Ultimate Guide to Self Employed Invoice Templates for Freelancers

Managing payments and maintaining a professional image is essential for independent professionals and small business owners. Clear, well-organized billing documents are key to ensuring clients understand charges and payments are processed smoothly. An effective billing method saves time, reduces errors, and establishes trust between service providers and clients.

For freelancers and contractors, having a consistent approach to invoicing is crucial. By using customizable documents that meet legal requirements and client expectations, professionals can streamline their financial workflow. Whether you’re just starting out or have been in business for years, the right tools can help simplify the process and enhance your credibility.

Ready-made solutions offer great flexibility and customization options, allowing you to tailor them to your specific needs. With the right structure, these documents not only keep everything organized but also ensure prompt payments. Understanding how to create and use such materials efficiently is a key part of any independent professional’s success.

Self Employed Invoice Templates Explained

For independent professionals, managing payments is a vital aspect of running a successful business. A clear and concise billing document serves as an official request for payment, outlining the details of services rendered, the agreed-upon amounts, and the terms for settlement. By using a well-structured format, individuals can ensure that their transactions are transparent, professional, and efficient.

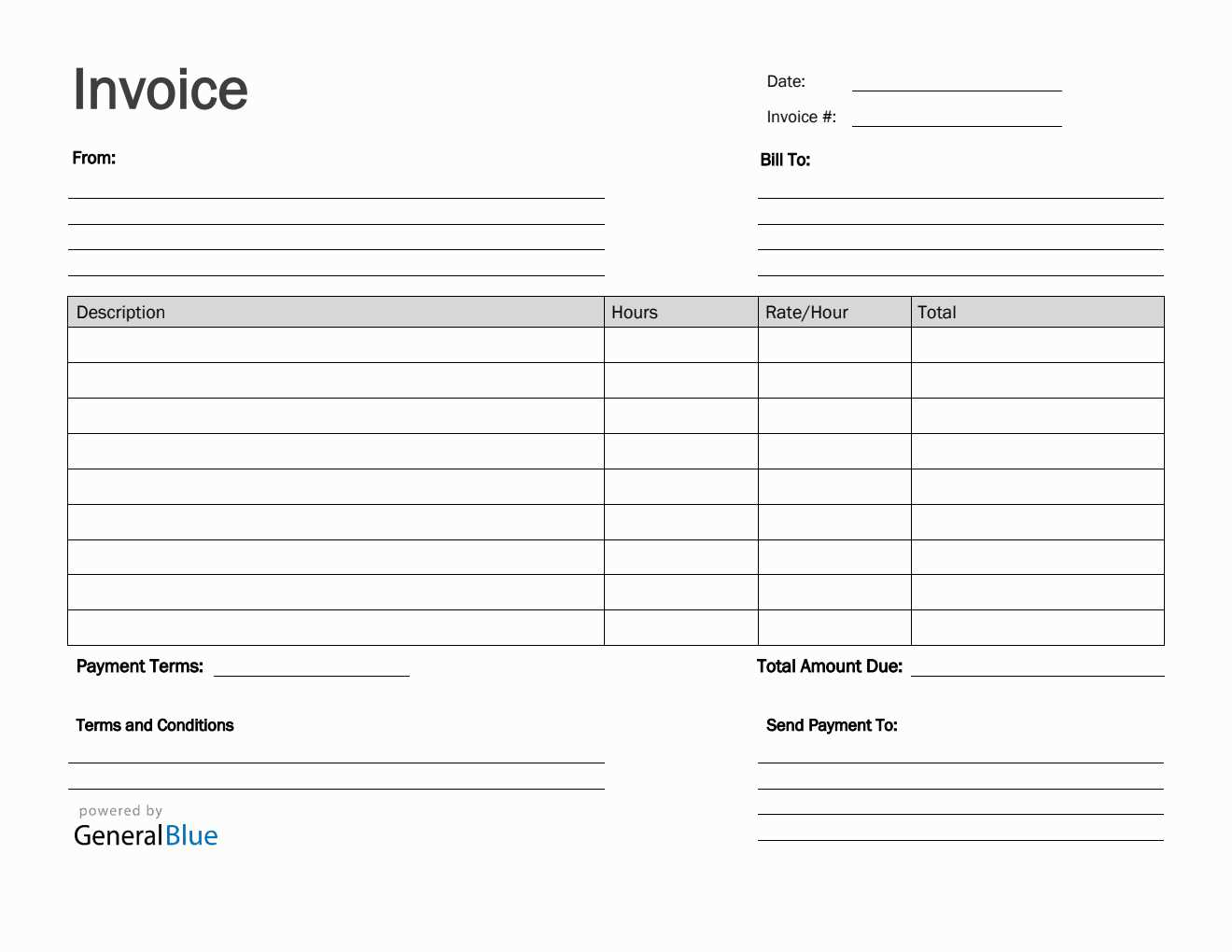

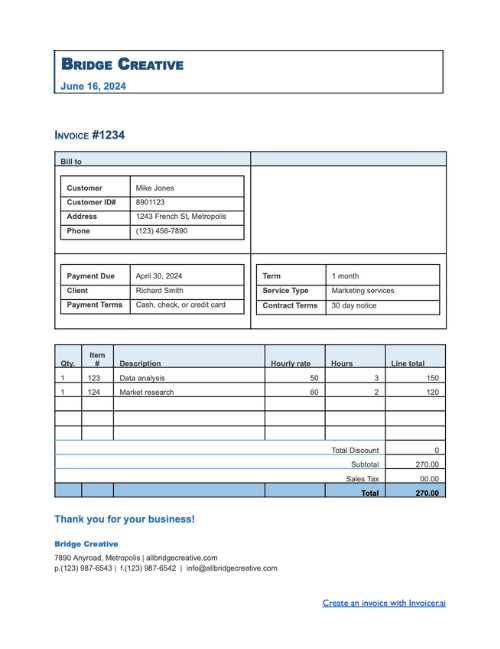

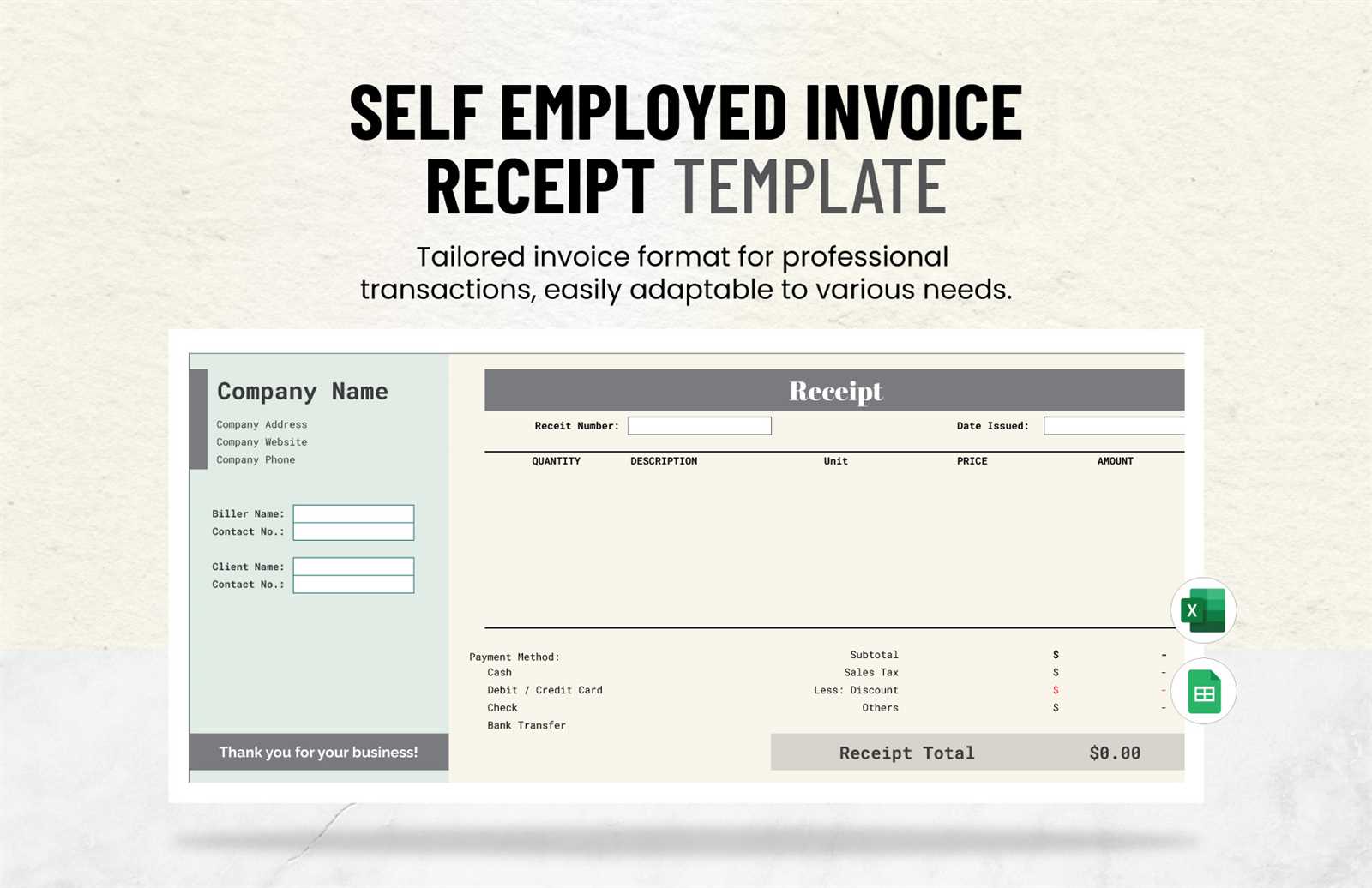

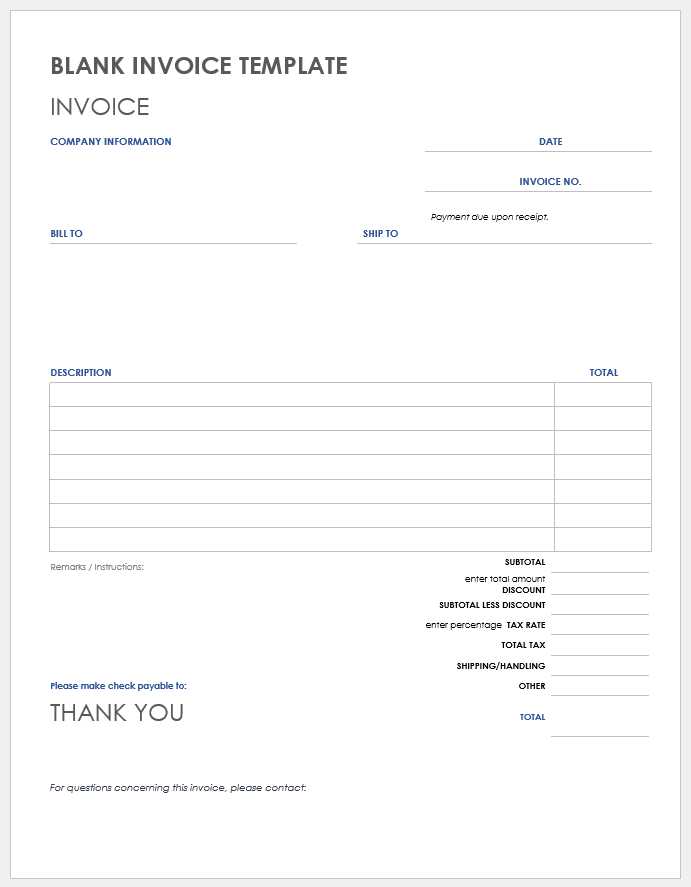

These billing documents are designed to streamline the financial process, making it easier to track earnings and reduce administrative errors. They typically include key information such as service descriptions, payment terms, and contact details, along with space for itemizing each charge. Customizable formats allow users to adjust the layout, content, and branding to match their business needs.

Using a predefined structure offers several benefits. First, it minimizes the risk of overlooking important details, such as deadlines or payment methods. Second, it helps establish credibility with clients, as a professional-looking document fosters confidence. Finally, these formats can be adapted for both one-time projects and ongoing contracts, offering flexibility for various business models.

Why Freelancers Need Invoice Templates

For independent workers, managing payments efficiently is essential to maintaining a steady cash flow. Having a standardized method of requesting compensation not only saves time but also ensures that important details are never overlooked. A consistent approach to billing can also help avoid misunderstandings and create a professional image that builds trust with clients.

Streamlining the Payment Process

One of the main reasons freelancers use predefined billing documents is to make the entire process more efficient. By eliminating the need to start from scratch with each client, they can focus more on their work while ensuring that the financial side of the business remains smooth. A simple, clear format helps both the provider and the client stay on the same page regarding expectations and deadlines.

Key Benefits of Using a Standardized Billing Format

| Benefit | Explanation |

|---|---|

| Time Efficiency | Freelancers can quickly fill in key details, saving time compared to creating documents from scratch. |

| Consistency | Using the same layout for all clients helps avoid errors and maintains a professional image. |

| Clear Communication | Clear, structured documents help ensure both parties are aligned on payment terms and service details. |

| Easy Record Keeping | A uniform format simplifies organizing and tracking payments over time. |

By relying on these structured documents, freelancers can reduce the chance of miscommunication, missed payments, and administrative headaches. The time and effort saved can be redirected toward growing their business and focusing on client relationships.

