Catering Invoices Template for Easy and Professional Billing

Managing the financial side of event services can often be a challenging task, especially when it comes to ensuring clear communication and accurate record-keeping. Having a well-organized document to outline the details of services provided is essential for both clients and service providers. It simplifies the process of payment collection and reduces misunderstandings.

Using structured billing documents allows businesses to maintain professionalism and consistency across transactions. These documents should not only detail the services offered but also specify the terms of payment, deadlines, and any additional charges. By incorporating a clean layout and easy-to-read format, you can enhance both the client experience and your administrative workflow.

Whether you are running a small event planning business or offering larger-scale services, a comprehensive document is crucial for smooth operations. Adopting a standardized approach can save valuable time and help you keep track of all financial interactions with ease. This guide will explore how to create, customize, and optimize such documents to ensure your business runs efficiently and effectively.

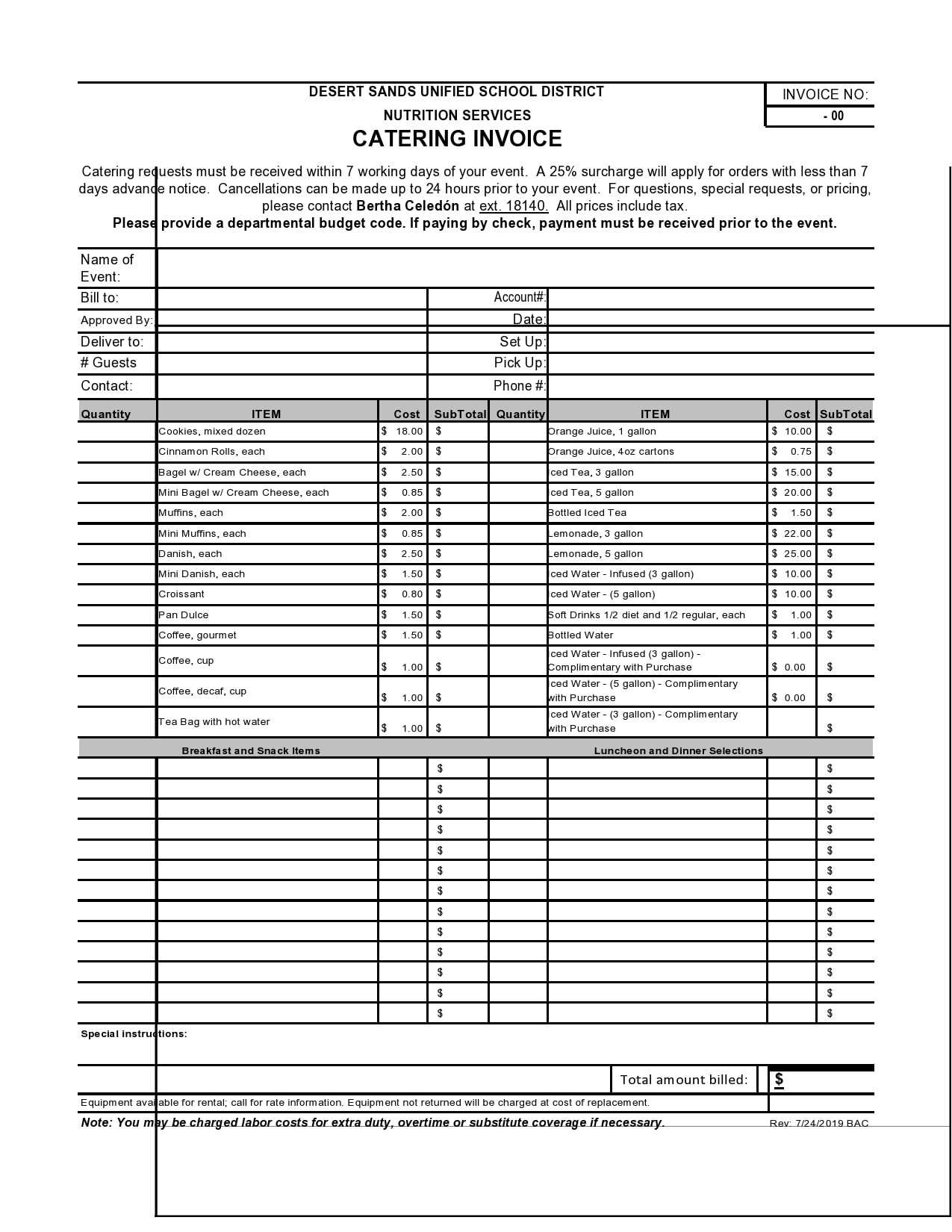

Catering Invoices Template Overview

For businesses in the event services industry, having a standardized document to detail financial transactions is crucial. These essential documents help ensure that both the provider and the client are on the same page regarding services rendered and payments owed. With the right format, these records not only improve efficiency but also foster clear communication between all parties involved.

Such documents typically include key information like a breakdown of services, itemized costs, payment terms, and deadlines. They serve as both a formal request for payment and a legal record of what was agreed upon. When designed correctly, they contribute to a smooth workflow and help businesses keep their financial records in order.

Benefits of Using Structured Billing Documents

Using well-organized records can save time and reduce errors. They ensure that all relevant information is presented in a clear and concise manner, reducing the chance of confusion or disputes. Professional appearance also plays a role in maintaining positive relationships with clients, making them more likely to pay on time.

