How to Use a Fee Invoice Template for Professional Billing

Managing client payments and maintaining a professional appearance can be time-consuming, especially for small businesses and freelancers. Ensuring that every transaction is documented accurately and clearly is essential for smooth operations. One of the best ways to achieve this is by utilizing a structured billing document that organizes the necessary information efficiently.

Such a document helps you outline the costs, terms, and services rendered in a format that is both easy to understand and legally sound. By choosing a flexible and customizable solution, you can adjust the layout and fields according to your needs, enhancing both efficiency and professionalism.

Whether you’re a freelancer, consultant, or running a small business, this streamlined approach not only saves you time but also ensures your clients are aware of what they are being charged for. The goal is to make the process as simple and transparent as possible, avoiding errors and unnecessary confusion for both parties.

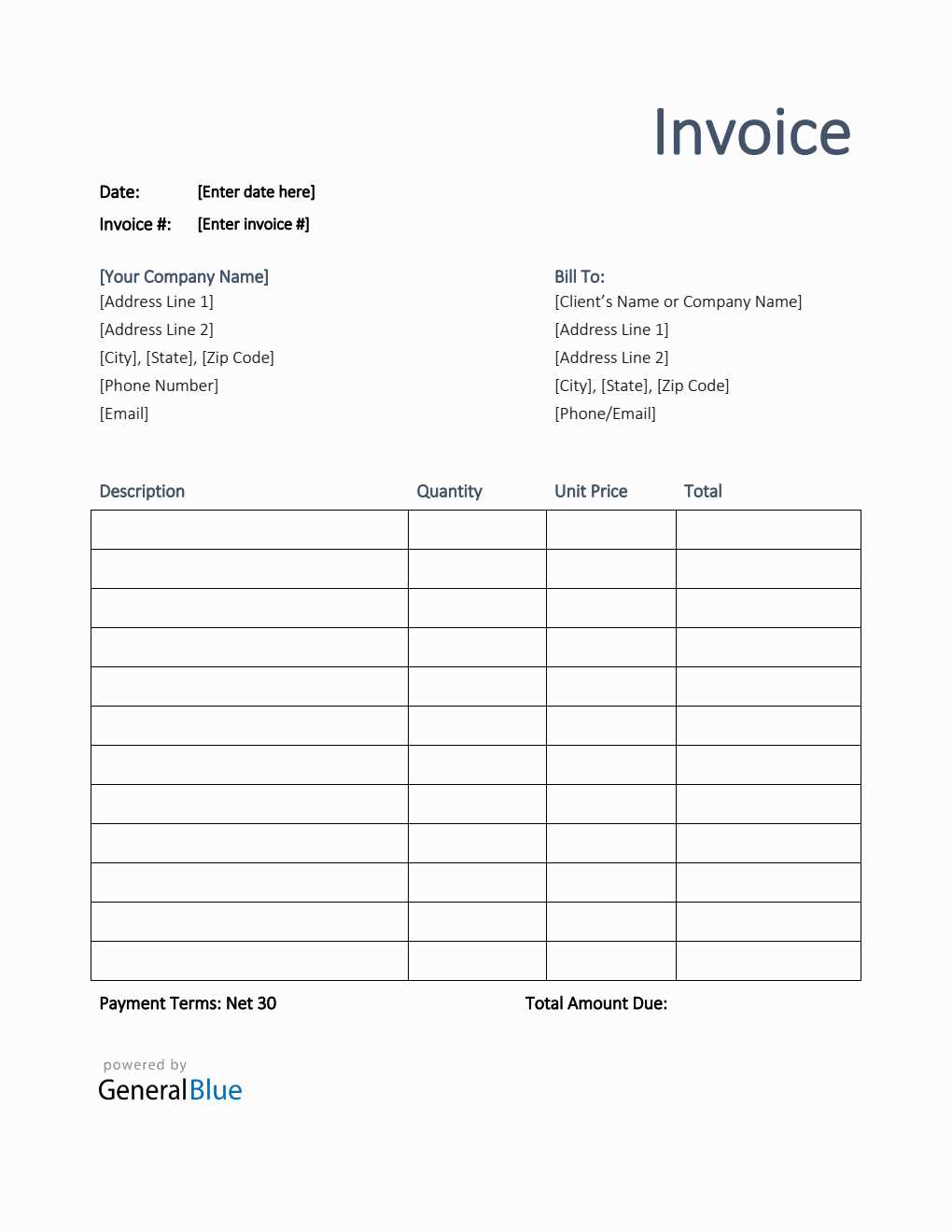

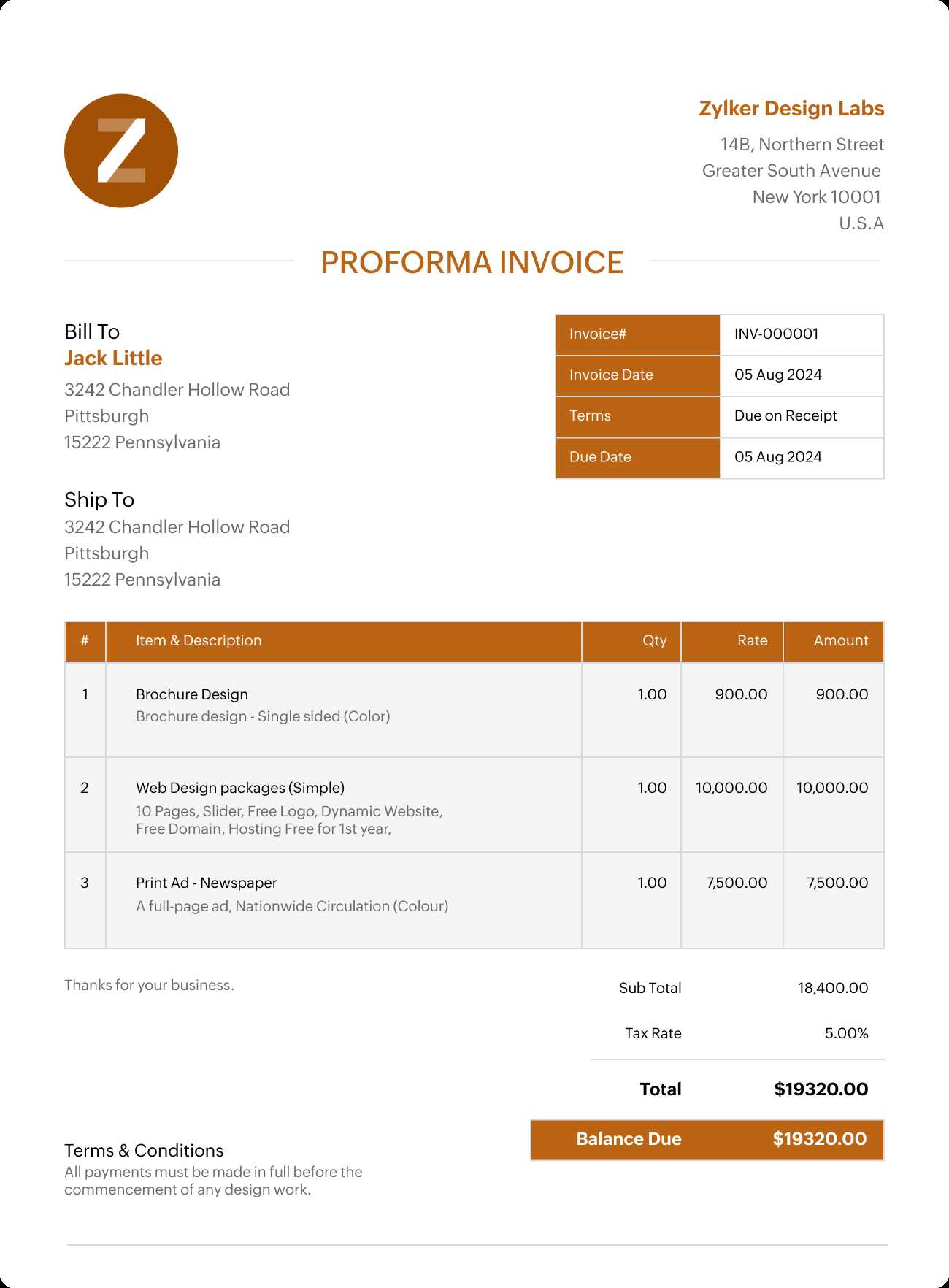

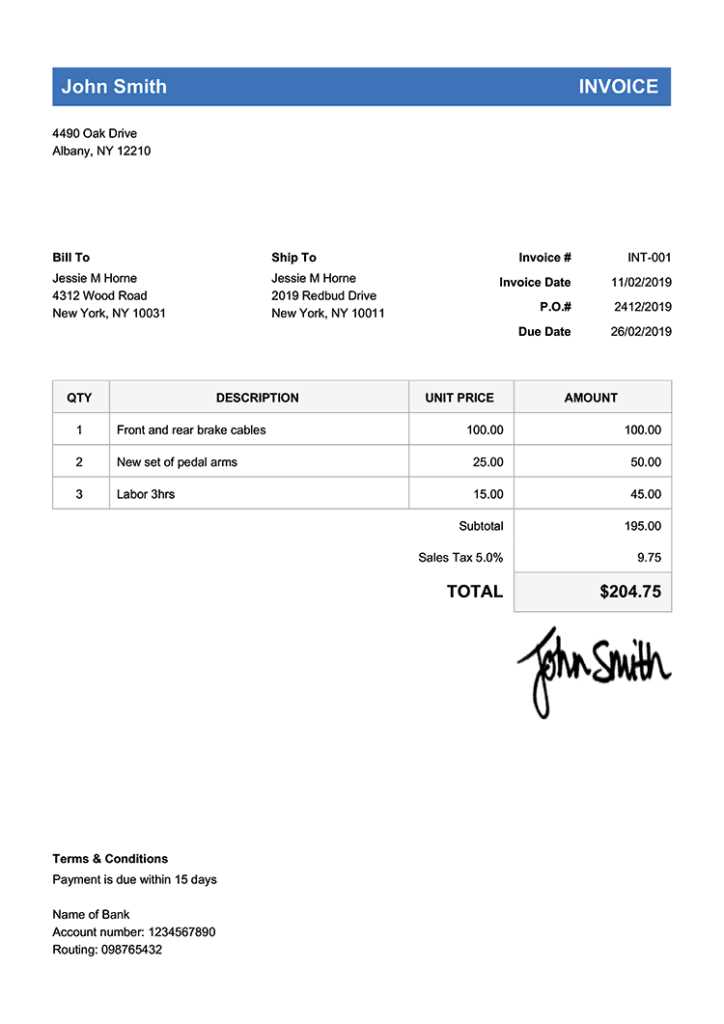

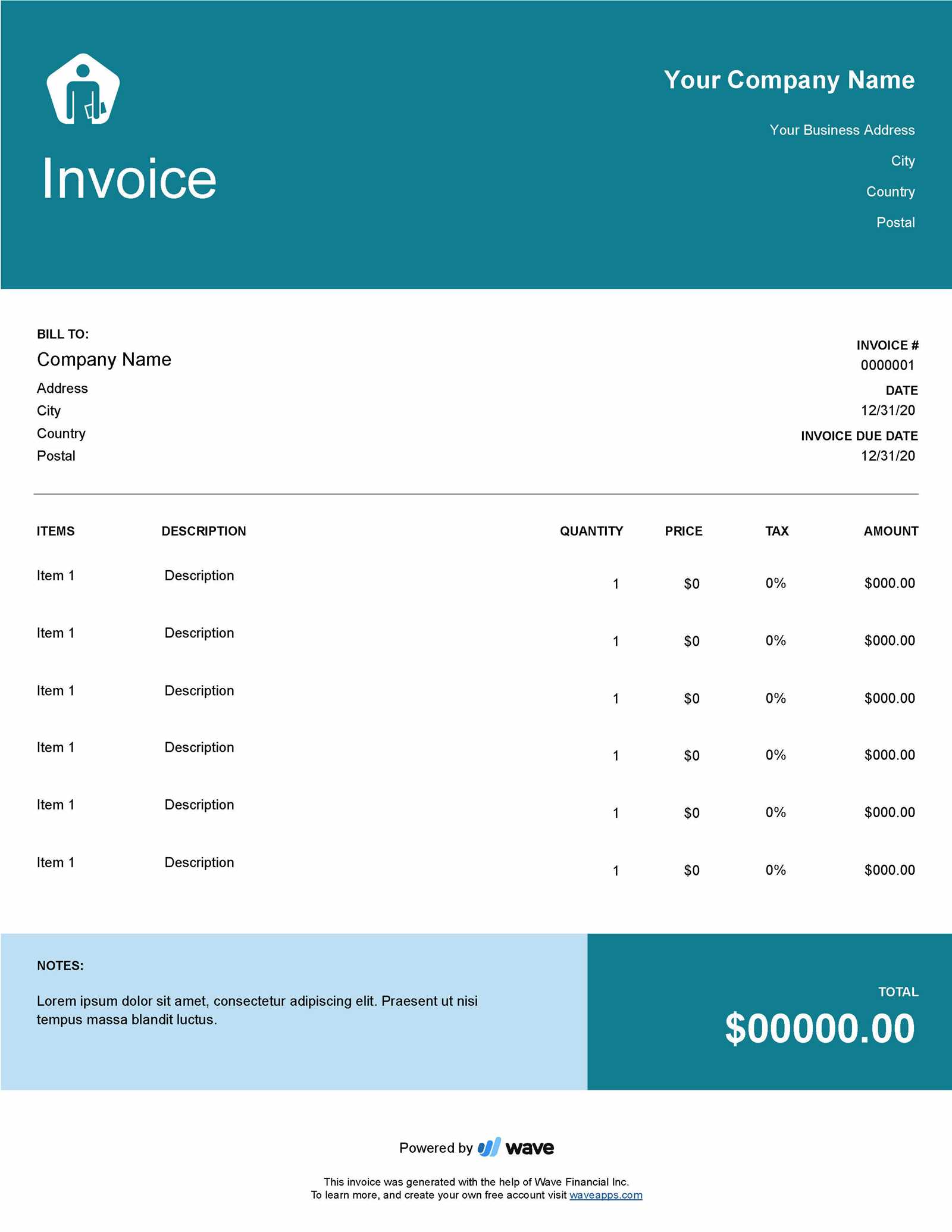

Fee Invoice Template Overview

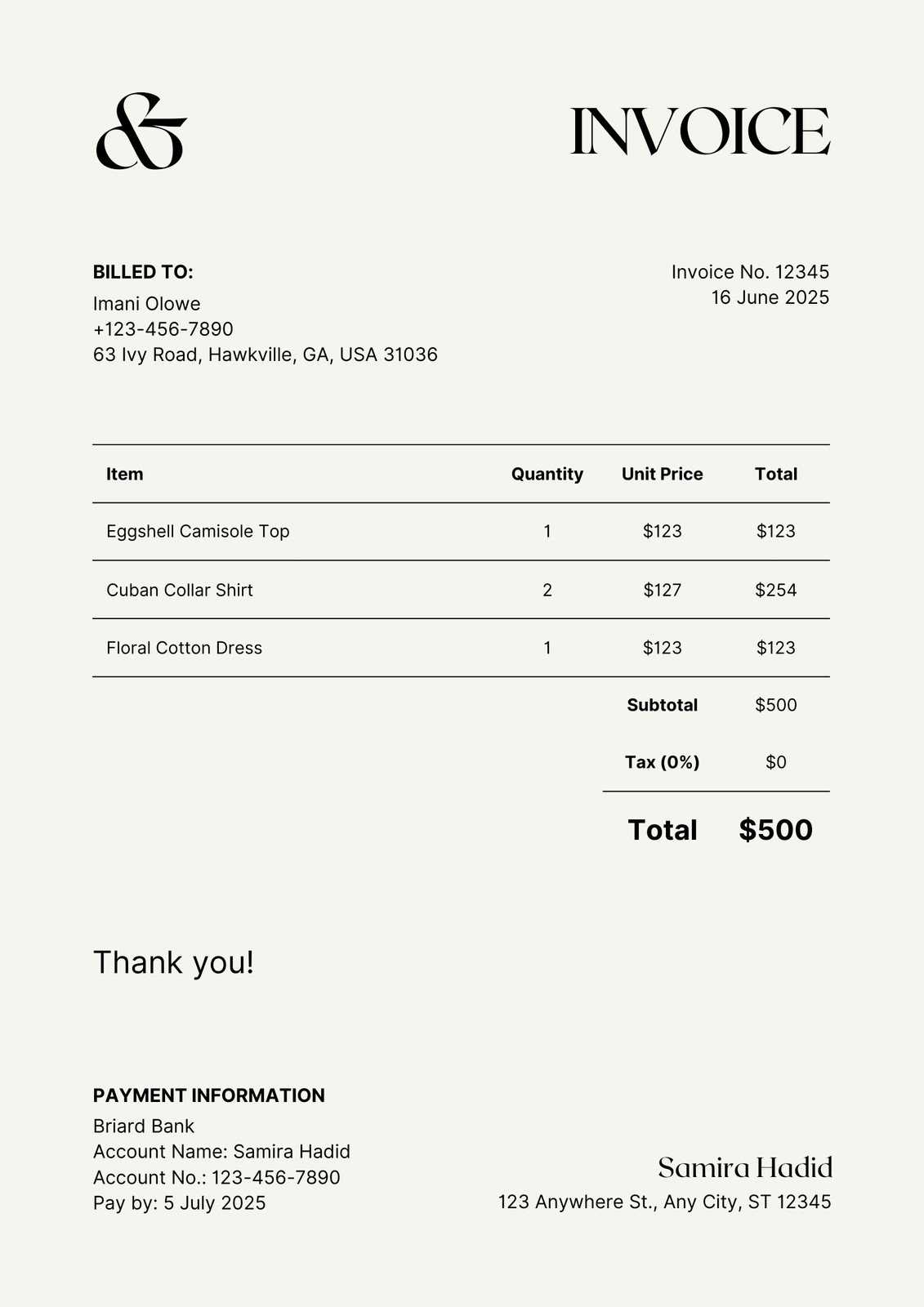

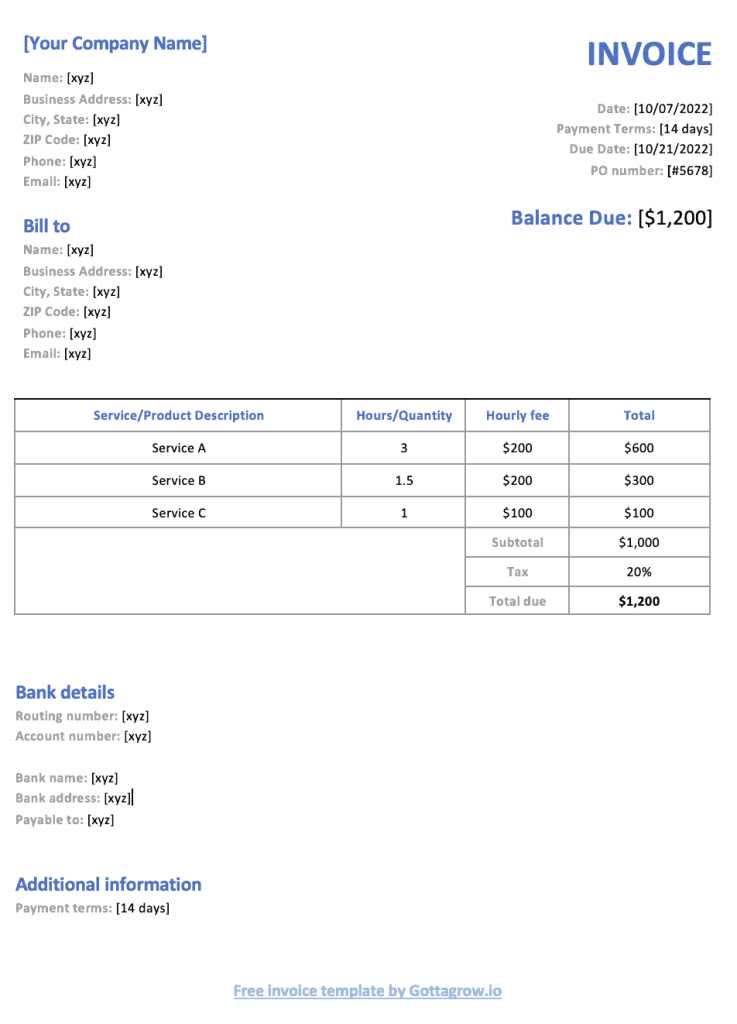

When it comes to requesting payments for services or products, having a clear and professional document is crucial. A well-organized billing sheet helps ensure both parties understand the charges and terms involved. It serves as a formal request for compensation and helps businesses maintain a record of transactions.

This type of document typically includes several key elements, which may vary depending on the business’s needs or the type of work provided. The main goal is to create an easy-to-read, transparent record that avoids confusion and promotes timely payments. Here are some common features:

- Business Information: The name, address, and contact details of the service provider.