Choosing the Right Invoice Template

Selecting the most suitable billing format is crucial for maintaining professionalism and ensuring that all necessary details are included. With numerous options available, it’s important to consider factors such as industry requirements, design preferences, and the specific needs of your clients. The right choice can streamline your administrative tasks, improve clarity, and even enhance your credibility with clients.

Factors to Consider When Selecting a Billing Document

When choosing a format, freelancers should prioritize simplicity and clarity. A well-structured document that is easy to read will leave a positive impression on clients. Additionally, incorporating the correct elements–such as service descriptions, payment terms, and contact information–ensures that both parties are clear on the agreement and expectations. Some clients may have preferences regarding the layout, so understanding their needs is also important.

Customization vs Pre-made Designs

While some prefer to create fully personalized formats to match their brand identity, others may opt for pre-made solutions that are simple to use and provide the necessary structure. Pre-designed formats often offer ease of use, while custom ones can provide a more personalized touch. The key is to find a balance between functionality and presentation, ensuring that your format serves its purpose while also representing your business professionally.

Key Elements of an Effective Invoice

For a billing document to be effective, it must clearly communicate all necessary details in an organized and professional manner. A well-constructed document not only outlines the amount owed but also serves as a clear record of the services provided, payment terms, and other essential information. Including the right components ensures that there are no misunderstandings and helps streamline the payment process.

