European Invoice Template for Simplified Billing Across the EU

Managing billing processes efficiently is crucial for businesses operating internationally. Having a well-structured and professional document for transactions ensures smooth communication with clients and partners. Whether you’re a freelancer or a company, ensuring that your financial paperwork is clear and error-free is essential for maintaining a positive relationship with customers.

One of the most effective ways to simplify this task is by using a pre-designed structure. A standardized document can save you time and help you avoid costly mistakes. It provides all the necessary fields for accurate information while also adhering to legal requirements in different regions. This guide will walk you through the key aspects of setting up a proper billing form and how to customize it to fit your needs.

Efficiency, clarity, and accuracy are the three pillars of a well-crafted document, and with the right tools, you can ensure that your financial communications are both professional and compliant with local regulations. Read on to learn how you can easily create and use an appropriate form for your business transactions.

European Invoice Template Guide

When it comes to managing billing for cross-border transactions, having a standardized form is key to ensuring smooth and compliant operations. A well-structured document simplifies the process of capturing all necessary details, from buyer information to payment terms, while also adhering to local regulations. By using a properly formatted structure, businesses can avoid errors and reduce the time spent on administrative tasks.

This guide will cover the essential components of a well-organized billing document and explain how you can tailor it for your specific needs. Whether you’re dealing with customers in multiple countries or just looking to improve the clarity and professionalism of your documents, understanding the core elements of a proper form is critical.

With the right structure in place, you can easily customize the fields to fit your industry, legal requirements, and preferred style. The goal is to create a document that conveys all the necessary information clearly and accurately, making transactions more efficient and reducing the chances of misunderstandings.

Key areas to focus on include correct formatting, including all required details like tax identification numbers and payment terms, and ensuring that the document meets any regional standards. In the following sections, we will walk through the main elements you need to include and best practices to follow when creating your own.

What is a European Invoice Template?

A standardized document used for billing purposes serves as a formal record of a transaction between a buyer and a seller. It contains all the relevant details needed for the exchange of goods or services, ensuring that both parties have a clear understanding of the terms. This type of document is essential for keeping financial records accurate and legally compliant across various regions.

