Interior Designer Invoice Template for Easy Billing and Professional Invoices

Managing financial transactions and maintaining clear communication with clients is essential for anyone working in creative fields. Whether you’re handling home makeovers, office spaces, or large-scale projects, keeping accurate records and presenting clear payment requests ensures a smooth workflow. This guide will explore how to organize and present your payment requests in a way that boosts professionalism and efficiency.

Having a structured method for documenting your charges and services not only simplifies the billing process but also minimizes the risk of misunderstandings. With a well-organized format, you can provide detailed breakdowns of work completed, ensuring that your clients know exactly what they’re paying for. Additionally, offering customizable options allows for personalization while maintaining consistency in your approach.

By utilizing a reliable framework for generating bills, you can save time and focus on what truly matters–delivering outstanding results. In this article, we’ll discuss key features that should be included in your financial documents and explore how these tools can enhance your professional image.

Interior Designer Invoice Template Guide

Creating a structured and professional billing document is an essential part of managing client relationships and maintaining a smooth workflow. An effective billing document provides clarity, ensures timely payments, and reduces the likelihood of disputes. In this guide, we will walk you through the process of creating a billing document that suits your needs and enhances your professional image.

Key Elements to Include in Your Billing Document

A well-crafted payment request includes several critical components that make the document clear, detailed, and easy to understand. Here are the core elements you should include:

- Client Information: Include the client’s full name, address, email, and phone number.

- Your Contact Details: Make sure your business name, address, and other contact information are easily accessible.

- Description of Services: Provide a breakdown of the services rendered, including a description of the work and any materials used.

- Dates: Mention the dates when the work was completed or when milestones were reached.

- Payment Terms: Clearly outline payment expectations, including deadlines and accepted methods of payment.

- Tax and Additional Costs: If applicable, include tax information and any additional charges such as delivery fees or late penalties.

- Total Amount Due: Highlight the total amount the client needs to pay for the services rendered.

How to Personalize Your Payment Requests

Customization can set your billing documents apart, making them both functional and aligned with your business identity. Here are a few ways to personalize your document:

- Use a unique design or branding elements, such as your logo and brand colors.

- Adjust the layout to match your style while keeping it professional and easy to read.

- Incorporate your business tagline or mission statement to reinforce your brand.

- Include a personalized note or message to thank your client for their business.

By including these elements, you not only provide a clear summary of the work but also showcase your professionalism, helping to build trust with clients and create a lasting impression.

Why Use an Invoice Template

Having a structured and consistent way of documenting payments and services is crucial for maintaining professionalism in business. Using a pre-designed structure for financial records helps save time, reduce errors, and ensure clear communication with clients. By leveraging a customizable format, you streamline the entire billing process and provide a more polished presentation of your services.

Time-Saving Benefits

One of the most significant advantages of using a predefined structure is the time it saves. Rather than creating a new document from scratch every time you need to request payment, a standard framework allows you to focus on the specific details of each job. Here’s how it helps:

- Consistency: You won’t have to worry about formatting or forgetting key elements each time.

- Speed: With a template, filling in the required information is quick and straightforward.

- Efficient Updates: When changes or additions are necessary, it’s much easier to modify an existing structure than start over.

Improved Professionalism and Accuracy

Using a well-designed structure ensures that your financial documents are consistent, accurate, and easy to understand. This not only makes it easier for your clients to review the information but also reduces the likelihood of misunderstandings or disputes. Additionally, templates typically include all the important sections, which helps you avoid missing vital information, such as:

- Detailed service descriptions

- Clear payment terms

- Tax calculations and additional fees

With a solid, easy-to-follow format, you demonstrate attention to detail and convey trustworthiness, which helps strengthen client relationships and promote repeat business.

Key Components of an Invoice

Creating a well-structured billing document requires more than just listing services and amounts due. A comprehensive record should include essential details that ensure clarity and transparency for both you and your client. These components help maintain professionalism, minimize confusion, and expedite payment processing.

To make your financial documents clear and accurate, certain key elements must always be included. Here are the main components to consider:

- Business Information: Your full business name, address, and contact details should be clearly visible at the top of the document. This helps clients easily reach you with any questions or concerns.

- Client Information: Include the client’s name, address, and contact information. This ensures that the document is tailored to the correct recipient and reduces the chance of errors in delivery.

- Invoice Number: Assign a unique identifier to each document. This helps you track payments and prevents any confusion between multiple requests.

- Service Description: Clearly detail the work completed, including any materials used, time spent, or milestones achieved. Be specific to avoid misunderstandings.

- Dates: Mention the date the services were rendered as well as the issue date of the document. Including payment deadlines ensures timely processing.

