Download and Customize Shipping Invoice Template in Excel

Managing the financial side of deliveries can be a complex task without the right tools. With the proper structure in place, you can easily track the cost of goods, services, and associated fees. Organizing this data in a clear and efficient manner not only saves time but ensures accuracy and minimizes errors. An organized system is crucial for businesses that deal with frequent shipments or product dispatches, whether locally or internationally.

Customized documents for recording transactions can be a game-changer. When tailored to your business’s specific needs, these documents simplify the process of invoicing and payment collection. The ability to automate calculations and track key details directly reduces administrative burdens and ensures seamless operations.

In this article, we will explore the most effective ways to create and utilize such documents, offering practical advice on how to enhance efficiency in your workflow. Whether you’re a small business or a large enterprise, implementing a well-designed system can significantly impact your bottom line and client satisfaction.

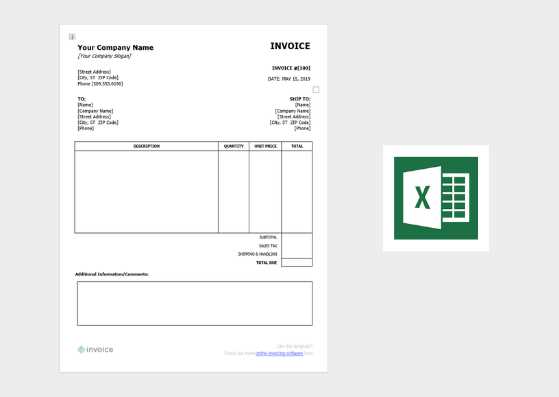

Shipping Invoice Template Excel Overview

Efficiently managing billing and payment records for deliveries requires a structured document to track all necessary details. By creating a standardized form, businesses can ensure that all relevant information is organized in a consistent manner. This approach saves time and reduces errors, especially for companies that frequently process shipments or handle complex orders. A well-designed system not only streamlines record-keeping but also enhances communication with clients by providing clear, easy-to-understand documents.

Key Benefits of Using Structured Documents for Deliveries

- Accuracy: Automating calculations and organizing data in a systematic format helps prevent mistakes.

- Efficiency: Standardized documents save time by eliminating the need for manual data entry or calculation.

- Consistency: Every transaction is recorded in the same way, making it easier to track and reference.

- Professionalism: Customizable forms allow businesses to create a branded and polished document for clients.

How These Documents Enhance Business Operations

These structured forms are ideal for businesses dealing with product shipments, allowing for seamless integration into financial and logistics workflows. They typically include fields for essential information such as item details, shipping costs, taxes, and payment terms. By using such a system, companies can easily monitor each transaction, track outstanding balances, and ensure timely payments. This level of organization not only aids in internal record-keeping but also contributes to improved client relationships through clear and transparent documentation.

What is a Shipping Invoice Template?

A structured document used to record the details of transactions related to goods or services is essential for efficient business operations. Such a document helps businesses clearly outline the charges, terms, and conditions involved in each sale or delivery, ensuring that both parties have a clear understanding of the transaction. It also serves as a formal record for accounting and payment purposes.

At its core, this type of document is designed to capture essential information about the delivery process and related costs. By having a pre-built structure, businesses can easily input data without having to create a new document from scratch each time, which saves time and ensures consistency.

