Complete Guide to Subcontractor Invoice Template and How to Use It

Managing financial transactions with clients and partners requires clear, professional documentation. Ensuring accuracy in these records is essential not only for maintaining trust but also for compliance with legal and tax requirements. Whether you’re a freelancer or running a small business, having a reliable format for your payment requests simplifies the entire process and ensures timely payments.

Designing an effective billing document involves more than just listing amounts due. It’s about presenting information in a structured, easy-to-read format that both parties can quickly understand. A well-crafted billing form can make a significant difference in how your payments are processed and how your business is perceived.

By using pre-designed formats, you can save time and effort while ensuring that all necessary details are included, from payment terms to services provided. These documents not only protect you but also enhance your professional image, making your business dealings smoother and more efficient.

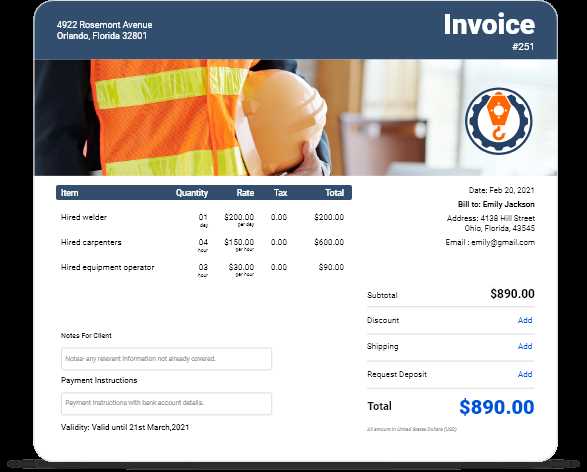

Subcontractor Invoice Template Overview

In any business arrangement, it’s important to have a structured document that clearly outlines the terms of payment for services rendered. These documents serve as formal requests for payment and include all necessary details to ensure smooth financial transactions between the service provider and the client. By using a consistent and professional format, both parties can avoid confusion and ensure timely compensation for work completed.

A properly designed billing document is essential in protecting both the worker and the client, as it includes all relevant information such as the description of services, payment terms, and deadlines. By utilizing a pre-designed form, the process becomes more streamlined, ensuring that nothing is overlooked and that all necessary details are provided in an organized manner.

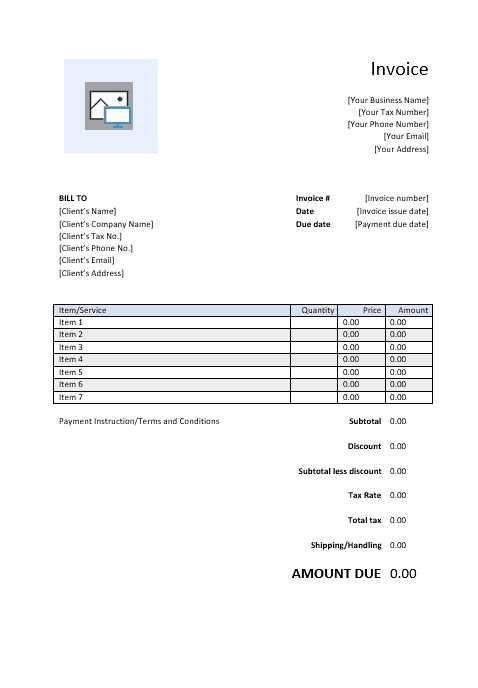

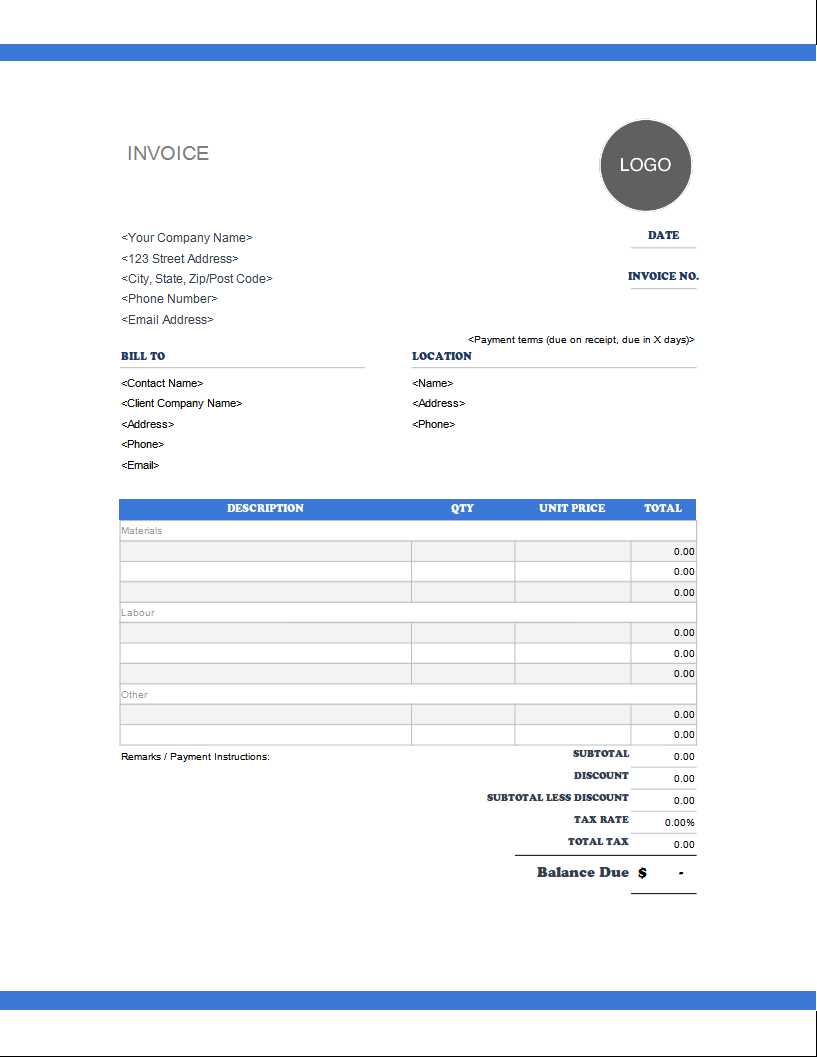

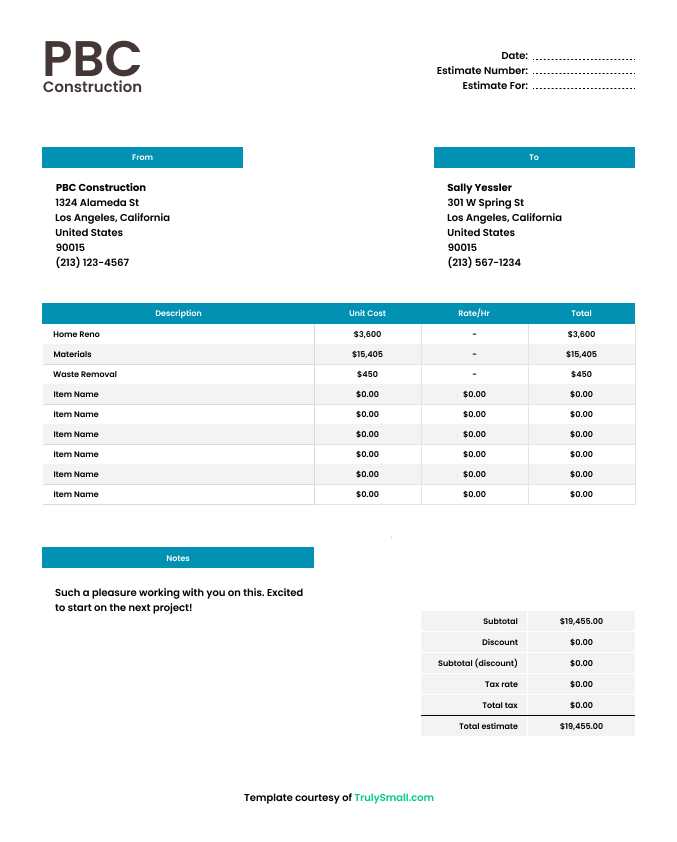

Here is an overview of what a typical billing document should include:

| Component | Description |

|---|---|

| Header | Includes the name and contact information of both the service provider and the client. |

| Work Description | A detailed breakdown of services performed, including dates and hours worked, if applicable. |

| Payment Terms | Clear instructions regarding payment amount, due date, and acceptable methods of payment. |

| Itemized Costs | A list of charges, including unit prices for each service or product provided. |

| Tax Information | Any applicable taxes or deductions that may apply to the payment. |

| Notes | Additional comments or instructions regarding the work or payment process. |

This structure helps ensure that both parties have a clear understanding of the terms and conditions, reducing the chances of disputes or confusion. Using a well-organized document simplifies the payment process and strengthens professional relationships.