- Amount Due: List the total amount the client owes, with any applicable taxes or fees added. Breaking down individual costs can provide transparency.

- Payment Terms: Outline the agreed payment methods, due dates, and any penalties for late payments. This section ensures clear expectations between you and your client.

- Notes or Special Instructions: If there are any additional details, like discounts, deposits, or project-specific instructions, include them in this section for better communication.

Including all of these components will not only make your financial records more professional but will also help ensure that both you and your client are on the same page regarding payments and expectations.

How to Create an Invoice

Creating a professional billing document involves more than just calculating amounts owed. It requires a clear structure and attention to detail to ensure that both you and your client are on the same page. The process should be straightforward, and with the right approach, it can become an easy task that ensures accuracy and professionalism in your transactions.

Follow these steps to create an effective payment request:

- Step 1: Include Your Business Information

Start by adding your business name, address, phone number, and email at the top of the document. This makes it clear who the payment is for and how clients can contact you if needed.

- Step 2: Add Client Details

Next, include the client’s full name, business name (if applicable), address, and contact information. Ensuring that this information is correct will help avoid any miscommunication.

- Step 3: Assign a Unique Reference Number

Every request for payment should have a unique identifier. This number helps you track payments and ensures that the request is easily distinguishable from others.

- Step 4: Detail the Services Provided

List the services you’ve rendered in a clear and specific manner. Be sure to include dates, project phases, or time spent on tasks, as well as materials used if applicable. The more detailed the description, the less likely there will be confusion later.

- Step 5: Include the Total Amount Due

Clearly indicate the total amount owed, including any applicable taxes or fees. If applicable, break down the total by category or service to give the client a transparent view of the charges.

- Step 6: Set Payment Terms and Due Date

Outline the agreed-upon payment terms. Mention the accepted payment methods, the due date, and any late fees or discounts for early payment. This ensures that both parties are clear on the expectations.

- Step 7: Double-Check for Accuracy

Before sending the request, review it carefully to ensure all details are accurate, including numbers, dates, and client information. Mistakes can delay payments or cause confusion.

By following these steps, you’ll ensure that your payment request is professional, clear, and easy to understand, leading to faster and smoother transactions.

Best Practices for Professional Invoices

Ensuring your billing documents are clear, organized, and professional is key to maintaining a positive relationship with clients and receiving prompt payments. A well-prepared document not only boosts your business image but also minimizes confusion and disputes. By following best practices, you can create an efficient system that improves both your workflow and client satisfaction.

1. Keep It Clear and Simple

Simplicity is crucial in ensuring your payment requests are easily understood. Avoid cluttering the document with unnecessary details, and focus on providing the necessary information in a clear format. Here are a few things to consider:

- Use easy-to-read fonts and make important details stand out.

- Use bullet points or tables to organize information neatly.

- Keep the language simple and direct, avoiding jargon or overly technical terms.

2. Stay Consistent with Branding

Your business identity should be reflected in your financial documents. Consistent use of your logo, colors, and fonts creates a professional and cohesive look that clients will recognize. Customizing your document style helps set you apart from the competition and reinforces your brand image.

3. Double-Check the Details

Always verify the accuracy of your billing document before sending it out. Double-check the client’s contact information, payment terms, and amounts due. Any errors can delay payments or cause confusion. Additionally, make sure all services rendered are accounted for and that taxes or discounts are correctly applied.

