Video Production Invoice Template for Easy Billing

When managing client work in the creative industry, having a clear and professional way to track payments is essential. Effective financial management starts with using the right tools to ensure that both parties are on the same page regarding costs, payment terms, and project milestones. A well-structured document plays a crucial role in this process, helping to establish transparency and trust between creators and their clients.

Creating a detailed record of the services rendered, including the time spent, the resources used, and the agreed-upon fees, allows for smooth transactions and reduces the chances of misunderstandings. This approach is invaluable not only for staying organized but also for maintaining professionalism in client relationships. With the right format in place, invoicing becomes less of a chore and more of a streamlined part of business operations.

Whether you’re a freelancer or part of a larger team, having a reliable system for billing ensures that your work is compensated fairly and promptly. A well-organized financial document can also help you track your earnings, which is essential for budgeting and future planning.

Video Production Invoice Template Overview

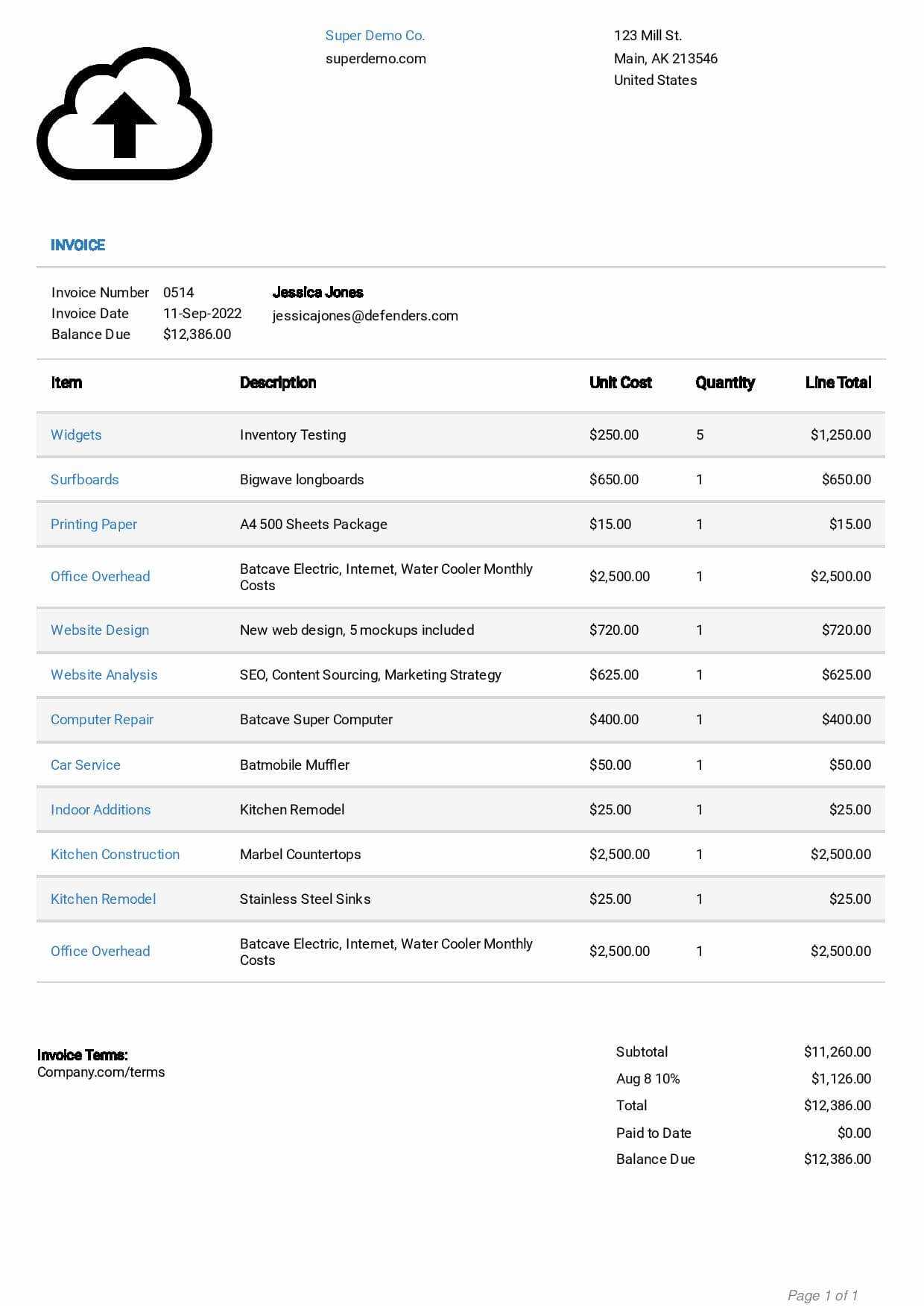

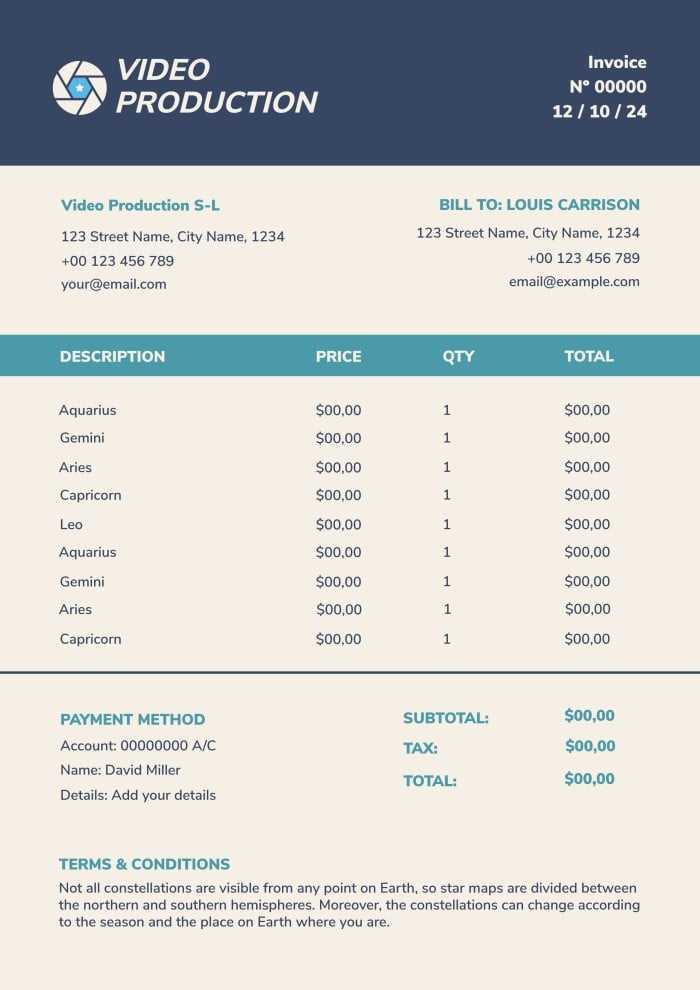

For anyone working in the creative field, organizing financial documentation is a crucial part of managing client relationships and ensuring smooth business operations. A clear, structured document that outlines the services provided, costs, and payment terms helps to avoid confusion and ensures that both parties are aligned. This type of record is designed to capture all relevant project details, offering a professional way to present charges while maintaining a streamlined workflow.

The layout of such a document typically includes several key sections that highlight specific elements of the project, such as the nature of the work, hours spent, and agreed-upon fees. It also ensures that payment methods and deadlines are clearly outlined. Having this form in place helps maintain a level of consistency across different projects, saving time and effort with each new client.

- Services Provided: A detailed list of tasks or deliverables completed as part of the project.

- Project Hours: An account of the total time invested in the work.

- Cost Breakdown: A clear breakdown of how costs are calculated for different aspects of the job.