What is a Subcontractor Invoice?

A formal request for payment is a crucial document in any business agreement where services are provided. This document serves as a detailed account of the work completed, the agreed-upon compensation, and other essential terms for both parties. It is issued by the service provider to request payment from the client once the contracted work has been finished.

Such a payment request typically includes the following key elements:

- Service Description: A clear outline of the tasks performed, including dates, hours, and specific activities completed.

- Payment Amount: The total due, often broken down into smaller charges or hourly rates.

- Payment Terms: The conditions under which payment should be made, such as due dates and acceptable payment methods.

- Tax Information: If applicable, any taxes that need to be added to the total amount due.

- Client and Contractor Details: Names, addresses, and contact information for both the provider and the client.

This document not only ensures that both parties are clear about the payment arrangements, but also helps in maintaining legal and financial transparency. By clearly laying out the terms and amounts, it reduces the chance of misunderstandings or disputes over payments.

Additionally, it often serves as an official record for both the client and the service provider, aiding in future reference or tax-related matters.

Key Components of an Invoice

When creating a formal request for payment, it is essential to include all the necessary details that ensure clarity and prevent misunderstandings. A well-structured document provides both the client and the service provider with a clear understanding of the work performed, the total amount due, and the payment conditions. These key elements ensure transparency, timely payment, and compliance with any contractual obligations.

Here are the critical components that should be included in any payment request document:

- Header Information: This section includes the names, addresses, and contact details of both the service provider and the client. It is essential to include the date of issue to help track the document.

- Work Details: A detailed description of the services rendered. This section includes the dates when the work was performed, the hours worked, and a breakdown of tasks or projects completed.

- Amount Due: This specifies the total amount the client needs to pay. It can be itemized, listing individual charges or rates for each service provided.

- Payment Terms: Clearly outline the payment due date, accepted payment methods, and any applicable late fees or penalties for overdue payments. This section helps avoid delays and ensures smooth transactions.

- Tax Information: If applicable, include any sales tax or other charges that may apply. Clearly indicate whether taxes are included in the total or should be added separately.

- Notes or Comments: This section may include additional instructions, reminders, or any special agreements made between the parties. It can also contain information on warranty terms, follow-up steps, or future services offered.

By ensuring that all these components are clearly outlined, both parties can avoid confusion and establish a smooth process for completing the transaction. A comprehensive document not only helps with immediate payment but can also serve as a reference in case of future disputes or audits.

Why Use a Template for Invoices

Using a pre-designed format for payment requests can significantly simplify the billing process. By relying on a structured document, you ensure that all critical details are included and organized in a consistent manner. This not only saves time but also reduces the risk of errors, which can lead to confusion or delays in payments.

Here are the main reasons why adopting a standardized form for payment requests is beneficial:

- Time Efficiency: A ready-to-use form allows you to quickly input the relevant details without having to design a new document each time. This can speed up the process and help you send out requests promptly.

- Consistency: A uniform format ensures that all necessary information is included every time. This consistency reduces the chances of leaving out important details, such as payment terms, service descriptions, or tax calculations.

- Professional Appearance: Using a polished, well-organized document reflects positively on your business and strengthens your professional image. Clients are more likely to take payment requests seriously when they are presented in a clear and formal manner.

- Legal Protection: A properly structured document can serve as evidence in case of disputes or audits. By adhering to a clear and consistent format, you ensure that both parties are aware of the agreed-upon terms, which helps avoid misunderstandings.

- Customization: Many formats can be easily customized to meet specific business needs. Whether you need to add extra sections for notes or adjust payment terms, these documents are adaptable to suit different requirements.

Incorporating a pre-made form into your workflow streamlines the entire process, making it easier for both the service provider and the client to manage financial transactions efficiently. It enhances organization, ensures accuracy, and ultimately contributes to smoother business operations.

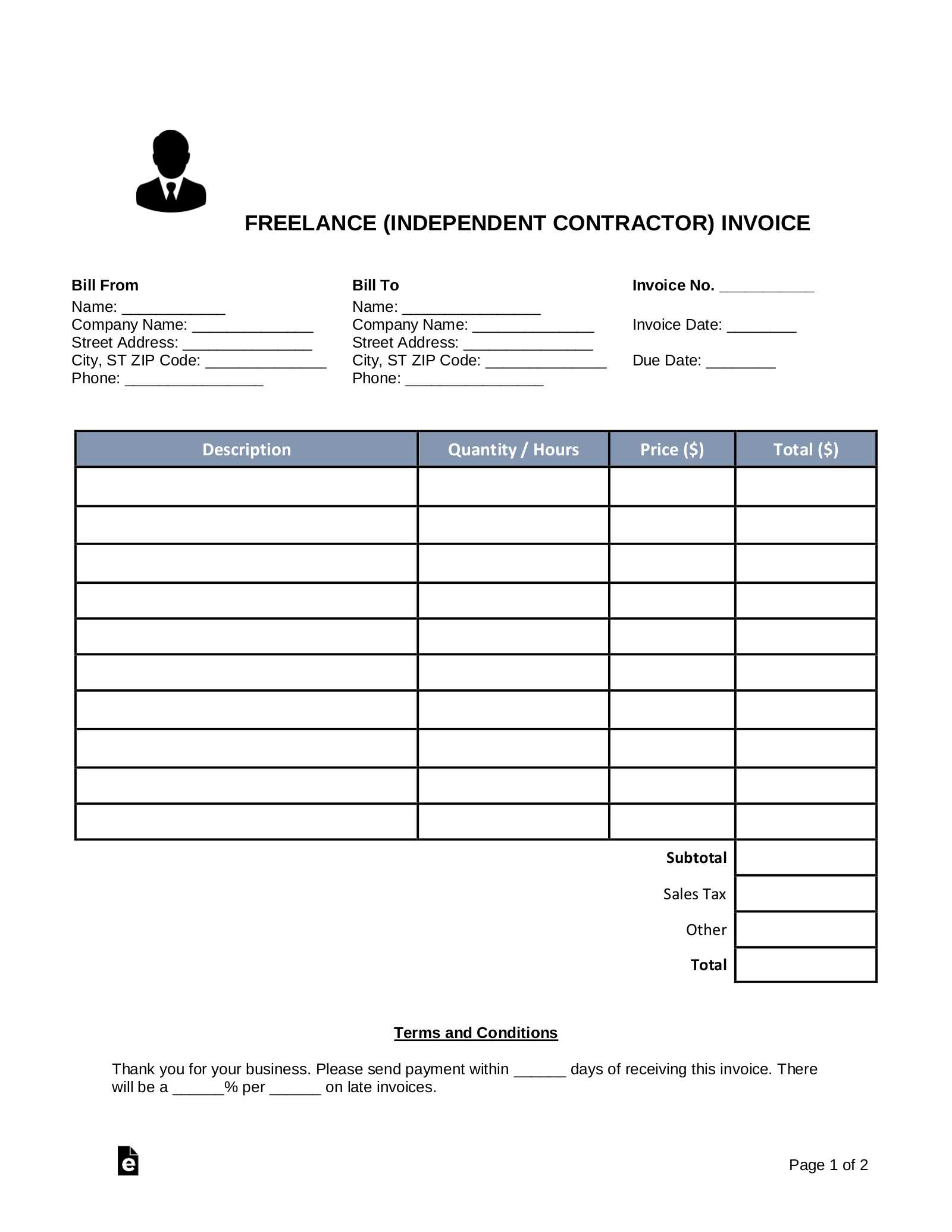

How to Create a Payment Request Document

Creating a professional document to request payment for services rendered is essential in ensuring a smooth financial transaction between the service provider and the client. The process involves outlining key information clearly and accurately to avoid confusion or delays. By following a systematic approach, you can create a document that not only reflects your professionalism but also helps ensure timely payment.