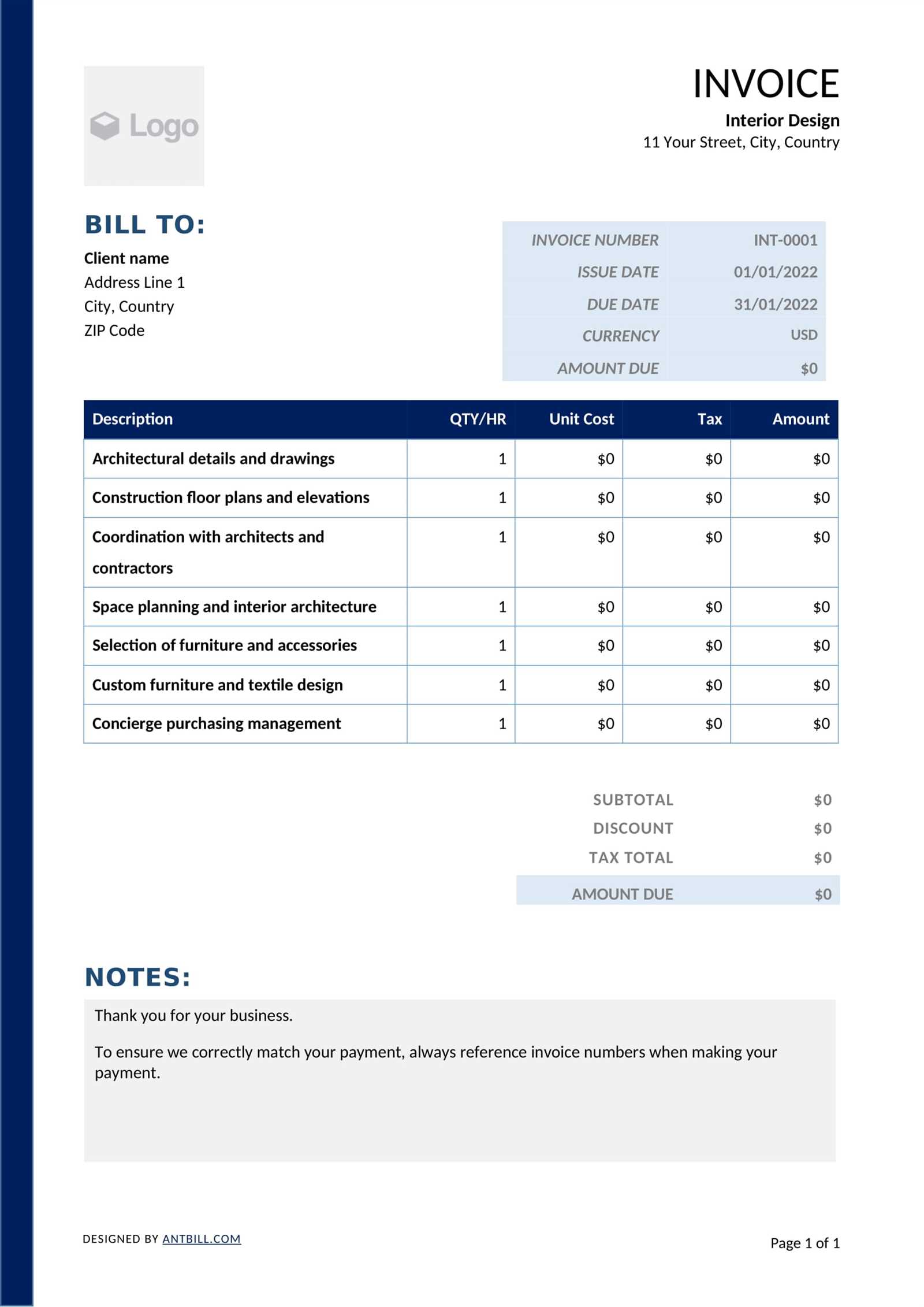

4. Use a Table to Organize Information

When listing services and costs, a table format helps break down the information for easy review. It allows clients to quickly see what they’re paying for and the corresponding costs. Below is an example of a clear and organized table format:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation Fee | 1 | $100 | $100 |

| Material Costs | 5 items | $50 | $250 |

| Subtotal | $350 | ||

| Sales Tax (5%) | $17.50 | ||

| Total Due | $367.50 |

By clearly showing the breakdown of services and costs, a table ensures both parties are aware of the details and avoids any confusion during payment.

5. Set Clea

Customizing Your Invoice Design

Personalizing your financial documents can elevate your brand and make a strong impression on clients. A well-designed and tailored format not only reflects your professionalism but also enhances your business identity. Customization gives you the flexibility to stand out, providing both aesthetic appeal and functionality in your billing process.

Here are some key aspects to consider when designing your billing documents:

1. Incorporate Your Brand Identity

Your business’s visual identity should be reflected in the design of your payment requests. Consistency in branding helps build recognition and trust with clients. Consider these elements:

- Logo: Place your logo at the top of the document for immediate brand recognition.

- Color Scheme: Use your brand’s colors to maintain a cohesive look. This can be applied to headers, text, or accents throughout the document.

- Typography: Use fonts that align with your brand’s style. Consistent typography helps create a polished and cohesive appearance.

2. Choose the Right Layout

The layout of your payment request should be clean and easy to read. Consider organizing information in a way that guides the client’s eyes naturally through the document. Here’s what you can focus on:

- Clear Structure: Group related information together (e.g., contact details, service breakdown, payment terms) to create a logical flow.

- Spacing: Ensure there is enough white space between sections to make the document easy on the eyes and prevent clutter.

- Headers and Footers: Use headers for section titles and footers for additional notes or payment details, such as your business’s terms and conditions.

3. Add Personal Touches

To make your document stand out and build stronger connections with your clients, you can include personalized elements:

- Personalized Message: A brief thank-you note or a custom message expressing appreciation for the client’s business adds a personal touch.

- Client-Specific Information: Include relevant details for each client, such as project-specific terms or special discounts.

- Professional Signature: Adding your signature at the bottom gives the document a personal and professional finish.

