Free Excel Invoice Template with Database Download

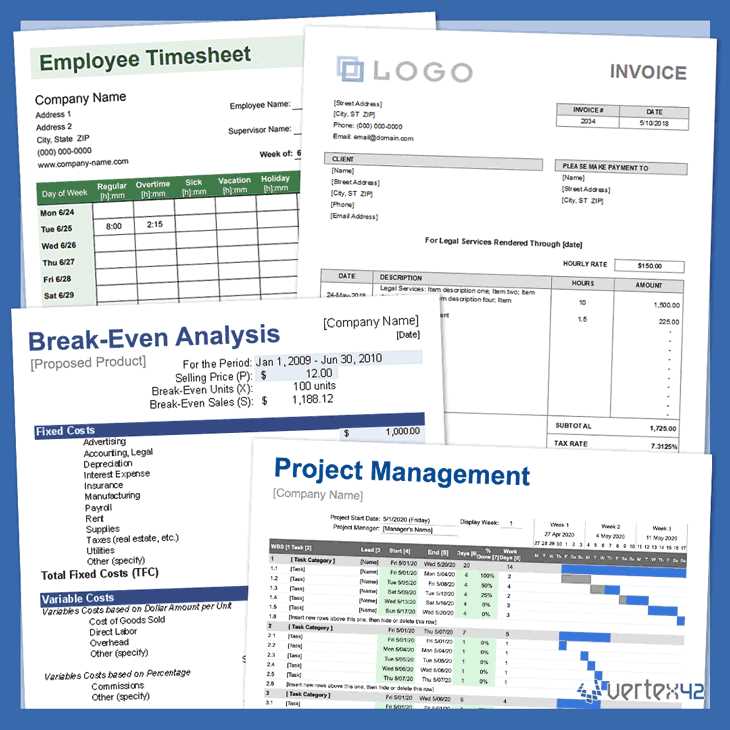

Managing client payments and keeping track of business transactions can be a time-consuming and complex task. For many professionals and small business owners, having a structured system to handle invoices and related financial details is essential. A well-organized approach not only saves time but also minimizes the risk of errors and mismanagement.

To make this process smoother, you can turn to pre-built solutions designed to help automate calculations, record payments, and organize client data. These tools allow you to easily generate accurate records and track outstanding balances, all while offering flexibility in terms of customization. Whether you’re a freelancer, a small business owner, or a larger company, adopting a streamlined method to handle these tasks can significantly improve your workflow.

Many options are available to suit various business needs. By using efficient tools, you can eliminate the hassle of manual record-keeping and focus on more important aspects of your work, such as growing your client base and delivering quality services. In this guide, you’ll learn how to access these resources and make the most of them for your business needs.

Excel Invoice Templates for Small Businesses

For small business owners, managing financial records can be a daunting task, especially when it comes to creating billing documents and tracking payments. An efficient system can help ensure that transactions are processed smoothly and clients are billed accurately. This is where pre-designed tools can play a crucial role, offering a simple yet effective way to keep your finances organized without the need for complicated software or manual calculations.

These tools can be customized to fit the unique needs of your business, whether you’re a freelancer, a consultant, or running a small retail operation. With the right solution, you can quickly generate professional documents, incorporate payment tracking, and organize customer details in one easy-to-use file. By utilizing such solutions, small businesses can save valuable time and reduce the risk of errors, making the process much more efficient and manageable.

Choosing the right system for your business will allow you to stay on top of your finances and avoid any unnecessary complications. Whether you’re dealing with multiple clients or managing recurring billing, having a well-organized method at your disposal can simplify many aspects of your business operations.