- Payment Terms: Clear instructions on payment deadlines, methods, and any applicable late fees.

- Client Information: Contact details for both the creator and the client.

By utilizing such a form, creative professionals can ensure that all financial aspects of their work are documented in a transparent and efficient way. It simplifies the billing process, making it easier to track earnings, resolve discrepancies, and manage client payments. Furthermore, it helps in creating a more professional image and maintaining positive client relationships.

Why You Need an Invoice Template

Having a standardized form to document the financial aspects of your work is essential for both clarity and professionalism. Without a consistent method for tracking payments and services rendered, misunderstandings can arise, leading to potential delays or disputes. This type of document simplifies the entire billing process, ensuring that all terms are agreed upon and that both parties are fully aware of the charges and deadlines.

Using a pre-structured format offers several benefits, including:

| Benefit | Description |

|---|---|

| Organization | Helps keep track of all the services provided and payments due in an easily accessible manner. |

| Consistency | Ensures all financial records are created in the same format, reducing errors and confusion. |

| Professionalism | Gives clients a sense of trust and reliability, knowing that payments and terms are clearly outlined. |

| Time-saving | Reduces the amount of time spent creating custom documents for every client by using a pre-made format. |

| Accuracy | Helps prevent mistakes by clearly listing each task, hours, and charges for easy reference. |

Overall, a well-designed document is key to streamlining your billing process, maintaining professionalism, and avoiding potential confusion when it comes to payment. By using a structured approach, you create a transparent and efficient way to manage your financial interactions with clients, ensuring smoother transactions and stronger working relationships.

Key Elements of an Invoice

To ensure clarity and accuracy in financial transactions, it’s essential to include specific components in your billing documents. Each part serves a unique purpose, helping to outline services, costs, and payment expectations. Having a clear structure allows both parties to easily understand the terms of the agreement and reduces the chances of confusion.

