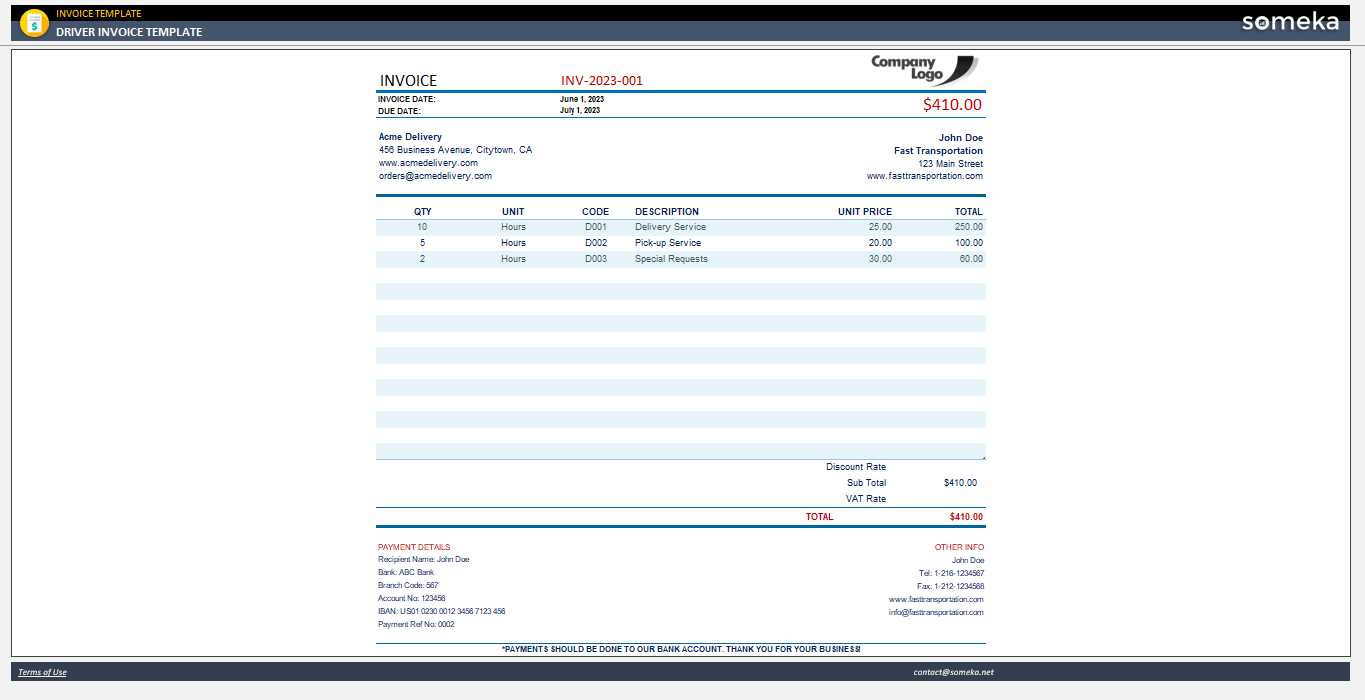

Free Delivery Driver Invoice Template for Easy Billing

In the world of logistics and transportation, keeping track of payments and ensuring timely compensation is crucial. Having a well-structured document that accurately reflects the services provided can help streamline this process, making it easier for both the service provider and the client. With the right tools, professionals in the field can reduce administrative tasks and focus more on their core operations.

Proper documentation not only ensures clarity but also builds trust between parties. Clear, concise records of completed tasks, hours worked, or distances covered are essential for a smooth transaction. Without such records, discrepancies may arise, leading to confusion and delays in payment. By using an organized format, individuals can present all necessary information in a simple, understandable manner.

Customizable formats allow for flexibility, catering to the specific needs of various services, whether it’s a one-time job or a regular commitment. Adopting a professional approach to payment requests will not only enhance business efficiency but also reflect positively on the overall client experience.

Understanding Billing Documents for Transport Services

For those offering transportation and logistics services, a well-organized financial record is essential for clear communication and prompt payment. Such documents serve as formal requests for compensation, outlining the details of completed tasks. These records not only track services rendered but also ensure that both parties agree on the payment terms and amounts.

Having a standardized format can greatly simplify the process, reducing errors and preventing misunderstandings. By using a consistent structure, service providers can quickly create accurate records that include all necessary information, such as dates, distances, fees, and payment instructions. This approach also minimizes the risk of missing key details, which could lead to disputes or delayed payments.

These documents can be customized to fit specific needs, whether for occasional jobs or ongoing contracts. Whether you operate independently or work with clients regularly, adopting a clear and professional method for detailing charges can enhance your reputation and efficiency in business dealings.

Why You Need an Invoice Format

In any service-based business, having a clear and consistent method of requesting payment is essential. A well-structured document ensures that all the necessary information is included, reducing the risk of errors or misunderstandings. Without a standardized system, it can be easy to overlook critical details, which may lead to delayed payments or confusion with clients.

