Free Child Care Invoice Template for Simplified Billing

Managing the financial aspects of any caregiving service can often feel overwhelming. For those offering support to families, simplifying billing can bring peace of mind and ensure smooth operations. A well-organized method for documenting payments and expenses not only keeps records clear but also helps establish trust with families.

With user-friendly resources at your disposal, creating a reliable record for financial exchanges becomes straightforward. Instead of developing documents from scratch, providers can use ready-made formats, saving both time and effort. These tools are designed to help caregivers ensure that each interaction related to fees is documented clearly and professionally.

Whether you are just starting or have been offering services for years, adopting efficient record-keeping practices can bring consistency to your work. Having access to structured resources makes it easy to stay organized, address client needs, and maintain accurate records, which can support the long-term growth of your caregiving business.

Child Care Invoice Template Guide

Organizing financial transactions is essential for those providing services to families, as it helps ensure that each detail is clearly communicated and properly recorded. Using structured documents for managing fees and payments can significantly ease the process, offering both providers and families a simple way to stay on the same page. The right approach can reduce confusion, foster trust, and keep your work streamlined.

Key Elements of a Well-Structured Document

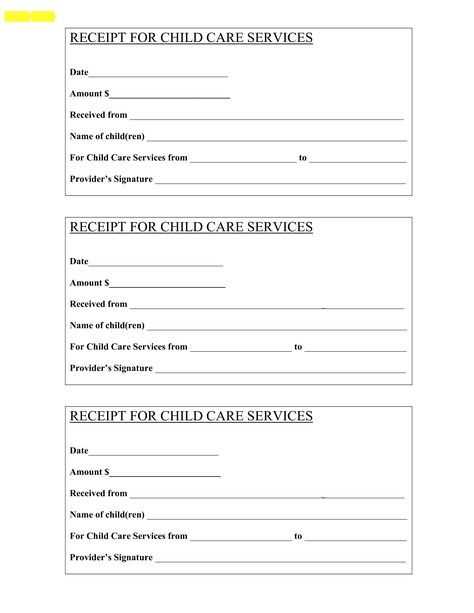

For effective record-keeping, a standard format typically includes sections that clearly outline details of the services provided, the agreed fees, and any relevant due dates. With these sections, both providers and families can easily track important information, enhancing transparency. This structure also minimizes the risk of misunderstandings by providing a consistent format for each transaction.

Why Use Ready-Made Formats

Opting for pre-designed forms offers multiple advantages, including time savings and the convenience of a professional layout. These resources are designed to cover all essential details, from service descriptions to payment terms, making them suitable for providers looking to simplify documentation. Adopting these pre-structured options not only ensures consistency but also allows caregivers to focus on their primary responsibilities while managing financial aspects smoothly.

Understanding the Importance of Invoices

In the realm of service-based work, having a consistent way to document transactions is invaluable. Maintaining accurate records helps ensure both parties understand the terms, dates, and amounts involved, building a foundation of clarity and trust. This approach to financial organization not only benefits the service provider but also promotes a transparent relationship with clients.

Using well-structured documents for each transaction brings several key advantages:

- Accountability: Clear documentation keeps both the provider and client informed of each payment and service detail.

- Financial Planning: Tracking payments over time enables better budgeting and planning for both parties, avoiding unexpected surprises.

- Professionalism: Presenting a formal record showcases a commitment to organized, reliable service, which can strengthen client relationships.

When records are organized and accessible, handling disputes or misunderstandings becomes simpler, as there is a clear reference for each service interaction. Additionally, consistent record-keeping allows providers to focus on core duties, knowing that each financial interaction is accurately tracked and well-documented.

Benefits of Using a Child Care Invoice

For professionals offering support to families, using organized documents for payment tracking provides a solid foundation for clear communication and financial consistency. This system helps eliminate confusion regarding fees, schedules, and services, creating a smoother experience for everyone involved. By utilizing structured records, providers can focus more on their work, knowing that each transaction is accurately documented.

Enhanced Financial Clarity

When each transaction is documented, both provider and client can easily follow up on due dates, fees, and any outstanding balances. This clarity minimizes misunderstandings, offering an efficient way to keep finances transparent. With a reliable format, professionals can reduce administrative tasks, allowing them to devote more time to their core responsibilities.

Trust and Professionalism

Presenting a professional document for each transaction not only keeps records neat but also fosters trust. Clients appreciate transparent systems where they can clearly see the services provided and the related costs. Consistent use of these records demonstrates reliability, which can lead to stronger, lasting relationships with families.

