Home Health Care Invoice Template for Easy Billing and Management

Managing payments for in-home services can often become a challenging task, especially when the process is not streamlined. For providers offering personalized assistance, creating a clear and professional financial record is essential for smooth transactions and maintaining trust with clients.

Having a reliable structure to document charges, services rendered, and payment details ensures accuracy and reduces the risk of misunderstandings. A well-organized system helps service providers focus more on their clients rather than on administrative tasks, while also maintaining financial transparency.

In this guide, we explore practical ways to design a document that effectively captures all necessary details, from patient information to service descriptions, while offering flexibility for customization. By using the right approach, professionals can simplify their billing process, stay organized, and keep their financial operations running smoothly.

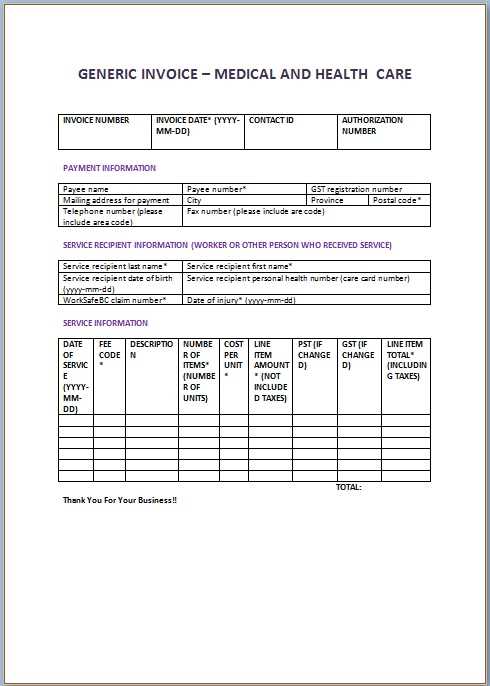

Home Health Care Invoice Template Overview

When providing in-home services, creating a clear and accurate document to track services rendered and payments is crucial. A well-designed document not only ensures smooth transactions but also helps maintain professional standards. The right structure makes it easier to handle billing, avoid errors, and offer clients a transparent view of the services provided.

Key Features of an Effective Billing Document

There are several essential elements that should be included in any billing record for in-home services. These features help ensure that all information is properly documented and can be easily understood by both service providers and clients. Here are some of the most important components:

- Service Provider Information: Includes the name, contact details, and any professional certifications or license numbers.

- Client Information: Includes the client’s name, address, and contact details, ensuring all communication is clear.

- Detailed Description of Services: A clear breakdown of each task or assistance provided, including the hours worked or specific procedures performed.

- Payment Terms: Specifies the agreed-upon amount, due date, and payment methods accepted.

- Dates of Service: Ensures each service is documented with accurate dates, which is essential for both legal and financial records.

- Tax Information: Details any applicable taxes, which vary by location and service type.

Why Having a Structured Document is Important

Using a well-organized form helps minimize confusion between service providers and clients. It also offers benefits such as:

- Professionalism: Clients feel confident when they receive a properly formatted statement, which reflects well on the provider’s reputation.

- Time-Saving: Pre-designed documents speed up the process of billing, allowing providers to focus on other aspects of their work.

- Legal Protection: A clear record of transactions helps resolve any disputes that may arise regarding payments or services rendered.

Importance of Accurate Billing in Healthcare

Accurate billing plays a crucial role in the overall success of any business providing in-home assistance. Ensuring that financial records are precise not only promotes trust between service providers and clients but also helps maintain compliance with legal and regulatory requirements. Mistakes in billing can lead to disputes, delayed payments, and unnecessary complications that affect both the service provider and the individual receiving assistance.

Key Reasons for Accuracy in Billing

Having a correct and transparent financial process offers several significant advantages:

- Building Trust: Clients rely on accurate billing to ensure they are being charged fairly for the services they receive. Errors can damage relationships and create doubts about the provider’s reliability.

- Avoiding Legal Issues: Inaccurate records can lead to legal disputes and financial penalties. Providers must comply with regulations to avoid penalties or lawsuits, which could be costly and harm their reputation.

- Efficient Cash Flow Management: Correct billing helps track outstanding payments, ensuring timely reimbursements and better cash flow. This improves the overall financial health of the business.

- Compliance with Insurance Providers: Many in-home services are reimbursed through insurance. Incorrect billing may result in claim denials or delays, affecting both the provider and the client.

Impact of Errors in Financial Documentation

Even small mistakes in financial records can lead to bigger problems down the line. Some of the potential consequences include:

- Delayed Payments: Mistakes or lack of clarity in the billing process may cause payment delays, affecting the cash flow and overall business operations.

