Free Invoice Template in Word Download for Easy Customization

Managing finances and keeping track of transactions is crucial for any business. Whether you’re a freelancer or run a small enterprise, having a reliable method to request payments is essential. A well-structured document can help streamline the process and ensure you maintain professionalism in your dealings.

One of the most efficient ways to create a payment request is by using customizable formats that allow you to adjust the details according to your needs. These documents can be easily adapted to different industries and payment structures, offering a simple solution for those looking to organize their billing system.

Accessing high-quality documents that can be easily edited saves both time and effort. With the right approach, you can generate professional payment requests in no time, giving you more time to focus on what truly matters: growing your business.

Free Word Invoice Template Download

For small business owners and freelancers, having a professional document for requesting payments is essential. A well-designed document not only ensures accuracy but also reflects your brand and professionalism. Fortunately, there are numerous options available online to easily access editable forms that can be customized for any business need.

These documents are designed to be user-friendly and versatile, offering a simple way to generate professional billing requests. Once you have the right format, you can quickly fill in client details, services rendered, and payment terms. Below are some key benefits of using these customizable forms:

- Time-saving: With pre-built structures, you don’t have to start from scratch every time.

- Customizable: Adjust the format and design to match your business style and needs.

- Professional Appearance: A polished document creates a lasting impression and fosters trust.

- Cost-effective: Many platforms offer no-cost options, making them accessible for businesses of all sizes.

To get started, simply visit trusted websites that offer high-quality, editable documents, and select the format that best suits your needs. Most platforms allow you to modify the content before you print or send the document, ensuring it aligns with your brand identity and billing requirements.

Whether you’re a consultant, designer, or contractor, having an organized and clear method to request payment is vital. By choosing the right format, you can ensure accuracy and avoid confusion with clients, while maintaining a professional approach to business transactions.

Why Use a Word Invoice Template

For any business or independent professional, keeping billing processes simple and efficient is crucial. Using an editable document to generate payment requests offers a streamlined and professional solution. With the right format, you can quickly create accurate records, save time, and maintain a consistent look across all your financial communications.

One of the main advantages of using this type of document is its versatility. The design can be easily customized to suit different industries and services, making it ideal for a wide range of businesses. Furthermore, it allows for quick edits, ensuring that all details, such as payment terms, client information, and services provided, are up to date.

Additionally, a structured document ensures that no important details are overlooked. By using a pre-set format, you are more likely to include all necessary components such as payment due dates, total amounts, and any additional terms or conditions. This reduces the risk of errors and ensures clarity for both you and your clients.

Finally, these documents are widely accessible and can be easily shared or printed. Whether you prefer sending them digitally or providing a hard copy, the format ensures your billing process remains organized and professional, no matter the delivery method.

Benefits of Customizable Invoice Formats

Using a flexible and adjustable billing format offers numerous advantages for businesses of all sizes. The ability to tailor payment request documents to your specific needs ensures that you can create a professional and accurate representation of your services or products. This customization capability makes it easier to align documents with your branding and business style.

One of the key benefits of customizable formats is their adaptability. You can adjust fields, add or remove sections, and change the design to fit various types of transactions, whether you’re working with clients on a project basis or providing recurring services. This flexibility allows you to maintain consistency across all of your financial documentation.

Another significant advantage is the ability to update content quickly. As your business evolves, you may need to change payment terms, add new services, or adjust prices. With an editable format, these changes can be made easily and swiftly, ensuring that your documents always reflect the most current information.

Customizable formats also help to maintain a clear and organized structure. By having the freedom to design your billing documents according to your preferences, you can prioritize important details, such as due dates and payment instructions, ensuring that nothing is overlooked. This level of control can lead to better communication with clients and fewer misunderstandings.

How to Download Free Invoice Templates

Obtaining editable billing documents is easy and can be done in just a few steps. There are a variety of online platforms offering customizable formats for businesses of all sizes, and many of them allow you to access them at no cost. These sources provide you with ready-to-use structures that can be personalized to match your unique needs.