4. Focus on Functionality

While aesthetics are important, functionality is

Choosing the Right Invoice Format

Selecting the right structure for your billing documents is crucial for ensuring clarity and efficiency in your financial transactions. The format you choose will influence how easily both you and your client can read and understand the details, helping to avoid confusion and delays. The right layout not only ensures professional presentation but also facilitates smooth payment processing.

1. Traditional vs. Digital Formats

One of the first decisions to make is whether to use a physical document or a digital format. Each option has its benefits depending on the type of business you run and how your clients prefer to receive their financial records:

- Traditional Formats: Printed documents are a more formal option and may be necessary for clients who prefer paper records. However, they require more time and effort to send and track.

- Digital Formats: Electronic files are faster to send, easier to store, and environmentally friendly. Common digital formats include PDF, Word, and Excel, which can be easily emailed or shared through cloud storage.

2. Layout and Structure

Choosing the right layout is key to creating a professional and functional document. Here are some layout considerations:

- Simple and Clean: Opt for a minimalistic design that includes essential information like client details, services rendered, payment terms, and amounts due, without unnecessary distractions.

- Structured Breakdown: A layout that clearly distinguishes each section (service description, costs, total due, payment methods) helps clients easily navigate the document.

- Editable Formats: If you frequently need to adjust the content, choose a flexible format, like Word or Excel, that allows for quick edits. A static PDF is great for finalized documents but may not be as versatile for modifications.

In general, the choice of format should align with your business operations and client preferences. For example, if you often deal with international clients, a digital format may be more convenient. However, for high-end clients who expect formal, printed documents, a traditional format might still be the best option.

How to Include Project Details

Incorporating detailed project information into your financial records is essential for providing clarity and ensuring that both you and your client are aligned. Including comprehensive descriptions of the work performed helps avoid misunderstandings and gives your client a clear view of what they are being billed for. It also helps you keep track of project milestones and deliverables.

1. Provide a Clear Description of Services

Detailing the scope of work is critical to ensuring transparency in your billing. Be specific about the services you provided and the tasks you completed. This includes:

- Work Type: Briefly describe the tasks or activities performed, such as consultation, planning, or project execution.

- Project Phases: If the project is divided into multiple stages, list each phase separately to show progress and payment due at each point.

- Materials or Resources Used: If any materials or special resources were required, include a detailed list or breakdown of these items.

- Time Spent: If billing by the hour or day, clearly state the amount of time spent on each task or project milestone.

2. Break Down the Costs and Payment Terms

Transparency in cost breakdown is just as important as the description of the services. Here’s how to effectively organize the financial details:

- Individual Service Costs: List each service or task separately, along with its associated cost or hourly rate. This helps clients see exactly what they are paying for.

- Total Costs: Sum up the costs for each task or phase and provide a subtotal before taxes and additional charges.

- Payment Milestones: If the payment is to be made in stages, specify the due dates or completion points tied to each payment. This could include deposits, partial payments, or the final amount due.

- Payment Terms: Include clear payment instructions, such as due dates, accepted payment methods, and any penalties for late payment.

By providing these project details, you not only offer a clearer view of the work done but also strengthen the trust and professionalism in your client relationship. Clear descriptions and accurate costs make it easier for your client to process payments promptly and with confidence.

Setting Up Payment Terms

Establishing clear payment terms is essential for maintaining smooth financial transactions with your clients. Clearly defined terms help avoid confusion, prevent delays, and ensure that both parties are on the same page regarding payment expectations. By specifying how and when payments should be made, you create a professional environment that encourages timely settlements and builds trust.

1. Specify the Payment Due Date

One of the most important elements of your payment terms is the due date. Setting a clear deadline ensures that both you and your client know when the payment is expected. Consider the following when determining the due date:

- Immediate Payment: For smaller projects or ongoing work, you may request payment as soon as the services are rendered or the document is submitted.

- Net Terms: Common terms such as “Net 15,” “Net 30,” or “Net 60” refer to the number of days from the billing date within which payment is due. This gives your clients a reasonable timeframe to process the payment.

- Milestone Payments: For larger projects, payments can be structured around specific milestones, such as after completing certain phases or deliverables.

2. Define Accepted Payment Methods

Clearly stating which payment methods you accept makes it easier for clients to pay promptly and without confusion. Include the following options based on your preferences:

- Bank Transfer: Provide your bank account details for wire transfers or direct deposits.

- Credit/Debit Cards: Accept payments via online payment systems like PayPal or Stripe, or through direct card transactions.

- Checks: If accepting checks, include details like your mailing address and processing times.

- Cash: For in-person payments, clearly state your preferences for cash transactions and any specific instructions.