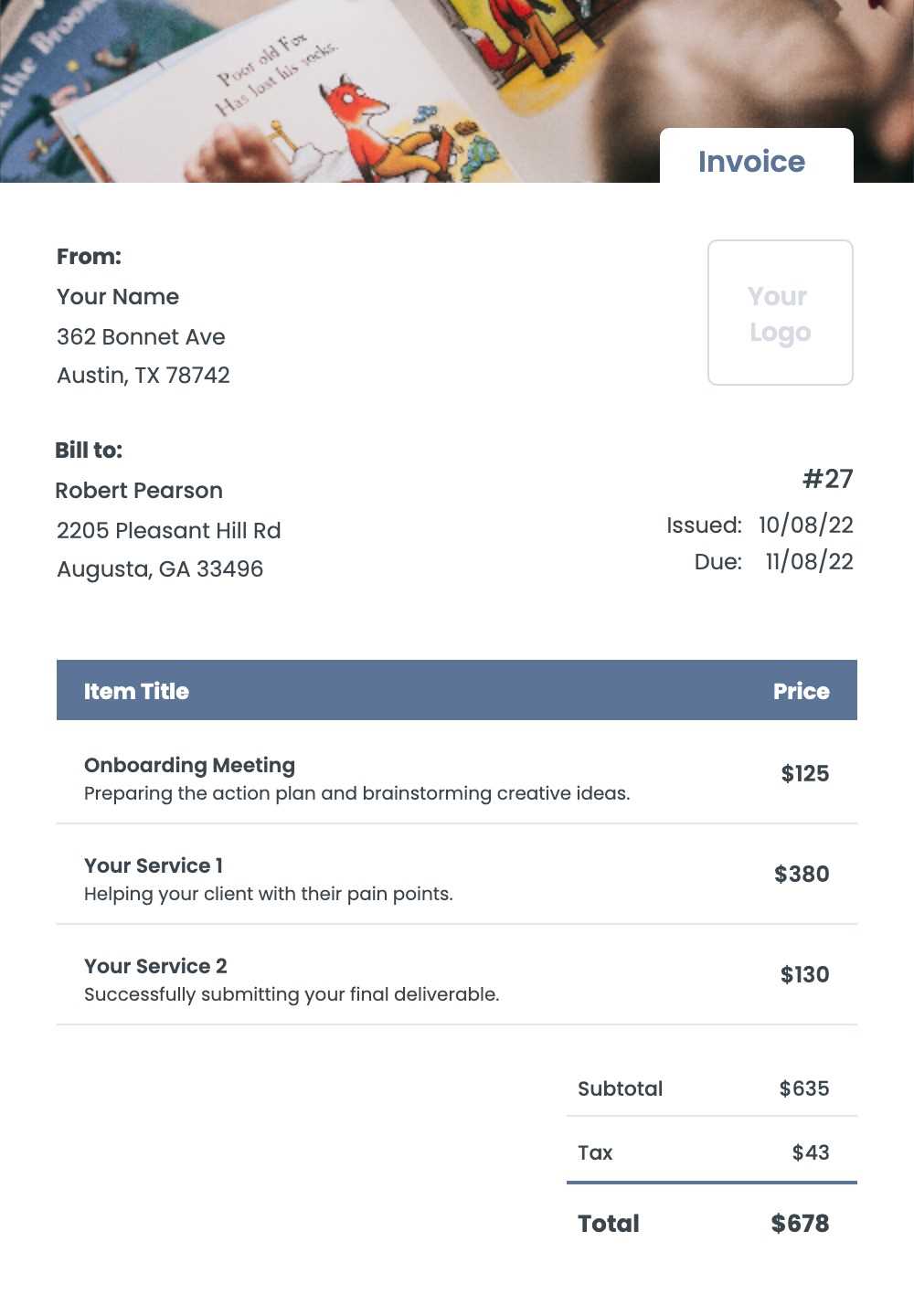

How to Create a Professional Invoice

Setting up a formal document for billing helps ensure that each financial transaction is clear and detailed, leaving no room for misunderstandings. Crafting a well-organized billing statement involves attention to layout, language, and accuracy. A professional approach in creating these records reflects positively on your services and helps establish trust with clients.

