Free Electrician Invoice Template Word for Easy Billing

Managing payments and maintaining a professional image is crucial for any tradesperson or service provider. Having an efficient system for generating accurate and clear financial records ensures smooth transactions with clients. A well-structured billing document can reflect professionalism and foster trust with customers, making it an essential tool for anyone offering hands-on services.

In this article, we’ll explore how to create and customize billing documents that meet your specific needs. Whether you’re looking to simplify the process or ensure your paperwork aligns with industry standards, a digital solution can save time and improve accuracy. Learn how easy it is to build a document that captures all necessary details and looks professional every time.

Stay organized and streamline your payment collection process by using the right format. The right approach not only makes your job easier but also helps in tracking payments and managing finances efficiently.

Essential Features of Billing Documents

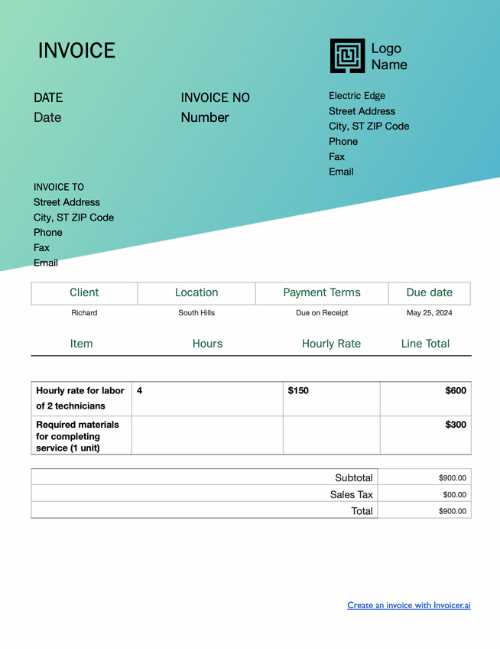

Creating a comprehensive and accurate billing document is essential for any service provider. It not only ensures that payments are properly tracked but also helps in presenting a professional image to clients. A well-constructed record includes key details that both you and your clients can rely on for clarity and transparency.

At the core of a strong financial record are essential elements like the service provider’s contact details, a breakdown of services rendered, and the total amount due. This allows the client to easily understand what they are being charged for and ensures that both parties are on the same page regarding the terms of payment.

Key components of a well-designed billing document include:

- Service Provider Information: Name, address, and contact details.

- Client Information: Name, address, and contact details for billing purposes.

- Service Description: Clear itemization of tasks completed, with dates and specific charges for each.

- Payment Terms: Clear instructions on due dates, payment methods, and penalties for late payment.

- Unique Identification: A document number or reference to easily track the record.

These features ensure that the document serves its purpose both as a legal record and a tool for maintaining smooth business transactions.

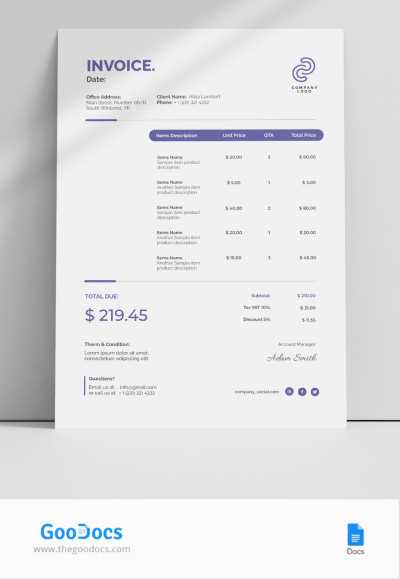

How to Customize Your Billing Document

Personalizing your financial records allows you to better reflect your business’s identity and ensure that all necessary details are captured accurately. Customization not only helps you stand out but also ensures that the document meets your specific needs and adheres to any legal or industry requirements.

To tailor your billing document, start by adjusting the design to match your business branding. Include your logo, choose appropriate fonts, and select colors that align with your company’s visual identity. This will make your document look professional and cohesive with other materials you use, such as your website or promotional content.

