HubSpot Invoice Template Generator Create Professional Invoices in Minutes

Managing billing and payments can be a time-consuming task for businesses of all sizes. Creating professional and accurate documents for clients is crucial, but it doesn’t have to be complicated. With the right tools, generating these documents can be quick, easy, and efficient. Simplifying this process not only saves time but also ensures that your records are accurate and consistent.

Automated solutions have revolutionized the way businesses handle their finances. Instead of manually drafting each document from scratch, you can rely on powerful tools that allow you to create personalized, branded documents with just a few clicks. These solutions offer flexibility and customization, making it easier to meet your specific needs without sacrificing professionalism.

In this article, we will explore how such tools can simplify your billing routine, helping you create polished documents for your clients effortlessly. Whether you’re a freelancer, small business owner, or part of a larger organization, these solutions offer valuable features that save time and ensure accuracy in your financial communications.

HubSpot Invoice Template Generator Overview

Creating professional billing documents for your clients can be a tedious and time-consuming process. Fortunately, with the right platform, you can automate and streamline this task, ensuring that your communications are both polished and accurate. The right tool not only simplifies document creation but also helps businesses maintain consistency, save time, and reduce errors in their financial documentation.

The tool we’ll be discussing offers a robust set of features that allow users to design, customize, and send documents quickly. Whether you’re a freelancer, small business owner, or part of a larger team, this solution is built to meet a wide range of needs, making it an ideal choice for anyone looking to optimize their billing workflow.

Here’s a breakdown of the core functionalities:

| Feature | Description |

|---|---|

| Customization | Allows users to personalize documents with logos, color schemes, and specific data fields. |

| Automation | Reduces manual work by automatically filling in recurring details and generating professional layouts. |

| Tracking | Provides insights into document status, including whether the recipient has opened or paid. |

| Integration | Seamlessly integrates with other business tools, improving workflow efficiency. |

This tool simplifies the process of creating essential documents while offering powerful features for managing financial transactions. It’s designed to help businesses of all sizes ensure timely and professional communications with their clients.

Why Use HubSpot for Invoicing

Managing billing processes effectively is crucial for any business, but doing so manually can quickly become a hassle. Using an automated solution not only saves time but also helps maintain a high level of professionalism in client communications. With the right platform, businesses can streamline their financial operations, reduce human error, and create consistent, customized documents for clients with ease.

Efficiency is one of the key reasons to adopt this tool. It significantly reduces the amount of time spent on repetitive tasks like document creation, customization, and tracking. By automating much of the process, you can focus on other essential aspects of running your business while ensuring that your clients receive accurate and timely documents.

Additionally, the ability to integrate seamlessly with other business systems is another compelling reason to choose this solution. Whether you are managing customer relationships, tracking payments, or handling other administrative tasks, having a unified system reduces the need to switch between multiple platforms, improving workflow and accuracy.

Lastly, the flexibility this tool offers allows businesses to personalize documents according to their specific needs. Customizing design elements, adding unique fields, or tailoring messages to each client ensures a professional appearance and reinforces brand identity every time a document is sent.

Key Features of HubSpot Invoice Tool

The tool designed for creating billing documents offers a wide range of features that simplify the entire process. By integrating a variety of useful functions, it helps businesses automate and streamline their workflow, ensuring that important tasks like document creation, customization, and tracking are handled efficiently and professionally. Here are some of the key features that make this platform stand out:

- Customizable Designs: Personalize your documents with logos, colors, and tailored layouts to match your brand’s identity.

- Automation: Automatically populate recurring information, saving time on each new document and reducing the risk of errors.

- Real-Time Tracking: Monitor the status of your documents, including whether they have been viewed or paid.

- Seamless Integration: Sync with your existing CRM, email, and accounting tools, ensuring smooth data flow and minimizing the need for manual entry.

- Multiple Payment Methods: Allow clients to make payments using different methods directly from the document, improving convenience for both parties.

- Professional Templates: Choose from a variety of pre-designed formats that suit different business needs, or create your own unique layout.

- Collaboration Tools: Enable team members to collaborate on documents, ensuring consistency and accuracy across multiple users.

These features are specifically designed to save time and reduce administrative burden, allowing businesses to focus on what truly matters–building strong relationships with clients and growing their operations.

