How to Create an Online Invoice Template for Your Business

Managing business transactions efficiently requires having a reliable system to generate and send payment requests. With the right approach, this task can be automated and made hassle-free, reducing manual errors and saving valuable time. Setting up a structured method for invoicing is essential for ensuring timely payments and maintaining professional relationships with clients.

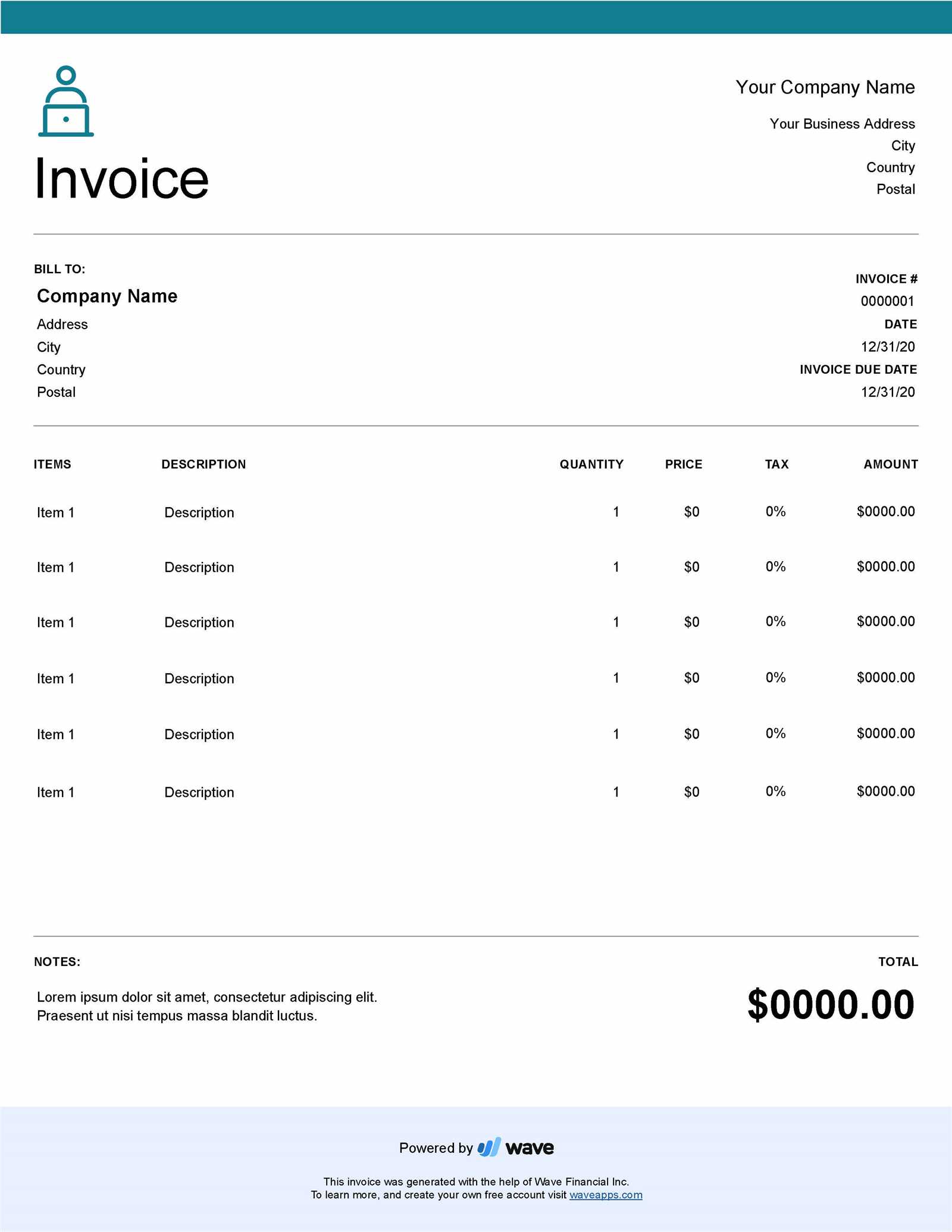

Having a customized document that fits your brand’s style and clearly outlines the necessary details can significantly improve your financial management. A consistent and well-organized format helps avoid confusion and ensures all critical information is included, such as amounts, services rendered, and payment terms.

Adopting a digital system to handle these documents offers many benefits. It simplifies the process of creating, sending, and tracking payment requests, as well as offers features like automatic reminders and payment links. With a few simple tools, you can generate high-quality, professional documents in just minutes.

How to Build an Invoice Template

Setting up a professional document for billing purposes involves combining clarity with a structured layout that suits your business needs. The goal is to create a form that efficiently communicates the required details while maintaining a consistent, polished appearance. By following a few essential steps, you can design a format that works for various clients and services, ensuring a smooth transaction process each time.

