Invoice Discounting Agreement Template for Business Financing

In the world of business finance, companies often rely on various funding methods to maintain cash flow and support operations. One such method involves leveraging outstanding invoices as collateral to secure immediate working capital. This approach allows businesses to access funds quickly without waiting for customers to pay their bills in full.

To formalize this process, a written contract is essential. This document outlines the terms and conditions under which businesses can access these funds, ensuring both parties understand their responsibilities and rights. Such contracts help prevent misunderstandings and provide a clear framework for the financing arrangement.

Businesses typically tailor these agreements to suit their specific needs, adjusting elements such as repayment schedules, fees, and penalties. A well-structured contract is crucial for both the borrower and the lender to ensure smooth operations and mitigate risks associated with the transaction.

What is Invoice Discounting Agreement

In business financing, certain arrangements allow companies to unlock the value of their unpaid bills to quickly access funds. This method is often used to address cash flow issues, especially when a business needs immediate liquidity but does not want to wait for customer payments. By leveraging receivables, companies can secure a portion of the owed amount from a financial institution.

How the Process Works

Through this arrangement, businesses can receive a significant upfront amount, typically a percentage of the outstanding sums, from a lender or financial partner. In return, the company agrees to repay the lender once the customer clears the debts. The funds provided are usually less than the full owed amount, with the difference covering the financial institution’s fees and interests.

Benefits for Companies

This method of financing offers quick access to cash, which can help businesses cover operational expenses without waiting for the typical payment cycles. It allows for smoother operations, even during times when income may be delayed. However, it also comes with certain terms that need to be understood before committing to such an arrangement.

Understanding the Basics of Invoice Discounting

At its core, this financing strategy allows businesses to access funds based on their outstanding receivables. Instead of waiting for customers to pay off their balances, companies can receive an immediate cash injection, which can be crucial for maintaining day-to-day operations. This approach provides the flexibility to cover expenses without waiting for lengthy payment cycles.

How It Works

Typically, a business will work with a financial institution or lender who provides a certain percentage of the value of the unpaid amounts. Once the customers settle their outstanding debts, the remaining portion of the payment, minus any fees or interest, is returned to the business. The lender takes on the risk of not receiving payment, while the business gets the capital it needs more quickly.

Key Factors to Consider

Before entering into such an arrangement, businesses need to consider the costs involved, including any fees or interest rates charged by the financial institution. Additionally, it’s important to fully understand the terms regarding repayment, as these can vary depending on the lender and the specifics of the business relationship.

Key Components of the Agreement

When entering into a financing arrangement based on outstanding debts, several essential elements need to be clearly defined to ensure a smooth transaction for both the business and the lender. These components outline the terms under which funds are provided and the conditions that must be met for repayment.

Primary Elements to Include

- Advance Rate: The percentage of the outstanding debts the business will receive upfront. This is typically a major factor in determining the terms of the financing.

- Repayment Terms: The conditions under which the lender will be repaid, including when and how the remaining balance is settled.

- Fees and Charges: Any fees associated with the transaction, such as interest rates, administration costs, or other charges that may apply.

- Duration: The length of time for which the financing will remain in effect and the repayment schedule.

- Obligations of Both Parties: The responsibilities of both the business and the lender, including any actions the business must take to ensure timely repayment and what the lender’s role entails.

Other Important Considerations

- Collateral and Risk: A detailed explanation of how risk is managed, especially if payments are not received from the customers.

- Dispute Resolution: The procedure to follow in case of disagreements or defaults during the term of the arrangement.

- Exit Clauses: Conditions under which either party can terminate the agreement before its completion, and any penalties or costs associated with early termination.