To get started, simply search for trusted websites that offer no-charge billing formats. Most of these platforms feature a selection of layouts that cater to different industries and use cases, whether for freelancers, contractors, or small businesses. Once you find the right document, you can quickly select it and proceed with saving it to your device.

After saving, the next step is to open the document with your preferred editing software. These formats are often compatible with various programs, allowing you to fill in your information, such as client details, services provided, and payment terms. The best part is that you can adjust the content anytime to fit each new transaction, ensuring your records are always up to date.

Additionally, many platforms offer multiple design options, so you can choose the one that best represents your business’s image. Once downloaded, these documents can be used repeatedly, making them a cost-effective and time-saving solution for managing your financial communications.

Steps to Personalize Your Invoice in Word

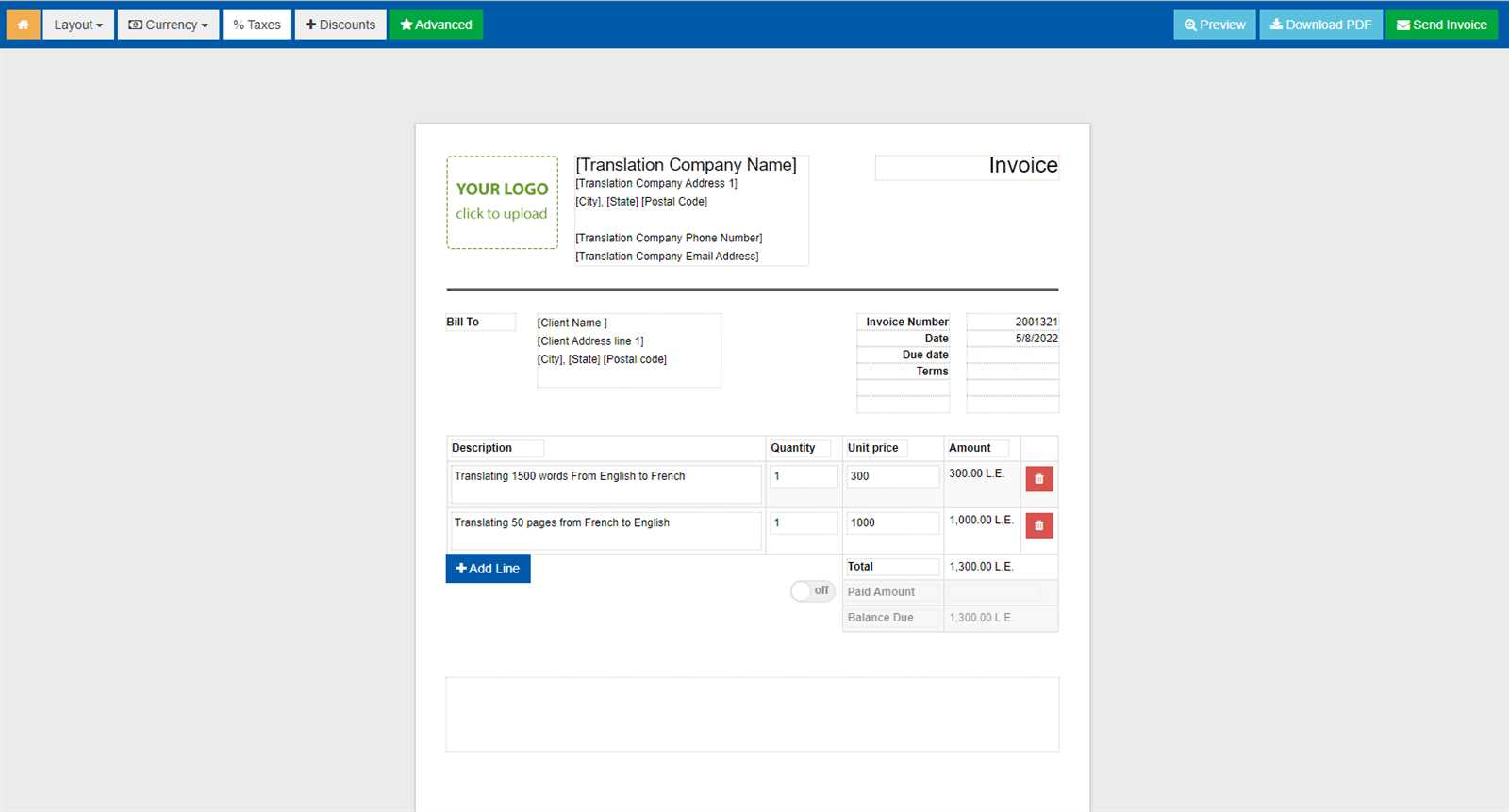

Customizing your billing document is a straightforward process that ensures each request matches your business needs and maintains professionalism. By following a few simple steps, you can easily tailor a pre-made structure to reflect your unique branding, services, and payment terms.

First, open the document you’ve selected in your preferred editing software. Start by adding your business name, logo, and contact information at the top. This helps establish your brand identity and makes your document instantly recognizable to clients.

