Complete Contractor Labor Invoice Template for Efficient Billing

When managing your business, it’s essential to have a clear and efficient way to bill clients for services rendered. A well-structured billing document not only ensures you are compensated properly, but it also helps maintain professionalism and transparency with your clients. Whether you’re offering skilled work or specialized services, having a standardized approach to invoicing can streamline your operations and prevent misunderstandings.

In this guide, we will explore the importance of having an organized billing system, the key components to include, and how to craft a document that both you and your clients will find easy to understand. By using a consistent format, you can save time, avoid errors, and improve your cash flow. Additionally, adopting modern tools and techniques can make this process even more efficient.

Get ready to learn how to design a billing document that reflects your professionalism and keeps you on top of payments. From basic information to advanced customization, this guide will help you navigate the essentials of creating an effective financial request that meets your needs and those of your clients.

Contractor Labor Invoice Template Guide

Creating a billing document that clearly outlines the services provided is a crucial part of any business. It ensures transparency between the service provider and the client while making the payment process smooth and straightforward. This section will walk you through the key steps to build an efficient and professional billing document that you can easily customize for any job.

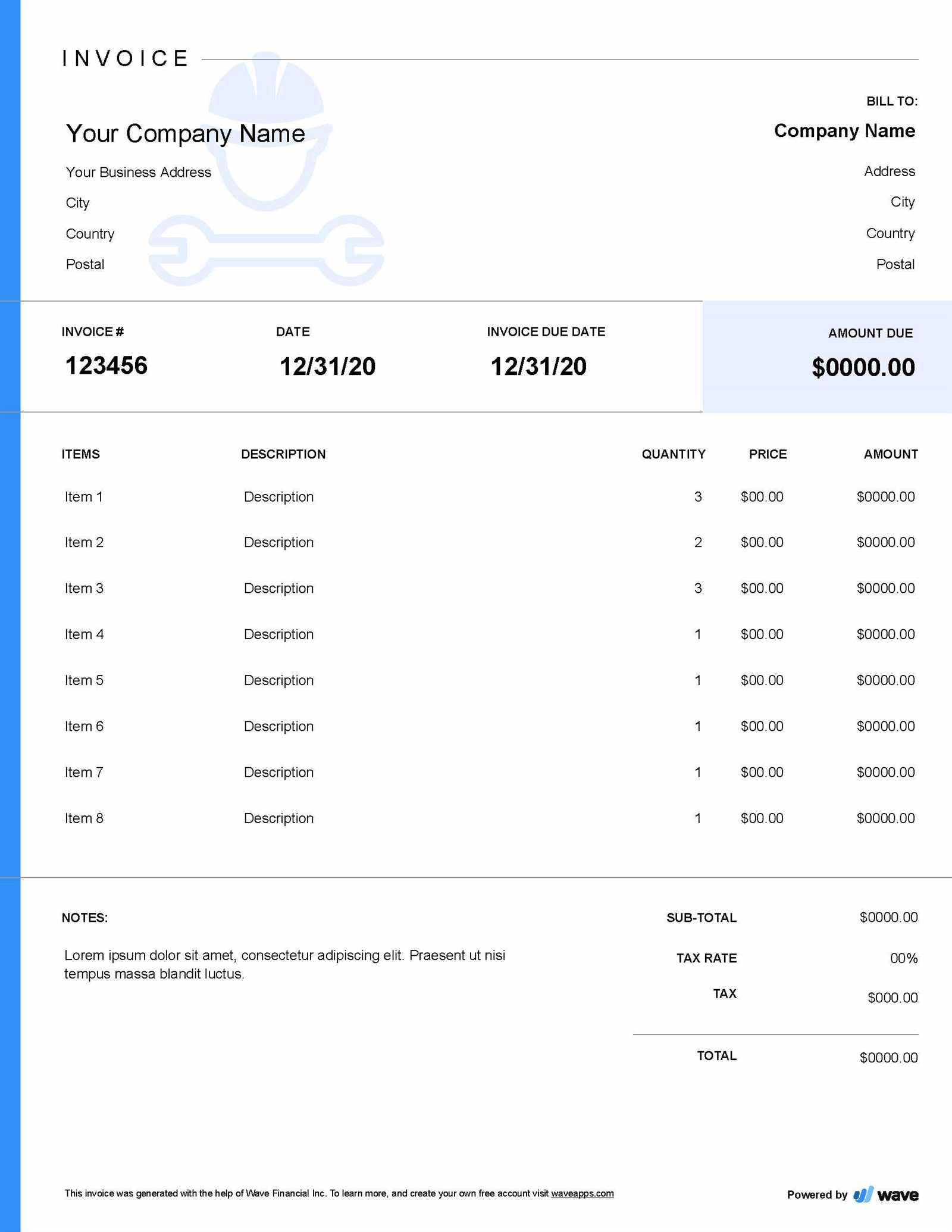

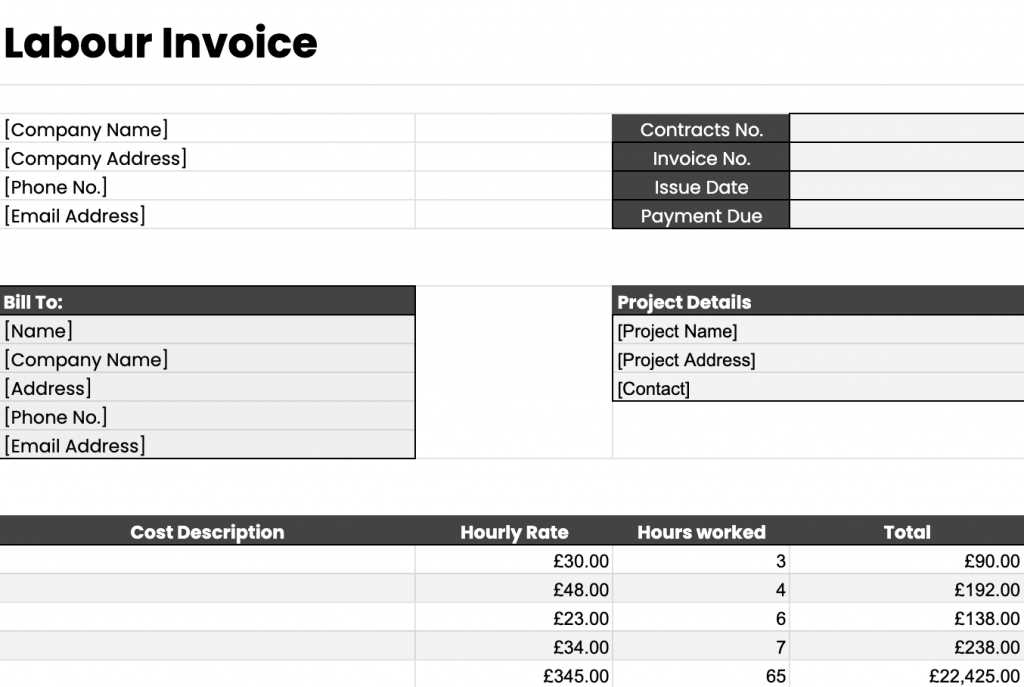

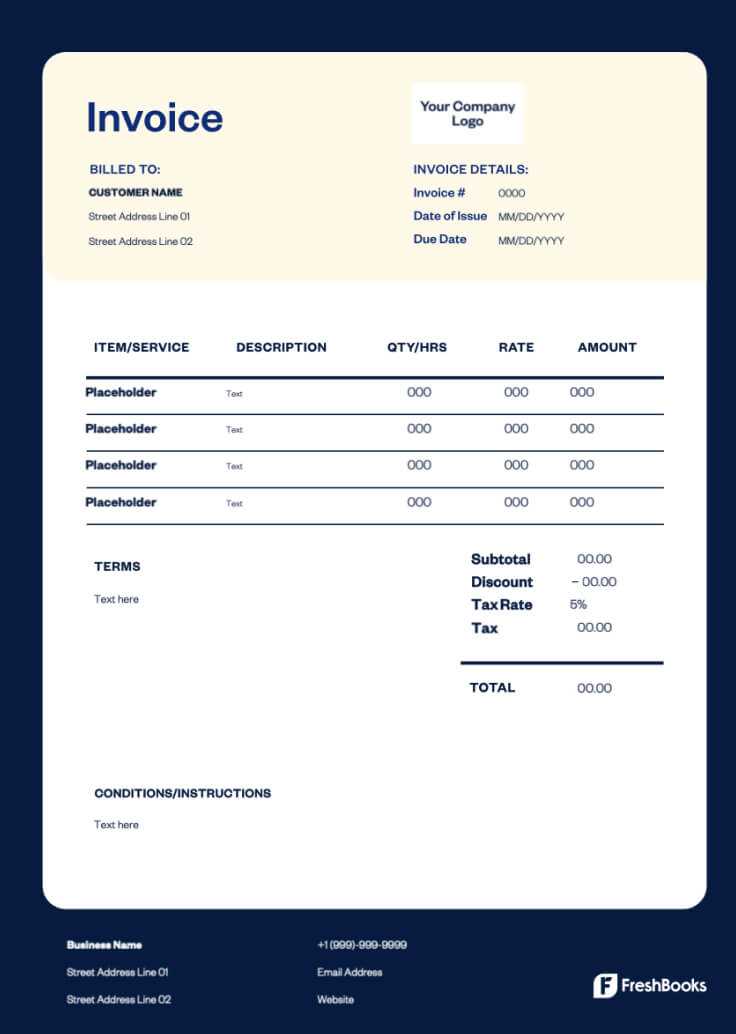

Key Elements to Include

To ensure your billing document is complete and effective, you must include certain information. This includes both basic details such as your business name, client information, and specific service descriptions, as well as payment terms and rates. A well-crafted document helps avoid confusion and sets clear expectations for both parties.

| Information | Description |

|---|---|

| Business Name & Contact | Your name, address, phone number, and email for easy communication. |

| Client Details | Name, address, and contact information of the client. |

| Service Description | A detailed breakdown of the work completed, including quantities and rates. |

| Payment Terms | Due date, late fees, and any specific payment instructions. |

| Total Amount Due | The final amount to be paid, including taxes and other charges. |

Customizing the Format

To make the billing document more effective, it’s important to tailor it to suit your specific needs. Customization can include adding a logo, adjusting the layout for clarity, and using a color scheme that matches your brand. The more professional and pol

What is a Contractor Labor Invoice?

