Pest Control Invoice Template for Efficient Billing

Running a successful business requires not only offering great services but also ensuring that the financial side is properly managed. One key component of this is having a structured and professional way to charge customers for the work performed. A well-organized billing document helps streamline the payment process, ensuring accuracy and saving time for both parties.

For service providers, creating a consistent billing system is essential. This document serves as a clear record of the services rendered, the costs involved, and the payment terms. By using a flexible and easy-to-customize format, businesses can maintain a professional image while simplifying administrative tasks.

Whether you’re just starting out or looking to improve your existing processes, having the right structure in place can lead to better financial management. With the right tools, invoicing becomes not only more efficient but also an opportunity to showcase your professionalism and build trust with your clients.

Pest Control Invoice Template Overview

A structured billing document is essential for any business offering specialized services. This tool simplifies the process of charging customers, ensuring all necessary information is clear and well-organized. By adopting a standardized approach, service providers can streamline their accounting practices and improve customer satisfaction.

Key Features of an Effective Billing Document

An ideal document for service-based businesses includes a few important elements to ensure clarity and professionalism. These features not only provide transparency but also help in avoiding misunderstandings about the payment process:

- Service Description: A detailed list of the work done or services provided.

- Cost Breakdown: Clear pricing for each service or product offered.

- Payment Terms: Specifying due dates, late fees, and payment methods.

- Client Details: Accurate information about the client to avoid confusion.

Why Standardization Matters

Using a consistent format for every transaction helps establish credibility and ensures that all necessary information is captured. This approach can improve overall efficiency and make financial tracking much easier for business owners. Moreover, a standardized document fosters a professional image and reinforces the reliability of the services provided.

Benefits of Using an Invoice Template

Utilizing a pre-designed billing document provides numerous advantages for businesses, particularly in terms of efficiency and accuracy. With a ready-to-use format, companies can avoid errors and reduce the time spent creating documents from scratch, which helps streamline financial processes. This approach offers convenience and ensures consistency in every transaction.

Time-Saving and Efficiency

One of the most significant benefits of using a standardized billing format is the time saved. Rather than drafting a new document for each client, businesses can quickly fill in the required details. This allows service providers to focus on their core work rather than spending excessive time on administrative tasks.

- Quick Setup: Easily customize the document for each job without starting from scratch.

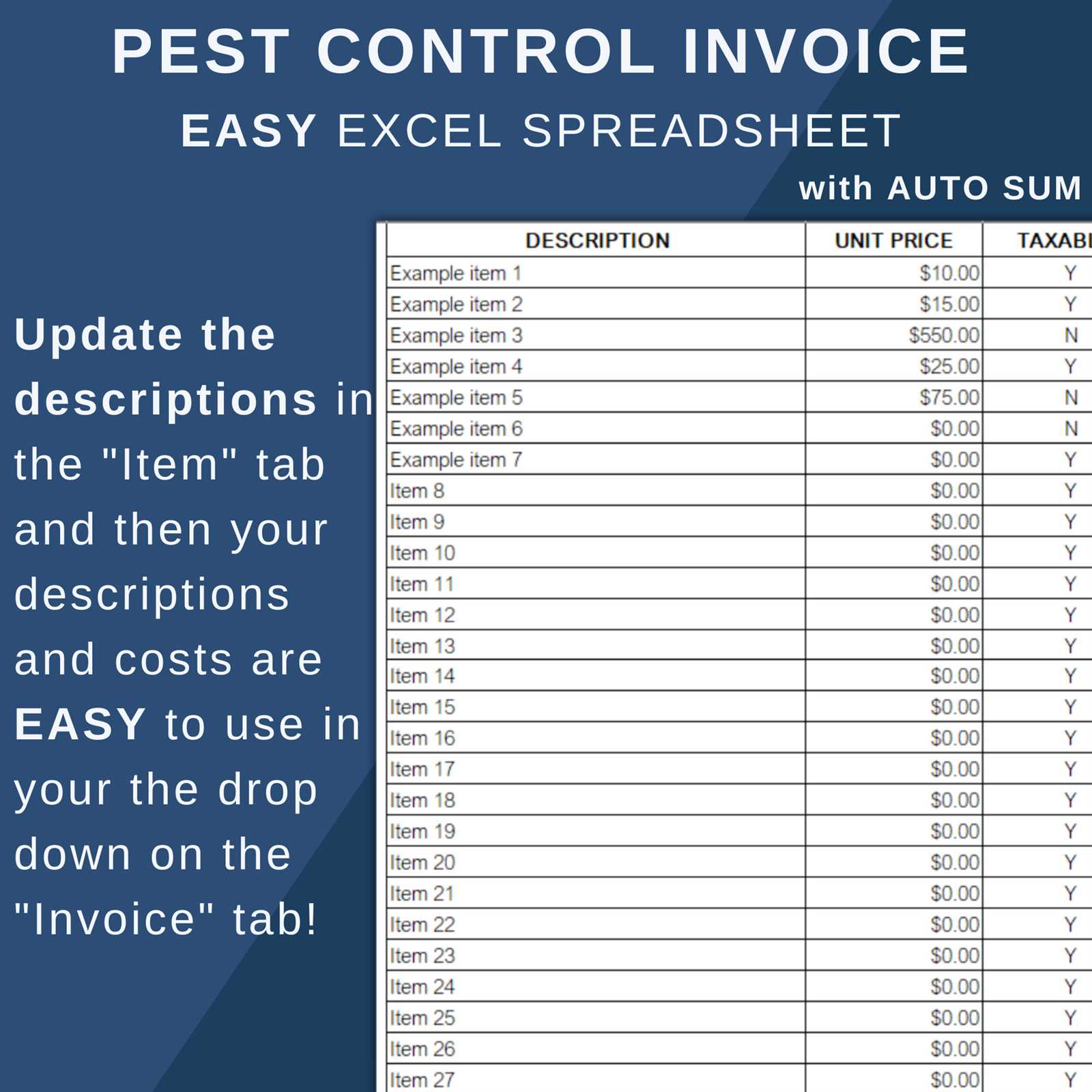

- Automated Calculations: Many formats include built-in functions for summing totals and applying taxes.

