Download Free Sample Invoice Template in Excel Format

Creating accurate and professional documents for payment requests is essential for maintaining smooth financial transactions. Whether you’re a freelancer, small business owner, or a contractor, having a reliable method to generate these documents can save time and reduce errors. The right tool can help you stay organized and present a polished image to your clients.

Streamlining your billing process allows you to focus on your core business while ensuring timely payments. With the right structure, you can quickly input necessary details such as amounts, dates, and payment terms, without the hassle of manually creating documents from scratch each time.

In this guide, we’ll explore various resources that can simplify this task and provide you with a flexible structure to suit your needs. You’ll discover how to easily modify these tools to match your branding and business requirements, all while ensuring accuracy in your calculations and consistency in your format.

Free Sample Invoice Template in Excel

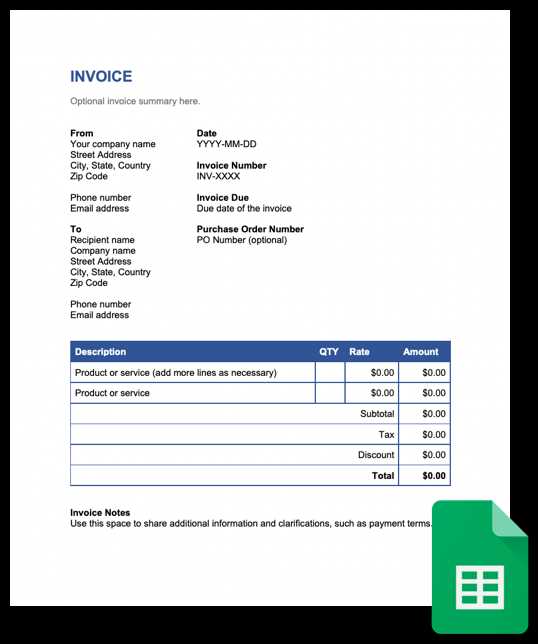

Having a well-organized document for billing purposes can significantly improve the efficiency of your business transactions. With the right structure, you can ensure that all important details are included in an easy-to-read format, which can be quickly customized for each client or project. The simplicity of such a document means less time spent on creating and more time for business operations.