- Client Information: The name and contact details of the person or company receiving the services.

- Description of Services: A detailed list of the services rendered or goods delivered.

- Pricing Details: The cost associated with each item or service and the total amount due.

- Payment Terms: The due date and any applicable late fees or discounts.

- Invoice Number: A unique identifier for record-keeping purposes.

By using this document, businesses can ensure they are providing clear, professional requests for payment, and clients can easily understand the breakdown of costs. The format helps both parties keep track of financial transactions while maintaining legal and financial clarity.

Why Use a Fee Invoice Template

For any business or freelancer, ensuring a smooth payment process is vital for maintaining healthy cash flow and professional relationships with clients. A structured document that clearly outlines payment expectations simplifies the entire transaction. Using a ready-made document for requesting payment offers numerous advantages that can save time, reduce errors, and enhance professionalism.

Time Efficiency

Creating a well-organized payment request from scratch for each project can be tedious and time-consuming. A pre-designed layout allows you to fill in the necessary details quickly, cutting down on administrative tasks. You no longer need to worry about formatting or deciding which information to include; it’s all preset for you.

Consistency and Professionalism

Using a standardized document ensures that your requests for payment are always presented professionally, regardless of the client or project size. Consistency in design and structure improves the client’s perception of your business, creating a sense of reliability and trustworthiness.

- Clear Communication: A consistent structure eliminates confusion, ensuring clients understand exactly what they are being charged for.

- Reduced Errors: Having a template minimizes the risk of missing important information, such as payment terms or pricing details.

