GST Invoice Template for India

For businesses operating under specific taxation frameworks, having the right tools to generate clear and accurate financial records is crucial. The need for structured formats to reflect business transactions accurately ensures compliance with regulatory requirements and minimizes errors. Using an effective structure helps in organizing transactions, making reporting simpler and more reliable.

Understanding the components that must be included in these essential documents can prevent misunderstandings and promote smooth interactions between businesses and tax authorities. Whether you are dealing with goods or services, ensuring that each document meets legal standards is important for avoiding penalties and streamlining your accounting processes.

Adopting the right solution for creating these documents can save time and reduce the complexity of managing business finances. A flexible tool that aligns with the latest tax laws provides businesses with the assurance that they are fulfilling their legal duties without unnecessary complications.

GST Invoice Template for Indian Businesses

For businesses operating within the Indian taxation framework, creating standardized documents for each sale or service transaction is essential. These records must contain specific details that comply with the country’s legal tax requirements. A well-structured document ensures accurate reporting and simplifies the process of filing taxes, reducing the risk of errors or audits.

Key elements that should be included in these business documents are:

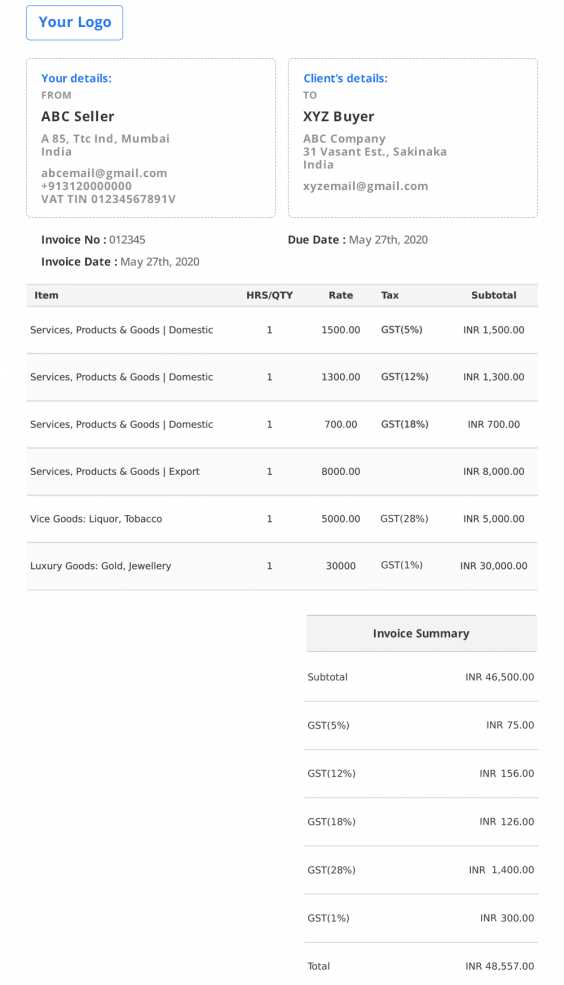

- Supplier Information: The name, address, and registration number of the seller.

- Buyer Details: The name and address of the buyer, along with any relevant identification numbers.

- Description of Goods or Services: A clear list of the items sold or services provided, including quantities and unit prices.

- Tax Amount: The total applicable tax based on the transaction value, including any tax rates or exemptions that may apply.

- Date and Unique Identification Number: The date of the transaction and a unique reference number for easy tracking.

Utilizing a consistent format helps businesses maintain order and transparency, which is crucial for both legal compliance and effective financial management. Moreover, having an easy-to-use solution that accommodates these details ensures a smoother operation for all parties involved. Businesses can choose from various digital solutions that automate the generation of these documents, making the process quicker and more efficient.

By adhering to the correct standards and including all the necessary information, businesses not only meet legal obligations but also enhance trust with clients and partners. This structured approach makes managing finances more predictable and allows for easier reconciliation during tax periods.