- Pre-defined Sections: Common fields such as client information and service details are already included, minimizing errors.

Professionalism and Accuracy

A well-structured document enhances the perception of a business and establishes trust with clients. Clear and consistent formatting helps avoid confusion and ensures that the correct information is communicated. Accurate billing reduces the likelihood of disputes, making the payment process smoother for both businesses and customers.

- Consistent Branding: A professional layout reflects the business’s identity and makes the document look polished.

- Reduces Mistakes: Standardized sections make it easier to fill in the right information without omissions or errors.

- Clear Communication: A well-organized document ensures that clients can easily understand the charges and payment terms.

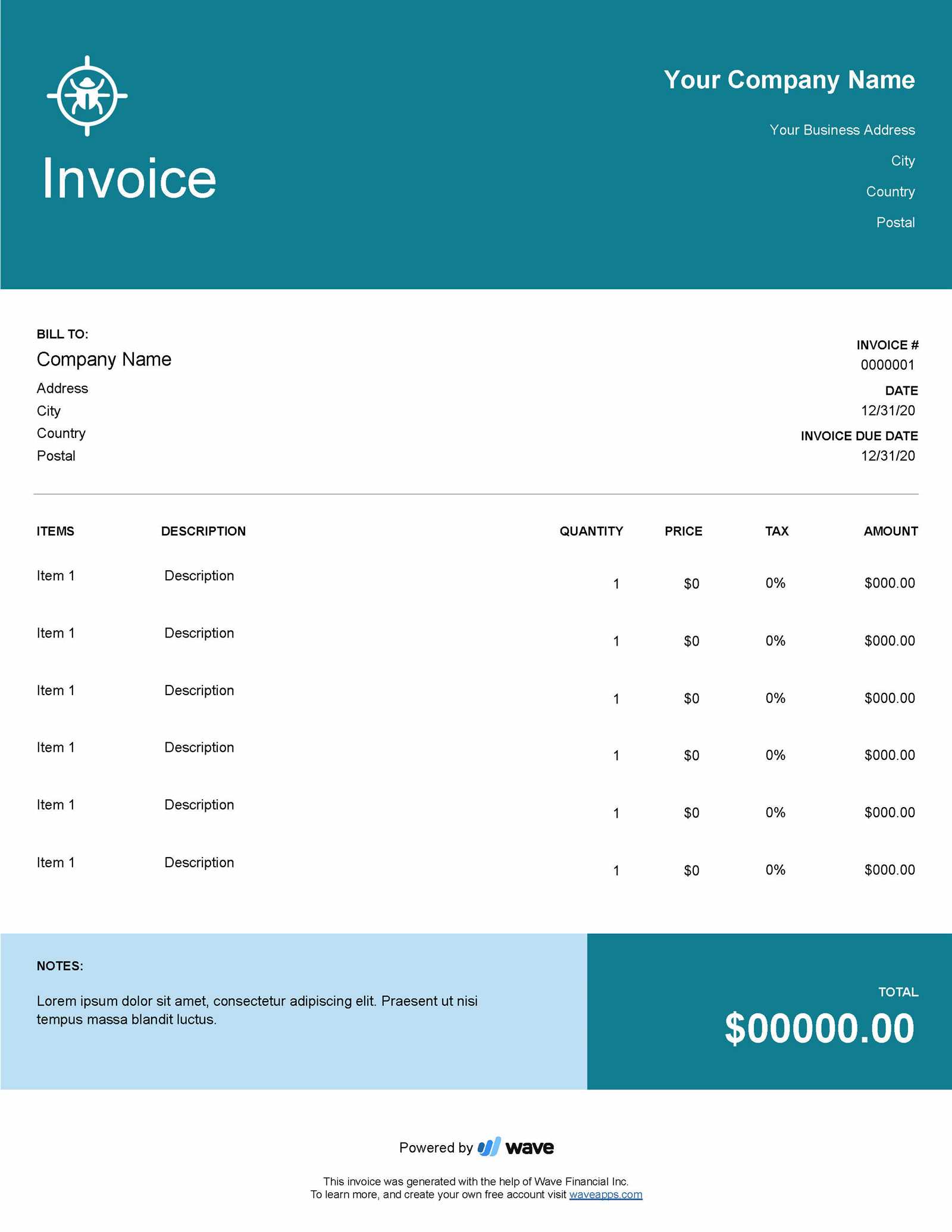

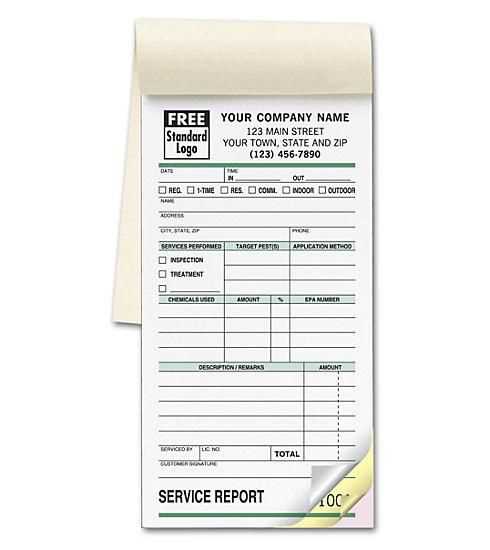

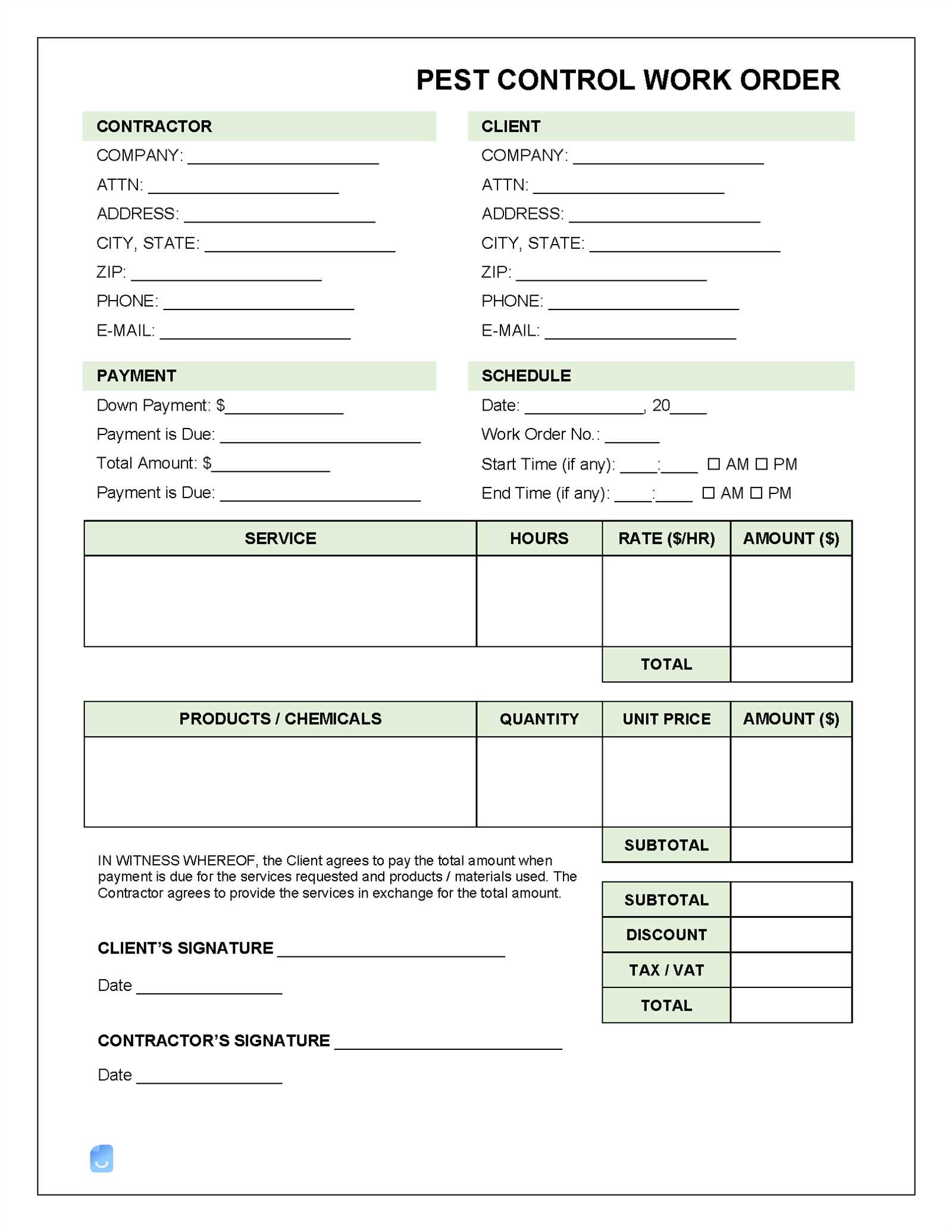

Key Elements of an Invoice

A well-structured billing document contains several crucial components that ensure clarity and proper communication between the service provider and the client. These elements not only help in detailing the services provided but also facilitate smooth transactions by offering transparency and reducing misunderstandings. Each part plays a vital role in keeping the process organized and professional.

Essential Information to Include

To create a complete and professional billing document, certain details must always be included. These essential elements ensure that the recipient has all the information needed to understand the charges and make timely payments.

- Service Description: A clear and concise explanation of the services rendered or products delivered.

- Pricing Breakdown: Itemized costs for each service or item provided, including any applicable taxes.

- Payment Terms: Information on when the payment is due and accepted payment methods.

- Client and Provider Details: Contact information for both the service provider and the client to avoid confusion.

- Unique Identifier: An invoice number or reference code to track and organize documents.

Additional Information to Consider

While the key elements are critical, adding extra details can further enhance the clarity of the document and assist in smoother business operations. Including these components ensures a more complete and polished billing experience.

- Late Payment Fees: A clear indication of any penalties if the payment is delayed beyond the due date.

