Philippines Invoice Template Free Download and Customization Guide

Effective billing is essential for any business, ensuring smooth transactions and clear communication between service providers and clients. Having a well-structured and legally compliant document for every sale or service rendered can save time, reduce errors, and enhance professionalism. Using a customizable format makes this process even more efficient, enabling business owners to focus on what truly matters–growing their company.

In this guide, we explore how to streamline the billing process with easy-to-use formats that meet local requirements. Whether you’re a freelancer, small business owner, or part of a larger organization, utilizing a standardized document system simplifies record-keeping and payment tracking. By adapting these solutions to your unique needs, you can ensure that every transaction is processed seamlessly and accurately.

Adaptability is a key feature of these documents. With just a few adjustments, you can tailor them to fit your specific industry, whether you’re offering consulting, product sales, or professional services. This flexibility helps maintain clarity while ensuring that all necessary details are present and compliant with local regulations.

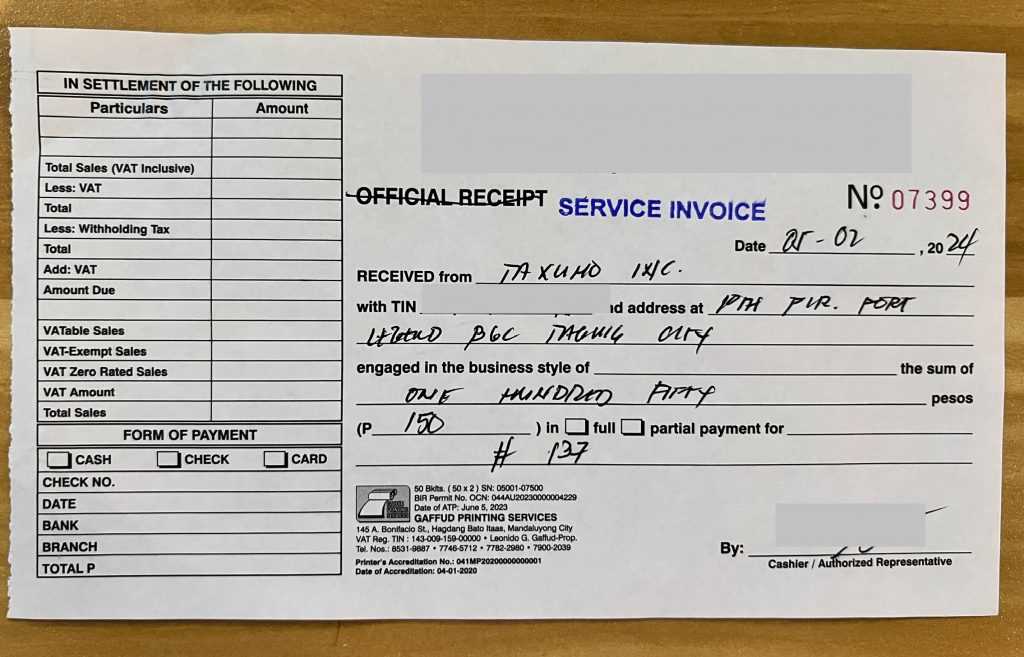

Philippines Invoice Template Overview

Having a well-organized document for billing is essential for smooth business operations. It not only helps maintain professionalism but also ensures that both parties involved in a transaction are clear about payment expectations. A good billing document is designed to be easy to customize and flexible enough to accommodate various business needs, while meeting local regulatory standards.

Key Features of a Billing Document

Effective billing documents typically include important details such as the business name, contact information, client details, payment terms, and itemized services or products provided. These features ensure transparency and can serve as a legal record for both parties. The document should also have space for additional notes, discounts, or taxes, making it adaptable to a variety of industries.

Customization and Flexibility

One of the main advantages of using a structured billing format is its adaptability. You can easily modify it to reflect the nature of your business, whether you’re invoicing for products, services, or a combination of both. Customizable fields allow for quick updates, saving time and reducing the chance of errors. By adjusting the layout or adding necessary sections, you can create a document that fits your unique requirements while maintaining professionalism.

Why Use an Invoice Template

Using a pre-designed billing format offers numerous benefits for businesses of all sizes. It simplifies the process of creating professional documents by providing a clear structure and eliminating the need to start from scratch each time. This not only saves valuable time but also ensures consistency and accuracy in every transaction.

One of the main advantages is efficiency. A well-structured document allows you to quickly input relevant details, minimizing errors and ensuring that all required information is included. Additionally, these formats often come with fields for essential components such as payment terms, client contact details, and itemized lists of services, which makes it easier to meet legal and business requirements.

Another key reason to use a pre-designed format is professionalism. Customizing a standardized layout ensures that your business maintains a polished image, reflecting a serious approach to financial dealings. It helps build trust with clients by offering clear, concise, and organized billing that looks both professional and reliable.

