Intercompany Invoice Template for Easy Business Transactions

Managing financial transactions between different divisions or branches of the same company can often be complex, requiring clear documentation and consistent procedures. Properly documenting these exchanges ensures smooth operations and avoids potential misunderstandings or compliance issues. A standardized approach can significantly reduce administrative overhead and enhance accuracy in recording financial data.

Using a structured document for internal transactions helps to clearly outline the details of each exchange, including the amount, services rendered, and payment terms. This practice not only keeps the financial processes transparent but also makes it easier to reconcile accounts and ensure that all parties are on the same page.

Customizable documents designed specifically for internal business dealings allow organizations to maintain consistency while adapting to specific needs. These tools can be easily adjusted for different departments or subsidiaries, ensuring that each transaction is recorded accurately and efficiently, regardless of the complexity involved.

Intercompany Invoice Template Overview

Efficient management of internal transactions between different parts of an organization requires a systematic approach. Having a well-defined method for documenting these exchanges ensures clarity, accuracy, and consistency across departments or subsidiaries. Such a document provides a structured framework to record and process charges, helping to keep financial activities transparent and compliant with regulations.

Key Features of an Effective Document

An ideal document for internal billing should be clear and comprehensive. Here are some essential characteristics:

- Customization: Tailored to fit the specific needs of different departments or divisions.

- Standardization: Ensures consistency in format, making it easier for all parties to understand and process.

- Clarity: Clearly outlines the transaction details, including descriptions, amounts, and payment terms.

- Compliance: Adheres to financial and regulatory standards within the company or across regions.

Why It’s Important for Your Business

Using a standardized inte

What Is an Intercompany Invoice?

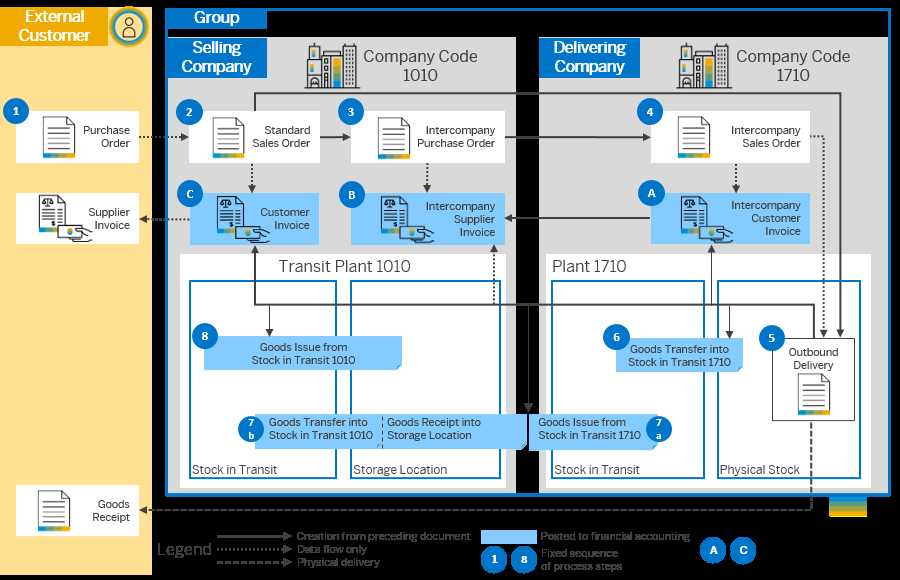

Within a large organization, different divisions or subsidiaries often engage in financial transactions with one another. These transactions need to be formally documented to ensure accurate accounting and proper financial management. Such documents detail the terms, amounts, and nature of the exchange between internal business units, helping to maintain a transparent and organized record of all internal dealings.

In simple terms, this document serves as a formal record of any goods, services, or financial arrangements between various parts of a company. It outlines the specifics of the transaction, including payment expectations, itemized charges, and relevant dates. This makes it easier for each division to track its financial commitments and reconcile accounts accordingly.

For companies with multiple subsidiaries or branches, creating and maintaining a structured approach to these records is essential for smooth operations. It not only ensures accuracy in reporting but also simplifies tax reporting and auditing processes by providing clear documentation for all internal transactions.

Key Elements of an Intercompany Invoice

For internal business transactions to be properly documented, certain key information must be included in the formal record. This ensures clarity, accuracy, and proper reconciliation between departments or subsidiaries. A well-structured document should cover all the essential details to reflect the terms of the exchange, making it easier to manage payments and track financial activities.