Next, ensure that all fields are relevant to your services. You can add or remove sections based on your business’s particular needs, such as including a line for special discounts or additional charges. Modify payment terms to fit your practices–whether that’s offering discounts for early payments or specifying the exact due date for clarity.

Finally, save your personalized document in a format that’s easy to update, share, and print. This will make the invoicing process more efficient and professional, improving both your workflow and your clients’ experience.

Benefits of Using Digital Document Formats for Billing

Using digital formats for creating billing records offers numerous advantages for service providers. It streamlines the entire process, making it easier to generate and manage financial documents while ensuring they remain professional and accurate. By leveraging customizable digital solutions, you can save both time and resources while enhancing the quality of your business operations.

One of the key benefits is ease of use. With pre-designed structures, it becomes simple to input the required information, reducing the chances of errors and inconsistencies. You don’t need to start from scratch each time, which can significantly speed up the creation of your records.

Another advantage is flexibility. You can easily adjust the layout and content to fit your specific business needs, whether it’s adding extra details, changing the payment terms, or including a discount. This level of control ensures that the documents align perfectly with your service model and client requirements.

Efficiency is another key factor. With digital formats, you can quickly save and share your records electronically, reducing paper usage and improving the speed of communication with clients. You can also store these documents securely for future reference, ensuring that your financial records are easily accessible whenever needed.

Ultimately, using a digital system for creating billing documents can improve professionalism, enhance client satisfaction, and help maintain better organization in your business.

Why Choose Word for Billing Documents

When it comes to creating professional billing documents, flexibility, ease of use, and compatibility with various platforms are essential considerations. One of the most popular choices for generating these records is a widely accessible word processing software, which offers numerous advantages for businesses of all sizes.

First and foremost, using word processing software is user-friendly. It provides a straightforward interface that most people are already familiar with, reducing the learning curve and saving time when creating or editing documents. Additionally, many of these programs come with pre-built styles and layouts, allowing you to produce polished documents without the need for design expertise.

Another reason for choosing this option is customizability. You can easily modify the layout, fonts, colors, and structure to align with your business’s branding. Whether you need to add or remove sections, change payment terms, or include special instructions, word processing software makes it simple to tailor each document to your specific needs.

- Compatibility: Easily share, store, and open documents across multiple devices and operating systems.

- Templates: Access ready-made designs that can be personalized with just a few clicks.

- Time-saving: Quickly create and update records, reducing administrative overhead.

- Professional Appearance: Produce polished documents with minimal effort, boosting your business’s credibility.

For these reasons, many businesses prefer using word processing software to create billing records. It offers a perfect balance between functionality, simplicity, and flexibility, making it an ideal choice for service providers looking to streamline their billing process.

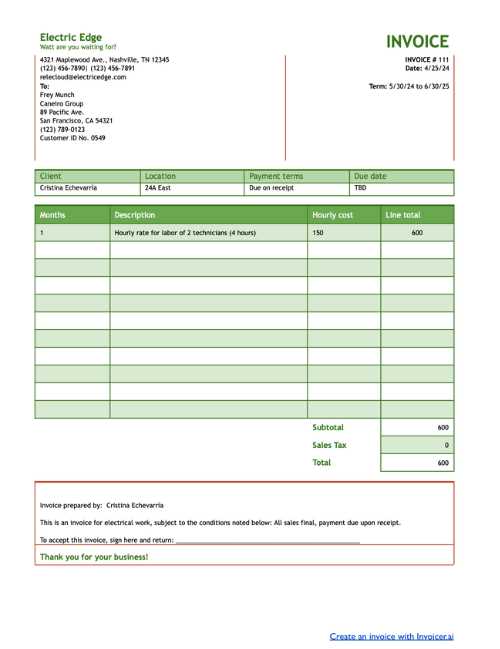

Step-by-Step Guide to Creating Billing Records

Creating accurate and professional financial documents is essential for any business. By following a clear, organized process, you can ensure that your records are both precise and easy to understand. Here’s a step-by-step guide to help you create a structured and effective document for your services.

