International Commercial Invoice Template for Global Transactions

When engaging in global business, clear and accurate documentation is crucial for smooth transactions. Proper paperwork ensures that both parties understand their obligations, leading to fewer disputes and delays. Whether you’re shipping goods or providing services across borders, having a structured document is key to maintaining transparency and compliance with local laws.

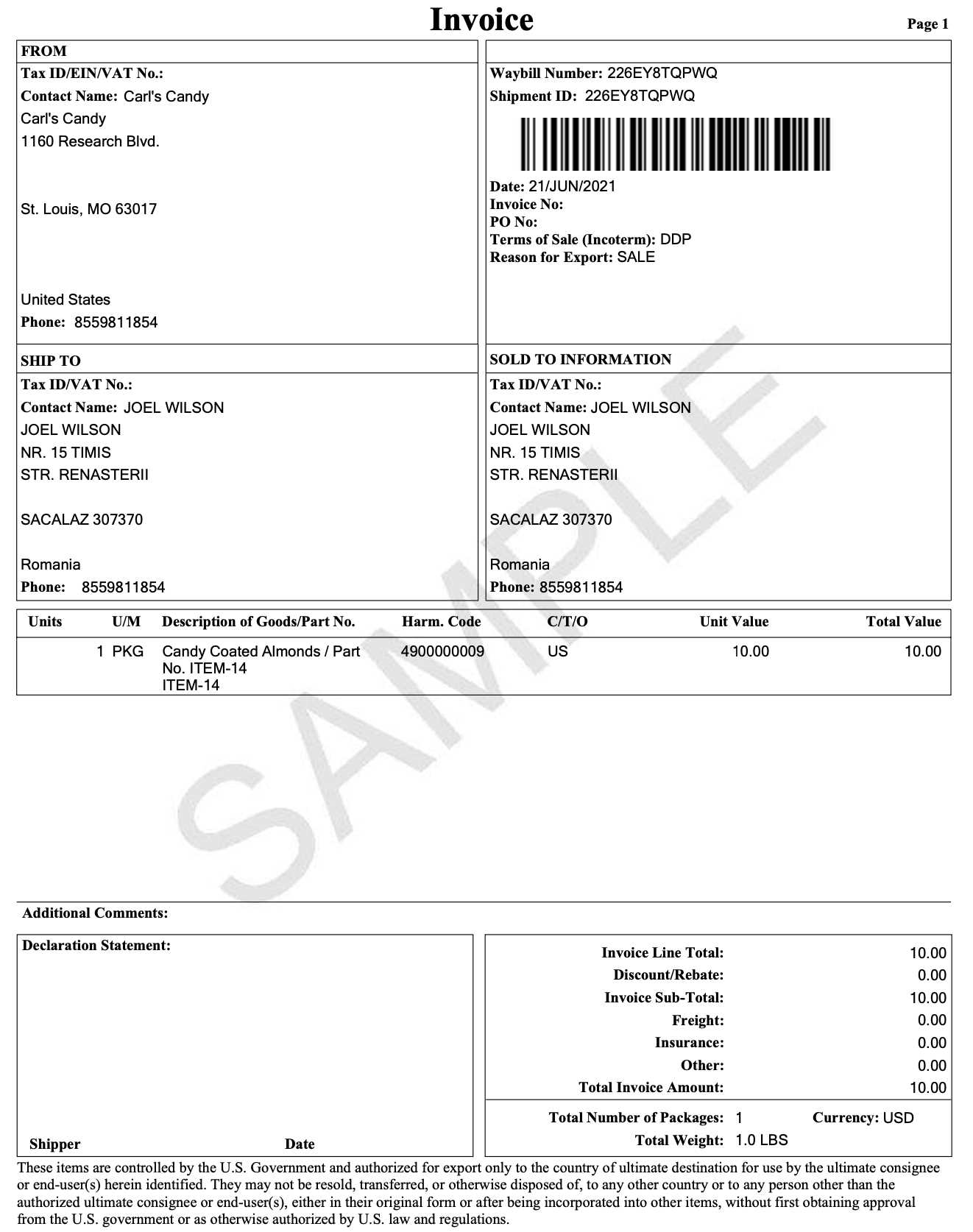

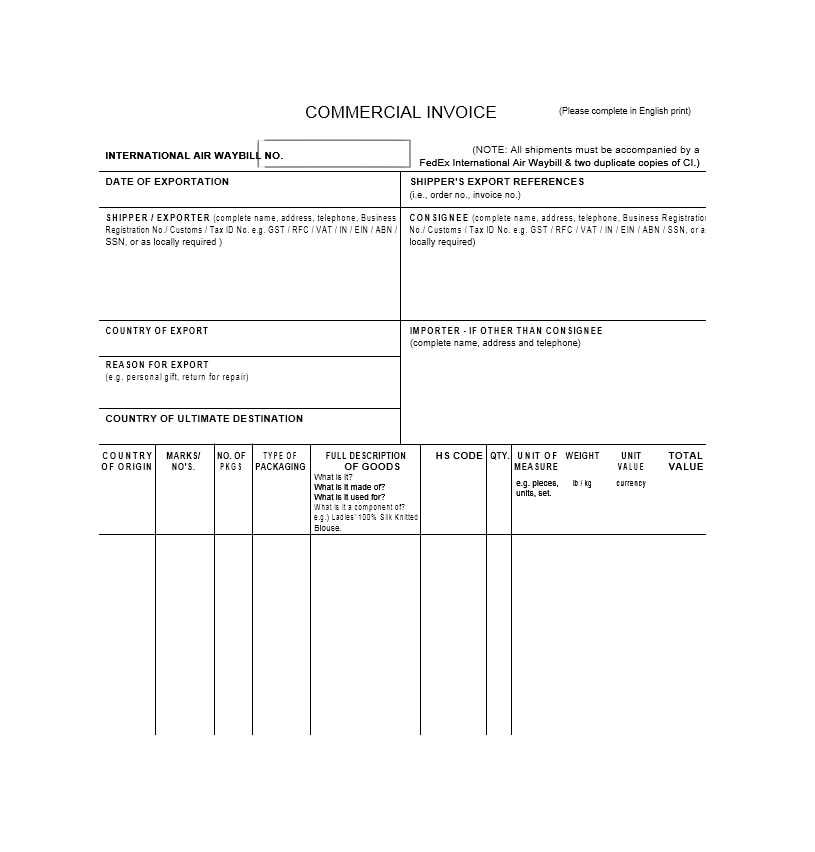

One of the most vital documents in cross-border trade is the detailed account of the goods or services provided. This document outlines important details such as pricing, delivery terms, and payment expectations. By using a well-constructed document, businesses can ensure that their shipments are processed quickly and correctly, minimizing the risk of errors or misunderstandings.

In this guide, we’ll explore how to create and customize these documents for global transactions. You’ll learn how to incorporate necessary information that satisfies regulatory requirements while facilitating smooth and efficient payments between buyers and sellers.

Global Trade Document Overview

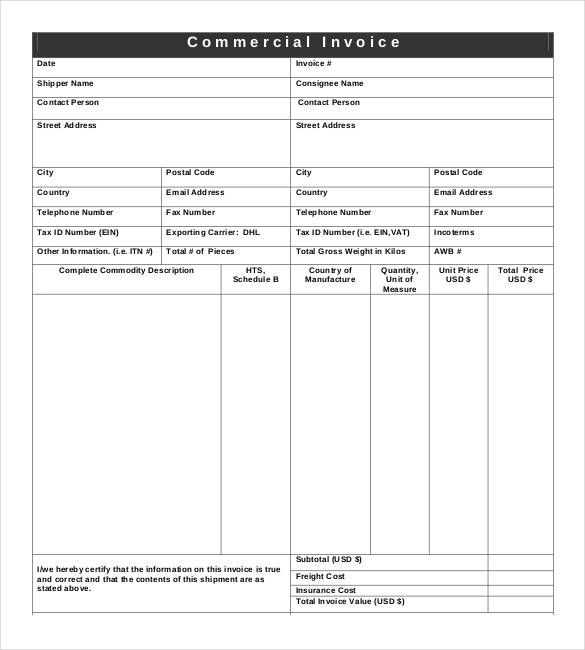

In the world of cross-border commerce, a well-organized and precise document is essential for ensuring smooth transactions. This document serves as a comprehensive record of the goods or services being exchanged, detailing everything from product descriptions to payment terms. It helps clarify expectations for both the buyer and the seller, preventing misunderstandings and minimizing the risk of disputes.