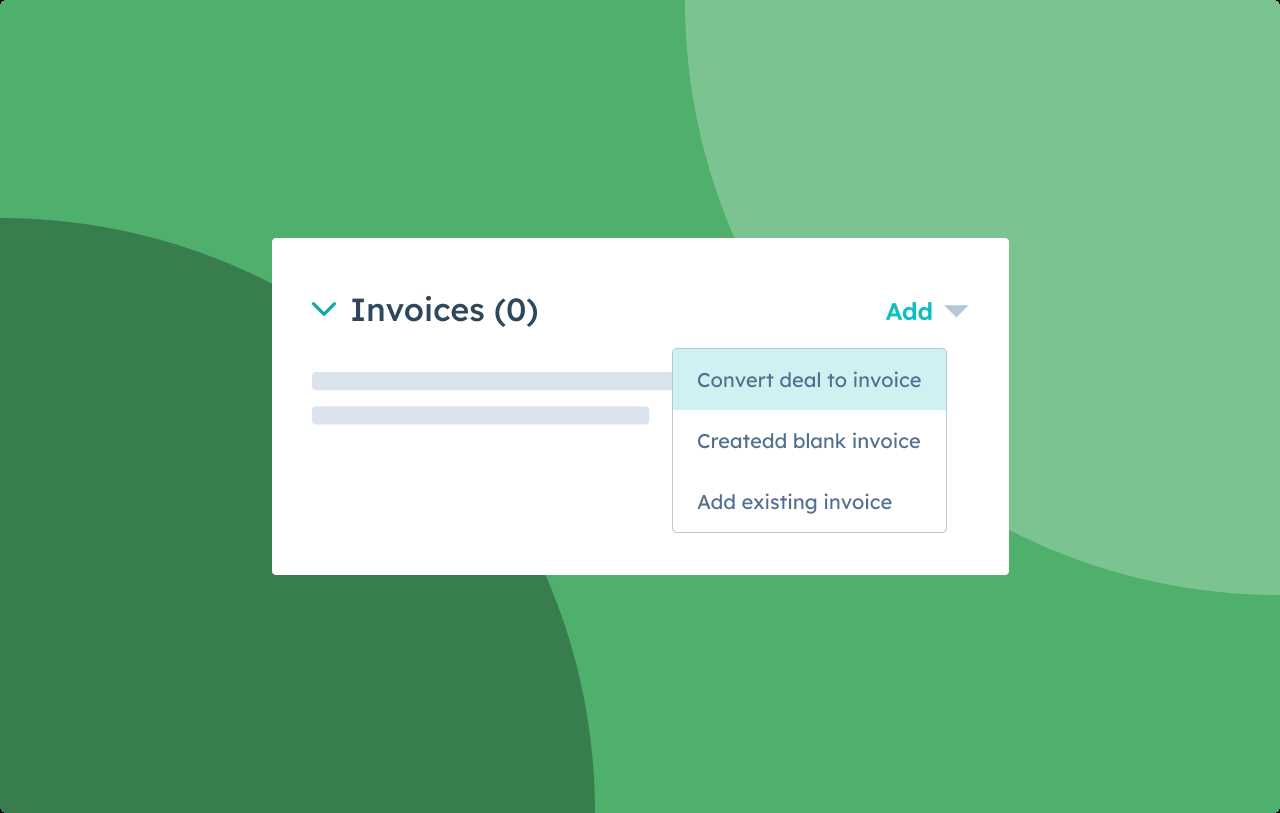

How to Create Invoices with HubSpot

Creating professional billing documents can be done quickly and easily with the right platform. By using an automated system, you can eliminate the need for manually inputting repetitive data and ensure that each document is consistent and polished. Whether you’re new to the platform or looking for a refresher, this guide will walk you through the process of generating billing statements in just a few simple steps.

