Free Printable Blank Invoice Template for Easy Billing

Managing finances and ensuring timely payments are crucial for any business. One of the most efficient ways to handle this task is by using organized documents that streamline the payment process. With the right tools, you can simplify your workflow and ensure a professional approach to client transactions.

For entrepreneurs and small business owners, having a ready-made format to issue payment requests can save both time and effort. Whether you offer services or products, utilizing a pre-designed structure can make billing smoother and more reliable. These documents not only provide clarity but also contribute to maintaining accurate records.

By using a versatile structure, you can create well-organized statements tailored to your business needs. Customizing such materials ensures that all necessary information is included, and it offers a consistent format for clients to understand payment terms clearly. Whether you’re a freelancer or a small enterprise owner, these tools are indispensable for effective financial management.

Free Blank Invoice Templates for Your Business

Having a well-organized document for billing is essential for businesses of all sizes. It allows you to present your services or products in a professional manner and ensures that clients are clear about the payment expectations. Using a standard format for your financial transactions can simplify the entire process, saving you time while maintaining consistency in your operations.

Why Your Business Needs a Structured Billing Document

A structured payment document offers several advantages for your business. Here are a few reasons why incorporating such tools into your workflow is crucial:

- Consistency: Maintaining a uniform style for every transaction builds trust and professionalism.

- Efficiency: Pre-made structures streamline the billing process, reducing the time spent on creating individual documents from scratch.

- Clarity: Well-designed forms ensure clients understand the details, including payment terms, due dates, and amounts.

- Record-Keeping: Using organized documents helps keep track of your sales and payments for future reference or tax purposes.

Where to Find Ready-to-Use Billing Documents

There are many sources available online where you can find ready-to-use formats for your business. Here’s a list of places to consider:

- Online platforms offering document-generation services.

- Business resource websites with downloadable formats suitable for various industries.

- Software tools designed for small business owners that include built-in billing options.

By choosing the right document structure for your needs, you

Why Use a Billing Document Structure

Having a standardized document for financial transactions is a smart way to maintain order and efficiency in your business operations. It simplifies the process of requesting payments and ensures that both you and your clients have a clear understanding of the terms. By using a consistent format, you can save time, reduce errors, and create a professional image for your business.

Benefits of Using a Pre-Designed Billing Format

When you opt for a structured format, you gain several advantages that help streamline your operations. Here are some key benefits:

- Time-Saving: Avoid starting from scratch every time you need to send a payment request. A ready-made format speeds up the process significantly.

- Professional Appearance: A polished and well-organized document communicates professionalism and reliability to your clients.

- Fewer Errors: A consistent structure minimizes the chances of missing essential information like payment terms, amounts, or client details.

- Clear Communication: A well-formatted document makes it easier for clients to understand the payment details, reducing confusion and disputes.

How It Helps in Financial Management

Using a consistent document format not only benefits your clients but also helps you manage your finances more effectively. It keeps track of payments and invoices, making it easier to monitor your business’s cash flow. Organized billing forms also make the process of tax filing and financial auditing much more straightforward.

In conclusion, adopting a structured approach to requesting payments provides numerous advantages. It ensures a smoother billin

How to Customize Your Billing Document

Customizing your billing form is essential to reflect your business’s identity and ensure that all the necessary details are included. By adjusting key elements, you can create a personalized structure that meets your specific needs and provides clarity for your clients. Customization allows you to maintain consistency while adding unique touches such as branding and specific terms relevant to your business.

Here’s how to tailor your payment request document effectively:

Steps to Personalize Your Document

- Include Your Branding: Add your company’s logo, name, and contact information at the top of the document to make it immediately recognizable.

- Adjust Layout and Design: Ensure the layout suits your business type. For example, service-based businesses may want more space for descriptions, while product-based businesses may prioritize itemized lists.

- Set Payment Terms: Clearly define payment deadlines, late fees, and accepted payment methods. This ensures both parties are aligned on expectations.

- Personalize Client Details: Always input the correct name, address, and contact information for each client to avoid errors.

