Tutoring Invoice Templates for Easy Billing and Payment Management

When offering personalized learning support, managing finances can become a time-consuming task. To ensure smooth transactions, it’s essential to have an organized and efficient way to document services and handle payments. Whether you’re working with individuals or groups, a well-structured document is crucial for both professionalism and transparency.

By using pre-designed structures, you can save time and avoid errors in your billing process. These tools not only make it easier to itemize the hours worked and services provided, but they also provide a clear breakdown that clients can easily understand. With the right system in place, you can focus more on teaching and less on administrative tasks.

Customizing your own format can add a personal touch, but it’s important to ensure that key information is always included. This could range from payment terms to contact details, ensuring all parties are on the same page. A clear, professional document helps establish trust and simplifies the entire process.

Essential Features of Billing Documents for Educational Services

To effectively manage financial transactions in an educational setting, it’s important to have a well-structured document that clearly outlines services rendered and payment details. This ensures that both the service provider and client are aligned, reducing confusion and promoting trust. A reliable billing record not only helps with timely payments but also streamlines accounting and record-keeping.

Key Information to Include

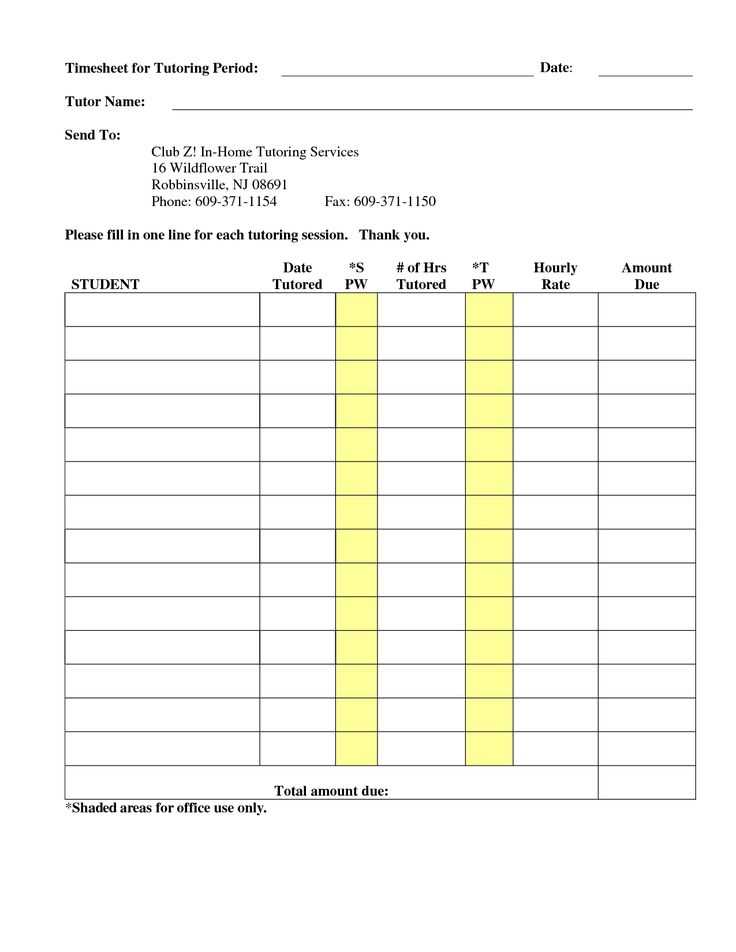

Each document should include basic yet vital details such as the name of the educator, the student, and the duration of the service. It should also specify the agreed-upon rates and any additional charges. Including a breakdown of the session’s costs makes it easy for clients to understand what they are paying for, and can help prevent misunderstandings about fees.

Clarity and Professional Appearance

To maintain professionalism, the document should be clearly formatted with easy-to-read fonts, a logical structure, and enough space to separate different sections. Sections like payment terms, due dates, and accepted payment methods should be outlined in a way that leaves no room for ambiguity. A clean, organized look reinforces credibility and makes the billing process more efficient for both parties.