Importance of GST Compliance for Invoices

Adhering to tax regulations is crucial for any business, as it ensures accurate reporting and the timely submission of required documents. When businesses follow the established rules for documenting transactions, they not only stay compliant with legal requirements but also minimize the risk of audits, penalties, and legal issues. Proper documentation creates transparency, making it easier to track payments and resolve disputes if necessary.

Legal and Financial Implications

Failure to comply with the country’s tax laws can result in serious consequences for businesses. The authorities may impose fines or penalties on businesses that do not adhere to the required standards for financial records. In some cases, non-compliance may even result in legal action, affecting a company’s reputation and bottom line. Businesses that follow the correct practices safeguard themselves from such risks.

Streamlining Business Operations

Beyond legal obligations, staying compliant with tax laws can help businesses improve their operational efficiency. Having a standardized way of recording transactions reduces the chances of errors, ensures consistency, and simplifies processes like audits and reconciliation. This makes it easier for businesses to manage their finances and maintain good relationships with clients and tax authorities.

Staying compliant also builds trust with customers and partners. Transparent and legally accurate documentation reflects professionalism and reliability, which can positively impact business growth and expansion. With the right practices in place, businesses can focus on scaling up while ensuring they meet all necessary regulatory requirements.

How to Create an Effective GST Invoice

Creating accurate and well-organized records for business transactions is essential to ensure smooth operations and tax compliance. The process involves including all necessary details to clearly document the exchange of goods or services. A well-structured document not only satisfies legal requirements but also promotes transparency and trust with clients and partners.

The following key steps will help you produce a comprehensive and compliant document:

- Include Basic Information: Always start by listing the names, addresses, and contact details of both the seller and the buyer. Ensure that both parties’ identification numbers are included if applicable.

- Detail Products or Services: Provide clear descriptions of the goods or services provided, including quantities, unit prices, and any relevant product codes. This ensures accuracy in calculations and avoids confusion.

- Apply the Correct Tax Rates: Ensure that you use the appropriate tax rates for the products or services. Be aware of different tax rates for various categories, such as exemptions or reduced rates for certain goods.

- Provide a Unique Identifier: Assign each document a unique reference number to facilitate tracking and reconciliation. This number will be useful for future reference, particularly in audits or client inquiries.

- Clearly Show Total Amount: Present the total value of the transaction, breaking it down into product or service cost, applicable tax, and the final total amount due. This enhances clarity and transparency.

Consistency in creating these records is key. By following a uniform process, businesses reduce the risk of errors and ensure their financial documents are always accurate. Having a reliable system in place also makes it easier to generate reports and meet any legal or tax requirements in a timely manner.

Investing time in producing a detailed, compliant document helps businesses stay organized, meet their obligations, and avoid future complications with tax authorities. Whether you’re working with clients locally or internationally, a well-designed record promotes professionalism and fosters long-term business relationships.

Key Elements of a GST Invoice

When documenting business transactions, it is essential to include all the necessary details to ensure clarity, accuracy, and compliance with tax regulations. A comprehensive record includes a combination of seller and buyer information, transaction specifics, and applicable taxes. These elements are not only required for legal purposes but also help maintain transparency and trust in business dealings.

Here are the essential components that must be present in any transaction record:

- Seller and Buyer Information: The document should clearly display the names, addresses, and contact details of both parties involved in the transaction. Any identification numbers for tax purposes should also be included, such as the seller’s registration number.

- Description of Goods or Services: A detailed list of the items sold or services provided, including quantities, unit prices, and a clear description of each product or service. This ensures there is no ambiguity regarding what was exchanged.

- Tax Information: The applicable tax rates should be specified for each item or service, as well as the total tax amount. This section ensures compliance with tax laws and provides clarity on the financial aspects of the transaction.

- Unique Document Reference: Each record must include a unique reference number or serial number, which helps with tracking and managing records. This identifier ensures that the document can be easily found or referenced in the future.

