Ultimate Guide to Using an Invoice Email Template for Effective Client Communication

Clear and professional communication with clients is crucial for maintaining strong business relationships. Sending a well-structured message for requesting payments not only helps ensure timely receipts but also leaves a lasting positive impression. Crafting the right message can make all the difference in how your client perceives your professionalism.

In this guide, we will explore how to create an efficient and polished approach for sending financial requests to your clients. By utilizing the right structure and language, you can reduce confusion and enhance the likelihood of prompt payments. Whether you’re a freelancer or a large corporation, mastering this form of communication is essential for your business’s financial health.

Adaptability and clarity are the keys to achieving success in this area. With a few simple strategies, you can ensure your messages are both effective and aligned with your brand’s voice.

Invoice Email Template: Key Elements

To create a professional and effective communication when requesting payment, it’s important to include several key components that will ensure clarity and minimize misunderstandings. A well-crafted message helps convey the necessary information in a structured manner, making it easier for the recipient to process the request and take action swiftly.

Core Components of a Payment Request

A successful payment request needs to be clear, concise, and complete. Here are the essential elements to include:

- Subject Line: Make it straightforward and easy to identify, such as “Payment Due for Services Rendered” or “Outstanding Balance for [Your Company Name]”.

- Greeting: Personalize the message to create a more professional and friendly tone, such as addressing the recipient by name.

- Clear Details of the Transaction: Include specifics like the amount due, the services rendered, and the date of the transaction.

- Payment Terms: Specify the due date, payment methods accepted, and any applicable late fees or penalties.

- Call to Action: Prompt the recipient with clear instructions on how to make the payment or if they need to contact you for any questions.

Additional Considerations for Professional Communication

Beyond the basics, there are several best practices that enhance the professionalism and effectiveness of your message:

- Polite Tone: Ensure the tone is courteous and respectful, regardless of the amount owed.

- Formatting: Use proper formatting to make the content easy to read, such as bullet points for key details, and bold text for important dates or amounts.

- Contact Information: Always include your contact details in case the recipient needs to discuss the payment or address any concerns.

- Branding: If appropriate, incorporate your company logo or signature at the end to reinforce your professional image.

By ensuring these elements are present, you increase the chances of your request being understood and paid promptly. A professional, clear, and concise message not only improves communication but also enhances your business’s reputation.

Why Use an Invoice Email Template

Utilizing a pre-designed structure for payment requests brings numerous advantages that go beyond simply saving time. By relying on a consistent approach, businesses can ensure that every communication sent is professional, accurate, and aligned with their brand’s voice. This consistency helps foster trust and reliability with clients while minimizing the risk of mistakes that could delay payments or lead to confusion.

One of the key benefits is efficiency. A standardized format allows for quick customization with minimal effort, reducing the time spent composing messages. This is particularly valuable for businesses that need to send numerous requests on a regular basis. Additionally, having a template ensures that no important information is overlooked, leading to fewer errors and smoother transactions.

Brand consistency is another significant advantage. By incorporating your company’s logo, tone, and style into each message, you reinforce your brand’s identity every time a payment request is sent. This contributes to a more cohesive client experience and can even enhance your company’s professional image.

Finally, using a set format helps establish clarity and professionalism in your communications. Clients are more likely to respond positively to a well-organized, clear request, especially when it includes all necessary details such as amounts due, payment methods, and deadlines. It sets the tone for a positive, mutually respectful transaction.