Key Details to Include

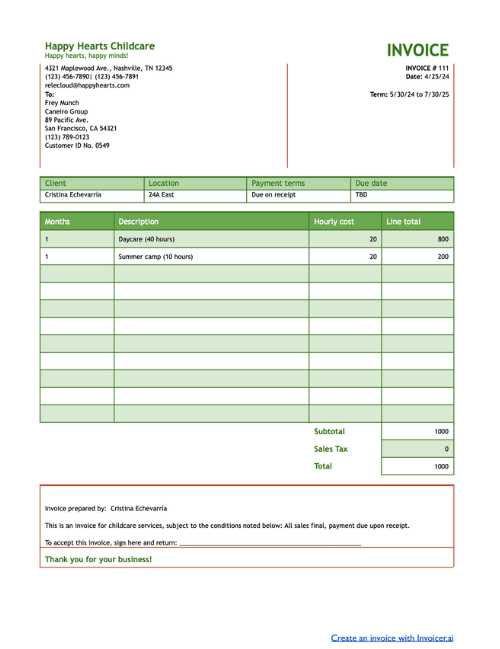

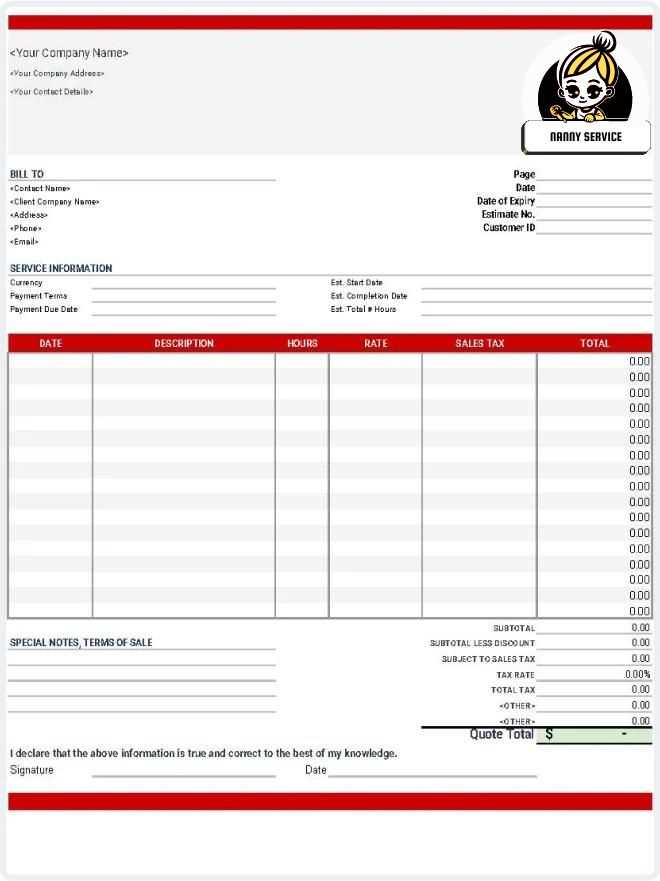

An effective billing document should contain specific information that leaves no questions unanswered. Essential elements include:

- Business Information: Clearly display your name, contact details, and any relevant business identification information.

- Client Details: Include the client’s name and contact information to ensure the document is personalized and specific.

- Service Description: Briefly outline the type of services provided and the dates or times associated with them.

