Free Invoice Form Template for Easy and Professional Invoicing

Creating professional documents for payments can be a time-consuming task, but it doesn’t have to be. By utilizing well-designed tools, you can simplify the entire procedure and ensure accuracy, consistency, and efficiency. These documents are essential for businesses of all sizes, whether you’re a freelancer or managing a large company.

Accessing ready-made solutions allows you to save time and avoid common errors when preparing financial records. Customizable options enable you to tailor each document according to your business needs, making it easier to maintain a professional image while handling administrative tasks. Whether you’re looking to streamline communication with clients or stay organized, having the right resources at your disposal is key.

Using these helpful tools can elevate your workflow, allowing you to focus on what matters most–growing your business and meeting your clients’ needs. With the right approach, managing financial paperwork becomes less of a burden and more of a simple, straightforward task.

Why Use a Free Invoice Template

Managing financial documents doesn’t have to be complicated or time-consuming. With the right tools, you can streamline the process and ensure that all important information is included, allowing for smoother transactions with clients. By using customizable resources, you can create professional records quickly and with minimal effort, improving efficiency and accuracy.

Save Time and Effort

When you rely on pre-designed documents, you can avoid the hassle of creating everything from scratch. These resources offer well-structured formats, saving you valuable time. Instead of worrying about layouts and content, you can focus on the specifics of each project or client, ensuring that everything is correctly tailored without delay.

Professional and Consistent Design

Using ready-made materials ensures that your documents maintain a polished appearance. Customizable options allow you to personalize your content while adhering to a consistent format, which is important for establishing credibility with your clients. This consistency helps reinforce trust and professionalism in every transaction.

Overall, leveraging these tools can improve both your workflow and the quality of your business interactions, leading to better client relationships and fewer administrative headaches.

Benefits of Customizable Invoice Forms

Having the ability to adjust and personalize payment documents offers significant advantages for businesses. Customizable solutions allow you to align your records with your brand and specific client requirements, enhancing both clarity and professionalism. These adaptable tools ensure that every document meets your unique needs without unnecessary complications.

Tailor to Your Business Needs

One of the main advantages of customizable documents is the flexibility they offer. Whether you need to add specific fields, adjust the layout, or include your company logo, these resources allow you to make modifications that suit your workflow. This means that each document can reflect the unique aspects of your business, ensuring a personalized touch for your clients.

Improved Professionalism and Accuracy

Customizable options also help ensure that all necessary details are present, reducing the risk of errors or missing information. By having consistent, branded materials, you reinforce your business’s professional image, which can help build trust with your clients. This attention to detail enhances the overall experience and keeps transactions running smoothly.

| Benefit | Advantage |

|---|---|

| Flexibility | Ability to add fields, adjust layout, and personalize content |

| Professional Appearance | Reinforces brand image with logos and consistent design |

| Accuracy | Reduces errors by ensuring necessary details are included |

Incorporating customizable resources into your workflow not only saves time but also elevates the quality of your client interactions. This flexibility and attention to detail can have a significant positive impact on your business’s operations.

How to Download a Free Invoice Template

Accessing a well-designed document for billing is easier than ever. Many online platforms offer downloadable resources that can be customized to fit your needs. Whether you’re a freelancer or a business owner, these resources can save you time and help you maintain consistency in your financial communications. The process of acquiring these tools is straightforward, and most options are available at no cost.