1. Set Up Your Document

Start by opening your preferred document editing program and creating a new file. You can either begin with a blank page or use an existing design as a base. Make sure the page is properly formatted, including appropriate margins and spacing for readability.

2. Add Your Business Details

- Your Business Name: Make sure to include your company name or your own name if you’re an independent provider.

- Contact Information: Add your phone number, email address, and physical address to make it easy for clients to reach you.

- Logo: If you have one, insert your logo at the top of the page to enhance the professional appearance.

3. Include Client Information

Next, add the details of your client, including their full name or company name, address, and contact information. This ensures that the document is personalized and properly directed to the correct recipient.

4. Detail the Services Provided

- Service Description: Clearly list each service or task performed, along with a brief description of what was done.

- Quantity/Hours: Indicate how many units or hours of service were provided, if applicable.

- Cost: Include the cost for each item or hour worked, followed by a total for all services rendered.

5. Add Payment Terms and Due Date

- Payment Due Date: Specify when the payment is expected to be made.

- Late Fees: If applicable, outline any penalties or interest that will be applied to overdue payments.

- Accepted Payment Methods: List the methods through which the client can pay, such as bank transfer, credit card, or cash.

6. Final Review and Save

Before sending the document to your client, double-check all the details for accuracy, such as the prices, service descriptions, and contact information. Once everything is correct, save the document in a format that can be easily shared, such as PDF, and send it to your client.

By following these simple steps, you can ensure that your financial records are clear, professional, and ready for payment processing.

Free Billing Document Templates Available Online

Many service providers turn to online resources to find customizable and free document formats that can simplify their billing process. These resources offer a variety of designs, making it easy to find one that fits your business’s needs. Whether you are just starting or looking to streamline your existing workflow, these templates can save you time while ensuring that your records remain professional and consistent.

Here are some key features to look for when exploring free resources for your billing documents:

| Feature | Description |

|---|---|

| Customizability | Adjust the layout, fonts, and content to match your business needs and brand identity. |

| Ease of Use | Most templates are simple to fill out, requiring only basic details like client information and services rendered. |

| Professional Design | Templates are often designed to look polished and formal, helping you create a professional image with minimal effort. |

| Free Access | Many resources offer free downloads, allowing you to access the documents without any cost. |

| Compatibility | These templates are typically compatible with popular document editing software, making them easy to use and share. |

By using online resources, you can access a wide variety of professional document formats without spending money or investing time in designing one from scratch. These templates are an excellent option for businesses looking to save time and maintain a high standard of professionalism in their financial records.

Design Tips for Professional Billing Documents

Creating a well-designed financial document is crucial for leaving a positive impression on clients and ensuring clarity in your transactions. The design of your record should reflect professionalism while remaining easy to read and understand. A clean, organized layout can also help streamline communication and improve your overall business efficiency.

Here are some design tips to keep in mind when creating your financial records:

- Simple and Clean Layout: Avoid cluttering the page with unnecessary information. Stick to essential details like your business name, client information, services provided, and total amount due. A well-spaced, clean layout makes it easier for clients to read and ensures that important information stands out.

- Clear Typography: Use legible fonts that are easy on the eyes. Stick to professional fonts like Arial or Times New Roman, and avoid using too many different styles or sizes. Consistency in font choice helps create a polished look.

- Branding: Incorporate your company’s logo and color scheme to maintain brand consistency. This not only makes your documents look more professional but also reinforces your brand identity with each communication.

- Use of Tables: Organize your services, hours, rates, and totals in a table format. This makes it easier for clients to follow along and quickly see what they are being charged for. A well-structured table helps present the information logically and avoids confusion.

- Highlight Important Details: Use bold text or underlining for critical information such as the total amount due, payment due date, or special instructions. This ensures that these details stand out to the client.

- Whitespace: Don’t be afraid of leaving blank space around text and tables. Proper use of whitespace improves the readability of the document and prevents it from feeling overcrowded.