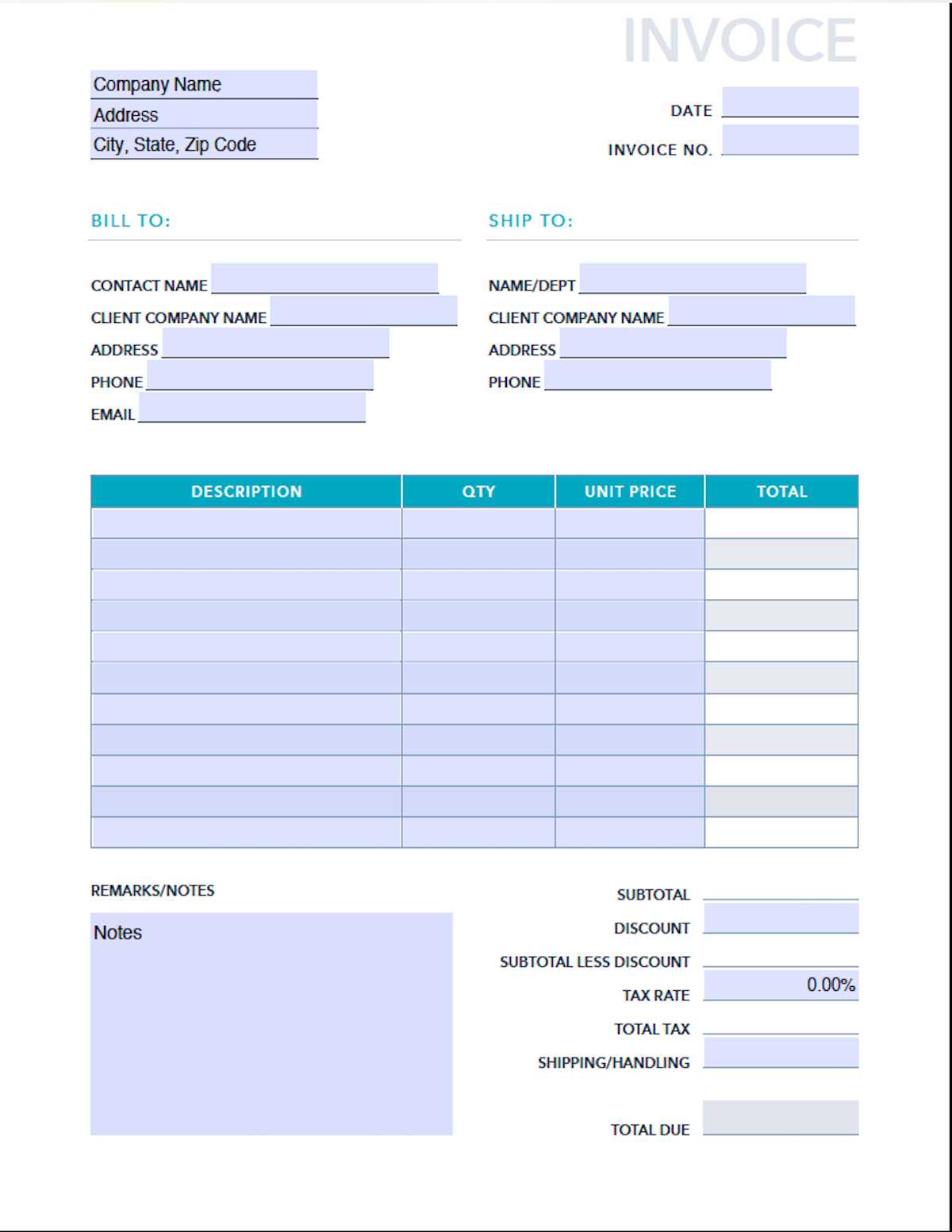

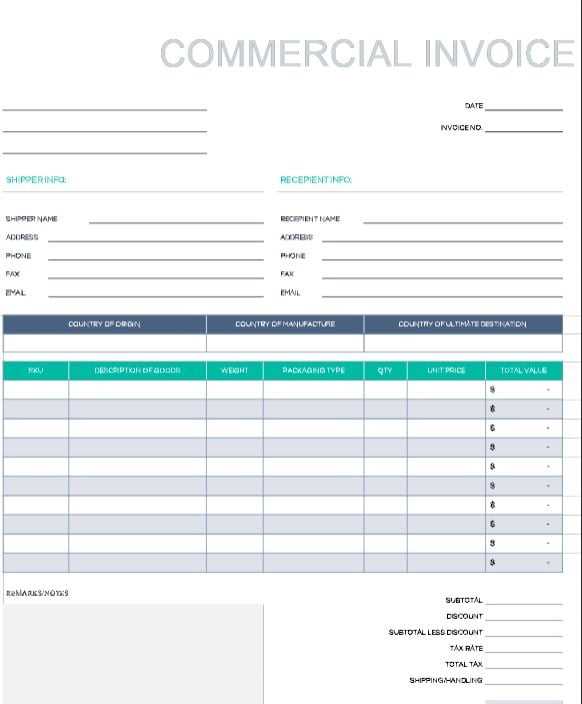

Step 1: Select a Document Format

First, choose a format that suits your needs. You can either select from pre-designed formats or create a custom layout tailored to your business. These formats typically include sections for client details, payment terms, and itemized charges. The platform makes it easy to personalize these sections, ensuring that the document reflects your unique style and branding.

Step 2: Enter Client and Payment Details

Next, input the necessary information such as client contact details, payment due date, and the products or services provided. The system will automatically populate any recurring fields, such as client names and addresses, based on your previous interactions. This feature significantly reduces the amount of time spent filling out forms and ensures accuracy.

Tip: Make sure to review all details before finalizing the document to avoid any errors that could delay payments or cause confusion.

Step 3: Customize and Finalize

After entering the basic information, you can further customize the layout by adding your company logo, adjusting the color scheme, and including personalized messages. Once you’re satisfied with the design, simply save and send the document directly to the client, or schedule it to be sent at a later time. The platform also offers a tracking feature, so you can monitor when the document is viewed or paid.

