Free Contractor Invoice Template Download for Easy Billing

Managing payments efficiently is a key component of any business, especially for those offering services. Having a structured method to document transactions ensures clarity and professionalism in financial dealings. It also helps maintain smooth communication with clients while protecting both parties legally. A well-organized document can save you time and minimize the chances of errors that could lead to misunderstandings or delays in payment.

Using a pre-designed format for financial documents is an excellent way to streamline this process. These ready-made forms are not only quick to implement, but they also ensure consistency across all your records. By filling in the necessary details, you can generate professional documents that meet the standards expected by clients and tax authorities alike.

Whether you are just starting out or looking to improve your current system, adopting a straightforward approach to billing can make a significant difference. In the following sections, we will explore how to use such tools effectively and why they are a practical solution for service providers of all sizes.

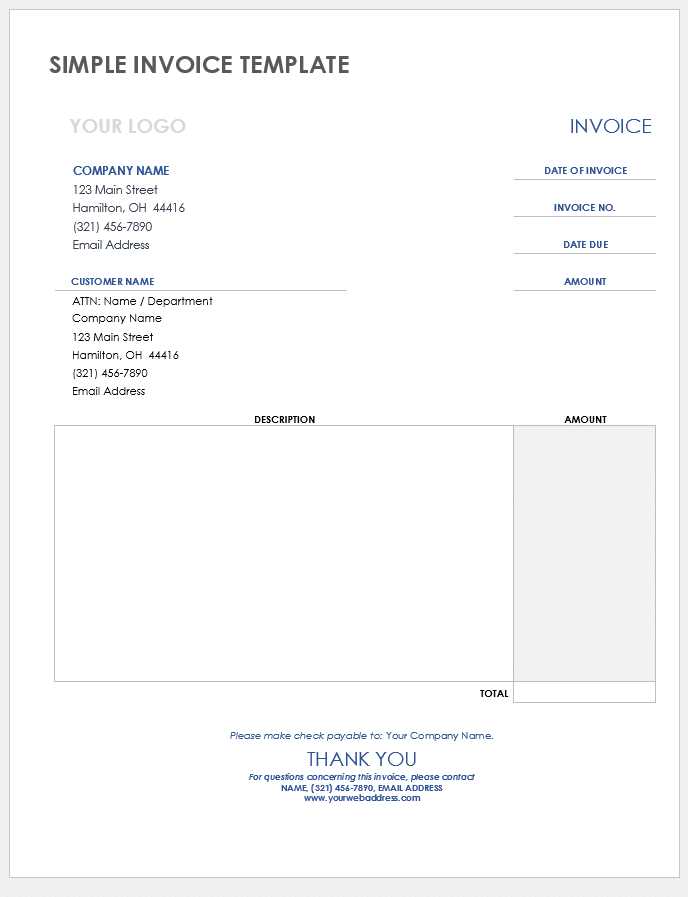

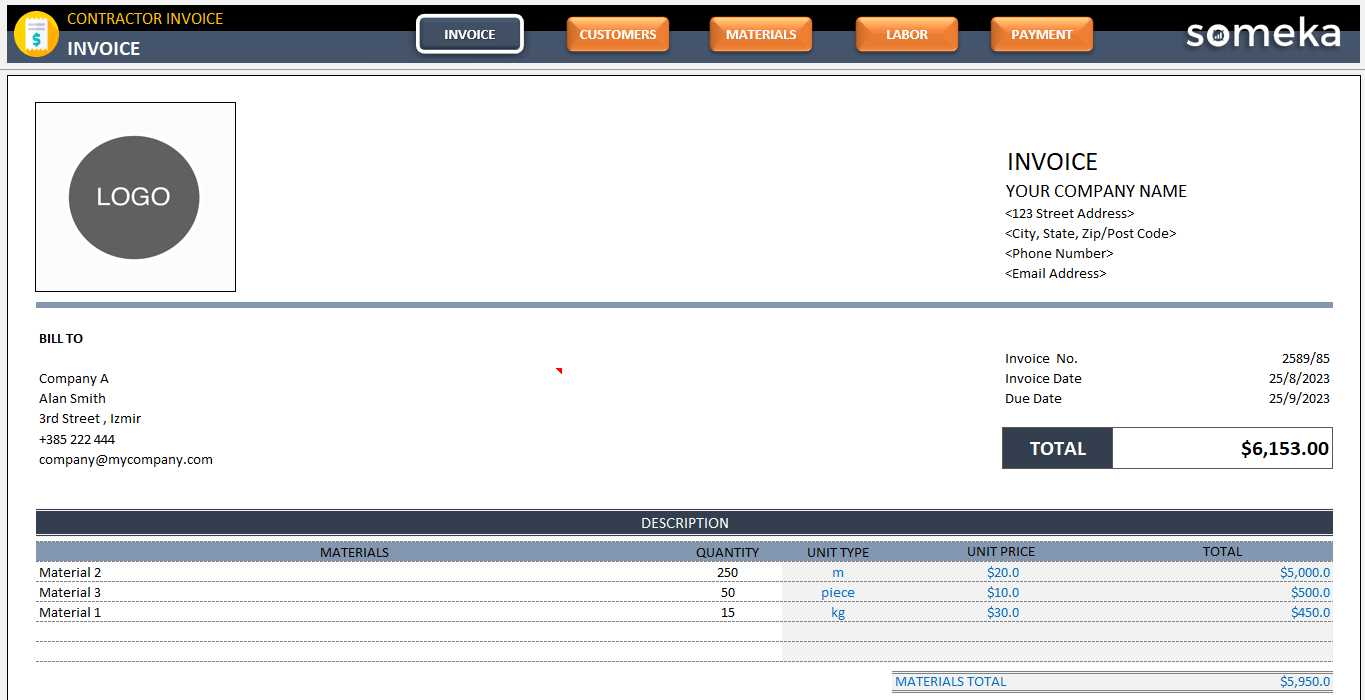

Contractor Invoice Template Free Download

When it comes to managing payments, having an organized and professional approach can make all the difference. Using a ready-made structure for your billing process allows you to quickly create accurate, consistent documents every time you complete a project. This not only saves time but also ensures your records are clear and meet industry standards. Having the right tools at hand is essential for smooth financial transactions with clients.

With numerous resources available online, you can easily find downloadable files that fit your specific needs. These forms come pre-designed, allowing you to simply input the necessary details without having to start from scratch. They help you maintain a professional image and reduce errors during the billing process.

Here are some benefits of using such ready-to-use documents:

- Time-saving: Pre-made structures minimize the effort of creating a new form each time.

- Consistency: All your documents will follow the same format, ensuring uniformity across your records.

- Clarity: Using a standardized document makes it easier for clients to understand your charges and payment terms.

- Professional appearance: A polished document can boost your reputation and convey reliability to your clients.

- Easy to customize: You can quickly add your own details and adjust the format as needed.

These resources are especially valuable for those who may not have the time or expertise to design complex billing systems. By downloading a pre-made document, you can focus on what matters most–delivering quality work and maintaining positive relationships with your clients.