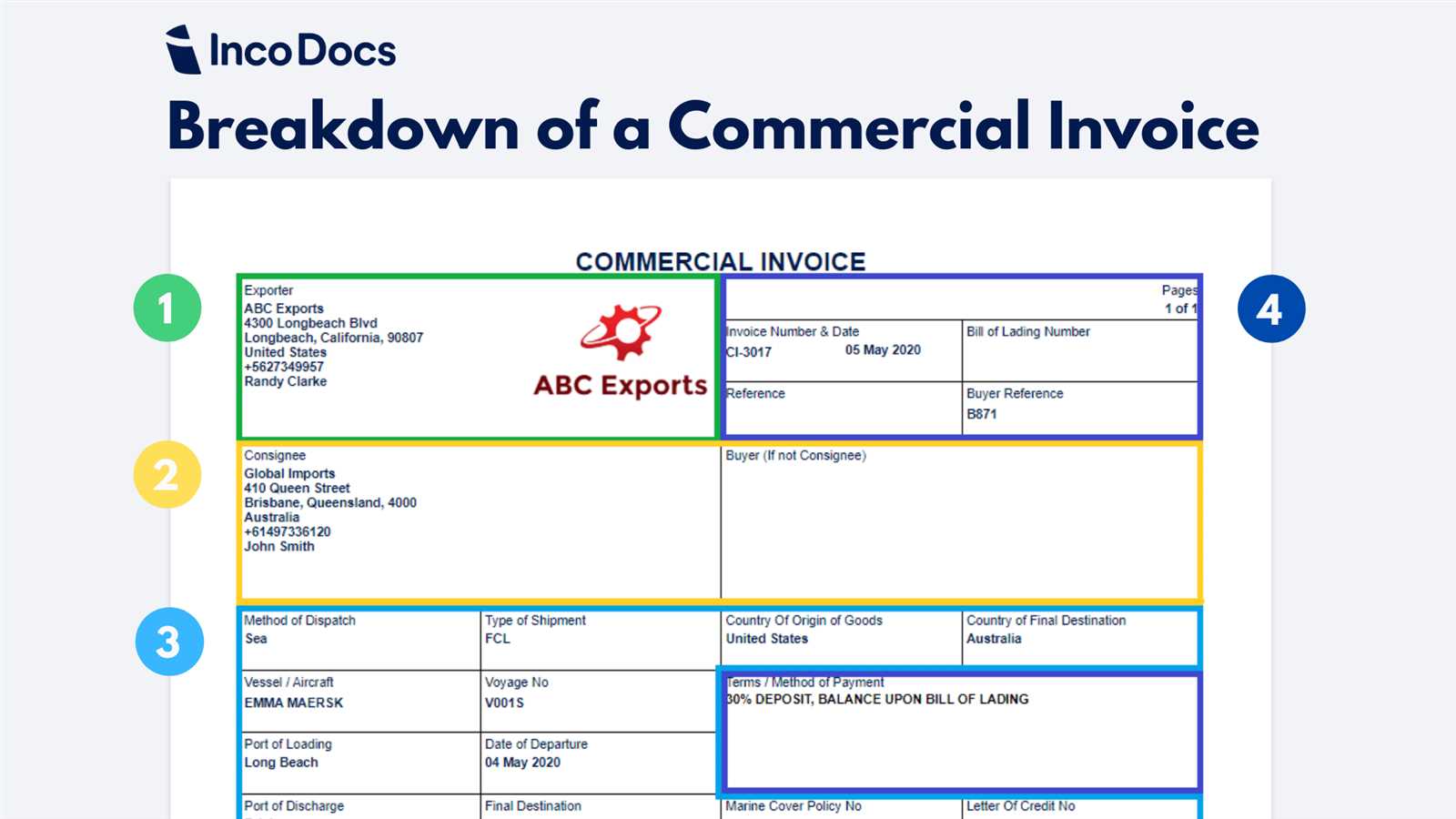

Key Elements Typically Included in These Documents

- Item Details: Information about the products or services being delivered, including quantities and descriptions.

- Cost Breakdown: A clear listing of all associated costs, such as unit prices, shipping fees, and taxes.

- Payment Terms: The terms under which payment is expected, such as due dates or installment options.

- Recipient Information: Contact details of the buyer or recipient, including shipping address.

- Transaction Dates: Dates of order and expected delivery or payment deadlines.

By using a ready-made structure, businesses ensure that they capture all necessary data and maintain accuracy in their financial records. This organized approach not only simplifies internal workflows but also helps maintain a professional and consistent image with clients and partners.

Benefits of Using Excel for Invoices

Using spreadsheet software for managing billing records offers numerous advantages for businesses. It provides a flexible and efficient way to organize, calculate, and track financial details. With its built-in functions and customizable features, spreadsheet software is a valuable tool for creating accurate documents that streamline the entire process, from data entry to payment tracking.

Ease of Customization and Automation

One of the primary benefits of using spreadsheets is the ability to easily customize the layout and functionality according to specific business needs. Fields can be adjusted, and complex formulas can be integrated to automatically calculate totals, taxes, and discounts, reducing the likelihood of human error. Additionally, formulas and templates can be reused across multiple transactions, saving significant time on future entries.

Improved Organization and Accessibility

Another significant advantage is the ability to organize and store all records in one central location. With spreadsheet software, you can maintain a comprehensive database of past transactions, making it easier to reference previous records or track payments over time. Moreover, digital files can be easily shared, stored, and accessed from any device, offering both flexibility and convenience.

Overall, using spreadsheets to manage financial documentation simplifies many aspects of the billing process, enhancing efficiency, reducing errors, and improving overall business operations.

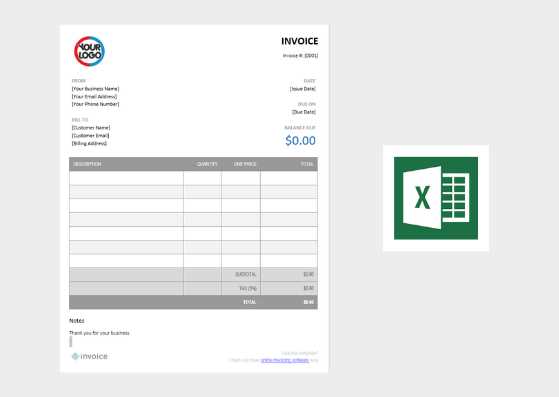

How to Create a Shipping Invoice in Excel

Creating a well-organized record for deliveries and payments can be done easily with the right software. By setting up a structured document, you can ensure that all the necessary details are included, such as item descriptions, quantities, pricing, and payment terms. This process allows for greater consistency and accuracy, while also saving time on manual data entry.