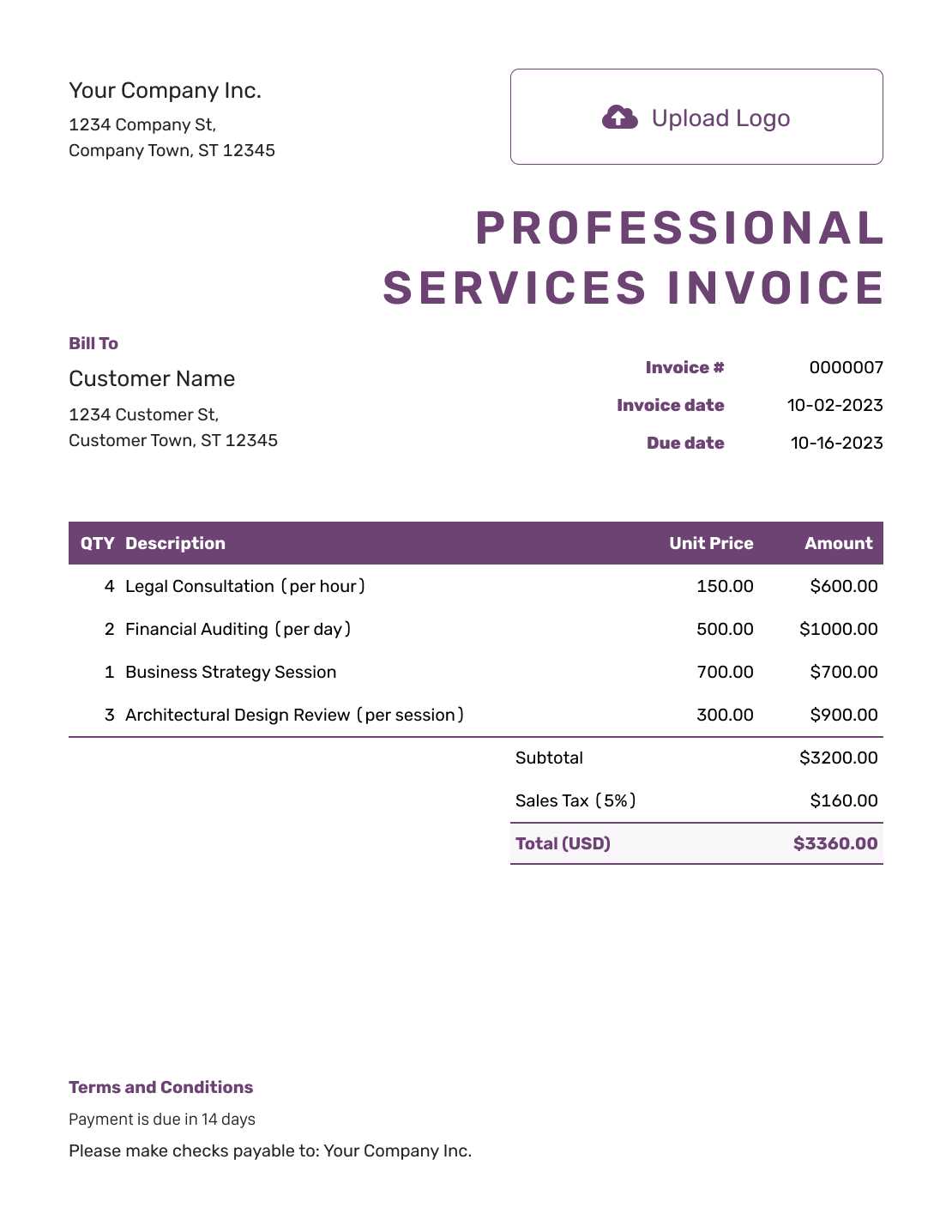

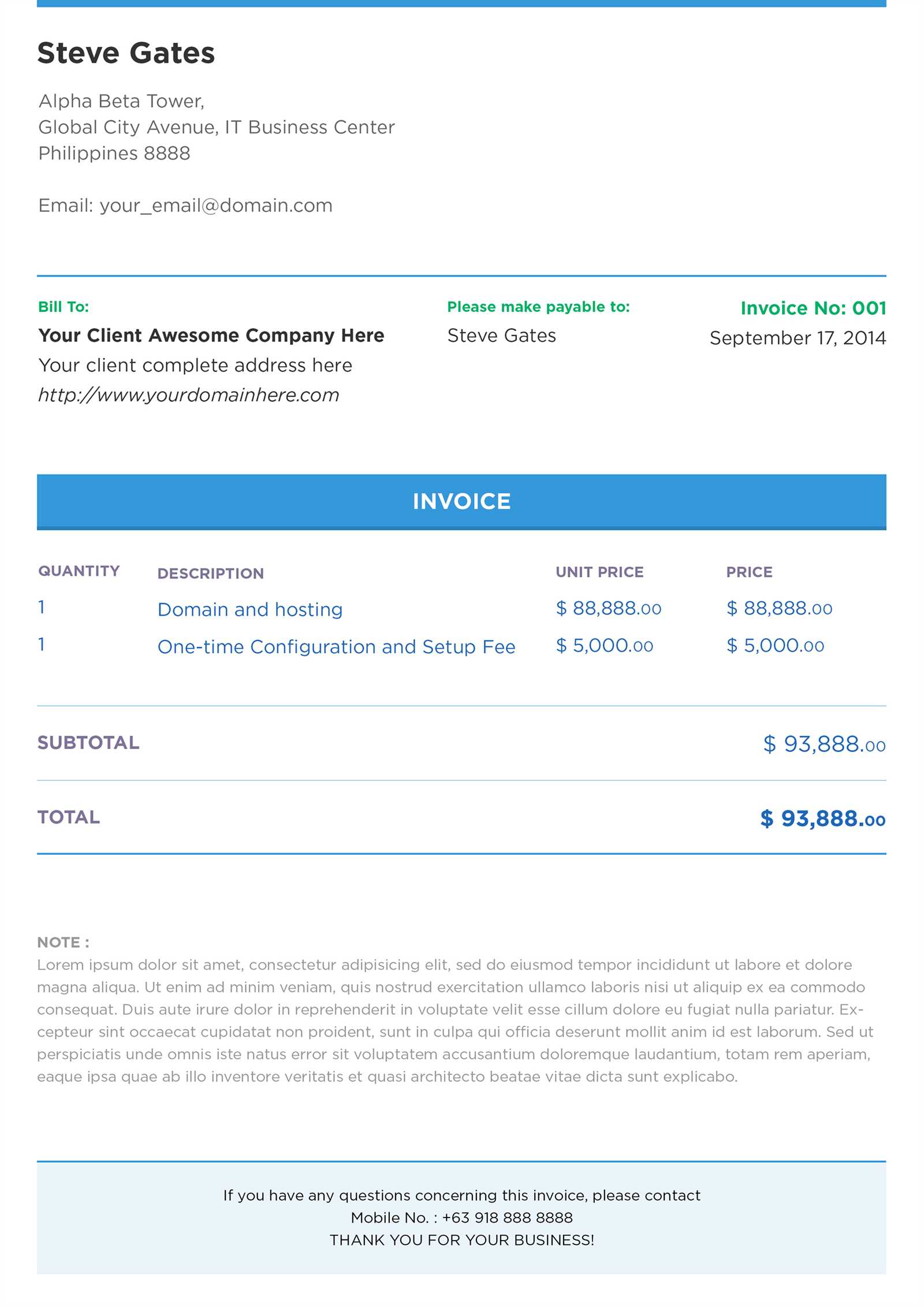

Benefits of Customizing Invoice Templates

Personalizing your billing document offers a range of advantages that can improve the efficiency and professionalism of your financial transactions. By adjusting a standardized format to meet your specific business needs, you ensure that every detail is tailored to reflect your services, branding, and legal obligations. Customization not only saves time but also enhances communication with clients.