Why You Need an Invoice Template

In any service-based business, clearly documenting payments is crucial for both professional relationships and financial management. Having a structured form for recording transactions ensures that all the necessary details are included, reducing the risk of errors or omissions. Whether you’re a freelancer or run a larger business, using a pre-formatted document helps streamline the billing process and maintain accuracy in your records.

Streamlining the Billing Process

Creating a new document from scratch for every client can be time-consuming and inefficient. A pre-designed structure simplifies this task by providing a ready-to-use framework. All you need to do is fill in specific details such as the amount due, services rendered, and payment terms. This efficiency saves time, especially when handling multiple clients or projects at once.

Maintaining Professionalism and Clarity

A clear, professional document helps you present your business in the best light. It conveys credibility and shows that you are organized, which can lead to more positive relationships with clients. It also helps avoid misunderstandings about payment terms, ensuring that clients know exactly what they are being charged for and when payment is expected. Using a standardized form creates consistency in your billing, making it easier for clients to track payments and for you to manage your finances.

Overall, having a well-organized method for creating and sending financial documents is essential for smooth business operations and fostering trust with clients.

Benefits of Using a Pre-Made Document

Adopting a ready-to-use document for billing and payment tracking offers several advantages. Whether you’re just starting out or looking to improve your workflow, these documents can save you time and ensure consistency. Instead of creating a new format every time you need to send a payment request, you can rely on a pre-structured design that takes the guesswork out of the process. This not only helps streamline your operations but also reduces the chance of errors.

Time Efficiency

One of the key benefits of using a pre-designed structure is the time you save. Instead of manually designing a new form or figuring out what needs to be included each time, you can focus on the work itself. With the details already laid out for you, all that’s left is to enter the specific information for each transaction.

Consistency and Professionalism

Using a standardized document helps you maintain a consistent approach across all your client transactions. This consistency helps build a professional image and ensures that each document adheres to the same format, making it easier for clients to understand. With a uniform structure, you can present your services more reliably and reduce any confusion regarding payment terms or charges.

- Quick Setup: Immediate access to a pre-made structure speeds up the billing process.

- Accuracy: Pre-designed forms minimize the risk of missing important details.

- Clarity: Clear formats make it easier for clients to understand your services and payment expectations.

- Cost-Effective: There is no need to invest in expensive software or tools when these resources are available at no cost.

Overall, leveraging a pre-designed document simplifies the billing process, enhances your efficiency, and helps maintain a professional appearance with minimal effort.

