Coaching Invoice Template for Easy and Professional Billing

For service providers, ensuring timely and accurate payments is a crucial part of running a successful business. One of the most important steps in this process is designing a clear and effective financial document that outlines the services rendered, payment amounts, and due dates. Whether you’re working with clients on a one-time project or a long-term arrangement, a well-structured document helps streamline the entire billing experience.

Customizing such documents to fit your specific needs can improve communication with clients, eliminate misunderstandings, and make your business appear more professional. This guide will walk you through the essentials of crafting an efficient billing statement, offering advice on what information to include and how to format it to ensure smooth transactions.

By using ready-made structures or building your own, you can create personalized statements that reflect your brand and maintain consistency in how you present your services. The flexibility to modify these documents allows you to adapt to different client needs and billing cycles, making the process both straightforward and effective.

Coaching Invoice Template Overview

When managing client relationships, having a well-organized and professional financial document is essential for maintaining smooth transactions. A structured form allows service providers to communicate the cost of their offerings clearly, helping clients understand what they are being charged for and when payments are due. This document serves not only as a request for payment but also as a formal record of the services completed.

Creating an effective financial statement requires more than just listing amounts owed. It involves capturing key details such as the scope of services, the time frame in which they were provided, and the agreed-upon rates. By including all relevant information, both parties can avoid confusion and ensure that expectations are met. In the next section, we will explore the main components that make up a comprehensive billing document for service providers.

Why You Need a Coaching Invoice

For anyone offering professional services, having a clear and structured document for requesting payment is essential. This ensures that both the service provider and the client are on the same page regarding the costs and terms of the agreement. Without such a record, misunderstandings or delays in payment can easily arise, which can lead to frustration and even damage client relationships.

Using a formal billing document not only helps you track your income but also protects both parties by providing a legally binding agreement for services rendered. By specifying all important details such as payment amounts, services, and deadlines, this document ensures clarity and transparency, making the entire process more efficient.

Benefits of Using a Professional Billing Document

| Benefit | Description |

|---|---|

| Clear Communication | Provides a straightforward breakdown of services and fees, reducing the chance for disputes. |

| Record Keeping | Helps keep accurate financial records for tax purposes and future reference. |

| Professional Image | Demonstrates a high level of professionalism, which can help build trust with clients. |

| Timely Payments | Clearly states payment deadlines, encouraging clients to settle invoices on time. |

How It Streamlines Your Business

Having a standardized document in place streamlines the billing process, saving both time and effort. With a clear record of all financial transactions, you can focus more on providing value to your clients and less on chasing payments or resolving payment issues.

Key Elements of a Coaching Invoice

A well-structured financial document must include all essential information that clearly communicates the details of the services provided and the payment required. The key elements ensure that both the service provider and the client are aligned on expectations, preventing confusion and ensuring timely compensation. These core components not only help maintain professionalism but also make the payment process more efficient and transparent.

When creating a billing document, it’s important to include several key pieces of information to avoid any misunderstandings and keep track of the transaction. Below are the essential elements that every service request statement should have.

