Home Repair Invoice Template for Simple and Professional Billing

For service providers, ensuring smooth financial transactions is essential to maintaining a successful business. One of the most effective ways to manage payments and keep records in order is through the use of well-organized documents that outline work completed, pricing, and terms for compensation.

Accurate documentation not only helps avoid confusion but also sets a professional tone when dealing with clients. With the right structure, these documents can be tailored to fit specific projects, offering clarity on the breakdown of charges for labor and materials. When designed properly, they become a valuable tool for tracking payments and maintaining transparency throughout the process.

In this guide, we’ll explore the key elements of crafting such documents, providing helpful insights on how to customize them for various types of work, ensuring that all necessary information is included, and optimizing their use for prompt and efficient transactions.

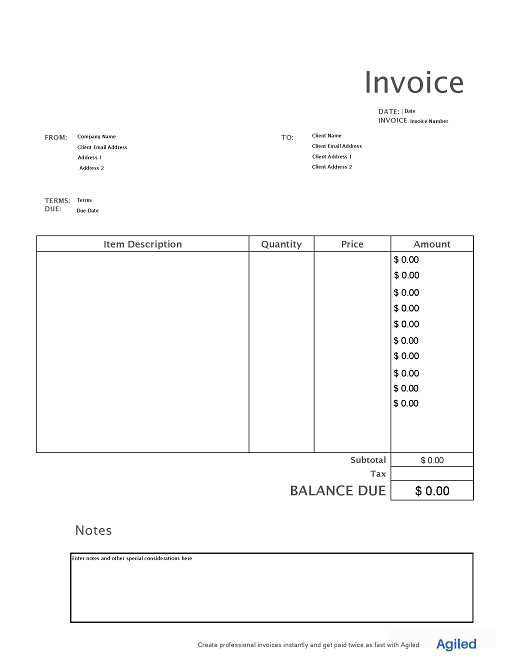

Home Repair Invoice Template Overview

When managing payments for services provided, having a structured document is crucial to ensuring clarity and professionalism. This document serves as a record of the work completed, charges incurred, and agreed payment terms between service providers and their clients. It acts as a formal request for payment and a reference for future transactions.

A well-crafted document should include several key components that ensure both parties are fully informed and protected. The main goal is to create a clear and concise summary of the transaction details, making the billing process smooth and efficient. Here’s an overview of what should be included:

- Service Description: A detailed account of the tasks completed or materials used.

- Itemized Costs: A breakdown of charges for each task, including labor and materials.

- Payment Terms: Clear instructions on how and when payments should be made.

- Contact Information: Essential details about both parties involved for communication.

- Legal Considerations: Any necessary terms that protect both the client and service provider in case of disputes.

By including these essential elements, the document ensures that both the service provider and the client have a mutual understanding of the work completed and the amount due. This transparency helps foster trust and a smooth business relationship. A good structure can prevent misunderstandings and create a solid foundation for ongoing work.

Why You Need an Invoice Template

Having a pre-designed structure for documenting transactions is essential for maintaining professionalism and organization in any service-based business. This document plays a key role in ensuring both the service provider and the client have a clear understanding of the work completed and the associated costs. Without such a structured approach, managing payments can become disorganized and confusing.

Here are several reasons why a well-organized document is necessary:

- Consistency: Using a standardized format ensures uniformity across all transactions, making it easier to manage and track payments.

- Time-Saving: A ready-made structure eliminates the need to create a new document from scratch every time, streamlining the billing process.

- Professionalism: A clean, clear document reflects well on the service provider, promoting trust and reliability with clients.

- Accuracy: A predefined structure helps ensure that all relevant details, such as

Key Features of a Home Repair Invoice

To ensure clarity and accuracy when requesting payment, certain essential components must be included in any billing document. These features provide a detailed breakdown of services rendered, materials used, and any additional charges, helping both parties avoid confusion and maintain transparency throughout the transaction.

