Download Free UK Invoice Template Excel for Easy and Professional Billing

For any business, having a well-organized system to manage financial transactions is crucial. One of the key components in this process is the ability to generate clear and accurate records for services provided or products sold. Having an efficient tool to create these documents can save time and ensure that all necessary details are captured.

In the UK, there are specific requirements for generating formal records of business transactions. This involves including essential information like payment terms, tax details, and contact information. A well-structured tool can help meet these standards while also allowing for customization based on your business needs.

Using the right format can streamline this process. Whether you’re a freelancer, a small business owner, or part of a larger enterprise, having access to an easy-to-use solution can simplify your administrative work. This guide will explore how you can easily create professional billing documents with customizable features, helping you maintain accuracy and compliance without hassle.

UK Invoice Template Excel Overview

Creating financial documents that are both accurate and professional is essential for maintaining smooth operations in any business. Having the right tools to manage these documents ensures that all necessary details, such as payment terms, item descriptions, and tax information, are included in a clear and organized manner. In the UK, businesses are required to follow specific guidelines when producing these documents, and using a structured system can help meet these requirements with ease.

What Makes This Tool Ideal for Businesses

This solution allows users to generate professional records quickly while maintaining flexibility in design and content. Whether you need to generate one document or multiple in a short period, the customizable nature of the format makes it an efficient option. It allows users to add their business details, adjust the layout, and track important payment information, all in one place.

Why Choose a Digital Format for Billing

Opting for a digital solution offers several advantages, including easier storage, faster editing, and the ability to quickly share documents with clients. A digital format helps reduce human error and provides a more reliable way of keeping financial records. It can also be easily integrated into other business tools, such as accounting software, for seamless financial tracking.

Why Use an Excel Invoice Template

Creating accurate and professional financial records is essential for any business, large or small. A well-organized system that allows for easy data entry, calculation, and customization can save valuable time and ensure all necessary details are captured. Using a digital tool to generate these documents offers multiple benefits, from reducing human error to simplifying the storage and sharing of information.

Advantages of Using a Digital Document for Billing

One of the key reasons businesses opt for a digital format is its flexibility. With a customizable structure, users can easily modify the document to meet their specific needs. Digital solutions also automate certain tasks, such as calculations for totals, taxes, and discounts, which helps to avoid mistakes that could affect business transactions.

How It Simplifies Record Keeping

With digital records, businesses can easily store, track, and access past documents. This eliminates the need for physical storage and ensures that data is backed up and retrievable when needed. The ability to organize and categorize records digitally also makes it easier to integrate with other accounting software or systems for seamless financial management.

| Benefit | Details |

|---|---|

| Customization | Allows users to adjust document layout and content based on business needs |

| Efficiency | Automates calculations to reduce human error and save time |

| Storage | Provides digital storage, eliminating the need for physical filing and reducing clutter |

| Integration | Easily integrates with other business tools, such as accounting or financial software |