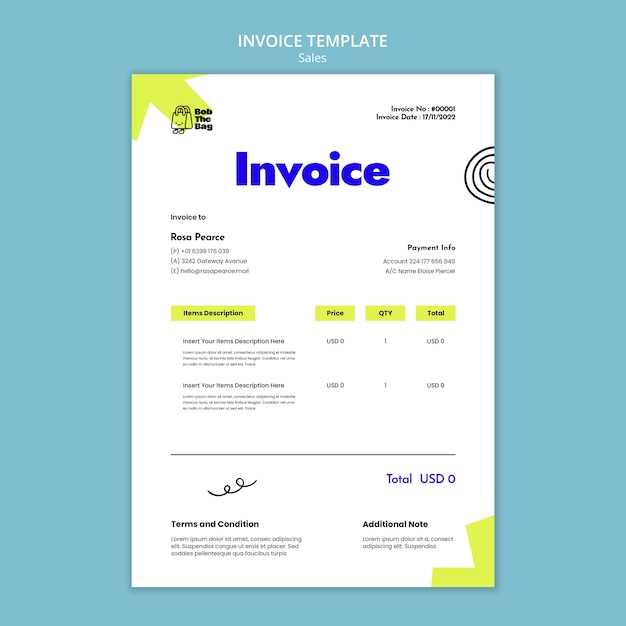

What Should Be Included in the Template

When creating a document for securing funds based on unpaid debts, it is essential to include several key details to ensure clarity and protection for both parties. These details help outline the terms of the arrangement, the expectations for repayment, and the responsibilities of both the business and the lender. A comprehensive document ensures that all elements of the transaction are understood and agreed upon before any funds are provided.

Essential Information to Include

- Amount and Percentage: Specify the total value of receivables and the percentage that will be advanced to the business upfront.

- Payment Terms: Clearly define the repayment schedule, including when the remaining balance will be settled and any interest or fees applied.

- Risk Management: Outline the responsibilities regarding non-payment, including who bears the risk if customers fail to settle their debts.

- Fees and Costs: List all fees associated with the funding, such as service charges, interest rates, or any additional administrative costs.

- Duration of the Arrangement: Specify the length of time the agreement will remain in effect, including renewal terms if applicable.

Additional Clauses to Consider

- Dispute Resolution: Establish a clear process for resolving disagreements that may arise between the two parties.

- Exit Strategy: Include terms for early termination of the arrangement, outlining any penalties or requirements for ending the contract prematurely.

- Legal Compliance: Ensure that the document complies with relevant laws and regulations to protect both parties from future legal issues.

Advantages of Using Invoice Discounting

Leveraging outstanding receivables as a form of business financing offers numerous benefits, especially when a company needs quick access to cash without the delays of traditional lending. This method allows businesses to access immediate funds based on their existing sales, providing them with the liquidity required to keep operations running smoothly.

Improved Cash Flow

One of the most significant advantages is the immediate improvement in cash flow. Businesses no longer have to wait for customers to pay their outstanding balances, which can often take weeks or even months. By securing funds upfront, companies can meet operational expenses, pay suppliers, or invest in growth opportunities without the financial strain caused by waiting for receivables to be cleared.

Flexible Financing Options

This financing method offers a flexible solution to businesses of all sizes. Unlike traditional loans that often require long-term commitments or assets as collateral, this approach is based on the value of current sales. As the business grows and generates more invoices, the amount of available funding also increases, providing a scalable way to meet evolving financial needs.

Why Businesses Prefer Invoice Discounting

Many businesses choose to secure funding based on their outstanding receivables due to the speed and flexibility this option provides. Instead of relying on lengthy loan approval processes or waiting for customers to make payments, companies can access cash quickly to address immediate financial needs. This method allows them to maintain smooth operations and avoid disruptions caused by cash flow delays.

Quick Access to Working Capital

One of the primary reasons businesses prefer this method is the rapid access to capital. Traditional loans can take weeks or even months to secure, and often require detailed documentation and credit checks. With receivables-based financing, companies can receive a significant portion of the owed amount within days, helping them manage short-term financial gaps without the wait.

Maintains Control and Flexibility

Unlike other financing options that may require businesses to relinquish control or take on long-term debt obligations, this method allows companies to maintain their independence. The terms are often flexible, with the business being able to adjust repayment schedules as needed. Additionally, there is no need for the business to give up equity or assets, which makes this approach particularly appealing for many entrepreneurs and small businesses.