- Date and Terms: The transaction date should be clearly stated, along with any payment terms, including due dates, discounts, or penalties for late payments. This helps manage financial expectations and timelines.

Including all of these key elements not only ensures legal compliance but also supports effective financial management. These details help businesses track their transactions, file taxes correctly, and resolve disputes quickly if they arise. Additionally, maintaining clear and thorough records builds trust with clients and partners, which is vital for long-term business relationships.

By making sure all essential details are included in each transaction document, businesses can streamline their operations and avoid potential compliance issues. These practices contribute to the smooth flow of financial operations and foster a professional reputation in the marketplace.

GST Invoice Formats and Variations

There are several formats available for creating business transaction records, each designed to meet specific requirements and preferences. While the basic structure remains consistent, variations exist to accommodate different types of transactions, industries, and legal specifications. Choosing the right format ensures that the document is both legally compliant and easy to understand for all parties involved.

Different Types of Business Records

Depending on the nature of the transaction, businesses may need to choose between several variations, such as:

- Standard Format: This is the most common format used for regular transactions, where both parties are subject to the same tax rate. It includes all essential information such as buyer and seller details, transaction description, and applicable taxes.

- Export Format: This format is used for international transactions, where goods or services are sold to buyers outside the country. It may exclude certain taxes or include additional export-specific details to comply with international trade regulations.

- Credit/Debit Note Format: These records are used when a transaction is adjusted due to returns or price discrepancies. The credit note reduces the amount owed, while the debit note increases it, and both formats include a reference to the original transaction.

Customizing Formats for Business Needs

Business-specific modifications to the format are common, especially for large or specialized companies. These modifications can include additional sections such as discounts, payment terms, or customized fields that reflect the unique needs of a business. Many businesses also choose to automate the generation of such documents to ensure consistency and efficiency in their operations.

By understanding the different formats and their intended purposes, businesses can ensure that their records are not only compliant but also tailored to their operational requirements. This level of customization enhances efficiency, reduces errors, and fosters trust with customers and tax authorities.

Steps to Customize Your GST Invoice

Customizing your business transaction documents ensures that they align with your company’s specific needs while adhering to legal requirements. A tailored document can include additional fields, unique branding elements, or other specific information that helps streamline your processes and maintain professional standards. The right customization makes it easier for both parties to understand the details and facilitates smoother business operations.

Step 1: Select a Suitable Layout

The first step is to choose a layout that best suits your business. Some companies may prefer a simple, clean design, while others may need a more detailed layout to accommodate multiple products or services. When choosing the format, ensure that it is clear and easy to read, with sufficient space for all necessary details.

Step 2: Add Business-Specific Information

Include your company logo and contact information at the top of the document to maintain a professional appearance. You may also want to add sections for additional details such as discounts, shipping costs, or special payment terms. Customizing the header and footer areas with your business name, address, and relevant registration numbers ensures that the document reflects your identity and complies with all legal requirements.

Step 3: Tailor the Transaction Details to reflect the specifics of each transaction. This may include adding custom fields for product codes, service descriptions, or payment options. Having fields for both the buyer’s and seller’s tax identification numbers is also essential for proper documentation and verification purposes. Make sure that each section is clearly labeled and easily distinguishable.

By following these steps, businesses can produce documents that are both professional and fully compliant, streamlining the transaction process and enhancing communication with clients.

Understanding HSN Codes in Invoices

In business transactions, it is essential to categorize products or services for proper documentation and taxation. One of the most important methods of categorization is the use of a standardized code system that helps identify and classify items. These codes ensure clarity in financial records and tax compliance, making it easier for businesses and tax authorities to manage transactions.

HSN (Harmonized System of Nomenclature) codes are used worldwide to classify goods in a systematic manner. Each product or service is assigned a specific code that indicates its category and tax rate. Including these codes in documentation ensures that the transaction is accurately categorized and compliant with applicable tax laws.

The following are key reasons why HSN codes are crucial in financial documentation:

- Tax Calculation: The HSN code helps determine the applicable tax rate for each product or service. Different categories may be taxed at different rates, and the code ensures the correct rate is applied.

