Effective Web Development Invoice Template for Freelancers and Agencies

Efficiently managing payments for digital projects can be challenging, especially when balancing creativity with organization. Having a reliable billing system helps professionals simplify this process, allowing them to focus more on delivering quality work rather than administrative tasks.

A well-structured billing document makes it easy to communicate service details, rates, and payment terms to clients. By using a versatile format, creators and agencies can adapt their billing to various projects, ensuring clarity and professionalism with each client interaction.

For freelancers and firms alike, a consistent and easy-to-follow approach to client payments can reduce misunderstandings and speed up the transaction process. Establishing this foundation benefits not only the service provider but also enhances trust and satisfaction from clients.

Project Billing Document Guide

Creating a clear and concise billing document is essential for effective project management and maintaining professionalism in client relationships. This guide provides an outline for structuring an organized and understandable record of your services, making sure that both you and your clients have a clear understanding of terms and expectations.

Key Components of a Billing Document

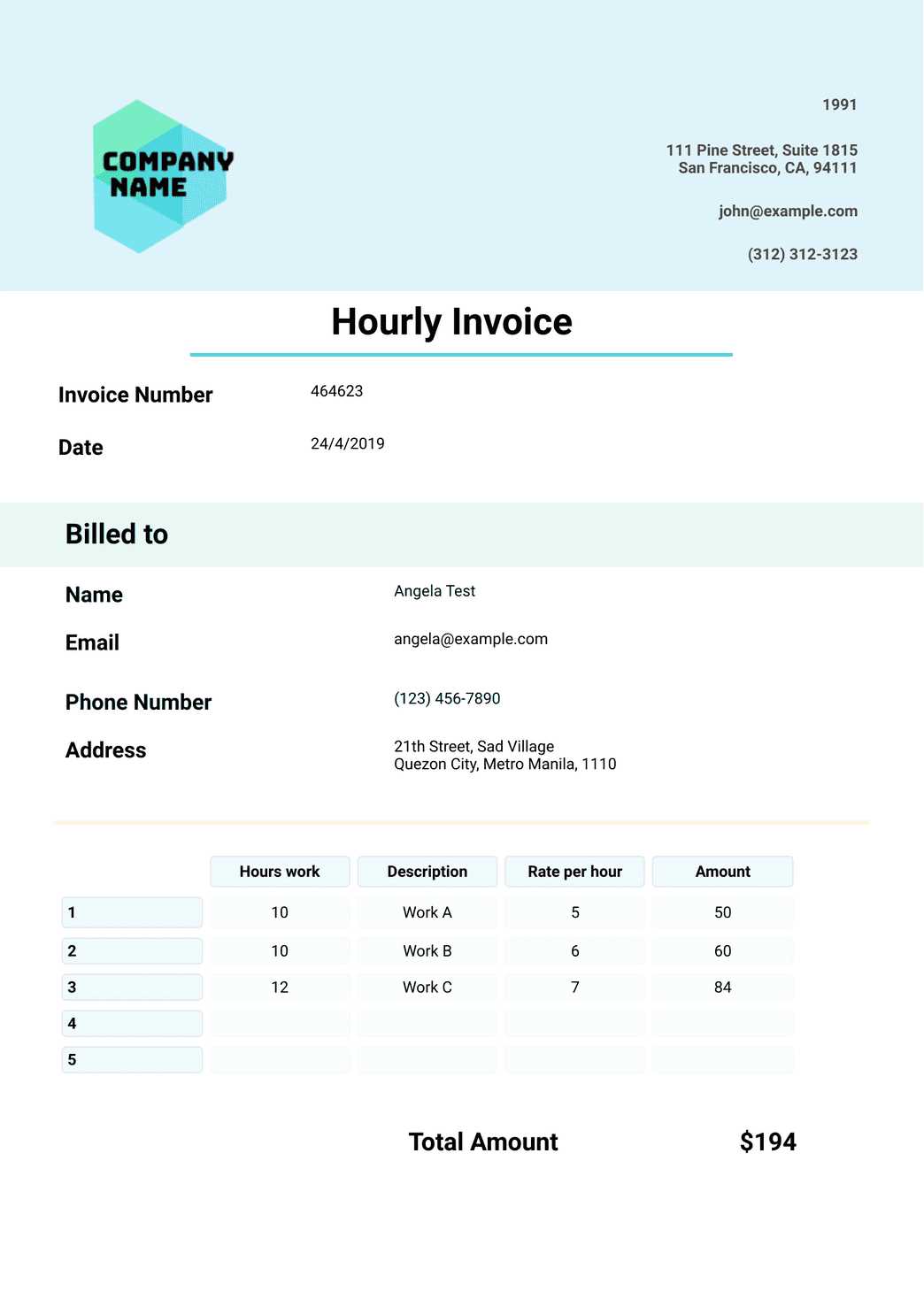

- Contact Information: Include your name, business address, and contact details, as well as those of your client.