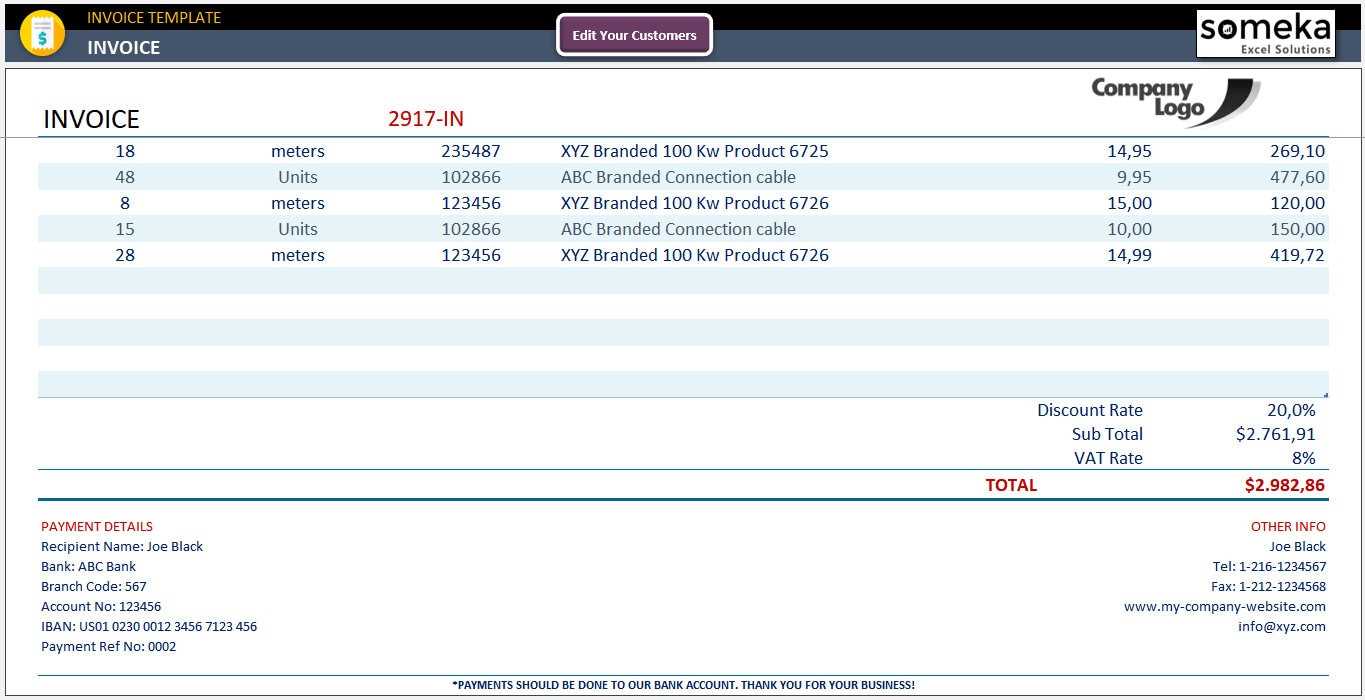

How to Use Excel for Invoices

Creating and managing billing documents doesn’t need to be a complicated process. Using spreadsheet software can simplify this task, allowing you to generate detailed and organized financial records quickly. By utilizing built-in functions and easy-to-use features, you can design a system that tracks client payments, calculates totals, and organizes necessary details in one accessible file.

Setting Up Your Document

To begin, set up a new file where you can input all relevant details for each transaction. A basic structure typically includes sections for client information, products or services provided, pricing, and payment status. Organizing these fields correctly ensures easy tracking and access to important data.

- Client Name

- Transaction Date

- Product/Service Description

- Amount Due

- Payment Status

Adding Formulas for Automation

One of the main advantages of using spreadsheet software is the ability to automate calculations. By incorporating simple formulas, you can ensure accurate totals for each entry, including tax, discounts, or additional charges. This eliminates manual errors and saves time when updating financial records.

- Sum Function: Automatically add up totals for multiple items.

- Percentage Calculations: Easily apply taxes or discounts to the amounts.

- Conditional Formatting: Highlight overdue payments or other key details.

Once set up, these systems can be reused for every new transaction, making them ideal for ongoing business operations. With just a few adjustments, you can quickly manage multiple clients and keep your financial records organized and up to date.

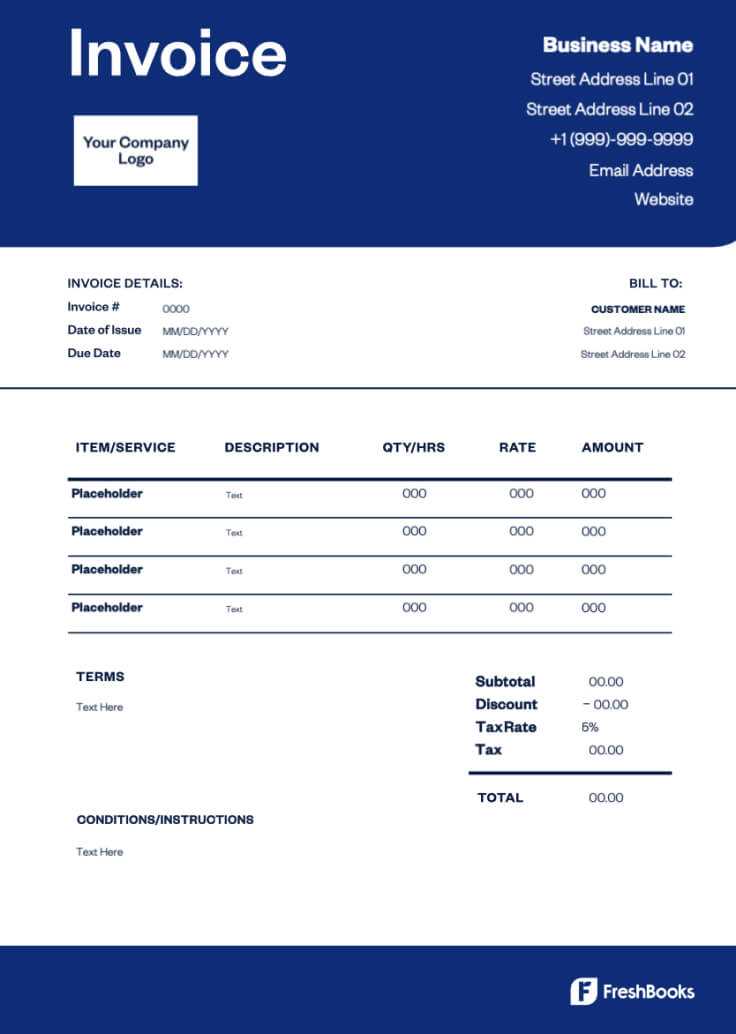

Benefits of Using an Invoice Template

Having a standardized document to handle billing can offer numerous advantages to businesses of all sizes. By using a pre-structured format, you save valuable time and ensure consistency in your financial records. This reduces the chances of mistakes and makes the overall process more efficient. Whether you’re a freelancer or managing a small business, utilizing an organized solution brings clarity and simplicity to your workflow.