With these steps, creating professional billing documents becomes a quick, automated process that saves time and improves efficiency in managing your financial transactions.

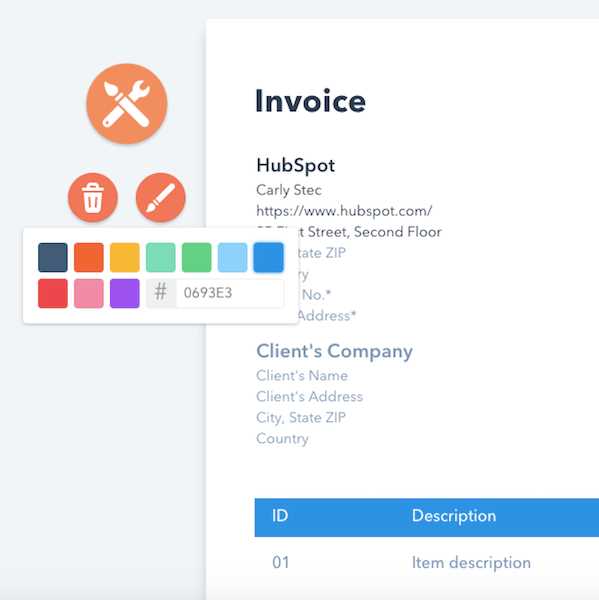

Customizing Your Invoice Template

Personalizing your billing documents is an essential step in maintaining a professional and branded appearance when communicating with clients. A customized document not only reflects your business identity but also ensures that all necessary information is presented in a clear, concise, and organized manner. With the right tools, you can easily modify layouts, add company details, and even adjust the color scheme to match your brand’s style.

Customization options are extensive, giving you the flexibility to modify key sections of the document. From changing fonts and adding logos to adjusting the positioning of various fields, these features allow you to create a document that is truly your own. Whether you prefer a minimalist design or a more detailed, professional look, the platform provides a range of choices to fit your needs.

Key customization features include:

- Adjusting layout and structure for better organization and readability

- Inserting your logo and branding elements to create a personalized appearance

- Choosing from a variety of color schemes to match your brand’s identity

- Customizing data fields to include relevant business or client-specific information

- Adding payment terms, deadlines, and special instructions to make your expectations clear

Once you’ve customized your document, you can save it as a reusable template, so each new billing statement automatically reflects your personalized settings. This ensures consistency across all client communications and streamlines the process for future transactions.

Benefits of Automated Invoicing with HubSpot

Automating the process of generating and sending billing documents offers a wide range of benefits for businesses, helping them save time, reduce errors, and improve cash flow management. By eliminating manual tasks, such as data entry and document creation, businesses can ensure greater accuracy while also enhancing overall efficiency. With automated systems in place, the entire financial process becomes more streamlined and predictable.

Time Savings is one of the most significant advantages of automating billing. Instead of manually creating and sending documents for each client, the process can be completed in a fraction of the time. The system automatically fills in recurring details, such as client information and pricing, allowing businesses to focus on other essential tasks without the need to constantly update documents.

Consistency is another key benefit. Automated tools help maintain uniformity across all financial communications, ensuring that each document is formatted correctly and includes all necessary details. This consistency boosts professionalism and helps reduce confusion for clients, which can lead to faster payments and fewer disputes.

Additional advantages include:

- Accuracy: Reduces the risk of human error by automatically filling in details from client profiles and transaction records.

- Improved Cash Flow: Automated reminders and follow-ups help ensure timely payments, preventing delays.

- Tracking: Easily monitor the status of sent documents and see when they’ve been opened or paid, enabling proactive follow-up.

- Customization: Tailor the design and content of documents to meet specific business needs while maintaining a professional appearance.

Overall, automating billing not only enhances operational efficiency but also supports better decision-making by providing a clear view of financial activities. By embracing automation, businesses can optimize their workflows and focus more on growing their core operations.

How to Save Time with Templates

Using pre-designed formats and automated systems can dramatically reduce the time spent on administrative tasks. Instead of starting from scratch each time you need to create a document, you can rely on saved layouts that automatically populate essential details. This not only streamlines the process but also ensures consistency across all client communications, allowing you to focus on more strategic tasks.

Pre-designed layouts are an excellent way to save time. Once you’ve created or selected a format that works for your business, it becomes a reusable template that can be quickly customized with new details. Whether it’s a client’s name, date, or specific services rendered, these fields can be automatically populated, cutting down on repetitive data entry and minimizing the risk of errors.

Here’s how you can save time:

- Pre-fill Information: Save client profiles and recurring details that auto-populate with each new document.

- Standardized Layout: Use consistent formatting for all documents, so you don’t need to manually adjust the design each time.