- Discounts or Promotions: If applicable, providing information on any discounts or offers applied to the total cost.

- Custom Notes: Any additional instructions or comments to communicate with the client.

How to Customize Your Template

Customizing a pre-made billing document to suit your business needs can significantly improve your workflow and enhance professionalism. Adjusting key sections allows you to tailor the document for different services or clients while ensuring it aligns with your brand identity. A well-personalized document reflects your business’s style and can make communication clearer and more efficient.

Here are some steps to help you effectively modify your billing format:

- Choose the Right Layout: Select a layout that best suits your business needs. Make sure the design is simple, easy to follow, and includes all necessary sections.

- Update Branding Elements: Add your business logo, contact information, and any specific colors or fonts that match your branding. This adds a professional touch and enhances brand recognition.

- Adjust the Service List: Tailor the description of services offered. If your business provides varying types of work, create distinct sections for each service, including the price and quantity.

- Modify Payment Terms: Customize the payment due date, accepted payment methods, and any special conditions or discounts that apply to your services.

Customizing your document helps create a more personalized experience for your clients and ensures that every transaction is clear and well-documented. With the right adjustments, you can make your billing process both efficient and professional.

Choosing the Right Template Format

Selecting the right format for your billing document is crucial for both ease of use and the professional presentation of your services. The format you choose should align with your business needs, ensuring the document is not only functional but also visually appealing and easy to navigate. A well-chosen format improves organization and helps you maintain consistency across all client transactions.

Factors to Consider When Choosing a Format

There are several factors to keep in mind when deciding on the best layout for your documents. Each factor plays a role in making the document more efficient and better suited to your business operations.

- Ease of Use: Choose a format that is simple to edit and fill in with client-specific information. Look for a layout that minimizes unnecessary steps.