Step 1: Include Your Contact Information

The first thing to include in your payment request is your business information. This should be at the top of the document and should include:

- Your business name, address, phone number, and email address.

- The name and contact details of the client or business you’re requesting payment from.

- The date the document is being issued and a unique reference number (if applicable).

Including these details helps both you and the client keep track of the transaction and makes the document more official.

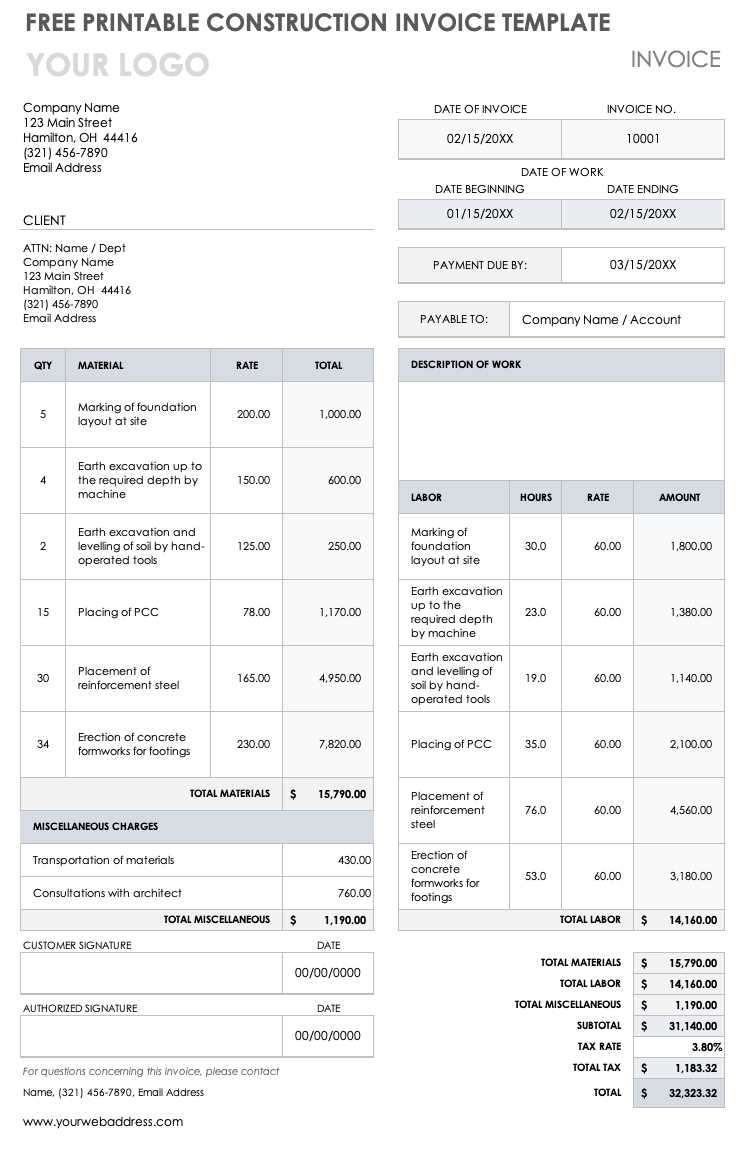

Step 2: Provide a Detailed Breakdown of Services

Next, include a thorough description of the services provided. This section should include:

- A clear list of tasks or work completed.

- The dates on which each task was completed, including the start and end dates if applicable.

- The quantity, hourly rate, or price for each service or item.

By breaking down the services in this way, you avoid any misunderstandings regarding the work completed and the associated charges. Be as detailed as possible to ensure both parties are clear on the expectations.

After providing this detailed information, ensure you also list the total amount due, along with any payment terms, such as the due date, acceptable payment methods, and potential late fees if applicable. Once all information is included, double-check for accuracy before submitting the document to the client.

Essential Information to Include in Payment Requests

To ensure a smooth and clear transaction process, it’s crucial to include all necessary details in your request for payment. A well-documented record of services provided, along with payment terms, helps prevent misunderstandings and promotes timely compensation. The more precise and organized the document, the easier it is for both the service provider and the client to process payments efficiently.

Key Elements to Include

Here are the essential components that must be included in any payment request:

| Component | Description |

|---|---|

| Contact Information | Include both the service provider’s and client’s business name, address, phone number, and email address for easy communication. |

| Document Date | The date when the payment request is issued, which helps both parties track deadlines and the timing of payments. |

| Unique Reference Number | A unique identifier for each request that helps to track and reference specific documents in case of queries or disputes. |

| Description of Services | A detailed breakdown of the work completed, including dates, hours, and specific tasks performed. This helps clarify what the client is being billed for. |

| Amount Due | The total amount to be paid, including any additional charges or taxes. If multiple services are listed, provide an itemized breakdown. |

| Payment Terms | Include details on payment deadlines, accepted methods of payment, and any late fees or discounts for early payments. |

Additional Considerations

In addition to the essential components listed above, consider adding any special instructions or terms that might apply to your specific agreement. This could include warranty information, follow-up work, or specific client requests. The goal is to provide enough detail so both parties are fully aware of the terms and expectations surrounding the payment process.

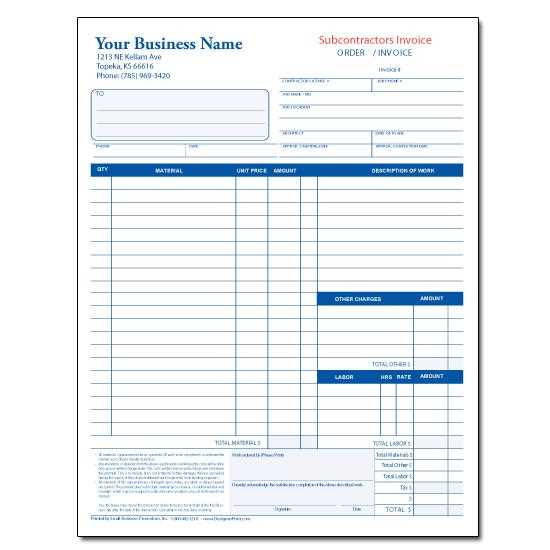

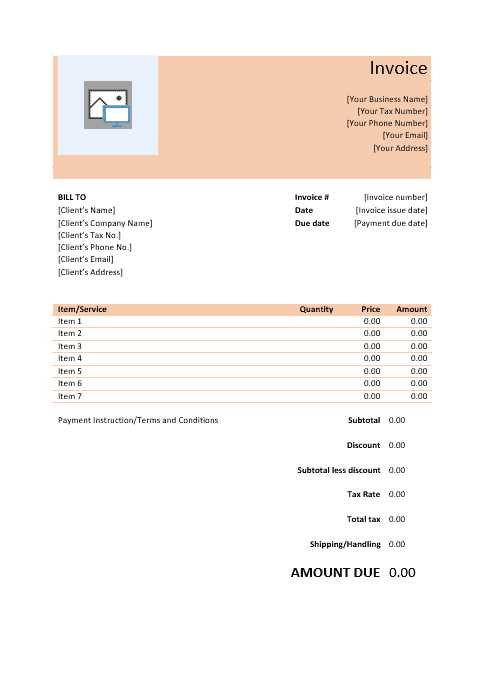

How to Customize a Payment Request Document

Customizing a pre-designed payment request form allows you to adapt it to your specific business needs, ensuring it reflects your branding and includes all necessary details. By adjusting certain elements, you can create a professional and clear document that aligns with your business processes, enhances client communication, and ensures accurate tracking of financial transactions.