- Bulk Updates: Make global changes to multiple documents at once, such as updating payment terms or company branding.

- Automation: Schedule documents to be sent automatically, ensuring that nothing slips through the cracks and no time is wasted on manual follow-up.

By relying on these pre-set structures, businesses can significantly cut down on the time it takes to prepare, send, and track documents, ultimately improving overall productivity and efficiency.

HubSpot Invoices for Small Businesses

For small businesses, managing financial documentation can often feel overwhelming, especially when resources are limited. Streamlining the process of creating and managing billing statements can free up valuable time and ensure that everything is handled professionally. An automated system designed for this purpose can simplify the entire process, from generating documents to tracking payments, making it easier for small business owners to stay organized and on top of their finances.

With easy-to-use tools, small businesses can create customized billing statements that match their brand identity, ensuring a polished and professional appearance. The ability to automate key aspects of the process, such as client details, payment terms, and recurring charges, helps save time and reduce errors, making it easier to handle multiple clients efficiently.

Additionally, by integrating this tool with other business management systems, small business owners can consolidate their operations, reduce the need for manual data entry, and improve cash flow management. Automated reminders and tracking features also ensure timely payments, which is essential for maintaining a steady cash flow.

In summary, using a streamlined billing solution tailored to small business needs allows owners to focus more on growing their company while leaving the administrative tasks to automation. This not only improves efficiency but also enhances client satisfaction through consistent, timely, and professional financial communications.

Integrating HubSpot with Other Tools

Integrating your billing and customer management platform with other business tools is a game-changer for efficiency. By connecting your financial system with CRM platforms, accounting software, and communication tools, you can create a seamless workflow that saves time and reduces the need for manual data entry. This ensures that all your systems work together, providing a more cohesive and automated experience for your business operations.

Key Integrations for Improved Workflow

By integrating with other essential business tools, you can streamline your operations and ensure consistency across all processes. Some key integrations include:

- Customer Relationship Management (CRM): Sync client details and transaction history, ensuring your team has up-to-date information when interacting with clients.

- Accounting Software: Link your financial documents with accounting systems for automatic updating of ledgers, tax reports, and financial records.

- Email and Communication Tools: Automate notifications, reminders, and follow-ups to keep your clients informed and engaged with minimal effort.

- Payment Platforms: Allow clients to make payments directly from the document, with integrations to payment gateways like PayPal or Stripe for faster transactions.

Benefits of Integrating Your Tools

Connecting your financial system with other platforms provides numerous benefits:

- Increased Efficiency: Automation reduces the need for duplicate data entry, speeding up your workflow and eliminating errors.

- Improved Accuracy: With integrated systems, data is synchronized across all platforms, ensuring consistency and accuracy in client records and financial documents.

- Better Insights: By bringing together different business functions, you can gain a holistic view of your operations and make more informed decisions.

- Enhanced Client Experience: Streamlining communication and transactions ensures that clients receive timely and professional service, increasing satisfaction and trust.

Incorporating these integrations into your daily operations allows your business to run more smoothly, freeing up time and resources for growth while ensuring accuracy and consistency in all your processes.

How HubSpot Helps with Client Management

Effective client management is essential for maintaining strong business relationships and ensuring long-term success. By using a comprehensive system to track interactions, manage communications, and maintain up-to-date client records, businesses can provide a more personalized experience and respond to client needs more efficiently. Such tools enable businesses to stay organized and ensure that no important details are overlooked, ultimately improving customer satisfaction and retention.

One of the key ways this system supports client management is by centralizing all client data in one accessible location. With real-time updates and detailed records of every interaction, businesses can better understand client preferences, track the progress of ongoing projects, and anticipate future needs. This comprehensive approach helps businesses maintain a high level of service while optimizing internal workflows.

Additional ways this system enhances client management:

- Client Profiles: Store and organize detailed client information, including contact details, past transactions, and communication history.

- Automated Follow-Ups: Set reminders and automate follow-up communications to keep clients engaged and ensure timely responses.

- Task Management: Assign tasks and deadlines to team members based on client needs, ensuring everyone is aligned and focused on delivering the best possible service.

- Customization: Tailor your interactions and services to individual client preferences, offering a personalized experience that builds loyalty.

By using these features, businesses can enhance their relationship with clients, improve internal processes, and ultimately provide better, more consistent service that meets client expectations.

Invoice Tracking and Reporting in HubSpot

Keeping track of financial documents and monitoring payment statuses is crucial for any business. A well-structured system allows businesses to stay on top of outstanding balances, track payment progress, and quickly identify any discrepancies. Effective tracking and reporting help maintain a steady cash flow, improve financial decision-making, and ensure that no payment goes unnoticed.