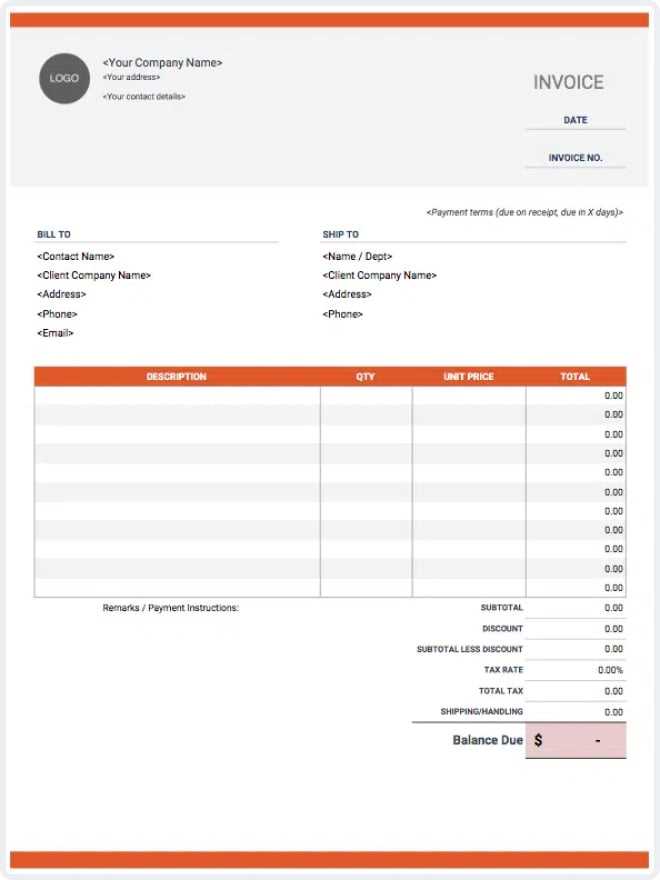

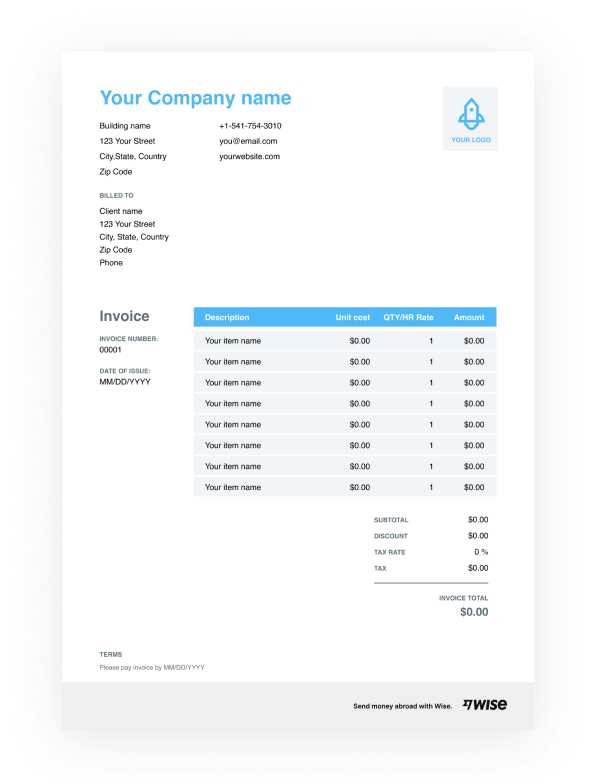

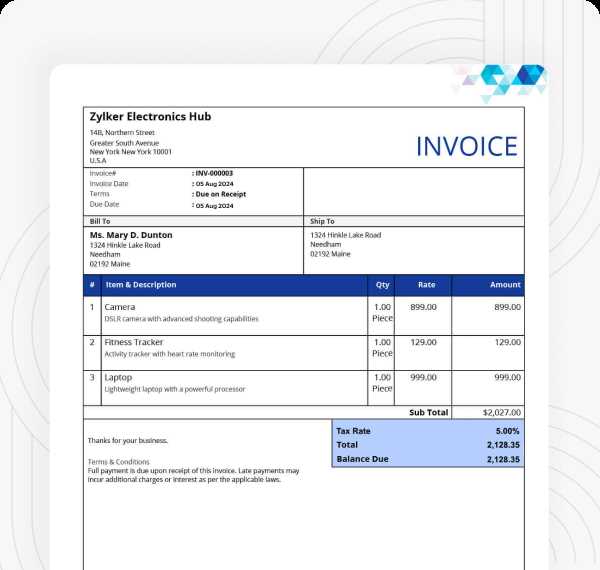

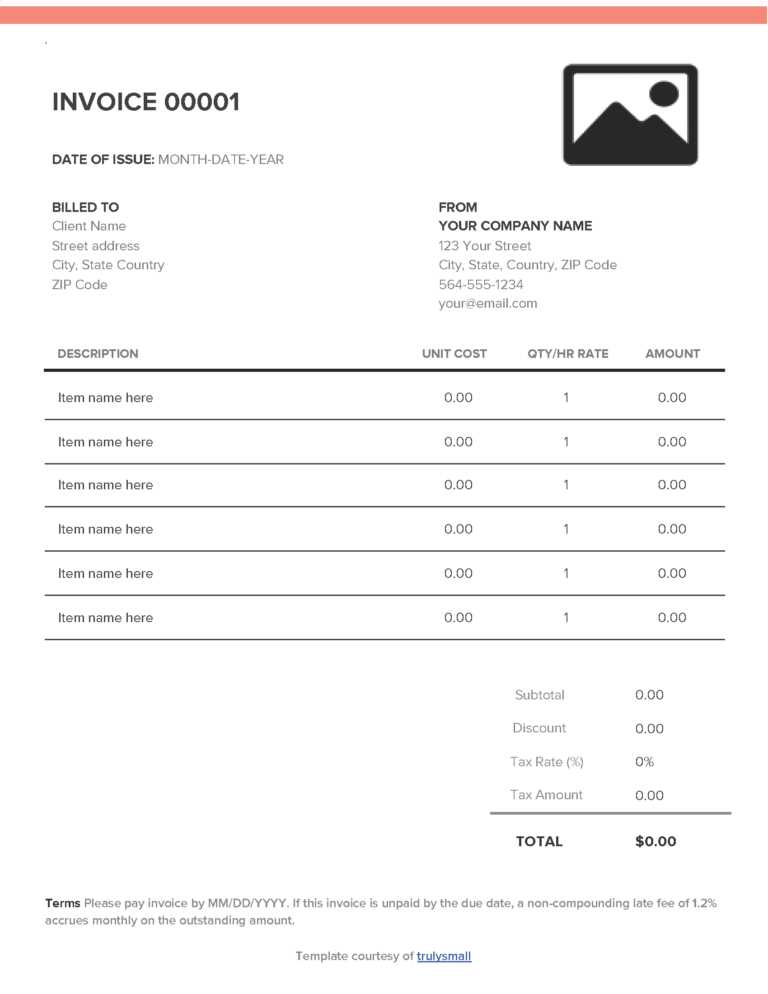

Essential Elements of a Contractor Invoice

When creating a billing document for your services, it is crucial to include key components that ensure clarity and professionalism. A well-structured document not only helps avoid misunderstandings but also ensures that you are compensated promptly. Every essential element serves a specific purpose, making it easier for your client to understand the charges and payment terms.

Here are the most important sections to include in your billing document:

- Business Information: Clearly display your name, address, phone number, and email address, along with any other relevant details such as your business registration number or tax ID.

- Client Details: Include your client’s name, address, and contact information so they can easily identify the document.

- Unique Identification Number: Every document should have a unique reference number to track payments and provide easy access to specific records.

- Description of Services: Detail the work completed, including dates, quantities, and a breakdown of the services provided. This section ensures transparency in what the client is paying for.

- Payment Terms: Clearly outline the payment due date, accepted methods, and any penalties for late payment. This sets expectations and reduces the likelihood of payment delays.

- Amount Due: Specify the total amount owed, broken down by individual services or tasks, as well as any applicable taxes or additional fees.

- Payment Instructions: Include clear instructions on how the client can make the payment, such as bank details, online payment links, or mailing addresses for checks.

Incorporating these elements ensures that your document is professional, complete, and easy to process. By providing all the necessary information upfront, you help foster trust and reduce the chances of disputes or confusion.

Common Mistakes in Contractor Invoices

Even with a well-organized billing system, it is easy to overlook certain details or make mistakes that can lead to confusion or delayed payments. These errors, although common, can impact your cash flow and harm your professional reputation. Being aware of the most frequent mistakes can help you avoid them and ensure your payment requests are clear and accurate.

Frequent Billing Errors

Some of the most common mistakes in creating payment documents stem from simple oversights. Below is a list of errors to watch out for:

| Error | Why It’s Problematic | How to Avoid |

|---|---|---|

| Missing Client Details | Incomplete client information can lead to confusion and make it difficult for both parties to track payments. | Ensure that you always include accurate and complete client contact information. |

| Incorrect Payment Terms | Vague or incorrect payment terms can cause delays or disputes about when payment is due. | Clearly specify the due date and accepted payment methods. Consider adding a late fee clause if necessary. |

| Unclear Descriptions of Services | Without clear details about the work completed, clients may question the charges or request further clarification. | Always provide specific descriptions of services rendered, including dates, quantities, and any relevant project details. |

| Overlooking Taxes and Fees | Failure to account for taxes or additional charges can lead to unexpected discrepancies in the total amount owed. | Double-check that any applicable taxes or additional charges are included in the final amount. |

| Missing Unique Identifier | Without a unique reference number, it becomes difficult to track or match payments with specific documents. | Always include a unique reference number for each billing document, especially when handling multiple clients or projects. |

How to Prevent These Mistakes

To avoid these errors, consider using a standardized format that includes all necessary sections. Carefully reviewing each document before sending it will also help spot any mistakes. By being thorough and attentive, you ensure that your billing process is smooth, professional, and free of confusion.

How to Ensure Accurate Billing

Accurate billing is critical for maintaining smooth financial operations and a positive relationship with clients. Errors in your billing process can lead to confusion, delayed payments, or even disputes. To ensure that your financial records are correct and clear, there are several practices you can adopt to avoid mistakes and improve efficiency.

Here are some key steps to help you achieve accurate billing:

- Double-check all details: Before sending any document, review it carefully. Ensure that the client’s information, dates, and payment terms are correct and complete.

- Use a consistent format: Having a standard structure for all your financial records helps eliminate confusion and reduces the risk of overlooking important details.

- Track hours and expenses: If your work is billed based on time or materials, keep precise records of hours worked, tasks completed, or supplies used. This ensures that the final amount reflects actual work done.

- Break down charges: List all services, products, or tasks separately with clear descriptions. A detailed breakdown helps clients understand what they are paying for, reducing the chance of disputes.

- Include taxes and fees: Always include applicable taxes or additional charges. Double-check the tax rates and ensure they are correctly applied to avoid discrepancies.

- Set clear payment terms: Specify the payment due date, accepted payment methods, and any penalties for late payments. This sets expectations for both parties.

By following these best practices, you can ensure that your billing process is accurate, transparent, and professional. Taking the time to implement these steps will not only improve the efficiency of your operations but also build trust and confidence with your clients.