Essential Information to Include

The following elements are vital for making sure the document is complete and professional:

- Service Provider Information: Name, contact details, and any relevant business identification.

- Client Details: Name, address, and contact information of the person or business receiving the services.

- Clear Service Description: A detailed list of tasks completed, with enough information for the client to understand what they are being billed for.

- Itemized Costs: A breakdown of charges, including labor, materials, and any additional fees.

- Payment Terms: Details on how and when payment is due, including accepted payment methods and any late fees or discounts offered.

Professional Appearance and Accuracy

In addition to the necessary details, the document should be formatted in a professional and easy-to-read manner. This includes:

- Clear Layout: An organized structure with sections for each piece of information makes the document easier to follow.

- Proper Numbering: A unique reference number for each document helps keep records organized and easily identifiable.

- Legal Compliance: Any applicable taxes, terms of service, or disclaimers that protect both the service provider and the client should be included.

By incorporating these features, the document not only helps facilitate smooth payment but also ensures that all necessary information is easily accessible for future reference or potential disputes.

How to Customize Your Template

Adapting a standard document to fit the specific needs of your business and clients is crucial for maintaining a professional and streamlined billing process. Customization ensures that the details reflect your unique services, terms, and brand identity. By tailoring the structure, you can make the document more efficient, relevant, and aligned with your business practices.

Adjusting the Layout and Structure

One of the first steps in customization is organizing the document to suit the flow of your service and transaction details. Consider the following:

- Branding: Add your company logo, business name, and contact information at the top for easy identification.

- Section Order: Rearrange the order of sections to reflect your preferred workflow, such as placing payment terms before the service description or after.

- Font Style and Size: Choose legible fonts and sizes that make the document easy to read, with clear distinctions between headings and content.

Incorporating Business-Specific Information

To make the document more relevant, add any specific details that relate directly to your business practices:

- Payment Methods: If you accept multiple payment options, list them clearly so clients know how to pay.

- Discounts or Promotions: Include fields for any special offers or discounts that may apply to the current transaction.

- Unique Terms and Conditions: Add any clauses that are unique to your services, such as warranty information or cancellation policies.

By customizing these elements, the document becomes more personalized, offering both clarity and a professional touch that strengthens your brand image and enhances communication with clients.

Essential Information for a Home Repair Invoice

For any billing document to be effective, it must include all the necessary details to ensure transparency and clarity between the service provider and the client. These elements not only prevent misunderstandings but also serve as a legal record for both parties. The following components are vital for creating a comprehensive and professional document.

Information Category Description Service Provider Details Include the name, contact information, and any relevant business identification or registration numbers. Client Information List the client’s full name, address, and contact details for proper identification and communication. Service Description A detailed explanation of the tasks performed or items supplied, breaking down each element of the service to ensure clear understanding. Itemized Costs A clear breakdown of charges, including labor, materials, and any additional costs incurred during the job. Payment Terms Specify how payment should be made, including methods, due dates, and any penalties for late payments or early discounts. Legal Considerations Include any applicable taxes, disclaimers, or terms to ensure the document complies with local laws and protects both parties. Including these key details ensures that both you and your client have a shared understanding of the services provided, the payment expectations, and the legal framework surrounding the transaction.

Benefits of Using an Invoice Template

Adopting a pre-designed structure for documenting transactions offers significant advantages for businesses, streamlining the billing process and ensuring consistency in communication. By relying on a standardized format, service providers can minimize errors, enhance professionalism, and improve efficiency when managing financial records.

Here are some of the key benefits of using a structured document:

- Time Efficiency: With a ready-made framework, creating new documents becomes quick and easy, saving time on administrative tasks.

- Consistency: Using a uniform format for all transactions ensures that each document contains the necessary information, making it easier to track and manage payments.

- Professional Appearance: A well-organized document helps maintain a polished image and builds trust with clients, reflecting attention to detail and reliability.