One of the key benefits is branding. Customizing the layout allows you to incorporate your company’s logo, color scheme, and other elements of your brand identity, helping to maintain a cohesive appearance across all business communications. This contributes to a stronger brand presence and helps foster trust with clients.

Another significant advantage is accuracy and clarity. Custom fields allow you to include only the necessary information for your specific industry, eliminating irrelevant sections and reducing the chances of confusion. By streamlining the content, you create clear and easily understood documents that clients are more likely to pay attention to.

| Benefit | Description |

|---|---|

| Branding | Incorporate company logo and design elements to maintain consistency and professionalism. |

| Efficiency | Speed up the billing process with pre-filled, customizable fields tailored to your business. |

| Accuracy | Ensure all relevant information is included and presented in a clear, concise format. |

| Legal Compliance | Customize documents to include necessary tax details and business registration information. |

How to Download Free Invoice Templates

Getting access to customizable billing documents online is simple and convenient. Many websites offer free downloads of pre-designed formats that can be easily tailored to your business needs. These resources allow you to save time and avoid the hassle of creating your own document from scratch while ensuring that the layout meets basic industry standards.

To download a free document, start by identifying reliable websites that specialize in providing business resources. Look for platforms that offer a variety of formats, such as those with editable fields for client information, pricing, and payment terms. Be sure to check that the designs are up-to-date and compliant with local regulations to ensure your document is valid and professional.

Once you’ve found the right platform, simply select the format that suits your needs and follow the download instructions. Most websites will offer a PDF or Word version, which can be easily customized using text-editing software. After downloading, you can personalize the document with your business logo, contact details, and specific payment terms.

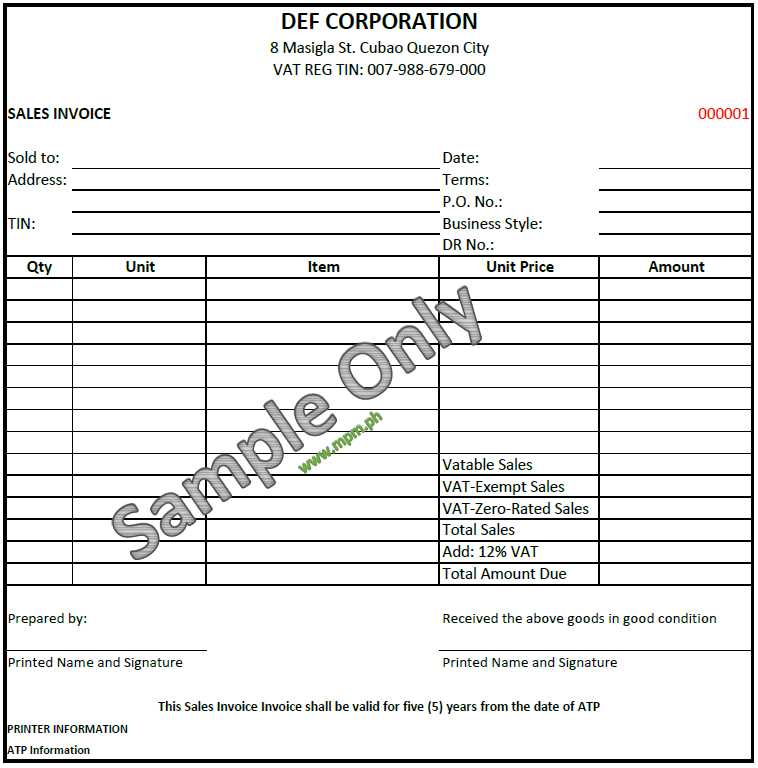

Essential Information to Include in Invoices

To ensure smooth transactions and avoid confusion, it’s crucial to include specific details in every billing document. These details not only help clarify the terms of the transaction but also protect both parties by creating a clear record of the exchange. By including all the necessary elements, you can ensure that payments are processed without delay and that your business remains organized.

Key Elements to Include

Every document should start with basic information such as the business name, address, and contact details. The recipient’s information should also be clearly listed, including their name, address, and any other relevant details. These pieces of information help identify both parties and establish the legitimacy of the transaction.

In addition, payment terms should be clearly outlined, specifying when the payment is due and any penalties for late payments. An itemized list of products or services provided, along with their corresponding prices, is essential for transparency. This helps both parties easily understand what is being paid for and ensures that no discrepancies arise.

Optional but Useful Details

Including additional elements, such as an invoice number, can make tracking easier. It helps your business maintain proper records for accounting and auditing purposes. Adding tax identification numbers and details about applicable taxes may also be required depending on local regulations, making your document compliant and official.

Clear communication through these essential details ensures timely payments and minimizes the risk of misunderstandings, keeping your business operations efficient and professional.

