Essential Freelancer Invoice Template PDF for Streamlined Billing

Managing financial transactions efficiently is crucial for any professional providing services. A well-organized billing system can not only enhance cash flow but also foster positive relationships with clients. Understanding how to create clear and concise billing documents is a vital skill that can significantly impact your business.

By utilizing a structured approach to billing, you can ensure that your clients receive accurate statements promptly. This not only aids in quicker payments but also reflects professionalism and reliability. Implementing an effective financial document strategy allows you to focus more on delivering exceptional service rather than getting bogged down by administrative tasks.

In this guide, we will explore essential aspects of crafting your billing documents, highlighting the importance of clarity and organization. From key components to design tips, you’ll find valuable insights that will help you enhance your billing process and maintain a seamless workflow.

Understanding Invoicing Basics

Grasping the fundamentals of billing is essential for anyone offering services. A well-structured financial document not only communicates the value of your work but also sets clear expectations regarding payment terms. Understanding these core principles can lead to smoother transactions and improved client relationships.

Key Components of a Financial Document

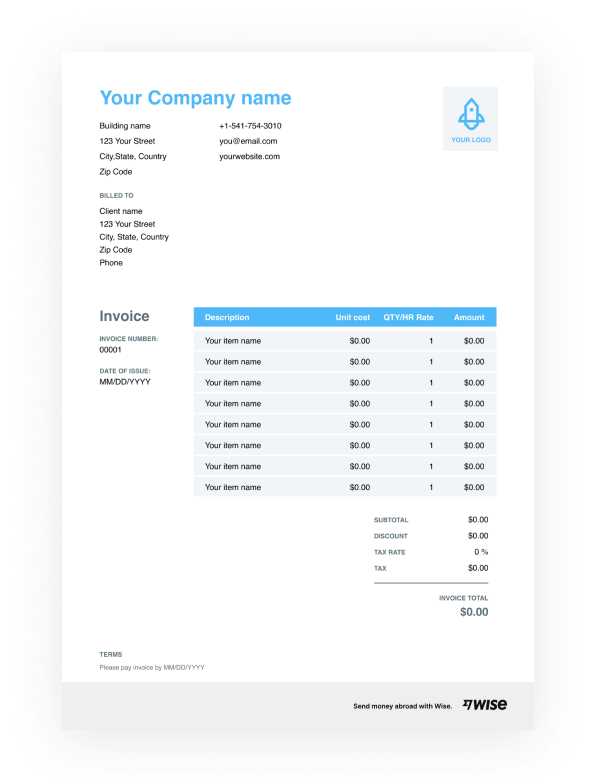

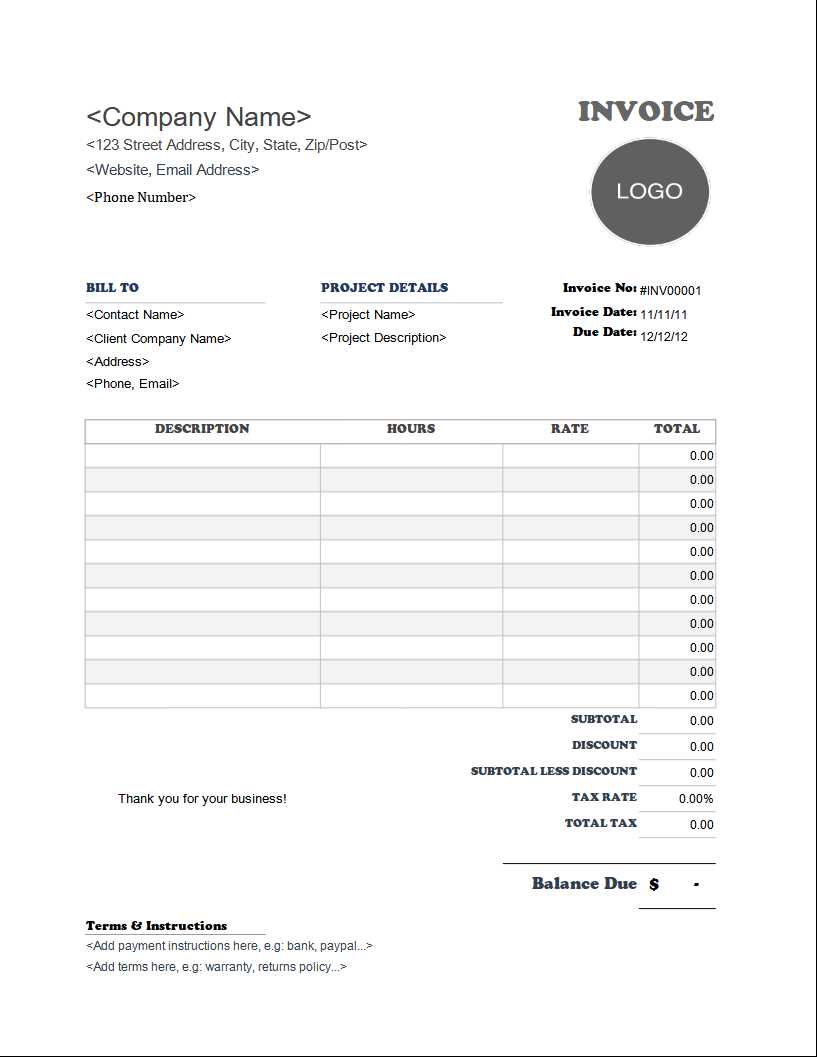

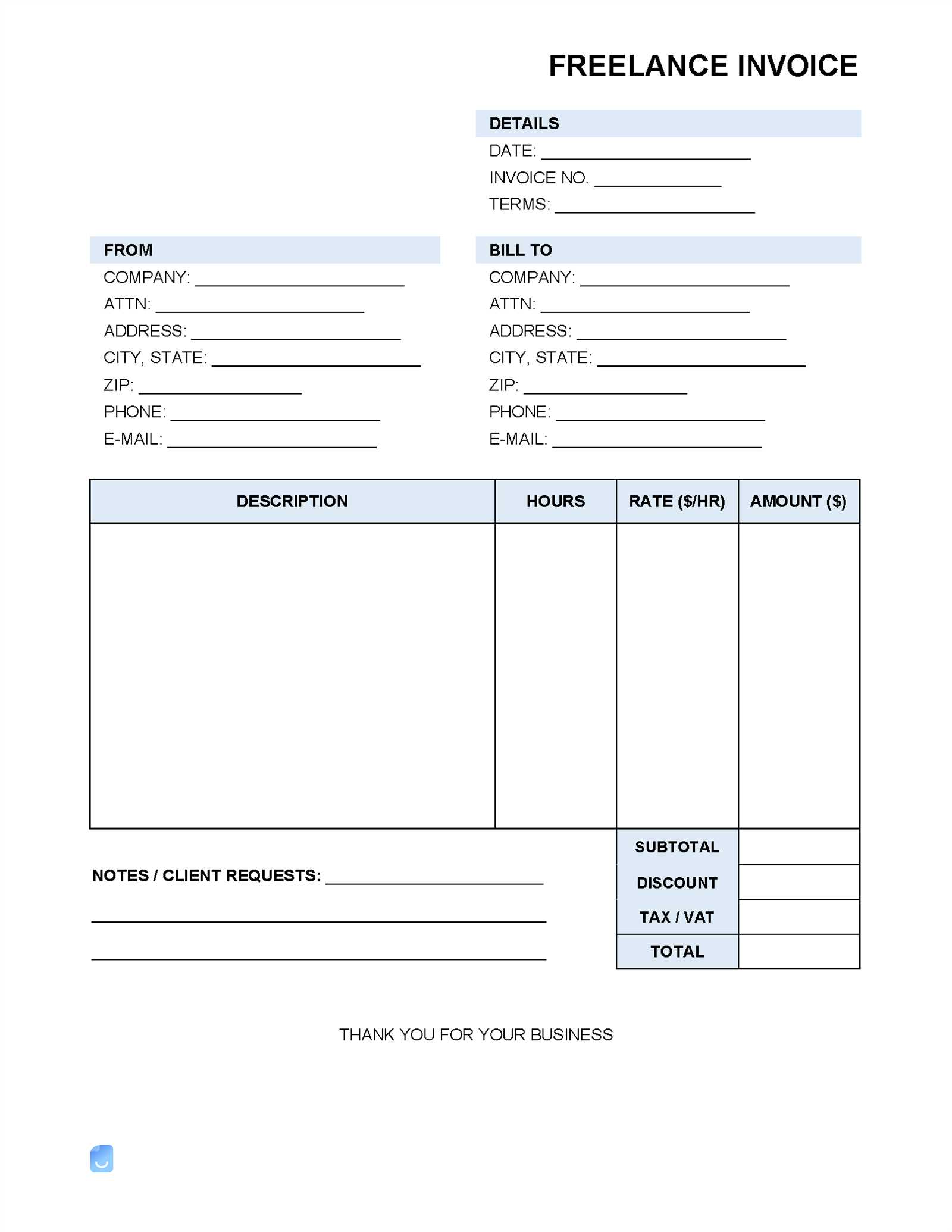