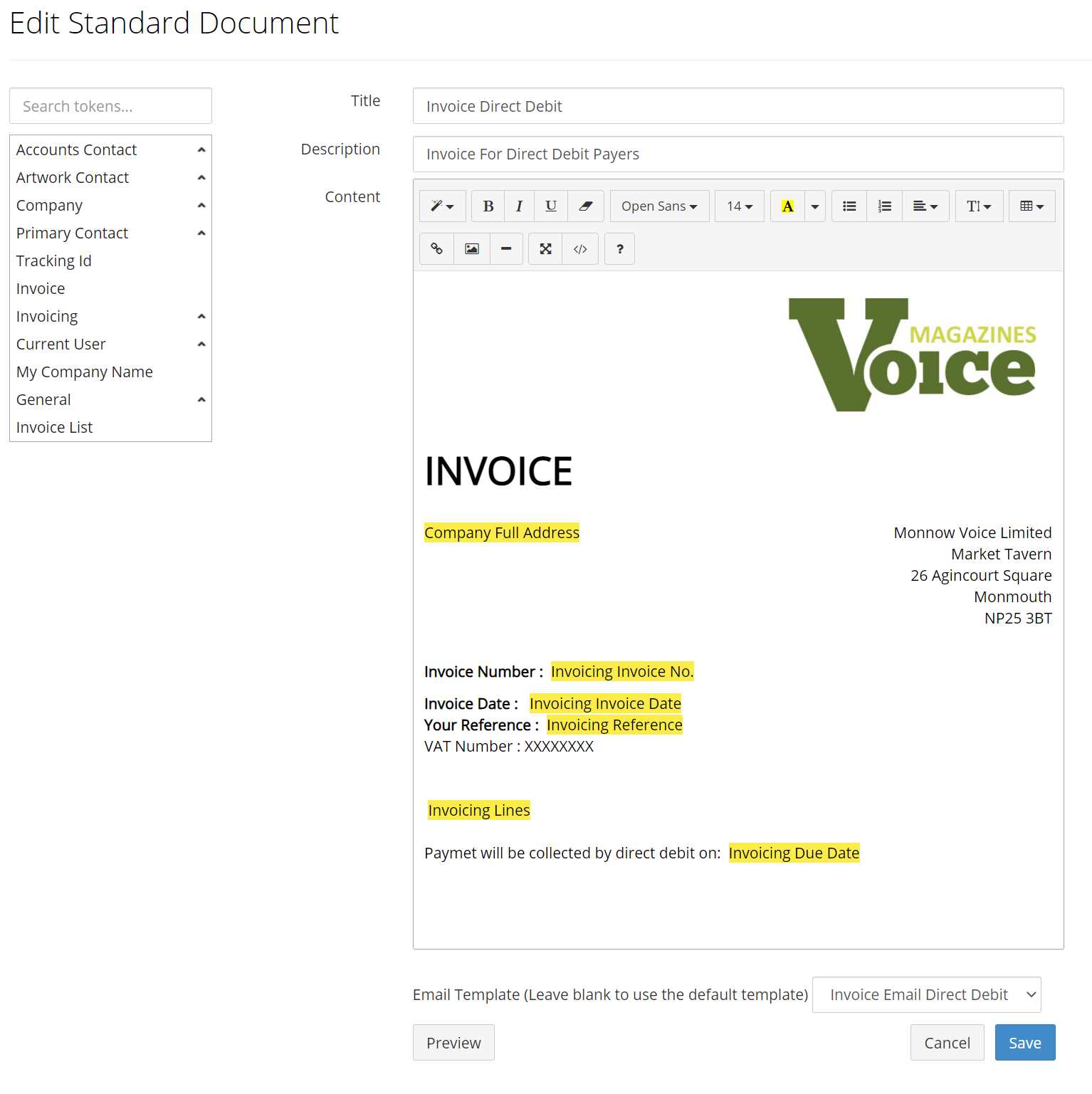

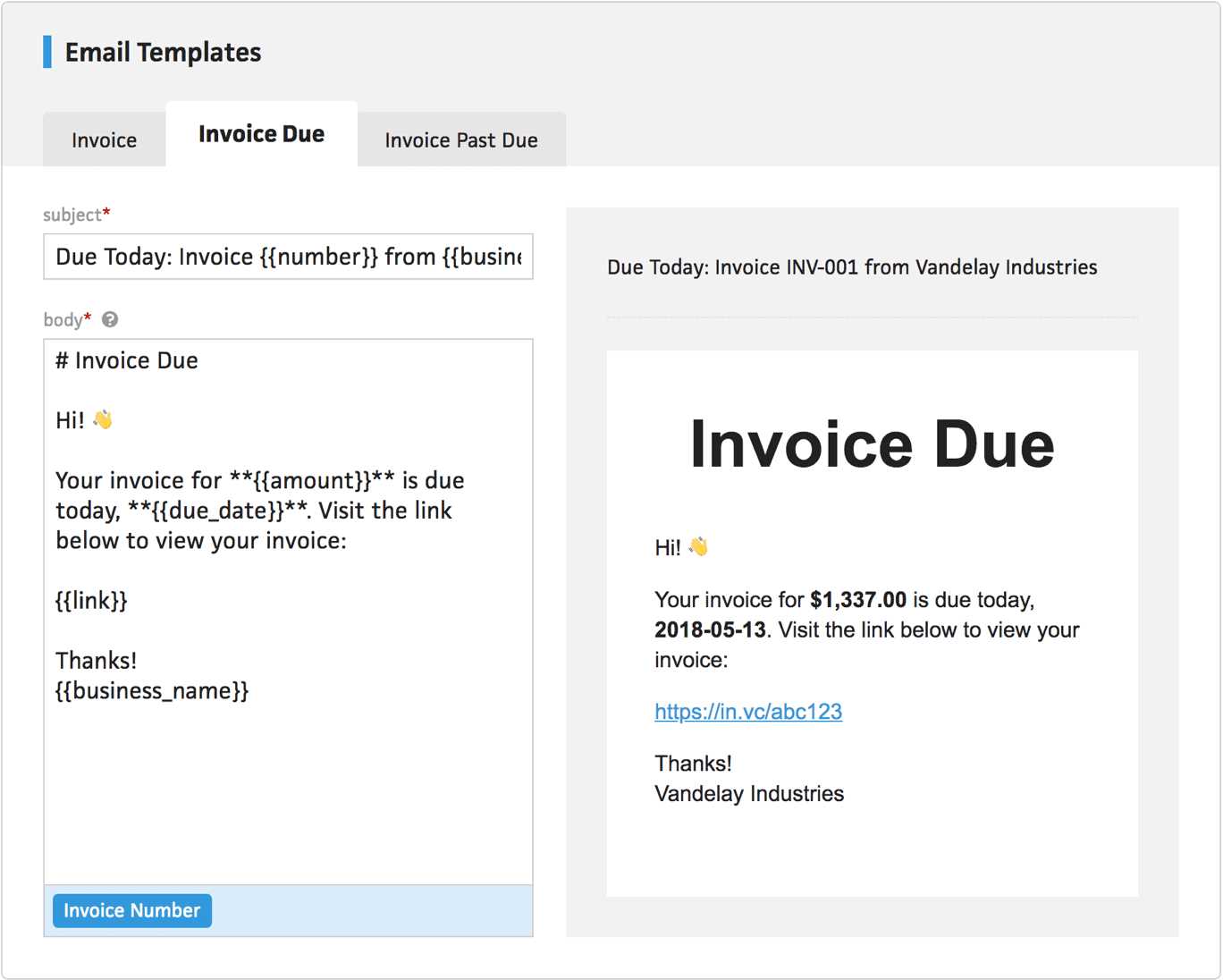

How to Customize Your Invoice Template

Personalizing your payment request communication is key to making a strong impression and ensuring it meets your specific business needs. Customization allows you to tailor the content, structure, and appearance to match your brand identity and provide all the necessary details in an easy-to-read format. Whether you’re adjusting the layout or modifying key information, a customized approach helps streamline the process and improve client interactions.

Here are the main areas you should focus on when adapting your standard format:

| Section | Customization Tips |

|---|---|

| Header | Include your business logo, name, and contact information to establish your brand. This creates a professional look and reinforces your identity. |

| Greeting | Personalize each message by addressing the recipient by name. This adds a personal touch and strengthens client relationships. |

| Details of the Transaction | Ensure that the list of services, products, or work provided is clear and includes accurate dates, descriptions, and amounts. Consider using bullet points or tables for clarity. |

| Payment Terms | Adapt the terms to your business needs, including payment deadlines, accepted methods, and any penalties for late payments. This should be concise yet detailed. |

| Call to Action | Provide clear instructions on how the recipient can complete the transaction, including any links or payment gateways you use. |

By customizing each section, you ensure that your request is clear, professional, and aligned with your business practices. Making these adjustments not only saves time but also helps you maintain consistency and professionalism with every communication sent to your clients.