- Time-Saving: Quickly generating requests for payment without starting from scratch frees up time to focus on other tasks.

Ultimately, using a ready-made format makes financial transactions smoother and more predictable, fostering good business practices and ensuring that both parties are on the same page when it comes to payments and expectations.

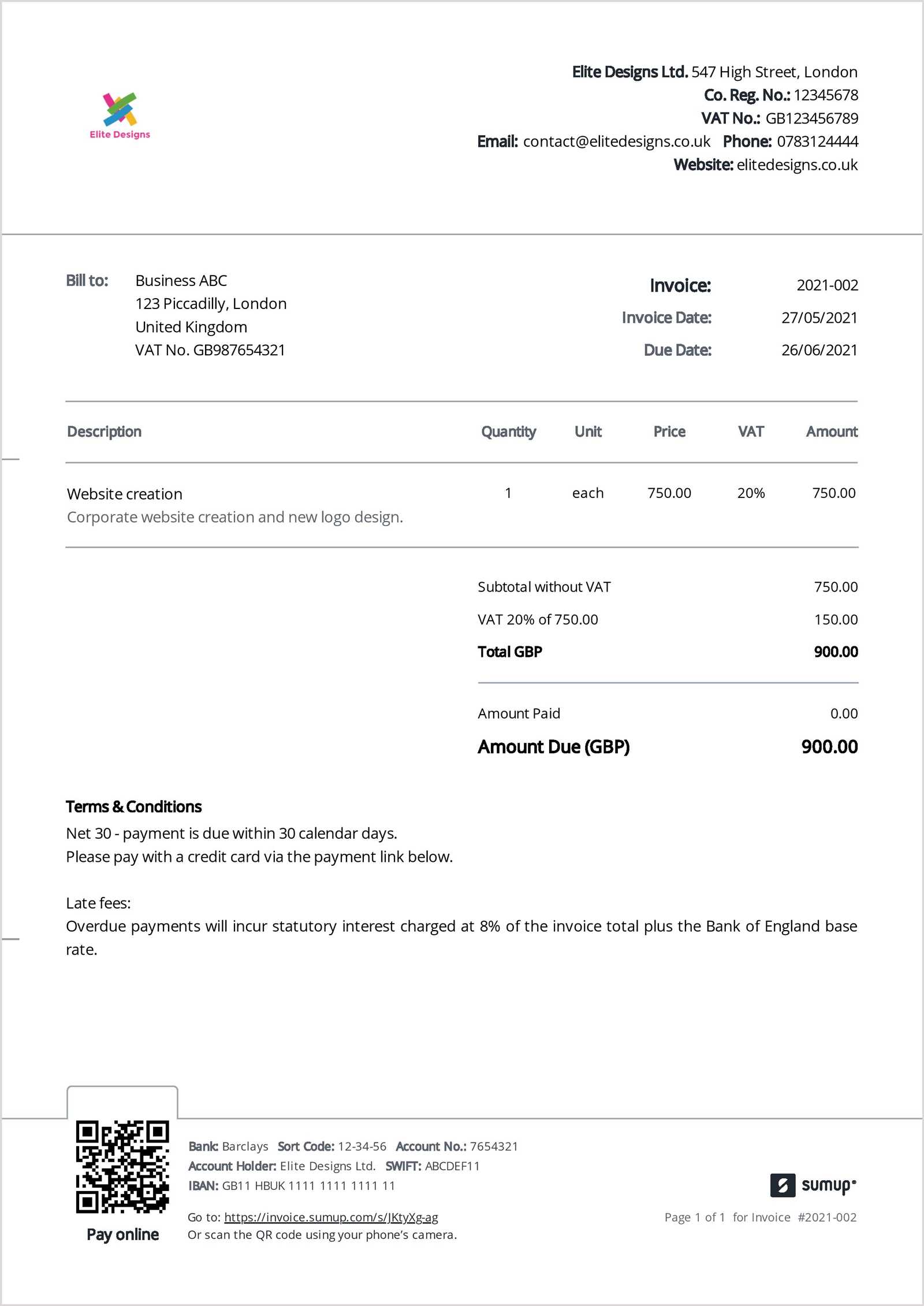

Essential Features of a Fee Invoice

A well-structured document requesting payment should contain several key elements to ensure both clarity and professionalism. These essential components help outline the agreement between the service provider and the client, ensuring that both parties are clear on the terms and expectations. The following features are fundamental to creating an effective and transparent billing request.

- Contact Information: The document should clearly display the service provider’s name, address, and contact details, along with the recipient’s information. This ensures that both parties can easily identify each other and communicate if needed.

- Unique Identification Number: Every request should include a reference number for tracking and record-keeping. This number helps avoid confusion in case of multiple transactions and simplifies financial management.

- Description of Services: It’s crucial to list all services or products provided, including any specifics, dates, or additional details that clarify the work done. This transparency ensures that the client knows exactly what they are being charged for.

- Cost Breakdown: The price of each individual item or service, along with any applicable taxes, fees, or discounts, should be clearly outlined. This allows clients to easily verify the charges.

- Payment Terms: Terms such as the due date, payment methods accepted, and any late fees or discounts should be explicitly stated to avoid misunderstandings.

- Additional Notes or Instructions: Any special terms, instructions, or information related to the transaction should be included in a designated area to ensure both parties are fully informed.