Using a ready-made format saves time and effort, allowing you to focus on your core work instead of creating new records from scratch each time. It guarantees that each bill contains the correct fields, such as service descriptions, pricing, and terms of payment. This consistency also makes it easier for clients to process payments quickly and accurately.

Moreover, a professional-looking document can enhance your credibility and establish trust with your clients. It conveys that you value your work and are serious about your business, which can lead to better relationships and future opportunities. A reliable format not only simplifies the billing process but also strengthens your professional image.

How to Create a Billing Document

Creating an accurate billing document involves several key steps to ensure that all relevant information is included and that both parties are clear on the terms of payment. A well-organized bill helps prevent confusion and allows clients to quickly process payments, ensuring timely compensation for services rendered.

Step 1: Include Basic Information

The first step is to include all necessary contact details. This typically includes your name or business name, address, and phone number, as well as the client’s contact information. Including a unique reference number for each document will help both you and your client keep track of payments and records more easily.

Step 2: List Services and Costs

Next, clearly list the services provided along with their respective costs. Include the date of service, the type of task completed, and any applicable rates or charges. It’s important to break down the costs for transparency and clarity, making it easier for clients to understand what they are paying for.

Once the details are organized and accurate, specify the total amount due, payment terms, and deadlines. Be sure to include your preferred method of payment, whether it’s via bank transfer, check, or another method. Providing clear instructions ensures that your client can pay without any complications.

Essential Information for Your Billing Document

To ensure that your payment requests are clear and complete, it’s important to include all the necessary details that both you and your client need. A thorough and accurate record not only speeds up the payment process but also prevents any misunderstandings. Missing information could cause delays or disputes, so it’s essential to get it right the first time.

Key Details to Include

Start with the basics: both parties’ names, addresses, and contact details. This includes your business name and the client’s full contact information. Each document should have a unique reference number or ID to differentiate it from previous or future records. This makes it easier to track and organize documents for both you and your client.

Breakdown of Services and Costs

Providing a clear breakdown of the work completed is crucial. List the services rendered, along with their corresponding rates, dates, and quantities. This helps the client understand exactly what they are being billed for and ensures transparency. You should also include any additional fees, such as taxes or surcharges, and clarify the total amount due.

Lastly, specify the payment terms, including the due date and accepted methods of payment. Providing this information upfront ensures there are no surprises later and helps the client process payments quickly and accurately.

Common Mistakes to Avoid in Billing

When preparing billing documents, even small errors can lead to delays or disputes. To ensure a smooth transaction process, it’s important to be aware of common mistakes and take steps to avoid them. A well-prepared document minimizes confusion and enhances your professionalism, making it easier for clients to pay promptly.

Common Errors to Watch Out For

| Mistake | Consequence | How to Avoid |

|---|---|---|

| Missing Contact Information | Client cannot reach you for clarifications or payment issues. | Double-check that both your details and the client’s contact info are included. |

| Incorrect Dates or Service Details | Confusion over the scope of work or incorrect payment amounts. | Ensure that all dates, tasks, and quantities are accurate before submission. |

| Omitting Payment Terms | Delays in payments due to misunderstandings about when and how to pay. | Clearly state the payment due date and accepted payment methods. |

| Forgetting to Include Additional Fees | Clients may dispute additional costs, leading to delays in payment. | List all applicable fees such as taxes, handling, or extra charges. |

| Not Numbering Documents | Hard to track and refer to past records, increasing the risk of confusion. | Use a unique reference or invoice number for each document. |

By staying vigilant and avoiding these common pitfalls, you can ensure that your billing process remains efficient and professional. Taking the time to thoroughly review each document before submission will help maintain a positive relationship with your clients and facilitate smoother financial transactions.