- Client Disputes: Inaccurate charges can lead to confusion and disagreements, potentially resulting in the loss of clients or damaging business relationships.

- Increased Administrative Costs: The time and resources required to rectify billing errors can add unnecessary costs, diverting attention from core tasks.

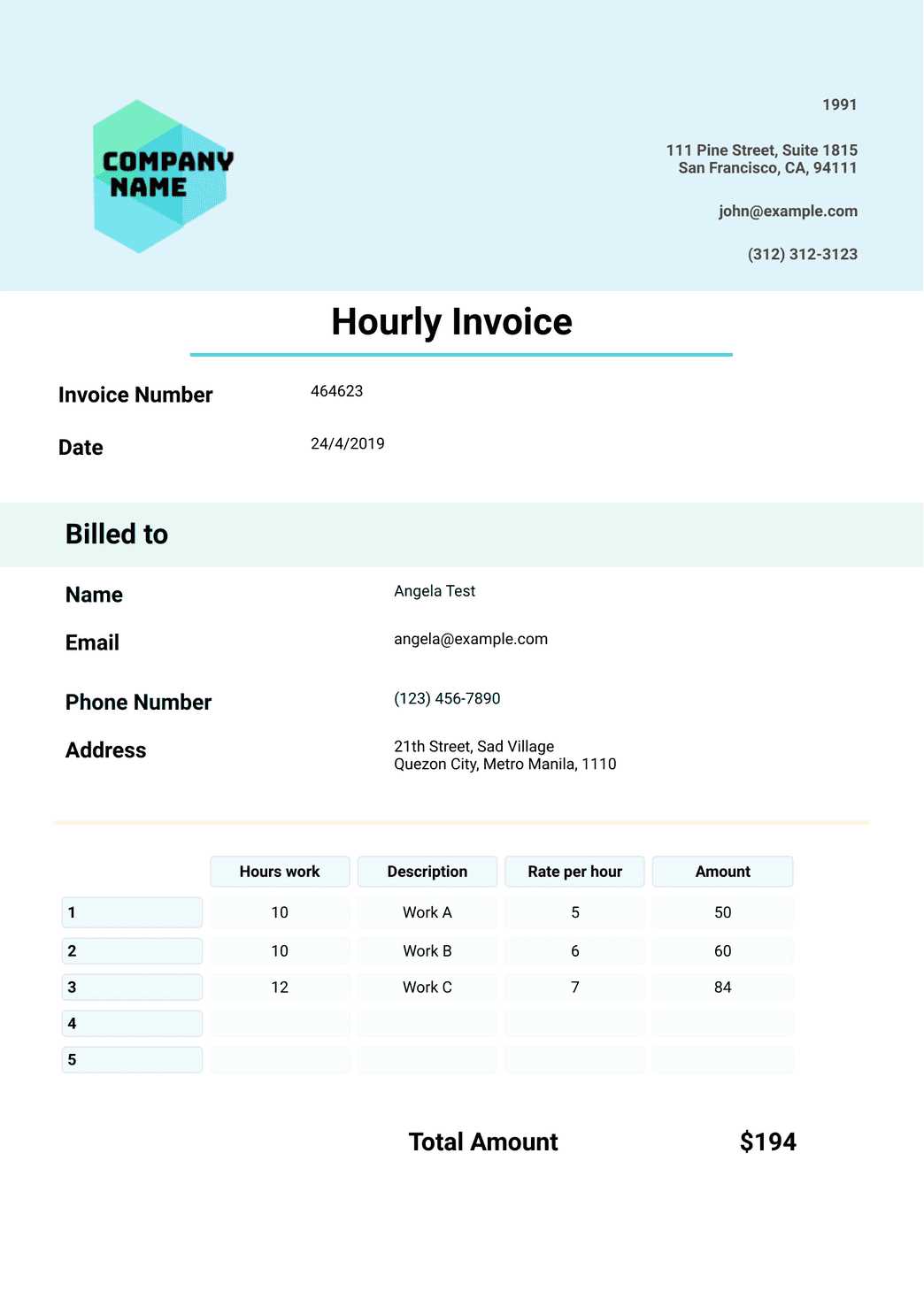

Customizing Your Invoice Template for Home Care

Tailoring your billing document to suit the specific needs of your services is essential for clarity and professionalism. Customization allows providers to create a financial record that reflects the unique aspects of their work, whether it’s specialized care or routine assistance. This flexibility ensures that all necessary details are captured, making the process smoother for both the provider and the client.

Essential Elements to Personalize

When creating a customized billing document, consider including the following elements to ensure it aligns with the services provided:

- Service Descriptions: Clearly outline each task or procedure, highlighting any specific care requirements or extra services provided.

