Easy to Use Excel Consulting Invoice Template for Streamlined Billing

Managing payments and tracking financial transactions is a crucial part of any professional service. Ensuring that clients are billed correctly and on time not only helps maintain cash flow but also builds trust and credibility. For many independent professionals, simplifying the billing process is essential to staying organized and reducing administrative burdens.

One of the most effective ways to handle this is by using digital documents that can be easily customized, ensuring each payment request meets the needs of both the provider and the client. These customizable forms can save valuable time, minimize errors, and help professionals stay on top of their finances with minimal effort.

By adopting a well-organized system, service providers can focus more on delivering quality work while managing their financial records with ease. Whether you are just starting or looking to improve your existing methods, having a streamlined approach to invoicing can make a significant difference in the efficiency of your business operations.

What is an Excel Consulting Invoice Template

A payment request document is a critical tool for any professional or business offering services. It provides a structured way to detail the work performed and the amount owed, ensuring that both parties are clear on the terms. Such documents can be tailored to fit the specific needs of a business and made reusable for future transactions.

In essence, this type of document is designed to simplify the process of requesting payment from clients. It typically includes all the necessary information that both the service provider and the client need to finalize the transaction. By using a pre-designed format, providers can save time and avoid errors, allowing them to focus on delivering high-quality work.