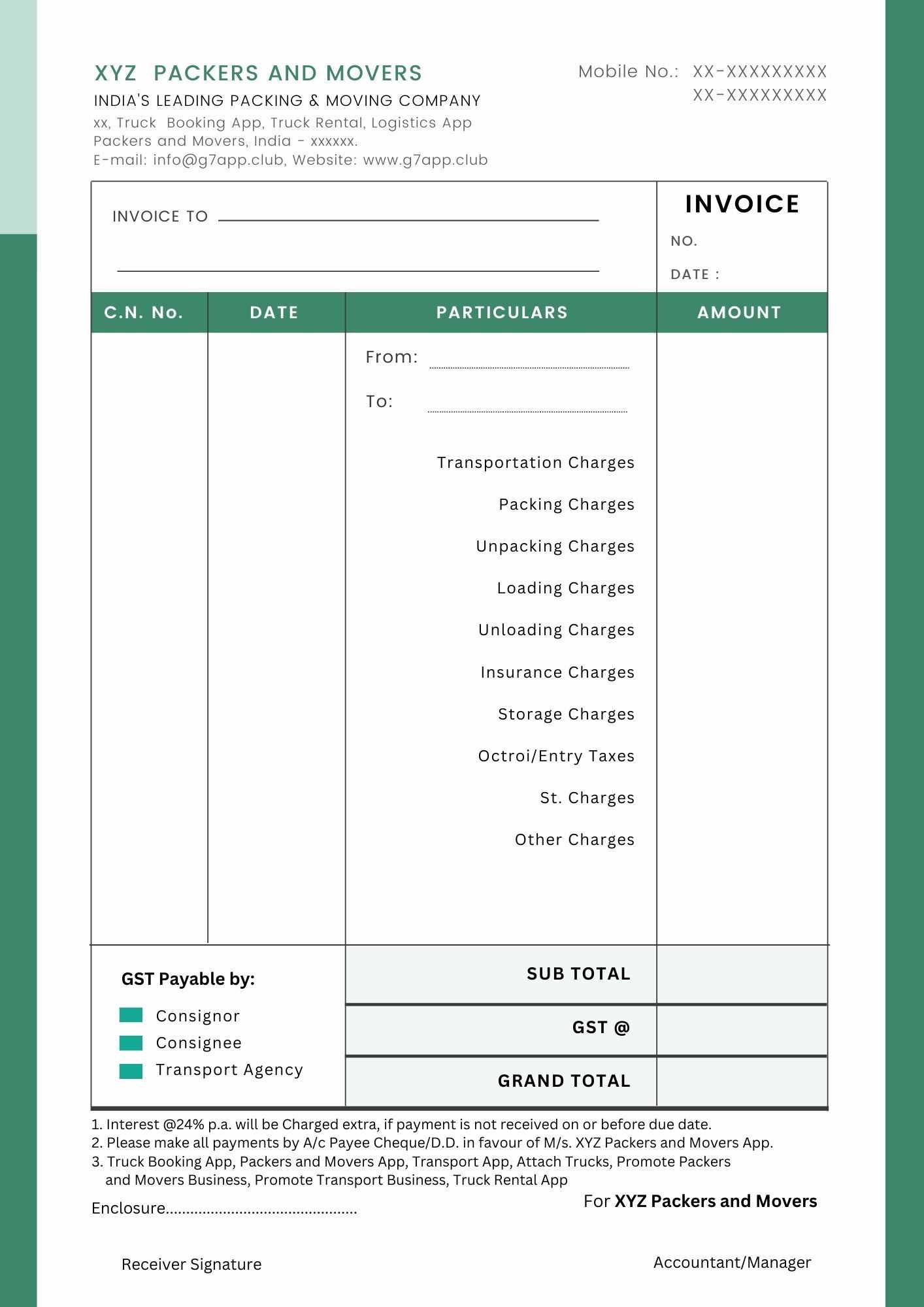

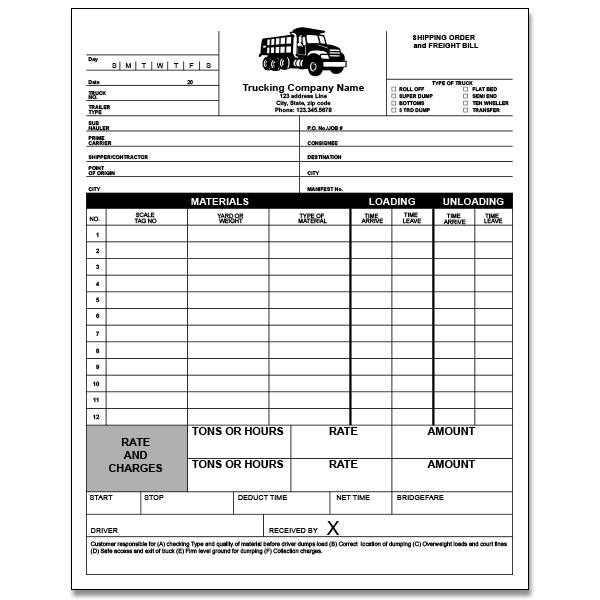

Free Billing Documents for Transport Professionals

For those in the transportation business, having access to no-cost, easy-to-use billing documents can greatly simplify the process of requesting payment. Many free options are available online, designed to make it easier to record services, list charges, and ensure that everything is properly documented. These pre-made formats are a valuable resource for independent operators who need to keep their financial records organized and professional.

Benefits of Using Free Billing Documents

- Time-saving: These ready-made forms help you create accurate records quickly, without the need to start from scratch.

- Professional appearance: A well-structured document creates a positive impression with clients, reflecting your business’s reliability.

- Easy customization: You can adjust the format to suit your specific needs, such as adding extra charges or specific payment terms.

- Cost-effective: Many options are free to download, helping you avoid additional expenses for software or services.

Where to Find Free Options

There are numerous resources online where you can find free billing documents, including:

- Website platforms offering downloadable forms.

- Spreadsheet software that allows for easy customization.

- Freelance and small business forums where users share templates.

- Professional associations that offer free tools for their members.

Using these free documents can help you save time and ensure that all your transactions are properly recorded, allowing you to focus on providing great service to your clients.