- Amount Due: Clearly state the total am

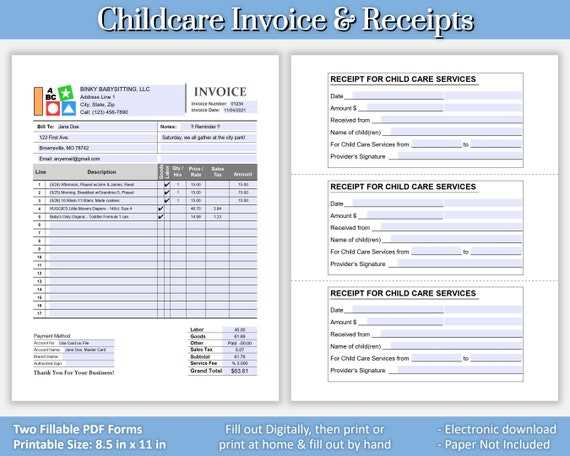

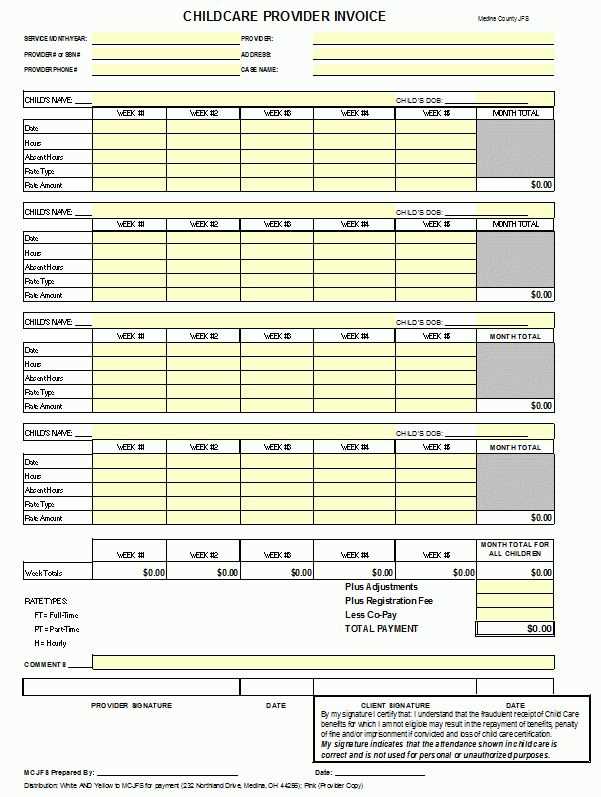

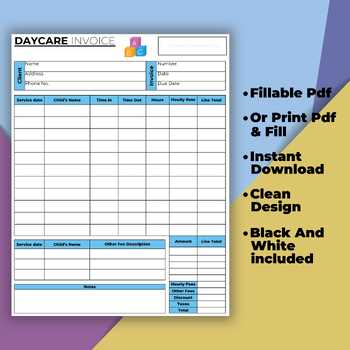

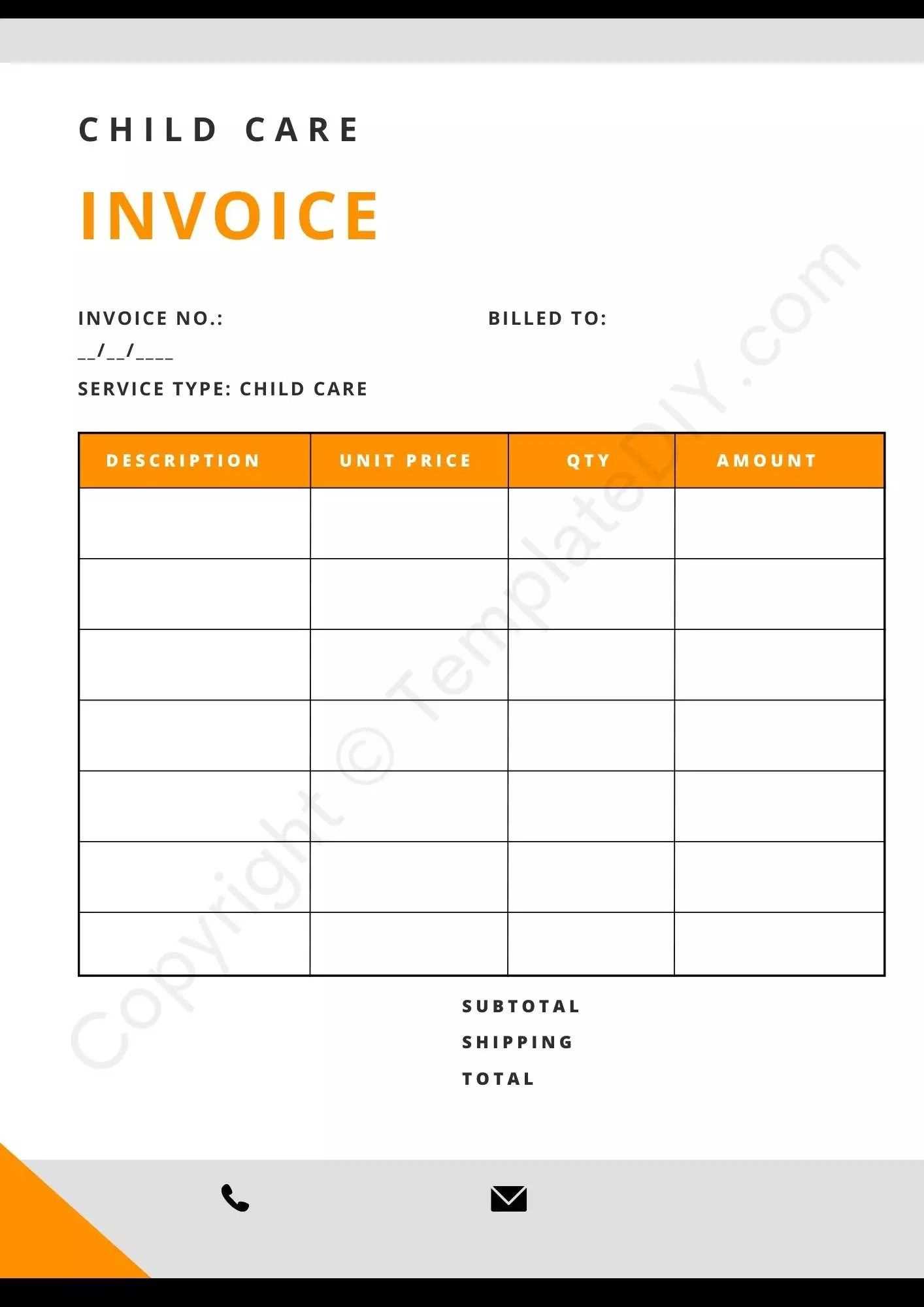

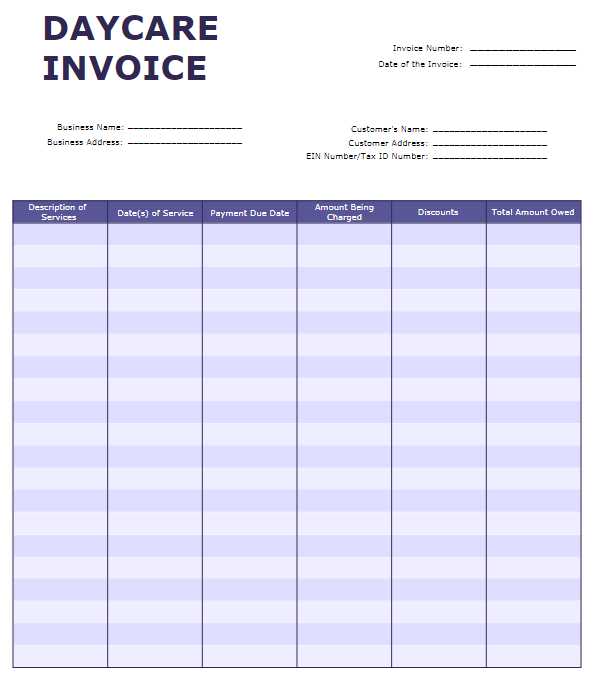

Essential Elements of a Child Care Invoice

To ensure clarity and professionalism in billing, a structured document should contain all the critical details necessary for accurate and transparent financial tracking. A well-designed format includes specific components that clearly outline the services provided and the associated costs, making it easy for both parties to understand the details of each transaction.

Here is a breakdown of key elements commonly found in a professional billing document:

Section Description Service Provider Details Includes the name, address, and contact information of the individual or business providing the service, establishing clear identification. Client Information Contains the recipient’s name and contact information to personalize the document and ensure accuracy. Description of Services Briefly outlines the specific services rendered, helping both parties understand the nature of the work provided. Service Date(s) Indicates when the services were provided, which is essential for record-keeping and billing verification. Amount Due Specifies the total cost for the services, including any applicable taxes or additional charges. Payment Terms Details the payment deadline and any policies on late fees, ensuring that the client is aware of when payment is expected. By including these elements, service providers can maintain c

Tips for Clear and Effective Invoicing

Creating well-structured billing documents is crucial for ensuring that transactions are understood and processed smoothly. Clarity in these records helps prevent misunderstandings and promotes timely payments. Adopting best practices in documentation can lead to a more professional appearance and enhanced client satisfaction.

Here are some helpful tips to ensure your billing statements are clear and effective:

- Use Clear Language: Avoid jargon and complex terms to make the document accessible to all clients.