Key Features of a Billing Document

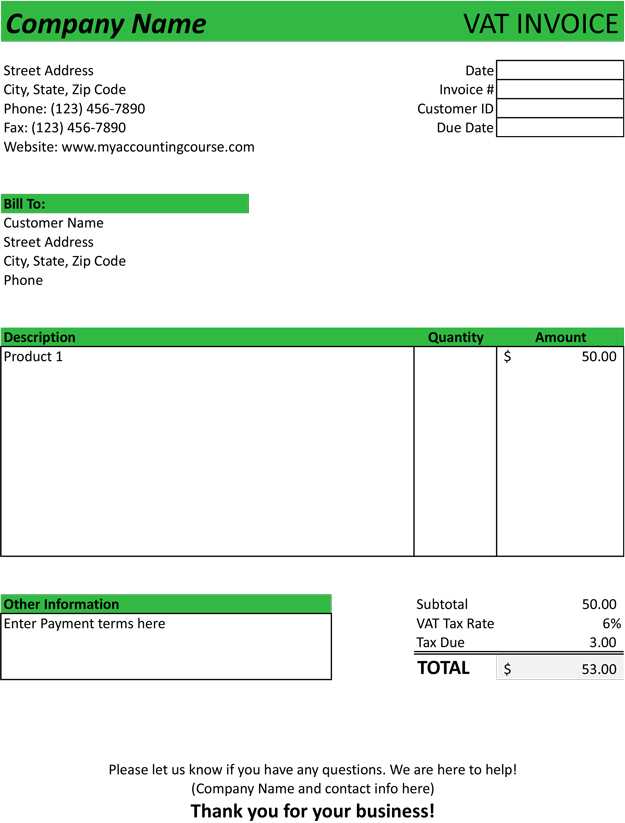

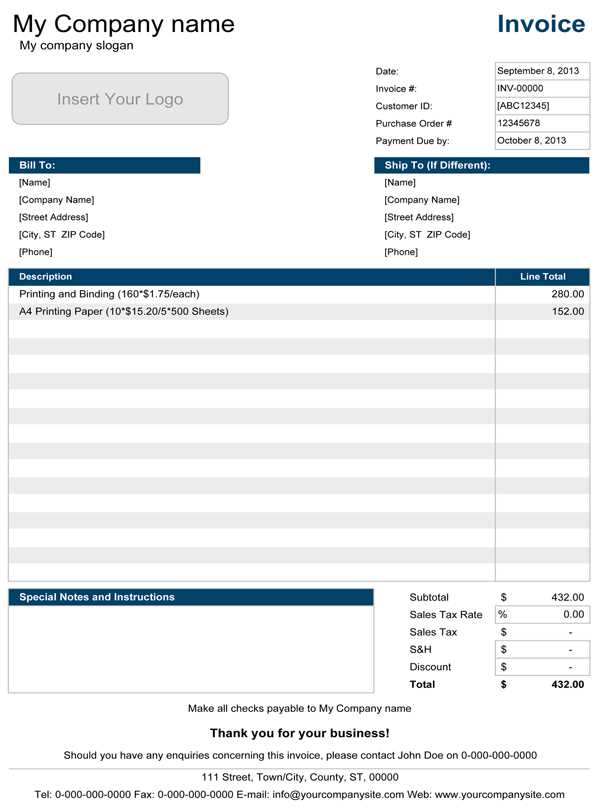

Such a document typically includes important information like the seller’s and buyer’s contact details, a list of goods or services provided, their corresponding prices, and payment terms. It may also include specific legal requirements such as tax identification numbers, VAT rates, or other region-specific regulations. Using a well-structured document ensures that the necessary details are always included and easy to find.

Why Standardization Matters

Standardization allows businesses to maintain consistency and streamline their processes. By following a set format, you reduce the risk of errors and misunderstandings between both parties. It also ensures that the document meets all regional legal and tax requirements, which is crucial for avoiding potential disputes or fines.

In short, a billing document in a standardized form ensures clarity, accuracy, and compliance with applicable laws, making it an essential tool for businesses operating in different markets.

Key Elements of a European Invoice

A well-structured billing document is crucial for ensuring clarity and compliance in business transactions. To guarantee that all necessary information is captured, certain components must always be included. These key elements provide both the buyer and seller with a clear overview of the transaction and protect both parties in case of disputes or audits.

- Seller and Buyer Details: This includes the full name, address, and contact information of both parties involved in the transaction. It may also include the tax identification number (TIN) for legal purposes.

- Unique Reference Number: Each document should have a distinct identification number for tracking purposes. This helps in organizing records and ensures each transaction is easily traceable.

- Date of Issue: The date when the billing document is created is essential for record-keeping and setting payment deadlines.

- Description of Goods or Services: A clear breakdown of what has been sold or provided. Each item or service should be listed along with quantities and unit prices.

- Total Amount Due: The total amount that the buyer is required to pay, including any applicable taxes, discounts, or additional charges.

- Payment Terms: Specifies the payment due date, method of payment, and any penalties for late payment. Clear terms help ensure timely payments and avoid misunderstandings.

- Tax Information: Depending on the region, details like VAT (Value Added Tax) rates or other tax information may need to be included. This helps ensure compliance with local tax laws.

By including all these key elements, a business ensures that all relevant details are communicated clearly and that the document meets legal and financial requirements in any jurisdiction.

Why Use a Template for Invoices?

Using a pre-designed structure for financial documents streamlines the billing process and reduces the risk of errors. By following a consistent format, businesses can ensure that all required information is included, saving time and effort on each transaction. Additionally, it helps maintain professionalism, which is crucial when dealing with clients and partners across different regions.

Time Efficiency and Consistency

With a ready-to-use layout, there is no need to start from scratch with each new bill. This significantly cuts down on the time spent preparing financial records. A standard design also guarantees consistency, so every document looks uniform and meets your business’s standards. This consistent approach builds trust with clients and simplifies bookkeeping.

Compliance and Accuracy

Using a pre-structured document ensures that all the necessary legal and financial details are included, reducing the likelihood of missing important elements. Templates are especially helpful for ensuring compliance with regional tax laws and regulations, which can vary greatly. With the right format in place, you can easily adjust the template to meet local requirements without worrying about overlooking critical details.