- Service Details: Clearly list each service provided, specifying its scope to avoid misunderstandings.

- Pricing and Rates: Provide a breakdown of charges, including hourly or fixed rates, to enhance transparency.

Creating a Professional Billing Layout

A polished layout for your billing documents ensures clarity and leaves a positive impression on clients. By designing an organized format, you can make it easier for clients to understand the details of your services, fees, and payment terms, contributing to smoother transactions.

Essential Elements for a Structured Layout

- Header with Contact Details: At the top, include your business name, contact information, and the client’s details for easy identification.

- Document Number and Date: Adding a unique identifier and date ensures easy tracking and helps both you and the client keep organized records.

- Clear Service Descriptions: List each task or service with a brief, clear description, giving clients a transparent overview of the work completed.

- Itemized Charges: Break down the fees, whether based on hours or fixed rates,

Essential Elements of a Project Billing Document

Including key components in your billing document is crucial for maintaining transparency and ensuring a smooth payment process. A well-organized document should clearly outline the services provided, associated costs, and terms to facilitate a positive and professional interaction with clients.

Core Components for Clear Communication

Contact Information: Ensure both your and the client’s details are easy to find at the top of the document. This typically includes names, addresses, email, and phone numbers for smooth correspondence.

Service Breakdown: List each service provided, along with a brief description. Detail the work completed, helping the client understand what each charge covers.

Pricing Structure: Specify rates, whether they are hourly or fixed. Include any additional charges or fees to give a full view of the cost structure.

Details to Ensure Timely Payments

Payment Terms: Clarify payment methods, deadlines, and any late fees to encourage prompt payments. Clearly stating these terms helps prevent delays.

Customizing Billing Documents for Different Projects

Tailoring billing documents to suit the unique needs of each project can improve clarity and strengthen your client relationships. Adjusting these documents allows you to provide specific information relevant to each assignment, ensuring transparency and professionalism in your communications.

Adapting Content to Reflect Project Scope

Detailed Service Descriptions: Modify the description section to reflect the exact nature of the work. Whether it’s a short-term assignment or a long-term project, include specific tasks and milestones completed, giving clients a clear view of the work involved.

Flexible Pricing Models: Adjust the pricing structure according to the project. For example, for ongoing projects, you might opt for an hourly rate, while fixed fees may be more appropriate for one-off tasks.

Personalizing Terms and Conditions

How to Automate Invoice Generation

Automating the process of creating billing documents can save time, reduce errors, and enhance overall efficiency in client management. By implementing automated tools, you streamline repetitive tasks, allowing you to focus more on delivering quality work.

Selecting the Right Software: Start by choosing software that integrates with your existing systems. Look for features that allow for recurring entries, adjustable formats, and options to store client data securely. Many tools also offer templates and customization options to match your branding.

Setting Up Automatic Entries: Once you have a tool in place, configure it to include standard details, such as your contact information, typical services, and base rates. Automation allows you to populate these fields quickly, ensuring consistency across documents.

Scheduling and Notifications: Use scheduling features to set reminders for upcoming billing dates or deadlines. Autom

Ensuring Accurate Billing for Clients

Maintaining precision in your billing processes is essential for fostering trust and satisfaction among clients. An accurate representation of services rendered and associated costs not only enhances professionalism but also minimizes disputes and confusion.

Key Practices for Accurate Billing

- Detailed Service Descriptions: Clearly outline each service provided with specific details to prevent misunderstandings. Include information such as hours worked, tasks completed, and any relevant milestones achieved.

- Regular Updates: Keep clients informed about any changes in scope or additional services required. This transparency ensures that clients are aware of any modifications before they appear on their billing documents.

- Double-Check Calculations: Always verify the accuracy of your calculations. Implement tools or software that can help automate and reduce the risk of human error when determining charges.

Tools to Enhance Accuracy

- Billing Software: Invest in reliable software that tracks time and expenses effectively. Many solutions offer features that help to ensure all details are captured accurately before finalizing documents.

- Standardized Formats: Use consistent formats for your billing documents. This not only improves clarity but also helps both you and your clients recognize familiar patterns, making it easier to spot any discrepancies.

By implementing these strategies, you can ensure that your billing processes are accurate and transparent, leading to improved client satisfaction and long-term relationships.

Benefits of Using an Invoice Format

Employing a standardized document layout for billing purposes can significantly streamline your financial processes. Utilizing a consistent format not only enhances professionalism but also improves efficiency, allowing for easier management of accounts and client relationships.

Time-Saving Efficiency

Quick Preparation: With a pre-designed structure, you can fill in the necessary details quickly, reducing the time spent on each billing cycle. This allows you to focus more on your core services rather than administrative tasks.