- Be Specific: Provide detailed descriptions of services rendered, including dates and duration, to ensure transparency.

- Organize Information Logically: Present information in a logical order, such as starting with provider details, followed by client information, services provided, and the total amount due.

- Highlight Important Information: Use bold text or color to draw attention to key details, such as payment amounts and due dates.

- Consistent Format: Maintain a uniform layout for all billing documents, which helps clients quickly recognize and understand them.

- Provide Payment Options: Clearly outline accepted payment methods to facilitate prompt payments and avoid confusion.

By following these tips, you can create effective and professional billing documents that enhance communication and foster trust with your clients.

Step-by-Step Invoice Creation Process

Creating an effective billing document requires a systematic approach to ensure that all necessary details are included and presented clearly. Following a structured process not only enhances professionalism but also helps avoid common pitfalls that can lead to confusion or delays in payment.

Gathering Essential Information

The first step involves collecting all relevant details before starting the document. This preparation phase ensures that no critical information is overlooked.

- Service Provider Information: Gather your name, address, and contact details.

- Client Details: Collect the recipient’s name, address, and preferred contact method.

- Service Details: Document the services rendered, including dates, duration, and specific tasks performed.

- Pricing Information: Note down the agreed-upon rates and any applicable taxes.

Creating the Document

Once all necessary information is collected, you can proceed to draft the billing document. Follow these steps for an organized layout:

- Header: Include your business name and contact information at the top.

- Client Information: List the client’s details below your information.

- Service Summary: Clearly outline each service provided with corresponding dates and amounts.