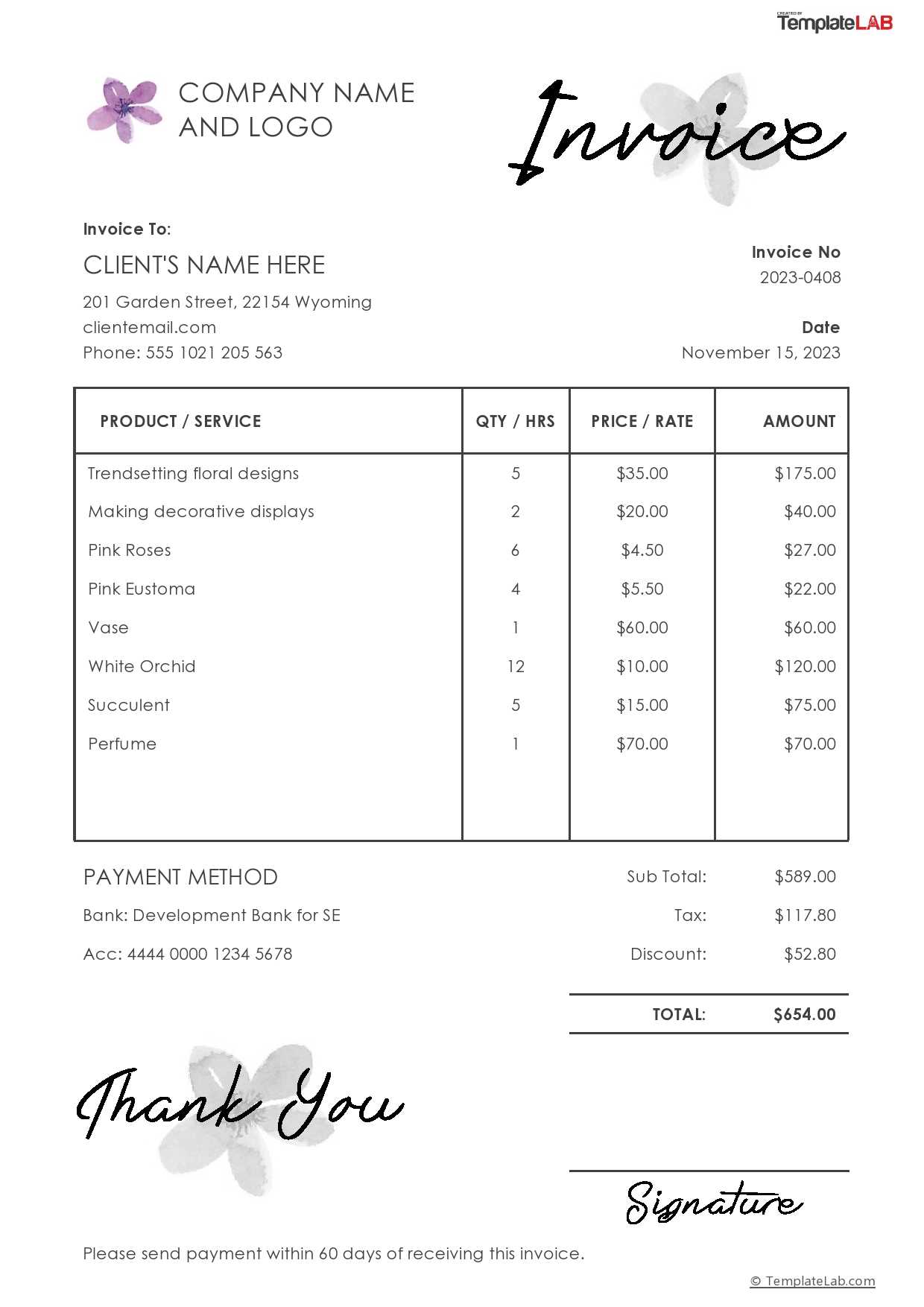

The most important elements to include in any billing document are the service description, total amount due, payment methods, and terms of payment. These components make the process transparent and ensure that the client knows exactly what they are paying for, when the payment is due, and how it should be made. Additionally, personal or business details such as your contact information, business name, and tax ID (if applicable) add a level of professionalism that can help build trust.

To avoid confusion, it is important to itemize services or products, especially if the job involves multiple tasks or items. Providing a breakdown allows the client to see exactly what they are being charged for and helps prevent disputes. Including clear payment instructions and deadlines ensures that the client knows how and when to complete the payment, further streamlining the financial transaction.

How to Customize Your Invoice Template

Customizing your billing document allows you to tailor it to your specific business needs while maintaining a professional appearance. Personalization is important, as it helps create a distinct identity for your business and ensures that your documents align with your branding. By adjusting elements such as layout, fonts, and colors, you can create a document that not only meets your functional requirements but also enhances your professional image.

Start by adding your business name, logo, and contact information to ensure that your clients can easily reach you. This personalization makes the document look more professional and serves as a reminder of who provided the service. You can also include your tax identification number or any other legal information relevant to your business, depending on local regulations.

Next, consider adjusting the layout to fit your needs. Depending on your industry, you might want to highlight certain sections such as the service description, payment due date, or total amount due. Many billing solutions offer customizable fields, which let you add extra details like discounts, late fees, or multiple payment options. Keep the design simple and clear, ensuring that the most important details stand out.

Additionally, including your business’s branding colors or using a unique font can help make your document visually distinctive. However, remember that readability is key–avoid overly complicated fonts or clashing colors that could make the document hard to read. Ultimately, the goal is to create a professional, clear, and easy-to-understand document that reflects your business values while meeting the needs of your clients.

Common Mistakes in Self Employed Invoices

While creating billing documents may seem straightforward, there are several common mistakes that can lead to confusion, delayed payments, or even damage your professional reputation. Simple oversights, such as missing information or unclear terms, can complicate the payment process and create unnecessary disputes with clients. Avoiding these pitfalls is crucial for ensuring smooth financial transactions and maintaining a positive relationship with your clients.

Overlooking Important Information

One of the most common errors is failing to include essential details in the document. Without clear service descriptions, payment terms, or contact information, clients may not fully understand what they are being charged for or when payment is due. This can lead to confusion, delays, and even missed payments. Always double-check that every key element is present and easy to read.

Not Setting Clear Payment Terms

Another frequent mistake is neglecting to specify the payment due date or accepted payment methods. Without these clear instructions, clients may not know when or how to make their payment. This ambiguity can cause delays and strain the working relationship. Be sure to clearly state the expected payment date and any penalties for late payments, if applicable. Including your preferred payment methods (bank transfer, credit card, etc.) helps eliminate confusion and encourages faster payments.

Ensuring that all the necessary information is present and accurate will help avoid these common mistakes, keeping your billing process efficient and professional. By paying attention to detail and setting clear expectations, you can create smoother transactions and build trust with your clients.

Free vs Paid Invoice Templates

When it comes to choosing the right billing document solution, freelancers and small business owners often face the decision between using free or paid options. Both have their advantages, but the right choice depends on your specific needs, preferences, and budget. While free solutions can be tempting, paid options often offer additional features and benefits that could justify the cost. Let’s explore the key differences between these two types of formats.

Advantages of Free Billing Documents

Free solutions are widely available and can be a great starting point for those just beginning or operating on a tight budget. Some of the benefits of using free billing formats include:

- Cost-effective – No financial commitment required, making it ideal for new businesses or freelancers just starting out.

- Quick and easy to access – Many free formats can be downloaded or used online with minimal effort.

- Simple design – Free formats are often straightforward and easy to understand, focusing on basic functionality.

Benefits of Paid Billing Solutions

While free formats may be sufficient for basic needs, paid options offer more advanced features that can enhance your billing process. Some of the advantages of opting for a paid solution include:

- Customization options – Paid formats often offer more flexibility in design and functionality, allowing you to tailor the document to match your business brand.

- Advanced features – You may gain access to features like automated payment reminders, integration with accounting software, and tracking of multiple clients.