Next, fill in the relevant fields with client information, such as their name, address, and contact details. Ensure that all details are accurate and up-to-date to avoid any confusion or errors in communication.

After the client details, modify the section that describes the services or products you provided. Be clear and concise in your descriptions, breaking down the costs and quantities where applicable. If needed, adjust the layout to include additional lines or remove unnecessary ones.

Don’t forget to update the payment terms, such as the due date and any penalties for late payments. This ensures clarity for both you and your client and helps avoid misunderstandings later. Finally, review the document for consistency, making sure that all sections are properly formatted and easy to read.

Once you’ve made all the necessary adjustments, save the document and you’re ready to send it to your client. Customizing your billing paperwork in this way not only streamlines your workflow but also gives your communications a polished and professional look.

Top Features of a Good Invoice Template

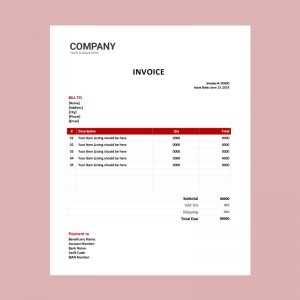

When choosing a structure for your billing needs, it’s important to look for certain features that enhance clarity, professionalism, and ease of use. A well-designed document not only makes the process easier but also improves your business image by ensuring accurate and clear communication with clients.