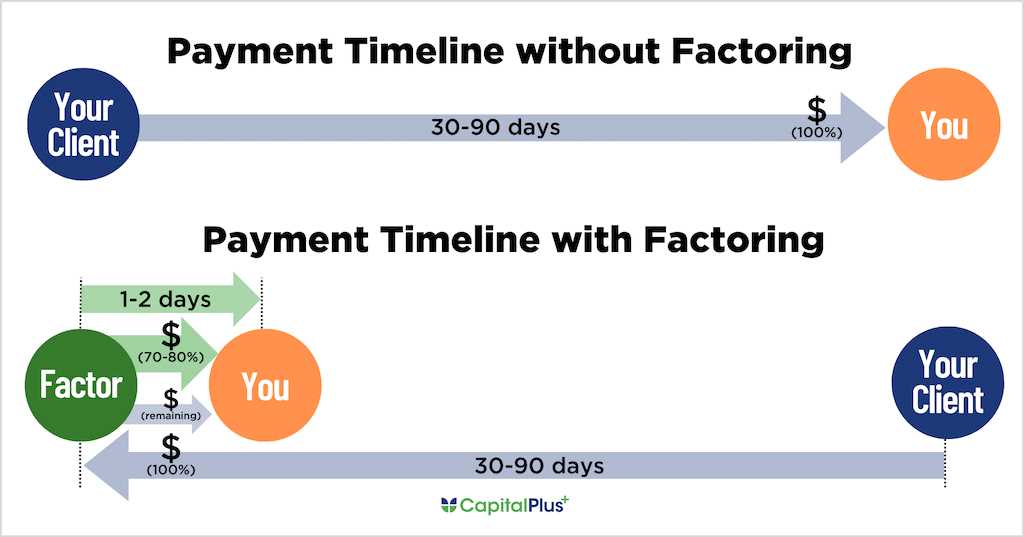

How Invoice Discounting Works

This financing method allows businesses to unlock the value of their unpaid invoices in exchange for immediate cash. Instead of waiting for customers to settle their outstanding bills, companies can secure a portion of those amounts from a financial institution or lender. Here’s an overview of how the process typically works:

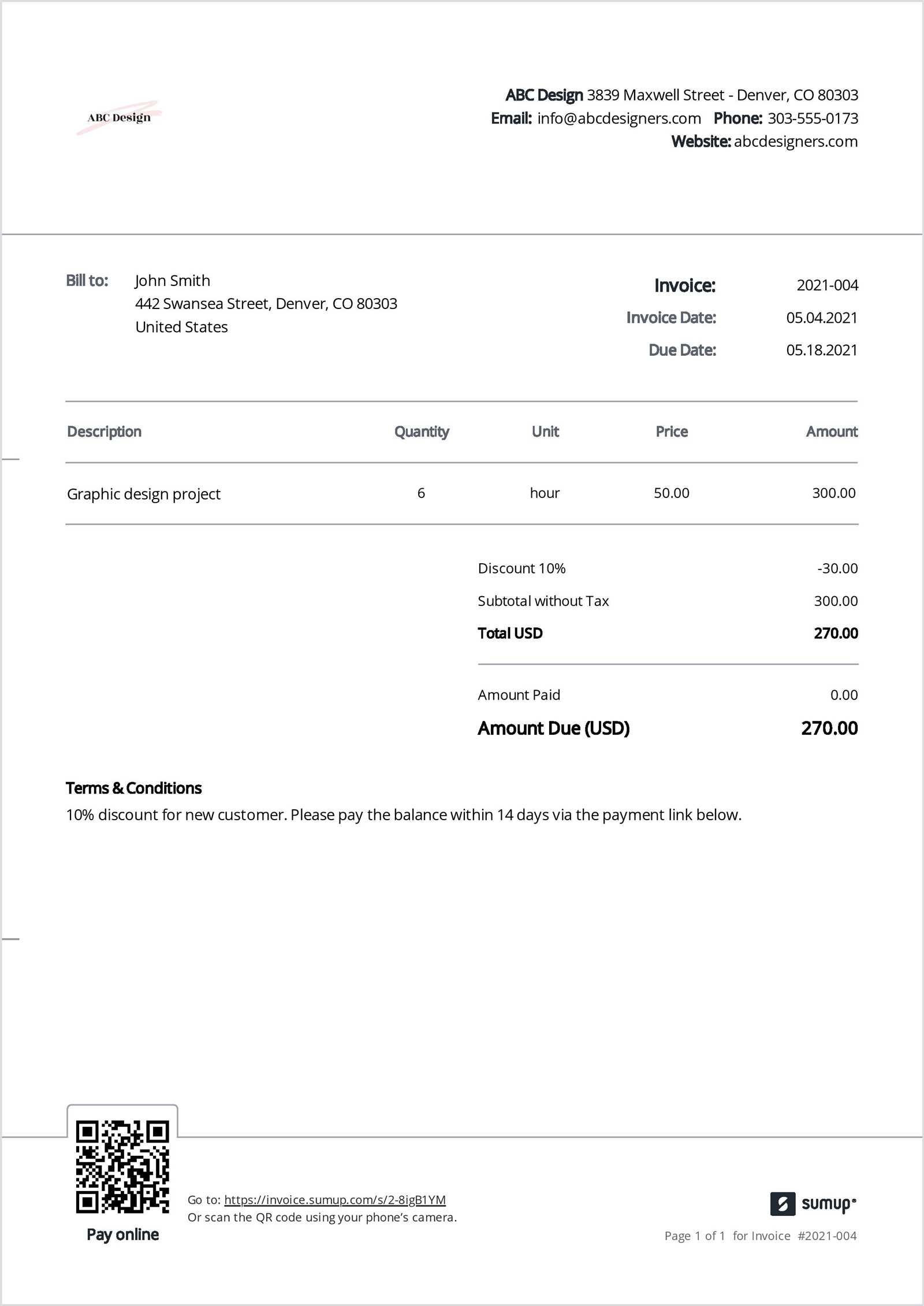

Step-by-Step Process

- Business Issues Invoices: The company provides goods or services to its customers and issues invoices with a payment term (e.g., 30, 60, or 90 days).

- Request for Funds: The business contacts a lender or financial partner, providing details of the invoices it wants to use for funding.

- Evaluation: The lender reviews the outstanding invoices and determines the amount of funding they are willing to provide. This is typically a percentage of the total value of the invoices.

- Funds Are Released: Upon approval, the business receives an upfront payment from the lender, usually between 70% and 90% of the value of the invoices.

- Customer Payments: When customers pay their outstanding debts, the business forwards the payments to the lender.

- Final Settlement: Once the lender receives the full payment, the remaining balance (minus fees and interest) is returned to the business.

Key Points to Remember

- The upfront payment is typically a percentage of the invoice amount, not the full value.

- The lender charges fees, which are often based on the outstanding balance and the length of time the business takes to repay.

- Repayment is made once the customer settles the invoice, and the business typically receives the remaining balance minus fees.

Step-by-Step Process for Businesses

For businesses looking to secure immediate funding based on their outstanding receivables, the process is straightforward. By following a clear set of steps, companies can quickly access the capital they need to maintain smooth operations without waiting for customer payments. Below is a detailed outline of the typical procedure.

Detailed Steps for Businesses

- Prepare Documentation: The business gathers all relevant documents, including a list of outstanding invoices or sales agreements with payment terms.

- Select a Financial Partner: The company identifies a lender or financing institution that specializes in receivables-based funding. This could be a bank, factoring company, or a specialized financing firm.

- Submit Receivables Information: The business submits the details of the unpaid invoices, including the customer names, amounts, and expected payment dates.

- Review and Approval: The lender assesses the creditworthiness of the customers and the value of the receivables. They then determine the percentage of the outstanding amount that can be advanced to the business.

- Receive Initial Payment: Upon approval, the business receives an upfront payment, typically between 70% and 90% of the total value of the receivables.

- Customer Payments: The business continues to manage customer relationships, and customers make payments directly to the lender or financial institution.

- Final Balance Settlement: Once the lender receives the full payment from the customer, they release the remaining balance, minus any applicable fees or interest.

Things to Keep in Mind

- The advance received from the lender is a percentage of the total outstanding amounts, not the full value.

- Additional costs such as fees and interest will be deducted from the remaining balance.

- Businesses must ensure that the payment terms with customers align with the lender’s requirements.

Common Terms in the Agreement

When engaging in a financial arrangement based on receivables, there are several standard terms that both parties should be familiar with. These terms outline the conditions of the transaction, helping ensure transparency and mutual understanding. Below are some of the most common terms found in such contracts.