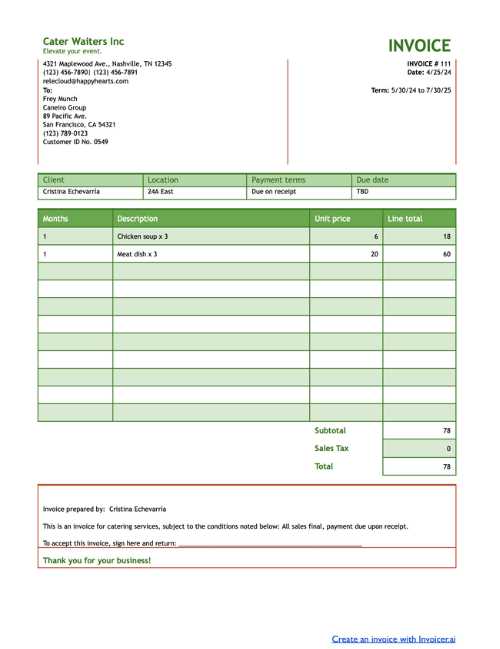

Customizing Your Financial Record Layout

One of the main advantages of these structured documents is the ability to tailor them to your specific needs. Businesses can choose from a variety of formats and designs, allowing them to incorporate their branding, highlight key payment details, and adapt the document to different event types. Customization ensures that every financial interaction aligns with the unique requirements of your business.

Why You Need a Catering Invoice

In any service-oriented business, having a clear and formal record of the work performed is essential for both legal and financial purposes. It ensures that both parties understand the details of the transaction and sets clear expectations regarding payment. A well-crafted document can help prevent misunderstandings and provide a solid foundation for professional relationships.

Such records serve as a reference for both the provider and the client, clearly outlining the services provided, their costs, and any payment terms. These documents are particularly important when dealing with large events or multiple clients, where the scope of services may be complex and require precise details to avoid confusion. Without this structure, tracking payments, managing finances, and maintaining trust with clients can become much more difficult.

Moreover, these documents play a vital role in protecting your business interests. They act as a formal request for payment and a legally binding agreement, ensuring that clients are held accountable for what they owe. Having a clear financial record helps you maintain control over your business operations and ensures timely compensation for your services.

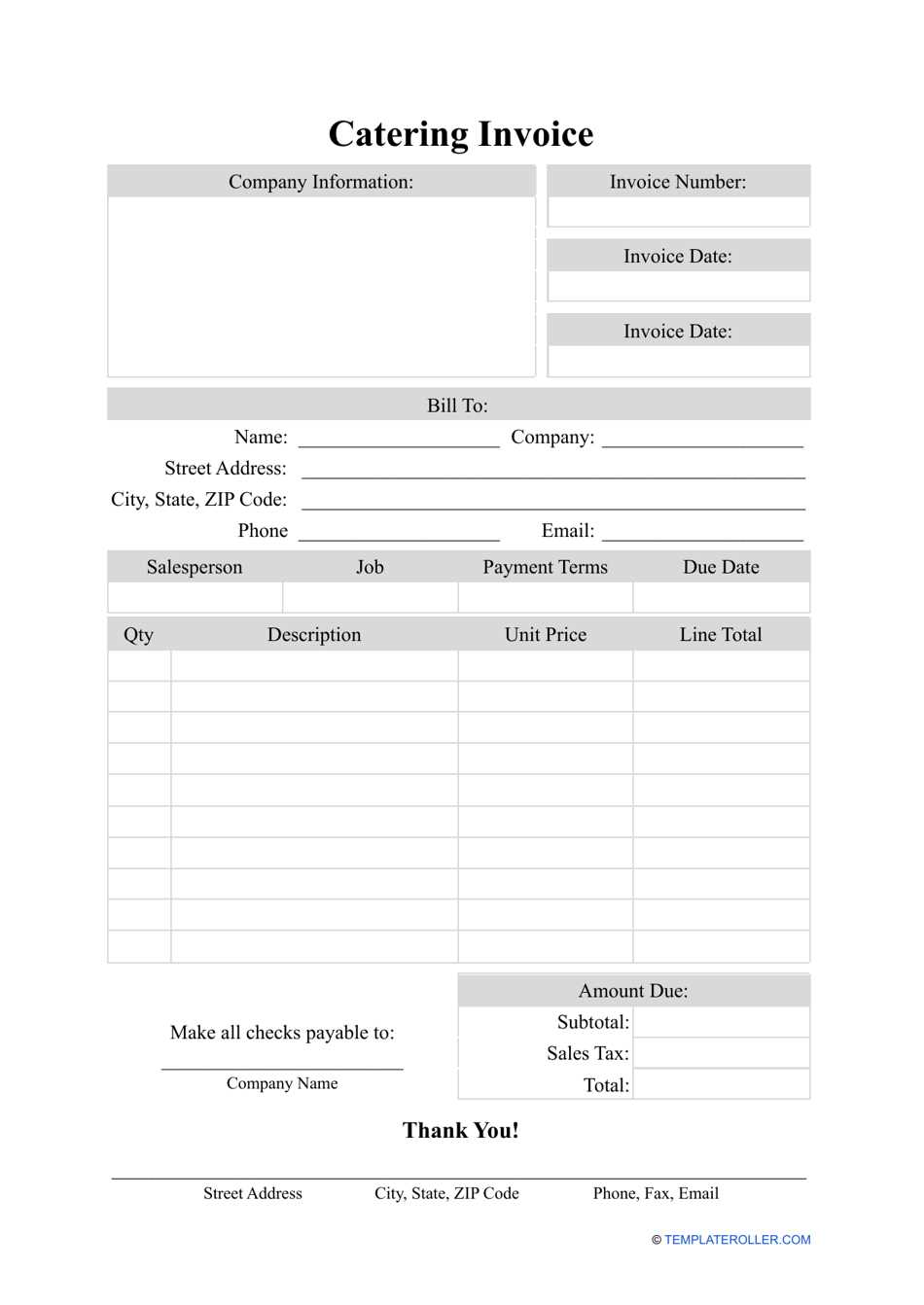

Key Features of Catering Invoice Templates

To effectively manage the financial side of any service-based business, certain elements must be included in the billing document to ensure clarity and professionalism. A well-designed record includes critical details that streamline both the payment process and communication with clients. These key features help avoid confusion and ensure that both parties are fully aware of the services rendered and the associated costs.

