Download Blank Free Invoice Template for Easy Customization

Managing financial transactions requires clear and professional documentation. Whether you’re running a small business or freelancing, providing your clients with well-organized records is essential for smooth operations. Customizing your documents can help you maintain consistency and accuracy in your billing process.

One of the simplest ways to ensure your records meet all requirements is by using easily customizable designs that allow you to include essential information such as your branding, payment terms, and itemized lists. This approach saves time and effort while presenting a polished appearance to your clients.

With various tools available online, anyone can quickly generate these documents. The flexibility of modern tools ensures that no matter your industry or personal style, you can produce professional-looking records tailored to your needs. Whether you are invoicing for services rendered or products sold, having a clear structure is key to effective communication with your clients.

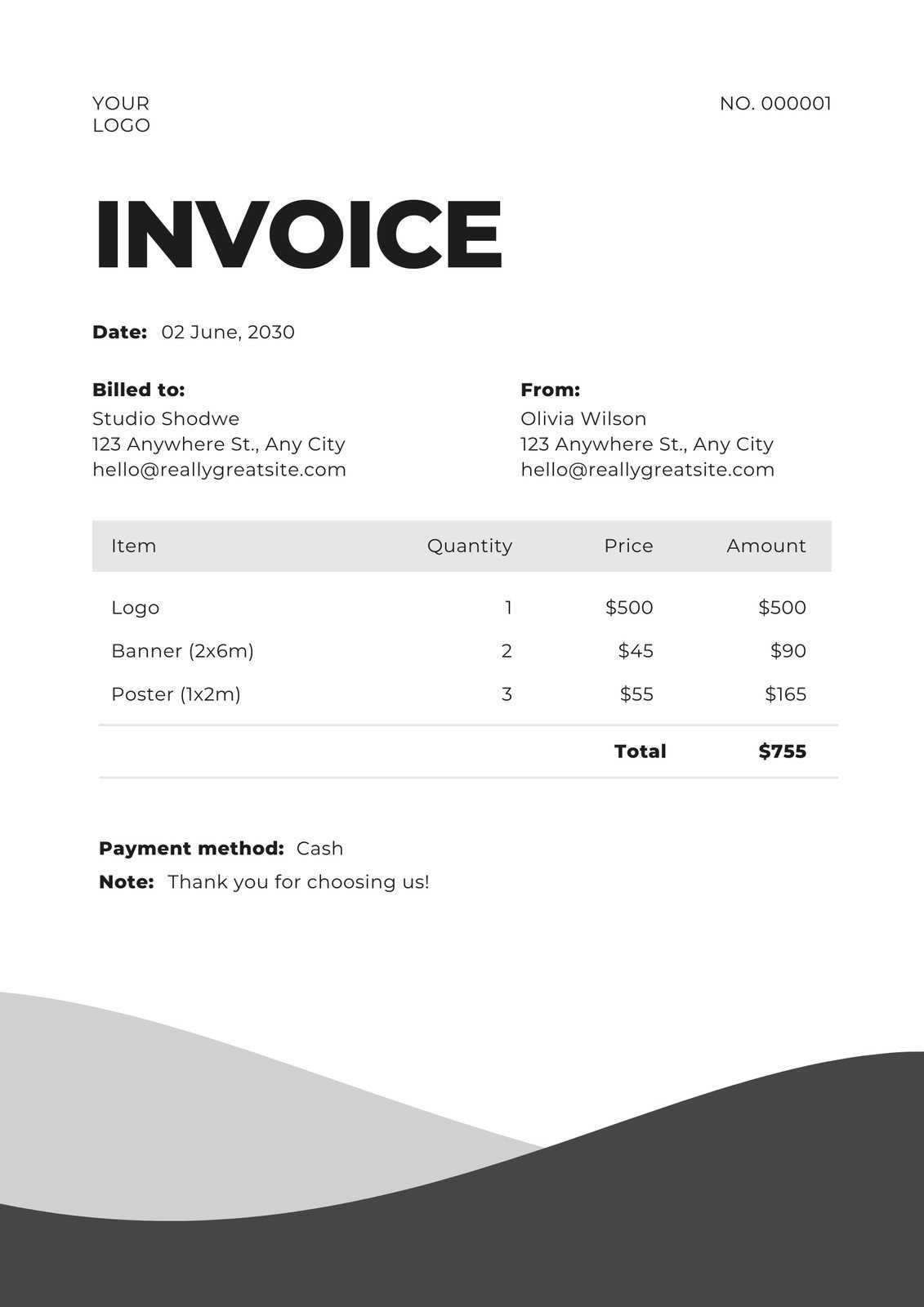

Blank Free Invoice Template

Creating clear and professional billing documents is crucial for any business or individual providing goods or services. Having a pre-designed format that can be easily customized ensures consistency and saves time when generating records for payments.

By using a basic document structure, you can personalize it with your specific details, such as company name, logo, and payment terms. This method allows you to tailor the information according to each transaction, ensuring that every client receives accurate and professional-looking statements.

These editable files are often available in various formats, enabling quick access and customization through common software. Whether you are handling a one-time transaction or ongoing services, having a reusable document saves effort and maintains a high level of professionalism.

Why Use a Free Invoice Template

Utilizing pre-designed formats for creating billing documents offers significant advantages, particularly for businesses and freelancers looking to save time and maintain consistency. These ready-to-use structures allow you to focus on the content without worrying about formatting or layout, ensuring that all essential details are included.

Here are some key reasons to consider using customizable billing formats:

- Time Efficiency: Quickly generate professional-looking documents without the need for manual design or formatting.

- Consistency: Maintain a uniform appearance for all your transactions, reinforcing your brand’s professionalism.

- Cost-Effective: No need for expensive software or designers, as these files are often available at no cost.