- Accuracy: A predefined structure reduces the likelihood of missing important details, such as service descriptions or payment terms, ensuring the document is complete and correct.

- Legal Protection: Including all necessary elements in a consistent format can help protect both parties in case of disputes by providing a clear record of the agreement.

- Customization Flexibility: Many documents can be easily tailored to fit specific services or client needs, allowing for personalization without sacrificing structure.

Ultimately, using a structured format improves overall business operations by reducing administrative workload, enhancing client relationships, and ensuring that payments are processed smoothly and accurately.

Common Mistakes to Avoid in Invoices

While creating billing documents is an essential task for any service-based business, several common errors can affect the clarity and accuracy of the transaction. These mistakes can lead to misunderstandings with clients, delayed payments, or even legal complications. Ensuring that all details are properly included and formatted is crucial for maintaining professionalism and ensuring smooth business operations.

Common Errors in Document Creation

These are some of the most frequent mistakes to watch out for when preparing a document:

- Missing Contact Information: Failing to include accurate details for both the service provider and the client can create confusion and hinder communication.

- Unclear Service Description: Not providing enough detail about the tasks performed can lead to confusion about what the client is being charged for.

- Incorrect Pricing: Failing to properly itemize charges or using incorrect rates can lead to disputes and payment delays.

- Omitting Payment Terms: Not specifying when payment is due or the acceptable methods of payment can lead to delays or misunderstandings about the terms of the transaction.

- Inconsistent Formatting: A lack of organization or using different styles and fonts can make the document harder to read and look unprofessional.

Other Key Considerations

Aside from common mistakes, keep an eye out for these additional issues:

- Failure to Include Legal Terms: Not including necessary legal disclaimers or tax information can lead to issues with compliance and legal disputes.

- Forgetting to Number Documents: Each document should have a unique reference number for easy tracking and record-keeping.

- Typos or Errors: Simple mistakes, such as spelling errors or incorrect dates, can undermine the credibility of the document and may lead to confusion or delay in payment.

By avoiding these common errors, you can create more effective, clear, and professional documents that facilitate smooth transactions and build trust with clients.