- Compatibility: Ensure that the format is compatible with the software you use, such as Microsoft Word, Excel, or other accounting programs.

- Professional Design: A clean, well-organized format enhances the professionalism of your business and builds trust with clients.

- Customizability: The format should allow you to easily make adjustments, such as adding or removing sections, updating pricing, or changing the layout as needed.

Popular Format Options

There are several common format types to choose from, depending on your preferences and business operations:

- Word Document: Simple and widely accessible, this format allows for easy customization and can be printed or emailed.

- Excel Spreadsheet: Ideal for businesses that require automatic calculations, such as adding taxes or summing totals.

- PDF: A fixed format that ensures the document remains unchanged, making it ideal for formal communications.

Choosing the right format ultimately depends on how you prefer to manage your financial documents and the specific needs of your business. Whatever format you select, ensure that it supports your overall efficiency and provides a positive experience for your clients.

Essential Information to Include

For a billing document to be effective and clear, it must include certain key details. These elements ensure that both the service provider and the client are on the same page regarding the charges, services rendered, and payment expectations. Including the right information helps avoid confusion and promotes a smoother transaction process.

Key Details Every Document Should Have

Each section of the document should contain specific details that make the transaction clear and professional. The following are the fundamental components that must be present in every billing document:

- Service Details: A brief description of the services or products provided, including any quantities or units.

- Pricing Breakdown: The cost of each service or item, listed individually, along with any applicable taxes or additional fees.

- Payment Information: Clear instructions on how and when payments should be made, including accepted methods and due dates.

- Client and Provider Information: Contact details for both the service provider and the client to ensure easy communication and verification.

- Unique Reference Number: A distinct document number that helps track and organize the transaction for future reference.

Additional Useful Details

While the basics are essential, adding some extra details can improve the experience for both parties and ensure smoother operations. These elements provide clarity and help manage expectations:

- Late Fees: Information on any charges that may apply if payments are not made on time.

- Discounts: Any special offers or price reductions that apply to the transaction.

- Custom Notes: Space for additional comments, reminders, or specific instructions that are relevant to the client.

Including these key details ensures that the document is both comprehensive and professional, reducing the chance of misunderstandings and improving client satisfaction.

Steps to Create an Invoice

Creating a well-organized billing document requires a few key steps to ensure that all necessary details are included and presented clearly. Following a structured process not only makes the document more professional but also reduces the risk of errors, helping both the service provider and client understand the transaction better. The steps outlined below will guide you in crafting a clear and comprehensive billing statement.

Step-by-Step Process

To create an effective document, follow these steps, ensuring all essential information is included and accurately presented:

- Step 1 – Choose a Format: Select a format that suits your needs, whether it’s a Word document, spreadsheet, or PDF file. Ensure it is easy to edit and share with clients.

- Step 2 – Include Your Business Information: Begin by adding your business name, address, and contact details at the top of the document. This ensures the client knows who the document is from.

- Step 3 – Add Client Information: Include the client’s name, address, and any other relevant details to help identify the recipient.

- Step 4 – Describe the Services: Clearly list the services provided, including dates and quantities, along with a brief description of each item or service rendered.

- Step 5 – Set the Price: Provide a breakdown of the charges for each service or item, including any applicable taxes or additional fees. Make sure the prices are clear and easy to understand.

- Step 6 – Specify Payment Terms: Clearly indicate the payment due date, accepted payment methods, and any late fees if the payment is delayed.

- Step 7 – Add a Unique Reference Number: Assign a unique number to the document to make it easy to track and reference in the future.

Final Review and Delivery

Once the document is complete, it’s important to review it for accuracy. Double-check all details to ensure there are no errors in pricing, service descriptions, or client information. After the review, save the document in the preferred format (PDF is recommended for professional communication) and send it to the client via email or physical mail.

Following these steps will ensure you create a professional, accurate, and efficient billing document every time, helping you manage payments and maintain positive client relationships.

How to Calculate Pest Control Costs

Accurately determining the cost of services is essential for both service providers and clients to ensure that pricing is transparent and fair. Whether you’re offering a one-time service or ongoing support, calculating the total charge involves understanding various factors that contribute to the overall cost. By breaking down the key elements that influence the price, you can provide clear and predictable pricing for your customers.

Factors to Consider in Cost Calculation

There are several factors that should be taken into account when calculating the overall cost for services rendered. Each factor plays a role in shaping the final price, and adjusting any of these elements can impact the total cost.

- Service Type: The complexity and scope of the service are critical. A simple visit may cost less than a comprehensive treatment plan for multiple areas or ongoing maintenance.

- Size of the Area: Larger properties typically require more resources and time, which can increase the overall charge. The square footage often directly affects pricing.

- Frequency of Visits: Whether the service is a one-time treatment or part of an ongoing schedule, regular visits might include a discounted rate due to the long-term nature of the service.

- Materials Used: The type and quantity of products used during the service can influence the cost. Specialized products or eco-friendly options may come at a premium.

- Location: The location of the property can also affect pricing due to travel expenses and the availability of service providers in the area.

Steps to Calculate the Total Cost

Here are the basic steps for calculating the total charge for a service:

- Step 1 – Estimate Time and Labor: Determine how much time the job will take and calculate the labor cost based on hourly rates or flat fees.

- Step 2 – Add the Cost of Materials: Factor in the cost of any chemicals, equipment, or supplies needed to perform the service.

- Step 3 – Include Additional Fees: Include any travel charges or service-related fees, such as a call-out fee or disposal charges for waste materials.

- Step 4 – Apply Discounts or Premiums: Consider any special discounts for recurring services or add extra charges for urgent or emergency visits.

- Step 5 – Total the Amount: Add all costs together to determine the final price, making sure to clarify any taxes or additional charges that may apply.

By carefully considering these factors and following these steps, you can accurately calculate the cost of services, ensuring fairness for both the provider and the customer.