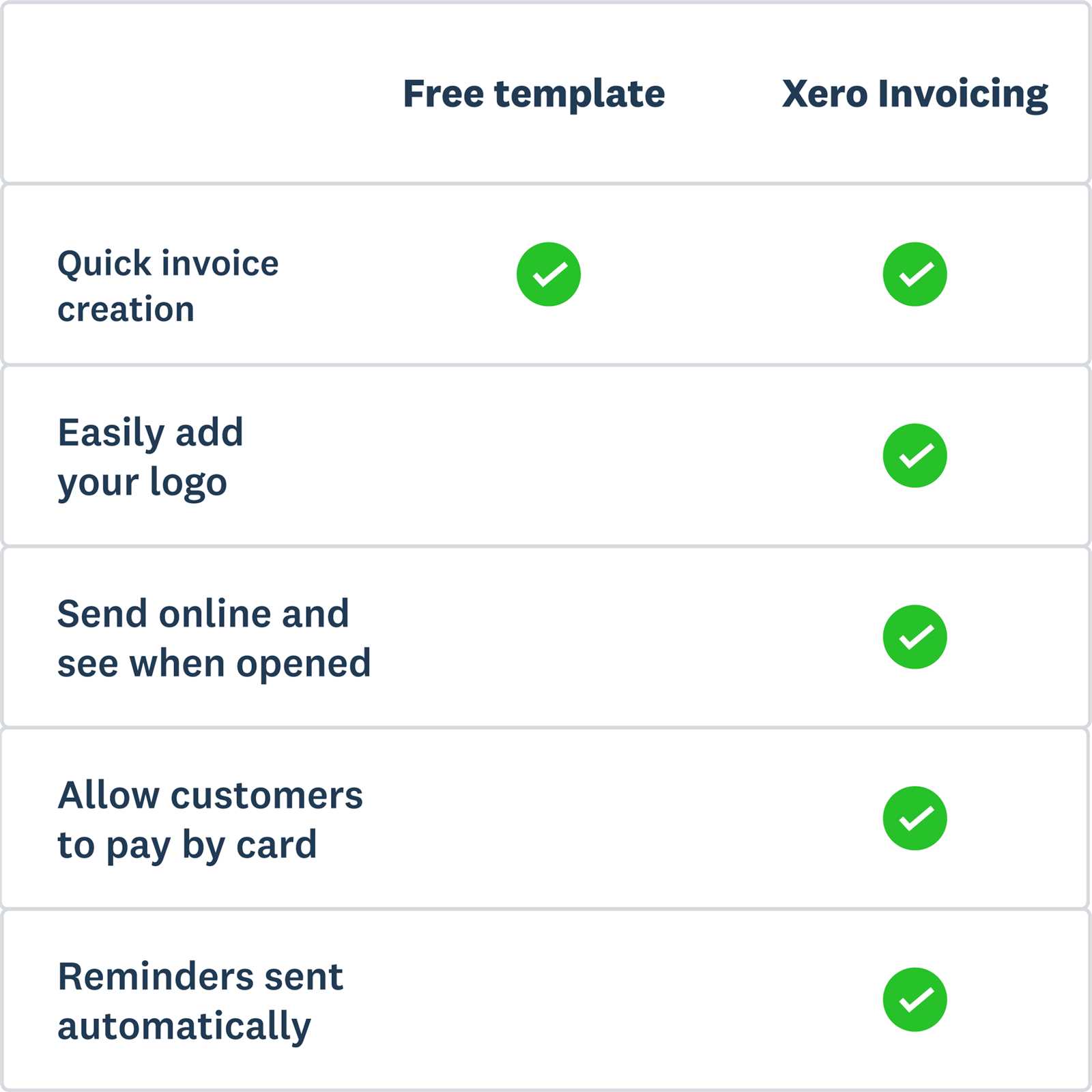

Free Invoice Templates vs Paid Options

When selecting a document for managing billing, there are two main choices: using a free version or opting for a paid service. Both options have their advantages and potential drawbacks, depending on your specific needs and business requirements. It’s important to understand the differences between these choices to determine which will best serve your needs in terms of efficiency, customization, and overall value.

Here’s a comparison between free and paid options for creating and managing financial records:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited customization. May require manual adjustments. | Extensive customization with advanced design tools and features. |

| Ease of Use | Basic formats with simple features. | User-friendly interfaces with guided templates and more professional designs. |

| Automation | Mostly manual entry; few or no automation options. | Automated calculations, recurring billing, and easy data entry integration. |

| Support | Limited support or none at all. | Comprehensive customer support, including help via email, chat, or phone. |

| Cost | No cost, making it ideal for small businesses or freelancers. | Subscription or one-time fees required, typically with added features and benefits. |

| Scalability | Not ideal for scaling or handling high volumes of clients. | Designed for businesses of all sizes, easily scalable as your business grows. |

Ultimately, the choice between a free or paid option depends on your specific needs. If you’re just starting out and have a small number of clients, a free document might be sufficient. However, if you plan to scale your business or need advanced features like automation and extensive customization, a paid option could provide more long-term benefits. Consider what will help you streamline your operations and enhance your professionalism in client communications.