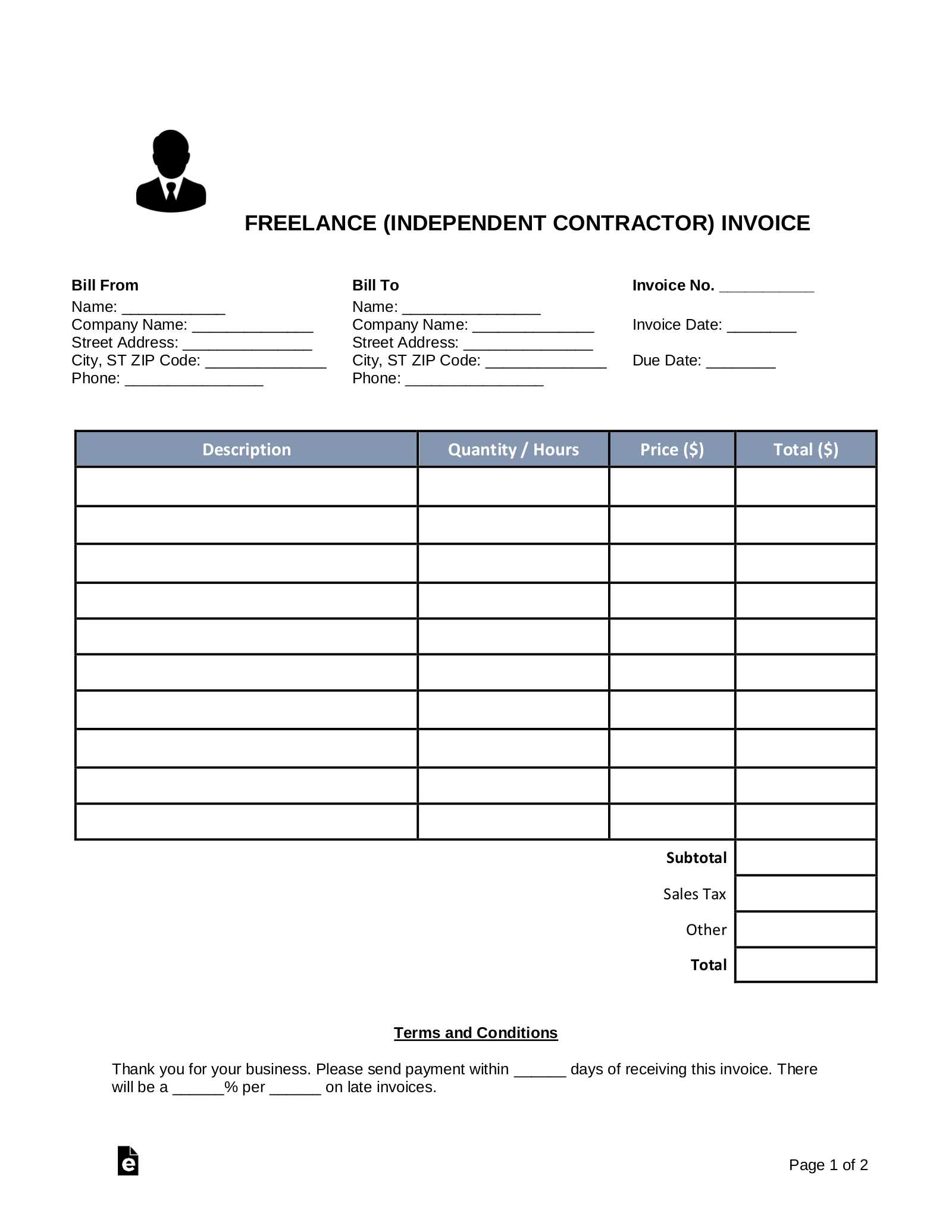

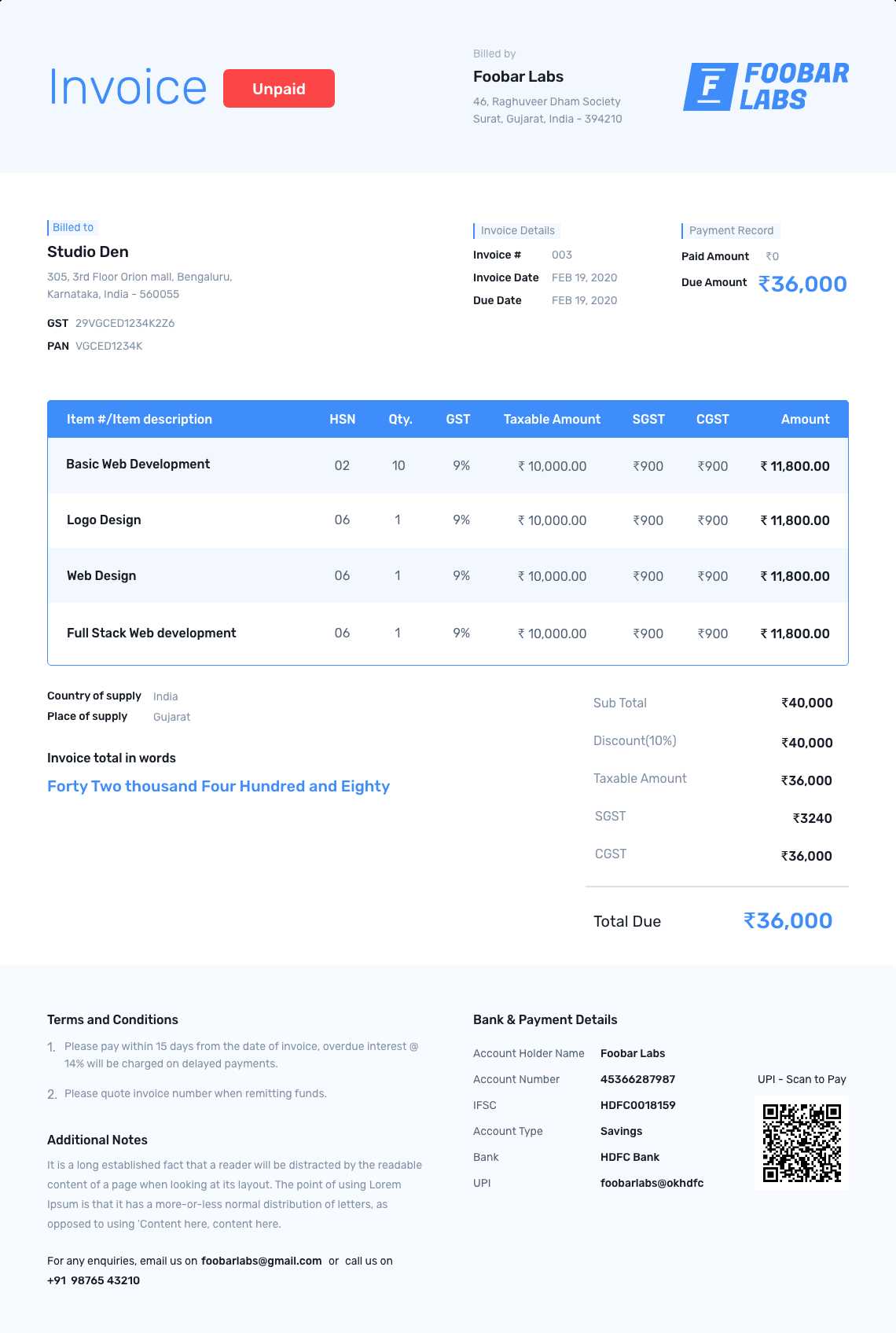

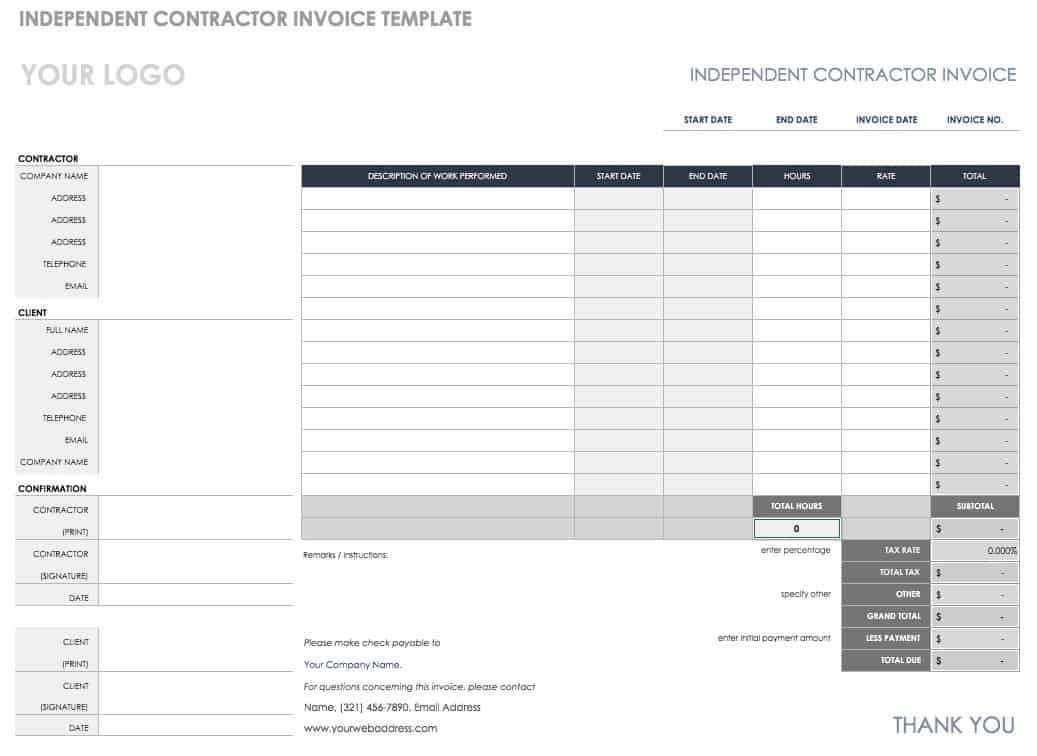

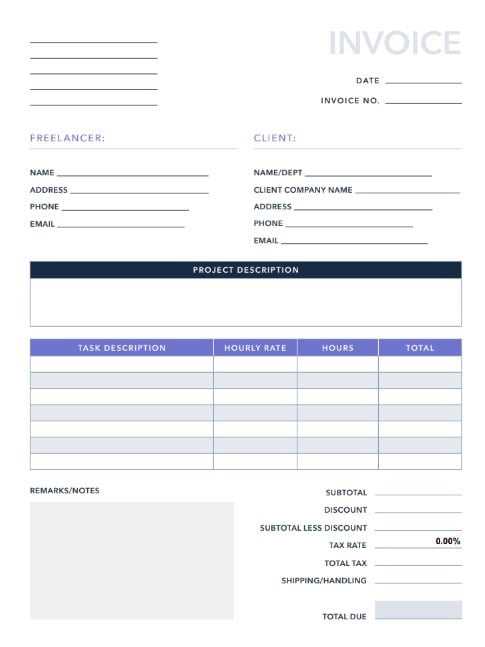

Every billing document should include specific elements that ensure clarity and professionalism. Start with your contact information, including name, address, and email, followed by the client’s details. Clearly itemize the services provided, including descriptions, quantities, and rates. Additionally, specify payment terms and due dates to avoid confusion.

The Importance of Accuracy

Maintaining accuracy in your financial documents is crucial for establishing trust with clients. Double-checking calculations and ensuring all information is correct can prevent disputes and delays in payment. A precise document demonstrates professionalism and reflects your commitment to quality, further solidifying your reputation in the industry.

Benefits of Using Billing Templates

Utilizing structured documents for financial transactions offers numerous advantages that can enhance your professional workflow. By adopting a standardized format, you streamline the process of generating statements, allowing for efficiency and consistency in your operations. This approach not only saves time but also minimizes errors, leading to a more organized financial management system.

Time Efficiency

One of the primary benefits of employing a standardized document format is the significant reduction in time spent on creating each financial statement from scratch. Instead, you can:

- Quickly input service details into a pre-designed structure.