Differences Between EU and Non-EU Invoices

The format and requirements for financial documents can differ depending on whether the transaction takes place within the European Union or with countries outside of it. These differences are mainly driven by varying legal, tax, and regulatory standards that businesses must adhere to when conducting international trade.

Taxation and VAT Rules

One of the most significant differences between documents for transactions within the EU and those with non-EU countries lies in the application of Value Added Tax (VAT). In intra-EU transactions, VAT is generally charged based on the buyer’s location and tax status. On the other hand, when dealing with non-EU countries, VAT is usually exempt or handled differently, depending on the nature of the goods or services. For cross-border transactions, proper documentation of the VAT status is crucial to ensure compliance and avoid any financial penalties.

Legal Information and Country Codes

Another key difference is the inclusion of country-specific details. For instance, transactions within the EU often require specific tax identification numbers, such as the VAT number, for both the buyer and seller. Additionally, the invoice format may need to follow local regulations or include country-specific codes. When trading with non-EU countries, businesses may need to include extra details like customs codes or export/import references, depending on the nature of the goods or services being exchanged.

Benefits of Using a Standardized Template

Using a consistent and pre-designed structure for financial documentation offers numerous advantages, particularly for businesses dealing with multiple clients or operating across different regions. A standardized format not only ensures accuracy but also saves time, improves professionalism, and reduces the likelihood of errors. These benefits are especially important for maintaining smooth financial operations and fostering strong business relationships.

Improved Efficiency and Time Savings

One of the primary advantages of using a pre-designed structure is the time saved in document preparation. With a set layout, you don’t need to manually create new records from scratch every time. Instead, you can simply update the relevant fields, significantly speeding up the billing process. This streamlined approach frees up time to focus on other areas of the business.

Consistency and Professionalism

Consistency in billing documents helps build trust with clients and partners. A standardized form ensures that all the necessary details are included in every document, reducing the risk of omissions. It also enhances the overall appearance of the document, giving your business a more professional image. Clients will appreciate the clear, organized format, which reflects positively on your company’s attention to detail.