To streamline the process and make global business dealings easier, a standardized structure is commonly used. This structured format ensures that all necessary information is included in a consistent and clear way, reducing errors and improving the overall efficiency of transactions. Below is an overview of the core components that should be present in any such document.

| Section | Description |

|---|---|

| Sender and Receiver Information | Details of both the exporter and importer, including names, addresses, and contact information. |

| Item Description | A detailed list of the products or services, including quantities, unit prices, and total value. |

| Payment Terms | Information on how and when payment is expected, including applicable currency and method of payment. |

| Shipping Details | Terms of delivery, including the method, cost, and destination of the goods. |

| Legal and Tax Information | Any relevant legal requirements or tax obligations, such as customs duties and tariffs. |

By following a consistent format and including these key elements, businesses can ensure their documentation is accurate and meets the requirements of both their country and their trading partners. This not only helps in reducing delays but also in avoiding potential legal issues that may arise during the shipment or payment processes.

Why You Need a Global Trade Document

When conducting business across borders, having a well-structured record of the transaction is essential for both parties involved. This document provides clarity on what is being exchanged, the agreed-upon price, and the terms of delivery. Without it, misunderstandings can arise, leading to delays, disputes, or even legal complications. Having a standardized document ensures that all necessary information is communicated clearly and accurately.

