Invoice Template for Software Development Services

When managing client relationships, it’s crucial to ensure clarity and professionalism in financial communications. A well-structured billing document not only helps ensure that payments are processed smoothly but also enhances the trust between you and your clients. Crafting an accurate and easy-to-understand record is key to maintaining a positive business reputation.

Effective financial documents include clear terms, itemized charges, and a format that suits both parties. Properly organizing information helps prevent misunderstandings and delays, ensuring that the business transaction proceeds without any issues. Whether you’re a freelancer or part of a larger team, using an organized approach to requesting compensation can save time and reduce the potential for disputes.

Having a standardized way of requesting payment can simplify administrative tasks. By using the right structure, you can ensure consistency across all projects, reducing the risk of errors. Whether your work is billed on a per-project or hourly basis, setting up a reliable system benefits both you and your clients.

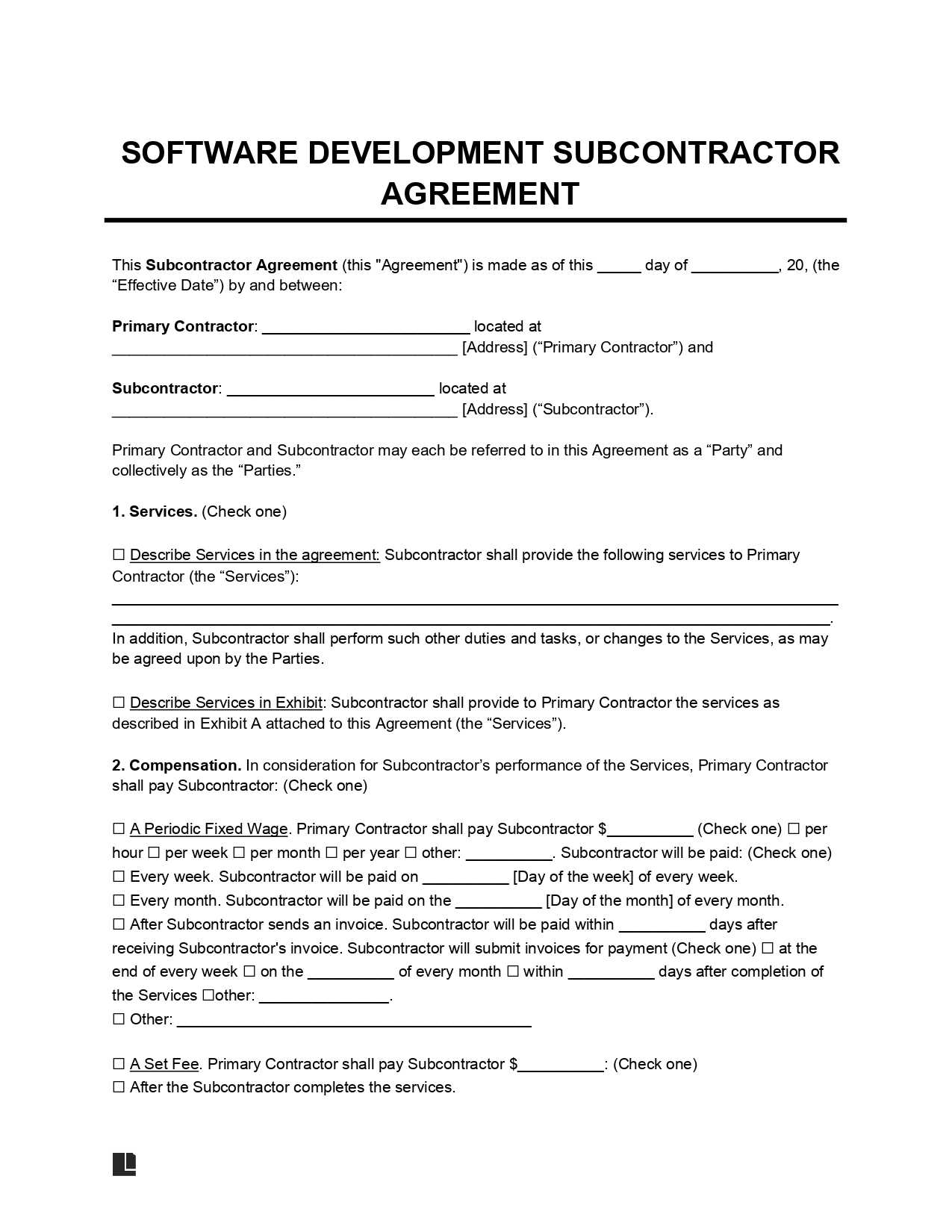

Billing Document for Technology Projects

When working on technical projects, it’s essential to create a document that outlines the work completed and the amount due. This record should reflect all details of the project, providing a transparent breakdown of tasks, time spent, and agreed rates. A well-crafted bill serves as both a professional reflection of your work and a tool to ensure you are compensated fairly.

Key Components of a Billing Document

To make sure your request for payment is clear and accurate, include the following essential elements:

- Client Information: Name, address, and contact details of the client.

- Your Details: Name, business name, address, and contact information.

- Project Description: Brief overview of the work completed and key deliverables.

- Breakdown of Charges: List of tasks or milestones, hours worked, and rates.

- Payment Terms: Due date, preferred payment method, and any late fees.

How to Customize Your Billing Record

Every project is unique, so it’s important to tailor the document to reflect the specifics of each engagement. Here are a few tips for customization:

- Include any special agreements or discounts negotiated with the client.

- If the project is ongoing, specify whether payments are due upon completion of milestones or at regular intervals.

- Consider adding a section for additional costs, such as travel expenses or third-party software licenses.

By adapting the layout and content to fit each particular job, you ensure that both you and your client are on the same page, preventing any confusion over what was agreed upon and what is owed.

Why Use a Structured Billing Document