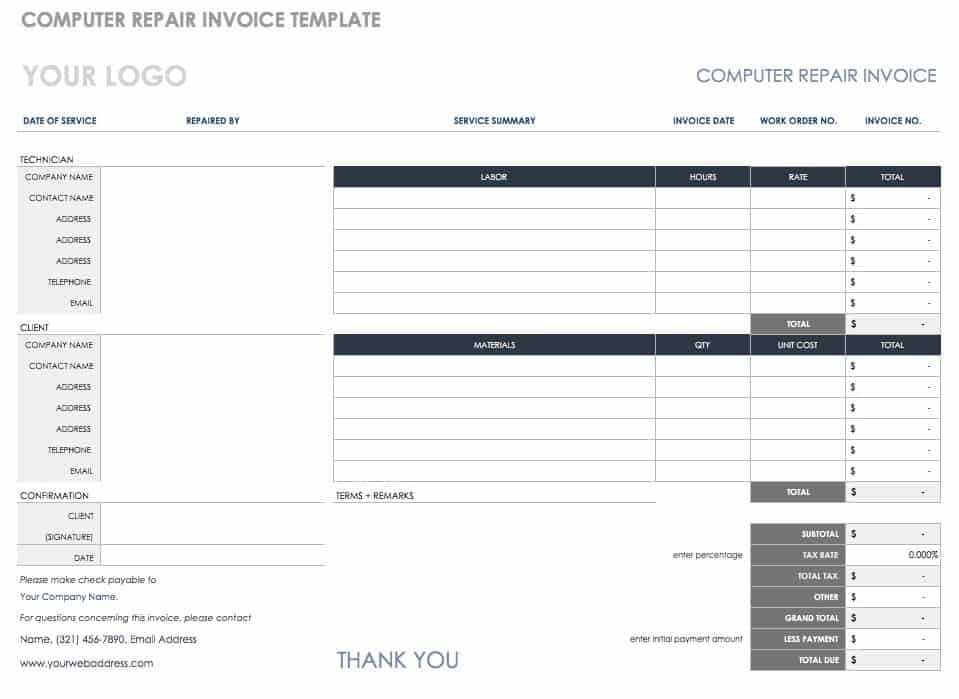

Customizing Your Billing Document Format

Personalizing your billing documents can help make them more suited to your business needs, ensuring that you capture all necessary details and present them in a professional manner. Customization allows you to adjust the layout, include additional information, and adapt the design to align with your brand. By tailoring your format, you can streamline the billing process and improve client satisfaction.

Key Elements to Customize

| Element | Purpose | How to Customize |

|---|---|---|

| Logo and Branding | Enhances the professional appearance and reinforces your brand identity. | Add your business logo and adjust colors to match your company’s theme. |

| Service Descriptions | Clearly defines what was provided, helping to avoid misunderstandings. | Modify the description fields to specify the types of services you offer. |

| Payment Terms | Specifies when and how payment is expected. | Include customized payment options, due dates, and any late fees. |

| Additional Charges | Accounts for extra costs such as fuel surcharges or handling fees. | Incorporate specific lines for any extra charges applicable to your services. |

Customizing your billing format ensures that your document not only reflects your business’s unique services but also provides clear and organized information to your clients. By tailoring each aspect to fit your needs, you can create a more efficient and professional billing process.

Tracking Payments with Billing Documents

Efficiently tracking payments is essential for maintaining cash flow and ensuring that all transactions are completed on time. By using well-organized records, you can easily monitor outstanding amounts, payment dates, and payment methods. This process helps avoid missed payments and provides a clear overview of your financial status.

Methods for Monitoring Payment Status

One effective way to track payments is by creating a simple tracking system alongside your financial documents. Keep a record of:

- Payment Due Dates: Always note the payment deadline to track overdue payments.

- Payment Status: Mark each document as “paid” or “unpaid” once the payment has been received.

- Payment Method: Record whether the payment was made via bank transfer, check, or cash.

- Payment Amount: Ensure the full amount due has been paid and match it with the document total.

Tools for Payment Tracking

Using digital tools can make tracking payments even more efficient. Many accounting software programs allow you to automatically generate reminders, update payment status, and even send follow-up notices to clients. For simpler methods, spreadsheet software also works well to manually update payment records and maintain accurate logs.

By keeping a close eye on payment statuses, you can ensure that your business stays financially stable, reducing the chances of delayed or missed payments.

Automating Billing for Efficiency

Automating the process of generating and sending payment requests can significantly improve business efficiency. By reducing the time spent on manual tasks, you can focus more on providing services and growing your business. With the right tools, creating accurate and timely financial records becomes a seamless part of your workflow.

Benefits of Automating the Process

- Time-saving: Automatically generated documents reduce the need for manual data entry, saving valuable time.

- Consistency: Automation ensures each record is formatted consistently, preventing errors and omissions.

- Faster Payment Processing: Automated reminders and follow-ups help speed up payment collection by keeping clients on track.

- Improved Accuracy: Automated systems can eliminate human error, ensuring all details are correctly filled in.

Tools for Automation

Various tools can help streamline the billing process:

- Accounting Software: Programs like QuickBooks, FreshBooks, and Xero offer automatic billing features, including recurring payments and reminders.

- Spreadsheet Templates: You can use custom spreadsheets with built-in formulas to automatically calculate totals and taxes.

- Online Platforms: Many online platforms allow you to set up recurring billing cycles and automatically send documents to clients.