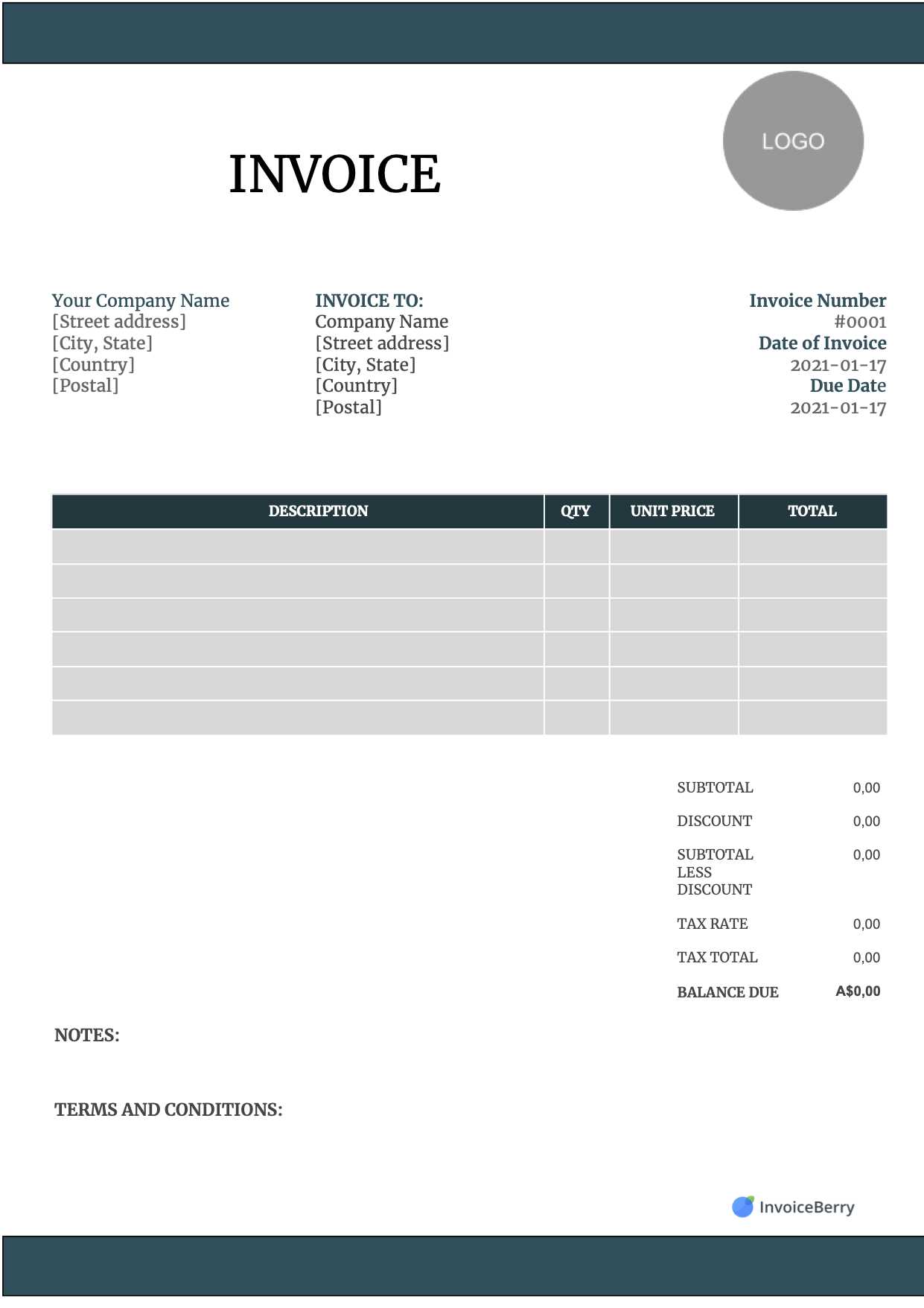

Example Layout for Customization

| Element | Suggested Customization | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Include your business name, logo, and address. | ||||||||||||||||||||||||||||

| Client Information | Customize this secti

Advantages of Free Billing Document FormatsUsing ready-made formats for financial transactions offers several practical benefits, especially for small business owners and freelancers. These pre-designed structures help ensure accuracy and consistency while saving time that would otherwise be spent creating documents from scratch. By relying on these resources, businesses can focus more on growth and customer service instead of spending unnecessary hours on administrative tasks. Key Benefits for Your BusinessAdopting these pre-built tools brings significant advantages:

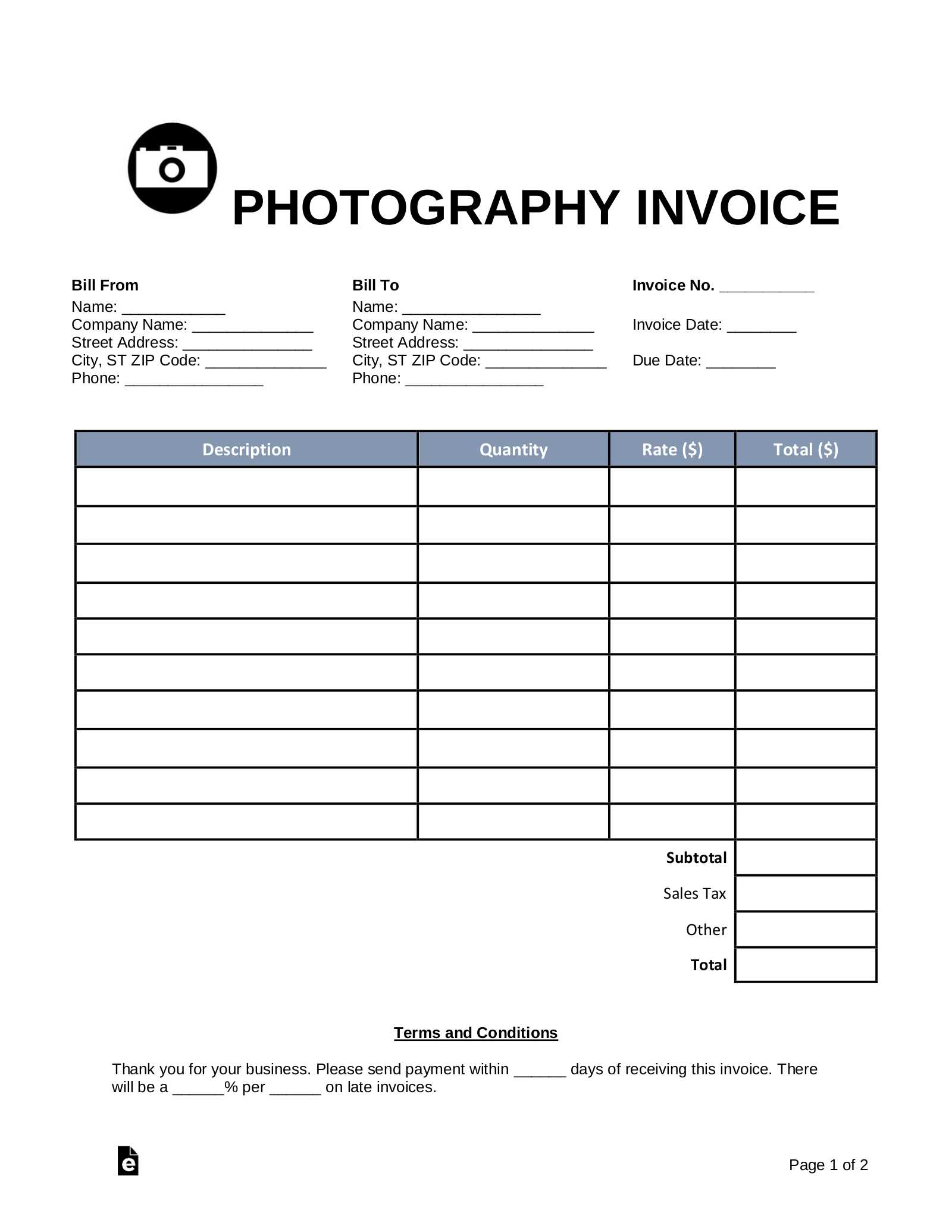

How These Tools Simplify Financial ManagementBeyond the immediate time and cost savings, using these resources can also improve your overall financial organization. A uniform approach to billing helps keep your records consistent and easy to track, making it simpler to monitor cash flow, manage client payments, and handle tax reporting. Additionally, the structured format makes it easier to spot any discrepancies or missing details before sending the document to a client. In summary, using ready-to-use billing forms can significantly benefit your business by providing a streamlined, cost-effective, and professional way to manage financial transactions. Choosing the Right Invoice FormatWhen it comes to managing financial transactions, selecting the appropriate document structure plays a crucial role in maintaining clarity and professionalism. The format you choose should not only reflect your business’s brand but also ensure that all necessary details are organized efficiently. An ideal structure helps both you and your clients quickly understand the key information, facilitating smoother payments and reducing confusion. Key Considerations for Selecting the Correct LayoutThere are several factors to take into account when deciding on the best design for your billing documents. First and foremost, it is essential to consider the type of services or products you offer. If you run a service-based business, a simpler layout with fewer details may suffice, while a product-based business may require more specific information such as itemized descriptions, quantities, and prices. Ensuring Clarity and ProfessionalismThe chosen structure should prioritize ease of use. Clear sections for item details, payment terms, and contact information can help avoid misunderstandings. Moreover, ensure that your document is aesthetically appealing, with a clean and organized appearance. A disorganized or cluttered design can create confusion, while a well-structured format can enhance your credibility and reputation. Remember, the right document format can streamline financial processes, improve communication, and leave a lasting positive impression on your clients. How to Save Time with TemplatesUsing pre-designed structures for your business documents can significantly reduce the time spent on repetitive tasks. By having a consistent layout ready, you can quickly fill in relevant information without needing to create new formats from scratch each time. This not only boosts efficiency but also ensures that your paperwork remains professional and accurate with minimal effort. Instead of manually entering the same headings, formatting details, and layout choices for every transaction, you can rely on a saved design that automatically incorporates these elements. This allows you to focus more on the specific content, such as client details and transaction amounts, while the rest remains standardized and error-free. By leveraging this approach, you streamline the entire process, saving valuable time and reducing the chances of mistakes that can arise from starting with a blank document each time. Where to Find Printable Invoice TemplatesIf you’re looking for pre-designed documents to simplify your billing process, there are many places online where you can find high-quality options. These resources offer a variety of formats suitable for different business needs, allowing you to easily customize them to your preferences. Whether you need something simple or more detailed, there are numerous platforms to explore. Online Resources and WebsitesNumerous websites offer ready-made structures for business documents, often available for immediate download. Some of these sites specialize in various business tools, offering templates tailored for specific industries or transaction types. You can search