How to Create and Use a Bid Invoice Template for Your Projects

Managing payments and project details can be a complex task, especially when working with multiple clients or vendors. Having a clear and organized method for documenting costs and agreements is essential to ensure smooth financial transactions and avoid misunderstandings. A well-structured document that outlines the services rendered, pricing, and terms helps both parties stay on the same page.

Whether you’re a freelancer, contractor, or business owner, creating and sending these financial records in a professional manner is crucial. This process not only enhances communication but also ensures timely payment for completed work. By using a properly designed document, you can reduce errors, save time, and improve the overall efficiency of your administrative tasks.

In this article, we will explore the key components of an effective billing statement and provide guidance on how to create one that suits your specific needs. With the right structure and details, you can ensure that your records are both comprehensive and easy to understand for your clients or partners.

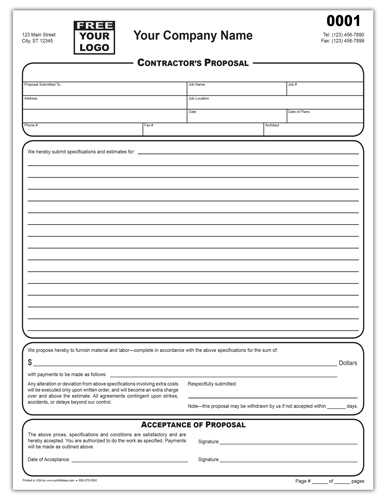

Bid Invoice Template Overview

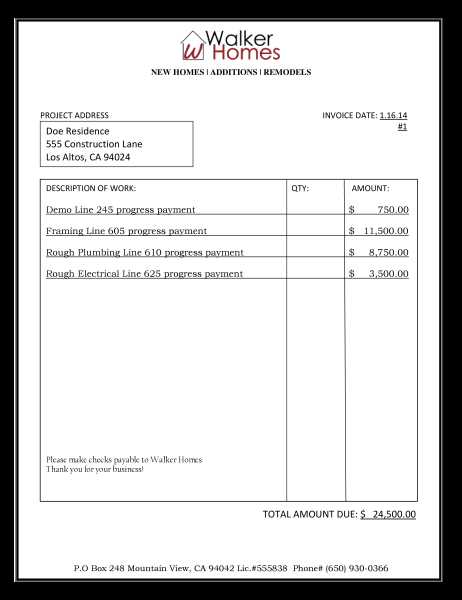

When working with clients or partners, having a well-organized document to outline the scope of work and agreed-upon costs is essential. This document helps to establish clear expectations and provides a formal record of the financial transaction. It is a professional way to ensure that both parties are on the same page regarding the services provided, pricing, and payment terms.

Such a document is often used in various industries, including construction, consulting, and creative services. It typically includes essential details like service descriptions, itemized costs, and payment deadlines. By using a structured format, you can avoid misunderstandings and ensure that you are paid promptly for the work completed.

The following are the key components you will typically find in such a document:

- Client Information: Name, address, and contact details of the person or business receiving the services.

- Service Details: A description of the work performed or products provided, along with any additional terms agreed upon.

- Payment Breakdown: A clear list of prices, taxes, and any other applicable fees.

- Payment Terms: Information on due dates, accepted payment methods, and late fees if applicable.

- Project or Reference Number: A unique identifier that helps track the transaction for both parties.

Using a well-designed version of this document can streamline your billing process and create a more professional interaction with clients or business partners. It reduces the risk of errors, provides clarity, and promotes transparency in all transactions.

Why Use a Bid Invoice Template

Using a structured document for recording the details of work completed and the payment expected provides numerous benefits for both service providers and clients. This method not only ensures clarity but also saves time and minimizes errors that can occur when dealing with complex projects or multiple clients. A consistent approach to documenting transactions fosters professionalism and trust.

Here are some reasons why utilizing such a document is a smart choice:

- Professionalism: A clearly formatted record shows clients that you are organized and serious about your work. It sets the tone for a positive business relationship.

