Essential Sample Invoice Templates for Efficient Billing

Effective billing is crucial for maintaining smooth financial operations in any business. Whether you are a freelancer, small business owner, or part of a larger organization, using well-structured financial documents can help you manage payments efficiently. A properly formatted billing document not only ensures clear communication with clients but also improves your cash flow and reduces errors.

There are various formats available to help create professional billing records, each offering flexibility for different needs. These documents can be customized to match your company’s branding and specific payment terms. With the right approach, you can create accurate, easy-to-read records that streamline your administrative tasks and reinforce your professionalism in the eyes of your clients.

Having a variety of document formats at your disposal allows you to adapt to different client requirements and business situations. From simple layouts to more detailed designs, the ability to choose the best format can make the billing process faster and more efficient. In the following sections, we will explore some of the most practical options and how to use them effectively in your daily operations.

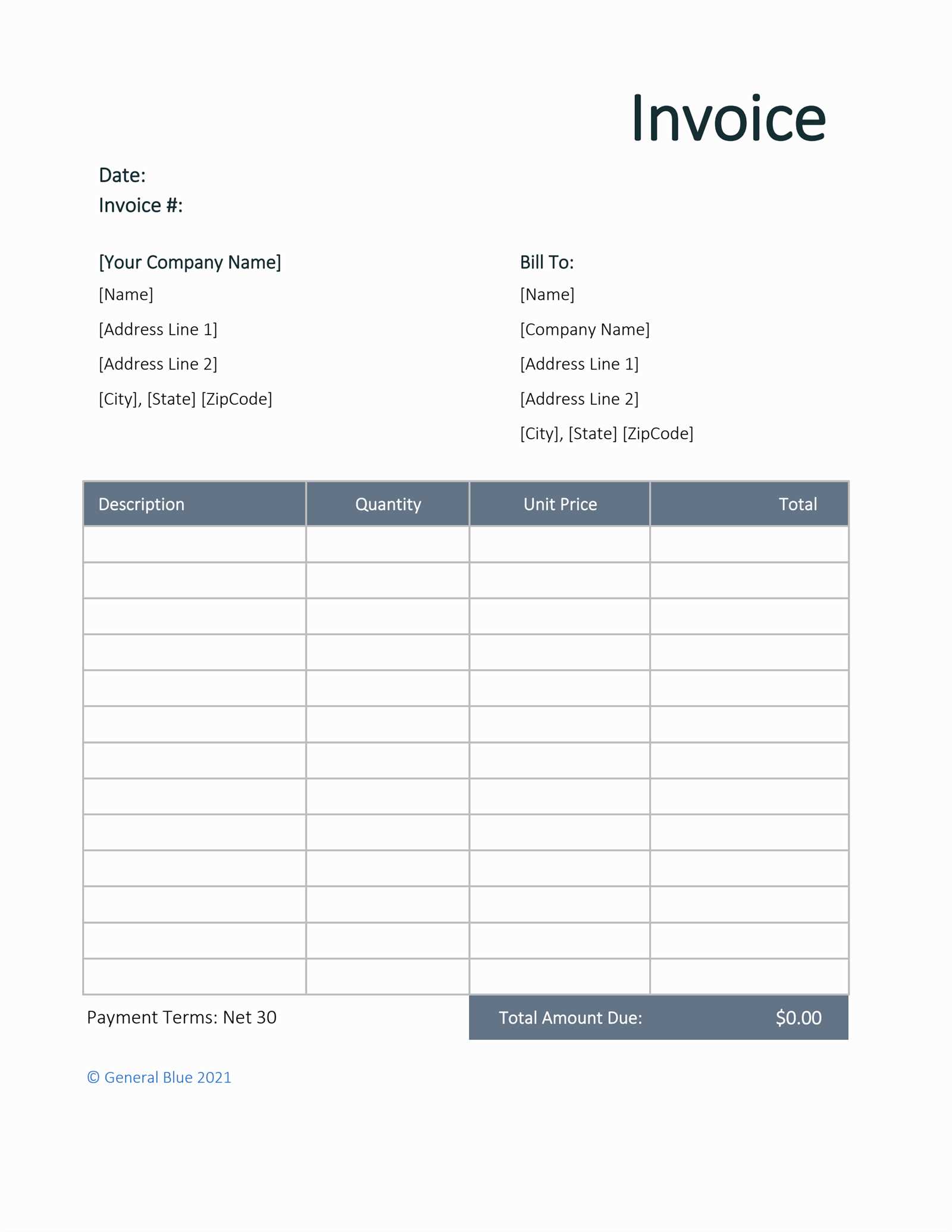

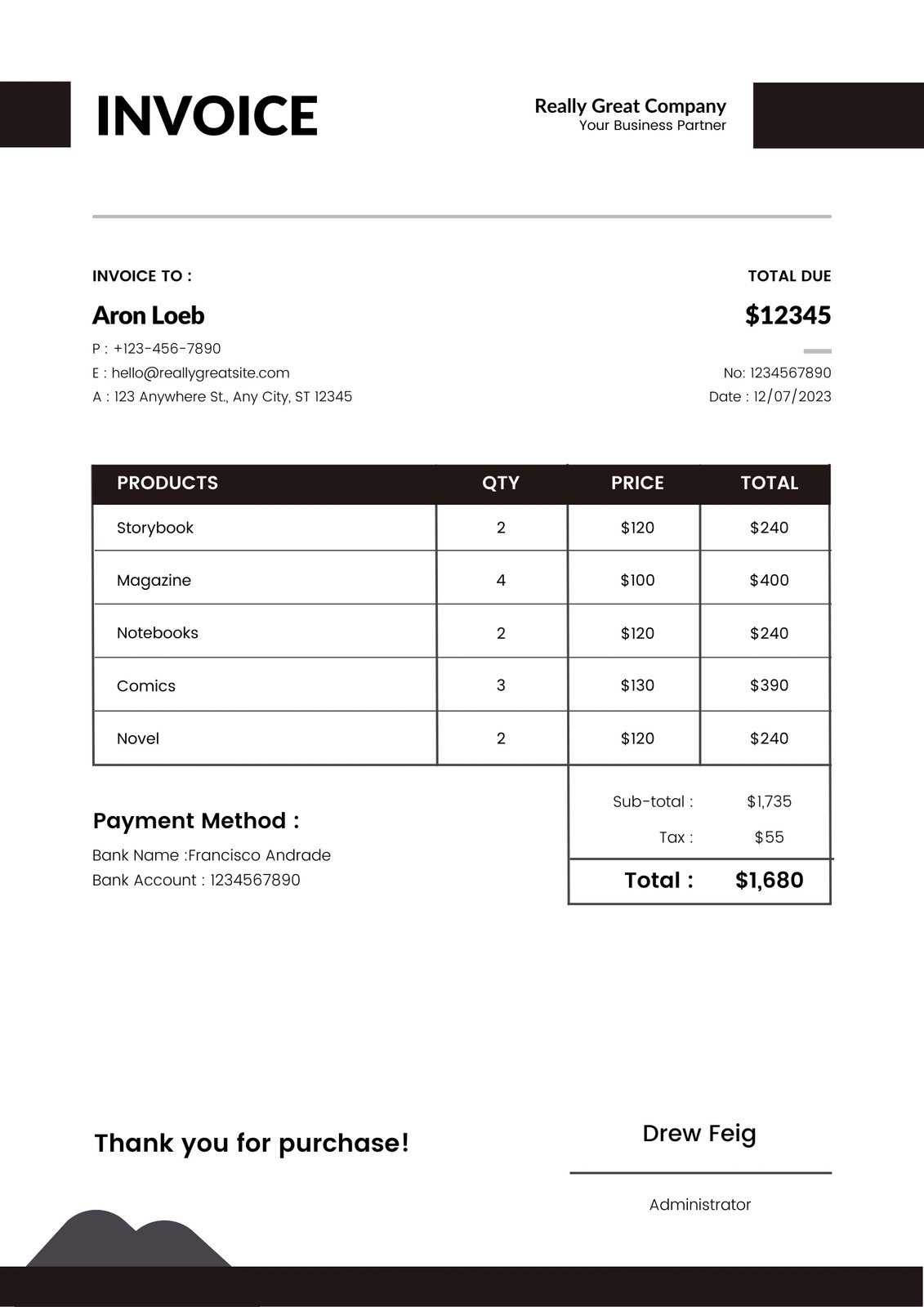

Sample Invoice Templates for Small Businesses

For small businesses, having a well-organized and professional document to request payment is essential for maintaining a smooth cash flow. A clear and structured billing record helps ensure that clients understand the charges, payment terms, and due dates. It also minimizes the chance of misunderstandings or delayed payments, which can be detrimental to the growth of a small business.

Using pre-designed formats can save time and effort while ensuring consistency in every transaction. These formats can be easily customized to reflect your brand and specific billing requirements, offering flexibility for various types of products or services. With the right approach, you can ensure that every financial document you send conveys professionalism and clarity.

Benefits of Using Pre-Made Billing Formats

One of the main advantages of utilizing these ready-made documents is the simplicity they bring to the billing process. Small business owners can focus on their core activities without getting bogged down by complicated accounting tasks. Pre-made formats often include all the necessary fields for a comprehensive record, such as customer details, a breakdown of services, taxes, and payment instructions.

Customizing Documents to Fit Your Needs

Although many ready-made designs are available, the ability to tailor them to your specific business needs is crucial. Whether it’s adjusting the layout, adding a logo, or altering payment terms, customizing these documents allows you to reflect your brand identity while keeping your administrative tasks efficient. A well-branded billing document enhances customer trust and contributes to a more professional image for your business.

Why You Need Invoice Templates

Efficient billing is a cornerstone of any successful business. Without a structured way to document financial transactions, it can be difficult to maintain consistent cash flow, manage payments, and stay organized. Having a ready-made format for issuing payment requests streamlines the process, ensures accuracy, and ultimately saves time for business owners.