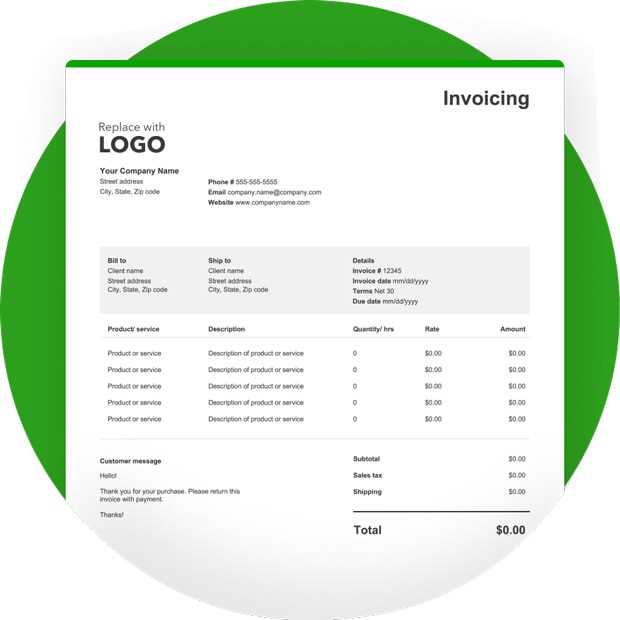

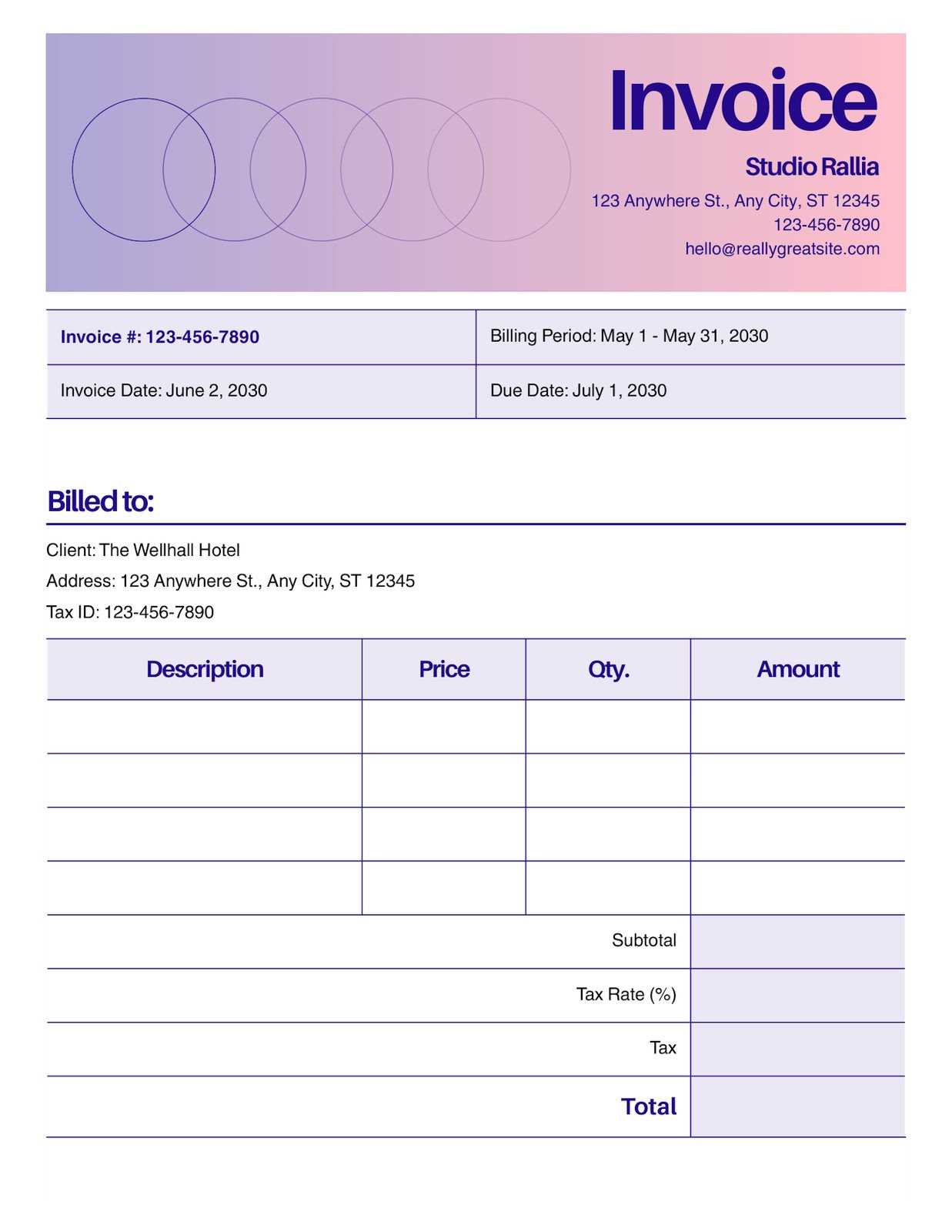

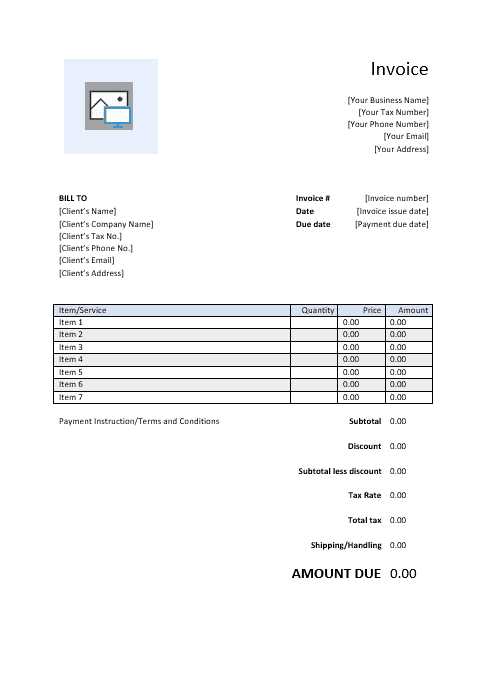

Top Features to Look for in Templates

When choosing a document to manage your billing needs, it’s important to select one that offers the right set of features to streamline your process and ensure professionalism. The right features can save you time, improve accuracy, and enhance the overall presentation of your records. Below are key elements to look for in a well-designed document for your business transactions.

- Customizable Layout: The ability to adjust the layout to suit your branding and specific needs. A customizable structure allows you to add your logo, change fonts, and modify colors, making your document align with your business image.

- Clear Breakdown of Services: An effective document should allow you to list services or products in detail, including descriptions, quantities, rates, and any additional costs. This transparency helps clients understand exactly what they’re paying for.

- Automatic Calculations: Look for features that automatically calculate totals, taxes, and discounts. This reduces the risk of human error and ensures that your documents are accurate every time.

- Professional Design: A clean, visually appealing design enhances the credibility of your business. Look for options with a polished appearance, with well-organized sections and a clear structure that makes it easy to read and understand.

- Payment Terms Section: Include clear spaces to outline payment terms, due dates, and accepted payment methods. Having this information readily available reduces confusion and sets clear expectations for your clients.

- Unique Reference Number: A place for assigning a unique identifier to each document is essential for easy tracking and organization. This helps you reference specific transactions and manage your financial records more effectively.

- Multiple File Formats: The ability to save or export your document in various formats, such as PDF, Word, or Excel, ensures that it’s easy to share and print as needed.

- Mobile-Friendly: If you frequently work on the go, look for documents that are easily accessible on mobile devices. This can be especially helpful if you need to send a record quickly or make changes while away from your office.

Choosing a document with these features will make your billing process more efficient, reduce the risk of errors, and improve your professionalism when communicating with clients. Whether you’re a small business owner or a freelancer, investing time in finding the right solution is essential for smooth financial operations.

How to Save Time with Templates

Time is one of the most valuable resources for any business owner or freelancer. By streamlining repetitive tasks, you can focus more on growing your business or completing client work. Using a structured format for your financial documents is a great way to save time and increase efficiency. Instead of creating a new document from scratch every time you need to send a payment request, you can rely on pre-designed layouts that allow you to input the necessary details quickly and easily.

Time-Saving Benefits

Here are some ways in which using a pre-made structure can help you save time:

| Benefit | How It Saves Time |

|---|---|

| Pre-filled Fields | With common fields already in place, you simply add specific details like dates, amounts, and client information, reducing manual work. |

| Standardized Format | The consistent format eliminates the need for formatting adjustments or rethinking the layout, so you can quickly generate accurate documents. |

| Reusable Structure | Once you set up your layout, you can use it repeatedly for all future transactions without starting over each time. |

| Automation of Calculations | Many formats include automatic calculations for totals, taxes, and discounts, which reduces the time spent on manual math. |

How to Maximize Time Savings

To make the most of a pre-designed structure, set up your document with all your standard details, such as your business name, payment terms, and general service descriptions. This way, you can minimize the amount of customization needed for each new record. Also, consider keeping a list of your most common services or products, so you can quickly select and add them to each document without typing everything out each time.