Key Features of an Effective Billing Document

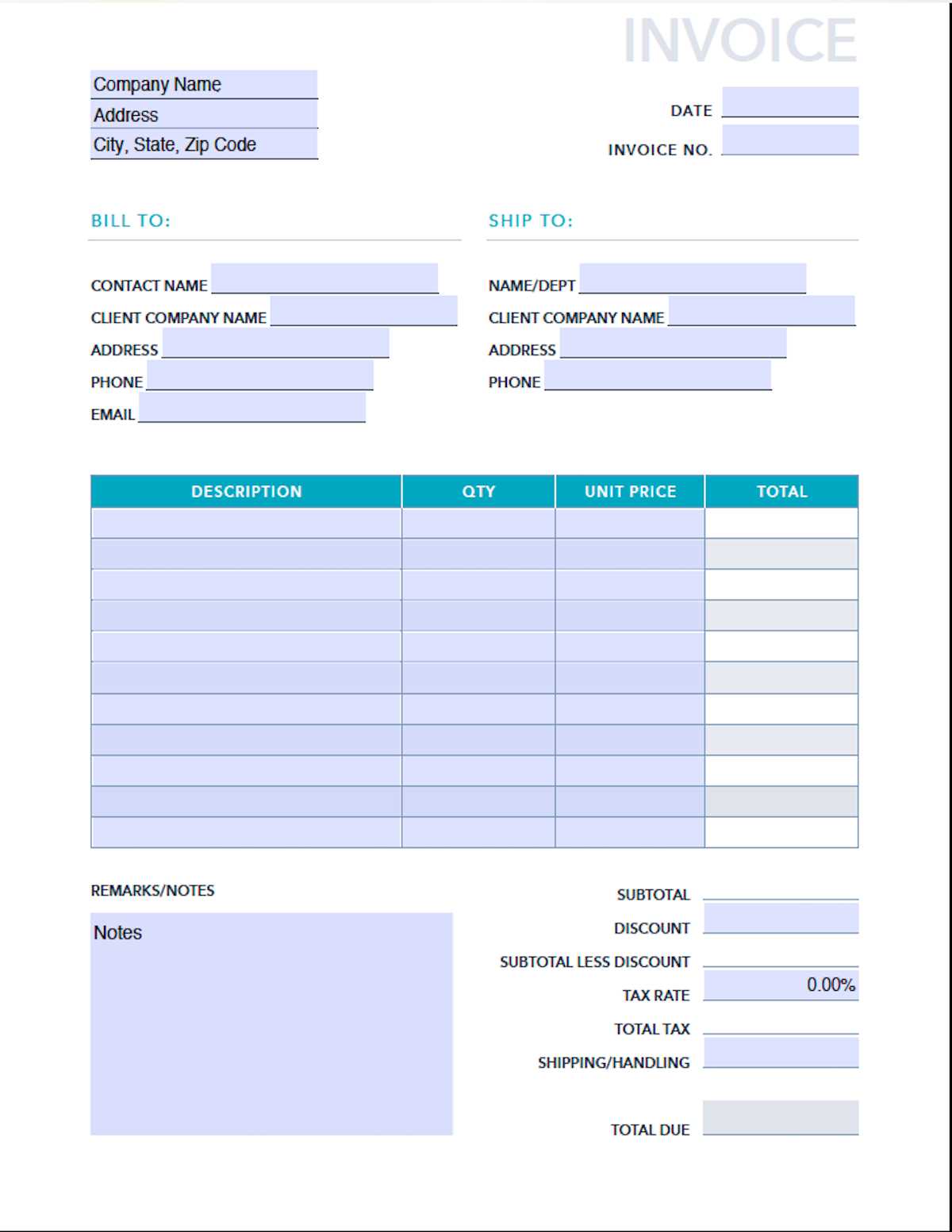

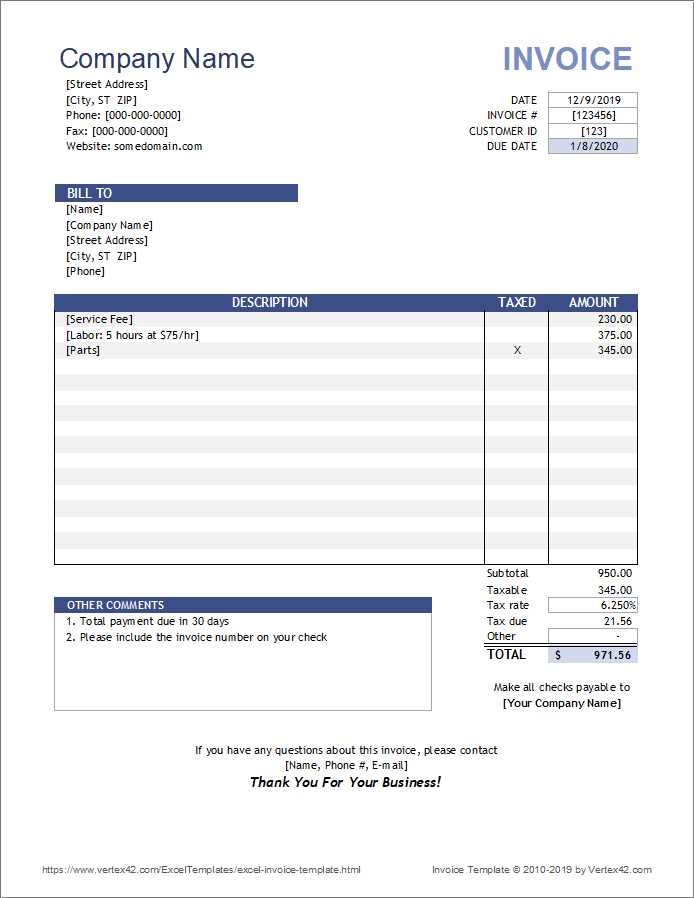

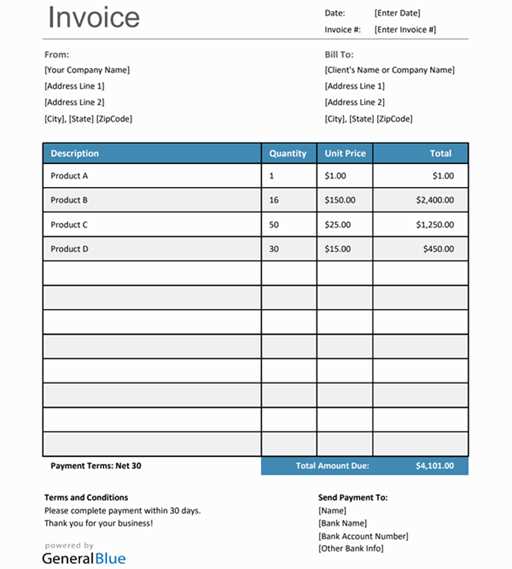

An effective payment request form should contain all the necessary information for your client to understand the charges and make a payment promptly. This includes clear itemization, payment terms, and contact details. The structure should also be easy to navigate, with rows and columns that make the information clear and well-organized.