By using a standardized structure for all payment requests, you create a professional image and ensure that your clients understand exactly what they owe. Customizable formats can be adapted to different types of services, payment terms, and client preferences, offering the flexibility you need while keeping things organized.

Key Advantages of Using Pre-Designed Billing Documents

- Consistency: Maintaining the same structure for all payment requests builds professionalism and makes it easier for clients to review and process payments.

- Time-Saving: Ready-to-use layouts eliminate the need to start from scratch every time, letting you focus on more important tasks.

- Accuracy: Pre-set fields ensure that no important information is missed, helping avoid costly mistakes.

- Clarity: A well-structured record makes it clear what services or products were provided, the costs involved, and the due date for payment.

- Legal Protection: Well-documented payment records can be useful in case of disputes, offering clear evidence of agreed-upon terms.

How Ready-Made Formats Help Small Business Owners

Small business owners can particularly benefit from using pre-designed formats as they often juggle multiple roles. The time spent manually creating records or worrying about missing details can be significantly reduced with these efficient tools. With just a few adjustments, you can personalize each document to fit your needs while maintaining a professional approach in every transaction.

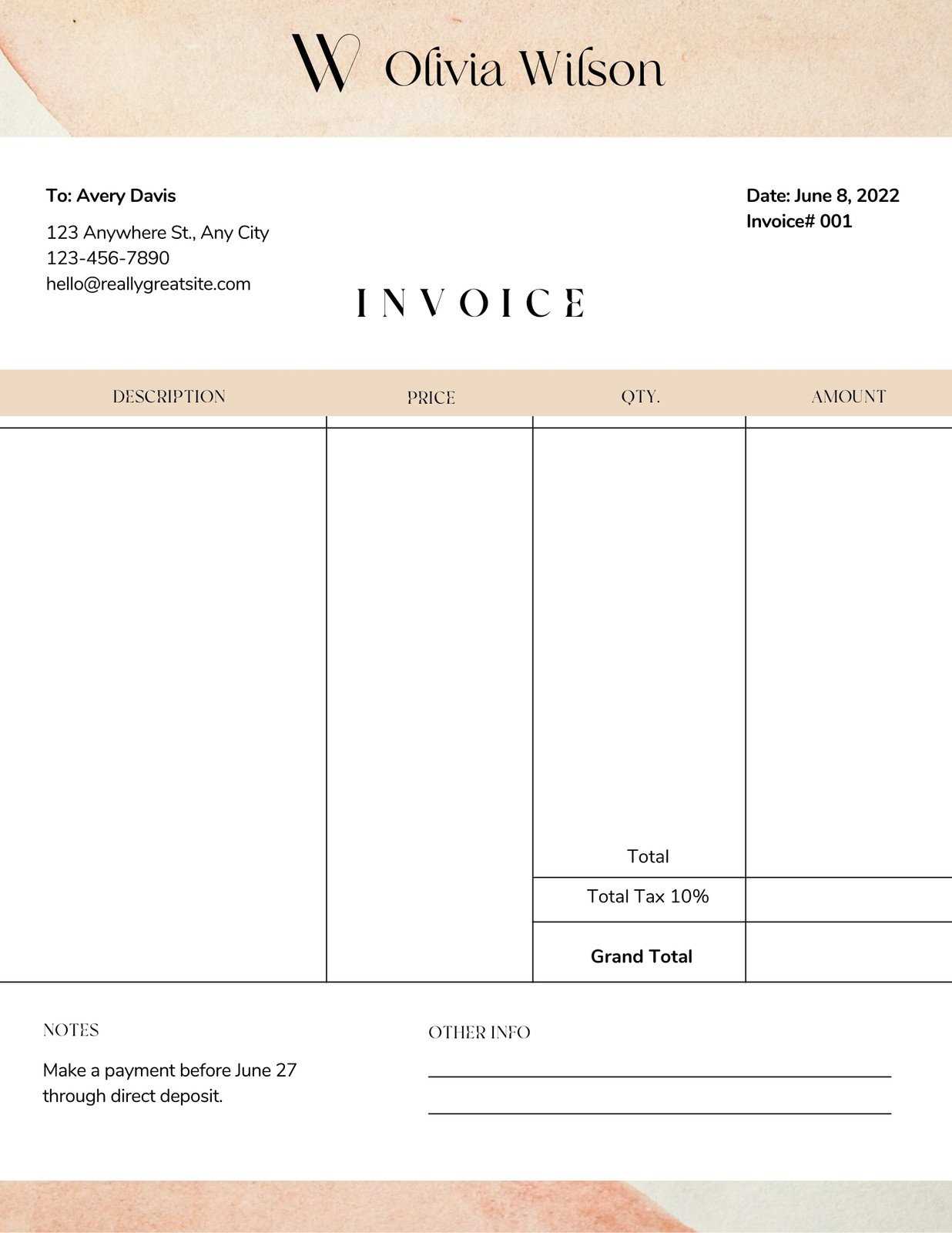

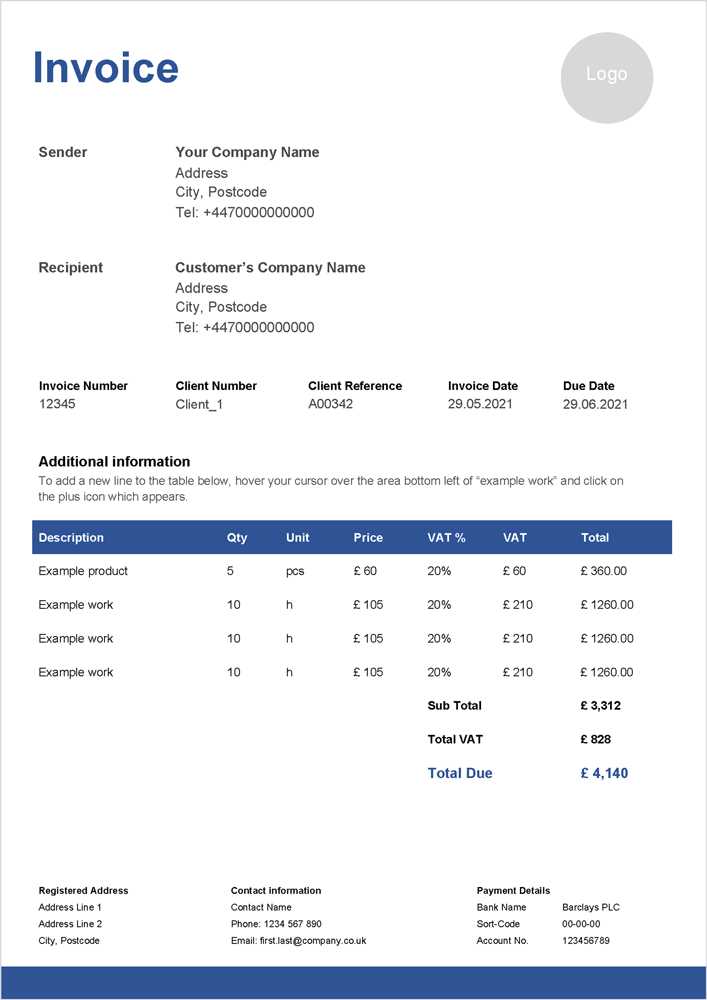

Choosing the Right Invoice Design

Selecting the right format for your billing records is essential for presenting a professional image and ensuring clarity. The design of your payment request document plays a significant role in how clients perceive your business and can influence how quickly they process payments. A well-organized layout improves readability, while an appealing design helps build trust and reinforces your brand identity.

When choosing the appropriate structure, consider factors such as the complexity of your services, your target audience, and the level of detail required. The right format should be easy to customize and adaptable to different client needs while maintaining consistency across all your financial transactions.

Factors to Consider When Selecting a Design

| Factor | Importance |

|---|---|

| Clarity of Information | High |

| Branding and Aesthetics | Medium |

| Ease of Customization | High |

| Amount of Detail Required | Medium |

| Mobile Compatibility | Low |

It’s important to ensure that the chosen design clearly separates key information such as the service or product provided, the amount due, and the payment terms. A minimalist layout may be best for simple transactions, while a more detailed structure might be needed for services that require itemized billing. Also, consistency in color schemes and fonts helps reinforce your brand, even in financial documents.

Free vs Premium Invoice Templates

When it comes to choosing a format for your billing records, one of the key decisions you’ll face is whether to go with a free option or invest in a premium solution. Both options have their advantages and disadvantages, depending on your business needs, budget, and desired level of customization. Understanding the differences between these choices can help you determine which one is right for you.

Free options are generally suitable for businesses that are just starting out or for those that need simple, straightforward documents without the need for extensive branding or customization. On the other hand, premium solutions offer advanced features, better customization options, and often come with customer support, making them ideal for businesses that need more flexibility and a polished, professional appearance.

Advantages of Free Formats

- Cost-Effective: Free options are ideal for businesses with tight budgets or those just getting started.

- Quick and Easy Setup: These formats often come with basic fields and layouts, making them easy to use with minimal effort.

- Simple Features: If you don’t need advanced customization or specific design elements, free options are often sufficient for basic billing needs.

Benefits of Premium Options

- Advanced Customization: Premium solutions often offer more options for branding, allowing you to align the document with your company’s identity.

- Higher Quality Design: These formats tend to have more polished, professional-looking layouts that can impress clients.

- Support and Updates: With a premium purchase, you often gain access to customer support and regular updates, ensuring you always have access to the latest features.

While free formats may be a good starting point, businesses looking to project a more polished image or requiring more specialized features may find that a premium solution offers greater value in the long run. Ultimately, the choice depends on your specific needs, resources, and the level of professionalism you wish to maintain in your billing process.