When you complete a project or task for a client, you need a formal way to request payment for your services. A billing document is a tool that outlines the details of the work completed, the time spent, and the costs incurred. This document serves as a request for compensation, ensuring both you and your client are clear on the financial terms and expectations. It plays a crucial role in maintaining a professional relationship and ensuring timely payments.

Key Components of a Payment Request

A well-constructed payment request includes several important components that make it clear and easy to understand. First, it includes detailed descriptions of the services performed, including any applicable rates. Second, it should specify the total amount due, including any taxes, fees, or additional charges. Finally, it should outline the payment terms, including deadlines and methods of payment.

Why is It Important?

Clear financial documentation is essential for both you and your clients. It provides transparency, builds trust, and helps avoid any misunderstandings. By using a detailed billing document, you make the payment process easier for everyone involved and ensure you are paid in a timely manner.

Benefits of Using a Template

Using a pre-designed document for billing and payment requests offers several advantages that can save time, reduce errors, and improve overall efficiency. Whether you are a freelancer, small business owner, or service provider, leveraging a consistent and structured format ensures that you maintain professionalism and streamline your financial operations.

Time-Saving and Efficiency

One of the main benefits of using a pre-built structure is the significant amount of time it saves. Instead of creating a new document from scratch every time, you can simply fill in the necessary details and send it off. This streamlined process helps you focus on the work itself instead of administrative tasks.

- Pre-filled sections save time.

- Quick customization for different projects.

- Consistency in layout and content.

Accuracy and Reduced Errors

Another advantage is the reduction of mistakes that can occur when manually creating financial documents. With a template, all the essential fields are pre-organized, reducing the chances of missing important information such as rates, hours, or payment terms. This ensures that your requests are clear, complete, and error-free.

- Predefined fields for common information.

- Automatic calculations for totals and taxes.

- Fewer chances for oversight or miscommunication.

Professional Appearance

Using a well-designed format also enhances your image as a professional. A clean, organized document not only reflects positively on you but also helps establish trust with clients. By presenting a polished financial request, you show that you take your work and the relationship seriously.

- Customizable to match branding.

- Consistent presentation of your services.

- Creates a positive, professional impression.