Here are the steps to effectively personalize your document:

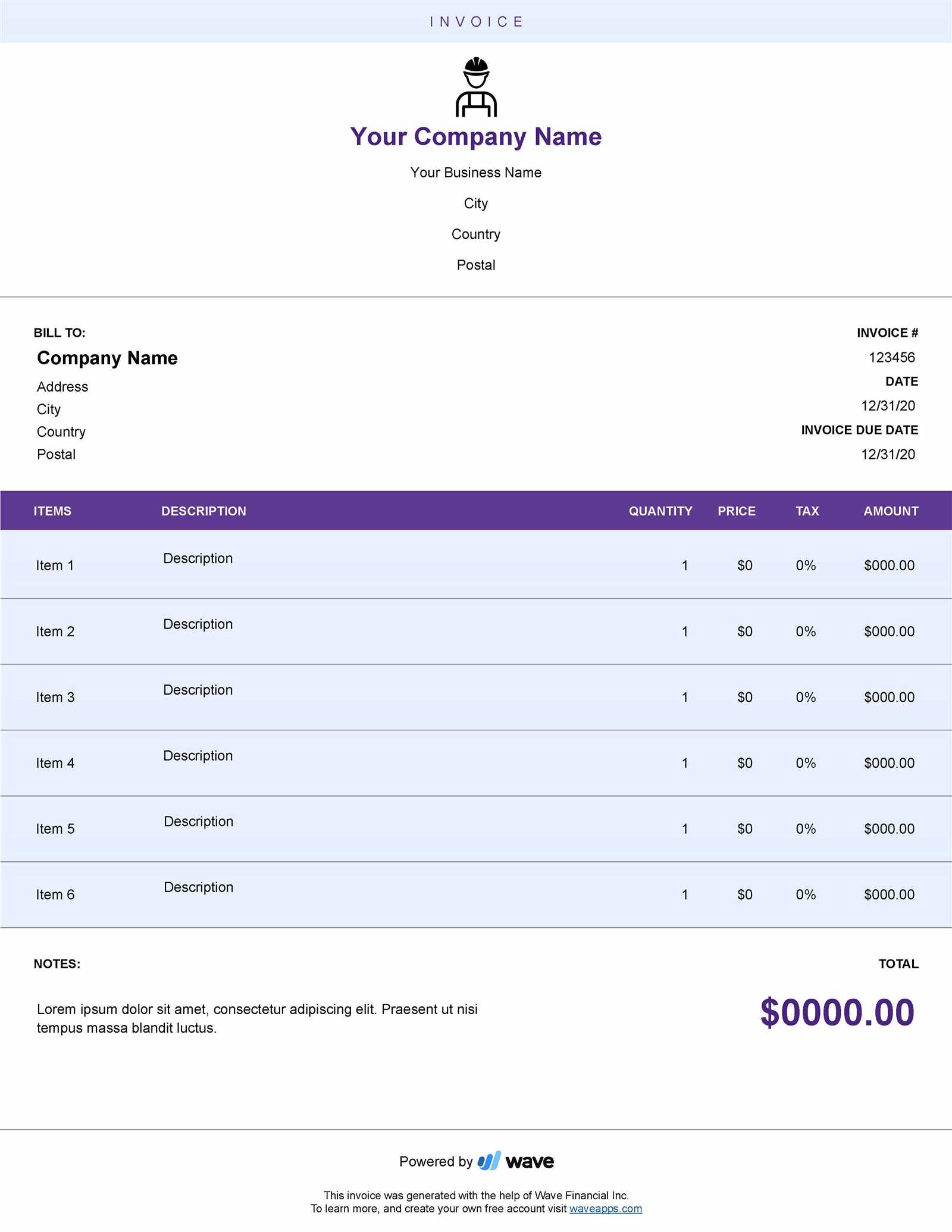

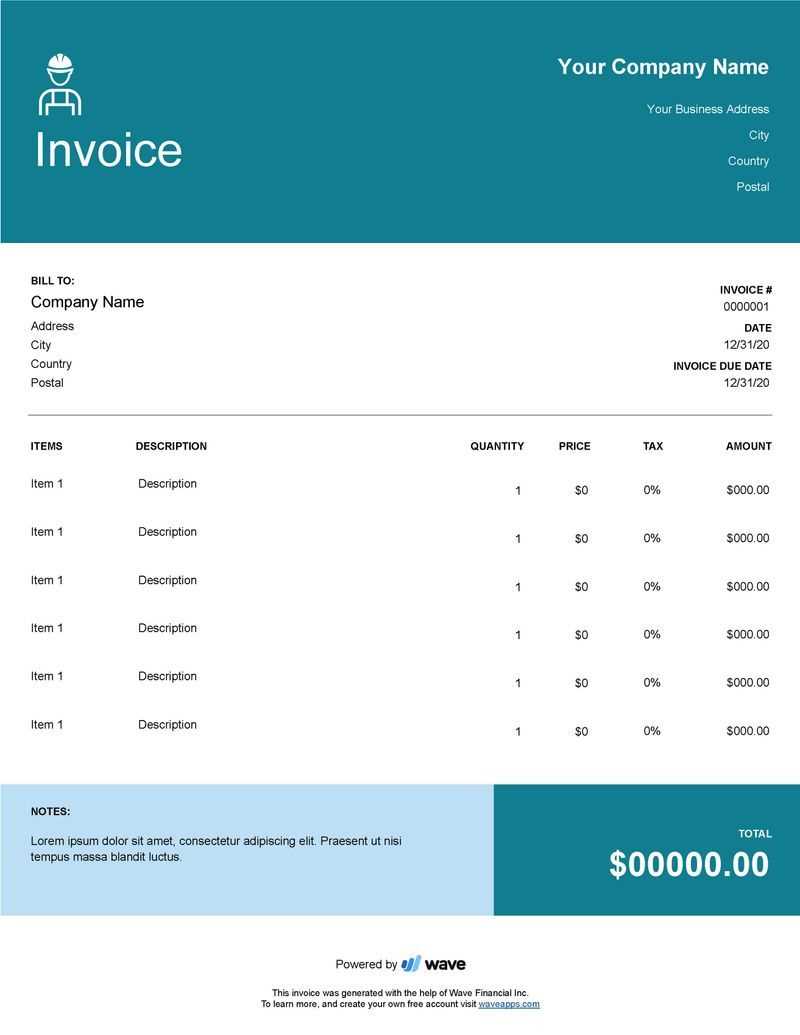

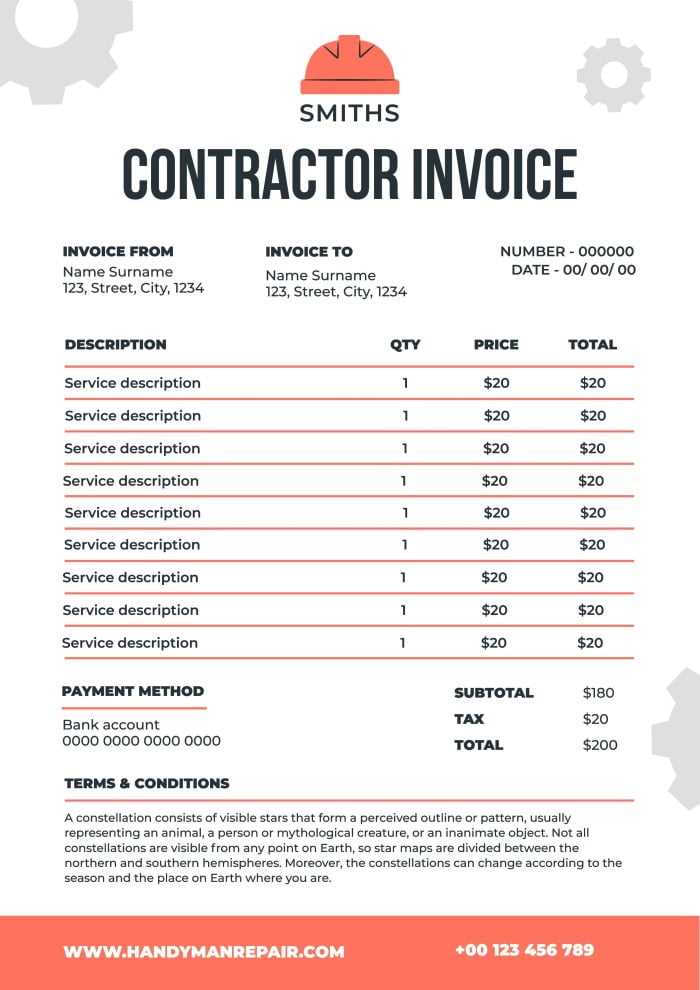

1. Adjust the Header Section

The header of the document is the first point of contact, so it should clearly display your company name, logo, and contact information. Additionally, make sure to include the client’s details, as this helps with quick identification and easy communication. You can also customize the layout of this section by adjusting font styles, sizes, and colors to match your brand’s identity.

2. Modify the Service Breakdown

Ensure that the description of services provided is tailored to your specific business offerings. If you provide a variety of services or products, categorize them accordingly and provide a detailed breakdown of the work completed. This section should be customizable to add specific dates, hours worked, unit prices, or other relevant billing criteria that apply to your work.

When adjusting the pricing details, ensure that any taxes, fees, or discounts are clearly listed to avoid confusion. This will help maintain transparency and ensure both parties understand the full cost of the transaction.

3. Customize Payment Terms and Conditions

Each business may have unique payment conditions. Adjust the payment terms section to reflect your specific requirements, such as:

- Accepted payment methods (e.g., bank transfer, credit card, checks).

- Due dates and deadlines.

- Late fees or penalties for overdue payments.

- Discounts for early payments or special offers.

By customizing these sections, you ensure that the client is fully aware of your payment policies and expectations, reducing the risk of delays or disputes.

4. Include Additional Notes or Custom Sections

Some businesses may need to add extra sections, such as special instructions, terms of service, or disclaimers. For example, if your work includes a warranty period or follow-up service, clearly outline these terms in the document. Personalizing these sections will help the client understand all the details of your service agreement and encourage clear communication.

Once you’ve made the necessary adjustments, review the document carefully to ensure that all relevant information is included and correctly formatted. Customizing your payment request form ensures it fits your specific needs while maintaining a professional appearance that reflects your business values.

Benefits of Using Professional Templates