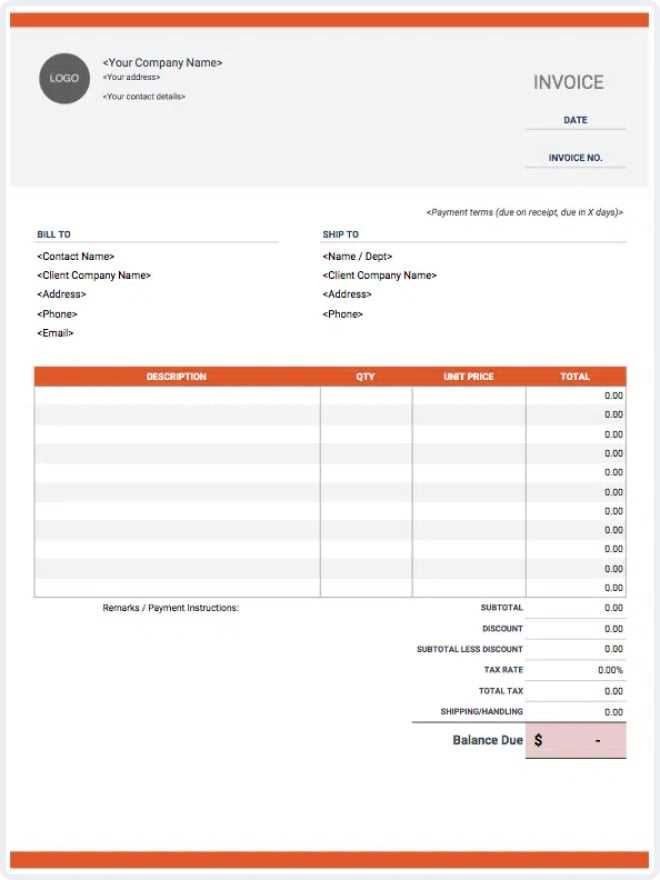

Customizing Invoice Templates for Your Brand

Adapting your billing records to reflect your company’s unique identity can have a significant impact on your overall brand image. By personalizing your payment request documents, you can create a cohesive and professional look that resonates with your clients. Customizing the format allows you to incorporate elements such as your logo, brand colors, and specific fonts, giving your business a more polished and recognizable presence.

Customization goes beyond aesthetics–it’s also about ensuring that the document reflects your business values and communication style. Whether it’s adding personalized payment terms, including a client-friendly design, or ensuring that the document is consistent with your other branding materials, a customized layout makes a lasting impression and reinforces your business’s professionalism.

Here are a few ways to personalize your payment request format:

- Brand Colors: Use your company’s color scheme to align the document with your overall brand aesthetic, creating a seamless experience for clients.

- Logo Placement: Adding your logo to the header of the document helps reinforce brand identity and builds recognition.

- Custom Fonts: Choose fonts that reflect your company’s tone–whether formal, modern, or creative–to convey the right message.

- Payment Terms: Tailor the payment instructions to suit your business model, making it easier for clients to understand payment methods, due dates, and any applicable discounts or fees.

Ultimately, customizing your billing records allows you to create a unique client experience while maintaining consistency across all business communications. It demonstrates your attention to detail and commitment to professionalism, all of which help build trust and long-term relationships with clients.

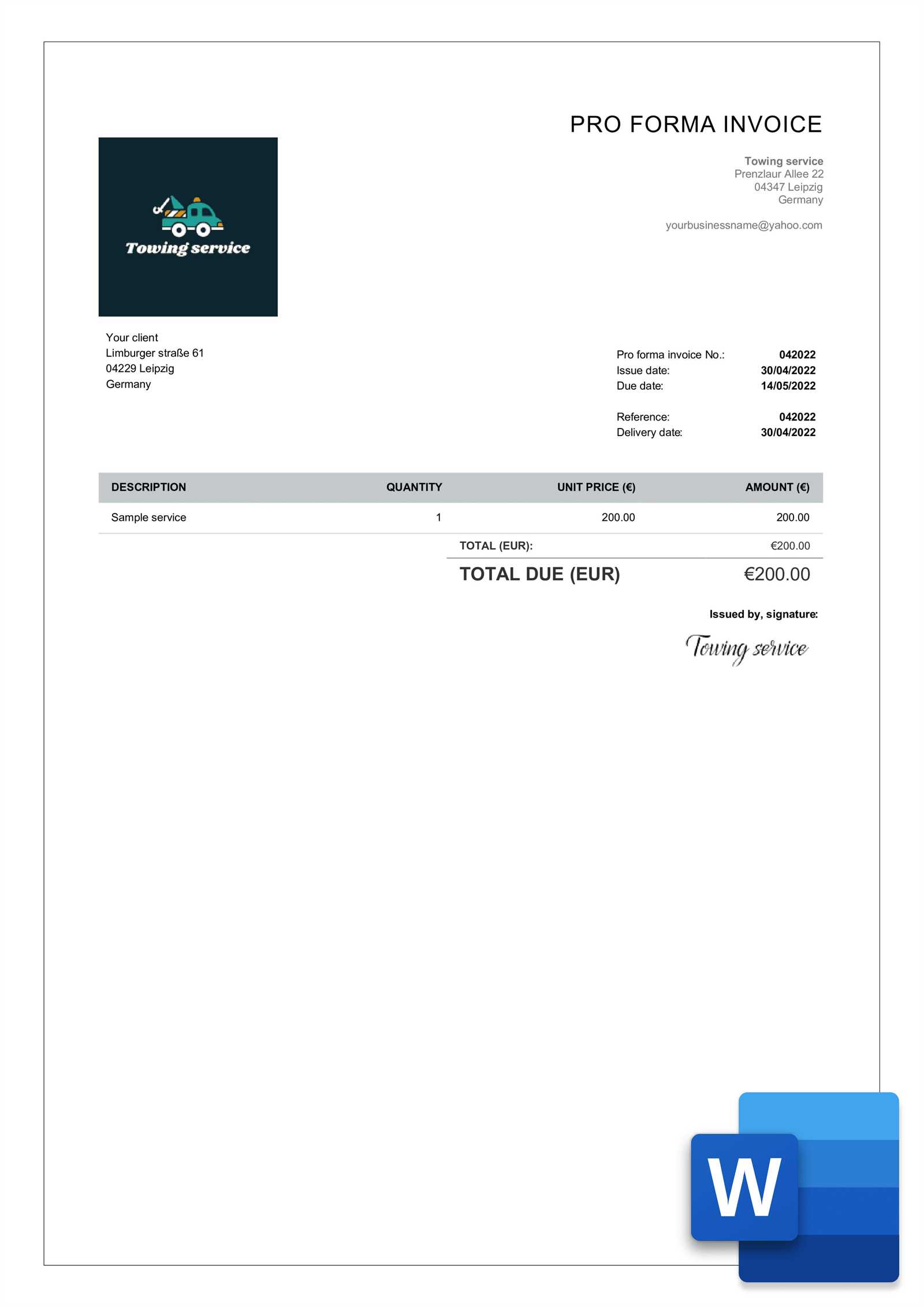

How to Create an Invoice from Scratch

Creating a billing document from scratch may seem like a daunting task, but with a clear structure, it can be a straightforward process. A well-organized record not only provides the necessary details for clients but also helps ensure accuracy and professionalism. By understanding the key components of a billing document, you can easily build one tailored to your business needs, whether you are a freelancer or a small business owner.

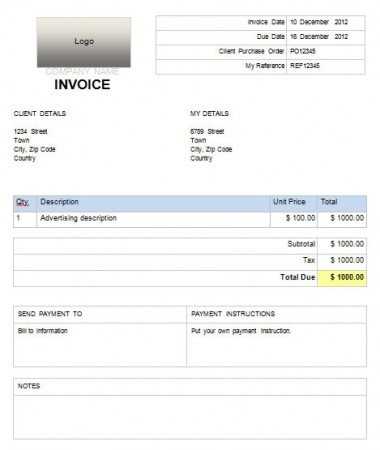

The key to creating an effective billing record is to include all the necessary information in a clear and logical layout. This helps clients understand the charges and ensures that payments are processed smoothly. Below is a breakdown of the essential elements you should include when creating a billing document from scratch.

Essential Information to Include

| Section | Description |

|---|---|

| Header | Include your business name, logo, and contact information. This helps clients easily identify your company. |

| Client Details | Provide the client’s name, address, and contact information for clarity and proper record-keeping. |

| Invoice Number | A unique identifier for each document. This ensures proper tracking and helps avoid confusion. |

| Dates | Include both the date the bill was issued and the due date for payment to avoid any misunderstandings. |

| List of Services or Products | Clearly describe the goods or services provided, including quantities, rates, and totals for each item. |

| Subtotal | Calculate the total before taxes and additional fees. This helps clients understand the cost breakdown. |

| Taxes and Discounts | Include any applicable taxes or discounts, ensuring they are clearly itemized. |

| Total Amount Due | Provide the final amount due, including taxes and any additional fees or discounts. |

| Payment Instructions | Clearly explain how the client can make payment, including methods such as bank transfer or credit card. |

By following this structure, you can create a billing document that is both clear and professional. Additionally, you can customize the design and layout based on your business style or industry needs. Once the structure is in place, ensure you double-check all the details for accuracy before sending it to your client. Proper documentation is crucial for maintaining trust an

Top Features of a Good Invoice Template

When creating a billing document for your business, it’s essential to include certain features that ensure clarity, professionalism, and ease of use. A well-structured document not only helps you communicate effectively with clients but also promotes prompt payment and minimizes misunderstandings. The right features will make your document look polished and ensure that all necessary details are covered.

A good billing format is more than just a list of charges; it should be easy to read, customizable to your needs, and efficient for both you and your clients. Below are some of the key features that make a billing document effective and professional.

Essential Elements for Clear Communication

- Unique Identification Number: Each document should have a distinct reference number for easy tracking and to prevent confusion with previous transactions.