By following these design principles, you can create financial documents that are not only functional but also aesthetically pleasing. A well-designed record shows clients that you care about the details, which can lead to better client relationships and prompt payments.

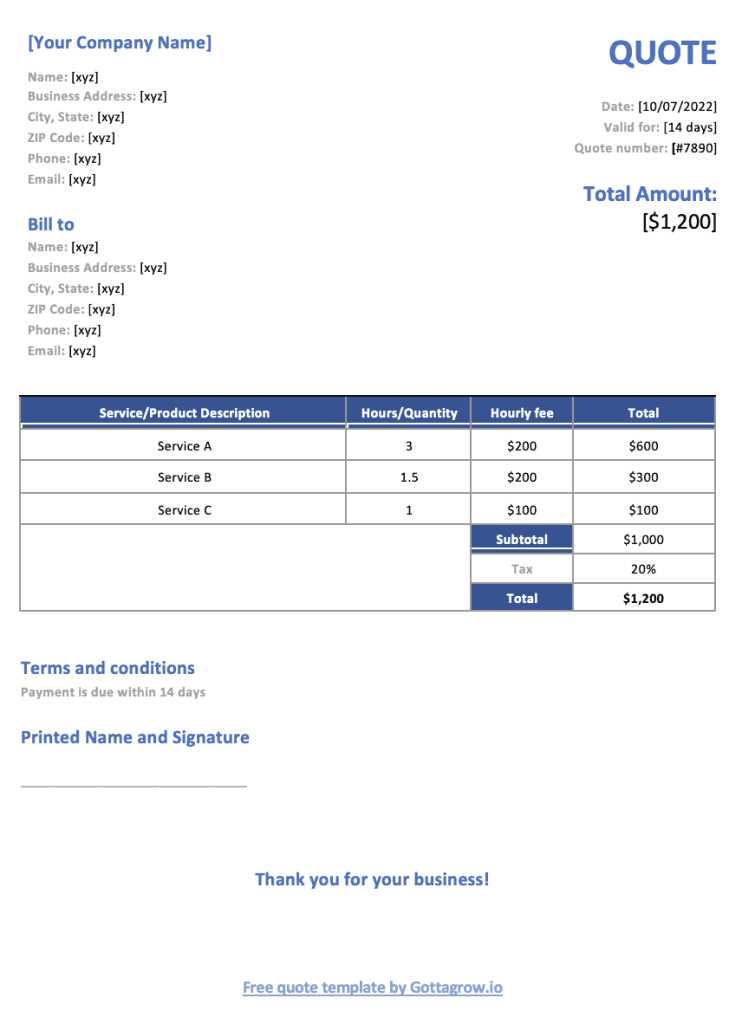

How to Add Tax and Discounts on Billing Documents

Adding taxes and discounts to your financial records is an important part of accurately reflecting the cost of services and products. These adjustments ensure that both you and your clients are clear on the final amount due, including any additional charges or savings. It is essential to present this information in a transparent and organized manner to avoid confusion and maintain trust with your clients.

Adding Tax

When including tax in your records, you need to calculate it based on the applicable rate for your region or service. Most businesses will charge a specific percentage of the total amount for tax. This can either be a flat rate or vary depending on the type of service or location.

| Description | Amount |

|---|---|

| Subtotal (before tax) | $100.00 |

| Tax (8%) | $8.00 |

| Total Amount Due | $108.00 |

Make sure to clearly state the tax percentage and total tax amount on the document so that the client can easily see how it was calculated.

Applying Discounts

Discounts can be a great way to incentivize early payments or reward loyal customers. There are two main ways to apply a discount: a flat amount or a percentage off the total cost. Clearly note the discount applied and ensure that the client can see both the original price and the discounted price.

| Description | Amount |

|---|---|

| Subtotal (before discount) | $150.00 |

| Discount (10%) | -$15.00 |

| Total Amount Due | $135.00 |

Always mention the discount percentage or amount in a separate line and ensure the final amount due reflects the discount. This shows transparency and helps clients understand the savings they received.