Here are some key benefits:

| Benefit | Description |

|---|---|

| Time Efficiency | Quickly generate new records without needing to start from scratch each time. |

| Accuracy | Built-in calculations help ensure that totals and taxes are correct every time. |

| Professional Appearance | Presenting well-organized documents builds trust with clients and enhances your brand. |

| Consistency | Maintaining uniformity across all billing records prevents confusion and errors. |

| Easy Tracking | Helps keep track of payments, outstanding amounts, and client details in one place. |

By streamlining the billing process, you can focus more on other critical aspects of your business, such as improving services and growing your client base. An organized system makes a significant difference in maintaining smooth financial operations.

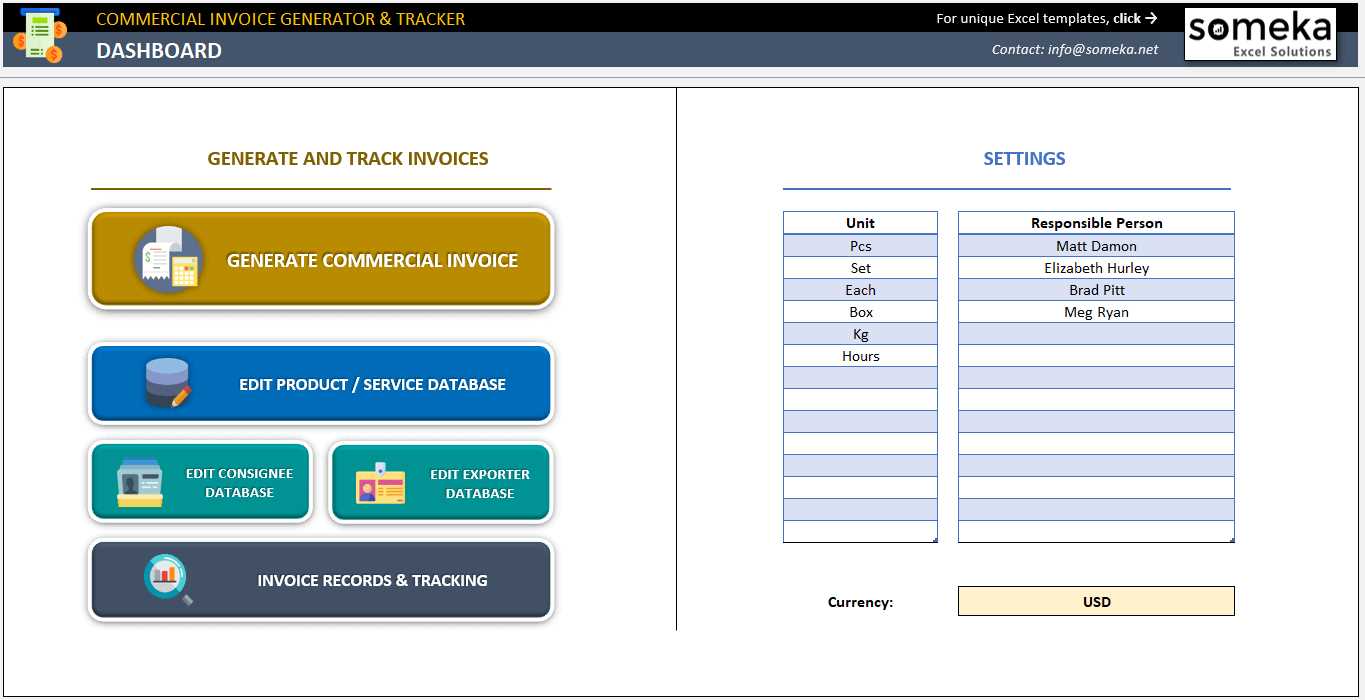

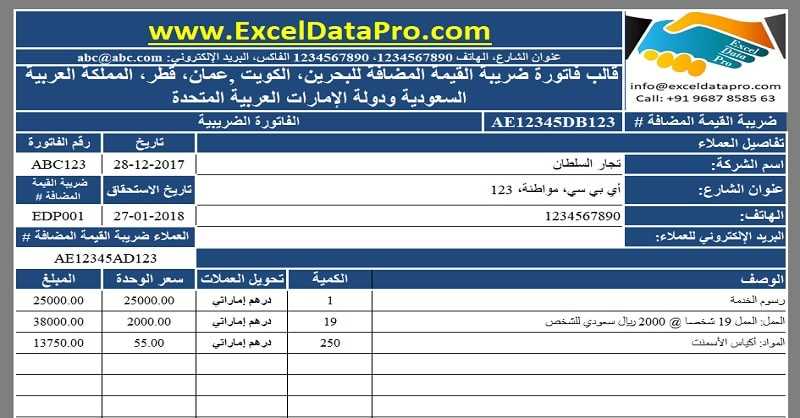

Download Free Invoice Templates with Database

Many business owners, especially small and medium-sized enterprises, struggle with maintaining organized financial records. Fortunately, there are various tools available that help automate the process of generating accurate documents and storing transaction details. These resources simplify billing and client management, making it easier to track payments and other relevant information efficiently.