3. Include Late Fees and Discounts

To encourage timely payments, it’s important to outline any late fees or discounts that may apply. Here’s how to handle these situations:

- Late Fees: Specify a percentage or fixed fee that will be added if payment is not made by the due date. For example, “A late fee of 5% per month will be applied to overdue amounts.”

- Early Payment Discounts: You can offer clients a small discount if they pay before the due date, which incentivizes early payment. For example, “A 2% discount will be applied if payment is received within 10

How to Add Taxes and Discounts

Including taxes and discounts in your billing documents is essential for accurate financial records and clear communication with clients. Taxes ensure compliance with legal requirements, while discounts can incentivize prompt payments or reward loyal customers. Both elements should be clearly outlined to avoid any confusion and ensure that the amounts charged are understood by all parties involved.

1. Calculating and Adding Taxes

Taxes vary depending on your location, business type, and the nature of the service provided. It’s crucial to apply the correct tax rate to ensure compliance with local regulations. Here’s how to add taxes:

- Identify the Applicable Tax Rate: Research the tax rate that applies to your services or products. This may include state, local, or national taxes, depending on your jurisdiction.

- Apply the Tax to the Total: Multiply the total amount before taxes by the applicable rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Show the Tax Clearly: Add a separate line item for the tax on the billing document. Clearly label it so the client can see the exact amount being charged for tax.

- Specify Tax Rate: Include the tax rate percentage next to the tax amount for transparency. For example: “Sales Tax (10%)”.

2. Applying Discounts

Discounts can be a great way to encourage early payments or offer incentives for repeat customers. Here’s how to apply them correctly:

- Percentage Discount: If offering a percentage-based discount, calculate the discount by multiplying the total amount due by the discount percentage. For example, a 5% discount on a $500 bill would result in a $25 reduction.

- Flat Amount Discount: Alternatively, you can offer a flat dollar amount discount. For example, a $50 discount on a $500 bill would reduce the total to $450.

- Show Discounts Clearly: Make sure to list the discount as a separate line item, showing the discount percentage or dollar amount and the total after the discount is applied.

- Set Terms for Discounts: If the discount is conditional, such as for early payment, be sure to specify the terms clearly, such as “5% discount if paid within 10 days”.

3. Example of Taxes and Discounts Calculation

Here is an example of how taxes and discounts might appear on your document:

- Subtotal: $500

- Sales Tax (10%):

Common Mistakes to Avoid

When preparing billing documents, attention to detail is crucial to ensure clarity, accuracy, and timely payments. Small mistakes can lead to misunderstandings with clients, delays in payment, or even legal complications. Avoiding common errors in your financial records not only promotes professionalism but also ensures a smoother transaction process for both parties involved.

- Missing Client Information: One of the most common mistakes is failing to include complete contact details for both the client and your business. Ensure that all relevant information–such as names, addresses, phone numbers, and email addresses–is accurate and up to date.

- Unclear Service Descriptions: Vague or ambiguous descriptions of the services provided can lead to confusion and disputes. Always provide detailed, specific descriptions of the work performed, including any materials used, time spent, and milestones reached.

- Incorrect Calculation of Amounts: Double-check all calculations, including totals, taxes, and discounts. Errors in arithmetic can lead to frustration for clients and damage your reputation. Use automated tools or formulas to reduce the likelihood of mistakes.

- Not Specifying Payment Terms: Failing to clearly outline payment due dates, methods, and late fees can result in delays. Be explicit about when the payment is expected and what happens in case of overdue amounts.

- Omitting Taxes or Fees: Taxes and additional fees (such as delivery or administrative charges) should always be included if applicable. Missing these elements can lead to confusion or disputes with clients, especially if the final amount differs from what was expected.

- Inconsistent Formatting: Consistency in your layout, fonts, and alignment makes the document easier to read and more professional. Avoid jumbled or inconsistent formats that could confuse your client or make the document appear disorganized.

- Not Including a Payment Confirmation or Receipt: Once the payment is made, always issue a confirmation or receipt to the client. This confirms the transaction and serves as a record for both parties.

- Missing or Incorrect Dates: Always include both the date the document is issued and the due date for payment. Missing or incorrect dates can delay processing and create unnecessary confusion.

By avoiding these common mistakes, you can streamline the billing process, enhance client trust, and ensure a more efficient and professional experience for everyone involved.

How to Track Payments Efficiently

Effectively managing and tracking payments is crucial for maintaining financial stability and ensuring a smooth cash flow. Without a proper system in place, it becomes easy to lose track of paid and outstanding amounts, leading to confusion or delayed collections. By organizing and monitoring transactions carefully, you can stay on top of your finances and provide better service to your clients.