| Element | Description |

|---|---|

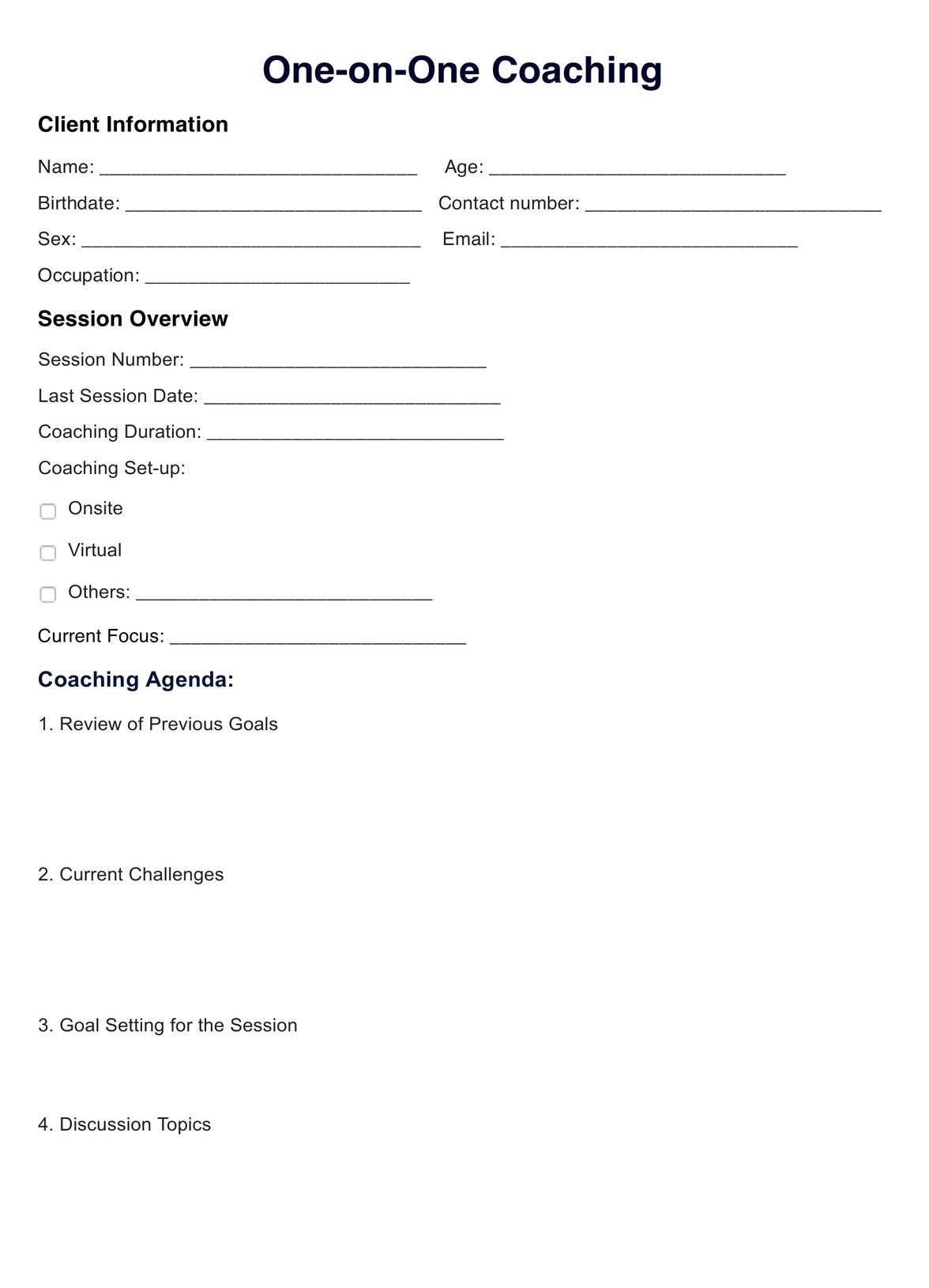

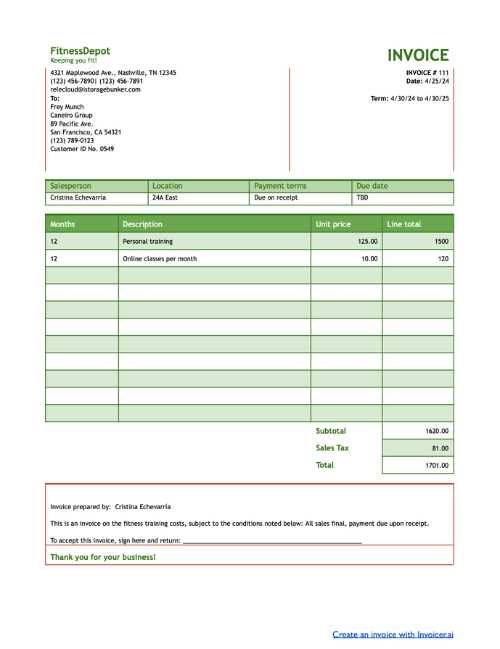

| Client Information | Include the full name, address, and contact details of the client for proper identification and communication. |

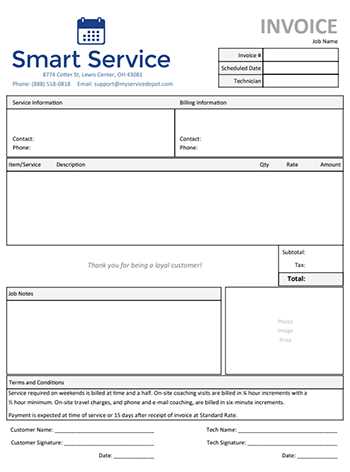

| Service Provider Details | Clearly state your name or business name, address, and contact information, ensuring your client knows how to reach you. |

| Service Description | Provide a detailed breakdown of the services rendered, including dates, duration, and specific tasks completed. |

| Amount Due | List the total amount owed, including rates for individual services, and any applicable taxes or discounts. |

| Payment Terms | Clearly define payment deadlines, methods of payment accepted, and any late fees or penalties for delayed payments. |

| Invoice Number | Assign a unique reference number to the document for tracking purposes and maintaining records. |

| Date | Indicate the date the document was issued and the due date for payment to avoid confusion. |

Including these elements ensures that your billing documents are complete and clear, helping to create a smooth payment experience for both you and your client. In the next section, we’ll explore how to customize this structure to suit your specific needs.

How to Create a Coaching Invoice

Creating a professional payment request document requires careful attention to detail. The goal is to produce a clear, concise statement that accurately reflects the services provided and the amount due, while also fostering trust and transparency with your clients. Whether you are crafting this document manually or using a pre-made structure, it’s important to ensure that all relevant information is included and formatted correctly.

Steps to Create a Payment Request Document

Follow these simple steps to build a clear and efficient financial statement:

- Choose the Right Format: Decide whether you want to use a digital or printed document. Digital formats can be easily customized, while printed ones may be suitable for more formal settings.

- Include Client and Service Provider Information: Ensure both your and your client’s contact details are listed at the top, making it easy to identify who is involved in the transaction.

- Detail the Services Rendered: Break down the services provided, including the time, scope, and any specific deliverables agreed upon.

- Specify Payment Amount: Clearly list the total amount due, including any taxes, discounts, or additional charges. If applicable, also mention the hourly rate or flat fee.

- Set Payment Terms: Include payment deadlines, accepted methods of payment, and penalties for late payments, if necessary.

- Add a Unique Reference Number: Assign a unique number to the document to help you keep track of transactions and facilitate future communications.

Customizing Your Document

Once you have all the essential details in place, you can tailor the document to suit your preferences and branding. Some ways to customize your payment request include:

- Personalizing the Design: Use your business logo, colors, and fonts to create a branded look.

- Including Payment Instructions: Add specific instructions for your clients on how to make payments, including account details or links to online payment platforms.

- Including Additional Notes: If you wish, include a message to thank your client or provide extra details about the services rendered.

By following these steps, you can create a professional and clear payment request document that streamlines the billing process and helps ensure prompt payment from your clients.

Choosing the Right Invoice Format

Selecting the right structure for your financial document is an important step in ensuring smooth transactions with clients. The format you choose should reflect your professional image, be easy to understand, and align with the needs of both you and your clients. Whether you opt for a digital or printed document, the goal is to make sure it’s clear, accurate, and easy to process.

Digital vs Printed Formats

When choosing between a digital or paper format, consider the preferences of your clients as well as the ease of use for your own business. Here are the main benefits of each option:

- Digital Format: Easily customizable and can be sent via email or through online platforms. It’s more convenient for both parties and can often be processed faster.

- Printed Format: Ideal for formal settings or if your clients prefer physical documentation. It can be mailed or handed over in person, adding a personal touch to the transaction.

Key Considerations for Format Selection

When selecting the format for your financial request document, keep these factors in mind:

- Client Preferences: Consider how your clients prefer to receive their bills. Some may prefer digital formats for convenience, while others may request paper copies for record-keeping purposes.

- Customization Needs: Digital formats offer more flexibility in customization, allowing you to adjust layouts, fonts, and logos easily to reflect your brand.