Essential

Customizing Your Video Invoice Template

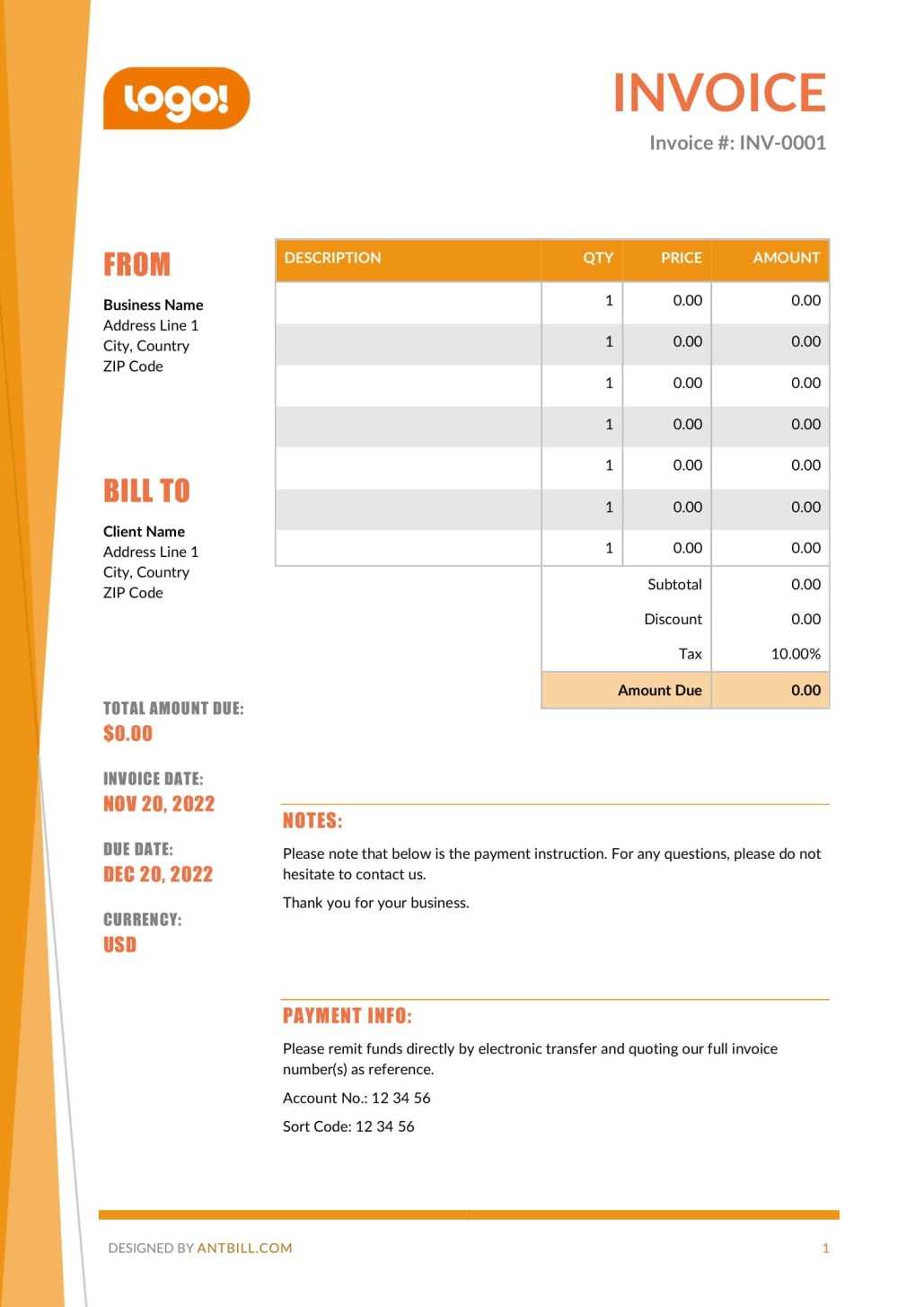

Adapting your billing documents to fit the specific needs of each client or project ensures that your financial records are not only accurate but also tailored to your business style. By personalizing the layout and content, you can create a professional appearance that aligns with your brand while making it easier for clients to understand the charges and payment terms. Customization can range from adding your logo to adjusting the format to better suit the type of work you do.

Key Customization Options

Here are some important elements to customize for a more personalized and functional document:

| Customization Option | Benefits |

|---|---|

| Branding | Including your logo, company colors, or design elements makes the document look professional and aligns with your brand. |

| Service Categories | Adjust the sections to reflect the specific types of services you provide, such as creative consultation, editing, or equipment rental. |

| Payment Options | Tailor the payment methods and instructions to suit your business model, whether through bank transfer, credit card, or online payment platforms. |

| Terms & Conditions | Customize the payment terms, late fees, and other conditions according to your standard practices and business policies. |

Ensuring Clarity and Simplicity

While customization allows for personalization, it’s crucial to maintain a clean and organized structure. Avoid overcomplicating the layout or including unnecessary details. Focus on making the information clear and easy to read, which will enhance client trust and make the document more efficient. By balancing creativity with simplicity, you can create a billing document that is both functional and professional.

How to Calculate Video Production Costs

Accurately calculating the costs associated with a project is key to maintaining profitability and ensuring fair compensation. Understanding all the elements that contribute to the final amount allows you to provide transparent pricing to clients while covering all expenses. The calculation process involves both fixed and variable costs, each of which should be carefully considered to determine the total fee for the services rendered.

Identifying the Key Cost Components

There are several factors that make up the overall cost of a project. These can include:

- Labor Costs: This includes the time spent by you and any team members, whether in preparation, execution, or post-work. Hourly rates or daily fees should be factored in.

- Equipment and Materials: The cost of using or renting cameras, lighting, software, or other necessary tools must be included, along with any consumables required for the project.

- Travel and Logistics: Any transportation, accommodation, or location fees incurred during the course of the project should be accounted for.

- Overheads: This can include business-related expenses such as office space, utilities, and insurance that contribute indirectly to the project cost.

Adding Profit Margin and Final Calculation

Once you have calculated all direct and indirect costs, it’s important to include a profit margin to ensure that you are compensated for your expertise and time. Typically, this percentage varies depending on the complexity of the project, market rates, and your business model. After applying the margin, you will arrive at the final cost, which should be clearly communicated to the client before the project begins.

Remember, being transparent with your clients about how costs are determined builds trust and helps manage expectations throughout the duration of the project.

Including Project Hours in Invoices

Tracking and accurately reflecting the time spent on each aspect of a project is essential for both transparency and fair compensation. By documenting the number of hours worked, you provide a clear record of the effort involved, which is crucial for clients to understand how the final cost was determined. Whether charging by the hour or offering flat-rate pricing, including project hours helps maintain professionalism and ensures that both parties are aligned on expectations.

When incorporating hours into a billing document, it’s important to detail the following:

- Hourly Rate: Clearly state the agreed-upon rate for each hour worked, ensuring that it reflects the complexity of the tasks performed.

- Task Breakdown: List the specific tasks or stages of the project that were worked on, along with the time dedicated to each.

- Time Tracking: Keep a detailed record of when work started and ended, including any breaks or interruptions, to provide an accurate account of hours worked.

- Milestone Hours: If applicable, divide hours according to specific milestones or phases in the project, allowing for a more granular breakdown of time spent.

Including project hours in your documents not only helps justify the charges but also creates a transparent framework that can be easily referenced by both you and your clients. This approach builds trust and reduces the potential for disputes related to the time and effort invested in the work.