Utilizing a professionally designed document format for billing and payment requests brings several advantages to both the service provider and the client. These pre-built forms offer a streamlined approach to creating clear, consistent, and organized records that can significantly enhance business operations. By adopting these formats, businesses can ensure a higher level of professionalism and efficiency in their financial processes.

Here are some of the key benefits of using professionally crafted documents:

- Time Savings: Pre-made forms save valuable time by eliminating the need to create a new document from scratch. With all the necessary fields and sections already in place, you can simply fill in the required details and send it out quickly.

- Consistency and Accuracy: Using a standardized document ensures that all essential information is included every time. This consistency reduces the chances of missing important details, such as payment terms, descriptions of work, or taxes, leading to fewer mistakes.

- Enhanced Professionalism: A clean, well-organized form reflects positively on your business. It presents a professional image to clients, helping you build trust and credibility. Clients are more likely to respond positively to a clearly structured document.

- Legal Protection: A professional form can serve as a solid reference point in case of disputes. With all the necessary details clearly outlined, both parties have a transparent record of the agreed-upon terms, which can help prevent conflicts or misunderstandings.

- Customization Options: Many pre-designed formats are flexible, allowing you to customize them according to your specific needs. You can adjust sections, add logos, change fonts, or modify payment terms to suit the nature of your business.

- Improved Efficiency: Professional formats are designed for ease of use, making it quicker to input and process information. This results in faster turnaround times for both the service provider and the client, contributing to smoother business operations.

Overall, using a professionally designed document for payment requests not only saves time and reduces errors but also helps present your business in the best possible light. It ensures that all transactions are transparent, organized, and easily accessible for both parties.

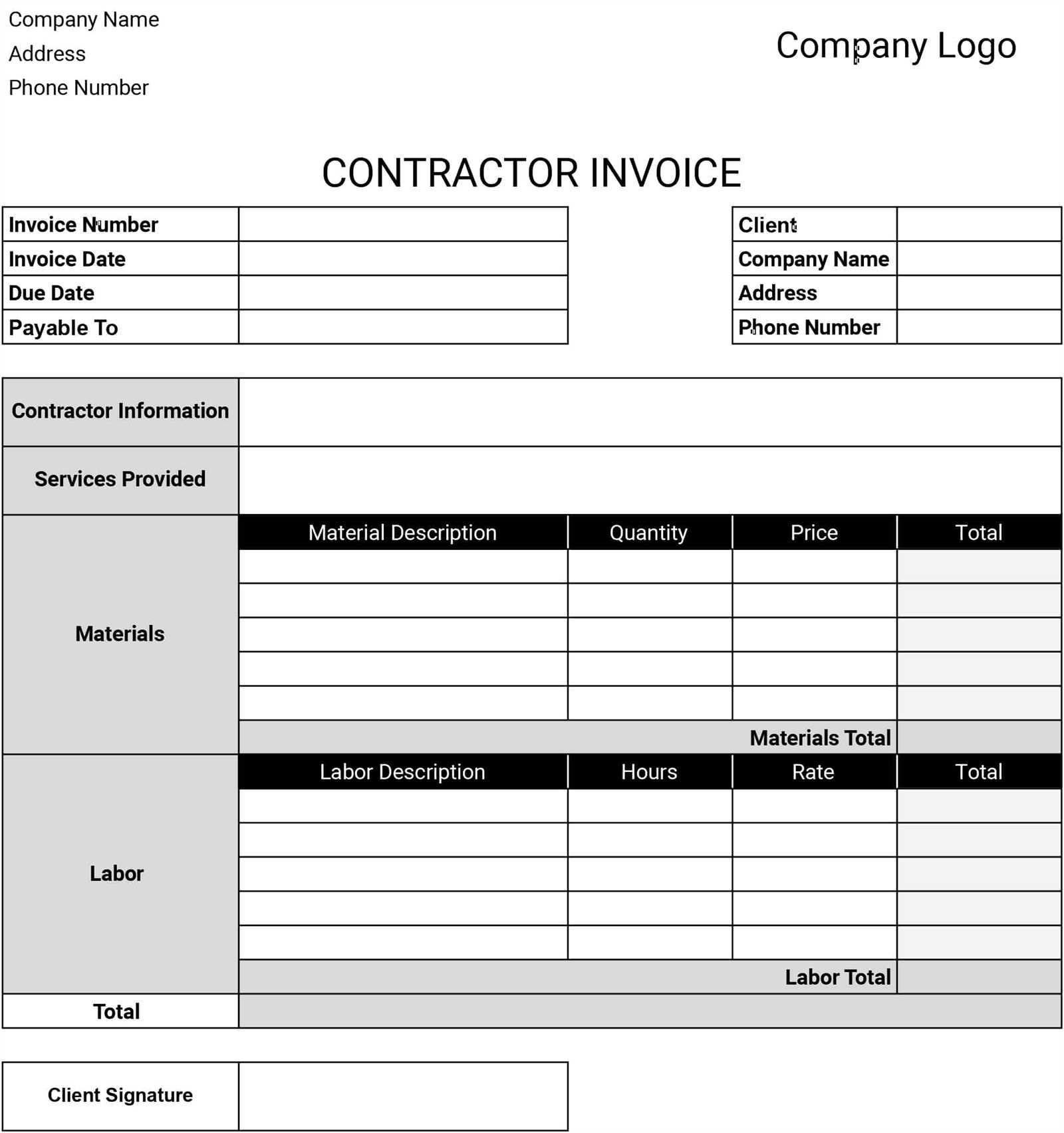

Choosing the Right Payment Request Document

Selecting the right format for your billing and payment requests is crucial for ensuring that your financial transactions are clear, professional, and efficient. A well-suited document helps both you and your client understand the terms of payment and the services rendered. It is important to choose a format that aligns with your business needs, industry standards, and the specific expectations of your clients.