To get started, follow these simple steps to set up your document:

- Open a New Document: Start with a blank sheet in your preferred software to create a clean slate for your new document.

- Add Key Information: In the first rows, include basic details like company name, contact information, and document number. This ensures each document is easily identifiable.

- List Items or Services: Create columns for item descriptions, quantities, prices, and total costs. You can use formulas to automatically calculate totals and taxes.

- Include Payment Terms: Clearly outline when payment is due and any relevant discounts or late fees. This ensures both parties are on the same page.

- Finalize and Review: Double-check all fields for accuracy. Ensure totals are calculated correctly and that all necessary details are included before sending the document to the client.

By following these steps, you can create a functional and professional document that is easy to update, share, and track. The flexibility of the software allows for future adjustments, making it a long-term solution for your billing needs.

Essential Elements of a Shipping Invoice

To ensure a smooth transaction and avoid confusion, it’s crucial to include all necessary details in a billing document. Each section of the record should provide clear, concise information about the products, services, and payment expectations. A well-structured document minimizes errors, improves communication, and helps both businesses and clients stay organized throughout the process.

Key Components to Include

- Business Information: Include your company’s name, address, and contact details. This ensures that your client knows who to reach out to for inquiries.

- Client Information: Make sure the recipient’s details–name, address, and contact–are listed accurately to avoid shipping issues and ensure proper communication.

- Item Details: List each item or service provided, along with a clear description, quantity, unit price, and total cost. This ensures transparency and helps the client understand exactly what they are paying for.

- Pricing and Taxes: Include a breakdown of any applicable taxes, shipping fees, or other additional costs, along with the final total amount due.

- Payment Terms: Clearly state when payment is due, any available discounts, and penalties for late payments. This helps prevent misunderstandings between the business and the client.

Additional Optional Elements

- Unique Reference Number: A unique number or code for each document helps with easy tracking and reference for future communication.

- Dates: The date of the transaction, as well as any relevant deadlines, should be listed to provide context for the payment terms.

- Delivery Information: If applicable, include shipment tracking details, expected delivery dates, or delivery instructions to ensure smooth logistics.

By including these essential elements, you can create a clear and professional document that ensures both parties understand their obligations and rights, reducing the potential for confusion or disputes.

Customizing Your Shipping Invoice Template

Personalizing your billing document allows you to align it with your business’s branding and specific operational needs. By adjusting the layout, adding or removing fields, and incorporating business-specific details, you can create a more efficient and professional tool for managing transactions. Customization not only enhances the document’s clarity but also improves its functionality, making it easier for both you and your clients to navigate the important details.

Steps to Personalize Your Billing Record

- Adjust Layout and Design: Tailor the structure of the document to highlight the most important information, such as item lists, pricing, and payment terms. You can also add your company logo, colors, or a custom font to make the document look professional and consistent with your brand.

- Add Specific Business Fields: If your business deals with special conditions (e.g., discounts, installment payments), include relevant sections to capture this information. Custom fields like “custom order number” or “project details” can make tracking and managing multiple transactions easier.

- Automate Calculations: Integrate formulas to automatically calculate totals, taxes, and other additional fees. This will save time and prevent manual calculation errors.

- Set Up Payment Terms: Customize the payment due date, late fees, and any discounts for early payments based on your business policies.

Advanced Customization Tips

- Include Multiple Payment Methods: Add a section for different ways to pay, such as bank transfers, credit cards, or online payment systems, based on your business’s offerings.

- Integrate Client Information: For frequent clients, consider adding pre-filled information like billing addresses or previous order numbers to streamline the process.

- Use Conditional Formatting: For greater clarity, use color coding or bold text for overdue payments or high-priority items.

Customizing your document helps ensure that it meets the unique needs of your business while making it easy for clients to understand. A well-tailored record can also reinforce your brand identity and build client trust through professional presentation.