- Accurate Record Keeping: Including HSN codes in financial records makes it easier to track and manage inventory, payments, and taxes. This simplifies the process during audits or reconciliations.

- Compliance with Regulations: Using the correct codes ensures adherence to local tax laws and prevents issues with tax authorities. This reduces the risk of fines or penalties.

- International Trade: For businesses engaged in cross-border transactions, HSN codes help in smooth customs clearance and prevent delays in international shipping.

By using the appropriate HSN codes, businesses can ensure that their records are properly classified, taxes are calculated correctly, and they remain compliant with regulations. This practice enhances transparency and reduces the likelihood of errors in documentation, benefiting both businesses and tax authorities.

How GST Invoice Impacts Tax Filing

Accurate record-keeping plays a significant role in ensuring smooth tax filing processes. The detailed documentation of each transaction helps businesses calculate taxes correctly, track eligible credits, and ensure compliance with legal requirements. Properly prepared transaction records not only streamline the filing process but also reduce the risk of errors or discrepancies that could lead to penalties or audits.

Incorporating detailed transaction records into the tax filing system provides clarity on the total tax liabilities a business is required to pay. These records also enable businesses to claim tax credits for purchases made from registered suppliers, ensuring that the tax burden is minimized. If the required information is not correctly documented, businesses may face difficulties during audits or when reconciling their accounts.

Some key ways in which well-documented transaction records affect tax filing include:

- Accurate Tax Calculation: Properly recorded details ensure that the correct tax rate is applied to each transaction, helping businesses calculate the right amount of taxes due at the time of filing.

- Claiming Tax Credits: Businesses can use their records to claim credits for taxes paid on eligible purchases, reducing the amount payable during filing.

- Transparency and Compliance: Clear documentation of transactions makes it easier to maintain transparency with tax authorities, ensuring the business remains compliant with the latest tax regulations.

- Simplified Audits: A well-organized set of records simplifies audits and reduces the time spent responding to inquiries from tax authorities.

In conclusion, businesses that maintain thorough transaction records significantly improve the efficiency and accuracy of their tax filings. By ensuring proper documentation and following the appropriate filing procedures, businesses can reduce the chances of errors and penalties, fostering better financial management and regulatory compliance.

Common Mistakes in GST Invoices

Businesses must ensure that all transactional records are accurate and complete to avoid errors that could lead to issues with tax compliance or audits. Small mistakes can lead to bigger consequences, including fines or the inability to claim tax credits. Being aware of common errors can help organizations streamline their processes and prevent costly mistakes in the future.

Below are some of the most frequent mistakes businesses make when preparing transactional records:

- Incorrect Tax Rates: One of the most common errors is applying the wrong tax rate to goods or services. Tax rates can vary depending on the type of transaction, and miscalculating these can result in underpayment or overpayment of taxes.

- Missing Tax Identification Numbers: Failing to include the correct identification numbers for both the seller and the buyer can lead to difficulties in tax reporting and validation. It is essential to ensure that these details are correctly filled out to meet compliance standards.

- Incorrect Product or Service Codes: Using the wrong product or service classification codes can cause confusion and lead to discrepancies in tax filings. This can also hinder the proper allocation of taxes during audits or inspections.

- Not Including Necessary Documentation: Incomplete documentation, such as missing transaction details or descriptions, can cause delays during audits. Always ensure that every relevant detail is included for transparency and compliance.

- Errors in Date or Invoice Number: Missing or incorrect invoice numbers, or having inconsistent date formats, can lead to confusion and disrupt record-keeping systems. These elements are vital for tracking and referencing transactions accurately.

- Failure to Report Discounts or Adjustments: If discounts, returns, or adjustments are not reflected in the record, the total transaction amount might not match the actual payment made, affecting both the buyer and seller’s financial records.