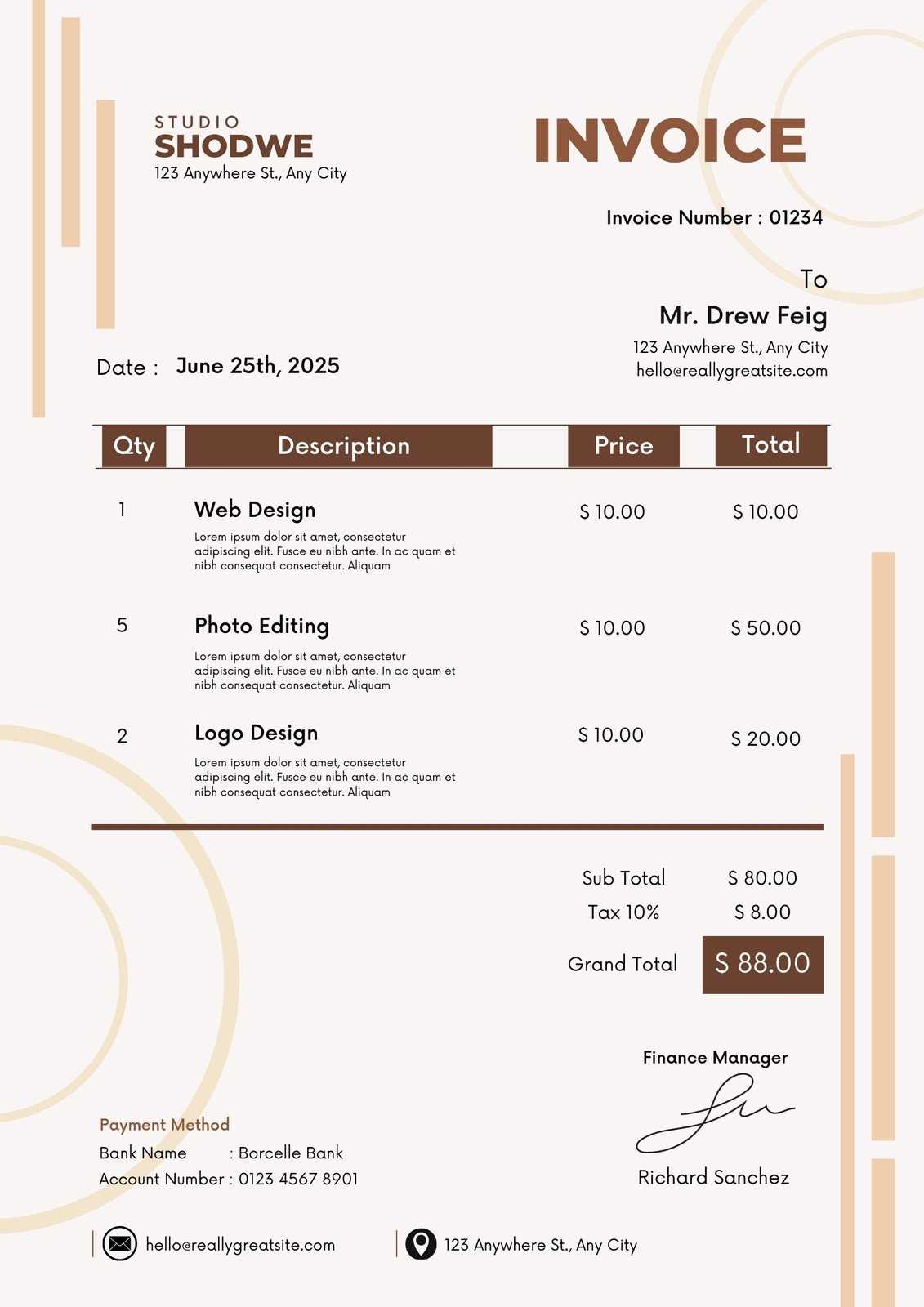

Customizing Your Billing Document

One of the key benefits of using a pre-structured financial document is the ability to tailor it to meet the specific needs of your business and clients. Customization ensures that the document reflects your brand, accommodates your services, and complies with regional requirements. Personalizing each section allows for greater flexibility and relevance in different transactions.

Key Customization Options

- Branding: Add your company logo, color scheme, and contact information to create a professional, branded look.

- Payment Terms: Adjust the payment due date, methods, and penalties according to your business’s preferences.

- Description of Services: Include detailed descriptions of the products or services provided to ensure clarity for your clients.

- Tax Details: Modify the tax rates and identification numbers based on the specific region or type of transaction.

- Currency Options: Change the currency to match the location of the buyer or the nature of the transaction, especially for international dealings.

Ensuring Legal Compliance

In addition to visual and functional adjustments, it’s essential to customize the document to meet any legal or regulatory requirements. Depending on the location of the buyer or seller, certain fields may need to be added, such as tax identification numbers, VAT registration details, or other country-specific information. Ensuring compliance with these legalities is critical to avoiding potential issues.

How to Format Your Document for EU Compliance

When conducting business within the EU, it is essential to format your financial documents in a way that meets the region’s legal and tax regulations. Compliance ensures that all necessary information is included, helping to avoid issues with tax authorities and fostering clear communication with clients. Properly structured documents also reduce the risk of misunderstandings and potential disputes.

The following key elements should be included to ensure that your billing document complies with EU regulations:

| Element | Required Information |

|---|---|

| Tax Identification Numbers | Both the seller’s and buyer’s VAT numbers must be included, especially for cross-border transactions within the EU. |

| VAT Rates | The applicable VAT rate must be clearly stated based on the product or service type and the buyer’s location. |

| Invoice Date | The date the document is issued is essential for determining payment terms and VAT calculation periods. |

| Unique Invoice Number | Each document must have a unique identification number for record-keeping and tracking purposes. |

| Currency and Amount | The total amount due should be displayed, including VAT, with the correct currency code used (e.g., EUR for Euro). |

| Payment Terms | Clear information regarding payment deadlines, methods, and any penalties for late payment. |

Ensuring that your document follows these guidelines will help maintain compliance and avoid potential fines. Additionally, it fosters transparency in business transactions, which is critical for building long-term relationships with clients across the EU.

Essential Fields in a Billing Document

For any financial document, it is crucial to include the right fields to ensure clarity, accuracy, and compliance with legal requirements. These essential components not only help in organizing the transaction details but also provide the necessary information for both the seller and buyer. Whether you’re issuing a document for a local or international transaction, certain fields are non-negotiable to make sure all parties are on the same page.