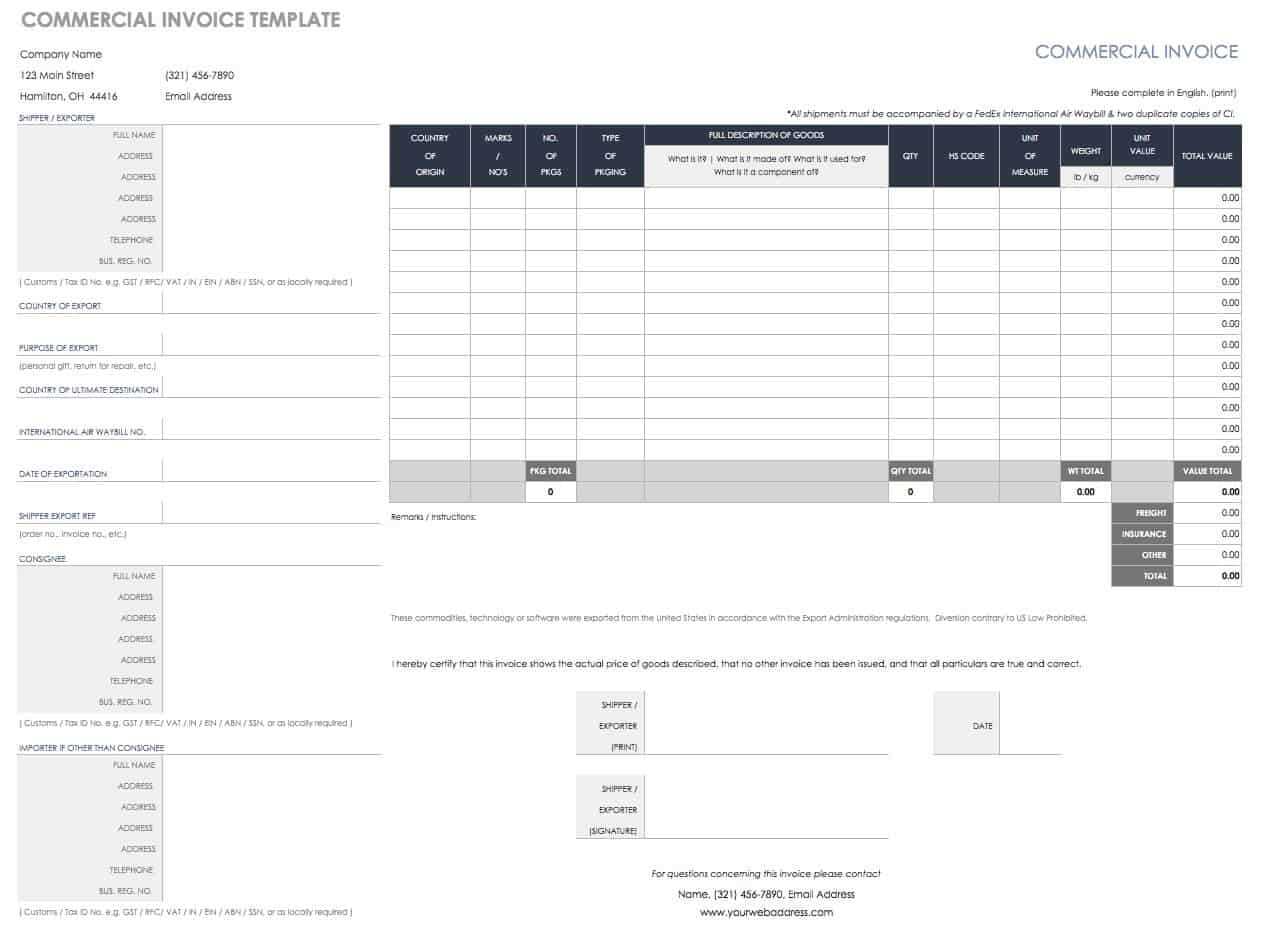

Step 1: Find a Reliable Source

Start by researching trusted websites that offer downloadable documents. Look for platforms that specialize in business resources, or visit popular productivity sites where you can find templates tailored to various industries and needs. Make sure the site is secure and provides files in easy-to-edit formats such as Word, Excel, or PDF.

Step 2: Choose the Right Format

Once you’ve identified a trusted source, browse through the available options. Select the format that works best for your needs–whether that’s a simple layout or something more comprehensive. Pay attention to whether the design is customizable so that you can adjust it to match your business’s branding.

Step 3: Download and Edit

After selecting your preferred resource, simply click the download button. The file will be saved to your device, allowing you to open and edit it. Once downloaded, you can easily personalize the document with your business details, such as your logo, payment terms, and client information.

By following these simple steps, you can quickly access professional documents that will help keep your business operations running smoothly and efficiently.