- Use saved formats for repeat clients to ensure consistency.

- Focus on your core activities rather than administrative tasks.

Professional Appearance

A well-crafted financial document reflects positively on your professionalism. A polished layout helps in:

- Enhancing your credibility with clients.

- Clearly presenting essential information without clutter.

- Creating a lasting impression that encourages prompt payment.

Incorporating a structured approach not only supports effective communication but also showcases your commitment to delivering high-quality service.

How to Customize Your Billing Document

Adapting your financial statements to fit your unique style and business needs can significantly enhance your communication with clients. Customization allows you to create a distinct brand identity and convey professionalism. By tailoring essential elements, you can ensure that each document resonates with your personal touch while maintaining clarity.

Personalizing Key Elements

Start by incorporating your branding into the document. This includes:

- Adding your logo and business name at the top.

- Choosing a color scheme that reflects your brand.

- Using a consistent font style that aligns with your overall aesthetic.

These details not only enhance the visual appeal but also reinforce your brand identity in the minds of your clients.

Adjusting Content for Specific Needs

In addition to visual customization, it’s essential to modify the content to suit different clients and projects. Consider the following:

- Including specific service descriptions tailored to each engagement.

- Modifying payment terms to accommodate different agreements.

- Adding notes or personal messages to enhance client relationships.

By making these adjustments, you ensure that each financial document is relevant and impactful, fostering stronger connections with your clients.

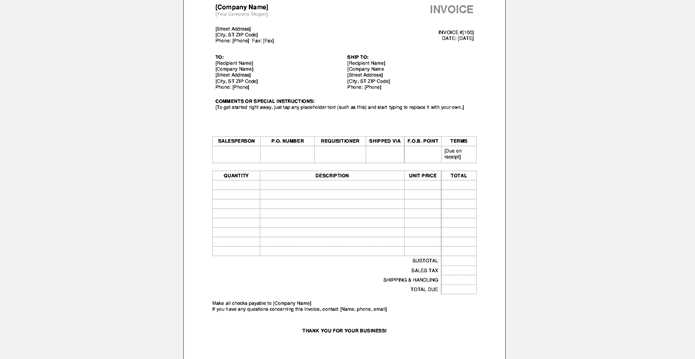

Key Elements of a Billing Document

Understanding the fundamental components of a financial statement is essential for ensuring clarity and professionalism. A well-structured document not only communicates the necessary information effectively but also establishes trust and fosters prompt payment. Here are the critical elements that should be included to create a comprehensive billing statement.

| Element | Description |

|---|---|

| Contact Information | Include your name, address, phone number, and email, as well as the client’s details. |

| Document Date | Specify the date the document is issued to track billing cycles. |

| Unique Reference Number | Assign a unique identifier to each statement for easy tracking and organization. |

| Description of Services | List the services provided, including quantities, rates, and total amounts for each item. |

| Payment Terms | Clearly outline the due date and any payment methods accepted. |

| Notes or Instructions | Include any relevant messages, such as thank you notes or special payment instructions. |

By incorporating these essential components, you ensure that your financial documents are not only functional but also reflect a high level of professionalism.