Why Educators Need Professional Billing Documents

For anyone providing personalized educational services, having a clear and professional method for documenting payment details is essential. Without a structured approach to financial management, it becomes easy to overlook important information, leading to potential misunderstandings with clients or delayed payments. A well-organized record helps both parties keep track of services rendered and ensures that all terms are clearly communicated.

Efficiency is a key factor when managing multiple students or clients. Professional billing records automate much of the process, reducing the time spent on calculations and administrative tasks. By using a predefined structure, educators can quickly create accurate documents, freeing up time to focus on what matters most: teaching.

Furthermore, professional documents build credibility. A clean, detailed account of services not only reflects well on the educator’s business but also sets expectations for future transactions. By establishing a system that looks organized and transparent, educators can foster trust and maintain strong relationships with their clients.

How to Customize Your Billing Document

Customizing your billing record allows you to tailor the document to your specific needs and client preferences. A personalized approach can help present a professional image while ensuring all relevant details are included. By adjusting the layout and content, you can create a document that is both functional and aligned with your branding or business style.

Steps to Personalize Your Document

To create a customized billing record, follow these key steps:

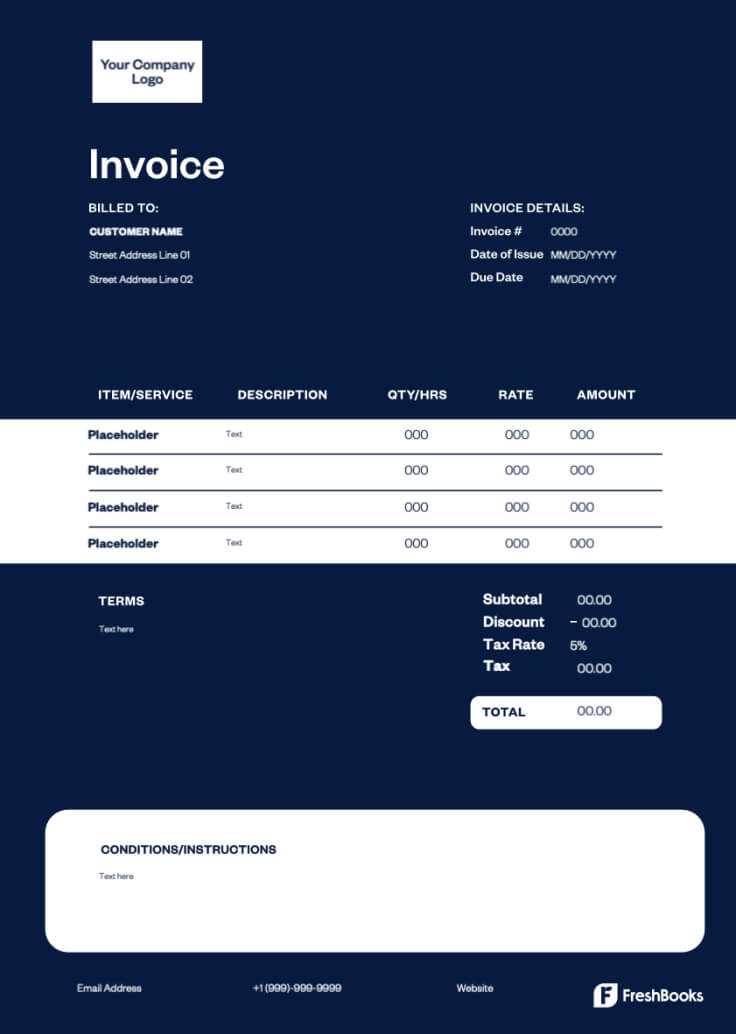

- Add Your Branding: Include your logo, business name, and contact details to establish a consistent, professional identity.

- Adjust the Layout: Customize fonts, colors, and spacing to match your aesthetic while keeping the document clear and easy to read.