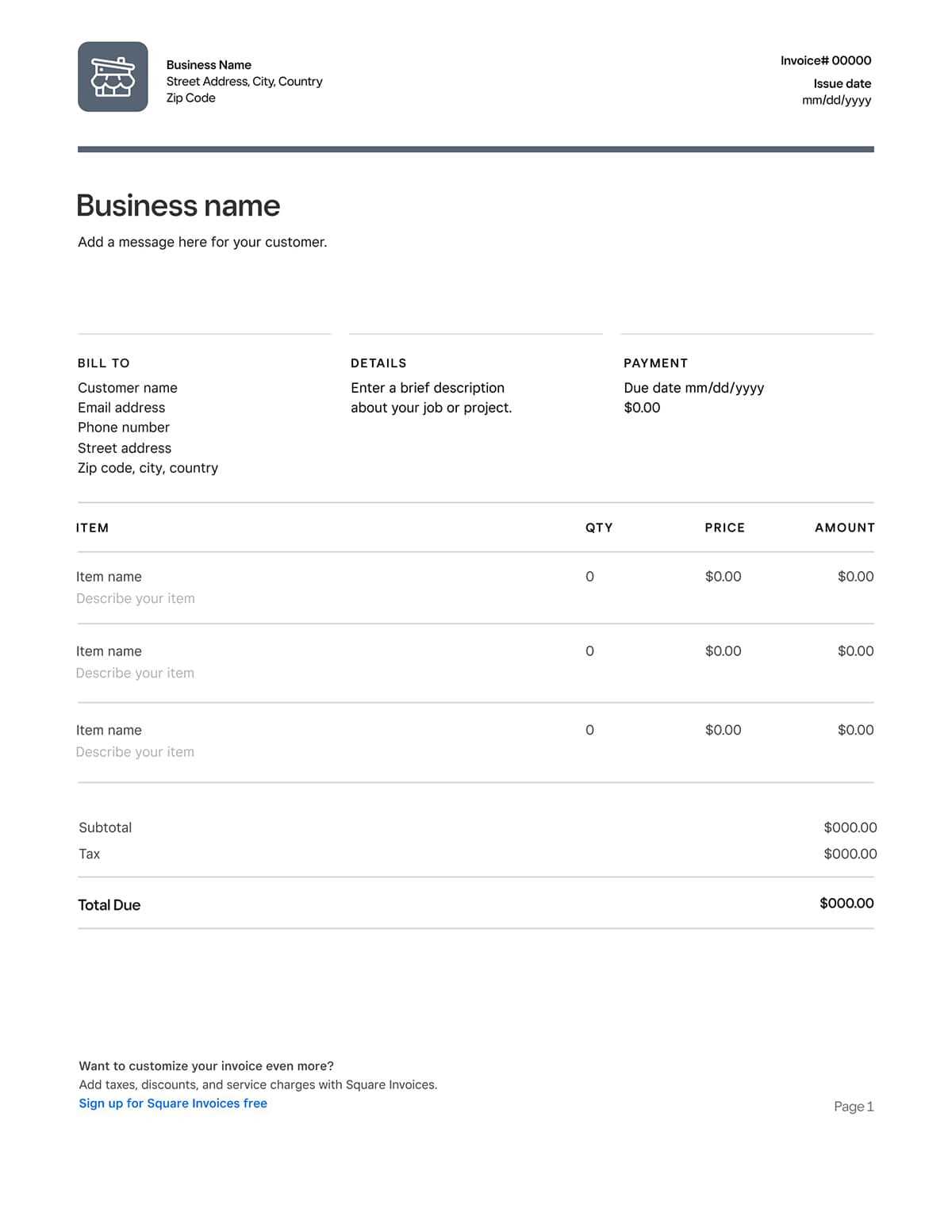

Essential Features of an Invoice Template

When creating a professional document for billing purposes, certain key elements must be included to ensure clarity, accuracy, and a seamless transaction process. These features not only help to standardize your records but also make it easier for both you and your clients to understand the details of each transaction.