- Clarity and Transparency: It ensures that both parties are on the same page regarding the terms of the agreement, services rendered, and pricing, which helps prevent misunderstandings.

- Time Efficiency: By using a predefined structure, you can quickly fill in the necessary details, avoiding the need to create a new document from scratch each time.

- Consistency: A standard format makes it easy to track past transactions and ensures that every document is uniform, making them easier to review and manage.

- Reduced Errors: A well-organized form reduces the likelihood of forgetting important details or making mathematical mistakes, improving accuracy in your financial records.

- Legal Protection: A properly documented agreement can serve as evidence in case of disputes, offering protection for both parties involved.

Incorporating a structured document into your business processes can streamline your operations, increase your credibility, and help ensure that payments are made promptly and accurately.

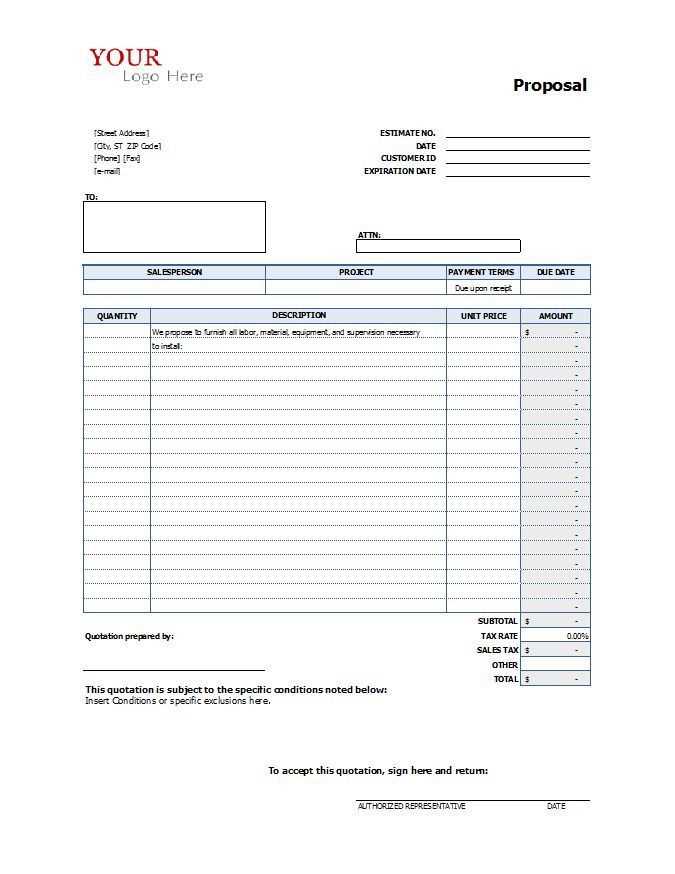

How to Create a Bid Invoice

Creating an effective document to outline the services provided, agreed-upon costs, and payment terms is crucial for ensuring smooth transactions with clients. By organizing this information clearly, you can prevent misunderstandings and make sure that both parties know exactly what to expect. This process can be done quickly with a standardized structure that ensures accuracy and consistency every time.

Step 1: Gather Relevant Information

Before creating the document, collect all the necessary details to include. These should cover both client and project-specific information. Key elements include:

- Client Details: Name, address, and contact information of the person or business receiving the services.

- Project or Service Description: A clear and concise breakdown of what has been provided or agreed upon, including any specific terms or conditions.

- Payment Amounts: Detailed pricing, including labor costs, material fees, taxes, and any other charges associated with the service.

- Payment Terms: Specify when payment is due, acceptable payment methods, and any late fees or penalties for overdue payments.

Step 2: Use a Structured Format

Once you have all the details, use a consistent structure to present the information. A clean, easy-to-read layout helps to avoid confusion. The essential sections to include are:

- Header: Include your business name and contact information, as well as the client’s details.