By clearly listing taxes and discounts, you provide clarity and professionalism in your documents, helping maintain a strong relationship with your clients.

Common Mistakes in Billing Documents

Accurate and clear financial records are crucial for maintaining strong relationships with clients and ensuring timely payments. However, mistakes can often occur when preparing these documents, leading to confusion, delayed payments, and even disputes. Understanding and avoiding common errors can help streamline your billing process and create a more professional image for your business.

1. Missing or Incorrect Contact Information

One of the most common errors is failing to include accurate or complete contact details for either the service provider or the client. If the recipient cannot easily find your contact information, it may delay communication or payment processing.

- Ensure the accuracy of both your own and your client’s contact information.

- Double-check that the business name, address, and phone numbers are correct.

2. Unclear or Incomplete Service Descriptions

Another frequent mistake is providing vague or incomplete descriptions of the work performed. If the client is unclear about what was done, it can lead to misunderstandings or disputes over payment.

- Be specific about the services provided, including details such as the tasks completed, materials used, and hours worked.

- Break down the costs so the client can easily understand how the total is calculated.

3. Incorrect Payment Terms

It’s essential to clearly communicate payment terms in your records, including the due date and accepted payment methods. Failing to do so can lead to confusion about when payment is expected and how it should be made.

- State the due date clearly and emphasize late fees if applicable.

- List all accepted payment methods to avoid delays or complications.

4. Overlooking Tax and Discount Details

Another mistake is neglecting to include taxes or discounts, or failing to clearly show how they are calculated. This can lead to confusion for the client and potential disputes about the final amount due.

- Always specify tax rates and total tax amounts separately.

- List any discounts applied and ensure the client can see the original and final amounts.

5. Failing to Use Unique Document Numbers

Not assigning a unique number to each billing document can make it difficult to track payments and follow up on overdue accounts. Unique document numbers also serve as a reference point in case of future inquiries or disputes.

- Use a numbering system to easily track and reference each document.

- Ensure consistency in your numbering format fo

Best Practices for Billing Your Clients

Efficient and professional billing is key to maintaining good relationships with your clients and ensuring timely payments. By implementing best practices for billing, you can streamline your payment process, avoid misunderstandings, and create a more seamless experience for both you and your clients. Clear communication and consistent procedures are vital to achieving these goals.

Here are some best practices to follow when managing client payments:

- Be Clear and Transparent: Always ensure that your documents clearly outline the services provided, the costs involved, and any applicable taxes or discounts. Transparency builds trust and helps prevent confusion over charges.

- Use Professional Language: The language used in your billing records should reflect professionalism. Avoid jargon and make sure your records are easy to understand, even for clients who may not be familiar with the industry.

- Set Clear Payment Terms: Always specify payment due dates and include any late fees or interest charges for overdue payments. Clearly outline acceptable payment methods (e.g., bank transfer, credit card, etc.) to avoid delays.

- Issue Timely Bills: Send your records as soon as possible after completing the work or delivering the goods. The sooner clients receive their bills, the sooner they can process payments, helping you maintain a steady cash flow.

- Maintain a Consistent Billing System: Develop a structured, consistent approach for all client records, including a unique reference number for each document. This makes it easier to track payments and manage follow-ups for overdue amounts.

- Follow Up on Overdue Payments: Keep track of outstanding payments and send polite reminders if the due date passes. A well-timed reminder can encourage clients to pay on time without causing friction in your relationship.

By following these best practices, you can ensure that your billing process runs smoothly, clients are satisfied, and your business maintains a positive cash flow. Consistency and professionalism in your billing approach will help you build a strong reputation and foster long-term client relationships.

Why Accurate Billing Matters for Service Providers

When it comes to providing services, accurate financial documentation is crucial for both the service provider and the client. Whether you’re a contractor, a technician, or any other type of professional, ensuring that your billing is precise can prevent misunderstandings, foster trust, and streamline business operations. Mistakes in financial records can not only delay payments but also damage your professional reputation.

