How to Create an Invoice Template in Notion for Better Organization

Managing financial transactions is crucial for any business, and having an efficient system to track and organize payments is essential. With the right tools, you can streamline the process of issuing and monitoring charges, making it easier to stay on top of financial records. A well-designed structure can help reduce errors and improve client satisfaction.

There are various ways to organize and present payment requests, whether you’re working with clients on an individual basis or handling larger accounts. By using flexible software solutions, you can create documents that meet specific needs and ensure smooth interactions. Customizable features allow for personalization, giving you the freedom to adapt to different billing scenarios.

Efficiency is key in these processes. With the right setup, you can automate repetitive tasks, track payment statuses, and maintain a clear overview of your financial dealings. The ability to adjust templates according to evolving requirements ensures that you’re always prepared to meet the demands of your business.

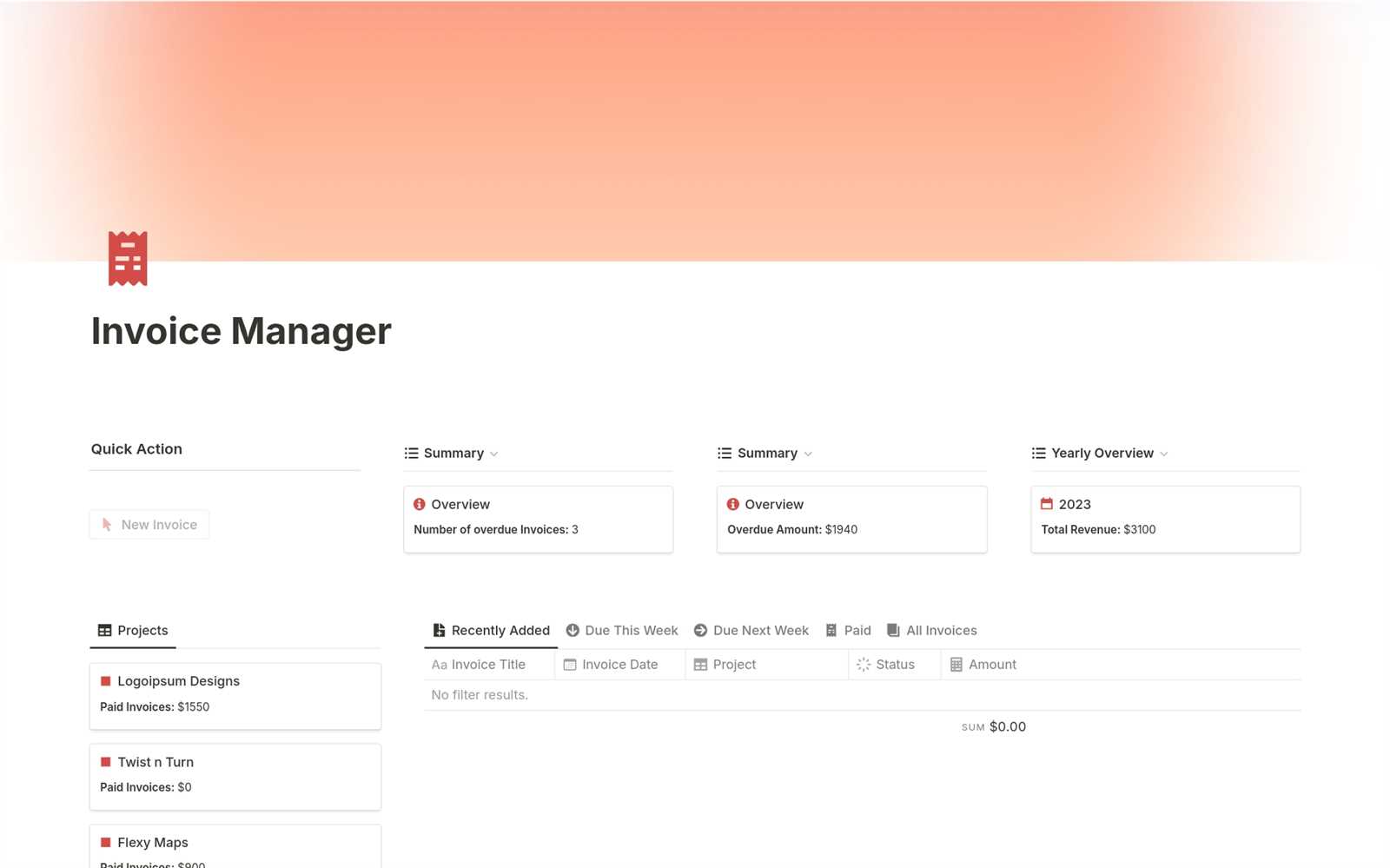

Invoice Template in Notion Overview

Efficient financial management requires a structured approach to handling payments and client accounts. With the right digital tools, it’s possible to simplify this process by organizing key information in one accessible location. This allows for quick updates, easy tracking, and seamless communication between businesses and clients.

By leveraging versatile platforms, users can create dynamic systems to track charges and balances. These systems can be customized to fit various business needs, whether it’s a small freelance operation or a larger organization. The ability to design these systems without complex software provides flexibility and ease of use.

Customizable Structure for Different Needs

One of the most useful aspects of using such platforms is the ability to customize each record. Users can include important fields like due dates, amounts, and client details, ensuring all relevant information is in one place. This flexibility makes it easy to adapt the layout to suit various industries or personal preferences.

Tracking and Organizing Financial Data

With a structured system in place, monitoring payment statuses becomes much more manageable. It allows users to track outstanding balances, received payments, and overdue items with just a glance. This streamlined organization ensures nothing falls through the cracks and provides a reliable way to stay on top of financial transactions.

Why Use Notion for Invoices

Choosing the right tool for managing financial documents can significantly enhance the efficiency of business operations. With the right platform, users can create and organize payment requests, monitor transactions, and ensure accuracy in their financial records. The flexibility of certain tools makes them ideal for both small and large-scale businesses, offering customizable features to meet diverse needs.

One major advantage of using such a platform is its versatility. It allows you to set up structures that can adapt to various workflows and business models. With built-in databases, users can quickly update or adjust information as needed without switching between multiple applications.

| Advantages | Benefits |

|---|---|

| Customizable layouts | Adaptable to various industries and workflows |

| Easy tracking | Monitor payment statuses and client balances with ease |

| Collaboration-friendly | Share and update documents in real-time |

| Centralized data | Store all relevant information in one place |

This combination of customization, accessibility, and collaboration makes the platform an ideal solution for those looking to streamline their payment management system and maintain a smooth workflow. It ensures that all necessary data is within reach, making updates and communication more efficient.