- Hourly Rates: If applicable, ensure the billing reflects the hourly rates for specific tasks, or include flat fees for particular services.

- Additional Charges: Customize your document to account for any extra charges such as transportation fees, emergency services, or equipment usage.

- Client Preferences: If clients have special preferences or requests, include these in the bill to show transparency and attention to detail.

- Payment Terms: Set clear guidelines for payment deadlines, accepted methods, and any late payment penalties specific to your business.

Designing for Flexibility and Ease

While customization is important, simplicity and ease of use should also be prioritized. A well-organized document ensures that the client can easily understand what services were provided and how much is due. Here are some tips for maintaining balance:

- Keep It Simple: Avoid clutter by focusing on the essential details and removing unnecessary information that could confuse the client.

- Use a Consistent Format: Stick to a clean, professional layout with clearly defined sections for services, charges, and payment terms.

- Make It Editable: Use a customizable format that allows easy updates, whether it’s for new clients, additional services, or changing rates.

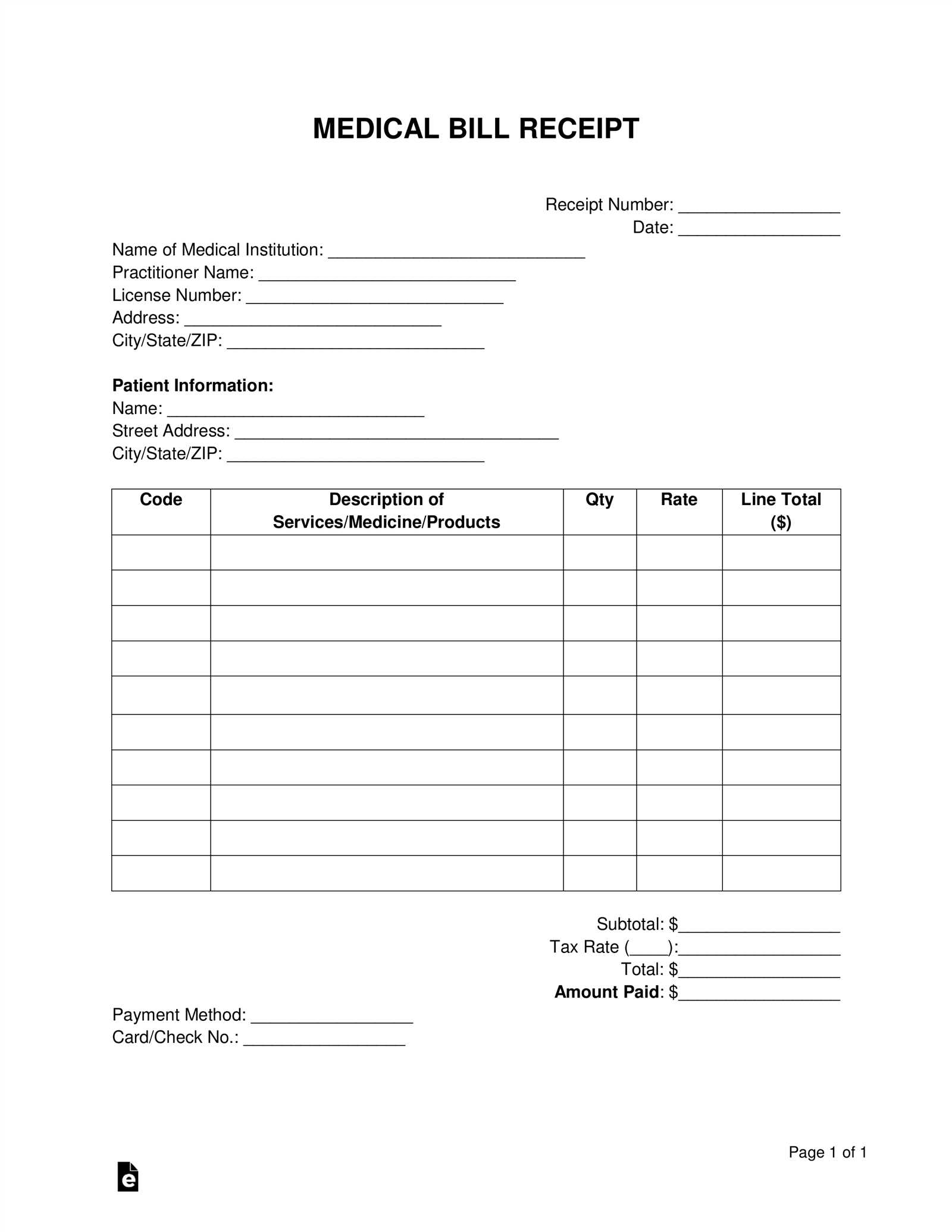

Key Elements in a Home Care Invoice

To ensure proper documentation and clear communication, a well-structured financial record must include specific details about the services provided, payments expected, and terms of agreement. Including the right components not only helps prevent confusion but also ensures transparency between the service provider and the client. These key elements allow both parties to have a complete understanding of the charges and expectations.