1. Use a Digital Payment System

Leveraging digital tools and software can simplify the tracking process and reduce the likelihood of errors. Here’s how to use technology to your advantage:

- Automated Payment Tracking: Use accounting software or invoicing platforms that automatically track payments. These tools often integrate with your bank accounts, alerting you when a payment is made.

- Online Payment Systems: Platforms like PayPal, Stripe, or bank transfers provide automatic records of all transactions. This eliminates the need to manually enter payment details.

- Cloud-Based Storage: Store your financial records in the cloud for easy access and retrieval. This ensures you have a backup in case of data loss and makes it easier to track payments across multiple devices.

2. Organize Payments by Status

Tracking the status of each payment ensures that you know whether you’re waiting on payments or have already received them. Consider organizing payments using these categories:

- Paid: Mark payments that have been received in full, and update your records to reflect that the transaction is complete.

- Pending: Payments that are due but have not yet been processed should be categorized as pending. Set reminders to follow up with clients as the due date approaches.

- Overdue: Keep track of any overdue payments to follow up with clients quickly. Be sure to set reminders for late fees or penalties if necessary.

- Partial Payments: If clients make partial payments, note the amount paid and the remaining balance to ensure accurate tracking and avoid confusion.

3. Create a Payment Log

Maintaining a manual or digital log can help you track payments step by step. Here’s how to create an efficient record system:

- Date of Payment: Always record the date the payment was made to ensure accurate tracking and follow-up actions.

- Payment Method: Specify how the payment was made (e.g., bank transfer, check, credit card) to help you track your preferred payment methods.

- Amount Paid: Clearly note the amount paid and ensure it matches the agree

Essential Invoice Templates for Designers

When it comes to managing your business’s finances, having well-structured billing documents is crucial. For those in the creative industry, presenting professional and organized financial records ensures timely payments and builds trust with clients. The right billing format can make all the difference, offering clarity and a smooth process for both you and your clients.

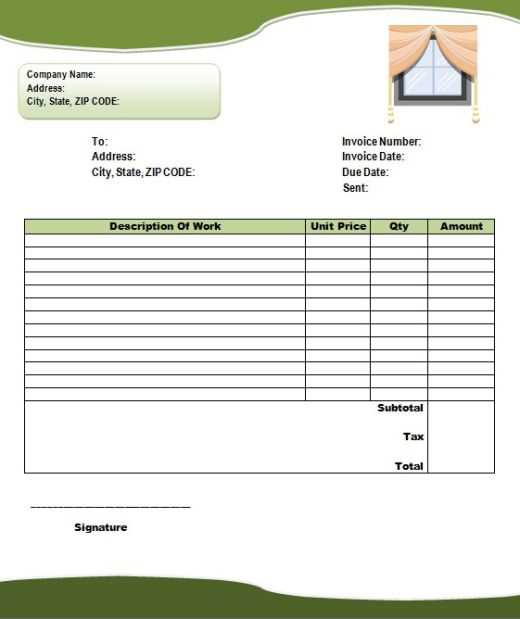

1. Standard Billing Format

A basic, no-frills document that includes the essential details of the project and payment terms. This format is suitable for straightforward projects and works well when there’s a fixed price or simple payment schedule. Key elements include:

- Client Information: Name, address, and contact details.

- Project Details: Clear description of the services provided.

- Payment Terms: Due date and any payment conditions.

- Total Amount: Final price including taxes and any applicable fees.

2. Hourly Rate Billing

For projects where payment is based on time spent, this format tracks hours worked and the corresponding charge per hour. It’s ideal for consultancy or other services where work can be billed on an hourly basis. Key components include:

- Hourly Rate: Specify the hourly charge and the number of hours worked.

- Time Tracking: Breakdown of hours worked, including dates and tasks completed.

- Total Hours: Calculate the total hours worked, then multiply by the hourly rate.

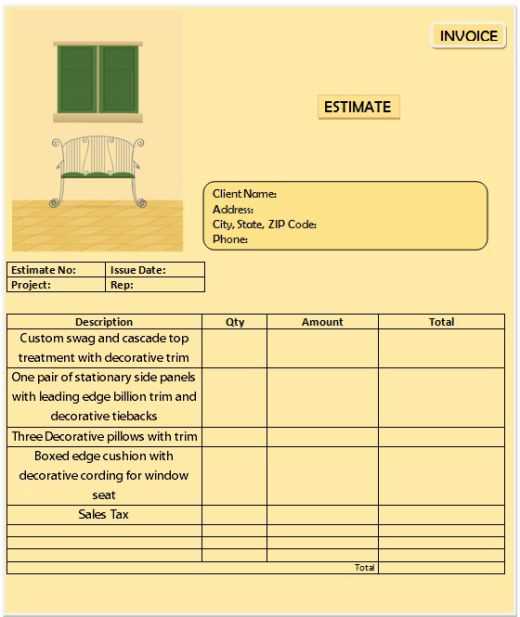

3. Milestone Billing

This structure is designed for larger projects that are completed in stages. It allows you to set payment intervals upon completion of specific milestones. This approach helps clients manage their budget over the course of the project. Key elements include:

- Project Milestones: List out the key stages of the project.