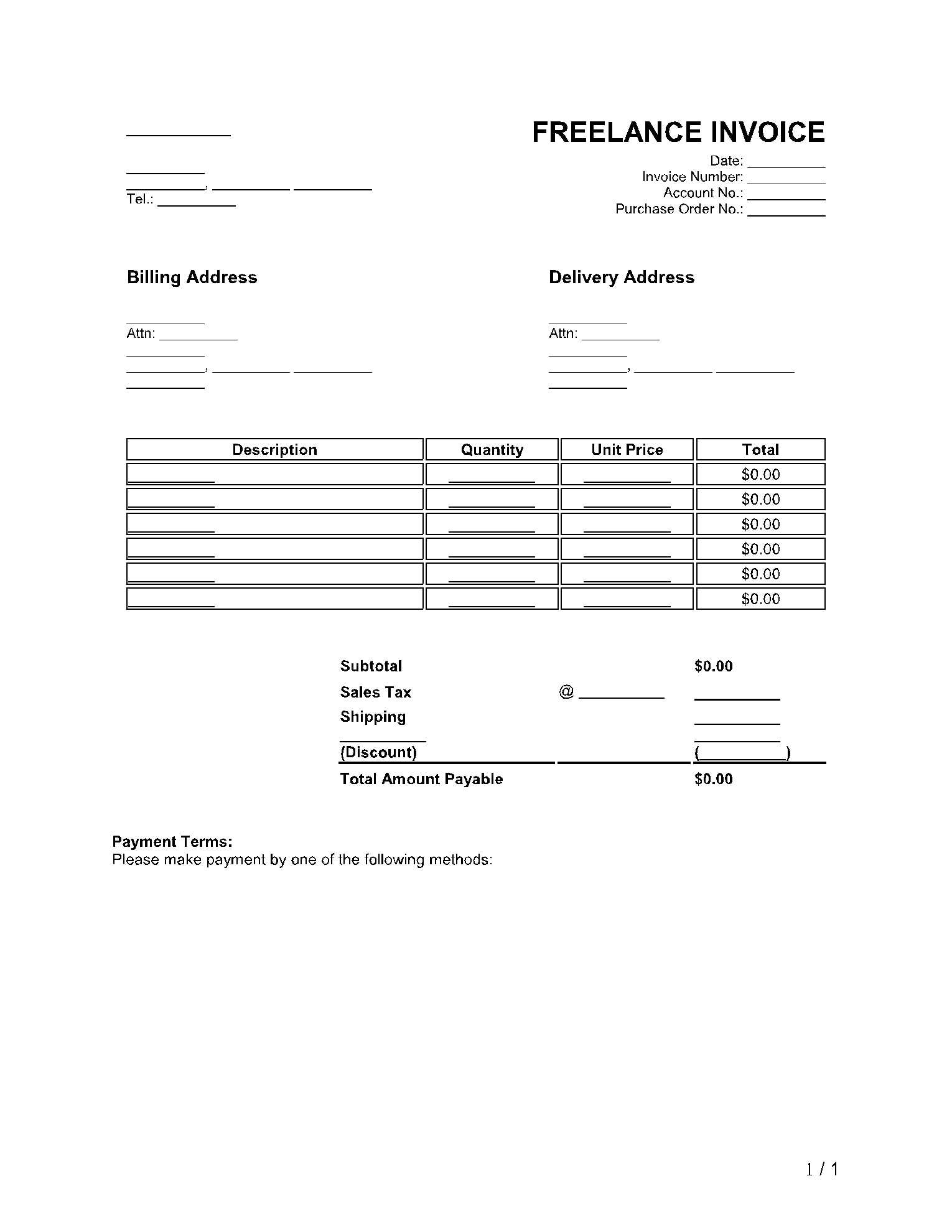

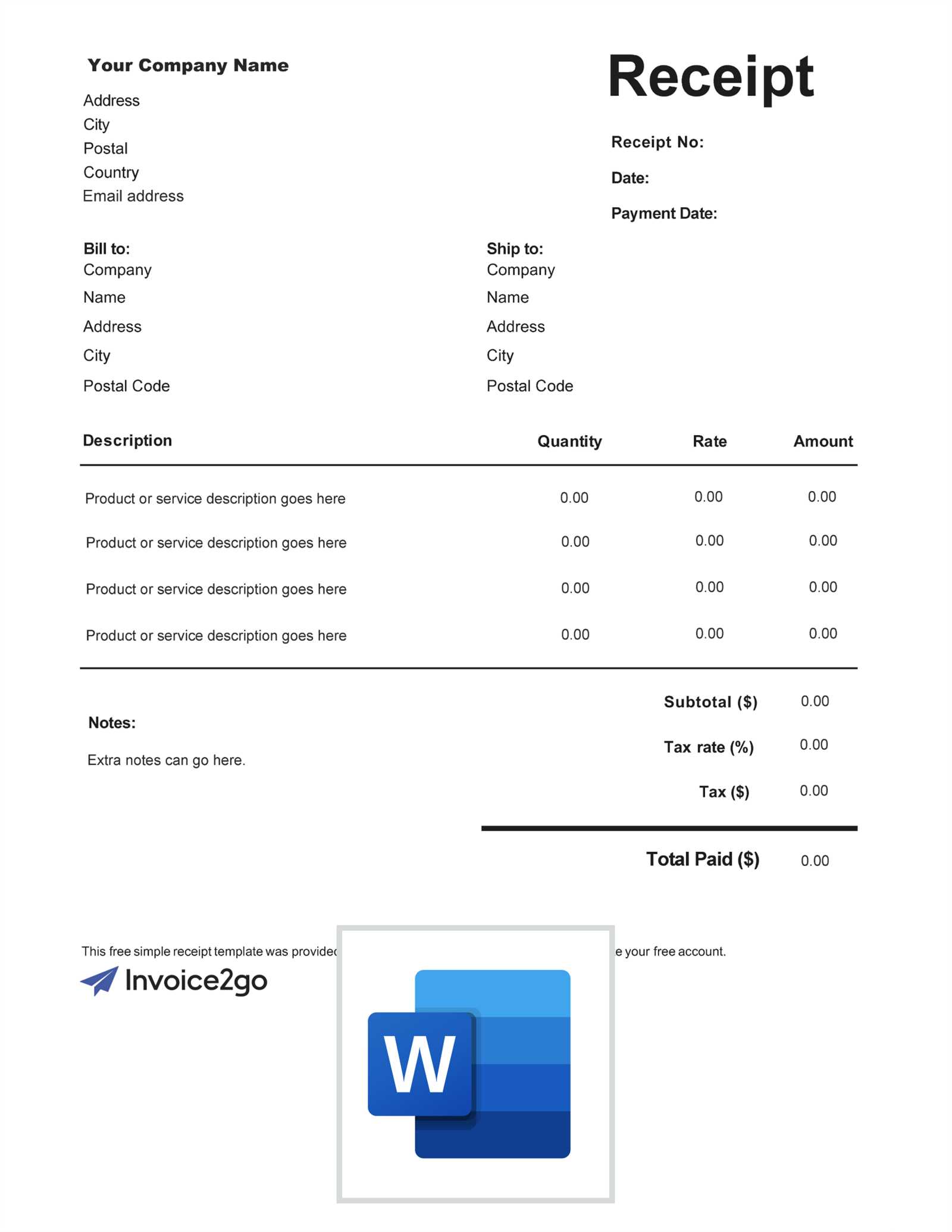

Essential Information on Your Billing Document

When requesting payment for your services, it’s crucial to include specific details in your financial document to ensure clarity and avoid confusion. These details help both you and your client keep track of the transaction and ensure that both parties are on the same page regarding the terms and expectations. A well-organized payment request should contain all necessary elements to facilitate smooth communication and timely payments.

