Customizable FileMaker Pro Invoice Templates for Efficient Billing

Efficient billing systems are crucial for maintaining smooth business operations. By utilizing specialized tools designed for generating and managing financial documents, businesses can save time, reduce errors, and improve overall accuracy. The right software allows for easy creation of professional documents tailored to specific needs, ensuring consistency and reliability in every transaction.

Whether you’re a freelancer, small business owner, or part of a larger enterprise, customizing financial documents to match your branding and organizational requirements can make a significant difference. These tools offer flexibility, allowing you to tailor layouts, incorporate company logos, and adjust formatting to suit your preferences.

With the right approach, businesses can streamline their billing process, automate repetitive tasks, and maintain organized records. The ability to customize and manage financial documentation in a user-friendly system ultimately leads to better client relationships and improved business efficiency.

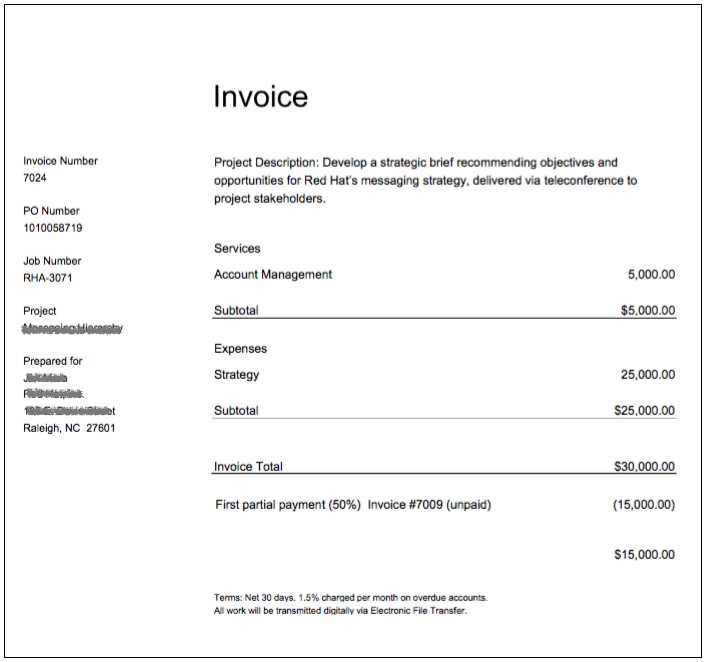

FileMaker Pro Invoice Templates Overview

When managing financial documentation, having an efficient system to generate and manage business forms is essential. Tools designed for creating custom billing documents provide an easy way to handle this task, offering features that cater to both simplicity and customization. These solutions are widely used by businesses of all sizes to ensure accuracy, consistency, and professionalism in their financial paperwork.

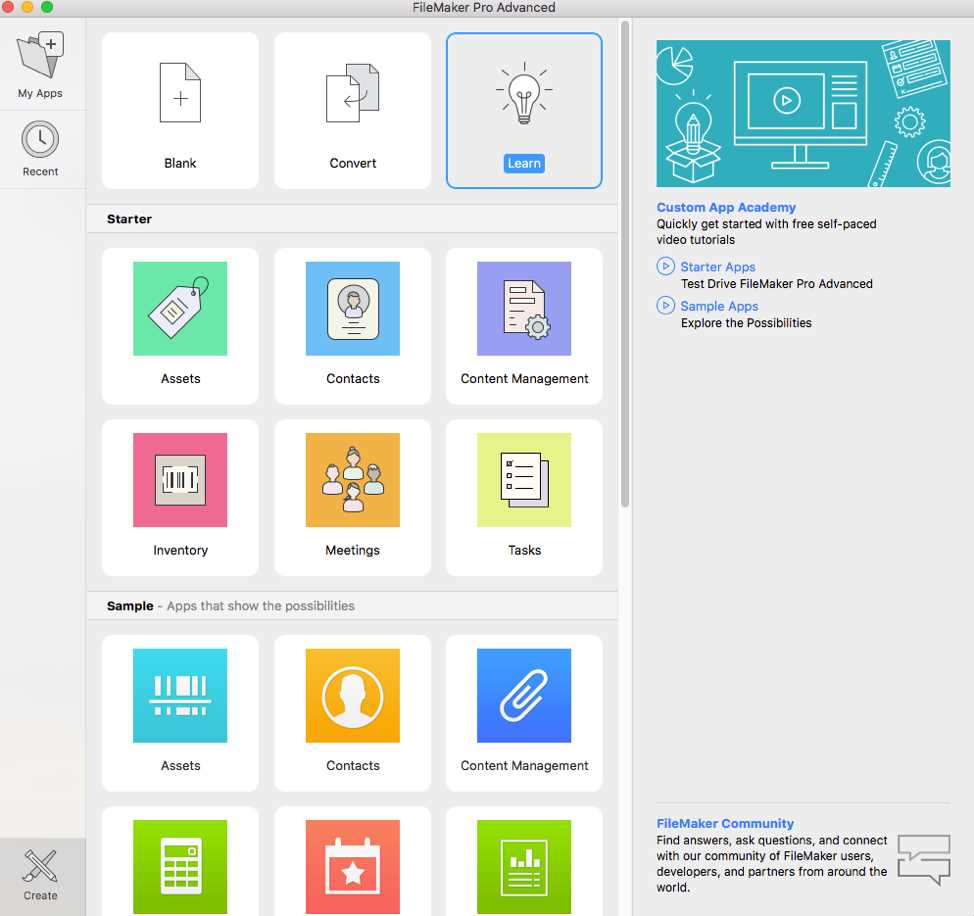

By using a customizable document creation system, users can easily adjust their layouts, incorporate unique branding, and ensure that each document meets their specific business requirements. Such tools often come with pre-built designs, but they also allow users to make modifications to suit particular needs, whether for clients, projects, or other purposes.

Key benefits of using these solutions include:

- Time efficiency: Pre-designed layouts allow users to quickly generate documents without starting from scratch.

- Customization: Adjust the design, fields, and content to match your specific requirements.

- Organization: Keep track of your financial records and customer information in one place.

- Automation: Set up automated processes to reduce manual entry and ensure consistency in your documents.

Ultimately, these tools help businesses optimize their document management processes, reduce errors, and create a professional image that fosters trust with clients and partners alike.