How to Use a Customizable Document Structure

Using a flexible structure allows you to quickly adjust the document based on the unique needs of each transaction. You can add or remove sections depending on what you need to communicate, such as taxes, discounts, or additional services. This helps ensure that each client receives a personalized, professional request for payment.

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 10 hours | $50 | $500 |

| Web Development | 1 | $1200 | $1200 |

| Design Work | 5 hours | $75 | $375 |

| Total | $2075 | ||

In this example, you can easily adjust the descriptions, quantities, and prices to match your specific services. The built-in calculation tools can help ensure that totals are automatically updated when changes are made. This makes it quick to generate accurate documents with minimal effort.

Why Use Excel for Invoices

Using a spreadsheet program for creating payment requests offers numerous advantages, especially for small businesses or freelancers. With its flexibility and ease of use, this tool provides a straightforward way to organize and manage financial transactions. The ability to customize the structure, automate calculations, and track payment histories makes it a powerful option for many professionals.

Benefits of Spreadsheet Software for Billing

One of the main reasons to choose spreadsheet software for financial documents is its versatility. Whether you are creating a single document or tracking multiple transactions, the software can handle various requirements, from simple billing statements to more complex invoicing that includes taxes, discounts, or multiple services. Additionally, spreadsheet programs allow for quick edits and adjustments, which is ideal when dealing with frequent updates or changing client information.

Automating Calculations and Reducing Errors

Another key benefit is the ability to automate calculations. By setting up formulas within the document, you can ensure that totals, taxes, or discounts are calculated accurately every time you update an entry. This automation reduces the risk of human error and saves time, allowing you to focus on other aspects of your business.

| Service | Quantity | Unit Cost | Subtotal |

|---|---|---|---|

| Consulting | 5 hours | $60 | $300 |

| Development | 1 | $500 | $500 |

| Design | 3 hours | $45 | $135 |

| Total Amount | $935 | ||

In the example above, the automated calculations would instantly update if the quantity or price changes, ensuring that your figures are always correct and ready to be sent to your client. This reduces the time spent on administrative tasks and minimizes the chances of mistakes in the final document.

Benefits of Using Free Invoice Templates

Utilizing pre-designed forms for payment requests can significantly simplify the billing process for businesses and freelancers. These ready-to-use documents provide a professional structure and ensure that all necessary details are included, helping you save valuable time. Whether you’re just starting or have been in business for years, such forms offer a reliable solution for streamlining your financial operations.

Time-Saving and Efficiency

One of the main advantages of using pre-made documents is the amount of time you save. Instead of designing a new layout or starting from scratch every time, you can simply input the required details into an already structured form. This allows you to quickly generate accurate documents for multiple clients, ensuring your workflow remains efficient and uninterrupted.

Professional Appearance

By using pre-designed forms, you ensure that your billing statements look professional and polished. These forms often feature a clean, organized layout that clients will recognize and appreciate. With clearly defined sections for dates, descriptions, and totals, your clients are more likely to trust the accuracy and reliability of your request for payment.

Customization and Flexibility

Although these forms are pre-designed, they are highly customizable to meet your specific business needs. You can adjust the layout, modify the fields, or add additional information such as discounts or payment terms. This flexibility allows you to tailor the form to match your branding, ensuring consistency across all your client communications.