Key Terms to Understand

| Term | Description |

|---|---|

| Advance Rate | The percentage of the outstanding amounts that the business will receive upfront, usually ranging from 70% to 90% of the value of the receivables. |

| Repayment Terms | Details about when and how the business will pay back the amount borrowed, typically after customers settle their debts. |

| Fee Structure | The costs associated with the financing arrangement, including service fees, interest rates, or any additional charges imposed by the lender. |

| Duration | The time period for which the financial arrangement will remain active, including renewal terms if applicable. |

| Collateral | Any additional assets or guarantees required by the lender as security for the financing, if applicable. |

| Risk Allocation | The section detailing who is responsible for any non-payment or customer defaults on the receivables. |

Additional Clauses to Be Aware Of

- Early Termination: This clause specifies any penalties or procedures for ending the arrangement before the agreed duration.

- Dispute Resolution: This outlines the method for resolving disagreements between the business and the lender, often through arbitration or mediation.

- Confidentiality: Ensures that sensitive financial information shared between the two parties remains confidential.

Essential Clauses to Look For

When entering into a financial arrangement based on unpaid receivables, it’s crucial to understand the key clauses that govern the terms of the deal. These clauses establish the rights, obligations, and expectations of both parties. Understanding them ensures that businesses can avoid potential pitfalls and protect their interests throughout the process.

Key Clauses to Review

| Clause | Explanation |

|---|---|

| Funding Limit | The maximum amount that can be borrowed against outstanding receivables. This clause will set the upper limit for financing based on the business’s receivables portfolio. |

| Repayment Schedule | Details how and when the business will repay the loan, typically aligning with when customers pay their outstanding invoices. |

| Interest Rates | Defines the cost of borrowing, typically expressed as an annual percentage rate. This clause specifies how interest is calculated and charged over time. |

| Fees and Charges | Outlines any additional fees, such as service fees, processing charges, or penalties for late payments, which can impact the total cost of the arrangement. |

| Default Clause | Describes the consequences if either party fails to meet their obligations, including potential penalties, termination of the arrangement, or legal actions. |

| Security Interests | Specifies any assets the business must pledge as collateral to secure the financing arrangement, protecting the lender in case of non-payment. |

Additional Considerations

- Transferability: Some agreements may allow the lender to transfer their rights to a third party, which can affect the business’s relationship with the lender.

- Customer Payment Terms: This clause may outline the terms under which customers are expected to make payments directly to the lender, impacting cash flow management.

- Dispute Resolution: This clause specifies how conflicts or disagreements between the parties will be resolved, often through arbitration or legal means.

Risks Involved in Invoice Discounting

While obtaining immediate funding by leveraging unpaid receivables offers several benefits, it also comes with inherent risks that businesses must consider. Understanding these risks is essential for making informed decisions and mitigating potential financial setbacks. Below are some of the primary risks associated with this type of financial arrangement.

Key Risks to Be Aware Of

- Credit Risk: If customers fail to pay their outstanding debts or experience financial difficulties, the business may still be required to repay the borrowed funds, resulting in a financial strain.

- High Costs: The fees and interest rates associated with such arrangements can be significant, particularly if the business needs to extend the term or if the customers delay payments.

- Loss of Control: When funds are secured based on receivables, businesses may lose some control over their customer relationships, as the lender may have direct involvement in the collection process.

Other Considerations

- Reputation Risk: In some cases, customers may feel uncomfortable knowing that a third-party financial institution is involved in the collection process, potentially affecting the business’s relationship with its clients.

- Dependency on Customer Payments: The success of the arrangement is closely tied to the customers’ ability and willingness to settle their invoices promptly. Any delays or defaults can disrupt the business’s cash flow.

Potential Drawbacks to Consider

Although utilizing unpaid receivables for immediate funding can be an effective solution for some businesses, there are several potential drawbacks to keep in mind. These challenges may affect both the long-term financial health and operational efficiency of the company. Understanding these drawbacks can help businesses make more informed decisions when considering this type of financial arrangement.

| Drawback | Description |

|---|---|

| High Cost of Financing | The costs associated with borrowing against receivables can be higher than traditional lending, as interest rates and fees are typically more expensive. |

| Dependence on Customer Payments | The success of the financing arrangement depends on timely payments from customers, which can be unpredictable and outside the business’s control. |

| Impact on Customer Relationships | Involving a third party in the collection process may strain relationships with clients, especially if they are uncomfortable with the lender’s involvement in managing their payments. |

| Limited Access to Full Funding | Most funding arrangements only provide access to a portion of the outstanding receivables, which may not meet the full financial needs of the business. |

| Potential for Overreliance | Regularly relying on this type of financing can lead to over-dependence, where a business might struggle with cash flow management and sustainable growth in the absence of the arrangement. |

How to Customize the Template

Customizing a financing document to suit the specific needs of your business is crucial for ensuring clarity and protecting both parties involved. Personalizing the content ensures that terms and conditions align with your business objectives and financial situation. The customization process involves several key areas to review and adjust according to your unique requirements.