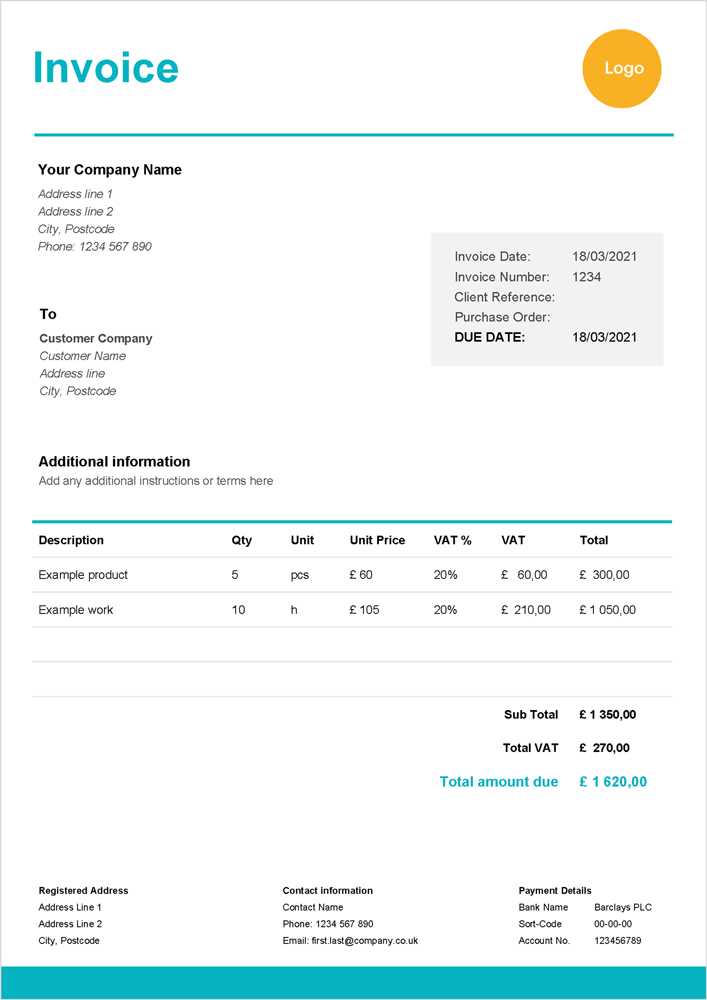

How to Customize Your UK Invoice

Customizing your financial documents is a crucial step in ensuring they align with your business needs and comply with local regulations. By adjusting key elements, you can make the document reflect your brand identity while maintaining the required legal details. Personalizing your billing format not only makes the document look professional but also streamlines the entire process of tracking payments and transactions.

Key Elements to Personalize

There are several essential components to customize when creating your billing documents. Tailoring these sections ensures that your records meet both your business requirements and legal obligations in the UK. Below are the main areas to focus on:

- Business Details: Add your company name, address, and contact information. This helps recipients easily identify the source of the document.

- Payment Terms: Clearly state your payment terms, such as the due date and any penalties for late payments, to avoid confusion.

- Tax Information: Include your VAT number (if applicable) and specify the tax rate on the products or services provided.

- Logo and Branding: Incorporate your logo and choose brand colors to give the document a professional and personalized look.

- Item Descriptions: Provide detailed descriptions of goods or services offered to ensure transparency.

Steps to Customize Your Document

Follow these steps to easily personalize your business records:

- Open the document and locate the header section where your business details should be entered.

- Insert your company’s contact information, including email and phone number, for easy communication.

- Customize the layout by adjusting column widths, fonts, and colors to match your brand style.

- Add rows for each product or service, including relevant descriptions, quantities, and prices.

- Ensure tax rates are calculated correctly, adding VAT information where necessary.

By following these steps, you can create a well-structured document that meets both your business and legal needs while providing a polished and professional presentation.

Key Features of Excel Invoice Templates

When it comes to managing business transactions, having an efficient and user-friendly document is essential. A well-designed financial document not only makes the process of issuing bills easier but also ensures accuracy and professionalism. The right tool offers a variety of features that simplify calculations, ensure consistency, and help maintain compliance with local regulations.

Essential Functionalities for Business Documents

Several features make this type of tool particularly valuable for small businesses, freelancers, and larger enterprises alike. These functionalities are designed to improve efficiency and reduce the chance of errors. Some of the key features include:

- Automatic Calculations: Built-in formulas for adding up totals, applying taxes, and calculating discounts, ensuring accuracy without manual effort.

- Customizable Layout: The ability to modify the design and structure, allowing users to adapt the document to their specific business needs.

- Client Information Fields: Pre-set fields for adding client details, making it easy to personalize documents quickly.

- Tax Management: Integration for adding and calculating applicable taxes, which ensures compliance with UK tax laws.

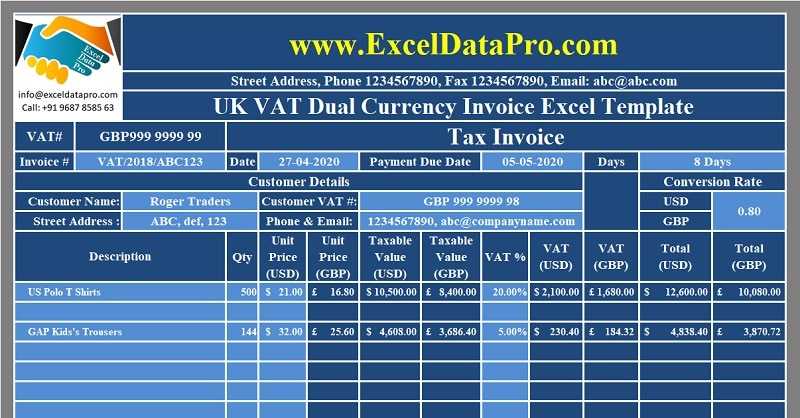

- Multiple Currencies: Flexibility to use different currencies, which is useful for businesses with international clients.