- Se

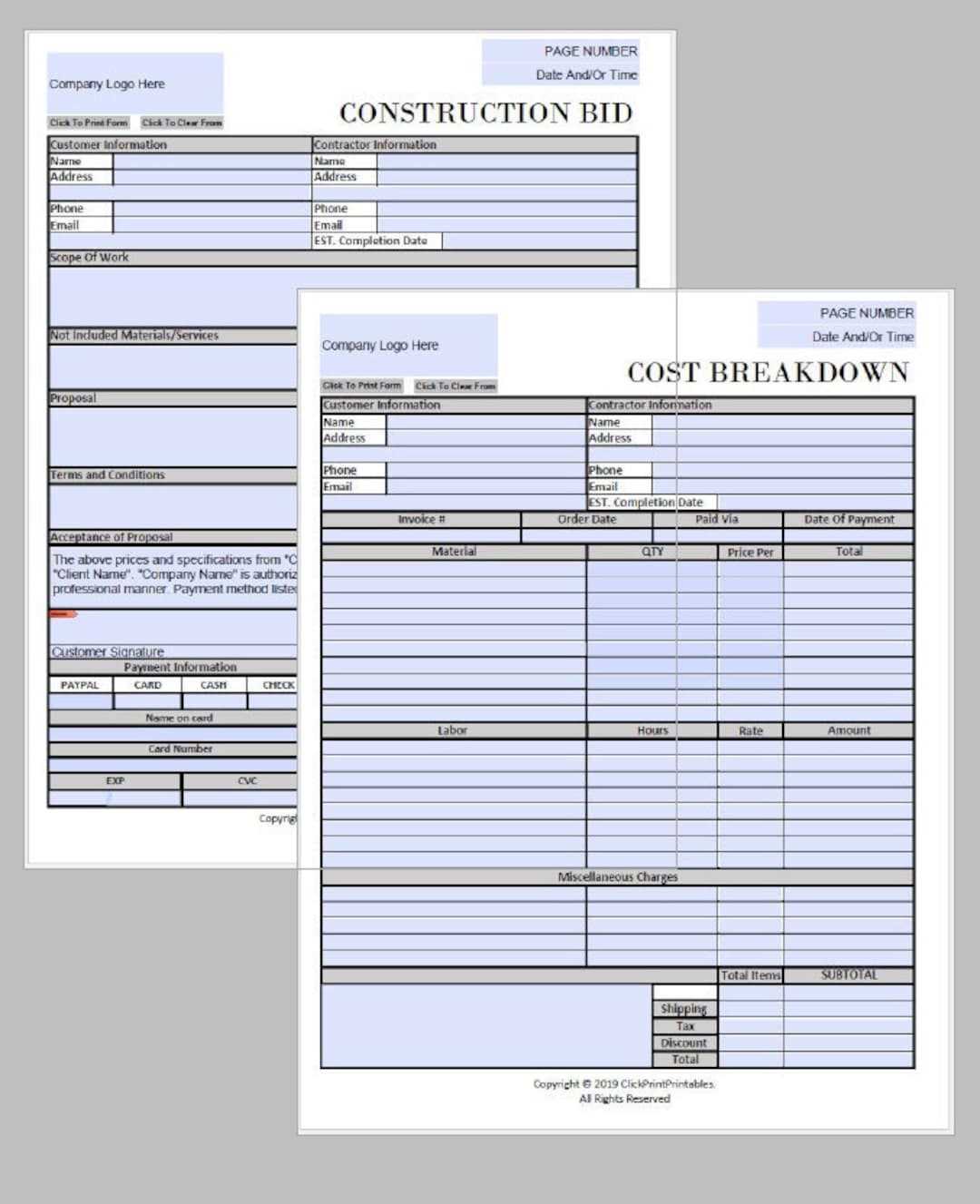

Key Elements of a Bid Invoice

When creating a document to outline the details of a completed project and payment expectations, it’s essential to include certain key components. These elements ensure that both parties involved have a clear understanding of the terms, services, and costs. A well-structured document minimizes confusion and helps to establish a transparent and professional business relationship.