- Professional look – Paid options often come with more polished designs, which can help make your business appear more established and trustworthy.

- Customer support – Paid solutions often include customer support, offering assistance in case you run into issues or need help with customization.

Ultimately, whether you choose a free or paid solution depends on your business needs. If you’re looking for a simple, no-cost option and don’t mind limited features, free formats may be sufficient. However, if you require more customization and advanced tools, investing in a paid option could provide significant value in the long term.

Best Tools for Creating Invoices

Choosing the right tool to create your billing documents can make a significant difference in how efficiently you manage payments and client relationships. The best tools not only help you design professional documents but also streamline the entire process, from generation to payment tracking. With the right software, you can save time, reduce errors, and ensure that your documents meet both your needs and your clients’ expectations.

Top Features to Look for in Billing Tools

When selecting the best tool for creating your billing documents, consider the following key features:

- Ease of Use – The tool should be intuitive and easy to navigate, even for those without technical experience.

- Customization Options – Look for tools that allow you to adjust the layout, colors, and content to reflect your business branding.

- Automated Functions – Automated payment reminders, recurring billing, and integration with accounting software can save you significant time.

- Security – Ensure the tool offers secure data handling and encryption, particularly when dealing with sensitive client payment information.

Recommended Tools for Creating Billing Documents

Here are some of the best tools available for creating and managing your billing documents:

- FreshBooks – Known for its user-friendly interface and robust features, FreshBooks offers invoicing, time tracking, and expense management all in one tool.

- Zoho Invoice – A great option for small businesses, Zoho Invoice offers customizable templates, automated reminders, and easy client management.

- Wave – A free tool ideal for freelancers and small businesses, Wave allows for easy invoicing, accounting, and receipt scanning with no upfront costs.

- QuickBooks – QuickBooks is an all-in-one accounting software that also features an advanced invoicing system, making it perfect for businesses looking to manage both accounting and billing in one place.

- PayPal Invoicing – Perfect for businesses already using PayPal, this tool allows you to create and send simple invoices directly from your PayPal account, with built-in payment processing.

Each of these tools offers a unique set of features tailored to different business needs. Whether you’re looking for a free solution or an all-inclusive platform, choosing the right tool can help streamline your billing process and enhance your professional image.

Tips for Professional Invoice Design

The design of your billing document plays a crucial role in how your business is perceived. A well-designed document not only enhances your professionalism but also makes the payment process clearer and more efficient for your clients. By incorporating thoughtful design elements, you can create a document that reflects your brand identity while ensuring the necessary details are easy to find and understand.

First and foremost, keep the layout simple and organized. A cluttered document can be overwhelming and may cause confusion about the charges. Use clear sections with headings for each important detail, such as services provided, total amount due, and payment terms. A clean, structured layout will help clients easily navigate the document and find the information they need quickly.

Another key aspect of professional design is choosing the right fonts and colors. Stick to legible, simple fonts such as Arial or Times New Roman, and avoid using more than two or three font types in the same document. Colors should complement your brand’s identity without being overwhelming. Consider using your business’s brand colors for headings or borders, but make sure the text remains easy to read against the background.

Incorporating your business logo and contact details in a prominent location can add a personal touch while maintaining professionalism. It also ensures that clients know exactly who the billing document is from. Lastly, be sure to leave enough white space between sections to create a clean, uncluttered look, making the document visually appealing and easy to understand.

How to Handle Late Payments with Invoices

Late payments are an unfortunate reality for many independent professionals and small business owners. They can disrupt cash flow and create unnecessary stress. However, having a clear process in place for addressing delayed payments can help minimize the impact and ensure that you’re compensated fairly for your work. Proper communication, well-defined terms, and polite but firm reminders are key to handling late payments effectively.

Setting Clear Terms and Expectations

Preventing late payments starts with clear communication right from the beginning. Make sure to include precise payment due dates and penalties for overdue payments in your billing documents. Being upfront about your expectations allows clients to understand the importance of meeting deadlines. Additionally, consider offering multiple payment methods to make it as convenient as possible for your clients to settle their balances.

Dealing with Late Payments

If payments are delayed, it’s important to act quickly but professionally. Send a polite reminder as soon as the payment due date passes. If the delay continues, follow up with a more formal request, outlining any late fees or additional charges that may apply. Below is an example of a typical late payment structure:

| Days Late | Action | Late Fee |

|---|---|---|

| 1-7 Days | Send a polite reminder email | No late fee |

| 8-14 Days | Send a second reminder with a formal tone | 5% of total amount due |

| 15+ Days | Send a final notice or collection letter | 10% of total amount due |

Maintaining a professional but firm approach will increase the likelihood of timely payments and reduce the chance of misunderstandings. In cases where a client continues to delay payments despite reminders, it may be necessary to explore further legal or collection options, depending on your business’s policies.