Essential Information to Include

A comprehensive billing document should have all the necessary information to maintain clarity and professionalism. Here are the key elements that should be present:

- Provider Details: Include the name, contact information, and any relevant credentials or licenses associated with the service provider.

- Client Information: Document the client’s name, address, and contact information to ensure there is no confusion regarding who is being billed.

- Service Descriptions: List each service performed, including a brief description and the time spent on each task if applicable.

- Rates and Charges: Clearly define the cost of each service provided. Include any hourly rates, flat fees, or additional charges for special tasks.

- Dates of Service: Make sure each service is assigned a specific date or range of dates to avoid ambiguity regarding when the services were rendered.

- Payment Terms: Specify how and when the payment is due, including details about accepted payment methods, due dates, and any late fees for overdue payments.

- Tax Information: If applicable, include the tax rates and the total tax amount that needs to be paid as part of the overall charges.

Additional Customization Options

While the above elements are essential for any billing document, customization can enhance the clarity and relevance of the statement. Some additional components to consider are:

- Discounts or Special Rates: If any discounts or special rates are applied, ensure they are clearly mentioned and calculated in the final total.

- Insurance Information: If the service involves insurance reimbursement, include details about the policy, the coverage, and any co-payments that may apply.

- Payment Instructions: Offer clear instructions for payment submission, including bank account information, online payment links, or mailing address.

How to Track Payments with Invoices

Effectively managing payments is essential for any service provider. Tracking payments ensures that all financial transactions are accounted for and helps prevent misunderstandings regarding outstanding balances. By incorporating a system for monitoring payments, you can ensure timely collection, identify overdue amounts, and maintain a clear financial record.

The key to tracking payments is organizing your records in a way that allows easy reference and provides clear visibility into the status of each transaction. With a well-structured system, you can quickly determine whether a payment has been received, is pending, or is overdue, and take appropriate action when necessary.

Steps to Track Payments Efficiently

- Assign Unique Identifiers: Each financial record should have a unique reference number. This helps in easily identifying and tracking individual transactions.

- Record Payment Dates: Always include the payment date on your financial documents. This allows you to track when a payment was made, and whether it aligns with the agreed-upon terms.

- Track Payment Methods: Specify how payments are made (credit card, bank transfer, check, etc.). This provides clarity on whether payment was processed through the expected channels.

- Monitor Outstanding Balances: Clearly indicate any remaining amounts owed, including previous unpaid invoices, to give both parties a clear picture of the current financial status.

- Use Payment Logs: Keep a detailed log of all payments received. This log should include the amount paid, the date received, the client’s details, and the method of payment.

Benefits of Efficient Payment Tracking

Tracking payments not only helps with accurate record-keeping but also streamlines the financial process. Some of the key benefits include:

- Reduced Administrative Work: Automating or organizing payment tracking reduces the time spent managing outstanding accounts and minimizes errors.

- Improved Cash Flow: By keeping track of due and overdue payments, service providers can follow up promptly, ensuring steady cash flow.

- Clear Communication: Both clients and providers benefit from a transparent system that clearly shows amounts paid and balances due.

Legal Considerations for Health Care Invoices

When providing in-home assistance, it’s important to ensure that all financial documents comply with local laws and regulations. Accurate and legally sound financial records not only protect the service provider but also safeguard the interests of the client. Failure to comply with legal standards can lead to disputes, fines, or even legal action, so understanding the legal requirements is essential for smooth business operations.

From ensuring that tax information is properly documented to understanding the specific terms related to billing for medical services, there are several key legal considerations to keep in mind. These factors help avoid complications and ensure that both parties are aware of their rights and responsibilities.

Key Legal Requirements

When creating financial records for services rendered, ensure the following elements are addressed to stay compliant:

- Accurate Tax Documentation: It’s essential to include the correct tax rates for the services provided, as these may vary based on location. Be aware of local sales tax laws and medical exemptions that might apply to certain services.

- Clear Payment Terms: Define payment due dates, accepted payment methods, and penalties for late payments. These terms should be mutually agreed upon and clearly outlined to avoid misunderstandings.

- Insurance Information: If insurance coverage is involved, ensure that relevant details are included, such as the policy number, provider information, and the amount covered. It’s important to specify any co-pays, deductibles, or out-of-pocket costs the client is responsible for.

- Service Descriptions: Provide detailed descriptions of the services rendered. Ambiguities can lead to disputes, so being specific about what was provided is important for legal transparency.