Choosing the Right Document Format

Selecting the appropriate file format for your financial statements is crucial for ensuring compatibility and accessibility. The right choice not only influences how your documents are received and viewed by clients but also affects the overall professionalism of your communication. Understanding the various options available can help you make informed decisions that meet both your needs and those of your clients.

Benefits of Using Standard Formats

Opting for widely accepted formats, such as the one used for fixed-layout documents, offers several advantages:

- Consistency: Ensures that the document appears the same on any device or platform.

- Professionalism: Reflects a polished and serious approach to business dealings.

- Security: Allows for password protection and restrictions on editing, keeping your information safe.

Considerations for File Size and Quality

When choosing a format, it is essential to balance quality with file size. While high-quality documents are important for clarity, overly large files can be cumbersome for clients to download or share. Aim for a format that maintains visual integrity while ensuring that the file size is manageable. A well-optimized document enhances user experience and facilitates easier transactions.

Common Mistakes in Billing

Errors in financial documents can lead to confusion, delayed payments, and strained client relationships. Recognizing typical pitfalls can help you streamline your process and ensure that your statements are clear and professional. Below are some frequent mistakes to avoid when creating your financial documentation.

Lack of Clarity

One of the most significant issues is presenting information in a way that is difficult for clients to understand. This can include:

- Using jargon or complex language that may confuse recipients.

- Failing to itemize services clearly, leading to uncertainty about what is being charged.

- Not providing sufficient details regarding payment terms or deadlines.

Inaccurate Information

Providing incorrect details can undermine your credibility. Common inaccuracies include:

- Listing the wrong client name or contact information.

- Errors in pricing, such as miscalculating totals or applying discounts incorrectly.

- Forgetting to include essential dates, such as the issuance date or payment due date.

Avoiding these mistakes will not only enhance your professionalism but also foster trust and encourage timely payments.

Tips for Professional Billing Statements

Creating polished financial documents is essential for maintaining a positive image and ensuring effective communication with clients. By following certain guidelines, you can enhance the professionalism of your statements and promote timely payments. Here are some practical tips to consider.

Maintain a Consistent Format

A cohesive layout can significantly improve the readability of your documents. Consider the following:

- Use the same font and size throughout to create a uniform appearance.

- Organize sections logically, grouping similar information together.

- Incorporate your branding elements, such as a logo, to reinforce your identity.

Provide Comprehensive Information

Ensuring that all necessary details are included can prevent misunderstandings. Make sure to:

- Clearly outline the services rendered with descriptions, dates, and quantities.

- Specify payment terms, including due dates and accepted payment methods.

- Include your contact information for any inquiries related to the statement.

By adhering to these tips, you can create effective financial documents that not only convey the necessary information but also reflect your professionalism and commitment to quality.

Tracking Payments and Due Dates

Effectively managing financial transactions is crucial for maintaining cash flow and ensuring the sustainability of your business. Keeping track of payments and their respective deadlines not only helps in avoiding overdue accounts but also fosters better relationships with clients. Here are some strategies to help you stay organized.

Establish a Tracking System

Implementing a reliable system for monitoring payments can simplify the process. Consider using:

- Spreadsheets to log transaction details, including amounts, dates, and client information.

- Accounting software that automates reminders and generates reports.

- Calendar applications to mark due dates and set alerts for follow-ups.

Sample Payment Tracking Table

A well-structured table can help visualize your payment status. Here’s a basic example:

| Client Name | Amount Due | Due Date | Status |

|---|---|---|---|

| Client A | $500 | 2024-11-15 | Pending |

| Client B | $750 | 2024-11-20 | Paid |

| Client C | $300 | 2024-11-10 | Overdue |

By employing effective tracking methods and maintaining clear records, you can manage your finances more efficiently and minimize the risk of late payments.

Software for Creating Invoices

In today’s digital landscape, using the right applications for generating financial documents can significantly streamline your business operations. A variety of software options are available to assist in crafting professional-looking records that not only save time but also enhance the clarity of your financial transactions. This section explores some popular tools that cater to different needs and preferences.

Top Tools for Document Creation

Here are several notable options to consider:

- QuickBooks: A comprehensive accounting solution that offers robust features for creating and managing financial records, including customizable templates and expense tracking.

- FreshBooks: Known for its user-friendly interface, this software allows users to create stylish records and track payments easily, making it ideal for service providers.

- Zoho Invoice: A versatile platform that supports multiple currencies and allows for recurring billing, ensuring that you can cater to a global clientele.

- Wave: A free financial tool that provides essential features for crafting documents and managing accounts, perfect for small businesses and independent contractors.

Considerations When Choosing Software

When selecting an application, keep the following factors in mind:

- User-Friendliness: Ensure the software has an intuitive interface to minimize the learning curve.

- Integration Capabilities: Look for tools that can integrate with your existing systems, such as accounting or payment processing platforms.

- Customization Options: Choose software that allows for personalization, enabling you to align documents with your brand identity.

Investing in the right software can simplify the creation of essential financial documents and help maintain professionalism in your business interactions.

Freelancer Tax Considerations

Navigating tax obligations is a critical aspect of managing a self-directed career. Understanding your financial responsibilities not only helps in compliance with the law but also aids in effective financial planning. This section highlights essential tax considerations that independent professionals should keep in mind.