Why Choose Pre-built Solutions?

Opting for pre-built files designed to handle invoicing tasks can save considerable time and effort. These ready-to-use solutions are equipped to handle both the creation of professional billing documents and the organization of client-related data. The ability to track outstanding payments, adjust totals, and maintain detailed records all in one place is an invaluable asset for businesses looking to streamline their operations.

How to Access These Resources

Getting access to these pre-designed solutions is easy. Most platforms offer a variety of formats that can be customized to your specific needs. By using these structured files, you can eliminate the need for manual entry, reduce the risk of mistakes, and ensure your records are both accurate and organized. Whether you choose an online or offline solution, these tools are accessible for a wide range of business types, from freelancers to established companies.

Note: Make sure to select the right format and features based on your business’s unique requirements. Customizing the file to match your needs is key to ensuring it becomes a valuable tool in your financial management process.

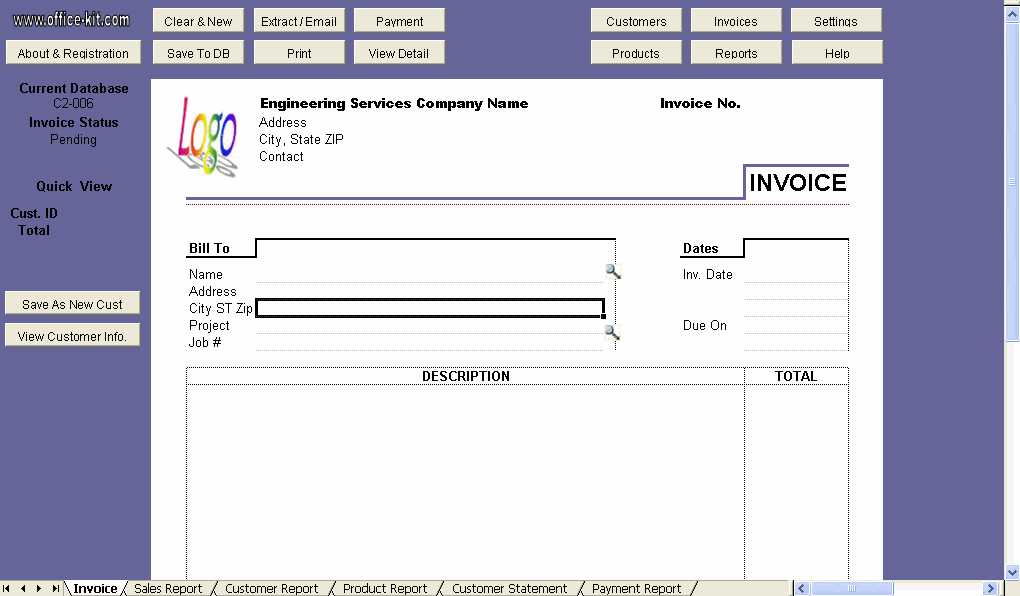

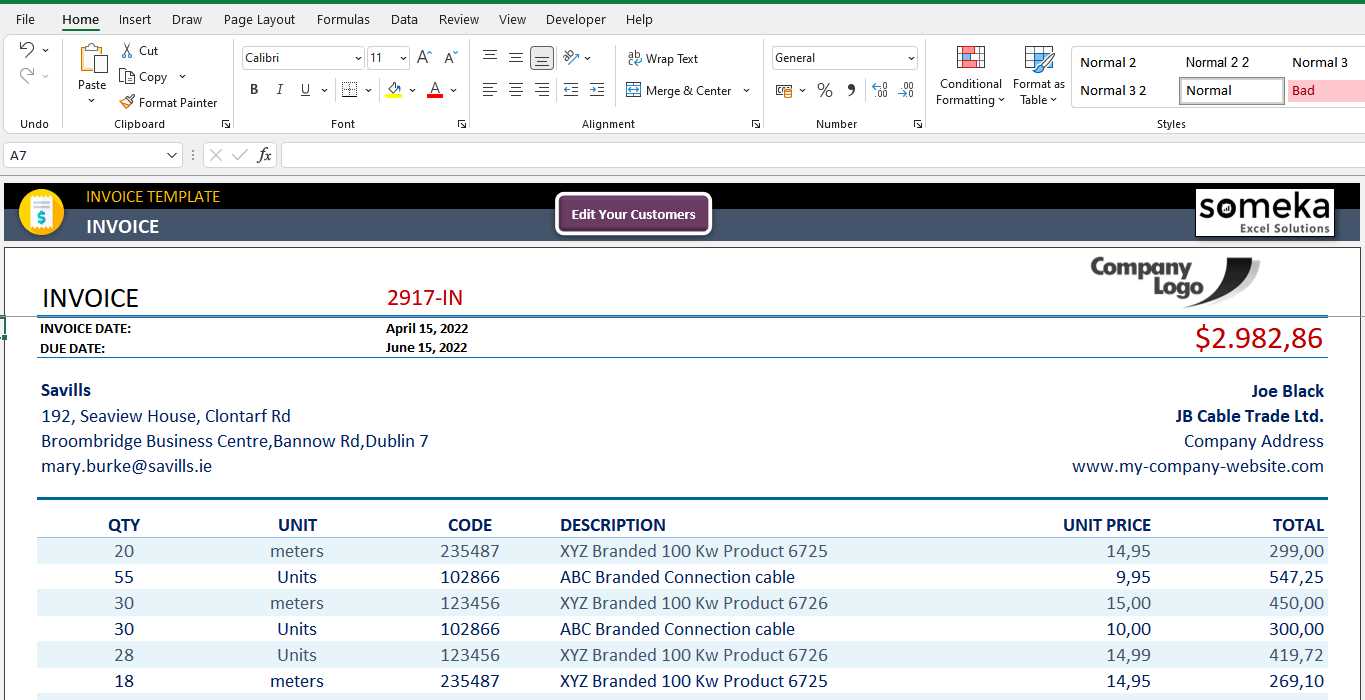

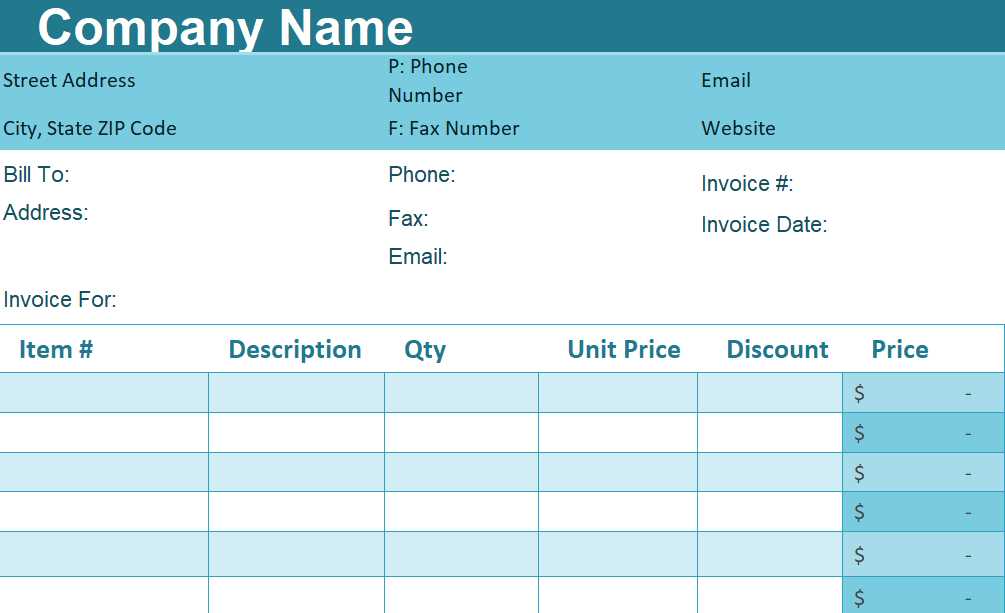

Creating Professional Invoices with Excel

Designing well-structured payment requests is an essential task for businesses of all sizes. A well-crafted document not only ensures timely transactions but also conveys professionalism to clients. Using a spreadsheet program can greatly simplify this process by allowing for customization, automation, and easy tracking. Whether you’re an independent contractor, small business owner, or freelancer, mastering this tool can significantly streamline your administrative work.

Streamlining the Payment Process