Essential Information to Include

- Transaction Date: The date when the exchange occurred, providing a clear timeline for financial records.

- Parties Involved: Names and contact details of the departments, divisions, or entities involved in the transaction.

- Description of Goods or Services: A detailed breakdown of the items or services being exchanged, including quantities and individual prices.

- Amount Due: The total charge for the transaction, including any applicable taxes or fees.

- Payment Terms: Clear terms outlining when and how the payment should be made, including due dates and accepted payment methods.

Additional Important Details

- Reference Number: A unique identifier for the transaction, allowing for easier tracking and reference.

- Internal Codes: Any internal account or project codes that help allocate the costs to th

Why Use an Intercompany Invoice Template?

Efficient financial management within a company often involves handling transactions between different departments or subsidiaries. A consistent approach to documenting these exchanges can save time, reduce errors, and improve accuracy. Using a predefined document helps streamline the process, ensuring that all essential details are captured and that internal dealings are processed smoothly and consistently.

Benefits of Using a Structured Document

Utilizing a standardized record format offers numerous advantages to businesses:

Benefit Explanation Consistency Ensures that all internal transactions are documented in the same format, making it easier for all departments to follow the same procedures. Efficiency Reduces the time spent creating documents from scratch and minimizes the risk of missing crucial details. Accuracy A predefined structure ensures that no critical information is overlooked, reducing the chances of errors or disputes. Compliance Helps ensure that all internal transactions are in line with financial regulations and company policies. Streamlined Reconciliation Facilitates easier reconciliation of accounts, as each transaction is recorded in a consistent and clear manner. Improved Communication Between Departments

A standardized document enhances transparency and communication between different units within the organization. By providing all relevant details in one document, departments can quickly unde

Benefits of Customizing Invoice Templates

Adapting billing documents to suit the specific needs of a business offers a wide array of advantages. By tailoring these records, companies can create a more streamlined process that not only reflects their brand identity but also enhances operational efficiency. Customization ensures that essential details are highlighted and the document is in line with internal standards, fostering clarity and consistency across transactions.

One key benefit is the ability to improve brand recognition. By incorporating logos, specific fonts, and unique color schemes, businesses can present a polished and professional appearance that strengthens their image with clients and partners. This simple adjustment can make a significant difference in how the business is perceived.

Additionally, personalized billing forms can help with better organization and compliance. By adjusting the layout and structure of the document, companies can ensure that all necessary information is included, reducing the likelihood of errors or omissions. This can be particularly useful in industries where specific data points are required for regulatory purposes.

Benefits Description Brand Identity Customized forms help reinforce company branding, making transactions more memorable. Efficiency Streamlined designs allow for faster processing and clearer communication. Compliance Tailoring documents to meet industry standards ensures all legal and regulatory requirements are met. Accuracy Custom layouts can help reduce errors by emphasizing the most important details. In conclusion, investing time in creating personalized billing documents not only helps to present a more professional image but also leads to greater accuracy, compliance, and efficiency in business operations. Customization allows businesses to better control how they communicate important financial details, fostering stronger relationships with clients and stakeholders alike.