By automating your billing process, you ensure greater efficiency and can provide faster, more accurate service to your clients while freeing up time to focus on other important tasks.

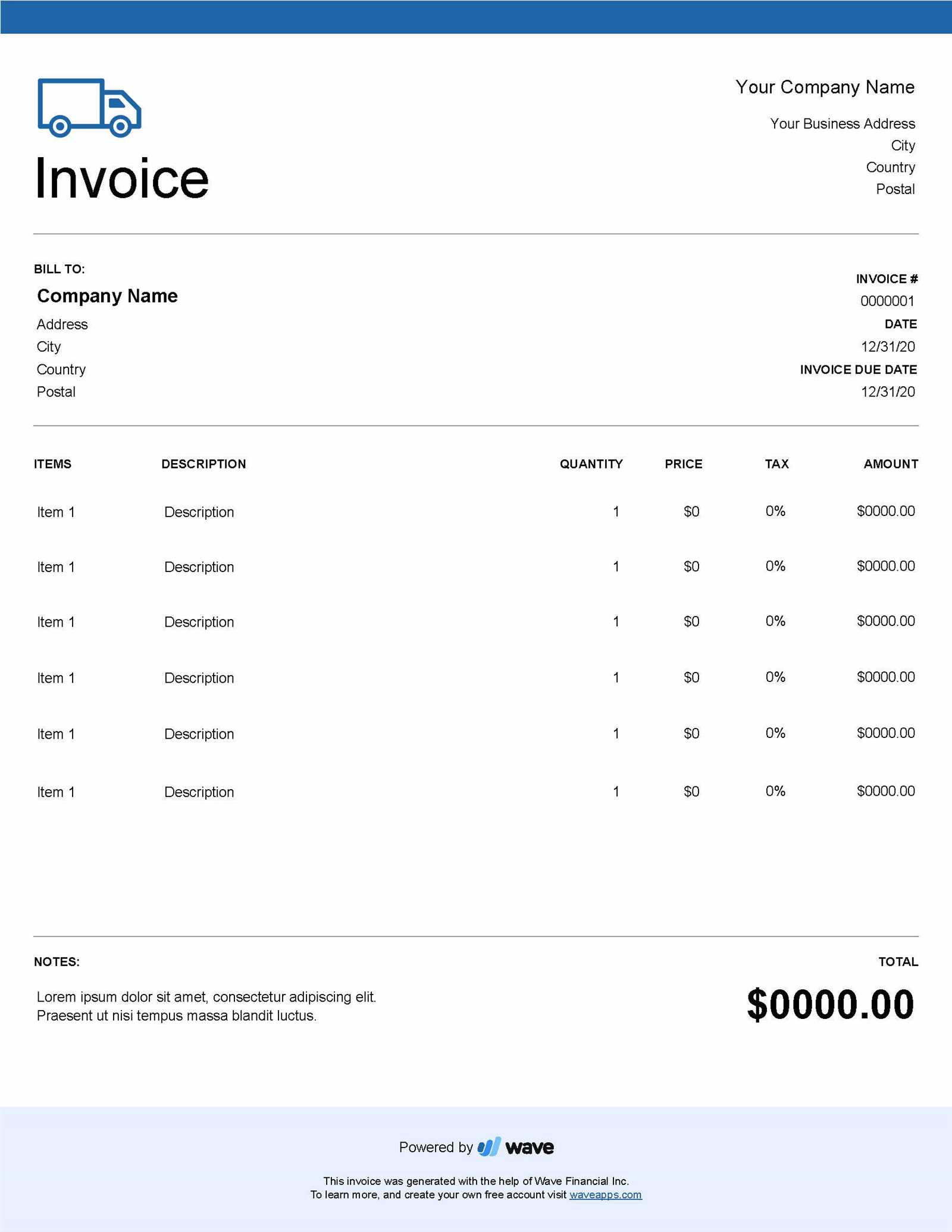

Best Practices for Professional Billing Documents

Creating professional billing records not only ensures smooth financial transactions but also helps maintain positive relationships with clients. When preparing payment requests, it’s important to follow best practices that enhance clarity, transparency, and trust. A well-structured document shows attention to detail and reflects the professionalism of your business.

Key Practices for a Polished Document

- Clear Layout: Use a clean, easy-to-read format. Keep sections organized, with ample space for each detail.

- Accurate Information: Double-check all service descriptions, dates, amounts, and client details to avoid discrepancies.

- Timely Submission: Send your billing records promptly after completing services to avoid delays in payment processing.

- Consistent Branding: Include your company logo, color scheme, and contact information to maintain a professional appearance.

Additional Tips for Improved Results

- Use Unique Reference Numbers: This helps both you and your clients track payments easily and avoid confusion with multiple records.

- Specify Payment Terms: Be clear about the due date, any early payment discounts, or late fees to set expectations from the start.

- Maintain a Personal Touch: If appropriate, add a brief thank you note or a personalized message to reinforce a positive working relationship.

By following these best practices, you ensure that your billing process is efficient, professional, and transparent, ultimately leading to faster payments and stronger business relationships.