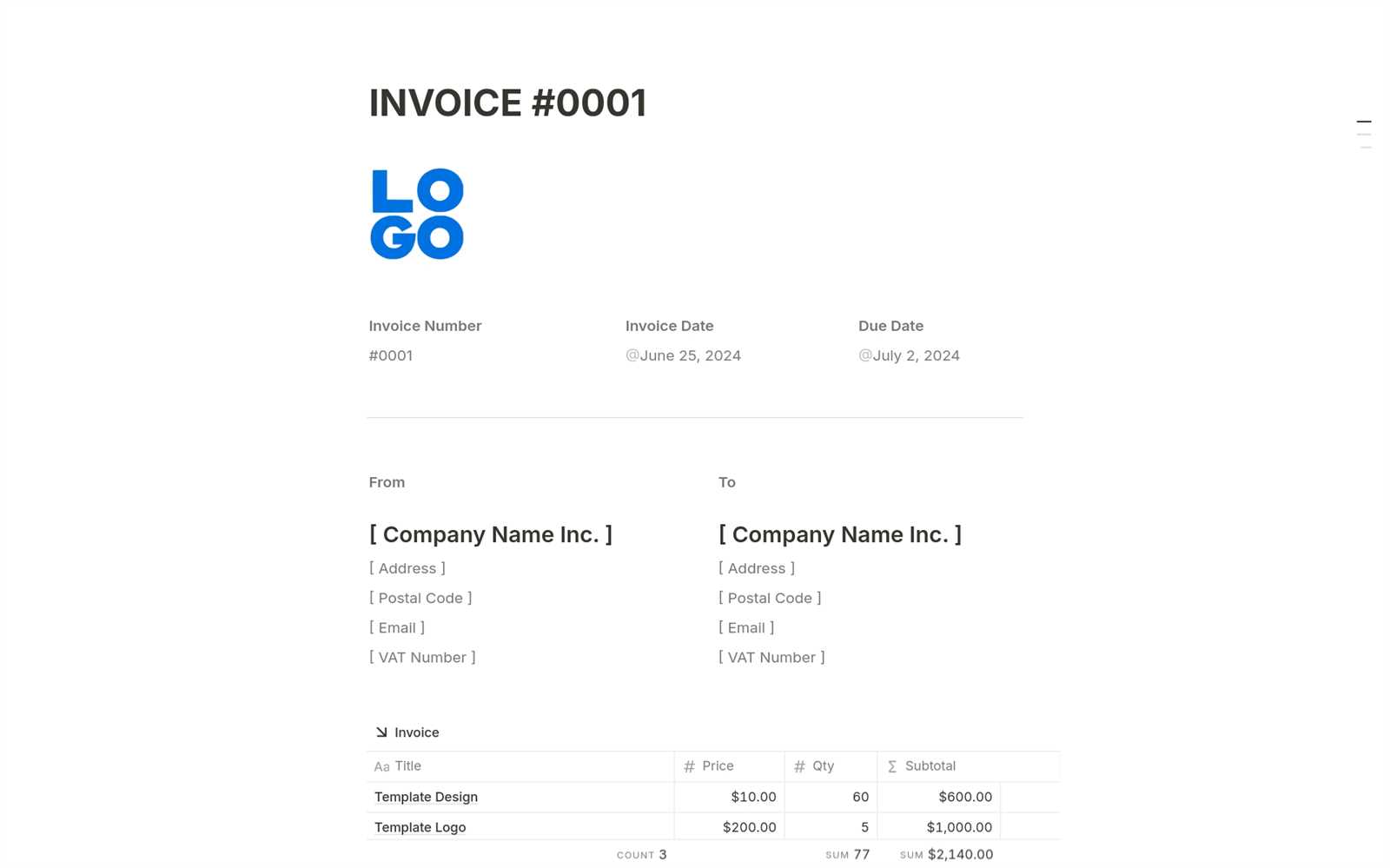

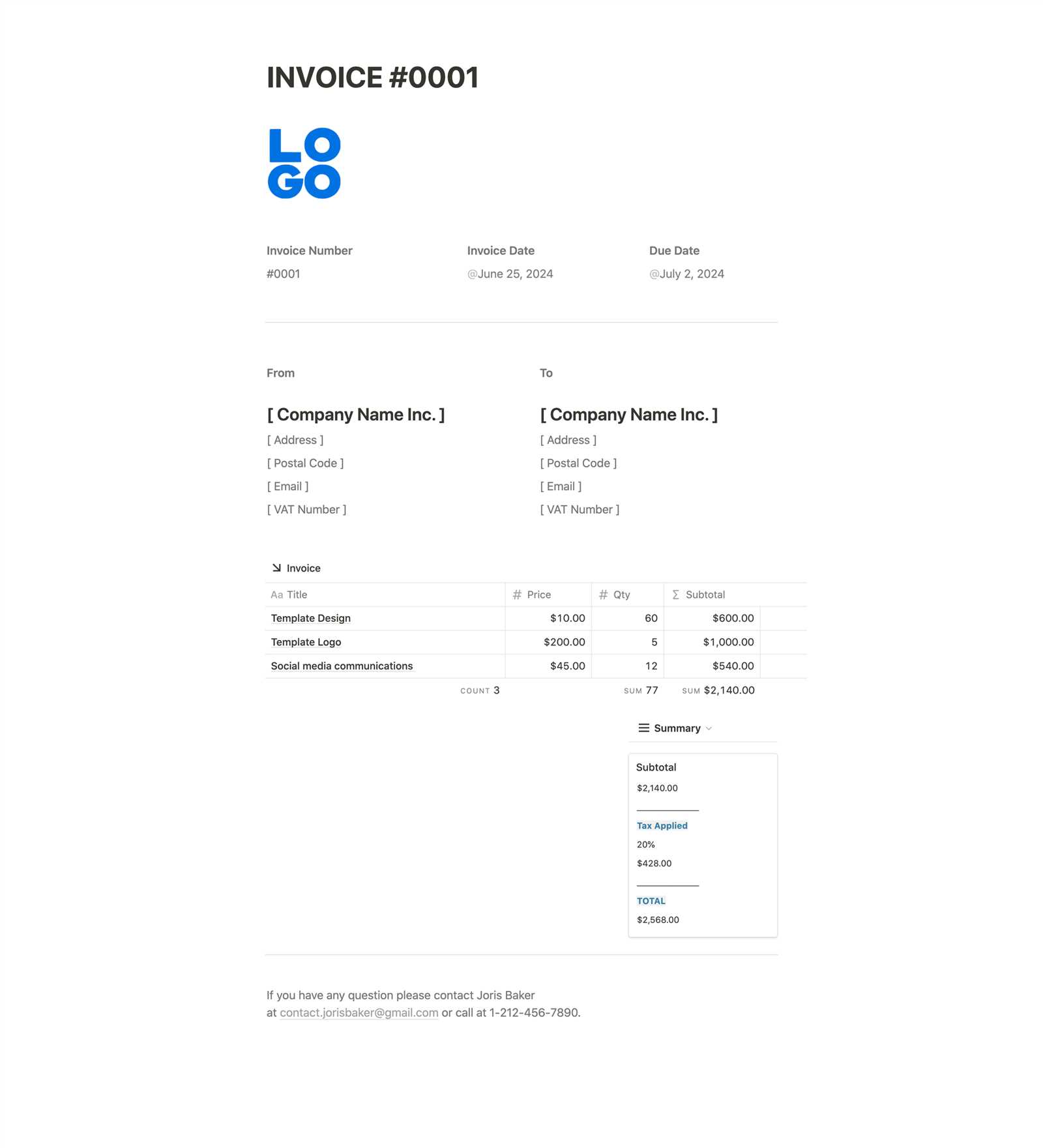

Creating an Invoice from Scratch

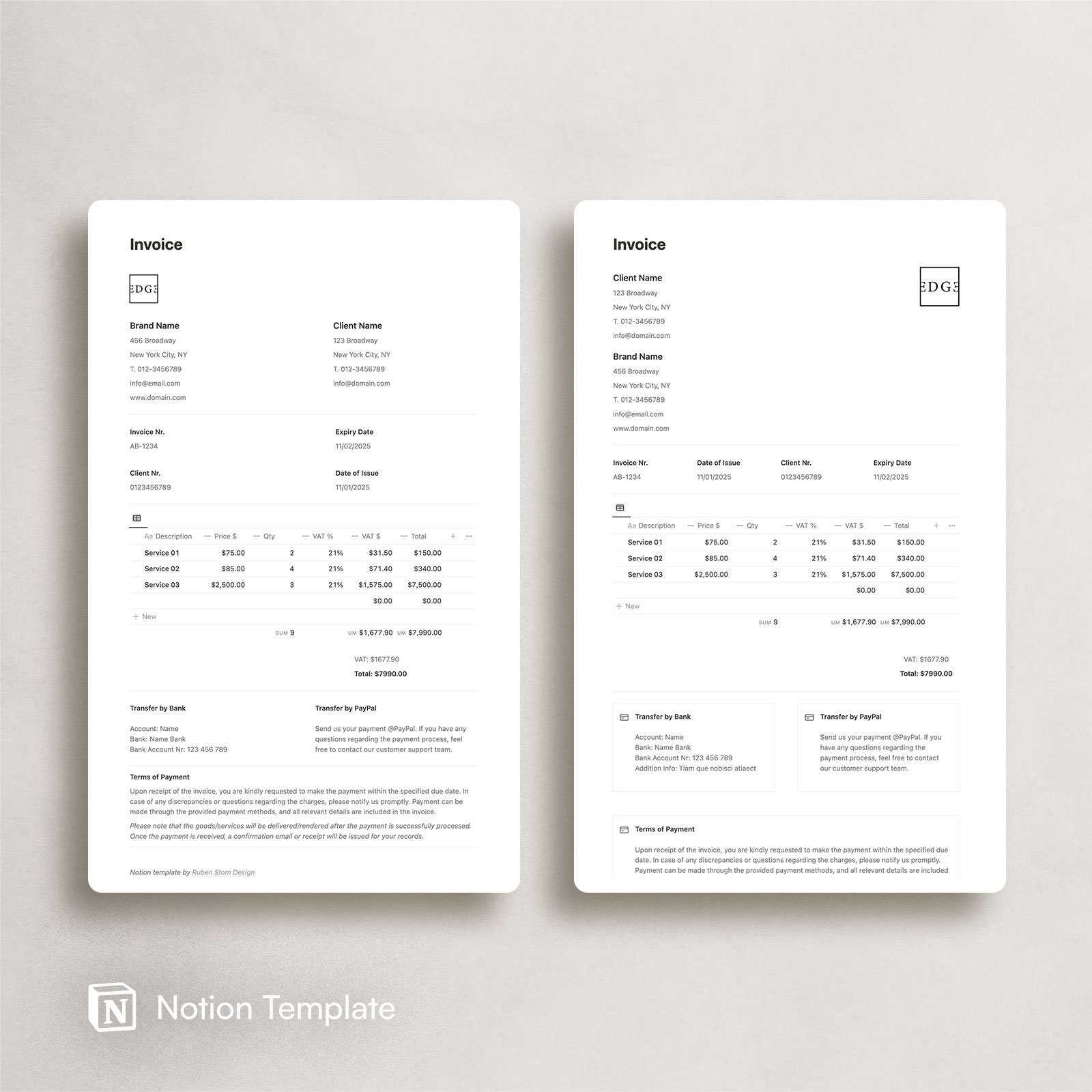

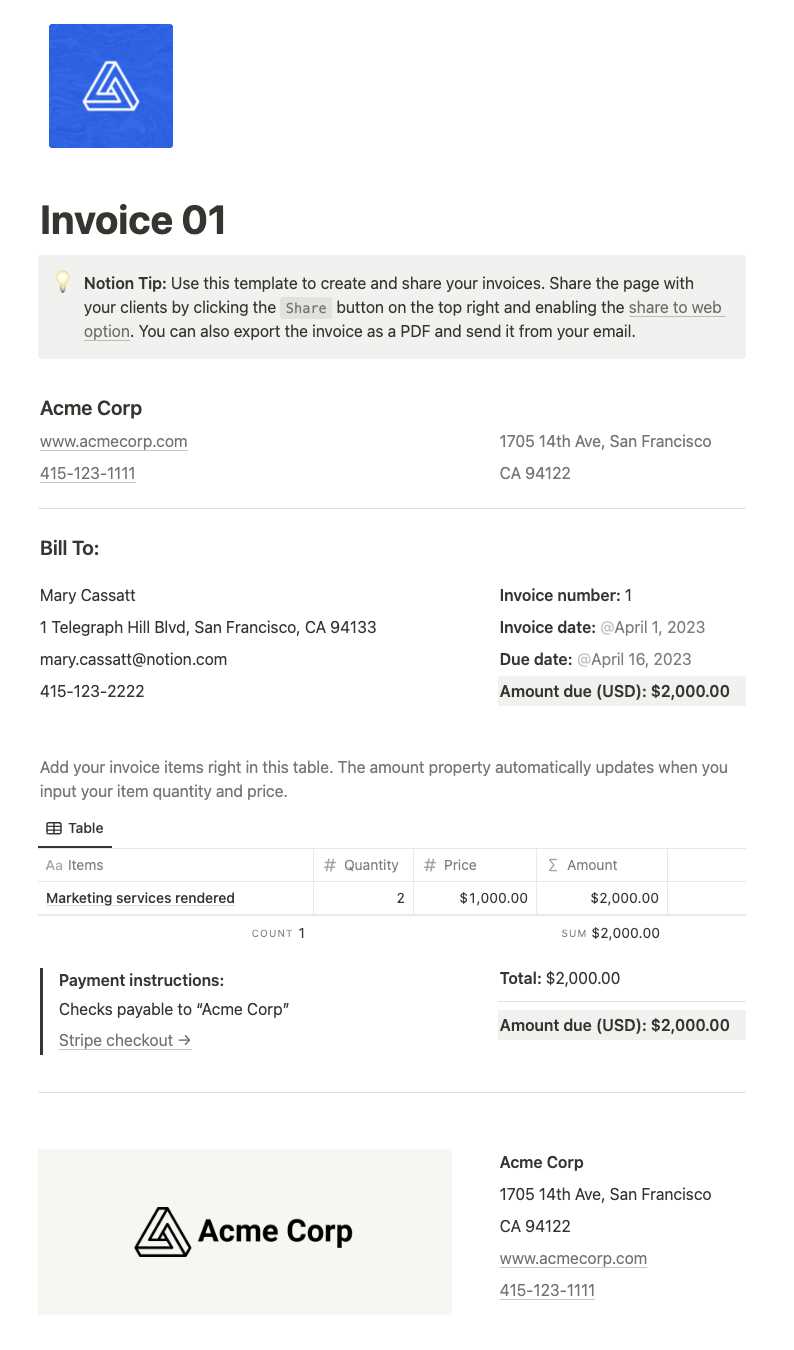

Building a billing document from the ground up can seem daunting, but with the right approach, it becomes a straightforward task. By organizing key sections, you can ensure all necessary details are captured, making the document both clear and professional. The first step is understanding the essential components that should be included to avoid missing important information.

To start, focus on structuring the document with fields that reflect your unique business needs. Customization is key, whether you are working with fixed or variable charges. Below are the main sections to consider when crafting your own format:

| Section | Description |

|---|---|

| Header | Include your business name, contact details, and the document’s title. |

| Client Information | Provide the client’s name, address, and any other relevant details. |

| Itemized List | Detail the goods or services provided, along with the respective amounts. |

| Payment Terms | Clarify due dates, accepted payment methods, and any late fees. |

| Total Amount | Sum up the charges and display the final amount due. |

Once you’ve included these sections, it’s important to maintain consistency in formatting, ensuring that everything is aligned correctly and easy to read. The use of tables and clear headings can greatly enhance the document’s professional appearance, making it easier for both you and the client to review the details.

Customizing Templates for Your Needs

Tailoring financial documents to suit your specific business requirements is an essential step in ensuring accuracy and professionalism. By adjusting the structure and content, you can create a layout that reflects your business practices and enhances your client interactions. Customization allows for flexibility, making it easier to accommodate various types of transactions and client needs.

When modifying a document structure, consider the following elements that can be personalized:

- Field Selection: Choose which details are necessary based on your industry and client preferences.

- Layout Adjustments: Rearrange sections or change the visual style to match your branding.

- Currency and Tax Options: Adapt to local tax rates or specify currency formats for international clients.

Additionally, it’s useful to incorporate dynamic features that make tracking payments easier. For example, you can include:

- Due Dates: Automatically highlight upcoming deadlines to avoid late payments.

- Discounts and Adjustments: Offer special pricing or adjustments based on client agreements.

- Payment Tracking: Add sections for tracking paid and unpaid amounts, helping you manage accounts more efficiently.

By fine-tuning these aspects, you ensure the document meets your needs while also providing a professional and streamlined experience for your clients.