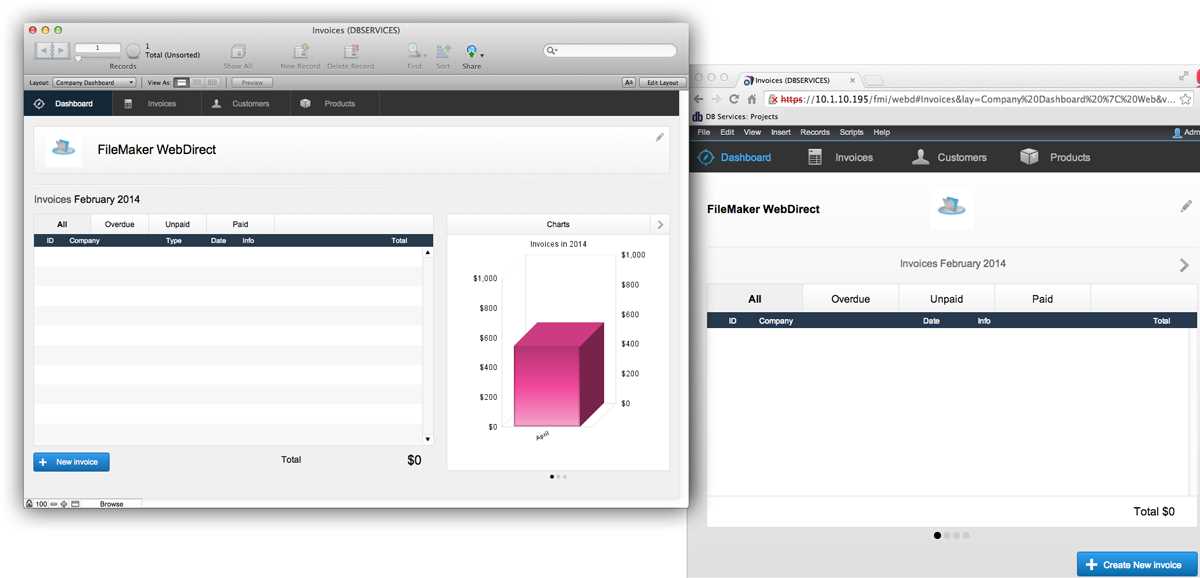

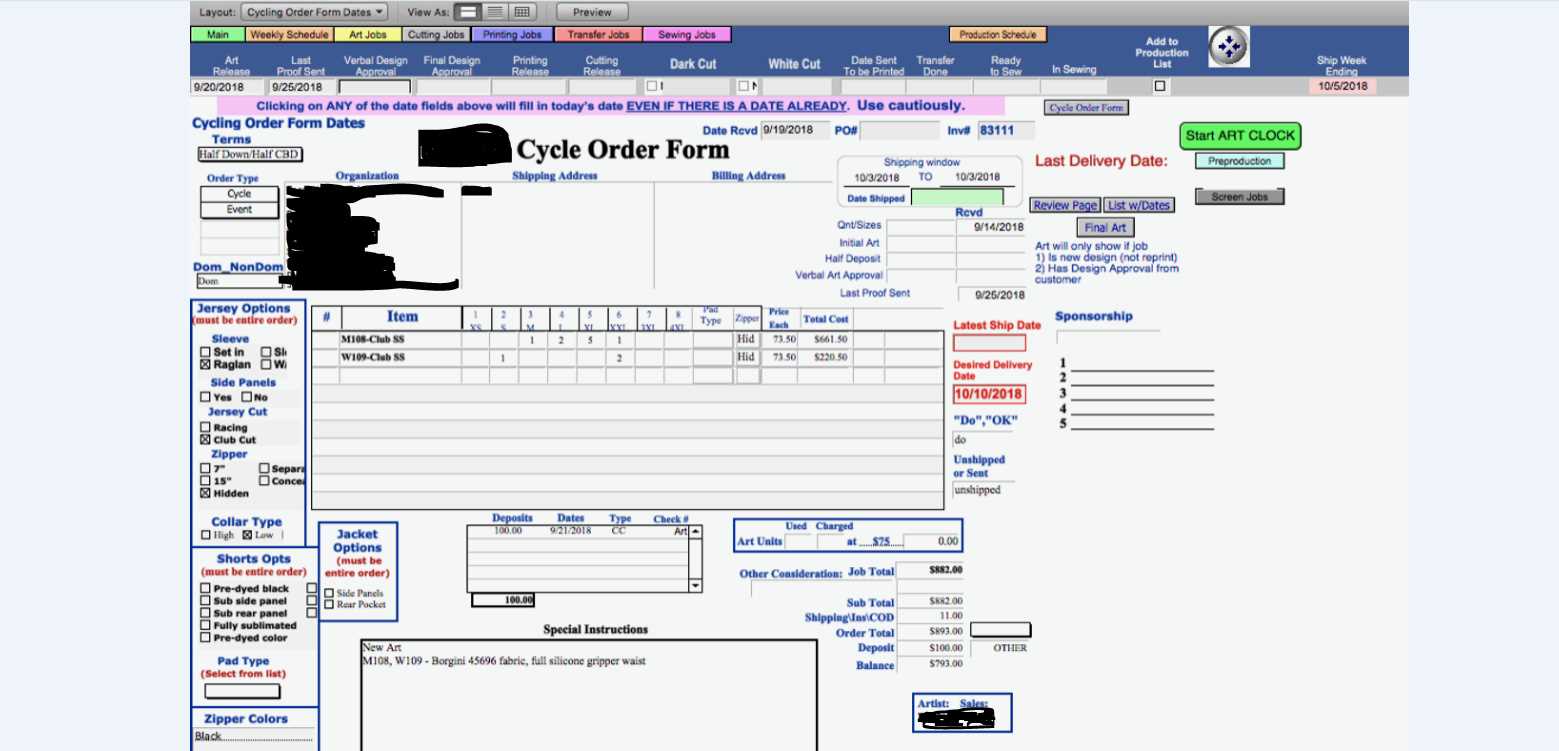

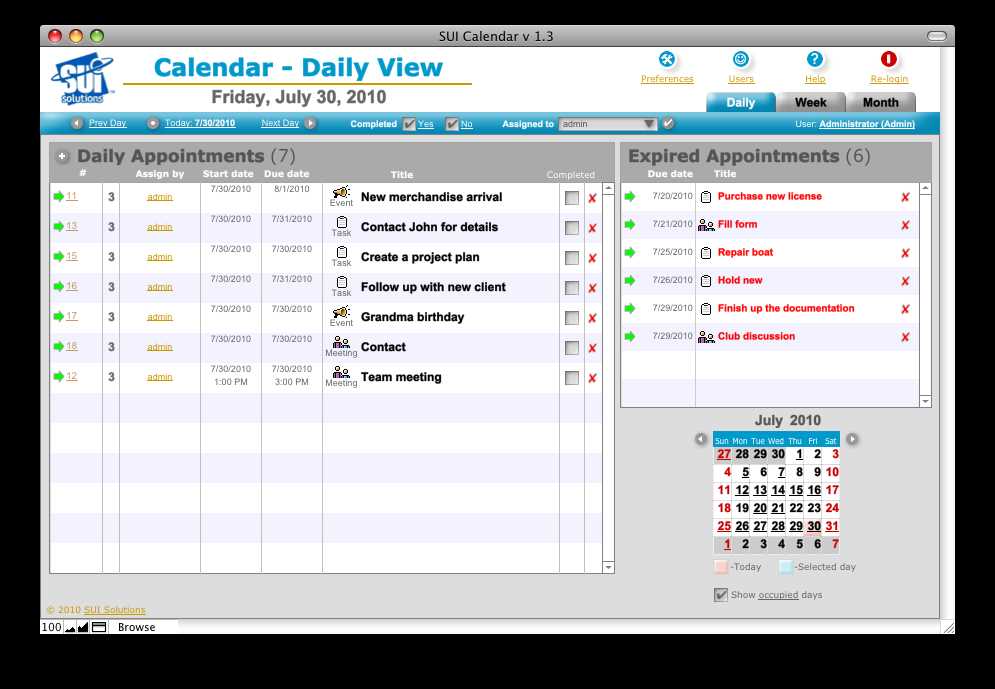

How to Create Invoices in FileMaker Pro

Creating financial documents with specialized software can greatly simplify the process of billing and managing transactions. By using a custom document creation tool, businesses can easily generate professional forms that are tailored to their specific needs. These systems typically offer a user-friendly interface that allows for quick creation and management of documents without requiring advanced technical skills.