Tracking Payments and Due Dates

Efficiently managing payments and tracking due dates is crucial for maintaining smooth financial operations. By staying organized and keeping track of each transaction, businesses can ensure timely payments, avoid confusion, and foster positive relationships with clients. Implementing a consistent system for tracking payments helps reduce administrative burden and ensures accurate financial records.

Key Steps for Tracking Payments

There are several important steps to follow when managing payments and their due dates. By adhering to a clear process, you can avoid delays and discrepancies in financial matters:

- Record Payment Terms: Clearly define payment terms in the agreement or document, including the due date, payment methods, and any penalties for late payments.

- Log Payment Details: Keep detailed records of each payment, including the amount paid, the date of payment, and the method of payment (e.g., check, bank transfer, or cash).

- Monitor Payment Status: Regularly check the payment status to see if payments have been made or if they are overdue. Use a simple tracking system or software to streamline this process.

- Send Reminders: If payments are approaching their due date or overdue, send timely reminders to clients to ensure they are aware of their obligations.

Best Practices for Due Date Management

Proper management of due dates is essential for maintaining financial order and ensuring that your business receives payments on time. Here are some best practices for managing payment deadlines:

- Set Clear Deadlines: Include specific due dates in every agreement or billing document to ensure both parties know when payments are expected.

- Provide Multiple Payment Options: Offer various methods for clients to make payments to increase convenience and improve the likelihood of timely payments.

- Track Due Dates in Software: Utilize invoicing or financial management software to automatically track due dates and send reminders to clients when payments are due.

- Offer Early Payment Incentives: Consider offering discounts or special deals for clients who pay before the due date as an added incentive for prompt payments.

By implementing these practices, businesses can effectively manage payments and due dates, ensuring smooth financial operations and a positive client experience.

Common Mistakes in Invoices

When preparing billing documents, even small errors can cause confusion, delay payments, and harm professional relationships. Avoiding common mistakes is key to ensuring smooth transactions and maintaining client trust. By being aware of typical errors, you can ensure that your billing process remains efficient and accurate.

Frequent Errors to Avoid

There are several common mistakes that service providers often make when preparing financial documents. Recognizing these issues early can help prevent complications later on:

- Incorrect Client Information: One of the most frequent mistakes is listing inaccurate client details, such as the wrong name, address, or contact information. Always double-check this information before sending any billing documents.

- Missing or Incorrect Dates: Omitting or using incorrect dates can lead to confusion about payment deadlines. Be sure to include the correct date of the service and the payment due date to avoid misunderstandings.

- Unclear Descriptions of Services: A vague or unclear description of the services rendered can create disputes. Always provide a detailed and precise breakdown of the work done, including the date and location if applicable.

- Mathematical Errors: Simple arithmetic mistakes, such as incorrect totals or wrong tax calculations, can lead to discrepancies. Double-check all amounts and ensure that taxes or discounts are accurately applied.

- Failure to Include Payment Terms: Not specifying payment terms, such as the accepted payment methods, due dates, and penalties for late payments, can cause confusion and delays in receiving payments.

How to Avoid These Mistakes

To avoid these common errors, follow a systematic approach when preparing your billing documents:

- Double-check all details: Review client information, dates, service descriptions, and calculations before finalizing the document.

- Use clear, professional language: Provide detailed descriptions of services rendered to eliminate any ambiguity.

- Utilize automated software: Consider using invoicing or financial software to minimize human error in calculations and formatting.