- Client Consent: If services require consent or authorization, ensure this is documented appropriately, either on a separate agreement or as part of the financial record.

Compliance with Privacy Regulations

Another crucial aspect of legal compliance is maintaining privacy and confidentiality. In many regions, laws such as HIPAA (Health Insurance Portability and Accountability Act) in the U.S. govern the protection of patient information. As a service provider, it is vital to ensure:

- Secure Handling of Client Data: Always store client information securely and ensure it’s only accessible to authorized personnel.

- Confidential Billing Practices: When communicating financial details, ensure that the client’s privacy is respected and that sensitive information is shared only with those directly involved in payment processing.

Common Mistakes to Avoid in Billing

Billing is a crucial aspect of any service-based business, and even small errors can lead to confusion, delayed payments, and strained client relationships. It’s essential to ensure that the financial records you create are clear, accurate, and professional. Avoiding common mistakes in the billing process will help maintain trust and ensure timely payments, reducing administrative stress in the long run.

Frequent Billing Errors

Below are some of the most common mistakes made during the billing process that can cause significant issues for both service providers and clients:

- Incorrect Client Information: Always double-check that the client’s name, address, and contact details are accurate. Errors here can result in missed payments or disputes regarding who is responsible for the charges.

- Unclear Service Descriptions: Vague or overly broad descriptions of the services provided can lead to confusion. Be specific about what was done, how long it took, and any additional services that were included.

- Missing or Incorrect Dates: Ensure that the dates of service are accurately listed. Incorrect or missing dates can make it difficult to track payments and can lead to misunderstandings with clients.

- Failing to List Payment Terms: Clearly state when payment is due, what methods are accepted, and any penalties for late payments. Failing to outline these terms can create confusion and delays in payment.

- Omitting Taxes or Fees: Always include applicable taxes or additional charges. Omitting these details can create discrepancies when clients review their records or when processing payments through insurance companies.

- Overlooking Payment Tracking: Not keeping track of payments as they come in can cause confusion when it’s time to follow up on outstanding balances. Maintain accurate records of payments received, including the date, amount, and method of payment.

How to Prevent Billing Mistakes

To avoid these common pitfalls, consider implementing the following practices:

- Use a Standardized Format: Create a consistent layout for your financial documents to ensure all necessary information is included every time.

- Double-Check Details: Before sending out any financial records, verify all the details–client information, service descriptions, payment terms, and dates.

- Stay Organized: Maintain up-to-date records of all transactions and payments, and regularly review any outstanding balances to stay on top of collections.

- Automate Billing: Consider using software tools that automate the billing process. Automation reduces human error and ensures consistency in the documentation.

Benefits of Digital Invoice Templates

Switching from paper-based financial records to digital versions offers numerous advantages for both service providers and clients. Digital documents streamline the entire process, making it easier to create, send, and track payments. With digital solutions, you can automate tasks, reduce errors, and improve overall efficiency, all while maintaining a professional appearance.

Key Advantages of Going Digital

Adopting electronic billing records comes with several benefits that enhance the management of financial transactions:

- Time Efficiency: Creating and sending digital documents is faster compared to manually preparing paper bills. Automation tools can quickly generate customized statements, saving valuable time.

- Cost Savings: By eliminating the need for paper, printing, and postage, service providers can reduce administrative costs. Digital records also reduce the need for physical storage space.

- Accuracy and Consistency: Digital formats help avoid common mistakes associated with handwritten records, ensuring that all necessary details are consistently included and reducing human error.

- Easy Updates: Making updates to billing information, rates, or services is far simpler with digital documents. Changes can be made quickly and are automatically reflected in all future records.

- Environmentally Friendly: Reducing paper use is not only cost-effective but also more eco-friendly. Going digital helps minimize waste and supports sustainability efforts.

Improved Organization and Tracking

One of the biggest advantages of digital records is the ability to stay organized. With digital systems, service providers can easily track payments, monitor outstanding balances, and set reminders for follow-up actions:

- Centralized Storage: All financial documents are stored in one accessible location, making it easy to retrieve any previous records or check payment histories at any time.

- Better Payment Tracking: Digital solutions often come with built-in features to track which payments have been received and which are still outstanding. This simplifies collections and minimizes the risk of overlooking a payment.

- Security: Digital documents can be encrypted and password-protected, providing a higher level of security than paper records, which can be lost or damaged.

How to Set Payment Terms for Home Care

Establishing clear payment terms is essential for ensuring a smooth financial relationship between service providers and clients. Well-defined terms help avoid confusion, set expectations, and ensure that both parties understand when and how payments should be made. Properly setting payment conditions also improves cash flow and reduces the likelihood of delayed or missed payments.