How to Bill for Multiple Services

When handling multiple tasks for a client, it’s important to provide a clear breakdown of each completed job. Properly documenting each service ensures that your client understands the charges and prevents any confusion. Billing for several jobs at once requires attention to detail and an organized approach to clearly separate each service’s cost.

Steps for Billing Multiple Tasks

- List Each Service Separately: For each completed task, include a separate line or section that details the nature of the work, the date it was performed, and the agreed-upon rate.

- Provide Total Costs: Sum up the costs of all the individual services at the bottom, ensuring the client knows the total amount due for the entire batch of work.

- Use Itemized Charges: If applicable, break down any additional fees, such as fuel charges, equipment use, or handling costs, to keep everything transparent.

- Clarify Terms: If there were specific payment terms for each task (such as early payment discounts for one job or payment deadlines for others), make sure they are clearly stated next to each service.

Organizing and Tracking Multiple Tasks

To avoid errors, it’s helpful to number each task or service line individually, especially when working with multiple clients or projects. This makes it easier to track which services are still unpaid and which ones have been completed. Keep detailed records of each job, including any adjustments or special terms that apply.

- Use Reference Numbers: Assign a unique number or code to each service to ensure they are easily distinguishable.

- Maintain a Payment Log: Create a simple spreadsheet or tracking system to monitor which payments have been received and which are still pending.

- Send Timely Updates: If payments are overdue for certain tasks, send follow-up reminders that specify the unpaid services.

By clearly organizing and presenting multiple jobs, you can ensure smooth communication with clients and avoid complications during payment processing.