- Include Custom Fields: If necessary, add sections for special services, discounts, or additional charges specific to your offerings.

- Update Payment Terms: Specify any particular payment methods or deadlines that are relevant to your business.

Tips for Effective Customization

- Keep It Simple: While personalization is important, make sure the structure remains easy to follow and doesn’t overwhelm the reader.

- Ensure Accuracy: Double-check that all figures, dates, and contact details are correct before sending the document.

- Maintain Consistency: Use the same fonts and design elements across all your documents to create a cohesive look.

By following these steps, you can create a customized billing record that enhances your professional image and simplifies the payment process for your clients.

Best Practices for Educational Billing Document Design

Creating a well-designed billing record is essential for maintaining a professional image and ensuring smooth transactions with clients. The design of your financial document should prioritize clarity, accuracy, and ease of understanding. A clean layout and thoughtful organization can make it easier for clients to review details, process payments, and track services rendered.

Key Elements of Effective Document Design

- Clear Structure: Organize the document in sections, such as contact details, service breakdown, and payment information, to make it easy for clients to navigate.

- Readable Font: Choose legible fonts in appropriate sizes. Avoid overly decorative fonts, as they may be hard to read.

- Logical Flow: Arrange information in a logical sequence, starting with basic details and moving to more specific items like rates and total charges.

- Whitespace: Use adequate spacing between sections and items to avoid clutter and make the document visually appealing.

Design Tips for Enhanced Professionalism

- Branding: Include your logo and consistent color schemes to align with your personal or business brand.

- Highlight Important Information: Use bold or colored text to emphasize key details like total amounts, due dates, and payment methods.

- Standardized Fields: Use consistent language and formatting for items like hourly rates, session descriptions, and discounts to maintain professionalism.

By following these best practices, you can design a billing document that is not only functional but also reflects the quality and p

Common Mistakes in Educational Billing Records

While creating financial documents for educational services may seem straightforward, it’s easy to overlook key details that can lead to confusion or errors. Small mistakes in your billing records can create unnecessary disputes with clients and delay payments. Ensuring accuracy and consistency is essential for maintaining trust and professionalism.

Frequent Errors to Avoid

- Incorrect Contact Information: Failing to list the correct names, addresses, or contact details for both parties can lead to communication breakdowns.

- Missing or Incorrect Dates: Leaving out session dates or listing the wrong ones can confuse clients about the billing period and delay payments.

- Ambiguous Service Descriptions: Vague or unclear descriptions of services rendered can leave clients unsure about what they are being charged for.

- Failure to Specify Rates: Not stating the hourly or flat rate clearly can lead to misunderstandings, especially if a client feels they were charged unfairly.

- Omitting Payment Terms: Not outlining payment methods, deadlines, or late fees can result in confusion and delays in receiving payment.

How to Prevent These Mistakes

- Double-check Details: Review all contact and service information for accuracy before sending the document.

- Be Specific: Always use clear, precise language when describing services and rates to avoid misunderstandings.

- Include Payment Terms: Clearly outline when and how payment is expected,

How to Ensure Accurate Billing for Clients

Accurate billing is essential for maintaining a smooth and professional relationship with your clients. Errors in your financial documents can lead to confusion, delays, and potential disputes, which can harm your reputation and business. To avoid these issues, it’s important to establish clear and reliable practices that guarantee every detail is correct before sending a bill.

Steps to Guarantee Precision in Billing

- Track Time and Services Carefully: Keep detailed records of the hours worked and the specific services provided for each session. Use a time log or digital tool to ensure nothing is overlooked.

- Use Clear and Consistent Rates: Always apply the same rates across all sessions unless prior arrangements have been made. Avoid offering unclear discounts or promotional pricing without documenting them in the record.

- Double-Check Mathematical Calculations: Make sure all totals, including hourly rates, service charges, and taxes, are correctly calculated. Small errors can accumulate and lead to significant discrepancies.