Enhanced Professional Appearance

Consistency in Branding: Using a specific layout helps to reinforce your brand identity. A polished and uniform design communicates reliability and attention to detail, making a positive impression on clients.

Incorporating a structured format for your billing documents brings numerous advantages, such as improved accuracy, easier tracking of transactions, and a more organized approach to managing client accounts. Overall, this practice fosters a smoother financial operation.

Common Mistakes in Developer Billing Documents

When creating financial statements for services rendered, various pitfalls can lead to misunderstandings and payment delays. Identifying and avoiding these common errors is essential for maintaining healthy client relationships and ensuring timely compensation.

Frequent Errors to Avoid

- Incomplete Details: Failing to provide all necessary information, such as client names, project descriptions, or service dates, can cause confusion and delay payments.

- Incorrect Calculations: Miscalculating totals or failing to apply discounts and taxes correctly can lead to disputes. Always double-check figures before sending documents.

- Not Specifying Payment Terms: Omitting details about due dates or accepted payment methods can result in late payments. Clearly outline your terms to avoid any ambiguity.

- Lack of Personalization: Sending generic documents without addressing clients by name or including personalized messages can diminish the perceived value of your services.

Improving Accuracy and Professionalism

- Regular Review: Periodically review your billing practices to identify and correct recurring mistakes, ensuring continuous improvement.

- Utilizing Software Tools: Consider using specialized tools that automate calculations and format documents, reducing the likelihood of errors.

By being aware of these common mistakes, you can enhance the accuracy and professionalism of your billing documents, ultimately leading to smoother transactions and stronger client relationships.

Tips for Effective Invoice Management

Managing billing documents efficiently is crucial for maintaining cash flow and fostering positive client relationships. By implementing a systematic approach, you can streamline processes, reduce errors, and ensure timely payments.

First, establish a consistent format for your billing documents to promote clarity and professionalism. A well-organized layout makes it easier for clients to understand charges and payment terms. Next, keep meticulous records of all transactions, including dates, amounts, and client communications. This will help you track outstanding payments and resolve discrepancies swiftly.

Additionally, set reminders for payment deadlines to proactively follow up with clients. Regular communication can prevent misunderstandings and encourage prompt payments. Lastly, consider leveraging software solutions designed for financial management. These tools can automate various aspects of the billing process, from generating documents to tracking payments, allowing you to focus more on your core work.

By following these tips, you can enhance your overall efficiency and ensure that your financial transactions are managed smoothly and professionally.

Streamlining Payments with Digital Invoices

In today’s fast-paced business environment, utilizing electronic billing documents can significantly enhance the efficiency of payment processes. By transitioning from traditional paper statements to digital formats, businesses can not only speed up transactions but also reduce administrative burdens.

Benefits of Electronic Billing

One of the primary advantages of using digital statements is the speed of delivery. Clients receive their billing documents instantly via email, which eliminates delays associated with postal services. Additionally, electronic formats often allow for interactive features, such as direct payment links, making it easier for clients to settle their accounts promptly.

Improving Tracking and Management

Digital documents also offer enhanced tracking capabilities. Many software solutions provide real-time insights into payment statuses, helping businesses monitor outstanding balances effectively. This transparency enables proactive follow-ups with clients, ensuring timely reminders for any pending payments. Moreover, the automated record-keeping that comes with digital systems minimizes the risk of errors and simplifies reconciliation processes.

Overall, adopting electronic billing practices not only streamlines payment workflows but also contributes to a more organized and responsive financial management system.

Designing Client-Friendly Invoices

Creating billing documents that are easy to understand and visually appealing can significantly enhance client satisfaction. When clients can quickly grasp the details of their charges, it fosters transparency and trust in the business relationship.

Clarity is Key: Ensuring that the content is clear and concise is essential. Use straightforward language to explain services and fees. Avoid technical jargon that might confuse clients, and break down complex charges into simpler components. A well-organized layout helps clients to easily follow the details without feeling overwhelmed.

Visual Appeal Matters: Incorporating a clean and professional design can greatly influence the client’s perception. Use consistent branding elements such as colors, logos, and fonts to create a cohesive look. Additionally, incorporating whitespace effectively can make the document less cluttered and more reader-friendly.

Personalization Enhances Connection: Adding personal touches, such as a thank-you note or a brief message, can make the client feel valued. Addressing clients by name and acknowledging their specific project can enhance their experience and encourage timely payments.

Ultimately, designing client-friendly billing documents not only facilitates easier payments but also strengthens the overall client-business relationship.

Tracking Expenses on Development Projects

Monitoring expenditures is crucial for the success of any project. By keeping a close eye on costs, businesses can ensure that they remain within budget and identify areas where savings can be made. This practice not only helps in financial management but also provides insights into project efficiency.