Additional Benefits of Using a Digital Tool

Beyond basic functionality, using a digital format for your financial documents offers several other advantages. These tools streamline the process of record-keeping and improve organization:

- Easy Sharing: Documents can be shared via email or cloud storage, making distribution simple and quick.

- Data Security: Digital records can be securely stored and backed up to avoid loss of important information.

- Time-Saving Features: Pre-filled fields and easy duplication of documents allow for faster document creation, especially for recurring transactions.

Advantages of Excel for Invoicing

Using a digital solution for creating billing documents offers numerous benefits that enhance the efficiency, accuracy, and overall management of business transactions. The flexibility of a well-designed system allows businesses to generate detailed records quickly while minimizing errors. Here, we will explore the key advantages that make this digital format a preferred choice for businesses worldwide.

Efficiency and Time-Saving Features

One of the most significant advantages of using a digital format is the time it saves. With built-in formulas and pre-defined structures, the process of creating financial documents becomes much faster. Here are some ways it enhances productivity:

- Automated Calculations: Complex calculations such as tax rates, totals, and discounts are automatically computed, reducing the risk of mistakes.

- Reusability: Once the format is set up, you can easily reuse it for multiple clients or transactions, eliminating the need to start from scratch each time.

- Customization: You can quickly adjust layouts, update client information, and tailor the content to suit different business needs or preferences.

Cost-Effective and Accessible

Another key advantage is the cost-effectiveness of using a digital solution compared to hiring professionals or purchasing specialized software. It offers a simple, low-cost solution for businesses of all sizes:

- Low Initial Investment: Many free or affordable options are available, providing high functionality without significant financial investment.

- Easy Access: Digital formats can be accessed from any device with the necessary software, allowing flexibility for remote work or on-the-go access.

- No Need for Physical Storage: Digital documents eliminate the need for physical storage space, reducing overhead costs and paper usage.

With these benefits, using a digital solution for creating billing documents streamlines the process and supports the growth and efficiency of a business.

How to Download a UK Invoice Template

Finding the right document for managing your business transactions is essential for staying organized and ensuring accuracy. Fortunately, there are various sources that offer downloadable formats specifically designed for UK businesses. These pre-made formats are customizable and can be easily tailored to suit your needs, saving time and effort. Below, we outline the steps to download and start using these tools for your business.

Steps to Download the Document

Downloading a ready-to-use business record format is a quick and simple process. Just follow these steps to get started:

- Choose a Reliable Source: Look for trusted websites that offer downloadable business document formats. These may include business resource platforms, accounting sites, or professional organizations.

- Ensure UK Compliance: Check that the format complies with UK regulations, including tax rates, VAT details, and other legal requirements.

- Select the Format: Choose a format that suits your needs. Look for options that are compatible with your preferred software and can be customized according to your business details.

- Download the Document: Click on the download link, and save the file to your computer or cloud storage for easy access.

- Open and Customize: Once downloaded, open the document in the required software and fill in your business and client information.

Additional Tips for Customization

Once the document is downloaded, it’s important to adjust it to reflect your business needs. Consider these customization tips:

- Add Your Branding: Include your company logo, address, and contact details at the top for a professional appearance.

- Modify Payment Terms: Customize payment due dates, discounts, and late payment fees according to your business policy.

- Include Legal Information: Make sure your VAT number and other required tax details are visible and accurate.

- Save for Future Use: Save the modified document as a template for future transactions, so you don’t need to start from scratch each time.

By following these steps, you can quickly download and customize a suitable document to manage your business transactions effectively and professionally.