To start creating a billing document, follow these basic steps:

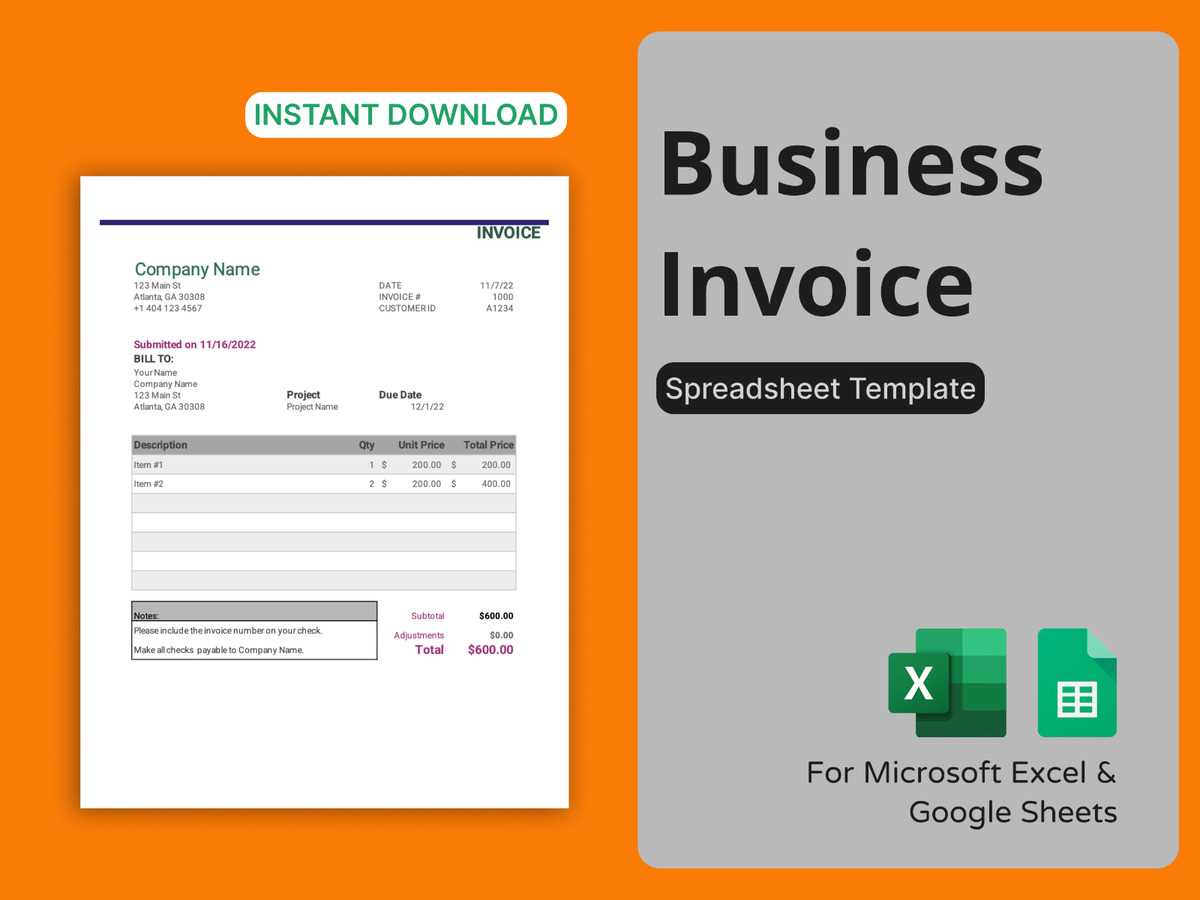

- Choose a Design: Select a pre-built layout or create a new one based on your preferences. Many tools offer templates that are easy to modify.

- Enter Client Information: Input the client’s details, including name, address, and contact information. This is essential for keeping records organized.

- Add Line Items: Enter the goods or services provided, along with their quantities, prices, and any applicable taxes or discounts.

- Customize Fields: Adjust the document’s structure to include any additional information, such as payment terms, due dates, or special notes.

- Preview and Edit: Before finalizing the document, preview it to ensure all information is accurate and properly formatted.

- Save and Export: Once satisfied with the document, save it in your desired format (PDF, for example) or export it for sharing with the client.

These steps provide a straightforward approach to generating customized business documents. The key advantage of using such tools is the flexibility to adapt the layout and content to your unique requirements, all while maintaining professionalism and accuracy.