By adopting this efficient approach, you’ll be able to process client transactions faster, improve your workflow, and free up time to focus on other important tasks in your business.

Creating Professional Invoices Quickly

Generating a well-organized and professional financial document is crucial for maintaining a good relationship with clients while ensuring timely payments. However, the process of crafting these documents doesn’t need to be time-consuming or complicated. With the right tools and approach, you can create polished, clear documents in a fraction of the time. Streamlining your workflow and automating certain steps will help you get back to focusing on your core business tasks.

Steps to Quickly Create a Professional Document

- Choose a Structured Layout: Select a format that organizes key details such as client information, services rendered, and payment terms. This will save you time adjusting the structure each time you create a new record.

- Include Key Information: Ensure that each document includes essential details such as your business contact information, a description of the work done, the total amount due, payment instructions, and a due date. With these elements in place, clients will have everything they need for a quick review and payment.

- Utilize Pre-filled Fields: Pre-fill your basic details (e.g., business name, payment terms, contact info) to avoid repetitive data entry. Having these sections already set up will allow you to focus on entering only the project-specific information.

- Automate Calculations: Many document formats offer automatic calculations for totals, taxes, and discounts. These features save you from doing the math manually, reducing the risk of errors and speeding up the process.

- Save as a Template: Once you’ve set up your document with standard sections and fields, save it as a template for future use. This way, you can reuse it repeatedly, making updates as needed without starting from scratch each time.

Best Practices for Speed and Accuracy

- Use Consistent Formats: Having a consistent format across all your financial documents not only saves time but also helps build your professional image. Clients will easily recognize your documents and feel more confident in the accuracy and reliability of the information.

- Proofread Quickly: While speed is important, don’t skip the proofing step. Double-check for any missing details or errors before sending out your document. A quick review ensures everything is correct and can save you from having to send a corrected version later.

By adopting these practices, you’ll be able to generate well-structured, professional documents in no time, allowing you to manage your billing process with efficiency and ease. The faster you can generate accurate records, the more time you’ll have for other business activities.