- Business Details – Include your company name, address, contact information, and any relevant tax identification numbers. This establishes your credibility and provides clients with all necessary information to reach you if needed.

- Client Information – Ensure that the recipient’s name, business name, and contact details are clearly stated. This avoids confusion and ensures that the right party receives the document.

- Unique Document Number – Each record should have a unique reference number for easy tracking and record-keeping. This helps in organizing your financial documents and simplifies the process of managing past transactions.

- Date of Issuance – Include the date the document is issued to ensure that there’s a clear timeline for payment and that the billing period is clearly defined.

- Payment Terms – Clearly outline payment deadlines, accepted methods of payment, and any late fees or discounts for early payment. This sets clear expectations for both parties and helps avoid misunderstandings.

- Description of Goods or Services – Provide a detailed breakdown of the products or services provided. Include quantities, unit prices, and total amounts to ensure that the recipient understands what they are being charged for.

- Total Amount Due – The final amount should be clearly stated at the bottom, making it easy for the client to see the full sum that needs to be paid.

Incorporating these essential elements into your documents will help ensure that each transaction is clear, professional, and well-organized. By keeping everything straightforward and easy to understand, both you and your clients can maintain a smooth, efficient billing process.

Choosing the Right Invoice Format

Selecting the appropriate layout for your billing documents is crucial for maintaining professionalism and clarity in every transaction. The right structure ensures that all necessary details are communicated effectively, while also making the process simpler for both you and your clients. Depending on the nature of your business and the types of services or products you offer, there are various formats to consider.

Consider Your Business Type

If you’re a freelancer or small business owner, you might prefer a simple, clean design that gets straight to the point. On the other hand, larger organizations may benefit from more detailed formats that accommodate complex pricing structures, multiple line items, and additional payment terms. Think about how much information you need to convey and how it will be best presented.

Choose Based on Client Needs

It’s important to think about the needs of your clients as well. If your clients are used to more formal documents, a detailed format may be preferred. For smaller, more casual transactions, a straightforward layout could be sufficient. Regardless of your choice, ensure that the format is clear, easy to navigate, and reflects the level of professionalism your business aims to project.

By taking the time to select the right format, you ensure that your documents are both functional and visually appealing, making it easier to maintain positive client relationships and streamline your financial processes.

Common Mistakes in Invoice Creation

Creating accurate and professional billing documents is essential for maintaining smooth business operations. However, it’s easy to overlook important details or make errors that can lead to confusion or delays in payments. Recognizing and avoiding common mistakes can help ensure that your records are clear, correct, and effective.

1. Missing or Incorrect Client Information

One of the most frequent errors is failing to include complete client details, such as the correct name, business name, or contact information. Even small mistakes in contact information can delay communication and payment. Double-check all details before finalizing any document to ensure they are accurate and up-to-date.

2. Inaccurate or Missing Payment Terms

Another common issue is unclear or incomplete payment terms. Be sure to specify the payment deadline, accepted methods of payment, and any applicable late fees. If the payment terms are not clearly stated, clients may misunderstand when and how to pay, leading to delayed payments.

3. Lack of a Unique Document Number

Without a unique identifier, it becomes difficult to track your transactions. Each billing document should have a reference number to ensure easy organization and to avoid any confusion when clients ask about specific charges. Without a proper system in place, managing past transactions can quickly become chaotic.

4. Incorrect Calculations or Pricing

It’s essential to double-check the math when listing goods or services. Even a small error in calculation can create discrepancies between what is owed and what is actually billed. Always verify unit prices, quantities, and totals to avoid any misunderstandings or the need for revisions later.

By being mindful of these common pitfalls, you can create clear, professional, and accurate documents that facilitate smoother transactions and stronger relationships with your clients.

How to Personalize Your Invoice Form

Customizing your billing documents is a great way to maintain a consistent brand identity while ensuring clear communication with your clients. Personalizing your records helps reflect your unique business style and can create a more professional impression. Making simple adjustments to design and content can elevate the overall experience for both you and your customers.

