Sample QuickBooks Invoice Template for Streamlined Billing

Managing client payments and ensuring timely transactions is crucial for maintaining a smooth workflow in any business. Having a streamlined approach to creating billing documents can save time and reduce errors. Whether you’re handling one-time projects or ongoing services, it’s important to use a structured format that meets both your needs and your clients’ expectations.

Customizable billing documents allow for flexibility in presenting charges, adding payment terms, and tracking outstanding balances. With the right tools, you can easily create professional documents that help reinforce your brand identity while keeping financial records organized. This method not only simplifies the billing process but also improves cash flow management.

By using a well-designed document structure, businesses can enhance client communication and reduce the chance of discrepancies. In the following sections, we will explore various ways to make your billing process more efficient, with options to tailor documents to suit your specific requirements.

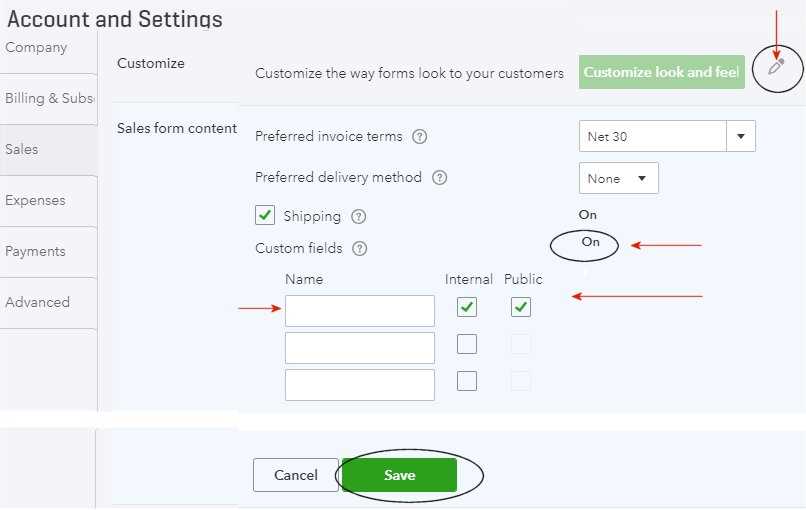

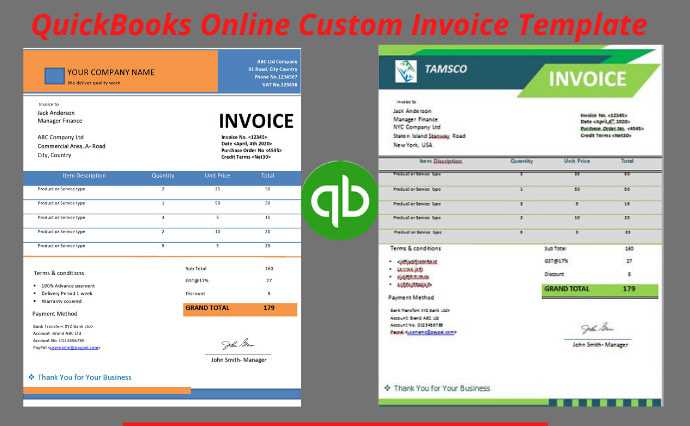

How to Customize Your QuickBooks Invoice

Customizing your billing documents allows you to create professional and consistent statements that reflect your business’s identity. A personalized format ensures that all necessary information is clearly presented, while also offering flexibility to match the unique needs of your clients and services. Tailoring your documents makes the payment process more seamless for both you and your customers.