Key Details to Include

To ensure your financial document is complete and professional, certain information must be included. These elements cover everything from identifying your business and the client to specifying the work performed and the amount owed. Below are the core components that should always be included in a billing request:

- Your Business Information: Your name or business name, address, phone number, and email address.

- Client’s Information: The name and contact details of the person or business you’re billing.

- Project or Service Description: A detailed breakdown of the work completed, hours worked, or any other relevant services.

- Payment Due Date: A clear due date by which payment should be made, including any applicable late fees.

- Total Amount Due: The final amount owed, including taxes and any additional fees.

Additional Information for Clarity

To further ensure clarity and avoid misunderstandings, you may choose to add extra details that clarify payment terms or specific conditions. This could include the method of payment, specific milestones for larger projects, or discounts for early payment. Including these extra elements helps to manage expectations and fosters trust with clients.

- Payment Method: Specify acceptable payment methods (bank transfer, credit card, etc.).

- Terms & Conditions: Any special conditions, such as a deposit requirement or late fees.

- Discounts or Adjustments: Discounts for early payment or other adjustments to the total amount.

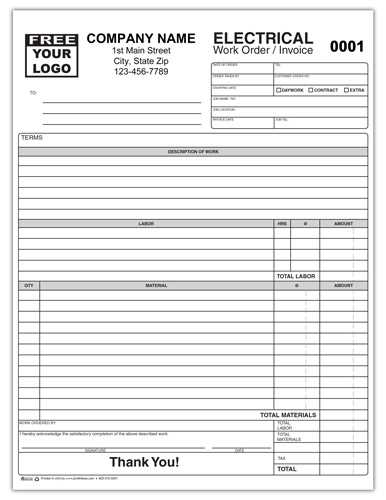

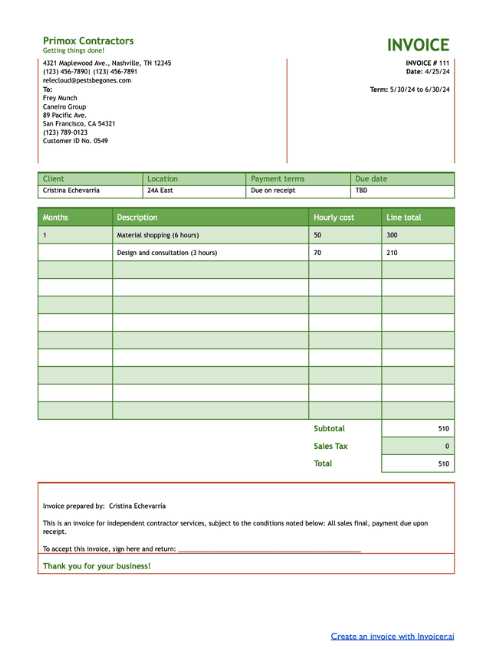

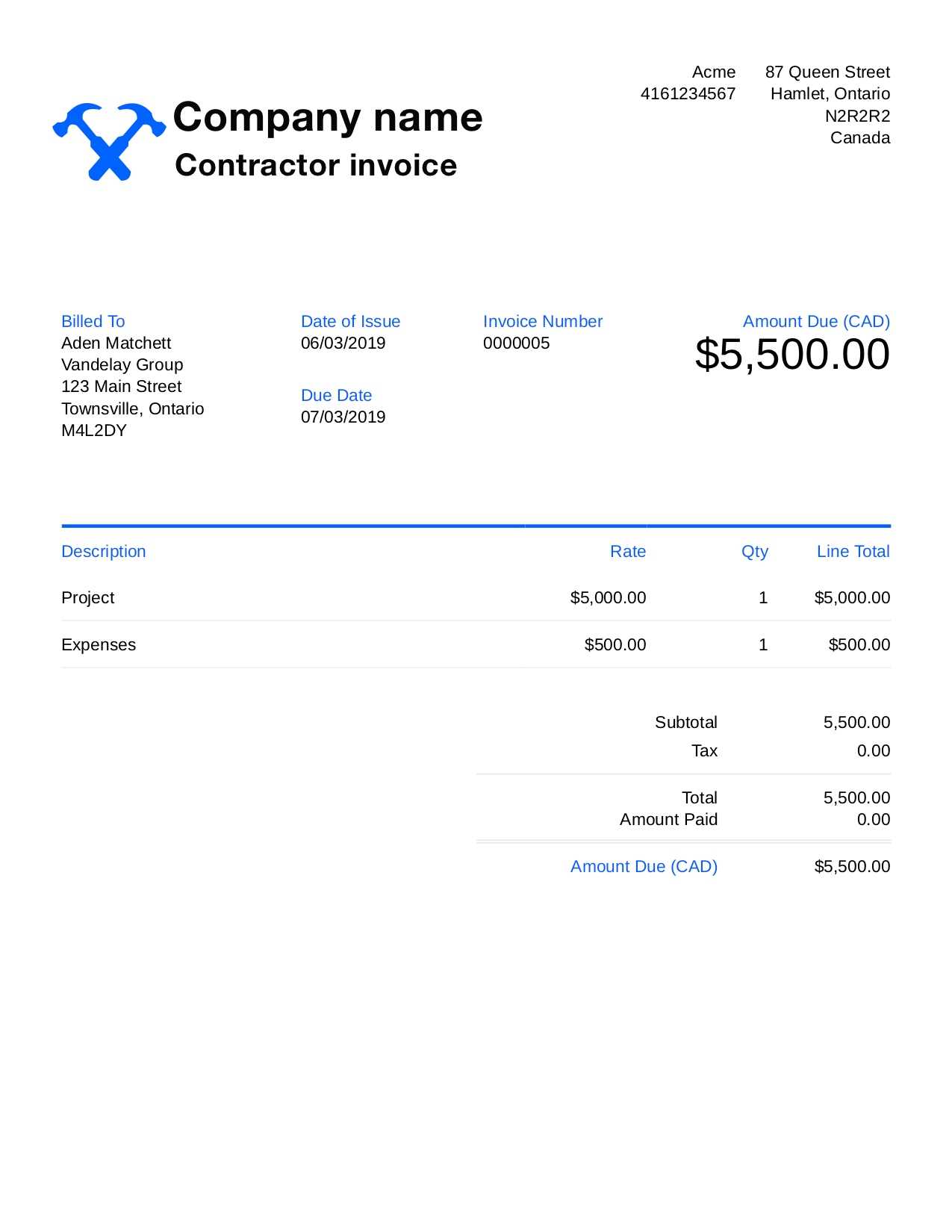

How to Create a Labor Invoice

Designing a billing document is essential for ensuring that services rendered are clearly communicated and compensated. This structured record not only helps in tracking payments but also serves as a professional representation of your work. Here’s a step-by-step guide to creating an effective billing document.