- Set Clear Payment Terms: Specify payment due dates, accepted methods, and any late fees or discounts for early payments. Ambiguity in payment expectations can cause delays and confusion.

Tools to Improve Billing Accuracy

- Automated Billing Systems: Using software designed for creating financial records can reduce human error and save time.

- Templates with Pre-set Fields: Utilizing a pre-designed structure ensures that all necessary information is included, and reduces the chances of forgetting critical details.

- Regularly Update Client Information: Always ensure that contact details, payment methods, and any agreed-upon terms are up to date to prevent billing mistakes.

By following these steps and using the right tools, you can ensure that your billing is accurate, timely, and professional, leading to better client relationships and smoother business operations.

Free Billing Documents You Can Use

If you’re looking for an easy and efficient way to handle your financial records, using a pre-designed document can save you time and effort. Free customizable formats are available online, allowing you to tailor them to your needs without having to create one from scratch. These ready-made options provide the basic structure, helping you focus on delivering services while ensuring your billing process is smooth and professional.

Popular Options Available Online

There are several resources where you can find free, downloadable formats. These can be tailored to suit different types of educational services, whether you’re working with individuals or small groups. Here’s an overview of some of the most commonly available options:

Resource Features Customization Options Microsoft Office Templates Pre-designed, easy-to-edit layouts with basic structure Adjust rates, session descriptions, and add logo Google Docs Free, simple formats that integrate with Google Sheets for calculations Fully customizable, includes client details and payment terms Canva Visually appealing designs with drag-and-drop features Customizable with your branding, fonts, and colors Invoicely Online platform with basic free options Can create recurring billing and track payments Creating a Billing Document from Scratch

Building your own billing record from the ground up offers complete flexibility, allowing you to design a document that fits your specific needs and preferences. While ready-made formats are convenient, creating a custom layout ensures that you include all the relevant details in a way that aligns with your business style and client expectations. Whether you want to incorporate branding elements or add specialized sections, starting from scratch gives you full control over the design and content.

To create an effective billing document, you should consider several key components to ensure accuracy and professionalism. A well-structured record not only facilitates clear communication but also helps avoid errors that could cause confusion or delays in payment. Below are some important elements to keep in mind when crafting your own document:

- Header: Include your name or business name, logo, contact information, and client details for easy identification.

- Service Breakdown: Clearly outline the services provided, including the time spent and rates charged for each session.

- Total Amount: Ensure the final amount is clearly stated, including any applicable taxes or discounts.

- Payment Terms: Specify payment methods, due dates, and any penalties for late payments to avoid confusion.

By paying attention to these key sections, you can create a professional, personalized document that simplifies the billing process and ensures transparency with your clients.

Legal Considerations for Educational Billing Records

When creating financial documents for services rendered, it’s important to understand the legal implications involved. These records serve not only as a tool for tracking payments but also as a legal agreement between you and your clients. Ensuring that your document complies with local regulations and includes all required information is crucial to avoid legal complications and ensure smooth business operations.

Key Legal Elements to Include

There are several legal factors to consider when crafting a billing record. Below are some essential elements that should always be included to protect both parties and ensure clarity:

Element Importance Notes Service Description Clarifies what was provided Be specific about the services to avoid disputes Payment Terms Establishes payment expectations Clearly state due dates, late fees, and accepted methods Tax Information Complies with tax laws Include any applicable taxes or fees based on location Client Information Identifies both parties involved Ensure accurate details, such as names and addresses How to Ensure Legal Compliance

- Check Local Regulations: Research the legal requirements in your area to ensure you

How to Include Payment Terms on Billing Documents

Clear payment terms are essential for ensuring both parties understand their financial obligations. When creating a financial document, outlining these terms can help avoid confusion and potential disputes. Defining when and how the payment should be made, along with any applicable late fees or discounts, sets expectations and promotes timely transactions.

To effectively include payment terms, it’s important to be specific and transparent. This section of your document should cover key details such as the payment deadline, accepted methods, and any penalties for late payments. Including this information ensures that your client knows exactly what is expected, reducing the likelihood of delays or misunderstandings.