Moreover, this document serves as a key element in meeting customs regulations and compliance requirements, both in the exporting and importing countries. It facilitates the smooth processing of shipments and payments while protecting both businesses legally and financially. Below are some reasons why having such a document is vital for successful global trade.

| Reason | Description |

|---|---|

| Clear Communication | It provides both parties with a clear understanding of the goods, their value, and agreed-upon terms. |

| Legal Protection | It acts as a legally binding document that can be used in case of disputes or misunderstandings. |

| Customs Compliance | It ensures that shipments comply with local customs regulations and minimizes delays at borders. |

| Tax and Duty Calculation | It helps determine applicable taxes, tariffs, and duties that need to be paid during the shipping process. |

| Financial Record | It serves as a financial record for both parties, aiding in proper accounting and tax filing. |

In conclusion, using a detailed document for cross-border transactions is not only necessary for ensuring clear communication but also for legal, financial, and regulatory purposes. It protects both the buyer and the seller, ensuring that the entire process is streamlined and compliant with international standards.

Key Elements of a Trade Document

For any global transaction, a well-crafted document must include specific details that ensure clarity and compliance with legal and financial requirements. Each element serves a distinct purpose, from identifying the parties involved to outlining payment terms and shipping arrangements. These components are vital for avoiding misunderstandings and ensuring the smooth processing of goods and services across borders.

Below is an overview of the key sections that should always be included in such a document, along with an explanation of why each one is important for successful global transactions.

| Element | Description |

|---|---|

| Seller and Buyer Details | Includes the full names, addresses, and contact details of both the exporter and importer, ensuring the correct identification of both parties. |

| Product Description | Accurate and detailed information about the items being sold, including quantity, unit price, and total value, helping prevent disputes over what is being shipped. |

| Terms of Payment | Specifies the agreed-upon method of payment (e.g., wire transfer, letter of credit) and payment schedule, reducing confusion regarding financial transactions. |

| Shipping Instructions | Describes the shipping method, delivery address, and related costs, ensuring smooth logistics and minimizing delays in transit. |

| Customs and Tax Information | Includes details on taxes, tariffs, and customs duties applicable to the shipment, helping both parties comply with import/export regulations. |

These core elements not only help in facilitating trade but also play a crucial role in ensuring the transaction is legally sound and meets regulatory standards in both the seller’s and buyer’s countries. With all necessary details outlined in the document, businesses can avoid unnecessary complications and streamline the shipping and payment process.