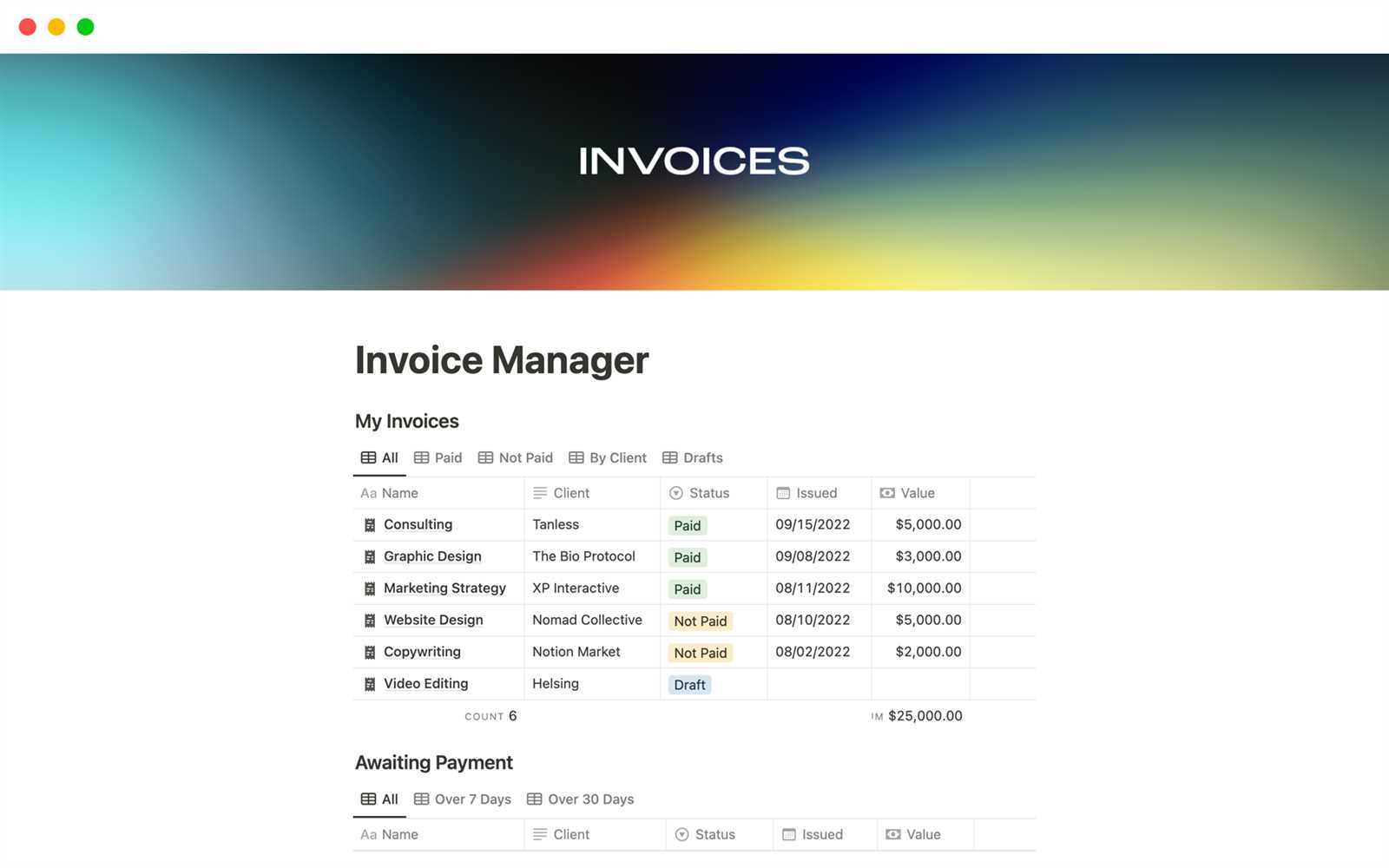

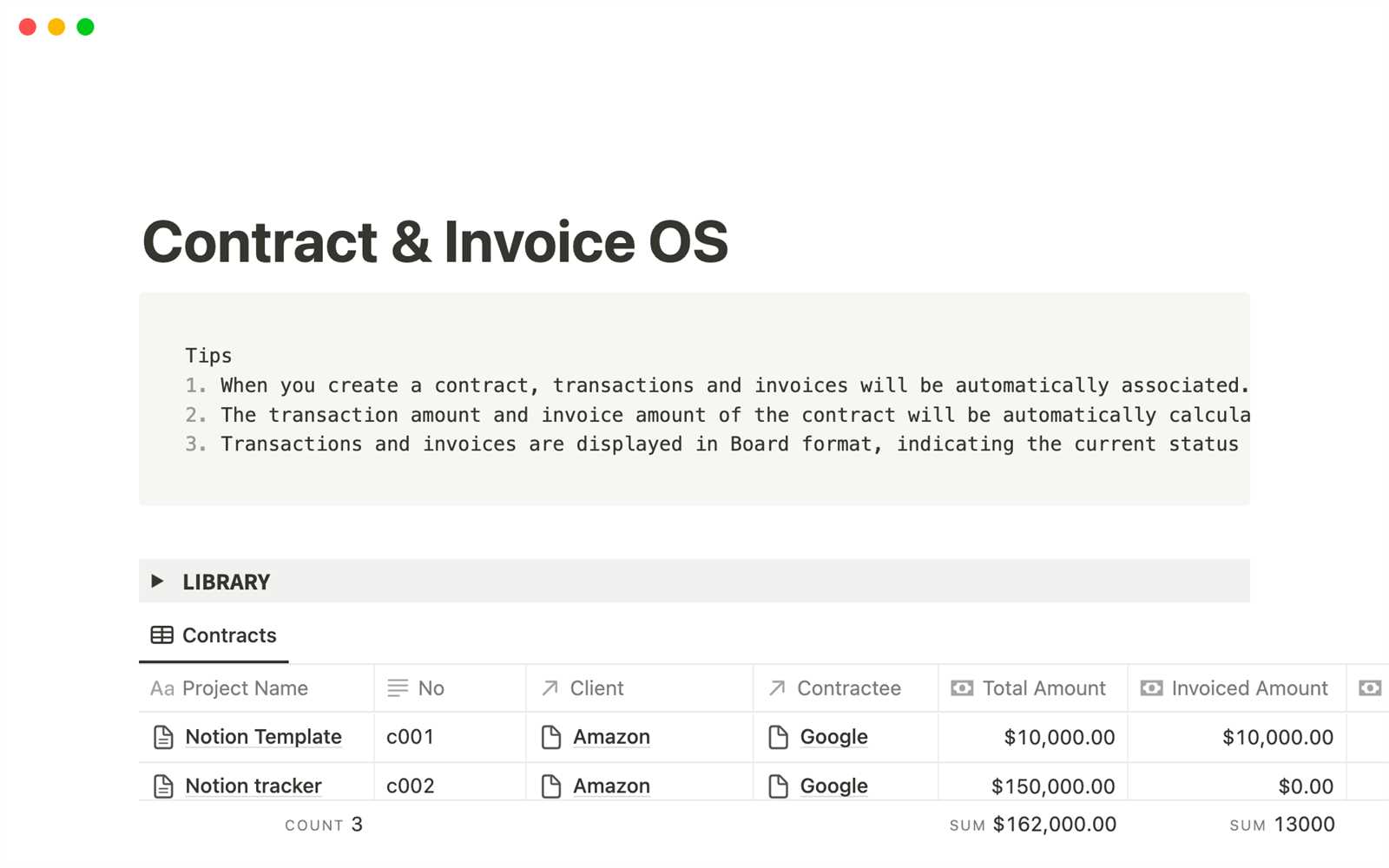

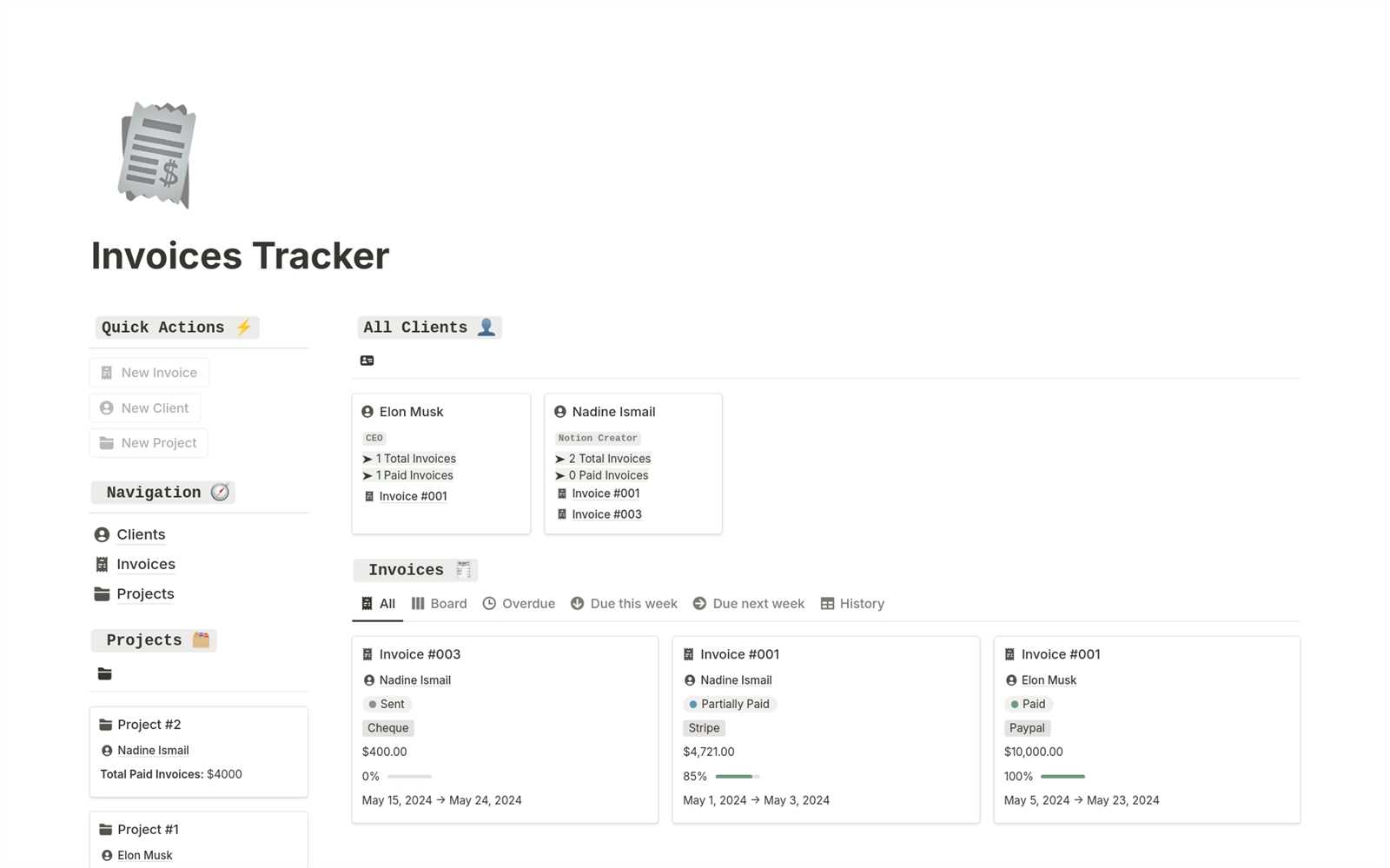

Organizing Clients with Notion Invoices

Effective client management is key to maintaining smooth business operations. By organizing client-related documents in a centralized system, you can easily track interactions, payments, and pending tasks. This approach ensures that no client request or payment falls through the cracks, making it easier to manage ongoing relationships.

With a structured approach, you can create a system that allows you to categorize clients, track the status of each transaction, and even store relevant notes for future reference. This helps keep all information in one place, so you don’t have to search through multiple platforms to find details about a particular client or transaction.