Here are some essential elements that should be present in any billing document:

| Feature | Description |

|---|---|

| Contact Information | Clear listing of both the service provider’s and client’s contact details, including names, addresses, and phone numbers. |

| Itemized Services | A detailed breakdown of all services provided, including descriptions, quantities, and individual pricing. |

| Total Amount Due | The sum of all charges, including any applicable taxes, discounts, or additional fees. |

| Payment Terms | Information on payment methods, deadlines, and any late fees or penalties for delayed payments. |

| Invoice Number | A unique identifier for each document, which helps in tracking and organizing financial records. |

| Service Date | The date when the services were provided, ensuring accurate reference for both parties. |

Including these features in your billing documents not only ensures accuracy but also boosts professionalism and trust with clients. By customizing these details according to your business needs, you can maintain clear communication and avoid any payment-related issues.

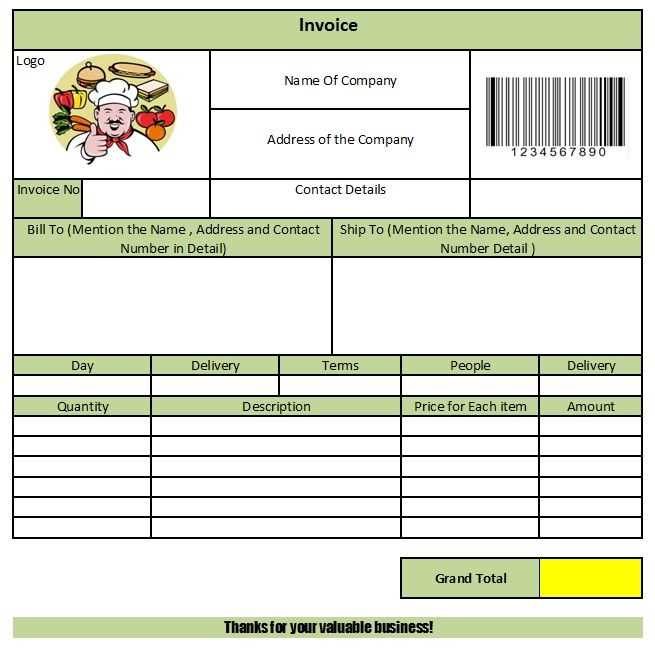

How to Customize Your Invoice

Customizing your financial documents is a crucial step in ensuring they reflect the unique needs and branding of your business. A personalized format not only enhances professionalism but also allows you to tailor the content to suit your specific services, payment structures, and client expectations. By adjusting key elements, you can create a more efficient billing process and improve client satisfaction.

There are several aspects of your record that can be customized to match your business goals. Start by incorporating your branding elements, such as logos, colors, and fonts, to give the document a consistent and professional look. This small detail can make a significant impact, reinforcing your company’s identity.

Next, ensure that the content is relevant and specific to your services. For instance, you may want to add or remove fields depending on the types of services you offer or the pricing structure you use. For example, if you offer multiple service packages, you can create sections that clearly outline each package’s costs and what is included. Customization also allows you to adjust payment terms, deadlines, and any applicable discounts or fees based on your agreements with clients.

Finally, consider adding personalized notes or messages to each document. This could be a thank-you note, a reminder of the payment terms, or any additional instructions. Personal touches help to foster positive client relationships and encourage timely payments.

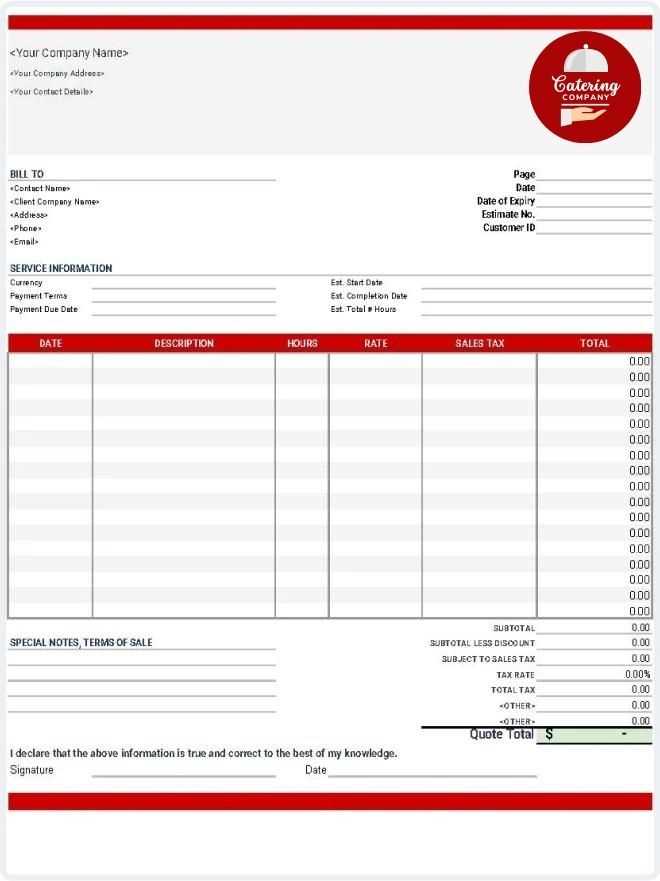

Free vs Premium Invoice Templates

When choosing a billing document for your business, you may find yourself deciding between free and paid options. Both types come with their own set of advantages and limitations, and selecting the right one depends on your specific needs and preferences. Understanding the key differences can help you make a more informed decision about which option is best suited for your business operations.