Step-by-Step Guide to Create Invoices

Creating clear and accurate billing documents is an essential part of managing business transactions. A well-structured record not only helps maintain financial clarity but also ensures that you get paid on time. Whether you’re invoicing for services rendered or products sold, following a systematic process will make the task quicker and easier. Below is a step-by-step guide to help you create a professional billing document for your business.

Step 1: Open a New Document

The first step is to open a new document in your preferred software. Choose a format that suits your business needs and allows for easy customization. Once the document is open, begin by setting up the basic structure, ensuring there’s enough space for all the necessary details.

Step 2: Add Business Details

In the header section, include your business name, address, phone number, and email. This will ensure that the recipient knows exactly where the document comes from. It’s important to make these details prominent for easy identification.

- Company Name

- Address

- Phone Number and Email

- Website (if applicable)

Step 3: Insert Client Information

Below your business details, create a section for the client’s information. This includes their name or company name, address, and contact information. Be sure to check the accuracy of these details to avoid any communication issues later.

Step 4: List Products or Services Provided

In this section, list the products or services provided along with their descriptions, quantities, unit prices, and total amounts. Break down each item clearly to ensure there is no confusion. Use a clean, organized table to present this information for better readability.

- Description of the product or service

- Quantity or units

- Unit Price and Total for each item

Step 5: Add Tax Information

Ensure that all relevant tax information is included. In the UK, this may include VAT or other applicable taxes. Make sure to specify the tax rate clearly and calculate the total tax amount to be added to the final sum.

Step 6: Specify Payment Terms

Clearly state the payment due date, along with any terms or conditions. If you offer discounts for early payment or charge a late fee, be sure to include these details in this section. Clearly outlining payment expectations helps to avoid confusion and ensures timely payments.

Step 7: Review and Finalize

Before sending the document, double-check all information for accuracy. Ensure that all totals, taxes, and calculations are correct. Review the layout to ensure the document looks professional and is easy to understand.

Step 8: Save and Send

Once the document is finalized, save it in your preferred format (e.g., PDF for easy sharing). You can then email it to your client or print it for mailing. Remember to keep a copy for your records.

By following these steps, you can create a professional, organized document that ensures your business transactions are clear, transparent, and easy to manage.

Using Formulas in Your Invoice Template

Incorporating formulas into your business record system can significantly reduce errors and save time. Rather than manually calculating totals, taxes, or discounts, automated formulas help ensure that the numbers are accurate and consistent every time you create a document. This section explains how to use formulas to streamline your billing process, making it faster and more reliable.

Essential Formulas for Business Documents

Several basic formulas are essential for any financial document. These can be used to automate key calculations like the total cost of services, tax amounts, and final balances. Below are some of the most commonly used formulas:

- SUM: This formula adds up a range of values. It’s perfect for calculating the total cost of multiple items or services.

- PRODUCT: The PRODUCT function multiplies two or more numbers. It’s useful for calculating the cost of multiple units of an item at a given price.

- TAX: You can use a simple formula to calculate tax by multiplying the subtotal by the applicable tax rate.

- DISCOUNT: To apply a discount, multiply the total amount by the discount percentage, then subtract that value from the total.

- SUBTOTAL: This is useful for calculating partial amounts before tax or discounts are applied.

How to Implement Formulas in Your Documents

Using formulas in your document is straightforward. Follow these steps to implement them effectively:

- Open the document: Start by opening your business record and preparing the relevant sections where you need calculations (e.g., item list, subtotal, tax).

- Insert Formula: In the appropriate cell, input the formula. For instance, to calculate a total, type “=SUM(A2:A10)” to add all the values in cells A2 through A10.

- Format Cells: Ensure that cells are formatted correctly, especially for currency or percentages. This ensures that your results display in a readable and accurate format.

- Check Results: After entering the formulas, verify that the calculations are working as expected. Make adjustments to the ranges if needed.

By using these simple formulas, you can automate many aspects of your billing process, improving accuracy and efficiency.

Free UK Invoice Templates Available Online

For businesses in the UK, there are numerous free resources available online to help create professional billing documents. These ready-made solutions are designed to meet local legal and financial requirements, making it easier for businesses to stay compliant. Whether you’re a freelancer or managing a small business, you can find various customizable options that save time and effort in creating your documents.