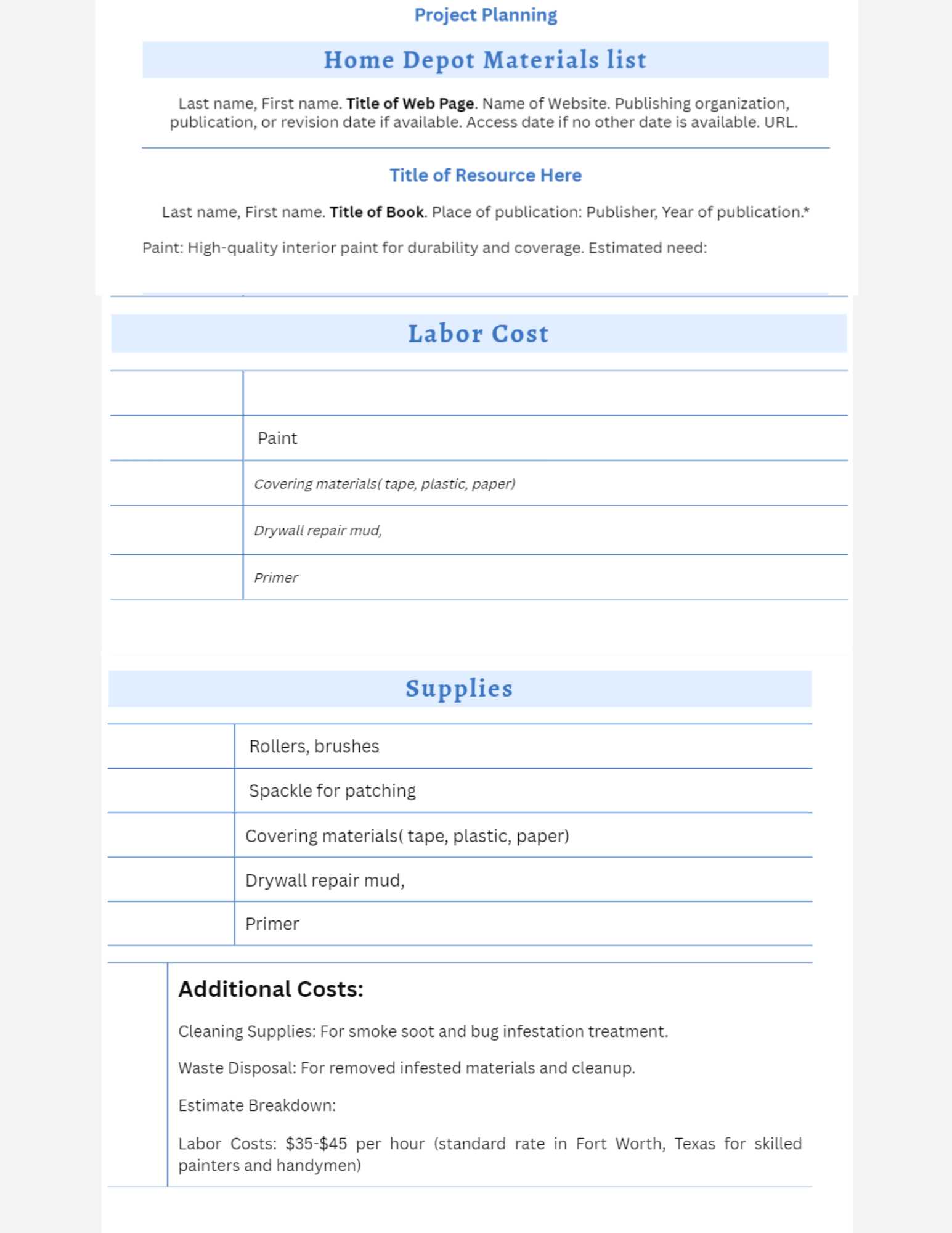

How to Calculate Service Fees Accurately

Accurately determining the cost of your services is essential for maintaining profitability and ensuring client satisfaction. By calculating fees properly, you not only avoid financial discrepancies but also build trust with clients. To achieve this, it’s crucial to factor in all relevant costs, apply fair rates, and ensure transparency in the breakdown.

Understanding Your Costs

The first step in calculating accurate fees is to understand the full scope of your expenses. These might include:

- Labor Costs: Factor in the time spent on each task, including travel, setup, and execution.

- Material Costs: Account for the cost of any materials used, from basic supplies to specialized items.

- Overhead: Include indirect costs such as insurance, tools, or business maintenance fees that are necessary for delivering services.

Applying a Pricing Structure

Once you have a clear understanding of your costs, apply a pricing model that fits your business. You can choose from several approaches:

- Hourly Rates: If the task is time-based, charging an hourly rate can help reflect the labor intensity of the job.

- Flat Fees: For standard services, offering a flat rate simplifies the process for both parties, provided you account for all potential costs.

- Markup on Materials: If materials are involved, consider adding a markup to cover your handling and procurement efforts.

By using these methods, you can ensure your fees are both competitive and fair, leading to clear agreements and timely payments.