Key Payment Terms to Include

- Due Date: Clearly state the exact date by which payment is expected. This could be based on the completion of a service or a set period after the document is issued (e.g., “Due within 30 days of receipt”).

- Accepted Payment Methods: List the payment options available, such as bank transfers, checks, credit cards, or online payment platforms like PayPal.

- Late Fees: If applicable, specify the penalties for late payments. For example, “A 5% late fee will be applied for every 10 days the payment is overdue.”

- Early Payment Discounts: If you offer any discounts for early payments, such as “10% off if paid within 7 days,” make sure to mention this clearly.

How to Format Payment Terms

Ensure that payment terms are easy to find and clearly highlighted in the document. You can format them in a separate section or as part of the summary at the end of the document. For better readability, consider using bullet points or bold text to emphasize important details like due dates or late fees.

Including these key elements in your financial documents ensures clarity and helps foster professional, efficient transactions between

Benefits of Digital Billing Documents for Educators

Using digital documents for financial transactions offers a range of advantages that can simplify the process and make managing payments more efficient. By adopting electronic billing systems, educators can save time, reduce errors, and improve their professional image. Digital formats also offer greater flexibility, allowing for easy customization, tracking, and organization of records.

Here are some key benefits of using digital billing records:

Benefit Description Time-Saving Digital formats automate many aspects of the billing process, such as calculations and organizing information, allowing you to focus more on your work. Easy Customization With digital records, you can quickly adapt the document to reflect specific details for each client, such as hourly rates, services, or discounts. Accuracy Digital systems often come with built-in error checks, reducing the risk of mistakes in calculations or missing information. Professional Appearance Electronic billing formats often come with polished, well-organized designs, which improve your image and build trust with clients. Easy Storage & Access Digital records are easy to store, search, and retrieve, ensuring you can keep track of all transactions for future reference or tax pur How to Track Payments with Your Billing Documents

Effectively tracking payments is essential for maintaining cash flow and staying on top of your financial records. By clearly recording each payment in your financial documents, you can ensure you’re aware of outstanding balances, avoid missing payments, and have an organized overview of your transactions. This not only helps you stay on track but also makes it easier to address any payment discrepancies that may arise.

To track payments efficiently, it’s crucial to include specific details in your billing records. Here are some key practices to follow:

- Payment Status: Mark the payment status (e.g., “Paid,” “Pending,” “Overdue”) directly on the document. This allows for quick identification of whether the balance has been cleared or if follow-up is necessary.

- Payment Date: Record the date each payment was made. This provides a clear timeline of when payments were received, which is especially helpful for reconciling records.

- Partial Payments: If your clients make partial payments, be sure to update the remaining balance accordingly and indicate how much has been paid so far.

- Payment Method: Note the method of payment (e.g., bank transfer, credit card, cash, etc.). This is useful for reference and for any future disputes or questions.

- Outstanding Balance: Keep track of the amount still owed after each payment is made. This helps you stay organized and avoid confusion later on.

By following these practices, you can easily monitor payment progress, ensure no payment is missed, and maintain accurate records for financial tracking and tax purposes. Consistently updating your documents will help you stay on top of your finances and foster a transparent relationship wit

Using Billing Documents to Save Time

When managing a service-based business, efficiency is key to maximizing productivity and maintaining smooth operations. One of the most effective ways to save time is by using pre-designed billing records. These ready-made structures help eliminate the need to start from scratch with each new client, allowing you to focus more on your work and less on administrative tasks. With the right tools, you can create and send financial documents quickly, ensuring you stay organized and professional.

Time-Saving Benefits of Pre-designed Billing Structures

Pre-made financial document formats offer a variety of time-saving advantages. Here are a few key reasons why using these tools can help you streamline your business operations:

- Faster Creation: Simply fill in the necessary details like client name, services provided, and payment terms without having to design the layout every time.