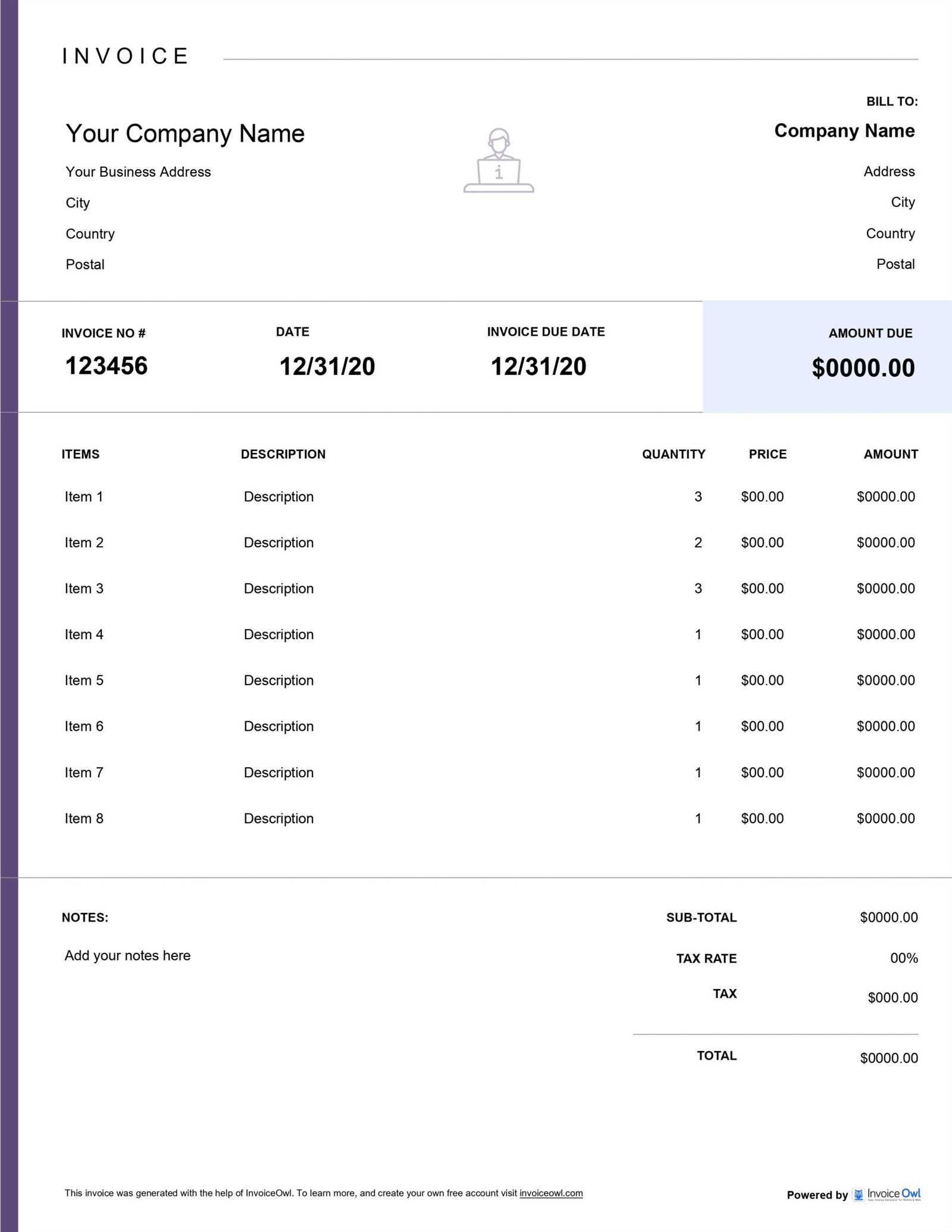

Key components of this kind of document often include:

- Service details: A breakdown of the tasks completed or hours worked.

- Client information: Contact details and billing address of the recipient.

- Payment terms: Due dates, fees, and penalties for late payments.

- Totals and taxes: The total amount due, including applicable taxes and any other charges.

Using such a document helps ensure that all the relevant information is consistently included in each request for payment, leading to smoother financial transactions and a professional appearance in dealings with clients. Furthermore, having a reusable system in place makes it easier for businesses to manage multiple clients and projects at once.

Benefits of Using Excel for Invoices

Managing financial records efficiently is essential for service providers, and using digital documents to request payments offers significant advantages. A widely used tool for this purpose allows professionals to automate many aspects of their billing process, reducing the time spent on administrative tasks and minimizing errors. By leveraging its features, businesses can streamline their financial workflows and improve accuracy.

Customizability and Flexibility

One of the key benefits of using this software for creating payment requests is its high degree of customization. Users can easily adjust the layout, design, and structure of the document to suit their specific needs. Whether it’s adding additional fields for detailed breakdowns, adjusting fonts for better readability, or incorporating branding elements like logos, the document can be tailored to reflect the professional image of the service provider.

Time-Saving Automation

Another major advantage is the ability to automate calculations, which can save a considerable amount of time. With built-in formulas, users can quickly calculate totals, taxes, and discounts without having to manually enter complex data. This not only speeds up the billing process but also reduces the risk of mistakes in financial calculations, ensuring more accurate and reliable documents.

Overall, using this tool helps service providers stay organized, maintain consistency, and keep financial processes smooth and efficient.

How to Create a Custom Invoice in Excel

Designing a personalized document for billing can greatly improve the professionalism of your financial transactions. The process of creating a custom payment request form involves setting up key fields for client information, services provided, and payment terms. With the right steps, anyone can build a functional and visually appealing document that fits their business needs.

Step 1: Set Up the Document Layout

Start by organizing the document’s structure. Divide it into sections that are easy to read and understand, ensuring all critical information is clearly presented. Begin by adding these elements:

- Service provider’s name and contact details.

- Client’s name, address, and contact information.

- Date of service and the date the payment is due.

Step 2: Add Detailed Breakdown

The next step is to list the services provided and the respective charges. Be sure to include:

- A description of each service or task performed.

- The quantity, hourly rate, or agreed-upon price.

- Subtotals for each service and the overall total amount.

To enhance readability, group related items together and use bold or underlined text for headings and important details.

By following these simple steps, you can easily create a custom document tailored to your business needs, improving your billing process and ensuring consistency across transactions.

Essential Elements of a Consulting Invoice

Creating a well-structured payment request document is key to maintaining professional relationships and ensuring timely payments. A comprehensive financial statement includes several important components that make it easy for clients to understand the charges and for service providers to keep track of their earnings. Each section should be clearly labeled and organized to prevent confusion.

1. Provider and Client Information

The first section should include the service provider’s contact details, such as their name, address, phone number, and email. Alongside this, the client’s information should also be listed, ensuring that the document can be easily associated with the correct recipient. This ensures proper communication and the timely delivery of payment.

2. Service Description and Fees

Next, you need to clearly outline the services provided. Include a detailed description of each task performed, the hours worked, or the fixed fees for each service. This section should also include the cost for each item and a subtotal. This transparency is crucial for avoiding misunderstandings.

- Hourly rate or project-based fee.

- Number of hours worked or service units delivered.

- Subtotal for each service provided.