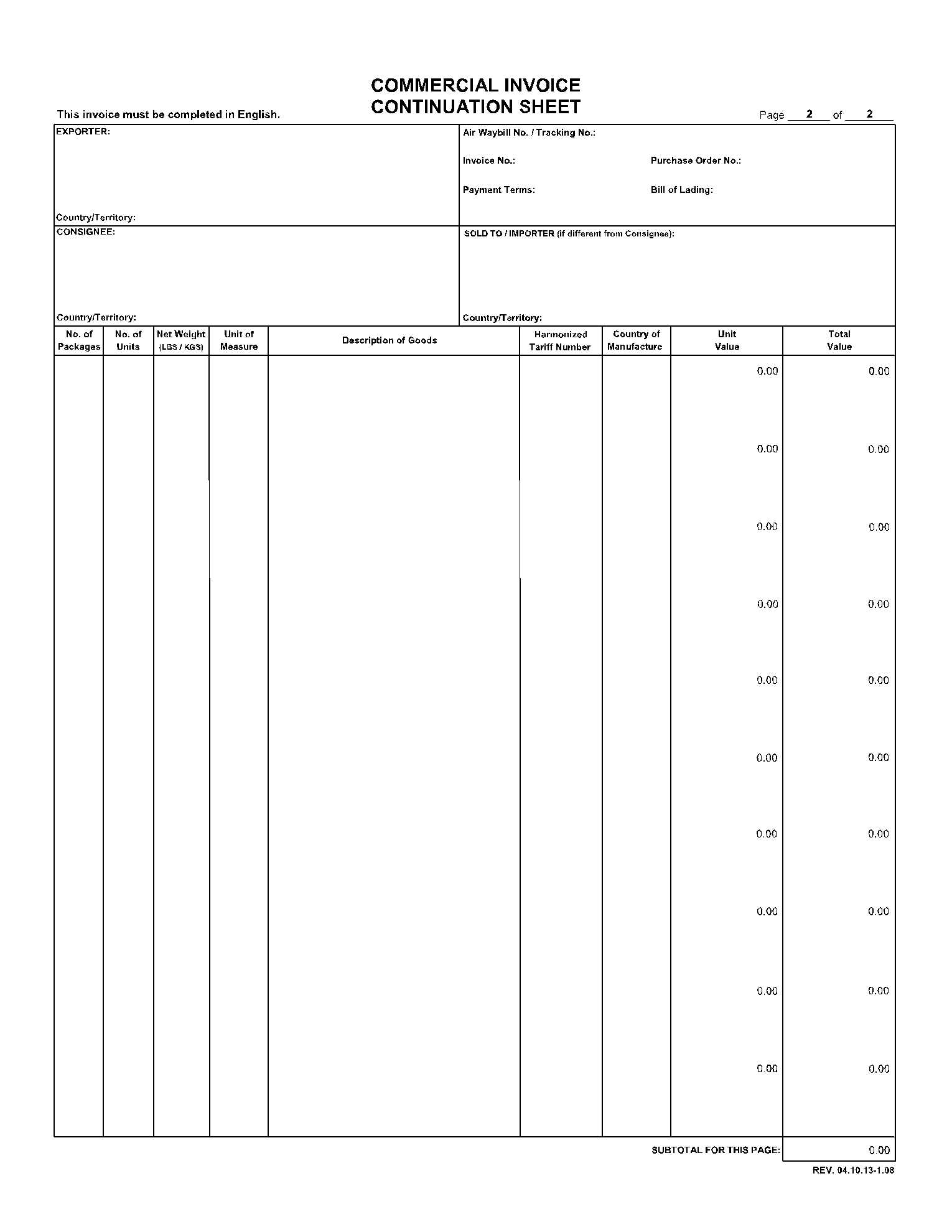

How to Create an Accurate Trade Document

Creating an accurate document for cross-border transactions requires attention to detail and proper organization. Each piece of information must be carefully recorded to ensure that all parties involved are on the same page, and that legal, financial, and logistical aspects are clearly outlined. Mistakes in any of the key details can lead to delays, disputes, or even financial loss. Here’s how you can ensure that your documentation is both precise and comprehensive.

The following steps outline the process for creating a reliable document that will help avoid misunderstandings and facilitate smooth transactions. By adhering to these guidelines, businesses can ensure they meet both local and international regulations while maintaining good relations with their trading partners.

| Step | Action |

|---|---|

| Step 1: Collect Information | Gather the necessary details about both the buyer and seller, including full names, contact information, and addresses. |

| Step 2: Describe the Goods or Services | Provide a detailed description of the products or services being sold, including quantities, unit prices, and total values. |

| Step 3: Define Payment Terms | Clearly state the payment method (e.g., bank transfer, credit card) and any deadlines or installment plans for payment. |

| Step 4: Specify Shipping Information | Include the shipping method, destination address, and shipping costs, along with any expected delivery dates. |

| Step 5: Account for Taxes and Duties | Ensure that applicable taxes, tariffs, and customs duties are calculated and included to avoid delays at customs checkpoints. |

| Step 6: Review for Accuracy | Double-check all the details, especially the amounts, terms, and addresses, to ensure there are no mistakes before sending. |

By following these steps, businesses can create accurate documents that prevent issues in the trading process. Proper documentation not only ensures that the terms of the agreement are clear but also reduces the risk of any complications during customs clearance or payment processing.

Customizing Your Document for Different Countries

When engaging in trade across different nations, it’s crucial to adapt your documentation to meet the specific requirements and expectations of each country. Various regions have different legal, financial, and customs regulations that must be considered when preparing a transaction record. Tailoring your document ensures compliance with local laws, facilitates smoother processing, and minimizes the risk of delays or disputes.

Different countries may have unique requirements for language, currency, tax calculations, or shipping details. For example, some countries may require specific terms related to import/export duties, while others might need the document in the local language or formatted according to local standards. Understanding these differences and adjusting your paperwork accordingly is essential for a successful global business operation.

Here are some key considerations to keep in mind when customizing your documents for international transactions:

- Currency and Payment Terms: Always use the local currency of the country where the buyer is based, and specify the payment methods and due dates according to regional standards.

- Language and Translation: Ensure that the document is translated into the official language of the country where the transaction is taking place, especially if it is required for customs clearance.

- Tax and Duty Information: Different countries have varying tax rates and customs duties. Be sure to calculate and display these accurately according to the destination country’s regulations.

- Legal Requirements: Some countries may require additional legal information such as trade license numbers or special certifications. Research these requirements and include them as necessary.

- Shipping Terms: Specify the shipping method, terms of delivery, and associated costs based on the international shipping laws of the destination country.

By customizing your documentation according to the specific needs of each country, you can avoid complications at customs, ensure smoother transactions, and build stronger business relationships with global partners.

Common Mistakes in Trade Documents

When preparing documentation for cross-border transactions, even small errors can lead to significant issues. Mistakes in the details can cause delays in shipping, complications with customs, or payment disputes. Understanding the most common pitfalls can help you avoid these problems and ensure smoother, faster transactions. Below are some of the frequent mistakes to watch out for when preparing such documents.

1. Incorrect or Missing Information

One of the most common mistakes is failing to include accurate or complete details. This includes missing addresses, incorrect product descriptions, or incomplete payment terms. If any of the key information is missing or wrong, it can lead to confusion, delayed shipments, or payment issues.

Tip: Always double-check the buyer’s and seller’s information, product details, and delivery terms. Be as precise as possible to avoid mistakes that could cause delays or complications.

2. Failing to Account for Taxes and Duties

Many businesses overlook the importance of correctly calculating taxes, tariffs, or customs duties. Failing to do so can result in costly delays at customs checkpoints or unexpected charges for the buyer. Each country has different rules for importing goods, so it’s crucial to stay informed about the regulations in both the seller’s and buyer’s countries.

Tip: Research the customs duties and taxes for the destination country and include them in your document to avoid surprises during customs clearance.

Accurate documentation is key to a successful global trade transaction. By avoiding these common mistakes, businesses can minimize risks and ensure that the process is as smooth as possible for all parties involved.