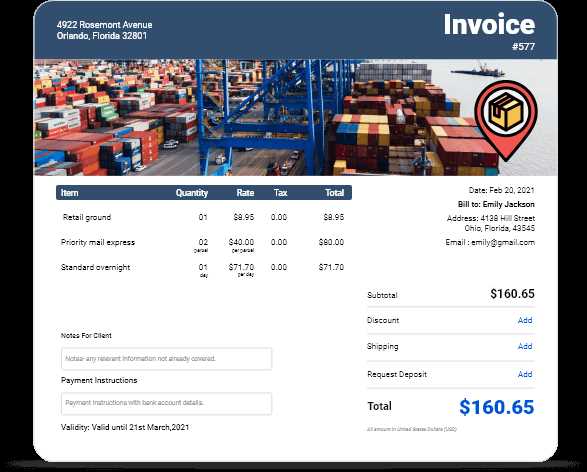

Tracking Shipments with Excel Invoices

Effective tracking of deliveries and payments is essential for businesses that deal with regular transactions. By integrating tracking features into your billing records, you can monitor the progress of orders, ensure timely deliveries, and easily reference any outstanding payments. A well-organized system provides clarity, reduces confusion, and helps businesses stay on top of their logistics and finances.

Using Spreadsheets to Track Orders

One of the key advantages of using a spreadsheet for managing transactions is the ability to track multiple shipments in one place. You can create columns that capture essential details such as the order date, shipment status, expected delivery date, and any tracking numbers. By doing so, you create a centralized database that allows you to quickly check the status of each order and ensure that everything is proceeding according to plan.

Helpful Features for Shipment Tracking

- Tracking Numbers: Including tracking numbers directly in your document allows you to quickly reference the status of each delivery with carriers.

- Status Updates: Adding a “status” column where you can mark orders as “dispatched,” “in transit,” or “delivered” helps you monitor progress easily.

- Conditional Formatting: Using color codes for different shipment statuses (e.g., green for delivered, yellow for in transit) makes it easy to spot delays or completed orders at a glance.

- Automated Alerts: By linking your spreadsheet to other software or setting reminders for delivery deadlines, you can receive alerts when shipments are due or overdue.

Incorporating these tracking features into your system enhances your ability to manage logistics efficiently and provides real-time updates on all ongoing transactions. This transparency not only keeps your team informed but also strengthens your customer relationships by ensuring that you can always provide up-to-date information about their orders.

How to Automate Invoice Calculations in Excel

Automating calculations in your billing records can save valuable time and reduce human error. By setting up simple formulas and functions, you can ensure that totals, taxes, discounts, and other charges are calculated automatically every time a new transaction is entered. This not only streamlines the process but also helps maintain consistency and accuracy across all records.

Setting Up Basic Calculations

To begin automating calculations, you can use basic formulas to add, subtract, multiply, and divide values within your document. For example, when listing the prices of multiple items, you can use the SUM function to automatically calculate the total cost. Similarly, to calculate taxes, you can apply a simple multiplication formula based on a fixed tax rate.

- Sum of Items: Use the =SUM(cell range) function to calculate the total for multiple items.

- Tax Calculation: Apply =price * tax rate to determine the amount of tax based on the item price.

- Total Calculation: Use =item total + tax to calculate the final amount due.

Advanced Features for Automation

For more complex scenarios, such as discounts or tiered pricing, you can use advanced functions like IF statements or VLOOKUP. These functions allow you to apply specific conditions, such as applying a discount only when an order exceeds a certain amount, or referencing a table to calculate varying prices based on quantity.

- Conditional Discounts: Use the IF function to apply discounts based on conditions, such as =IF(order total > 100, order total * 0.9, order total) for a 10% discount on orders over $100.

- Dynamic Pricing: Use VLOOKUP to pull pricing information from a separate table based on quantity or other factors.

By implementing these automated calculations, you can reduce the time spent on manual entry and ensure greater accuracy in your financial records. Automation not only simplifies the process but also enhances your ability to handle larger volumes of transactions without the risk of errors.

Tips for Designing Clear Shipping Invoices

Creating a well-organized and easy-to-read document is essential for both businesses and clients. When designing your billing records, clarity should be your top priority. A document that is structured logically, with a clean layout and clearly labeled sections, makes it easier for your clients to understand the charges, terms, and other important details. A well-designed document not only helps maintain professionalism but also improves communication and reduces the chance of disputes.

Key Design Principles

- Keep It Simple: Avoid clutter by limiting unnecessary information and using a simple, straightforward design.

- Use Consistent Formatting: Ensure uniform font styles, sizes, and spacing to create a cohesive look throughout the document.

- Highlight Key Information: Use bold or larger font sizes for important sections such as totals, payment terms, and due dates.

- Organize Information Effectively: Group related information together and use clear headings for each section to make it easy to locate specific details.