- Payment Schedule: Assign a payment amount to each milestone.

- Completion Dates: Set dates for when each milestone is due for payment.

4. Retainer Billing

For long-term engagements or ongoing work, a retainer agreement can ensure steady cash flow. This billing structure involves receiving an upfront payment to secure services over an extended period. Key components include:

- Retainer Amount: Specify the fixed amount the client will pay upfront.

- Scope of Services: Outline the services that will be covered by the retainer.

- Payment Period: Define how often payments will be made (e.g., monthly, quarterly).

5. Expense Reimbursement Format

In some cases, clients may reimburse you for expenses incurred during the project. This template allows you to keep track of the costs and pass them along to your client. Essential components include:

- Expense List: Detail each expense, including receipts or supporting documentation.

- Project Relevance: Indicate how each expense relates to the project.

- Reimbursement Amount: Specify the amount to be reimbursed by the client.

6. Payment Reminder Format

Occasionally, payments may be delayed. A formal reminder helps maintain professionalism while encouraging prompt payment. Essential elements of this template include:

- Outstanding Balance: Clearly state the amount owed.

- Due Date: Include the original payment due date and the new due date.

- Late Fee Details: If applicable, outline any penalties for overdue payments.

Having the right format for each type of engagement is essential for streamlining your payment processes and ensuring timely collections. By choosing the most appropriate billing structure, you can improve communication with your clien

Benefits of Digital Invoices

Adopting digital billing documents offers numerous advantages for businesses of all sizes. With the ability to streamline processes, reduce errors, and increase efficiency, digital records are rapidly becoming the preferred choice over traditional paper-based methods. Whether you are sending out payment requests or managing accounts, the shift to digital formats can significantly improve how you track and handle financial transactions.

1. Increased Efficiency and Speed

One of the key benefits of digital documents is the speed with which they can be created, sent, and processed. Here’s how:

- Instant Delivery: You can send billing documents within seconds, reducing the wait time compared to postal mail.

- Automatic Calculations: Many digital tools offer built-in calculations, ensuring that your totals, taxes, and discounts are correct every time.

- Fast Payment Processing: Digital records often integrate with online payment gateways, allowing clients to pay immediately via credit card, bank transfer, or other methods.

2. Reduced Risk of Errors

Manual errors, such as miscalculations or lost paperwork, are common with traditional methods. Digital billing reduces these risks:

- Automated Calculations: Automated systems calculate totals, taxes, and discounts, ensuring accuracy in every transaction.

- Easy Editing: If a mistake is found, changes can be made easily without reprinting or starting over.

- Digital Records: Digital documents are stored securely and can’t be misplaced, making it easier to access or reference past transactions.

3. Improved Organization and Accessibility

Digital systems offer better organization and easy access to all your financial records. You can:

- Store and Organize: Keep all documents in one place, sorted by date, client, or project, making retrieval simple and quick.

- Access Anywhere: Cloud-based storage allows you to access documents from any device, at any time, enhancing flexibility and convenience.

- Search and Retrieve: Easily search for specific documents, eliminating the need to sift through stacks of paper records.

4. Cost Savings

By switching to digital formats, businesses can cut down on paper and postage costs. Other ways digital records save money include:

- Reduced Paper Usage: No more printing, filing, or storing physical copies of billing documents.

- Eliminating Postage Fees: Sending digital records

Free vs Paid Invoice Templates

When managing financial transactions, choosing the right structure for billing can make a significant difference. There are numerous options available for creating billing documents, and businesses often face the decision of whether to use a free solution or invest in a paid one. Both have their advantages and limitations, and understanding the differences can help you make an informed decision about which option best fits your needs.

1. Free Solutions

Free options are often accessible and easy to use, making them a popular choice for small businesses or individuals just starting. These templates can be found in various formats, from online tools to downloadable documents, and they provide a simple way to create the necessary records for your transactions.

- Cost-Effective: No upfront cost, making them ideal for those with a limited budget or small-scale operations.

- Basic Features: While they are functional, free templates often come with limited customization options and basic features.

- Ease of Use: Most free solutions are simple and straightforward, with minimal learning curve required.

- Limited Support: Free options may not offer customer support or troubleshooting help if you encounter problems or need assistance.

- Basic Design: Often, free templates lack advanced design or branding features that would make your documents stand out.