3. Payment Terms and Deadlines

Specify when the payment is due and include any relevant terms, such as late fees or discounts for early payment. Providing clear payment terms reduces the chances of delays and establishes expectations on both sides.

Including these key elements ensures your payment requests are professional, transparent, and easy for clients to process.

Why Excel is Ideal for Invoicing

When it comes to creating and managing payment requests, using a versatile and user-friendly tool can significantly simplify the process. A widely popular software provides an intuitive platform where users can easily design, customize, and automate various aspects of their billing documents. Its features make it especially suitable for professionals who need a flexible, efficient, and cost-effective solution for managing financial transactions.

One of the key advantages of this tool is its ability to automate calculations. With built-in functions, users can quickly compute totals, taxes, and discounts, reducing the chances of human error. This automation ensures that each payment request is accurate, saving time and enhancing reliability.

Another benefit is the extensive customization options it offers. Whether you need to adjust the layout, incorporate your branding, or add additional fields for specific details, this platform gives you complete control over the design and format. You can create a unique document that reflects your business style while meeting your clients’ needs.

Finally, the software allows for easy storage and organization of payment requests. You can keep all your financial documents in one place, making it easier to track outstanding payments and maintain an organized record for future reference. This helps streamline your workflow and ensures that you never miss a payment or overlook important details.

Automating Calculations in Excel Invoices

One of the most valuable features of digital billing documents is the ability to automate calculations, which saves time and reduces the chance of errors. By using built-in formulas, users can easily compute totals, taxes, and other fees without manually inputting each value. This ensures that the financial details of every payment request are accurate and consistent.

Key Calculations to Automate

There are several common calculations that can be automated to streamline the billing process:

- Subtotal: Automatically calculate the cost for each service based on the quantity and rate.

- Tax Calculation: Apply the appropriate tax rate to the subtotal and compute the total tax amount.

- Total Amount: Add the subtotal and taxes, as well as any discounts or additional charges, to calculate the final amount due.

How to Set Up Basic Formulas

Setting up these calculations is simple. For example:

- To calculate the subtotal, multiply the quantity of services by the rate.

- For tax calculation, use a formula that multiplies the subtotal by the tax rate.

- The total amount is the sum of the subtotal, tax, and any additional fees or discounts.

Once these formulas are in place, they will automatically update every time data is changed, ensuring the document is always accurate and up to date. This minimizes manual work and makes invoicing more efficient.

Designing a Professional Invoice Template

Creating a polished and professional document for requesting payment is essential for maintaining credibility with clients. A well-designed bill not only reflects your business’s professionalism but also ensures that all necessary information is presented clearly and effectively. The goal is to create a document that is both visually appealing and functional, making it easy for clients to understand the services provided and the total amount due.

Key Elements of a Professional Layout

When designing your billing document, consider the following key elements to ensure it looks professional and is easy to navigate:

- Header Section: Include your business logo, name, and contact information. This makes the document instantly recognizable and adds a personal touch.

- Client Information: Clearly list the client’s name, address, and contact details. This ensures that the document is tailored to the correct recipient.

- Service Breakdown: Organize the services provided in a clean, easy-to-read table, detailing each task, the hours worked or quantity delivered, and the rate charged.

- Payment Terms: Include payment deadlines, discounts, or late fees to avoid misunderstandings and encourage prompt payment.

Design Tips for Readability

To enhance the readability of your payment request, follow these design tips:

- Use clear fonts: Opt for professional, easy-to-read fonts like Arial or Calibri. Avoid overly decorative fonts that can be hard to decipher.

- Use consistent formatting: Align your text, tables, and numbers in a clean and organized way. Ensure that all headings and subheadings stand out clearly.

- Use colors sparingly: While a splash of color can make the document look more engaging, too much can be distracting. Stick to one or two colors that complement your brand.

By focusing on these elements, you can design a document that not only looks professional but also functions seamlessly to facilitate smooth transactions with your clients.

Incorporating Client Details in Invoices

Including accurate and complete client information in your payment request documents is crucial for both clarity and professionalism. This not only helps ensure that your document is properly addressed but also facilitates efficient communication and payment processing. By including the right details, you demonstrate attention to detail and make it easier for your clients to process the payment without confusion.

Essential client information typically includes the following:

- Client Name: Ensure the full name or company name of the client is clearly stated.