Steps to Customize the Document

- Adjust Payment Terms: Modify the payment deadlines, late fees, and any other financial conditions based on your business’s cash flow needs and customer expectations.

- Specify the Repayment Schedule: Define clear timelines and installments, if applicable, to establish when payments will be due and in what amounts.

- Define Roles and Responsibilities: Ensure that the obligations of both parties, such as the responsibilities of the financing provider and the business, are clearly outlined.

- Include Confidentiality Clauses: Add any confidentiality terms to protect sensitive financial and customer data from being disclosed to third parties.

- Update Contact Information: Replace the default contact details with the specific names, addresses, and phone numbers of the involved parties.

Additional Considerations

- Review Legal Requirements: Ensure the document complies with local and international laws to avoid future legal complications.

- Consult with a Financial Expert: Have a financial expert or legal advisor review the document to ensure that all terms are properly structured and enforceable.

Modifying Terms for Your Business

Adapting the terms of a financing arrangement to better suit the specific needs of your business can improve cash flow and create a more efficient partnership with lenders. By modifying key clauses and conditions, you ensure that both the financial structure and the risks involved are aligned with your business objectives. This flexibility can provide a more tailored solution for your operational requirements.

Adjusting the Terms of Repayment is one of the most common modifications. Depending on the seasonality of your business or its unique cash flow cycles, you might want to extend the repayment periods, offer shorter terms, or adjust installment amounts. These changes can help better align with the financial realities of your business.

Setting Interest Rates and Fees is another crucial aspect to consider. Depending on the risk associated with the receivables and the creditworthiness of the clients involved, the interest rates can be modified. Lower fees or more favorable rates can reduce the overall cost of financing, making it more attractive for your company.

Clarifying Default Clauses is essential to protect your business. Modifying the conditions under which the agreement can be considered in default and specifying the actions that will be taken in such cases can provide more security for your organization. Clear and realistic default terms can reduce uncertainty and help in managing unforeseen financial setbacks.

By adjusting these and other terms, your business can create a more flexible and manageable financing structure that supports long-term growth while minimizing risk.

Legal Considerations for the Agreement

When entering into a financial arrangement with a lender, there are several legal factors that should be taken into account to ensure that both parties are protected and the terms are enforceable. Understanding these legal considerations can help prevent future disputes and provide clarity on the responsibilities of each party involved. It is important to address all relevant legal requirements when drafting or modifying these financial contracts.

Here are some key legal aspects to consider when finalizing the terms of such an arrangement:

| Legal Factor | Consideration |

|---|---|

| Jurisdiction | The governing law of the contract should be clearly defined to ensure that any disputes are resolved within the appropriate legal framework. |

| Confidentiality | It is crucial to include clauses that protect the confidentiality of sensitive information shared between the business and the financing provider. |

| Default Clauses | Clearly define the circumstances under which the agreement may be considered in default, including late payments and non-compliance with the agreed terms. |

| Termination Conditions | Establish conditions under which the contract can be terminated, ensuring that both parties understand their rights and obligations in case of early termination. |

| Dispute Resolution | Outline a clear process for resolving disputes, such as mediation or arbitration, to avoid lengthy and costly legal battles. |

It is essential to work with a legal professional when drafting or modifying such contracts to ensure compliance with applicable laws and to protect the interests of both parties. By addressing these legal factors, businesses can safeguard their operations and reduce the risk of misunderstandings or legal challenges in the future.

Ensuring Compliance with Regulations

In any financial arrangement, adherence to regulatory standards is crucial to ensure the legitimacy and smooth operation of the transaction. Regulatory compliance not only protects businesses from legal penalties but also builds trust between lenders and borrowers. A thorough understanding of the laws and regulations governing these types of transactions is essential for avoiding potential pitfalls.