These features work together to provide a comprehensive, clear, and professional document that protects both the provider and the client. Ensuring that all relevant details are included minimizes the risk of disputes and helps maintain smooth financial operations.

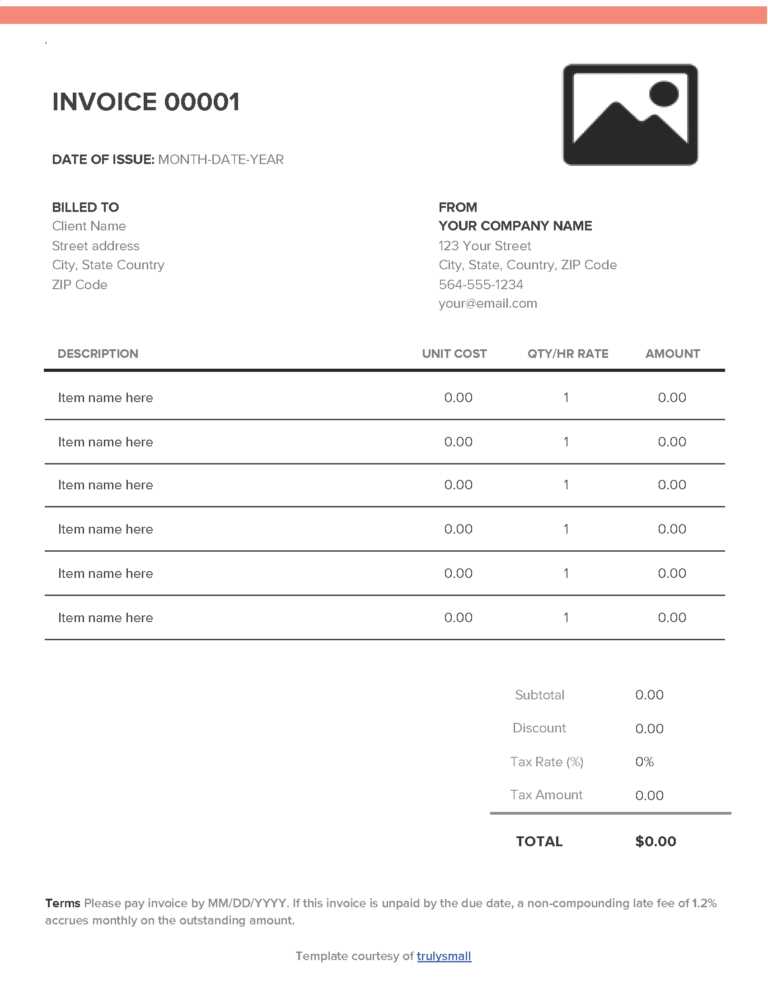

How to Customize Your Invoice Template

Customizing a billing document allows you to tailor it to your specific needs, ensuring it reflects your brand and business practices while providing all the necessary details for a clear transaction. Personalizing your request for payment not only adds a professional touch but also ensures that the format suits your workflow and industry requirements. Here’s how to make sure your document is perfectly suited to your needs.

- Adjust the Layout: Choose a layout that fits the style of your business. Whether you prefer a minimalist design or a more detailed format, ensure it is clear and easy to follow. Organize sections logically to help clients quickly find the information they need.

- Incorporate Branding: Add your company logo, color scheme, and fonts to make the document align with your business identity. This creates a professional appearance and strengthens brand recognition.

- Modify the Header: The header should contain key information like your business name, contact details, and the document title. You can also include your website or social media handles to encourage further client interaction.

- Tailor the Service Descriptions: Include specific details about the services or products you provided. You may want to add custom descriptions that reflect your unique offerings, making it easier for clients to understand what they’re paying for.

- Set Payment Terms: Define your preferred payment methods, due dates, and any applicable discounts or late fees. Customize this section based on the nature of your work or the agreements you have with different clients.

- Include Additional Information: If necessary, add extra sections for tax rates, shipping costs, or other relevant charges. The more specific you are, the fewer chances there are for confusion or disputes.

Customizing your billing documents not only ensures they are visually appealing but also helps maintain clarity and professionalism in every transaction. By personalizing the layout, content, and structure, you create a streamlined and effective tool for managing your business finances.

Choosing the Right Template for Your Business

Selecting the right document for requesting payment is crucial for ensuring consistency and professionalism across all your transactions. The ideal format should meet the specific needs of your business, be easy for clients to understand, and accurately reflect the nature of your services. With a variety of options available, it’s important to consider several factors before making a choice.

Consider Your Business Type

The type of business you run will significantly impact the structure and details you need to include in the document. Different industries may have varying requirements, such as specific tax rates, itemized lists, or additional terms. For example, a service-based business might focus more on detailed descriptions of tasks completed, while a product-based business may need to highlight quantities and item prices.

- Service Businesses: Focus on clear descriptions of services rendered, project timelines, and payment milestones.

- Product-Based Businesses: Emphasize product details, quantities, unit prices, and shipping charges.

- Freelancers and Contractors: Consider a flexible layout that accommodates varied project scopes and timelines.

Think About Customization Options

Choose a format that offers flexibility, allowing you to modify sections based on the needs of each transaction. A customizable document ensures you can adjust terms, add specific charges, and maintain a professional appearance, no matter the client or project.

- Editable Fields: Look for a document with editable areas to add or remove information as necessary.

- Predefined Sections: Make sure the template includes all essential elements, like client details, services, and payment terms, with room for custom notes.

- Branding Options: Choose a design that allows you to incorporate your logo, colors, and other brand elements to maintain a cohesive business identity.

The right document ensures that your billing process is as smooth and professional as possible, contributing to timely payments and strong client relationships. By considering the unique needs of your business and how customizable the format is, you can select the most effective option for your operations.

Common Mistakes to Avoid with Invoices

Creating a well-structured billing document is essential for maintaining professionalism and ensuring timely payments. However, many businesses make avoidable mistakes that can lead to confusion, delayed payments, or even strained client relationships. Being aware of these common errors can help you streamline your process and maintain clear communication with your clients.

| Common Mistakes | Consequences | How to Avoid |

|---|---|---|

| Missing or incorrect contact details | Delays in communication and payment processing | Always double-check contact information before sending |

| Not including a unique reference number | Difficulty tracking transactions and potential confusion | Use a consistent numbering system for each document |

| Unclear service descriptions | Client confusion and potential disputes | Provide detailed descriptions for each item or service |

| Omitting payment terms | Late payments and misunderstandings about due dates | Always specify payment methods, due dates, and late fees |

| Failing to account for taxes or additional charges | Underpayment or client dissatisfaction | Ensure all taxes, shipping costs, and fees are included |

| Using an unprofessional layout | Damaged business image and lack of trust | Choose a clear, clean design that reflects your brand |

By avoiding these mistakes, you can create a document that is easy for clients to understand, reduces the risk of payment delays, and helps maintain professional relationships. Always double-check your work and ensure that all necessary information is included before sending out any billing requests.

Benefits of Digital Fee Invoices

In today’s fast-paced business environment, transitioning to digital payment requests offers numerous advantages over traditional paper-based methods. From increased efficiency to improved tracking, digital solutions provide a wide range of benefits that can help streamline your financial processes. By adopting a digital approach, businesses can save time, reduce errors, and enhance communication with clients.

- Time Savings: Digital billing documents can be created, edited, and sent in minutes, eliminating the need for manual drafting, printing, or mailing. This speed allows businesses to focus on more critical tasks.

- Reduced Risk of Errors: With digital solutions, there is less room for human error, such as miscalculating totals or missing important information. Automated calculations and pre-filled fields reduce mistakes.

- Easy Record Keeping: Digital files can be stored, organized, and accessed with ease, making it simpler to manage and retrieve financial records when needed. This is particularly useful for tax reporting or audits.

- Faster Payments: Sending documents electronically often speeds up the payment process. Clients can easily access and review their bills, and with integrated payment options, transactions can be completed almost instantly.

- Environmentally Friendly: Going digital reduces paper waste, contributing to a greener, more sustainable business model. This is a step toward reducing your company’s carbon footprint.

- Improved Client Experience: Clients appreciate the convenience of receiving documents electronically. They can review details quickly, make payments easily, and keep digital copies for their own records.

Adopting digital billing methods is not only a time-efficient and environmentally responsible choice but also a strategic move for improving overall business operations. By reducing manual steps, increasing accuracy, and speeding up the process, digital documents create a smoother and more professional experience for both businesses and clients.