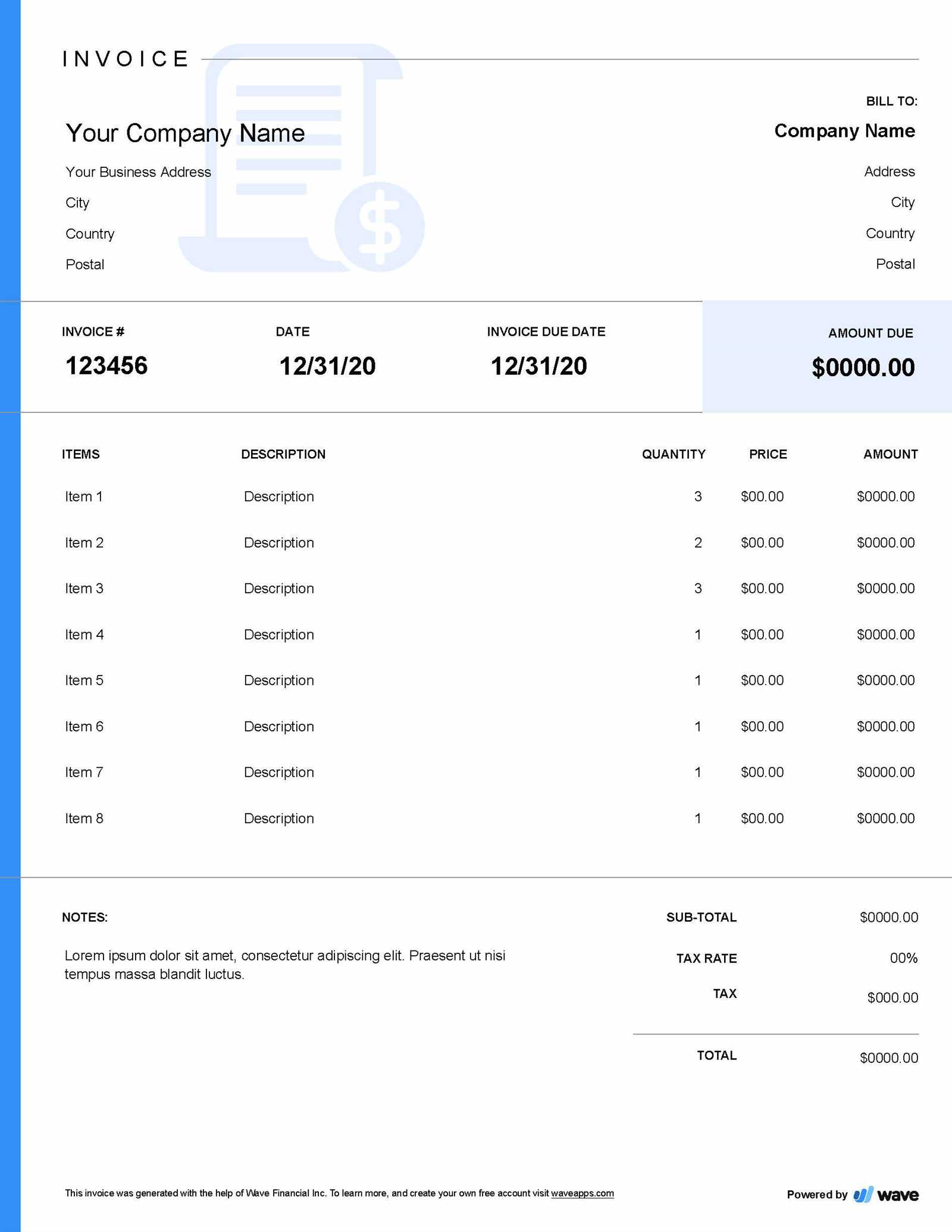

To begin customizing, start by adjusting the layout to include relevant fields such as your business name, logo, contact details, and payment terms. You can also modify the design elements, like fonts, colors, and placement, to align with your brand. This ensures that the documents you send out appear polished and trustworthy.

Additionally, consider incorporating essential components such as a clear breakdown of charges, applicable taxes, and due dates. By organizing this information effectively, you can help clients easily understand the amounts due, which in turn can improve payment timeliness. Adjusting these aspects of your documents ensures they not only look professional but also serve as effective communication tools.

Why Use a QuickBooks Invoice Template

Using a pre-designed document structure for billing can significantly streamline your administrative tasks. It allows businesses to maintain consistency in their financial communications while reducing the time spent on creating documents from scratch. By adopting a standardized format, you ensure that all relevant information is included, organized, and presented clearly every time.

Such structured formats help prevent common errors, such as missing details or incorrect calculations, ensuring that your clients receive accurate and professional-looking statements. This consistency not only boosts your credibility but also minimizes the chances of disputes or confusion over charges.

Moreover, these ready-made layouts save valuable time, enabling you to focus on other important business operations. Customizing the layout further allows it to reflect your business’s branding, enhancing the professional appearance of your financial documents. This makes the entire process more efficient and user-friendly for both you and your clients.

Essential Features of QuickBooks Invoices

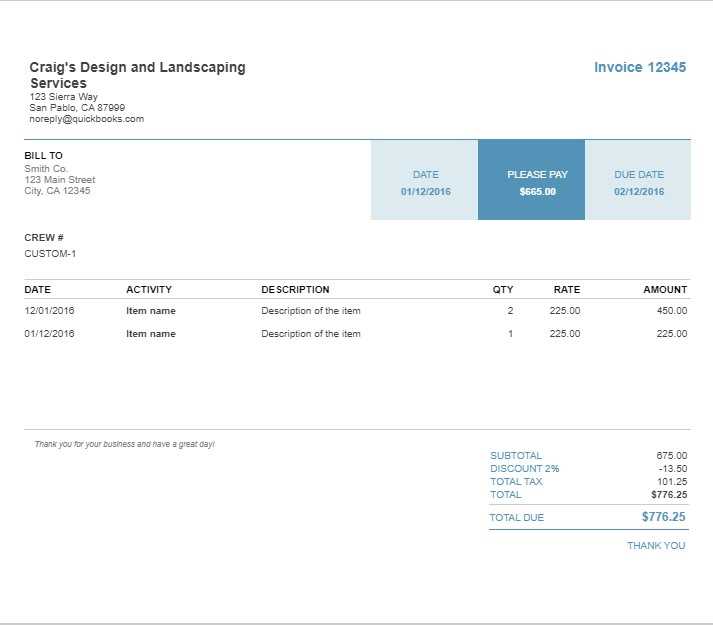

When creating billing documents, it’s crucial to include key elements that ensure clarity, accuracy, and professionalism. These features help both businesses and clients stay on the same page regarding services rendered, payment terms, and outstanding amounts. A well-structured document not only reflects your business’s professionalism but also streamlines the financial transaction process.