Free documents are widely available and offer a quick and accessible solution for small businesses or startups on a tight budget. They typically include basic features that are enough for businesses with simple billing needs. However, free options may have limited customization features, and you may find that some advanced functionalities are missing, such as automatic calculations, branding elements, or premium designs.

On the other hand, paid options often come with advanced features and higher levels of customization. With a premium version, you can expect more sophisticated layouts, the ability to integrate your branding seamlessly, and enhanced support. Premium documents might also offer added functionality, such as automated reminders, payment tracking, and integration with accounting software. These features are particularly beneficial for larger businesses or those seeking to streamline their operations.

Ultimately, the choice between free and premium comes down to the complexity of your billing needs. If you require a simple and cost-effective solution, free options may suffice. However, if you need greater flexibility and enhanced features to improve your workflow and professional image, investing in a premium version could be well worth the cost.

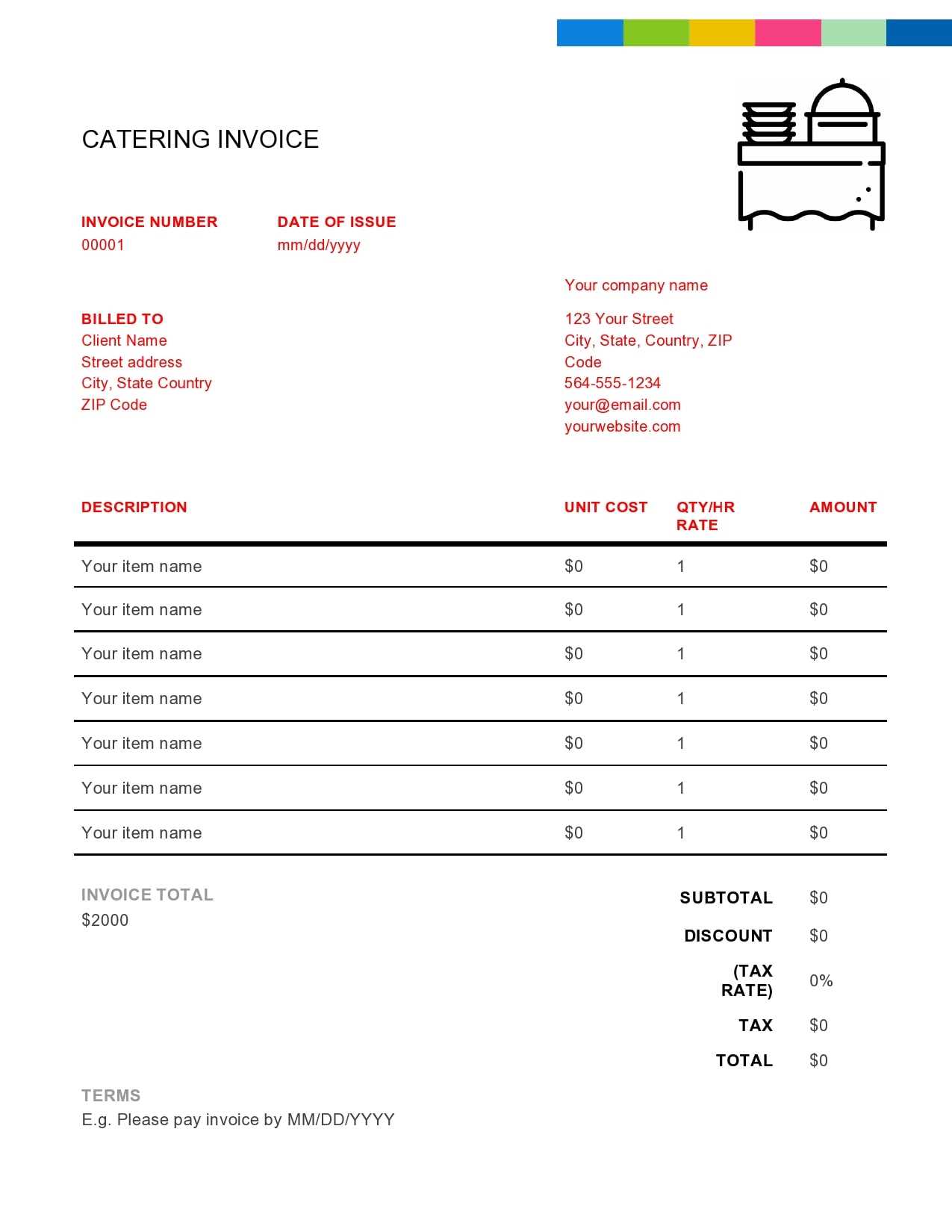

Best Formats for Catering Invoices

Choosing the right format for your billing documents is essential to ensure clarity, accuracy, and ease of use. The format you select should align with your business needs and offer flexibility for customization, allowing you to efficiently manage transactions and maintain a professional appearance. There are several formats available, each with its own strengths and features that can enhance the billing process.