How to Calculate Duties and Taxes

Accurately calculating duties and taxes is a critical part of preparing documents for cross-border transactions. These charges are imposed by governments to regulate imports and exports, and they can vary significantly depending on the type of goods, their value, and the destination country. Properly calculating these costs ensures that both the buyer and the seller are aware of the financial obligations before goods are shipped or received.

The process of calculating these charges can be complex, as each country has its own rules and rates. However, understanding the key factors involved can make the process easier and more transparent. Below are the main elements to consider when determining the duties and taxes for your trade transaction.

1. Determine the Harmonized System (HS) Code

The first step in calculating duties and taxes is identifying the correct Harmonized System (HS) code for the goods being traded. This code is used globally to classify products and determine the appropriate tariff rates. Different goods have different HS codes, which influence the amount of duty imposed. It is essential to use the correct code to ensure the right tariff is applied.

Tip: You can typically find the HS code for your product by consulting with a customs broker or referring to online databases provided by customs authorities.

2. Calculate Customs Duty and Tax Rates

Once you have the correct HS code, the next step is to calculate the applicable customs duties and taxes. Each country sets its own duty rate, which can vary based on the product type and value. Taxes, such as value-added tax (VAT) or sales tax, may also apply. To calculate the total amount due, multiply the product value by the duty rate and add any applicable taxes.

Tip: Make sure to factor in additional costs, such as shipping and insurance, as some countries calculate duties based on the total cost of the goods, including these fees.

By correctly calculating the duties and taxes, businesses can avoid unexpected charges or delays during the customs clearance process and ensure a smooth and compliant transaction.

Legal Requirements for Global Trade Documentation

When conducting business across borders, it’s crucial to comply with the legal requirements of both the exporting and importing countries. These regulations ensure that transactions are legitimate, taxes and duties are properly assessed, and that businesses meet the necessary obligations for customs clearance and financial reporting. Failing to meet these legal requirements can result in penalties, delays, or even the rejection of goods at customs.

Each country has its own set of rules and regulations governing trade documents. However, there are several common elements that businesses must consider when preparing documentation for cross-border transactions. Below are key legal considerations to keep in mind:

- Correct Classification of Goods: Ensure that products are classified according to the correct codes, such as the Harmonized System (HS) code, to avoid misclassification and incorrect duty calculations.

- Accurate Descriptions and Values: Provide a clear and precise description of the goods, including quantities, value, and origin, as this information is essential for customs authorities to assess duties and taxes.

- Proper Payment Terms: Include clear terms regarding payment, such as the currency, method of payment, and due date. These details help avoid disputes and ensure that payments are processed without delays.

- Compliance with Local Tax Laws: Be aware of the value-added tax (VAT) or sales tax requirements in both the exporting and importing countries, as this can impact the final price of goods and services.

- Export and Import Licenses: Some goods require export or import licenses, especially restricted or high-value items. Ensure all necessary licenses or permits are obtained before shipment.

- Accurate Shipping Information: Provide correct details regarding the shipping method, origin, and destination addresses. Inaccurate shipping information can lead to delays or even fines at customs.

- Language and Currency Compliance: In many countries, trade documents must be presented in the local language or currency. Check the local requirements for the destination country to ensure compliance.

By ensuring that these key elements are properly addressed, businesses can reduce the risk of legal issues and improve the efficiency of their international transactions. Complying with legal requirements is not only essential for smooth operations but also helps maintain a good reputation and avoid costly mistakes.

Choosing the Right Currency for Payments

When conducting business across borders, selecting the correct currency for transactions is a crucial step. The choice of currency can have significant financial implications, affecting exchange rates, payment processing times, and potential transaction fees. Ensuring that both parties agree on the currency not only facilitates smoother transactions but also helps avoid misunderstandings and unexpected costs.

There are several factors to consider when deciding which currency to use for cross-border payments. Below are some of the key considerations that will help guide your decision-making process:

1. Currency Stability and Exchange Rates

The stability of a currency and its exchange rate fluctuations should be a major consideration when choosing the currency for your payment. Some currencies are more volatile than others, meaning their value can fluctuate significantly, affecting the final cost of the transaction. It’s important to select a currency that minimizes the risk of dramatic changes in exchange rates between the time of agreement and the actual payment.

Tip: If you’re concerned about volatility, consider using a widely traded and stable currency such as the US Dollar, Euro, or British Pound, as these tend to be less prone to significant fluctuations.

2. Convenience for Both Parties

Another important factor is convenience for both the seller and buyer. Consider which currencies both parties can easily access and exchange. Some currencies may not be easily available or widely accepted in certain countries, which could complicate the payment process. It’s often a good idea to choose a currency that is common in the trade market and is easily accessible for both sides.

Tip: You may want to select a currency that aligns with the primary market or trading bloc of the buyer, as this can simplify transactions and reduce potential banking fees.

By carefully considering these factors, you can choose the right currency for your transactions, reducing risks and ensuring smoother financial exchanges in global business operations.

Importance of Correct Shipping Details

Accurate shipping information is essential for ensuring smooth delivery and avoiding delays in cross-border transactions. The details provided on shipping documents dictate how goods are routed, processed through customs, and delivered to the buyer. Incorrect or incomplete shipping information can lead to missed deliveries, additional costs, or even loss of goods, all of which can damage business relationships and disrupt operations.