- Contact Information: Clear contact details for both your business and your client ensure that communication can be easily made if needed.

- Detailed Breakdown of Products or Services: It’s important to include a description of each product or service provided, along with quantities and pricing, so clients know exactly what they’re paying for.

- Clear Payment Terms: Include the due date for payment and any late fees or discounts for early payment, making expectations clear from the outset.

Design and Usability Features

- Professional Layout: A clean, organized layout helps ensure that all relevant information is easy to find and understand.

- Branding Elements: Incorporating your logo, color scheme, and brand fonts adds a personal touch and makes the document feel like an official communication from your business.

- Easy Customization: The document should be flexible enough to allow easy adjustments, whether it’s adding new items, adjusting payment terms, or changing design elements to fit different client needs.

- Tax and Discount Calculations: Having automatic fields for taxes, discounts, and totals helps to avoid manual errors and ensures accuracy.

These features, when combined, not only make your billing documents functional but also enhance your professionalism and efficiency. A well-designed document that includes these elements will make the process of billing easier, more accurate, and less time-consuming for both you and your clients.

How to Use Invoice Templates in Excel

Microsoft Excel is one of the most accessible tools for creating and managing your billing records. With its customizable features and simple interface, Excel allows you to easily organize your financial transactions. Using pre-designed formats within Excel can save you time and ensure that your documents are consistent, accurate, and professional-looking. You can also modify these documents to fit your unique business needs and preferences.

By utilizing the built-in functions in Excel, such as calculations for totals, taxes, and discounts, you can streamline the entire process of creating and sending payment requests. Excel’s flexibility makes it easy to maintain a clear and organized system for managing all your transactions.

Steps to Use Billing Formats in Excel

- Select a Suitable Format: Start by choosing a pre-designed layout that best fits your needs. Excel offers a variety of simple and detailed options that you can customize to match your brand.

- Enter Your Business Information: Fill in your company’s details, such as the name, address, and contact information, in the designated fields. This ensures that your clients have all the necessary details to reach you if needed.

- Customize Client Information: Input the client’s name, address, and any other relevant contact information in the appropriate sections. This helps personalize the document and ensures that the correct person receives the payment request.

- List Products or Services: Enter the details of the goods or services provided, including quantities, unit prices, and total amounts. Excel will automatically calculate the totals if formulas are set up correctly.

- Review Calculations: Double-check all the amounts, taxes, and discounts to ensure they are correctly applied. Excel can automatically update the totals based on your input.

- Save and Send: Once the document is complete, save it in your preferred format (such as PDF) and send it to your client. You can also keep a copy for your records in Excel for easy tracking and management.

Using Excel to manage your billing records is an efficient way to ensure accuracy, consistency, and professionalism. The platform’s built-in features make it easy to calculate totals, track payments, and customize your documents to fit your needs, all while saving you time on administrative tasks.

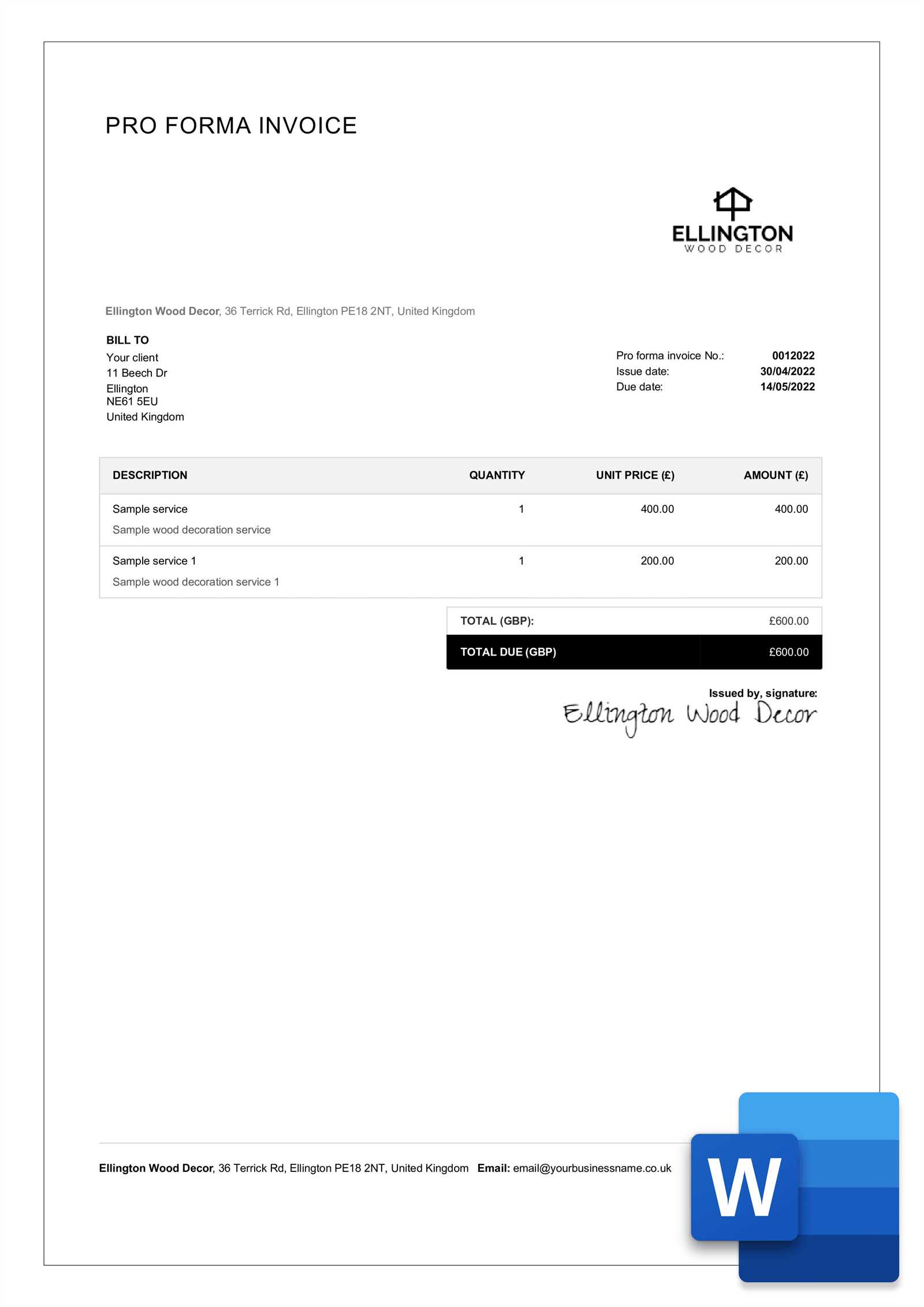

Printable Invoice Templates for Easy Use

Having a physical copy of your billing document can be important for some businesses or clients. Whether for record-keeping, filing purposes, or simply to provide a printed copy to a customer, printable billing documents offer a convenient way to ensure that everything is in order. A well-designed, printable format makes the process of issuing and sending bills faster and more professional, without the need for complex software or technical skills.

Printable versions are usually simple, easy to customize, and come in various designs to suit your business style. Whether you prefer minimalistic layouts or something more detailed, a printable format allows you to quickly generate a clear and accurate document to send to your client.

Advantages of Printable Billing Formats

- Easy to Print: Printable documents are designed to be easily printed, so you don’t need to worry about formatting issues or document alignment when printing.

- Convenient for Physical Records: If your business requires hard copies for record-keeping or for client meetings, having a printable version ensures you always have a professional-looking document ready.

- Simple Customization: You can easily add or modify details like your logo, business information, or client-specific data before printing, making each document unique and tailored to your needs.

- Quick Delivery: Once printed, you can hand-deliver or mail the documents to your clients quickly, ensuring they receive the payment request on time.

How to Use Printable Billing Formats Effectively

- Choose the Right Layout: Select a layout that is simple yet comprehensive, including all the necessary fields like item descriptions, totals, and payment instructions.

- Personalize the Document: Add your business logo, name, and contact details to make the document look professional and easily recognizable.

- Check for Accuracy: Before printing, double-check the accuracy of all information, including client details, services provided, and payment amounts.

- Print and Deliver: Once everything is reviewed, print the document in high-quality format and send it to your client through the preferred method (mail or in-person delivery).

Using printable versions of your billing documents is a practical solution for businesses that need a physical record or want to offer clients a printed copy. With the right format, you can save time, ensure professionalism, and create an easy-to-use solution that works both digitally and in print.

Automating Your Billing with Templates

Automating your billing process can significantly save you time and reduce errors. By using pre-designed formats that allow for easy customization, you can quickly generate accurate payment requests without manually entering every detail for each client. Automation not only speeds up the workflow but also ensures consistency across all your documents, improving both efficiency and professionalism.

Using automated solutions also allows for recurring billing, meaning you can set up documents that will be automatically generated and sent to clients on a regular basis, without needing to start from scratch each time. This helps reduce administrative tasks, freeing up time to focus on other important aspects of your business.

How Automation Can Improve Your Billing Process

- Consistency: Automated formats ensure that every document follows the same structure, making your billing process more uniform and professional.

- Time-Saving: Instead of manually entering data each time, automation allows you to quickly generate and send documents, even for large batches of clients.

- Accuracy: Automating calculations, such as totals and taxes, reduces the chances of human error and ensures that all financial details are correct.

- Recurring Billing: For businesses with regular clients, setting up automatic billing cycles eliminates the need to create new documents each month, streamlining operations.

Steps to Automate Your Billing Process

- Choose an Automation Tool: Select a billing platform or software that offers automation features, such as automatic document generation and scheduling.

- Set Up Templates: Create or customize a pre-designed format that suits your business. Add all the necessary fields, such as client information, payment terms, and itemized charges.

- Input Client Details: Enter the client’s information into the system once, and let the automation tool generate the necessary documents moving forward.