- Total Amount Due: Sum all charges and highlight the total for easy reference.

- Payment Terms: Specify payment methods accepted and the due date.

By adhering to this step-by-step process, you can create a clear and professional billing document that facilitates smooth transactions and enhances your relationship with clients.

Designing an Easy-to-Read Invoice Layout

Creating a visually appealing and easy-to-read billing document is essential for effective communication with clients. A well-structured layout not only enhances clarity but also reflects professionalism, making it easier for recipients to understand the information presented.

When designing your document, consider the following key elements to ensure readability:

- Use Clear Fonts: Select legible fonts and appropriate sizes to make the text easy to read. Avoid overly decorative styles that can distract from the content.

- Organize Information Logically: Structure the document in a way that flows naturally. Start with provider details, followed by client information, service descriptions, and totals.

- Incorporate White Space: Use ample white space between sections and elements to avoid clutter. This separation allows the reader to focus on each part without feeling overwhelmed.

- Highlight Key Information: Utilize bold text or color to emphasize important details, such as the total amount due and payment terms, ensuring they stand out.

- Consistent Formatting: Maintain uniformity in font styles, sizes, and colors throughout the document to create a cohesive look.

By implementing these design principles, you can create a billing document that is not only attractive but also facilitates clear communication, ultimately enhancing your client’s experience.

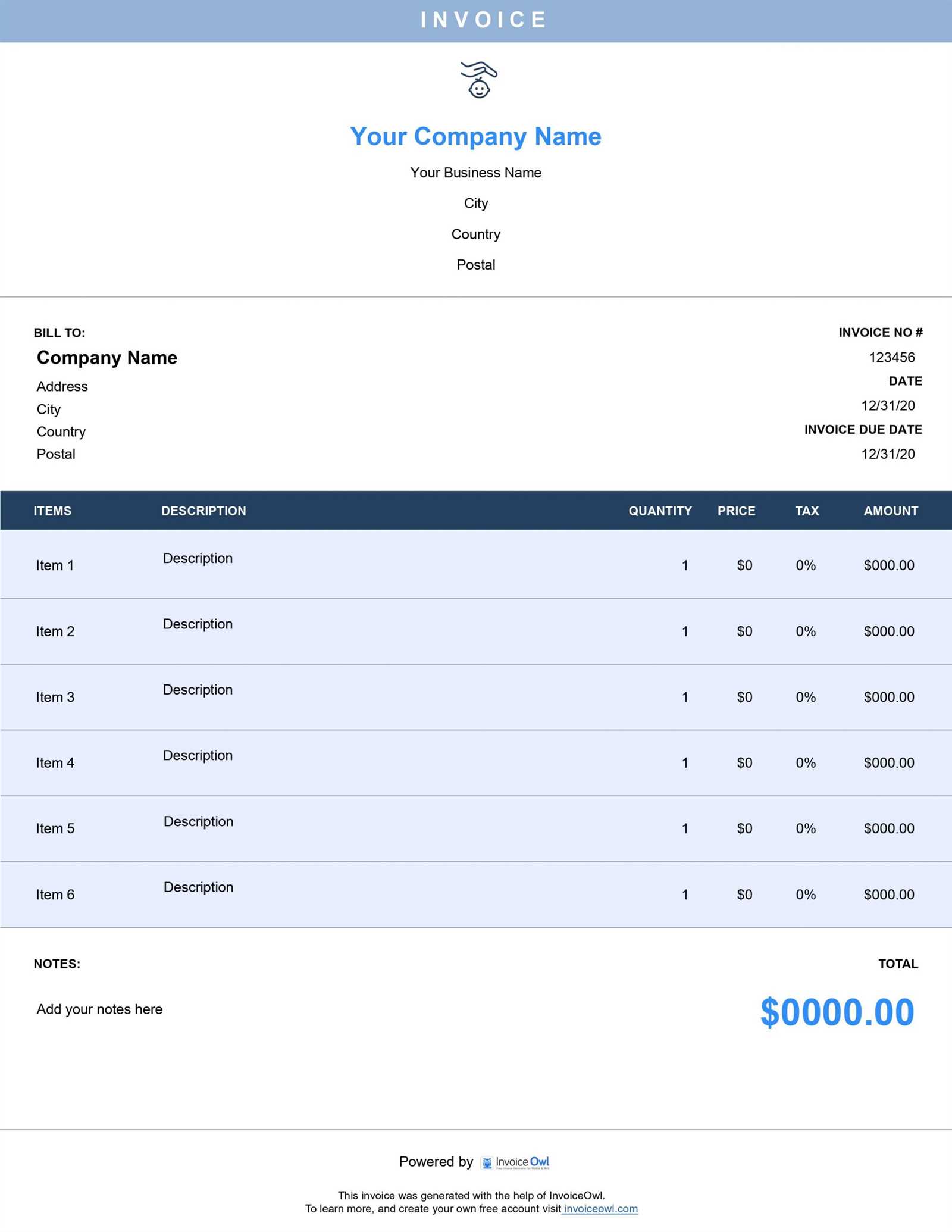

Recommended Tools for Invoice Templates

Choosing the right resources for creating billing documents can significantly enhance efficiency and professionalism. Various tools are available that cater to different needs, making it easier to design and manage your financial paperwork.