Creating a formal payment request can be time-consuming if you don’t have a clear format to follow. By using a predefined structure, you ensure that all necessary details are included and presented in a professional manner. This not only saves time but also reduces the chances of errors or omissions that might complicate payment processing.

Consistency is one of the main reasons to use a structured approach. With a set format, each record you send to clients will contain the same information in the same order. This makes it easier for both you and your clients to review and understand the charges. Moreover, it fosters a sense of trust and professionalism, which is essential for maintaining long-term business relationships.

Efficiency is another key benefit. A predefined structure allows you to quickly fill in the details, cutting down on the time spent drafting each request from scratch. This is especially valuable when handling multiple projects or clients at once. Additionally, it reduces the risk of omitting critical information like payment terms, rates, or deadlines, which can lead to confusion or delayed payments.

Key Elements of a Billing Request

To ensure clarity and accuracy, a billing document must include several important details. Each section should be well-structured to avoid confusion and facilitate smooth payment processing. A comprehensive request not only outlines the amount due but also provides a clear breakdown of the work and terms, which helps both you and the client stay on the same page.

Essential Information to Include

A well-organized request typically contains the following key components:

- Contact Details: The name and contact information of both the client and the service provider.

- Project Overview: A brief description of the tasks completed or milestones achieved during the engagement.

- Detailed Charges: A breakdown of hours worked, rates, and specific tasks or deliverables.

- Payment Terms: The due date for payment, preferred payment methods, and any penalties for late payments.

- Unique Reference Number: A specific identifier for easy tracking and reference.

Additional Considerations

Depending on the nature of the project, there are other elements that may be relevant to include:

- Tax Information: If applicable, tax rates or any applicable deductions should be noted clearly.

- Late Fees: Specify any additional charges that may apply if payment is overdue.

- Payment Schedule: If payments are to be made in installments, outline the schedule and amounts for each.

By incorporating these details, you ensure that both parties are fully aware of the financial obligations and expectations, leading to a smoother payment process and better professional relationship.

How to Customize Your Billing Document

Adapting your payment request to each specific project ensures it reflects the unique details and agreements you have with your clients. Customization allows you to tailor the content to fit the scope of work, deadlines, and any special terms. By personalizing the structure, you provide a clearer, more professional document that aligns with both your and your client’s expectations.