By utilizing the right features in a spreadsheet, you can automate many aspects of the process, such as calculations, date tracking, and client information. A properly set up sheet allows for quick generation of a document each time a transaction is made. This ensures accuracy and saves time, as details like item descriptions, pricing, and totals are all calculated automatically. Moreover, it enables you to maintain a clean and organized record of your past transactions for future reference.

Customizing for Your Needs

Customizing the layout and design is another significant advantage. You can adjust colors, fonts, and fields to reflect your brand’s identity, ensuring consistency across all communications. Adding your logo and company information can further enhance the professional appearance of the document. Additionally, incorporating a simple tracking system helps manage multiple clients and various service categories efficiently.

By using these features effectively, you can easily create professional documents that leave a positive impression on your clients while saving time and reducing the chance of human error in your billing process.

Creating Professional Invoices with Excel

Designing well-structured payment requests is an essential task for businesses of all sizes. A well-crafted document not only ensures timely transactions but also conveys professionalism to clients. Using a spreadsheet program can greatly simplify this process by allowing for customization, automation, and easy tracking. Whether you’re an independent contractor, small business owner, or freelancer, mastering this tool can significantly streamline your administrative work.

Streamlining the Payment Process

By utilizing the right features in a spreadsheet, you can automate many aspects of the process, such as calculations, date tracking, and client information. A properly set up sheet allows for quick generation of a document each time a transaction is made. This ensures accuracy and saves time, as details like item descriptions, pricing, and totals are all calculated automatically. Moreover, it enables you to maintain a clean and organized record of your past transactions for future reference.