Here are some factors to consider when choosing the ideal form for your payment requests:

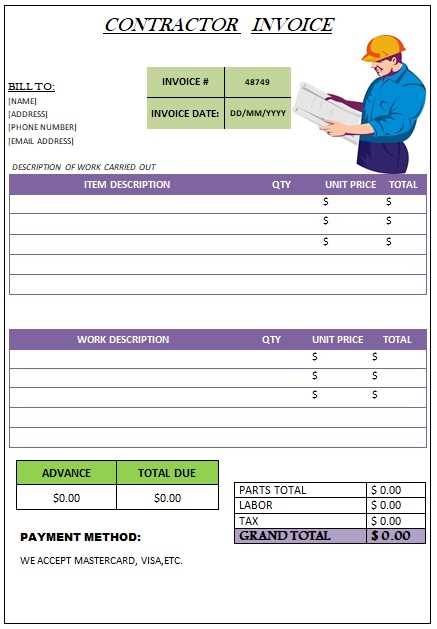

- Business Type and Industry: The design and structure of your document should match the nature of your business. For example, a creative agency may prefer a more visually appealing format, while a construction business might need a detailed breakdown of materials and labor costs.

- Level of Detail: If your services are complex or vary from client to client, choose a form that allows for detailed itemization. A format with clearly defined sections for each service or product will help avoid misunderstandings and ensure that both parties are aligned on what is being charged.

- Customization Flexibility: Look for a document that is easy to modify. You may want to adjust payment terms, add or remove sections, or incorporate your business logo and branding. A customizable layout will give you the flexibility to meet your specific needs.

- Client Preferences: Consider the preferences of your clients. Some may prefer a simpler, more straightforward document, while others may require detailed breakdowns with tax calculations, payment schedules, and other specifics. Understanding their expectations will help you choose the right format.

- Legal and Compliance Requirements: Ensure that the format you choose complies with any industry-specific regulations or tax laws. Certain businesses may need to include specific information, such as tax identification numbers or detailed descriptions of services, to meet legal standards.

By carefully considering these factors, you can choose a format that not only saves time but also enhances professionalism and ensures smooth transactions. The right document will reflect your business’s professionalism, help maintain clear communication, and contribute to the timely and accurate processing of payments.

Free vs Paid Payment Request Formats

When it comes to selecting a format for your billing and payment requests, one key decision is whether to use a free or paid version. Both options come with their own set of advantages and limitations, so it’s important to understand how each type can impact your business operations. While free options may seem appealing due to their cost-effectiveness, paid formats often offer additional features and customization that can help elevate your professional image and streamline your financial processes.

Benefits of Free Payment Request Formats

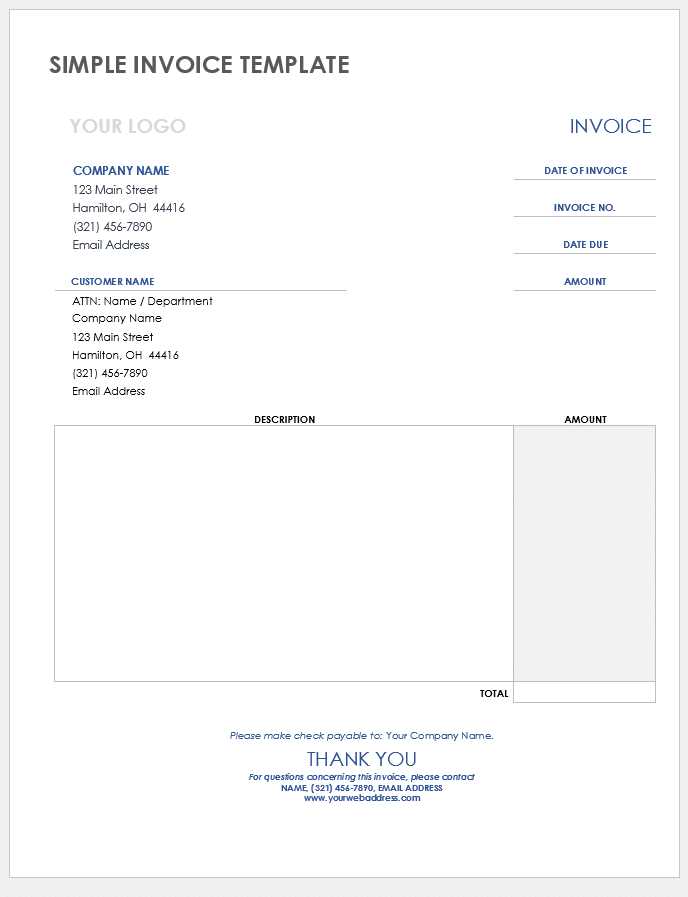

Free formats can be a great starting point for small businesses or independent contractors who are just getting started. Here are some reasons why you might consider using a free option:

- Cost-Effective: As the name suggests, free options do not require any upfront investment, making them an attractive choice for businesses on a tight budget.

- Quick and Easy to Use: Many free formats are straightforward and simple, allowing you to quickly input your information and send it out to clients without much hassle.

- Basic Functionality: Free forms often cover the essential elements, such as service descriptions, total amounts due, and payment terms, making them suitable for basic transactions.

Advantages of Paid Payment Request Formats

While free options are useful, paid formats come with additional features that can enhance the overall experience for both you and your clients. Here are some key benefits of investing in a paid version:

- Customization and Branding: Paid formats often allow more flexibility in design, letting you add logos, adjust colors, and create a document that aligns with your company’s branding and style.

- Advanced Features: Paid options typically offer advanced features such as tax calculations, recurring billing options, and automatic reminders for overdue payments, which can save you time and improve efficiency.

- Professional Appearance: A polished, well-designed document can enhance your business’s credibility and create a positive impression with clients, potentially leading to long-term relationships.

- Better Support: With a paid option, you often get access to customer support in case you encounter any issues or need help customizing the form.

Ultimately, whether you choose a free or paid format depends on your business needs, budget, and the level of professionalism you wish to project. Free options may be suitable for basic, one-off transactions, but if you’re looking to streamline your billing process and create a lasting impression, investing in a paid format could be a worthwhile choice.

Common Mistakes in Payment Request Documents

When creating payment request documents, it’s easy to overlook important details that can lead to confusion, delays, or disputes. Many businesses, especially those just starting out, may fall into common pitfalls that can undermine the clarity and professionalism of their financial communication. Avoiding these errors is essential for ensuring smooth transactions and maintaining a positive relationship with clients.

Here are some of the most frequent mistakes made when preparing billing documents:

- Missing Contact Information: One of the most basic mistakes is failing to include full contact details for both parties. Without this information, it becomes difficult to address any questions or concerns regarding the payment request, which can delay the process or lead to miscommunication.