1. Client and Service Provider Information

The first section of the document should include the contact details of both parties involved. This provides a clear point of reference for any future communication. Information to include:

- Client Details: Full name, address, phone number, and email of the individual or company receiving the services.

- Service Provider Details: Your business name, address, contact information, and possibly your business registration number or tax ID.

2. Service Description and Pricing

The heart of the document is the detailed description of the work provided, along with the associated costs. This section should include:

- Detailed Service Description: A clear breakdown of the work or products provided, highlighting any specific terms or conditions that apply to the services.

- Itemized Costs: A list of costs associated with the project, including labor, materials, taxes, and any other relevant charges.

- Total Payment Due: A clear total that summarizes the full amount owed for the s

Customizing Your Bid Invoice Template

Tailoring your document for proposals and financial summaries ensures it aligns with your unique business needs and brand identity. By adjusting the layout, content, and design, you can create a professional and cohesive presentation that clearly communicates terms, expectations, and costs. This process allows you to not only enhance the visual appeal but also streamline the communication between you and your clients, ensuring all relevant details are captured in an organized manner.

The first step in personalizing your document is choosing the right format. Depending on the nature of your work, you may prefer a minimalistic design with only essential fields or a more detailed structure that includes additional sections like payment terms, breakdown of services, and expected delivery dates. Carefully select which elements are most important for your clients and make sure these are easy to find.

Incorporating your branding is another key aspect of customization. Logos, color schemes, and font choices all contribute to the overall look and feel. Consistent use of brand elements helps establish credibility and trust, as well as reinforces your identity in every client interaction.

Moreover, make sure to adjust the document’s language and phrasing to suit the tone of your business. For example, if your company offers creative services, a more casual, approachable tone might be appropriate. For legal or consulting services, a formal, professional voice may be necessary. Personalizing the language ensures the communication resonates with your target audience.

Lastly, don’t forget to update your contact information and any necessary legal disclaimers. A customized document ensures that clients have all the details they need to proceed, without confusion or delay, fostering smoother transactions and clearer expectations.

Common Mistakes in Bid Invoices

When preparing financial documents for client projects, small errors can lead to misunderstandings, delays, or even disputes. These issues often arise from overlooked details, miscalculations, or unclear communication. Being aware of these common pitfalls can help ensure a smoother process, preventing unnecessary complications and fostering a more professional relationship with clients.

1. Lack of Clear Descriptions

One of the most frequent mistakes is failing to provide clear and concise descriptions of the services or products offered. Without detailed information, clients may not fully understand what they are paying for, which can lead to confusion or disputes later on. It’s essential to break down each item or service with enough detail for the client to see exactly what is being delivered.2. Missing or Incorrect Dates

Another common issue is the omission or inaccuracy of important dates. Whether it’s the project start date, completion date, or payment deadlines, any ambiguity can cause unnecessary delays or frustration. Always double-check that all dates are correct and reflect agreed-upon timelines.3. Inconsistent Pricing

Pricing errors, such as discrepancies between the quoted amount and the final charge, can create distrust. Ensure that all prices are consistent throughout the document, and if there are any changes or discounts, clearly outline them to avoid confusion. It’s important to break down pricing to ensure transparency and clarity.4. Missing Contact Information

Leaving out contact details, such as phone numbers, email addresses, or physical addresses, can create difficulties if the client needs to reach you. Always include the necessary contact information to facilitate easy communication, should any questions or issues arise.5. Not Including Payment Terms

Failing to specify payment terms is another common mistake. Without clear terms, clients may not know when or how they are expected to pay. Ensure you include payment deadlines, accepted methods, and any late fees or discounts for early payment to set clear expectations.6. Overcomplicating the Design

While it’s important to make your document look professional, overly complex layouts or excessive design elements can make it harder to read. Keep the structure simple and organized, ensuring that key details stand out and are easy to locate.By being mindful of these common mistakes, you can ensure that your document is clear, professional, and free from errors, allowing for smoother

Tips for Accurate Bid Invoicing

Ensuring precision in your financial documents is crucial for maintaining professionalism and avoiding misunderstandings. Clear and correct records not only help in getting paid promptly but also foster trust with your clients. Here are several strategies to help you achieve accuracy and clarity when preparing your financial summaries.