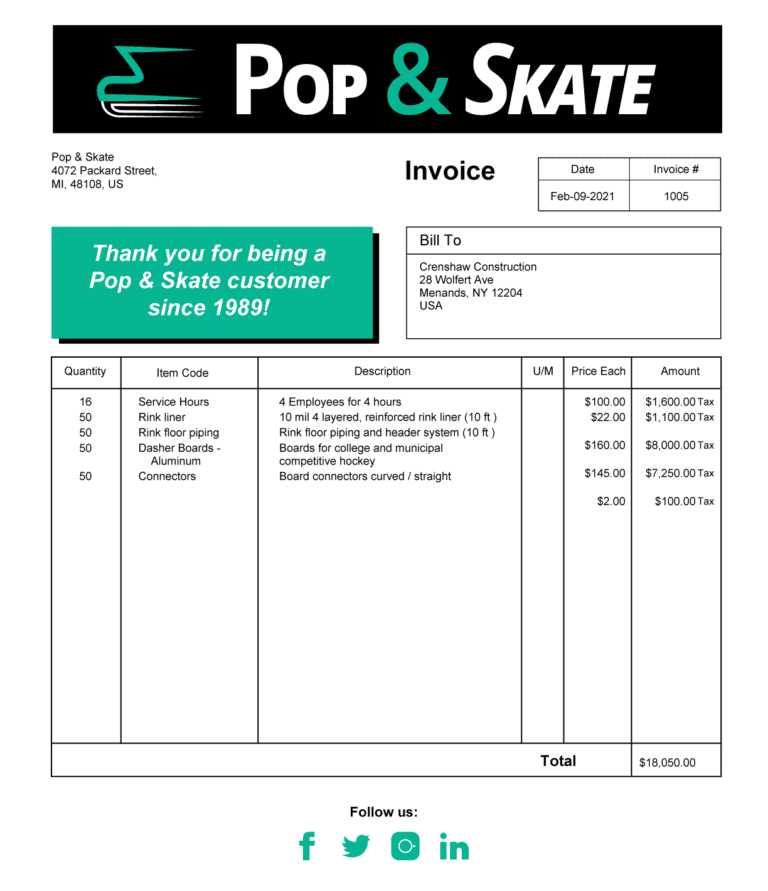

Clear Breakdown of Charges

A detailed list of services or products, along with their corresponding prices, is vital for transparency. This breakdown helps clients easily understand what they are being billed for and prevents confusion or disputes later on. Including quantities, unit prices, and totals for each item ensures all charges are clearly communicated.

Payment Terms and Due Dates

Another essential feature is the inclusion of payment terms and due dates. This sets clear expectations for when payment is due and what methods of payment are acceptable. Whether you offer early payment discounts or have specific late fee policies, outlining these terms upfront helps prevent delays and ensures timely payments.

Creating Professional Invoices in QuickBooks

Generating polished and professional billing documents is essential for maintaining a positive relationship with clients. A well-crafted statement not only communicates your business’s credibility but also helps to ensure timely payments. By using the right structure and design, you can create clear and visually appealing documents that represent your brand while outlining important financial details.

Key Elements of a Professional Billing Document

To create effective and professional statements, make sure to include the following elements:

- Your Business Information: Include your name, address, phone number, and email for easy contact.

- Client Information: Clearly list your client’s name, address, and any relevant contact details.

- Itemized List of Services/Products: Include a detailed list of all items or services provided, with prices and quantities.

- Payment Terms: Specify due dates, payment methods, and any applicable late fees or discounts.

- Taxes and Additional Fees: If applicable, clearly show any taxes or extra charges related to the sale.

Design and Layout Tips for Professional Appearance

Along with the essential elements, the design and layout of the billing document should be visually appealing. Here are some tips to make your statements look professional:

- Use a Clean Layout: Avoid clutter by organizing information into sections and using appropriate spacing.

- Incorporate Your Logo: A business logo adds a professional touch and reinforces your brand.

- Choose Readable Fonts: Opt for clear, easy-to-read fonts to ensure the document is accessible and legible.

By focusing on these elements, you can create statements that not only look professional but also reflect the quality of your services and products.

