder in a less formal tone.

- New Clients: For newer clients or first-time transactions, maintain a more formal tone. This sets the tone for professional conduct while ensuring that payment expectations are clearly communicated.

- Urgent Situations: In cases where the payment is seriously overdue, it’s important to adjust the tone to reflect the urgency. Be polite, but make it clear that timely payment is critical for maintaining the relationship.

By customizing your communication, you not only create a more positive interaction but also show that you value your clients individually. Personalization demonstrates professionalism and attention to detail, both of which can lead to quicker and more consistent payments.

Common Mistakes in Invoice Requests

When asking for payment, small mistakes in your communication can lead to confusion, delayed payments, or even damaged business relationships. While the goal is to ensure clarity and professionalism, certain errors can undermine your efforts. Being aware of these common pitfalls can help you craft more effective and respectful follow-ups, ultimately leading to smoother financial transactions.

Below are some of the most frequent mistakes people make when sending payment reminders and how to avoid them:

| Common Mistake | Why It’s Problematic | How to Avoid It |

|---|---|---|

| Unclear Amount or Payment Details | Vague or missing payment information can cause confusion, delaying the payment process. | Always specify the exact amount due, the due date, and clear instructions on how to pay. |

| Overly Harsh or Aggressive Tone | An overly demanding tone can damage the business relationship and make the client feel pressured. | Maintain a professional and polite tone, focusing on being firm yet respectful. |

| Failing to Personalize the Message | Generic, impersonal messages can come across as unprofessional and may not encourage the client to act promptly. | Personalize the message by addressing the client by name and referencing the specific transaction. |

| Sending Too Early or Too Late | Sending a reminder too soon can seem unnecessary, while waiting too long may result in delayed payments. | Send reminders promptly after the due date, typically 1-2 days after or a week if no payment is received. |

| Not Offering Payment Options | Failure to provide multiple payment methods can frustrate clients, making it harder for them to pay. | Offer various payment methods and make it as easy as possible for the client to fulfill the obligation. |

Avoiding these common mistakes can help ensure that your payment reminders are professional, effective, and lead to prompt payments. By taking the time to craft clear and respectful messages, you’ll strengthen your relationships with clients and improve your cash flow.

Follow-Up Strategies for Unpaid Invoices

Chasing overdue payments can be a delicate task, as you want to ensure your message is firm enough to encourage prompt action while maintaining a professional relationship with your client. A well-planned follow-up strategy helps you stay organized and consistent in your approach, ultimately improving the chances of receiving payment on time. Whether you are following up for the first time or after several reminders, the strategy you use can make a big difference in your success rate.

Below are some effective follow-up strategies to employ when dealing with overdue payments:

- Initial Follow-Up: As soon as the payment due date passes, send a friendly reminder. This can be a simple message thanking the client for their business and reminding them that payment is now due. Keep the tone polite and assume that the client may have simply forgotten.

- Second Reminder: If there’s still no response after a week or two, send a second, slightly firmer message. At this point, it’s appropriate to mention the importance of paying the amount promptly, but remain courteous. This is the stage where you can begin to reference the agreed-upon terms or mention potential late fees.

- Phone Call Follow-Up: If emails have not resulted in action, consider calling your client. Sometimes a personal conversation can resolve misunderstandings and prompt faster payments. Keep the conversation polite and professional, explaining the situation clearly and offering assistance if necessary.

- Late Fee Reminder: If payment is still not made after two or three follow-ups, it’s time to mention any late fees that might be applied based on your terms. Be sure to communicate this professionally, emphasizing that it’s a standard part of your payment policy.

- Final Notice: If all previous attempts fail, send a final notice. This message should be clear and direct, explaining that you will need to take further action if payment is not made within a specific time frame. Mention any legal steps or collections actions you might take, but remain polite and professional.

Throughout the process, it’s crucial to stay organized. Set clear deadlines for each step, and track all communication with your clients. Consistent and professional follow-ups will increase your chances of securing the payment while preserving a positive business relationship.