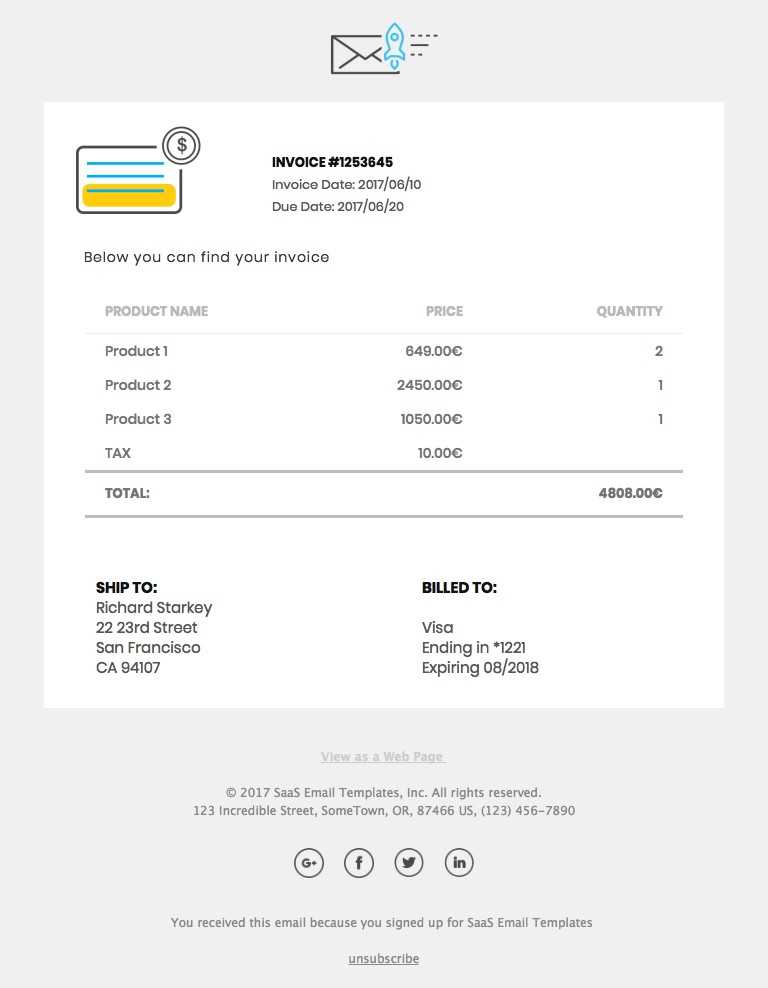

Essential Information for an Invoice Email

When sending a payment request, it’s crucial to include all necessary details to ensure that the recipient understands the transaction and can process the payment without any confusion. Providing the right information not only facilitates a smooth transaction but also helps maintain professionalism and transparency with your clients. Below are the key elements that should always be included in your communication.

| Information Section | Description |

|---|---|

| Recipient Details | Include the full name and address of the recipient. This ensures that the payment request is directed to the correct party and is more personal. |

| Transaction Breakdown | Clearly list the goods or services provided, with accurate descriptions, quantities, and pricing. This helps the recipient verify what they are paying for. |

| Total Amount Due | Make the total amount due easy to spot, either in bold or underlined, so there is no ambiguity about the payment owed. |

| Due Date | Specify the exact deadline for payment to avoid delays. Including the date helps to set expectations for both parties. |

| Payment Instructions | Provide clear details on how the recipient should make the payment, including methods accepted (bank transfer, credit card, etc.) and any relevant links or payment portals. |

| Contact Information | Always include your contact details for any questions or concerns the recipient may have regarding the payment. |

By including these key elements, you ensure that your payment request is comprehensive and transparent, minimizing confusion and helping to expedite the process. Each detail contributes to a smoother experience for both you and your client.

Best Practices for Sending Invoice Emails

When sending a request for payment, it’s essential to follow certain practices to ensure your communication is effective, professional, and well-received. Properly structured and timely payment requests help facilitate smooth transactions and ensure you’re paid on time. By adhering to a few key guidelines, you can increase your chances of prompt payment while maintaining a positive relationship with your clients.

Timeliness and Organization

One of the most important aspects of sending a payment request is timing. Sending it too early can lead to confusion, while sending it too late can result in delays. Additionally, organizing the information clearly is crucial for the recipient’s understanding. Below are some best practices to consider:

| Practice | Details |

|---|---|

| Send Early but Not Too Early | Send the payment request a few days before the due date to allow the recipient time to review and make arrangements, but avoid sending it too early to avoid unnecessary follow-ups. |

| Clear Subject Line | Make sure the subject line is direct and to the point, such as “Payment Due for [Service/Product]” or “Outstanding Balance for [Your Company Name].” This helps the recipient immediately recognize the purpose of the message. |

| Organize Information Visually | Use bullet points, tables, or bold text to highlight key details like the amount due, payment terms, and due date. This makes it easier for the recipient to find the relevant information quickly. |

Professional Tone and Clarity

Maintaining a professional and respectful tone is essential in every payment request. Even if the client is late with payment, a courteous and calm approach will help preserve your relationship. Here are some tips for maintaining professionalism:

| Practice | Details | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Be Polite and Courteous | Regardless of the amount owed or the timing of the payment, always use a friendly and respectful tone. A simple “thank you” and “please” can go a long way. | |||||||||||||

| Be Clear and Direct | Ensure that your message is easy to understand. Avoid unnecessary jargon and keep the language simple. Clients should be able to quickly identify the amount due and the due date. |

| Mistake | How to Avoid It |

|---|---|

| Incorrect or Missing Details | Always double-check the amount due, the payment methods accepted, and the due date. Missing or incorrect details can cause confusion and delays. |

| Unclear Payment Instructions | Ensure your payment methods and instructions are specific. Avoid using vague language like “pay by bank transfer” and include the exact account information or payment links. |

| Failure to Include Due Date | Not specifying the due date for payment can result in late payments. Always include a clear deadline and indicate whether there are any penalties for missing it. |

Poor Tone and Presentation

The tone and overall presentation of your communication play a significant role in how your client responds. Being overly aggressive, informal, or careless can negatively impact your professional image. Here are some tone-related mistakes to avoid:

| Mistake | How to Avoid It | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unprofessional Language | Even if a client is late with payment, always use a polite and professional tone. Avoid demanding language and instead use gentle reminders, such as “Kindly remind you of the payment due.” | |||||||||||||

| Excessive Informality | Avoid using casual phrases or informal greetings that may undermine your business professionalism. Maintain a tone that is both friendly and respectful. | |||||||||||||