Start with the Basics: Begin by including the standard elements–client information, project description, and payment details. These are essential in every document, but the real value comes when you adjust the format to fit the particularities of each job.

Include Project-Specific Details: Depending on the work completed, be sure to adjust the list of tasks, milestones, or hourly rates. For example, if certain phases of the project involved additional work or required extra resources, note those differences in the breakdown. This ensures your client fully understands what they are being billed for and why.

Making Adjustments for Unique Agreements

If you and your client have specific payment terms, such as early discounts, milestone-based payments, or different rates for different types of work, be sure to clearly state them. Customization in these areas shows your client that you’re paying attention to the terms you’ve agreed upon and helps avoid confusion.

- Early Payment Discounts: If you offer a discount for early payments, specify the percentage and deadline.

- Milestone Billing: If payments are due after specific phases of work, outline each milestone and its corresponding payment.

- Additional Costs: Be transparent about any extra charges, such as travel, tools, or licenses.

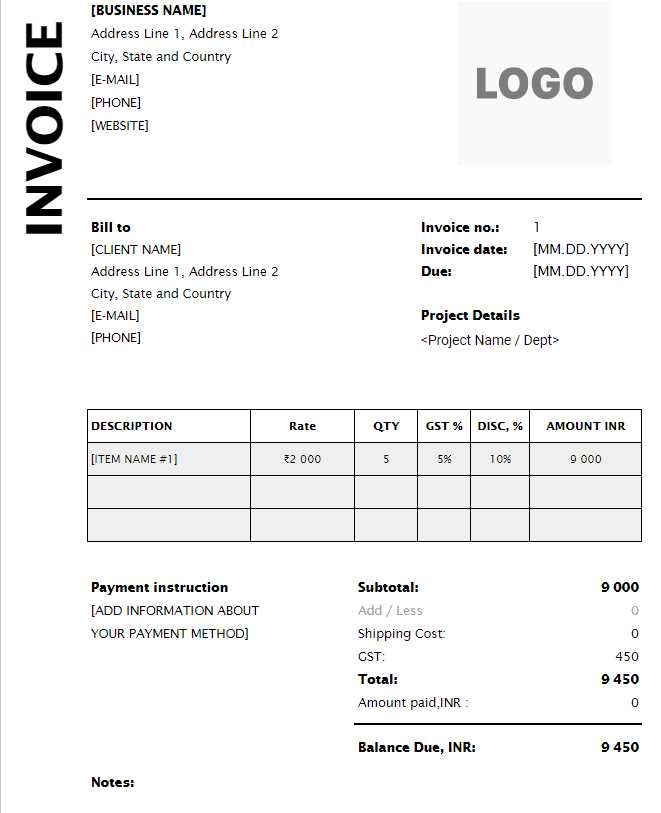

Visual Customization

Don’t forget to adjust the visual layout to make it more aligned with your brand. Adding your company logo, using consistent fonts, and applying a color scheme can enhance the professionalism of your document and create a more personalized experience for the client.

Benefits of Using Professional Invoices

Utilizing well-structured documents for financial transactions not only enhances credibility but also streamlines communication between parties. A well-organized statement ensures clarity, fosters trust, and helps in maintaining a consistent flow of information regarding payments and agreements.

Here are some key advantages of adopting a professional approach to handling billing records:

| Advantage | Description |

|---|---|

| Improved Accuracy | Clear and consistent formats minimize the chances of mistakes, ensuring that all details, such as amounts and terms, are correct. |

| Enhanced Credibility | A well-designed financial document reflects professionalism, boosting the confidence of clients and partners in your business. |

| Faster Payments | Clear and precise records make it easier for clients to understand their obligations, often resulting in quicker payment processing. |

| Legal Protection | Professionally formatted documents serve as an official record in case of disputes, helping you protect your rights and interests. |

| Efficiency in Management | Using standardized documents helps in organizing and tracking financial data, making it simpler to manage transactions over time. |

Common Mistakes in Software Invoices

When handling financial documentation, errors can easily creep in, leading to confusion, delays, or even disputes. Ensuring that all details are accurate and well-organized is crucial for maintaining good relationships with clients and avoiding unnecessary issues.