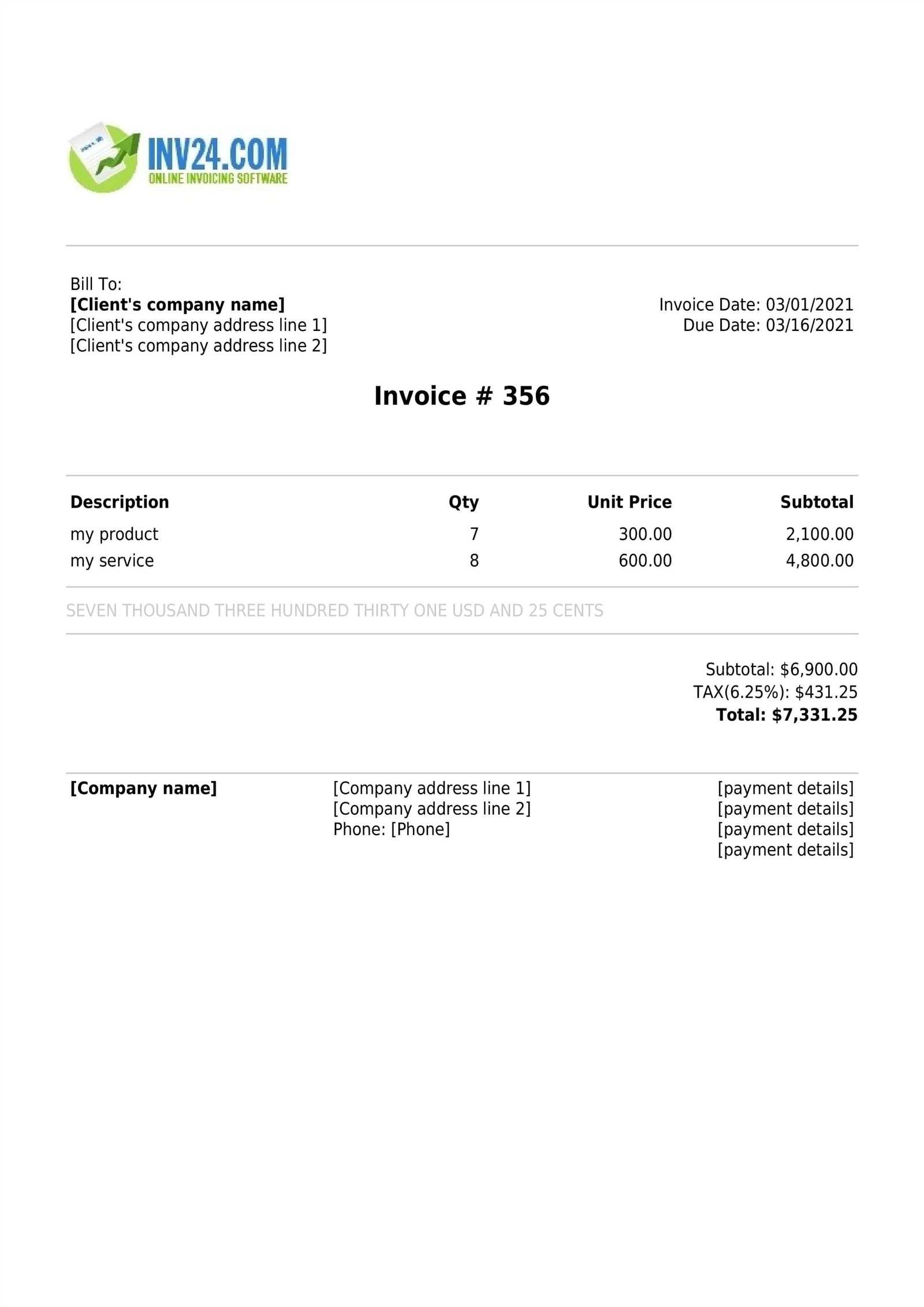

How to Create an Intercompany Invoice

Creating financial documents between two business entities requires careful attention to detail, ensuring that all necessary information is clearly outlined for accurate record-keeping and compliance. Whether the transaction involves goods, services, or other exchanges, the document must include specific elements to guarantee transparency and smooth processing. By following a structured approach, you can ensure that all parties are on the same page and that the details of the exchange are well-documented.

The first step is to include the basic information, such as the names and addresses of the companies involved, along with contact details. This provides a clear identification of the parties in the transaction. Next, it is essential to include the date of the exchange and a reference number, which can help in tracking the transaction throughout its lifecycle.

Another critical component is specifying the terms of the agreement, such as the price, quantity, and any discounts or additional charges. If applicable, clearly indicate payment terms and due dates to avoid any misunderstandings later on.

Component Description Company Information Include the names, addresses, and contact details of both parties involved in the transaction. Date & Reference Specify the date of the transaction and assign a unique reference number for tracking. Details of Exchange List the goods or services exchanged, including prices, quantities, and any applicable discounts or extra charges. Payment Terms Clearly outline the payment due dates, methods, and any conditions for payment. By ensuring that each element is properly included and formatted, businesses can create a reliable record that is easily understood by all involved parties. This process not only fosters clarity but also helps prevent disputes and miscommunication in future transactions.

Common Mistakes to Avoid in Invoices

When preparing financial documents between businesses, it’s essential to ensure that all details are accurate and clear. Small mistakes can lead to confusion, delayed payments, and even legal issues. Avoiding common errors helps maintain a smooth transaction process and ensures that both parties are aligned in their expectations.