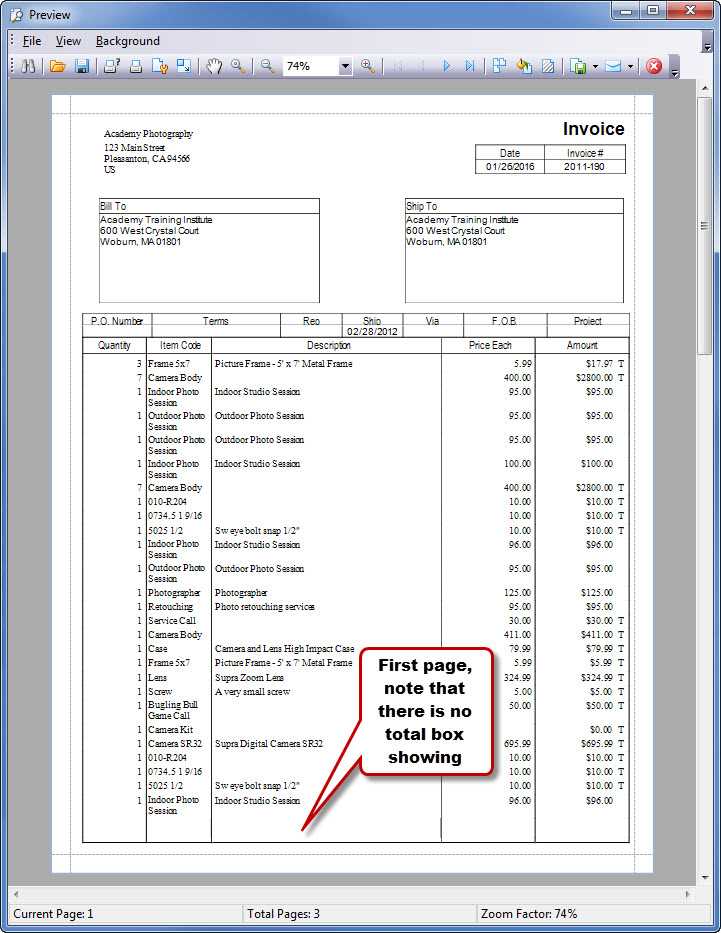

Best Practices for Invoice Formatting

Proper formatting is key to creating effective and professional billing documents. Clear and organized layouts not only make it easier for clients to read and understand the charges but also reflect the credibility and professionalism of your business. By following some best practices for organizing and presenting information, you can ensure that your statements are both functional and polished.

Key Guidelines for Effective Document Layout

When designing your billing documents, consider the following guidelines to ensure clarity and professionalism:

- Keep It Simple: Avoid overwhelming your client with too much information. Stick to the essentials, using clear headings and bullet points for easy navigation.

- Use Consistent Fonts: Choose legible, professional fonts and keep the style consistent throughout the document. This enhances readability and gives the document a polished look.

- Highlight Key Details: Use bold or larger fonts for important details like due dates, amounts, and your business contact information.

- Proper Alignment: Ensure all text is aligned properly to improve readability. For example, align the numbers in the itemized list and totals to the right.

How to Structure Billing Documents for Clarity

Organizing the content of your billing documents into clear sections is essential for both readability and functionality. Here’s how to structure the information:

- Business and Client Information: Place both your details and the client’s contact information at the top for easy reference.

- Itemized Charges: List each service or product separately, including descriptions, quantities, and prices. This transparency helps to avoid confusion.

- Summary Section: Include a summary of the total due, including taxes, discounts, and any applicable additional fees.

- Payment Instructions: Clearly state the payment terms and methods, ensuring that the client knows how and when to pay.

By applying these formatting best practices, you can create billing documents that are not only professional but also effective in communicating important information to your clients. This helps establish trust and improves payment efficiency.

Improving Efficiency with Invoice Templates

Streamlining the billing process can significantly enhance overall business efficiency. Using a pre-designed document structure allows you to generate consistent and accurate financial statements quickly, saving valuable time. By reducing the need to create each document from scratch, you can focus more on other essential tasks, improving productivity and ensuring faster payment cycles.

Benefits of Using Structured Billing Documents

Here are some key advantages of incorporating ready-made billing formats into your workflow:

- Time Savings: Automating the creation of billing documents allows you to process more transactions in less time.

- Consistency: Using a standardized format ensures that every document follows the same layout, reducing errors and confusion.

- Accuracy: Built-in calculations and clearly defined fields minimize the risk of mistakes in totals, taxes, and other details.

- Professionalism: A polished, uniform format strengthens your brand’s image and conveys a professional tone to clients.

How to Maximize the Use of Pre-Designed Billing Formats

To get the most out of ready-made formats, follow these tips to customize and adapt them to your needs:

- Personalize the Layout: Modify the design to include your business logo, colors, and fonts to create a unique and branded appearance.

- Set Up Recurring Documents: For regular clients or subscription-based services, set up automated billing cycles to reduce repetitive tasks.

- Integrate Payment Options: Include multiple payment methods and clear instructions to make it easier for clients to pay promptly.

By leveraging these pre-structured formats, businesses can significantly improve their efficiency, reduce administrative overhead, and ensure timely and accurate payments.

Common Mistakes in Invoice Creation

Creating accurate and clear billing documents is essential for maintaining a professional image and ensuring smooth financial transactions. However, certain errors often arise during the creation process, which can lead to confusion, delays in payment, or even disputes. Recognizing and addressing these common mistakes can help streamline the billing process and improve cash flow management.