Typical Errors to Avoid

- Incomplete Information: Omitting key details, such as project descriptions, client contact information, or payment terms, can lead to misunderstandings.

- Incorrect Amounts: Miscalculating costs or using outdated rates can cause unnecessary delays and strain client relationships.

- Failure to Specify Deadlines: Not including clear payment due dates can result in late payments and complications in cash flow management.

- Unclear Payment Instructions: Vague or missing instructions on how to make a payment can cause confusion and slow down the process.

- Omitting Tax Information: Failing to properly list taxes or fees can lead to legal issues or disputes with clients and tax authorities.

How to Prevent These Mistakes

- Double-check all figures: Ensure all costs, discounts, and taxes are calculated correctly before finalizing the document.

- Standardize format: Use a consistent format to make it easy for clients to follow and understand all the essential details.

- Provide clear instructions: Include payment methods, deadlines, and any other relevant details in a simple, easy-to-read layout.

- Verify legal requirements: Be sure to i

How to Add Taxes and Fees

Including taxes and additional charges in financial documents is essential to ensure compliance with local regulations and to provide a transparent breakdown of costs. Properly calculating and listing these elements helps avoid confusion and ensures that clients understand the full scope of the charges they are responsible for.

Steps to Include Taxes and Fees

- Determine Applicable Tax Rates: Research and apply the correct tax rate based on your location and the client’s region. Different regions may have varying rates or exemptions.

- Calculate the Tax Amount: Multiply the taxable amount by the applicable tax rate. Ensure that the calculations are correct to avoid discrepancies later.

- List Additional Fees: If there are extra charges beyond the basic cost–such as shipping, handling, or administrative fees–be sure to list them separately and clearly.

- Show Total Before and After Tax: Display the subtotal before taxes and fees, followed by the tax amount and any extra charges. Finally, show the total amount due, inclusive of all charges.

- Ensure Compliance with Local Laws: Double-check the relevant tax laws in your jurisdiction to ensure you are applying taxes correctly. In some cases, certain charges may be exempt from tax or taxed at different rates.

Best Practices for Clarity

- Break Down Costs: Avoid lumping everything together. Clearly separate the base price, taxes, and any additional charges for easy understanding.

- Provide Detailed Descriptions: If you include fees for specific services, provide a short description to justify the charge. This ensures t

Choosing the Right Invoice Format

Selecting the appropriate format for documenting financial transactions is essential for clarity, professionalism, and efficient processing. The right structure can enhance communication with clients, minimize errors, and help ensure timely payments. The format should suit both the type of work provided and the preferences of the client.

Factors to Consider

- Client Preferences: Some clients may prefer a detailed, itemized list of charges, while others might opt for a simple summary. Knowing your client’s preferences can guide your choice of format.

- Business Type: The complexity of the work or product provided influences the format. More complex projects may require a detailed breakdown, while simpler transactions might only need a basic outline.

- Legal Requirements: Certain regions or industries may require specific formats or mandatory fields, such as tax numbers or specific payment terms. Always ensure compliance with local regulations.

- Branding and Professionalism: The format should reflect your company’s branding, presenting your business in a professional light. Customizing the design can help reinforce your business identity.

Common Formats

- Simple Format: Ideal for straightforward, small-scale transactions. Includes basic information such as the amount, payment terms, and contact details.

- Detailed Format: Best for larger projects or ongoing work. This format includes itemized charges, dates, and specific descriptions, making it easier for clients to understand the breakdown.

- Recurring Format: For businesses with subs

Ensuring Payment Terms Are Clear

Clear communication of payment terms is crucial to prevent misunderstandings and ensure timely transactions. Establishing explicit terms at the outset sets expectations for both parties, reducing the chances of delays and disputes. A well-defined structure helps clients understand when and how payments are due, as well as any penalties for late payments.