Here are some important compliance aspects to consider when structuring these financial transactions:

| Compliance Aspect | Considerations |

|---|---|

| Financial Regulations | Ensure that all actions comply with financial industry standards, including regulations on lending, repayment terms, and interest rates. |

| Consumer Protection Laws | Check if consumer protection laws apply to the transaction, particularly if the client is a consumer or if the transaction involves vulnerable parties. |

| Data Privacy | Adhere to data protection regulations, such as GDPR, ensuring that sensitive customer and financial information is securely handled and stored. |

| Tax Compliance | Make sure that tax obligations, including applicable sales tax or VAT, are considered when structuring the terms of the deal. |

| Anti-Money Laundering | Follow anti-money laundering (AML) laws to ensure that the transaction is not used for illegal purposes, such as money laundering or fraud. |

By closely following these regulatory guidelines, businesses can avoid legal complications and ensure that the transaction process remains transparent, secure, and compliant with the law. Working with a legal professional or compliance expert can help to further safeguard the process and ensure adherence to the appropriate regulations.

Choosing the Right Financial Partner

When engaging in a financial arrangement that involves the sale or funding of receivables, selecting the right partner is key to ensuring a smooth and beneficial process. A reliable partner can offer flexibility, financial stability, and transparency, making the entire transaction more efficient and secure. It’s crucial to assess various factors before entering into such a relationship to ensure that the chosen provider aligns with your business goals and financial needs.

Key Factors to Consider

When evaluating potential partners for these financial services, here are some essential criteria to keep in mind:

- Reputation and Trustworthiness: Choose a provider with a solid reputation in the market. Look for reviews, testimonials, and case studies from other businesses to gauge their reliability.

- Terms and Fees: Understand the financial terms, including any fees, interest rates, or hidden costs. Make sure the provider’s terms align with your business’s cash flow needs.

- Speed of Processing: Timeliness is critical in financial transactions. Evaluate how quickly the partner can process and provide funding against receivables.

- Customer Service and Support: A good partner should offer excellent customer service. Ensure they are accessible, responsive, and capable of providing support throughout the process.

- Transparency: Look for clarity in all aspects of the process. The partner should be upfront about all terms, conditions, and fees with no hidden surprises.

Building a Long-Term Relationship

Finding the right financial partner isn’t just about immediate benefits; it’s about establishing a long-term, mutually beneficial relationship. By selecting a provider that understands your business needs and aligns with your financial strategy, you can create a lasting partnership that supports your business’s growth and success.

What to Look for in Lenders

When seeking financial assistance through receivable-based lending, choosing the right lender is crucial for securing favorable terms and ensuring smooth cash flow management. The right lender not only offers competitive rates but also supports your business in achieving its financial objectives. It’s essential to thoroughly assess several key factors before committing to any lending relationship to ensure it aligns with your company’s needs.

Reputation and Track Record: The lender’s reputation is a critical aspect to consider. Look for lenders with a proven track record of trustworthiness and reliability. This can be gauged through online reviews, recommendations from peers, and industry ratings. A reputable lender will demonstrate a history of providing transparent and consistent services.

Flexible Terms: Flexibility in repayment terms, loan amount, and the speed of funding are essential components. Your chosen lender should offer terms that accommodate your business’s financial cycles. A flexible repayment plan can ensure that your business is not burdened with rigid deadlines that might not fit its cash flow.

Competitive Interest Rates: While rates may vary depending on the lender, it’s important to shop around and compare offers. A lender that offers competitive rates can save your business substantial amounts in the long run. Be cautious of lenders who offer deceptively low rates but charge hidden fees that make the deal less favorable.

Transparency in Fees and Charges: Clear communication regarding all fees and charges is vital. A trustworthy lender should be upfront about any costs associated with the loan. Ensure you understand the full breakdown of fees, including any potential late payment penalties or administrative costs, to avoid unexpected surprises down the road.

Customer Support: Exceptional customer service can make a significant difference in your experience with a lender. Ensure that the lender provides responsive and knowledgeable support, particularly during critical moments such as the loan application process, repayment periods, and any potential challenges that may arise.