Steps to Personalize Your Billing Documents

- Include Your Logo and Branding – Adding your company logo and using your brand colors makes the document instantly recognizable and reinforces your business identity. Ensure the design complements your brand’s style.

- Adjust the Layout – Customize the structure to fit your needs. You can adjust column widths, reorder sections, or add extra fields for special requirements. This makes the document more functional and aligned with your business model.

- Customize the Language – Tailor the language and terminology to fit the tone of your brand. Whether you prefer a formal or casual approach, make sure the wording reflects your business’s voice and values.

- Add Custom Fields – Depending on your business needs, you may want to include additional information like project numbers, order references, or specific notes that are relevant to the client or service.

Additional Tips for Personalization

- Set Payment Terms – Clearly define your payment conditions, including deadlines, accepted methods, and any discounts or penalties, to make the process straightforward.

- Include Contact Information – Don’t forget to add your contact details, including phone number and email address, so your clients can easily reach you with questions or concerns.

By following these simple steps, you ensure that your documents not only look professional but also convey the right message and meet your specific business needs. Personalizing your records helps you stand out and ensures your clients feel valued and informed.

Tips for Professional Invoice Design

Designing professional billing documents is more than just about functionality–it’s about creating a polished, easy-to-read record that reinforces your business’s credibility. The visual appeal and clarity of your documents play an important role in the way clients perceive your professionalism. A well-designed document not only makes transactions smoother but also enhances your brand image.

Here are some tips to ensure your documents look professional and are effective in communicating all necessary details:

- Use Clear and Legible Fonts – Choose simple, readable fonts for all text. Avoid overly decorative or difficult-to-read fonts. A clean, professional font like Arial, Helvetica, or Times New Roman ensures that the document is easy to read and looks polished.

- Maintain Consistency – Keep your design consistent across all documents. Use the same font styles, colors, and layout structure for each billing record. Consistency helps reinforce your brand and makes your documents more recognizable to clients.

- Leave Enough White Space – A cluttered document can be difficult to navigate. Make sure to leave adequate white space between sections, such as client details, item descriptions, and totals. This will improve readability and make the document look clean and organized.

- Organize Information Logically – Present your details in a clear, structured manner. Group related information together, such as separating client information, services provided, and payment details. A logical flow ensures that everything is easy to find and understand.

- Include Your Branding – Adding your company logo, color scheme, and business name to the document gives it a professional look and strengthens your brand identity. Ensure that your branding is subtle and not overwhelming, keeping the focus on the document’s content.

- Highlight Key Information – Make the most important elements, like the total amount due and payment due date, stand out by using bold text or a larger font size. This draws attention to crucial details and makes it easier for clients to process the information quickly.

By following these tips, you can create documents that not only function well but also reflect the professionalism and reliability of your business. A well-designed document is a small yet powerful way to leave a positive impression on your clients and encourage prompt payment.

Free Invoice Templates for Small Businesses

For small business owners, managing payments and maintaining financial organization can be a challenge. Fortunately, there are various resources available that make creating professional billing documents quick and easy. These tools can help you streamline your administrative tasks, saving you both time and money while ensuring your records remain clear and consistent.

Why Small Businesses Should Use Ready-Made Billing Documents

- Cost-Effective – For startups or small businesses on a tight budget, utilizing downloadable templates eliminates the need for costly software or external services. Many platforms offer high-quality resources at no cost.

- Professional Appearance – Pre-designed documents have a polished, consistent look, ensuring that your communications with clients are always professional. This can enhance your business’s credibility and strengthen client relationships.

- Time-Saving – Ready-made tools allow you to quickly fill in client details, services, and pricing, making the entire billing process more efficient. With no need to design from scratch, you can focus more on growing your business.

Where to Find High-Quality Resources for Small Businesses

- Online Business Platforms – Websites dedicated to small business resources often offer downloadable tools for invoicing. These platforms typically provide customizable documents to suit various industries and business models.

- Accounting Websites – Many accounting and finance websites offer free billing documents, along with helpful advice for small businesses on managing finances and staying organized.

- Spreadsheet Tools – Spreadsheet applications like Google Sheets and Microsoft Excel often have customizable billing document options available in their template galleries. These resources allow for easy edits and quick updates as your business grows.