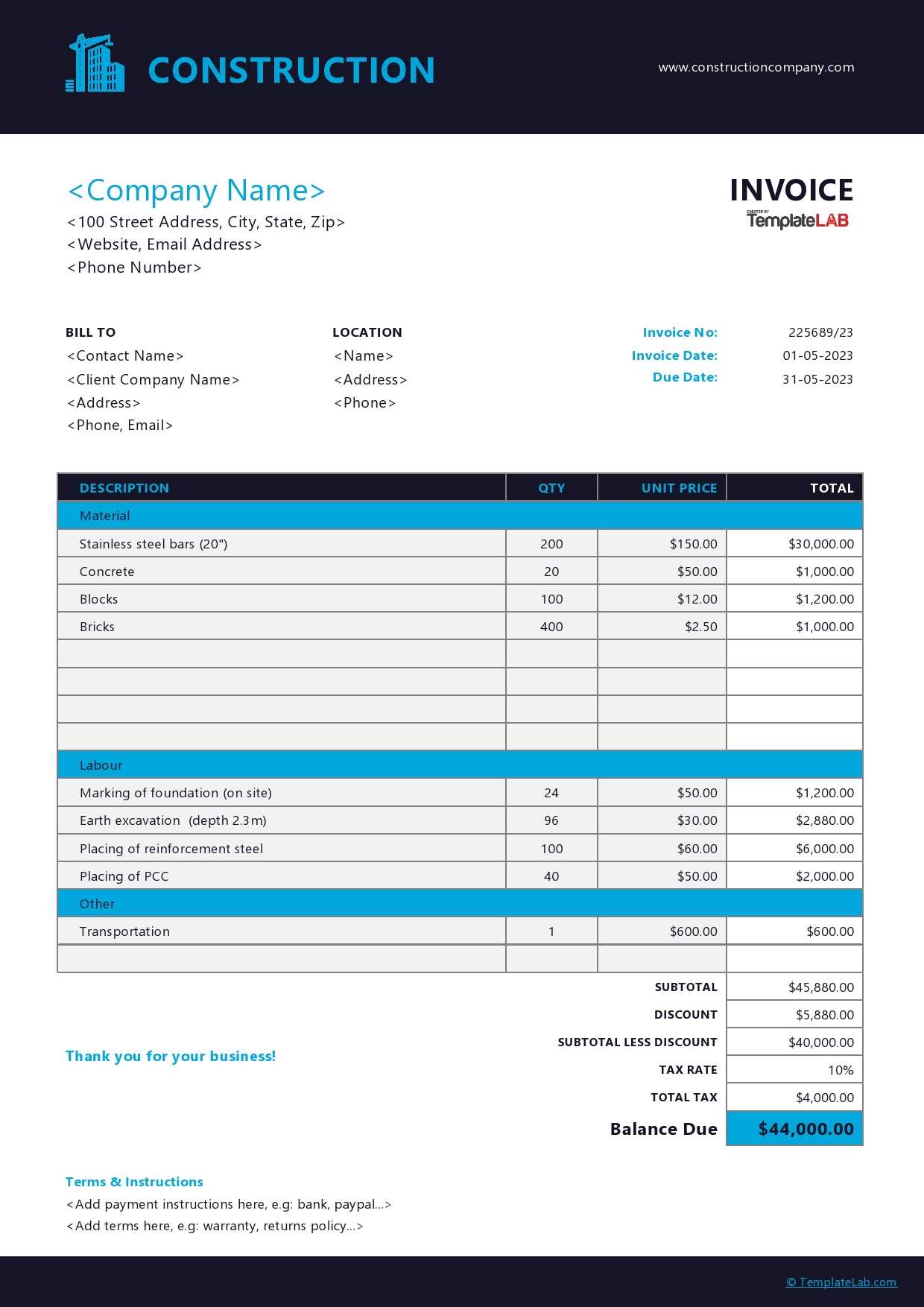

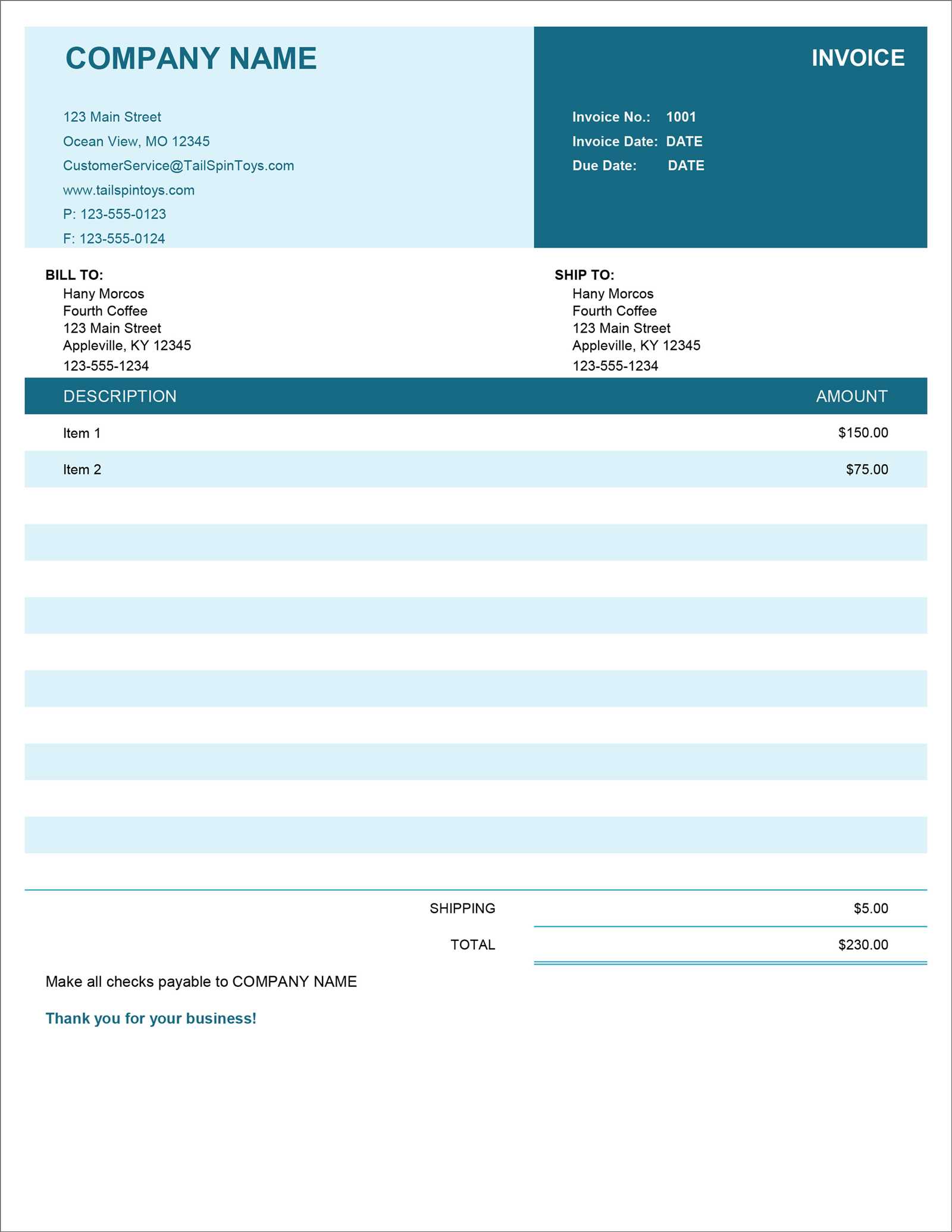

How to Customize Your Invoice Template

Personalizing your billing documents is essential for ensuring they accurately reflect your business and maintain consistency across all communications. Customizing your forms allows you to include specific details that are relevant to your services and branding. Whether you want to add your company logo, adjust the layout, or incorporate custom fields, the process is straightforward and offers great flexibility.

Steps to Modify Your Billing Document

Follow these simple steps to personalize your financial documents:

- Update Company Information: Make sure your business name, address, and contact details are correct and prominently displayed at the top of the form.

- Add Your Logo: Insert your logo in a corner or header area to reinforce your brand identity and make the document look more professional.

- Adjust Layout and Design: Customize the font, colors, and spacing to match your brand style. Choose colors that align with your company’s visual identity.

- Modify Fields: Depending on your needs, you can add extra sections for things like taxes, discounts, or additional services. Make sure the document includes all the relevant fields required for each transaction.

- Include Payment Terms: Clearly specify payment due dates, late fees, or any other important terms to avoid confusion and ensure timely payments.

Customizing for Specific Clients

In addition to general customization, you can adjust each document for individual clients or projects. This can include adding project descriptions, varying payment structures, or detailing specific services provided. By tailoring your forms to each client’s unique needs, you ensure clarity and professionalism in your communication.

- Project Descriptions: Include a brief overview of the work completed for each client, especially for long-term projects or services with multiple phases.

- Flexible Payment Structures: Customize payment schedules, such as deposits, installment payments, or milestone-based billing.

- Special Terms: Add any client-specific terms, such as volume discounts or custom rates, to avoid misunderstandings.