Additionally, having this organization in place allows for better communication. You can quickly identify overdue payments, follow up on open matters, and maintain a professional and consistent workflow across all client interactions.

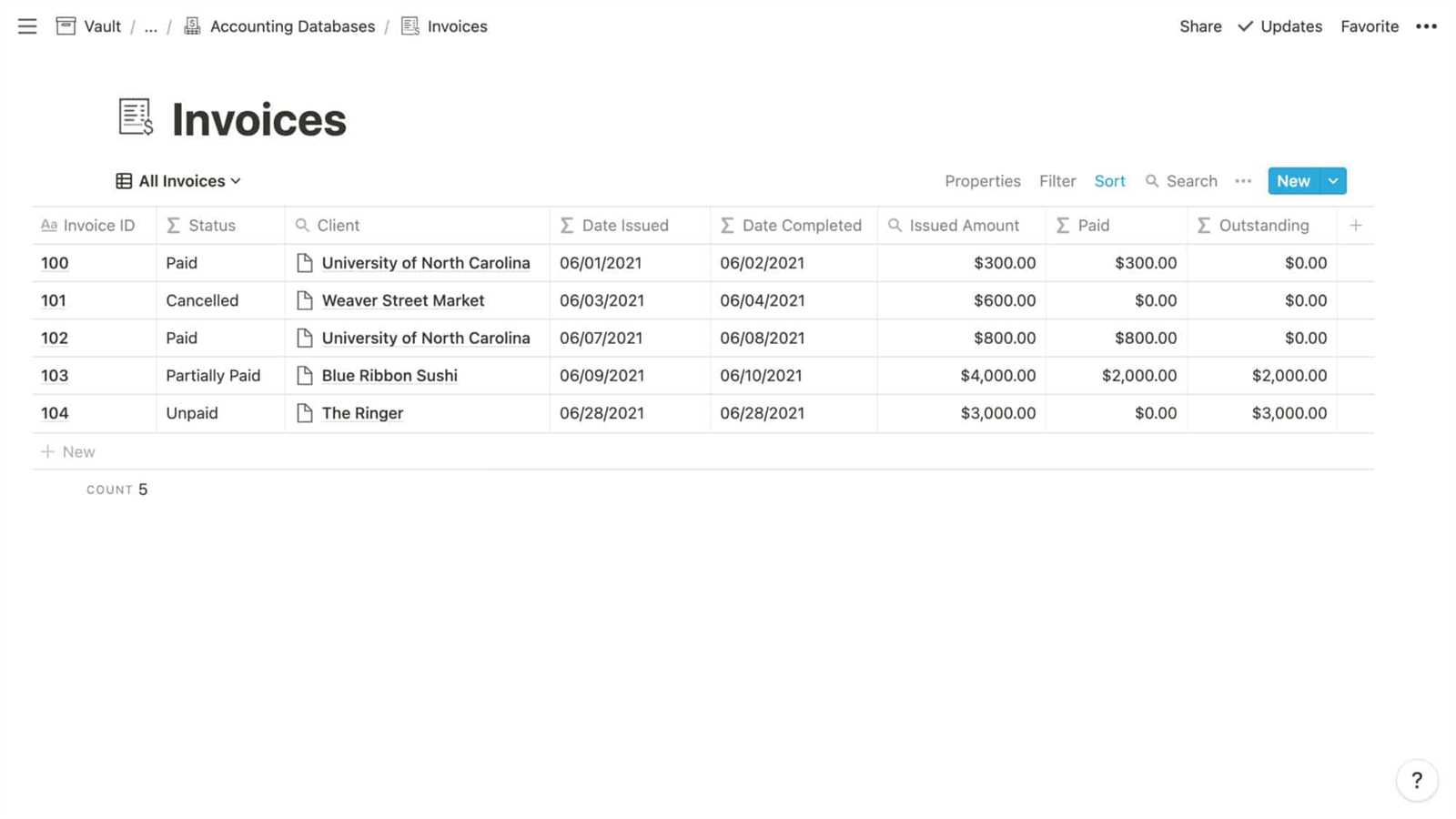

Tracking Payment Status in Notion

Keeping track of payments is a crucial part of managing any business. Knowing which payments have been completed, which are pending, and which are overdue can help ensure smooth cash flow and prevent misunderstandings with clients. A well-organized system allows you to monitor this status easily, giving you a clear overview of your financial dealings.