With automated tracking and reporting tools, businesses can easily monitor the status of all documents. Whether it’s checking whether a document has been viewed, paid, or is overdue, these tools provide real-time insights into payment activity. Additionally, detailed reports allow for deeper analysis, helping businesses identify trends, assess performance, and make data-driven decisions about their financial operations.

Key tracking and reporting features include:

- Real-Time Status Updates: Automatically track when a document has been opened, viewed, or paid, helping businesses stay informed and act quickly when necessary.

- Payment Reminders: Set up automated reminders for clients who have not yet paid, reducing the need for manual follow-up and improving payment collection speed.

- Financial Reports: Generate detailed reports on transactions, overdue payments, and outstanding balances to gain a clear view of your financial status.

- Customizable Dashboards: Create dashboards that provide at-a-glance insights into key metrics, helping you monitor cash flow and track important trends.

- Transaction History: Easily access a client’s full transaction history, providing insights into previous payments, patterns, and preferences.

By leveraging these tracking and reporting features, businesses can improve their financial oversight, reduce errors, and ensure timely payments, all while maintaining a streamlined, organized process for managing financial documentation.

HubSpot vs Other Invoice Generators

When it comes to managing financial documents and automating billing processes, there are many tools available on the market. Each platform offers a unique set of features designed to streamline the creation and management of transactions. While some focus on simple templates and document creation, others provide more comprehensive solutions that integrate with other business systems. Comparing the available options can help businesses find the right solution to fit their needs, balancing ease of use, customization, and automation.

One key difference between various tools is the level of integration with other business processes. Some solutions may only focus on creating and sending financial documents, while others offer deeper integration with customer relationship management (CRM) systems, accounting software, and payment platforms. This integration can save significant time and reduce the need for manual data entry by automatically syncing client details and transaction records across all systems.

Here’s how different tools compare in terms of key features:

- Ease of Use: Some platforms are highly intuitive and require minimal setup, allowing users to quickly create and send documents. However, more complex systems may offer advanced customization options, at the cost of a steeper learning curve.

- Automation: While basic tools allow for document creation, more advanced solutions automate reminders, follow-ups, and updates, ensuring that payments are tracked and clients are notified without the need for manual intervention.

- Customization Options: Many systems offer customizable layouts, but some provide more flexibility in terms of branding, including the ability to integrate logos, colors, and personalized messaging throughout the document.

- Integration with Other Platforms: Platforms that offer integration with CRM systems, accounting software, and payment gateways can help businesses manage the entire lifecycle of a financial document–from creation to payment–without switching between multiple tools.

- Cost: Pricing models vary widely. Some systems offer free plans with basic features, while others come with premium pricing for more advanced tools and integrations. Businesses need to evaluate the overall value based on their needs and budget.

Ultimately, the right solution depends on the specific needs of the business. For companies looking for an all-in-one, integrated approach that simplifies both document management and customer interactions, choosing a more robust system may offer better value in the long run. On the other hand, businesses seeking simple and straightforward document creation may prefer a less complex tool that focuses primarily on ease of use and quick setup.

Improving Professionalism with Custom Invoices

Presenting well-crafted, personalized financial documents can significantly enhance the professionalism of a business. Customizing the design, structure, and content of these documents ensures that they not only reflect your brand’s identity but also provide a clear and organized representation of the transaction. A polished document builds trust with clients, reinforces your brand image, and increases the likelihood of timely payments.

Personalization allows businesses to convey professionalism in a way that generic, one-size-fits-all documents cannot. Customizing key elements such as logos, colors, and fonts helps maintain a consistent look across all business materials, reinforcing your brand’s presence. Additionally, tailored content such as personalized terms or specific service details makes the document more relevant and meaningful to the client.

Benefits of customizing financial documents:

- Brand Recognition: Including your company’s logo, colors, and style helps clients recognize your business immediately, adding a professional touch to every document.

- Clear Communication: Custom content ensures that all terms and conditions are specific to the transaction, reducing confusion and ensuring both parties are on the same page.

- Professional Appearance: A well-designed document with personalized elements is more likely to be taken seriously and creates a positive impression of your business.

- Improved Client Experience: Personalization demonstrates attention to detail and shows that you care about the client’s needs, making them feel valued and appreciated.

By focusing on customization, businesses can improve the professionalism of their financial communications, fostering stronger relationships with clients and creating a more cohesive brand identity across all touchpoints.

Invoice Management Tool for Teams

When multiple team members are involved in the creation and management of financial documents, collaboration and consistency become crucial. A shared tool that allows team members to access, update, and track documents in real time ensures that everyone is aligned and working with the latest information. This reduces the risk of errors, increases efficiency, and allows teams to streamline their workflows, resulting in a smoother and more coordinated billing process.