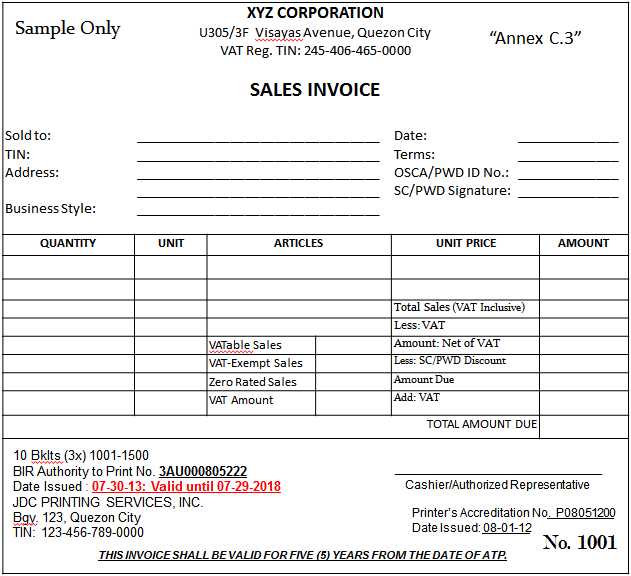

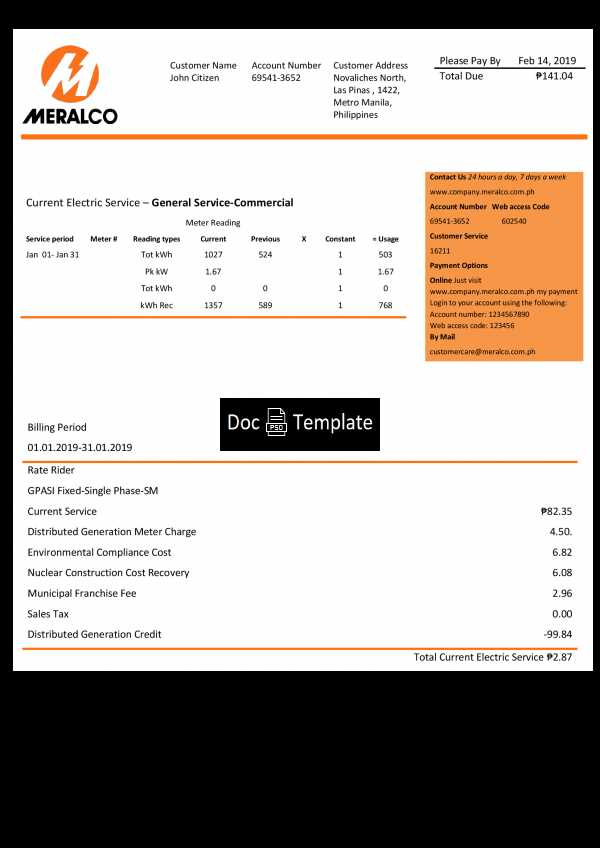

Legal Requirements for Invoices in the Philippines

When creating business documents for billing purposes, it’s essential to ensure compliance with local laws and regulations. In many regions, including the Philippines, there are specific requirements for what must be included in every document used for financial transactions. These legal standards help ensure that all business dealings are transparent, and they also safeguard both the business and the customer in case of disputes.

Essential Information for Legal Compliance

To meet legal requirements, certain information must be included in every billing document. This ensures that the document is both valid and traceable. For businesses operating in the Philippines, failure to comply with these requirements can result in penalties or delays in processing payments. The key details required by law include tax registration numbers, the full name and address of both parties, and itemized services or products provided.

| Required Information | Description |

|---|---|

| Tax Identification Number (TIN) | Each party involved must provide their TIN to ensure tax compliance. |

| Business Registration Number | The company should include their official registration number as per local laws. |

| Detailed Product or Service Descriptions | Each product or service listed must be clearly described and priced for transparency. |

| Applicable Taxes | Taxes should be calculated and listed separately according to local tax rates. |

| Issue Date | The date the document is issued must be clearly stated. |

Consequences of Non-Compliance

Not including the required information or failing to follow the legal guidelines could lead to penalties, fines, or even the invalidation of the document. This can disrupt cash flow and create legal issues for the business. Ensuring that your document complies with all necessary laws not only avoids these complications but also promotes trust and credibility with clients.

Common Invoice Mistakes to Avoid

When creating business documents for billing, it’s easy to overlook key details that can lead to misunderstandings or delays in payment. Mistakes in the billing process can cause confusion, disrupt cash flow, and create unnecessary complications for both parties. Being aware of these common errors and knowing how to avoid them ensures smoother transactions and better client relationships.

Frequent Mistakes in Billing Documents

One of the most common errors is not providing complete contact details for both the business and the client. Missing addresses, phone numbers, or tax information can create confusion and delay payments. Additionally, failing to accurately list items, services, or prices can lead to disputes over the amount due.

| Mistake | Consequences |

|---|---|

| Missing Contact Details | Leads to communication issues and delays in payment processing. |

| Incorrect or Unclear Descriptions | Causes confusion and disputes over what was provided and the amount owed. |

| Omitting Payment Terms | Results in misunderstandings regarding when and how payments are due. |

| Failure to Include Tax Information | Can lead to legal complications and tax-related issues. |

How to Avoid These Errors

To avoid these common mistakes, always double-check that all required fields are filled out completely and accurately. Ensure that all products or services are clearly described and priced correctly, and include any applicable taxes. Additionally, clearly state payment terms, including due dates and accepted methods of payment, to avoid confusion. By doing so, you help ensure that your billing process is smooth and professional.

Understanding Payment Terms on Invoices

Clear and well-defined payment terms are crucial for any business transaction. They set expectations regarding when and how payments should be made, helping to avoid confusion and disputes between the business and the client. By outlining the terms of payment in detail, you ensure both parties understand the financial obligations and timelines involved, which can significantly improve cash flow management and strengthen business relationships.

Payment terms typically include details such as the due date, acceptable payment methods, and any penalties for late payments. These terms not only protect your business from delayed payments but also inform the client of their responsibilities. For example, specifying a due date or a grace period helps prevent misunderstandings and sets a clear deadline for the payment to be completed.

Discounts for early payments are another common aspect of payment terms. Offering a small discount for prompt payment can motivate clients to pay ahead of schedule, improving your cash flow. On the other hand, including late fees or interest charges for overdue payments encourages timely action from clients who may otherwise delay payments.