Customizing for Your Needs

Customizing the layout and design is another significant advantage. You can adjust colors, fonts, and fields to reflect your brand’s identity, ensuring consistency across all communications. Adding your logo and company information can further enhance the professional appearance of the document. Additionally, incorporating a simple tracking system helps manage multiple clients and various service categories efficiently.

By using these features effectively, you can easily create professional documents that leave a positive impression on your clients while saving time and reducing the chance of human error in your billing process.

Creating Professional Invoices with Excel

Designing well-structured payment requests is an essential task for businesses of all sizes. A well-crafted document not only ensures timely transactions but also conveys professionalism to clients. Using a spreadsheet program can greatly simplify this process by allowing for customization, automation, and easy tracking. Whether you’re an independent contractor, small business owner, or freelancer, mastering this tool can significantly streamline your administrative work.

Streamlining the Payment Process

By utilizing the right features in a spreadsheet, you can automate many aspects of the process, such as calculations, date tracking, and client information. A properly set up sheet allows for quick generation of a document each time a transaction is made. This ensures accuracy and saves time, as details like item descriptions, pricing, and totals are all calculated automatically. Moreover, it enables you to maintain a clean and organized record of your past transactions for future reference.

Customizing for Your Needs

Customizing the layout and design is another significant advantage. You can adjust colors, fonts, and fields to reflect your brand’s identity, ensuring consistency across all communications. Adding your logo and company information can further enhance the professional appearance of the document. Additionally, incorporating a simple tracking system helps manage multiple clients and various service categories efficiently.

By using these features effectively, you can easily create professional documents that leave a positive impression on your clients while saving time and reducing the chance of human error in your billing process.

Creating Professional Invoices with Excel

Designing well-structured payment requests is an essential task for businesses of all sizes. A well-crafted document not only ensures timely transactions but also conveys professionalism to clients. Using a spreadsheet program can greatly simplify this process by allowing for customization, automation, and easy tracking. Whether you’re an independent contractor, small business owner, or freelancer, mastering this tool can significantly streamline your administrative work.

Streamlining the Payment Process

By utilizing the right features in a spreadsheet, you can automate many aspects of the process, such as calculations, date tracking, and client information. A properly set up sheet allows for quick generation of a document each time a transaction is made. This ensures accuracy and saves time, as details like item descriptions, pricing, and totals are all calculated automatically. Moreover, it enables you to maintain a clean and organized record of your past transactions for future reference.

Customizing for Your Needs

Customizing the layout and design is another significant advantage. You can adjust colors, fonts, and fields to reflect your brand’s identity, ensuring consistency across all communications. Adding your logo and company information can further enhance the professional appearance of the document. Additionally, incorporating a simple tracking system helps manage multiple clients and various service categories efficiently.

By using these features effectively, you can easily create professional documents that leave a positive impression on your clients while saving time and reducing the chance of human error in your billing process.

Creating Professional Invoices with Excel

Designing well-structured payment requests is an essential task for businesses of all sizes. A well-crafted document not only ensures timely transactions but also conveys professionalism to clients. Using a spreadsheet program can greatly simplify this process by allowing for customization, automation, and easy tracking. Whether you’re an independent contractor, small business owner, or freelancer, mastering this tool can significantly streamline your administrative work.

Streamlining the Payment Process

By utilizing the right features in a spreadsheet, you can automate many aspects of the process, such as calculations, date tracking, and client information. A properly set up sheet allows for quick generation of a document each time a transaction is made. This ensures accuracy and saves time, as details like item descriptions, pricing, and totals are all calculated automatically. Moreover, it enables you to maintain a clean and organized record of your past transactions for future reference.

Customizing for Your Needs

Customizing the layout and design is another significant advantage. You can adjust colors, fonts, and fields to reflect your brand’s identity, ensuring consistency across all communications. Adding your logo and company information can further enhance the professional appearance of the document. Additionally, incorporating a simple tracking system helps manage multiple clients and various service categories efficiently.

By using these features effectively, you can easily create professional documents that leave a positive impression on your clients while saving time and reducing the chance of human error in your billing process.

Integrating Payment Tracking in Excel Templates

Efficiently tracking payments is crucial for maintaining smooth cash flow and ensuring accurate financial records. By incorporating payment monitoring into your billing system, you can easily keep tabs on outstanding balances, received amounts, and payment due dates. This integration not only simplifies the accounting process but also helps prevent missed payments or misunderstandings with clients. Automating the tracking process within a structured document ensures better organization and quicker access to financial information.

Automating Payment Status Updates

One of the key advantages of incorporating payment tracking into your workflow is the ability to automatically update payment statuses. By using built-in functions, you can create a system that marks payments as “paid” once entered, or highlights overdue amounts. This eliminates the need for manual updates and reduces errors, ensuring your records are always up to date. You can also include columns for payment methods, amounts received, and payment dates, allowing for a comprehensive view of the transaction history.

Creating Payment Reminders and Alerts

Adding automated reminders and alerts within the document ensures you never miss an important payment date. Simple conditional formatting rules can be used to highlight overdue payments or approaching due dates, making it easy to identify which clients or transactions require immediate attention. This functionality can significantly reduce the risk of delayed payments and improve communication with clients regarding outstanding amounts.