Key Features for Teams

Team-oriented platforms for managing financial documents offer several features that help businesses coordinate their efforts effectively:

- Multi-user Access: Grant permissions to different team members based on their roles, ensuring that each person has the appropriate level of access and responsibility.

- Real-Time Collaboration: Enable team members to work on documents simultaneously, making updates, editing, and tracking progress without the need for back-and-forth communication.

- Centralized Database: Store all client and transaction information in a single location, so that every team member can access the most up-to-date details instantly.

- Audit Trail: Keep track of every change made to a document, which is essential for maintaining transparency and ensuring accountability among team members.

- Task Assignment: Assign specific tasks to team members, such as follow-ups, document creation, or client communication, to ensure that responsibilities are clear and deadlines are met.

Advantages of Using a Team-Based Solution

Utilizing a collaborative tool for managing financial documents provides several benefits to teams:

- Increased Efficiency: Streamlined workflows and real-time collaboration mean that team members spend less time searching for information or updating documents manually.

- Reduced Errors: Centralizing and automating key processes minimizes the likelihood of mistakes that can occur when handling documents individually.

- Improved Communication: Everyone on the team has access to the same information, which reduces misunderstandings and ensures that everyone is on the same page.

- Better Tracking: Monitoring the status of documents, payments, and client interactions becomes easier with an integrated tool, making it simpler to track progress and follow up when needed.

In a team environment, using a tool that fosters collaboration, accountability, and real-time updates ensures that the process of managing financial documents is efficient, error-free, and coordinated, leading to better client relationships and improved team performance.

Tips for Efficient Invoice Creation

Creating accurate and professional financial documents quickly is essential for any business. Streamlining the process not only saves time but also ensures that you maintain consistency and accuracy in all your transactions. Implementing best practices for document creation can help you avoid errors, reduce administrative work, and ensure that payments are processed smoothly.

Here are some tips to make the process more efficient and effective:

- Use Predefined Formats: Start with pre-designed structures to save time. Customizing these formats according to your needs ensures consistency while minimizing repetitive tasks.

- Automate Data Entry: Link your billing system with other business tools like CRM or accounting software to automatically pull in client information, reducing the time spent on manual data entry and minimizing errors.

- Standardize the Process: Create a step-by-step procedure for generating financial documents. Having a standard process ensures that every document includes the necessary details and follows the correct format every time.

- Batch Create Documents: Instead of creating each document one by one, group similar tasks together. For example, generate multiple documents in one session to maintain focus and reduce the time spent switching between tasks.

- Double-Check Client Information: Always verify that client names, addresses, and payment terms are up to date before generating documents. This ensures that no errors occur during the creation process.

- Save Frequently Used Terms: Store commonly used terms, services, and descriptions in a central location so you can easily insert them into your documents without retyping the same information each time.

- Use Digital Tools for Delivery: Delivering documents electronically rather than manually reduces the time spent on postage and follow-ups. Consider using automated emails or payment links to make the process even smoother.

By following these tips, businesses can significantly reduce the time spent on administrative tasks while ensuring the accuracy and professionalism of their financial documentation. Automation, organization, and consistency are the key elements in creating an efficient document generation process.

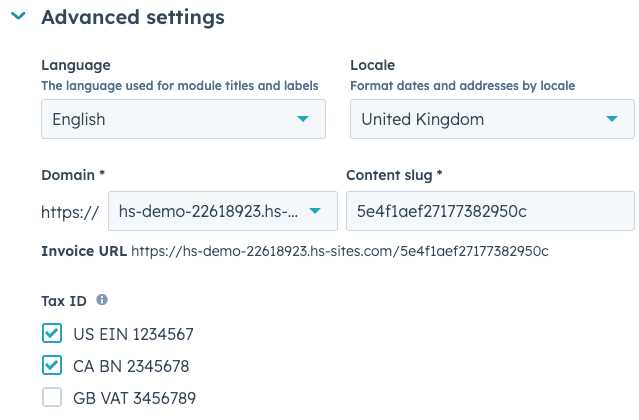

How to Export Invoices from HubSpot

Exporting financial documents from your management system allows for better organization and sharing. Whether you’re looking to save a document for your records, send it to a client, or import it into accounting software, having an easy process for exporting is essential. By following a few simple steps, you can ensure that your records are stored securely and accessible whenever needed.

Step-by-Step Process

The process for exporting documents is straightforward. Here’s how to do it efficiently:

- Step 1: Navigate to the document section of your platform where the relevant documents are stored. You’ll typically find a list of all your completed records.

- Step 2: Select the specific document(s) you wish to export. You may be able to select multiple entries at once to save time.