- Include clear payment instruct

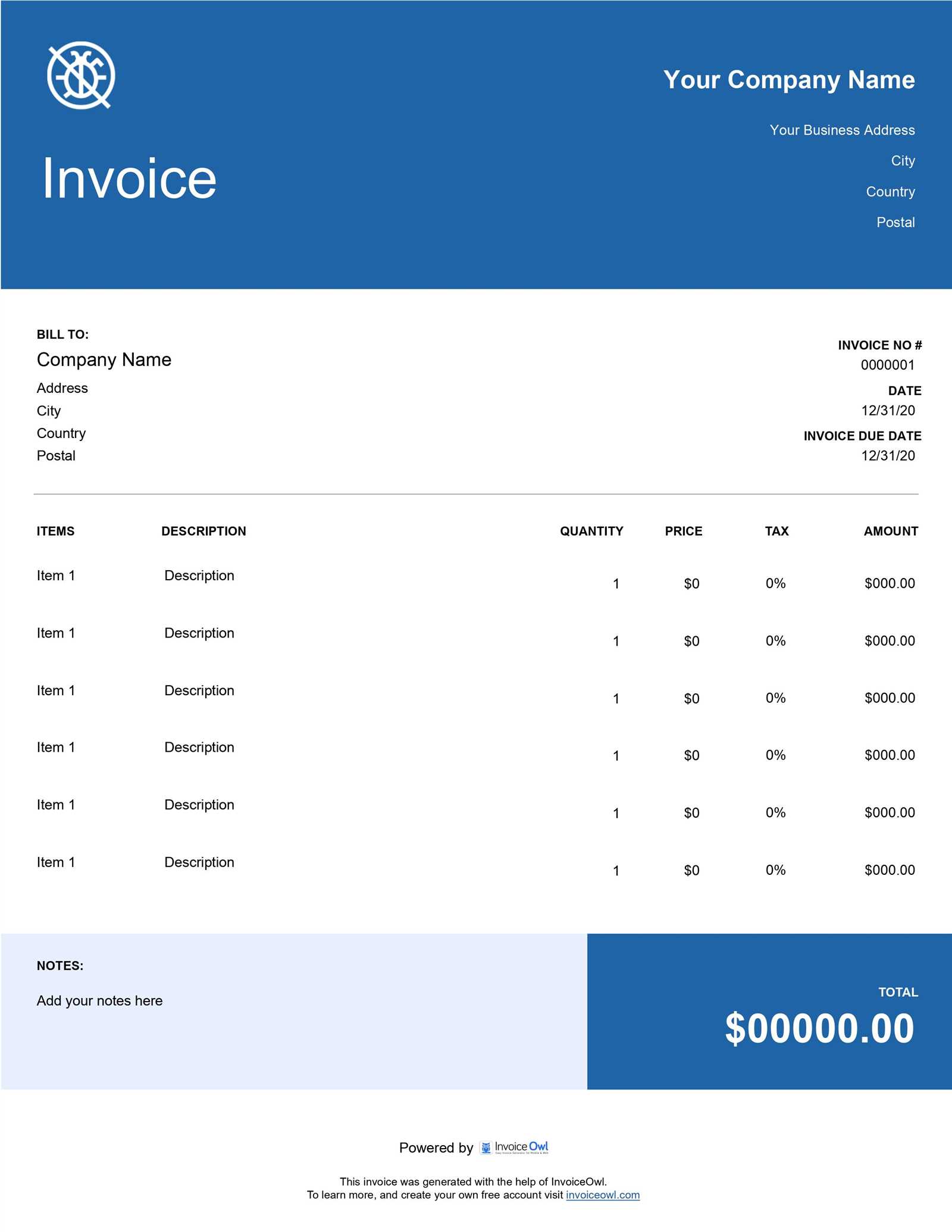

Best Practices for Invoice Design

Creating well-designed billing documents not only ensures clarity but also helps reinforce a professional image for your business. The layout, structure, and content of these documents play an essential role in facilitating smooth transactions and ensuring that clients understand the details of what they are being charged for. A clean, organized design makes it easier for clients to process payments on time and avoids potential confusion.

To create a highly effective and user-friendly billing document, consider implementing the following best practices:

- Maintain Simplicity: Avoid clutter and ensure that the design is clean and straightforward. A simple layout with clear headings and well-organized sections helps clients quickly find the necessary information.

- Use Consistent Branding: Align the design with your business’s branding. Use your company logo, color scheme, and fonts to maintain a professional and cohesive look.

- Highlight Key Information: Ensure that critical details such as the client’s name, the due date, and the total amount due are easy to find. Use larger font sizes or bold text to make these details stand out.

- Incorporate Clear Itemization: Clearly break down services or products, including descriptions, quantities, rates, and totals. This transparency prevents misunderstandings and builds trust with your clients.

- Include Payment Instructions: Make sure your payment terms are clearly outlined. Provide information about accepted payment methods and where or how payments should be made.

- Provide a Professional Look: Use high-quality, readable fonts and avoid excessive decoration. Professional formatting enhances the perception of your business and makes your documents easier to read.

By following these design practices, you can ensure that your billing documents are not only effective in communicating payment details but also help maintain a positive relationship with your clients.

Automating the Invoice Process

Automating the billing procedure can significantly streamline operations and reduce the risk of errors. By utilizing software or digital tools, businesses can set up automatic generation and delivery of financial documents, ensuring accuracy and timeliness. Automation not only saves time but also helps maintain consistency in how documents are formatted and delivered to clients.

Here are the key benefits of automating the billing process:

- Time Efficiency: Automating repetitive tasks allows you to focus on more strategic activities while the system handles document creation and distribution.

- Improved Accuracy: Automated systems minimize human errors, ensuring all details such as calculations, dates, and client information are correct.

- Consistent Branding: Automation ensures that every document sent out adheres to your company’s branding guidelines, creating a professional and consistent appearance.

- Timely Payments: Automated reminders and recurring billing options ensure that clients receive timely notifications about their financial obligations, improving cash flow.

- Record Keeping: Automation also simplifies record-keeping, making it easy to track past transactions and retrieve billing history when needed.

One popular tool for automating this process is invoicing software, which typically offers features like:

Feature Description Recurring Billing Set up automatic billing cycles for regular services or subscriptions. Customizable Templates Design consistent documents with company branding and personalize client information. Payment Integration Allow clients to pay directly through links or embedded options within the billing document. Automated Reminders Send follow-up messages for overdue payments or upcoming due dates without manual intervention. Tracking and Reporting Monitor payment statuses, generate reports, and keep track of pending balances effortlessly. Incorporating automation into your billing system not only reduces manual effort but also helps ensure a smooth, professional process from start to finish.

Legal Requirements for Billing Documents

When issuing financial statements for services rendered, it’s important to understand the legal obligations involved. Proper documentation ensures that all transactions are transparent, compliant with tax laws, and protect both the business and the client. Adhering to legal requirements not only avoids potential fines or penalties but also enhances your business’s credibility and trustworthiness.

Mandatory Information

To comply with legal standards, certain details must be included in each billing document. These requirements may vary depending on the location, but the following elements are typically required:

- Business Identification: The business name, address, and registration number must be clearly visible. This ensures that the client can verify the legitimacy of the business.

- Client Details: The name, address, and contact information of the client must also be included to confirm the transaction was made with the correct party.

- Clear Itemization of Services: The document should provide a detailed breakdown of the services provided, including dates, descriptions, and rates for each item.

- Payment Terms: Clearly state payment terms, including the due date, payment methods accepted, and any late fees or penalties for overdue payments.

- Tax Information: Include applicable taxes and indicate the tax rate applied. Many jurisdictions require this information for legal compliance and tax reporting.

- Unique Reference Number: Each document must have a unique reference number for tracking purposes and to avoid confusion in the event of disputes.

Compliance with Local Regulations

It’s crucial to stay informed about any local or national regulations that may affect the structure and contents of your billing statements. Different countries, or even states within countries, may have varying rules regarding tax rates, acceptable payment terms, and required disclosures. Failure to comply with these laws could lead to penalties or difficulties in the future.

By ensuring that your billing documents meet legal standards, you protect your business, provide clarity for your clients, and maintain smooth financial operations.

Using Billing Documents for Tax Purposes

Accurate financial records are essential for tax reporting, and billing documents play a key role in ensuring that both income and expenses are properly documented. These records provide proof of transactions and help businesses track their earnings and expenditures. They are also critical for tax authorities to verify the accuracy of your financial statements and assess any taxes owed.