1. Ensures Timely Payments

Accurate records help clients understand exactly what they are paying for, minimizing confusion and disputes over charges. This clarity encourages prompt payment as clients can quickly review the details and settle their balances. On the other hand, errors or omissions in your documents may lead to delays, as clients may need clarification or dispute charges.

2. Builds Professionalism and Trust

Clear and error-free records reflect a professional approach to business. When clients see that you pay attention to detail and deliver accurate documents, they are more likely to trust you with future projects. A professional appearance in your financial paperwork can be just as important as the quality of the service you provide.

Accurate financial records also ensure that your business complies with tax regulations, helping you avoid potential legal issues. Properly documenting all transactions can prevent costly errors at the end of the year, especially when preparing financial statements or submitting tax returns.

By prioritizing accuracy in your billing, you not only improve your cash flow but also build a solid foundation of trust and reliability with your clients. Consistency in your financial documents reinforces your professionalism and supports long-term business growth.

How to Save and Send Billing Documents

After creating a professional billing record, the next step is to save and send it to your client efficiently. Proper handling of your documents ensures that they are secure, easy to access, and can be delivered in a timely manner. By following a simple process for saving and sending, you can ensure your records remain organized and that payments are processed without delay.

Saving Your Document

Once you’ve completed your billing document, saving it correctly is crucial for future reference and record-keeping. It’s important to name your files in a consistent and organized way, so they can be easily located when needed. Consider using a naming system that includes the client’s name, service date, and a unique reference number for each record.

- Choose the right format: Save the document in a format that is widely accessible, such as PDF or DOCX. PDFs are often preferred because they preserve formatting and cannot be easily edited.

- Store documents securely: Use cloud storage services or external drives to store your documents safely. Regularly back up your files to prevent data loss.

Sending Your Document

After saving your billing document, the next step is sending it to your client. It’s important to choose the appropriate method based on your client’s preferences and convenience. Email is often the most efficient way, but you can also consider other methods like postal mail or through a secure file-sharing service, depending on the situation.

- Attach the document to an email: If you’re sending via email, attach the saved file as an attachment. Ensure the email’s subject line is clear and indicates it’s a billing document.

- Provide clear instructions: In the email body, briefly explain the contents of the document and mention any necessary actions, such as payment due dates or instructions for payment.

- Follow up: If you don’t receive a response or payment by the due date, send a polite reminder to ensure your client is aware of the pending charges.

By following these steps, you can save and send your financial documents professionally and efficiently, making the process easier for both you and your clients. Proper document handling helps maintain a smooth workflow, reduces errors, and promotes timely payments.

Legal Requirements for Billing Documents

When creating financial records for services rendered, it’s important to ensure that the documents meet all legal and regulatory standards. These records not only serve as a formal request for payment but also function as legal proof of the transaction. To protect both the service provider and the client, certain elements must be included in each document to comply with tax laws and business regulations.

1. Necessary Information for Compliance

In many regions, legal requirements mandate that specific details must appear on your billing records to ensure compliance with tax regulations and consumer protection laws. These requirements often include:

- Business Information: Your business name, address, and contact details must be clearly stated on the document. This allows the client to know exactly who they are dealing with and provides a point of contact if needed.

- Client Information: It’s essential to include the name and address of the client, especially in case of disputes or for record-keeping purposes.

- Unique Document Number: Assign a unique number to each document. This serves as a reference for both you and the client and ensures that all records can be tracked efficiently.

- Description of Services: The document should list all services provided, with clear descriptions of each task or product delivered. This transparency helps prevent disputes about what was included in the agreement.

2. Tax and Payment Information

Another critical aspect of legally compliant billing documents is the inclusion of tax details and payment terms. Depending on your jurisdiction, you may need to specify the tax rate applied and the total amount of tax charged.

- Tax Identification Number: Some countries require businesses to include their tax ID number or VAT registration number on all financial records.

- Tax Amount: Ensure that the applicable tax rate is included, along with the total amount of tax calculated on the subtotal. This helps maintain transparency for the client and keeps you compliant with tax authorities.