Ensuring that all of these aspects are correctly addressed will help businesses avoid common pitfalls. Regular audits and staff training can also be valuable tools for minimizing these errors and maintaining proper documentation practices.

Automating GST Invoice Generation for Businesses

In today’s fast-paced business environment, efficiency is key to maintaining smooth operations. Automating the process of generating transaction records can save businesses time, reduce errors, and ensure compliance with tax laws. By integrating automated systems, businesses can streamline their financial workflows, allowing for faster processing, better accuracy, and enhanced productivity.

Benefits of Automation

Automating the generation of transactional documents offers several advantages for businesses, including:

- Time Savings: Automated systems can create and send documents in minutes, significantly reducing manual effort and freeing up valuable time for other critical tasks.

- Reduced Human Error: By eliminating the need for manual data entry, automation reduces the risk of errors such as incorrect tax calculations or missing details.

- Consistency: Automated systems ensure that all documents are generated in a consistent format, adhering to legal requirements and company standards every time.

- Improved Compliance: With automation, businesses can ensure that each document is compliant with the latest tax regulations, reducing the risk of fines or audits.

Implementing Automated Systems

To effectively implement automated document generation, businesses should consider the following steps:

- Choose the Right Software: Select a reliable software solution that integrates seamlessly with your existing systems. Many cloud-based tools offer customization options, real-time updates, and automatic tax rate adjustments.

- Integrate with Accounting Systems: Ensure that the automation tool integrates with your accounting software to sync data and ensure smooth transaction processing.

- Set Up Custom Fields: Customize the system to include business-specific fields such as product codes, discount structures, or custom payment terms.

- Regular Updates and Monitoring: Regularly update the software to stay compliant with any tax changes and monitor the system for any discrepancies or issues.

By leveraging automation, businesses can simplify their financial workflows, enhance operational efficiency, and stay compliant with the necessary tax regulations while focusing on core business activities.

Free vs Paid GST Invoice Templates

When choosing a solution for creating financial documents, businesses often face the decision between free and paid options. While both have their benefits, each comes with specific advantages and limitations depending on the business’s needs. Understanding the key differences between free and paid tools is essential for making an informed choice that aligns with the company’s requirements and long-term goals.

Advantages of Free Options

Free solutions are typically the go-to choice for small businesses or startups that are just getting started. Here are some of the main benefits:

- Cost-effective: Free tools are ideal for businesses on a tight budget, providing essential functionalities without any upfront costs.

- Easy to Use: Many free solutions are designed to be user-friendly, allowing users to generate documents quickly and easily without technical expertise.

- Basic Features: For businesses with simple needs, free tools often provide enough features to meet the minimum requirements for record-keeping and compliance.

Disadvantages of Free Options

While free tools may seem like a good option, they often have limitations that can become an obstacle as the business grows:

- Limited Customization: Free solutions may lack flexibility in customization, which could be a problem for businesses with specific branding or formatting needs.

- Fewer Features: Basic tools may not offer advanced functionalities like automatic tax calculations, report generation, or integration with accounting software.

- Potential for Errors: Some free tools may not have advanced error-checking features, leading to a higher risk of mistakes in the documents generated.

Advantages of Paid Solutions

Paid solutions often offer more robust features and can cater to the needs of growing businesses. Here are some benefits of investing in a paid tool:

- Advanced Features: Paid options generally come with comprehensive features, including automation, tax calculation, and multi-currency support, which can save time and reduce errors.

- Custom Branding: Businesses can customize documents to reflect their brand’s identity, making the documents more professional and consistent.

- Customer Support: Paid tools typically offer customer support, ensuring that businesses can resolve any issues quickly and keep operations running smoothly.

Disadvantages of Paid Solutions

While paid tools offer more functionality, they come with their own set of challenges:

- Higher Initial Cost: The cost of paid options can be a consideration, especially for small businesses or startups with limited budgets.

- Learning Curve: Some paid solutions may require more time to learn due to their extensive features, which could slow down the initial adoption process.