Self-Employment Tax: Unlike traditional employees, individuals working for themselves are responsible for paying self-employment taxes. This includes Social Security and Medicare contributions, which are typically withheld by employers in standard employment situations. It’s vital to budget for these expenses to avoid surprises at tax time.

Deductions and Credits: Many independent workers are eligible for various tax deductions that can significantly reduce their taxable income. Common deductions include home office expenses, equipment purchases, and business-related travel costs. Keeping detailed records of these expenditures can facilitate the deduction process.

Estimated Tax Payments: Since taxes are not withheld from payments received, it is crucial to make estimated tax payments throughout the year. This prevents a large tax bill at the end of the year and helps manage cash flow effectively. Consulting with a tax professional can provide guidance on calculating and scheduling these payments.

Record Keeping: Maintaining accurate and organized financial records is essential. This not only simplifies the tax filing process but also supports claims for deductions and credits. Consider utilizing accounting software or spreadsheets to track income and expenses efficiently.

By staying informed and proactive regarding tax responsibilities, independent professionals can ensure a smoother financial journey and maximize their earnings.

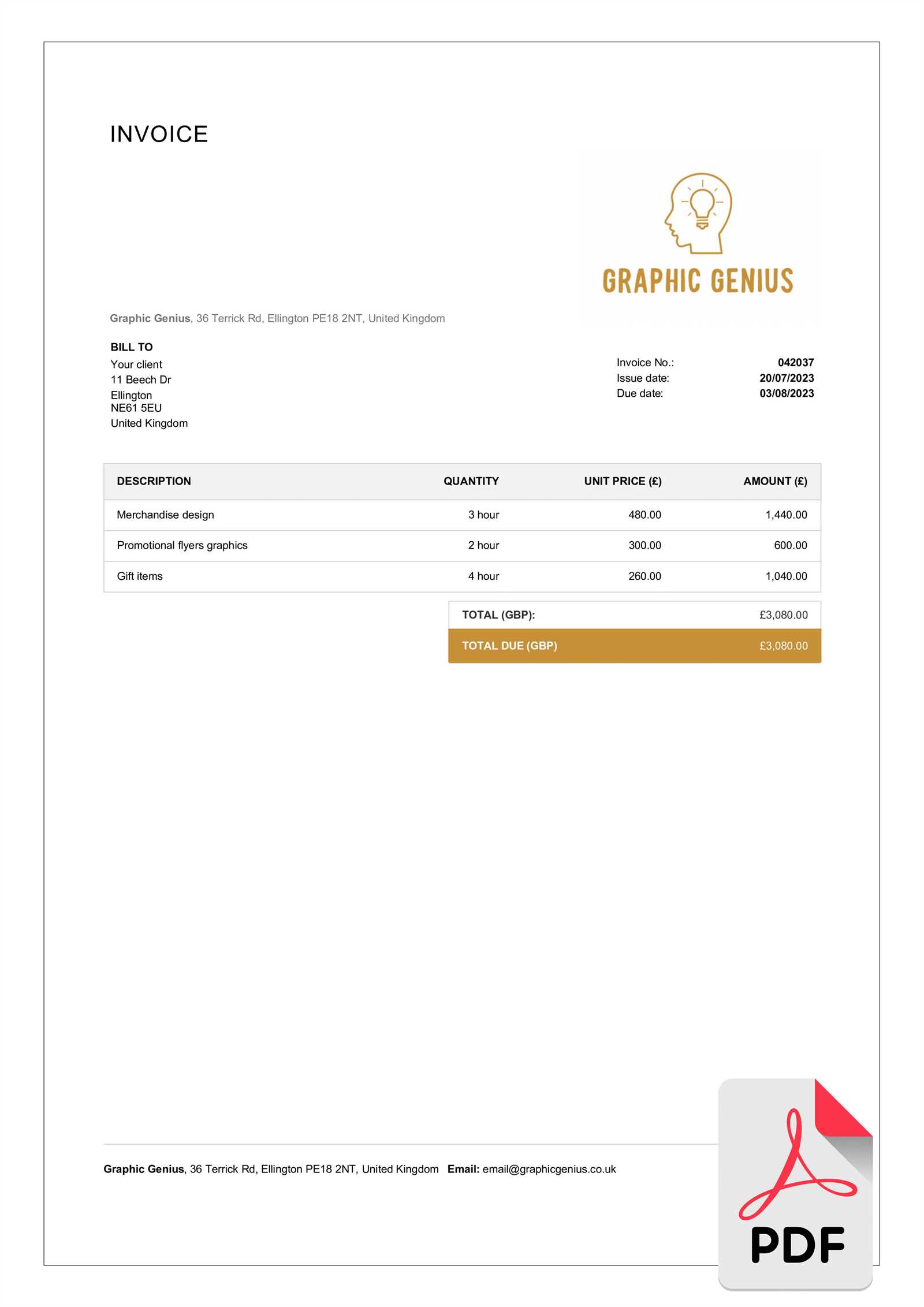

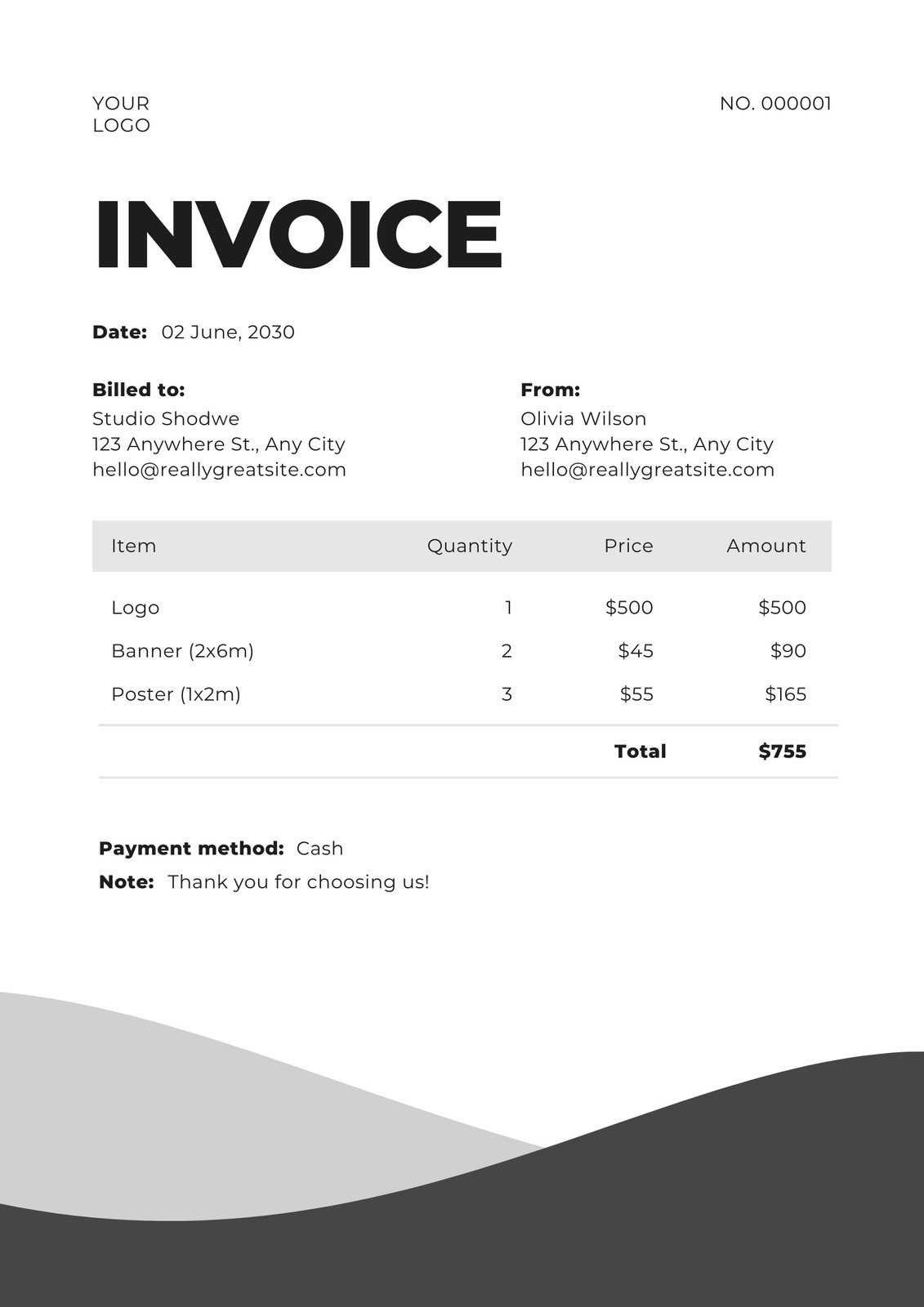

Designing Visually Appealing Invoices