1. Double-Check All Figures

Before sending any document, always verify the numbers. Mistakes in calculations can cause delays and potentially strain client relationships. Cross-check the total amounts, tax rates, and individual line items to make sure everything adds up correctly. A small error can be costly, so attention to detail is key.2. Provide Detailed Breakdowns

Break down your charges clearly so that clients understand exactly what they are paying for. This includes listing all services, products, or hours worked, along with their respective costs. The more detailed the breakdown, the less likely clients are to question the charges or request clarifications.3. Use Consistent Formats

Maintain a consistent format for all your documents. Whether it’s the structure of the headings, the way numbers are presented, or the layout, uniformity ensures that your document looks professional and is easy to follow. Standardizing your format will also help avoid confusion and improve efficiency when creating future summaries.4. Specify Clear Payment Terms

Clearly outline your payment expectations to prevent delays. Indicate the due date, the payment methods accepted, and any late fees that may apply. By setting clear payment terms, you ensure that both parties are aligned on expectations from the outset.5. Include All Relevant Contact Information

Make it easy for clients to reach you by providing complete contact details. This includes your phone number, email address, and any other preferred communication methods. Clear contact information allows for quick resolution if any questions or issues arise.Benefits of Digital Bid Invoice Templates

Using digital tools to create financial documents offers numerous advantages over traditional manual methods. By embracing technology, businesses can streamline their processes, save time, and reduce the risk of errors. Digital solutions provide greater flexibility, enhanced accuracy, and improved accessibility, making them an essential part of modern business operations.

1. Increased Efficiency

Digital solutions allow you to generate and send financial documents quickly, eliminating the need for time-consuming manual calculations and data entry. With pre-built fields and automated calculations, you can complete documents in a fraction of the time it would take to do them by hand. This increased speed helps you focus more on client relationships and project execution, rather than administrative tasks.

2. Improved Accuracy and Reduced Errors

One of the most significant advantages of using digital tools is the reduction in errors. Automated calculations ensure that numbers are correct, and preset fields prevent common mistakes like typos or missing information. This accuracy helps avoid misunderstandings with clients and ensures timely payments. The ability to quickly review and modify the document before sending also reduces the likelihood of mistakes slipping through.

3. Customization and Flexibility

Digital formats allow for easy customization, enabling you to tailor each document to the specific needs of your clients. Whether adjusting the layout, adding specific terms, or incorporating branding elements, digital solutions provide much more flexibility than traditional paper-based methods. Customizing your documents ensures a professional, personalized touch that strengthens your business’s image.4. Environmentally Friendly

Going digital significantly reduces the need for paper, contributing to a more sustainable business model. Reducing paper waste not only benefits the environment but can also help lower operational costs associated with printing, storing, and mailing physical documents.5. Easy Storage and Access

Digital records are easy to store and retrieve, helping you stay organized and avoid the clutter of paper files. With cloud-based storage options, you can access yourFree Bid Invoice Templates to Use

There are numerous free resources available online that offer ready-to-use documents for business transactions. These resources allow you to quickly generate professional-looking records without the need to start from scratch. By using these free solutions, you can save time, maintain accuracy, and ensure your financial documentation meets industry standards.