By implementing these tracking features, you streamline your financial processes, enhance accuracy, and improve the overall efficiency of managing payments. This proactive approach ultimately saves time and resources, while helping maintain strong relationships with clients.

How to Avoid Common Excel Invoice Mistakes

Creating payment requests can seem straightforward, but small mistakes can lead to confusion, delays, and even damage to professional relationships. By paying attention to details and utilizing some basic best practices, you can ensure that your documents are error-free and convey a high level of professionalism. Below are some common pitfalls to watch out for and tips on how to avoid them.

Key Mistakes to Watch For

- Incorrect or Missing Client Information: Always double-check that the recipient’s details, such as name, address, and contact information, are accurate. Errors in these fields can delay payments or cause confusion.

- Wrong Payment Terms: Clearly state payment deadlines, including any late fees or discounts for early payments. Failing to do this can lead to misunderstandings and late payments.

- Calculation Errors: Ensure all numbers are calculated correctly, especially when adding taxes or discounts. Automating this process within your document reduces the chance of mistakes.

- Missing Invoice Number: Each payment request should have a unique reference number for tracking purposes. Leaving this out can make it difficult to follow up on outstanding payments.

Best Practices for Accurate Payment Requests

- Double-Check All Information: Before sending, review the document for accuracy. Ensure all fields, from client details to pricing, are correct.

- Use Automation: If possible, automate calculations and due dates to minimize the chance of human error. Simple formulas can handle tax rates, totals, and discounts for you.

- Include Clear Payment Instructions: Make sure clients understand how to pay, where to send funds, and any additional details regarding payment methods.

- Review the Layout: A clean, organized layout makes it easier for your clients to read and understand the document. Ensure your design is straightforward and easy to follow.

By staying mindful of these common mistakes and implementing preventive measures, you can ensure that your payment requests are always professional, clear, and accurate.

Setting Up Automatic Calculations in Excel

Automating calculations within your financial documents can save significant time and reduce the chance of human error. By setting up formulas and functions, you can easily manage complex tasks like adding taxes, applying discounts, and calculating totals without needing to input these values manually each time. This not only speeds up the process but also ensures consistent accuracy across all transactions.

Essential Calculations to Automate

- Subtotal Calculation: Automatically sum up the individual items or services listed, ensuring the total before taxes and discounts is always accurate.

- Tax Calculations: Set up a formula to automatically apply the correct tax rate to the subtotal, ensuring you never have to manually adjust this for each transaction.

- Discount Application: Use conditional formulas to apply discounts based on set criteria, such as early payment or bulk purchases.

- Total Amount: Create a formula that combines the subtotal, taxes, and any discounts to calculate the final amount due.

Steps to Automate Calculations

- Define Your Variables: Start by setting up columns for each item or service, including quantity, unit price, and any applicable tax or discount rates.

- Insert Formulas: Use basic functions like SUM for totals, and multiplication (*) for applying prices and quantities. For taxes, use the formula: =Subtotal * Tax Rate.

- Apply Conditional Formatting: Set up conditional formatting to highlight any overdue amounts or incomplete calculations, so they can be quickly addressed.

- Test the Calculations: Before finalizing your document, input a few test values to make sure that all formulas are functioning as expected and updating correctly.

By automating these key calculations, you not only save time but also improve the reliability of your financial records, making it easier to track and manage payments. Automation eliminates the possibility of errors and gives you more control over your invoicing process, ultimately improving both efficiency and accuracy.

Managing Multiple Invoices with Excel

Handling a large volume of billing documents can quickly become overwhelming without an organized system. Efficiently managing multiple payment requests involves keeping track of client information, due dates, amounts, and payment statuses. By structuring your documents and using the right tools, you can streamline the process, ensuring that nothing is overlooked and that payments are processed on time.

Steps to Organize and Track Multiple Transactions

- Create a Centralized Record: Set up a master sheet where you can list all transactions, including client names, due dates, amounts, and payment statuses. This allows you to have an overview of all pending and completed payments in one place.

- Use Filters and Sorting: Utilize sorting features to group transactions by due date, client name, or amount. Filters can help you quickly find specific entries and track overdue payments.

- Leverage Conditional Formatting: Apply conditional formatting to highlight late payments or upcoming due dates. This provides a visual cue to quickly identify which payments require immediate attention.

- Set Up Payment Reminders: Add columns for payment reminders or alerts. You can use formulas to flag upcoming due dates, ensuring timely follow-up with clients.

Automating the Process

- Automate Calculations: Set up automatic calculations for totals, taxes, and discounts to minimize manual entry and reduce the risk of errors across multiple transactions.

- Track Payments Using Checkboxes: Add a column for checkboxes or drop-down lists that you can mark when a payment is received. This helps track the status of each transaction at a glance.

- Create Reports: Design a reporting system that compiles important data such as total revenue, outstanding payments, and overdue accounts. Running reports regularly can give you insight into your financial status.