Key Elements to Include

- Due Date: Always specify when the payment is due. This helps avoid confusion and sets a clear deadline for when the transaction should be completed.

- Accepted Payment Methods: List all the available methods for payment (e.g., bank transfer, credit card, PayPal) to ensure clients know how they can settle the amount.

- Late Fees: Clearly state any fees or interest that will be charged if the payment is not made on time. This encourages timely payments and provides legal backing if necessary.

- Discounts for Early Payment: Offering a discount for early settlement can incentivize clients to pay sooner, benefiting both parties.

- Partial Payments or Installments: If applicable, outline the possibility of paying in stages, specifying the amounts and due dates for each installment.

Best Practices for Clarity

- Be Direct: Avoid ambiguous language. Use straightforward terms like “due upon receipt” or “net 30 days” to clearly define the expectations.

- Highlight Key Dates: Make sure the due date is easy to find and well-emphasized in the document.

- Include Cont

Legal Considerations for Invoicing

When creating financial records, it’s important to be aware of the legal requirements that apply to the documentation process. These guidelines help ensure that your business complies with local laws, protects both you and your clients, and avoids any potential disputes. Clear and accurate documentation can safeguard your rights and make the transaction process more transparent.

Essential Legal Elements

- Tax Information: Always include relevant tax details, such as your business’s tax identification number, applicable tax rates, and the total tax amount being charged. This helps to comply with tax laws and ensures that the client is aware of the taxes they are paying.

- Legal Names and Addresses: Both your company’s and your client’s legal names and addresses must be clearly stated. This information is crucial for record-keeping, especially in case of disputes or audits.

- Terms and Conditions: Include specific terms regarding payment deadlines, late fees, and any other contractual obligations. This not only protects your business but also sets clear expectations for the client.

- Currency and Payment Method: Specify the currency in which payment is due and the accepted methods of payment. This is essential for international transactions and ensures there are no misunderstandings.

- Jurisdiction Clause: In case of legal disputes, it’s important to indicate the jurisdiction that will govern the agreement. This clarifies where any legal matters will be addressed, providing both parties with certainty.

How to Ensure Compliance

- Stay Updated on Local Regulations: Laws regarding invoicing, taxes, and contracts can vary by region and may change over time. Regularly review and update your invoicing practices to ensure compliance with current regulations.

- Consult with a Legal Professional: If unsure about the legal requirements, seek advice from a legal expert to ensure that your documentation adheres to the relevant laws.

- Maintain Records: Always keep copies of all financial records for the appropriate duration, as required by local tax authorities. This helps in case of future audits or disputes.

- Provide Clear Communication: Be transparent with your clients about all terms, fees, and legal aspects of the transaction. This minimizes misunderstandings and fosters a professional relationship.

How to Track Payments Efficiently

Managing and monitoring financial transactions is essential for maintaining healthy cash flow and ensuring that all dues are paid on time. Efficient tracking helps identify overdue amounts, prevent errors, and streamline the reconciliation process. Establishing a clear and organized system allows businesses to stay on top of payments and maintain accurate financial records.

Effective Methods for Tracking Payments

- Use Accounting Software: Invest in reliable accounting or financial management software that automates the tracking process, sends reminders, and generates reports. This reduces manual errors and saves time.

- Maintain a Payment Schedule: Keep a detailed schedule or calendar of payment due dates to track when payments are expected. This helps you stay organized and avoid missing deadlines.

- Create a Payment Log: Record every payment as it’s received, including the date, amount, and method of payment. This creates a clear trail for each transaction and makes it easier to identify any discrepancies.

- Follow Up Regularly: Set up reminders to follow up with clients who have outstanding payments. A timely, polite reminder can encourage prompt payment and reduce delays.

- Categorize Payments: Organize payments by their status–paid, pending, or overdue. This classification makes it easy to see which transactions require attention and helps prioritize actions accordingly.