1. Microsoft Word and Google Docs Templates

Both Microsoft Word and Google Docs offer a variety of free document designs that you can customize to suit your needs. These templates often include fields for service descriptions, pricing, and payment terms, making them a convenient option for businesses of all sizes. You can easily edit the text, adjust the layout, and save the document for future use.2. Excel and Google Sheets Formats

If you prefer working with spreadsheets, both Excel and Google Sheets offer templates that automatically calculate totals and taxes. These formats are particularly useful for businesses that need to include detailed cost breakdowns or multiple line items. The ability to automate calculations reduces the risk of errors and ensures that the numbers are accurate every time.3. Online Platforms and Websites

Various websites provide free downloadable files that can be customized and printed. Websites like Invoice Generator, Zoho Invoice, and Wave offer simple solutions where you can enter information, adjust the design, and download the document in multiple formats like PDF or Word. Many of these platforms also offer free tools that allow you to track and manage your records, making them an ideal option for small businesses.4. PDF Fillable Forms

PDF fillable forms offer an easy-to-use option for creating customized documents. These PDFs can be filled out directly in the reader, and once completed, the file can be saved and emailed. Free PDF templates are available from many online resources, and they often allow for custom fields and editable text boxes. This format is perfect for users who prefer not to use word processors or spreadsheets.5. Open Source Tools

For those comfortable with more advanced tools, open-source software like LibreOffice offers a variety of customizable documents. These tools are free to download and use and allow for greater flexibility in creating professional business records. Open-source options are highly customizable and can be adapted for different industries or specific client requirements.By

Legal Considerations in Bid Invoices

When preparing financial documents for client transactions, it’s crucial to be aware of the legal requirements that govern the content and delivery of such records. Properly structured documentation ensures that both parties are clear on the terms, reducing the likelihood of disputes and ensuring compliance with relevant laws and regulations. This section covers key legal aspects to consider when creating these essential business documents.

1. Compliance with Local and International Laws

Different regions and countries have specific laws that regulate business transactions. Ensuring that your document adheres to these local or international regulations is vital for legal protection. Key legal aspects include:

- Tax Requirements: Different jurisdictions may require specific tax rates or information to be included. Ensure that all applicable taxes are clearly stated and compliant with local tax codes.

- Currency Specifications: When dealing with international clients, it’s important to specify the currency in which payments are due, along with any exchange rate considerations.

- Contractual Obligations: Make sure that the terms of agreement, such as payment schedules, service timelines, and penalties for late payments, are legally sound and clear.

2. Essential Information to Include

To ensure your document is legally enforceable, certain information must be included. The absence of these elements could lead to complications or misunderstandings in the future:

- Identification of Parties: Both the business and client should be clearly identified, including legal names and contact details.

- Terms and Conditions: Always specify the agreed-upon terms of service, including deadlines, deliverables, and responsibilities.

- Pay

How to Track Payments with Bid Invoices

Efficiently tracking payments for services or products is essential for maintaining healthy cash flow and ensuring that your business operations run smoothly. Keeping a detailed record of each transaction not only helps you stay organized but also minimizes the risk of missed payments and disputes. Below are key strategies to help you monitor payments effectively.

1. Use a Payment Tracking System

Implementing a systematic approach to tracking payments can save time and reduce errors. Consider using one of the following methods:

- Accounting Software: Utilize tools like QuickBooks, FreshBooks, or Xero to track payments automatically. These platforms allow you to input transaction details and monitor outstanding balances, due dates, and payment history.

- Spreadsheet Tracking: For smaller businesses or freelancers, a simple spreadsheet (Google Sheets or Excel) can be used to track payments. Set up columns for the client name, amount due, payment date, and payment method.

- Manual Logs: If you prefer paper records, create a logbook or ledger to manually track payments. While less efficient than digital methods, this can still be effective if maintained diligently.

2. Categorize Payment Status

To avoid confusion, it’s helpful to categorize the status of each payment. This can be done using clear labels like:

- Paid: Payments that have been fully received and processed.

- Pending: Payments that are expected but have not yet been made by the client.