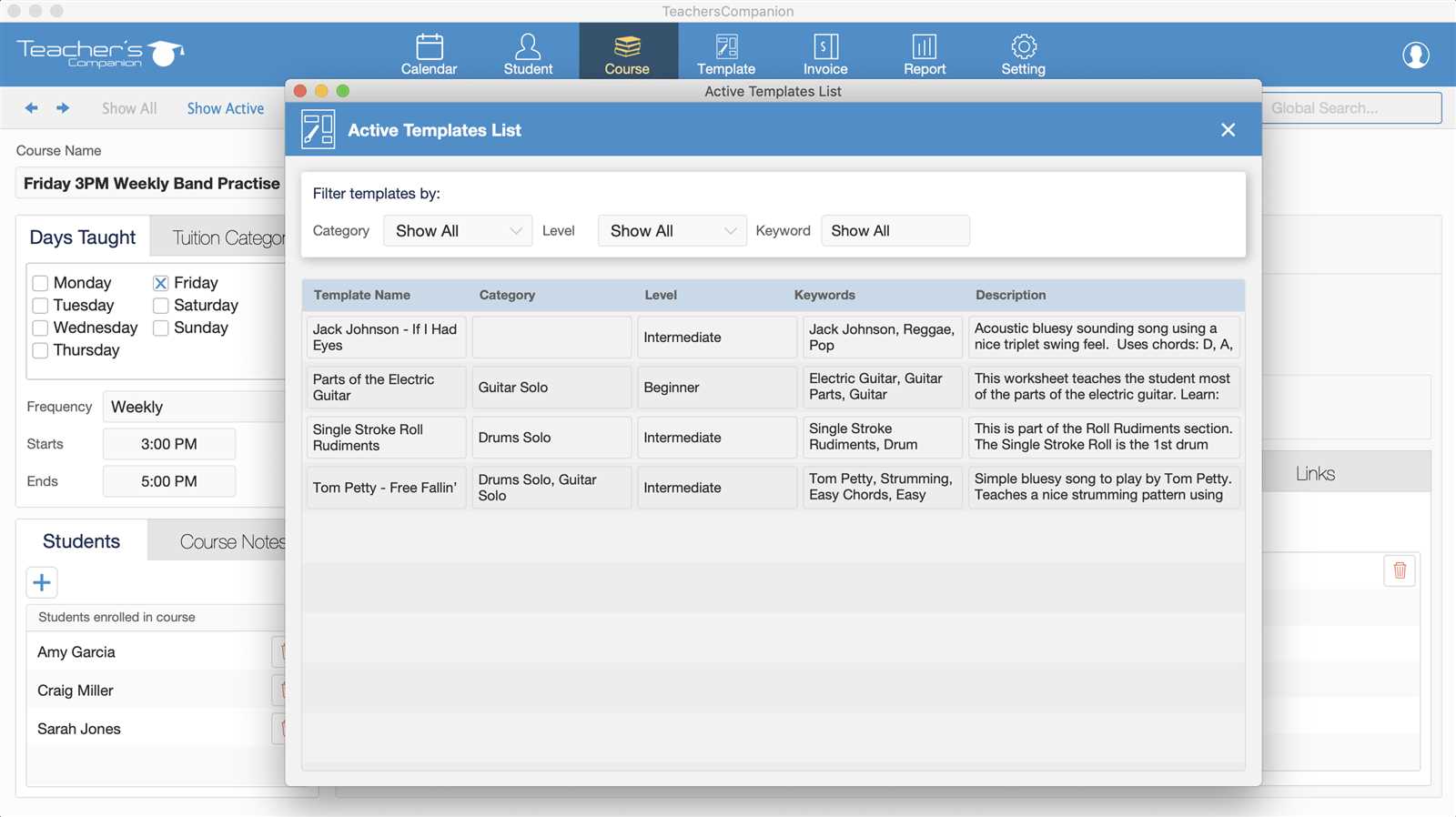

Top Features of FileMaker Pro Templates

When it comes to creating custom business documents, using advanced tools offers a variety of features that streamline the process. These systems provide built-in functionalities that allow users to personalize documents according to their specific needs, all while ensuring efficiency and accuracy. Below are some of the key features that make these solutions popular for managing financial records and client communications.

Customization and Flexibility

One of the standout features of these solutions is the ability to customize every aspect of a document. Users can adjust the layout, modify fields, and add or remove sections as needed. This level of flexibility ensures that businesses can create documents that match their branding and meet their unique requirements.

Data Management and Automation

Another important feature is the ability to automate repetitive tasks and manage client data efficiently. Users can store client information in a centralized location, which simplifies the process of creating documents. Additionally, certain systems offer automation options for invoicing, such as generating recurring charges or sending reminders for overdue payments.

| Feature | Benefit |

|---|---|

| Customizable Layouts | Tailor designs to fit company branding and specific business needs. |

| Client Data Storage | Store and access client information quickly, reducing the need for manual entry. |

| Automation Options | Set up automatic document generation, payment reminders, and follow-ups. |

| Multi-currency Support | Handle international clients by incorporating multiple currencies into documents. |

| Export Formats | Save and export documents in various formats such as PDF, Excel, or Word. |

These features combine to offer a robust and efficient way to handle business documentation, helping companies save time while ensuring accuracy and consistency in all their financial forms.

Benefits of Using Invoice Templates

Utilizing pre-designed business documents provides significant advantages for companies looking to streamline their billing process. These ready-to-use solutions help ensure that all financial records are consistent, professional, and accurate. By automating the creation of financial forms, businesses can save time and reduce the likelihood of human error, leading to smoother transactions and improved customer relations.

Time and Efficiency Savings

One of the most obvious benefits of using such systems is the time saved by eliminating the need to create documents from scratch. Instead of manually entering data into each new form, businesses can use pre-configured layouts where only the necessary details need to be updated. This not only speeds up the process but also helps employees focus on other important tasks.

Professional and Consistent Documents

Another major benefit is the ability to create uniform, polished documents every time. These tools ensure that all forms follow the same structure and design, which helps reinforce a consistent brand image. The ability to integrate company logos, contact details, and other essential elements into each document further enhances professionalism and credibility in the eyes of clients.

Other key advantages include:

- Customization: Tailor the forms to meet specific business needs, from adding new fields to adjusting the layout.

- Automation: Set up recurring tasks such as generating periodic charges or sending reminders for overdue payments.

- Data Accuracy: Reduces manual entry, ensuring fewer mistakes and improving overall accuracy in financial records.

- Improved Client Experience: Consistent and professional documents contribute to a better overall customer experience, building trust and fostering stronger business relationships.

Overall, using automated systems for generating business documents not only improves internal processes but also ensures that your organization presents itself in a more professional and reliable manner to clients and partners alike.

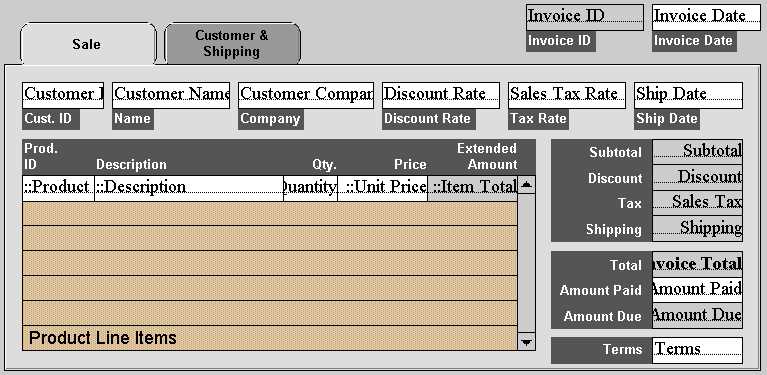

Designing Custom Invoices in FileMaker

Creating personalized billing documents allows businesses to maintain a consistent brand image while ensuring that every form meets specific operational needs. Custom designs enable companies to include relevant details such as payment terms, product descriptions, and client-specific information in a way that aligns with their unique workflow. By utilizing powerful tools to modify layouts and add custom fields, businesses can create tailored forms that not only look professional but are also functional and efficient.

Steps for Designing a Custom Billing Document

Designing a personalized business document involves several key steps that help ensure the final product is both attractive and effective. The process is straightforward, whether you’re creating a new layout or customizing an existing one.

- Choose a Layout: Start by selecting a base layout that suits the overall design you’re aiming for. This could be a minimalist layout or one with more detailed information, depending on your needs.

- Add Business Information: Include your company name, logo, address, and other relevant contact details at the top of the document to reinforce branding.

- Customize the Fields: Modify the fields to capture all necessary information, such as item descriptions, prices, and taxes. You can add custom fields to meet your specific requirements.

- Define Payment Terms: Clearly state payment terms, due dates, and any discounts or late fees. This ensures clients are aware of your policies upfront.

- Preview and Edit: After designing the document, preview it to check for errors and ensure that everything is properly formatted and aligned.

Key Design Elements to Consider

When designing a custom document, it’s important to consider the following elements to ensure clarity and ease of use:

- Brand Consistency: Maintain consistent font choices, colors, and logo placement that reflect your company’s branding.

- Legibility: Use clear, readable fonts and spacing to make the document easy to understand at a glance.

- Organization: Arrange the information logically, grouping similar items together for a more professional appearance.

- Client Customization: Consider including personalized client information to create a more tailored experience.

By following these steps and design principles, businesses can create custom forms that not only meet legal and financial requirements but also provide a polished, professional image to their clients.

Automating Billing with FileMaker Pro

Automating the billing process can significantly improve efficiency by reducing manual effort and minimizing errors. By integrating automated systems, businesses can streamline the creation and management of financial documents, saving valuable time and ensuring consistency in their transactions. Automation helps businesses quickly generate accurate records, track payments, and maintain organized client data without having to manually handle every step of the process.

Benefits of Automating Billing

Automating billing processes brings several key advantages, allowing businesses to focus on other important tasks while ensuring that financial operations run smoothly. Below are some of the major benefits:

- Time-saving: By eliminating the need for manual entry and calculations, automated systems speed up the entire billing process.