Where to Find Free Resources

There are several reputable websites offering free business record formats that cater to UK businesses. These resources are usually simple to download and include customizable fields for your specific business needs. Some popular sources include:

- Accounting Websites: Many accounting platforms offer free downloadable resources as part of their service to small businesses.

- Government Websites: Some UK government sites provide downloadable formats that comply with local tax laws, including VAT rates and other legal requirements.

- Business Resource Platforms: Numerous websites dedicated to small business needs offer free tools that can be used immediately without registration.

Benefits of Using Free Online Resources

Choosing free downloadable formats can be especially beneficial for small businesses and freelancers looking to streamline their workflow without spending money on paid software. Key benefits include:

- No Cost: Accessing these resources is free, making them an ideal option for businesses with tight budgets.

- Customizability: Most online resources are easy to personalize, allowing you to add your business details, logo, and other specific information.

- Quick Setup: These formats are ready to use with minimal setup required, saving you time and effort.

By using these free resources, you can quickly create professional business documents that meet your needs without any financial investment.

Choosing the Right Invoice Template for Your Business

Selecting the right format for your billing documents is crucial for maintaining professionalism and ensuring that all necessary information is included. The right document should align with your business style, meet legal requirements, and streamline your workflow. Depending on the type of business you run, the format you choose may differ in terms of design, functionality, and complexity.

Factors to Consider When Choosing a Document Format

When deciding on the best structure for your financial records, there are several key factors to consider. These elements will help you ensure that the format suits both your business needs and your clients’ expectations:

- Business Type: The nature of your business affects what details should be included. For instance, a service-based business may focus on hours worked, while a product-based business will need to list items and quantities.

- Branding and Professionalism: Your document should reflect your business’s image. Choose a design that aligns with your brand, including logo placement, color schemes, and layout.

- Legal Requirements: Ensure that the document includes all necessary legal information, such as VAT numbers and payment terms. For UK businesses, it’s essential to comply with local tax laws.

- Ease of Use: The format should be user-friendly, with sections clearly defined and easy to update as needed.

Basic Features to Look For

When choosing a suitable document structure, it’s important to ensure that it includes the following basic features:

| Feature | Description |

|---|---|

| Client Details | Include fields for your client’s name, address, and contact information to ensure accurate record-keeping. |

| Itemized List | Clearly list products or services provided with descriptions, quantities, and prices to avoid confusion. |

| Payment Terms | Include clear terms regarding payment due dates, late fees, and discounts if applicable. |

| Tax Information | Include relevant tax rates (e.g., VAT) and the corresponding amounts to ensure compliance with tax regulations. |

| Branding Options | The document should allow for your business logo, colors, and other branding elements to be added for a professional look. |

By keeping these factors and features in mind, you can select the most suitable structure to efficiently manage your billing process and ensure all necessary information is included for both your business and your clients.

Best Practices for Professional Invoices

Creating professional billing documents is essential for maintaining a smooth business operation and ensuring timely payments. Well-crafted documents not only reflect your professionalism but also help in building trust with your clients. By following best practices, you can ensure that your records are clear, organized, and legally compliant. This section highlights some key practices to make your billing process more effective and efficient.

To start, always ensure that your documents include all necessary information in a structured and easily understandable format. This includes accurate client details, itemized lists of services or products, and clearly defined payment terms. It’s equally important to avoid clutter by keeping the layout simple and organized, with well-defined sections and clear headings.

Additionally, make sure to maintain consistency in the formatting and style of your business records. This not only helps with readability but also reflects the reliability and professionalism of your business. Finally, review every document for accuracy before sending it to your clients. Small errors in calculations or details can lead to confusion or delayed payments.

By following these best practices, you ensure that your billing documents are effective in conveying professionalism, promoting clear communication, and facilitating smooth transactions.

Ensuring Legal Compliance with UK Invoices

For businesses operating in the UK, it’s essential that all billing documents comply with local regulations to avoid legal issues or delays in payment. Compliance not only protects your business but also ensures transparency and builds trust with your clients. In this section, we’ll discuss the key requirements that your documents must meet to stay legally compliant with UK law.