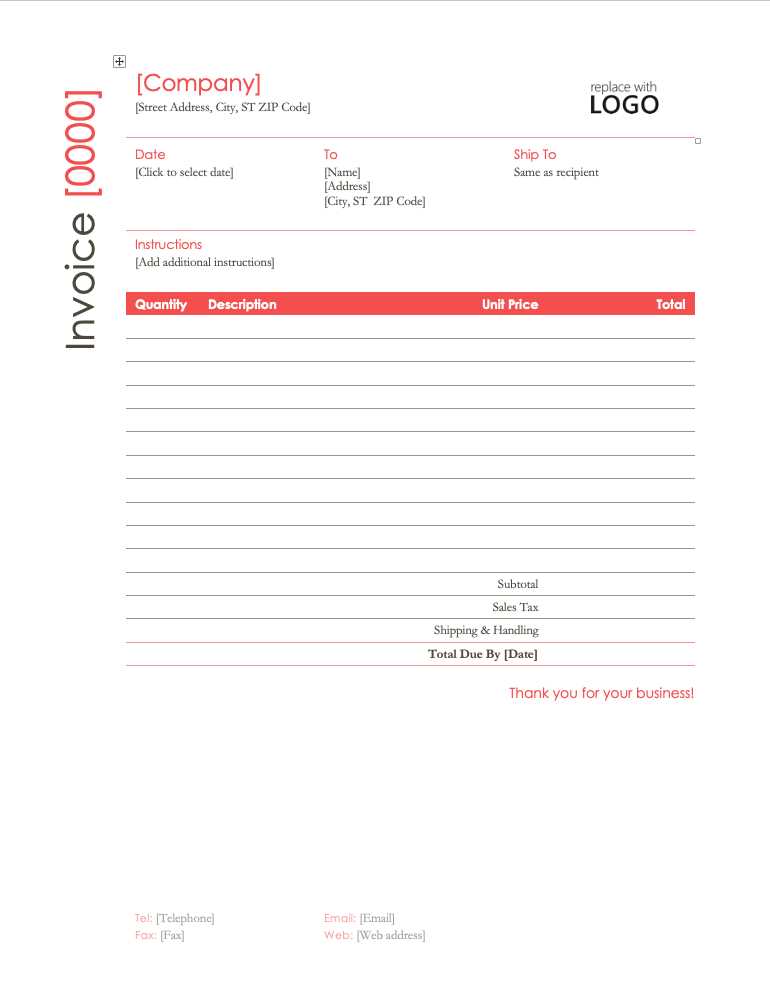

Clear and Organized Layout

A good billing document should have a clean and organized layout, with all sections clearly defined. This includes easy-to-read headings for each category, such as client details, service description, pricing, and payment terms. The information should be logically ordered, allowing both you and the client to quickly review the contents without confusion.

Customizable Sections

The ability to personalize sections is essential. Every business has unique needs, and being able to modify the fields (such as adding discounts, taxes, or special terms) can make a huge difference. Look for a structure that lets you easily edit the document for different clients, services, and situations. This flexibility ensures that the document remains useful no matter how your business evolves.

Accurate Calculations are a must. The format should automatically calculate totals and allow for easy adjustments. This reduces the risk of human error, ensuring you charge the correct amounts every time. An automated process can save you time and prevent costly mistakes.

Professional Design is also a key feature. A polished and professional appearance creates a positive first impression and strengthens your brand image. Elements like your business logo, consistent font styles, and appropriate color schemes can all contribute to a document that looks high-quality and trustworthy.

With these top features in place, your billing process will be faster, more efficient, and more professional, helping to ensure smooth transactions and build trust with your clients.

Free Word Templates for Small Businesses

For small business owners, having access to easily editable documents is essential for managing finances and maintaining professionalism. Many platforms offer no-cost, customizable formats that allow you to create professional billing records, saving both time and effort. These documents are designed to be simple, yet flexible enough to suit various business needs.

Benefits of Using Customizable Formats for Small Businesses

- Cost-effective: These documents provide a no-expense solution for small business owners who want professional results without additional costs.

- Time-saving: Pre-made structures help speed up the process of creating payment requests, ensuring quick turnaround times.

- Flexible: The formats can be easily adjusted to fit different services, industries, or pricing models, making them ideal for diverse business needs.

- Professional Look: Even without a design background, you can create polished, professional-looking documents that enhance your brand image.

Where to Find Free Editable Documents

There are numerous websites offering a wide variety of ready-to-edit formats for small business owners. These sources typically allow you to browse through different categories–whether you’re offering one-time services or ongoing subscriptions–and choose a layout that fits your needs.

Once selected, you can quickly customize the details such as client information, pricing, and services provided. Some platforms also offer additional features like built-in calculation tools, helping you create accurate documents with minimal effort.

By using these no-cost options, small business owners can streamline their billing processes and present themselves as organized and professional to their clients, all without the need for complex software or expensive services.

How to Create an Invoice from Scratch

Creating a billing document from scratch may seem intimidating at first, but it can be a straightforward process if you break it down into manageable steps. By following a simple structure and paying attention to key details, you can ensure that your payment requests are clear, professional, and easy to understand.