When deciding on payment terms, it’s important to consider factors such as the type of services provided, the frequency of billing, and the financial capabilities of your clients. Setting realistic and transparent terms can build trust and encourage timely payments.

Key Components of Payment Terms

To create clear and enforceable payment terms, ensure the following elements are addressed:

- Due Dates: Specify when the payment is expected. Common options include “due upon receipt,” “within 30 days,” or “due by the 15th of each month.” Ensure the due date is clearly stated on the financial record.

- Accepted Payment Methods: Outline the payment methods that are acceptable, such as credit cards, bank transfers, checks, or online payment platforms. Make the process as simple and convenient as possible for your clients.

- Late Fees: Include a late payment penalty clause if applicable. This encourages timely payments and protects against the impact of overdue balances. Be transparent about the amount or percentage added to overdue payments.

- Installment Options: For larger sums, consider offering installment payments. This can make it easier for clients to manage their expenses while ensuring you receive payment over time.

- Advance Payments or Deposits: For long-term services or significant projects, consider requesting an upfront payment or deposit to secure the arrangement. This reduces the risk of non-payment and demonstrates the client’s commitment.

Communicating Payment Terms Clearly

Clear communication is key to preventing misunderstandings. Here are some tips for ensuring that your payment terms are well-understood:

- Include Terms in Contracts: Whenever possible, formalize payment terms in a signed agreement to ensure that both parties are legally bound to the terms.

- Highlight Important Details: Emphasize key payment details such as the due date, accepted methods, and any late fees in bold or by using bullet points to make them easy to find.

- Provide Regular Reminders: Send gentle reminders a few days before the payment due date to ensure clients are aware and prepared to pay on time.

- Clarify Responsibilities: Clearly explain which party is responsible for any fees or charges, such as transaction fees or bank processing charges.

Best Software for Creating Invoices

Using software to generate financial documents can save time, reduce errors, and increase overall efficiency for any service provider. The right software offers a variety of features, including customizable templates, automated calculations, and tools for tracking payments. Choosing the best software depends on your business needs, such as the complexity of your billing process, the volume of records, and your preferred payment options.

Here are some of the most popular and reliable software solutions designed to streamline the creation and management of financial statements:

Top Software Options for Generating Billing Statements

- QuickBooks: A widely used accounting tool that offers a range of features including customizable billing statements, expense tracking, and integration with various payment methods. QuickBooks is suitable for both small businesses and larger organizations.

- FreshBooks: Known for its user-friendly interface, FreshBooks makes it easy to create professional-looking records, track payments, and send automated reminders. It’s particularly well-suited for freelancers and small business owners.

- Zoho Invoice: An excellent option for those looking for a free or affordable solution with customizable templates, automated billing, and multi-currency support. It also offers integration with other Zoho apps for more comprehensive business management.

- Wave: Wave is a free tool that offers professional billing document creation along with accounting features. It’s perfect for entrepreneurs or small businesses that need basic, no-cost software to manage financial records.

- Bill.com: Bill.com provides automated billing and payment management, allowing users to send and track payments easily. It also integrates with accounting software like QuickBooks, making it ideal for businesses looking to streamline their entire financial workflow.

Features to Look for in Billing Software

When choosing the right tool, consider these features to ensure you get the most out of your software:

- Customization: Look for a platform that allows you to customize billing statements with your business logo, color scheme, and specific details to make the documents more professional.

- Automation: Choose software that automates recurring billing, late payment reminders, and payment tracking to reduce manual effort and ensure timely payments.

- Integration: Consider software that integrates with other tools you use, such as accounting programs, payment gateways, and customer relationship management (CRM) systems, for a seamless workflow.

- Security: Ensure the software has robust security features, including data encryption, to protect sensitive financial information.

- Multi-Device Access: Opt for cloud-based software that allows you to create and manage billing records from any device, whether at the office, at home, or on the go.

How to Include Insurance Details in Invoices

When services are provided to clients covered by insurance, it’s important to include the relevant insurance details in your financial records. Properly documenting insurance information helps ensure that claims are processed smoothly and that the client’s coverage is accurately applied. By including these details, you provide transparency, avoid disputes, and help facilitate prompt payment from both the client and their insurance provider.

Including insurance details on financial statements may seem complicated, but with the right approach, it can be a straightforward process. The key is to ensure that all necessary information is clearly presented and easy to reference for both the client and the insurance company.

What Insurance Information to Include

Ensure that the following insurance details are clearly listed in the financial records:

- Insurance Provider Information: Include the name of the insurance company, their contact details, and any relevant policy numbers. This allows the payer or claims department to easily locate the client’s coverage information.