Key Legal Requirements for UK Billing Documents

There are several mandatory elements that should be included in your financial records to ensure they meet UK legal standards:

- Business Information: Your business name, registered address, and VAT registration number (if applicable) must be clearly stated.

- Client Details: The full name and address of the recipient of the goods or services, including any other contact information.

- Unique Reference Number: Every document should have a unique reference number for tracking purposes.

- Description of Goods or Services: Provide a clear description of the goods or services offered, including quantities and unit prices.

- Tax Information: If applicable, ensure that VAT is listed at the correct rate and clearly marked, with the total tax amount specified.

- Payment Terms: Clearly define the payment due date, any late fees, and the total amount owed, including taxes and discounts (if applicable).

Common Mistakes to Avoid

To maintain compliance and avoid potential fines, it’s important to steer clear of common mistakes:

- Incorrect VAT Rates: Always ensure that the correct VAT rate is applied according to the goods or services provided. This may vary based on the product or service type.

- Missing Business Information: Ensure that all required business details, including your VAT number (if applicable), are present and accurate.

- Inaccurate Totals: Double-check all calculations, including taxes and discounts, to prevent discrepancies that could lead to disputes or delayed payments.

By adhering to these legal requirements, you can ensure that your billing practices are fully compliant with UK law, minimizing the risk of errors or legal complications.

How to Add VAT Information on Invoices

When conducting business in the UK, it’s essential to include accurate tax details in your billing records, especially if your business is VAT registered. Adding the correct VAT information ensures compliance with tax regulations and provides clarity for both you and your clients. In this section, we’ll explore how to effectively include VAT details in your business documents.

The VAT details are important for both transparency and legal compliance. Including these details correctly will help prevent disputes and ensure that you can claim back any VAT you’ve paid on business expenses. To get it right, it’s crucial to include the correct tax rate, the amount of VAT charged, and your VAT registration number if applicable.

Essential VAT Information to Include

Here’s the basic VAT information you need to ensure is included in your billing records:

- Your VAT Registration Number: This number must be displayed clearly on all business records if your business is VAT registered.

- VAT Rate Applied: Specify the VAT rate you’ve applied (e.g., 20%, 5%, or 0%), depending on the goods or services provided.

- VAT Amount: Include the total VAT amount for each item or service, and calculate the overall VAT charged in the document.

- Net and Gross Amounts: Clearly list both the net amount (before VAT) and the gross amount (including VAT) for each item or service provided.

How to Format VAT Details in Your Document

Once you’ve gathered the necessary VAT information, here’s how you can format it in your document:

- Start by listing the net amount (the price before VAT) for each product or service in the itemized section.

- Next, apply the appropriate VAT rate to each item or service to calculate the VAT due.

- Clearly display the total VAT amount separately from the item prices, and include the gross total (the final amount including VAT).

- Don’t forget to add your VAT registration number at the top or bottom of the document to ensure full transparency.

By including these details, you’ll ensure that your records are fully compliant with VAT regulations and help avoid any issues with clients or tax authorities.

Tracking Payments Using Excel Invoices

Effectively managing payments is a crucial part of running any business. Tracking payments ensures that you know which bills are settled and which are still outstanding, helping you maintain a healthy cash flow. With the right tools, you can automate the tracking process and quickly identify any overdue amounts. This section covers how to use spreadsheets to track payments efficiently, making your financial management easier and more organized.

By incorporating payment tracking into your business records, you can easily monitor outstanding balances and avoid missing any payments. With simple tools like automated formulas and date tracking, you can gain better insight into your financial situation and ensure timely collection of funds.

How to Track Payments Effectively

There are several ways to structure your documents to track payments. Below are some key elements to include when setting up a system to monitor payments:

- Payment Status Column: Add a column to your record that indicates whether a payment has been made or is still due. You can use labels like “Paid”, “Pending”, or “Overdue” to easily track the status of each transaction.

- Due Date Tracking: Include a “Due Date” column to keep track of when payment is expected. You can use conditional formatting to highlight overdue payments, making it easier to follow up with clients.

- Total Amount and Payments Received: Include columns for both the total amount due and payments received. This allows you to calculate the balance due and quickly see if any amount is outstanding.