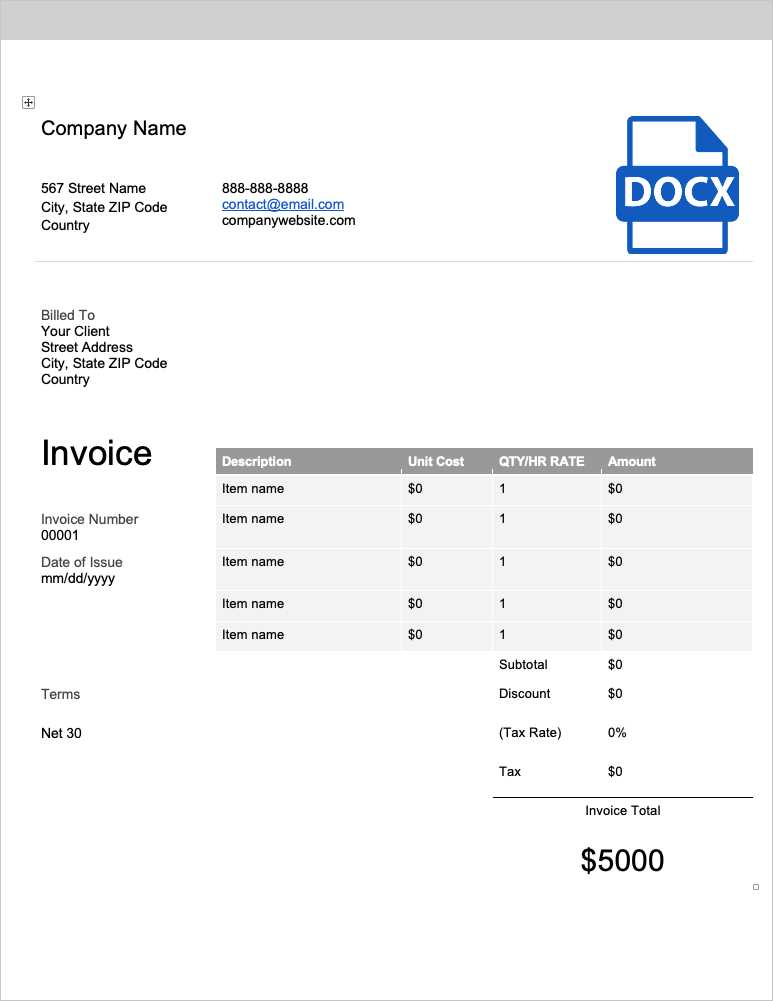

Essential Components of a Billing Document

- Header Information: At the top of the document, include your business name, address, contact details, and logo (if applicable). This helps establish your brand and makes it easy for clients to identify your company.

- Client Details: Include the recipient’s name, address, and contact information. Make sure all details are accurate to avoid confusion.

- Unique Reference Number: Assign a unique reference number to each payment request. This helps you keep track of documents and maintain organized records.

- Itemized List of Services or Products: Break down the services or products provided. List each item separately along with the quantity, unit price, and total cost.

- Payment Terms: Clearly state the payment due date, accepted payment methods, and any late fees or discounts for early payment.

- Total Amount: Sum up the charges and provide the total amount due at the bottom of the document. Make sure the totals are clear and easy to find.

Formatting Your Document

Once you’ve included all the necessary information, focus on the layout. Make sure the document is easy to read by using a clean, simple design. Use bold or larger fonts for headings, and make sure the text is aligned properly for a professional look. Leave enough space between sections so that clients can easily follow the content.

After completing the document, review it to ensure there are no mistakes, especially in pricing or client details. Once everything is accurate, you can save it in your preferred format and send it to your client for payment.

Why Word is Ideal for Invoices

When it comes to creating professional billing documents, choosing the right software is key. The ideal tool should offer flexibility, ease of use, and a range of customization options. One of the most popular choices for generating payment requests is word processing software, which combines simplicity with powerful features, making it perfect for this task.

Key Advantages of Using Word Processing Software

- Ease of Use: The interface is user-friendly, requiring little to no technical knowledge. You can quickly create, edit, and format your documents with just a few clicks.