- Configure Payment Schedules: Set up recurring billing cycles for clients who need regular invoicing, ensuring documents are automatically generated at specified intervals.

- Review and Send: Review the documents before they are sent out to clients, ensuring all details are correct and ready for distribution.

Automating your billing process with the right tools and formats not only simplifies your workflow but also improves the client experience by providing timely, accurate, and professional documents with minimal effort on your part. Whether you’re managing a handful of clients or handling hundreds, automation can scale with your business needs.

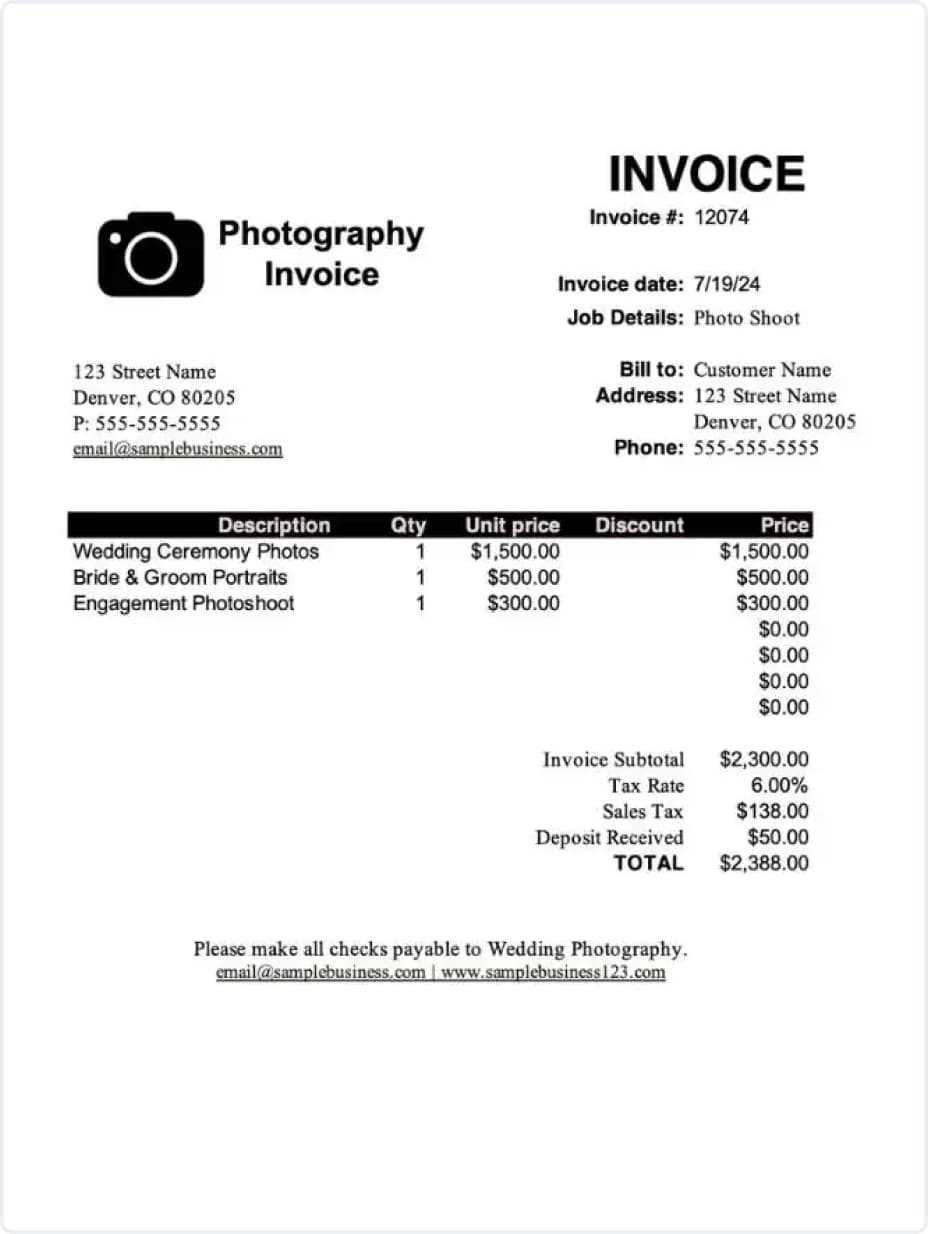

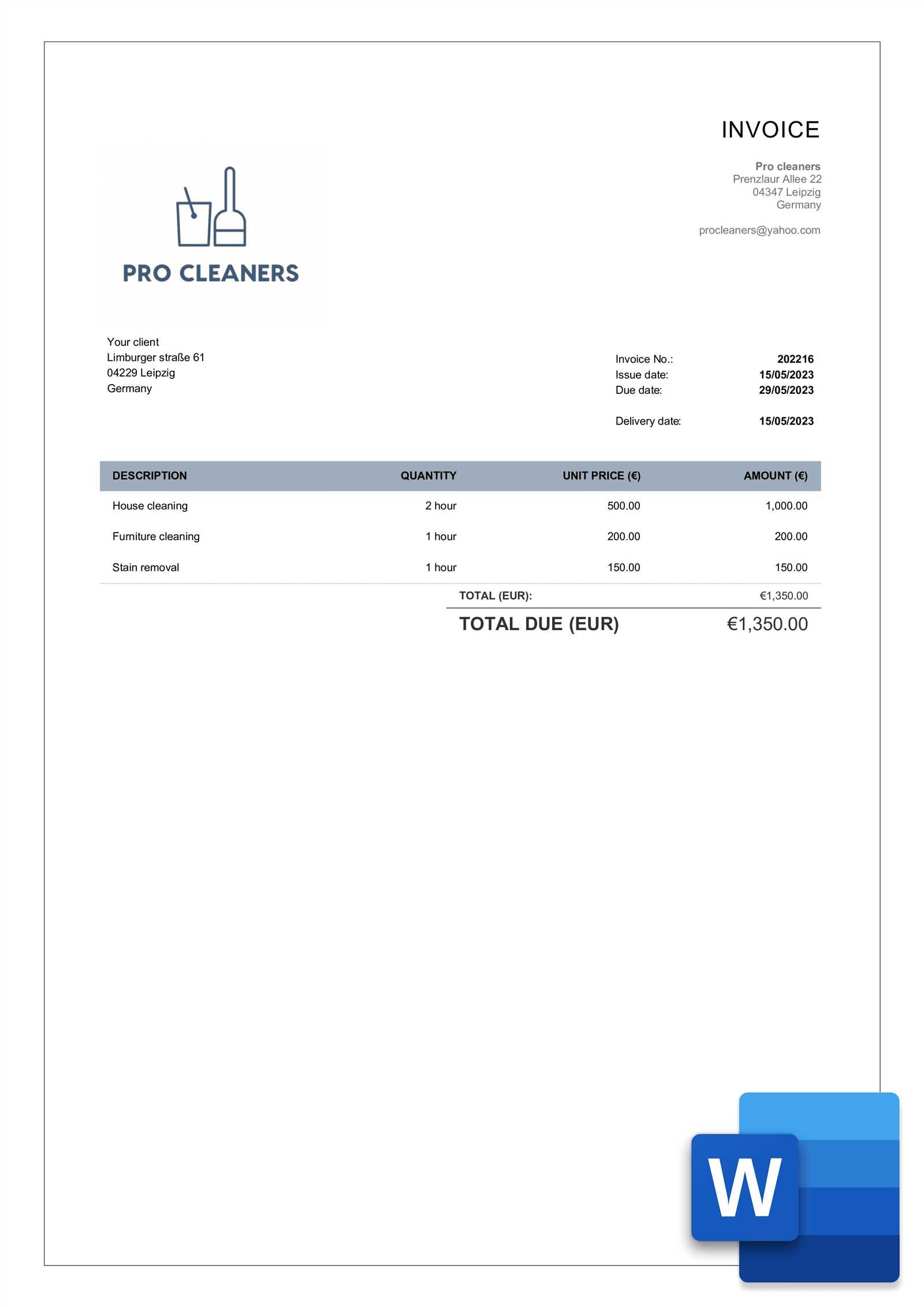

Invoices for Different Types of Services

Billing for services can vary greatly depending on the nature of the work being provided. Whether you are a freelancer, consultant, or running a service-based business, it’s essential to structure your payment request documents to accurately reflect the type of service delivered. Different services may require different levels of detail, payment terms, or pricing structures, so understanding how to tailor your document for each type of service is crucial for smooth transactions.

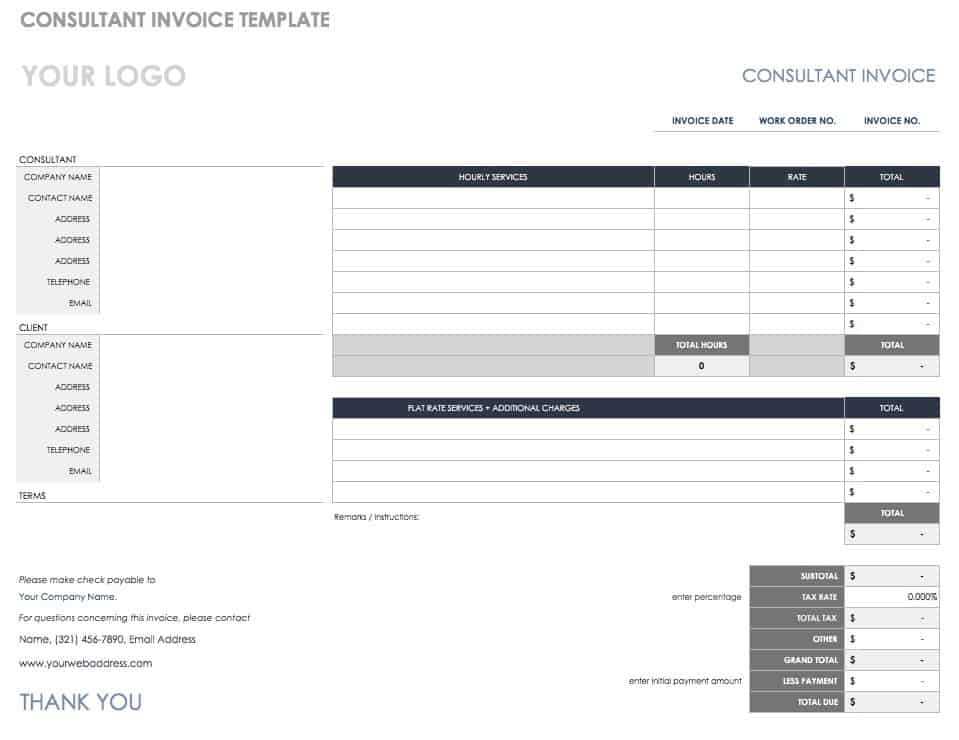

For example, some services may involve one-time projects with clear deliverables, while others, such as ongoing consulting or maintenance work, may require recurring charges or hourly rates. Adjusting your document to fit the specific service type ensures that your clients understand the charges and helps avoid confusion or disputes over payment terms.