| Cluttered Layout | A cluttered or hard-to-read layout can fru

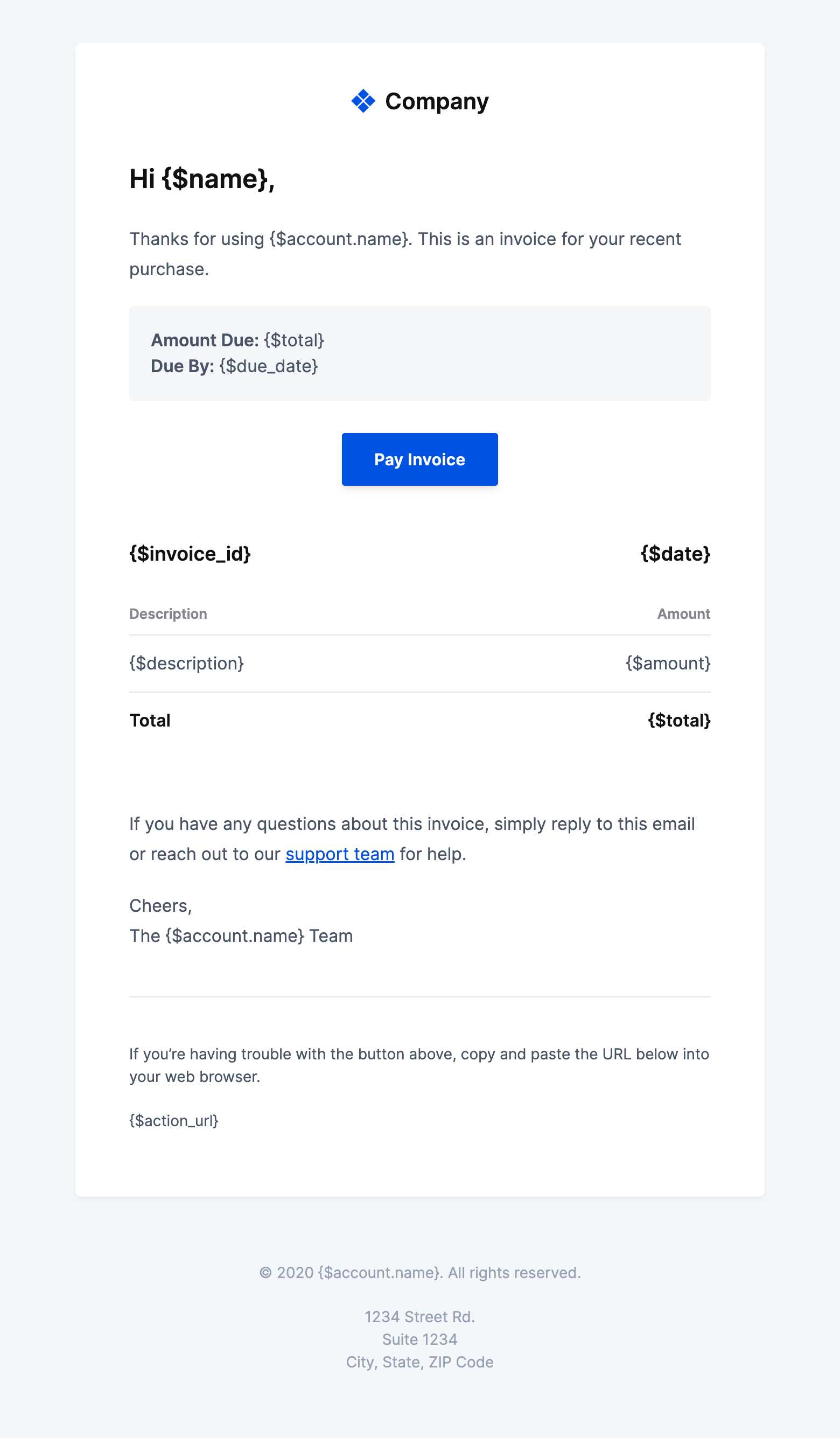

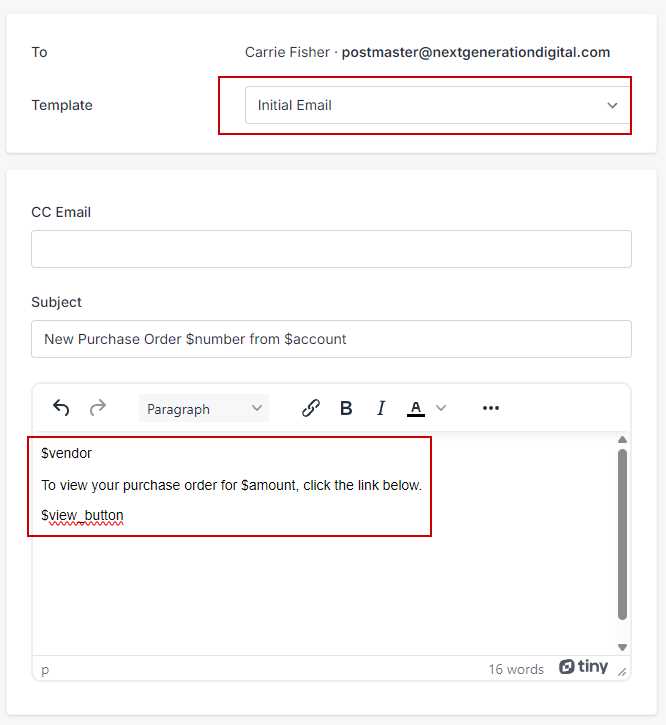

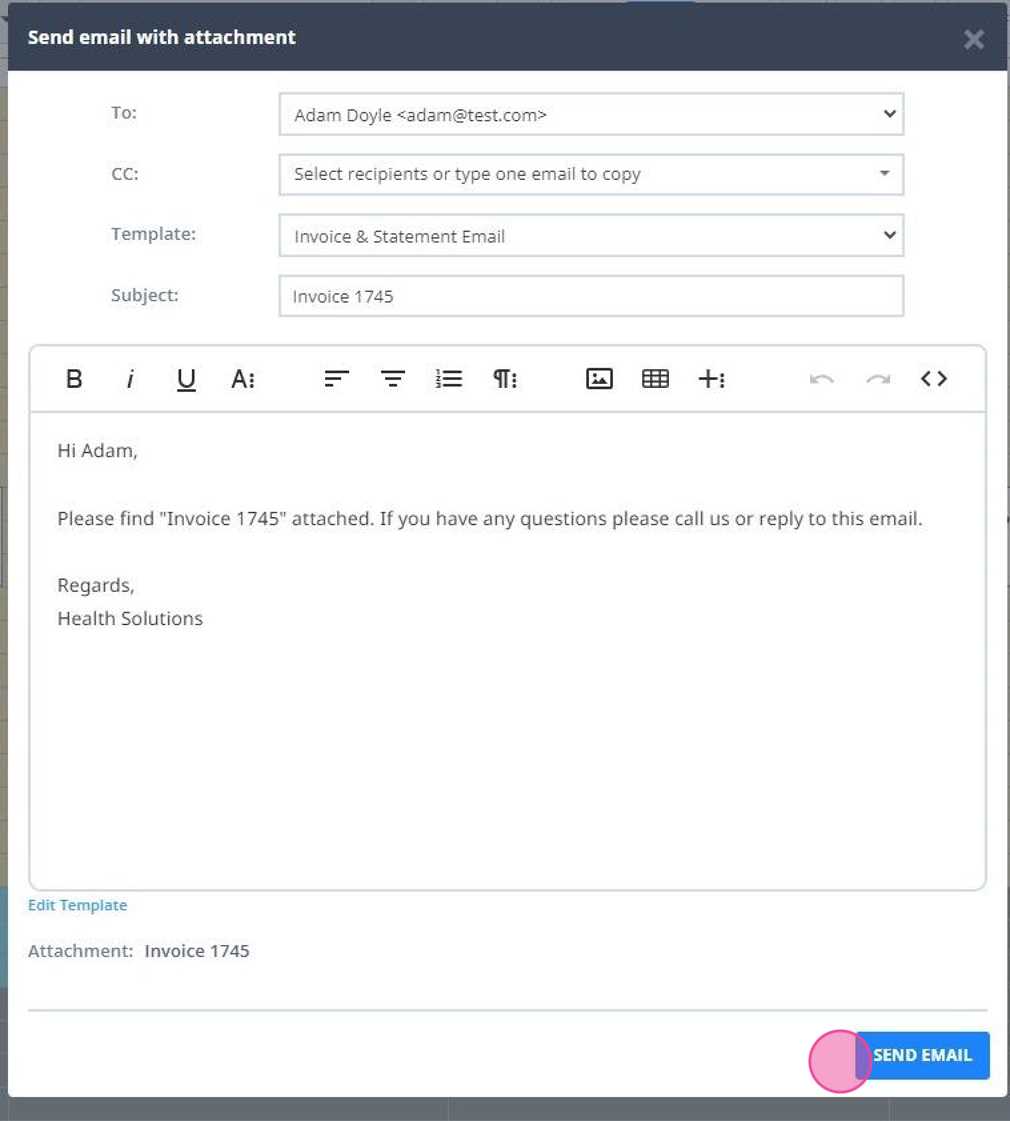

How to Add Payment Instructions in Emails

Providing clear and concise payment instructions is vital for ensuring that your clients can easily complete their transactions. The easier you make it for the recipient to understand how to pay, the faster you can expect the payment to be processed. Properly outlining payment steps in your communication helps reduce confusion and the chances of delayed payments. Below are some key strategies for effectively adding payment instructions. Start by making the payment process as straightforward as possible. Clients should never have to guess how to proceed. Whether you accept bank transfers, credit card payments, or online payment gateways, each method should be explained with clear, easy-to-follow steps. Here’s how you can structure this section:

Example: If you are accepting bank transfers, you could include the following details:

Alternatively, if you’re using an online payment system, you can include a clickable link to your payment page: Click here to pay securely via PayPal: www.paypal.com/payments Be sure to check that all payment information is correct before sending. A small error can cause delays and inconvenience for both you and your client. Finally, it’s a good practice to include a call to action at the end of the payment instructions. A simple phrase like “Please complete your payment by [due date]” or “Feel free to contact us if you need any assistance with your payment” helps remind your client to take immediate action while also offering support if needed. Choosing the Right Invoice Format for Emails

When requesting payment, the way you present your financial details can significantly impact how efficiently the transaction is processed. Selecting the right format for your communication is essential for ensuring that your client understands the payment terms and is able to complete the payment promptly. The correct format makes it easier for the recipient to access, read, and act on the information, improving the overall payment experience. Considerations for Choosing the Right FormatThere are several factors to consider when choosing the format for your payment request. Depending on the complexity of the transaction and your client’s preferences, you might choose a simple, straightforward approach or something more detailed. Here are some formats to consider:

Which Format to Choose?

When deciding on the format, think about the following points:

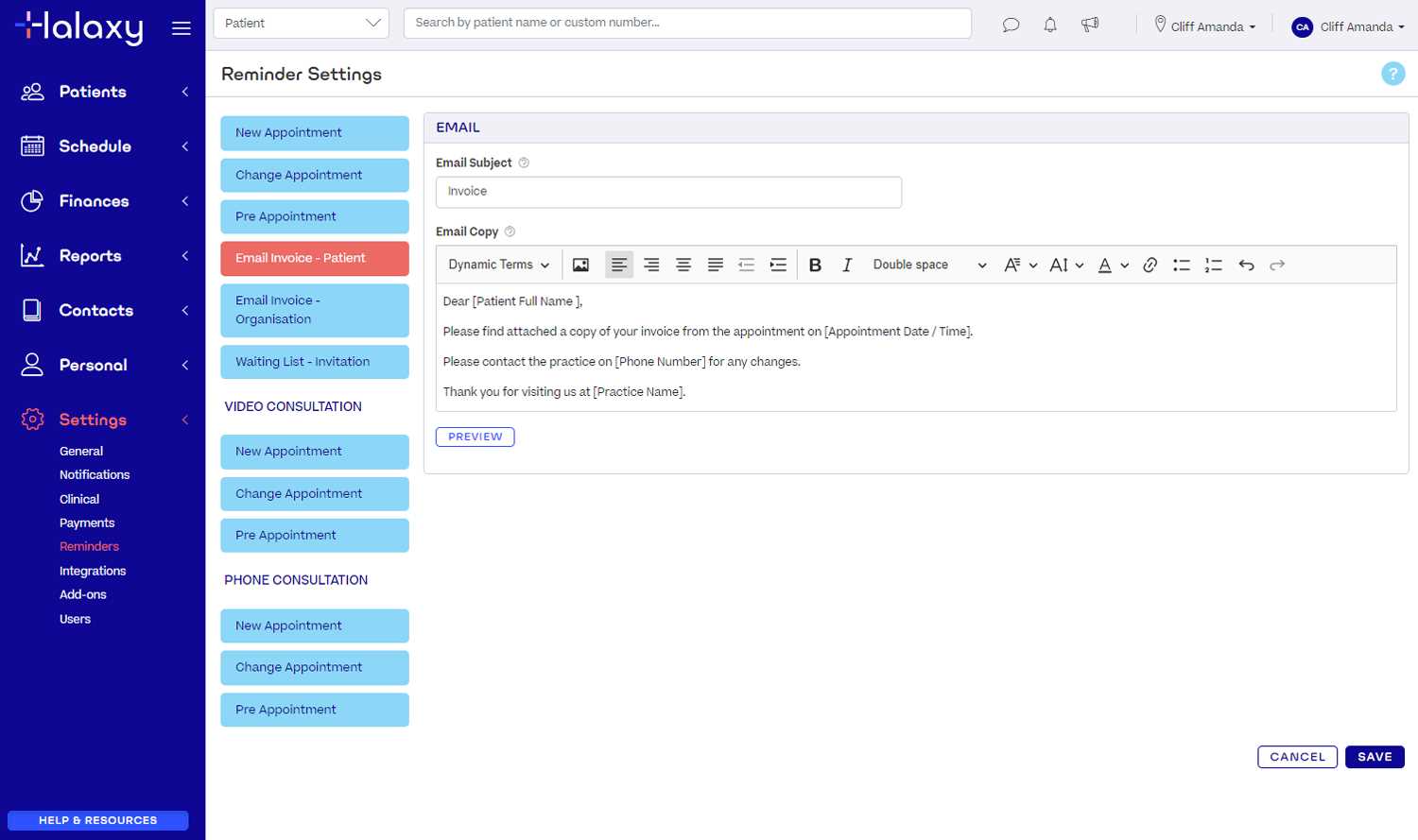

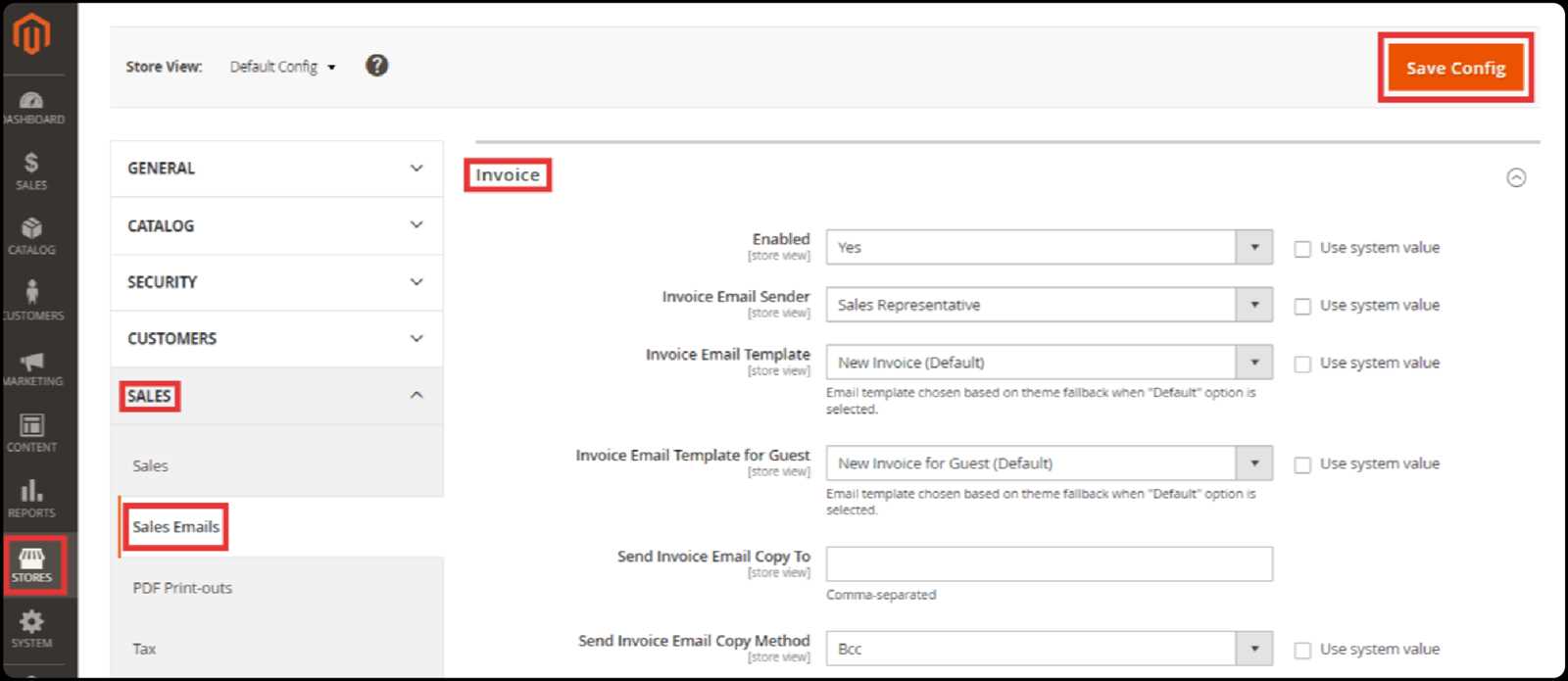

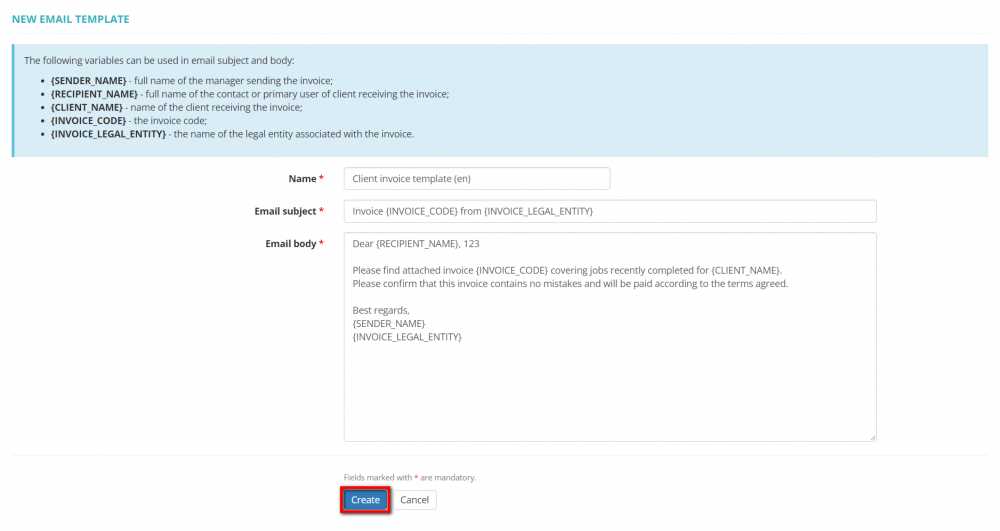

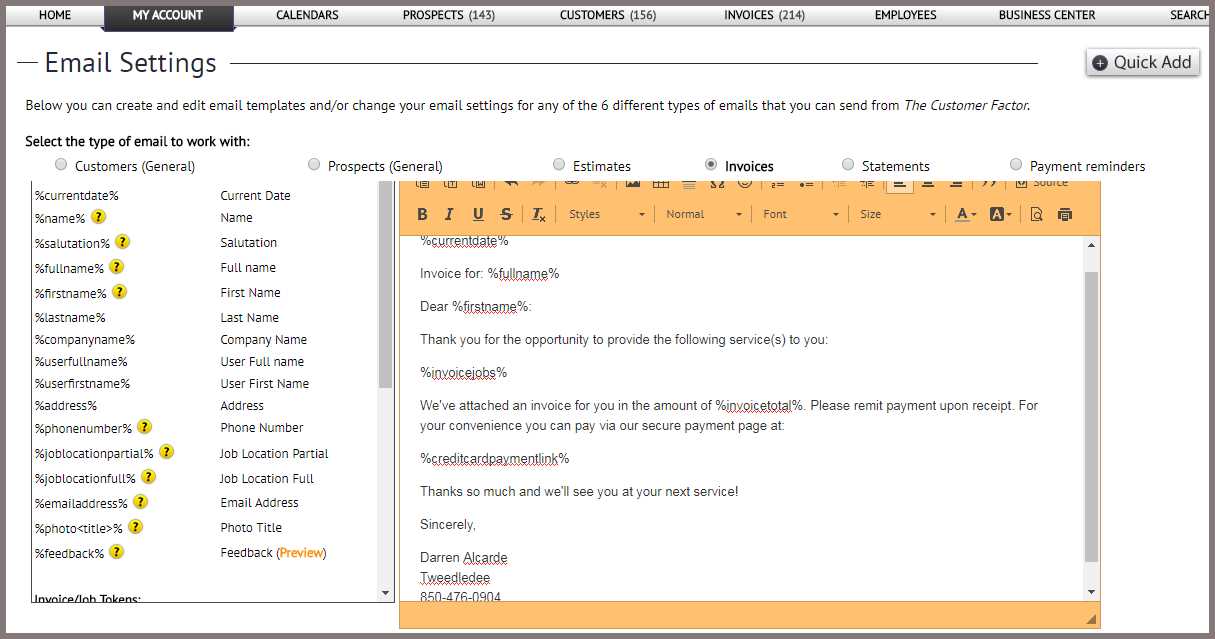

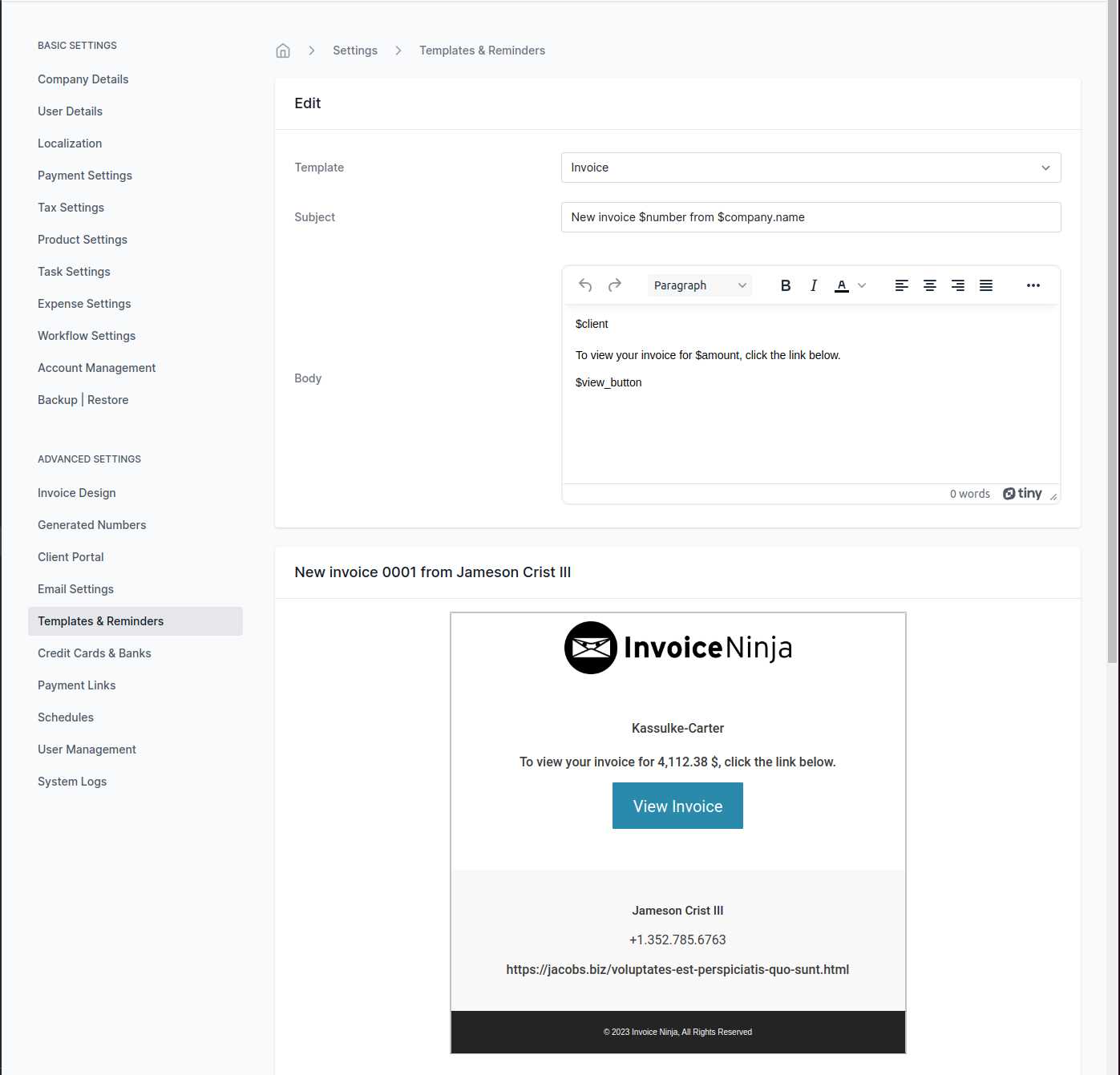

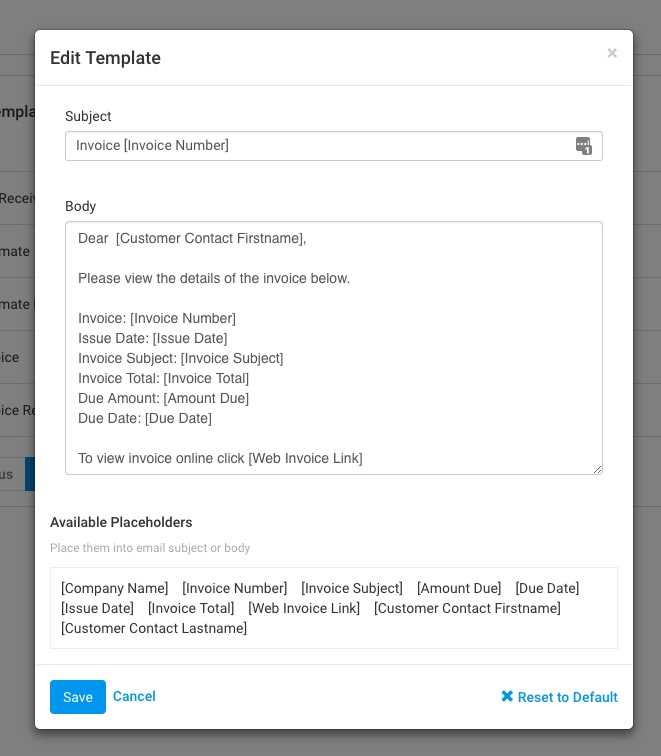

By considering these factors, you can choose the most appropriate format for your payment request, ensuring a smooth and efficient transaction for both you and your client. Time-Saving Tips for Invoice Email TemplatesEfficiently managing payment requests is essential for any business looking to save time and reduce administrative overhead. Streamlining the process of sending payment reminders or requests ensures that you can focus on other important aspects of your work while maintaining a professional standard of communication with clients. Here are several tips to help you save time when creating and sending these messages. Automate Your Process One of the best ways to save time is to automate the sending of payment reminders. Many invoicing platforms and accounting tools allow you to set up automatic reminders for clients, which can be sent at predetermined intervals before or after the due date. This minimizes the need for manual follow-ups and ensures that no client is overlooked. Use Pre-Formatted Messages Another time-saving technique is to create a set of pre-formatted messages that can be reused. Rather than drafting a new message each time, having a standard structure for your payment requests allows you to simply update the relevant details, such as the amount owed and the due date. This ensures consistency and reduces the time spent composing emails. Personalize with Merge Fields To save time while still personalizing each message, consider using merge fields. These fields automatically pull in personalized information, such as the recipient’s name, company, or transaction details, from your database or invoicing system. This allows you to send individualized messages quickly without manually editing each one. Set Templates for Different Scenarios Not every payment request is the same. Sometimes you may need to send a friendly reminder, while at other times, you may need a more formal or urgent tone. By creating multiple message templates for different scenarios (e.g., first reminder, second reminder, final notice), you can save time by selecting the appropriate one without having to rewrite the message each time. Use Bullet Points and Clear Formatting When including transaction details, using bullet points or tables can greatly improve the readability of your message. Clients will be able to quickly scan the content and find the key information, reducing the likelihood of errors or misunderstandings that could lead to delays. This simple format can save you time by reducing follow-up questions from clients. By implementing these time-saving tips, you can significantly streamline your payment request process, allowing you to focus on growing your business while ensuring timely payments and clear communication with your clients. How to Follow Up on Unpaid Invoices