Legal Considerations for Self Employed Invoices

When creating billing documents, it’s important to be aware of the legal aspects that ensure your payments are protected and your business remains compliant with tax laws and regulations. Proper documentation can help you avoid legal disputes, ensure timely payments, and establish clear terms of agreement with clients. Understanding what needs to be included and how to structure your documents legally is essential for freelancers and independent professionals.

One key element to consider is the inclusion of your business details, including your legal business name, tax identification number (TIN), and relevant licensing information (if applicable). This provides transparency and confirms that you are a legitimate business entity. Additionally, ensure that you clearly state the payment terms in your documents. Specify the due date, late fees, and accepted payment methods to avoid any confusion later on. Including terms of service or a contract clause can also protect both parties by defining the scope of work and the agreed-upon payment structure.

Another important consideration is your local tax laws. In many countries, freelancers and small business owners are required to charge sales tax or value-added tax (VAT) on services provided. Ensure that your billing documents reflect the appropriate tax rates and that you are properly collecting and remitting these taxes. Keep accurate records of all transactions, as this will be necessary when filing taxes and if you need to defend against any disputes regarding payments or services rendered.

Lastly, always make sure your documents are clear and unambiguous. If a dispute arises, a well-drafted document that outlines the specifics of the transaction will be invaluable in resolving the matter. Taking these legal considerations into account will help you run a smoother, more professional business and protect your financial interests.

Tracking Payments Using Invoice Templates

Accurately tracking payments is a crucial aspect of managing finances for independent professionals and small businesses. A clear and organized system for monitoring outstanding and received payments ensures that you maintain positive cash flow and avoid misunderstandings with clients. By using a well-structured billing document, you can streamline the payment tracking process, keep detailed records, and stay on top of your financial situation.

One of the easiest ways to track payments is by including a payment status section on your document. This section can include fields like “Amount Paid,” “Amount Due,” and “Payment Method,” allowing you to quickly identify the outstanding balance after a payment is made. Keeping this information updated regularly helps you stay organized and provides both you and your clients with a clear view of the financial status of the project.

Another effective method is to include a payment reference number or a unique invoice number on each document. This number acts as a record identifier, making it easier to track individual transactions and ensuring you can quickly locate any invoice in your records. By assigning a specific reference number to every payment, you minimize the chance of confusion, especially when dealing with multiple clients or ongoing projects.

Additionally, if you are using digital tools for managing your business finances, many platforms allow you to integrate payment tracking directly into the system. These tools can automatically update the status of your payments and send reminders for overdue amounts. This automation saves you time and reduces the chance of errors in your tracking system.

By organizing your billing documents with clear tracking features, you can easily stay on top of your financial records, reduce administrative work, and ensure timely payments from your clients.

How to Automate Invoice Generation

Automating the process of creating billing documents can save time and reduce errors, especially for those who regularly send out multiple bills. By using software or online tools, you can eliminate the need to manually create each document from scratch, ensuring accuracy and efficiency. Automation can also streamline workflows, allowing you to focus on growing your business while ensuring that payments are generated and tracked in a timely manner.

The first step in automating the billing process is to select the right tool or software that meets your needs. There are many platforms available that offer automated document generation, some of which integrate with other business management tools like accounting or project management software. These platforms often allow you to create custom billing documents that can automatically pull client details, project descriptions, and payment terms into the document.

Once you’ve selected a tool, set up templates that include all the necessary fields, such as client information, services rendered, due dates, and payment instructions. With the automation system in place, every time you complete a project or reach a specific milestone, the tool will automatically generate a new document for you, saving you the trouble of inputting the same details repeatedly. Some tools even allow you to schedule recurring bills for long-term clients, ensuring that payment requests are sent out at regular intervals.

Integrating payment reminders into your automated process is another great way to stay on top of your finances. Many platforms offer the ability to send automatic reminders for unpaid balances. These reminders can be customized to send at specific intervals, such as after a certain number of days or a week after the due date. This feature helps to reduce the risk of late payments while maintaining professionalism.

Lastly, once your system is set up, make sure to review the generated documents regularly for accuracy. Although automation minimizes human error, it’s always a good practice to double-check that everything is correct before sending or submitting any document. With the right automation tools in place, you can streamline your billing process, ensuring both accuracy and efficiency in your business operations.