- Speed of Payment: Digital documents tend to expedite the payment process due to faster delivery and tracking options, while paper bills may take longer to reach clients.

- Record Keeping: Both formats allow you to maintain records, but digital versions are easier to store, organize, and retrieve when necessary.

Ultimately, the format you choose should suit both your workflow and your client’s preferences. By offering a format that is accessible and efficient, you can ensure a smooth and hassle-free billing experience for everyone involved.

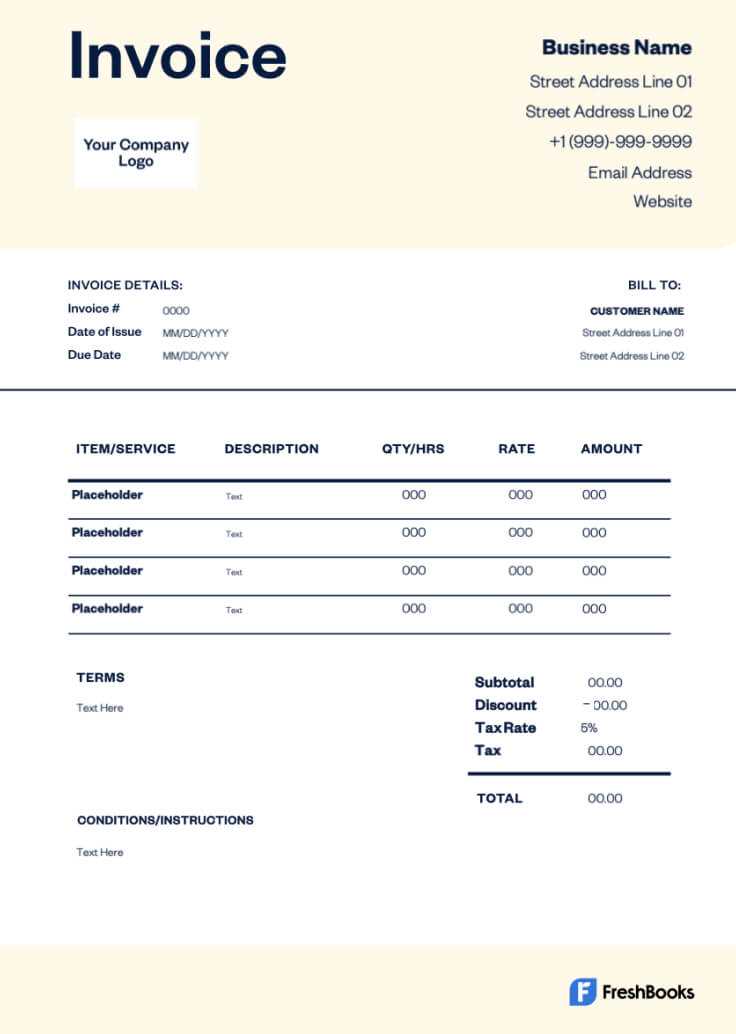