Here are some recommended options to consider:

- Online Software: Platforms like FreshBooks and QuickBooks offer user-friendly interfaces for creating and managing documents, complete with customization options and tracking features.

- Word Processing Applications: Programs such as Microsoft Word and Google Docs provide templates and formatting tools that can help you create tailored documents easily.

- Spreadsheet Programs: Utilizing Excel or Google Sheets allows for dynamic calculations, making it simple to keep track of amounts and adjustments while creating visually organized records.

- Graphic Design Tools: Applications like Canva or Adobe Express enable you to design attractive documents from scratch, giving you full control over the aesthetics and layout.

- Mobile Apps: Various apps are available for smartphones, such as Invoice2go, which allow you to generate and send documents on the go, ensuring you never miss an opportunity for invoicing.

By utilizing these tools, you can streamline your billing process, making it easier to create documents that reflect your brand and meet your clients’ needs.

How to Choose the Right Template

Selecting the appropriate format for your billing documents is crucial for ensuring clarity and professionalism. A well-designed layout not only communicates important information effectively but also enhances your brand image. Here are some essential factors to consider when making your choice:

Consider Your Audience

Understanding the preferences of your clients can greatly influence your selection. Different audiences may respond better to various styles, so think about the following:

- Business Type: Tailor your choice based on whether your clients are individuals or organizations, as each may appreciate distinct designs.

- Formality Level: Evaluate whether a formal or casual approach aligns with your relationship with clients.

Focus on Usability

A user-friendly format ensures that both you and your clients can easily navigate the document. Keep these points in mind:

- Clarity: Ensure that all essential details, such as services rendered and payment information, are clearly presented.

- Customizability: Opt for a design that allows you to modify elements to fit your branding and specific needs.

- Visual Appeal: Choose a layout that is aesthetically pleasing while maintaining a professional appearance.

By carefully evaluating these aspects, you can select a suitable format that meets your operational needs and resonates with your clientele.

Personalizing Your Billing Documents

Customizing your billing statements can significantly enhance your professionalism and strengthen client relationships. By incorporating personal touches, you can create a unique experience that reflects your brand and values. This process involves several key elements to consider for effective personalization.

Branding Elements: Ensure that your documents prominently feature your logo, colors, and fonts. This not only creates a cohesive look but also reinforces your identity in the eyes of your clients. Utilizing consistent branding helps build trust and recognition.

Client Information: Including specific details about your clients, such as their names and addresses, makes the documents feel tailored and thoughtful. Personalized greetings, such as “Dear [Client’s Name],” can add a warm touch that fosters a sense of connection.

Custom Messages: Adding a personal note or a message of appreciation can go a long way. Thanking clients for their trust or wishing them well can make your documents stand out. This simple gesture can leave a lasting impression and encourage repeat business.

By focusing on these aspects, you can create invoices that not only convey essential information but also reflect your commitment to quality service and client satisfaction.

Managing Payments with Invoice Tracking

Efficiently handling financial transactions is crucial for maintaining a smooth operation in any business. Utilizing a systematic approach to monitor payments can help you keep track of what has been received and what is still outstanding. This practice not only enhances your financial management but also promotes timely payments from clients.

The Importance of Payment Tracking

Organized Records: Keeping detailed records of all transactions helps you maintain an accurate overview of your finances. This organization minimizes errors and ensures that you can easily reference past payments. Well-structured records also aid in preparing for tax season and audits.

Improving Cash Flow

Timely Follow-ups: By tracking payment statuses, you can identify overdue accounts and follow up promptly. Sending reminders or notifications can encourage clients to fulfill their obligations, thereby improving your cash flow. Establishing a routine for checking outstanding payments can help you stay on top of your finances.

Implementing effective tracking practices allows you to manage your financial health more effectively, ensuring that you are always informed about your earnings and cash flow.

How to Send Invoices Digitally

In today’s fast-paced environment, utilizing electronic methods for delivering financial documents is essential for efficiency and convenience. This approach not only accelerates the billing process but also reduces the environmental impact associated with paper usage. Adopting digital communication methods can enhance the overall experience for both providers and clients.