Creating documents that stand out can greatly enhance your professional image and make a lasting impression on clients. A well-designed bill not only conveys necessary information but also reflects your brand identity. This section explores key elements to consider when crafting visually attractive financial statements.

Utilizing a Clean Layout

A clean and organized layout is essential for effective communication. Ensure that all crucial details are easy to find and comprehend. Using adequate spacing between sections can prevent clutter and improve readability. Employing consistent fonts and sizes throughout the document enhances visual harmony.

Incorporating Brand Elements

Branding: Integrate your logo and brand colors into the design to reinforce your identity. This helps in establishing recognition and trust with clients. Visual elements should complement the overall aesthetic while maintaining professionalism.

Images and Graphics: Thoughtfully chosen graphics can add interest and context. However, avoid overwhelming the document with too many visuals. Aim for a balanced approach that maintains clarity and elegance.

By focusing on these design principles, you can create documents that not only fulfill their purpose but also contribute to a positive client experience, enhancing your overall reputation.

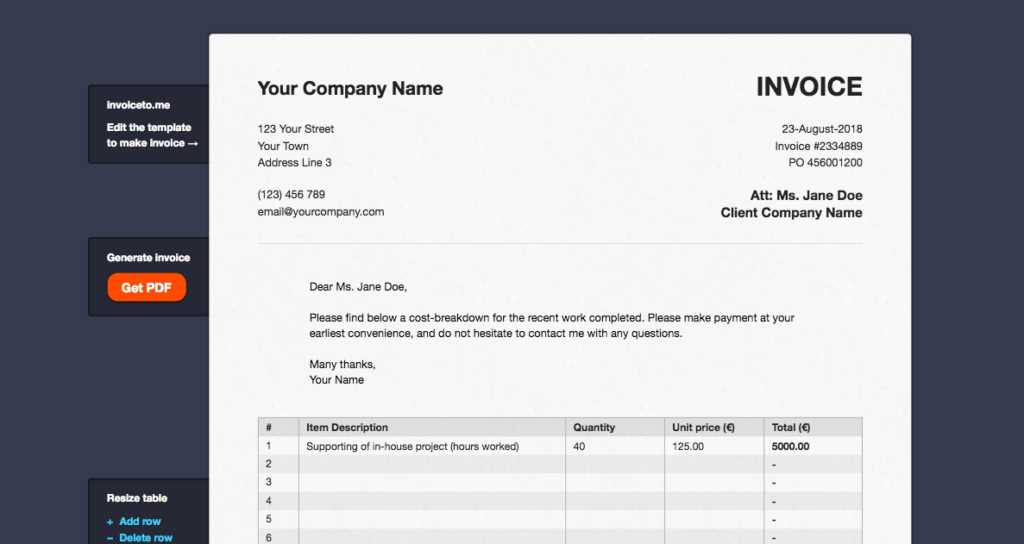

Using Online Invoice Generators

Leveraging digital tools for creating financial documents can significantly streamline your workflow and enhance productivity. Online generators offer a user-friendly way to produce professional-looking statements quickly and efficiently. This section highlights the advantages and features of utilizing these platforms.