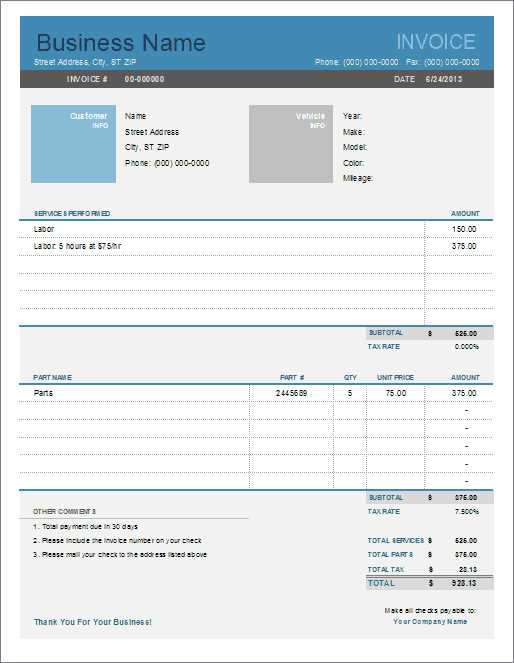

How to Include Materials and Labor Costs

Properly accounting for both materials and labor in your billing documentation ensures that clients are fully informed about the costs associated with the services provided. These components are often the largest portions of the total price, and clear itemization helps avoid confusion and disputes later. Knowing how to allocate these costs effectively is essential for transparency and accuracy.

Including Labor Costs

Labor charges are typically based on the amount of time spent on a project. Here’s how to accurately calculate and include them:

- Hourly Rate: Define a clear hourly rate for your services. Make sure to include both working hours and any additional time required for tasks like setup or travel.

- Total Hours: Track the number of hours spent on each task and multiply by the hourly rate to calculate the labor charge.

- Breakdown of Time: If the job requires different types of work (e.g., design, installation, or troubleshooting), break down the time spent on each to provide more clarity to your client.

Including Materials Costs

Materials costs should be carefully recorded and presented to the client. Here are some guidelines for including them in the final calculation:

- Itemized List: Include a detailed list of materials used for the project, including quantities, unit prices, and the total cost for each item.

- Receipts and Proof: Provide receipts or estimates for any materials purchased to show that the listed prices reflect actual costs.

- Markups: If you charge a markup on materials, clearly state the percentage or amount added to the base cost to ensure the client understands the pricing structure.

By clearly outlining labor and materials charges, you create a transparent and professional document that fosters trust and ensures fair compensation for your work.

Making Your Invoices Legally Compliant

Ensuring that your billing documents comply with legal requirements is critical for both protecting your business and maintaining transparent relationships with clients. Legal compliance helps avoid potential disputes, ensures that all necessary information is included, and safeguards your financial transactions. By adhering to the relevant laws, you can prevent costly errors and ensure your transactions are above board.

Key Legal Requirements

To make sure your documents are legally compliant, it’s important to include the following elements:

- Business Details: Always include the full legal name of your business, business address, and contact information. In many regions, it’s also required to provide your business registration number or tax ID.

- Client Information: Ensure the client’s full name or company name, address, and contact details are accurate and included.

- Itemized Breakdown: Clearly list the services provided, materials used, hours worked, and associated costs. Some jurisdictions require a detailed description to justify charges.

- Tax Information: If applicable, include the relevant tax information such as VAT or sales tax, along with your tax identification number. This is essential for both compliance and proper financial reporting.

Other Important Considerations

In addition to the basic legal elements, there are a few more things to consider when ensuring compliance:

- Payment Terms: Clearly state the payment due date, accepted payment methods, and any late fees or penalties for overdue payments. Some regions may require specific wording for this.

- Legal Disclaimers: Depending on your location, you may need to include certain legal disclaimers or notices about warranties, liability, or dispute resolution procedures.

- Proper Documentation: Keep accurate records of all documents issued and received. These may be required for tax purposes or in case of a dispute.

By ensuring that your billing documents meet all legal requirements, you protect both your business and your clients, leading to smoother transactions and better professional relationships.

Best Practices for Invoice Formatting

Proper formatting of your billing documents not only ensures clarity but also enhances professionalism. A well-structured layout makes it easier for clients to understand the charges, helps avoid errors, and reflects positively on your business. By following some key formatting best practices, you can create documents that are both efficient and visually appealing.

Use Clear and Organized Layouts

A clean, organized structure is essential for readability. Consider the following tips:

- Consistent Font: Choose a professional, easy-to-read font like Arial or Times New Roman. Maintain consistent font sizes throughout the document.