By leveraging these resources, small businesses can maintain a professional appearance, streamline their billing processes, and focus on what matters most–building a successful business.

Best Tools for Editing Invoice Forms

When it comes to managing your business finances, having the right tools to edit and personalize billing documents is essential. Whether you’re looking to create something from scratch or make adjustments to a pre-designed resource, there are several powerful tools available that cater to different needs. The right tool can help you streamline the process and ensure your documents meet professional standards.

Top Tools for Editing Billing Documents

There are many software options available, each offering unique features for customization and ease of use. Here are some of the best tools you can use:

| Tool | Key Features | Best For |

|---|---|---|

| Microsoft Word | Easy customization, flexible design, wide range of templates | Users who need simple and customizable document creation |

| Google Docs | Cloud-based, easy sharing and collaboration, basic templates | Collaborative work or businesses that need cloud access |

| Excel/Google Sheets | Data-driven design, automatic calculations, customizable structure | Businesses that need to manage large amounts of numerical data |

| Canva | Visually appealing designs, user-friendly drag-and-drop interface | Businesses that want to create highly polished, branded documents |

| Zoho Invoice | Integrated billing software, customizable templates, automated billing | Small to medium-sized businesses looking for all-in-one invoicing solutions |

Choosing the Right Tool for Your Business

The best tool for editing billing documents depends on your business’s specific needs. If you only need basic customization, simple word processors like Microsoft Word or Google Docs might suffice. For those who need to manage large datasets or automatically calculate totals, spreadsheet tools like Excel or Google Sheets are ideal. On the other hand, if you want an all-in-one solution with automated features, specialized tools like Zoho Invoice could be a better fit.

By selecting the right tool, you can create customized, professional documents that improve your workflow, ensure accurate billing, and present a polished image to your clients.

How to Use Invoice Templates in Excel

Excel offers a versatile and user-friendly way to create and manage billing documents, making it a popular choice for small businesses and freelancers. With the right structure, you can efficiently handle client details, itemized lists, and total calculations. Using Excel for your billing records not only saves time but also ensures accuracy, allowing you to quickly create personalized and professional documents.

Here’s a step-by-step guide on how to use Excel for crafting your billing documents:

- Step 1: Choose a Template – Start by selecting a pre-designed document layout within Excel. Many versions of the software come with built-in templates that you can easily access. Simply search for “billing” or “billing document” in the template search bar, and choose a format that suits your needs.

- Step 2: Customize Your Details – Once you have selected a layout, replace the placeholder text with your business name, contact information, and any relevant details about your client. Be sure to enter all the necessary information, including the invoice number and date of issue.

- Step 3: Enter Items and Costs – In the designated sections, list the goods or services you provided. For each item, include a description, quantity, unit price, and any applicable taxes or discounts. Excel will automatically calculate the total for you if the formula is already set up.

- Step 4: Review and Adjust – Double-check all the details before finalizing the document. Ensure that the numbers add up correctly and that the document contains all the necessary information. You can adjust fonts, colors, and cell formatting to match your business branding.

- Step 5: Save and Send – Once your document is complete, save it as a PDF or an Excel file. PDFs are ideal for sending to clients, as they preserve the formatting and are easy to open on any device. Email or print your document and send it to your client for payment.

Using Excel to create customized billing documents not only simplifies the process but also helps you keep everything organized and accessible. With a few simple adjustments, you can produce accurate, professional documents that reflect your business’s attention to detail.