- Policyholder Information: Specify the name of the individual whose insurance policy is being used, along with their relationship to the client, if necessary.

- Claim Number: If a claim has been filed, include the claim number assigned by the insurance company to streamline the reimbursement process.

- Coverage Details: Include the specific services covered under the client’s plan, along with the percentage or dollar amount the insurance will pay. This provides clarity on what the client’s out-of-pocket responsibility will be.

- Authorization or Pre-Approval Information: If prior approval was required for services, include any relevant reference numbers or confirmation details from the insurer.

Tips for Including Insurance Information Clearly

To make sure the insurance details are presented in an organized and professional manner, consider the following tips:

- Dedicated Section for Insurance Details: Create a separate section on the document specifically for insurance information. This will help prevent confusion and ensure that both parties know where to find the relevant details.

- Clear and Concise Descriptions: Be sure to use clear and simple language when describing coverage, co-pays, deductibles, and amounts paid by the insurance provider. Avoid unnecessary jargon that may cause confusion.

- Highlight Key Information: Use bold or underline to emphasize important details, such as the claim number, amount covered, and the amount due from the client. This makes it easier to spot the key pieces of information quickly.

- Regular Updates: If there are any changes in the client’s insurance details, ensure that these are promptly updated in all financial documents to reflect the most cur

Understanding Tax Rates for Health Care Services

Tax rates can vary significantly based on the nature of the services provided, the location of the service, and the specific regulations that govern different industries. For professionals providing medical, therapeutic, or similar services, understanding the tax implications is crucial. Correctly applying and calculating tax rates ensures compliance with local and federal regulations while avoiding errors that could result in penalties or disputes.

In many regions, certain services may be exempt from taxes, while others may be taxable depending on factors like the provider’s qualifications, the type of care given, or whether the services are considered essential or elective. Knowing when and how to apply taxes on your financial documents will help maintain transparency and accuracy.

Types of Taxes to Consider

When applying taxes to services, consider these main types of taxes that may apply to your financial statements:

- Sales Tax: This is a common tax applied to goods and services. However, some regions may exempt specific services related to treatment or therapeutic services from sales tax, while others may include them under taxable categories.

- Value Added Tax (VAT): VAT is common in many countries outside the U.S. and applies to the total value of the service. Depending on the jurisdiction, medical-related services might be exempt or taxed at a reduced rate.

- Service Tax: Some locations have a specific service tax on health-related or similar services, especially when provided in non-clinical settings or by independent contractors. These taxes often apply to ancillary services, such as consultations or assessments.

- Local Taxes: In addition to national or state-level taxes, local government authorities may impose their own tax rates. These can vary widely by city or county and may impact billing records based on the service location.

How to Apply Taxes Correctly

To ensure accurate tax calculation on your billing records, follow these steps:

- Research Local Tax Laws: Understand the specific tax laws and exemptions that apply to your services within your state or country. Consult with a tax professional if necessary to ensure compliance with local regulations.

- Specify Tax Rates on Statements: Always clearly specify the tax rate applied to each service. Include this information as a separate line item on financial records so that clients can easily understand how their total amount is calculated.

- Use Tax Calculators: Many accounting and financial management tools have built-in tax calculators that automatically adjust the tax rate according to the service type and location. This helps eliminate manual errors.

- Keep Track of Changes: Tax rates can change periodically. Stay updated on any shifts in local, state, or nat

Creating Professional Invoices for Caregivers

For professionals providing personal support services, creating clear and professional billing records is essential. A well-structured financial statement not only reflects the quality of service provided but also ensures transparency and builds trust with clients. A detailed, easy-to-read document helps clients understand what they are being charged for and provides a record for both the caregiver and the client to refer to.

When crafting these financial records, it is important to include all necessary information in an organized manner. A professional-looking document helps convey reliability and attention to detail, which is crucial for maintaining strong client relationships and ensuring prompt payment.

Essential Elements to Include in Billing Records

To create a comprehensive and professional statement, make sure to include the following components:

- Service Provider Information: Include your business name, address, and contact details. It is important for clients to know who is issuing the statement and how to reach you for any inquiries.

- Client Information: Clearly list the client’s name, address, and any other relevant details, such as account numbers or unique identifiers that may be part of your client records.

- Service Description: Provide a detailed description of the services provided, including the date and time of service, duration, and the specific tasks performed. This allows clients to see exactly what they are being charged for.

- Rate and Charges: Clearly state the rate for each service and the total amount charged. Include any additional fees, such as travel or administrative fees, if applicable. Ensure these are broken down separately for transparency.

- Total Due: Indicate the total amount due, including any applicable taxes, discounts, or adjustments. This ensures that both parties have a clear understanding of the final amount to be paid.