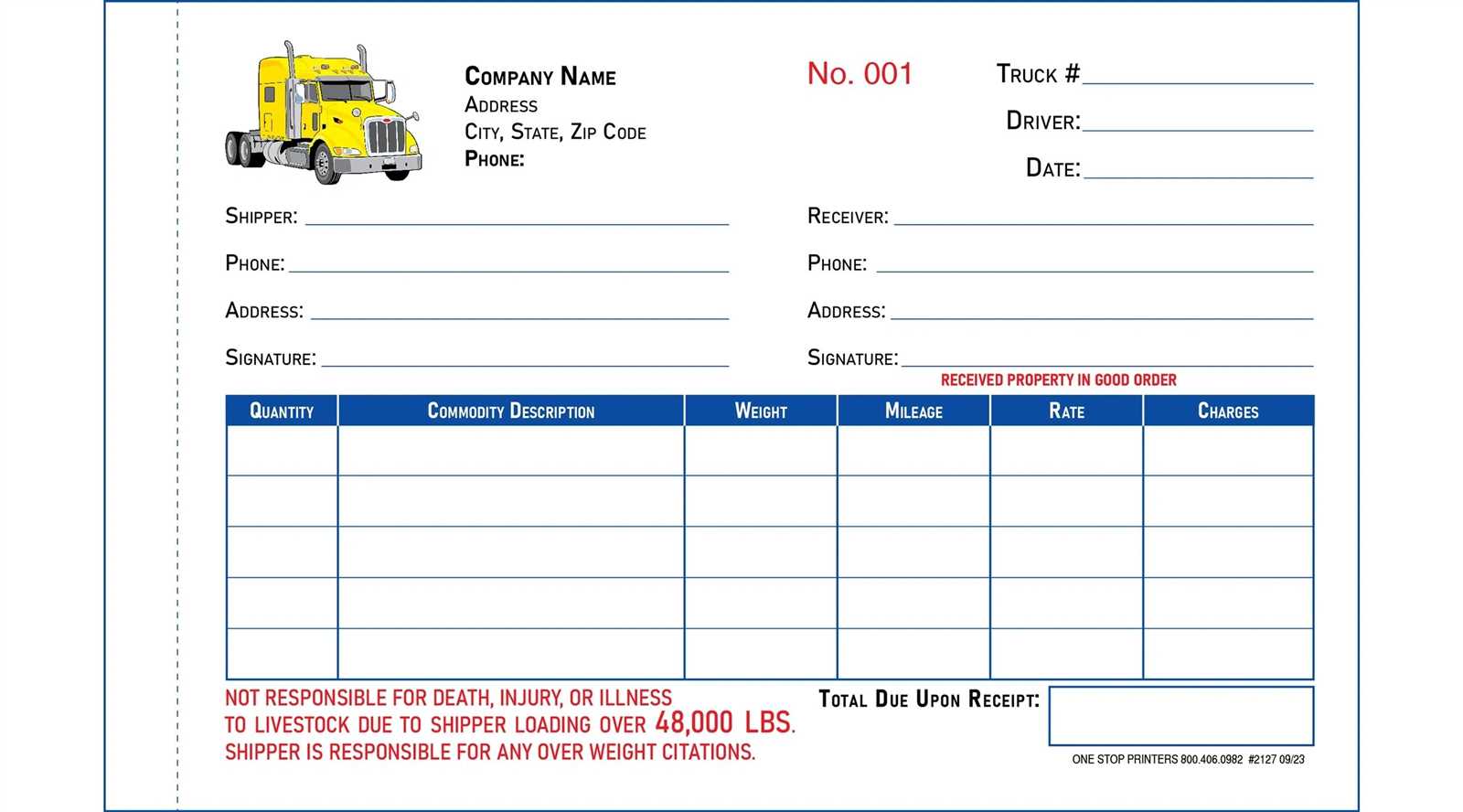

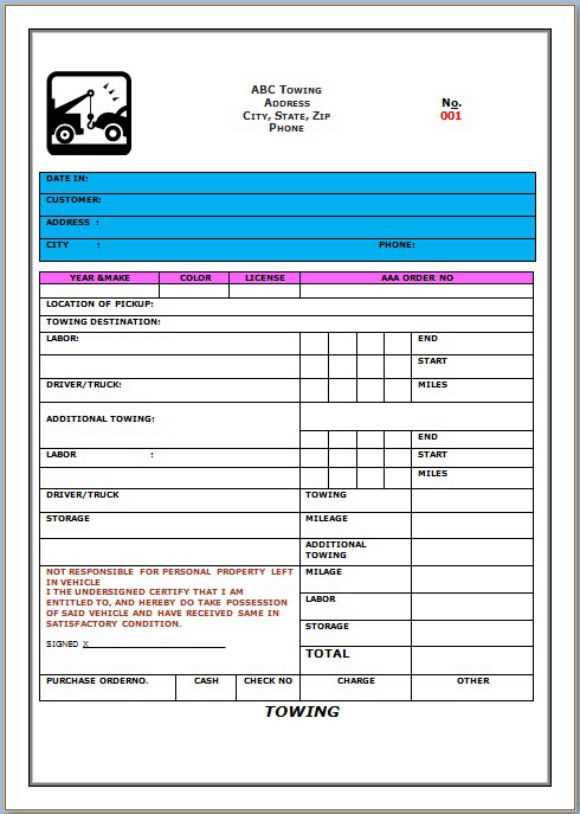

What to Include in a Billing Document for Transportation Services

When creating a billing document for transport-related services, it’s essential to provide clear, detailed information to ensure prompt and accurate payment. A well-structured document not only outlines the charges but also helps prevent misunderstandings with your clients. To achieve this, several key details should always be included, ensuring that all aspects of the service are accounted for.

Key Details to Include

- Service Description: Clearly describe the service provided, including the nature of the transport, any special requests, or extra services offered (such as additional stops or special handling).

- Dates and Times: Specify when the service was performed, including the start and end times, as well as the date of service. This helps clients verify the work and track when charges were incurred.

- Itemized Charges: List the cost for each part of the service, such as mileage, hourly rates, or any additional fees. This ensures that clients understand exactly what they are being charged for.

- Payment Terms: Include the payment due date and the accepted methods of payment. It’s also helpful to mention any late fees or discounts for early payment, if applicable.

- Contact Information: Make sure to include your full name, business name (if applicable), address, and phone number. The client should be able to reach you easily if any questions arise regarding the charges.

- Unique Reference Number: Assign a unique reference number to each document. This makes it easier for both you and your client to track and organize multiple payments over time.

Additional Considerations

When preparing your document, it’s important to remain clear and precise. Avoid vague terms and always ensure that your calculations are accurate. By providing detailed information and organizing it properly, you can build trust with your clients and avoid confusion during the payment process.

Incorporating all these elements into your billing document ensures that it is both professional and comprehensive, helping you maintain smooth financial transactions with your clients.

How to Set Payment Terms in Billing Documents

Setting clear and straightforward payment terms is essential for ensuring that clients understand when and how payments are expected. Well-defined terms not only provide clarity but also protect both parties by establishing mutual expectations. By setting proper guidelines for payment, you can avoid confusion and ensure a smoother transaction process.

Key Components of Payment Terms

- Payment Due Date: Specify the exact date by which payment should be made. Common due dates are 15, 30, or 60 days from the date of service, but you can adjust it based on your agreement with the client.

- Accepted Payment Methods: Clearly list the payment options available, such as bank transfer, credit card, PayPal, or check, to ensure clients know how they can pay.

- Late Payment Penalties: To encourage timely payments, include a late fee clause. For example, a percentage of the total bill for each week past the due date. Make sure this is stated upfront to avoid any surprises.

- Discounts for Early Payments: Offering a small discount for early payments can motivate clients to pay ahead of the due date. Be sure to specify the discount rate and the time frame in which it applies.

- Payment Installments (if applicable): If the client cannot pay the full amount upfront, offer installment options. Clearly outline the amount and due dates for each installment.

How to Communicate Payment Terms Effectively

Once you’ve defined the payment terms, make sure they are clearly stated in your billing document. Place them in an easy-to-find section, such as at the bottom of the document or near the total amount due. By being transparent and upfront about your expectations, you reduce the risk of miscommunication and ensure that both you and the client are on the same page.

Incorporating well-defined payment terms into your documents helps maintain professionalism and fosters a positive relationship with clients, while also ensuring that you are compensated for your services in a timely manner.

Designing a Clean Billing Layout

A well-designed billing document can make a significant difference in how your clients perceive your professionalism. A clean and organized layout not only makes it easier for clients to understand the charges but also enhances the overall appearance of your business. The goal is to keep the layout simple yet informative, ensuring that all relevant details are easy to find and read.