Creating a Payment Tracking System

To track payments effectively, create a dedicated section where each transaction can be logged and updated as it progresses. This can include important details such as the amount due, the date it was issued, the due date, and the payment status. Using a checklist or dropdown menu for the status (e.g., “Paid”, “Pending”, “Overdue”) can help you quickly visualize the current state of each transaction.

Using Filters for Easy Updates

Filters can be especially useful for managing large numbers of transactions. By applying filters based on status or due date, you can quickly sort through records and focus only on items that need attention. For instance, you could filter out all payments that have already been received and focus only on overdue payments or those that are still awaiting confirmation.

Automation can also play a role in streamlining this process. For example, setting up automated reminders for overdue payments can help you stay on top of follow-ups without having to manually check each entry.

Automating Invoice Reminders in Notion

Managing payment reminders manually can be time-consuming and prone to oversight, especially when dealing with multiple clients and transactions. Automating this process can save valuable time and reduce the risk of missing important deadlines. By setting up automated alerts and notifications, you can ensure that payments are tracked and followed up on in a timely manner.

Automating reminders involves configuring your system to send notifications based on specific conditions, such as due dates or overdue payments. This ensures that clients are reminded of their obligations without you having to manually check each transaction. Below is a simple overview of how you can set up these reminders:

| Step | Action |

|---|---|

| 1 | Set a due date for each transaction or request. |

| 2 | Use a date-based reminder system to notify you or your clients before the due date. |

| 3 | Enable alerts for overdue items to prompt follow-up actions automatically. |

| 4 | Customize the frequency and timing of reminders to suit your needs. |

Automated reminders can be set to send emails or in-app notifications, depending on your platform’s capabilities. This allows you to stay focused on other tasks while ensuring that your clients are always informed of upcoming payments or overdue balances.

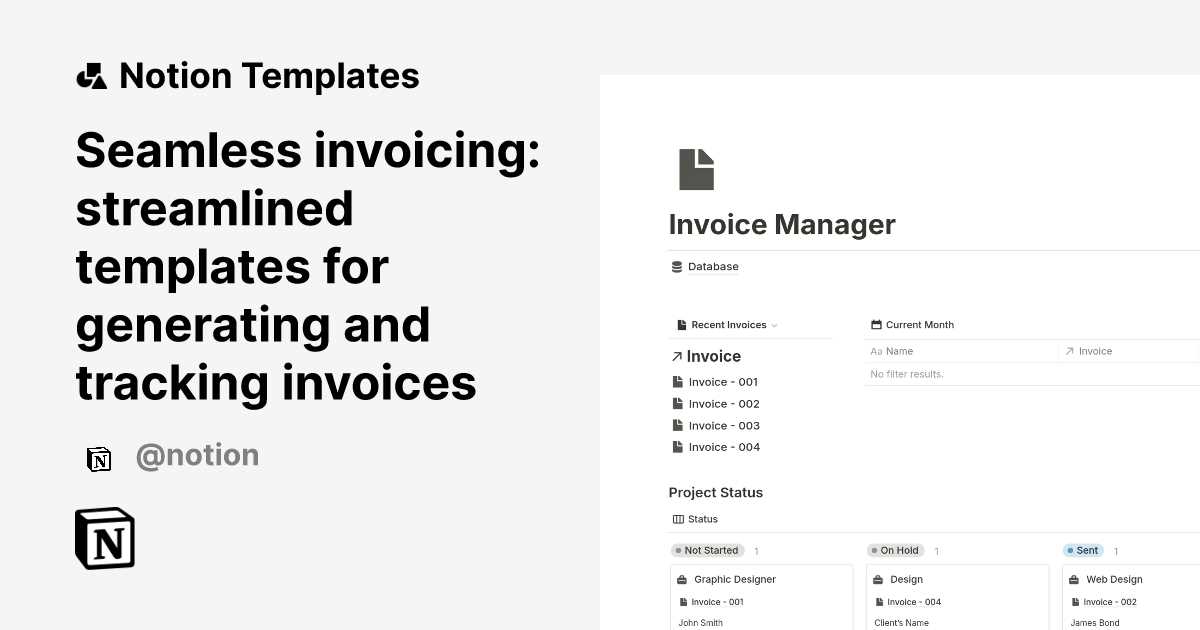

Managing Multiple Invoice Templates

For businesses that deal with a variety of clients and services, managing multiple document formats can become complex. Different clients may require different structures, whether it’s based on the type of service provided, billing frequency, or specific formatting preferences. Having an organized system for handling these variations is crucial to maintaining efficiency and professionalism.

To effectively manage various document formats, it’s essential to categorize and label them in a way that makes them easy to access and modify. Here are some tips for managing multiple formats:

- Use Categorization: Organize your formats by client type, service offered, or billing cycle to easily locate the appropriate document.

- Standardize Key Elements: While customization is important, standardizing key sections such as payment terms and business details can save time.

- Create Versions: Maintain several versions of the document, allowing quick adaptation for different circumstances without starting from scratch.

In addition to organization, consider creating a central repository for all formats. This way, you can quickly find the right version when needed, reducing the time spent searching through folders or systems. Automating the selection process based on client profiles or transaction types can further streamline the workflow.

Consistency across various documents also helps avoid confusion. While each format can have unique elements, a consistent visual style and structure can make all documents easily recognizable and professional.

Using Tables to Structure Invoices

Tables are an effective tool for organizing data and presenting information in a clear and structured way. When creating a financial document, using tables helps ensure that each detail is properly aligned and easy to read. A well-structured table can improve the document’s clarity, making it easier for both the creator and the recipient to review the necessary details, such as costs, dates, and descriptions.

By incorporating tables, you can clearly delineate various sections such as itemized charges, total costs, and payment terms. Here’s an example of how to structure a document using tables:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product/Service 1 | 1 | $100 | $100 |

| Product/Service 2 | 2 | $50 | $100 |

| Subtotal | $200 | ||

| Tax (10%) | $20 | ||

| Total Amount Due | $220 |

The use of tables ensures that each item or service is listed clearly with corresponding quantities and pricing, making it easy for clients to review all details at a glance. Additionally, including sections for taxes, discounts, and total amounts due helps to ensure that all financial information is transparent and well-organized.

Integrating Notion with Other Tools

To streamline workflows and increase productivity, it’s essential to connect different platforms and tools that you use regularly. Integrating your document management system with other applications can automate processes, reduce manual entry, and improve overall efficiency. By connecting these tools, you can ensure that all your data is synchronized and accessible from one place, eliminating the need to switch between platforms constantly.

Benefits of Integration

Integrating different tools allows for seamless data exchange. For example, connecting your document system with accounting or project management tools can help you automatically update records, track payments, or generate reports without manually entering the same information multiple times. This saves valuable time and minimizes the chances of errors.

Popular Integrations

There are several platforms that can be integrated with your document management system to enhance its functionality:

- Google Drive: Sync your documents to store them in a cloud-based environment, ensuring easy access and sharing across devices.

- Zapier: Automate tasks by connecting your system to hundreds of apps for tasks like sending reminders or creating tasks in other platforms.

- QuickBooks: Integrate your accounting software to track payments, generate reports, and keep your financial data updated automatically.

By integrating

Setting Up Invoice Calculations

Calculating the total cost of services or products provided is a crucial aspect of financial documentation. Setting up an automated calculation system ensures that every transaction is accurate, timely, and transparent. This eliminates the need for manual calculations, reducing errors and saving time. By creating formulas that automatically update based on inputs, you can streamline the process and maintain consistency across all documents.