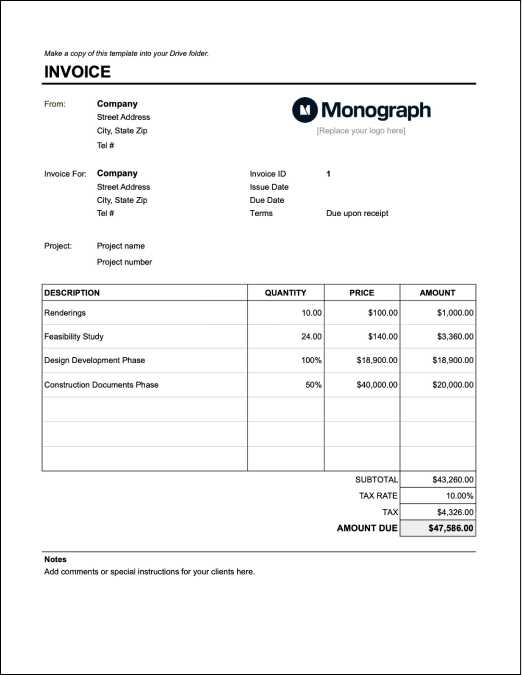

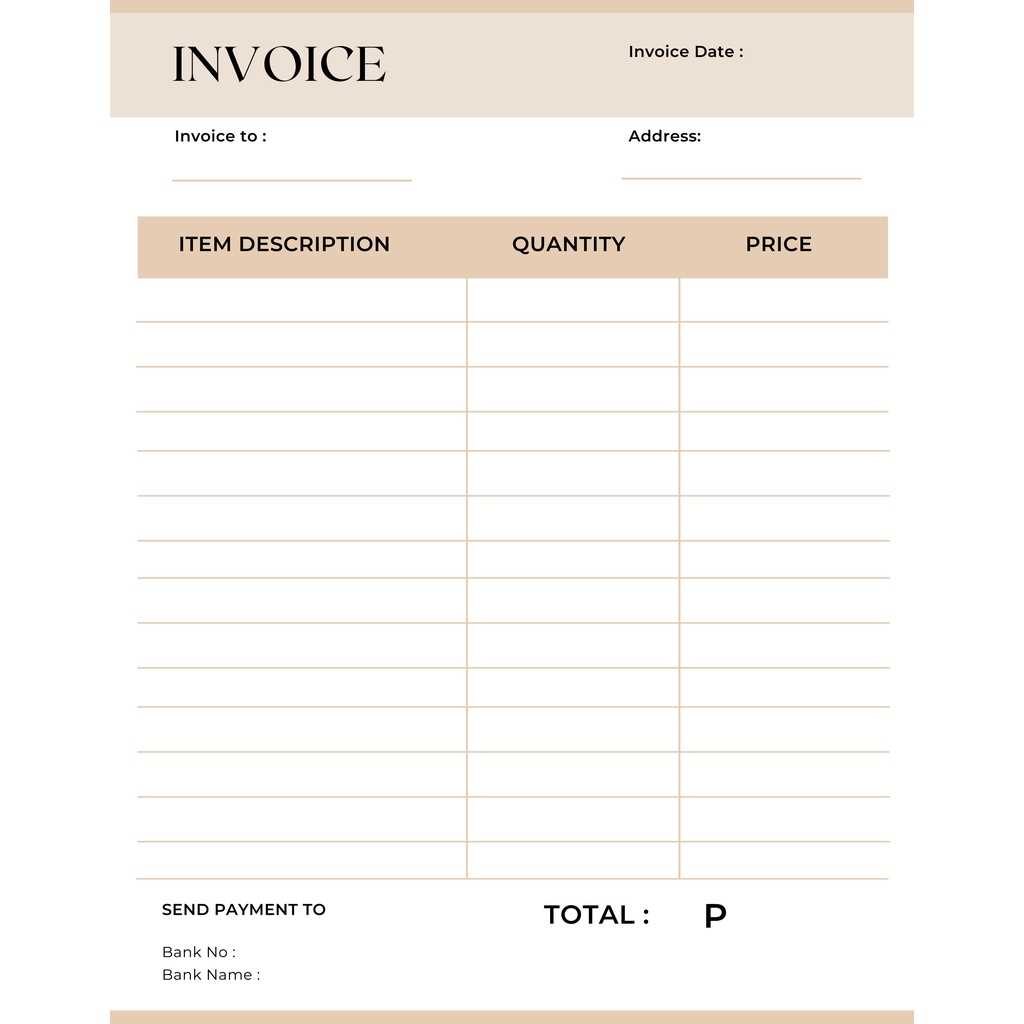

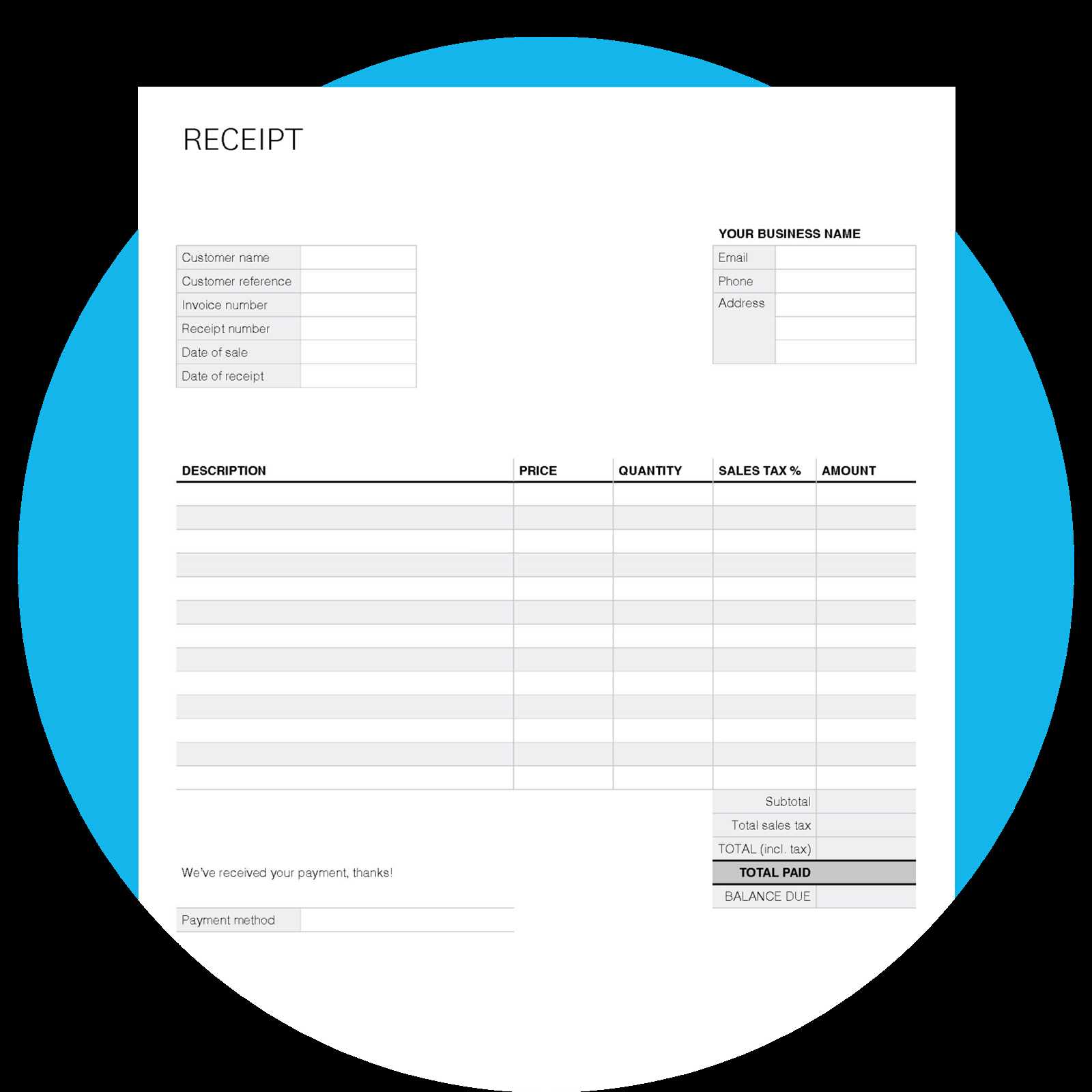

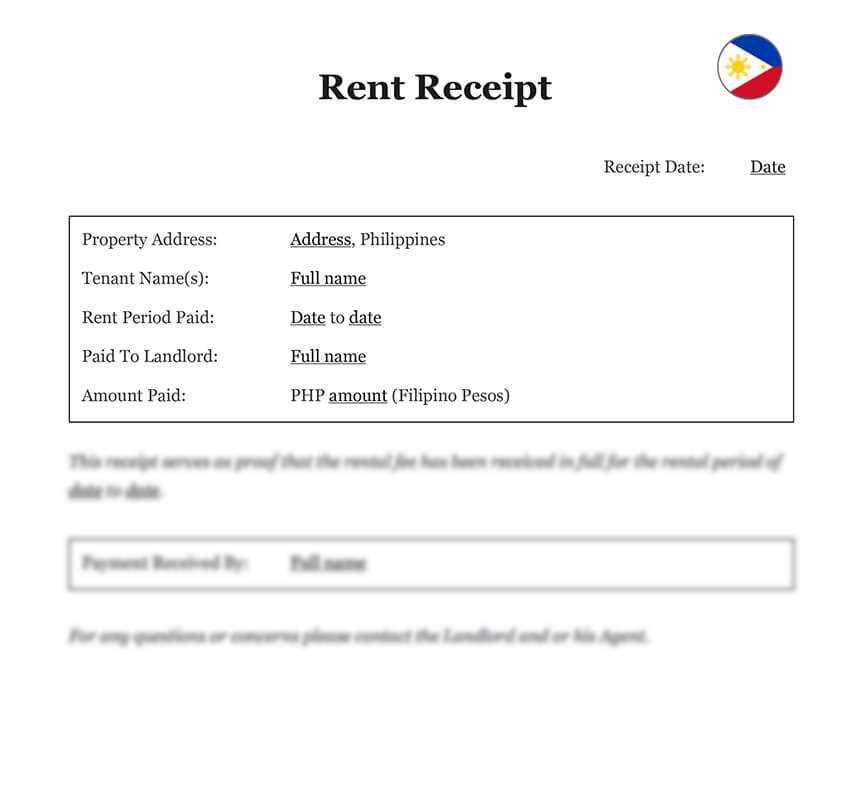

Choosing the Right Invoice Format

Selecting the appropriate billing document format is essential for ensuring that your financial transactions are organized, clear, and professional. The format you choose will depend on various factors such as the nature of your business, the services or products you offer, and the preferences of your clients. A well-designed format can help you maintain consistency, avoid errors, and improve the overall efficiency of your billing process.

When choosing a format, consider the following factors:

- Clarity and Simplicity – The layout should be easy to read and navigate. Avoid cluttered designs and focus on presenting essential information in a straightforward manner.

- Customization – Choose a format that allows you to easily customize the document with your company’s branding, logo, and other personalized details.

- Industry-Specific Requirements – Some businesses may require specific fields such as serial numbers, shipping details, or tax-related information. Make sure the format you choose includes these fields if necessary.

- Compatibility – Consider how the format can be edited and shared. Formats like Word or PDF are commonly used because they are easy to customize and compatible with most devices and systems.

Additionally, you should decide whether you need a basic or more detailed format. For example, a basic format might be ideal for small businesses with straightforward transactions, while a more complex format might be better for businesses that offer multiple products or services, or deal with larger transactions.

In the end, the right format is one that suits your business operations while remaining professional and easy to manage. Choosing the correct format can save you time, reduce errors, and help ensure timely payments.

How to Create Professional Invoices

Creating a polished and professional billing document is essential for maintaining a strong business reputation. A well-designed document ensures that clients understand the details of their transaction clearly and establishes credibility. By following a few key guidelines, you can produce documents that are both professional and easy to process, which helps build trust and fosters positive relationships with your clients.

To start, include all necessary details such as your business name, contact information, and tax identification number, along with the client’s information. This helps establish both parties and makes the document legally valid. Next, ensure that the payment terms are clearly stated, including the due date and any applicable late fees or discounts for early payment.

Use a clean and consistent layout that emphasizes clarity. This means aligning all sections neatly, using legible fonts, and organizing information in a logical order. For example, list items or services in a table format with clear descriptions, quantities, and prices. Additionally, always include a unique reference number for each document to facilitate tracking and future reference.

Lastly, incorporate your branding, such as your logo and business colors, to create a cohesive and professional look. This helps reinforce your brand identity while ensuring the document stands out as a legitimate business transaction.