Key Elements of a Clean Layout

- Simple Structure: Keep the layout uncluttered with clear headings and plenty of white space. This makes it easier for clients to read and process the information.

- Legible Fonts: Use easy-to-read fonts and avoid overly decorative styles. Choose a professional font like Arial, Helvetica, or Times New Roman with a readable size (usually between 10-12pt).

- Clear Sections: Organize your document into clear sections, such as “Service Details,” “Charges,” and “Payment Information.” This will help clients quickly navigate through the document.

- Consistent Formatting: Use consistent formatting for dates, amounts, and other details. This gives your document a polished look and avoids confusion.

- Bold for Important Info: Highlight key information such as the total amount due and the payment due date using bold text or a larger font size.

Additional Design Tips

- Branding: Include your company logo and use your brand’s color scheme. This adds a professional touch and reinforces your business identity.

- Alignment: Ensure that all text, including the service descriptions and charges, is properly aligned. This improves readability and keeps the document looking neat.

- Minimalist Design: Keep decoration to a minimum. A clean, minimalist design looks more professional and is easier for clients to understand.

By following these design principles, you can create a billing document that is both visually appealing and functional. A clean layout not only improves clarity but also reflects your attention to detail and professionalism in handling financial transactions.

Legal Requirements for Billing Documents

When creating billing documents, it is essential to adhere to legal standards to ensure compliance and avoid potential disputes with clients or tax authorities. Legal requirements for such records vary depending on the country, industry, and nature of the service provided. However, there are several universal elements that should be included to meet basic legal expectations.

Key Legal Elements to Include

- Business Information: Always include your company’s full name, legal address, and contact information. This allows clients and authorities to easily identify you as the service provider.

- Client Details: Include the client’s full name or company name, address, and contact information. This ensures that the document can be matched to the correct customer.

- Unique Reference Number: Every billing document should have a unique identifier (e.g., an invoice number or reference code). This helps in tracking payments and ensures clarity in case of disputes.

- Date of Service: Include the date(s) on which services were provided. Some jurisdictions require this for tax reporting and auditing purposes.

- Breakdown of Charges: List all services provided in detail along with their associated costs. This helps to prevent misunderstandings and can be required in case of a tax audit.

- Tax Information: If applicable, include details about tax charges such as VAT or sales tax, including the tax rate and the total amount of tax charged. Certain regions require this to be clearly stated on all payment requests.

- Payment Terms: Clearly outline the payment due date, acceptable payment methods, and any late fee policies. This helps avoid legal issues related to overdue payments.

Other Considerations

- Currency and Amounts: Always specify the currency in which the payment is expected. This is particularly important for international transactions to avoid confusion.

- Digital or Paper Copy: While both formats are legally acceptable in many countries, you should ensure that your records are accessible and verifiable in the format agreed upon with the client.

- Retention of Records: Legally, you are often required to keep copies of all billing documents for a specific period (e.g., 5 years). Make sure to store these properly for future reference or audit purposes.

Ensuring that your billing documents meet legal requirements not only helps maintain good business practices but also safeguards you from potential legal issues. Always check local regulations to confirm you’re following the appropriate rules for your area and industry.

Tips for Faster Payment Processing

Receiving payments promptly is essential for maintaining healthy cash flow and avoiding delays in your business operations. To ensure that clients settle their bills quickly, it’s important to implement strategies that encourage timely payments. By adopting clear communication and efficient practices, you can speed up the payment process and reduce the risk of overdue accounts.

Effective Strategies to Speed Up Payments

- Set Clear Payment Terms: Clearly define the payment due date, methods, and any late fees on your billing documents. The more transparent you are about your expectations, the easier it is for clients to follow through.

- Offer Multiple Payment Options: Make it easy for clients to pay by offering various methods such as bank transfer, credit card, or online payment platforms like PayPal or Stripe. The more options they have, the quicker they can process the payment.

- Send Reminders: Don’t hesitate to send friendly reminders as the due date approaches. A polite follow-up a few days before the due date can ensure clients are aware and prepared to pay on time.

- Use Early Payment Incentives: Consider offering a small discount for clients who pay before the due date. This can motivate clients to settle their accounts more quickly.

- Invoice Promptly: Send your billing document as soon as the service is completed. The sooner you issue the document, the sooner clients can process the payment.

- Keep Invoices Simple: An easy-to-read, well-organized billing document will help avoid confusion. The simpler the document, the less time clients will spend questioning the charges.

Communication and Follow-Up

- Maintain Regular Communication: Build a relationship with clients that encourages open communication. The more they trust you, the more likely they are to prioritize your payments.

- Use Automated Tools: Consider using invoicing software that can automate reminders and follow-ups. This saves you time and ensures consistent communication.

- Address Disputes Quickly: If a client has concerns or disputes regarding a charge, address it as soon as possible. Quick resolution can prevent delays in payment.

By implementing these strategies, you can encourage faster payment processing and improve your business’s financial health. Timely payments help you maintain smooth operations and reduce the stress of chasing overdue accounts.