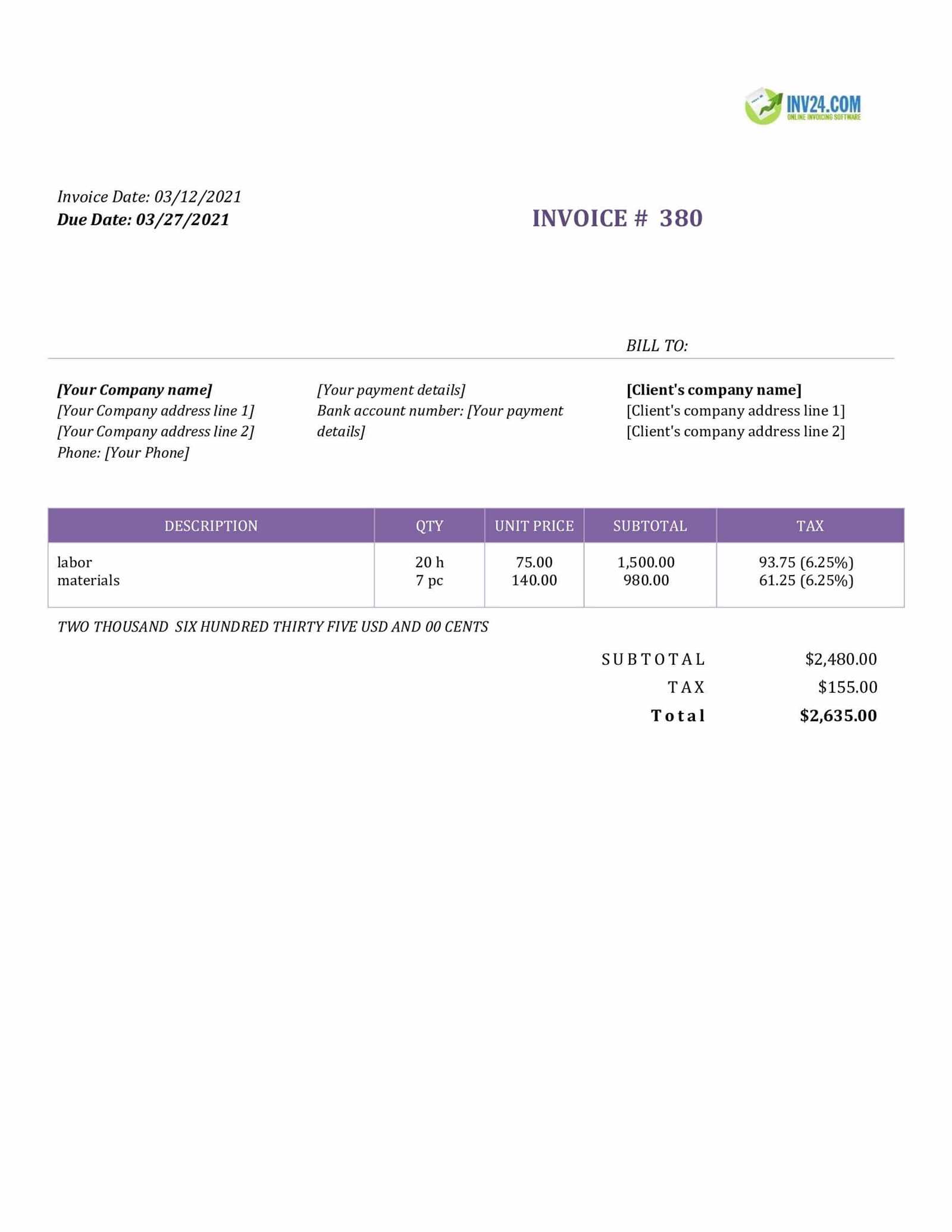

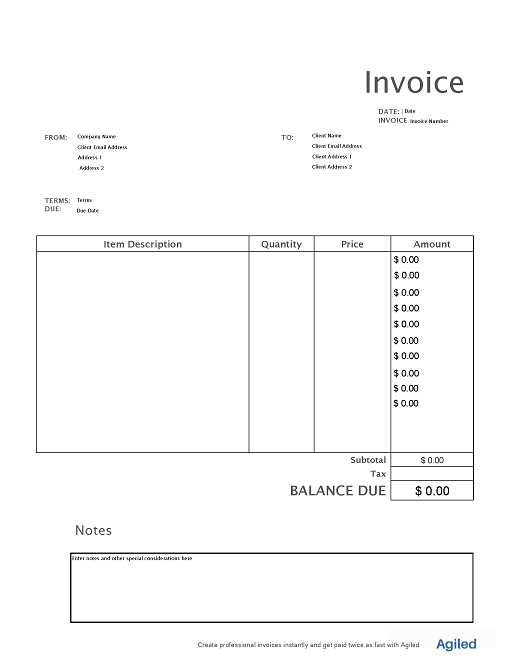

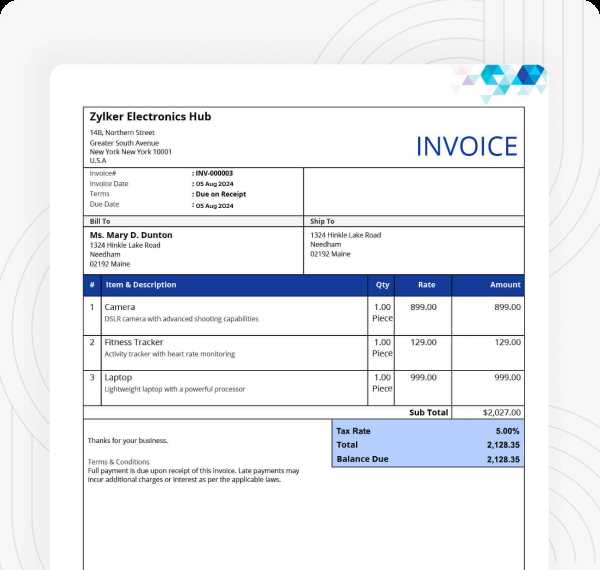

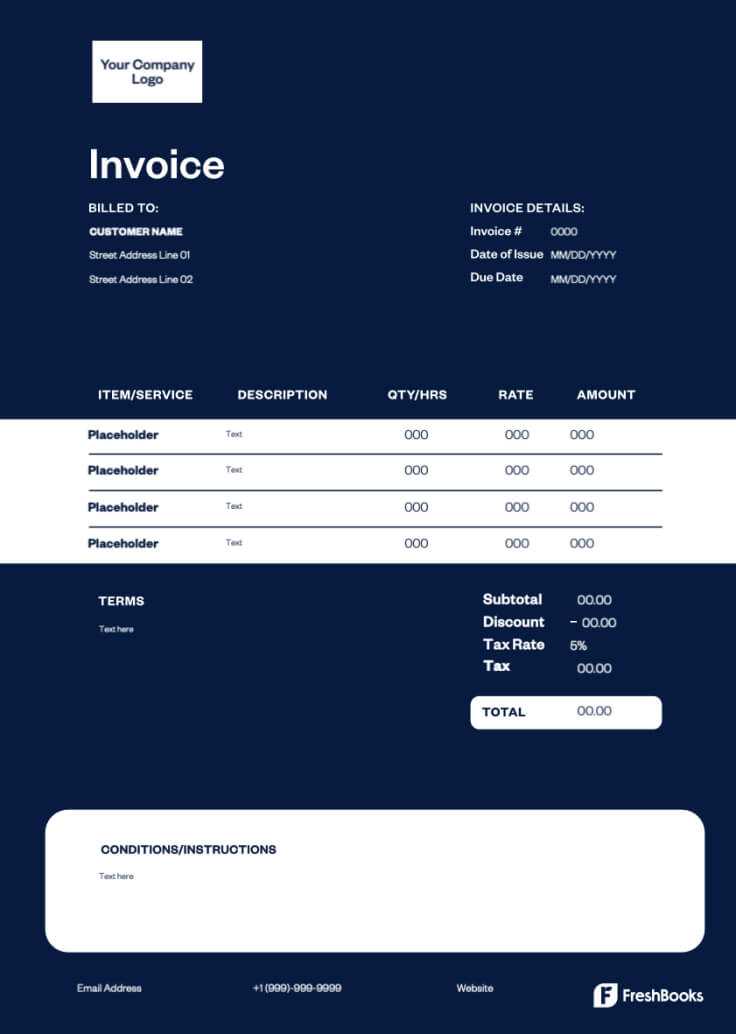

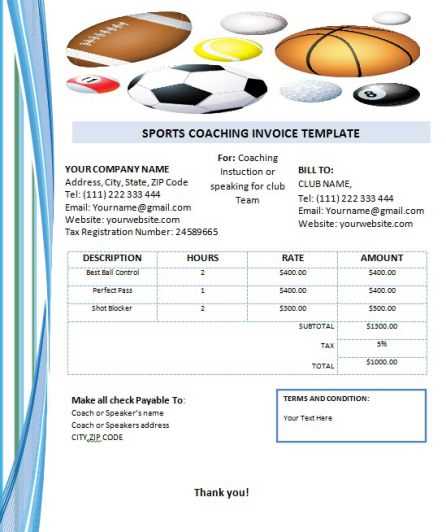

Free Coaching Invoice Templates

Many service providers prefer to use ready-made documents to simplify the billing process. These pre-designed structures can save time and effort, offering a professional format that’s easy to fill in with relevant details. Using a free structure can be particularly helpful for those just starting out or anyone who wants to avoid the hassle of designing their own form from scratch.