-

Choose a Format:

- Use a word processor or spreadsheet software.

- Consider online tools that offer customization.

- Decide on a digital or printed version based on your client’s preferences.

-

Include Your Information:

- Business name and logo.

- Contact details such as phone number and email.

- Address of your business.

-

Add Client Details:

- Client’s name and contact information.

- Client’s address.

-

Document the Services Provided:

- List each service performed along with a brief description.

- Specify the date of each service.

- Indicate the quantity or hours worked.

- Provide the rate charged for each service.

-

Calculate Total Amount:

- Sum up the costs for all services listed.

- Add any applicable taxes or additional fees.

- Clearly display the final amount due.

-

Payment Terms:

- Specify the due date for payment.

- Include accepted payment methods.

- Mention any late fees if applicable.

-

Review and Send:

- Check for accuracy and completeness.

- Send the document via email or postal service, depending on client preference.

By following these steps, you can create a clear and professional billing document that ensures both you and your clients are on the same page regarding services rendered and payment expectations.

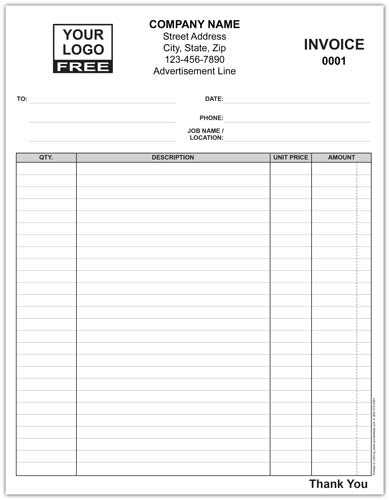

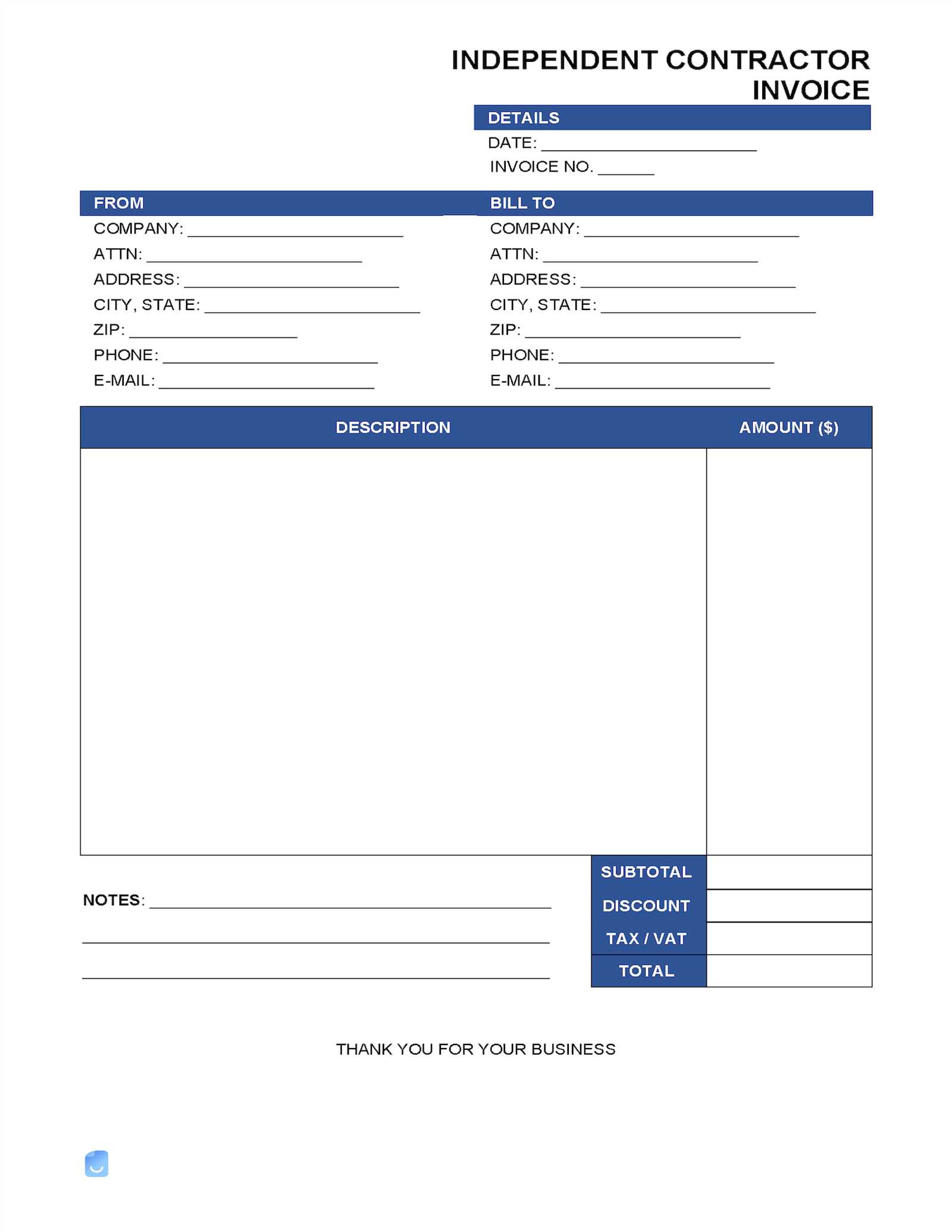

Customizing Your Contractor Invoice

Personalizing your billing document is an important step in showcasing your professionalism and aligning the format with your brand. Customization not only makes the document more visually appealing but also ensures it fits your specific needs and the preferences of your clients. Here’s how to tailor your billing sheet effectively.

-

Add Your Branding:

- Incorporate your business logo and name prominently.

- Use your brand colors or fonts to enhance the overall design.

- Ensure consistency in style across all documents for a cohesive appearance.

-

Include Clear Section Titles:

- Label important sections such as “Services Rendered,” “Amount Due,” and “Payment Terms” clearly.

- Consider adding a brief description for each section to clarify its purpose.