Missing or Incomplete Information

One of the most common mistakes is omitting important details or leaving sections incomplete. This could include:

- Incorrect Contact Information: Failing to include accurate client details or your business contact information can delay communication and payment.

- Unclear Descriptions: Not providing sufficient details about the products or services being billed can lead to misunderstandings and delayed approvals.

- Omitting Payment Terms: Without clear payment instructions or due dates, clients may not know when to pay or what methods are accepted.

Formatting and Calculation Errors

Another area where mistakes commonly occur is in the formatting and calculation of charges. These errors can lead to confusion and make the billing process seem less professional:

- Math Errors: Simple calculation mistakes, such as incorrect totals or tax calculations, can undermine trust and delay payments.

- Unorganized Layout: Poorly structured documents, where information is hard to find or not aligned correctly, can confuse clients and make it difficult for them to review charges.

- Inconsistent Design: Using varying fonts, colors, or styles in different sections can make the document look unprofessional and less cohesive.

Avoiding these common pitfalls by double-checking details, using standardized formats, and maintaining consistency can help create clear, accurate, and professional documents that support smooth financial transactions.

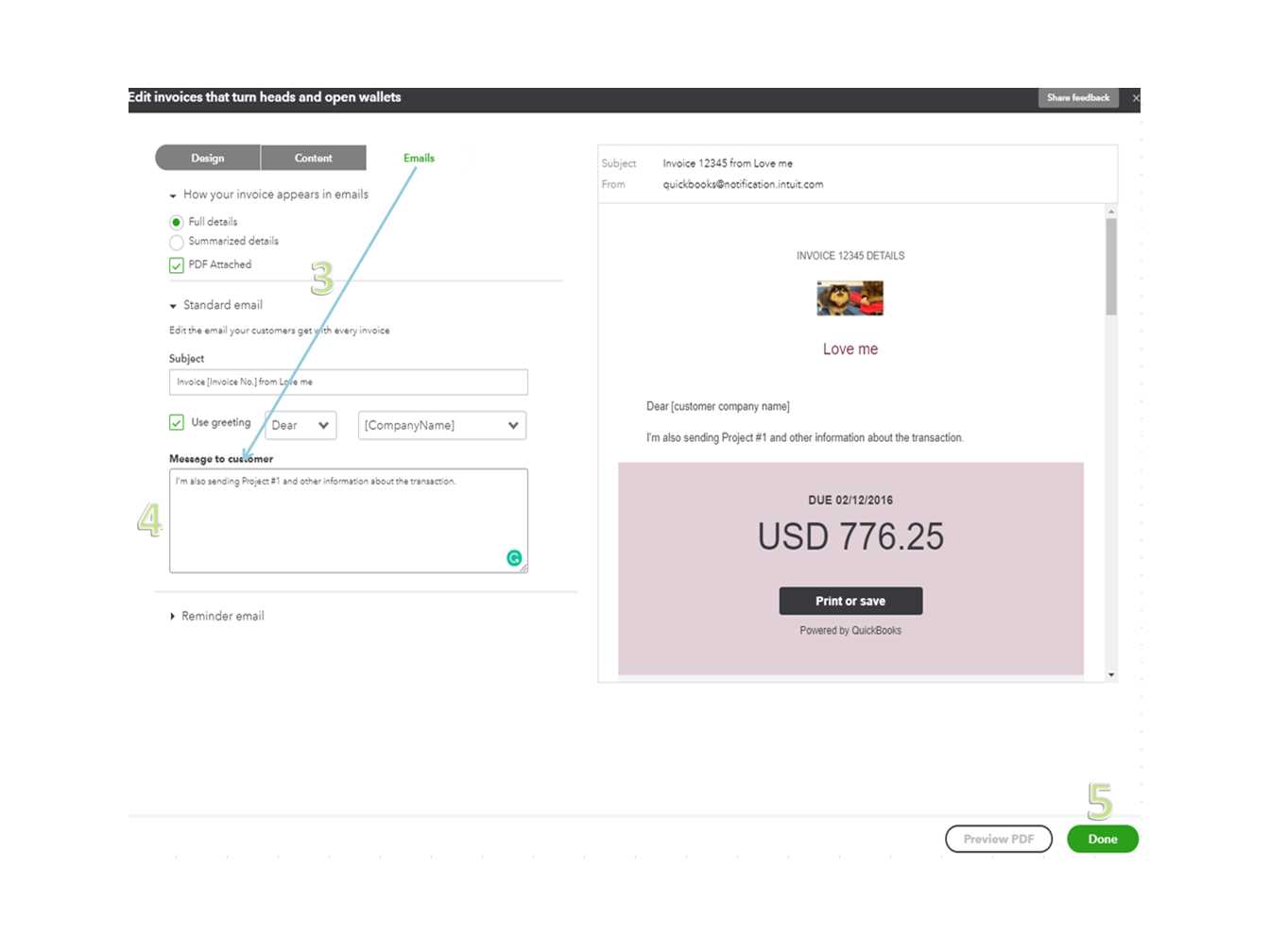

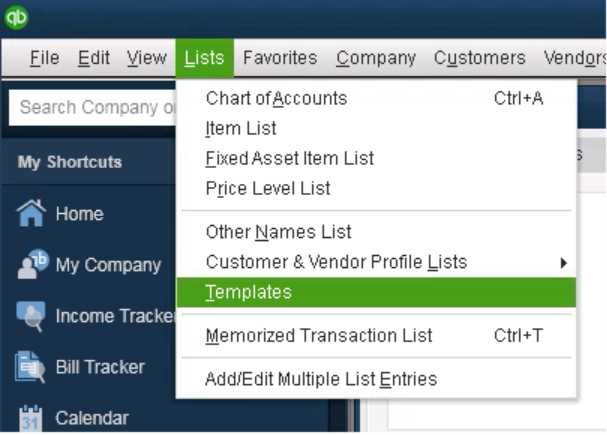

How to Add Your Logo to QuickBooks

Incorporating your business’s logo into your billing documents not only enhances their professional appearance but also reinforces your brand identity. Adding a logo to your documents is a simple process that can help establish a consistent and cohesive look, making your paperwork easily recognizable to clients. Here’s how to add your logo to your billing documents in a few easy steps.

Step-by-Step Guide to Adding a Logo

Follow these steps to add your logo to your billing documents:

| Step | Action |

|---|---|

| 1 | Open your document customization settings within the platform you are using for billing. |

| 2 | Navigate to the section where you can customize your document layout (often under ‘Settings’ or ‘Appearance’). |

| 3 | Select the option to add or upload a logo. You will be prompted to browse your computer for the file. |

| 4 | Upload your logo image file, ensuring that it is high resolution and formatted properly for display. |

| 5 | Adjust the size and position of your logo on the document to ensure it appears clear and well-placed. |