Designing a Clear Table Layout

A table layout is one of the most effective ways to present itemized information. It allows you to display the necessary details in a structured manner, making it easier for both parties to understand the breakdown of costs.

| Description | Quantity | Unit Price | Total Cost |

|---|---|---|---|

| Product A | 2 | $20 | $40 |

| Service B | 1 | $50 | $50 |

| Shipping Fee | – | – | $10 |

| Total | – | – | $100 |

This layout provides a clear breakdown of each item, its quantity, individual price, and the total cost. The final total is emphasized to make it easy to identify. When designing your table, be sure to leave enough space between rows for readability and use consistent alignment for numbers.

By following these design tips, you can ensure that your documents are not only professional and easy to read but also effective in conveying the necessary details to your clients in a clear and understandable way.

Using Formulas to Simplify Shipping Invoices

Incorporating automated calculations into your billing records can greatly reduce the time spent on manual math and improve accuracy. By using built-in formulas, you can quickly calculate totals, taxes, discounts, and other important financial details. This allows you to streamline your workflow, avoid errors, and ensure that every transaction is processed efficiently and correctly.

Formulas are a powerful tool that can simplify complex tasks. Instead of manually calculating each amount, formulas can automatically adjust totals as data changes, making it easy to update records and keep them consistent. Here are a few key formulas that can help simplify your billing process:

- SUM Function: The =SUM() function is perfect for adding up the costs of multiple items. Simply enter the range of cells you want to total, and the formula will automatically calculate the sum.

- Multiplication for Totals: To calculate the cost of each item based on quantity and unit price, use the formula =Quantity * Unit Price. This ensures that each total is calculated correctly based on the entered data.

- Tax Calculation: To apply taxes, use a formula like =Item Total * Tax Rate. This will instantly calculate the tax amount based on the percentage you provide.

- Discounts: Apply discounts by using the IF function. For example, =IF(Order Total > 100, Order Total * 0.9, Order Total) will apply a 10% discount if the order exceeds $100.

These formulas not only save time but also reduce the risk of errors by automating repetitive tasks. Whether you’re managing a few transactions or handling a large volume, formulas help ensure that your financial calculations are always accurate and up to date.

By leveraging these tools, you can focus more on growing your business and less on time-consuming calculations, all while maintaining professional, error-free records for every transaction.

Common Mistakes to Avoid in Shipping Invoices

Creating accurate and professional billing records is essential to maintaining positive business relationships. However, mistakes can easily occur during the process, leading to confusion, payment delays, and even disputes. Recognizing common errors and knowing how to avoid them will help ensure that your financial documents are clear, correct, and reliable every time.

Frequent Errors in Billing Records

- Incorrect or Missing Information: Failing to include essential details like the client’s name, contact information, or correct order number can make it difficult to track payments and resolve issues. Always double-check the accuracy of the data before sending the document.

- Miscalculations: Manual errors in adding up totals, applying tax rates, or calculating discounts are common. These mistakes can lead to discrepancies in the final amount due and create frustration for both parties. Using automated formulas can help avoid this issue.

- Unclear Payment Terms: Not specifying payment deadlines or terms clearly can lead to misunderstandings. Always outline when the payment is due, accepted methods of payment, and any late fees or discounts for early payment.

- Overcomplicating the Layout: A cluttered and hard-to-read document can confuse the recipient. Use a clean, simple design with clear headings and organized sections to make the information easy to follow.

How to Prevent These Mistakes

- Double-Check Details: Before finalizing the document, verify all key details, such as customer info, pricing, and totals. Ensure everything is accurate and up to date.

- Automate Calculations: Using formulas to calculate totals, taxes, and discounts helps prevent errors in mathematical operations.

- Be Clear About Payment Terms: Clearly communicate your payment expectations, including due dates and applicable fees. Consider adding a reminder about the due date for extra clarity.

- Keep It Simple: Use a straightforward, clean layout with minimal distractions. Organize the document logically to make it easy for the recipient to review and understand the charges.

By avoiding these common mistakes and following best practices, you can create billing records that are professional, accurate, and easy to understand, leading to smoother transactions and stronger business relationships.

Integrating Shipping Invoices with Other Systems

Integrating your billing records with other business systems can greatly streamline your operations. By connecting financial documents with inventory management, customer databases, and accounting software, you can automate data entry, improve accuracy, and reduce manual work. This integration enables a seamless flow of information between systems, providing real-time insights into your business and enhancing efficiency across various departments.

Benefits of Integration

- Automated Data Syncing: When your billing system is integrated with other platforms, data such as customer details, product prices, and payment statuses are automatically updated across all systems, saving time and reducing the chance of errors.

- Real-Time Financial Tracking: Integration allows for up-to-date tracking of financial transactions, providing a clear view of cash flow and helping you make informed decisions.

- Improved Accuracy: By minimizing manual data entry, integration reduces human errors and ensures that all records are consistent and accurate.

- Better Customer Experience: With integrated systems, you can quickly provide customers with up-to-date status information and payment details, improving communication and customer satisfaction.