-

Personalize the Service Details:

- Modify service descriptions to fit the unique work you’ve done.

- Include special terms or conditions that apply to a particular project.

- Provide detailed breakdowns if multiple tasks were performed.

-

Set Specific Payment Instructions:

- Clearly state the methods of payment you accept (e.g., bank transfer, PayPal, etc.).

- Include your payment details or account information, where appropriate.

- Outline any discoun

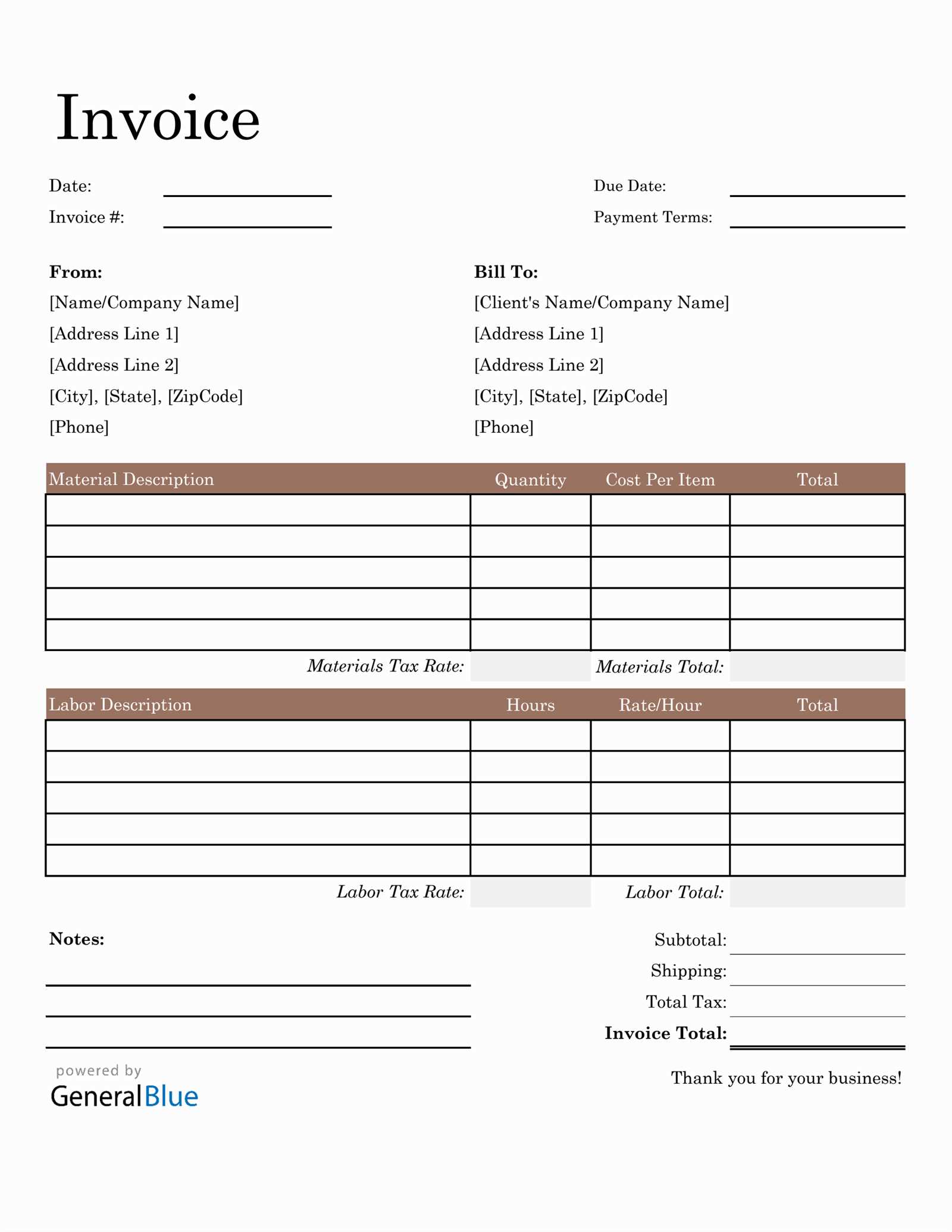

Understanding Hourly vs Fixed Rates

When charging for services, two common pricing structures are often used: hourly rates and fixed fees. Each approach has its own advantages and is suited to different types of projects. Understanding the difference between these pricing models is essential for determining which one aligns best with the nature of the work and the needs of your client.

Pricing Model Advantages Disadvantages Best For Hourly Rate - Fair compensation for time spent on the job.

- Flexibility if project scope changes.

- Suitable for tasks with uncertain duration.

- Can be difficult to predict total cost.

- Clients may feel unsure of final expenses.

- Requires detailed tracking of hours worked.

- Ongoing or open-ended tasks.

- Projects with unclear timelines.

- Work that requires flexibility in scope.

Fixed Rate - Clear, predictable cost for the client.

- Ideal for well-defined tasks with specific outcomes.

- Both parties know the total amount in advance.

- Less flexibility if the scope changes during the project.