There are numerous free options available online that cater to different needs and preferences. These templates can be customized to reflect your branding, services, and payment terms, making them a flexible solution for any business. Below are some key benefits of using free pre-made documents for your billing needs:

- Time-Saving: Pre-designed documents are ready to use, so you don’t have to start from zero.

- Professional Design: Templates are typically created by experts, ensuring your financial documents look polished and well-organized.

- Easy to Customize: You can quickly add your details, adjust rates, and tailor the content to suit each client.

- Accessible and Free: Many websites offer these documents for free, making them an affordable solution for small businesses and freelancers.

When selecting a free template, it’s important to ensure that it includes all necessary details such as service descriptions, payment terms, and contact information. This will help you avoid the need for additional correspondence or clarifications. Below are a few factors to consider when choosing the right one for your business:

- Compatibility: Make sure the document is available in a format you can easily edit, such as Word, PDF, or Excel.

- Customization Options: Look for templates that allow you to modify fonts, colors, and logos to match your business branding.

- Comprehensiveness: Ensure the structure covers all the necessary fields, including client details, payment terms, and service descriptions.

- Ease of Use: Choose a template that’s simple to fill out, with clear fields and intuitive layout.

By using a free pre-designed document, you can focus more on delivering your services and less on administrative tasks. These tools are a great way to streamline your billing process while maintaining a professional appearance with your clients.

Customizing Your Coaching Invoice

Personalizing your financial request document not only enhances professionalism but also helps reflect your unique business style. Customization allows you to tailor the form to your specific services, branding, and client needs. By adjusting the layout, content, and design, you can create a document that is both functional and aligned with your business identity.

Design Elements to Personalize

There are several ways you can modify the look and feel of your document to make it more personalized:

- Logo and Branding: Adding your logo and adjusting the color scheme to match your brand can create a cohesive experience for your clients.

- Fonts and Typography: Choose fonts that align with your business style, ensuring they are easy to read while maintaining a professional look.

- Contact Information: Customize your contact details, including social media links or additional methods of communication, to make it easier for clients to reach you.

Content Customization

In addition to visual adjustments, customizing the content of your financial request document can help make it more relevant to your business operations:

- Service Descriptions: Provide a detailed breakdown of the services you’ve offered, with clear pricing for each item if applicable.

- Payment Terms: Adjust payment deadlines, methods, and any discounts or penalties specific to each client or service agreement.

- Additional Notes: Include a personal message, such as a thank you note or a reminder about future sessions or engagements.

Customizing your document not only streamlines the payment process but also helps reinforce your brand identity and build stronger client relationships. By taking the time to personalize it, you create a more engaging and professional experience for your clients, making your business stand out in a competitive market.

Best Practices for Coaching Invoices

Creating a professional and effective financial request document is essential for maintaining smooth business operations and positive client relationships. Adhering to best practices ensures that the document is clear, accurate, and facilitates prompt payment. By following a few simple guidelines, you can avoid common mistakes and enhance the overall billing process.

Essential Best Practices

Below are some key practices to follow when preparing a financial request document:

| Practice | Description |

|---|---|

| Be Clear and Detailed | Provide a thorough breakdown of the services delivered, including dates, hours, and specific tasks. This ensures transparency and prevents misunderstandings. |

| Use Professional Language | Maintain a formal and respectful tone. Clear language helps to ensure the client understands the request and avoids confusion. |

| Provide Accurate Payment Terms | Clearly state the payment deadline, methods of payment, and any applicable late fees. Be explicit about due dates to encourage timely payments. |

| Number Each Document | Assign a unique reference number to each request document for easy tracking and organization of records. |

| Double-Check for Errors | Ensure all amounts, dates, and other details are correct before sending. Mistakes can delay payment and damage your professional reputation. |

Additional Tips for Efficiency

- Send the Request Promptly: Don’t delay sending your financial request document once services have been rendered. Sending it in a timely manner helps ensure prompt payment.

- Keep Records: Maintain a copy of all financial documents for future reference and tax purposes.

- Offer Multiple Payment Methods: Make it easy for clients to pay by offering several payment options (bank transfer, PayPal, credit card, etc.).

By following these best practices, you not only make the billing process smoother but also present yourself as a reliable and professional service provider. Clear and efficient financial documentation can strengthen client trust and contribute to the long-term success of your business.

Common Mistakes in Coaching Invoices

Even with the best intentions, errors can occur when preparing financial request documents, which can lead to delays in payment or confusion with clients. Common mistakes can undermine the professionalism of your business and create unnecessary complications. Identifying and avoiding these errors is crucial to ensuring smooth transactions and maintaining trust with clients.

Below are some of the most frequent mistakes made when creating financial request documents and how to avoid them:

Common Errors to Watch For

- Incomplete Client Information: Failing to include full details such as the client’s name, address, and contact information can cause delays in payment and make it difficult to track transactions.

- Unclear Service Descriptions: A vague or incomplete description of the services provided can lead to confusion. Ensure you list the exact services, hours worked, and any specific tasks to avoid misunderstandings.

- Incorrect Amounts: Double-check all figures to ensure that the total amount due is accurate, including hourly rates, discounts, and taxes. Mistakes in the amounts can lead to frustration and payment disputes.

- Missing Payment Terms: Not specifying payment deadlines, accepted methods of payment, or late fees can create uncertainty and delay payments. Always include clear and concise payment terms to avoid confusion.

- Neglecting to Include a Reference Number: A unique reference number for each document helps with tracking and organization. Without it, managing payments and follow-ups becomes more difficult.

- Failure to Proofread: Typos or incorrect information can damage your professional image. Always proofread the document carefully before sending it to ensure accuracy.

How to Avoid These Mistakes

- Double-Check Your Details: Always verify client information, service descriptions, rates, and amounts before finalizing your document.

- Use Clear and Specific Language: Be as specific as possible when describing services and pricing to avoid confusion.