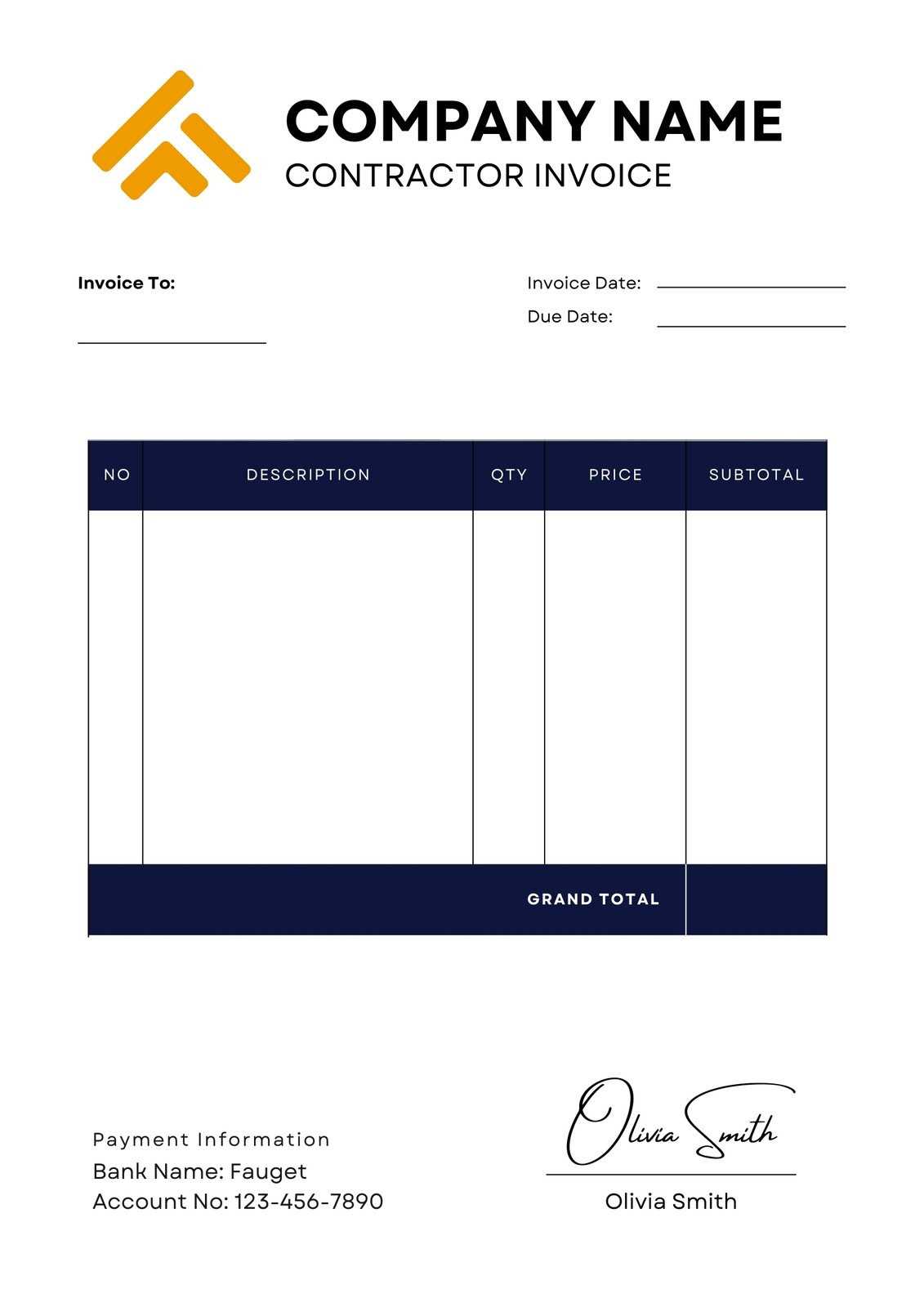

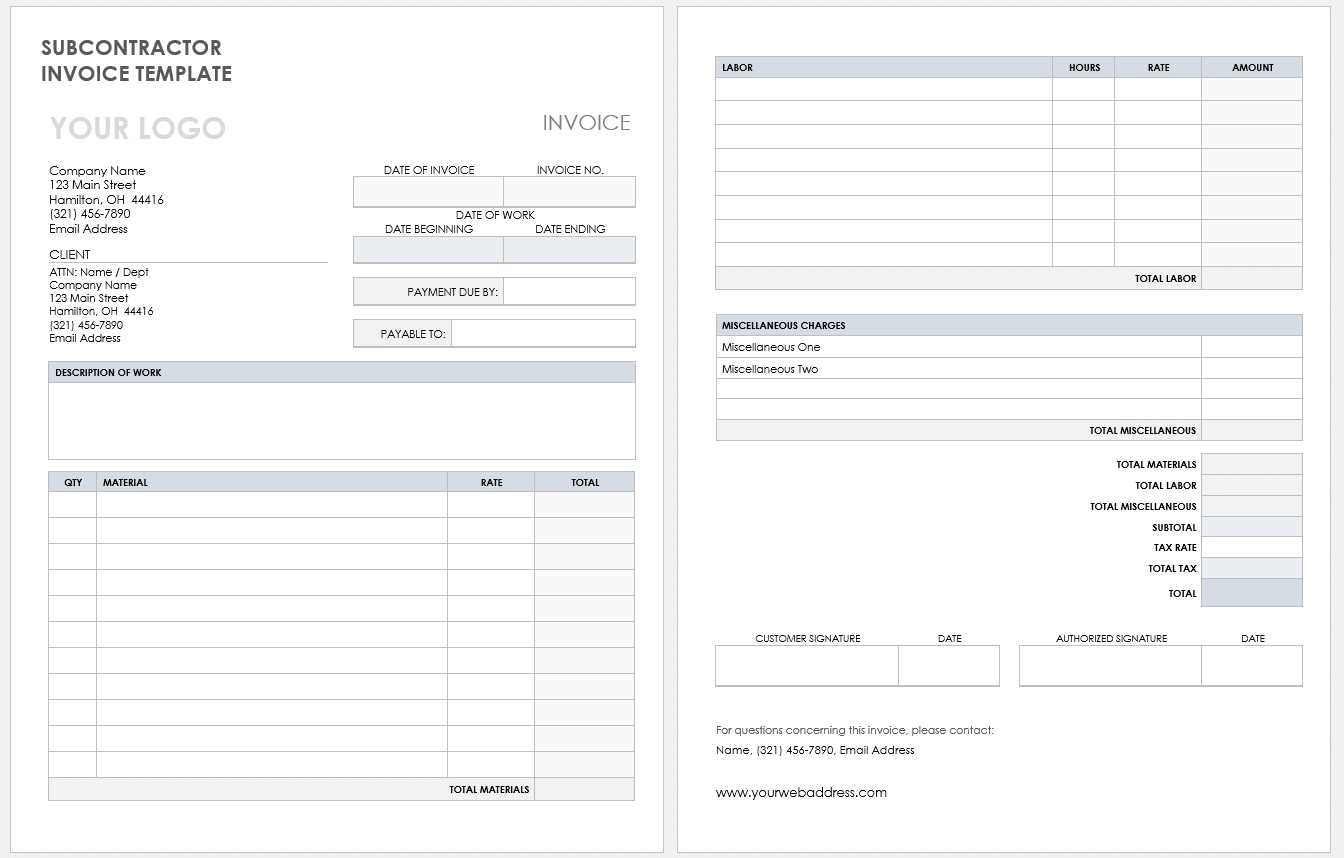

Free Templates for Different Contract Types

When managing various types of agreements, it’s important to use structured documents that cater to the specifics of each project or contract. Different contracts may involve varying terms, services, and pricing structures, so having an appropriate document format can save time and ensure clarity. Whether you’re handling a fixed-price agreement, a time-based arrangement, or a retainer, having a document ready for each type helps streamline the billing process and maintain professionalism.

For each contract type, you’ll need a document that reflects the unique aspects of the work being performed. Below are examples of different contract types and how pre-designed documents can support each situation:

- Hourly Contracts: For agreements based on the time worked, use a document that includes sections for hourly rates, total hours worked, and any applicable overtime or special charges. This ensures clear communication regarding the amount due and avoids confusion over rates.

- Fixed-Price Contracts: If your agreement is based on a predetermined price for the entire project or scope of work, a document template that includes project milestones, flat fees, and payment schedules can keep everything organized and easy to follow.

- Retainer Agreements: When dealing with retainer-based contracts, it’s helpful to have a document format that reflects the ongoing nature of the work, with sections for monthly fees, hours allocated, and any additional charges for extra services. This keeps both parties informed of expectations.

- Project-Based Contracts: If your agreement covers a specific project or deliverable, ensure your document includes details such as the project scope, deadlines, payment schedules based on progress, and terms for project completion. This ensures that all project parameters are met and clearly outlined.

- Recurring Billing Contracts: For agreements involving ongoing, recurring services, it’s best to use a format that automatically reflects regular billing intervals, fees, and terms for automatic renewals. This helps maintain consistency and eliminates the need for constant adjustments.

Having the right document for each contract type allows you to maintain professionalism and streamline your workflow. With clear and detailed documents, you reduce the risk of errors or misunderstandings, ensuring both you and your client are on the same page throughout the duration of the agreement.

Where to Download Reliable Templates

Finding dependable resources for financial documents is essential to ensure you are using professional and accurate formats for your business transactions. A reliable document not only saves time but also guarantees that all necessary information is included, reducing the risk of errors. With the right resources, you can quickly access well-designed formats that cater to different business needs and can be easily customized to suit your specific requirements.

Trusted Online Sources

Here are some reliable platforms where you can find quality document formats:

- Business Software Websites: Many business software companies offer document formats as part of their service packages. These options are often tailored to the needs of various industries and are regularly updated to comply with legal and financial standards.

- Online Document Libraries: Websites dedicated to providing a variety of business tools often have a collection of well-designed financial documents. These sites usually allow you to browse multiple formats and choose one that best fits your business needs.

- Freelancer Platforms: Many freelancer websites provide customizable document templates as part of their service offerings. These resources are especially useful for those working independently and can often be tailored to meet the unique needs of freelance contracts and billing.

- Industry-Specific Websites: For specialized fields, there are often industry-specific platforms that offer documents designed with the particular requirements of that sector in mind. These can be useful for ensuring that all required information is included for a specific type of work.

Considerations When Choosing a Source

When selecting where to get your document, it’s important to consider the following:

- Customization Options: Choose a source that allows you to easily modify the document to suit your branding, terms, and specific services.

- Reliability and Updates: Ensure the source is reputable and provides regularly updated formats to reflect the latest business practices and legal requirements.

- Security: Opt for a platform that offers secure downloads to protect your business and personal data.

By selecting a trusted source, you can rest assured that your documents will meet both your business standards and client expectations. Finding the right resource makes the process faster and more efficient, while also ensuring that your financial records are professional and accurate.

How to Send an Invoice Effectively

Sending a payment request may seem straightforward, but the way you deliver it can significantly impact how quickly and efficiently you receive payment. Clear communication and professionalism are key to ensuring that the recipient understands the details and urgency of the request. Additionally, choosing the right delivery method and timing can make the process smoother for both you and your client, reducing delays and misunderstandings.

Below are some strategies to effectively send your payment requests and improve the likelihood of timely payments:

Best Practices for Sending Payment Requests

- Use Clear Subject Lines: Whether sending by email or through a client portal, a clear subject line will make your request stand out. For example, “Payment Due for [Project Name] – [Amount Due]” gives the recipient immediate context.