- Ease of Use: Simple and straightforward to edit, even for individuals with minimal design experience.

- Customization: Adjust the layout, colors, and details to fit your specific needs and business branding.

Incorporating these tools into your workflow can simplify the billing process and enhance your overall customer experience. Whether you’re a freelancer or a small business owner, using a pre-designed structure helps keep transactions organized and professional.

How to Download an Invoice Template

Accessing and obtaining customizable billing documents is a straightforward process that allows you to quickly start managing your transactions. Several websites and online platforms offer easy access to these essential files, often with no cost involved. Below are the steps to successfully download a suitable document for your needs:

- Search Online Resources: Look for reputable websites that offer customizable formats for business transactions. Many platforms provide a range of designs to choose from.

- Select the Right Format: Choose the structure that best fits your business requirements. Make sure the document contains fields for essential information such as payment terms, services/products, and client details.

- Download the File: Once you have selected the right format, simply click the download button. Common file formats include Word, Excel, and PDF, making it easy to use across various software.

- Open and Customize: After downloading, open the file in your preferred software and adjust the content to include your branding, client details, and specific terms.

- Save and Export: Once customized, save the document on your device and export it in a preferred format (such as PDF) for sharing with clients.

By following these steps, you’ll have a professional document ready for use in just a few minutes, simplifying the billing process and improving client communication.

Benefits of Customizing Your Invoice

Personalizing your billing documents offers several advantages that can enhance both the professionalism of your business and the clarity of your transactions. Customization not only helps make your documents unique to your brand but also improves communication with clients. Below are some of the key benefits:

- Brand Consistency: Including your company logo, colors, and other branding elements helps reinforce your identity, making your documents instantly recognizable.

- Improved Professionalism: A well-designed and personalized document signals to clients that you are organized and detail-oriented, which builds trust.

- Clear Communication: Tailoring the document allows you to highlight key information such as payment due dates, terms, and services provided, ensuring everything is clear.