Essential Components for Calculations

To set up effective calculations, you need to define key components, such as unit prices, quantities, discounts, and taxes. These components must be properly linked to ensure that changes made to one field, like the quantity, automatically adjust the total cost. Here’s a breakdown of the key elements that should be part of the calculation system:

- Unit Price: The cost per unit of the item or service provided.

- Quantity: The number of items or the amount of service provided.

- Discounts: Any reductions in the price based on special offers, client agreements, or promotions.

- Tax Rates: The applicable tax percentage based on the region or business type.

Automating the Process

Once the necessary components are established, you can use built-in functions or custom formulas to automate the calculation process. For instance, the total cost of a service can be calculated by multiplying the unit price by the quantity and then applying any discounts or taxes. Setting up this system to update in real-time ensures that the final amounts are always accurate, even if adjustments are made to the data.

Accuracy is essential when calculating totals, and automation provides a fail-safe mechanism against human error, ensuring that financial records remain correct and professional.

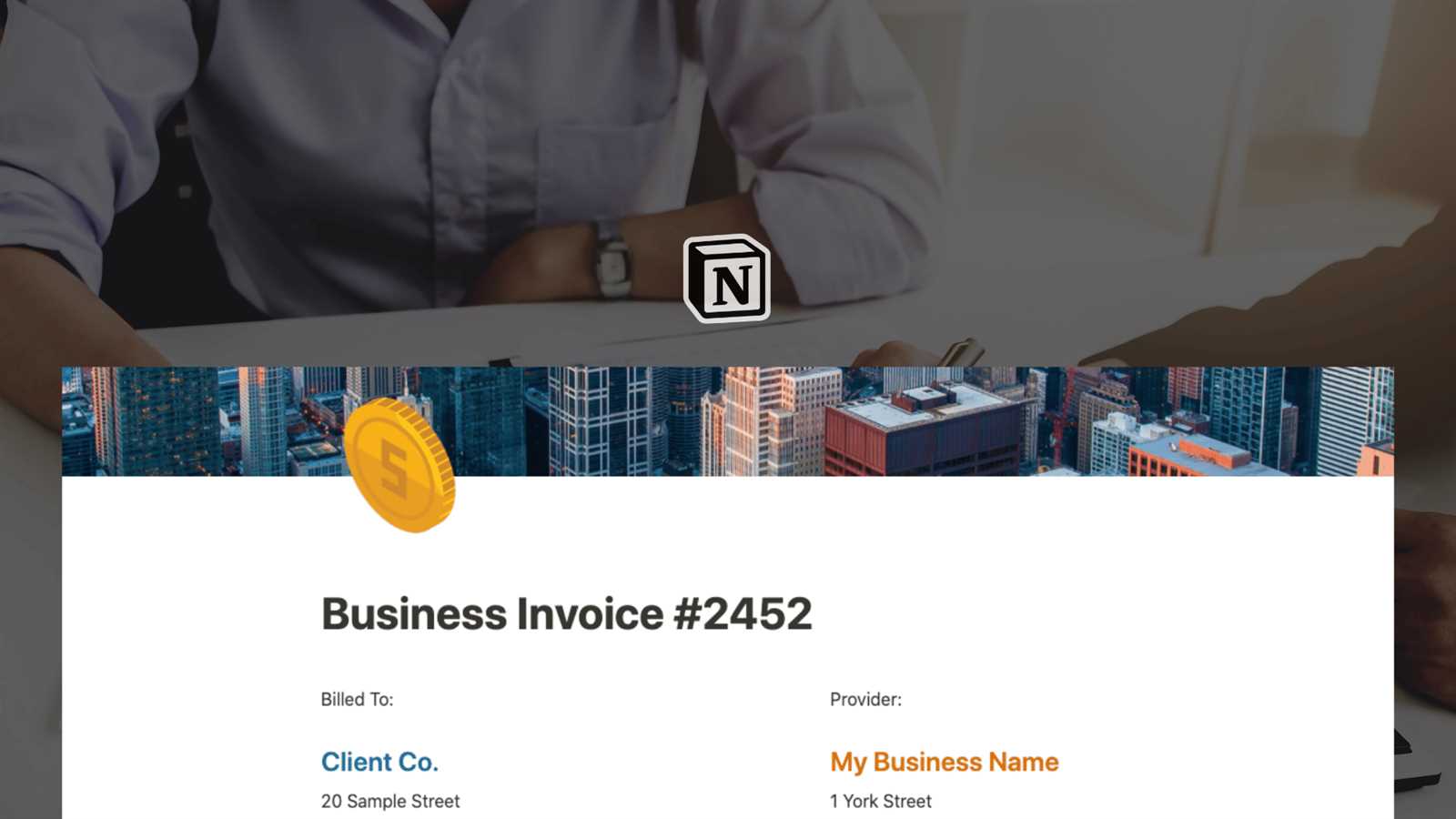

Design Tips for Professional Invoices

The design of a financial document plays a crucial role in conveying professionalism and clarity. A well-structured layout not only makes the document easier to understand but also reflects positively on your business. Whether you’re dealing with a single client or multiple clients, the appearance of the document can impact how your services are perceived. Focusing on key design elements ensures that your document communicates its message effectively and leaves a lasting impression.

Key Elements of a Professional Design

When creating a document that demands attention and professionalism, it’s essential to incorporate several important design elements:

- Branding: Include your company logo and use your brand colors to maintain consistency across all your business materials.

- Legibility: Ensure that fonts are easy to read, with a good contrast between text and background. Avoid overly decorative fonts.

- Spacing: Use sufficient white space to prevent the document from looking overcrowded. This helps highlight key information and makes the document easier to read.

- Alignment: Align your data in a way that makes it easy for the reader to follow. For example, align text to the left and numbers to the right for consistency.

- Sections: Organize information into clear sections, such as the client’s details, services provided, totals, and terms. This helps readers navigate the document easily.

Designing for Clarity

One of the primary goals of any financial document is clarity. To ensure that your records are understood, consider these design tips:

- Use Clear Headers: Distinguish section headers with bold text or different font sizes to clearly separate each part of the document.

- Color Accents: Use subtle color accents to highlight important information like total amounts or due dates without overwhelming the reader.

- Logical Flow: Arrange the information in a logical order so the recipient can quickly grasp the details of the document.

These design elements not only enhance the readability of your document but also reflect your attention to detail and commitment to professionalism. A well-crafted design contributes to a positive experience for your clients and helps build trust in your services.