How to Integrate Your Billing System

Integrating your records with other systems requires a thoughtful approach. Below are a few common methods to consider:

- Use API Connections: Many modern platforms offer API integrations that allow you to connect your billing software with other systems, such as accounting or inventory management tools. This enables seamless data exchange between platforms.

- Cloud-Based Solutions: Cloud software often provides built-in integration options that allow different business systems to work together. This can simplify setup and ensure continuous synchronization.

- Custom Integration via Middleware: If your systems don’t support direct integration, middleware can act as a bridge, transferring data between platforms and ensuring that everything stays up to date.

- Accounting Software Integration: Syncing your billing documents with accounting tools can automate the transfer of transaction data, making financial reporting and tax preparation more efficient.

By taking advantage of integration, businesses can significantly reduce the time spent on administrative tasks and improve overall workflow. This allows for greater focus on core operations and better decision-making across the organization.

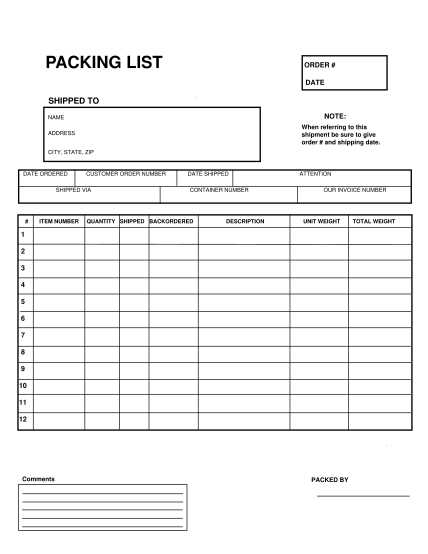

How to Handle Multiple Shipments in One Invoice

Managing several deliveries under a single billing record can seem challenging, but it’s essential for businesses that handle bulk orders or ongoing shipments. By organizing multiple transactions clearly and effectively, you can provide clients with a consolidated overview of all their orders, reducing confusion and ensuring they have all the necessary information in one place. This method not only saves time for your customers but also streamlines your record-keeping process.

When dealing with multiple shipments, the key is to ensure that each delivery is clearly distinguished, and all associated costs are transparently listed. Here’s how to handle this process effectively:

Organizing Multiple Shipments

- Break Down Each Shipment: Clearly list each shipment on a separate line or section of your document. Include all relevant details for each delivery, such as the date of dispatch, tracking numbers, destination, and itemized cost breakdown.

- Include Subtotals: For each shipment, calculate the subtotal before adding up the total for all deliveries. This will help you and your client clearly track the cost of each individual order.

- Group Related Shipments: If multiple shipments are part of the same order or are being sent to the same address, group them together under a common heading. This makes it easier to understand that they are part of a larger, connected transaction.

Finalizing the Total

- Summing Up the Costs: Once each shipment is accounted for individually, add up the subtotals to get a final total. Make sure to include any applicable taxes, fees, or discounts at this stage to ensure the final amount is accurate.

- Clarify Payment Terms: If the shipments are being invoiced separately but paid together, specify this in the document. Include the payment method, deadlines, and any applicable terms to ensure your client is clear about how to settle the total balance.

By organizing and clearly presenting all the details for multiple deliveries, you can make it easier for your clients to understand the full scope of their orders and ensure smooth processing of payments. This method also helps avoid errors, ensures transparency, and improves overall efficiency for both businesses and customers.

Setting Up Payment Terms in Excel Templates

Clearly defining payment terms in your financial documents is crucial for ensuring timely payments and avoiding confusion. Payment terms outline the conditions under which a client is expected to settle their balance, including deadlines, accepted payment methods, and any discounts or late fees. By setting up these terms correctly, you can help prevent payment delays and maintain smooth cash flow for your business.

Using automated financial documents provides a powerful way to consistently display these terms, making it easy to update and share them with clients. When designing your document, it’s important to specify the terms in a way that’s easy to understand and integrates well with the overall structure.

Incorporating Payment Terms

- Specify the Due Date: Clearly state the date when the payment is due. You can use a formula in your document to automatically calculate this date based on the date the document is issued, making it easier to track deadlines.

- Outline Accepted Payment Methods: Include a section where you specify the payment methods you accept (e.g., bank transfer, credit card, check). This helps ensure that clients know how to proceed with their payments.

- Include Discounts for Early Payment: If you offer a discount for early payment, make sure to note this in the terms. A formula can be used to automatically calculate the discount based on the total amount and payment date.

- Late Fees: Specify any late fees that will apply if the payment is not received by the due date. This helps encourage clients to meet deadlines and avoid unnecessary delays.