Advantages of Online Generators

Using online tools for document creation provides numerous benefits, including:

- Time Efficiency: These platforms allow users to generate documents in minutes, saving valuable time.

- User-Friendly Interface: Most online generators are designed for ease of use, requiring no prior experience.

- Customizable Options: Many tools offer a range of designs and formats, enabling you to personalize documents to match your brand.

- Cloud Storage: Online services often provide secure storage, allowing easy access to your documents from any device.

- Automatic Calculations: Built-in features can automatically compute totals, taxes, and discounts, reducing the risk of errors.

Choosing the Right Tool

When selecting an online generator, consider the following factors:

- Features: Look for essential functions like customization options, templates, and payment integrations.

- Cost: Evaluate pricing structures, including any subscription fees or pay-per-use models.

- Reviews and Ratings: Research user feedback to gauge reliability and effectiveness.

By adopting online generators, you can create polished documents that convey professionalism while minimizing the administrative burden of manual creation.

How to Send Invoices Effectively

Successfully delivering financial statements is crucial for maintaining a smooth business operation. The manner in which these documents are sent can influence timely payments and enhance professional relationships. This section outlines effective strategies for distributing your financial documents.

Best Practices for Sending Documents

To ensure your statements are received and processed efficiently, consider the following best practices:

- Choose the Right Format: Use widely accepted formats that can be easily opened and viewed by your clients, such as Word or Excel files.

- Utilize Email: Sending documents via email provides a quick and direct method of communication. Ensure the subject line is clear and concise.

- Include a Personal Note: Adding a brief message can enhance the personal touch, reminding the recipient of the value of your work.

- Attach Supporting Documentation: If applicable, include any relevant files or agreements that support the request for payment.

- Follow Up: If you do not receive a response within a reasonable timeframe, consider sending a polite follow-up message to confirm receipt.

Setting Up a System

Establishing a consistent process for delivering financial statements can streamline your workflow:

- Use Automation Tools: Consider utilizing software that automates the sending of documents, which can save time and reduce errors.

- Maintain a Schedule: Develop a regular timeline for sending out documents, whether it’s weekly, bi-weekly, or monthly, to help establish expectations.

- Organize Client Information: Keep a well-organized database of client details to ensure accurate and personalized communication.

By adopting these practices, you can enhance the efficiency and professionalism of your communication, ultimately leading to improved client satisfaction and timely payments.

Maintaining Client Relationships through Invoicing

Effective financial documentation plays a vital role in fostering strong connections with clients. It is not merely a request for payment; it serves as a reflection of professionalism and attention to detail. A well-structured and timely delivery of these documents can significantly enhance the trust and rapport between parties.

Here are key factors that contribute to nurturing client relationships through financial statements:

| Factor | Description |

|---|---|

| Clear Communication | Ensure that all details are clearly articulated, including services rendered and payment terms, to prevent misunderstandings. |

| Timeliness | Sending documents promptly demonstrates reliability and respect for the client’s time, reinforcing a positive business relationship. |

| Professional Presentation | A visually appealing and organized format reflects your commitment to quality, making clients feel valued. |

| Personal Touch | Including a personalized note or message can enhance the relationship, reminding clients of the partnership beyond just transactions. |

| Openness to Feedback | Encouraging clients to provide input on their experiences with your documentation can foster trust and improve future interactions. |

By focusing on these elements, you can create a positive atmosphere that strengthens client loyalty and promotes ongoing collaboration. Remember, each financial statement is an opportunity to reinforce your professional image and build lasting relationships.

Adapting Invoices for Different Clients

Tailoring financial documents to meet the specific needs of various clients is essential for maintaining professionalism and enhancing relationships. Each client may have unique requirements and preferences, which can influence how you present your billing statements. Adapting these documents accordingly can lead to improved clarity and satisfaction.

Here are some key considerations for customizing financial documents based on client profiles:

- Industry Standards: Research the norms within the client’s industry to ensure your documents align with their expectations.

- Preferred Format: Some clients may favor electronic delivery, while others prefer printed copies. Always inquire about their preference.

- Detail Level: Adjust the amount of detail provided based on the client’s familiarity with your services. Some may appreciate a thorough breakdown, while others might prefer a summary.

- Personalization: Incorporate the client’s branding or specific terminology that resonates with them to create a sense of familiarity.

- Payment Terms: Different clients may have varying expectations regarding payment schedules. Clarifying these terms helps avoid confusion.

By considering these factors, you can create tailored documents that resonate with each client’s expectations, fostering trust and ensuring smooth financial transactions.

Staying Organized with Invoice Records

Maintaining a well-structured system for tracking financial documents is crucial for managing business operations efficiently. Effective organization not only helps in monitoring payments but also streamlines the overall process of managing accounts. Implementing a systematic approach can save time and reduce stress during financial reviews.

Strategies for Organizing Financial Documents

Here are some effective methods to keep your financial records in order:

- Digital Storage: Utilize cloud storage solutions to keep your documents accessible and secure. This allows for easy retrieval from anywhere.

- Consistent Naming Conventions: Develop a standard naming system for your files that includes the client’s name, date, and type of service. This makes searching for documents more straightforward.

- Regular Updates: Schedule regular intervals to update and review your records. This ensures that all entries are accurate and up-to-date.

- Organized Categories: Create folders based on client names, services provided, or time periods to facilitate easy navigation through your records.

- Backup Solutions: Regularly back up your data to prevent loss from unforeseen circumstances. Consider both local and cloud-based backups for redundancy.

The Benefits of Staying Organized

Having a systematic approach to financial documents can lead to numerous advantages:

- Improved accuracy in financial reporting.

- Enhanced ability to track payments and outstanding balances.

- Streamlined processes during tax season and audits.

- Increased professionalism in dealings with clients.

By adopting these practices, you can ensure that your financial records are well-organized, leading to more efficient business management.