One frequent issue is failing to include complete or accurate contact information. Missing details such as the company name, address, or phone number can cause delays, especially if a problem arises and communication is needed. Another common mistake is neglecting to provide clear payment terms. This includes not specifying due dates or acceptable payment methods, which can create ambiguity and potential disputes.

- Incorrect or Missing Details: Double-check company names, addresses, and contact information for accuracy.

- Unclear Payment Terms: Clearly state the due date, payment methods, and any applicable late fees.

- Inaccurate Amounts: Ensure all amounts, including unit prices, taxes, and total costs, are calculated correctly.

- Lack of Reference Numbers: Always include a unique reference number to make tracking easier.

Additionally, failing to break down costs properly is a major mistake. It’s crucial to list all items, services, and their corresponding prices so both parties know exactly what is being charged. Another mistake is not addressing any discounts, taxes, or additional fees separately, which can lead to confusion over the final amount.

- Unclear Breakdown of Costs: List a

Legal Considerations for Intercompany Invoices

When preparing financial documents between related business entities, it is crucial to be mindful of the legal aspects involved. These records are not just transactional; they must also comply with various regulations and laws that govern corporate dealings. Failing to adhere to these legal requirements can result in penalties, disputes, or challenges during audits. Understanding the key legal considerations helps ensure that both parties are protected and that all transactions are documented appropriately.

Accurate Reporting: It is essential that all details within the financial document are accurate. This includes the transaction amount, the goods or services provided, and any applicable taxes. Discrepancies or inaccuracies can lead to complications during tax filings or financial audits. Always ensure that the amounts are clearly stated and that the nature of the transaction is well-documented.

Compliance with Tax Laws: Each jurisdiction has its own set of tax rules, and businesses must ensure that they are in compliance with local, state, and international tax regulations. This includes applying the correct tax rates, whether it’s value-added tax (VAT), sales tax, or other taxes. It is also important to properly account for any exemptions or special tax statuses that may apply to the transaction.

Transfer Pricing Rules: When dealing with related entities in different countries or regions, transfer pricing laws are critical. These regulations govern the prices at which goods, services, or intellectual property are transferred between entities. The prices must be set at arm’s length, meaning they should be consistent with market rates to avoid tax manipulation and ensur

How to Format Your Invoice Correctly

Properly structuring financial documents is crucial to ensure clarity and prevent misunderstandings. A well-organized record not only makes the transaction easier to process but also ensures that both parties have a clear understanding of the terms and details. Correct formatting can streamline communication, facilitate timely payments, and help avoid disputes or errors.

Start by clearly labeling the document with a title that identifies its purpose. This helps to avoid any confusion about the type of record being presented. Then, include the essential business details for both parties involved, such as company names, addresses, and contact information.

Here are some key elements to include when formatting your record:

- Title of Document: Clearly label the document (e.g., “Payment Statement,” “Billing Statement”).

- Identification Numbers: Assign a unique reference number for easy tracking and future reference.

- Dates: Include the date of the transaction and the due date for payment.

- Detailed Description: List the items or services being exchanged, including quantities, unit prices, and any applicable discounts.

- Amount Breakdown: Show a detailed breakdown of the costs, including any taxes, fees, or other additional charges.

- Payment Terms: Specify due dates, payment methods, and any late fee policies.

Additionally, maintaining a consistent and clean layout is essential. Use clear, legible fonts and organize the conte

Best Practices for Intercompany Transactions

When conducting financial exchanges between related business entities, it is important to follow best practices to ensure transparency, accuracy, and compliance. These transactions often involve complex processes and require careful coordination to prevent errors, maintain clear documentation, and uphold legal and tax requirements. Implementing sound practices helps streamline operations and builds trust between the involved parties.

Here are some key practices to follow for smooth and efficient business transactions:

- Maintain Clear Documentation: Always ensure that all records are complete and clearly outline the details of the exchange, including the parties involved, the goods or services provided, and the agreed-upon terms. This helps avoid confusion and ensures that both entities are aligned.

- Adhere to Transfer Pricing Regulations: When businesses in different locations exchange goods or services, it is essential to comply with transfer pricing laws. These rules ensure that transactions are priced fairly and in line with market rates, avoiding tax manipulation.

- Establish Clear Payment Terms: Clearly define payment deadlines, methods, and any applicable penalties for late payments. Transparent payment terms help prevent disputes and ensure that both parties understand their financial obligations.