for these on trusted platforms such as Microsoft Office, Google Docs, or various specialized document-sharing websites. Business Software SolutionsMany accounting and business management software packages come with built-in formats that you can use for your transactions. These tools often allow for easy customization, helping you create professional-looking documents in just a few clicks. Platforms like QuickBooks, FreshBooks, and Zoho Invoice often include customizable document options designed to meet the needs of businesses of all sizes. By exploring these options, you can save time and effort while ensuring that your documents are both functional and professional. Whether you choose to download a ready-made design or use software tools, there are plenty of resources available to help you manage your financial transactions effectively. Creating Professional Invoices in MinutesGenerating polished and well-structured business documents can be done in just a few minutes with the right tools and approach. By using pre-set structures that are designed for quick customization, you can ensure that every transaction you handle is properly documented. With the necessary details already in place, you only need to input specific information related to each deal, significantly reducing the time spent on paperwork. Using Pre-Designed LayoutsOne of the easiest ways to create professional documents quickly is to use established formats. These layouts come with all the essential sections and alignments you need, allowing you to simply focus on the specifics of each transaction, such as customer names, amounts, and services rendered. The ability to add or modify details in seconds makes these tools ideal for busy professionals. Essential Elements of a Well-Structured DocumentA well-crafted document should include several key sections. Here’s a basic structure that ensures clarity and professionalism:

By organizing these sections efficiently, you can create professional documents in a matter of minutes, ensuring both speed and accuracy in your financial dealings. Printable Invoices for Small BusinessesFor small businesses, managing finances efficiently is essential to maintaining a steady cash flow and professional reputation. One key aspect of this is creating accurate and clear documents for each transaction. These records help ensure that customers understand what they are being charged for and can help your business stay organized and compliant with tax requirements. Having a well-structured document ready for use can save time and reduce the risk of errors. Whether you’re just starting out or looking to streamline your processes, using ready-to-go designs can ensure that every detail is included, from client information to payment terms, with minimal effort. For small businesses, this approach means more time spent on growth and less time on administrative tasks. Customizing these documents to reflect your brand can also enhance your company’s image. Adding your logo, adjusting colors, or choosing a professional font can make a simple form feel personalized and trustworthy, improving your client’s experience and confidence in your business. Incorporating this practice into your routine ensures that you maintain a high level of organization and professionalism, essential for long-term success in a competitive market. Essential Elements of an InvoiceTo ensure clarity and accuracy in any financial transaction, certain key details must be included in each business document. A well-structured record not only provides transparency but also helps both parties understand the terms of the agreement. By incorporating these essential components, you create a professional, effective document that minimizes confusion and promotes timely payments. Here are the critical sections that should be part of every financial document:

How to Add Branding to Your InvoiceCreating a professional and cohesive experience for your clients goes beyond just the product or service you offer. One of the easiest ways to reinforce your business identity is through the documents you send, especially when it comes to financial records. Adding your unique branding elements helps establish a consistent visual presence and enhances your company’s reputation. Incorporating Your Logo and Company ColorsStart by placing your company logo prominently at the top of the document. This instantly connects the transaction with your brand and provides a professional appearance. Additionally, using your brand’s color palette for headers, borders, or text can further strengthen the connection between the document and your overall identity. It’s important to keep the design clean and uncluttered to ensure the document remains easy to read while still showcasing your brand. Personalizing with Fonts and TaglinesUsing a specific font style that aligns with your brand’s personality is another way to add a personal touch. Whether it’s a bold, modern font or a more classic serif type, consistency in font choice helps create a unified look across all your communications. Additionally, consider adding a tagline or a brief slogan at the bottom of the document, which can serve as a reminder of your values or mission statement. By thoughtfully incorporating these elements, you not only make your documents visually appealing but also reinforce the recognition of your business, which can leave a lasting impression on clients. Free Invoice Templates for FreelancersAs a freelancer, managing your financial documents efficiently is essential for maintaining professionalism and staying organized. Having a ready-made document structure can save you time and ensure you’re consistently providing your clients with accurate records of services rendered. These pre-designed formats are especially useful for freelancers, allowing them to focus on their work rather than on administrative tasks. Many online platforms offer simple and customizable formats that cater to the specific needs of freelancers. These structures include essential fields like project descriptions, hourly rates, and payment terms, making it easy for you to adapt them to different types of projects. Whether you’re a writer, designer, or developer, you can find a design that suits your workflow and presents your work in a clear and professional manner. By using these readily available resources, you not only save time but also create a consistent and polished look for your financial documents, which helps to build trust with your clients. Whether you’re just starting or are an experienced freelancer, having access to these materials simplifies the process of managing payments and records. How to Avoid Common Billing MistakesManaging financial transactions can be challenging, especially when it comes to maintaining accuracy and clarity in your documentation. Even minor mistakes in your business records can lead to misunderstandings, delayed payments, and a loss of trust with clients. However, with a little attention to detail, you can easily avoid the most common errors that occur in the billing process. Here are some key practices to help you steer clear of typical mistakes:

Additionally, reviewing the document before sending it off is crucial. Many billing errors can be caught by simply taking a few extra minutes to proofread. This small effort can save you from costly misunderstandings or delays in payment. By adopting these best practices, you’ll improve the accuracy and professionalism of your business records, ultimately leading to smoother transactions and stronger relationships with clients. Using Invoices for Tax PurposesProper documentation of financial transactions is crucial for maintaining accurate records, especially when it comes to tax reporting. Recording details of sales, purchases, and services ensures that both businesses and individuals can comply with local tax regulations. These documents serve as the foundation for tax filings and can help avoid penalties by providing a clear and organized overview of income and expenses. For tax purposes, it’s important that each transaction is supported by a detailed record that outlines the amounts, parties involved, dates, and nature of the service or goods provided. These records are often required during audits and can also be used to substantiate deductions, exemptions, or credits when preparing tax returns. They provide transparency and help ensure that businesses are accurately reporting their earnings and expenses to the tax authorities. By maintaining precise and complete records, individuals and businesses can also track their financial performance throughout the year. This not only simplifies the filing process but also allows for better financial planning. Whether you’re a freelancer, small business owner, or large enterprise, these documents play an essential role in safeguarding against potential tax issues and supporting financial growth. Printable Invoices for Service ProvidersFor service-based professionals, documenting the work done and the amount charged is essential for both transparency and financial tracking. These records ensure that clients understand what they are being billed for and can help service providers maintain organized accounts. Clear documentation supports smooth transactions, fosters trust, and provides a structured way to request payment. Whether you’re a consultant, contractor, or freelancer, a well-structured billing statement should detail the services rendered, the hourly or flat rate, and any additional costs. It should also include client information, payment terms, and due dates to avoid confusion. Having a consistent format can improve the professional image of your business and streamline the payment process. By using a proper record of transactions, service providers can also better manage cash flow, track unpaid amounts, and make tax reporting easier. Accurate documentation is key to avoiding disputes and ensuring that services are compensated promptly. Investing time in creating clear and detailed records can lead to better financial management and client satisfaction. Customizable Invoice Templates for Different IndustriesDifferent sectors have unique requirements when it comes to documenting transactions and managing payments. Tailored records help businesses accurately reflect the services, goods, or time spent in a way that aligns with industry standards. Customizing these documents ensures that all necessary details are included, such as specific service descriptions, project milestones, or product categories, making it easier for both parties to understand the terms of the agreement. For example, a construction contractor may need to include itemized labor costs and material fees, while a consultant might require a breakdown of hours worked and the scope of services provided. On the other hand, retailers often list product quantities and individual prices. Each sector benefits from having a flexible framework that can be adapted to reflect the nature of their work accurately. Industry-specific customization helps avoid confusion and ensures that both the seller and buyer are on the same page regarding what is being charged. By adapting these records to suit their specific needs, businesses can create a more professional image, streamline payment processes, and reduce the chances of disputes. Having the right structure for your industry not only saves time but also aids in compliance with financial regulations and tax requirements. How to Maintain Invoice RecordsKeeping accurate and organized documentation of all financial transactions is essential for any business. Properly managing these records not only ensures smooth operations but also helps in tax preparation, auditing, and resolving disputes. A well-maintained system can prevent confusion, reduce errors, and make it easier to track outstanding payments or due amounts. Establishing a clear method for record-keeping is key to staying organized and compliant with regulations. 1. Organize Records by CategoriesIt’s important to categorize your records based on the type of transaction, such as sales, purchases, or services rendered. Within each category, separate documents by date or client to make it easier to find specific entries. This organization method reduces the time spent searching for records and ensures you can quickly access the necessary information when needed. Consider using digital tools for sorting and labeling, which can also provide automatic backups. 2. Keep Copies of All DocumentsWhether you store physical or digital versions, always ensure you keep copies of all transaction records. For physical records, create a safe, organized filing system that protects the documents from damage or loss. For digital records, use cloud storage or dedicated accounting software to back up your files securely. Retaining copies allows you to easily access past records for tax filing, financial audits, or future reference. Regularly updating and reviewing your record-keeping system will help you stay ahead of any issues and ensure that your business remains financially organized. Proper documentation management is a crucial practice for long-term business success and compliance with financial regulations. Tips for Streamlining Your Billing ProcessEfficiently managing payment requests is essential for maintaining smooth cash flow and reducing administrative workload. By simplifying the way you track and issue charges, you can ensure timely payments and focus more on growing your business. Implementing a clear, consistent process for handling charges can save time, reduce errors, and improve client satisfaction. 1. Automate Where PossibleOne of the most effective ways to streamline your billing procedures is to incorporate automation. Many software tools can generate and send billing documents automatically based on predefined schedules or milestones. This reduces the chance of human error and ensures that clients receive their charges on time without requiring manual intervention. Automation can also help track unpaid amounts, send reminders, and generate reports on outstanding balances. 2. Use Clear and Consistent FormatsAdopting a standard format for all payment requests makes the process more predictable for both you and your clients. Clearly defined sections, such as the services or products provided, the amount due, and payment terms, eliminate ambiguity. Clients appreciate when everything is easy to read and understand, and this consistency reduces the chances of disputes. Using a uniform structure across all transactions helps maintain a professional image and simplifies the billing process. By implementing these strategies, you can reduce administrative overhead and improve the efficiency of your financial operations. A well-structured, organized process benefits both businesses and clients, leading to smoother interactions and quicker payments. |