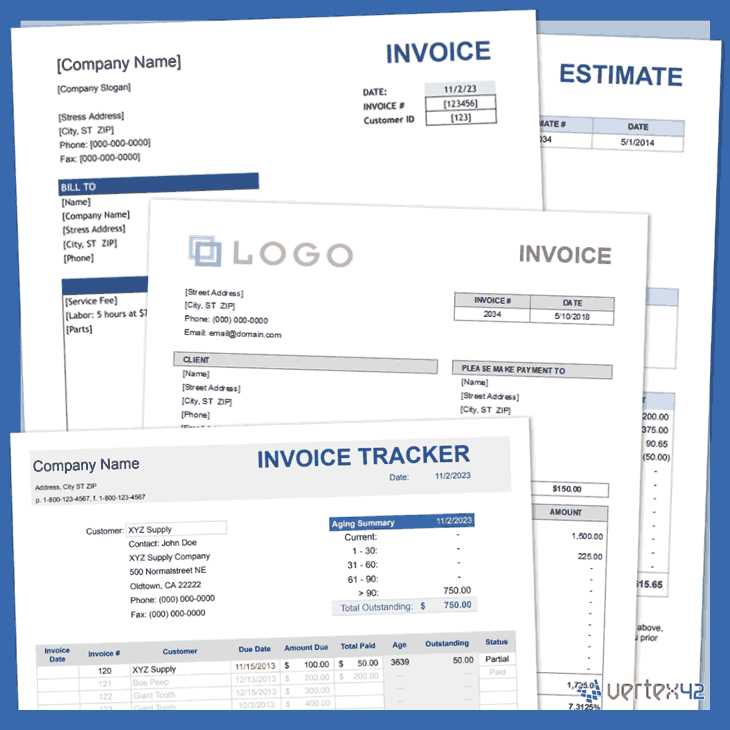

Popular Invoice Template Software for Businesses

For businesses looking to streamline their billing process, using dedicated software to create and manage financial documents can save time and reduce errors. These tools offer pre-designed formats that can be easily customized to meet the specific needs of any business. From freelancers to large corporations, these solutions ensure that every transaction is processed professionally and efficiently.

Top Software Solutions for Billing Documents

Many businesses rely on specialized software to create clean, customizable billing formats. Some popular options include:

- QuickBooks – A leading accounting software that allows businesses to generate detailed billing documents, track payments, and manage financial records all in one place.

- FreshBooks – Known for its user-friendly interface, FreshBooks makes it easy to create and send professional billing documents, track time, and monitor payments from clients.

- Zoho Invoice – An affordable option for small to medium-sized businesses, Zoho Invoice offers customizable templates and integrates well with other Zoho products for comprehensive business management.

Key Features of These Tools

These software tools often include a range of features designed to make the billing process easier and more efficient. Some of the most common features include:

- Customization – The ability to adjust fields, branding, and layout to match the business’s needs.

- Automation – Automated reminders and recurring billing options to help businesses stay on top of payments.

- Integration – Many tools integrate with accounting systems, payment gateways, and customer relationship management (CRM) software, providing a seamless workflow.

By choosing the right software, businesses can create professional documents with ease, maintain accurate records, and ensure timely payments, all while reducing administrative overhead.

How to Issue and Send Invoices

Issuing and sending professional billing documents is a crucial step in maintaining smooth business operations and ensuring timely payments. The process involves creating a clear and accurate statement of services or goods provided, followed by sending it to the client through the appropriate channels. By following a systematic approach, businesses can avoid delays and ensure that the transaction is properly recorded and processed.

First, generate a well-organized document that includes all necessary details such as the service or product descriptions, prices, applicable taxes, and payment terms. Ensure that the document is free of errors and clearly presents the agreed-upon terms. Once the document is ready, it’s time to send it to the client.

Choosing the right delivery method is important. Many businesses opt to send these documents via email, attaching a PDF version for easy access and reference. Email is fast and cost-effective, allowing the client to quickly review the billing details and make payment accordingly. Alternatively, businesses may choose to send printed documents through postal mail, particularly for clients who prefer physical copies.

Once the document has been sent, it’s advisable to follow up with the client if payment has not been made by the due date. Setting automated reminders or sending a polite follow-up email can help keep the payment process on track and prevent overdue amounts.

Tracking Invoice Payments Effectively

Effectively tracking payments is essential for maintaining smooth financial operations and ensuring that businesses get paid on time. Without a proper system in place, it can be challenging to keep track of outstanding balances, identify late payments, and reconcile financial records. An organized approach to monitoring payments helps businesses avoid cash flow problems and ensures that all transactions are accounted for accurately.

Using a systematic approach is key to managing payment tracking. Start by assigning a unique reference number to each transaction, which makes it easier to identify and match payments with the corresponding documents. Record all relevant details such as the payment method, amount, and date received, and update your records promptly as payments come in.

Automation tools can also be extremely helpful in managing payment tracking. Many accounting software programs offer automated tracking features that update payment statuses in real-time, generate reminders for overdue payments, and send follow-up notifications to clients. These tools help eliminate manual tracking errors and save valuable time.

Another useful practice is to maintain clear communication with clients regarding payment schedules. Regularly send updates about the outstanding balance, and be proactive in reaching out when payments are overdue. This transparency not only keeps clients informed but also reinforces the importance of timely payments.

By establishing a reliable payment tracking system, businesses can ensure accurate financial records, reduce the risk of missed payments, and maintain healthy cash flow.