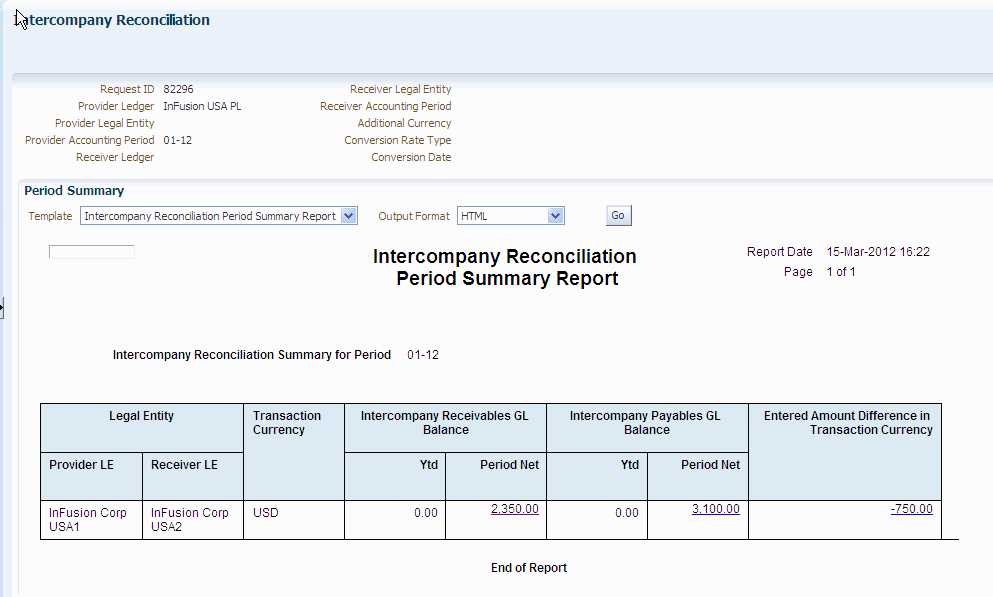

- Regularly Reconcile Accounts: Regularly comparing and reconciling accounts between the two entities helps identify discrepancies early. Timely reconciliations reduce the risk of errors and help both parties stay on top of their financial records.

- Ensure Compliance with Tax Laws: Be sure to apply the appropriate tax rates and correctly document taxes for cross-border transactions. Understanding the tax obligations in each jurisdiction involved is essential to avoid legal issues and financial penalties.