Common Formats for Billing Documents

- Word Documents: A popular choice for simple, editable files. These are easy to customize and can be saved or printed in various formats. Word documents are particularly useful if you want a quick, straightforward solution without advanced features.

- Excel Spreadsheets: Ideal for businesses that need to track multiple entries, calculate totals automatically, or store large amounts of data. Excel formats are perfect for businesses that deal with detailed itemizations or require extensive data management.

- PDF Files: A secure and professional format that ensures the document cannot be altered once sent. PDF files are ideal for providing finalized records to clients and are universally accessible across different devices and platforms.

- Online Tools: Platforms like Google Docs or invoicing software can be accessed from anywhere and often include automated features such as payment reminders and real-time tracking. These tools are great for businesses looking to streamline their billing process.

Choosing the Right Format for Your Business

- If you need flexibility and easy customization, Word or Excel files may be the best option for you.

- For those who prioritize security and a professional presentation, PDF is an excellent choice.

- If automation and convenience are key, using online tools will help you manage payments and track records efficiently.

The best format will depend on the specific needs of your business, such as the volume of transactions, your level of technical expertise, and how you prefer to share or store the documents. Each option offers unique benefits to help improve your billing process.

How to Add Taxes to Invoices

Including taxes in your financial documents is essential for compliance with local regulations and to ensure accurate payment from clients. Whether you need to apply sales tax, value-added tax (VAT), or any other form of tax, it’s important to calculate and present these charges clearly. This helps to avoid confusion and ensures that both parties are fully aware of the total amount due.

Understanding Tax Rates

Before adding taxes to your documents, it’s crucial to understand the tax rate applicable to your business. Tax rates vary by location, industry, and even the type of service provided. Make sure you research the correct rate based on your region and the nature of your business. You may need to apply different rates for various services, so it’s important to be clear on what applies to each service you offer.

Steps to Add Taxes

- Determine the Tax Rate: Research the applicable tax rate for your services and region. This could be a flat percentage or a variable rate depending on the type of service.

- Calculate the Tax Amount: Multiply the service total by the applicable tax rate. For example, if the total cost is $500 and the tax rate is 10%, the tax amount would be $50.

- Add the Tax to the Total: After calculating the tax, add it to the subtotal of the services provided. This will give you the final amount due. Be sure to clearly separate the tax amount from the original service charges on your document.

- Include a Tax Breakdown: Provide a clear breakdown of the tax calculation. This shows your client exactly how the tax was applied and avoids any confusion about the final amount owed.

Incorporating taxes into your billing documents ensures compliance with regulations and promotes transparency with your clients. It’s important to calculate taxes correctly and present them in a way that is easy to understand, keeping your billing process efficient and professional.

Incorporating Payment Terms in Your Invoice

Clearly stating payment terms in your financial documents is essential for establishing expectations and avoiding misunderstandings between you and your clients. By outlining the details of when and how payments are to be made, you set a professional tone and help ensure timely payments. These terms provide important information on due dates, accepted payment methods, and potential penalties for late payments.

When adding payment terms, be specific and detailed. Include clear instructions on how clients can make payments, whether through bank transfer, credit card, or another method. Additionally, it’s important to specify the due date for payment, as well as any late fees or interest charges that may apply if payment is not received by the deadline.

- Payment Due Date: Clearly state the date by which the payment must be received. You may choose a specific calendar date or specify a time frame, such as “within 30 days of service completion.”

- Accepted Payment Methods: Indicate the payment options available to your clients, such as credit card, PayPal, bank transfer, or checks.

- Late Payment Fees: Define any penalties for overdue payments. This could be a flat fee or a percentage of the total amount due, and it should be explained clearly to avoid disputes.

- Discounts for Early Payment: If you offer any incentives for early payments, such as a discount, be sure to mention them. For example, “5% discount for payments made within 10 days.”

By including these details in your document, you provide your clients with the necessary information to ensure smooth and timely transactions. Clear payment terms contribute to a professional relationship, reduce payment delays, and protect your business from financial uncertainty.

Common Mistakes to Avoid in Invoicing

Inaccurate or unclear financial documents can lead to confusion, delayed payments, and strained relationships with clients. Even small errors can have a big impact on your business operations and cash flow. It’s essential to be aware of the common mistakes people make when creating billing records, so you can avoid them and maintain a smooth, professional process.

One of the most frequent mistakes is failing to include all relevant information, such as contact details, service descriptions, and payment terms. If clients are unsure about what they are being charged for or how to pay, they are more likely to delay payment or even dispute the charges. Missing important details or not clearly communicating terms can create unnecessary friction between you and your clients.

Another common mistake is not ensuring the accuracy of calculations. Overcharging or undercharging can lead to client dissatisfaction and financial issues. It’s important to double-check all amounts before sending out your document. Automating calculations or using templates that perform these tasks for you can help eliminate human error.

- Ambiguous Payment Terms: Failing to specify the payment deadline or accepted methods can cause confusion and delay payments. Always include clear payment instructions.

- Incorrect Client Information: Sending a document with the wrong client details, such as an incorrect address or contact person, can delay payment or result in miscommunication.

- Not Including Late Fees: If late payment penalties are part of your agreement, be sure to clearly state them in the document to avoid any misunderstandings later.

- Not Using a Unique Reference Number: Without a unique identifier for each transaction, tracking payments can become difficult, especially as your business grows.

By paying attention to these common mistakes and taking the time to ensure your documents are accurate and clear, you’ll avoid unnecessary complications and maintain positive relationships with your clients. Properly structured and error-free records help ensure that payments are made on time and that your business operations run smoothly.