2. Paid Solutions

Paid options generally offer enhanced features, better customization, and more robust support. These solutions often cater to businesses that require a more professional and scalable approach to managing financial documents.

- Advanced Customization: Paid templates typically allow for greater customization in design, layout, and branding, helping you create documents that align with your business’s professional image.

- Additional Features: Paid options often come with useful extras, such as the ability to automatically calculate taxes, track payments, or integrate with accounting software.

- Customer Support: With paid services, you can usually expect dedicated customer support, which can be a great advantage if you encounter issues or need specific assistance.

- More Professional Design: Paid templates often come with more polished, well-organized, and aesthetically pleasing designs that create a strong, professional impression.

- Ongoing Updates: Paid templates or services are likely to be updated regularly to ensure compliance with changing laws, taxes, or best practices.

Which Option is Right for You?

The choice

How to Automate Invoicing

Streamlining the process of creating and sending payment requests is essential for improving business efficiency. Automating billing can save time, reduce errors, and ensure that payments are received on time. With the right tools and processes in place, you can fully automate the creation, sending, and tracking of payment records, freeing up valuable time to focus on other aspects of your business.

1. Choose the Right Automation Tool

The first step in automating your billing system is selecting the appropriate software or tool. There are numerous online platforms and accounting software that provide automation features to simplify this process. Look for tools that offer the following features:

- Customization: Ability to create professional-looking documents that align with your business’s branding.

- Integration: Ensure the tool integrates with your accounting system, bank, and payment platforms for seamless data transfer.

- Recurring Billing: If you offer subscription-based services or retainer agreements, look for tools that allow for recurring billing automation.

- Payment Reminders: Choose a platform that sends automatic reminders to clients before or after payment due dates.

- Tracking and Reporting: Tools that offer real-time tracking and reporting of payments will give you insights into your cash flow.

2. Set Up Automation Rules

Once you’ve selected your automation tool, the next step is to configure it according to your specific needs. Here are some key automation rules to consider setting up:

- Automatic Generation: Set your system to automatically generate payment records based on completed projects or milestones.

- Payment Due Dates: Establish clear rules for when payments are due and automate the creation of payment requests with appropriate due dates.

- Payment Reminders: Automate follow-up emails or notifications to clients reminding them of upcoming or overdue payments.

- Late Fee Application: If applicable, set up automatic calculations for late fees when payments are delayed past the agreed-upon date.

- Tax Calculations: Automate the calculation of taxes based on the location or type of service offered to ensure accuracy in your billing process.

3. Utilize Online Payment Integration

Integrating online payment gateways with your automated system allows clients to make payments directly from the payment request. This streamlines the payment process, reduces delays, and ensures quicker settlement of your accounts. Key benefits include:

- Instant Payments: Clients can pay immediately via secure payment platforms, speeding up the payment cycle.

- Payment Confirmation: Automated systems provide instant payment confirmations, redu

Ensuring Accuracy in Invoices

Maintaining precise financial records is essential for the success of any business. Ensuring that the details on your billing documents are correct not only helps avoid confusion but also fosters trust between you and your clients. Mistakes, even minor ones, can lead to payment delays, misunderstandings, or even disputes. Therefore, it’s crucial to put systems in place that support accurate and error-free recordkeeping.

1. Double-Check Your Information

Before sending out any billing document, always review the information thoroughly. Pay close attention to the following details:

- Client Details: Ensure that the client’s name, address, and contact information are accurate and up to date.

- Service Descriptions: Clearly describe the services rendered or products delivered, making sure there are no ambiguities that could lead to confusion.

- Payment Amount: Double-check the amounts listed, including any discounts, taxes, or additional charges, to ensure they align with what was agreed upon.

- Dates: Verify that the date of issue and the due date are correct. Incorrect dates could delay the payment process or cause administrative issues.

2. Use Automation for Consistency

Automation tools can help reduce the likelihood of human errors. By using an automated system for generating payment records, you can eliminate many manual tasks that could lead to mistakes. Features to consider include:

- Template Consistency: Pre-set templates can standardize the format and ensure consistency across all your documents.

- Automated Calculations: Use software that automatically calculates totals, taxes, and discounts to avoid mathematical errors.

- Data Integration: Tools that integrate with your accounting software can pull in accurate, real-time data to ensure the information on your billing documents is correct.

3. Review Tax and Legal Compliance

Make sure your billing documents comply with relevant tax laws and industry regulations. Incorrectly calculating taxes or failing to include necessary legal information could lead to legal issues or fines. Keep these tips in mind:

- Tax Rates: Verify the correct tax rates based on the location of your business and the client. Tax rates can vary by region, so it’s important to stay updated.

- Legal Requirements: Ensure your documents include req