- Consistency: Using a standardized format ensures that all your documents look professional and contain the same important information every time.

- Automated Calculations: Many digital tools come with built-in calculations, which automatically update totals based on hours worked, rates, or discounts applied, saving you the hassle of manual math.

- Easy Tracking: Pre-designed documents make it easier to track outstanding payments and due dates, helping you stay on top of your finances with minimal effort.

How to Maximize the Time-Saving Benefits

- Customize Once: Personalize your document format to suit your specific needs, such as adding your logo or adjusting the la

Improving Cash Flow with Better Billing Records

Efficient financial management is key to maintaining a healthy cash flow in any business. One of the most effective ways to ensure timely payments and avoid cash flow problems is by improving the clarity and structure of your financial documents. By providing clients with clear, professional, and well-organized records, you can minimize delays, reduce errors, and encourage faster payments.

Better billing records not only help with payment tracking but also set clear expectations for your clients. When clients know exactly what they are being charged for and when payment is due, they are more likely to pay on time, improving your overall cash flow. Here are a few strategies to improve your billing system and boost your cash flow:

Key Strategies to Enhance Cash Flow

- Clear Payment Terms: Include specific payment deadlines, accepted methods, and any late fees or discounts for early payments. This transparency encourages prompt payments and reduces the chances of overdue balances.

- Automated Reminders: Set up automated reminders for clients as the payment due date approaches. This gentle nudge helps clients remember their obligations and reduces the risk of missed payments.

- Detailed Billing Records: Provide a thorough breakdown of services, rates, and time spent. The more information you provide, the less room there is for disputes, which can cause delays in payment.

- Consistent Follow-Up: Establish a routine for following up with clients who have missed payments. A polite, consistent reminder increases the likelihood of getting paid on time.

Benefits of Improving Your Billing Records

- Faster Payments: Clients are more likely to pay promptly when they have a clear understanding of what they owe and the payment process.

- Reduced Errors: Well-organized records minimize mistakes in calculations and service descriptions, reducing the need for time-consuming corrections.

- Better Cash Flow: With timely and accurate payments, you’ll have a steadier income stream, making it easier to manage your expenses and reinvest in your business.

By making these improvements to your billing system, you can create a more efficient, professional process that fosters better relationships with clients and helps maintain a healthier cash flow.

What Information Should Be on a Billing Document

When creating a financial record for services rendered, it’s important to ensure that all relevant details are included. A well-organized document helps prevent confusion, ensures timely payments, and protects both parties in case of disputes. Whether you’re billing for one-time or ongoing services, including the right information is key to maintaining a professional and efficient process.

Here’s a list of essential details that should appear on your financial records:

- Your Contact Information: Include your full name, business name (if applicable), phone number, email address, and mailing address. This ensures clients can easily reach you if needed.

- Client’s Information: List the client’s name, address, and contact details. This helps avoid any confusion about who the billing record is intended for and ensures accurate communication.

- Unique Reference Number: Assign a unique reference or identification number to each document for easier tracking and future reference. This can be a sequential number or a code that helps identify the record in your system.

- Detailed Description of Services: Clearly describe the services provided, including the date(s) of service, the hours worked, and any relevant details such as the rate per hour or fixed fee. This ensures transparency and minimizes misunderstandings.

- Amount Due: State the total amount that is owed, including the breakdown of any individual charges such as hourly rates or additional fees. This should be clear and easy to understand.

- Payment Terms: Specify the due date for payment, accepted payment methods (e.g., bank transfer, credit card), and any late fees or discounts for early payment. This helps set clear expectations regarding when and how payments should be made.

- Tax Information: If applicable, include details on taxes that are being charged. This is especially important for businesses that are required to collect sales tax or other applicable taxes based on your location.

By including all of these key details in your billing documents, you can create a professional, organized record that is easy to understand and encourages timely payments. It also helps protect both you and your clients by ensuring that all terms are clear and agreed upon in advance.