| 6 | Save the changes and preview your document to ensure the logo appears as expected. |

Additional Tips for Logo Placement

Here are a few tips to ensure your logo is placed effectively within your documents:

- Positioning: Place the logo in the header area of the document, usually at the top left or center, for maximum visibility.

- Size: Avoid making the logo too large or too small–ensure it’s proportional and doesn’t overpower the rest of the document.

- Format: Use a transparent PNG or high-quality JPEG to ensure your logo looks crisp and professional.

By following these simple steps, you can easily add your logo to your documents and ensure that your billing materials reflect your brand identity while maintaining a professional appearance.

Managing Payment Terms in QuickBooks

Properly managing payment conditions is essential for maintaining healthy cash flow and ensuring timely payments from clients. Setting clear terms regarding when payments are due, including any discounts or late fees, can help avoid confusion and ensure that your business is paid on time. This section outlines how to manage and customize payment terms to suit your business needs.

Steps to Set Payment Terms

Follow these steps to effectively manage payment terms for your clients:

| Step | Action |

|---|---|

| 1 | Navigate to the payment settings or terms section within your business management system. |

| 2 | Select the option to add or customize payment terms, such as the number of days after the billing date that payment is due. |

| 3 | Choose whether to offer discounts for early payments or charge additional fees for overdue payments. |

| 4 | Ensure that the terms are clear and easy to understand, specifying both the payment due date and any associated conditions. |

| 5 | Save your settings and apply them to your client accounts for automatic use in future billing cycles. |

Types of Payment Terms to Consider

Here are some commonly used payment conditions to include in your settings:

- Net 30: Payment is due within 30 days from the billing date. This is a standard term for many businesses.

- Early Payment Discount: Offering a percentage discount (e.g., 2% off) if the payment is made within a specific number of days, such as 10 days.

- Late Fees: Applying a fixed fee or percentage charge if the payment is not made by the due date.

- Deposit Requirement: Requesting a deposit upfront, particularly for large or custom projects.

By setting clear payment conditions and utilizing automated reminders, you can ensure smoother transactions and better cash flow management for your business.