- Customizability: These programs allow for extensive customization. You can easily adjust fonts, colors, and layouts to match your business’s branding, ensuring each document looks professional and unique.

- Compatibility: Most word processing programs are compatible with a variety of other formats, such as PDF and Excel, making it simple to save or share your documents in the format that works best for you and your clients.

- Automatic Calculations: Some word processors allow for basic formulas to be inserted, making it easier to calculate totals, taxes, or discounts automatically, reducing the risk of errors.

- Wide Accessibility: This software is widely accessible and can be used across different devices and operating systems, making it convenient for business owners on the go.

Overall, word processing tools are an ideal choice because they strike the perfect balance between simplicity and functionality, allowing you to create, customize, and manage your billing documents without unnecessary complexity. With the right design and features, you can create documents that are both accurate and visually appealing, reflecting the professionalism of your business.

Best Websites for Free Invoice Templates

When looking for customizable billing documents, many websites offer excellent options at no cost. These platforms provide a wide selection of ready-to-use structures that can be tailored to fit the unique needs of your business. Whether you’re a freelancer, contractor, or small business owner, these sources ensure that you can create professional payment requests quickly and easily.

Top Platforms for Customizable Billing Documents

Here are some of the best websites where you can find high-quality, editable formats:

- Invoice Generator: A straightforward online tool that allows you to create and customize billing forms in just a few minutes. No sign-up required, and it offers several styles to choose from.

- Canva: Known for its design capabilities, Canva provides a variety of professional-looking templates that are easy to customize. You can add your branding, adjust fonts, and quickly generate a personalized document.

- Zoho Invoice: A cloud-based solution with free access for small businesses. Zoho offers customizable formats that integrate with accounting tools and allow you to send documents directly to clients.

- Invoicely: Offers a simple and efficient way to generate billing documents. With both free and paid plans, Invoicely provides numerous templates that you can personalize to meet your needs.

- FreshBooks: Another great online platform offering free templates for business owners. FreshBooks also provides invoicing and accounting tools to help track payments and manage clients.

Why Choose These Platforms

Each of these platforms stands out for its ease of use, flexibility, and the ability to create professional documents without the need for specialized software. Whether you need a basic layout or a more detailed format, these websites offer tools that are accessible to businesses of all sizes.

By exploring these options, you can find the right platform for your needs and start creating accurate, clear, and visually appealing billing documents with minimal effort.

How to Save Time with Invoice Templates

Managing your billing process can take up a significant amount of time, especially when creating each document from scratch. Using pre-designed structures allows you to streamline the process, reducing the time spent on formatting and ensuring consistency across all payment requests. With a few simple adjustments, you can quickly generate accurate and professional documents for each transaction.

Streamlined Document Creation

By utilizing a ready-to-use layout, you eliminate the need to recreate the structure for every new billing cycle. All the key fields, such as client details, item descriptions, and pricing, are already organized in the document. You simply need to fill in the specific information for each job. This approach drastically cuts down on the time spent formatting and retyping common elements.

Consistent and Professional Look

With a pre-set design, you can ensure that every document you send is professionally formatted and aligned with your brand. This consistency not only saves time but also improves the impression you leave with clients. Having a polished appearance for each payment request helps convey trustworthiness and professionalism.

Automated Calculations can further speed up the process. Some formats include built-in formulas that automatically calculate totals, taxes, and discounts, allowing you to focus on the actual content without worrying about numbers.

Reduced Errors are another advantage. Since the structure remains the same, there’s less risk of missing important information or making formatting mistakes. This means fewer revisions and corrections, saving both time and effort in the long run.

Overall, using pre-designed billing formats not only enhances efficiency but also helps ensure that every document is accurate and professionally presented. This time-saving approach allows you to focus more on other areas of your business while maintaining a high standard of financial communication.

Invoice Template Design Tips for Professionals

When creating billing documents, having a well-designed layout is crucial for making a lasting impression on your clients. A professional design not only makes your communication more effective but also reflects your brand’s quality and attention to detail. Whether you’re working with a simple format or a more intricate layout, certain design principles can elevate the overall impact of your documents.