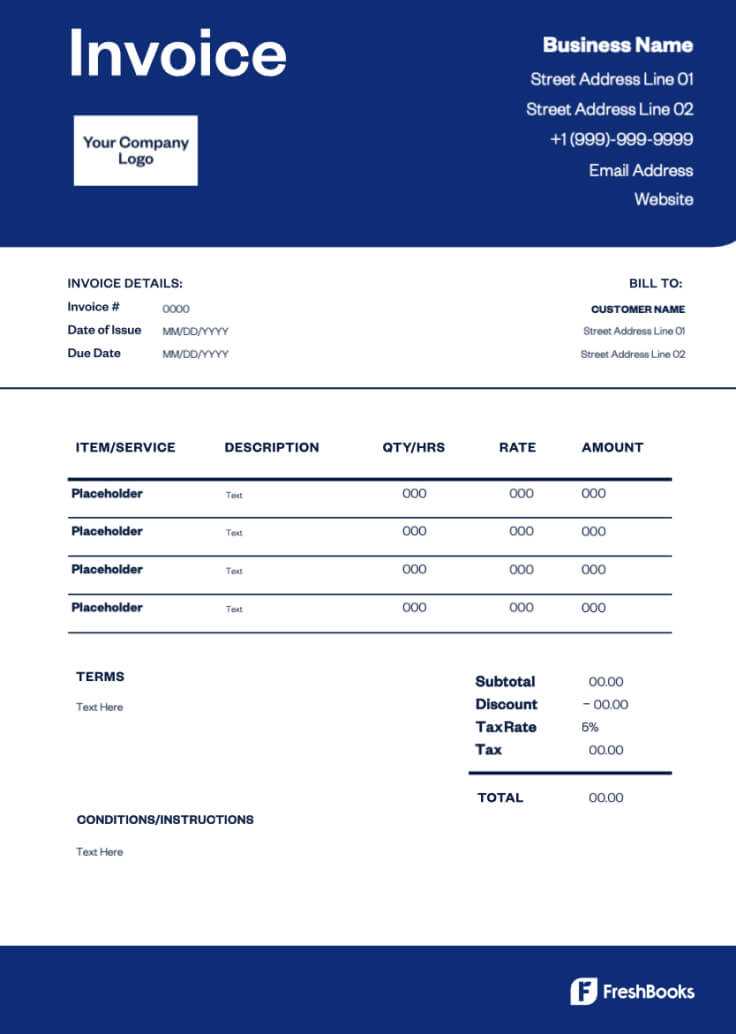

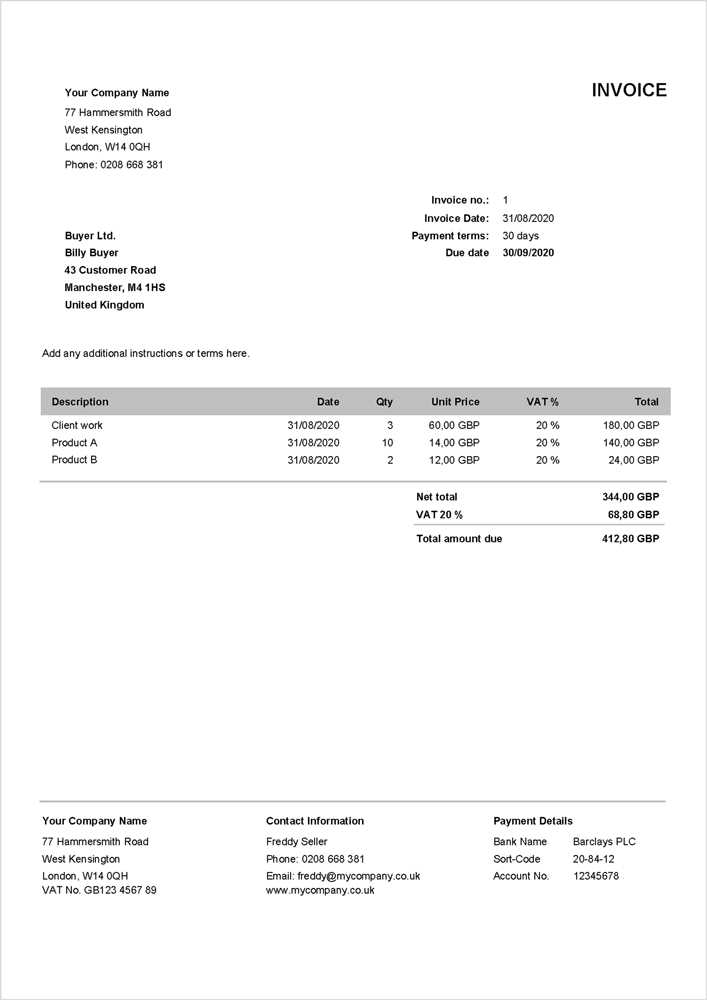

Key Elements of an Invoice

For any business, a payment request document must be clear and well-structured to ensure smooth transactions and proper communication with clients. Including all necessary information helps avoid confusion and ensures that both parties understand the terms of the agreement. Here are the essential components that should be present in every billing document.

| Element | Description |

|---|---|

| Business Information | Include your company name, address, phone number, and email for easy contact. |

| Client Details | List the name, address, and contact information of the person or business being billed. |

| Unique Identifier | Assign a unique number or code to each document for tracking and reference purposes. |

| Issue Date | Include the date the document was generated to track the timing of the request. |

| Due Date | Clearly indicate when the payment is due to avoid any misunderstandings. |

| Itemized List of Services or Products | Break down the work or goods provided, including quantities, rates, and brief descriptions. |

| Total Amount | Provide a total cost, including taxes, discounts, or any other applicable charges. |

| Payment Terms | Include instructions on how payments should be made, such as bank account details or online payment options. |

These elements ensure that the document is not only complete but also professional. When these sections are clearly laid out, clients can easily understand the charges and respond promptly, leading to a smoother payment process and healthier cash flow for your business.