- Set Clear Payment Guidelines: Ensure that payment terms, including deadlines and methods, are prominently displayed and easy to understand.

- Keep Organized Records: Assign unique numbers to each request document and maintain detailed records to stay organized.

- Review Before Sending: Take the time to proofread your document for errors and clarity before sending it to the client.

By being mindful of these common mistakes and taking the necessary steps to prevent them, you can ensure that your financial documents are clear, professional, and effective. A well-prepared request document helps foster better relationships with your clients and ensures timely payment.

Coaching Invoice for International Clients

Working with clients across different countries presents unique challenges when it comes to billing and payments. When creating a financial request document for international clients, it’s essential to account for various factors like currency, taxes, and payment methods. Addressing these elements upfront helps avoid confusion and delays, ensuring that both you and your clients are clear on the terms of the transaction.

Key Considerations for International Billing

When preparing a billing statement for clients outside your home country, consider the following important factors:

- Currency: Specify the currency in which the payment is expected. Make sure to clarify whether you are using your local currency or the client’s currency. Exchange rates should also be taken into account if necessary.

- Taxes and VAT: Different countries have varying tax regulations. Ensure that the appropriate tax rate is applied and clearly stated on the document. You may need to include your VAT number if working with clients in regions that require this information.

- Payment Methods: Provide options for how payments can be made. Online payment systems like PayPal, wire transfers, or international credit card payments may be necessary for clients in other countries.

- Payment Terms: Be clear about payment deadlines and any late fees that may apply, particularly when dealing with different time zones and international holidays that may affect payment schedules.

Tips for Smooth International Transactions

To ensure smooth transactions with clients abroad, here are some helpful tips:

- Set Clear Expectations: Outline all aspects of the payment process, including due dates and methods, to avoid misunderstandings due to time zone differences or cultural variations in payment practices.

- Use Reliable Payment Platforms: Choose a payment service that offers secure transactions and is widely accepted internationally, such as PayPal or international bank transfers.

- Provide Clear Instructions: If the client is unfamiliar with your preferred payment method, include detailed instructions on how to make the payment, ensuring a smooth process for both parties.

By addressing these considerations, you can simplify the billing process for international clients and reduce potential delays or issues with payments. A well-prepared financial request document tailored to the specifics of international transactions will foster trust and ensure that your global business runs efficiently.

How to Calculate Coaching Fees

Determining the right fees for your services is crucial for ensuring your business remains profitable while staying competitive in the market. Setting your rates involves considering several factors, such as the time invested, your expertise, and the market demand. Properly calculating your fees not only reflects the value you provide to clients but also ensures that you are compensated fairly for your work.

Factors to Consider When Setting Fees

There are multiple aspects to take into account when determining how much to charge for your services. Below are the key elements to consider:

- Experience and Expertise: If you have specialized knowledge or extensive experience, you may be able to charge higher rates compared to those who are just starting out in the field.

- Time Spent: Calculate how much time you dedicate to each session or package. Consider both the actual time spent with clients and any prep work involved.

- Market Rates: Research what others in your industry are charging to ensure your rates are in line with industry standards. Overcharging or undercharging can impact your credibility and ability to attract clients.

- Client Type: Different clients may have different expectations and budgets. Adjust your rates accordingly based on the type of client (individuals, groups, corporate clients, etc.).

- Location: If you are providing services internationally, consider any differences in income levels or local economies that may affect what clients are willing to pay.

Methods to Calculate Your Fees

There are a few different methods to determine your rates based on the above factors:

- Hourly Rate: One of the simplest methods is to set an hourly rate. Calculate how much you want to earn per hour and apply that rate to the time spent with each client. This method is suitable for one-on-one sessions or short-term engagements.

- Package Pricing: For longer-term clients or those purchasing multiple sessions, you can offer package deals. This approach gives clients a discounted rate for purchasing multiple services upfront, while also ensuring you’re committing to an ongoing relationship.

- Value-Based Pricing: Set your fees based on the value you provide to the client. This method takes into account the results your clients can expect and what they are willing to pay for a transformative experience.

By considering these factors and pricing strategies, you can establish a rate that reflects both your expertise and the market demand. Regularly reviewing your fees based on changes in the industry or your

Digital vs Paper Coaching Invoices

When it comes to sending financial documents to clients, service providers often face a choice between digital or traditional paper formats. Both methods have their advantages and disadvantages depending on the nature of the business, the preferences of the client, and the administrative resources available. Understanding the key differences between these two approaches can help you choose the best option for your business operations.

Advantages of Digital Financial Documents

In recent years, digital documents have become increasingly popular due to their convenience and efficiency. Here are some of the main benefits of going digital:

- Speed: Sending a digital financial request document via email or online platform is nearly instantaneous. This ensures quicker delivery and can lead to faster payments.

- Convenience: Clients can access and store digital documents anywhere, making it easy for them to refer back to them at any time without worrying about lost papers.

- Cost-Effective: Digital documents eliminate the costs associated with printing, paper, and postage, which can add up over time.

- Environmentally Friendly: Reducing paper use contributes to a more sustainable business practice and minimizes your environmental footprint.

- Easy to Track and Organize: Digital files can be easily stored, indexed, and retrieved using simple software tools, helping you stay organized and reducing the risk of losing records.

Advantages of Paper Financial Documents

Despite the growing trend toward digital documentation, there are still cases where traditional paper documents may be preferred or necessary. Below are some reasons why businesses might choose to stick with paper:

- Personal Touch: Some clients may appreciate the personal touch of receiving a physical document, especially in more formal or traditional industries.

- Legal Requirements: In some jurisdictions, paper documentation may be legally required for certain transactions, particularly for larger payments or international dealings.

- Better for Certain Clients: Some clients, particularly those not familiar with digital tools, may find paper forms easier to manage and more trustworthy.

- No Technical Barriers: Paper documents don’t require an internet connection or digital literacy to view, ensuring that they are accessible to everyone regardless of their technological proficiency.

Choosing between digital and paper financial request documents largely depends on your business model, your client base, and your operational priorities. For many modern businesses, a mix of both methods works best, depending on client preferences or specific circumstances. However, as digital technologies continue to evolve, the trend is moving toward paperless solutions for greater efficiency and cost savings.