Key Design Principles for Professional Billing Documents

- Keep It Simple: A clean and minimal design enhances readability and reduces distractions. Use enough white space to allow for easy scanning of the document.

- Use Brand Colors: Incorporating your business’s color scheme can help maintain consistency across all communications and reinforce your brand identity.

- Readable Fonts: Choose easy-to-read fonts like Arial or Helvetica for body text and use a slightly bolder or larger font for headings to create a clear hierarchy of information.

- Consistent Alignment: Ensure that text, numbers, and headings are aligned properly. This creates a sense of order and professionalism in your billing documents.

Essential Elements to Include in Your Design

Every billing document should include certain key elements to ensure clarity and completeness. Below is a table highlighting the most essential components that should appear in any professional payment request:

| Section | Description |

|---|---|

| Business Details | Your company name, address, contact information, and logo. |

| Client Information | Recipient’s name, company (if applicable), and contact details. |

| Itemized Services | A detailed breakdown of the products or services provided, including quantities, rates, and total costs. |

| Payment Terms | Due date, payment methods, and any applicable late fees or early payment discounts. |

| Total Amount Due | The final sum to be paid, including taxes and any additional fees. |

By following these tips and structuring your billing documents with attention to detail, you not only create professional and aesthetically pleasing documents but also foster clear communication with your clients. Consistent and well-d

How to Add Branding to Your Invoice

Incorporating your brand identity into billing documents is a powerful way to reinforce your business image while maintaining professionalism. By adding key visual elements such as logos, colors, and fonts, you can create a consistent experience for your clients. Customizing your billing documents ensures that they not only convey important financial details but also reflect the personality of your business.

Essential Elements for Brand Integration

- Logo: Placing your business logo at the top of the document is one of the easiest ways to brand your billing forms. It gives your clients an immediate visual connection to your company and helps establish recognition.

- Color Scheme: Use your company’s primary colors for headings, borders, or backgrounds. This helps align the document with your overall visual identity, making it feel cohesive with your other marketing materials.

- Font Style: Choose fonts that reflect your brand’s tone–whether modern, professional, or friendly. Ensure that the fonts are legible and appropriate for business communication.

- Contact Information: Include your business’s website, phone number, and social media handles. This not only provides clients with ways to reach you but also reinforces your brand’s presence across multiple channels.

Additional Tips for Customization

When adding branding to your billing documents, it’s important to maintain balance. Overcrowding the document with too many elements can distract from the key details. Focus on clean, clear design while integrating your branding in subtle ways that don’t overwhelm the content.

Consistency is Key: Ensure that all your documents, from payment requests to contracts, feature the same branding elements. This reinforces your professional image and helps build trust with your clients.

By adding these branding touches, you make your billing forms more than just a request for payment–they become an extension of your company’s identity and an opportunity to showcase your business’s unique character.

Using Word to Track Payments

Managing payments and keeping track of outstanding balances is essential for any business. With the right structure, you can easily use a simple document editor to monitor your transactions, record received payments, and manage due amounts. By creating a system that works for your business, you can stay organized and ensure that your financial records remain up-to-date.

Creating a Payment Tracking System

By setting up a well-organized format, you can efficiently track payments for each client. Here’s how you can structure it:

- Client Information: Start by including the client’s name, contact information, and relevant project or service details. This will help you easily reference each record.

- Payment Schedule: Include a section that details the agreed payment terms–whether it’s a full payment, installments, or partial payments. Clearly indicate the due date and amount for each installment.

- Payment Status: Create a column or section to record the payment status, such as “Paid,” “Pending,” or “Overdue.” This allows you to quickly identify which clients have completed their payments and which are still outstanding.

- Payment Method: Document the payment method used for each transaction (e.g., bank transfer, credit card, check). This will give you a clearer picture of how you receive funds.