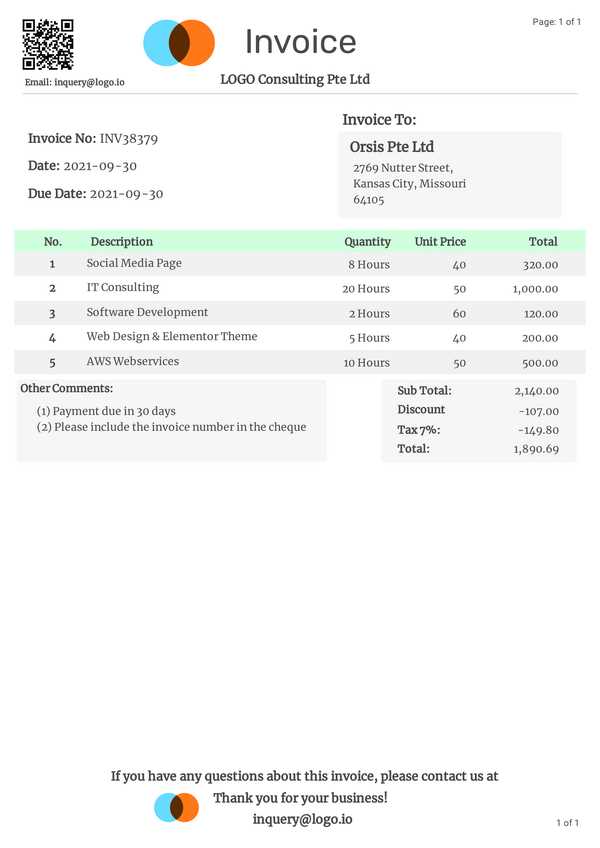

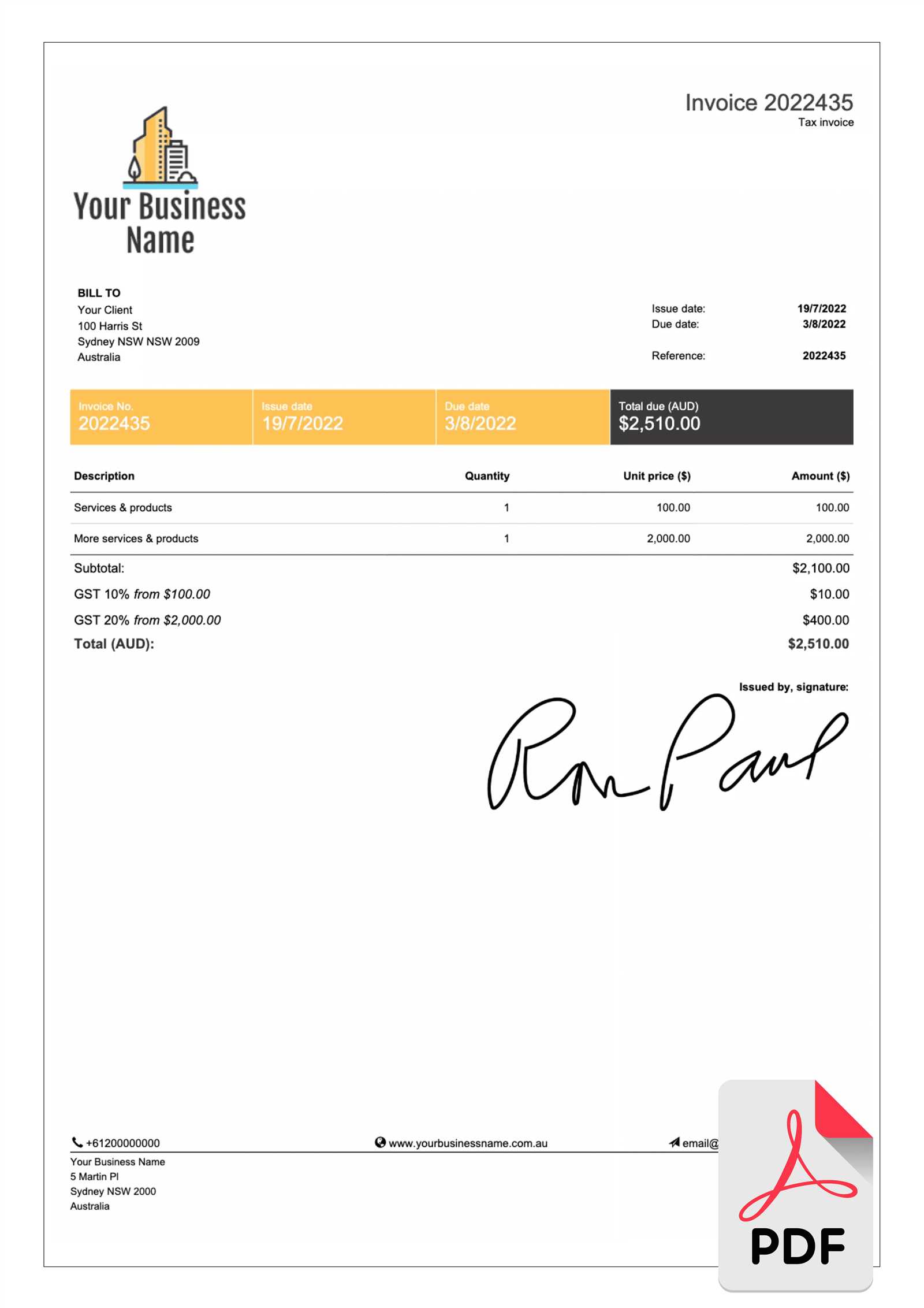

Start by identifying the necessary fields that should appear in your document. This typically includes sections for the recipient’s information, a clear breakdown of the products or services provided, and the corresponding amounts. Additionally, ensure that payment terms, due dates, and contact details are easy to locate. This structure not only ensures that all relevant information is captured but also makes the document user-friendly for your clients.

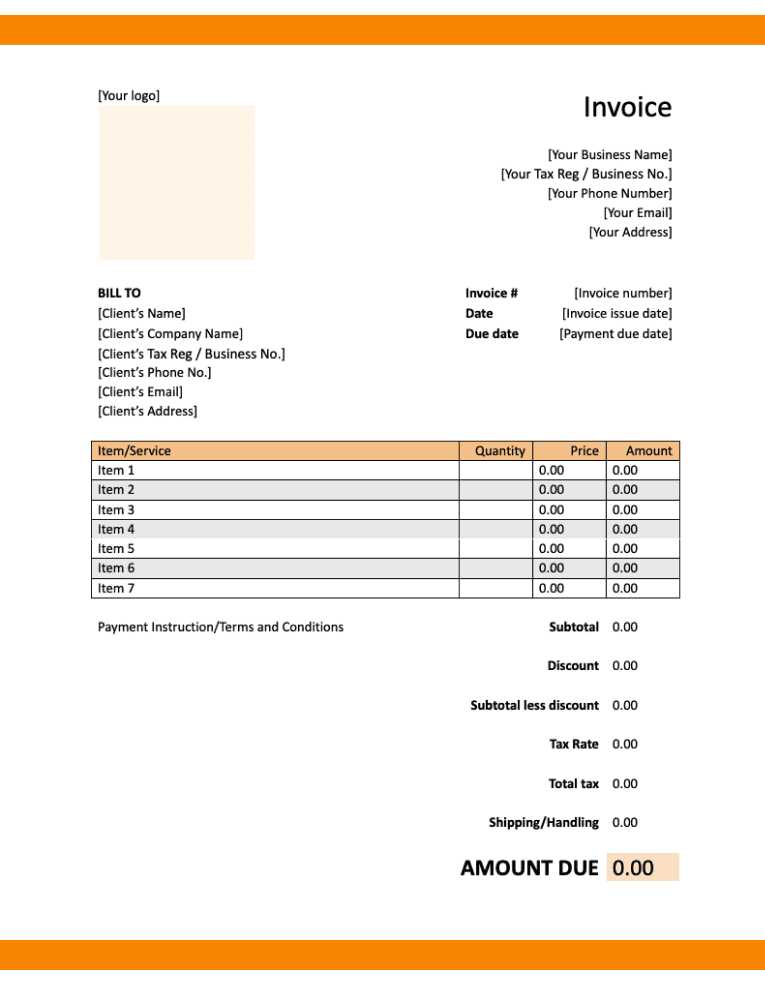

Next, think about customization. The design should reflect your brand identity, so consider adding your logo, business name, and contact information in prominent places. You can also adjust the color scheme and font styles to match your company’s visual identity, making the document both functional and aligned with your overall branding.

Once you have the layout and content in place, make sure your form is easy to update. Using digital tools to generate your documents ensures that changes to pricing or services can be made quickly without needing to start from scratch. Additionally, setting up a system for saving and storing these documents will streamline your workflow and improve record-keeping efficiency.

Why Use Online Invoice Templates

Utilizing pre-designed documents for billing offers numerous advantages that save both time and effort. Instead of starting from scratch each time, these ready-made forms streamline the entire process, allowing for quicker preparation and fewer errors. With automated features and customizable designs, they make managing financial transactions more efficient, ensuring a professional appearance for every communication with clients.