- Billing Address: Include the client’s complete billing address to ensure that invoices are correctly processed and to comply with legal or contractual requirements.

- Contact Information: Providing a phone number or email address allows clients to easily reach out in case of any issues or questions related to the payment.

- Client Account Number (if applicable): Some clients may have a specific account or reference number that helps identify their transactions in your system.

Including these details not only ensures smooth and efficient payment processing but also provides a record for both parties to refer to when needed. Accurate client information reduces the likelihood of errors and delays, making it easier to track payments and maintain professional relationships.

Setting Payment Terms in Your Template

Clearly defining payment expectations in your billing documents is essential for ensuring timely payments and maintaining smooth business operations. Payment terms provide both you and your clients with a clear understanding of when and how payments should be made, reducing the chances of misunderstandings or delays. A well-defined set of terms helps establish professionalism and sets the foundation for a positive business relationship.

When setting payment conditions, consider including the following key elements:

- Due Date: Specify the exact date by which payment must be received. This creates a clear deadline and sets expectations for the client.

- Late Fees: To encourage timely payments, outline any penalties for late payments. This can be a fixed fee or a percentage of the total amount due for each day or week the payment is delayed.

- Payment Methods: Clearly state the accepted forms of payment, whether through bank transfer, credit card, online payment services, or other methods.

- Discounts for Early Payments: Offering discounts for early settlement can incentivize clients to pay ahead of schedule. If applicable, make sure to define the discount percentage and the timeframe during which it’s available.

- Installment Payments (if applicable): For larger amounts, you may choose to allow clients to pay in installments. Specify the frequency of payments and any interest charges if applicable.

By including these details in your billing documents, you can ensure a clearer understanding between you and your clients, fostering trust and reducing the potential for confusion or delays in payment.

How to Track Payments with Excel

Tracking payments efficiently is crucial for managing cash flow and ensuring that all transactions are properly accounted for. With the right tools, you can easily monitor the status of each payment, identify overdue amounts, and maintain an organized record of completed transactions. By incorporating simple tracking methods, you can stay on top of your financial situation and reduce the risk of missed or delayed payments.

One of the most effective ways to track payments is by creating a detailed record in a spreadsheet. This allows you to keep a clear overview of each payment’s status, due date, amount, and any outstanding balances. Here is an example of how to organize your payment tracking:

| Client Name | Invoice Number | Amount Due | Payment Received | Balance Due | Payment Date | Status |

|---|---|---|---|---|---|---|

| Client A | #001 | $500 | $500 | $0 | 01/10/2024 | Paid |

| Client B | #002 | $750 | $500 | $250 | 01/15/2024 | Partial |

| Client C | #003 | $300 | $0 | $300 | 01/20/2024 | Unpaid |

In the table above, each row represents a separate payment transaction. The columns include key details such as the client name, the invoice number, the amount due, and the payment status. This format provides a clear overview of which payments have been made, which are partially paid, and which are still pending. You can easily update this sheet as payments are received, and use it to follow up with clients when necessary.

By regularly updating and reviewing your payment records, you can maintain an organized financial overview and ensure that all due amounts are collected promptly.

Excel Templates for Freelancers and Consultants

Freelancers and independent contractors often juggle multiple projects and clients, which can make managing finances a challenge. Having a reliable tool to create clear, organized, and professional payment request documents can streamline this process significantly. Pre-designed forms for tracking services rendered, calculating payments, and maintaining records help freelancers focus more on their work and less on administrative tasks.

Benefits of Using Pre-Designed Forms

Using ready-made documents allows freelancers to quickly generate billing statements without having to start from scratch each time. These forms often include useful features like automatic calculations for totals, taxes, and discounts, which reduces errors and saves time. In addition, they provide a professional appearance, which helps build trust with clients and ensures timely payments.

Customizing Your Documents for Your Business

While pre-designed forms are a great starting point, customization is key to making them suit your unique business needs. You can adjust the structure, colors, and branding to reflect your personal or company style. Adding fields for specific services, hourly rates, or project milestones ensures that the document fits your business model. This way, you can maintain consistency across all your billing communications and make the payment process as straightforward as possible for your clients.

By utilizing these resources, freelancers and contractors can save time, stay organized, and present themselves as professionals in every financial interaction.