The following table outlines the key fields that should be present in any billing document:

| Field | Purpose |

|---|---|

| Seller and Buyer Information | Names, addresses, and contact details of both parties involved in the transaction. This ensures that the document is traceable and verifiable. |

| Unique Document Number | A unique reference number that serves to identify and track the transaction for record-keeping and future reference. |

| Issue Date | The date when the document is created. This is important for determining payment deadlines and the period of service or delivery. |

| Description of Goods/Services | Detailed descriptions of the items or services provided, including quantities, unit prices, and any applicable discounts. |

| Tax Information | Details such as VAT numbers, applicable tax rates, and total tax amounts based on the goods or services provided. |

| Total Amount Due | The sum total of the transaction, including taxes, shipping fees, and any other charges, displayed clearly for payment purposes. |

| Payment Terms | Terms specifying when payment is due, acceptable payment methods, and any penalties for late payment. |

By ensuring that all these key fields are present in your document, you can avoid common issues and guarantee that the transaction is clearly documented, legally compliant, and easy to process for both parties involved.

VAT Requirements in Billing Documents

When dealing with transactions within the EU, one of the most important aspects of financial documentation is the correct application and reporting of Value Added Tax (VAT). VAT is a consumption tax that varies depending on the goods or services sold, the location of the buyer, and the seller’s tax status. Properly documenting VAT is essential not only for compliance with tax laws but also for ensuring transparent and accurate financial reporting.

The following table highlights the key VAT-related elements that must be included in any billing document to ensure legal compliance within the EU:

| VAT Field | Description |

|---|---|

| VAT Registration Number | The seller’s VAT identification number is required on all transactions that involve VAT. If the buyer is registered for VAT, their number should also be included. |

| VAT Rate | The applicable VAT rate (e.g., standard, reduced, or exempt) must be specified based on the product or service type and the buyer’s location. |

| VAT Amount | The exact amount of VAT charged should be clearly shown, calculated based on the applicable rate and the price of goods or services provided. |

| Exemption Information | If the transaction is exempt from VAT (e.g., exports or specific goods/services), this must be clearly stated, along with the legal basis for the exemption. |

| Total Amount Due (Including VAT) | The final total should include the VAT amount, making it clear to the buyer how much they are paying in taxes as part of the overall sum. |

Correctly applying VAT on your documents not only ensures legal compliance but also helps maintain transparency and trust with your clients. Be sure to follow the relevant guidelines and regulations specific to the jurisdiction in which you are operating to avoid any potential issues with tax authorities.

How to Handle Multi-Currency Billing Documents

When conducting international transactions, especially with clients in different countries, it’s essential to properly handle multi-currency billing. A document issued in one currency may not be practical or clear for the recipient if their local currency differs. To avoid confusion and ensure smooth payment processing, it’s important to include all necessary details about currency conversion and payment options.

Key Considerations for Multi-Currency Transactions

When managing transactions across borders, there are several factors to keep in mind:

- Currency Choice: Clearly state the currency in which the transaction is conducted (e.g., USD, EUR, GBP) and use the appropriate currency symbol or code (e.g., € for Euro, $ for Dollar).

- Conversion Rates: Specify the conversion rate used if the transaction involves currency exchange. This ensures transparency and avoids confusion for the buyer.

- Total Amounts in Multiple Currencies: If both the buyer and seller use different currencies, list the total amount due in both currencies (the original and the converted amount). Include the exchange rate used to calculate the final total.

- Payment Methods: Provide clear instructions on how payment should be made, especially if you’re accepting payments in multiple currencies or through different channels.

Ensuring Accuracy and Clarity

To avoid errors or misunderstandings, make sure the currency symbols, conversion rates, and amounts are clearly listed. Additionally, if there are any fluctuations in exchange rates or specific terms related to international payments (e.g., fees for currency conversion), these should be clearly explained in the document. This helps ensure both parties are aware of the agreed-upon amount and reduces the risk of discrepancies during payment processing.

By taking the time to format your billing documents clearly and accurately when dealing with multi-currency transactions, you can streamline the process and ensure smooth, transparent business operations across borders.