One of the key benefits of using such tools is consistency. By using the same structure for every transaction, you create a cohesive experience for your customers, which helps build trust and improve brand recognition. Moreover, these tools often include built-in features such as calculations, which reduce the risk of manual mistakes.

Here’s a quick comparison between manual creation and using a pre-designed system:

| Aspect | Manual Creation | Using Pre-Designed Forms |

|---|---|---|

| Time Investment | High | Low |

| Risk of Errors | High | Low |

| Customization | Limited | Flexible |

| Ease of Use | Complicated | Simple |

By using digital solutions, you can also automate recurring tasks, such as sending reminders or generating new entries. This reduces the workload and makes it easier to manage large volumes of transactions.

Key Elements of an Effective Invoice

For any business, having a well-structured document to request payment is essential for ensuring smooth transactions. An effective billing document not only provides clear information but also promotes professionalism and helps avoid misunderstandings. The key to a successful document lies in ensuring it includes all the necessary details in an easy-to-read format.

Essential Information to Include

To make sure your document serves its purpose, it should contain the following key details:

- Sender’s Information: Your business name, address, phone number, and email should be clearly visible at the top.

- Recipient’s Details: The name, address, and contact information of the client should be included to avoid confusion.

- Unique Identifier: Every document should have a unique reference number to track and manage payments easily.

- Description of Goods or Services: List the items or services provided, including quantities, rates, and dates.

- Amount Due: Clearly state the total amount owed, including any taxes or discounts applied.

- Payment Terms: Mention the payment due date, acceptable payment methods, and any late fee conditions.

Design Considerations

While the content is crucial, the layout and design of the document can significantly affect its effectiveness. A clean, well-organized design ensures the information is easy to find and visually appealing. Consider these points:

- Logical Structure: Group related information together, such as client details, itemized lists, and payment instructions.

- Branding: Add your logo and business colors to maintain consistency with your brand’s identity.

- Readability: Use readable fonts and clear headings to guide the reader through the document.

By including these key elements, you can ensure that your payment requests are both effective and professional, reducing the chances of errors or delays in payment.

Choosing the Right Tools for Invoice Creation

Selecting the appropriate software or platform to generate billing documents can significantly enhance your workflow. With numerous options available, it’s important to choose the tools that align with your business needs, offering features that improve efficiency and reduce the risk of errors. The right choice will not only save time but also streamline the entire payment process for both you and your clients.

There are several factors to consider when deciding which tools to use for preparing payment requests. These factors include customization options, ease of use, and integrations with other systems, such as accounting or payment processing software. Below are some important aspects to keep in mind when evaluating different tools:

- Customization: Choose software that allows you to adjust the layout and content, such as adding your logo, changing fonts, or modifying payment terms to fit your business style.

- Automation: Tools with automated features can generate recurring bills, send reminders, and even track unpaid amounts, saving you time on administrative tasks.

- Ease of Use: The platform should be intuitive, allowing even non-technical users to create professional documents with minimal effort.

- Integration Capabilities: Ensure the tool integrates smoothly with other systems you use, such as accounting software or payment gateways, to streamline the entire financial workflow.

- Security Features: Opt for tools that provide secure methods of storing and sharing documents to protect sensitive financial data.

By choosing the right platform, you can ensure that your billing process remains efficient, consistent, and error-free, allowing you to focus on growing your business.

Steps to Design Your First Invoice

When you’re ready to request payment for your services or products, it’s essential to have a well-organized document to outline the details of the transaction. This document should not only provide clear information but also maintain a professional look. Whether you’re running a small business or working as a freelancer, creating a clear and accurate document is a key part of the process.

1. Start with Your Business Information

The first step in preparing a payment request is to include your contact details. This helps the recipient identify who the bill is from and how to reach you if needed. Include the following:

- Your full name or business name

- Business address

- Email address

- Phone number

- Website or social media links (if applicable)

2. Include Client Information

Next, add the recipient’s details. Make sure you have accurate information to ensure that the document reaches the right person or department. Include:

- Client’s full name or business name

- Client’s address

- Client’s email and phone number

3. Provide Clear Payment Details

Clearly list the products or services provided. Include detailed descriptions, quantities, rates, and any other relevant information. For example, if you’re billing for a service, provide an itemized list with hourly rates and time spent. Be sure to break down any additional fees or taxes.

4. Set Payment Terms

It’s important to outline the terms of payment, such as the due date, late fees, and accepted payment methods. This section ensures that both you and your client are on the same page regarding when and how the payment should be made.

5. Add a Unique Identifier

For organizational purposes, assign a unique number or code to each document. This makes it easier to track multiple transactions and can help in case of future disputes or queries.