- Recurring Costs: Paid tools often come with ongoing subscription fees, which could add up over time.

Choosing between free and paid solutions depends largely on the specific needs of the business, including budget, volume of transactions, and required features. While free tools are a good starting point, paid options provide greater flexibility and scalability, making them ideal for bus

GST Invoice Software for Small Enterprises

For small businesses, managing financial transactions efficiently is crucial for maintaining smooth operations and ensuring compliance with tax regulations. With the rise of digital tools, software solutions tailored for generating transaction records have become an essential resource. These tools help small enterprises streamline their document generation processes while also ensuring that their financial paperwork adheres to regulatory standards.

Key Features for Small Enterprises

When selecting software for document creation, small businesses should prioritize tools that offer a combination of simplicity and advanced features:

- User-Friendly Interface: Small businesses need software that is easy to navigate, with intuitive interfaces that don’t require extensive training.

- Automation: The ability to automate key functions such as tax calculations and document generation can save time and reduce manual effort.

- Customization: Customization options are essential for businesses to tailor documents to their brand and specific needs.

- Compliance Tracking: Software that ensures the documents are aligned with the latest tax regulations is crucial to avoid compliance issues.

Benefits of Using Software for Small Enterprises

Adopting dedicated software for financial documentation offers several advantages, particularly for small enterprises:

- Time Efficiency: Automating routine tasks helps save valuable time that can be focused on other important aspects of the business.

- Accuracy: Reducing the potential for human errors ensures that transaction records are more accurate and reliable.

- Scalability: As the business grows, the software can handle increasing volumes of transactions, making it a scalable solution for the future.

- Record Keeping: Software can automatically store and organize documents, ensuring easy retrieval whenever needed for audits or reporting.

For small enterprises, choosing the right software solution can greatly improve efficiency, accuracy, and compliance. It not only simplifies the process of generating financial documents but also ensures that businesses remain on top of regulatory changes while supporting their growth over time.

How to Manage GST Invoices Digitally

In today’s digital age, managing financial documents electronically has become a crucial part of streamlining business operations. With the need for accuracy and efficiency, transitioning from paper-based systems to digital solutions offers many benefits. Businesses can use digital tools to create, store, and manage their records with ease, ensuring compliance and reducing the chances of errors.

Benefits of Digital Management

Managing financial records digitally provides several advantages that can enhance a business’s workflow:

- Time-Saving: Automated processes allow businesses to generate and store records quickly, reducing manual efforts and saving time.

- Improved Accuracy: With built-in checks and calculations, digital tools minimize human errors that could occur in manual entries.

- Better Organization: Digital storage systems make it easier to categorize and retrieve documents when needed, reducing clutter and improving overall organization.

- Remote Accessibility: Cloud-based systems enable business owners and teams to access records from anywhere, increasing flexibility and collaboration.

Steps to Digitally Manage Financial Documents

Here are key steps for businesses to successfully manage their records digitally:

- Select the Right Tool: Choose software or platforms that align with your business needs, offering customization, security, and essential features for document creation and management.

- Automate Record Creation: Set up automation for common tasks, such as generating financial documents and performing tax calculations, to streamline processes.

- Store Documents Securely: Use cloud-based storage or digital filing systems to ensure safe, long-term storage of all important records.

- Maintain Regular Backups: To avoid data loss, regularly back up your digital records and ensure that recovery options are in place.

- Ensure Compliance: Regularly update your digital solutions to comply with the latest regulatory changes to avoid errors or penalties.

By managing financial documents digitally, businesses can save time, reduce errors, and maintain better organization. Digital tools offer the flexibility to adapt to growing business needs while ensuring that compliance requirements are met with ease.

Difference Between Taxable and Exempt Invoices

When managing financial records for your business, it’s crucial to understand the distinction between taxable and exempt transactions. These differences impact how you generate and manage your business documents, especially when it comes to tax reporting. Properly classifying each transaction ensures that you comply with regulations and avoid penalties.