- Payment Terms: Specify the payment due date, accepted methods of payment, and any late fees or penalties for overdue payments. Clear payment terms help ensure that you are paid promptly and minimize misunderstandings.

Tips for Creating Polished Billing Statements

To ensure your financial records stand out as professional and reliable, follow these tips:

- Consistency: Use consistent formatting, fonts, and design elements across all your statements. This helps establish your brand and makes your documents easy to read.

- Clarity: Avoid clutter and keep the layout simple. Organize the information logically, with the most important details (such as the total due) prominently displayed.

- Custom Branding: Include your business logo and colors to create a cohesive, branded look. This adds a professional touch and makes your financial documents stand out.

- Digital Solutions: Consider using accounting software or online tools that allow you to create and send professional records. These solutions often include built-in templates, making it easier to customize an

Integrating Payment Methods in Your Template

Offering multiple payment options in your financial documents can significantly enhance the client experience and improve cash flow. By clearly outlining payment methods in your billing statements, you provide convenience and flexibility, which can help ensure faster payments. Integration of various payment channels allows clients to choose the most convenient method for them, whether they prefer to pay online, via credit card, check, or another method.

Incorporating payment details directly into your billing statements not only streamlines the payment process but also reduces the chances of errors and delays. It ensures that both you and your clients are on the same page regarding how payments are to be made, and it can speed up the overall transaction process.

Common Payment Methods to Include

Consider offering these widely used payment options in your financial documents:

- Credit/Debit Card Payments: Providing clients with the option to pay via credit or debit card is one of the most convenient and widely accepted methods. Include instructions for using online payment gateways such as PayPal, Stripe, or Square to make the process seamless.

- Bank Transfers: For clients who prefer to pay directly from their bank accounts, include your banking details, such as the account number, routing number, and any reference codes needed for payment processing.

- Checks: Many clients may still prefer paying by check. Ensure that your statement includes clear instructions for how to send a check, including the name and address of the recipient.

- Online Payment Portals: Use platforms like PayPal, Venmo, or Zelle to accept online payments quickly and securely. Many of these platforms also allow for easy invoicing directly from the service.

- Cash Payments: While less common in today’s digital world, some clients may prefer paying in cash. If this is an option, clearly note on your document that cash payments are accepted and specify where and when they can be made.

How to Effectively Present Payment Methods

To make payment options easy to find and use, follow these tips:

- Clear Payment Instructions: Provide a step-by-step guide on how to make payments using each method. Ensure clients understand how to proceed based on their chosen option, whether that involves entering an online payment portal, writing a check, or making a bank transfer.

- Include Payment Links: If you accept online payments, include direct links to payment portals or services like PayPal. This reduces the friction for clients, making it easier for them to complete the transaction.

- Highlight Payment Due Date: Make sure that the payment due date is clearly marked in the statement, along with any penalties or late fees for delayed paym

How to Handle Late Payments Efficiently

Late payments can be a significant challenge for service providers, impacting cash flow and causing unnecessary stress. To handle overdue payments efficiently, it’s essential to establish clear procedures and maintain a professional, consistent approach. Having a system in place for addressing delayed payments can minimize disruptions and help ensure that clients are reminded of their obligations without damaging the relationship.

By proactively managing overdue payments, you can reduce the chances of future delays and maintain a steady income stream. Clear communication, timely reminders, and well-defined policies are key to ensuring payments are collected in a professional manner.

Establish Clear Payment Terms from the Start

Prevent late payments before they happen by clearly outlining payment terms at the beginning of your working relationship. Include the following in your payment agreements:

- Due Dates: Always specify a clear due date for payment and include it on all billing records.

- Late Fees: Define the late fee amount or percentage that will be charged for overdue payments. Make sure this information is well communicated to the client in advance.

- Accepted Payment Methods: Clearly state the methods of payment that are accepted and any associated instructions to make the payment process as simple as possible.

Efficient Strategies for Handling Overdue Payments

If a payment is delayed, consider the following steps to handle the situation professionally:

- Send a Friendly Reminder: If the payment is only a few days late, send a polite reminder. Sometimes, clients simply forget, and a gentle nudge can prompt them to pay without any issues.

- Follow Up with Clear Communication: If the payment is more than a week overdue, send a second reminder that clearly explains the amount due, any late fees incurred, and the new due date for payment. Keep the tone respectful yet firm.

- Offer Payment Plans: For clients who are having trouble paying in full, offer the option of a payment plan. This can help ensure that you receive payments without further delays while accommodating the client’s financial situation.

- Use Collection Agencies as a Last Resort: If a client continues to delay payment despite reminders, consider working with a collection agency to recover the outstanding amount. This should be the final step, and only after you’ve made several attempts to resolve the issue directly.