- Step 3: Look for the export or download option. This is usually indicated by a button labeled “Export,” “Download,” or “Save As.”

- Step 4: Choose your preferred file format, such as PDF or Excel. These formats are most commonly used for sharing or storing documents in external systems.

- Step 5: Confirm your choice and click the export button. The system will process the request and generate a downloadable file for you.

Additional Tips

- Batch Export: For larger volumes of documents, look for batch export options to save time and effort.

- Automated Export: Some systems allow you to automate the export process, so documents are saved or sent regularly without manual intervention.

- File Storage: Once exported, ensure the files are stored in a secure location for easy access and long-term archiving.

Exporting financial documents is a simple yet powerful way to keep your records organized and ready for further processing or sharing. By mastering this process, you can streamline your workflow and improve overall business efficiency.

Common Mistakes to Avoid When Invoicing

Creating financial documents may seem straightforward, but even small errors can lead to misunderstandings with clients, delays in payments, and unnecessary confusion. Avoiding common mistakes during the document creation and submission process ensures that your transactions are smooth, professional, and accurate. By being aware of these pitfalls, you can streamline your billing process and maintain strong client relationships.

Here are some of the most common mistakes to watch out for:

- Incorrect Client Information: Double-check client details such as name, address, and contact information before sending the document. Mistakes in this area can delay payment processing and create confusion.

- Missing or Incorrect Payment Terms: Always clearly define the payment terms, including the due date, late fees, and accepted methods of payment. Failing to specify this can lead to disputes or delayed payments.

- Omitting Important Details: Leaving out key elements such as the description of services or the correct amounts can result in questions or disagreements. Be sure to include all relevant details, including quantities, rates, and any applicable taxes.

- Using Unprofessional Language: The tone of your financial document should remain professional and clear. Avoid using jargon or ambiguous terms that may confuse the recipient.

- Failing to Follow Up: Sometimes, simply sending the document is not enough. If the payment is delayed, follow up promptly and professionally. Ignoring overdue accounts can result in longer delays in receiving payments.

- Overcomplicating the Format: A document that is difficult to read or overly complex can frustrate your client. Keep the format simple and easy to follow, with a clear breakdown of all charges and totals.

- Neglecting to Keep Records: It’s essential to keep accurate records of all documents sent, including dates and payment status. Not maintaining these records can lead to confusion and make it difficult to track outstanding balances.

By avoiding these common mistakes, you can improve the accuracy and professionalism of your financial documentation, reduce the likelihood of disputes, and ensure timely payments. Always take the time to review your documents before sending them to clients and maintain clear communication throughout the process.

Why HubSpot Is Ideal for Freelancers

Freelancers often juggle multiple clients, projects, and deadlines while managing their business independently. Having a tool that streamlines administrative tasks such as creating and managing financial documents, tracking projects, and maintaining client communication is crucial for maximizing productivity. A platform that offers these capabilities in an intuitive and flexible way can significantly reduce the amount of time spent on non-billable activities, allowing freelancers to focus on their core work.

Key Benefits for Freelancers

Freelancers can enjoy several advantages when using an all-in-one platform designed to simplify daily operations:

- Ease of Use: Freelancers typically work on tight schedules, so having a tool that is easy to navigate is essential. The platform’s user-friendly interface ensures quick setup and minimal learning curve, even for those without a background in business management.

- Automation Features: Automating repetitive tasks like document creation, payment reminders, and follow-ups can free up valuable time for more creative or revenue-generating work.

- Client Management: A centralized system for managing client information helps freelancers stay organized and ensures that important details, like contact information, project status, and payment terms, are readily accessible.

- Customizable Documentation: The ability to easily create professional-looking financial documents that reflect your brand is invaluable for freelancers. Customization options allow for consistent and tailored communication with clients.

- Mobile Accessibility: Freelancers are often on the go, and having access to their business tools from a mobile device means they can handle tasks like invoicing or project updates from anywhere, at any time.

How HubSpot Supports Freelancers

In addition to simplifying administrative tasks, a versatile platform can also help freelancers enhance their client relationships and improve their overall workflow:

- Centralized Communications: Keep all client communications in one place, ensuring important details aren’t lost in email chains or notes. This promotes clear, consistent interaction with clients.

- Easy Financial Tracking: With the ability to track payments and outstanding balances, freelancers can easily monitor their cash flow and ensure they get paid on time.

- Scalable for Growth: As your freelance business grows and you take on more clients, a flexible platform can scale with your needs, adding functionality and streamlining processes as required.

For freelancers who need to balance creativity with business efficiency, a comprehensive tool designed to simplify client management, financial tracking, and document creation offers the perfect solution. With these benefits, freelancers can maintain a professional image while reducing the administrative burden that comes with running their own business.