Automating Payment Terms in Your Document

- Use Date Calculations: Automate the due date by using a formula like =Issue Date + X, where “X” is the number of days you want to give the client to pay.

- Automate Discount and Late Fee Calculations: Set up formulas that automatically calculate any discounts or late fees based on the payment date. For example, use the =IF function to apply a discount if the payment is made within a certain number of days.

By incorporating these payment terms into your automated financial documents, you can create a clear, professional, and consistent approach to managing payments. This not only simplifies the process for both you and your clients but also ensures that your terms are always transparent and easy to follow.

Improving Invoice Accuracy and Efficiency

Ensuring the accuracy and efficiency of your billing documents is crucial for maintaining smooth financial operations. Mistakes in calculations, missing details, or inconsistent formats can lead to delays, disputes, and an overall negative experience for your clients. By adopting best practices and utilizing the right tools, you can minimize errors, speed up the process, and maintain a professional standard that helps your business thrive.

There are several strategies you can implement to enhance both the precision and speed of your billing system. These approaches focus on automation, consistency, and streamlining the overall process to save you time while improving the quality of your records.

Key Strategies for Improvement

- Automate Calculations: Use built-in formulas to automatically calculate totals, taxes, discounts, and other key financial data. This reduces the risk of manual errors and ensures all numbers are consistent across your document.

- Predefined Fields and Data Validation: Set up predefined fields for common entries (e.g., customer information, item descriptions) and use data validation rules to ensure the correct format is always entered. This minimizes the chances of missing or incorrect data.

- Use Templates for Consistency: Consistently use a standardized layout for all documents. This ensures that every bill follows the same structure, making it easier to review, compare, and update records.

- Review and Confirm Before Sending: Implement a review process to cross-check the document for errors before it’s sent to clients. A second set of eyes can often catch mistakes that might be overlooked during the initial creation process.

Leveraging Technology for Efficiency

- Integrate with Other Systems: Connect your billing records with inventory, accounting, or CRM systems. This reduces the need for manual data entry and ensures your financial documents are always up-to-date with other parts of your business.

- Utilize Cloud-Based Solutions: Cloud-based platforms enable easy access, collaboration, and real-time updates. This enhances workflow efficiency and ensures that everyone involved in the process is working with the most current version of the document.

- Track Payments Automatically: Automate payment tracking by linking your system with payment gateways or accounting tools. This reduces administrative work and provides a clear view of your financial standing without needing manual reconciliation.

By implementing these strategies and tools, you can improve the accuracy and efficiency of your financial documents, ensuring that your business operates smoothly and that your clients receive professional, error-free records every time.

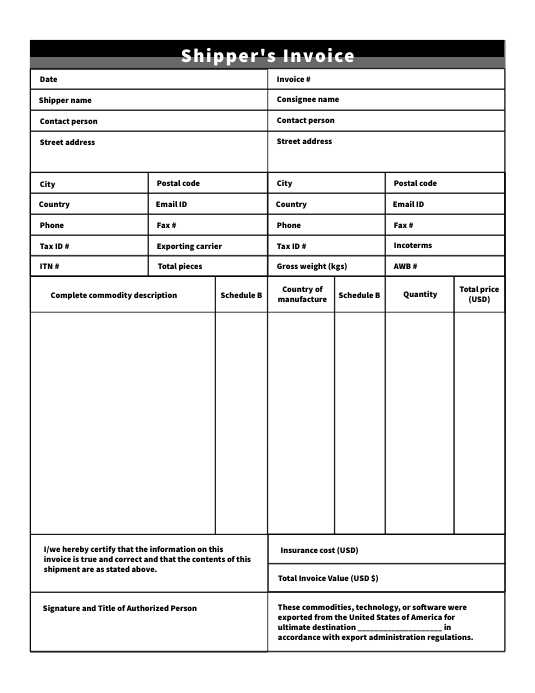

Managing International Shipping with Invoices

When dealing with international transactions, it’s essential to provide clear and accurate records that comply with various regulations and ensure smooth cross-border payments. Managing overseas deliveries involves additional complexities such as different currencies, customs regulations, and varying tax laws. Using well-structured financial documents helps you keep track of these factors and ensures that your clients understand the terms of the transaction, regardless of location.

To effectively manage international orders, you must pay attention to certain details in your financial records. Here are some key considerations when handling global deliveries:

Key Considerations for International Transactions

- Currency and Payment Method: Clearly indicate the currency used for the transaction. If applicable, mention exchange rates, and specify the accepted payment methods, such as wire transfers or international credit card payments.

- Customs and Import Fees: Make sure to include any potential customs duties or import taxes in the total amount. Specify whether these fees are included in the price or will be charged separately to the customer.

- Delivery Terms and Shipping Costs: Define the delivery method and include a breakdown of all related costs, such as freight charges, handling fees, and insurance. Ensure that both the buyer and seller agree on who is responsible for these costs (e.g., ExWorks, FOB, CIF).