Customizing Invoice Styles and Layouts

Creating a well-organized and visually appealing billing document is essential for maintaining a professional image and ensuring that clients can easily understand the charges. Customizing the style and layout of your billing forms allows you to tailor them to your brand, making them more recognizable and polished. A unique and thoughtfully designed layout helps communicate professionalism while keeping the focus on the essential details of the transaction.

Key Elements to Customize

There are several key aspects of the document that you can adjust to enhance both its appearance and functionality:

- Header Section: Incorporate your business logo, name, and contact information. This section sets the tone for the document and should reflect your brand identity.

- Client Information: Ensure the client’s details, such as name, address, and contact information, are clearly presented. You can adjust the layout to ensure this information is easy to find and read.

- Service Breakdown: Organize the list of services in a clear table format. You can experiment with different table styles and column widths to make the information easy to read while ensuring each service or task is clearly separated.

- Payment Terms: Adjust the placement and styling of payment terms to ensure they stand out. Use bullet points or bold text to highlight important information such as due dates, late fees, or early payment discounts.

Design Tips for a Professional Look

When customizing your document, consider these design tips to create a polished and cohesive look:

- Use Consistent Fonts: Choose one or two easy-to-read fonts for the entire document. Avoid using too many different fonts, as this can make the document look cluttered and unprofessional.

- Color Scheme: Choose a color palette that complements your brand and creates contrast for key details. Use colors sparingly to avoid overwhelming the document.

- Spacing and Alignment: Ensure that all text and tables are properly aligned and spaced. Consistent margins, padding, and line spacing will make the document easier to read and more visually appealing.

By carefully adjusting these elements, you can create a custom, professional billing document that not only represents your business well but also enhances the client experience.

Using Excel for International Billing

When working with clients from different countries, managing payments can become more complex due to varying currencies, tax laws, and payment methods. However, with the right tools and techniques, it is possible to streamline this process and handle international transactions with ease. A powerful tool allows you to create flexible documents that can be tailored to different regions, ensuring clarity and efficiency in the billing process.

Key Considerations for Global Transactions

When dealing with international payments, there are several important factors to keep in mind:

- Currency Conversion: It’s essential to account for currency differences when billing clients in different countries. Many tools offer built-in currency conversion features, or you can manually apply exchange rates to ensure the correct amount is charged.

- Tax Rates and Regulations: Different countries have different tax regulations that must be adhered to. Make sure you adjust the tax rate according to the client’s location, ensuring compliance with local tax laws.

- Payment Methods: International clients may prefer specific payment methods such as wire transfers, PayPal, or credit cards. Specify the available payment options and any associated fees to avoid confusion.

Creating International Billing Documents

To tailor your documents for global transactions, consider incorporating the following features:

- Multi-Currency Support: Include a column to list the amount in both your local currency and the client’s currency. This transparency can help clients understand the charges in their own currency and avoid any confusion.

- Payment Instructions: Provide clear instructions for international payments, including your bank details, payment platforms, and any additional fees that might apply for foreign transactions.

- Language Preferences: If you’re working with clients in non-English speaking regions, you may want to offer billing documents in multiple languages to make the process more accessible.

By adapting your billing process to accommodate international clients, you can ensure smooth transactions and maintain strong professional relationships across borders.

Saving Time with Pre-made Excel Templates

For busy professionals, time is a valuable resource. One of the most effective ways to save time and reduce the risk of errors is by using pre-made forms designed for specific tasks. These ready-to-use documents can help you quickly generate accurate records without the need to manually create every detail from scratch. Whether you’re tracking payments, organizing service lists, or calculating totals, using pre-made solutions helps streamline your workflow and ensure consistency across all your documents.

Advantages of Using Pre-made Forms

Here are a few key benefits that come with utilizing pre-made documents:

- Time Efficiency: Ready-to-use forms eliminate the need to design layouts or structure data manually, enabling you to focus more on your core tasks and less on administrative work.

- Accuracy: Pre-made solutions often include built-in formulas and calculations, reducing the likelihood of errors when it comes to pricing, tax rates, or totals.

- Consistency: Using a standardized format ensures that all your documents maintain a professional and uniform appearance, which is important for branding and client trust.

- Easy Customization: Pre-made forms can typically be customized to suit your specific needs, whether it’s adding more columns, changing labels, or adjusting the layout. This flexibility allows you to adapt the form to your business model.