Common Service Types and Their Billing Needs

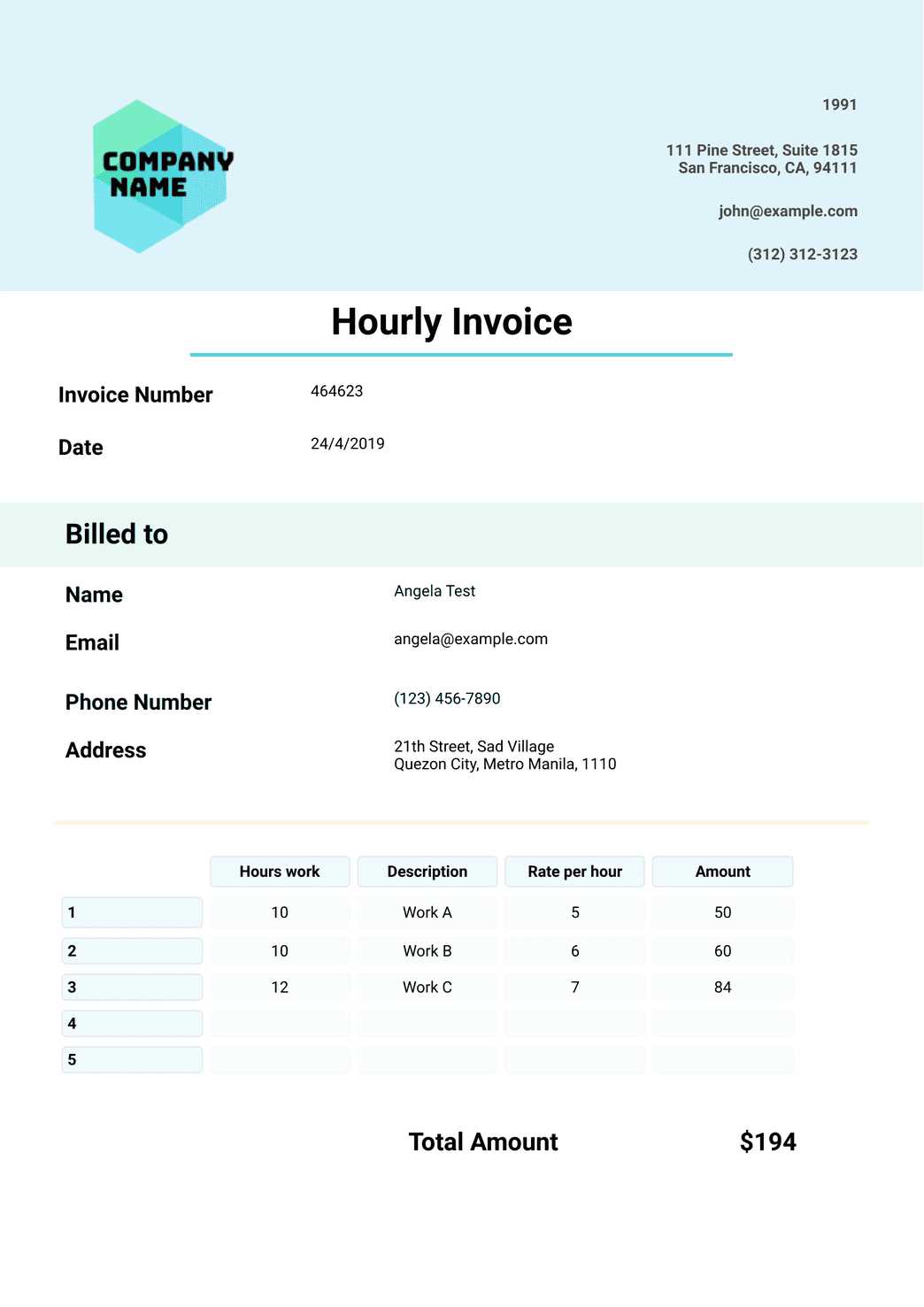

- Hourly Services: For services charged by the hour, it’s essential to include a breakdown of the time spent on each task or project phase, along with the hourly rate. This provides transparency for clients and ensures they can see exactly how the total was calculated.

- Fixed-Price Projects: For projects with a set price, you should clearly outline the agreed-upon amount, along with a brief description of the scope of work. This type of billing helps avoid confusion when delivering the final product or service.

- Recurring Services: If you provide services on a subscription or retainer basis, include the agreed-upon payment schedule (weekly, monthly, quarterly) and the terms of the service period. This ensures clients understand when they will be billed next and what they are paying for.

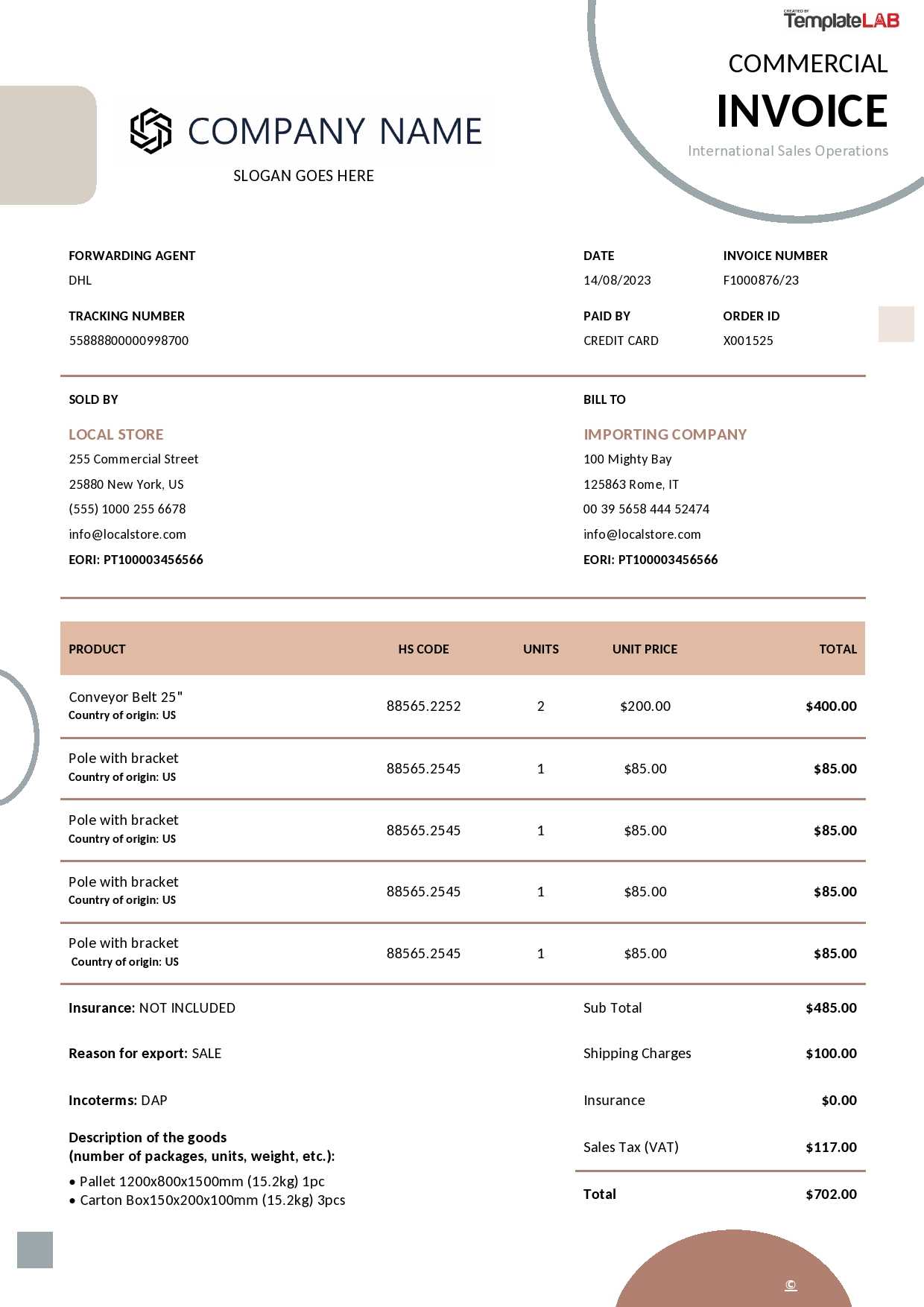

- Materials or Product-Based Services: In cases where you’re providing both services and physical products (such as construction or design services), make sure to itemize both the labor and materials costs separately for clarity.

By adapting your billing documents to the specific needs of each service you provide, you can maintain a clear and organized system that helps streamline the payment process and promotes transparency. This approach ensures that both you and your clients are on the same page, reducing misunderstandings and fostering better professional relationships.