- Compliance with Local Regulations: Be mindful of the legal requirements in both the seller’s and buyer’s countries. This can include specific taxes, documentation, or product restrictions. Including a note about these regulations ensures transparency and helps avoid delays.

Best Practices for International Billing

- Clarify Payment Terms: Clearly define the payment terms for international transactions, including due dates and any early payment discounts or late fees. This helps prevent payment delays and fosters better business relationships.

- Provide Detailed Descriptions: Include detailed descriptions of the products being sold, their value, and their origin. This will assist in customs clearance and can also prevent misunderstandings about the goods being shipped.

- Offer Multilingual Support: If possible, provide a translated version of the document or key terms to accommodate clients who may not speak the same language. This ensures that all parties understand the terms clearly.

By ensuring that all necessary information is included and well-organized in your financial records, you can mitigate risks, str

Sharing Shipping Invoices with Clients

Sharing financial documents with clients is a crucial step in the transaction process. Providing clear and professional records ensures that both parties are on the same page regarding the terms of the sale, payment deadlines, and any applicable fees. How you share these documents can impact your relationship with clients and contribute to smoother communication and faster payments.

In today’s digital age, there are several ways to securely send these records to clients. Whether through email, cloud-based platforms, or direct links, it’s important to choose a method that aligns with your business practices while maintaining transparency and ease of access for your clients.

Methods for Sharing Financial Records

- Email Attachments: Sending the document as an email attachment is the most common method. Ensure the file is in a universally accessible format, such as PDF, and that it is clearly named (e.g., “Order #1234 – Payment Details”). This provides a professional touch and allows clients to keep a copy for their records.

- Cloud-Based Platforms: Using cloud-based storage services like Google Drive, Dropbox, or OneDrive enables you to store and share financial documents securely. This method allows for easy access, sharing with multiple team members, and the ability to update documents in real time.

- Client Portals: For businesses with a large customer base, setting up a dedicated client portal where clients can log in and view, download, and track their payment history can streamline the process. This also ensures that sensitive financial records are handled securely.

Best Practices for Sharing Records

- Ensure Clarity: Before sending, double-check that all details are correct and easy to understand. This includes confirming the payment terms, item descriptions, totals, and any additional charges.

- Maintain Security: Sensitive financial data should be protected. Use encrypted emails, secure cloud storage, or password-protected files to ensure that only the intended recipient has access to the document.

- Follow Up: After sharing the document, send a polite follow-up message to confirm receipt. This helps ensure that your client is aware of the details and can address any potential issues or questions before the due date.

By selecting the appropriate sharing method and following best practices, you can enhance your client’s experience and ensure timely payment processing. Clear communication and secure sharing will build trust and support efficient financial management for your business.

Best Practices for Shipping Invoice Templates

Creating clear, professional, and accurate billing documents is essential for any business dealing with transactions. These documents should be well-organized, easy to understand, and contain all the necessary details to ensure smooth financial processing and communication with your clients. By following best practices, you can improve accuracy, reduce errors, and build trust with customers.

When designing a billing document, it’s important to focus on consistency, clarity, and functionality. This will not only streamline your internal processes but also provide a better experience for your clients. Here are some best practices for creating efficient and effective financial records.

Key Best Practices for Effective Billing Documents

- Use a Standardized Layout: Consistency is key. Ensure that all your documents follow a similar format, with consistent font sizes, headings, and spacing. This makes it easier for clients to read and find the necessary details quickly.

- Include Clear and Concise Descriptions: Every item or service listed should have a detailed description, including quantities, unit prices, and applicable taxes. This prevents misunderstandings and allows clients to see exactly what they are being charged for.

- Provide Payment Details: Always include payment terms clearly, such as the due date, accepted payment methods, and any discounts for early payments or late fees. This sets clear expectations and avoids confusion.

- Double-Check for Accuracy: Mistakes in pricing, quantities, or other details can cause delays in payment or even disputes. Always review your documents before sending them out to ensure all information is correct.

Enhancing Efficiency and Professionalism

- Incorporate Automation: Use automated tools or formulas to calculate totals, taxes, and discounts. This reduces the risk of human error and saves time when creating new documents.

- Keep a Consistent Branding: Include your company’s logo, colors, and contact information to make your documents look professional and reinforce brand identity.

- Use Secure Sharing Methods: When sending documents, ensure that they are shared securely. Use encrypted emails or password-protected files to maintain confidentiality and protect sensitive financial information.

By following these best practices, you can ensure that your billing documents are accurate, professional, and effective in communicating all necessary details to your clients. This will not only help streamline your financial operations but also create a more positive and efficient experience for everyone involved.