- Overdue: Payments

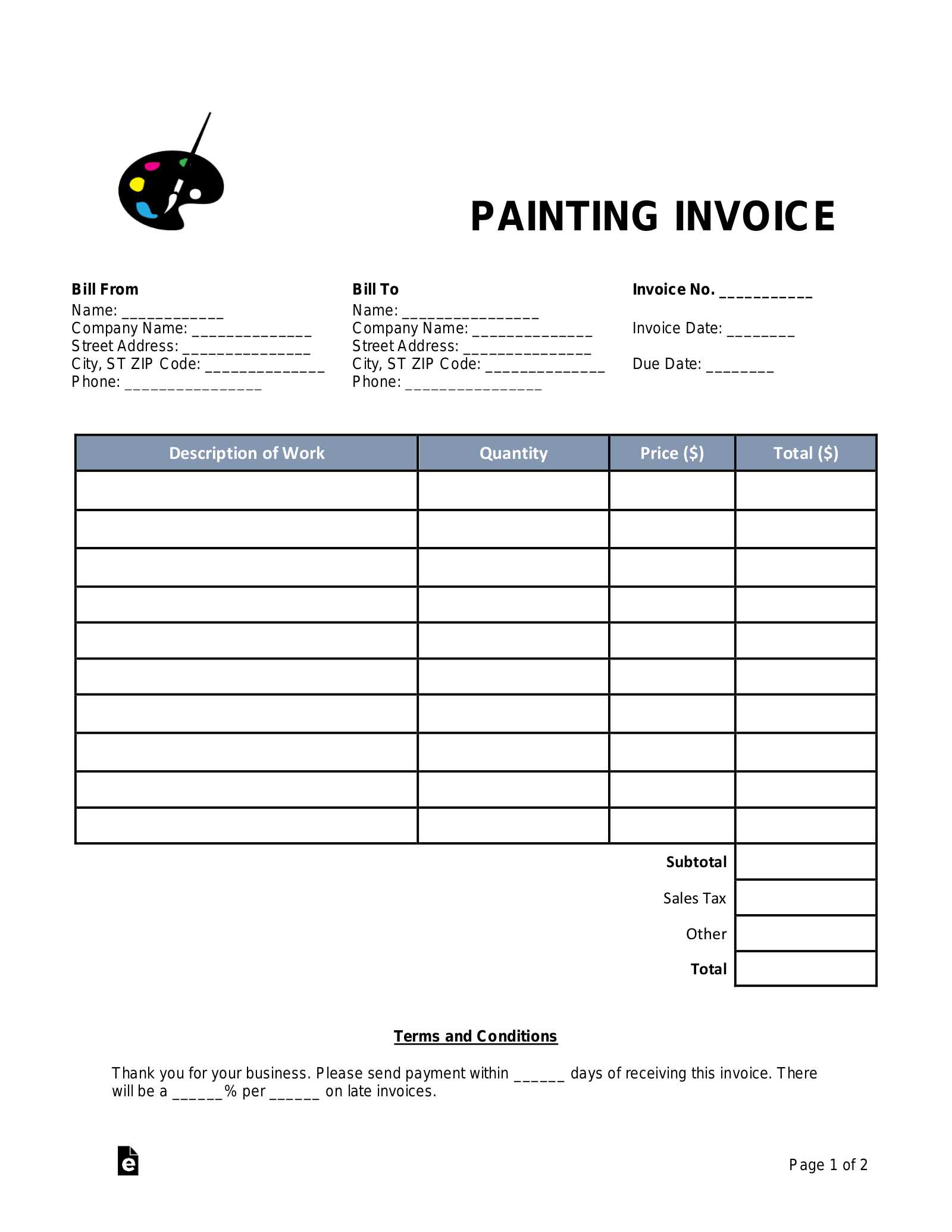

Designing a Professional Bid Invoice

Creating a well-organized and visually appealing financial document is essential for maintaining a professional image and ensuring clear communication with clients. The design of your record should reflect your brand’s identity, while also presenting the necessary details in a straightforward, easy-to-understand format. A clean, structured layout not only enhances the credibility of your business but also makes it easier for clients to process the information and make timely payments.