- Consistency: Automation ensures that each document is formatted correctly and consistently, reducing the likelihood of errors or omissions.

- Improved Accuracy: Automated systems reduce human error, ensuring that prices, taxes, and discounts are applied correctly every time.

- Faster Payments: With automatic reminders and recurring billing features, businesses can accelerate payment cycles and reduce late payments.

How to Set Up Automated Billing

Setting up automation for your billing process typically involves configuring certain features within your document management system. Here are some steps to help you get started:

- Define Recurring Charges: Set up automatic billing for regular services or subscriptions, specifying the frequency of payments (e.g., weekly, monthly, annually).

- Set Payment Reminders: Configure the system to send automatic payment reminders to clients before and after the due date.

- Customize Document Generation: Create rules for generating and sending invoices automatically based on specific triggers, such as project completion or product delivery.

- Track Payments: Set up an automated system to track payments and update records in real-time, making it easier to manage accounts.

By automating your billing process, you not only improve operational efficiency but also enhance customer satisfaction through quicker, more accurate transactions.

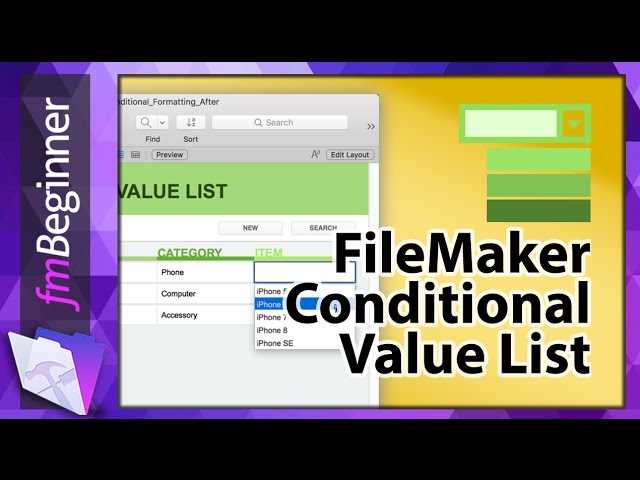

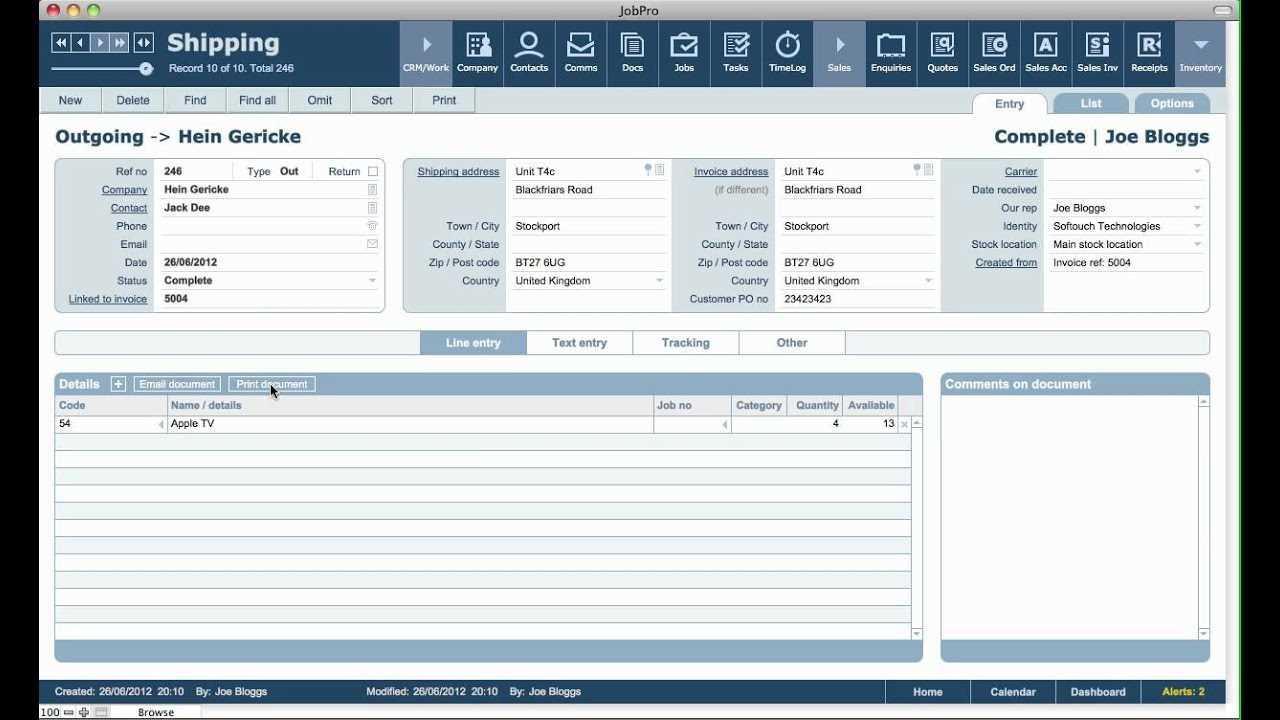

How to Customize Invoice Layouts

Customizing the layout of business documents allows companies to present their financial records in a way that reflects their brand and meets their specific needs. A well-designed layout not only enhances the professional appearance of the document but also makes it easier for clients to read and understand the information. Tailoring the layout enables businesses to adjust the format, fields, and sections to ensure that each document is clear, organized, and aligned with company standards.

Steps to Customize Your Document Layout

Customizing a document layout typically involves adjusting the design elements to ensure a cohesive and functional structure. Below are the key steps to follow when designing your own layout:

- Select a Base Design: Choose a layout that suits your document’s purpose. This could be a simple design with basic fields or a more complex layout that includes tables and graphs.

- Modify Field Placement: Arrange the fields in a way that makes sense for your business needs. For example, place the client’s contact information at the top and payment terms at the bottom for clarity.

- Adjust Fonts and Colors: Customize the fonts and color scheme to match your brand’s style. Ensure that the text is legible and the colors are professional, using contrasting tones for emphasis.

- Add Branding Elements: Incorporate your company logo, slogan, or other branding assets to personalize the document and reinforce your business identity.

Advanced Customization Options

For those looking for more advanced customization, there are additional options to further refine the layout:

- Conditional Formatting: Use conditional rules to highlight certain elements, such as overdue payments or discounts, making them stand out.

- Dynamic Fields: Include fields that automatically populate based on client data, such as contact information or previous transactions.

- Custom Sections: Add custom sections like notes, payment instructions, or legal disclaimers to ensure all necessary information is included.

By following these steps and incorporating advanced features, you can create a highly customized and professional document layout that meets the unique needs of your business while enhancing the client experience.

Using Templates for Multiple Currencies

For businesses that operate internationally or work with clients from various countries, the ability to handle multiple currencies in financial documents is essential. Having a system that can accommodate different currencies not only improves accuracy but also ensures that clients receive clear, understandable statements. By incorporating currency conversion and formatting options into your document layouts, you can create tailored forms that cater to a global client base.

Key Considerations for Multi-Currency Support

When working with various currencies, it’s important to consider several factors to ensure the process runs smoothly:

- Currency Conversion: Set up automatic conversion rates based on current market values. This ensures that the amounts are accurate and reflect the latest exchange rates.