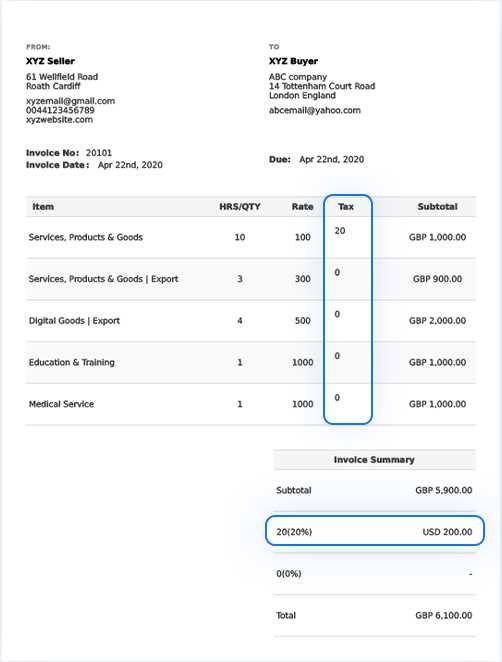

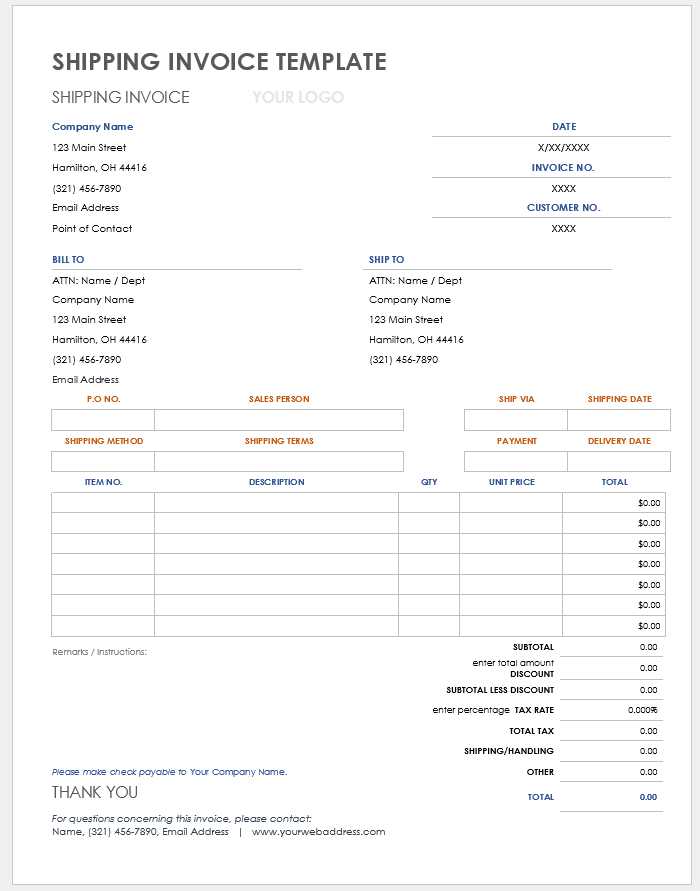

Incorporating Payment Terms Effectively

Clearly outlining payment terms in your billing documents is essential for setting expectations and ensuring timely compensation. By specifying when and how payments should be made, as well as any conditions related to late fees or discounts, you create a framework that encourages prompt payments and reduces the likelihood of misunderstandings. Well-defined terms also help protect your business from cash flow issues, ensuring that you are paid fairly for your services.

To effectively incorporate payment terms, consider including the following details in your billing documents:

| Payment Term | Description |

|---|---|

| Due Date | Specify the exact date by which the payment is expected, avoiding any ambiguity and helping the client plan accordingly. |

| Accepted Payment Methods | List the payment options available, such as bank transfers, credit cards, or online payment systems, making it easy for the client to choose a method that works for them. |

| Late Fees | Clearly state the consequences of delayed payments, such as interest charges or flat late fees, to incentivize timely payments. |

| Discounts for Early Payment | Offer a discount as an incentive for clients to pay before the due date, improving cash flow while providing an added benefit to the client. |

| Installment Plans | If applicable, include information about payment installments or a schedule, allowing flexibility for clients with larger amounts due. |

By including these key details, you can establish clear, professional payment terms that minimize confusion and foster positive relationships with clients. A well-structured payment agreement ensures that both parties understand their obligations and can avoid potential disputes down the line.