Tips for Efficient Billing Management

Effective financial record-keeping is essential for maintaining smooth business operations and ensuring timely payments. Proper management of your billing system not only saves time but also helps you stay organized and reduces the risk of errors. By adopting the right practices and tools, you can streamline your billing process and improve cash flow.

One of the most important tips for efficient management is automating your billing process. Automation software can generate and send out documents on schedule, calculate totals, and even track payments in real-time. This reduces the amount of manual work and minimizes the chances of mistakes, while also ensuring your clients receive timely reminders for payment.

Another tip is to maintain a consistent filing system for all financial records. Whether you use digital tools or physical filing, keeping your records organized is key to efficient management. A clear, structured system makes it easier to retrieve documents when needed, track overdue payments, and prepare for tax season. Digital tools such as cloud storage or accounting software can further enhance organization by allowing easy access and sharing.

- Set Payment Deadlines: Always include clear payment deadlines in your documents, and set reminders for yourself to follow up on overdue payments.

- Use Consistent Billing Dates: Create a schedule for billing–whether it’s weekly, bi-weekly, or monthly–so that clients know when to expect their documents, and you can maintain a predictable cash flow.

- Track Outstanding Balances: Keep a running total of all outstanding payments and set up automatic notifications to follow up with clients who haven’t paid on time.

- Offer Multiple Payment Options: Providing clients with several ways to pay–such as bank transfers, online payment systems, or credit cards–can help speed up the payment process and reduce friction.

By implementing these practices, you’ll be able to stay on top of your financial management tasks, avoid delays in payment, and create a more efficient workflow. A well-organized approach to billing can save you both time and resources while fostering positive relationships with your clients.

How to Organize Your Invoice Records

Properly organizing your financial documents is essential for maintaining a smooth workflow and ensuring that you can quickly access any needed information. An effective system helps you track payments, stay on top of outstanding balances, and easily manage records for accounting or tax purposes. With a bit of planning, you can set up a method that suits your business and makes it easy to retrieve and update your billing records.

The first step in organizing your records is creating a consistent naming convention for your documents. This ensures that each record is easy to find and sort. You can include the client’s name, date, and a unique reference number to make identification simpler.

Methods for Organizing Your Records

- Digital Filing Systems: Using cloud storage or a digital accounting tool to store your documents allows easy access from anywhere. Create folders by client, date, or service type to ensure everything is sorted logically and can be retrieved quickly.

- Physical Filing Systems: If you prefer hard copies, use a filing cabinet with clearly labeled folders. You can organize by client name, date, or service type. Make sure to store documents in a secure, easily accessible location.

- Automated Tracking Tools: Using software that tracks outstanding payments and generates reports can help you stay on top of records. These tools often allow you to filter records by client, date, or status, making them invaluable for managing finances.

Organizational Tips

- Consistency: Stay consistent with your naming and filing conventions. This will save time when searching for specific records or reviewing past transactions.

- Regular Updates: Make it a habit to update your records regularly. Schedule weekly or monthly check-ins to ensure that new documents are filed and paid records are marked as completed.

- Backup Your Records: Always have a backup of your important documents. If you use digital records, store a copy on an external hard drive or another cloud service for added security.

- Categorize by Status: Organize your records by payment status, such as “Paid,” “Pending,” or “Overdue.” This will make it easier to follow up on outstanding amounts and stay up-to-date on financials.

By setting up an organized system for managing your financial documents, you can easily keep track of all transactions, avoid errors, and ensure your business stays on top of its finances. A clear system not only saves time but also provides peace of mind knowing that your records are accurate and accessible when needed.

How to Create Professional Invoices

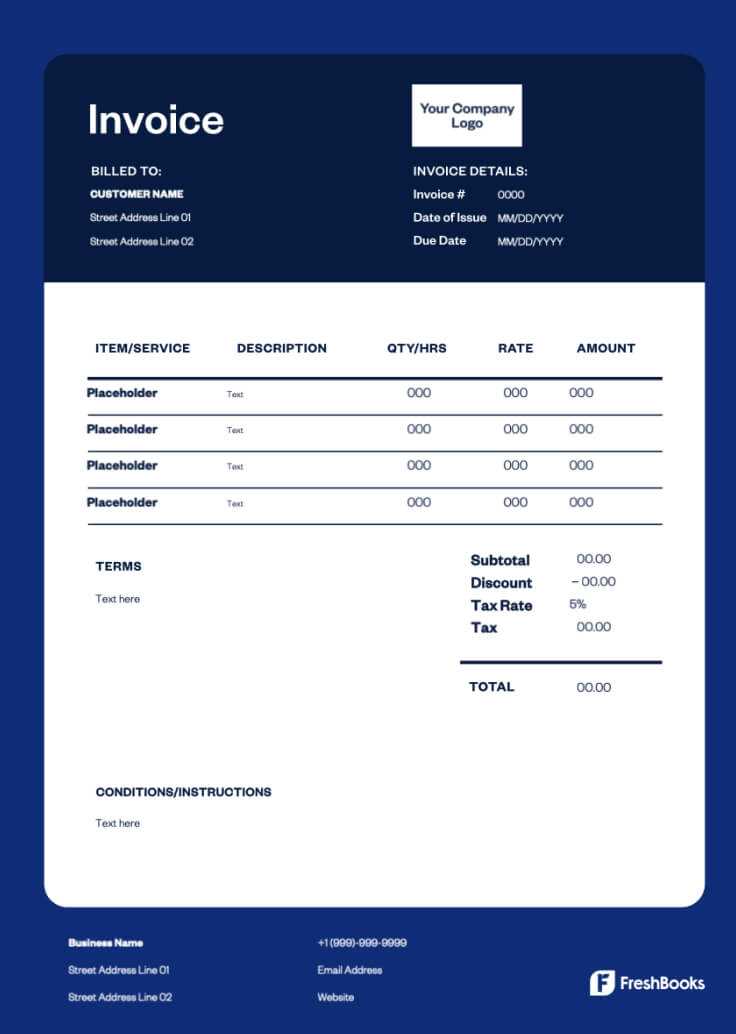

Creating well-structured, professional financial documents is crucial for establishing credibility and ensuring smooth transactions with your clients. A well-designed record not only reflects your business’s professionalism but also helps avoid confusion about charges, payment terms, and services provided. Crafting such documents involves focusing on clarity, accuracy, and consistent formatting.