- Localized Formatting: Adjust the document formatting to match regional preferences, such as the placement of currency symbols, decimal separators, and the use of commas or periods.

- Accurate Tax Calculations: Make sure that taxes are calculated in the correct currency, with conversion applied where necessary.

- Multi-Currency Fields: Include separate fields for each currency used in the document, ensuring that clients can easily see the amounts in their preferred currency.

Steps to Implement Multi-Currency Features

To add multi-currency functionality to your financial documents, follow these simple steps:

- Enable Currency Support: In your system’s settings, activate the multi-currency option and specify the currencies you will be working with.

- Add Currency Fields: Customize your document layout to include fields for entering different currencies. This could involve creating specific sections for each currency type.

- Set Conversion Rates: Link your system to a reliable data source that automatically updates exchange rates, ensuring the values are accurate and up-to-date.

- Test for Accuracy: Before finalizing your documents, test the currency conversion and ensure all amounts are calculated and displayed correctly.

By setting up multi-currency features in your system, you can create financial documents that are both accurate and user-friendly, making it easier to work with clients around the world while maintaining a professional image.

Integrating with Payment Systems

Integrating your document management system with payment processing platforms allows businesses to automate and streamline their financial operations. This integration ensures that transactions are seamlessly recorded, payments are tracked in real-time, and clients can make payments directly from their financial documents. By connecting with payment gateways, companies can create a more efficient and secure way of handling transactions, reducing the chances of errors and speeding up the overall payment process.

Benefits of Integration

Integrating with payment systems offers a variety of advantages for businesses, from improved workflow to enhanced client satisfaction. Here are some key benefits:

- Real-Time Payment Tracking: Payments are processed instantly, and the system can update your records automatically, reducing manual data entry.

- Improved Cash Flow: Faster payments mean that businesses can maintain better cash flow and reduce the time spent chasing overdue payments.

- Enhanced Client Experience: Clients can pay directly through their digital forms, offering a seamless, convenient payment option.

- Reduced Human Error: Automatic payment logging minimizes the chances of errors in record-keeping or miscommunication with clients.

- Security: Payments processed through secure gateways ensure that client information is kept safe and comply with relevant financial regulations.

Steps to Integrate with Payment Gateways

Here are the general steps to integrate your system with a payment gateway, allowing for automatic transaction processing:

- Choose a Payment Gateway: Select a payment processor that suits your business needs, such as PayPal, Stripe, or Square. Ensure it supports the payment methods your clients prefer.

- Set Up API Connections: Use the provided API to connect your document management system with the payment gateway. This allows the systems to communicate with each other and exchange payment data securely.

- Customize Payment Options: Tailor the payment fields to suit your specific billing process, such as adding the option for clients to pay in installments or offering discounts for early payments.

- Test the Integration: Before going live, thoroughly test the integration to ensure that payments are processed correctly, and all data flows seamlessly between systems.

By integrating payment processing capabilities into your document system, you can simplify your workflow, improve client interactions, and ensure faster, more secure transactions.

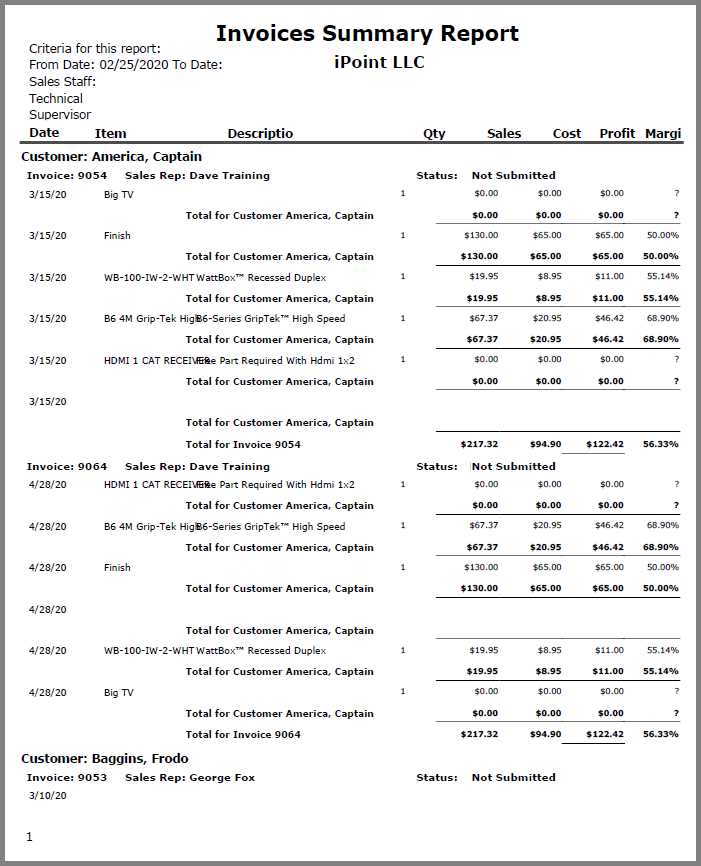

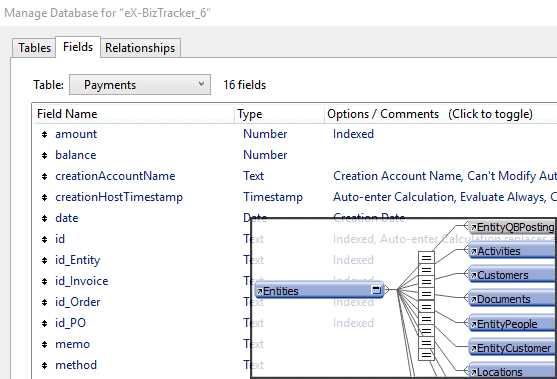

Tracking Payments with Invoices

Effective payment tracking is crucial for businesses to ensure that all transactions are properly documented and payments are received on time. By integrating payment tracking features into your document management system, you can automatically update records, send reminders, and stay on top of outstanding balances without needing to manually manage each payment. This not only saves time but also minimizes the risk of errors, helping businesses maintain a clear and accurate financial overview.

Key Features for Payment Tracking

When setting up a system to track payments, several important features can streamline the process and ensure that you always know the status of your transactions:

- Payment Status Indicators: Display the payment status (e.g., “Paid”, “Pending”, “Overdue”) directly on the document, making it easy to track at a glance.

- Real-Time Updates: Automatically update the payment status as soon as a payment is made, keeping all records accurate and up-to-date.

- Payment History: Store and access a history of all payments received, including transaction details, dates, and amounts.

- Automatic Payment Reminders: Set up automated reminders that notify clients of upcoming or overdue payments, reducing the need for manual follow-ups.

Steps to Track Payments Efficiently

To ensure smooth payment tracking, here are some steps to help you set up an effective system:

- Integrate Payment Processing: Connect your system to payment gateways to enable real-time payment updates and automatic transaction logging.

- Set Up Payment Fields: Create specific fields for recording payment dates, amounts, and methods, ensuring you capture all necessary details for each transaction.

- Monitor Outstanding Balances: Set up automatic calculations to track outstanding amounts and display them clearly in the record, ensuring you never miss a payment.

- Generate Reports: Use the data from the system to generate detailed reports on payment statuses, trends, and client balances, helping you stay on top of your finances.

By implementing these tracking features, businesses can ensure they are always informed about their financial status, reducing the risk of missed payments and improving cash flow management.