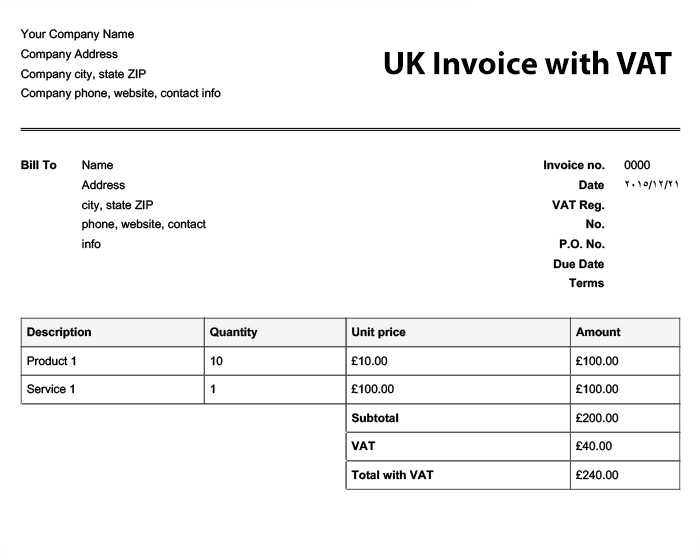

Legal Considerations for Invoices

When creating billing documents, it’s important to understand the legal requirements that apply to them. Ensuring that your documents comply with local regulations not only helps avoid disputes but also ensures that your business operates in a transparent and lawful manner. There are specific details that must be included in each document, as well as rules about payment terms and tax requirements, all of which vary by jurisdiction.

Essential Legal Information to Include

- Business Information – Your business name, address, and contact details should be clearly stated. If your business is registered, include your registration number or tax identification number (TIN).

- Client Details – The recipient’s full name or business name, address, and contact information should be included to ensure there’s no confusion about the party responsible for the payment.

- Unique Document Number – Each document should have a unique reference number. This helps with tracking and ensures there are no mistakes or double entries in your records.

- Date of Issue – Include the date on which the document is issued and, if applicable, the due date for payment. This helps clarify the timeline for both parties.

- Breakdown of Charges – List the products or services provided, including descriptions, quantities, unit prices, and total amounts for each item. This ensures transparency and clarity for the client.

- Tax Information – Make sure to clearly show applicable taxes, such as sales tax or VAT, and include the tax rate. This is legally required in many countries and provides clarity for the client.

Payment Terms and Conditions

- Payment Due Date – Clearly state when the payment is due. This helps set expectations and prevents misunderstandings regarding payment deadlines.

- Late Fees – If applicable, include terms regarding late fees or interest on overdue payments. This legally protects you in case of delayed payments.

- Accepted Payment Methods – Specify the methods of payment you accept (e.g., bank transfer, credit card, check), making it easier for clients to pay.

By ensuring that these legal details are included in every billing document, you not only protect your business but also maintain clear and transparent communication with your clients. Following the relevant laws helps avoid costly errors and ensures your operations are compliant with local tax and business regulations.

When to Update Your Invoice Template

As your business grows and evolves, the documents you use for transactions should reflect those changes. Updating your billing records is crucial to ensure that they stay accurate, professional, and in compliance with any new regulations or business practices. Knowing when and how to update your billing documents can help avoid confusion, streamline your accounting processes, and maintain a positive relationship with your clients.

When to Make Changes to Your Billing Documents

- Business Name or Contact Information Changes – If your business undergoes a rebranding, changes its address, phone number, or email, it’s essential to update these details on your records immediately. Keeping outdated contact information can lead to missed communications or payment delays.

- New Services or Products – As your business expands, you may offer new products or services. Ensure that your documents include accurate descriptions and pricing for these new offerings. This ensures clients have up-to-date information about what they are paying for.

- Tax Law Changes – Changes in tax rates or regulations may require adjustments to how taxes are calculated or displayed. Make sure your records reflect any new tax codes or adjustments, especially if you are required to charge VAT, sales tax, or other applicable taxes.

- Payment Terms Modification – If you change your payment terms, such as offering early payment discounts or implementing late payment penalties, ensure that the new terms are clearly reflected in your documents. Clear payment instructions reduce the risk of misunderstandings.

- Changes in Business Structure – If your business transitions from a sole proprietorship to an LLC, partnership, or corporation, update your billing documents to reflect this change, including any updated business registration or tax identification numbers.

- Software or Platform Updates – If you switch to a new accounting software or platform for managing payments, make sure that your billing structure integrates smoothly with the new system. You may need to adjust the layout or content of your records for compatibility with the new software.