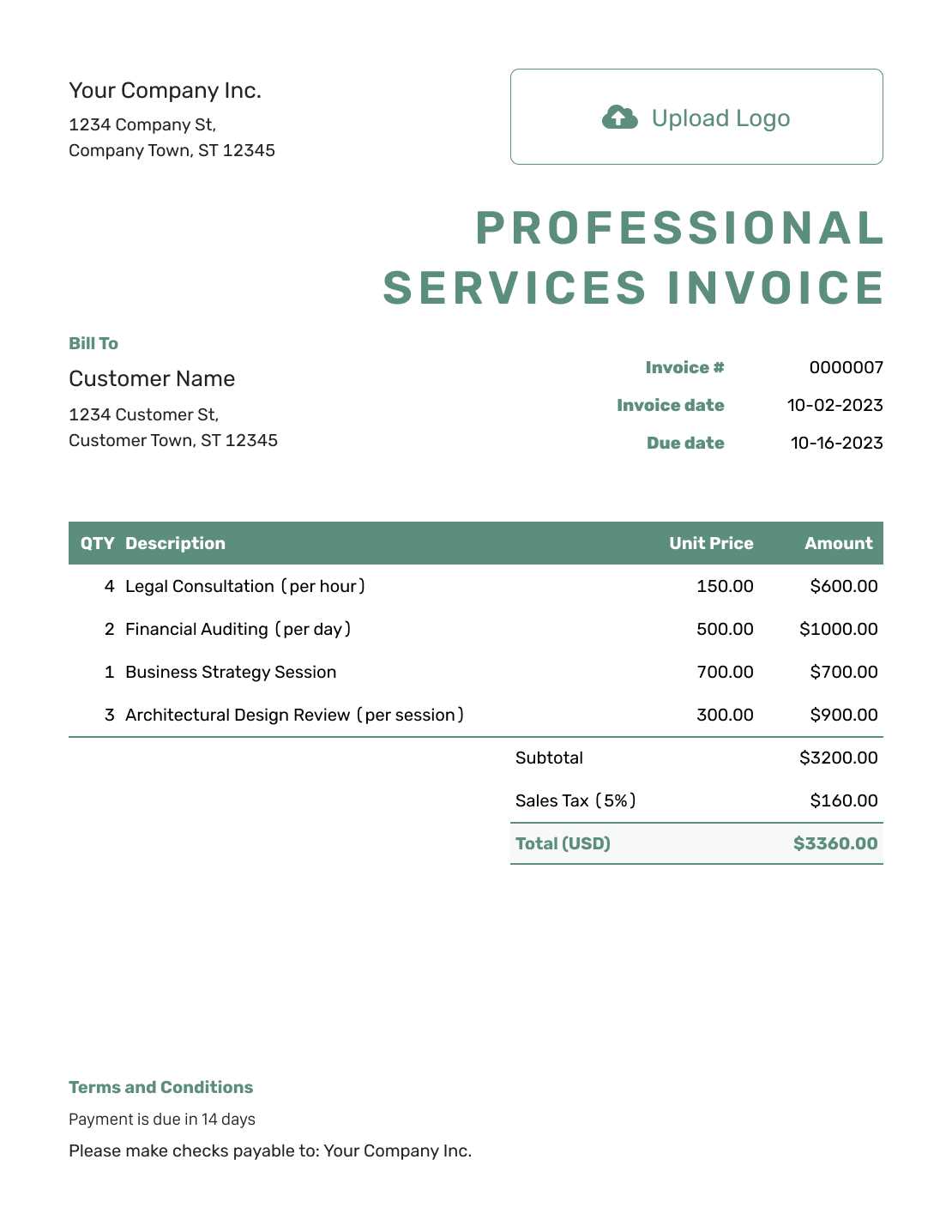

How to Add Taxes and Discounts

Including taxes and discounts in a payment request is essential for accurately reflecting the total amount due. Whether you need to apply a tax rate or offer a discount for early payment, these adjustments help ensure the final amount is correct and transparent. Understanding how to properly calculate and display these figures can prevent confusion and disputes with clients.

Adding Taxes

When including taxes, it’s important to apply the correct rate based on your location, industry, and the type of service or product provided. Taxes can vary significantly, so make sure to check the current rates and determine how they apply to your transaction.

- Identify the Tax Rate: Research the applicable tax rate for your location or industry (e.g., sales tax, VAT, GST).

- Calculate the Tax Amount: Multiply the total cost by the tax rate to determine the amount to be added.

- Include a Line for Tax: Clearly label the tax amount in the document so that the client can easily see the breakdown.

Applying Discounts

Offering a discount can incentivize timely payments or reward loyal customers. Discounts can be applied either as a fixed amount or a percentage of the total cost, depending on your business policies.

- Specify the Discount Type: If it’s a percentage, indicate the percentage rate (e.g., 10% off). If it’s a fixed amount, list the dollar value.

- Clearly State the Terms: Include any conditions for receiving the discount, such as early payment or special promotions.

- Deduct the Discount: Subtract the discount from the total amount before calculating taxes to ensure the discount is applied correctly.

By including taxes and discounts in your documents accurately, you provide clear and transparent pricing for your clients. This not only ensures that both parties are on the same page regarding the total amount due, but also helps to build trust and professionalism in your transactions.

Understanding Payment Terms in Invoices

Clear payment terms are essential for avoiding confusion and ensuring that both the business and the client are on the same page regarding expectations. These terms outline how and when payment should be made, as well as any additional conditions such as late fees or early payment discounts. A well-defined set of terms helps streamline the financial transaction and reduces the risk of payment delays or disputes.

Key Elements of Payment Terms

Payment terms typically include the due date, accepted payment methods, and any additional conditions related to payment timing. Below are the most important elements that should be considered when setting up payment terms:

| Payment Term | Description | Example |

|---|---|---|

| Due Date | The date by which the payment must be received. | Payment due within 30 days from the issue date. |

| Payment Methods | The acceptable forms of payment for the transaction. | Bank transfer, credit card, PayPal, etc. |

| Late Fees | Additional charges if the payment is not made by the due date. | Late fee of 5% if not paid within 15 days past due. |

| Early Payment Discount | A discount for clients who pay before the due date. | 5% off if payment is made within 10 days. |

Why Payment Terms Matter

Clearly defined payment terms benefit both the business and the client. For the business, they ensure predictable cash flow and reduce the likelihood of delayed payments. For the client, transparent terms reduce uncertainty and help them plan their payments accordingly. Having these terms in writing helps avoid misunderstandings and creates a more professional and trustworthy relationship.

Including specific payment terms in your billing documents ensures that both parties are clear on expectations, creating a smoother, more efficient transaction process.

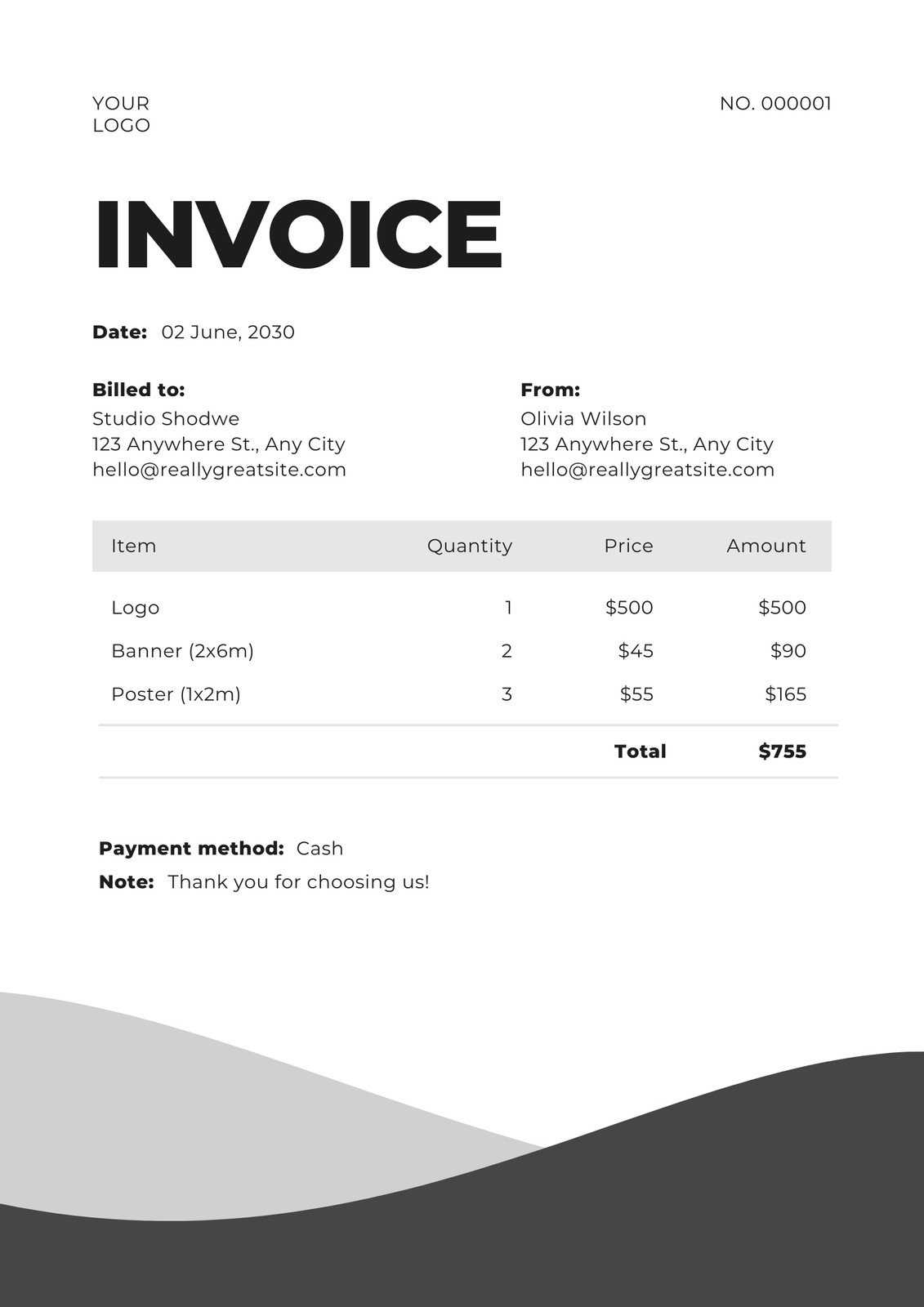

How to Format Your Invoice Properly

Proper formatting is crucial when creating a billing document as it ensures clarity, professionalism, and ease of understanding. A well-organized document not only reflects well on your business but also makes it easier for your client to review the charges and make timely payments. The layout and structure should be simple, logical, and easy to navigate, highlighting all necessary details without overwhelming the recipient.