- Incorrect or Incomplete Service Descriptions: Failing to provide a clear and detailed breakdown of the work completed can result in confusion. Clients may dispute charges if they don’t fully understand what they’re being billed for, especially if the services were complex or varied in scope.

- Unclear Payment Terms: Not specifying the payment terms clearly can lead to delays or missed payments. It’s important to outline the due date, payment methods accepted, and any late fees or discounts to avoid misunderstandings and ensure timely compensation.

- Incorrect Amounts or Calculations: Mistakes in adding up totals, applying taxes, or calculating rates can cause significant issues. Double-checking all figures, including discounts and taxes, will help prevent errors that could cause your client to question the document’s accuracy.

- Omitting Unique Reference Numbers: Each document should have a unique reference number for tracking purposes. Without this, it can be difficult for both you and your client to track the payment history, leading to potential issues during audits or follow-up communications.

- Failure to Include a Professional Design: A lack of organization and a cluttered layout can give the impression of unprofessionalism. A clear, concise, and well-organized document helps enhance your business’s image and ensures that the payment request is easy to read and understand.

By paying close attention to these details, you can avoid common mistakes that often result in delayed payments or strained client relationships. Clear, accurate, and professionally structured documents not only enhance efficiency but also help build trust and credibility with your clients.

Legal Considerations for Payment Request Documents

When preparing a payment request, it’s crucial to be aware of the legal aspects that govern how these documents should be structured and the information they should include. Properly crafted financial documents not only ensure clarity between parties but also protect your business in case of disputes or legal challenges. Being informed about your legal obligations can help you create a document that is both effective and compliant with relevant laws.

Essential Legal Elements to Include

To avoid legal issues, it’s important to incorporate the following elements in your payment request documents:

- Clear Payment Terms: Payment terms, including the due date, accepted payment methods, and penalties for late payments, should be explicitly stated. These terms form the legal foundation for how payments will be handled and can protect you if the client fails to comply with agreed-upon dates or conditions.

- Tax Identification Numbers: Depending on your location, including your tax identification number (TIN) and the client’s TIN may be required. This ensures that the transaction is properly documented for tax purposes and reduces the risk of disputes during tax filings.

- Detailed Description of Services: A comprehensive breakdown of the services provided, including dates, quantities, and rates, can be critical if a dispute arises. The more detailed your record is, the more legally secure it becomes, as it provides clear evidence of what was agreed upon.

- Jurisdiction and Governing Law: In cases of legal disputes, specifying which jurisdiction’s laws apply can be very helpful. Including a clause on governing law can determine which region’s courts have the authority to resolve any potential legal issues that arise from the agreement.

Compliance with Local and International Regulations

Depending on your business location and the nature of your transactions, you may need to comply with various local, national, or international regulations. For example, businesses in some countries are required to issue documents in specific formats or include certain disclosures, such as VAT numbers, in accordance with tax laws.

Additionally, if you’re dealing with international clients, it’s important to be aware of the specific regulations governing cross-border transactions, including foreign currency conversions, applicable taxes, and any relevant international agreements. Consulting a legal professional or accountant can help ensure that your documents are fully compliant with all applicable laws.

By understanding the legal requirements surrounding payment requests, you can avoid unnecessary risks, streamline your billing process, and protect your business from potential legal challenges.

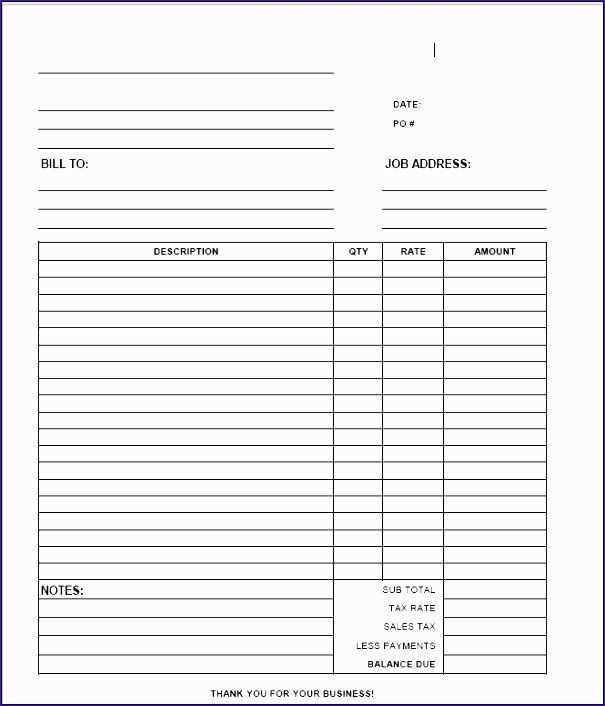

How to Format Your Payment Request Properly

Proper formatting of your payment request is essential to ensure that it is clear, professional, and easy to understand for both you and your client. A well-structured document not only reflects professionalism but also helps avoid confusion or delays in the payment process. Organizing the content logically, with attention to detail, ensures that all necessary information is presented effectively.

Here are some key steps to properly format your payment request document:

- Use a Clear and Consistent Layout: A clean, easy-to-read layout with consistent fonts, spacing, and headings is essential. Break the document into distinct sections such as contact details, service descriptions, and payment terms to guide the reader through the content smoothly.

- Include a Header with Your Business Information: The header should clearly display your business name, logo, and contact details (email, phone number, and address). This makes it easy for your client to identify who the payment is for and how to reach you if needed.

- Provide Client Information: Beneath your details, include your client’s full name, company name (if applicable), and contact information. This ensures that the document is properly addressed and personalized.

- Describe the Services Clearly: List each service or product provided with a clear description, quantity, rate, and total. This allows your client to see exactly what they are being charged for, avoiding any confusion or disputes.

- Use Itemized Pricing: Include an itemized breakdown of costs, taxes, discounts, and additional fees. This transparency helps to build trust and clarifies how the final total is calculated.

- Specify Payment Terms: Clearly state the due date for payment, accepted payment methods, and any late fees or penalties for overdue payments. This ensures that both parties are aligned on when and how the payment should be made.

- Provide a Unique Reference Number: Include a unique reference number for each payment request. This helps with tracking and ensures that both you and the client can easily reference the document in future communications.

- Maintain Consistent Formatting: Ensure that all sections are consistently aligned and formatted. Use bold or underlined text for headings and important details, but avoid over-styling that may make the document difficult to read.

By following these guidelines, you can create a professional and well-organized payment request that is both clear and efficient. A properly formatted document makes it easier for your client to process the payment and minimizes the chances of disputes or misunderstandings.

Using Payment Request Documents for Tax Purposes

Properly documenting and organizing financial transactions is essential for maintaining tax compliance. When preparing a payment request, it’s important to include all relevant details that will not only ensure timely payments but also support your tax filings. By using a standardized document, you can simplify the process of tracking income, deductions, and tax liabilities, which is crucial for both business and personal tax obligations.

Why Detailed Documentation is Important

For tax purposes, a clear and well-organized record of all business transactions helps ensure that you accurately report income and expenses. Properly formatted documents serve as proof of income, which is vital for tax filings. Additionally, having a consistent and detailed record can reduce the chances of errors or audits and help you maintain transparency with tax authorities.

Here are key elements to include in your payment request documents to ensure they are useful for tax purposes:

| Element | Description |

|---|---|

| Date of Transaction | The date the service was completed or product delivered should be clearly stated. This helps in correctly categorizing transactions for tax periods. |

| Tax Identification Numbers | Include your tax ID number and the client’s tax identification number, if applicable. This is necessary for tax reporting and verification. |

| Detailed Breakdown of Charges | Provide an itemized list of services rendered or products provided, including applicable taxes. This ensures transparency and helps in tracking deductible expenses. |

| Tax Amounts | Clearly indicate the applicable tax rates and amounts charged. This is necessary for reporting both income and tax liabilities accurately. |

| Payment Terms | Outline the payment due date and terms. This helps ensure that income is recognized in the correct tax period. |

How to Use Payment Request Documents for Tax Filing

When tax season arrives, having organized and complete financial records is crucial. The documents you generate for each transaction should reflect the income you’ve received and the expenses you may be able to deduct. To ensure your payment requests are effective for tax purposes, follow these steps:

- Keep Detailed Records: Store all your payment requests in an organized manner so you can easily retrieve them for tax filing purposes. Use digital tools or accounting software to track and categorize your documents.