Tracking Income and Expenses

For businesses, keeping track of sales and purchases is vital for tax filing. Billing documents serve as a record of income, providing clear details about each transaction, including the amount, date, and nature of the service or product provided. This documentation helps businesses report their earnings to tax authorities accurately. Additionally, receipts or purchase documents can be used to track expenses, which may be deductible, lowering the overall tax liability.

- Income Reporting: Keep a detailed record of every payment received and the corresponding billing document to report income correctly.

- Expense Tracking: Retain purchase documents that detail business expenses, such as supplies or services, to claim deductions where applicable.

- Tax Calculation: Ensure that sales tax or VAT (if applicable) is included in the billing document for proper tax reporting.

Supporting Tax Audits

In the event of an audit, properly formatted billing documents provide the necessary evidence to support your tax returns. They act as a reliable reference for verifying reported income and deductible expenses. Organized and accurate records can help you avoid penalties and fines in case of discrepancies.

By using billing records for tax purposes, businesses can ensure they are compliant with tax laws, maintain accurate financial reports, and streamline the filing process.

Integrating Billing Documents with Accounting Tools

Efficiently managing financial records is critical for businesses, and integrating billing documents with accounting software simplifies the process. By automating data transfer between your billing system and accounting platform, you can minimize manual data entry, reduce errors, and ensure your financial records are always up to date. This integration helps streamline bookkeeping, improves accuracy, and saves time, allowing you to focus on other aspects of your business.

Benefits of Integration

Connecting billing documents with accounting tools offers several advantages that help businesses maintain financial clarity and avoid discrepancies:

- Reduced Errors: Automation reduces human errors that can occur when manually entering data into accounting systems.

- Time-Saving: Integrating systems cuts down on the time spent switching between platforms and manually inputting information.

- Real-Time Updates: Your accounting software will always have the most recent data, allowing for accurate and timely financial reporting.

- Improved Financial Analysis: Seamless integration enables better tracking of revenue and expenses, facilitating comprehensive financial insights.

How Integration Works

The process of integrating billing documents with accounting software typically involves using APIs or other data syncing mechanisms. These tools allow your financial systems to “talk” to one another, ensuring that data flows seamlessly between them. The following table outlines a basic flow of information between the two systems:

Action Accounting Tool Outcome Generate a billing document Automatically updates sales records in accounting software Receive payment Payment status is reflected in both systems in real time Track outstanding balances Accounting tool shows up-to-date accounts receivable reports By linking your billing system with accounting software, you enhance both operational efficiency and financial oversight, making it easier to manage your business finances.

Ensuring Clarity and Professionalism

When managing financial documents, ensuring clarity and professionalism is essential for building trust with clients and avoiding confusion. A well-structured document reflects positively on your business, providing all necessary information in a clear, easy-to-read format. Achieving this requires a balance between including all relevant details and maintaining a clean, professional layout. This approach not only helps clients understand the charges but also encourages timely payments.

Key Elements for Clarity

To maintain clarity, your document should have the following components:

- Clear Titles and Headings: Use descriptive titles and section headings to break down the document into easily navigable parts.

- Simple Language: Avoid jargon and overly complex terms. Clear and straightforward language helps ensure the reader easily understands the information.

- Readable Layout: Make use of bullet points, consistent fonts, and sufficient white space to improve readability and make the document visually appealing.

- Itemized List: Clearly list all services or products with descriptions and prices, so there are no misunderstandings about what is being charged.

Maintaining Professionalism

Professionalism in your documents helps you build credibility and strengthens the relationship with your clients. Here are a few tips to ensure a professional presentation:

- Branding: Include your company’s logo, color scheme, and contact information to maintain consistency with your brand’s image.

- Consistent Formatting: Ensure that fonts, colors, and overall style remain consistent throughout the document, reflecting a polished and cohesive appearance.

- Accurate Information: Double-check that all details are correct, including dates, charges, and client information. Errors can undermine your professionalism and lead to confusion.

By focusing on clarity and professionalism, you can ensure that your documents are not only functional but also leave a lasting positive impression on your clients.