By organizing your payment records and utilizing automation tools, you can manage numerous transactions effectively, ensuring timely payments and maintaining a professional and efficient billing process. Proper tracking reduces errors and improves communication, ultimately strengthening client relationships and supporting business growth.

Managing Multiple Invoices with Excel

Handling a large volume of billing documents can quickly become overwhelming without an organized system. Efficiently managing multiple payment requests involves keeping track of client information, due dates, amounts, and payment statuses. By structuring your documents and using the right tools, you can streamline the process, ensuring that nothing is overlooked and that payments are processed on time.

Steps to Organize and Track Multiple Transactions

- Create a Centralized Record: Set up a master sheet where you can list all transactions, including client names, due dates, amounts, and payment statuses. This allows you to have an overview of all pending and completed payments in one place.

- Use Filters and Sorting: Utilize sorting features to group transactions by due date, client name, or amount. Filters can help you quickly find specific entries and track overdue payments.

- Leverage Conditional Formatting: Apply conditional formatting to highlight late payments or upcoming due dates. This provides a visual cue to quickly identify which payments require immediate attention.

- Set Up Payment Reminders: Add columns for payment reminders or alerts. You can use formulas to flag upcoming due dates, ensuring timely follow-up with clients.

Automating the Process

- Automate Calculations: Set up automatic calculations for totals, taxes, and discounts to minimize manual entry and reduce the risk of errors across multiple transactions.

- Track Payments Using Checkboxes: Add a column for checkboxes or drop-down lists that you can mark when a payment is received. This helps track the status of each transaction at a glance.

- Create Reports: Design a reporting system that compiles important data such as total revenue, outstanding payments, and overdue accounts. Running reports regularly can give you insight into your financial status.

By organizing your payment records and utilizing automation tools, you can manage numerous transactions effectively, ensuring timely payments and maintaining a professional and efficient billing process. Proper tracking reduces errors and improves communication, ultimately strengthening client relationships and supporting business growth.

Excel Invoice Templates for Freelancers

For independent workers, managing financial transactions efficiently is crucial to maintaining a steady cash flow and ensuring prompt payments. Customizing a document that suits your specific needs as a freelancer can save time and reduce errors when billing clients. By creating an organized, professional structure for each payment request, you can focus more on your work and less on administrative tasks.

Essential Features for Freelancer Billing Documents

- Client Information Section: Always include fields for the client’s name, address, and contact details. This ensures that the payment request is clear and personalized.

- Service or Product Descriptions: Be detailed in listing the services you’ve provided or products you’ve delivered. Include the quantity, rate, and description to avoid confusion.

- Payment Terms: Clearly outline the payment due date and any applicable penalties for late payments. Freelancers often face delayed payments, so setting clear terms upfront is important.

- Hourly Rate or Fixed Fee: For freelancers, it’s important to specify the rate, whether hourly or fixed, and the total amount owed based on your work.

- Tax Information: If applicable, include the tax rate and the amount due to ensure both you and your client are on the same page regarding total costs.

Tips for Customizing Your Billing Documents

- Maintain Consistency: Use a consistent layout and design across all your documents. This reinforces your professional image and makes your documents easier to navigate.

- Automate Calculations: Set up basic functions to automatically calculate totals, taxes, and discounts. This minimizes the risk of errors and ensures accuracy.

- Keep a Record of Past Transactions: Maintain a master sheet or log where you can track all completed payments. This helps you stay organized and monitor outstanding balances.

- Use Personalized Branding: Add your logo and company details (if applicable) to make the document feel more professional and cohesive with your brand.

By customizing your payment documents with these features, you can ensure timely and accurate billing, reduce administrative stress, and present a professional image to your clients. Automation, consistency, and clear terms are the key elements for freelancers to efficiently manage their financial interactions.

Save Time with Excel Invoice Templates

Streamlining the billing process is essential for businesses and freelancers who need to focus more on their core tasks and less on administrative work. By using a pre-designed structure, you can generate payment requests quickly and accurately, avoiding the need to create each one from scratch. Automation and efficient layout can significantly reduce the time spent on creating and managing financial documents.

How Pre-Designed Structures Save Time

- Automation of Calculations: Instead of manually adding up totals, applying tax rates, or calculating discounts, a well-designed system can do all of that for you automatically. This speeds up the process and reduces the risk of human error.

- Quick Customization: Once set up, the layout can be reused, allowing you to simply plug in new client details and transaction amounts, saving time on formatting and layout adjustments.

- Consistent Design: A standardized structure ensures that every document looks professional and is formatted consistently, making it easy to track and organize your records.

- Built-In Client Records: Many systems allow you to store and retrieve client details easily, meaning you don’t have to repeatedly enter the same information for returning clients.

Additional Time-Saving Features

- Pre-Populated Fields: Having default fields for common information like service descriptions, rates, and payment terms allows you to create a document in just a few clicks.

- Integrated Reminders: You can set up reminders for due dates, ensuring you don’t forget to send payment requests or follow up on overdue accounts.

- Fast Reporting: With a structured system, generating reports on outstanding payments, revenue, or clients becomes a quick and easy task, allowing you to gain insights into your financial status without extra effort.

By using these time-saving features, you can efficiently manage your billing process, improve cash flow, and devote more time to growing your business or serving clients.