- Document Terms in

Automation Tools for Invoice Creation

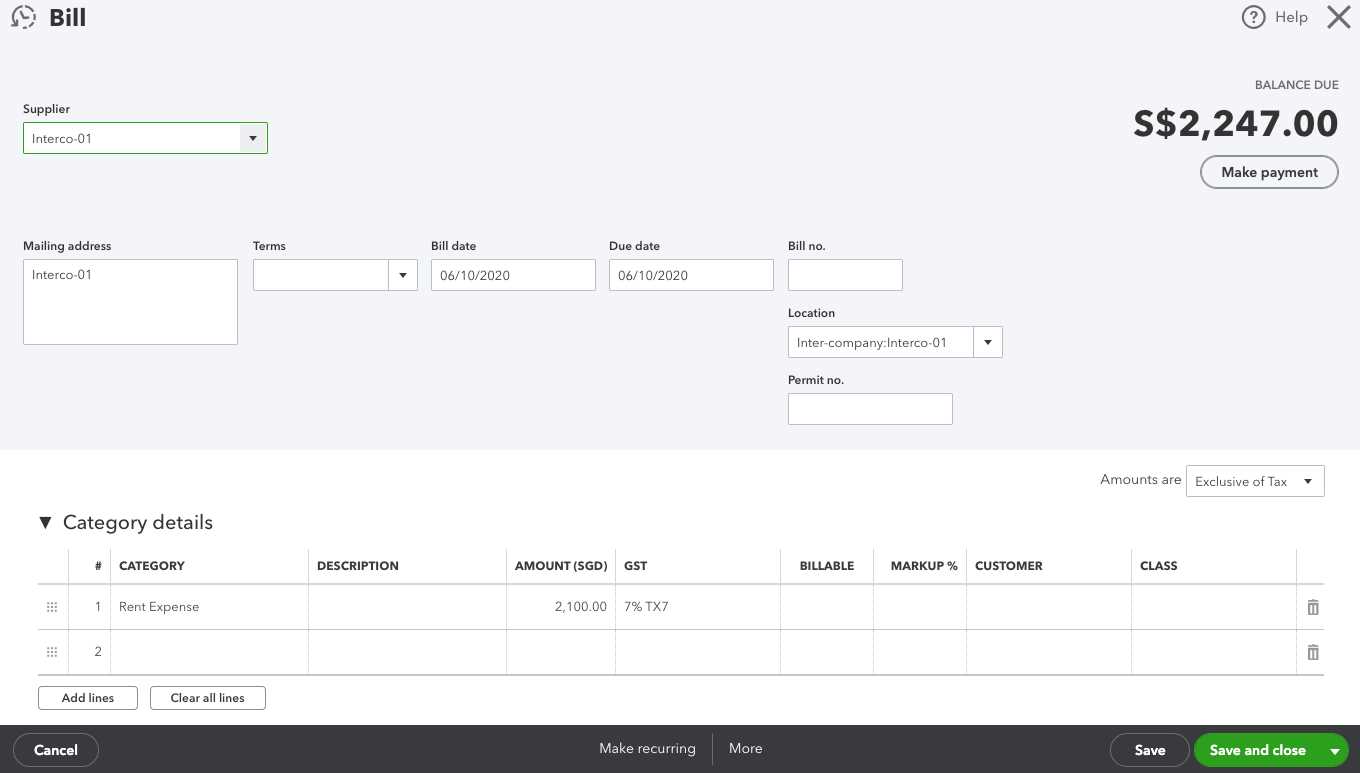

With the growing demands of modern business operations, manually creating financial records can be time-consuming and error-prone. Automation tools are increasingly being used to streamline the creation and management of these documents, significantly improving efficiency and reducing human mistakes. These tools can handle repetitive tasks, generate consistent formats, and integrate with other systems to ensure a seamless workflow.

Automation platforms offer a range of features that simplify the process of generating financial statements, including pre-built templates, customizable fields, and automatic calculations. By using these tools, businesses can ensure that all necessary information is included and that the records are formatted correctly every time, saving valuable time and effort.

Key Benefits of Automation Tools:

- Time Savings: Automation eliminates the need for manual data entry, allowing staff to focus on more strategic tasks.

- Consistency: Automated systems ensure that each document follows the same format and contains all necessary details, reducing the chance of mistakes.

- Integration: Many tools can integrate with other business software, such as accounting or enterprise resource planning (ERP) systems, ensuring smooth data flow across departments.

- Customization: These tools often allow for custom fields and layouts, enabling businesses to personalize documents to their specific needs.

- Compliance: Automation tools can be set to follow local tax and legal requirements, helping businesses stay compliant with regulatory standards.

Popular Automati

How to Track Intercompany Payments

Monitoring financial transactions between related business entities is crucial to maintaining clear accounting and ensuring timely settlement of amounts owed. Proper tracking helps prevent errors, ensures transparency, and simplifies the reconciliation process. By utilizing effective methods and tools, businesses can stay on top of their cash flow and ensure that payments are processed smoothly and accurately.

One effective way to track payments is by setting up a clear system for recording all transactions. This can include using specific reference numbers, establishing payment due dates, and maintaining a detailed history of all amounts owed and received. It’s important to consistently update records and monitor payment statuses to avoid delays or missed transactions.

Tracking Method Description Use of Unique Reference Numbers Assign a unique number to each transaction for easy tracking and future reference. This helps with cross-referencing between the involved parties. Establish Payment Terms Define due dates, payment methods, and any penalties for late payments to avoid confusion and ensure timely processing. Regular Reconciliation Regularly compare internal records with bank statements or other payment processors to ensure consistency and accuracy. Automated Payment Systems Use automated tools that sync with your accounting software to streamline the process and reduce the risk of errors. In addition to manual tracking methods, many businesses now rely on automated systems that sync payment data with accounting software. This can help ensure that all payments are accurately recorded in real-time and that reminders are sent for any outstanding amounts. Automated systems can also generate reports that provide an overview of payment statuses, making it easier to identify any discrepancies or delays.