The first step in designing an effective financial document is choosing the right layout. Keep the design simple and focused on the key details–client information, service or product descriptions, pricing, and payment terms. Avoid cluttering the page with unnecessary graphics or excessive text, as this can make the document harder to read and detract from the professionalism of the presentation.

Use clear headings and sections to organize the information logically. The client’s name and contact information should be prominently displayed at the top, followed by a breakdown of the services or products provided, with corresponding prices and quantities. Group related items together to make it easier for clients to understand the charges, and use bullet points or tables to present this information neatly.

Typography is another important element. Choose fonts that are easy to read and professional in appearance. A

How to Handle Disputes in Bid Invoices

Disagreements over financial documents can arise for various reasons, such as discrepancies in charges, misunderstandings about payment terms, or differences in expectations. When conflicts occur, it’s crucial to address them promptly and professionally to maintain good client relationships and avoid legal complications. Knowing how to handle these situations effectively can help resolve issues quickly and ensure both parties are satisfied.

1. Review the Agreement and Terms

The first step in resolving any dispute is to review the original agreement or contract that outlines the terms of service, pricing, and payment. Check the details carefully to determine if there has been any misunderstanding or error on either side. Pay special attention to:

- Payment Terms: Were the payment deadlines, amounts, and methods clearly defined?

- Scope of Services: Did the services provided match what was agreed upon in the contract?

- Customizable Documents: The ability to create personalized and professional-looking reports with your company branding.

- Automated Calculations: Tools that automatically calculate totals, taxes, and discounts, minimizing manual input.

- Cloud Integration: Accessing and sharing documents from any device with internet connectivity for added flexibility.

- Tracking and Analytics: Features that allow tracking the status of requests and generating detailed insights into payment histories.

- FreshBooks: A comprehensive solution with strong customization options and cloud-based access for both small and large businesses.

- Zoho Invoice: Known for its automated features and a variety of templates, this software is ideal for companies looking to streamline their financial processes.

- QuickBooks: While primarily accounting software, QuickBooks also offers solid features for managing estimates, invoices, and client payments.

- Service or Product Breakdown: List each item or service separately with descriptions, unit costs, and quantities.

- Payment Terms: Specify the payment method, due date, and any late fees if applicable.

- Contact Information: Include contact details for inquiries or clarification, ensuring a quick response to any issues.

- Email: Ideal for quick delivery, ensuring all recipients have access to the document instantly.

- Physical Copies: Considered more formal and may be required in certain industries or regions.

- Online Payment Platforms: Sending through platforms like PayPal or bank transfer systems can streamline the payment process for both parties.

Bid Invoice Template Software Options

When it comes to generating detailed project proposals and managing payment requests, using specialized software can greatly enhance efficiency and accuracy. These tools provide a structured approach to organizing, creating, and managing financial documents, saving time and reducing the chances of errors. From simple, user-friendly platforms to more advanced solutions with custom features, there is a wide range of software available to meet diverse business needs.

Key Features to Look For

Choosing the right software for generating detailed project summaries and payment demands involves understanding the essential features that can make the process smoother and more professional. Some of the key functionalities to consider include:

Popular Software Options

Several platforms stand out in the market due to their ease of use, range of features, and positive user feedback. Here are some notable options:

Best Practices for Sending Bid Invoices

Successfully managing and sending financial documents is a key aspect of maintaining strong client relationships and ensuring timely payments. To ensure clarity and professionalism, it’s important to follow a set of best practices when dispatching these documents. Proper organization, clear communication, and accuracy are crucial to avoid misunderstandings and delays in processing.

Clear and Detailed Information

Providing a comprehensive and clear breakdown of the services offered or products delivered helps the recipient easily understand the charges. Include detailed descriptions, pricing, quantities, payment terms, and due dates. Transparency is vital to prevent confusion and ensure there are no surprises for the client.

Choose the Right Delivery Method

How you deliver the financial document can impact its reception and timeliness. While email is the most common and efficient method, some clients may prefer physical copies or require additional verification for electronic documents. Ensure you are aware of your client’s preferences and choose the most appropriate delivery method.