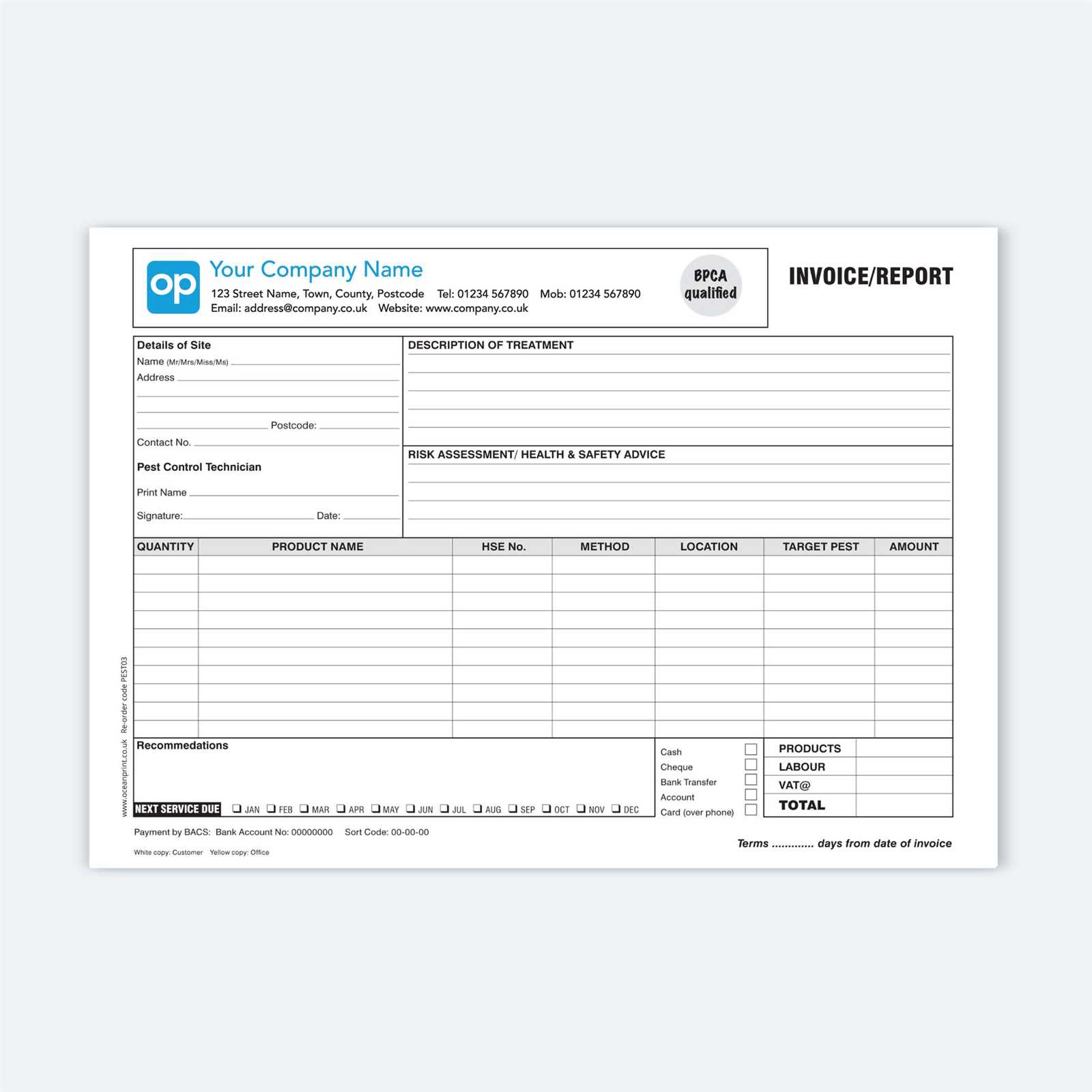

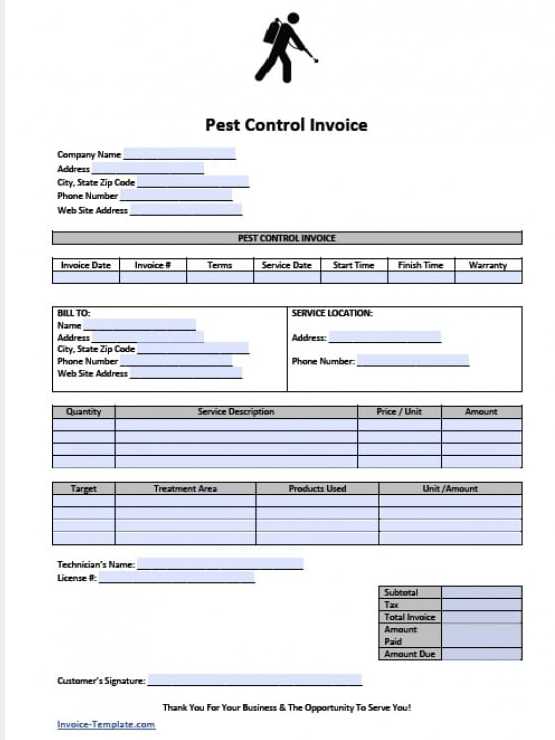

Templates for Different Pest Control Services

When providing various services, it’s essential to tailor the documents you issue to meet the specific needs of each type of job. Different types of work often require different formats to effectively communicate all relevant details to your clients. Whether you’re dealing with a one-time treatment or a recurring service, having the right structure ensures clarity and helps both parties stay organized. In this section, we will explore the different formats for various services and what should be included in each document.

1. One-Time Service Visits: For a single visit, the document should focus on detailing the service performed, the materials used, and the cost. It’s important to provide a concise breakdown of all charges and services so that the client can easily verify the details. This format tends to be more straightforward, emphasizing transparency in pricing and service description.

2. Recurring Service Agreements: For ongoing services, such as regular maintenance or treatment, the document should reflect the terms of the contract. This might include a fixed monthly or annual cost, along with details of the services provided during each visit. You should also include the agreed-upon frequency of visits and any conditions or additional fees that may apply based on specific circumstances.

3. Emergency or Special Treatments: If you are providing specialized or emergency services, it is crucial to outline the unique aspects of the service, including any urgent procedures, special equipment, or additional charges for after-hours work. These types of services often come with a higher cost, and clearly communicating this to your clients ensures that expectations are managed.

4. Consultation Services: If your work includes consulting, such as property inspections or advice for prevention, the document should outline the time spent, the scope of the consultation, and any recommendations made. Including clear notes on follow-up services, if applicable, can also add value and demonstrate professionalism.

By customizing your documents for each type of service, you not only improve communication with your clients but also streamline your business operations. A clear and well-organized document tailored to the specific service helps to avoid misunderstandings and enhances customer satisfaction.

Where to Find Free Templates

If you’re looking for ready-made formats to use for documenting your services, there are many free resources available online. These documents can save you time and help maintain a professional appearance when dealing with clients. In this section, we’ll explore where you can find free formats and what you should look for when selecting one.

1. Online Platforms

There are numerous websites that offer free downloadable formats for various needs. These platforms often provide customizable documents, making it easier for you to adapt them to your specific services.

- Google Docs: Offers a variety of free, editable documents that you can easily customize online and share with clients.

- Microsoft Office Templates: If you use Microsoft Word or Excel, the Office website offers a wide range of free formats, many of which are suitable for different types of services.

- Template Websites: Sites like Canva and Template.net provide free options with the ability to personalize the layout and content according to your preferences.

2. Specialized Service Providers

Some companies that offer service-related tools may also provide free formats. These can often be tailored to meet industry-specific requirements. Check out the following:

- Accounting Software Providers: Many accounting software platforms offer free versions with basic document generation capabilities, including documents for service businesses.

- Industry-Specific Websites: Certain websites dedicated to the service industry offer free formats that are designed specifically for service providers, ensuring you meet all necessary standards.

When searching for a free document, ensure it meets your business needs and can be easily customized. Look for options that allow you to add your branding, update pricing, and modify service details with ease. Free resources can be a great starting point to streamline your administrative tasks, without needing to invest in expensive software or services.