Providing the correct shipping details from the outset helps to streamline logistics, reduce potential risks, and guarantee timely delivery. Below are the key reasons why accurate shipping information is critical:

1. Preventing Customs Issues

Customs authorities require precise information about shipments to process goods efficiently and ensure compliance with local import/export laws. Errors in shipping addresses, descriptions, or values can lead to customs clearance delays, fines, or even the seizure of goods.

- Tip: Ensure that all addresses, including the buyer’s and seller’s details, are complete and accurate. Double-check postal codes and contact information.

- Tip: Include a clear and accurate description of the goods, as well as the country of origin, to avoid confusion during the customs inspection process.

2. Reducing Delivery Delays

Incorrect shipping details can lead to significant delays in the delivery process. If the shipping carrier cannot locate the correct address or if the delivery instructions are unclear, the shipment may be delayed or returned. This can create unnecessary frustration for both the buyer and the seller.

- Tip: Always verify the shipping address with the recipient before finalizing the transaction. Include any special instructions or information that might help the carrier ensure timely delivery.

- Tip: Make sure to include phone numbers or email addresses for both the sender and the recipient, allowing the carrier to reach out if there are any issues with the delivery.

Ensuring correct shipping details is a key factor in maintaining the flow of international trade. By carefully reviewing and confirming all shipping information, businesses can avoid costly mistakes, streamline logistics, and ensure customer satisfaction.

Incorporating Terms of Sale in Trade Documents

Including clear and concise terms of sale in transaction documents is essential for defining the responsibilities and expectations of both the buyer and seller. These terms outline the conditions under which the goods or services are being sold, specifying payment obligations, delivery schedules, and any additional conditions that both parties have agreed upon. By clearly stating these terms, businesses can minimize misunderstandings and ensure that both parties are on the same page throughout the transaction.

Properly incorporating terms of sale helps prevent legal disputes, ensures smooth payment processes, and provides transparency to all parties involved. Below are some key aspects to include when specifying these terms in your trade documents:

1. Payment Terms

Defining the payment terms is one of the most important aspects of a transaction. This section should clearly outline how and when payments will be made, including the currency, method of payment, and any installment plans if applicable. Clear payment terms help prevent confusion and ensure that the seller receives compensation as agreed.

- Tip: Specify whether payments are due upfront, upon delivery, or within a certain number of days (e.g., 30 days after receipt of goods).

- Tip: Include details of any early payment discounts or late payment penalties to incentivize timely payments.

2. Delivery and Shipping Terms

It’s essential to clearly define when and where the goods will be delivered. This includes specifying shipping methods, delivery times, and any costs associated with transportation. These terms also outline the responsibilities of the buyer and seller regarding shipping and handling fees, as well as who bears the risk during transit.

- Tip: Use commonly recognized shipping terms like FOB (Free on Board), CIF (Cost, Insurance, and Freight), or DAP (Delivered at Place) to avoid confusion.

- Tip: Specify the expected delivery dates or timeframes to ensure both parties know when the goods are expected to arrive.

By clearly incorporating these terms into your documents, you can help both parties understand their obligations, reduce the risk of disputes, and ensure a smoother transaction process overall.

Understanding Incoterms in Trade Documents

Incoterms (International Commercial Terms) play a critical role in global transactions by defining the responsibilities of both the buyer and the seller regarding the delivery of goods. These terms specify who is responsible for shipping, insurance, duties, and other logistics-related costs, making them essential for avoiding confusion and ensuring that both parties understand their obligations. Properly including Incoterms in trade documentation provides clarity and helps streamline the entire process of cross-border trade.

Incorporating Incoterms into your transaction documents helps prevent misunderstandings about who is responsible for each stage of the delivery process, from shipping to customs clearance. The following are key aspects of using Incoterms effectively in your documents:

1. Defining Risk and Responsibility

Incoterms clearly outline where the responsibility for the goods transfers from the seller to the buyer. This includes identifying which party will cover the costs of shipping, insurance, and customs duties, as well as who assumes the risk if goods are lost or damaged in transit.

- Tip: Common terms like FOB (Free on Board) or CIF (Cost, Insurance, and Freight) clarify when the seller’s responsibility ends and the buyer’s begins.

- Tip: Ensure both parties understand where the goods are being delivered, as this influences who is liable for transport costs and risk during transit.

2. Choosing the Right Incoterms for Your Transaction

Not all Incoterms are suitable for every type of transaction. Different terms apply depending on the mode of transport, the nature of the goods, and the specific agreements between the parties involved. It’s important to choose terms that align with both the seller’s and buyer’s expectations and capabilities.

- Tip: For example, if the buyer is responsible for the transportation, consider using DAP (Delivered at Place) or DDP (Delivered Duty Paid) to ensure the buyer handles the delivery and customs costs.

- Tip: For bulk shipments, terms like EXW (Ex Works) might be appropriate, where the buyer assumes responsibility for all transport and customs arrangements from the seller’s premises.

Using the correct Incoterms in your trade documents helps clarify the distribution of responsibilities, reduce risks, and ensure that both parties are in agreement regarding delivery, payment, and insurance obligations.