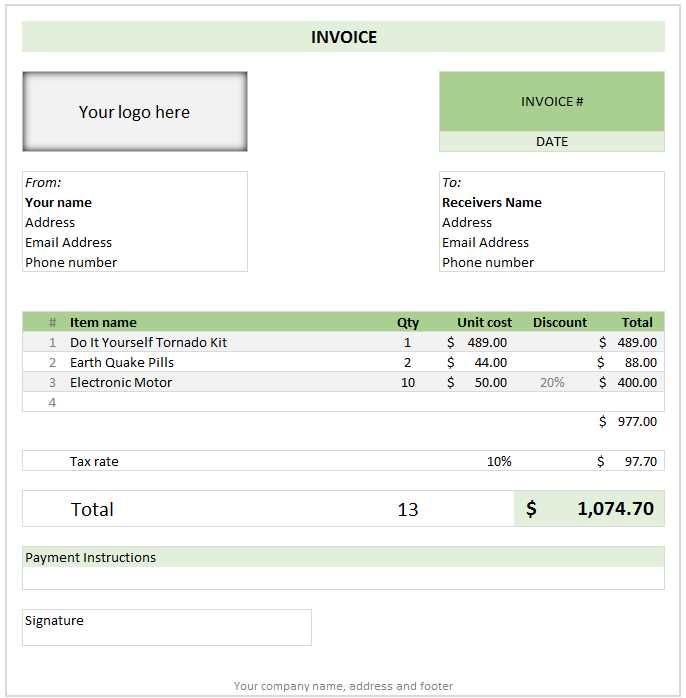

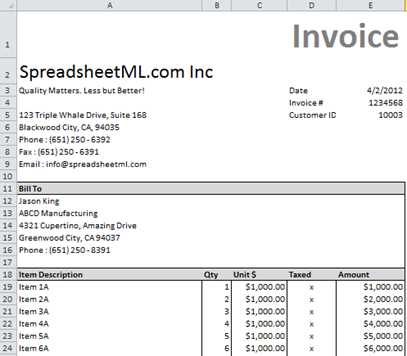

Steps to Create an Invoice in Excel

Creating a billing document in a spreadsheet program is a quick and efficient way to generate professional payment requests. With the flexibility to customize fields and automate calculations, this process can be easily adapted to meet your specific business needs. The following steps guide you through creating a well-organized document that ensures accuracy and saves time.

Step-by-Step Process to Build Your Document

Follow these simple steps to create a billing document that meets your requirements:

- Open a New Spreadsheet: Start by opening a blank spreadsheet to begin structuring your form.

- Set Up Header Information: Include your business details (name, address, and contact info) and client information (name, address, and contact details) at the top of the sheet.

- Create an Invoice Number: Assign a unique number for tracking purposes. This can be sequential or include client identifiers.

- Add the Date and Due Date: Make sure to clearly mark the issue date and payment due date, making it easy for clients to see when payment is expected.

- Itemize the Services or Products: In the following rows, list all the products or services provided. Include columns for descriptions, quantities, unit prices, and subtotals.

- Calculate Total: Use formulas to calculate the subtotal for each item and the overall total. Ensure taxes and any applicable discounts are included.

- Add Payment Instructions: Specify payment methods, bank details, or other necessary instructions for how the client can complete the payment.

Example Layout of Your Billing Document

Here’s a basic structure of what your billing document could look like:

| Item Description | Quantity | Unit Price | Subtotal | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Web Design Service | 1 | $500 | $500 | |||||||||||||

| Content Writing | 3 hours | $40 | $120 | |||||||||||||

| SEO Optimization | 5 hours | $60 | $300 | |||||||||||||

For businesses or individuals looking for a quick and efficient way to create payment requests, there are many places online where you can find customizable and downloadable document formats. These ready-made forms provide a convenient starting point and can be easily tailored to suit your specific needs. By using these resources, you can save time and ensure your documents meet professional standards. Online Resource WebsitesThere are several websites that offer downloadable document formats for billing purposes. These sites typically provide a variety of layouts, ranging from basic designs to more complex options with additional features like tax calculations or payment tracking. Some of the most popular sources include:

Business Software and Accounting ToolsSome business management and accounting software offer integrated tools for creating billing documents. Many of these tools come with pre-set formats that can be customized and exported into your preferred file format. Popular options include:

These resources are perfect for businesses of any size, offering quick access to high-quality, customizable document formats without the need for design experience. By choosing a platform that suits your business style, you can ensure your documents are professional and tailored to your needs. Common Invoice Mistakes to AvoidCreating payment documents might seem straightforward, but several common errors can cause confusion or delays in receiving payment. Whether you’re new to managing financial documents or have been in business for years, it’s important to be aware of the mistakes that can occur. Avoiding these pitfalls can help ensure smooth transactions and build trust with your clients. Common Errors in Payment Requests