Best Practices for Updating Your Documents

- Regularly Review Your Documents – Set a schedule to review your billing records every quarter or after any major changes in your business. This ensures they are always current and functioning properly.

- Test for Errors – Before sending out any updated billing documents, double-check for errors in calculations, contact details, or missing sections. Accuracy is key in maintaining professionalism.

- Keep a Backup – Always save a copy of your previous versions before making updates. This allows you to refer back to older records if necessary, and helps track the evolution of your business’s billing practices.

By staying on top of these updates, you ensure that your billing documents remain accurate, legally compliant, and ali

Free Invoice Templates vs Paid Options

When choosing resources for creating billing documents, businesses often face the decision of using free or paid options. Both types offer distinct advantages depending on your needs, budget, and the level of customization required. Understanding the differences between these two options can help you make an informed decision about which solution is best for your business.

Comparing Features: Free vs Paid Options

While both free and paid options can fulfill basic needs, the additional features and support offered by paid services can make them a worthwhile investment for some businesses. Here’s a comparison of what each offers:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited customization; often basic layouts | Advanced customization with brand elements and design flexibility |

| Support | Minimal or no customer support | Dedicated customer support with troubleshooting and updates |

| Ease of Use | Simple and easy to use, though might lack advanced features | Intuitive interface with additional features for ease of use |

| Legal Compliance | May lack built-in tools for ensuring legal compliance (e.g., tax rates, regulations) | Often includes features to comply with specific regulations and tax laws |

| Automation | Manual updates and entries | Automated calculations, recurring billing, and data sync options |

| Cost | Completely free, with no cost involved | Subscription or one-time payment required |

When to Choose Each Option

Deciding whether to use free or paid resources for your billing documents depends on several factors:

- Free Options are ideal for small businesses or freelancers with basic needs. If you just need a simple, no-frills solution and are comfortable doing everything manually, free resources are a great starting point.

- Paid Options are better suited for businesses that need more advanced features, customization, or integration with other tools. If you handle large volumes of transactions or need automated processes to save time, investing in a paid option might be worth it.

Both free and paid resources have their place depending on the size and requirements of your business. Consider the features you need and your budget to choose the best option for creating effective and professional billing documents.

How Invoice Templates Save Time and Money

Efficient billing is essential for any business, and using pre-designed documents can significantly reduce the time and effort spent on administrative tasks. Whether you’re a freelancer or running a small company, streamlining your invoicing process can help you focus on growth while ensuring accuracy and timely payments. By automating parts of the process and eliminating errors, these ready-made documents provide both time savings and financial benefits.

Time-Saving Benefits

One of the biggest advantages of using ready-made billing records is the reduction in time spent creating each document from scratch. Here’s how they help save time:

- Quick Setup: Most pre-designed records only require you to fill in basic information, such as client details, products or services, and amounts. The structure is already in place, so you don’t need to worry about formatting or adding sections manually.

- Automation of Calculations: Many ready-made options come with built-in formulas that automatically calculate totals, taxes, and discounts. This reduces human error and speeds up the entire process.

- Consistency: Using the same document format for every transaction helps ensure consistency in your paperwork. This eliminates the need to redesign your documents for each client, saving you time in the long run.

Money-Saving Benefits

In addition to saving time, using ready-to-go billing documents can also have a significant impact on your finances:

- Reduced Errors: When you automate calculations and use a pre-designed structure, the chances of errors decrease dramatically. Fewer mistakes mean fewer costly corrections, which can save money in both time and potential disputes with clients.

- Lower Administrative Costs: By streamlining the billing process, you reduce the amount of time your employees (or yourself) spend on administrative tasks. This reduces overhead costs, allowing you to allocate resources more efficiently.

- Faster Payments: Consistent, professional-looking documents help establish trust with clients and create a more efficient billing process. With quicker and clearer records, clients are more likely to make timely payments, improving your cash flow.

By adopting pre-designed solutions, you not only optimize your time but also cut unnecessary costs, all while maintaining a professional and efficient workflow. Using these tools effectively is a simple yet powerful way to improve your business operations and increase profitability.