Coaching Invoice Payment Terms Explained

Setting clear payment terms is crucial for both service providers and clients to ensure smooth transactions and avoid misunderstandings. Payment terms outline when and how clients are expected to pay, as well as any penalties for late payments. By clearly defining these terms, you establish transparency and help ensure timely payments for your services.

Common Payment Terms to Include

When preparing a financial request document, it’s important to outline the payment terms clearly. Here are some common terms that should be included:

- Due Date: Specify when the payment is due. This could be a specific date or a number of days after the service is provided (e.g., “Payment due within 30 days”).

- Accepted Payment Methods: List the payment methods you accept, such as bank transfer, credit card, PayPal, or other online payment systems. This ensures clients know their options.

- Late Fees: If applicable, include information about any penalties for late payments. This might be a fixed fee or a percentage of the total amount due after a certain number of days beyond the due date.

- Discounts for Early Payment: Offering discounts as an incentive for early payment can encourage prompt settlements. For example, “2% discount for payments made within 10 days.”

- Installments: If the payment amount is significant, you might offer the option of installment payments. This could be a series of payments over a specified period.

- Currency and Exchange Rates: If you work with international clients, be clear about the currency in which payment is expected and whether exchange rates will affect the amount due.

How to Communicate Payment Terms Effectively

Proper communication of payment terms can help prevent disputes and misunderstandings. Here are a few tips for making sure your terms are clear and well-received:

- Be Clear and Direct: Ensure your payment terms are stated clearly, avoiding any ambiguity. Use simple language to describe due dates, late fees, and other important details.

- Provide Multiple Payment Options: The more convenient you make the payment process, the more likely clients are to pay on time. Offering different payment methods ensures accessibility for everyone.

- Highlight Important Dates: Make key dates, such as the due date or discount period, stand out in the document. This can reduce confusion and increase the likelihood of prompt payments.

- Confirm Terms with Clients: Before finalizing the financial request document, confirm the terms with your client to ensu

Coaching Invoice for Recurring Payments

For businesses that offer subscription-based or ongoing services, it is essential to set up a clear and consistent process for managing payments. Recurring billing can save time and ensure continuous cash flow, but it requires a well-structured approach. Establishing an effective system for managing regular payments ensures that clients are billed accurately and on time, while minimizing administrative overhead.

Key Elements for Recurring Billing

When creating a financial request document for clients with recurring payments, there are several important factors to consider:

- Billing Frequency: Clearly define how often payments are due, whether it’s weekly, monthly, or annually. This ensures the client knows when to expect each payment request.

- Amount to Be Paid: Specify the agreed-upon amount to be charged for each billing cycle. Ensure that this amount reflects any discounts or additional fees based on the length of the subscription or package.

- Start and End Dates: Indicate the start and end dates of the billing period, particularly if the service is tied to a specific subscription term or contract.

- Payment Methods: Offer clear options for how clients can pay. Common methods for recurring payments include credit cards, direct bank transfers, or automatic payment platforms like PayPal.

- Renewal and Cancellation Terms: Outline the conditions under which the subscription will renew automatically or the process for canceling the recurring service. Make it clear when clients are able to modify or terminate their subscription.

Best Practices for Managing Recurring Payments

To ensure that your recurring payment system runs smoothly, here are some best practices:

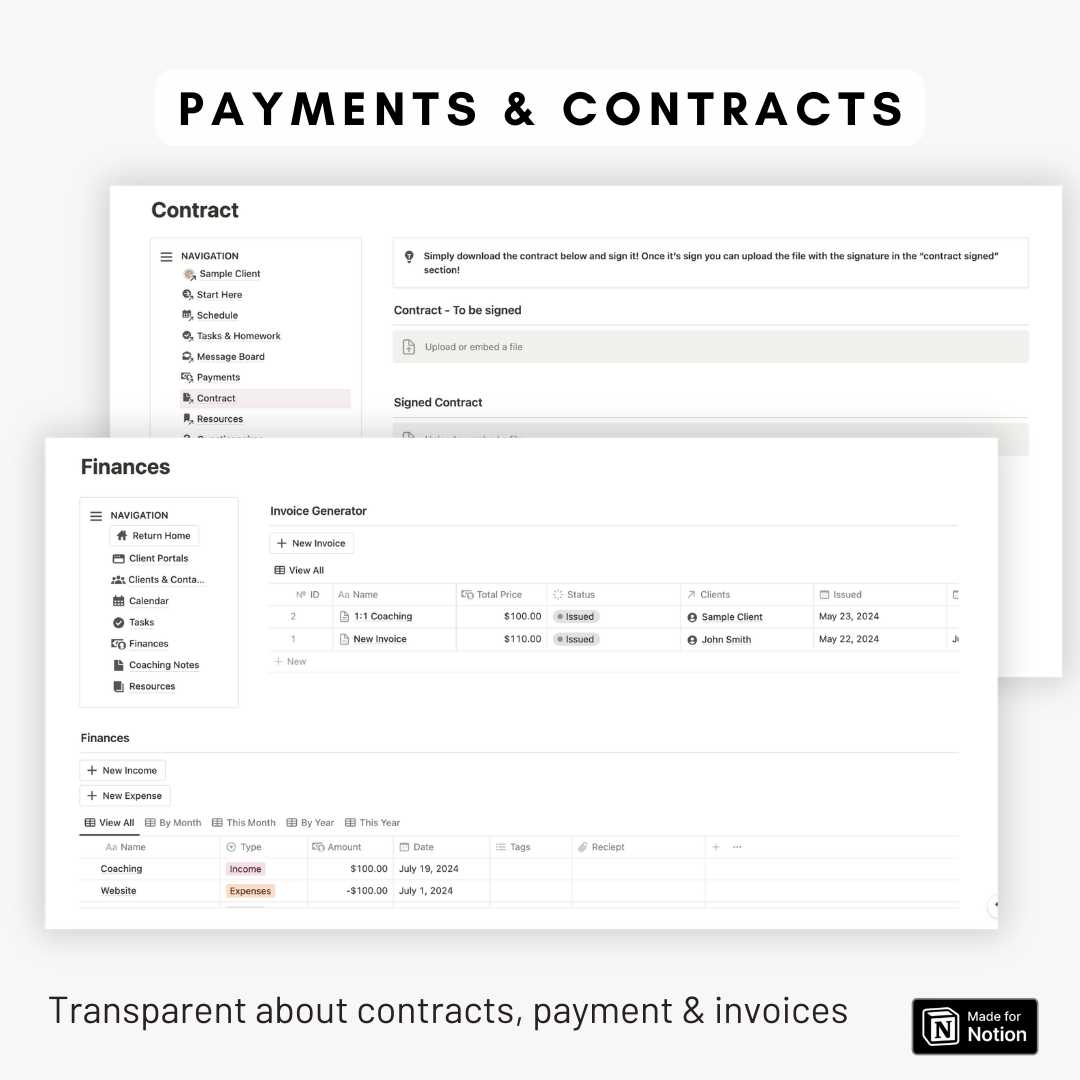

- Automate the Process: Use a reliable payment processing platform that supports recurring billing to automate payments and reduce the risk of human error. Automation also ensures payments are received on time.

- Provide Clear Terms: Transparency is key when dealing with recurring payments. Be sure your clients fully understand the payment structure, including frequency, amount, and cancellation policies.

- Send Reminders: Consider sending reminders to your clients before each payment is due. This helps avoid confusion and ensures timely payments.

- Offer Discounts for Long-Term Commitments: To encourage longer-term contracts, consider offering discounts or incentives for clients who commit to extended periods, such as six-month or yearly plans.

Recurring billing is an excellent way to streamline your payment processes and provide consistent service to clients. By clearly outlining terms and automating the system, you can minimize administrative work and create a more efficient way to manage long-term relationships with clients.

Coaching Invoice Legal Requirements

When providing professional services and issuing financial documents, it’s crucial to adhere to the relevant legal requirements to ensure compliance and protect both parties involved. Legal obligations surrounding billing include ensuring that certain information is included, following tax laws, and respecting any jurisdiction-specific regulations. By understanding these requirements, service providers can avoid legal complications and maintain professional integrity.

Essential Legal Information to Include

Regardless of the nature of the services, there are key elements that must be present on every financial request document to make it legally valid. Below are some of the most critical components:

- Service Provider Details: Always include your full name or business name, address, and contact information. If you’re registered for VAT or any other relevant tax, include your tax identification number.

- Client Information: Include the full name or business name and address of the client. This helps identify the parties involved and is crucial in the event of a dispute.

- Issue Date and Due Date: Clearly state the date when the financial request document is issued and the due date for payment. This is important for tracking payment timelines and for any legal proceedings related to overdue payments.

- Description of Services Provided: Include a detailed description of the services you provided, specifying what the client is paying for. This helps avoid any misunderstandings or disputes over the scope of the work.

- Total Amount Due: State the total amount due for the services provided, including any taxes or additional fees. Break down the charges if necessary, so that the client can easily understand how the total was calculated.

- Tax Information: In many jurisdictions, service providers must collect and remit taxes on the services they provide. Ensure that the applicable tax rate (such as VAT or sales tax) is clearly shown, along with the amount charged.

Jurisdiction-Specific Considerations

Different regions and countries may have specific regulations regarding the creation and delivery of financial documents. Here are some jurisdiction-specific considerations:

- Value Added Tax (VAT): In the European Union and other VAT-registered countries, service providers must collect VAT on applicable services. Ensure your financial documents reflect the correct VAT rates and that you’re adhering to local tax laws.

- Retain Copies for Re

Tools to Manage Coaching Invoices

Managing financial documents for services can become time-consuming without the right tools. Fortunately, there are many digital solutions available that streamline the process of creating, sending, and tracking payments for regular services. Using specialized software and platforms can simplify administrative tasks, reduce errors, and ensure you maintain a professional appearance with clients. These tools often provide additional features such as automatic reminders, easy payment processing, and detailed reporting.

Popular Tools for Managing Financial Documents

There are several highly-rated platforms and software tools designed specifically to help businesses manage their billing efficiently. Here are some of the most popular ones:

- FreshBooks: FreshBooks is a user-friendly tool designed for service-based businesses. It offers customizable billing templates, time tracking, and easy invoicing. It also integrates with a variety of payment gateways, making it convenient for clients to pay online.

- QuickBooks: Known for its comprehensive accounting features, QuickBooks also includes invoicing capabilities. It allows you to create professional financial documents, track payments, and manage expenses, all within one platform.

- Wave: Wave is a free accounting software that provides invoicing features, including the ability to create and send recurring billing statements. It’s ideal for freelancers and small business owners who need a simple, cost-effective solution.

- Zoho Invoice: Zoho Invoice offers customizable templates and integrates with payment platforms like PayPal and Stripe. It’s a great option for those looking for a comprehensive tool that also provides reporting and automated reminders.

- PayPal: While PayPal is known primarily for online payments, it also offers features for generating financial documents. With PayPal’s billing system, you can send recurring payment requests and track payments directly from your account.

Features to Look for in Billing Tools

When selecting a platform to manage your billing, consider tools that offer the following essential features:

- Customization Options: Look for a tool that allows you to customize the documents to match your business branding. This ensures that the documents are professional and aligned with your image.

- Automation: Many tools allow you to automate recurring billing and send reminders. This reduces the time spent on manual follow-ups and minimizes the risk of late payments.

- Payment Integration: Ensure that the tool integrates with popular payment gateways such as Stripe, PayPal, or bank transfers, allowing clients to pay quickly and securely.

- Reporting and Tracking: Effective tools offer robust reporting capabilities. This allows you to track payments, view financial summaries, and manage client history easily.

- Mobile Access: If you’re frequently on the go, a mobile-friendly tool is essential. Many platforms offer mobile apps or mobile-responsive websites for easy access and management from anywhere.

By using the right tools to manage your financial documents, you can save time, reduce errors, and improve your cash flow. These tools also ensure that your business operates smoothly, giving you more time to focus on providing excellent service to your clients.