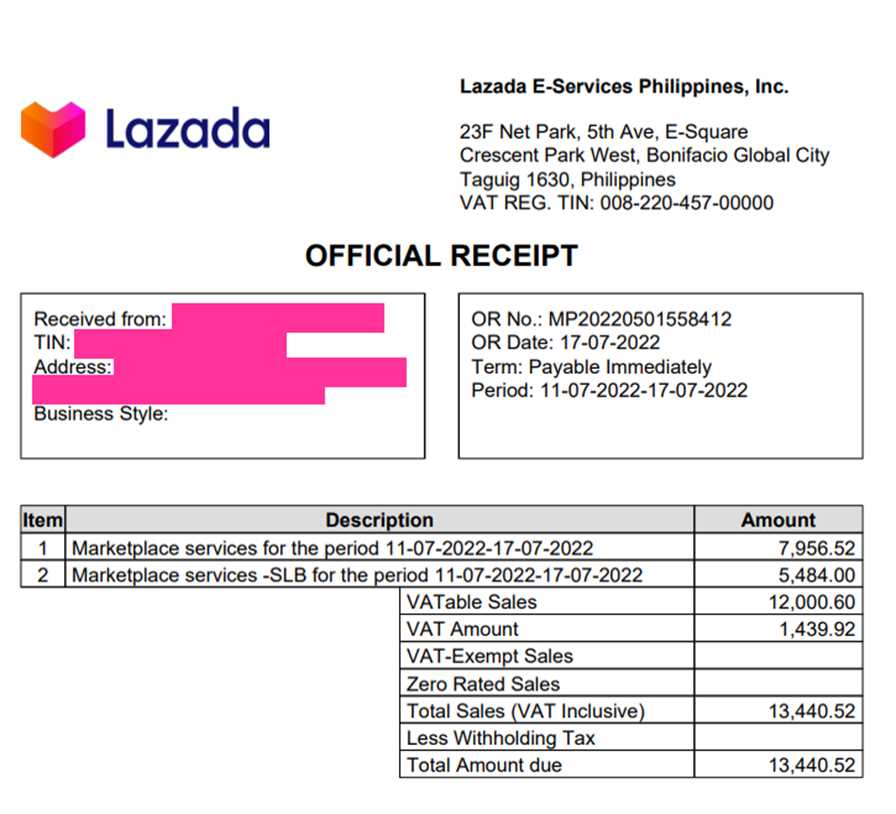

VAT and Tax Considerations for Invoices

When issuing billing documents, it is crucial to account for taxes, particularly VAT, as they significantly affect both the total amount due and the legal compliance of the transaction. Ensuring that tax information is correctly reflected on these documents helps businesses maintain transparency and avoid legal complications. Properly applying VAT and other applicable taxes also ensures that businesses meet local regulations and remain financially organized.

Understanding VAT Requirements

Value Added Tax (VAT) is typically applied to the sale of goods and services in many jurisdictions. When preparing a financial document, businesses must clearly outline the VAT rate applied to the transaction. This not only helps clients understand the cost breakdown but also ensures that the business is correctly accounting for the tax. Failure to include the proper VAT rate or calculate it incorrectly could result in penalties or disputes with clients or tax authorities.

| Tax Detail | Description |

|---|---|

| Tax Identification Number (TIN) | Both the business and client’s tax numbers should be included to ensure tax compliance. |

| Applicable Tax Rates | The correct VAT rate should be clearly indicated, along with the total tax amount added to the transaction. |

| Taxable Amount | The amount before tax should be stated so the customer can see the base price of the goods or services. |

Other Tax Considerations

Aside from VAT, businesses may also need to account for other taxes, such as sales tax or withholding tax, depending on local laws. These taxes should be clearly itemized and explained to avoid confusion or disputes. It’s also essential to know whether certain products or services are exempt from taxes, as this can affect the total amount due. Ensuring that your documents comply with local tax regulations protects both your business and your clients from potential issues.

Accurate tax information is vital for legal compliance, transparent pricing, and efficient record-keeping. By including all relevant tax details, businesses can maintain smooth operations and avoid costly mistakes.

How to Handle Invoice Disputes

Disputes over financial documents can arise for various reasons, whether due to errors, misunderstandings, or disagreements about the terms. Handling these disputes in a professional and systematic manner is crucial to maintaining good client relationships and ensuring that any issues are resolved promptly. By staying organized, communicating effectively, and following the correct steps, you can minimize the impact of such disputes on your business operations.

Steps to Address a Dispute

When a client raises a dispute over a billing document, it’s important to approach the situation calmly and with a clear plan. Here are some steps you can follow to resolve the issue efficiently:

- Review the Dispute – Examine the specific reason for the dispute. Is it due to a pricing issue, missing items, incorrect payment terms, or a misunderstanding? Clarifying the cause helps determine the next steps.

- Communicate Clearly – Reach out to the client and listen to their concerns. Respond politely and professionally, ensuring that you understand the issue from their perspective.

- Check the Documentation – Double-check the details in the financial document, comparing it with the contract, previous agreements, or communication. If an error has been made on your part, acknowledge it and take steps to correct it.

- Provide a Solution – Once you have a clear understanding of the issue, offer a resolution. Whether it involves correcting the document, offering a discount, or adjusting the payment terms, be sure to act quickly and fairly.

Preventing Future Disputes

While resolving disputes effectively is crucial, taking proactive measures can help prevent them in the future. Consider implementing the following practices:

- Clear Communication – Ensure that all terms, including pricing, payment deadlines, and services rendered, are clearly stated and agreed upon before issuing any documents.

- Detailed Documentation – Include as much relevant detail as possible in each billing statement to avoid any ambiguity.

- Timely Follow-Ups – Regularly follow up on pending payments to catch potential issues early before they escalate.

By handling disputes professionally and preventing misunderstandings, you not only protect your business interests but also build stronger, more trusting relationships with your clients.

Top Tips for Invoicing in the Philippines

When managing billing processes in any country, it’s important to understand local best practices and legal requirements to ensure smooth transactions and compliance. In the context of managing financial documents, attention to detail and an understanding of regional norms can help businesses avoid mistakes and foster positive relationships with clients. Here are some essential tips to consider when preparing and sending billing documents in this region.

Essential Considerations for Effective Billing

To make sure your financial documents are professional, compliant, and clear, keep these tips in mind:

- Include Legal Requirements – Ensure that your business’s tax identification number (TIN) is included, along with any applicable tax rates. This is important for compliance and clarity in billing.

- Clearly Outline Payment Terms – Specify the due date for payment, any applicable discounts for early payment, or penalties for late payments. This helps avoid confusion and encourages timely transactions.

- Provide Accurate Details – Double-check all the details in your documents. Ensure that the descriptions, prices, and quantities are correct to prevent disputes or misunderstandings later on.

Tips for Streamlining the Billing Process

To further improve the efficiency of your billing process, consider these strategies:

- Automate Where Possible – Use accounting or billing software to automate the creation and sending of documents. This minimizes errors and speeds up the entire process.

- Follow Up Regularly – Keep track of outstanding payments and send polite reminders to clients if necessary. Timely follow-ups can prevent overdue payments and help maintain cash flow.

- Use Consistent Formats – Keep a consistent format for all your billing documents. This not only helps with internal organization but also makes it easier for clients to review and process your transactions.

By following these tips, businesses can ensure that their financial documents are both professional and compliant, ultimately making the billing process smoother and more efficient.