Enhancing Invoice Security

Ensuring the security of financial documents is critical for businesses to protect sensitive information and prevent unauthorized access. By implementing strong security measures, you can safeguard your documents from potential threats such as data breaches, fraud, and identity theft. Securing billing records not only protects client data but also helps maintain the integrity of your company’s financial information, ensuring compliance with industry standards and regulations.

Key Security Measures for Financial Documents

There are several effective ways to enhance the security of your business documents, ensuring that they remain safe and accessible only to authorized individuals:

- Data Encryption: Encrypt sensitive data both during transmission and storage. This ensures that even if documents are intercepted, the information will remain unreadable without the proper decryption key.

- Access Control: Set up user authentication and access control measures to restrict who can view or edit the financial documents. Only authorized personnel should have the ability to access sensitive billing information.

- Audit Trails: Maintain an audit trail of all document modifications, including who made the changes and when. This helps track unauthorized changes and provides accountability for the individuals interacting with the documents.

- Secure Cloud Storage: Store documents in a secure, encrypted cloud service that offers backup and redundancy. This protects against data loss from local hardware failures or cyberattacks.

- Password Protection: Use strong passwords for accessing documents and ensure that they are regularly updated. Password protection adds an extra layer of security for sensitive information.

Best Practices for Document Security

In addition to the technical measures above, adopting best practices can further enhance the security of your documents:

- Regular Software Updates: Ensure that your document management software and any associated security tools are up to date with the latest patches and improvements.

- Two-Factor Authentication: Implement two-factor authentication for accessing sensitive systems, providing an extra layer of protection beyond just a password.

- Employee Training: Educate employees on security best practices, including recognizing phishing attacks and handling sensitive information securely.

By applying these security measures and best practices, businesses can ensure that their financial documents are protected from unauthorized access and potential threats, giving clients confidence in the safety of their personal and payment information.