Automating Payment Tracking with Formulas

Using simple formulas in your records can automate the tracking process. For example:

- Outstanding Balance: Use a formula to subtract payments received from the total amount due, automatically updating the outstanding balance.

- Due Date Alerts: You can use conditional formatting to highlight any payments that are overdue, based on the current date.

- Summing Payments: Use the SUM function to calculate total payments received over a certain period, helping you track how much you’ve collected.

By using these strategies and simple functions, you can efficiently track payments, ensuring you stay on top of your business’s financial health. This not only saves you time but also minimizes the chances of overlooking unpaid amounts.

Benefits of Digital Invoicing in Excel

In today’s fast-paced business world, adopting digital solutions for managing financial records offers numerous advantages over traditional paper-based methods. Digital documentation not only saves time but also enhances accuracy and efficiency. Using a digital system for generating and managing financial records simplifies the entire process, from creation to tracking payments, while ensuring compliance and reducing errors. In this section, we will explore the key benefits of switching to a digital system for your billing needs.

Advantages of Going Digital

Making the shift to digital methods offers several key benefits for businesses of all sizes. Here are some reasons why businesses are increasingly turning to digital solutions for managing their financial records:

- Efficiency: Creating, modifying, and sharing digital records is much faster than manual paperwork. With pre-designed formats, you can easily input details and generate professional documents within minutes.

- Cost Savings: By eliminating the need for paper, ink, and postage, digital records help businesses reduce overhead costs associated with traditional methods.

- Easy Storage and Retrieval: Digital documents can be stored on computers or cloud platforms, making it easier to organize and retrieve them when needed. You no longer have to worry about misplacing physical documents or dealing with filing cabinets.

- Environmental Impact: By reducing paper usage, businesses contribute to sustainability efforts and minimize their environmental footprint.

Improved Accuracy and Control

Using digital tools for your financial documents helps improve both accuracy and control over your records. Here are some key advantages:

- Automated Calculations: Digital systems can automatically calculate totals, taxes, and discounts, minimizing the risk of human error in calculations.

- Instant Updates: Any changes made to the document, such as updated prices or payment statuses, can be updated instantly and reflected across all relevant sections without requiring reprints or revisions.

- Version Control: Digital documents allow you to easily track changes and maintain a version history, ensuring that you always have access to the most up-to-date information.

Overall, digital solutions streamline the management of business transactions, improve accuracy, and reduce costs–making them an indispensable tool for modern businesses.

Common Mistakes in Invoice Creation

Creating accurate and professional financial records is crucial for ensuring smooth transactions and maintaining healthy cash flow. However, even small mistakes in the preparation of these documents can lead to confusion, delayed payments, or disputes. Understanding the common errors that can occur during the creation process is essential for preventing issues and improving overall efficiency. This section highlights some of the most frequent mistakes businesses make when preparing their billing documents.

Frequent Errors in Billing Documents

There are several mistakes that can compromise the accuracy and clarity of your financial records. Below are some of the most common errors to avoid:

- Missing or Incorrect Client Information: Failing to include the full name, address, or contact information of the recipient can lead to confusion or delays in processing payments.

- Incorrect Payment Terms: Not specifying the payment due date or the payment methods accepted can lead to misunderstandings, causing delays in receiving payments.

- Errors in Calculations: Simple mistakes in totaling amounts, calculating taxes, or applying discounts can result in incorrect totals and confusion. Always double-check all calculations.

- Omitting Tax Information: Failing to include tax details (e.g., VAT number or tax rates) or not clearly indicating the tax amount can create legal issues, especially if you’re required to charge taxes based on local regulations.

Other Issues to Avoid

In addition to the common mistakes listed above, there are a few other important points to watch out for:

- Not Including a Unique Reference Number: Every record should have a unique reference number for easy tracking. Missing this detail can make it difficult to manage records, particularly when dealing with large volumes of transactions.

- Unclear Item Descriptions: Be specific and detailed when describing goods or services provided. Vague or ambiguous descriptions can lead to disputes or confusion about what was purchased.

- Failure to Update Information: If there are any changes to the terms of the transaction (e.g., price adjustments or changes in payment methods), ensure the document reflects these updates.

By avoiding these common mistakes, you can ensure that your records are accurate, professional, and clear–helping to prevent confusion and facilitate timely payments.