Choosing the Right Format

When sending documents electronically, selecting an appropriate format is crucial. Here are some common options:

Format Advantages Considerations PDF Widely accepted, maintains formatting Ensure compatibility with all devices Word Document Editable, easy to customize Formatting may vary between programs Excel Spreadsheet Ideal for detailed calculations May require specific software to open Delivery Methods

There are several efficient ways to transmit documents to clients:

- Email: Directly attach the document and send it to the recipient’s email address.

- Cloud Storage: Upload the document to a cloud service and share a link with the client for easy access.

- Online Invoicing Software: Use dedicated software that allows for digital delivery and tracking of documents.

Implementing these methods can streamline the process of sending financial documents, ensuring that they reach clients promptly and securely.

Common Mistakes to Avoid in Invoices

When creating financial documents, it is crucial to ensure accuracy and clarity. Small errors can lead to misunderstandings and payment delays, ultimately affecting cash flow. By recognizing and avoiding common pitfalls, you can improve the efficiency and professionalism of your billing process.

Mistake Description Consequence Missing Information Omitting key details like contact information or payment terms. Confusion for the client, leading to delayed payments. Incorrect Amounts Errors in calculations for services rendered or total due. Disputes over charges, risking payment delays. Unclear Descriptions Vague or overly complex descriptions of services. Clients may not understand what they are being charged for. Lack of Professionalism Using informal language or unbranded formats. Can lead to a negative impression and reduce trust. Failure to Follow Up Neglecting to check on the status of outstanding payments. Missing out on potential late fees or payment reminders. By being mindful of these common mistakes, you can create more effective and professional financial documents that facilitate timely payments.

Understanding Legal Aspects of Invoices

Comprehending the legal considerations surrounding financial documents is essential for any business or service provider. These documents serve as formal requests for payment and carry specific implications regarding rights and responsibilities for both the issuer and the recipient. Ensuring compliance with relevant laws and regulations helps in safeguarding your interests and avoiding potential disputes.

Key Legal Considerations

Aspect Description Importance Compliance with Tax Laws Understanding local and federal tax requirements related to financial documentation. Ensures that you accurately report income and remit the correct amount of taxes. Contractual Obligations Clarifying terms of service or agreements reflected in the documents. Helps in enforcing agreements in case of disputes. Record Keeping Maintaining copies for a specified period as mandated by law. Facilitates audits and supports tax filings. Payment Terms Clearly stating due dates, late fees, and acceptable payment methods. Prevents misunderstandings regarding expectations for payment. Confidentiality Protecting sensitive information included in the documents. Ensures compliance with privacy laws and builds trust with clients. Consequences of Non-Compliance

Failing to adhere to legal requirements can lead to serious repercussions, including financial penalties, damaged reputation, and potential legal action. Therefore, it is crucial to stay informed and seek legal advice when necessary to ensure all practices align with the law.

Advantages of Free Invoice Templates

Utilizing complimentary formats for financial requests offers numerous benefits for businesses and individual service providers. These resources simplify the billing process while ensuring that all necessary details are clearly communicated. Here are some key advantages:

- Cost-Effective: Accessing these formats eliminates the need for expensive software or professional services, making it an ideal choice for startups and small enterprises.

- User-Friendly: Many of these designs are easy to navigate, allowing users to fill in relevant information without a steep learning curve.

- Customizable: Complimentary formats often allow for personalization, enabling users to tailor their documents to reflect their brand identity.

- Time-Saving: Pre-designed structures help speed up the billing process, allowing for quicker turnaround times in payment collection.

- Professional Appearance: Utilizing a well-organized format contributes to a polished and credible image, instilling confidence in clients regarding your services.

By incorporating these resources, individuals and businesses can enhance their billing practices without incurring additional expenses.

Where to Find Free Invoice Templates

Discovering complimentary resources for billing documents is essential for many professionals seeking efficient solutions. Numerous platforms offer a variety of options to meet diverse needs. Below are some reliable sources to explore:

1. Online Template Libraries: Websites such as Canva, Microsoft Office, and Google Docs provide extensive collections of customizable formats suitable for different purposes.

2. Freelance Websites: Platforms like Fiverr or Upwork often have freelancers who offer complimentary samples or budget-friendly designs that can be adapted for personal use.

3. Accounting Software: Many accounting applications, such as Wave or FreshBooks, offer built-in options for creating professional billing documents at no cost.

4. Business Blogs and Forums: Various business-oriented websites and online communities frequently share resources and links to useful billing documents, along with tips for usage.

By utilizing these platforms, individuals can efficiently access a range of options to create effective billing solutions tailored to their specific requirements.