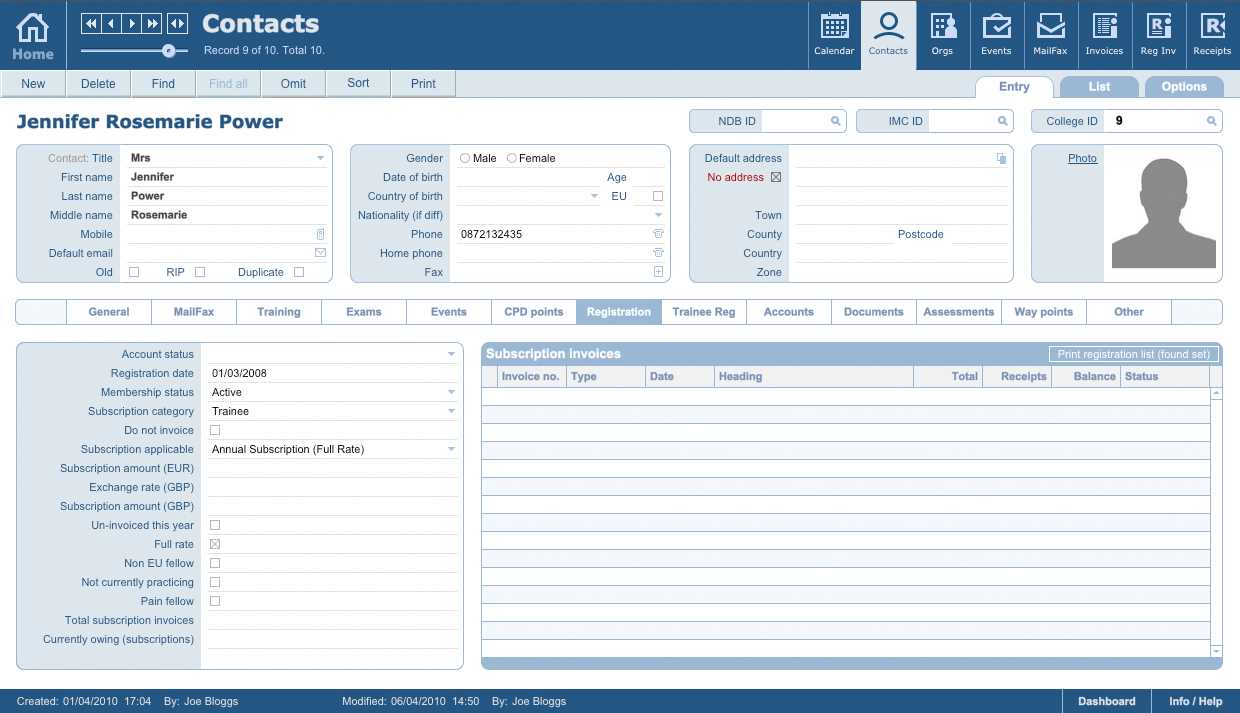

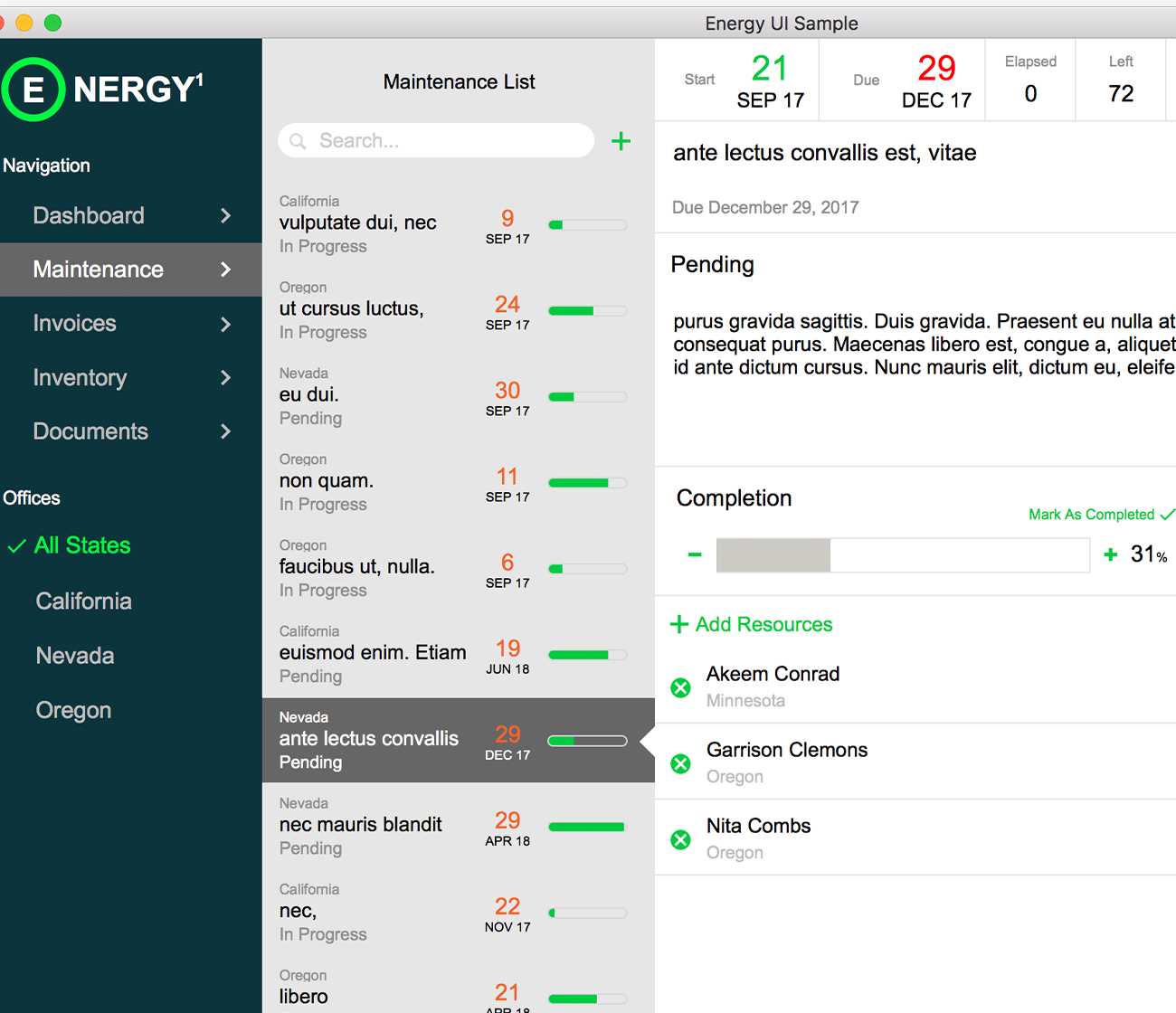

Managing Client Information Efficiently

Effectively managing client information is essential for businesses to maintain strong relationships, ensure smooth operations, and provide personalized services. Organizing and storing client data in a centralized system helps teams access important details quickly, track interactions, and make informed decisions. With a well-structured approach to client information, companies can improve communication, streamline workflows, and increase overall productivity.

Key Strategies for Efficient Client Data Management

There are several best practices to follow when organizing and managing client information to ensure it is both accessible and secure:

- Centralized Database: Store all client data in a centralized, digital database that is easily accessible to authorized users. This allows for quick retrieval and ensures consistency across teams.

- Organized Categories: Categorize client information based on relevant criteria such as contact details, purchase history, preferences, and service requests. This enables better segmentation and targeted communication.

- Regular Updates: Keep client records up to date by regularly reviewing and updating information such as contact details, billing preferences, and service agreements.

- Automated Data Entry: Use automation to capture and store client data from emails, forms, and other interactions. This reduces the risk of human error and ensures accurate, timely updates.

Best Practices for Client Relationship Management

In addition to organizing client data, businesses should also focus on maintaining strong relationships by using the stored information efficiently:

- Personalized Communication: Use client data to personalize communications, such as tailoring offers and promotions to a client’s preferences or previous interactions.

- Track Client Interactions: Maintain a record of client communications, including meetings, calls, and emails, to ensure a complete history of each client relationship.

- Provide Timely Support: Leverage stored information to quickly address client concerns and offer solutions, improving overall client satisfaction.

By applying these strategies, businesses can create a more organized, efficient, and personalized approach to managing client data. This not only enhances customer relationships but also drives operational success and helps businesses scale effectively.

Importing and Exporting Invoice Data

Managing financial records efficiently often requires transferring data between different systems or platforms. Importing and exporting data allows businesses to share, backup, and update records without manual entry. By automating the process, companies can ensure accuracy, reduce errors, and save time while maintaining comprehensive and up-to-date financial records.

Benefits of Importing and Exporting Data

Importing and exporting data provide a variety of benefits for businesses looking to streamline their accounting processes:

- Increased Efficiency: Automating data transfers eliminates the need for manual entry, speeding up workflows and reducing human error.

- Data Integration: Exporting data allows seamless integration with other software or systems, such as accounting platforms or CRM tools, for comprehensive financial management.

- Backup and Recovery: Exporting data provides a backup, which can be crucial in the event of system failure or loss of information.

- Improved Accuracy: Importing data from reliable sources ensures that the information is accurate and up-to-date without the need for re-entry.

How to Import and Export Data Effectively

To ensure smooth data imports and exports, it’s important to follow best practices and use compatible file formats. Below is a guide to help you import and export data efficiently:

| Step | Action | Notes | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Step 1 | Choose the Correct File Format | Ensure the file format (CSV, Excel, etc.) is compatible with your system and the system you are transferring data to. | |||||||||||||||

| Step 2 | Map Fields | Align the data fields to ensure that the correct information is transferred into the right columns (e.g., client names, dates, amounts). | |||||||||||||||

| Step 3 | Import Data | Import data from external sources into your system, checking for errors and inconsistencies during the process. | |||||||||||||||

| Step 4 | Export Data | Export data from your system to the required file format for use in other applications or for backup purposes. | |||||||||||||||

| Step 5 | Verify Data Integrity | After importing or exporting, verify that the data

Common Errors When Using TemplatesWhile utilizing pre-designed forms can greatly enhance efficiency, there are several common mistakes that businesses often make when customizing or using these forms for their financial operations. These errors can lead to inaccurate data entry, delays, and miscommunication with clients. Understanding these pitfalls and how to avoid them is essential to ensuring smooth workflows and maintaining professional standards. Common Pitfalls to AvoidBelow are some of the most frequent errors that can occur when working with pre-designed forms and how to avoid them:

Best Practices to Minimize ErrorsTo avoid these common mistakes and ensure the accuracy of your documents, follow these best practices:

By being aware of these common errors and adopting the suggested best practices, you can improve the efficiency and accuracy of your forms, providing a better experience for both your business and your clients. FileMaker Pro vs Other Invoice SolutionsWhen choosing a system to manage financial records, businesses often face the decision of which solution best fits their needs. While many platforms offer specialized tools for handling billing and documentation, some stand out due to their flexibility and customization options. In this section, we will compare a popular platform with other common solutions, highlighting their strengths and limitations to help businesses make an informed choice. Flexibility and CustomizationOne of the key advantages of the discussed platform is its high degree of customization. It allows users to design and modify forms according to their specific requirements, providing a more tailored solution compared to more rigid alternatives. However, some other tools, while less customizable, come with pre-built, industry-specific features that can save time for businesses without complex needs.

Integration with Other Tools

Another important factor in choosing an invoice management system is its ability to integrate with other software. The discussed platform offers strong integration options, allowing it to sync with accounting tools, payment gateways, and CRM systems, making it a powerful tool for businesses that require cross-platform functionality. On the other hand, many simpler solutions are designed to work in a closed ecosystem, which might limit their ability to communicate with other systems but can offer ease of use for smaller businesses.

In conclusion, while both customizable platforms and more straightforward alternatives offer valuable features, the best choice depends on the specific needs of your business. For companies that need flexibility and integration, the discussed platform provides significant advantages. However, for businesses with simpler needs, other solutions may offer a quicker, more intuitive setup. How to Share Invoices with Clients

Sharing financial documents with clients is an essential part of maintaining professional relationships and ensuring timely payments. The method of sharing these documents can vary based on the preferences of the client, as well as the nature of the business. Whether through email, secure portals, or printed copies, there are several effective ways to deliver these records while ensuring accuracy, security, and accessibility. Common Methods for Sharing Financial RecordsHere are some of the most commonly used methods for sharing financial documents with clients:

Best Practices for Secure Document Sharing

When sharing financial records, security should always be a top priority to protect both your business and your clients. Follow these best practices to ensure safe delivery:

By following these methods and best practices, businesses can efficiently and securely share financial documents with clients, ensuring smooth transactions |