- Potential for underpayment if the pr

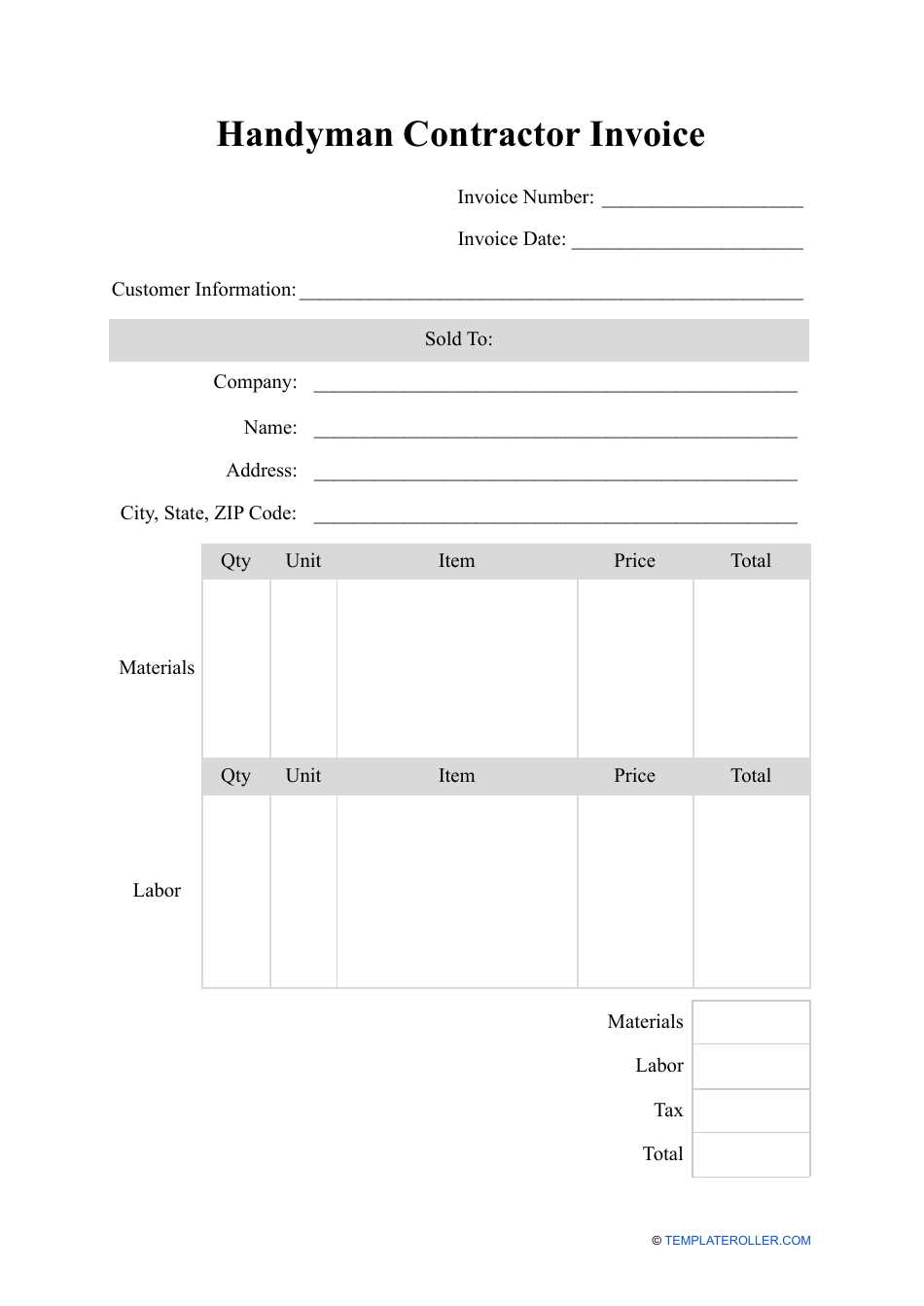

How to Calculate Labor Costs Accurately

Accurately calculating the cost of work is crucial for both budgeting and ensuring fair compensation for services rendered. Whether you are setting rates for your own business or determining charges for a client, knowing how to calculate these costs helps avoid undercharging or overestimating. There are several factors to consider when determining the true cost of work, including time spent, rates, and overheads.

Step 1: Determine Hourly or Project Rate

The first step is to decide whether you will charge by the hour or set a fixed price for the entire project. If you charge by the hour, make sure you have a clear rate that reflects your experience, skills, and market standards. For fixed-price projects, estimate how much time the task will take and multiply it by your hourly rate.

Step 2: Calculate Total Time Spent

For hourly work, keeping track of every minute spent on a task is essential. This includes not just the actual work time but also any administrative tasks, such as meetings, research, or communication with the client. Accurate time tracking ensures that all work is compensated fairly.

Step 3: Factor in Overhead Costs

To calculate your total expenses, don’t forget to factor in any indirect costs associated with the work. These can include:

- Office supplies and equipment.

- Utilities and software subscriptions.

- Insurance and business-related fees.

Adding these overhead costs to your base rate ensures that you are covering all aspects of the job and not just your direct working hours.

Step 4: Include Taxes and Benefits

When calculating costs, ensure that you account for taxes and any benefits you may need to provide, such as health insurance or retirement contributions. This is especially important if you’re working independently or running a small business. These additional costs

Design Tips for Professional Invoices

Creating a polished billing document is essential for conveying professionalism and ensuring clarity in your financial communications. A well-designed statement not only reflects your brand identity but also enhances the client’s experience. Here are several tips to help you design effective and visually appealing billing documents.

1. Keep It Clean and Simple

A cluttered layout can confuse clients and obscure important information. Use plenty of white space and avoid overcrowding the page with text or graphics. Aim for a clean, organized design that guides the reader’s eye to the key details.

2. Use Consistent Branding

Incorporate your business logo, color scheme, and fonts throughout the document. Consistent branding not only reinforces your identity but also makes your documents easily recognizable. This builds trust and professionalism in your interactions.

3. Organize Information Clearly

Structure your document logically. Begin with your contact information, followed by the client’s details, and then outline the services provided. Clearly label each section to make it easy for clients to find relevant information quickly.

4. Highlight Key Figures

Use bold text or larger font sizes to emphasize important figures, such as the total amount due or payment due date. This draws attention to critical information and reduces the likelihood of oversight.

5. Choose Readable Fonts

Select professional, easy-to-read fonts. Avoid overly decorative typefaces that can be difficult to read at a glance. Aim for a font size of at least 10-12 points to ensure clarity.

6. Include Clear Payment Instructions

Make sure to outline how clients can make payments, including accepted methods and any necessary account information. Providing clear instructions helps facilitate timely payments and reduces confusion.

7. Add a Personal Touch

Consider including a brief thank-you note or a personalized message. This small gesture can enhance the client relationship and demonstrate your appreciation for their business.

8. Use Professional Software or Tools

Utilize software or online platforms designed for creating billing documents. These tools often offer templates that can simplify the design process while ensuring a professional appearance.

By following these design tips, you can create an effective billing document that not only looks professional but also communicates all necessary information clearly, helping to foster positive client relationships.

Common Mistakes to Avoid on Invoices

Creating a billing document may seem straightforward, but several common errors can undermine its effectiveness and lead to misunderstandings or delayed payments. Avoiding these pitfalls is crucial for maintaining professionalism and ensuring that you receive timely compensation for your work. Here are some frequent mistakes to watch out for:

-

Incomplete Information:

- Failing to include your business name, contact details, and address.

- Omitting the client’s information, which can lead to confusion.

- Not specifying the date of service or project completion.

-

Lack of Itemization:

- Providing a total amount without detailing individual services or products.

- Not specifying the quantity and rate for each item, which can cause disputes.

-

Inaccurate Calculations:

- Making mistakes in adding up totals or applying tax rates.

- Forgetting to account for discounts or additional charges.

-

Unclear Payment Terms:

- Not stating the payment due date, which can lead to delays.

- Failing to specify accepted payment methods, leaving clients unsure.

-

Ignoring Professional Appearance:

- Using inconsistent fonts or colors that detract from readability.

- Submitting a document with typos or grammatical errors.

-

Missing Follow-Up:

- Neglecting to follow up on unpaid bills, which can result in lost revenue.

- Not communicating with clients about any discrepancies or questions.