Updating Your Excel Invoice Template Regularly

As your business evolves, so do your financial requirements and legal obligations. It’s essential to keep your billing records up to date to reflect these changes. Regularly reviewing and updating your documentation system ensures that it remains compliant with the latest regulations, accommodates new business needs, and reflects any changes in your products or services. This section discusses why and how you should make periodic updates to your billing system.

Why Regular Updates Are Important

Keeping your financial records current is not just about maintaining accuracy; it’s also about staying compliant with changing laws and improving the efficiency of your business. Here are some reasons why regular updates are essential:

- Legal Compliance: Tax laws, payment terms, and other regulations can change over time. Regular updates ensure that your business stays in line with legal requirements, avoiding potential fines or disputes.

- Improved Accuracy: Over time, your services, products, and pricing structures may change. Regularly updating your system ensures that the correct information is always used.

- Better Efficiency: By reviewing your existing records, you may find ways to streamline the process, reduce manual errors, and automate tasks.

- Enhanced Professionalism: Keeping your financial documents up to date reflects well on your business and can help build trust with your clients.

How to Update Your Billing Documents

To ensure your documents remain relevant and accurate, consider these steps when updating your system:

- Review Business Information: Make sure your company’s details, such as name, address, contact information, and payment terms, are correct and up to date.

- Adjust for Pricing Changes: If your products or services have undergone a price adjustment, be sure to update your system to reflect these changes in your billing records.

- Include New Tax Rates: Keep track of any changes to VAT or other tax rates and ensure that your documents reflect these updates.

- Automate Repetitive Tasks: Utilize formulas to automate calculations, such as taxes and totals, reducing the risk of errors in your records.

- Check for User Feedback: Solicit feedback from clients and staff on areas for improvement, ensuring your system remains user-friendly and efficient.

By regularly reviewing and updating your financial documents, you can ensure that your business runs smoothly, remains compliant, and projects a professional image to your clients. Keeping your records in top shape not only improves your internal processes but also enhances your customer relations.

Integrating Excel Invoices with Accounting Software

Integrating your financial records with accounting software can significantly improve the efficiency of your business operations. This integration streamlines the process of tracking payments, managing expenses, and generating financial reports. By connecting your billing system with accounting tools, you reduce the need for manual data entry and minimize the risk of errors. This section discusses the benefits of integrating your financial documents with accounting software and provides a simple approach to setting up such an integration.

Benefits of Integration

Integrating your billing system with accounting software offers several key advantages:

- Automation: Data entered in your billing system can automatically sync with accounting software, reducing the time spent on manual entry and ensuring that records are updated in real time.

- Improved Accuracy: With automatic data transfer, the risk of human error is minimized. Financial records remain accurate and up-to-date across all platforms.

- Time Efficiency: Streamlining the process saves time by eliminating redundant tasks like entering the same data into multiple systems.

- Better Reporting: Integrated systems allow for faster and more comprehensive financial reporting, helping you make informed decisions based on up-to-date information.

- Enhanced Compliance: By keeping your records consistent and aligned with accounting software, you ensure that your business is always in compliance with financial regulations and tax requirements.

How to Integrate Your Billing System with Accounting Software

Here are the steps to successfully integrate your financial records with your accounting tools:

- Choose Compatible Software: Ensure that your billing and accounting tools are compatible or can easily integrate. Many accounting platforms offer built-in integrations or third-party connectors for popular financial tools.

- Use Data Import/Export Features: Most accounting software allows you to import data from spreadsheets. Set up the import process to automatically pull information from your billing system at regular intervals.

- Set Up Automatic Syncing: If your accounting software offers automatic syncing, enable this feature to ensure your records are always aligned across both platforms.

- Test the Integration: After setting up the integration, perform a test to ensure that all data is transferring correctly. Verify that the amounts, client details, and dates are accurate in both systems.

- Train Your Team: Ensure that your staff understands how to use the integrated system properly. Provide training on how to enter and update data to ensure accuracy across both systems.

By integrating your financial documents with accounting software, you can streamline your operations, improve accuracy, and save time. This integration helps you maintain organized records while ensuring that all your financial data is easily accessible and up-to-date.