- Logical Flow: Present the information in a logical sequence–client details, description of services, costs, and payment terms should follow an intuitive order.

- Separation of Sections: Use lines or spacing to separate key sections like the client’s information, service breakdown, and payment terms. This helps prevent information from blending together.

Highlight Important Information

Emphasizing key details ensures they stand out for easy reference:

- Bold Titles: Use bold text for section titles such as “Total Due” or “Service Summary” to make them easily identifiable.

- Color and Contrast: While maintaining professionalism, use subtle color or shading to differentiate between sections or highlight totals.

- Clear Summaries: Ensure that total amounts due are clearly stated and easy to find. Consider using a larger font size for the final total to make it stand out.

By focusing on clean design and highlighting essential details, you ensure that your billing documents not only look professional but also provide all the necessary information in an accessible manner.

How to Handle Partial Payments

When a client is unable to pay the full amount upfront, partial payments can offer a flexible solution. Managing partial payments effectively is important for maintaining cash flow while ensuring clarity and transparency in the billing process. By establishing clear terms and communication, you can avoid confusion and ensure that both parties are satisfied with the arrangement.

Setting Clear Payment Terms

Before accepting partial payments, it’s essential to define the terms clearly. This includes:

- Payment Schedule: Outline when payments will be due and the amount of each installment. Whether it’s a fixed percentage or specific dollar amount, make sure both you and the client are in agreement.

- Late Fees: Specify if there will be any penalties for overdue partial payments. This helps to encourage timely payments and protect your business from delayed cash flow.

- Final Balance: Clearly indicate the remaining amount due after each partial payment, so clients know exactly how much they owe after each transaction.

Tracking Partial Payments

Tracking payments is crucial to ensure that both you and your client have accurate records. Consider the following practices:

- Payment Receipts: Always provide a receipt or confirmation for each partial payment, specifying the amount paid and the remaining balance.

- Update Billing Records: Keep your records up to date by marking the payments as they come in. This will help you avoid mistakes and ensure that your client is correctly credited for each payment.

- Communication: Regularly update the client on their outstanding balance and send reminders as necessary. Keeping open communication ensures that both parties are on the same page.

By implementing clear terms and diligently tracking payments, partial payment arrangements can be a beneficial option for both you and your client.

Including Payment Terms in Your Invoice

Clearly outlining payment expectations is essential for smooth transactions. By specifying the terms upfront, you ensure that both you and the client understand the agreed-upon conditions, reducing the likelihood of confusion or disputes. Properly presented payment terms can also contribute to timely payments and professional business relationships.

Key Payment Terms to Include

Including essential payment information in your billing documents can help avoid delays and miscommunications. Consider including the following:

- Due Date: Clearly state when the payment is due. This can be a specific date or a time frame, such as “30 days from the issue date.”

- Accepted Payment Methods: Specify the forms of payment you accept, whether it’s credit cards, checks, or digital payment systems.

- Late Payment Fees: Indicate any additional charges that will apply if the payment is made past the due date. This helps encourage timely settlement.

- Discounts for Early Payment: Some businesses offer incentives for paying early. If this applies, clearly state the discount percentage and the conditions under which it is valid.

Communicating Payment Terms Effectively

When detailing payment terms, clear communication is key to ensuring both parties are aligned:

- Prominent Placement: Ensure that payment terms are easily visible, either at the top or bottom of the document, so they are immediately noticeable.

- Simple Language: Avoid legal jargon or overly complicated terms. Use straightforward language to ensure the client fully understands the payment expectations.

- Confirmation: Confirm with the client that they understand and agree to the payment terms before proceeding with the work.

Including clear and precise payment terms not only ensures you get paid on time but also fosters trust and transparency in your client relationships.

Using Online Tools for Invoice Creation

With the advancement of technology, creating detailed billing documents has become much more accessible. Online platforms offer a variety of tools that simplify the process of generating professional statements, helping you save time and ensure accuracy. These digital solutions allow for customization, quick editing, and seamless management of billing tasks, all from one centralized location.