Establishing a Clear Budget

Before beginning a project, it is essential to create a comprehensive budget. This budget should outline all expected expenses, including materials, labor, and overhead costs. Setting a clear financial framework allows for better tracking of actual expenses against planned figures, enabling adjustments to be made as necessary.

Utilizing Tracking Tools

Employing tools and software designed for financial tracking can simplify the process. These tools can automate the recording of expenses, categorize them, and generate reports. Regularly reviewing these reports helps project managers stay informed about financial health and make informed decisions regarding resource allocation.

Effective expense tracking ultimately contributes to a project’s overall success, ensuring that resources are used efficiently and that financial goals are met.

Choosing the Right Template Format

Selecting an appropriate format for your billing documents is essential for ensuring clarity and professionalism. The right structure not only enhances readability but also streamlines the communication of essential information between you and your clients. Here are some key considerations to keep in mind when deciding on a format:

- File Type: Consider which file type is most suitable for your needs. Common options include PDF, Word, and Excel. PDFs are ideal for maintaining formatting, while Word and Excel allow for easier editing.

- Design Layout: Choose a layout that reflects your brand identity. A clean and organized design can make a significant impact on how your documents are perceived.

- Customization Options: Ensure that the chosen format allows for easy customization. You may want to adjust elements like logos, colors, and fields to align with specific project requirements.

- Compatibility: Verify that the format is compatible with various devices and software. This ensures that clients can easily view and interact with the documents, regardless of their technology.

By carefully selecting the right format, you can enhance your billing process and foster better relationships with your clients.

How to Add Payment Terms

Clearly defining payment conditions is crucial for ensuring smooth transactions between service providers and clients. Properly outlined terms help avoid misunderstandings and set clear expectations regarding the timing and methods of payment. Below are some essential elements to consider when incorporating payment conditions into your documents:

Payment Condition Description Due Date Specify when the payment is expected to be made, whether it’s upon receipt, within 30 days, or another timeframe. Late Fees Indicate if there will be additional charges for late payments, including percentage rates or fixed fees. Accepted Payment Methods List the methods available for payment, such as credit cards, bank transfers, or online payment systems. Deposit Requirements Outline if a deposit is necessary before commencing work, including the percentage and timing of the deposit. Discounts for Early Payment Mention any incentives for clients who pay before the due date, such as a percentage discount. Incorporating these conditions effectively ensures clarity and fosters a professional relationship, making it easier for clients to fulfill their financial obligations.

Tools for Managing Project Invoices

Effectively handling billing documents is vital for maintaining financial health and ensuring timely payments in any project. A variety of tools are available that can simplify the management process, enhance organization, and improve overall efficiency. Below are some notable solutions to consider:

1. Accounting Software

Dedicated accounting software offers comprehensive features for tracking expenses, generating statements, and managing client records. These platforms often come with customizable features that allow users to adapt them to their specific needs.

2. Online Billing Platforms

Cloud-based services provide a user-friendly interface for creating, sending, and tracking billing documents. Many of these platforms support automation, allowing for recurring billing and reminders for overdue payments.

3. Spreadsheet Applications

For those seeking a more manual approach, spreadsheet applications can be customized to track and organize billing documents. They provide flexibility and can be tailored to specific project requirements, though they require more hands-on management.

4. Time Tracking Tools

Incorporating time management solutions helps accurately account for hours worked, which can be crucial for project-based billing. Many of these tools integrate with billing software, streamlining the process of generating accurate statements.

5. Document Management Systems

These systems enable users to store, organize, and retrieve financial documents efficiently. With features like version control and access permissions, they enhance collaboration and ensure that all team members have access to the latest documents.

By leveraging these tools, professionals can improve their financial management processes, leading to more effective project handling and enhanced client satisfaction.

Best Practices for Transparent Billing

Ensuring clarity and openness in financial transactions fosters trust and strengthens client relationships. Adopting effective strategies for clear billing can prevent misunderstandings and promote satisfaction. Here are some recommended approaches:

1. Provide Detailed Descriptions

Every charge should be accompanied by a comprehensive description to help clients understand what they are paying for. Consider including:

- A breakdown of services rendered

- Time spent on each task

- Any applicable rates or fees

2. Use Consistent Formatting

Standardizing the layout of financial documents helps clients easily locate essential information. Consistency in formatting may include:

- Using the same font and size

- Adhering to a structured layout

- Maintaining uniform terminology throughout

3. Communicate Payment Terms Clearly

Clearly stating payment expectations is crucial for avoiding confusion. Ensure that your documents include:

- Due dates

- Accepted payment methods

- Late fee policies, if applicable

4. Offer Itemized Statements

Providing itemized billing statements allows clients to see a detailed account of all charges. This transparency can help address any potential disputes before they arise.

By implementing these best practices, professionals can enhance the clarity of their financial dealings, leading to improved client trust and satisfaction.