- Flexibility: Customizing allows you to adapt the format to suit the needs of different clients or projects, making it easier to manage diverse business transactions.

- Efficiency: By adapting a pre-designed structure, you save time and reduce errors, as the layout is already set, and only the details need updating.

Overall, customizing your billing records ensures they are not only functional but also contribute positively to your professional image and client relations.

Key Elements of an Invoice

When creating a billing document, it is essential to include specific information to ensure that the transaction is clear and transparent for both parties. A well-structured document provides all the necessary details for clients to understand the services or products they are being charged for, as well as the terms of payment. Below are the key components that should be included in any billing record.

Basic Information

The foundation of any billing document includes several basic details that identify both the business and the client. These elements ensure that the document is properly attributed and that both parties can easily reference the transaction in the future.

- Business Details: Include your company name, address, and contact information, as well as your tax ID if applicable.

- Client Information: The client’s name, address, and contact details should also be clearly listed to ensure proper identification.

- Document Number: Assign a unique reference number to each document for tracking and organizational purposes.

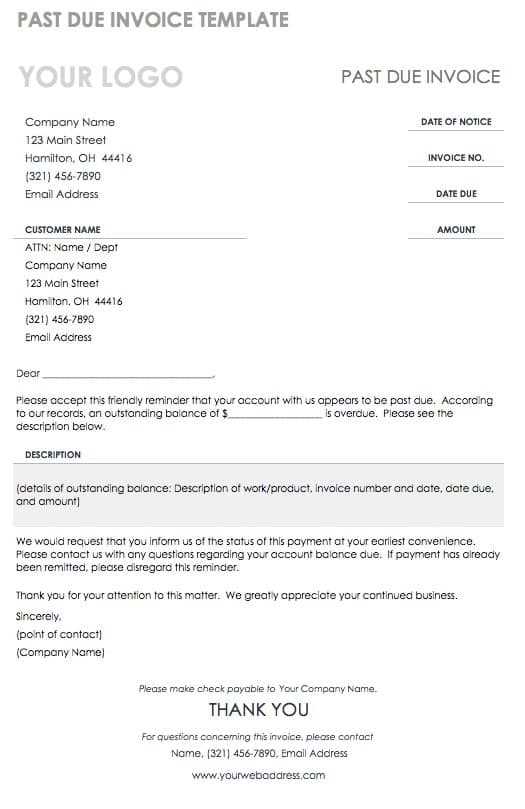

Transaction Details

In addition to identifying information, the document should clearly outline the specifics of the services rendered or goods sold, as well as payment terms. This section is crucial for avoiding misunderstandings and ensuring smooth processing of payments.

- Description of Services/Products: Provide a detailed breakdown of each item or service, including quantities, rates, and total amounts.

- Payment Terms: Clearly state the due date, acceptable payment methods, and any applicable late fees or discounts.

- Total Amount: Summarize the total amount due, including taxes and any additional fees.

By including these essential elements in your billing documents, you ensure that your clients have all the information they need for easy reference and payment processing.

Choosing the Right Invoice Format

Selecting the correct structure for your billing documents is essential for clarity and efficiency. A well-chosen format not only streamlines the billing process but also ensures that your clients can quickly understand and process the charges. There are several factors to consider when choosing the ideal design to suit your needs.

Factors to Consider

Before choosing a specific structure, it’s important to evaluate the specific requirements of your business and the preferences of your clients. Consider the following:

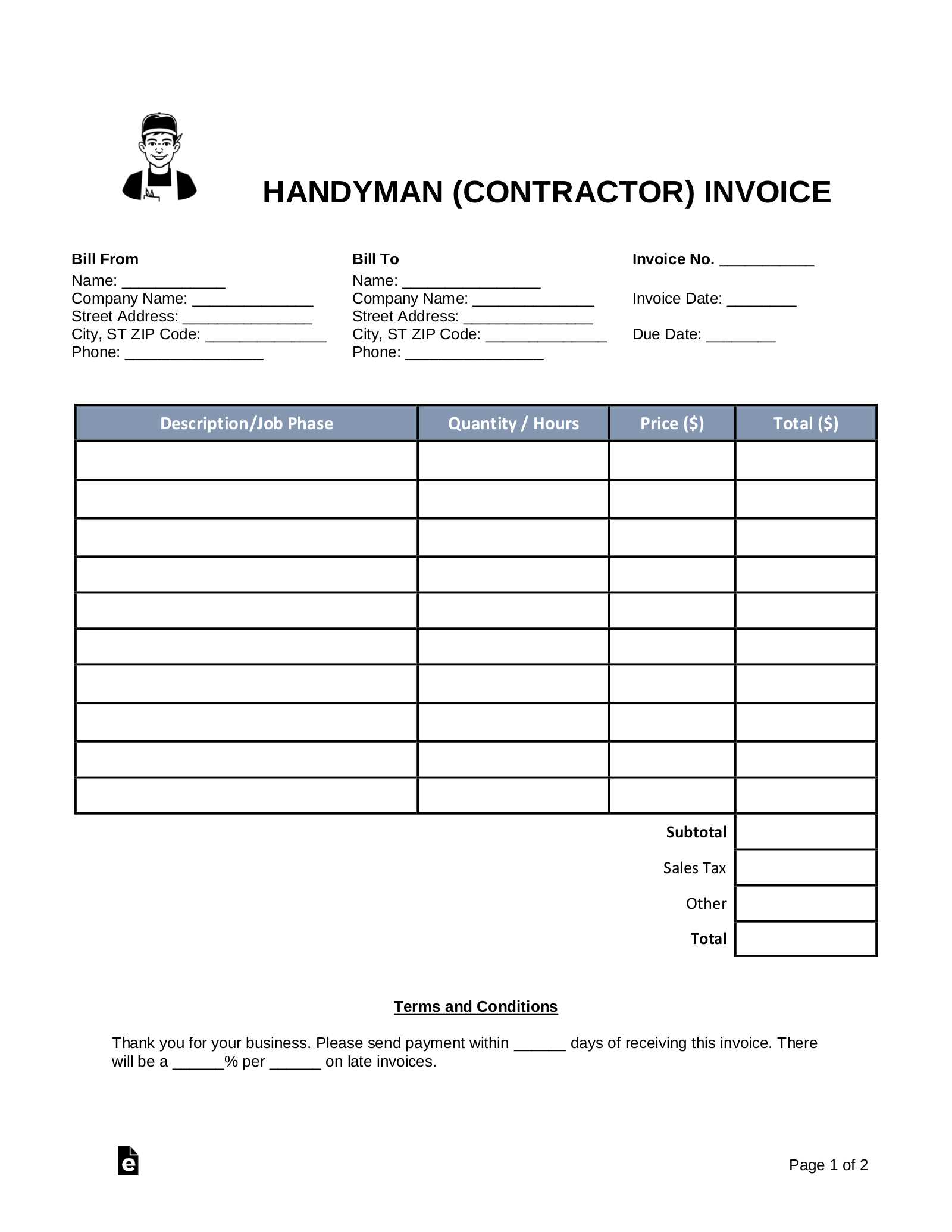

- Business Type: Different industries may require distinct layouts. A service-based business might focus more on labor hours, while a product-based business needs detailed descriptions of items sold.

- Client Preferences: Some clients prefer simple, straightforward documents, while others may require more detailed breakdowns. It’s useful to understand your audience.

- Compliance Requirements: Make sure the format complies with local tax regulations and legal requirements for invoicing in your area.

Types of Formats

Once you’ve assessed your needs, you can choose from various formats that best suit your transaction style. Below are some common options:

- Basic Format: A simple and clean design, suitable for smaller businesses or freelancers with straightforward transactions.