6. Review and Send

Before sending, double-check for any errors or missing information. Ensure everything is clearly written, easy to read, and free from mistakes. Once verified, you can send the document via email, post, or any other preferred method.

Steps to Design Your First Invoice

When you’re ready to request payment for your services or products, it’s essential to have a well-organized document to outline the details of the transaction. This document should not only provide clear information but also maintain a professional look. Whether you’re running a small business or working as a freelancer, creating a clear and accurate document is a key part of the process.

1. Start with Your Business Information

The first step in preparing a payment request is to include your contact details. This helps the recipient identify who the bill is from and how to reach you if needed. Include the following:

- Your full name or business name

- Business address

- Email address

- Phone number

- Website or social media links (if applicable)

2. Include Client Information

Next, add the recipient’s details. Make sure you have accurate information to ensure that the document reaches the right person or department. Include:

- Client’s full name or business name

- Client’s address

- Client’s email and phone number

3. Provide Clear Payment Details

Clearly list the products or services provided. Include detailed descriptions, quantities, rates, and any other relevant information. For example, if you’re billing for a service, provide an itemized list with hourly rates and time spent. Be sure to break down any additional fees or taxes.

4. Set Payment Terms

It’s important to outline the terms of payment, such as the due date, late fees, and accepted payment methods. This section ensures that both you and your client are on the same page regarding when and how the payment should be made.

5. Add a Unique Identifier

For organizational purposes, assign a unique number or code to each document. This makes it easier to track multiple transactions and can help in case of future disputes or queries.

6. Review and Send

Before sending, double-check for any errors or missing information. Ensure everything is clearly written, easy to read, and free from mistakes. Once verified, you can send the document via email, post, or any other preferred method.

Benefits of Using Digital Invoices

Switching from paper-based billing to electronic documents offers a variety of advantages for both businesses and clients. The transition to digital formats simplifies processes, enhances accuracy, and promotes efficiency. In this section, we will explore how moving to a digital system can positively impact your business operations.

1. Improved Efficiency and Speed

Digital documents streamline the process of issuing and receiving bills. The time it takes to send a physical document through the mail can be significantly reduced by sending it electronically. Some of the key benefits include:

- Instant delivery via email or other digital channels

- Faster processing and payment from clients

- No need for printing, postage, or manual handling

2. Enhanced Accuracy and Reduced Errors

Manual entry of information can lead to mistakes that might result in delays or misunderstandings. Digital systems often come with built-in features to reduce human error. Some of the advantages include:

- Automatic calculations for totals, taxes, and discounts

- Built-in checks for missing or incorrect information

- Easy editing and corrections if needed

3. Cost Savings

Switching to digital billing can significantly reduce operational costs. With fewer physical materials involved, businesses can save on:

- Paper, ink, and printing costs

- Mailing and delivery expenses

- Storage space for physical records

4. Easier Record-Keeping and Tracking

Storing paper documents can quickly become disorganized and difficult to manage. Digital systems make it easy to archive and retrieve information when needed. Benefits include:

- Organized and searchable digital records

- Quick access to past transactions for auditing or reporting purposes

- Simple backup and recovery options

5. Eco-Friendly

By eliminating the need for paper, businesses can reduce their environmental impact. This shift not only contributes to sustainability efforts but also aligns with modern corporate responsibility goals.

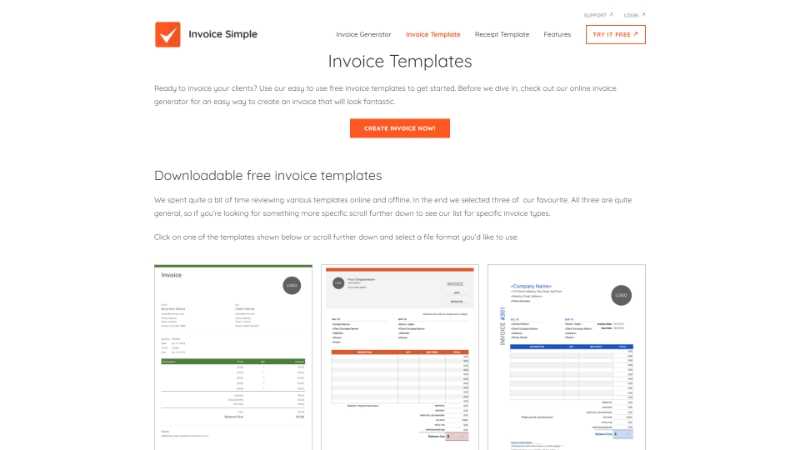

Free Online Invoice Template Resources

For businesses and freelancers looking to streamline their billing process, there are various free tools and platforms that offer ready-made designs to simplify the task. These resources provide customizable documents that help save time while ensuring professional standards are met. In this section, we’ll highlight some of the best places to find free options to meet your needs.