- Double-Check Details: Before sending, ensure that all details in the request are accurate. This includes the correct payment amount, payment methods, due date, and any relevant terms. Mistakes can lead to confusion and delays.

- Attach the Document in Multiple Formats: Attach the document in at least one editable format (like Word or Excel) and one non-editable format (like PDF). This makes it easier for the recipient to review and process, especially if they need to forward it to someone else for approval.

- Set a Clear Deadline: Always specify the due date and the consequences of late payments (e.g., late fees). A clear deadline helps ensure prompt action and sets expectations for both parties.

- Follow Up: If you haven’t received payment by the due date, send a polite follow-up email or message. Include the original request and remind the client of the due date and amount due. This serves as a gentle nudge while maintaining professionalism.

Choosing the Right Delivery Method

- Email: Sending payment requests via email is one of the most common and efficient methods. It ensures immediate delivery and allows for easy tracking of the message. Always use a professional email address and avoid using casual language.

- Client Portals or Accounting Software: If you’re using client management or accounting software, these platforms typically offer secure and streamlined ways to send payment requests. Using these tools allows clients to directly view and pay through the portal, simplifying the process.

- Postal Mail: For clients who prefer physical documents or for those in regions where electronic communication is less common, sending a hard copy through postal mail may be appropriate. However, this method takes longer and can result in delays in receiving payment.

By following these practices and choosing the right delivery method, you can make sure that your payment requests are clear, professional, and easy to process. This approach not only speeds up the payment process but also strengthens your business relationships with clients.

Legal Considerations When Invoicing

When sending a payment request, it is essential to ensure that the document complies with relevant laws and regulations. This not only helps protect your business but also fosters a transparent and professional relationship with clients. Failing to address legal aspects can lead to disputes, delayed payments, or even legal action. Understanding the key legal requirements for your billing process is crucial for maintaining credibility and avoiding unnecessary complications.

Here are some important legal considerations to keep in mind when preparing payment requests:

Key Legal Elements to Include

- Correct Business Information: Always include accurate and up-to-date details about your business, such as your legal business name, address, and contact information. This helps verify the legitimacy of the request and ensures that payments are directed to the right place.

- Clear Payment Terms: Clearly state the agreed-upon payment terms, including the total amount due, the due date, and any late fees or interest charges. Be sure to include a statement of the accepted payment methods (e.g., bank transfer, check, or online payment). This helps avoid confusion and disputes over payment timelines.

- Tax Identification Number: Including your business’s tax identification number (TIN) is important for both you and your client. It may be required by tax authorities for record-keeping, and it helps establish the legitimacy of your business transactions.

- Legal Jurisdiction: It’s a good idea to include a clause that specifies the legal jurisdiction under which disputes will be resolved. This will clarify which laws apply if any legal issues arise, reducing potential conflict over venue or governing law.

- Clarity of Services Rendered: List all services or goods provided in detail, including quantities, prices, and descriptions. A well-documented record ensures there’s no ambiguity about what was delivered, which can protect you in case of any disputes.

Important Legal Compliance Issues

- Data Protection and Privacy: Ensure that any personal information provided by the client is stored securely and in accordance with data protection laws, such as the GDPR if you’re operating in the European Union. This includes client details and payment information.

- Sales Tax and VAT: If applicable, you must include sales tax or VAT on your payment request. Be sure to list tax rates and amounts clearly and follow local tax regulations for your jurisdiction. Some regions have specific rules for who is responsible for collecting and remitting these taxes.

- Late Payment Laws: Familiarize yourself with the laws governing late payment fees in your jurisdiction. Many countries have specific rules regarding when you can charge interest or fees for overdue payments. Ensure that any late fees are clearly outlined in your terms and comply with the law.

By addressing these legal elements in your documents, you can protect both your business and your clients. Keeping everything transparent, clear, and compliant with applicable laws ensures that you minimize risks and avoid misunderstandings. It also enhances your professionalism and builds trust with your clients, paving the way for a smooth payment process.

Tracking Payments with Invoice Templates

Keeping track of payments is crucial for maintaining a healthy cash flow and ensuring timely compensation for services rendered. An efficient tracking system helps monitor outstanding balances, identify overdue amounts, and stay organized in the event of disputes. By using properly structured documents, you can easily record and track the status of each payment, which simplifies the entire billing and collection process.

Here are some tips for effectively tracking payments with structured documents:

- Include Payment Status Columns: Add clear sections or columns for payment status, such as “Paid,” “Pending,” or “Overdue.” This allows you to quickly determine which requests have been settled and which ones still require attention.

- Record Payment Dates: Track when each payment was made by including a field for the payment date. This helps you keep accurate records of when payments are received, making it easier to follow up on delayed or missed payments.

- Provide Balance Due Information: Clearly state the amount due, along with any partial payments made. This ensures that both you and the client know the remaining balance, avoiding confusion and miscommunication.

- Use Unique Reference Numbers: Assign unique reference numbers or codes to each payment request. This simplifies the process of matching payments to specific requests, reducing the likelihood of errors in payment allocation.

By incorporating these tracking features into your documents, you can streamline the payment process and maintain better control over your accounts. Effective tracking not only ensures timely payments but also provides a reliable record for both you and your clients in case any issues arise in the future.

Maximizing Efficiency with Invoice Software

Using specialized software to manage billing and payment requests can significantly improve efficiency for businesses of all sizes. These tools streamline the entire process by automating many of the tasks that would otherwise be time-consuming and prone to human error. From creating professional documents to tracking payments and sending reminders, invoice software can save time, reduce mistakes, and ensure that every transaction is processed accurately and on schedule.

Key Benefits of Using Software for Billing

- Automation: Invoice software can automate many steps of the billing process, such as calculating totals, taxes, and discounts. This reduces the likelihood of errors and ensures that all figures are accurate every time.

- Customization: Most software platforms allow for customization of payment requests, making it easy to tailor the look and feel of your documents to match your brand and specific needs.

- Streamlined Tracking: With software, you can easily track the status of each request, including whether payments have been made, are pending, or are overdue. This allows for better financial management and follow-up on outstanding balances.

- Integration with Payment Systems: Many software options integrate directly with payment processors, allowing clients to pay directly through the platform. This simplifies the process and ensures faster payments.

Features to Look for in Invoice Software

When choosing software for managing payment requests, it’s important to evaluate the features that will best serve your needs. Here are some key features to consider:

| Feature | Description |

|---|---|

| Templates | Pre-built formats that make it easier to create professional documents quickly. |

| Recurring Billing | Automates the creation of regular requests for clients with ongoing services, saving time and effort. |

| Multi-Currency Support | Allows businesses to send requests in different currencies, which is essential for international transactions. |

| Payment Reminders | Automatically sends reminders to clients when payments are due, helping to reduce late payments. |

With the right software, you can significantly reduce the time spent on administrative tasks, focus more on delivering services, and ensure that your financial records are up-to-date and organized. Whether you’re a small business owner or a freelancer, investing in invoice management software can help you streamline your operations and improve overall cash flow management.