Benefits of Using Online Platforms

Adopting online tools for generating your billing statements comes with several advantages:

- Efficiency: Creating and sending a detailed document becomes faster, allowing you to focus on other aspects of your work.

- Customization: Many online platforms provide customizable features, enabling you to create documents that reflect your brand and professional identity.

- Accuracy: Built-in calculators and automatic updates minimize the risk of errors, ensuring the document is correct every time.

- Access Anywhere: Cloud-based tools allow you to access and manage documents from any device, anywhere, making it easy to stay organized on the go.

Popular Online Tools for Document Creation

Several reputable platforms are available to streamline the process of generating professional documents. Some widely used tools include:

- QuickBooks: A comprehensive accounting tool with invoicing features, offering robust customization options and reporting capabilities.

- FreshBooks: A user-friendly platform designed for small businesses, providing customizable templates and automatic reminders for payments.

- Wave: A free solution ideal for freelancers and small businesses, allowing users to easily create and send detailed statements.

By using these online tools, you can ensure that your billing process is streamlined, professional, and efficient, while reducing the potential for errors.

How to Track Invoices and Payments

Keeping a close eye on payments and billing records is essential for maintaining a healthy cash flow and ensuring business operations run smoothly. Without an efficient system for tracking outstanding amounts and received payments, it becomes easy to lose track of finances. A well-organized method helps prevent overdue payments and makes it easier to reconcile your financial records.

To effectively monitor financial transactions, consider the following strategies:

- Use Software or Online Tools: Many accounting platforms and apps offer features that automatically track sent statements, due dates, and payments. These tools help you stay on top of what’s been paid and what remains outstanding.

- Set Reminders: Implement reminders for upcoming due dates to ensure you follow up with clients before payments become overdue.

- Maintain Detailed Records: Keep a record of all transactions, including amounts, payment dates, and method of payment. This can be done manually or with digital tools.

- Organize by Client: Track payments by client to ensure you know which accounts are settled and which ones require attention.

By staying organized and proactive with tracking, you can streamline your payment processes and avoid unnecessary delays in receiving funds.

How to Send and Store Your Invoices

Efficiently managing the delivery and storage of financial statements is key to maintaining a smooth operation and ensuring proper record-keeping. Proper organization of documents not only helps with tracking payments but also simplifies future reference and tax filing. The method of sending and securely storing these records is just as important as creating them.

Sending Your Statements

To ensure that your clients receive their documents promptly and in an accessible format, it is important to consider the following options for delivery:

- Email: The most common and quickest method for sending financial statements. Attach them as PDF files for easy viewing and downloading.

- Postal Mail: If necessary, hard copies can be sent through the postal service. Ensure the document is well-organized and clear.

- Online Payment Platforms: Many platforms allow you to send billing details directly to clients through their interface, offering automated tracking of payments.

Storing Your Financial Documents

Proper storage ensures that your records are safe, easily accessible, and can be retrieved if needed. Here are some methods:

- Cloud Storage: Securely store your documents in cloud-based systems that offer encryption and backup features. This also allows you to access your records from anywhere.

- Accounting Software: Many accounting tools automatically save documents within their system, allowing you to categorize and search for records easily.

- Physical Filing Systems: For those who prefer hard copies, maintain a well-organized filing system with clearly labeled folders by client or year.

Best Practices for Storing Documents

Ensure that your stored documents are safe and organized by following these best practices:

Action Description Label Clearly Always label your files with clear names, including client names, dates, and services provided for easy reference. Backup Regularly Whether you store records digitally or physically, ensure backups are made periodically to prevent data loss. Review Periodically Set a schedule to review stored documents, ensuring all necessary files are updated and complete. By following these methods for sending and storing your documents, you can ensure smooth business operations, proper financial tracking, and easy retrieval whenever necessary.