By implementing a combination of these practices, businesses can maintain accurate records, improve their cash fl

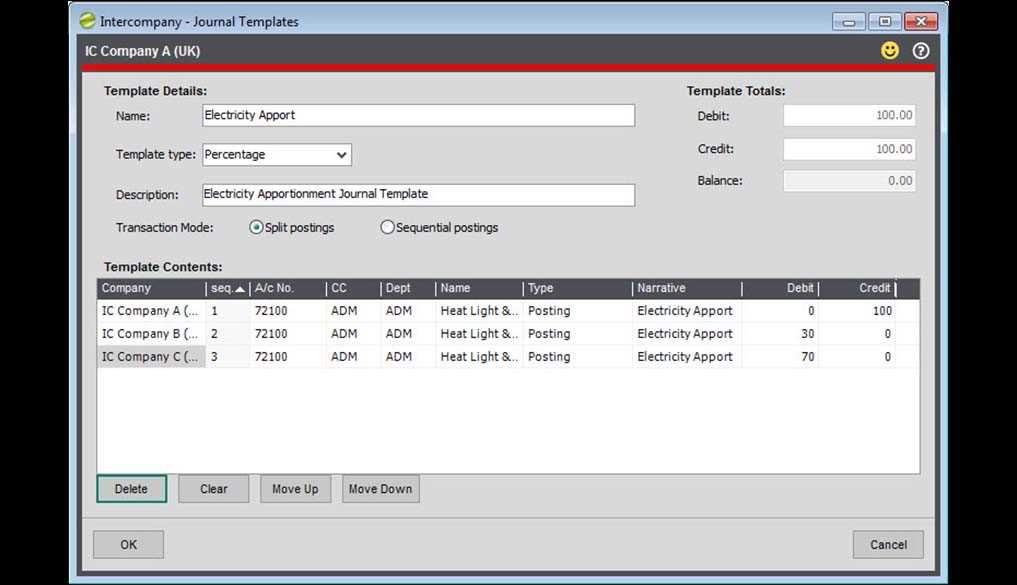

Managing Multiple Entities with One Template

When dealing with several business units or subsidiaries, managing financial documents can become a complex task. Having a unified structure for all entities can significantly simplify the process, ensuring consistency, reducing the chance of errors, and streamlining overall management. By using a single customizable framework, businesses can handle the needs of different entities while maintaining clarity and control over their transactions.

Benefits of Using One Template for Multiple Entities

One of the primary advantages of using a single structure for all related businesses is standardization. A unified approach ensures that all records follow the same format, making it easier to compare and consolidate data from various entities. This consistency reduces the chances of miscommunication or misinterpretation between business units and external partners.

- Efficiency: With a single, standardized format, creating and processing documents becomes faster, reducing the time spent on administrative tasks.

- Consistency: All financial records will follow the same structure, making it easier to spot errors and discrepancies.

- Simplified Reporting: Consolidating multiple units’ financial data into one cohesive report becomes easier when all records are formatted the same way.

- Cost Savings: Reducing the need for multiple templates or customized systems can lead to significant savings in both time and resources.

How to Set Up a Unified System

To effectively manage multiple business entities, the structure o

Integrating Invoices with Accounting Systems

Connecting financial documents with accounting platforms is a critical step in streamlining business operations. By automating the transfer of transaction details into accounting software, companies can reduce human error, enhance efficiency, and ensure accurate financial records. This integration not only saves time but also improves the overall accuracy and consistency of financial data across the organization.

Here are some key benefits of seamless integration between financial documents and accounting systems:

- Improved accuracy: Automatic data transfer reduces manual entry errors, ensuring financial information is accurate.

- Time savings: Integration eliminates the need for repetitive data input, freeing up time for other tasks.

- Real-time updates: Financial data is updated instantly across all systems, providing up-to-date information for decision-making.

- Streamlined processes: It simplifies workflows, from document creation to accounting reconciliation, enhancing overall efficiency.

- Compliance support: Ensures all financial records are properly documented and ready for audits or regulatory reviews.

When implementing such integrations, businesses should consider the compatibility of their existing software with other tools, such as ERP or CRM systems, to create a seamless flow of information. Establishing clear protocols and standards for data entry, along with regular system updates, is essential for maintaining consistency and reliability over time.

Additionally, companies should evaluate the level of automation that best suits their operations, ensuring that the process is tailored to their specific needs. For instance, integrating data entry, payment tracking, and financial reporting can drastically simplify accounting tasks, minimizing manual intervention.

Tax Implications of Intercompany Invoicing

When businesses transact between different subsidiaries or divisions, it’s essential to understand the tax consequences of these internal transactions. Proper handling of these financial exchanges ensures compliance with local and international tax regulations and prevents potential legal and financial complications. Companies must carefully manage pricing, taxes, and reporting mechanisms to avoid tax liabilities and ensure that all transactions are fully compliant with governing laws.