The primary difference lies in whether a transaction is subject to applicable taxes or exempt from them. Taxable records require specific calculations for applicable rates, while exempt records do not include such charges. Let’s break down the key differences:

| Aspect | Taxable | Exempt |

|---|---|---|

| Tax Charges | Includes applicable taxes based on government rates | No taxes applied to the transaction |

| Legal Obligation | Must comply with tax collection and remittance | No need to collect or remit taxes |

| Examples | Goods and services that are subject to tax laws | Essential goods, some services, or exports that are exempt |

| Record-Keeping | Must maintain accurate tax calculation records | Requires simplified documentation without tax details |

Understanding the difference between taxable and exempt transactions helps businesses maintain accurate records, comply with tax regulations, and avoid mistakes when generating documents. By categorizing your transactions correctly, you ensure that your financial documents reflect the correct tax treatment.

Legal Requirements for GST Invoice Templates

Ensuring that your financial documentation complies with the legal framework is crucial for any business, as improper records can lead to penalties and legal issues. For businesses dealing with tax obligations, it’s important to understand the necessary elements that need to be included in official documents. These include details that verify the authenticity of the transaction and ensure transparency between the business and tax authorities.

Key Legal Components

There are specific elements that must be included in any official document to fulfill the legal requirements. These are designed to ensure clarity and compliance with national regulations:

- Business Information: Full details of the seller, including name, address, and registration number.

- Transaction Details: Precise descriptions of the goods or services provided, along with their respective amounts.

- Tax Identification Number: The unique identifier assigned to businesses to ensure proper tax tracking.

- Tax Rates: Clear indication of the applicable tax rates, whether standard or reduced, as per the legal structure.

- Date of Issue: The date on which the document was issued, to ensure proper documentation for auditing and legal purposes.

Compliance and Penalties

Failure to meet these requirements can lead to non-compliance penalties, including fines or audits. Additionally, errors or omissions in records may complicate the process of filing returns, potentially leading to disputes or delays. It is essential for businesses to integrate these legal components seamlessly to avoid these risks.

Staying compliant with the legal structure is not only a regulatory requirement but also builds trust with clients and authorities, ensuring smooth transactions and fostering long-term business success.

Best Practices for Maintaining GST Invoices

Proper record-keeping is essential for any business, not only to meet regulatory requirements but also to streamline financial management. When it comes to managing official financial documents, adopting best practices ensures accuracy, transparency, and compliance. Below are some key recommendations for effectively handling and organizing these critical records.

Organizing and Storing Records

To maintain order and easily access documents when needed, consider the following steps:

- Digitize Records: Scan and store all relevant paperwork in a secure digital format to avoid loss or damage. Use cloud storage for easy access and backup.

- Keep Records Categorized: Sort documents by date, customer, and transaction type to simplify retrieval during audits or tax filings.

- Use Proper Filing Systems: Implement a clear, structured filing system, whether physical or digital, to maintain consistency and prevent disorganization.

Ensuring Accuracy and Timeliness

Accuracy is key to avoiding errors that could lead to penalties. Make sure your documentation process includes:

- Review for Accuracy: Double-check the details, including amounts, tax rates, and registration numbers, to ensure they match the transaction and the tax rules.

- Issue Timely Records: Send all documents as soon as transactions are completed to ensure timely compliance with legal deadlines.

- Stay Updated on Regulations: Tax laws can change, so it’s important to stay informed and update records accordingly to remain compliant.

Backup and Security

Ensuring the security of your financial records is essential to prevent unauthorized access or loss:

- Data Backup: Regularly back up your records to secure locations, such as encrypted cloud storage or external hard drives.

- Access Control: Limit access to authorized personnel only and set clear permissions for document editing and sharing.

- Implement Security Measures: Use strong passwords, encryption, and multi-factor authentication to protect sensitive data.

By following these best practices, businesses can streamline their financial processes, reduce the risk of errors, and ensure smooth operations when it comes time for audits, tax filings, or client inquiries.