Best Practices for Accuracy and Organization

Creating Recurring Invoices for Clients Setting up regular payment schedules for clients ensures predictable cash flow and reduces administrative effort. By automating this process, businesses can avoid the need to manually issue new records each time payment is due, saving both time and resources. This method is particularly useful for ongoing projects or subscription-based offerings where the same amount is charged on a recurring basis.

Steps to Create Recurring Payments

- Define the Payment Frequency: Determine how often payments will be due–whether weekly, monthly, quarterly, or annually. This is essential for establishing a consistent schedule.

- Set Payment Amounts: Ensure that the agreed-upon amount for each period is clearly specified. This avoids any confusion on both sides and ensures the client knows what to expect each time.

- Automate the Process: Use tools or accounting software to automatically generate and send the necessary records for each billing cycle. Automation ensures that payments are consistently tracked and billed without needing manual intervention.

- Include Payment Terms: Clearly outline the terms for each payment cycle, including the due date, late fees, and acceptable payment methods. This keeps the client informed and helps reduce payment delays.

- Provide Payment History: Offer clients access to previous records to ensure transparency. This helps both parties track payments and resolve any potential issues more efficiently.

Best Practices for Recurring Payment Systems

Best Practice Description Clear Communication Make sure the client is fully aware of the payment structure, including frequency, amounts, and any applicable late fees or discounts. Invoice Design Best Practices

Designing clear and professional financial documents is crucial for ensuring a smooth transaction process. A well-organized layout not only improves readability but also enhances the overall client experience. The design should focus on making key information easily accessible, avoiding clutter, and maintaining consistency with your brand identity.

Here are some best practices to follow when designing these documents:

- Prioritize Readability: Choose legible fonts and appropriate font sizes to make the content easy to read. Keep the text concise and ensure there is enough white space to avoid overwhelming the viewer.

- Use Clear Headings: Organize the information with bold headings and subheadings to guide the reader. Each section should be distinct, such as “Client Information”, “Payment Terms”, and “Amount Due”.

- Include Essential Details: Always include vital information, such as your company name, contact details, a unique reference number, and payment instructions. This makes it easier for clients to understand and process payments.

- Consistency with Branding: Maintain your brand’s colors, fonts, and logo to create a cohesive design. This adds professionalism and strengthens your company’s visual identity.

- Highlight Important Information: Use bold or larger fonts for crucial data like the total amount due, payment due date, and payment instructions. This helps the client focus on what matters most.

- Keep It Simple: Avoid excessive decoration or graphics that can distract from the key financial details. A clean, minimalistic approach is often the most effective.

- Incorporate Interactive Elements: If sending electronically, consider making key elements, such as the payment amount or terms, clickable for added convenience.

By following these design principles, you can create documents that not only look professional but are also functional, enhancing the ef

How to Include Project Milestones

In any long-term initiative, breaking the work into clear phases ensures both parties understand the scope and expectations. Milestones serve as key indicators of progress, making it easier to track achievements and identify when specific goals have been met. These benchmarks should be outlined clearly to avoid confusion and help maintain the momentum of the work.

To incorporate milestones effectively, follow these steps:

- Define clear objectives: Each milestone should represent a specific and measurable outcome. This could range from completing a particular feature to reaching a predefined stage of progress.

- Establish deadlines: Assign a realistic deadline to each milestone to ensure timely completion. It’s important to have a sense of urgency while allowing sufficient time for quality work.

- Link milestones to payment terms: Often, payment is tied to the completion of certain milestones. Specify in the agreement what percentage or fixed amount will be paid once a milestone is achieved.

- Detail deliverables: Describe what is expected at the completion of each phase. This can include documents, functional components, or other tangible outputs.

- Regular progress reviews: Schedule check-ins to evaluate whether the project is on track. These reviews can help adjust timelines or expectations if necessary.

Clearly defined milestones help to ensure transparency, facilitate communication, and establish a reliable way to monitor the success of the initiative throughout its lifecycle. By setting these markers, both parties can have a shared understanding of progress and what is still to come.