| Resource | Description | Features |

|---|---|---|

| Wave | Wave offers a free invoicing solution with easy-to-use features for small businesses and freelancers. | Customizable design, automatic reminders, payment tracking |

| Zoho Invoice | Zoho provides a range of free templates that can be tailored to different business types. | Multi-currency support, recurring billing, reports |

| Invoice Generator | This simple tool allows you to generate and download invoices without creating an account. | Quick customization, PDF export, no sign-up required |

| PayPal | PayPal offers a free invoicing feature for users to send and track payments quickly. | Easy integration with PayPal payments, automatic updates, detailed reports |

| Microsoft Office Templates | Microsoft offers a wide range of free documents for various business needs, including billing. | Downloadable templates, easy integration with Word or Excel, customizable formats |

These resources are designed to save you time and provide flexibility. Whether you need a basic document or something more specialized, there’s a free tool available to suit your business needs.

Integrating Payment Options in Your Invoice

Offering multiple payment methods can make it easier for your clients to settle their bills promptly. By including various payment options in your billing documents, you not only enhance convenience for the recipient but also increase the likelihood of on-time payments. This section will guide you through how to effectively integrate these methods into your documents to ensure a smooth transaction process.

1. Choose the Right Payment Methods

Consider the preferences of your clients and the nature of your business when selecting payment methods to include. Here are some common options:

- Credit and Debit Cards (Visa, MasterCard, American Express)

- Bank Transfers (ACH, wire transfers)

- Payment Platforms (PayPal, Stripe, Square)

- Checks or Money Orders

- Cash (for in-person transactions)

2. Clearly Display Payment Information

Ensure that payment details are easy to find and understand. Including the following is crucial:

- Bank account details for direct transfers (account number, routing number, etc.)

- Links to payment platforms (PayPal email, Stripe link, etc.)

- Instructions for paying via check or cash, if applicable

- Currency information, especially for international clients

3. Add Payment Due Date and Late Fees

Make sure to include clear terms regarding the due date and late payment penalties. This helps clients understand the urgency of settling the amount, and protects you from delayed payments. Consider including:

- Payment due date

- Late fee percentage or fixed charge if payment is not received by the due date

- Grace periods, if applicable

4. Offer Discounts for Early Payments

If you want to incentivize clients to pay sooner, consider offering a discount for early payment. This can be a powerful motivator for faster cash flow. For example:

- 5% discount if paid within 10 days

- Discount details clearly mentioned next to the total amount due

Integrating multiple payment options in your billing documents provides flexibility for your clients and ensures you get paid in a timely manner. The easier you make it for them to pay, the more likely they will follow through with the transaction quickly.

How to Save Time with Automated Invoices

Managing billing manually can be time-consuming and prone to errors. By automating the process, you can eliminate repetitive tasks, reduce human mistakes, and free up valuable time to focus on other aspects of your business. This section will show you how automation can streamline your workflow and make the billing process faster and more efficient.

1. Automate Recurring Billing

If your business provides subscription-based services or regularly charges for the same products, automating the recurring billing process can save significant time. Key benefits include:

- Automatic generation of invoices on set intervals (monthly, quarterly, etc.)

- Consistent and accurate billing without manual intervention

- Automatic notifications sent to clients

2. Set Up Payment Reminders

Automating payment reminders ensures clients never forget a due date, while you don’t have to manually follow up. Features of this automation include:

- Customizable reminder settings (e.g., 5 days before, on due date, and after due date)

- Automatic email or SMS notifications sent to clients

- Reduces late payments and improves cash flow

3. Use Pre-built Document Formats

Automated systems allow you to use pre-designed documents that automatically populate with your business and client information. Benefits include:

- Faster document creation with minimal input required

- Reduced risk of errors when filling in client and transaction details

- Consistent look and feel across all your billing documents

4. Integration with Payment Systems

Linking your billing process with payment gateways can automate the process from sending the document to receiving payment. Here are some key advantages:

- Clients can pay instantly through integrated payment options (credit card, PayPal, etc.)

- Automatic payment status updates in your system

- Reduces the need for manual tracking of payments

5. Track and Analyze Billing Data

Automating the process also allows for better tracking and analysis of your financial data. Benefits of automated tracking include:

- Instant access to reports on payments received and outstanding balances

- Detailed analytics on client payment history

- Quick insights into your overall financial performance

| Automation Feature | Benefit |

|---|---|

| Recurring Billing | Saves time on repeated tasks, ensures consistency |

| Payment Reminders | Reduces the need for manual follow-ups, encourages timely payments |

| Pre-built Formats | Speeds up the process and ensures accuracy |

| Payment Integration | Streamlines payment collection and tracking |

| Financial Tracking | Instant access to key financial data and insights |

By automating the billing process, you can reduce administrative work, improve payment timelines, and increase your overall efficiency. Adopting automation is a smart move for any business looking to save time and

Best Practices for Invoice Layout and Design

Presenting a clean, professional, and easy-to-read document for billing is essential for maintaining strong relationships with clients and ensuring smooth transactions. A well-organized layout not only improves clarity but also enhances the credibility of your business. In this section, we’ll cover some best practices to ensure your documents are visually appealing and functional.