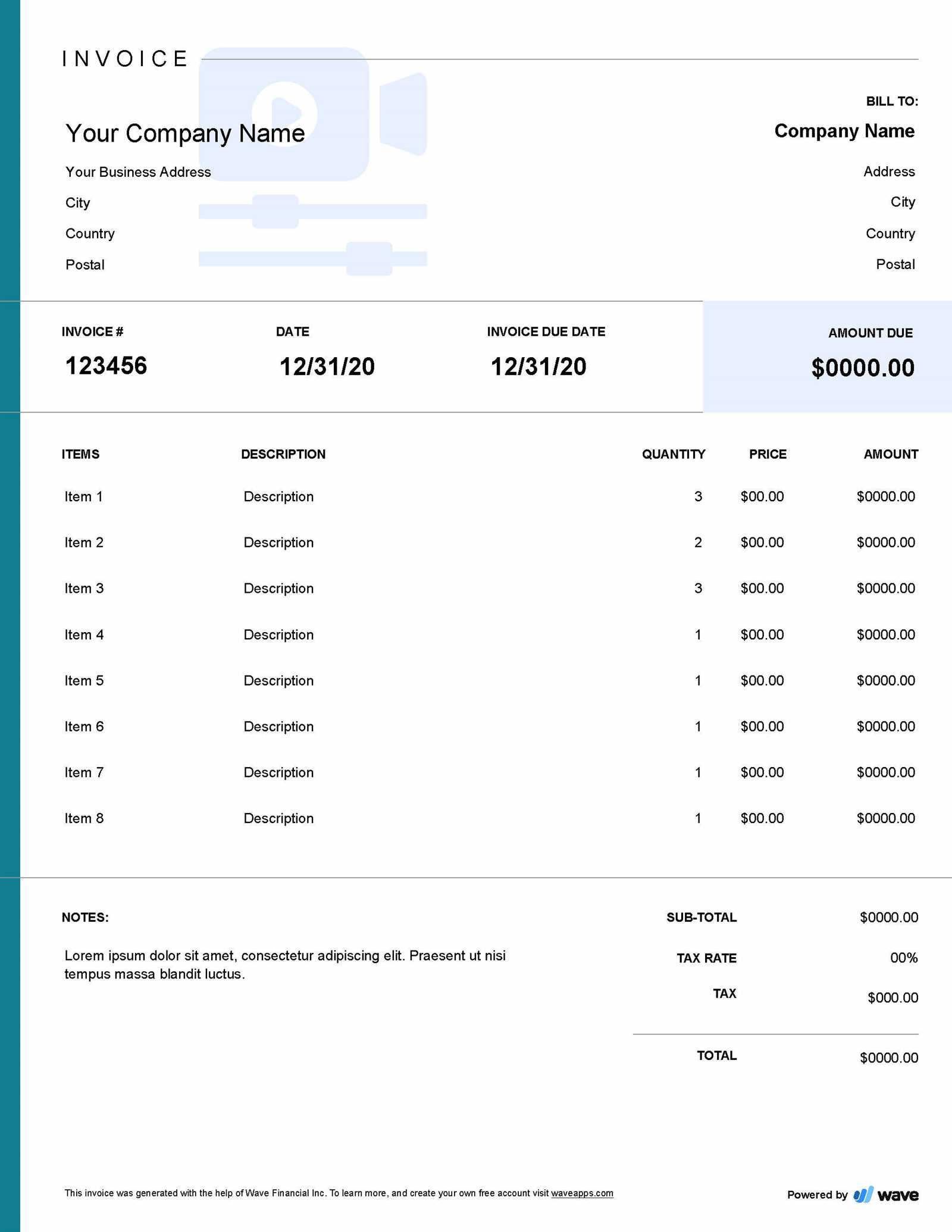

Best Practices for Invoice Formatting

Properly formatting your billing documents ensures that all necessary information is presented clearly and professionally. A well-organized document helps both you and your client to easily understand the charges, terms, and payment details. Effective formatting also contributes to your business’s professionalism, reinforcing your brand and making your documents easier to process and file for future reference.

Here are some best practices for formatting your billing documents:

- Clear and Concise Layout: Use a simple and clean design that allows for easy reading. Keep the layout logical, with each section clearly separated, so that the client can quickly find the information they need.

- Use Readable Fonts: Stick to easy-to-read fonts, such as Arial, Helvetica, or Times New Roman, and avoid using too many different font styles or sizes. Keep the font size large enough to be legible without straining the eyes.

- Organize Information in Sections: Break the document into distinct sections such as “Client Details,” “Service Breakdown,” “Costs,” and “Payment Terms.” This ensures that each area is easy to locate and review.

- Highlight Key Details: Make important information stand out, such as the total due, due date, and payment instructions. You can use bold or a larger font size to emphasize these points without overloading the document with unnecessary highlights.

- Maintain Consistency: Use a consistent format for all documents. This includes having the same headers, fonts, and styles throughout. Consistency helps clients recognize your work and fosters a professional image.

- Incorporate Branding Elements: If appropriate, include your logo, color scheme, or other brand elements to maintain consistency with your overall brand identity. This adds a personalized touch while reinforcing your business’s image.

- Ensure Proper Spacing: Leave sufficient space between sections, rows, and columns. A crowded document can be overwhelming and difficult to read, while appropriate spacing enhances readability.

By following these best practices, you can create a polished and professional document that is easy to read, accurately communicates the charges, and supports a positive client experience. Well-formatted billing documents help build trust, ensuring smooth financial transactions between you and your clients.

Common Mistakes to Avoid

When preparing billing documents, there are several common mistakes that can lead to confusion, delays, or disputes with clients. Whether it’s missing key details or making formatting errors, these issues can undermine your professionalism and affect the smoothness of financial transactions. Avoiding these mistakes will ensure that your documents are clear, accurate, and well-received by your clients.

Some of the most common mistakes to avoid include:

- Omitting Key Information: Failing to include critical details such as the payment due date, service breakdown, or client contact information can cause unnecessary confusion. Always ensure that all necessary information is provided in the document.

- Inaccurate Billing Amounts: Double-check all calculations and ensure that any taxes, fees, or discounts are correctly applied. Errors in the total amount due can lead to trust issues and delays in payment.

- Unclear Payment Terms: Not specifying the payment method, due date, or any late fees can create ambiguity and lead to delayed payments. Be explicit about when and how payments should be made.

- Neglecting to Itemize Services: Providing a lump sum without breaking down the individual services or hours worked can make it difficult for the client to understand the charges. Always itemize your services for transparency.

- Formatting Issues: A cluttered or hard-to-read layout can make the document difficult to navigate. Make sure the document is well-organized, with clear sections and sufficient spacing for easy reading.

- Not Including Contact Information: Failing to provide your business contact details or client information can cause unnecessary delays, especially if the client has questions or needs to follow up.

- Missing Client Approval: Always ensure that the client has reviewed and agreed to the final cost and payment terms before sending the document. In some cases, not getting prior approval can lead to disputes later on.

By being aware of these common mistakes and taking the necessary steps to avoid them, you can create clear, professional documents that facilitate smooth and timely payments. This attention to detail not only improves your cash flow but also helps in maintaining positive, long-term client relationships.

Tracking Payments Using Invoices

Efficiently tracking payments is crucial for maintaining a healthy cash flow and ensuring timely compensation for your work. By systematically documenting each transaction and keeping a clear record of what has been paid and what is still owed, you can manage your finances more effectively and avoid misunderstandings with clients. Using detailed billing documents can help you track payments and follow up on overdue amounts with ease.

Creating a Payment Tracking System

Establishing a payment tracking system is essential for staying organized. Each document should have a unique reference number, which helps in tracking and cross-referencing payments. Additionally, recording the date the payment was received, the amount paid, and any outstanding balances will keep your financial records up to date.