How to Avoid Payment Delays with Trade Documents

Delays in payment are a common issue in global transactions, and they can have a significant impact on cash flow and business operations. Ensuring that all necessary details are included in your trade documents is essential to avoiding payment hold-ups. A well-prepared document not only facilitates smoother processing but also sets clear expectations for both the buyer and seller, reducing the chances of misunderstandings or disputes.

There are several key steps that businesses can take to prevent payment delays. By following these best practices, you can help ensure that payments are processed promptly and efficiently:

- 1. Clearly Define Payment Terms: Specify the agreed-upon terms of payment in your document. Indicate whether payment is due upon receipt, within a set number of days, or upon completion of the transaction.

- 2. Include Accurate Banking Details: Ensure that the buyer has all the necessary information to make a payment, such as correct bank account details, currency, and payment methods. This helps avoid confusion and delays.

- 3. Provide Complete and Correct Information: Missing or incorrect details in the document can lead to confusion and payment processing issues. Ensure all product descriptions, quantities, pricing, and shipping details are accurate and clearly stated.

- 4. Use Clear Invoice Numbers and References: Include a unique reference number for each document. This makes it easier for the buyer to track and process payments and helps prevent any potential delays due to miscommunication or confusion.

- 5. Set Clear Deadlines and Late Fees: Be explicit about the payment due date and any late fees that may apply. This encourages timely payments and can serve as an incentive for buyers to meet the agreed deadline.

By ensuring that your trade documents are clear, complete, and accurate, you can significantly reduce the chances of payment delays, improving your cash flow and strengthening business relationships.

Digital vs Paper Documents for Global Trade

The decision between using digital or paper documentation for cross-border transactions is an important one. Both methods have their advantages and challenges, depending on the nature of the business, the countries involved, and the preferences of the parties involved. As global trade becomes more digitized, many businesses are shifting toward electronic records due to their efficiency and ease of use, but paper-based documents are still widely used in certain regions or industries. Understanding the pros and cons of each method is crucial to ensuring smooth and effective transactions.

Both digital and paper-based documentation can serve the same purpose, but each offers distinct benefits. Below are some key factors to consider when choosing between digital or physical documents for your business dealings:

1. Speed and Efficiency

One of the main advantages of digital documentation is its speed. With electronic records, transactions can be processed immediately, and documents can be sent or received with just a few clicks, avoiding the delays associated with postal services. This is particularly beneficial when time is of the essence, such as in time-sensitive shipments or urgent payments.

- Tip: Digital documents enable faster approval and review cycles, which can improve the overall efficiency of global trade processes.

2. Security and Compliance

While paper documents are tangible and may feel more secure in some cases, digital documentation offers advanced security measures like encryption, access control, and secure file-sharing, which help protect sensitive information. Additionally, digital records are often easier to store, retrieve, and organize in compliance with international standards and regulations.

- Tip: Many countries have recognized the legality of electronic signatures and digital records, making them as binding as paper-based documents in many cases.

3. Environmental and Cost Considerations

In terms of cost and environmental impact, digital documents often have the upper hand. They eliminate the need for paper, ink, printing, and postage, leading to significant cost savings and a reduced carbon footprint. On the other hand, paper-based records involve ongoing costs for materials and shipping, particularly when dealing with multiple international destinations.

- Tip: Moving to a digital platform can help businesses reduce their operational costs and contribute to sustainability goals.

4. Accessibility and Convenience

Digital documents can be accessed from anywhere at any time, making it easier to manage records remotely and share information with stakeholders in different time zones. Paper documents, however, require physical handling, which can be inconvenient, especially when dealing with multiple international parties.

- Tip: Cloud-based storage systems allow both buyers and sellers to access records instantly, ensuring that information is always available when needed.

Ultimately, the choice between digital and paper records depends on your specific business needs. While digital documentation is increasingly becoming the preferred method for its speed, security, and cost-effectiveness, paper-based records may still be necessary in certain situations where regulations or customer preferences dictate their use.