Transfer Pricing and Tax Compliance

Transfer pricing refers to the pricing of goods, services, or intellectual property between different branches of the same organization. These prices must align with market values, ensuring that no subsidiary is unfairly benefiting or overcharging another, which could potentially trigger tax penalties. Most countries require businesses to maintain detailed documentation to justify the pricing applied to internal transfers, which helps establish that they are consistent with arm’s length principles, as if the transactions were conducted between unrelated parties.

Indirect Taxation Considerations

In addition to transfer pricing, businesses must also consider indirect taxes, such as VAT, GST, or sales tax, when transferring goods or services across borders. Different jurisdictions may have varying rules on whether such transactions are taxable, or whether any exemptions or reductions apply. It is crucial to understand the local tax regulations to avoid double taxation or non-compliance.

Jurisdiction Tax Type Tax Rate Exemption Conditions Country A Value Added Tax (VAT) 20% Exempt for intra-group transact How to Handle Currency Conversions

When dealing with cross-border transactions, businesses must account for fluctuations in currency values. Properly managing currency conversions ensures that financial records remain accurate and consistent across different regions. Without effective conversion practices, a company may face discrepancies in its financial reporting or even potential losses due to exchange rate fluctuations. A structured approach to currency handling is vital to minimize risks and maintain financial integrity.

Here are some key steps for efficiently managing currency conversions in business transactions:

- Use Accurate Exchange Rates: Always apply the most up-to-date exchange rates to ensure accuracy in conversions. Rely on trusted sources such as central banks, financial institutions, or currency exchange platforms.

- Choose the Right Conversion Method: Decide whether to use spot rates (real-time exchange rates) or forward rates (agreed-upon rates for future dates) based on the nature of the transaction.

- Set Conversion Dates: It’s important to standardize when currency conversions will be applied. Choose a consistent date for all conversions, such as the transaction date or the financial reporting date.

- Account for Fees: Currency exchanges often come with fees. Be sure to factor in these additional costs when calculating the final amount to avoid underreporting or overreporting of financials.

- Document Conversions: Keep clear records of all exchange rates used and the source of the data. This documentation will help with financial audits and ensure transparency in financial reports.

Businesses can benefit from automation tools that update exchange rates in real-time and facilitate smooth currency conversions. These systems can integrate with accounting software, allowing for accurate and timely reporting without requiring manual intervention.

Additionally, multinational organizations should consider establishing currency management policies. This ensures consistency across all subsidiaries and helps in managing risks associated with currency fluctuations. For example, companies may choose to hedge against exchange rate volatility through financial instruments or currency options, providing further stability to their financial operations.

Frequently Asked Questions About Intercompany Invoices

Managing financial exchanges between different divisions or subsidiaries within an organization often raises various questions, particularly when it comes to internal documentation and reporting. Businesses frequently seek clarity on the best practices, tax implications, and compliance requirements for handling these types of transactions. Below, we address some of the most common concerns related to these internal financial documents and processes.

General Questions

- What is the purpose of internal billing? Internal billing helps track the value of goods, services, or intellectual property exchanged between different departments or entities within the same organization. It provides a clear record for financial reporting and helps manage internal transfers efficiently.

- How do I determine the appropriate price for internal transactions? The pricing for internal exchanges should align with market value or arm’s length standards. This ensures that the transaction is not artificially inflated or deflated, which could lead to tax or regulatory issues.

- Do internal transactions require separate tax filings? In most cases, yes. Tax treatment of internal exchanges can vary depending on local regulations, so it’s essential to consult tax advisors or local tax authorities to ensure compliance with VAT, sales tax, or other indirect taxes.

Accounting and Reporting Questions

- How should these transactions be reported in financial statements? Internal transactions should be clearly documented, with appropriate revenue and expense entries recorded for both sides of the transaction. These transactions are typically eliminated during consolidation for group financial reporting purposes.

- What documentation is required to support internal billing? Proper records include transaction details, pricing justification, and any relevant agreements. Documentation should be kept in case of an audit or regulatory review, ensuring that all internal transfers are transparent and compliant with tax laws.

- Should exchange rates be considered in internal billing? Yes. When transactions occur between entities in different countries, the applicable exchange rates should be used to convert currencies. It