Organizing Payment Information

To track payments effectively, it’s important to maintain clear and concise records. You can set up a spreadsheet or use accounting software to organize your payment data. Include the following details:

- Reference Number: A unique identifier for each transaction.

- Client Name: The name of the client making the payment.

- Amount Due: The total amount originally billed.

- Amount Paid: The amount received from the client.

- Balance Owed: The remaining amount that has not been paid yet.

- Payment Date: The date the payment was received.

Having this system in place not only ensures that you can quickly verify payments, but also helps you identify any overdue balances. By staying on top of these details, you can follow up with clients in a timely manner and reduce the chances of missed payments.

By tracking payments in an organized manner, you can minimize the risk of errors, improve cash flow, and maintain stronger relationships with your clients. Proper documentation serves as a safeguard against payment disputes and provides a clear trail of financial transactions for both parties.

Integrating Invoices with Accounting Software

Streamlining financial operations is essential for running a successful business. One of the most efficient ways to do this is by integrating billing documents with accounting software. This integration helps to automate the process of tracking payments, managing expenses, and generating reports, which ultimately saves time and reduces the risk of errors.

Benefits of Integration

Integrating your billing system with accounting tools brings several advantages, such as:

- Automation: With integration, data from your documents is automatically transferred into the software, eliminating the need for manual data entry.

- Real-time Tracking: This integration allows for real-time updates on paid and outstanding amounts, helping you stay up-to-date with your financial status.

- Accuracy: Reduces the risk of human errors in calculations and record-keeping, ensuring more accurate financial reporting.

- Easy Tax Filing: With all transactions neatly recorded in your accounting system, preparing for tax season becomes much more efficient.

How to Integrate

Many modern accounting platforms offer the ability to connect with various billing systems. Here’s how you can integrate:

- Select Compatible Software: Ensure that your billing system and accounting software are compatible or that third-party integration tools are available.

- Set Up Syncing: Configure the settings in both systems to allow for seamless data syncing, so that every new document is automatically logged into the accounting software.

- Review Settings: Periodically check that all information is syncing correctly to avoid discrepancies in your records.

By connecting your billing system with accounting software, you can streamline your financial processes, improve accuracy, and save valuable time, allowing you to focus more on growing your business.

Creating a Professional Image with Invoices

The way you present your billing documents plays a crucial role in how clients perceive your business. A well-crafted and professional document not only reflects your attention to detail but also reinforces the credibility of your services. By ensuring that your paperwork is organized, clear, and visually appealing, you convey a sense of reliability and professionalism that can positively influence client relationships.

Key Elements for Professionalism

To establish a professional image through your billing documents, focus on the following aspects:

- Clean Design: A clean and structured layout with consistent fonts and colors gives a polished look. Avoid clutter and ensure the document is easy to read and navigate.

- Clear Branding: Including your logo, company name, and contact information on every document helps reinforce brand identity and makes it easier for clients to reach you if needed.

- Consistent Formatting: Consistency in formatting, such as uniform itemization, clear headings, and well-aligned text, contributes to a more professional appearance.

- Personalization: Personalizing the document with the client’s name and details not only shows attention to detail but also fosters a more personal connection with your client.

Benefits of a Professional Appearance

By putting effort into the design and structure of your billing documents, you communicate several positive attributes to your clients:

- Trustworthiness: Well-organized documents make your business appear more credible and trustworthy, which can lead to faster payments.

- Efficiency: A clear and well-laid-out document suggests that your business is efficient and values both time and accuracy.

- Customer Satisfaction: Clients are more likely to feel confident in doing business with a company that shows professionalism in every interaction, including financial dealings.

By focusing on the quality and professionalism of your documents, you can set your business apart from competitors and build stronger, long-lasting client relationships.

Ensuring Legal Compliance in Invoices

For businesses, maintaining legal compliance is crucial when handling financial documents. Properly structured billing documents must adhere to relevant laws and regulations to avoid potential legal issues or disputes. Ensuring compliance not only protects your business but also demonstrates professionalism and accountability to your clients. Adhering to legal standards can help you maintain a positive reputation and avoid penalties or fines.

Each country or region may have different requirements for what must be included in these records. For example, certain legal elements such as tax identification numbers, specific billing language, or mandatory payment terms may be required by law. By understanding and following these guidelines, you ensure that your business remains legally sound while minimizing the risk of complications.

Key Legal Elements to Include

To stay compliant with legal requirements, your documents should include the following elements:

- Tax Information: Depending on your location, your documents must include relevant tax identification numbers, such as VAT or sales tax numbers, to ensure proper tax reporting.

- Clear Payment Terms: Specify the agreed-upon payment conditions, including the due date and any late payment penalties, to protect both parties legally.

- Legal Business Details: Ensure that your business name, registration number, and physical address are clearly displayed on each document.

- Client Information: The recipient’s details, including full name and contact information, should be accurate and up to date for legal purposes.

Consequences of Non-Compliance

Failure to include necessary legal information in your financial records can lead to several issues:

- Legal Disputes: Incomplete or inaccurate billing details can lead to misunderstandings or disputes with clients, especially in regard to payments or terms.

- Penalties: Depending on your jurisdiction, failure to comply with tax and legal reporting requirements can result in fines or audits from government agencies.

- Loss of Credibility: Clients may lose trust in your business if they notice irregularities in your documents, potentially affecting future relationships.

By ensuring that your documents meet legal requirements, you not only protect your business but also enhance your professional standing, making your business more attractive to clients who value transparency and compliance.

How to Handle Late Payments

Late payments can disrupt your business cash flow and create unnecessary stress. It’s important to have a clear strategy in place for addressing overdue amounts in a professional yet firm manner. By implementing effective methods for managing late payments, you can protect your revenue while maintaining strong client relationships.

There are several steps you can take when dealing with overdue payments. Early intervention is key, as is maintaining clear communication with clients. Having well-defined payment terms from the outset, along with a system for following up, can often resolve the situation without escalation. Below are key strategies for handling late payments smoothly.