Here are key elements to consider when formatting your document:

| Section | Description | Example |

|---|---|---|

| Header | Clearly display your business name, logo, and contact information. Include the client’s details as well. | Business Name, Address, Phone Number, Email; Client Name, Address, Email |

| Reference Number | Assign a unique identification number for easy tracking and record-keeping. | Invoice #12345 |

| Service Description | Provide clear and detailed descriptions of the services or products provided. Include any relevant dates, quantities, or additional notes. | Consulting for website redesign – 10 hours; Graphic design services – 2 logos |

| Cost Breakdown | List the cost of each item, including taxes or fees, and any discounts applied. | Consulting: $500; Graphic design: $300; Tax (5%): $40; Total: $840 |

| Payment Terms | Clearly define the payment due date, accepted payment methods, and any applicable late fees or early payment discounts. | Due by 30 days; Payment via bank transfer or credit card; Late fee of 2% per month after due date |

| Footer | Include additional information like your business’s payment details or terms and conditions, if necessary. | Bank account details; Terms of service |

By ensuring that each section is clearly organized and visually separated, you make it easier for your clients to understand the charges and terms associated with the transaction. A clean and professional format not only facilitates smoother financial dealings but also helps build trust and credibility with

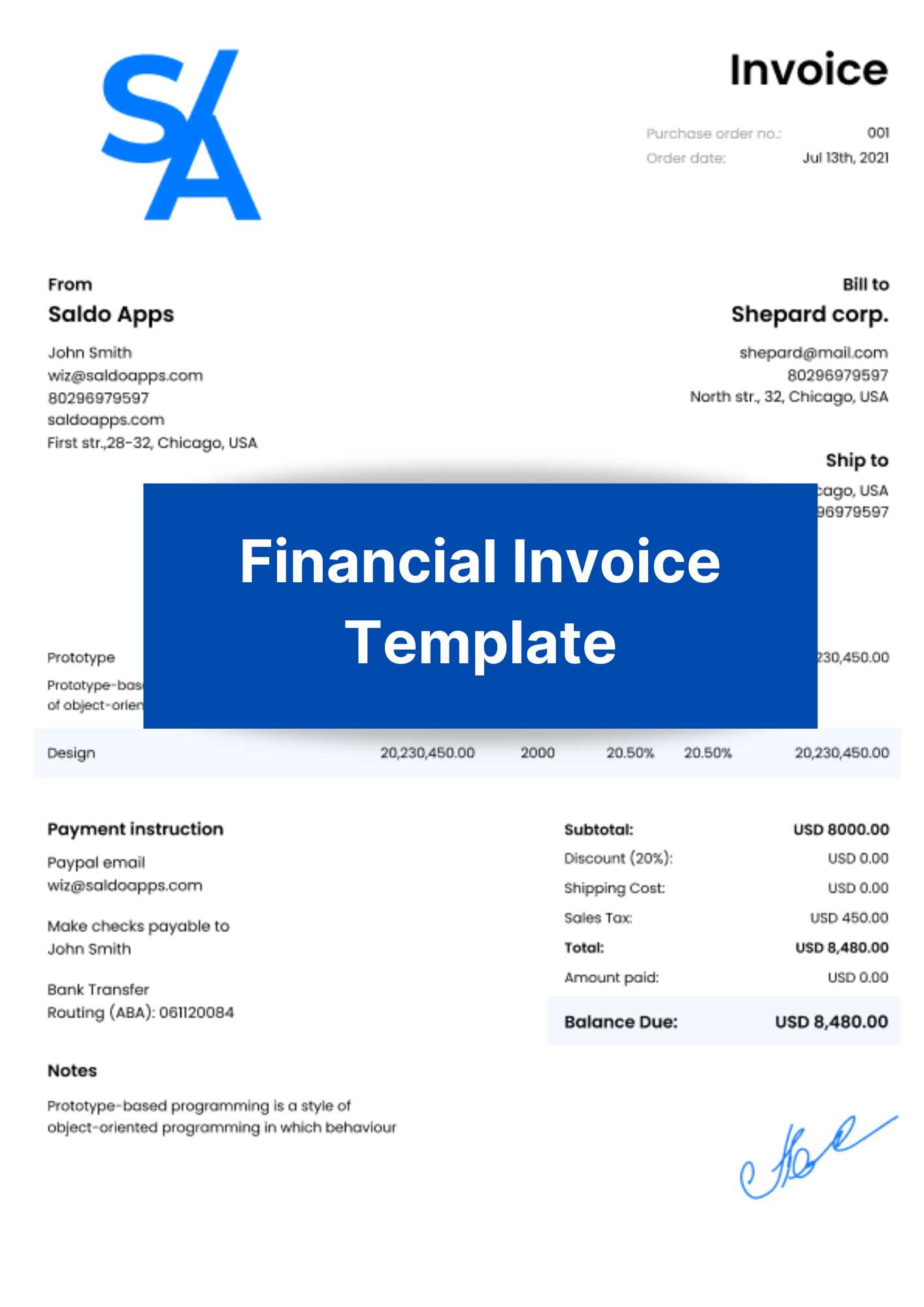

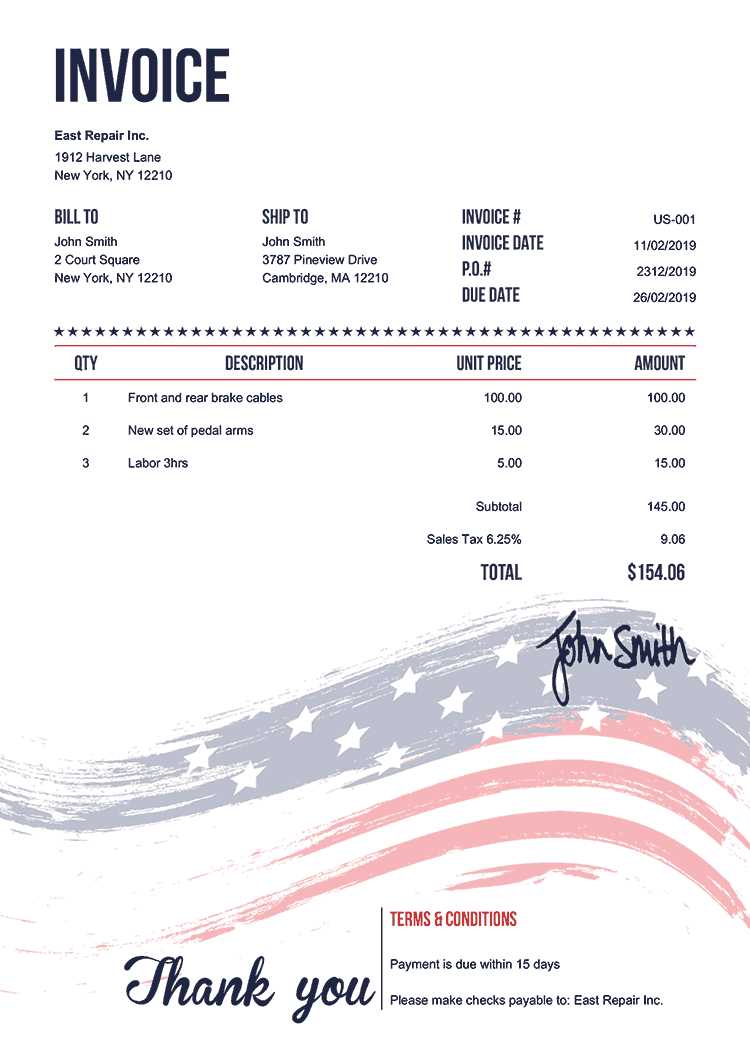

Creating Professional Invoice Designs

A well-designed billing document is an essential tool for any business, offering both functionality and a polished, professional appearance. A well-thought-out design can make a significant impact, reflecting the quality and reliability of your business. When creating a professional design, it’s important to consider visual clarity, branding, and ease of use to ensure that your document communicates the necessary information in a clean and organized manner.

Key Elements of a Professional Design

To create an effective and professional layout, several key design elements should be considered. These elements help to enhance readability, reinforce your brand identity, and make the document more visually appealing:

- Branding Consistency: Incorporate your logo, business colors, and fonts to ensure consistency with your other marketing materials.

- Clean Layout: Maintain a balanced, uncluttered design. Clear headings, ample white space, and logical flow of information make it easier for clients to read and understand.

- Legible Typography: Choose easy-to-read fonts, with clear distinctions between headings, subheadings, and content. Use appropriate font sizes to ensure clarity.

- Professional Color Scheme: Stick to a limited color palette that complements your branding. Avoid overly bright or distracting colors that may take away from the message.