Common Mistakes in Invoice Creation

Creating accurate and professional payment requests is essential for maintaining good business practices and ensuring timely payments. However, many businesses make common mistakes when drafting these documents that can lead to confusion, delayed payments, or even disputes. Being aware of these errors and knowing how to avoid them is crucial for streamlining your billing process and fostering positive relationships with your clients.

From simple data entry mistakes to issues with formatting and payment terms, these mistakes can affect your credibility and the efficiency of your financial operations. By understanding the most common errors, you can take steps to ensure that your billing documents are clear, accurate, and professional every time.

Common Errors to Avoid

- Missing Contact Information: Failing to include your business name, address, or contact details can cause confusion for the client and delay the payment process. Always ensure that your information is clearly displayed at the top of the document.

- Incorrect or Incomplete Client Details: Double-check that your client’s name, address, and contact information are correct. Sending documents with incorrect details can lead to payments being delayed or misdirected.

- Omitting or Miscalculating Tax: Not including the correct tax rate or leaving out taxes altogether can lead to undercharging or overcharging clients. Always verify that the tax is calculated properly and clearly indicated.

- Vague Descriptions of Services or Products: Being unclear about what you’re charging for can result in disputes. It’s important to provide detailed descriptions of the work completed or products delivered, including quantities, rates, and any additional fees.

- Failure to Include Payment Terms: Clearly stating the due date and any late fees or payment discounts is crucial. Not including these details can lead to misunderstandings about when payments are expected or what happens if they are delayed.

- Unprofessional Formatting: A disorganized or hard-to-read document can give the wrong impression and cause confusion. Use a clean layout with clear headings, sections, and enough white space to make it easy for clients to understand the charges and payment terms.

By avoiding these common mistakes, you can ensure that your payment requests are professional, clear, and effective. Paying attention to the details and maintaining consistency in your billing process will not only make the transaction smoother for your clients but also help you build trust and a reputation for reliability in your business.

How to Add Payment Terms to Invoices

Clearly defined payment terms are a vital part of any billing document. They establish the rules for how and when payments should be made, and they help prevent misunderstandings between you and your clients. Including payment terms not only ensures that both parties are on the same page but also provides legal protection in case of late payments. By specifying due dates, late fees, and accepted payment methods, you can create a clear and professional agreement that encourages timely payments.

Adding payment terms is a straightforward process, but it requires careful attention to detail. You need to consider factors such as the payment schedule, acceptable methods, any discounts for early payments, and penalties for overdue amounts. Including all of this information in a concise, understandable way will streamline the payment process and reduce the risk of confusion.

Key Elements to Include in Payment Terms

- Due Date: Always specify a clear due date for payment. This ensures that both you and the client know exactly when the payment is expected.

- Accepted Payment Methods: List all the payment options available, such as bank transfers, credit cards, or online payment systems, so clients know how they can pay you.

- Late Payment Fees: Clearly state any fees that will be applied if payment is not received by the due date. This can encourage clients to pay on time and help cover any administrative costs related to late payments.

- Early Payment Discounts: Offering a discount for early payment can incentivize clients to pay sooner. Make sure to outline the terms of any discounts, including the percentage and the payment deadline.

- Payment Installments: If your payment arrangement allows for installments, be sure to include the schedule and amounts for each installment to avoid confusion.

Including detailed payment terms in your documents not only protects your business but also sets clear expectations for your clients. Whether you’re working on a project-based agreement, offering recurring services, or dealing with large transactions, well-defined payment terms create a professional atmosphere and ensure that both parties understand their obligations.

Legal Considerations for Invoice Templates

When creating billing documents, it’s important to ensure that they comply with local laws and regulations. A well-structured document not only helps you maintain professional standards but also protects your business legally. Including the right legal information, such as payment terms, tax details, and business registration numbers, is essential for avoiding disputes and ensuring that your financial transactions are transparent and legitimate.

Legal considerations can vary depending on the nature of your business, the location of your clients, and the type of services or products you provide. Understanding the legal requirements and making sure they are reflected in your payment requests will help you stay compliant and build trust with your clients.

Key Legal Elements to Include

- Business Identification: It’s crucial to include your business’s legal name, address, and contact information. In some regions, you may also need to include your business registration number or VAT ID.

- Tax Information: If you are required to collect taxes, include the relevant tax identification number and specify the applicable tax rate for your products or services. This helps ensure that you are in compliance with tax laws.

- Terms and Conditions: Clearly outline the payment terms, including the due date, late fees, and any other relevant conditions. Having these terms documented can protect you if there are disputes about payment timing or amounts.

- Currency and Payment Methods: Specify the currency in which the payment should be made and any accepted payment methods, such as bank transfer, credit card, or online payment services. This reduces ambiguity and makes transactions smoother.

- Legal Disclaimers: Depending on your business, it may be necessary to include legal disclaimers or limitations of liability, especially if you provide consulting or advisory services. This can protect your business in case of legal action or client dissatisfaction.

Sample Structure for Legal Information

| Item | Details |

|---|---|

| Business Name | Your Company Name |

| Address | Your Company Address |

| Tax ID | Your Tax Identification Number (if applicable) |

| Payment Terms | Due date, late fees, or discounts for early payment |

| Tax Rate | Applicable tax rate for products or services |

| Accepted Payment Methods | Bank transfer, credit card, PayPal, etc. |

By taking the time to include these legal elements, you can ensure that your payment documents meet legal requirements and create a professional, transparent relationship with your clients. It’s always advisable to consult with a legal professional to ensure that your documents are fully compliant with applicable laws and regulations.

How to Send and Track Invoices

Sending and tracking payment requests efficiently is key to maintaining healthy cash flow in your business. It’s not enough to simply create a document; you need to ensure it reaches the right person and that you can easily follow up on outstanding payments. With the right tools and methods in place, you can streamline the process, reduce delays, and stay on top of your financial transactions.

Effective tracking also allows you to monitor overdue payments and take appropriate action when necessary. By keeping records of sent documents, payment due dates, and payment statuses, you ensure transparency and avoid potential disputes with clients. Whether you prefer digital methods or traditional mail, understanding how to send and track payment requests will help you manage your business finances smoothly.

Methods for Sending Payment Requests

- Email: The most common and fastest way to send documents is via email. You can attach your document as a PDF or use an online invoicing platform that allows you to send documents directly from the software.

- Postal Mail: For clients who prefer traditional communication methods, mailing a printed version of your document might be necessary. Ensure that you use a reliable service to track delivery.

- Online Payment Systems: Many businesses use online payment platforms that generate and send documents automatically. This method can be convenient as it also provides a way for clients to pay directly from the document.

- Fax: In certain industries, faxing payment requests may still be used, though it’s less common than email and digital methods.

How to Track Payment Status

- Manual Tracking: Keep a detailed log of sent documents, including the date sent, client details, and the amount due. You can use spreadsheets or physical records to track payments manually.

- Accounting Software: Many accounting platforms offer automatic tracking features. These tools can notify you when a payment is received and help you send reminders for overdue amounts.

- Email Read Receipts: For emails, you can enable read receipts or use email tracking tools to confirm when a document has been opened by the recipient.

- Online Payment Platforms: Platforms like PayPal, Stripe, or other invoicing systems provide tracking features that show when a payment has been made, giving you a clear view of the transaction status.

By using these methods to send and track your payment requests, you can ensure timely payments and reduce the administrative burden of managing your financial documents. Tracking your documents also allows you to easily follow up on overdue payments, which is crucial for maintaining positive cash flow and client relationships.

Creating Recurring Invoices with Templates

For businesses that provide ongoing services or products on a regular basis, creating recurring billing documents is essential to ensure that payments are received on time without needing to generate a new document for each cycle. Automating this process not only saves time but also helps maintain consistency and reduces the chances of forgetting to send a request when payment is due.

Setting up recurring documents requires careful planning, including specifying the billing frequency, payment methods, and clear terms regarding what is being charged each period. Once established, these recurring requests can be easily generated and sent on a set schedule, whether it’s weekly, monthly, or annually. By using the right system or method, you can create a smooth and reliable process for both you and your clients.

Steps to Set Up Recurring Billing

- Define the Billing Cycle: Clearly state the frequency of the payments (e.g., weekly, monthly, quarterly) and make sure the client is aware of this upfront. Consistent timing helps prevent confusion and late payments.

- Detail Services or Products: Specify the services or products being provided during each cycle, making sure that both you and your client are clear about what is being billed. Include any variations that may change from cycle to cycle, such as different quantities or new services.

- Set Clear Payment Terms: Include payment deadlines, any late fees, and preferred payment methods. Clear terms ensure that both parties know when and how payment is expected, which reduces misunderstandings.

- Automate Reminders: Many digital systems allow you to schedule reminders to be sent before the due date. These reminders can help prompt clients to make payments on time and ensure that there is no delay in processing the next payment.

- Keep Accurate Records: Track the payment history for each recurring client. This can be easily managed through accounting software or spreadsheet systems that allow you to monitor when payments were made and when the next one is due.

By setting up recurring payment schedules in an organized way, you not only simplify the billing process but also help build trust and professionalism with your clients. Consistency in your billing ensures that your business can rely on steady cash flow while providing a seamless experience for customers who prefer predictable payment cycles.

Invoice Templates for Freelancers and Contractors

Freelancers and contractors often face unique challenges when it comes to managing payments, as they typically work with a variety of clients and on a project-by-project basis. Having a professional document that outlines the scope of work, payment amounts, and deadlines is essential to ensure timely payments and avoid misunderstandings. Whether you are offering creative services, consulting, or specialized skills, using a consistent format for your payment requests helps maintain organization and professionalism.

For independent workers, a clear and detailed payment request document can prevent delays, clarify expectations, and ensure that clients know when and how to make payments. Unlike traditional employment, where payments are typically automated, freelancers and contractors must actively manage their billing process. Creating a standard, customizable structure for your requests ensures efficiency, reduces errors, and saves valuable time.