Best Practices for Document Numbering

Properly numbering your financial documents is essential for effective record-keeping and business organization. A unique and logical numbering system helps to easily track and reference transactions, ensuring clarity for both you and your clients. It also simplifies accounting processes and ensures compliance with legal and tax regulations, especially when it comes to audits or reviews.

Key Guidelines for Effective Numbering

Here are some best practices to follow when creating a numbering system for your documents:

- Unique and Sequential: Ensure that each document has a unique number that follows a sequential order. This avoids confusion and ensures that every document can be traced back to a specific transaction.

- Year and Month Indicators: Include the year and month in the numbering format (e.g., 2024-001, 2024-002). This makes it easier to organize documents chronologically and quickly identify when they were issued.

- Avoid Gaps: Never skip numbers in your sequence. Gaps can raise questions during audits or when reviewing past records. Always issue documents in a continuous sequence.

- Simple and Clear Format: Keep the numbering system simple and easy to understand. Avoid overly complex formats that might confuse clients or employees handling the records.

Ensuring Consistency and Compliance

By adopting a structured approach to document numbering, you ensure consistency across your business operations. It’s important to keep a detailed log of all issued numbers and regularly review your numbering system to ensure it aligns with accounting or legal requirements. A well-organized numbering system can help streamline your operations and prevent errors in record-keeping.

How to Save Time with Pre-Formatted Documents

Creating financial documents from scratch for every transaction can be time-consuming and inefficient. By using a pre-designed structure, you can streamline the process and avoid the need to re-enter the same information repeatedly. Pre-formatted documents help ensure that all necessary details are included, while also reducing the likelihood of errors. This not only saves time but also increases accuracy and consistency across all your transactions.

Benefits of Using Pre-Formatted Documents

- Consistency: Pre-made structures ensure that every document follows the same format, including all required fields, making it easier to maintain a professional and organized approach.

- Speed: By eliminating the need to manually create each document, you can generate them faster. You can simply fill in the relevant information, which accelerates the process and allows you to focus on other important tasks.

- Accuracy: Pre-designed forms often come with built-in fields and calculations that help reduce mistakes, such as incorrect totals or missing information.

How to Maximize Efficiency

To get the most out of pre-formatted documents, ensure that your system allows for easy customization. You can create a master template for your transactions, then quickly adjust details such as the customer name, services provided, and payment terms. By keeping the basic structure intact and only updating variable information, you can generate a new document in minutes. Additionally, ensure your system is automated to handle recurring fields, such as tax rates, currency symbols, or payment instructions, so you don’t have to manually input this data each time.

Free Billing Document Templates Available Online

For small business owners and freelancers, finding the right tools to streamline administrative tasks can make a significant difference. One of the most useful resources available is free pre-designed billing documents that can be downloaded and customized for your specific needs. These ready-to-use formats save time and effort, allowing you to quickly create professional-looking records for your transactions without the need for advanced software or design skills.

Where to Find Free Billing Document Formats

There are several online platforms offering free, customizable document designs suitable for businesses of all sizes. Many websites allow you to download files in various formats, including Word, Excel, PDF, and even Google Docs, making it easy to choose the one that works best for your workflow. Some websites even offer templates specifically tailored to different industries, such as retail, consulting, or construction.

Benefits of Using Free Templates

- Time-Saving: With a ready-made format, you can skip the formatting and focus on filling in the details of your transaction.

- Cost-Effective: These resources are free, which makes them a great option for small businesses or freelancers working with limited budgets.

- Easy Customization: Many templates are editable, allowing you to easily adjust fields, add your branding, or modify the layout to fit your needs.

- Compliance-Friendly: Pre-designed formats are often structured according to legal requirements, helping you ensure that your documents meet necessary regulations.

By leveraging these free resources, you can quickly generate professional documents that help you stay organized, meet regulatory requirements, and maintain a high level of professionalism in your business transactions.

How to Send Your Billing Document in the EU

Sending billing documents across the EU requires careful attention to both the format and the method of delivery. Whether you’re dealing with clients within your own country or across borders, it’s essential to ensure that your documents are transmitted efficiently and in compliance with regulations. The method of sending can vary depending on your client’s preferences, the nature of the transaction, and legal requirements in different jurisdictions.