Integrating Invoices with Accounting Software

Connecting your billing documents with accounting software can significantly improve the efficiency and accuracy of your financial management. By integrating these two systems, you can streamline processes, reduce manual entry errors, and get real-time insights into your business’s cash flow. This integration ensures that every payment, expense, and transaction is accurately recorded and easily accessible, helping you stay organized and compliant with tax regulations.

Here are some key benefits of integrating your billing documents with accounting software:

- Time-saving automation – Once the systems are linked, you can automatically send payment data from your billing documents to your accounting system without having to manually input it.

- Accurate financial tracking – Integration ensures that every bill generated is properly recorded in your financial system, reducing discrepancies between your revenue and actual cash flow.

- Improved reporting – With everything in one place, generating financial reports becomes much easier. You can quickly see a full picture of your business’s income, expenses, and outstanding payments.

- Efficient tax filing – Integrated systems make it easier to track tax-related data, including sales tax, deductions, and overall revenue, which simplifies the process of tax preparation.

- Reduced errors – By linking both systems, you minimize the risk of human error from manual data entry, ensuring all payment details are accurately recorded.

Many accounting software platforms offer built-in integration with popular billing and payment tools, making the setup process seamless. Here are some examples of accounting software that can easily integrate with billing systems:

- QuickBooks – A widely used accounting platform that supports automatic syncing with billing tools, simplifying payment tracking and invoicing.

- Xero – A cloud-based accounting solution with easy integration options for billing systems, offering features like bank reconciliation and automated tax calculations.

- Wave – A free accounting software that allows for integration with billing tools to track payments, manage expenses, and generate financial reports.

- Zoho Books – Zoho Books integrates well with various billing platforms, offering streamlined accounting processes and reports in real time.

Integrating your billing process with accounting software not only saves time but also gives you a clearer view of your business’s financial health, helping you make better-informed decisions.

How Invoices Build Trust with Clients

Clear, professional billing documents not only facilitate the payment process but also play a vital role in establishing trust with clients. When clients receive an organized and accurate document detailing the work completed and the amount due, it reinforces your credibility and professionalism. This transparency builds confidence, ensuring that clients feel secure in their business relationship with you and are more likely to return for future services.

In order to foster trust, it is essential to include all the necessary details in your billing document. Clients should never be left guessing about what they are being charged for, the services provided, or the payment terms. Providing an itemized breakdown of the charges and clear payment instructions demonstrates that you are both thorough and honest in your dealings.

| Key Elements to Include | Why It Builds Trust |

|---|---|

| Detailed Description of Services | Clients can see exactly what they are paying for, which eliminates confusion and potential disputes. |

| Clear Payment Terms | Having a set due date, payment methods, and any penalties for late payments shows professionalism and reduces misunderstandings. |

| Accurate Business Information | Including your business name, contact details, and tax information proves that you are a legitimate, accountable professional. |

| Itemized Charges | Breaking down the total cost ensures that clients can verify the services they are paying for, which enhances transparency. |

In addition, maintaining consistency in the format and presentation of your billing documents helps create a sense of familiarity for clients. When clients recognize that they are consistently receiving clear, professional documents, it reinforces their confidence in your business practices. This not only encourages timely payments but also fosters long-term relationships built on mutual respect and reliability.

Creating Recurring Invoice Templates

For professionals and businesses that provide ongoing services or products on a regular basis, setting up recurring billing documents can simplify the administrative process. Automating this aspect ensures that you don’t have to manually generate a new document each time a payment is due, saving you valuable time and effort. By creating recurring billing documents, you can maintain consistent cash flow and reduce the risk of missed payments from clients.

To create an effective recurring billing document, consider including the following essential elements:

- Fixed payment amount – Clearly outline the amount due for each billing cycle, whether it’s monthly, quarterly, or yearly.

- Billing frequency – Specify the frequency of payments (e.g., weekly, monthly, or annually) and ensure this matches the agreement with your client.

- Start and end dates – Define the duration of the agreement, including the start date and the end date (if applicable), or indicate if it is an ongoing agreement.

- Payment terms – Include clear instructions on when and how payments should be made, as well as any late fees for overdue payments.

- Automatic payment options – If possible, integrate payment methods that allow clients to set up automatic payments, reducing the chance of missed payments.

One of the main benefits of recurring billing is the ability to reduce administrative work. Once the document is set up, it can be automatically sent to clients at regular intervals without requiring any additional input. Many digital tools and platforms offer this automation feature, making it easy to schedule and track payments.

Finally, maintaining communication with your clients is key. While recurring billing helps streamline the process, it’s still important to notify clients ahead of time about upcoming payments. A friendly reminder or confirmation can ensure that clients are prepared for the payment, reinforcing the professional nature of your business.