Key Elements of a Professional Document

- Business Information: Always include your business name, address, contact details, and logo. This reinforces your brand and makes it easy for clients to reach you if needed.

- Client Details: Ensure the recipient’s name, business name, and contact details are accurate. This prevents any mistakes and ensures the document is directed to the right person.

- Unique Reference Number: Assign a unique number to each record. This allows you and your clients to track the document easily and avoids confusion when managing multiple transactions.

- Itemized List of Services: Clearly describe the services provided, including quantity, rate, and total cost for each item. Transparency in this section minimizes misunderstandings.

- Payment Terms: Specify the due date, accepted payment methods, and any penalties for late payments. This sets clear expectations and helps ensure timely payments.

- Taxes and Additional Charges: If applicable, include the tax rate and any other charges like shipping or handling fees. Make sure these amounts are clearly labeled to avoid confusion.

Tips for Making Your Documents Stand Out

- Use Consistent Formatting: Choose a clean, simple layout with readable fonts and consistent headings. This makes your document professional and easy to read.

- Stay Organized: Make sure the document flows logically. Keep sections like service descriptions, payment terms, and totals clearly separated for easy navigation.

- Double-Check for Accuracy: Always review the details before sending. Ensure the amounts, dates, and client information are correct to prevent any issues later on.

- Include a Personal Touch: Consider adding a brief thank-you note or a message of appreciation. This can help build positive client relationships and show professionalism.

By following these steps, you can create clear, professional documents that will not only help you get paid faster but also enhance your business’s reputation. Accurate, well-designed f

Legal Requirements for Catering Invoices

Every business must comply with local laws and regulations when issuing financial documents to clients. These documents not only serve as proof of transactions but also help businesses stay compliant with tax authorities. Failing to meet legal requirements can lead to penalties, disputes, or issues with tax reporting. It’s important to include specific information in each record to ensure compliance and avoid any legal complications.

Essential Information to Include

- Business Identification: Always include your legal business name, address, and contact information. If applicable, include your tax identification number (TIN) or VAT number. This information confirms your legitimacy and allows the tax authorities to track your business activities.

- Client Information: Ensure the recipient’s full name and address are listed correctly. Accurate client details are essential for proper documentation and can help in case of disputes.

- Unique Reference Number: Assign a unique number to each document. This helps track the transaction and prevents confusion when managing multiple records.

- Service Description: Provide a clear description of the goods or services provided, including quantities and unit prices. This helps justify the charges and ensures transparency with the client.

- Dates: Include both the date the document was issued and the date the services were rendered (if different). This ensures clarity on when the payment is due and provides a clear timeline for the transaction.

- Tax Details: If taxes apply, you must include the applicable tax rate and the total amount of tax charged. Ensure you follow your local tax laws for correct calculation and presentation.

- Total Amount Due: Clearly state the total amount due, including both the subtotal for services rendered and any taxes or additional charges. This provides a complete picture of the financial transaction.

Additional Legal Considerations

- Payment Terms: Specify the payment deadline and any penalties for late payments. Many jurisdictions require businesses to clearly communicate their payment terms to clients, especially in the case of overdue payments.

- Currency: Clearly state the currency in which the payment is to be made. This is especially important for international transactions to avoid any confusion.

- Legal Notices: Depending on your jurisdiction, you may need to include specific legal disclaimers or other notices about rights, warranties, or liabilities.

- Record Retention: Many regions require businesses to keep financial records, including transaction documents, for a certain period (often several years). Ensure you have a system in place to store and retrieve records when necessary.

By ensuring that your financial records comply with all relevant laws and regulations, you protect your business from potential legal issues and maintain professional standards. Proper documentation helps foster trust with clients while ensuring your business operates smoothly within legal frameworks.

How to Send Your Invoices Electronically

In the digital age, sending financial documents electronically is a fast, efficient, and eco-friendly way to manage transactions. Not only does it streamline the process, but it also allows for quicker payment processing and better record keeping. By leveraging various online tools and platforms, you can send documents instantly while ensuring they reach your clients securely.

There are several methods you can use to electronically send your financial documents, depending on your preference and the tools you have available. Below is a comparison of common options to help you choose the most suitable method for your business.

| Method | Pros | Cons |

|---|---|---|

| Quick, direct, and easy to use. Can attach documents in PDF or other formats. | May end up in the spam folder. Lacks tracking and security features. | |

| Online Payment Platforms | Convenient for both parties, offers built-in payment options, and allows tracking of payment status. | May incur fees for processing payments. Limited customization options for documents. |

| Cloud Storage (e.g., Google Drive, Dropbox) | Easy to share large files securely with multiple clients. Good for long-term storage and accessibility. | Requires both parties to have access to the platform. Not directly integrated with payment systems. |

When sending financial records electronically, it’s crucial to keep the following best practices in mind to ensure smooth transactions and protect sensitive data:

- Use Secure File Formats: PDF is the most commonly used and secure format for sending financial documents. It’s universally accessible and prevents unauthorized alterations.