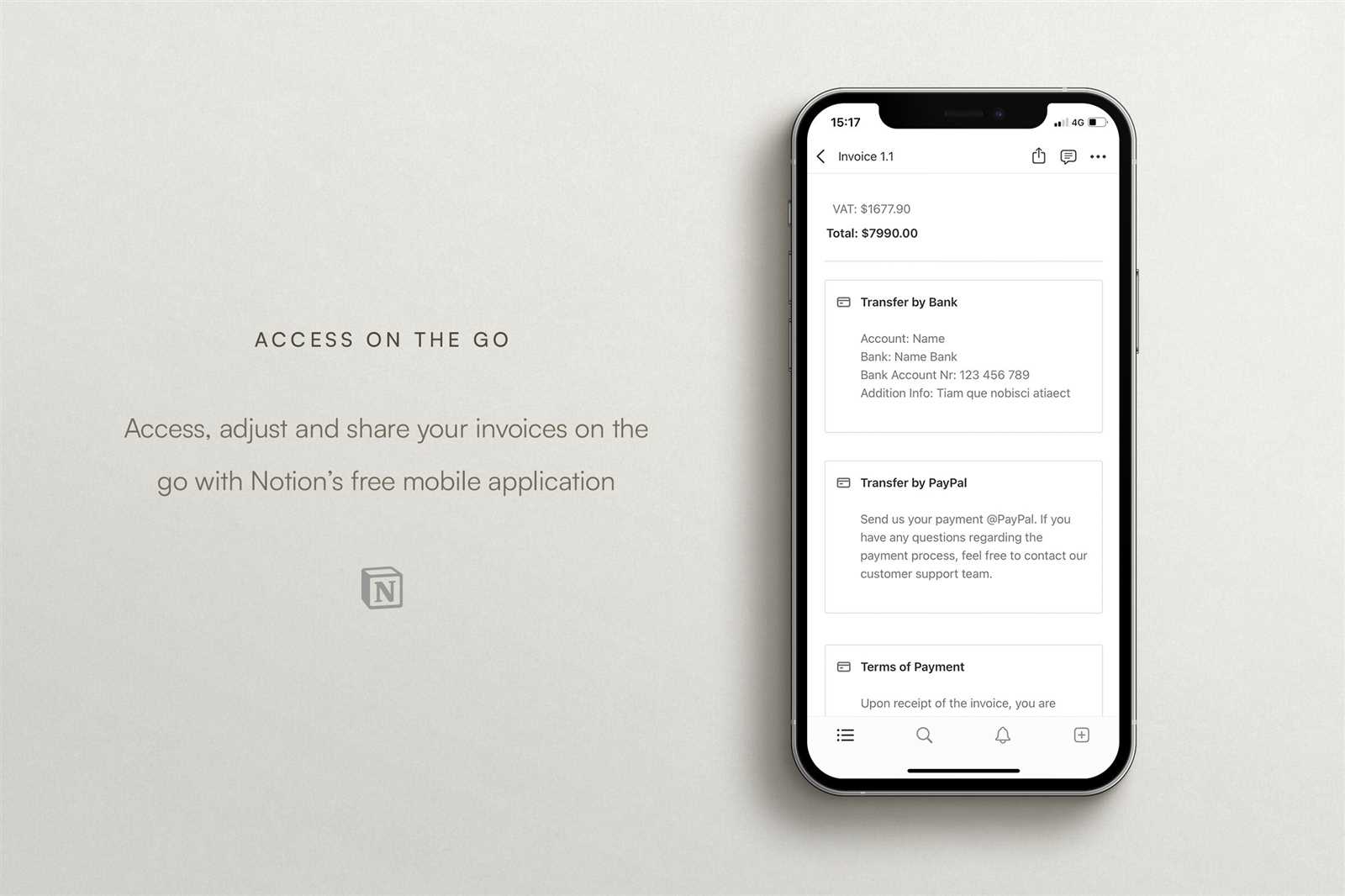

Sharing Your Invoice Template Efficiently

Sharing documents with clients, colleagues, or stakeholders should be a seamless process to ensure that all parties involved can access and review the necessary information quickly. Whether you’re distributing a financial statement or a record of transactions, choosing the right sharing method is key to maintaining professionalism and clarity. The goal is to make the document easily accessible, secure, and editable if needed, without overcomplicating the process.

When sharing documents, it’s important to consider how the recipient will interact with it. For instance, choosing file formats that are universally accessible, like PDF or shared cloud links, ensures that there are no compatibility issues. Additionally, using platforms that allow for real-time updates or collaboration can streamline the process, especially when multiple people need to view or make changes to the document.

For efficient sharing, you might also want to explore automation tools that send out reminders or provide tracking to ensure that the document reaches its destination. By leveraging the right tools, you can cut down on manual effort and reduce the time spent on managing document distribution.

Collaborating on Invoices in Notion

Effective collaboration is essential when managing financial documents, especially when multiple team members are involved in creating, editing, or approving these records. By working together in a shared environment, you can streamline the process, reduce errors, and ensure accuracy. Collaboration tools allow multiple individuals to update a document in real-time, track changes, and provide feedback, all in a centralized space.

Benefits of Collaborative Tools

Using collaborative platforms to manage and edit financial records offers several advantages:

- Real-time Editing: Multiple team members can work on the same document simultaneously, ensuring that updates are reflected instantly.

- Version Control: Collaboration tools often provide version history, so you can track changes and revert to previous versions if necessary.

- Seamless Feedback: Team members can leave comments or suggestions directly on the document, improving communication and reducing the need for additional meetings or emails.

- Centralized Access: Everyone involved has access to the same document, reducing confusion and ensuring that the most up-to-date version is always available.

Structuring Collaborative Financial Documents

Organizing collaborative documents for ease of use and clarity is key to an efficient workflow. A well-structured layout helps participants quickly locate relevant information and minimize confusion. Here’s an example of how to structure your shared financial records:

| Field | Details |

|---|---|

| Client Name | Enter the name of the client. |

| Service Description | Provide a brief overview of the service rendered. |

| Amount Due | Specify the total amount to be paid. |

| Due Date | Set the date when payment is expected. |

By using a collaborative approach, you not only make the process more efficient but also foster a transparent and organized workflow for everyone involved. With proper structure and real-time communication, collaboration can be smooth and error-free, leading to better results for all parties.

Security and Privacy of Notion Invoices

When handling sensitive financial documents, ensuring their protection is of the utmost importance. In this regard, safeguarding both the data itself and the users’ personal information requires a reliable system that prioritizes security and confidentiality at every step of the process. Strong measures need to be in place to prevent unauthorized access while maintaining the integrity of all stored content.

Data Encryption: It is essential for any system to encrypt documents to protect them from external threats. Using robust encryption methods ensures that information remains unreadable to anyone without proper authorization, even if it is intercepted during transmission.

Access Control: Limiting access to specific individuals or groups is a critical aspect of maintaining privacy. By implementing user roles and permissions, a platform can effectively restrict who can view or edit certain files, minimizing the risk of accidental or intentional breaches.

Two-Factor Authentication: To further enhance security, integrating two-factor authentication provides an additional layer of defense against unauthorized access. This mechanism makes it more difficult for intruders to gain entry, even if login credentials are compromised.

Regular Audits: Conducting periodic audits and security assessments is necessary to identify potential vulnerabilities. Keeping software up to date and regularly reviewing system protocols helps ensure that the protection methods remain effective and responsive to emerging threats.

Data Ownership and Privacy Policies: It’s also crucial for users to understand how their data is handled and protected. Transparent privacy policies outlining how information is stored, used, and shared can provide peace of mind and ensure compliance with privacy regulations.

Common Mistakes to Avoid in Notion Invoices

Creating professional documents for financial transactions requires careful attention to detail. Even small errors can lead to confusion, delays, or misunderstandings with clients or stakeholders. It is essential to be mindful of common pitfalls to ensure that all records are clear, accurate, and legally sound.

1. Missing or Incorrect Contact Information: One of the most frequent mistakes is neglecting to include correct contact details. This includes both the issuer’s and recipient’s addresses, emails, or phone numbers. Without accurate contact information, communication becomes difficult, and important notices may not reach the intended parties.

2. Inconsistent Formatting: Poorly organized documents can create confusion and give an unprofessional impression. Consistency in font styles, spacing, and layout is crucial. Make sure that all sections are clearly labeled, with well-defined headings, amounts, and dates in a uniform format.

3. Incorrect Tax Calculations: Mistakes in calculating taxes can result in either overcharging or undercharging, leading to disputes. Ensure that the correct tax rates are applied to the right items, and always double-check calculations for accuracy.

4. Failure to Include Payment Terms: Payment terms outline important details such as due dates, accepted payment methods, and any penalties for late payments. Omitting these terms can cause confusion and delay payments, as clients may not know when or how to submit the required amount.

5. Overlooking Legal Requirements: In many jurisdictions, there are specific legal requirements for business documents related to payments. These might include mandatory fields like registration numbers, VAT identification, or references to applicable laws. Failing to comply with local regulations can result in penalties or complications.

6. Lack of Clarity in Item Descriptions: Vague or unclear descriptions of products or services can lead to misunderstandings. Ensure each item is listed with sufficient detail so that there is no ambiguity about what was provided and its cost.