Steps to Take When Payments Are Late

Follow these steps to handle overdue payments effectively:

- Send a Reminder: A polite reminder can be the first step in addressing a late payment. It’s possible that the client simply forgot or overlooked the due date.

- Offer Payment Solutions: If the client is facing financial difficulties, consider offering payment plans or alternative payment options to make it easier for them to settle their balance.

- Charge Late Fees: If your payment terms include late fees, this can act as an incentive for clients to pay on time in the future. Make sure to clearly communicate these fees upfront.

- Follow Up Regularly: Keep track of overdue amounts and follow up regularly, but ensure your communication remains respectful and professional.

- Seek Legal Assistance: As a last resort, if the payment is significantly overdue, you may need to consider legal options or debt collection services.

Setting Clear Payment Terms

One of the most effective ways to prevent late payments is by setting clear and comprehensive payment terms from the beginning. Include details such as:

| Aspect | Details |

|---|---|

| Due Date | Clearly state the due date for payments to avoid confusion. |

| Late Fees | Specify if and when late fees will apply, and how they will be calculated. |

| Payment Methods | List the payment methods you accept to ensure clients know how to pay. |

| Consequences of Non-payment | Explain the steps that will be taken in case of non-payment, including legal action or withholding services. |

Having well-structured payment terms in place will make it easier to handle late payments while maintaining your professionalism and

Choosing the Right Payment Methods

Selecting the appropriate payment methods for your services is crucial to ensuring smooth transactions and client satisfaction. Different clients may have preferences for how they pay, and offering flexible options can enhance the convenience and speed of the payment process. It’s important to consider both ease of use and security when deciding on the payment methods you will accept.

When choosing payment methods, it’s essential to balance the needs of your clients with your business’s operational efficiency. Some methods may be faster or more secure, while others may incur higher fees. Offering a variety of choices can help meet the diverse preferences of your clients, while also minimizing delays and potential issues.

Below are some popular options to consider when determining the best payment methods for your services:

- Bank Transfers: Secure and widely used, bank transfers are a traditional method that many clients trust. They can be ideal for larger payments but may take a few days to process.

- Credit and Debit Cards: Offering card payments provides quick and easy processing, especially for international transactions. However, fees can apply, and security measures should be in place to protect sensitive information.

- Online Payment Systems: Platforms like PayPal, Stripe, or Venmo allow clients to make payments quickly and conveniently. These services typically charge transaction fees but provide a seamless user experience.

- Checks: Although slower, checks are still a common method for clients who prefer to pay manually. However, they may have longer processing times and could potentially be lost or delayed in the mail.

- Cryptocurrency: For tech-savvy clients, accepting digital currencies like Bitcoin can be an option. This method offers quick transactions and low fees but may not be as widely adopted as other options.

When selecting which methods to use, consider transaction fees, processing times, and the security measures each payment option offers. By making informed decisions, you can enhance the payment experience for your clients while also improving your cash flow and operational efficiency.