Here are some frequent mistakes that businesses make when generating payment documents:

How to Prevent These MistakesTo avoid these common errors, double-check all details before sending the document. Implementing a checklist can help ensure that every key element is included and accurate. Additionally, using automated tools or pre-designed forms can reduce the chances of making mistakes, as they often come with built-in calculations and consistent formatting. By carefully reviewing your payment documents and paying attention to the details, you can maintain professionalism and avoid delays in receiving payments from your clients. How Excel Can Streamline BillingManaging financial records and creating billing documents can be time-consuming and error-prone without the right tools. However, using a spreadsheet program can significantly streamline the billing process by automating calculations, organizing data, and simplifying the customization of forms. With a few basic steps, you can create a system that allows you to generate accurate and professional payment requests efficiently. Automating Calculations and Reducing ErrorsOne of the main benefits of using a spreadsheet program is the ability to automate complex calculations. By setting up formulas, you can ensure that totals, taxes, and discounts are calculated automatically. This reduces the likelihood of human error, especially when dealing with multiple items or varying rates. With each adjustment to the numbers, the document will update in real time, making the entire process faster and more accurate. Organizing Client and Transaction DataAnother way a spreadsheet program can simplify billing is by organizing client and transaction data in one place. You can create a master list of clients, including their contact details, payment histories, and specific billing terms. By linking this information to your payment forms, you can easily reference and update client details without manually entering them each time. This not only saves time but also ensures consistency across documents. Example: Instead of manually calculating the cost for multiple hours worked on a project, you can use a formula to multiply the hourly rate by the number of hours and automatically add any applicable taxes or discounts. Additionally, any changes made to the pricing model can be instantly reflected in future documents, ensuring that you always use the most up-to-date figures. Key Features to Streamline Billing:

With these features, spreadsheet programs can simplify the entire process of billing, making it easier to create, track, and manage payment requests. The efficiency gains not only save time but also help you maintain accuracy and professionalism in your business operations. How to Automate Invoice Calculations in ExcelAutomating calculations in a billing document is a powerful way to save time and ensure accuracy. By setting up formulas, you can quickly compute totals, taxes, discounts, and other fees without having to manually input numbers every time. This reduces the risk of errors and ensures that every payment request is consistent and professional. Here’s how to set up and use these automatic calculations in a spreadsheet program. Setting Up Basic Formulas for CalculationsThe first step in automating calculations is creating formulas for the essential fields. Some of the most common calculations you’ll need are for item subtotals, totals, and taxes. Here’s a simple approach:

Using Functions to Enhance AutomationTo make your billing document even more efficient, you can use built-in spreadsheet functions that further automate the process. Here are some examples:

By using these functions and formulas, you can automate the process of calculating each component of your billing document. This ensures that the calculations are correct and that updates are reflected immedi Design Tips for Professional InvoicesWhen creating billing documents, the design is just as important as the content. A well-designed payment request not only looks professional but also makes it easier for clients to understand the details and process payments. A clean, organized layout can help prevent errors and foster trust between you and your clients. Here are some key design tips to ensure your documents are both functional and visually appealing. Essential Design ElementsTo create a visually effective document, certain elements must be clearly organized. These key components should always be included:

Visual Clarity and Professional AppearanceA well-structured layout will help guide the reader’s eye and make the document easy to follow. Here are some additional tips for enhancing the design:

By following these design principles, you ensure that your billing documents are not only functional but also polished and easy to understand. The clearer and more professional your documents look, the more confident your clients will be in processing payments promptly and efficiently. How to Track Payments with ExcelTracking payments is essential for maintaining accurate financial records and ensuring your business’s cash flow remains steady. Using a spreadsheet program to track incoming payments allows you to stay organized and easily access all the information you need in one place. With the right setup, you can monitor payment statuses, overdue amounts, and client histories, all while saving time and reducing the risk of errors. Setting Up a Payment Tracking SystemTo effectively track payments, it’s important to create a well-structured system that captures all necessary details. Follow these steps to get started:

Using Conditional Formatting to Track Overdue PaymentsTo easily identify overdue payments, you can use conditional formatting to highlight any entries that have not been paid by the due date. This makes it simple to spot late payments and take appropriate action.

Summarizing Payment DataAt the end of each billing cycle, summarizing your payment data can help you assess your business’s financial health. Use the SUM function to calculate total payments received, total amounts due, and outstanding balances. This allows you to have a clear overview of your financial status at any time.

|

||||||||||||||||