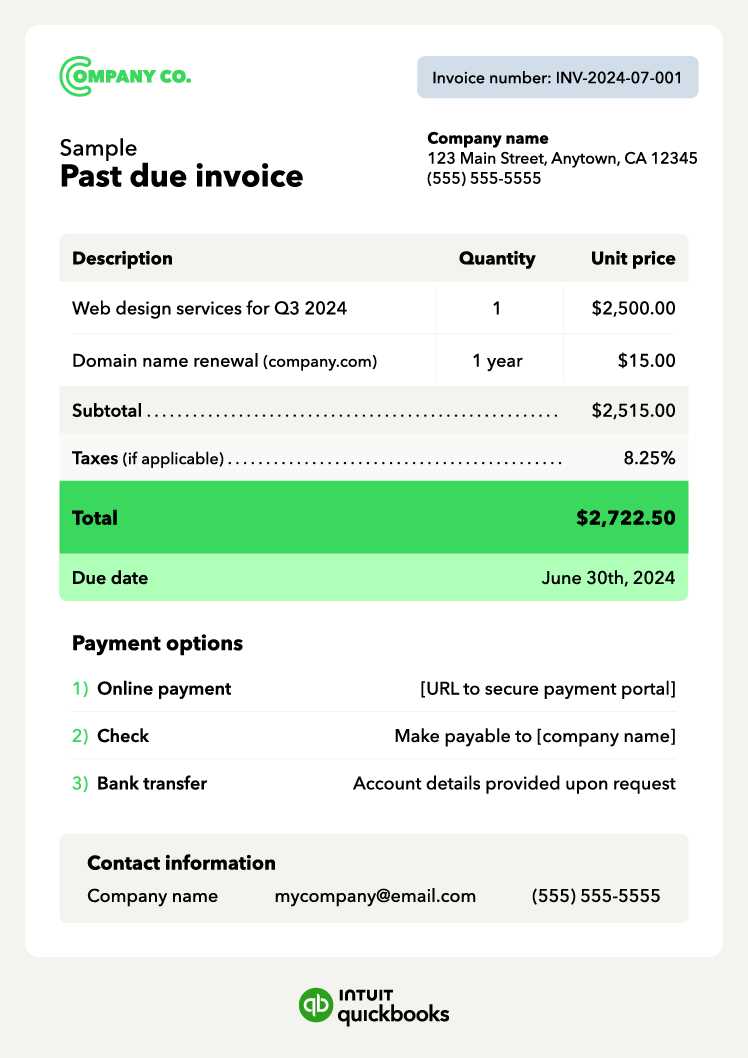

Integrating Taxes into Your Invoice Template

Including accurate tax information in your billing documents is essential for compliance and clarity. Properly accounting for taxes ensures your clients understand the full cost of the goods or services they are purchasing, while also ensuring that your business meets local tax regulations. This section outlines how to effectively incorporate taxes into your billing documents to avoid errors and provide transparent billing details.

Steps to Add Taxes to Your Billing Documents

Here’s how to integrate taxes into your documents:

| Step | Action |

|---|---|

| 1 | Go to the tax settings or configuration section in your business management platform. |

| 2 | Define the applicable tax rates based on your location and the type of products or services you offer. |

| 3 | Ensure that the tax is applied automatically to the relevant items on your billing documents, including any applicable discounts. |

| 4 | Adjust the tax settings for different regions or countries if you operate internationally or in multiple jurisdictions. |

| 5 | Preview the document to ensure that tax charges are clearly displayed with proper breakdowns, including subtotals, taxes, and the total amount due. |

Types of Taxes to Include

There are several types of taxes that may need to be integrated into your documents depending on your location and business type:

- Sales Tax: A tax on the sale of goods and services, typically calculated as a percentage of the sale price.

- Value Added Tax (VAT): Common in many countries outside the U.S., VAT is typically applied at each stage of production and distribution.

- Service Tax: A tax specifically on the services you provide, rather than physical products.

- Excise Tax: A tax applied to specific goods, such as alcohol or tobacco.

By following these steps and ensuring proper tax integration, you can maintain transparency, stay compliant, and reduce the risk of tax-related errors in your business operations.

Tracking Invoice Payments in QuickBooks

Effectively managing payment tracking is crucial for maintaining a healthy cash flow and ensuring that your business receives payments promptly. By monitoring payment statuses, you can easily identify which transactions are completed, which are pending, and which require follow-up. This section provides a comprehensive guide on how to track and manage the status of your payments seamlessly.

Steps to Track Payments

Follow these steps to monitor the status of your payments and ensure your financial records remain accurate:

- Step 1: Navigate to the section for payments or transactions in your business management system.

- Step 2: Locate the billing records or payment history for each client or customer.

- Step 3: Update the payment status to reflect whether the payment has been made, is pending, or is overdue.

- Step 4: Mark completed transactions as paid and apply any relevant payment methods, such as checks, bank transfers, or credit card payments.

- Step 5: Set up automated reminders for overdue payments and generate reports to track outstanding balances.

Useful Tools for Tracking Payments

In addition to manual tracking, there are several tools and features that can help streamline payment monitoring:

- Payment Status Indicators: Use color-coded indicators (e.g., green for paid, red for overdue) to easily spot which payments are still pending.

- Payment Notifications: Set up email alerts to notify you when a payment is received or when a payment is overdue.

- Automatic Payment Matching: Integrate your payment gateway to automatically match incoming payments with open balances, reducing the risk of errors.

- Detailed Reports: Generate comprehensive payment reports to view outstanding payments and track your business’s financial health.

By utilizing these strategies and tools, you can easily stay on top of payments, ensuring smooth financial operations and improved customer relationships.

Exporting and Printing QuickBooks Invoices

Being able to export and print your billing documents is essential for both record-keeping and sharing with clients. Whether you need a physical copy for your records or a digital file for email, having the ability to easily export and print these documents streamlines your business processes. This section covers the steps for exporting and printing your billing documents efficiently.