Enhancing User Experience

In addition to the aesthetics, it’s important to ensure that the layout enhances the client’s experience. A well-structured design facilitates quick access to crucial information, reducing any confusion or potential delays in payment:

- Logical Structure: Organize the content in a logical sequence, with clearly defined sections for each detail such as client information, services provided, payment terms, and total amount.

- Easy-to-Find Payment Information: Make payment instructions or account details prominent and easy to find to encourage timely payment.

- Interactive Elements: Consider adding interactive elements like clickable payment links or buttons if sending the document digitally, allowing clients to pay directly from the document.

By combining these elements, you can create a document that not only looks professional but also serves its purpose effectively, helping you maintain a strong and trustworthy business image while streamlining the payment process.

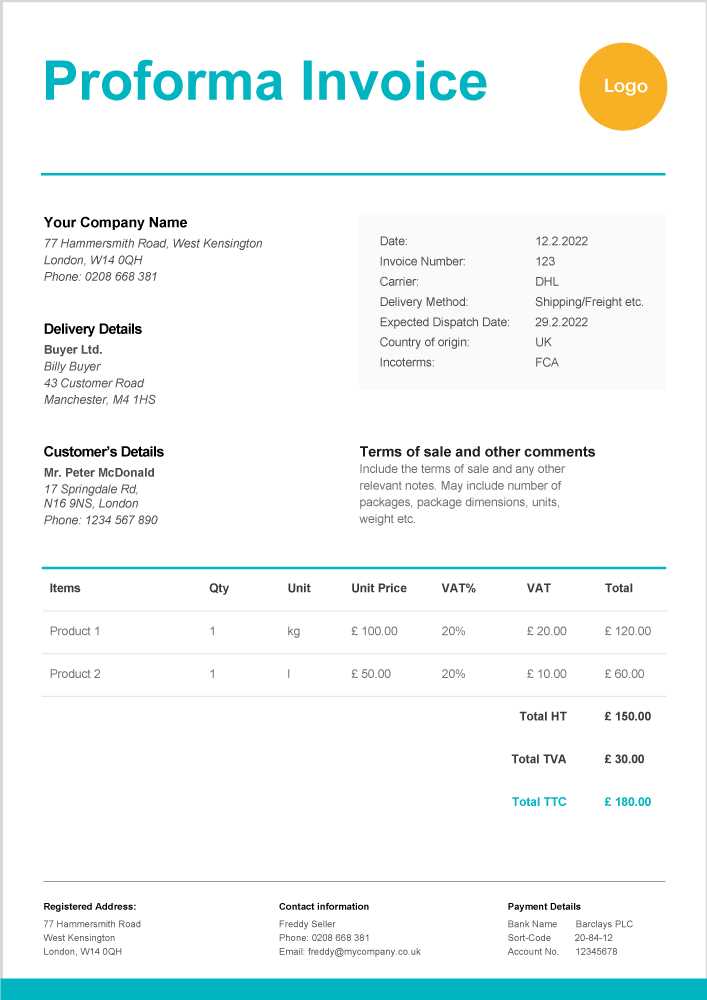

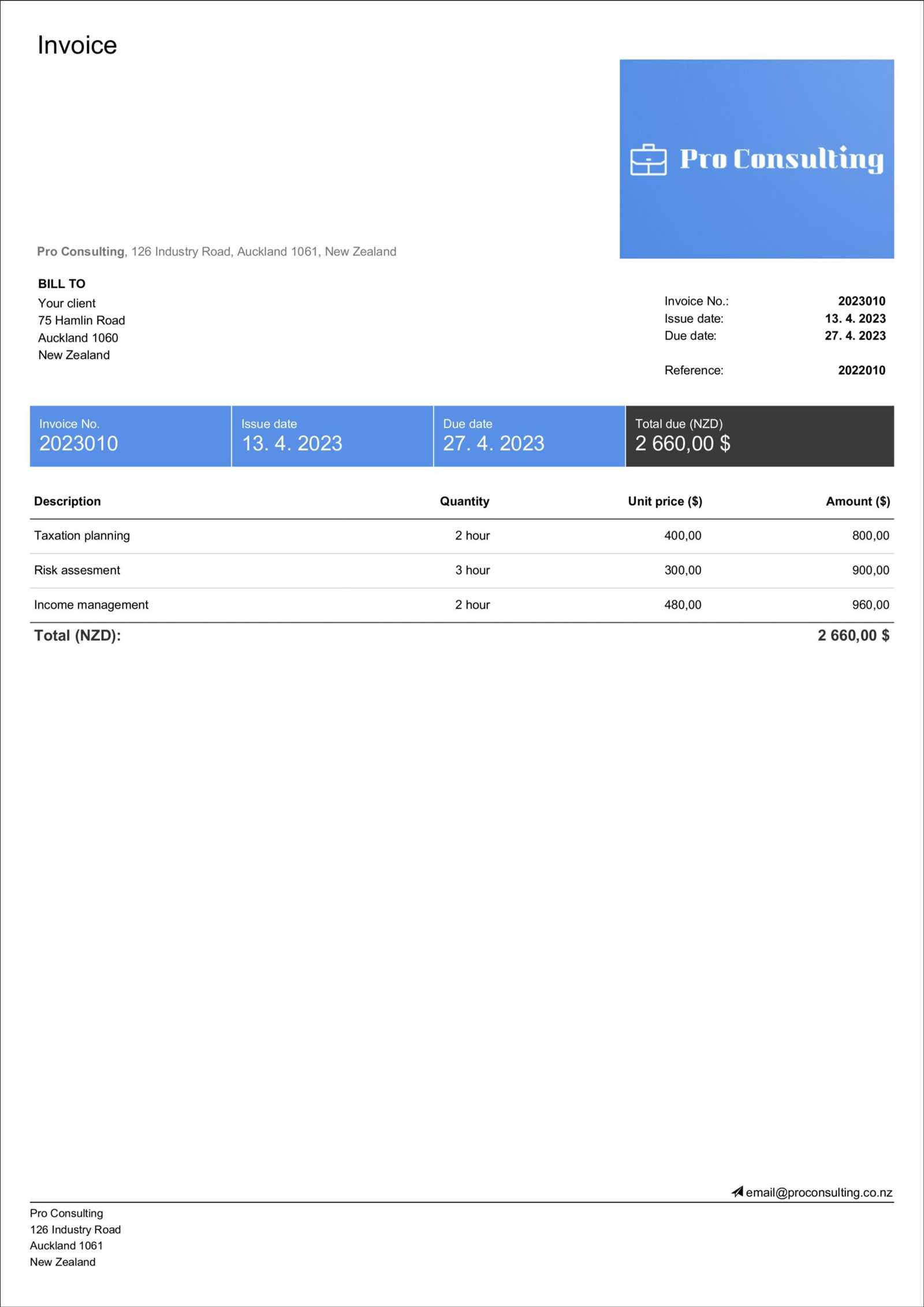

Invoice Templates for Different Industries

Every industry has its unique set of needs when it comes to billing documentation. Whether you’re a freelancer, a retail business, or a service provider, the way you structure and present your payment requests can vary depending on the type of service or product offered. Understanding how to customize your documents based on your industry can help ensure that all relevant details are included and that your clients have a smooth and clear experience when reviewing your charges.

Billing Documents for Service-Based Businesses

For service-based businesses, billing documents often require a detailed breakdown of hours worked, services rendered, or specific tasks completed. These documents should emphasize clarity regarding the scope of services to avoid misunderstandings.

- Hourly Rates: List the hourly rate and the number of hours worked.

- Detailed Descriptions: Provide thorough descriptions of the services provided to ensure transparency.

- Project Milestones: For long-term projects, consider breaking down the charges by phases or milestones.

Billing Documents for Product-Based Businesses

Businesses selling products require a different structure that focuses on itemized costs, quantities, and taxes. These documents should highlight each product, its unit price, and any applicable discounts or fees.

- Itemized List: Include each product with a description, quantity, and unit price.

- Shipping Costs: Don’t forget to include shipping or handling fees if applicable.

- Applicable Taxes: Clearly display the tax rate and the amount of tax applied to the total sale.

Billing Documents for Consulting Firms

Consultants often deal with complex pricing structures that may involve retainers, hourly rates, or flat fees. A clear document is essential to ensure clients understand what they are paying for, and how much they are being charged for each service rendered.

- Retainers: If you’re using a retainer model, clearly outline the number of hours covered and the rate for additional services.

- Breakdown of Work: Include a detailed list of consultations or deliverables provided during the billing cycle.

- Payment Terms: Outline payment deadlines and any deposit requirements if applicable.

By tailoring your billing documents to fit the needs of your specific industry, you can ensure that clients understand the value of your work and the costs associated with it, leading to smoother transactions and stronger business relationships.

Tracking Payments with Fee Invoices

Efficiently tracking payments is a crucial part of managing any business. It helps ensure that you are paid on time, identifies any outstanding balances, and provides a clear financial record for both you and your clients. By properly recording payment statuses and maintaining detailed records, you can minimize the risk of missed payments and resolve any payment-related issues swiftly.