- Itemized Format: Best for businesses offering multiple products or services, providing a detailed breakdown of each item with quantities, rates, and totals.

- Professional Design: A polished, branded format often used by larger companies or those wanting to reinforce their brand identity through custom logos and colors.

Choosing the right structure is key to simplifying your billing process while maintaining professionalism and transparency in your financial transactions.

Free Templates vs Paid Options

When choosing a design for your billing documents, one of the main decisions is whether to go for no-cost options or invest in a premium service. Both types of formats have their advantages and limitations, and understanding the differences can help you make the best choice for your business needs.

Advantages of No-Cost Options

Many businesses, especially startups or freelancers, opt for free designs due to their immediate availability and cost-effectiveness. These options are often sufficient for smaller businesses that require basic functionality.

- Accessibility: Free formats are readily available on various websites and platforms, making them easy to download and use right away.

- Cost-Effective: They incur no additional expenses, which is ideal for businesses with a tight budget or those just starting.

- Simplicity: Basic designs are often easy to customize and don’t require advanced skills or software.

Benefits of Paid Options

For businesses that need more advanced features or professional customization, paid designs often provide greater flexibility and higher-quality layouts. These options can make a significant difference in terms of presentation and efficiency.

- Customization: Premium options often offer more advanced customization features, such as branding, tailored layouts, and additional fields for specific business needs.

- Professional Appearance: Paid formats typically have a polished, high-quality design, which can enhance your company’s image and credibility.

- Advanced Features: These formats may come with integrated tools for tracking payments, managing recurring billing, or automating reminders.

Choosing between free and paid designs depends on your business size, budget, and the complexity of your billing needs. For many, a no-cost option is a good starting point, while others may find that investing in a premium design pays off in the long run.

How to Add Your Logo to an Invoice

Incorporating your company logo into your billing documents is an excellent way to reinforce your brand identity and ensure that your materials look professional. Including your logo on these documents not only enhances their appearance but also helps clients instantly recognize your business. The process is simple and can be done in just a few steps, depending on the software you’re using.

Steps to Add a Logo

Here are the general steps to follow when adding your company logo to your billing document:

- Select Your Document Software: Open the file in the software you are using, such as Microsoft Word, Excel, or Google Docs. Most platforms offer easy ways to insert images.

- Choose the Right Location: Typically, the logo should be placed at the top of the document, either centered or aligned to the left or right, depending on your layout preferences.

- Insert the Logo: Look for the “Insert” tab or menu and choose the “Image” or “Picture” option. Select the logo file from your computer or cloud storage.

- Adjust the Size: Once the logo is inserted, resize it to fit the header without overwhelming the document. Make sure it’s large enough to be clear but not so large that it distracts from the rest of the content.

- Align the Logo: Position the logo properly within the document. If it’s aligned with the left or right, ensure the rest of the information is balanced and not too cramped.

Tips for Optimal Logo Placement

When adding your logo, keep these tips in mind to maintain a clean and professional look:

| Tip | Explanation | ||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Keep it simple | A logo with a simple design works best. Avoid large or overly complex logos that may distract from the important details. | ||||||||||||||||||||||||||||||||||||||||

| Ensure clarity | Make sure your logo is clear and legible, especially when it is resized. Poor-quality images can diminish the professionalism of your document. | ||||||||||||||||||||||||||||||||||||||||

| Consider color | Choose a color that complements

Adjusting Payment Terms in TemplatesCustomizing payment terms is an essential part of creating professional billing documents that align with your business policies. Whether you need to adjust the due date, specify early payment discounts, or outline late fees, these modifications ensure that both parties are clear on the expectations for payment. By customizing the payment terms, you can better manage cash flow and avoid potential misunderstandings with clients. Understanding Payment TermsPayment terms typically include the time frame within which the client is expected to pay, along with any discounts or penalties associated with early or late payments. Customizing these details allows businesses to set clear expectations and improve financial management.

|