How Pre-made Documents Improve Workflow

By incorporating pre-made resources into your routine, you can greatly enhance your productivity:

- Speed: You can quickly generate accurate records without needing to start from scratch each time.

- Focus: Since much of the document creation process is automated, you have more time to dedicate to actual work rather than administrative tasks.

- Convenience: Pre-made forms can be stored, reused, and adapted easily, ensuring a smooth workflow for future projects.

Overall, leveraging pre-made documents not only saves time but also helps maintain consistency and professionalism in your financial records.

How to Avoid Common Invoice Mistakes

Creating accurate and professional billing documents is crucial for maintaining good relationships with clients and ensuring timely payments. However, there are several common errors that can delay payments, create confusion, or damage your reputation. By paying attention to details and following best practices, you can avoid these pitfalls and streamline the payment process.

Common Mistakes to Avoid

Here are some of the most frequent errors when preparing financial documents and how to prevent them:

- Incorrect Client Information: Double-check that the client’s name, address, and contact details are correct. Mistakes in contact information can cause delays in processing payments.

- Missing or Wrong Due Dates: Clearly state the payment deadline on your document. Ambiguity around the due date can lead to missed payments or confusion regarding expectations.

- Omitting Payment Terms: Always include clear terms regarding accepted payment methods, late fees, and any discounts for early payment. Lack of transparency can lead to misunderstandings.

- Failure to Itemize Charges: Provide a detailed breakdown of the services provided, including the cost per service, hours worked, or other applicable charges. Vague descriptions can confuse clients and delay payment processing.

- Not Accounting for Taxes: Make sure all applicable taxes are included in your calculations, whether it’s sales tax, VAT, or other regional taxes. Forgetting to add taxes can result in financial discrepancies and awkward follow-ups.

- Using Inconsistent Formats: Ensure your billing documents follow a consistent format. Using different styles, fonts, or layouts in each document can reduce professionalism and cause confusion for clients.

Best Practices to Prevent Mistakes

To reduce the chance of errors and improve the accuracy of your financial documents, follow these tips:

- Double-Check All Information: Before sending out any billing document, review all the details carefully to ensure they are correct. This includes client information, amounts, and due dates.

- Use Automated Calculations: Incorporate built-in calculations for totals, taxes, and discounts to avoid manual errors. This can save time and ensure accuracy.

- Standardize Your Documents: Create a standard format for your billing documents to maintain consistency and professionalism. Using a familiar layout will also make it easier to review and process payments quickly.

- Maintain Clear Communication: If there are any questions or issues regarding the payment, address them promptly. Clear communication can prevent misunderstandings and build trust with clients.

By being mindful of these common mistakes and following best practices, you can avoid delays and ensure that your billing process runs smoothly and efficiently.

Best Practices for Excel Invoice Management

Effective management of billing documents is crucial for maintaining a smooth financial operation. Proper organization ensures timely payments, reduces errors, and helps track the status of each transaction. By implementing efficient management strategies, you can avoid confusion, minimize delays, and maintain a professional relationship with your clients.

Key Strategies for Managing Billing Documents

Here are some best practices for organizing and managing your financial records:

- Keep a Clear File Structure: Organize your records by client, date, or project. A consistent file naming system can help you quickly find any specific document when needed.

- Track Payment Status: Use a column or a separate sheet to track whether each payment has been completed. This makes it easier to follow up on overdue payments and prevents confusion about outstanding balances.

- Use Date Stamps: Make sure to include the date of issue for each document. This helps in identifying which documents are overdue and keeps your records chronological.

- Implement Version Control: Keep a history of any changes made to documents. If you modify a document for any reason, ensure that you save it as a new version to avoid confusion between previous and current records.

Optimizing Workflow for Efficiency

Streamlining the process for managing billing documents can save you time and reduce stress:

- Automate Calculations: Use built-in formulas to automatically calculate totals, taxes, and discounts. This reduces the chances of human error and saves time when creating new records.

- Maintain Consistent Formats: Standardize your document layout and structure. This consistency helps reduce mistakes and makes it easier for clients to understand the billing process.

- Backup Your Records: Regularly back up your files to avoid losing important information. Cloud storage or external drives can provide additional security for your documents.

By following these best practices, you can maintain better control over your billing documents, enhance accuracy, and improve your overall financial management process.