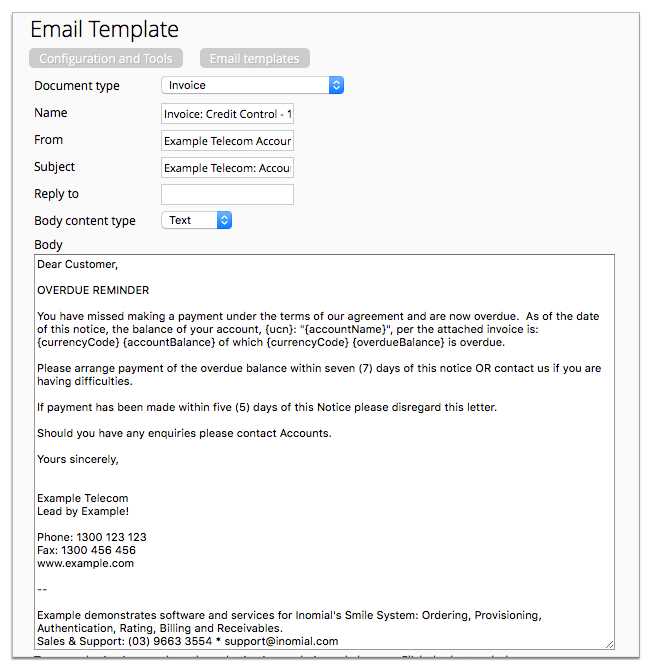

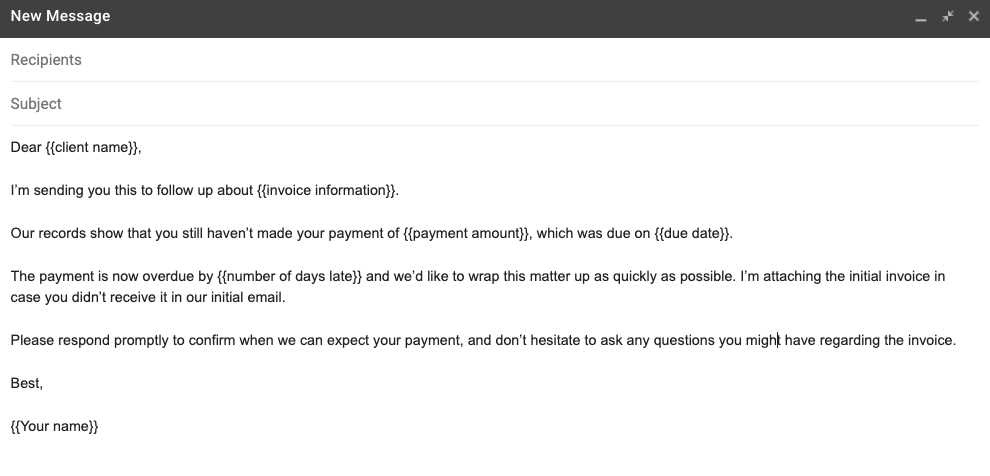

Following up on unpaid bills is an essential part of managing your business’s cash flow. Timely and respectful reminders ensure that your clients remain informed about their outstanding balances without damaging the business relationship. Crafting the right follow-up message can encourage prompt payment while maintaining professionalism. Here are some tips on how to effectively follow up on unpaid amounts. 1. Send a Polite Reminder The first step in following up is sending a gentle reminder shortly after the payment due date has passed. A friendly tone and a clear reference to the original payment terms can help set expectations without sounding too forceful. You can mention the payment deadline and ask if there were any issues with processing the payment. The key is to maintain a polite and non-confrontational tone. 2. Provide Clear Payment Details Ensure that your follow-up message includes all relevant payment information, such as the total amount due, payment methods accepted, and any relevant account details. Including a clickable link to a payment platform can help simplify the process for the client, making it easier for them to pay promptly. 3. Set a New Deadline If you haven’t received the payment after your initial reminder, it’s important to set a firm new deadline. This adds urgency to your request and helps both parties know when payment is expected. Politely but clearly communicate that the payment must be made by a specific date to avoid any late fees or interruptions in service. 4. Offer Payment Solutions Sometimes clients may be facing financial difficulties that prevent them from paying the full amount upfront. In these cases, it can be helpful to offer flexible payment solutions, such as partial payments or payment plans. This can help resolve the issue quickly while ensuring that you still receive compensation for your services. 5. Send a Final Reminder If the payment is still not received after a second reminder, it may be time to send a more formal final notice. This message should clearly state that if payment is not received by a specific date, you may need to take further action, such as suspending services or involving a collections agency. While this message should still maintain professionalism, it should be firm in its tone. 6. Keep Records of Communication Throughout the follow-up process, it’s important to maintain accurate records of all communication. This documentation can be helpful if the situation escalates and you need to take legal action or involve a third-party collections service. By following these steps, you can effectively manage unpaid balances, minimize the risk of overdue payments, and ensure that your clients understand the importance of adhering to payment terms. A respectful and methodical approach helps preserve the business relationship while ensuring you get paid for your services. Creating a Professional Invoice Email ToneEstablishing the right tone in your payment request messages is crucial to maintaining professionalism while ensuring that your clients understand the importance of timely payment. Whether you’re sending a friendly reminder or a formal notice, the way you communicate can influence how quickly your clients respond and how your business is perceived. Striking the right balance between friendliness and professionalism will help you create positive, effective communication that encourages prompt payment without damaging relationships. Key Elements of a Professional Tone

A professional tone in a payment request should be polite, clear, and respectful, while also conveying the necessary urgency. Here are some key elements to consider when composing your messages:

Examples of Tone in Different Scenarios

Here’s how you might adjust your tone depending on the situation:

Tip: Always express appreciation for the client’s business, even if the payment is overdue. Phrases like “Thank you for your continued partnership” or “We appreciate your prompt attention to this matter” go a long way in maintaining goodwill. By using a professional tone in your payment-related communication, you demonstrate respect for both your client and your business. It helps ensure that your messages are taken seriously while promoting a smooth and positive payment experience. Why Clear Payment Terms MatterClearly outlined payment terms are crucial for ensuring smooth transactions between businesses and clients. When both parties are on the same page regarding expectations, it eliminates confusion and reduces the likelihood of payment delays. Transparent terms help establish trust and prevent misunderstandings, ultimately leading to more efficient cash flow and stronger business relationships. Benefits of Clear Payment Terms

Clear payment terms not only help clients understand what is expected of them, but they also protect your business and contribute to more timely payments. Here are some key reasons why having well-defined payment terms is important:

Key Components of Payment TermsWhen outlining your payment terms, it’s essential to include the following elements to ensure that everything is understood:

|