To track payments effectively, it’s important to include specific sections in your billing documentation that allow you to monitor payment progress. These sections not only help you stay organized but also provide your clients with a clear overview of their payment status.

| Section | Description | Example |

|---|---|---|

| Payment Due Date | Clearly mark the payment due date to help both you and your client track when payment is expected. | Due by 30th November 2024 |

| Payment Status | Track whether the payment is “Paid”, “Pending”, or “Overdue” to easily manage outstanding balances. | Status: Pending |

| Partial Payments | If the client is making partial payments, make sure to list the amount paid and the remaining balance. | Paid: $200, Remaining: $300 |

| Payment Method | Specify how the payment was made (e.g., bank transfer, credit card, check, etc.) to keep a record of transactions. | Paid via bank transfer |

Regularly updating these details will allow you to track your receivables and prevent any confusion about unpaid amounts. Additionally, keeping this information up to date will help during financial reporting, audits, and when addressing payment discrepancies. By including these tracking elements in your billing documents, you maintain control over your accounts receivable and ensure transparency with your clients.

Best Tools for Invoice Management

Managing billing documents efficiently is vital for maintaining cash flow and ensuring that all transactions are recorded properly. Whether you’re a freelancer, small business owner, or part of a larger organization, using the right tools can help streamline the process, reduce human error, and improve your overall financial management. These tools not only simplify the creation and sending of payment requests but also help track outstanding balances, manage multiple clients, and keep your financial records organized.

Here are some of the top tools to consider for managing your billing and payments:

- QuickBooks: A highly popular choice among small businesses and freelancers, QuickBooks offers comprehensive financial management features, including invoice creation, expense tracking, and payment management.

- FreshBooks: Known for its user-friendly interface, FreshBooks makes it easy to create professional-looking bills, track payments, and send reminders to clients. It’s especially useful for service-based businesses and freelancers.

- Zoho Invoice: Ideal for businesses of all sizes, Zoho Invoice provides customizable billing options, automated reminders, and seamless integration with other Zoho software for a complete accounting solution.

- Wave: A free, cloud-based software that offers a range of invoicing and accounting features, including recurring bills, payment tracking, and real-time updates on client balances.

- PayPal Invoicing: A great tool for businesses that already use PayPal for transactions. It allows you to create and send digital payment requests, track payments, and manage invoices easily within the PayPal interface.

- AND.CO: Perfect for freelancers and small businesses, AND.CO offers a range of tools for creating, tracking, and managing billing documents, along with additional features like time tracking and contract generation.

Each of these tools offers unique features suited to different business needs, so selecting the right one depends on the size of your business, the complexity of your billing process, and your preferred way of working. By using the best tools for managing your billing documents, you can save time, stay organized, and ensure that your financial transactions are always up to date.

How to Protect Invoice Data

Securing sensitive financial information is essential for any business, as improper handling or unauthorized access can lead to data breaches, fraud, and loss of trust. When managing payment documents, it’s crucial to implement effective security measures to safeguard both your own business data and your clients’ details. By adopting best practices for data protection, you can prevent unauthorized access and ensure that all sensitive information remains confidential.

Best Practices for Securing Payment Documents

There are several strategies you can use to enhance the security of your financial documents. These measures help protect the integrity of your data and ensure that your business complies with legal and industry standards for privacy:

| Security Measure | Description | Example |

|---|---|---|

| Encryption | Encrypt payment documents to prevent unauthorized parties from viewing the data. Encryption converts information into a secure format that is only readable by authorized users. | Use encrypted PDFs or secure cloud services with end-to-end encryption. |

| Secure Payment Platforms | Use trusted payment gateways and platforms that offer secure transaction processing to protect financial data during transfers. | Platforms like PayPal, Stripe, or Square offer secure payment processing. |

| Strong Passwords | Ensure that all accounts used for managing payment records are protected by strong, unique passwords. Avoid using easy-to-guess information. | Use a combination of letters, numbers, and special characters, and enable two-factor authentication. |

| Restricted Access | Limit access to sensitive financial records to authorized personnel only. Ensure that those handling financial documents understand the importance of confidentiality. | Implement role-based access control (RBAC) within your accounting software. |

| Regular Audits | Conduct periodic audits to ensure that there have been no unauthorized changes to financial documents and that your security practices are being followed. | Review payment documents and logs on a quarterly basis to identify any irregularities. |

Additional Security Measures

In addition

Invoice Template Best Practices

Creating a well-structured billing document is essential for maintaining clear communication with clients and ensuring smooth transactions. A properly designed document not only makes it easier for clients to understand the charges but also helps maintain a professional image for your business. Following best practices when designing these documents can enhance their effectiveness and avoid misunderstandings or payment delays.

Here are some key best practices to consider when crafting your billing documents:

- Clear and Detailed Information: Ensure that your documents include all necessary details such as client information, descriptions of the products or services, payment terms, and total amounts. The more specific you are, the less room there is for confusion.

- Consistent Branding: Incorporate your business logo, colors, and font choices to maintain a professional and consistent image across all client communications.

- Organized Layout: Use headings, bullet points, and tables to organize the information in a way that makes it easy for clients to find what they need. A clean and readable design goes a long way in promoting professionalism.

- Accurate Calculations: Double-check all calculations to avoid any errors that could cause confusion or delays in payment. Include breakdowns of costs, taxes, and discounts if applicable.

- Payment Terms and Due Dates: Clearly state your payment terms, including the due date and accepted payment methods. This helps manage client expectations and encourages timely payments.

- Flexible Formats: Provide clients with different ways to access and pay, such as digital versions that can be downloaded or printed, and links to online payment platforms if applicable.

- Professional Language: Use formal, polite language that reflects your business’s tone. Clear communication is key to building strong client relationships.

By following these best practices, you ensure that your billing documents are not only functional but also contribute to a positive client experience, improving the likelihood of timely payments and long-term partnerships.

How to Handle Invoice Disputes

Disputes over payment documents are a common issue in business transactions. They can arise for various reasons, such as discrepancies in charges, misunderstandings about terms, or delays in delivery. Handling these disputes efficiently is crucial to maintaining good client relationships and ensuring that payments are processed smoothly. The key is to approach the situation with clarity, professionalism, and a focus on resolving the issue as quickly as possible.

Here are some steps to follow when handling disputes related to payment documents:

| Step | Action | Purpose |

|---|---|---|

| Step 1: Stay Calm and Professional | Respond to the dispute calmly and professionally, even if the client is upset. Avoid becoming defensive or confrontational. | Maintains a positive relationship and shows that you’re committed to resolving the issue fairly. |

| Step 2: Review the Document | Thoroughly check the payment document in question. Look for any errors or discrepancies that could have caused the dispute. | Ensures that you understand the issue and can provide a valid explanation or correction if needed. |

| Step 3: Communicate Clearly | Contact the client to discuss the issue. Provide clear and concise information regarding the charges, terms, and any potential misunderstandings. | Promotes transparency and clarity, helping to resolve confusion and build trust. |

| Step 4: Offer Solutions | If the dispute is valid, offer a solution, such as a discount, a corrected document, or an alternative payment arrangement. If no error is found, provide a clear explanation. | Demonstrates your willingness to resolve the issue and ensures that the client feels heard and valued. |

| Step 5: Document the Resolution | Once the dispute is resolved, document the agreed-upon solution in writing and send an updated payment document, if necessary. Ensure both parties have a clear record of the resolution. | Helps prevent future misunderstandings and provides a reference point in case of further issues. |

By following these steps, you can manage disputes effectively and maintain a positive relationship with your clients. Timely and transparent communication, along with a willingness to find mutually agreeable solutions, is key to preventing conflicts from escalating and ensuring that business transactions run smoothly.

Automating Invoice Creation for Efficiency

Automating the process of creating payment documents can significantly improve the efficiency of your business operations. Instead of manually entering details for each transaction, automation tools allow you to generate these documents quickly, ensuring consistency, reducing errors, and saving valuable time. Whether you’re managing a large volume of transactions or just want to streamline your workflow, automation can provide you with the tools to handle financial records seamlessly.

Advantages of Automating Payment Document Creation

There are several key benefits to implementing automated systems for generating payment documents:

- Time Savings: Automation eliminates the need for manual data entry, allowing you to generate payment documents instantly, freeing up time for other important tasks.

- Accuracy and Consistency: Automated systems reduce human errors and ensure that all documents are consistent in format, calculations, and content, enhancing professionalism.

- Customization: Many automation tools allow you to customize payment documents to suit your brand, including logos, color schemes, and specific terms, providing a tailored approach to client communications.

- Better Record Keeping: With automation, payment documents are easily saved, tracked, and organized. This ensures better financial record-keeping and easier access for future reference or audits.

- Reduced Administrative Costs: By cutting down on manual tasks, automation helps reduce the time spent on administrative duties, lowering overhead costs for your business.

Steps to Automate Payment Document Creation

To start automating your payment document creation, follow these steps:

- Choose the Right Software: Select a tool or software that suits your business needs. Many platforms offer automation features that integrate with your accounting system.

- Set Up Client Profiles: Input client details, such as contact information and payment terms, into the system for faster document generation.

- Create Templates: Design document templates that include your business logo, payment terms, and common charges. This way, you can reuse the same layout without starting from scratch every time.

- Automate Data Entry: Integrate your automation system with other platforms, such as your CRM or sales system, so that transaction details are automatically transferred to payment documents.

- Enable Recurring Billing: For clients with regular billing cycles, set up recurring payments to automatically generate documents on a schedule.

By automating payment document creation, you can greatly enhance the efficiency of your financial processes, leaving you with more time to focus on growing your business and maintaining positive client relationships.