- Double-Check Email Addresses: Ensure that you’re sending the document to the correct recipient to avoid any confidentiality issues or errors.

- Include a Clear Subject Line: Clearly state in the subject of your email that it contains a financial record to avoid confusion and ensure that your client knows what to expect.

- Use Encryption or Password Protection: If you’re sending particularly sensitive information, consider encrypting the file or using a password for added security.

By utilizing these electronic methods and following the best practices outlined above, you can streamline your billing process, ensure timely payments, and maintain a professional, secure method of communication with your clients.

Tracking Payments with Invoice Templates

Efficiently monitoring payments is crucial for maintaining healthy cash flow and keeping track of outstanding balances. By using well-organized financial documents, businesses can easily identify which payments have been made, which are pending, and which need follow-up. Tracking payments allows for accurate reporting and ensures that nothing is overlooked, helping you manage your finances effectively.

When managing financial transactions, it’s essential to have a system in place for tracking the status of payments. Many businesses use specific fields or features within financial documents to note whether payments have been completed, are overdue, or are still pending. This systematic approach helps ensure no details are missed and allows you to follow up with clients when necessary.

| Payment Status | Action Required | Details |

|---|---|---|

| Paid | No action needed | The payment has been received in full and recorded as completed. |

| Pending | Send a reminder | The payment is due but has not yet been made. A reminder should be sent before the deadline. |

| Overdue | Follow up | The payment has not been made by the due date. A formal follow-up is needed, possibly with a late fee. |

| Partial Payment | Track remaining balance | A partial payment has been made, but there is still an outstanding balance to be paid. |

By including these payment status categories in your financial documents, you can easily track and manage the progress of each transaction. Many accounting tools or digital platforms allow you to automatically update the status of payments as they are processed, providing you with real-time updates. This reduces manual effort and ensures that payment statuses are always up to date.

To streamline payment tracking further, consider integrating payment reminders and deadlines directly into your documents. This proactive approach ensures clients are aware of due dates and encourages prompt payment, helping you maintain a healthy cash flow.

Integrating Invoice Templates with Accounting Software

Integrating financial documents with accounting software can significantly streamline your business operations. By automating the creation, tracking, and reporting of transactions, you can save time, reduce errors, and improve financial transparency. This integration ensures that all your records are aligned, making it easier to manage your finances, track outstanding balances, and generate reports.

Using accounting software in conjunction with your financial documents allows for seamless data transfer. When a transaction is entered into the system, it can automatically generate and send the required records, update payment statuses, and even send reminders to clients. Below are some key benefits of integrating financial documents with accounting software:

- Automation of Data Entry: Reduces the need for manual data entry, minimizing human error and speeding up the process of generating records.

- Real-Time Updates: Automatically updates payment status, taxes, and balances as payments are received or processed.

- Improved Accuracy: By syncing your documents with accounting software, the risk of discrepancies between financial records and your accounting system is greatly reduced.

- Efficient Tracking: Easily track outstanding payments and overdue accounts by integrating real-time payment information.

- Simplified Reporting: Generate accurate financial reports quickly and easily without the need for manual input or reconciliation.

Here’s how to integrate your financial documents with accounting software:

- Choose Compatible Software: Ensure that your accounting software supports document generation and integration. Many platforms like QuickBooks, Xero, and FreshBooks offer features for creating and sending records directly from the system.

- Set Up Automation Rules: Configure the software to automatically generate records when certain conditions are met, such as after completing a service or fulfilling an order.

- Link Payment Gateways: Connect payment systems or gateways to your accounting software to track payments automatically as they are made.

- Sync Client Data: Make sure your client information is up-to-date in both the software and your document system to avoid mismatches.

By integrating your financial documents with accounting software, you can increase efficiency and maintain a high level of organization in your business. The synchronization of both systems helps ensure accurate record-keeping, reduces the risk of errors, and allows for better control over your financial operations.

How to Improve Your Client Relationships with Invoices

Effective communication and transparency are key to fostering strong relationships with clients. Financial documents play a significant role in this, as they not only facilitate payments but also demonstrate professionalism and trustworthiness. By ensuring that your records are clear, detailed, and easy to understand, you can improve your clients’ experience, reduce confusion, and promote long-term business partnerships.

When creating financial documents, consider how the presentation and content can positively impact your relationship with clients. A well-crafted document can showcase your attention to detail, increase trust, and encourage timely payments. Below are some strategies to use your financial documents to enhance client relationships:

| Strategy | Benefit | Client Impact |

|---|---|---|

| Clear Itemization | Breakdown of services or products with individual costs | Clients understand exactly what they are paying for, fostering transparency and trust. |

| Personalized Touch | Include a thank-you note or personalized message | Clients feel valued, which strengthens your relationship and builds loyalty. |

| Payment Flexibility | Offer multiple payment options and flexible terms | Clients appreciate the convenience, which can enhance their satisfaction and likelihood of repeat business. |

| Clear Due Dates | Specify payment deadlines and overdue penalties | Clear expectations reduce confusion and improve the likelihood of timely payments. |

| Professional Formatting | Use a clean, organized design | Clients view your business as organized and professional, leading to a stronger partnership. |

By incorporating these practices into your financial documents, you not only make the payment process easier for your clients but also foster goodwill and professionalism. When clients feel that their business is valued and that communication is clear, they are more likely to trust your company and engage in future transactions. Building strong client relationships through thoughtful and transparent financial practices can set you apart from your competitors and promote long-term success.