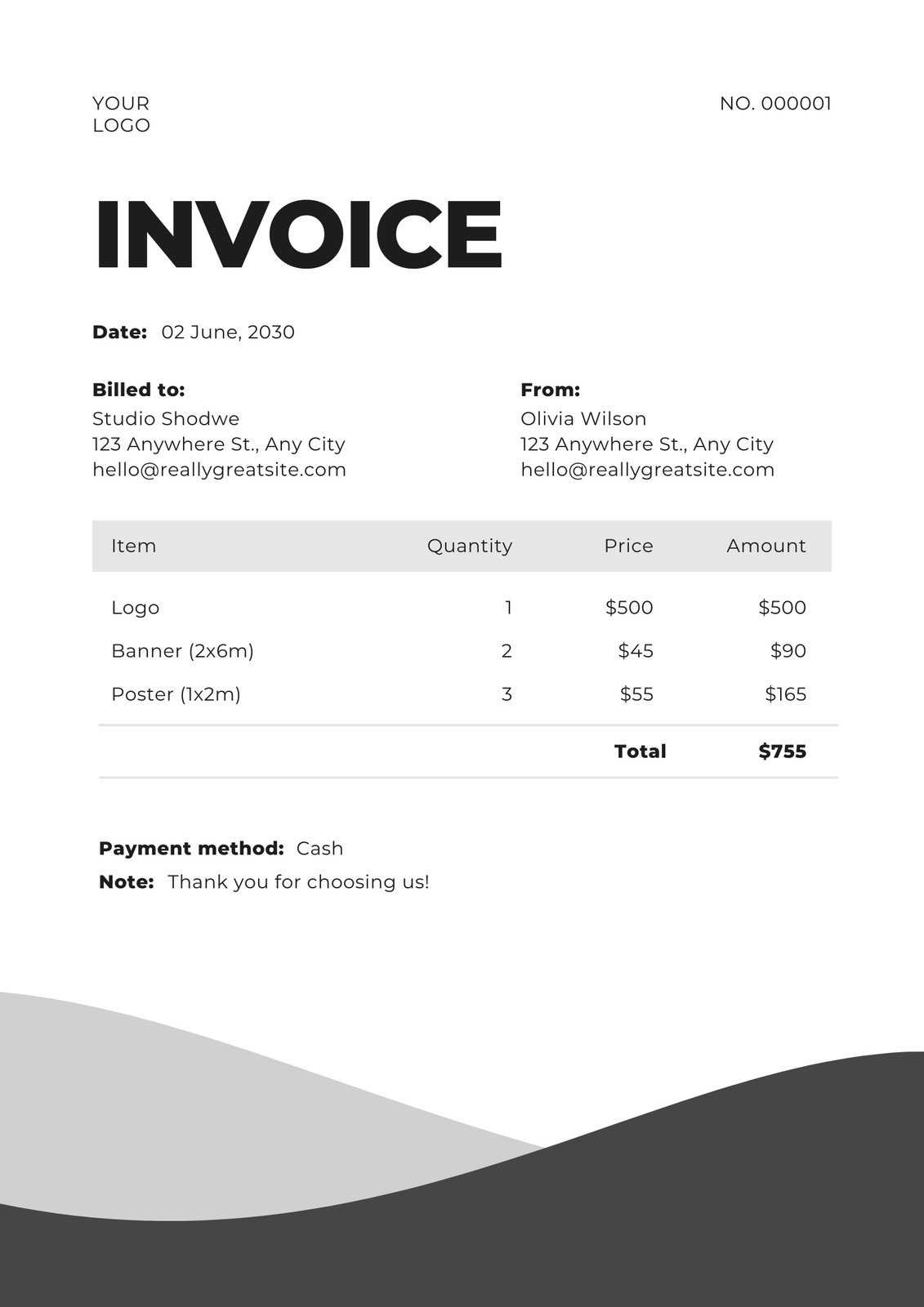

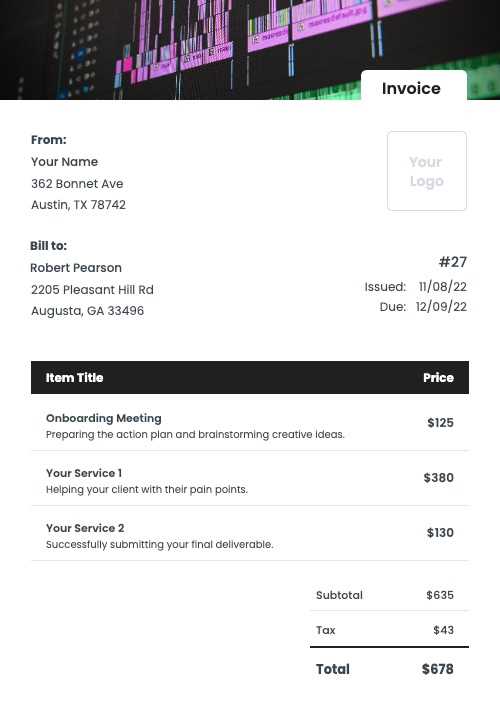

Invoice Templates for Freelance Videographers

Freelancers in the creative industry, such as those offering film-making services, need a streamlined way to request payment for their work. A well-structured billing document helps ensure that both parties are clear on the terms of payment and provides a professional touch to the transaction. This document should clearly outline the services provided, payment due, and any additional relevant details such as deadlines or terms.

Using a pre-designed document for billing can save time and eliminate errors, making the entire process more efficient. Whether you’re a freelancer working on individual projects or collaborating with clients over long-term contracts, a solid billing structure can prevent confusion and set the right tone for your professional relationships.

Key Features of an Effective Billing Document

For freelancers, certain elements are essential to include in every billing document to ensure it meets both legal requirements and client expectations:

- Clear Identification: Include your name, contact information, and professional details, alongside the client’s name and contact info. This establishes transparency and makes it easier for clients to recognize and process your bill.

- Itemized List of Services: Break down the specific services you provided. This not only helps clients understand what they are paying for but also ensures you are paid fairly for each aspect of the work.

- Payment Terms: Clearly state the payment deadlines, accepted payment methods, and any penalties or late fees that may apply. This minimizes confusion and helps avoid delays in receiving payment.

- Amount Due: Specify the total amount due, any deposits paid, and the remaining balance. This section should be easy to understand and calculate, ensuring that there is no ambiguity about the total cost.

Choosing the Right Format

Freelancers should also consider the format of their billing document. Some clients may prefer digital files, while others might request printed versions. Providing your billing documents in a PDF format is generally the best option, as it ensures the layout remains intact and is easily accessible for most clients.

Ultimately, using a structured and professional billing document can help freelancers get paid promptly and maintain positive working relationships with clients. This small investment in time and effort can make a big difference in the way clients perceive your business and can lead to smoother transactions in the future.

Free vs Paid Invoice Templates

When it comes to billing for services, individuals and businesses often have to choose between using free or paid documents to handle financial transactions. Both options have their advantages and limitations, depending on the complexity of the work, the client’s expectations, and the specific needs of the service provider. While free options are accessible and straightforward, paid solutions often offer enhanced features and professional designs that can improve the overall client experience.

Choosing the right option depends on factors such as the volume of transactions, the level of customization required, and how much time you are willing to invest in setting up and maintaining your billing system. Here, we’ll compare the benefits and drawbacks of both free and paid documents to help you make an informed decision.

Advantages of Free Billing Documents

Free billing options can be incredibly appealing for small businesses, freelancers, and individuals just starting out. Here are some of the key benefits:

- Cost-Effective: The most obvious advantage is that they are free. No upfront investment is required, making them a great choice for new service providers or those on a tight budget.

- Easy to Access: Free billing documents are usually easy to find online and can often be downloaded instantly, which can save time when you need to generate an invoice quickly.

- Simplicity: Free options are typically straightforward with no complicated features, which may be ideal if your service offerings are simple and you don’t require much customization.

Benefits of Paid Billing Documents

While free options are tempting, paid solutions often offer a higher level of professionalism and flexibility. Below are some reasons why you might choose a paid option:

- Customization: Paid documents often come with greater flexibility for customization, allowing you to brand your bills with your logo, specific colors, and fonts that align with your business identity.

- Advanced Features: Paid options frequently include features like automatic calculations, integration with accounting software, and the ability to store client information for easy access to past records.

- Professional Design: Paid options tend to have more polished and aesthetically pleasing designs that can leave a strong impression on your clients and reflect the quality of your services.

- Customer Support: Paid solutions often come with customer service support, which can be helpful if you run into any issues while using the billing system.

Ultimately, the decision between free and paid documents depends on your business’s needs, the complexity of your transactions, and how much value you place on design and features. For simple, one-off services or if you’re just starting out, free documents can be a good place to begin. However, as your business grows and your requirements become more complex, investing in a paid solution may help streamline your billing process and enhance your professional image.