- Outstanding Amount: Always include a column to track the remaining balance. If a payment was partial, you can calculate and track what is left to be paid.

Benefits of Using This Approach

- Simplicity: Setting up a tracking system is easy and doesn’t require specialized software. You can customize the layout to suit your needs, keeping it straightforward and user-friendly.

- Real-Time Updates: Since you update the document as payments come in, you always have an accurate record at your fingertips. This minimizes errors and helps you stay on top of finances.

- Tracking Trends: With consistent record-keeping, you can track payment patterns over time. This can help you understand client behavior and make more informed decisions about your billing strategy.

Using a simple document editor to track payments is a cost-effective and efficient way to manage your financial records. By keeping everything organized and clearly outlined, you can avoid confusion, minimize errors, and ensure timely payments from your clients.

Editing and Updating Your Invoice Easily

Making adjustments to your billing documents is essential as your business grows or changes. Whether you need to update client details, change payment terms, or correct any errors, having an editable format simplifies this process. With the right setup, you can quickly modify your documents without starting from scratch each time.

Simple Steps for Quick Modifications

- Update Client Information: Always ensure that the client’s name, contact details, and billing address are correct. A simple text edit can prevent any issues with communication or payment.

- Adjust Payment Amounts: If there are changes to the agreed amount or additional charges, simply update the price fields to reflect the new total. Be sure to recalculate any taxes or discounts.

- Edit Payment Terms: If the payment schedule or due date needs to be adjusted, this can be done quickly in the document. Adjust terms as necessary and make sure both parties are aware of the changes.

- Customize for New Services: If you are offering new products or services, add them to your document with ease. Simply insert new line items or update existing descriptions to match the service provided.

Advantages of Easy Editing

- Time-Saving: Instead of creating a new document each time you need to make a change, you can quickly modify the existing one, saving valuable time on administrative tasks.

- Accuracy: Having the ability to easily correct errors or update information ensures that your billing remains accurate and up-to-date, preventing potential confusion with clients.

- Consistency: Consistently using a single, easily adjustable document format helps maintain uniformity across all your payment records, making your financial communication more professional.

With a well-designed, editable structure, making updates to your billing documents becomes a seamless process. You can ensure that your documents are always accurate, reflect the most current terms, and help your business maintain smooth financial operations.

Saving Your Invoice for Future Use

Once you’ve created and sent out a billing document, it’s important to keep a copy for your records and for future reference. Storing these documents properly ensures that you can quickly access them when needed, whether it’s for tracking payments, preparing for audits, or generating recurring requests. By saving your documents efficiently, you maintain organized financial records that can streamline your administrative processes.

Best Practices for Storing Billing Documents

- Use Organized Folders: Create a folder structure that makes sense for your business. For example, you can have separate folders for each client, or group documents by month or year. This will make it easier to locate specific documents when needed.

- Label Documents Clearly: Use descriptive file names that include the client’s name, the date, and other relevant details. This makes searching for a specific document faster and ensures you don’t lose track of any records.

- Cloud Storage: Storing your documents in a cloud service allows for easy access from any device, as well as additional security in case of a system failure. Cloud services like Google Drive or Dropbox offer convenient solutions for saving and organizing your files.

- Backup Your Records: It’s crucial to back up your stored documents regularly. Whether you store files on a local device or in the cloud, having a backup ensures that you won’t lose important data in case of hardware failure or unexpected issues.

Benefits of Proper Document Storage

- Quick Access: Having your documents organized means that you can retrieve any previous request quickly, without the hassle of searching through unorganized folders.

- Efficient Record-Keeping: With organized storage, you can track payment histories, identify unpaid balances, and maintain an accurate financial overview without missing any important details.

- Legal Protection: Storing billing records securely is important for legal reasons. If a client disputes a charge, you can easily access the corresponding documents to resolve the issue efficiently.

By following these simple steps to save and organize your documents, you can keep your financial records in order and be prepared for any situation, whether it’s a client inquiry or tax season.