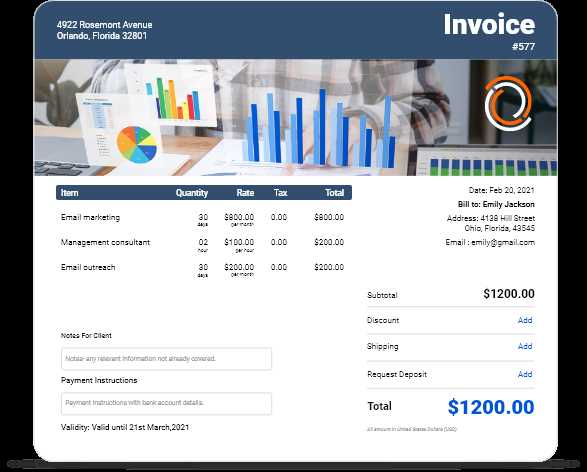

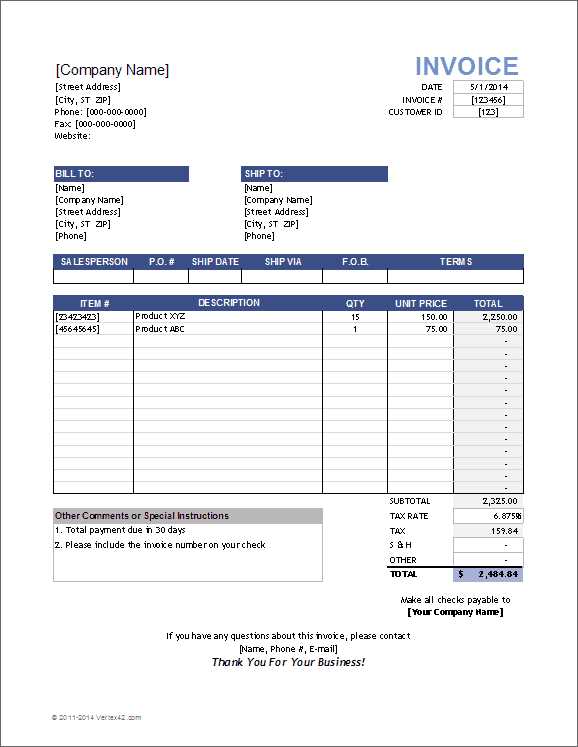

Invoice Templates and Automation Tools

In today’s fast-paced business environment, efficiency and accuracy are crucial when handling transaction documentation. Using pre-designed forms and automation tools can significantly streamline the process of creating and managing sales records, reducing the likelihood of errors and saving valuable time. By leveraging templates and automation, businesses can ensure that their paperwork is consistently accurate and professional, while also speeding up routine tasks such as sending and tracking payments.

Many businesses are adopting automation tools to manage their sales documents more effectively. These tools not only help in creating professional-looking records but also enable quick updates and easy distribution. The integration of templates and automation can enhance overall workflow, particularly in global trade where multiple parties and varying requirements must be managed efficiently.

1. Benefits of Using Pre-Designed Forms

Pre-designed forms or layouts for sales documents offer businesses several advantages, such as standardized formats, easy customization, and time savings. These templates often come with placeholders for all necessary details, ensuring that no key information is overlooked.

- Tip: Using standardized forms reduces the risk of missing critical fields like payment terms, product descriptions, or shipping information.

- Tip: Customizable templates allow for easy modifications, ensuring that the document meets the specific needs of each transaction.

2. How Automation Enhances Document Management

Automation tools take efficiency a step further by enabling automatic generation, tracking, and sending of trade documents. This helps businesses keep track of due payments, monitor sales progress, and automatically generate documents based on pre-set criteria.

- Tip: Automation can also send reminders for upcoming payments or overdue balances, ensuring timely follow-ups and reducing the chance of delayed payments.

- Tip: Some systems allow for automatic currency conversions, tax calculations, and language adjustments, making global transactions simpler to manage.

By combining templates with automation tools, businesses can significantly reduce administrative overhead and improve the overall efficiency of their transaction processes, allowing teams to focus on other critical aspects of the business.

How to Manage Global Transaction Records

Effectively managing transaction records is crucial for businesses involved in global trade. Keeping accurate and organized documentation ensures compliance with regulations, smooth financial operations, and easy tracking of payments and shipments. A well-maintained record system also simplifies auditing, reduces the risk of disputes, and supports timely financial reporting. Whether you are dealing with hundreds of transactions or just a few, having a clear strategy for record management is essential to business success.

There are several best practices for managing records related to global transactions. These include establishing a consistent filing system, using digital tools for easier access, and maintaining thorough details for each transaction. Proper management of these records helps avoid errors, supports transparency, and ensures quick retrieval when needed.

1. Organize Records by Categories

It’s important to categorize your documents in a way that makes them easy to search and retrieve. This can be done by transaction type, client name, payment status, or date. For example, separating completed transactions from pending ones helps you quickly follow up on outstanding payments and monitor delivery progress.

- Tip: Use software that allows you to tag or categorize documents, making them easily searchable by different parameters like date, client, or product.

- Tip: Regularly update and back up your records to prevent data loss and ensure you have a recent version of all important documents.

2. Use Digital Tools for Efficiency

Digital record-keeping tools offer immense advantages, such as faster processing, better security, and reduced risk of errors. Cloud-based systems allow for real-time updates and remote access, making it easy to manage documents across different locations. These tools can also automate repetitive tasks, such as generating new records or sending reminders for unpaid balances.

- Tip: Invest in a document management system that integrates with other business tools, such as accounting software or CRM platforms, to ensure seamless data flow.

- Tip: Cloud storage can offer automatic backups, minimizing the risk of losing critical transaction details due to hardware failure or other issues.

3. Maintain Clear and Complete Details

Ensure that each record is detailed and contains all necessary information, such as product descriptions, prices, payment terms, and shipping details. Missing or incorrect data can lead to delays or disputes, so double-checking the accuracy of each entry is essential. Having clear and complete records also simplifies reporting and auditing processes.

- Tip: Include relevant references, such as order numbers or transaction IDs, to ensure easy tracking and follow-up.

- Tip: Consistently update payment statuses and shipping information to maintain an accurate picture of your business’s financial standing.

By adhering to these strategies, you can effectively manage your transaction records, ensuring smoother operations and fewer complications as your business engages in global trade.