- Payment Terms: State your payment terms clearly, including the due date and any penalties for late payments. This ensures both parties are clear on expectations.

By adhering to these legal requirements, you help protect your business and avoid potential issues with tax authorities or clients. It also builds trust, as clients can see that your business operates with transparency and professionalism.

How to Track Payments Using Billing Documents

Accurately tracking payments is an essential part of managing your business’s finances. By using clear and structured financial records, you can easily monitor outstanding balances, identify paid transactions, and follow up on overdue amounts. Keeping track of payments ensures that you maintain a steady cash flow and reduces the risk of payment disputes.

Here are some strategies to track payments effectively:

1. Assign Unique Document Numbers

Every financial record should have a unique identification number. This helps you easily track and reference each document. It also simplifies payment tracking, as you can match payments to their respective documents.

2. Update Payment Status Regularly

Once a payment is received, update the status on your record promptly. This not only keeps your financial documents up to date but also helps you spot any outstanding balances quickly.

Document Number Client Name Amount Due Amount Paid Payment Status Due Date 00123 John Doe $500 $500 Paid 2024-11-05 00124 Jane Smith $300 $0 Unpaid 2024-11-12 00125 Mike Johnson $750 $500 Partially Paid 2024-11-10 3. Set Up a Payment Tracking System

Using a payment tracking system–whether it’s a simple spreadsheet, accounting software, or a more complex financial management tool–can make tracking much easier. This allows you to monitor payments, generate reports, and even send reminders for overdue balances automatically.

4. Send Payment Reminders

If a payment has not been made by the due date, sending polite follow-up reminders is important. Include the original billing document along with the updated balance, so the client has all the information needed to complete the payment.

By following these steps and regularly updating your records, you can ensure a smooth and efficient payment process, minimize confusion, and stay on top of your financials.

How to Create Recurring Billing Documents for Clients

For businesses that offer ongoing services or products, setting up recurring billing is an efficient way to ensure a steady cash flow. Recurring billing helps automate the process of charging clients on a regular basis, saving both time and effort. By using clear, structured documents, you can streamline this process and provide clients with predictable, transparent charges.

1. Set Clear Terms for Recurring Payments

The first step in creating recurring payments is to define the terms. This includes how often payments will occur, the amount to be charged, and the duration of the agreement. Clear communication is key to ensuring both you and your client are aligned on the schedule.

- Frequency: Decide if the payments will be made weekly, monthly, quarterly, or annually.

- Amount: Specify the exact amount that will be charged each cycle. Ensure both parties agree on this amount before proceeding.

- Duration: Define the length of the contract. Is it ongoing until canceled, or will there be an end date after a set number of cycles?

2. Automate Recurring Billing with Tools

While it’s possible to manually create and send a recurring billing document each cycle, using software or an online platform can save significant time. These tools allow you to set up automated billing cycles, reducing the chance of errors and ensuring timely payments.

- Billing Software: Many accounting and billing software programs offer recurring billing features that can automatically generate and send documents to clients.

- Payment Platforms: Some payment platforms, such as PayPal or Stripe, allow you to set up subscription billing, ensuring automatic charges and updates.

- Cloud-Based Tools: Cloud-based invoicing platforms can store recurring billing details securely and automatically send reminders or notifications to clients about upcoming payments.

3. Include Payment Details and Terms

Each recurring document should clearly outline the payment details, including the total amount, frequency, and payment methods. Clients should also be informed about how they can cancel or modify the agreement if needed.

- Payment Methods: Specify which payment options are available, such as credit card, bank transfer, or digital wallets.

- Cancellation Policy: Clearly explain how clients can cancel the agreement or modify their payment plan if necessary.

- Late Payment Fees: If applicable, outline any penalties for missed payments or overdue amounts.

By creating a streamlined process for recurring billing, you can ensure consistency in payments, reduce administrative tasks, and provide a more professional service to your clients. Clear terms, automation, and transparent communication are key to successful recurring transactions.