Methods for Sending Billing Documents

There are several ways to send your billing document, each with its own advantages and considerations:

| Method | Advantages | Considerations |

|---|---|---|

| Fast, easy, and cost-effective. Allows for quick transmission across borders. | Ensure the document is properly formatted (PDF is recommended for security and consistency) and that it’s clear and legible. | |

| Postal Mail | Preferred for formal or legally binding transactions. Allows for physical proof of delivery. | Slower and more expensive, especially for international deliveries. Consider adding tracking or requiring a signature to confirm receipt. |

| Electronic Data Interchange (EDI) | Ideal for larger businesses with regular transactions. Automated system with secure, structured data exchange. | Requires both parties to have compatible systems in place, making it less ideal for smaller companies or occasional transactions. |

Ensuring Compliance and Proper Documentation

Regardless of the delivery method, make sure your billing document complies with any local or international tax regulations. When sending documents electronically, consider using secure communication channels to protect sensitive financial data. In the case of physical mail, ensure that all required copies are included and that they’re delivered through a reliable courier or postal service.

By selecting the appropriate method of delivery and ensuring your document is accurate and secure, you can maintain smooth and professional transactions across the EU.

Common Mistakes in Billing Documents

When preparing billing documents, even small mistakes can lead to confusion, delays in payment, or compliance issues. It’s crucial to be aware of common errors that can occur during the creation or transmission of financial records, as these can cause unnecessary complications. By identifying and correcting these common pitfalls, you can ensure smoother transactions and build stronger business relationships with clients and partners.

Common Mistakes to Avoid

- Incorrect or Missing Contact Information: One of the most frequent mistakes is omitting or incorrectly listing the business’s contact details. Always double-check the accuracy of the recipient’s name, address, phone number, and email address to ensure clear communication.

- Failure to Include Payment Terms: Not specifying the payment terms, such as due dates, late fees, or early payment discounts, can lead to confusion or delays. Clearly state these terms to ensure both parties are on the same page.

- Omitting Tax Information: Incorrect or missing tax rates and amounts are a significant issue, especially for businesses operating internationally. Always verify that the applicable tax rates are correctly applied and that the tax number is included if necessary.

- Missing Unique Document Number: Failing to assign a unique identification number to each document can lead to issues with tracking payments or reconciling financial records. Be sure to maintain a consistent numbering system for all documents.

- Not Specifying Currency: If you’re dealing with clients from different countries, make sure to specify the currency being used for the transaction. This avoids confusion and potential disputes over payment amounts.

- Unclear Descriptions of Goods/Services: Vague descriptions of what was sold or provided can lead to misunderstandings. Be as specific as possible about the items or services to avoid ambiguity.

How to Avoid These Mistakes

To minimize these errors, consider using a consistent system for creating your documents and double-checking the information before sending it out. Using pre-designed forms or automated invoicing systems can also help reduce human error. Additionally, ensure that both you and your clients are clear on all terms, including payment schedules, delivery expectations, and any applicable tax or currency details.

By being mindful of these common mistakes, you can ensure that your billing documents are accurate, professional, and ready for smooth processing.

How Pre-Formatted Documents Improve Accuracy

Using pre-designed structures for financial records greatly enhances the precision and reliability of your transactions. By eliminating the need to manually create every document from scratch, the risk of human error is significantly reduced. Pre-formatted documents ensure that all required fields are consistently included and that they follow a logical structure, making it easier to avoid mistakes that could lead to discrepancies or payment delays.

Key Ways Pre-Formatted Structures Enhance Accuracy

- Standardized Layout: A consistent format ensures that no essential information is omitted, such as customer details, item descriptions, or payment terms. This reduces the chances of overlooking important sections.

- Automated Calculations: Many pre-designed formats come with built-in formulas for calculating totals, taxes, and discounts. This eliminates the need for manual calculations, which can sometimes lead to errors.

- Consistency in Content: By using the same structure for every document, you ensure that all your records follow the same guidelines, making them easier to read and understand for both you and your clients.

- Reduced Risk of Missing Details: With a pre-designed structure, all the necessary fields (such as date, number, and tax information) are already included, which reduces the risk of forgetting to add vital details to the document.

Overall, pre-formatted documents help streamline the creation process while maintaining a high level of accuracy, ensuring that both you and your clients have the correct and consistent information for every transaction.