Steps to Export Your Billing Documents

Follow these steps to export your billing documents in a format that suits your needs:

| Step | Action |

|---|---|

| 1 | Open the document you wish to export in your business management platform. |

| 2 | Select the export option, typically located under the ‘File’ or ‘Export’ menu. |

| 3 | Choose your preferred file format (PDF, Excel, etc.) for exporting the document. |

| 4 | Save the exported file to your desired location on your computer or cloud storage. |

| 5 | If needed, send the exported document to clients or stakeholders via email or cloud sharing. |

Steps to Print Your Billing Documents

If you prefer a hard copy, here’s how to print your documents directly from your platform:

| Step | Action |

|---|---|

| 1 | Ensure your printer is connected and properly set up. |

| 2 | Open the billing document you want to print. |

| 3 | Select the ‘Print’ option from the document’s menu. |

| 4 | Adjust print settings, such as the number of copies or page range. |

| 5 | Click ‘Print’ to send the document to your printer for a physical copy. |

With these simple steps, you can easily export and print your documents, ensuring that you have both digital and physical copies for your records and clients.

Using QuickBooks for Recurring Invoices

Managing repetitive billing cycles can be time-consuming if done manually. However, automating these tasks can significantly improve efficiency and accuracy. By utilizing automated billing solutions, businesses can set up recurring transactions that are generated and sent automatically, saving valuable time and minimizing errors. This section covers how to set up and manage recurring billing efficiently using your financial management system.

Setting Up Recurring Billing

Follow these steps to set up a recurring billing cycle that suits your business needs:

| Step | Action |

|---|---|

| 1 | Open your system and navigate to the section for creating new billing records. |

| 2 | Choose the option for setting up a recurring billing schedule, typically found under “Recurring Transactions” or similar menu options. |

| 3 | Enter the customer information and specify the billing frequency (e.g., monthly, quarterly, annually). |

| 4 | Define the start and end dates for the recurring cycle, if applicable. |

| 5 | Set up payment methods and automated reminders to ensure payments are processed on time. |

Managing Recurring Transactions

Once your recurring billing is set up, it’s important to regularly manage and review the transactions:

| Step | Action |

|---|---|

| 1 | Review the list of active recurring transactions to ensure they are accurate and up to date. |

| 2 | Make adjustments to billing amounts, frequencies, or customer details as needed. |

| 3 | Monitor the completion status of each cycle and track payments received automatically. |

| 4 | Cancel or pause any recurring cycles that are no longer needed or require temporary suspension. |

By automating and managing recurring billing through your system, you can streamline processes, reduce human error, and ensure that all transactions are handled smoothly and on time.

Choosing the Right Invoice Template for Your Business

Selecting the appropriate document format for billing is crucial for maintaining professionalism and clarity in your transactions. Whether you’re a small business owner or part of a larger enterprise, your billing method should align with your company’s image and operational needs. The right document layout not only ensures accurate communication with clients but also streamlines payment processing and reduces errors.

When choosing a layout for your billing records, it’s essential to consider several factors:

- Branding: Choose a design that reflects your business’s branding, including colors, logos, and overall style. A consistent look across all documents strengthens your brand’s identity.

- Functionality: Ensure the layout includes all necessary fields, such as service/product descriptions, quantities, pricing, and payment terms, to make processing smooth for both parties.

- Clarity: Opt for a clean and organized structure that is easy for your clients to understand. Avoid clutter and focus on delivering key details clearly.

- Flexibility: Choose a format that allows for customization, whether for adding specific line items, adjusting payment terms, or changing billing frequency as per the client’s needs.

By evaluating these key aspects, you can ensure that your billing documents are not only effective tools for financial tracking but also professional representations of your business.

How to Share QuickBooks Invoices with Clients

Sharing billing documents with your clients efficiently is essential to maintaining smooth business operations and fostering strong client relationships. Providing a seamless experience when delivering financial records ensures clients have all the necessary details to process payments on time, without confusion.

There are several ways to send billing documents to clients, each offering unique benefits:

- Email: Sending billing records directly through email is one of the most common methods. Most modern accounting software allows you to email the document directly from the platform. Simply ensure that the document is in a format that is easily accessible, such as PDF, and include a clear subject line and brief message for clarity.

- Client Portal: Some businesses opt for a more interactive approach by using a client portal. This online space allows clients to access, view, and pay their billing records at their convenience. It’s an effective method for recurring billing and ensuring both you and your clients have access to a complete history of transactions.

- Printed Copies: Although digital methods are typically faster, providing hard copies might be necessary for certain clients. If you need to send printed documents, ensure they are well-organized, clearly formatted, and sent promptly via mail or hand delivery.

- Cloud Storage Links: For larger organizations, utilizing cloud storage options like Google Drive or Dropbox can be beneficial. Upload your financial documents there and share the link with your clients. This method also allows for real-time updates and easy tracking of document versions.

Regardless of the method, ensure the document is clear, accurate, and easy to navigate. Always follow up with a polite reminder if payments are delayed, and provide clear instructions on how clients can reach you in case of any questions regarding their statements.