- Review Tax Compliance: Ensure that your payment request includes all required tax information, such as VAT, sales tax, or other applicable taxes, based on the nature of the service or product provided.

- Specify the Due Date: Always include the exact date by which payment should be made. This could be a specific calendar date or a time frame, such as “30 days from the date of issue.” Make it clear to the client when the payment is expected.

- Detail Accepted Payment Methods: Clarify which methods of payment are acceptable. Whether it’s a bank transfer, credit card, online payment systems, or check, make sure to list the preferred options so the client knows how to submit payment.

- Outline Late Payment Penalties: If you charge late fees for overdue payments, clearly state the terms. For example, you might specify a percentage of the total amount due per day after the due date or a fixed fee for each day the payment is delayed. This encourages timely payments and discourages procrastination.

- Provide Early Payment Discounts: If applicable, include any discounts for early payments. For example, you might offer a 2% discount for payments made within 10 days of the payment request date. This can motivate clients to pay early and improve cash flow.

- Specify Currency and Amount: Always ensure the payment terms include the currency in which payment is to be made (especially in international transactions). This helps prevent confusion regarding the amount owed and the expected form of payment.

- Clarify Partial Payments (if applicable): If the payment is to be made in installments, break down the payment terms accordingly. Specify when each installment is due and the amount of each payment to be made. This will ensure that both parties are on the same page regarding payment expectations.

- Use Accounting Software: Invest in accounting or invoicing software that allows you to track and manage multiple payment requests. These tools often include features like automatic reminders, easy categorization, and payment tracking, which save you time and reduce errors.

- Create a Payment Request Log: Maintain a central log (digital or physical) where you can record all the details of each payment request, including the date issued, due date, client information, amount owed, and payment status. This will serve as a quick reference for upcoming or overdue payments.

- Group by Payment Due Dates: Organize your payment requests by their due dates to ensure you prioritize payments that are coming up soon. This helps in managing workloads and following up with clients in a timely manner.

- Set Automated Reminders: Set up automated reminders or alerts to notify you when a payment request is nearing its due date. Many invoicing systems and email tools allow you to schedule notifications, which helps ensure nothing falls through the cracks.

- Send Polite Reminders: If a payment is overdue, send a polite but firm reminder. You can automate these reminders through email or invoicing systems to ensure consistency in your communication.

- Offer Payment Plans: If a client is facing financial difficulty, consider offering a payment plan. Breaking down the total amount into smaller, more manageable installments can help maintain a positive relationship while still ensuring you receive your payment.

- Maintain Professionalism: Always approach overdue payments with professionalism. Even if a client is late, maintaining a courteous and respectful tone increases the likelihood of a positive resolution.

- Record Payment Status: Include a section on the document where you can note whether a payment has been made, is pending, or is overdue. This provides an easy way to track the payment progress without needing to look up details separately.

- Use Unique Reference Numbers: Assign each payment request a unique reference number. This makes it easier to match incoming payments with the correct request, reducing the likelihood of confusion or misapplied funds.

- Note Payment Method and Date: Include fields to specify the payment method (e.g., bank transfer, credit card, cash) and the date the payment was received. This ensures you have a complete record of each transaction, which is essential for accounting and tax purposes.

- Set Up Payment Reminders: For unpaid or overdue payments, include reminders in your documents or set automatic alerts. This can help ensure timely follow-up with clients and improve your chances of receiving prompt payment.

How to Add Payment Terms to Payment Requests

In any business transaction, clearly outlining payment terms is essential to avoid confusion and ensure timely compensation. Payment terms specify when and how a client should pay for services rendered or products delivered. Including these details in your financial documents helps establish clear expectations, reduces the chances of late payments, and ensures both parties are aligned on payment deadlines and conditions.

Here’s how you can effectively add payment terms to your payment request documents:

By including clear and specific payment terms in your documents, you help protect both your business and your clients. Having well-defined conditions prevents misunderstandings and creates a professional and transparent relationship that benefits both parties.

Managing Multiple Payment Requests Effectively

Handling numerous payment requests at once can be a challenging task, especially if you deal with a variety of clients, different payment schedules, and unique service terms. To ensure smooth operations and avoid confusion, it’s crucial to have a systematic approach to track, organize, and follow up on these financial documents. By employing effective strategies, you can stay on top of deadlines, ensure timely payments, and maintain a professional workflow.

Steps to Organize and Track Multiple Payment Requests

Here are some methods to effectively manage multiple payment requests without losing track of important details:

Tips for Effective Follow-Up

Follow-ups are essential to keep the payment process smooth. Here are some best practices to ensure you’re effectively following up on overdue payments:

By keeping a clear record of all your payment requests and being proactive in managing due dates, reminders, and follow-ups, you can ensure that multiple requests are handled efficiently and professionally. This not only streamlines your cash flow but also builds trust wit

Tracking Payments with Payment Request Documents

Effectively managing and tracking payments is crucial for maintaining healthy cash flow and ensuring that all financial transactions are properly recorded. Using well-organized payment request documents makes it easier to monitor which payments have been made, which are still pending, and which might be overdue. Proper tracking helps businesses stay on top of their finances, identify any discrepancies, and take prompt action when needed.

One of the key advantages of using structured payment request documents is that they allow you to maintain clear records of each payment, including the amount, due date, and payment method. With this information at your fingertips, you can quickly determine the status of any outstanding debts, follow up with clients if necessary, and ensure that payments are processed on time.

Here are some ways you can use your payment request documents to track payments effectively:

By tracking payments through these documents, you not only keep accurate records but also create a reliable system for managing your finances. Whether you’re dealing with a few clients or a large volume of transactions, this approach streamlines the process, helping you stay organized and on top of your financial commitments.

Automating Payment Request Creation for Efficiency

Automating the process of generating financial documents can significantly improve efficiency and save time for businesses. Instead of manually creating each document from scratch, automation allows you to quickly generate standardized documents with accurate details, reducing the risk of errors and ensuring consistency. By streamlining this process, you free up valuable time to focus on other essential aspects of your business while ensuring timely and accurate communication with clients.

Automation can simplify the creation of payment requests in several ways, from setting up recurring payment schedules to automatically populating client information and transaction details. Here are some ways you can leverage automation to enhance your workflow:

| Automation Feature | Description |

|---|---|

| Recurring Billing | For clients who are billed regularly, set up automatic billing cycles. The system will automatically generate and send payment requests at predefined intervals, such as weekly, monthly, or annually, without requiring manual input. |

| Client Information Storage | Store client details like name, address, and payment terms in your system. When creating new requests, the system can auto-populate these fields, saving you time and ensuring that all information is consistent and up-to-date. |

| Pre-set Service Details | For recurring services, save standard descriptions, rates, and charges. When creating new documents, the system can insert these pre-set details automatically, allowing you to focus only on any custom adjustments or updates. |

| Automatic Reminders | Set up reminders to be sent to clients automatically when a payment is due or overdue. This ensures clients are consistently notified and helps you avoid manual follow-ups. |

| Integration with Payment Systems | Integrate your payment request system with payment platforms (like PayPal, Stripe, or direct bank transfers). This allows clients to pay directly from the document, simplifying the process and reducing delays in receiving payments. |

By automating the creation and management of financial documents, businesses can operate more smoothly and efficiently, improve cash flow management, and ensure that all details are accurate and consistent. Automation also helps reduce the administrative burden, allowing you to allocate more time to growing your business and enhancing customer relationships.