-

Not Keeping Copies:

- Failing to retain copies of submitted documents for your records.

- Not tracking payments received, which can complicate financial management.

By being aware of these common mistakes and taking steps to avoid them, you can create clearer, more effective billing documents that facilitate smooth transactions and enhance your professional reputation.

Choosing the Right Invoice Software

Selecting the appropriate software for generating billing documents is crucial for managing your financial transactions efficiently. With numerous options available, finding the right fit for your business needs can enhance your workflow, improve accuracy, and ensure timely payments. Here are key factors to consider when evaluating different software solutions.

1. Assess Your Business Needs

Before choosing software, evaluate the specific requirements of your business. Consider factors such as:

- Volume of transactions: Determine how many billing documents you generate monthly.

- Complexity of services: Assess whether your offerings require itemization or detailed descriptions.

- Integration: Check if the software can integrate with your existing accounting or project management tools.

2. Look for Essential Features

Different software programs come with various functionalities. Key features to look for include:

- User-friendly interface: Choose software that is intuitive and easy to navigate.

- Customization options: Ensure that you can tailor templates to reflect your branding.

- Automated reminders: Look for tools that send payment reminders to clients automatically.

- Reporting capabilities: Good software should provide insights into your income and outstanding payments.

- Multi-currency support: If you work internationally, check if the software can handle various currencies.

By carefully considering your business needs and the features available, you can select software that streamlines your billing process, improves efficiency, and supports your financial management goals.

Legal Considerations for Contractor Invoices

When issuing billing documents, it is essential to be aware of the legal implications associated with them. Properly understanding the requirements and regulations can help prevent disputes and ensure that you receive fair compensation for your work. Here are some key legal considerations to keep in mind.

1. Compliance with Local Laws

Different jurisdictions have specific regulations regarding billing practices. Consider the following:

- Research local laws governing billing and payment terms.

- Ensure compliance with any specific invoicing requirements for your industry.

- Be aware of consumer protection laws that may apply to your transactions.

2. Payment Terms and Conditions

Clearly stating your payment terms is vital for legal protection. Consider including:

- Due dates: Specify when payments are expected to be made.

- Late fees: Outline any penalties for overdue payments.

- Accepted payment methods: Clearly indicate how clients can make payments.

- Dispute resolution: Include a clause outlining how disputes will be handled.

By addressing these legal considerations, you can create billing documents that not only protect your interests but also promote transparency and professionalism in your business transactions.

How to Handle Disputes Over Invoices

Disagreements over billing documents can arise for various reasons, from discrepancies in amounts charged to disagreements about the services rendered. Effectively managing these disputes is essential to maintaining professional relationships and ensuring timely payments. Here are steps to take when addressing billing disagreements.

1. Stay Calm and Professional

Approach the situation with a level head. Maintaining professionalism is crucial in resolving disputes amicably. Consider the following tips:

- Listen carefully to the client’s concerns without interrupting.

- Avoid becoming defensive; instead, focus on finding a solution.

- Keep all communication polite and respectful.

2. Review the Details

Before responding to the client, take the time to review the relevant details. This includes:

- Checking your records to confirm the accuracy of the charges.

- Comparing the billing document with the initial agreement or contract.

- Gathering any supporting documentation that can clarify the situation.

3. Communicate Clearly

Once you have reviewed the information, reach out to the client to discuss the issue. Consider the following:

- Clearly explain your perspective and the rationale behind the charges.

- Provide any necessary documentation to support your position.

- Be open to the client’s feedback and willing to discuss possible adjustments if warranted.

4. Seek a Resolution

Work collaboratively with the client to reach a resolution. This may involve:

- Offering a compromise, such as a partial refund or adjusted payment.

- Agreeing on a revised payment plan if applicable.

- Documenting any changes to the agreement in writing to prevent future misunderstandings.

5. Escalate if Necessary

If you cannot reach an agreement, consider the following steps:

- Refer to any dispute resolution clauses outlined in your initial agreement.

- Consider involving a neutral third party, such as a mediator, to facilitate a resolution.

- As a last resort, evaluate your legal options if the dispute remains unresolved.

By approaching disputes with professionalism and a focus on resolution, you can maintain positive relationships with clients while ensuring that your financial interests are protected.

Payment Terms to Include in Invoices

Clear and well-defined payment terms ensure a smooth financial relationship between the service provider and the client. They clarify when and how payments should be made, helping avoid misunderstandings and delays. Here are essential elements to consider including in any professional payment agreement.

1. Payment Due Date

- Specify the exact date when the payment is expected, such as “within 30 days from the billing date.”

- Clarify any adjustments to standard terms if agreed upon with the client.

2. Accepted Payment Methods

- List all acceptable methods, like bank transfers, checks, or online payment services.

How to Send Invoices to Clients

Efficiently delivering billing statements to clients is essential for maintaining clear communication and timely payments. Choosing the right method and format helps ensure that clients receive, review, and process payments without delay. Here are key steps to streamline this process.

1. Choose the Appropriate Delivery Method

Consider the most reliable method for reaching each client. Options include email, secure online portals, or traditional mail, depending on the client’s preferences. Email is often the quickest and most convenient, while online portals provide a secure platform for sharing and storing documents.

2. Confirm Client Information

Verify that you have accurate contact details for each client to prevent delivery issues. Double-check email addresses, postal addresses, and any other relevant contact information to ensure the billing reaches the right pe

Tracking and Managing Invoice Payments

Effectively monitoring payment statuses is crucial to maintaining cash flow and ensuring timely income. Organizing and tracking records allow you to quickly identify outstanding balances and manage follow-ups with clients. Here are strategies and tools to streamline this process.

1. Create a Payment Tracking System

Implement a tracking system to monitor all sent bills, due dates, and received payments. Using a spreadsheet, dedicated software, or even a simple table can make it easy to stay organized. Regularly update this system to reflect recent transactions.

Client Billing Date Due Date Amount Status Client A Tips for Getting Paid Faster

Prompt payments are essential for maintaining financial stability and minimizing delays. By taking a proactive approach to how you request and manage payments, you can help ensure a smoother cash flow. Here are practical tips to encourage timely payments from clients.

1. Set Clear Payment Terms

Define straightforward terms that specify due dates, accepted payment methods, and any potential penalties for late payments. This clarity helps clients understand expectations from the beginning, reducing the chances of delayed payments.

2. Send Detailed and Accurate Requests

Double-check all information, including amounts, descriptions, and due dates, before sending. Accuracy reduces the likelihood of disputes or confusion, ensuring the payment process proceeds without interruptions.

3. Offer Multiple Payment Options

Make it convenient for clients by providing several payment methods, such as