Subject Line Tips for Invoice Emails

The subject line is one of the most important elements of any payment reminder message. It’s the first thing your client sees, and it directly impacts whether or not your message is opened. A well-crafted subject line can set the tone for the rest of the communication, ensuring that your message is noticed and acted upon promptly. To increase the likelihood of a positive response, it’s essential to strike the right balance between clarity, professionalism, and urgency.

Here are some key tips for writing effective subject lines that will grab attention and encourage timely action:

- Be Clear and Direct: Avoid vague or overly creative subject lines. A straightforward approach makes it clear that the message is regarding a payment matter. Examples:

- “Payment Due for [Service/Product] – Action Required”

- “Reminder: Payment Due on [Date]”

- Keep It Concise: Clients are busy, and they don’t have time to read long subject lines. Stick to a brief, clear phrase that communicates the purpose of the message in just a few words. For instance:

- “Outstanding Balance for [Project Name]”

- “Payment Reminder: Due [Date]”

- Include Relevant Details: If possible, include specific details such as the due date or amount in the subject line. This can encourage your client to open the message right away. Examples:

- “Reminder: $500 Due for [Service] by [Date]”

- “Action Required: Payment of [Amount] Due [Date]”

- Use Professional Language: A subject line should always maintain a professional tone. Even if the payment is overdue, your approach should remain respectful and business-like. Avoid using aggressive or overly casual language. Examples:

- “Payment Due: [Company Name] – Friendly Reminder”

- “Final Notice: Payment Due for [Service/Product]”

- Create a Sense of Urgency (When Appropriate): If the payment is overdue, you can encourage a quicker response by adding a sense of urgency. However, do so in a way that maintains professionalism. Examples:

- “Urgent: Payment Due for [Service] – Please Process Immediately”

- “Final Reminder: Payment Due [Date]”

By following these tips, you can ensure your subject lines are both effective and respectful, helping to prompt a quicker response without damaging your professional relationship with the client.

How to Maintain Professional Tone

Maintaining a professional tone in payment-related communication is crucial to preserving your business relationships while ensuring timely payments. The way you word your messages reflects your business’s level of professionalism and can influence the response you receive. It’s important to strike a balance between being firm about the need for payment and respectful toward your client. A well-crafted message can encourage prompt action without creating tension.

Key Principles for Maintaining Professionalism

Here are some essential tips to help you craft polite, firm, and professional messages that keep the tone respectful while reinforcing the need for timely payments:

| Principle | What It Means | Example |

|---|---|---|

| Use Respectful Language | Always treat your clients with respect, regardless of the situation. Avoid any language that could be perceived as demanding or disrespectful. | “We kindly request that you settle the outstanding balance by [Date].” |

| Maintain a Polite but Firm Tone | Be clear about the importance of payment, but don’t sound threatening or impatient. Assertiveness is key without being pushy. | “As per our agreement, we would appreciate receiving payment at your earliest convenience.” |

| Be Concise and Clear | Make your point without unnecessary details. Clients are more likely to respond to a clear, straightforward message. | “This is a reminder that your payment of $[Amount] is due on [Date].” |

| Avoid Overly Casual Language | Maintain a formal tone, even if you have a friendly relationship with the client. Avoid slang or overly informal phrases that can undermine

Best Practices for Invoice Request FormattingEffective formatting plays a critical role in ensuring your payment reminder is clear, professional, and easy to read. A well-structured message not only conveys the necessary details but also makes it easier for your client to process the information quickly. Proper formatting can lead to faster responses and payment processing, reducing the chances of errors or misunderstandings. Key Elements of Well-Formatted Payment RequestsTo ensure your communication is clear and easy to follow, here are some formatting best practices to consider:

Organizing Information for Maximum ImpactProper organization helps to ensure that your communication is both easy to read and actionable. Below is a suggested structure for your message:

By following these formatting best practices, you can ensure that your payment reminders are professional, easy to understand, and likely to get the desired result. Clear, concise, and well-structured communication helps maintain good client relationships and improves the likelihood of t Handling Disputes After Invoice RequestsWhen requesting payment, it’s not uncommon for disagreements or disputes to arise. Clients may question the charges, cite errors, or delay payment due to dissatisfaction with the service or product. How you handle these disputes can have a lasting impact on your business relationships and financial outcomes. Addressing issues professionally, calmly, and promptly is key to resolving the situation in a way that maintains goodwill while ensuring that you receive payment. Steps to Handle Payment Disputes EffectivelyHere are some effective strategies for addressing disputes that may arise after a payment reminder or request:

When to Escalate the SituationWhile most payment disputes can be resolved through open communication, there are times when further action may be required. If the dispute cannot be resolved through negotiation or if payment continues to be delayed despite your efforts, consider escalating the situation. This could involve:

Disputes are an inevitable part of business, but by handling them professionally, you can maintain positive relationships with clients and protect your bottom line. Clear communication, flexibility, and pat Legal Considerations in Invoice RequestsWhen requesting payment for goods or services, it’s essential to be aware of the legal framework surrounding such transactions. Clear and correct communication can prevent misunderstandings and reduce the risk of legal disputes. Understanding your rights, obligations, and the regulations governing payment collection can help ensure that your business remains compliant with the law while protecting your interests. Legal considerations should be taken into account when drafting payment reminders or following up on overdue amounts. Key Legal Factors to ConsiderTo avoid any legal issues when requesting payments, consider the following important factors:

Steps to Protect Your Business LegallyTo protect your business and avoid legal issues when requesting payment, it’s essential to adopt best practices for your payment processes:

By understanding the legal aspects of payment collection and ensuring that your processes are compliant with relevant laws, you can mitigate the risk of disputes and legal challenges. This proactive approach not o How to Set Payment Deadlines in EmailsSetting clear and specific payment deadlines is essential when communicating with clients regarding overdue balances or upcoming payments. A well-defined deadline not only helps prevent misunderstandings but also encourages timely action. When requesting payments, it is important to communicate expectations in a firm but respectful way. By setting a clear payment deadline, you can ensure that both parties are on the same page regarding when the payment is due and avoid unnecessary delays. Here are a few tips on how to effectively set payment deadlines in your communications:

By clearly stating payment deadlines and using a balanced tone, you can encourage timely payments and minimize delays. A straightforward approach not only improves cash flow but also helps maintain a positive relationship with your clients. Incorporating Payment Terms into RequestsClearly stating payment terms is crucial when seeking compensation for products or services. By defining the conditions of payment upfront, both you and the recipient know exactly what is expected, reducing the likelihood of misunderstandings or disputes. Including these terms in your communication ensures that your client is aware of deadlines, methods, and any potential consequences for late payments, leading to smoother transactions and better cash flow management. Here are some key ways to incorporate payment terms effectively:

By clearly outlining payment terms, you establish transparency and professionalism in your communications. This can lead to quicker payments, stronger relationships with clients, and fewer payment-related disputes. Tracking Payment Requests EffectivelyTracking payment communications is essential for maintaining organized financial operations and ensuring timely follow-ups. Without an effective tracking system, payments can be overlooked, leading to cash flow issues or strained client relationships. A well-structured tracking system helps you monitor outstanding balances, set reminders for follow-ups, and ensure that all necessary actions are taken when payments are delayed. Here are some best practices for tracking payment requests efficiently:

By implementing an organized tracking system, you can stay on top of all payment matters, ensure timely follow-ups, and maintain healthy cash flow. This proactive approach to managing payment timelines helps foster professional relationships with clients and protects your business’s financial stability. Templates for Different Payment ScenariosDifferent payment situations require distinct approaches and tones. Whether you are reminding a client of an upcoming payment, following up on a late payment, or confirming receipt of funds, customizing your communication is essential to maintain professionalism and clarity. Tailoring your message to the specific circumstances not only makes the process smoother but also helps foster positive business relationships. 1. Initial Payment RequestWhen sending the first request for payment, it’s important to keep the tone polite and professional, while being clear about the terms. The goal is to set expectations early on and encourage prompt action without coming across as demanding. Below is an example of a template for an initial payment communication:

|