Managing Multiple Client Invoices

When working with numerous clients simultaneously, keeping track of payments and ensuring that each account is handled accurately becomes crucial. Proper organization is necessary to avoid confusion, missed payments, or errors. The ability to effectively manage multiple accounts can significantly streamline cash flow and client relationships.

Here are some best practices to manage various client accounts effectively:

- Maintain separate records: Keep distinct files or digital systems for each client. This ensures that you can track payment schedules, outstanding balances, and details without mixing them up.

- Set clear terms for each client: Clearly define the payment schedule, amounts due, and any other relevant conditions in advance. This clarity helps prevent misunderstandings and keeps everything organized.

- Automate reminders: Use software tools to send automatic payment reminders. This ensures clients are aware of upcoming deadlines, reducing the chances of late payments.

- Prioritize high-priority clients: Some clients may have stricter deadlines or larger amounts outstanding. Prioritize those accounts to avoid delays that could affect your cash flow.

- Consolidate reports: Create periodic financial reports that summarize the status of all active accounts. This helps you quickly see who has paid, who owes what, and what actions need to be taken.

- Offer flexible payment options: If appropriate, provide clients with multiple ways to pay–such as bank transfer, credit card, or online platforms. This can encourage prompt payments and simplify the collection process.

By following these strategies, you can ensure that you stay on top of multiple accounts, minimizing administrative errors and ensuring that financial aspects of your work are well-managed and transparent.

How to Send Your Invoice Securely

Sending sensitive financial documents requires attention to security to protect both your and your client’s information. Safeguarding payment details, personal data, and transaction terms is essential to prevent unauthorized access, fraud, or data breaches. Implementing secure methods ensures confidentiality and builds trust with clients.

To send documents securely, follow these practices:

- Use encrypted email: If sending via email, ensure the message is encrypted. Tools like PGP or secure email platforms offer an additional layer of protection for sensitive content.

- Leverage trusted platforms: Use well-established, secure platforms for file sharing, such as Dropbox, Google Drive, or specialized invoicing systems, which offer encryption and access control features.

- Require password protection: When sending files as attachments, use password protection for the document or file itself. Share the password through a separate communication channel, such as a phone call or text message.

- Limit access: Ensure that only the intended recipient has access to the document by managing permissions. Most secure platforms allow you to control who can view, edit, or download the file.

- Verify recipient details: Double-check the recipient’s email address or communication channel before sending. A simple error could result in your document reaching the wrong party.

- Keep software up-to-date: Ensure your email client, file-sharing software, and antivirus programs are always up-to-date with the latest security patches to minimize vulnerabilities.

By following these steps, you can send your documents securely, maintaining confidentiality and ensuring the integrity of your financial transactions.

Tools for Automating Invoices

Automating the process of creating and sending financial documents can save time, reduce errors, and streamline administrative tasks. By using the right tools, you can simplify routine tasks, ensure consistency, and focus more on your core work rather than on manual processes. These tools can generate bills, send reminders, and track payments automatically, helping maintain cash flow while minimizing human error.

Here are some popular tools that can help automate billing and payment tracking:

- FreshBooks: A cloud-based platform designed to simplify billing, it offers automated invoicing, recurring bills, and payment reminders, along with easy integration with accounting systems.

- QuickBooks: Known for its comprehensive financial management features, QuickBooks automates invoice creation, payment tracking, and even tax calculations.

- Zoho Invoice: This tool allows you to create professional-looking bills, automate recurring payments, and send reminders, all while providing detailed reporting features.

- PayPal Invoicing: PayPal’s invoicing tool makes it easy to create, send, and track payments, particularly for clients who prefer using PayPal for transactions.

- Wave: A free invoicing tool with automation features, Wave provides an easy way to create and send bills, track payments, and manage financial records.

- AND.CO: This tool specializes in automating billing and contract management, as well as providing payment reminders and time-tracking features.

By using these automation tools, you can ensure accuracy, save valuable time, and create a more efficient process for handling financial documents, helping you stay organized and on top of your business finances.