1. Keep the Layout Simple and Structured

A cluttered or overly complex document can confuse clients and slow down the payment process. It’s best to organize the information clearly. Some key tips include:

- Use a clear header: Place your business name, contact details, and document title at the top for immediate recognition.

- Group related information: Break down sections logically, such as client information, product or service details, and payment terms.

- Use white space effectively: Ensure there’s enough spacing between sections to make the content easy to digest.

2. Highlight Key Information

Make sure essential details stand out so clients can quickly find what they need. Focus on the following:

- Bold or underline totals: The total amount due should be clearly visible, ideally in a larger font or bolded.

- Use contrasting colors: Utilize subtle background shading or color highlights for key sections like the due date and payment instructions.

- Emphasize payment terms: Ensure the due date, accepted payment methods, and any late fees are prominently displayed.

3. Consistent Branding

Your billing document is a reflection of your brand, so it’s important to include consistent elements that reinforce your business identity:

- Logo: Include your logo at the top for brand recognition.

- Brand colors: Use your business colors to create a cohesive and professional look.

- Fonts: Choose clean, easy-to-read fonts, and avoid using too many different styles.

4. Include Clear Payment Instructions

Clients should know exactly how to make payments. Ensure that you provide clear, step-by-step instructions on how they can settle the amount. This may include:

- Bank account details for direct transfers.

- Payment links for online platforms (e.g., PayPal, Stripe).

- Instructions for checks or cash if applicable.

5. Organiz

How to Ensure Accurate Invoice Details

Providing precise and error-free billing documents is crucial for maintaining trust and professionalism in your business relationships. Inaccurate information can lead to delays, confusion, and even disputes. This section will guide you through the best practices for ensuring that all the details in your billing documents are correct and clearly presented.

1. Double-Check Client Information

Always verify the recipient’s contact details before sending out a billing document. This includes:

- Full name or business name

- Correct address (physical and email)

- Up-to-date phone number

Ensuring this information is accurate will prevent miscommunication and ensure your document reaches the right person or department.

2. Be Thorough with Product or Service Details

Make sure every item or service being billed is listed with enough detail for the client to understand what they’re paying for. Include:

- Item descriptions that are clear and concise

- Quantities and unit prices for each product or service

- Discounts or special rates that may apply

Providing a breakdown helps the client understand the charges and minimizes the chances of confusion.

3. Verify Payment Terms

Clearly state the terms of payment to avoid misunderstandings. This includes:

- Due date: The exact date by which payment is expected

- Accepted methods of payment: List the methods the client can use to pay (e.g., credit card, bank transfer, PayPal)

- Late fees: Specify any penalties for late payment, if applicable

Clarifying these terms ensures that both parties are on the same page and reduces the likelihood of delays.

4. Review Calculations Carefully

One of the most common sources of error in billing documents is miscalculation. Always review the following:

- Subtotal: The total cost of all listed products or services

- Taxes: Ensure the correct tax rate is appl

Managing Recurring Invoices Online

For businesses offering subscription-based services or regularly billed products, handling recurring transactions can quickly become time-consuming without the right system in place. Automating the generation and management of periodic billing documents ensures consistency, reduces administrative workload, and maintains a smooth cash flow. This section explores how to efficiently handle recurring payments through digital tools and methods.

1. Automate Billing Cycles

One of the most significant benefits of managing periodic payments digitally is automation. Instead of manually generating a new document every billing cycle, use tools that can automatically:

- Generate documents based on a pre-set schedule (monthly, quarterly, etc.)

- Send reminders to clients before the next payment is due

- Track payment status automatically to reduce the need for manual follow-up

Automation minimizes the chances of human error and ensures that your clients are billed accurately and on time.

2. Use Subscription Management Software

Many subscription-based businesses find it helpful to use dedicated software that manages the entire recurring payment process. Features to look for in such software include:

- Customizable billing intervals: Tailor the payment schedule to fit your client’s needs (weekly, monthly, annually, etc.)

- Client management: Store and update customer details, including billing preferences and payment methods

- Integration with payment processors: Automatically charge clients through systems like PayPal, Stripe, or credit cards

This type of software reduces administrative tasks and ensures that clients are always charged according to the agreed-upon schedule.