Key Elements for Freelancers and Contractors

- Client Information: Always include the client’s full name, address, and contact details. This helps ensure that the correct party is billed and that there is no confusion about the recipient.

- Work Description: Clearly describe the services or products provided. Break down the tasks, hours worked, or deliverables for each specific job to give your client a detailed breakdown of the charges.

- Rates and Fees: Specify your hourly or flat rate and the total amount due for the completed work. If applicable, mention any agreed-upon discounts, taxes, or additional fees that should be included in the final amount.

- Due Date: Include a clear payment deadline, such as “Due within 30 days,” or a specific date. This helps set expectations for timely payment and helps you avoid chasing clients for overdue amounts.

- Payment Methods: List all accepted payment methods, including bank transfer, PayPal, credit card, or any other relevant payment system. Providing multiple payment options can encourage quicker payments from clients.

- Late Payment Terms: It’s a good idea to include information about any penalties or interest for late payments. This serves as a reminder to clients that they are expected to pay on time and discourages delays.

By utilizing a professional structure and including these key details in your payment requests, you can streamline the billing process and maintain a good relationship with your clients. A well-structured payment document not only helps you get paid on time but also establishes credibility and trust in your freelance or contracting business.

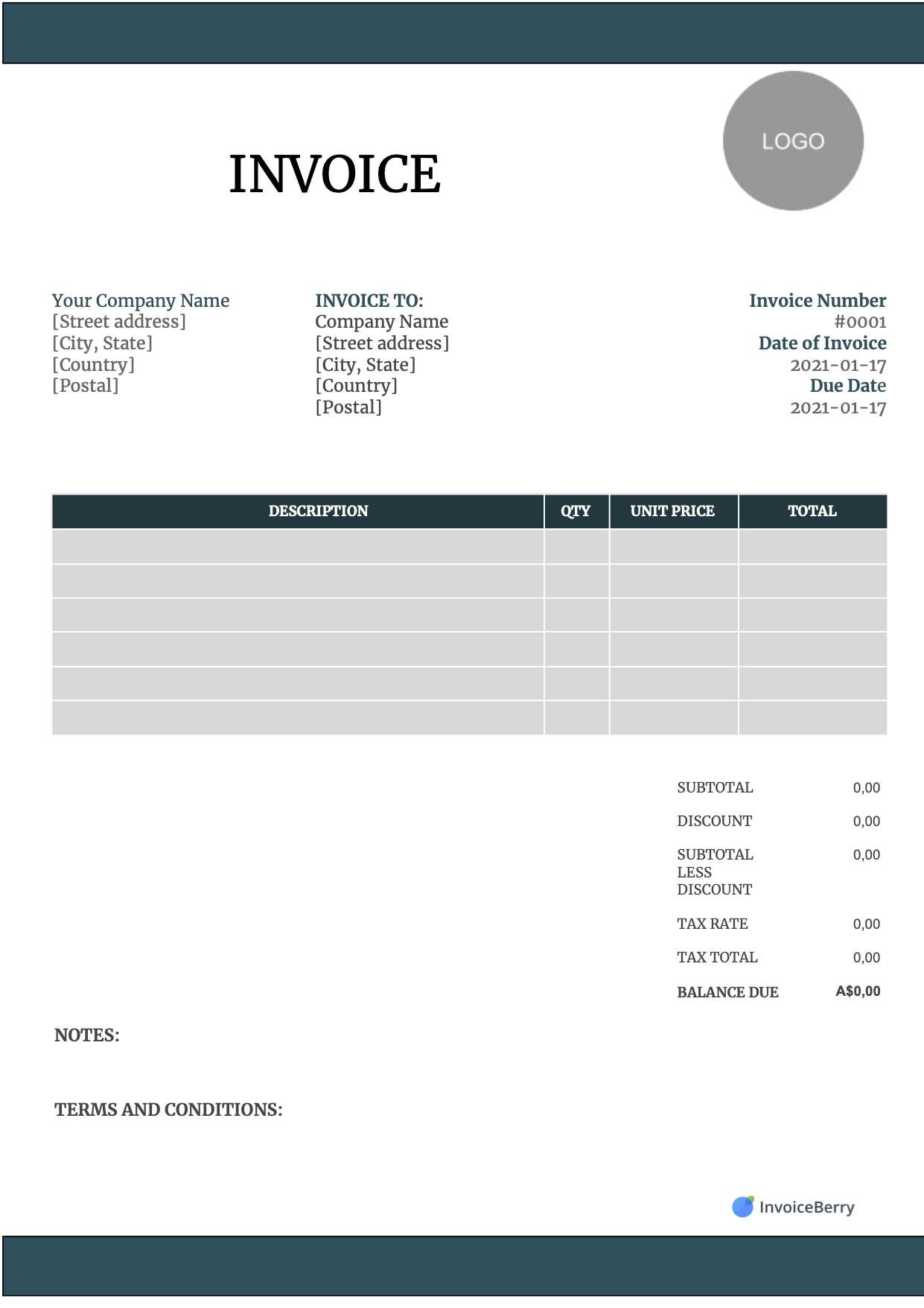

Where to Find Free Invoice Templates Online

Finding the right document format to request payments can be time-consuming, but there are many resources available online that offer free, customizable options. Whether you’re a freelancer, contractor, or small business owner, these resources can help you create professional payment requests without having to start from scratch. Many websites provide a wide variety of designs and formats, so you can choose the one that best suits your business needs.

Free resources are often easy to access and offer flexibility to adapt the structure of the document to your specific requirements. Some of these platforms even allow you to download the documents in different file formats such as PDF, Word, or Excel, making it simple to fill in and send them to clients. Here are some of the best places to find free payment request templates online:

Top Websites for Free Payment Request Documents

- Microsoft Office Templates: Microsoft’s official website offers a range of free, professionally designed payment request documents that can be customized in Word or Excel. These templates are perfect for small business owners and freelancers who need an easy-to-edit solution.

- Google Docs/Sheets: Google offers free templates for payment requests that can be accessed through Google Docs or Sheets. These templates are fully customizable and can be used collaboratively with team members or shared with clients directly via email.

- Canva: Canva provides a variety of customizable designs for billing documents, allowing you to create a visually appealing document without design skills. You can use their templates online and export them in various formats.

- Zoho Invoice: Zoho offers free billing tools and pre-made documents for different business needs. While primarily a paid platform, they provide a free version with limited features that includes basic payment request templates.

- Invoice Generator: Invoice Generator is a free, easy-to-use online tool that allows you to create payment requests quickly. After entering the necessary information, you can download your document in PDF format to send to clients.

- Template.net: Template.net offers a large collection of free and paid designs for billing documents. Their templates are fully customizable and can be downloaded in multiple formats including Word, Excel, and PDF.

Additional Resources

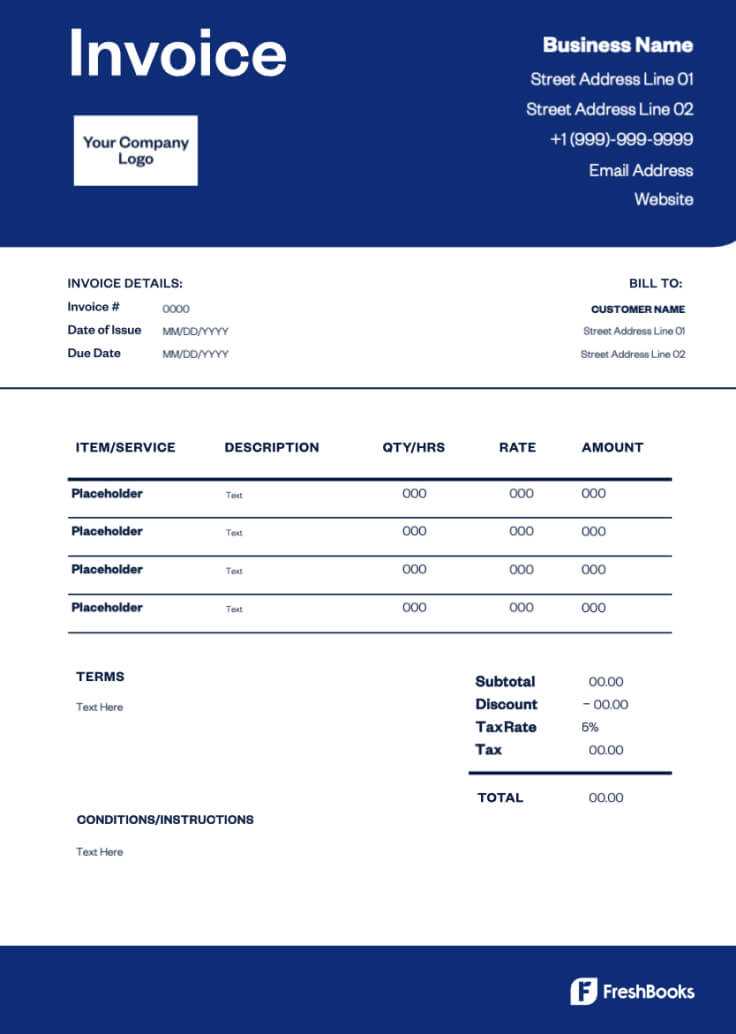

- FreshBooks: FreshBooks is an online accounting tool that provides free sample documents as part of their trial plan. These can be useful for small business owners looking to automate their billing process.

- Free Invoice Maker: This platform offers free, simple, and straightforward templates for creating billing documents without the need for an account or software.

- TemplateLab: TemplateLab offers a variety of free downloadable formats, from basic to more detailed designs, suitable for freelancers and businesses of all sizes.

With these free online resources, you can easily find a solution that matches your needs, whether you’re looking for something simple or more specialized. These tools can save you time and help you maintain professionalism, ensuring your clients always receive clear and accurate billing documents.