3. Offer Flexible Payment Methods

Offering multiple payment options makes it easier for clients to pay their recurring bills, reducing the likelihood of missed payments. Consider the following:

- Credit and debit cards: Clients can securely save their details for automatic processing

- Bank transfers: Provide clients with the option to set up automatic transfers

- Payment platforms: Integrate with services like PayPal, which supports recurring payments

By accommodating different payment preferences, you make it more convenient for clients to meet their obligations, which can help improve retention rates.

4. Keep Clients Informed

Transparency is key when managing recurring payments. Make sure your clients are well informed about their payment schedules and any cha

Securing Online Invoice Data

Protecting sensitive financial information is a top priority for businesses that manage electronic billing documents. With increasing digital transactions, ensuring the confidentiality and integrity of payment details, client data, and transaction histories is essential. This section covers the best practices to safeguard your data and protect both your business and your clients from security breaches.

1. Use Encryption for Data Transmission

One of the most effective ways to secure billing data is by using encryption technologies when transmitting information over the internet. Encryption ensures that sensitive data is scrambled and unreadable to unauthorized users. Key points to consider:

- SSL/TLS certificates: Ensure that your website and payment portals are secured with SSL (Secure Sockets Layer) or TLS (Transport Layer Security) certificates, which encrypt data between your site and the client’s browser.

- End-to-end encryption: Use systems that offer end-to-end encryption for all sensitive communications, so only the intended recipient can access the data.

2. Implement Strong Authentication Methods

To prevent unauthorized access to your billing system, it is important to use robust authentication methods. Some key security measures include:

- Two-factor authentication (2FA): Require an additional layer of verification, such as a code sent to the user’s phone, alongside their usual login credentials.

- Secure passwords: Ensure that strong, unique passwords are used for both clients and staff accessing sensitive data. Consider enforcing password complexity requirements.

- Role-based access control: Limit access to billing information based on job roles, ensuring that only authorized personnel can view or manage sensitive details.

3. Regularly Update Security Systems

Cybersecurity is constantly evolving, so keeping your systems up to date is crucial in defending against emerging threats. This includes:

- Software updates: Ensure that all software used for managing payments and storing client information is regularly updated with the latest security patches.

- Firewalls and anti-malware: Use firewalls, anti-virus software, and anti-malware tools to prevent unauthorized access and protect against malicious attacks.

- Regular security audits: Conduct routine audits to identify vulnerabilities and address them proactively before they become security risks.

4. Secure Payment Gateway Integration

When processing payments, it is critical to use a secure and reputable payment gateway. Here are some security considerations:

- PCI-DSS compliance: Ensure that the payment gateway you choose adheres to the Payment Card Industry Data Security Standard (PCI-DSS) for handling credit card information.

- Tokenization:

Common Mistakes to Avoid in Invoices

When preparing a document for requesting payment, accuracy and clarity are essential. Small errors or omissions can lead to misunderstandings, delayed payments, or even strained business relationships. Ensuring that all necessary details are included and correct is crucial to maintaining professionalism and ensuring prompt payment. Below are some common pitfalls to watch out for when drafting these important documents.

1. Missing or Incorrect Contact Information

One of the most basic yet often overlooked mistakes is failing to include accurate contact details. Double-check that both your and the recipient’s information is up-to-date. This includes addresses, phone numbers, and email addresses. Mistakes here can result in confusion or delays when trying to reach the correct party regarding the payment.

2. Lack of Clear Payment Terms

Without specifying clear terms, such as the due date, payment methods, and any late fees, you may create uncertainty about when and how the transaction should be completed. Make sure to state exactly when payment is expected and which channels are available for processing the amount. Ambiguity can lead to frustration and delays.

3. Incorrect Item Descriptions or Quantities

Always ensure that the list of goods or services provided is accurate. Descriptions should be specific, with quantities and unit prices clearly listed. An error in either could confuse the client and lead to disputes over the charges, slowing down the payment process.

4. Missing Invoice Number

An invoice number helps both you and the client keep track of payments. Not including a unique identifier can make it difficult to reference the transaction, potentially leading to a lack of clarity or even non-payment. Always include a sequential number for each document you issue.

5. Overcomplicated or Unclear Formatting

Clarity is key. A cluttered or poorly formatted document can confuse the recipient. Keep the layout simple, with clear headings, well-organized sections, and easy-to-read fonts. Excessive information or unorganized data will make it harder for the client to understand the charges.

6. Failing to Review for Typos and Errors

A simple typo in amounts or dates can create unnecessary complications. Before sending the document, thoroughly review all figures, dates, and text for accuracy. A small oversight can damage your credibility and cause delays in payment.